MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

S&P 500 Above 5400: Economic Optimism or Irrational Exuberance?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the continued optimism for technology shares following this morning's bullish CPI data and the Fed's statements suggesting a Goldilocks scenario for risk assets. He also breaks down key technical signals and levels for AAPL,...

READ MORE

MEMBERS ONLY

Apple Blasts Through $200 On AI Optimism

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave reviews key charts from a technical analysis perspective, including AAPL, FSLR, MSTR, and STT. He also addresses the potential bearish momentum divergence for the S&P 500 index and reviews the negative breadth conditions, with new 52-week lows...

READ MORE

MEMBERS ONLY

NVDA Stock Split Launches S&P 500 Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a bullish day for stocks, with 8 out of 11 S&P 500 sectors finishing higher. He breaks down the charts of NVDA, ENPH, FSLR, and AMD, and reviews a potential upside reversal in gold.

See Dave&...

READ MORE

MEMBERS ONLY

Tracking the Three Signs of the Bear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024. But what about the conditions "under the hood" of the major benchmarks? Today, we'll highlight three "signs of the bear&...

READ MORE

MEMBERS ONLY

Hindenburg Omen Flashes Initial Sell Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 did manage to finish the week above tactical support at 5250, one of the most widely-followed macro technical indicators recently registered an initial sell signal for the second time in 2024. Today we'll explain the three components of the Hindenburg Omen, show...

READ MORE

MEMBERS ONLY

MUST SEE! Top 10 Stock Picks For June 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through top 10 charts to watch in June 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into...

READ MORE

MEMBERS ONLY

S&P 500 Sinks on Software and Semiconductor SELLOFF

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Jonathan Krinsky, CMT of BTIG. Jonathan speaks to the weakness in market breadth conditions and the software group as a key space to watch for relative strength weakness. David breaks down the relationship between the S&P...

READ MORE

MEMBERS ONLY

Failed Bearish Patterns are Bullish for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Frank Cappelleri, CMT CFA of CappThesis. Frank shares how the bull market phase has been marked by confirmed and completed bullish patterns and failed breakdowns after bearish patterns. Meanwhile, Dave discusses the rising interest rate environment, what it...

READ MORE

MEMBERS ONLY

Three Stock Ideas as S&P 500 Treads Water

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Tony Zhang of OptionsPlay. Tony shares three stock ideas showing favorable risk/reward characteristics as the S&P 500 index treads water above support at 5250. David describes the deteriorating market breadth conditions and reviews charts of...

READ MORE

MEMBERS ONLY

Technical Indicator Showdown: MACD vs. PPO vs. PMO

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions from The Final Bar Mailbag. He outlines the differences between the MACD, PPO, and PMO indicators, covers the mechanics of corporate buybacks, examines the basics of candlestick analysis, and discusses whether applying trendline analysis to the...

READ MORE

MEMBERS ONLY

Dow Theory Flashes Bear Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis." Many of the tools we employ to better analyze market structure and investor sentiment, from trend analysis to index construction, are derived from Dow's original essays from the early...

READ MORE

MEMBERS ONLY

S&P 500 Downside Target 4800?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Jeff Huge, CMT of JWH Investment Partners. David reflects on NVDA's gap higher, quick deterioration in market breadth indicators, and bearish candle patterns for ON and HOOD. Jeff shares his downside target for the S&...

READ MORE

MEMBERS ONLY

Growth is Alive and Kicking for S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mike Singleton of Invictus Research. David highlights a bearish momentum divergence for gold, and also illustrates how mid-cap and small-cap stocks have yet to make new highs in Q2. Mike paints a bullish picture for stocks based on...

READ MORE

MEMBERS ONLY

These Sectors are Showing Strength as S&P 500 Soars!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by special guest Julius de Kempenaer of RRG Research. Dave hits on the out-performance of traditionally defensive sectors and breaks down the charts of FSLR, NVDA, and more. Julius, meanwhile, is cautiously optimistic as the equity indexes...

READ MORE

MEMBERS ONLY

Bitcoin Blasts ABOVE 70K!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights strong market breadth as the S&P 500 digests last week's break above 5300 and Bitcoin powers above the crucial 70K level. He also breaks down key technical levels for CCL, HD, ZM, MSTR, NFLX,...

READ MORE

MEMBERS ONLY

The One Chart to Watch as S&P 500 Makes New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the S&P 500 and Nasdaq 100 have once again made new all-time highs, and the Dow Jones Industrial Average has briefly broken above the 40,000 level for the first time, how should we think about further upside for our equity benchmarks?

There are two general ways...

READ MORE

MEMBERS ONLY

TOP 10 Stock Picks for May 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through the top 10 charts to watch in May 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights...

READ MORE

MEMBERS ONLY

Larry Williams: Dow 40k, Cycle Analysis, and Lessons Learned

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave in the StockCharts TV studio. Larry shares his latest thoughts on Dow 40K, the resilient rise of gold and precious metals, cycle analysis on the S&P 500 and crude oil,...

READ MORE

MEMBERS ONLY

China Tariffs Drive Upside for Rare Earth Minerals

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024. David charts the S&P 500'...

READ MORE

MEMBERS ONLY

Watch for Higher Lows in These Three Tech Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

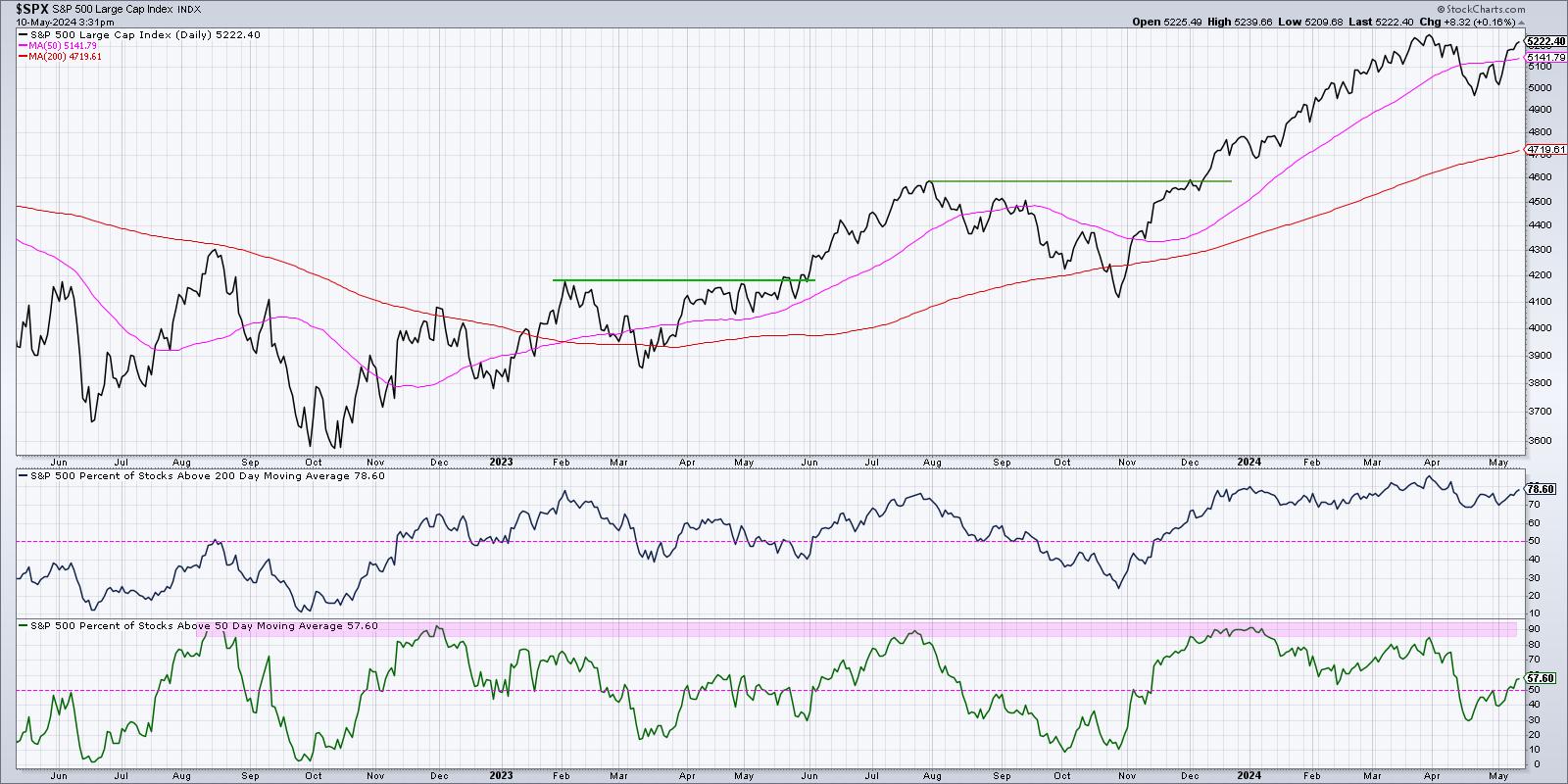

Three Breadth Indicators to Confirm a Bullish Market Trend

by David Keller,

President and Chief Strategist, Sierra Alpha Research

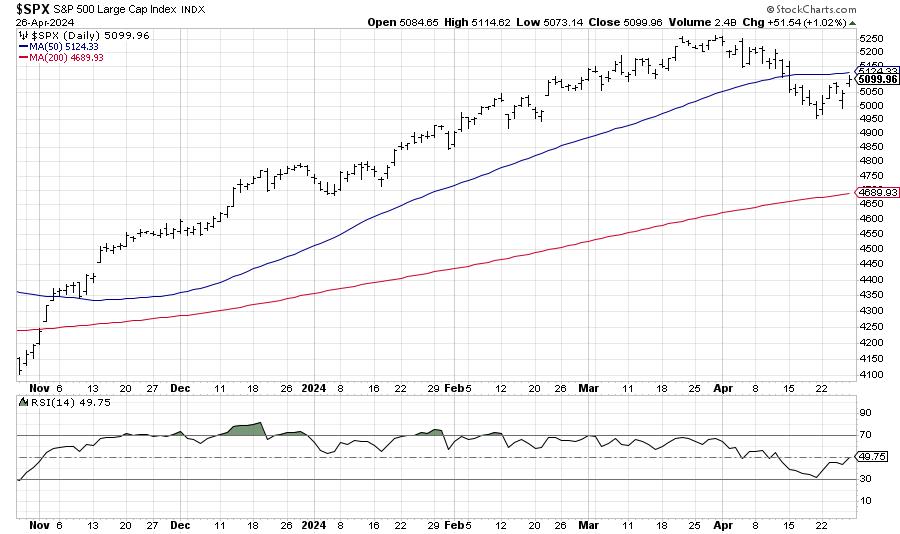

There's no denying the strength the major averages have displayed off their April lows. The S&P 500 finished the week within a rounding error of the previous all-time high around 5250. What would it take for the SPX and NDX to power to new all-time highs...

READ MORE

MEMBERS ONLY

Relative Strength Screams Bullish for This Tech Stock

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

Stocks Pop Higher as Defensive Sectors Thrive

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an unusual day for stocks. The S&P 500 and Nasdaq closed higher, but the top sectors were defensive - real estate and utilities! He shares key levels to watch for NVDA, AAPL, TSLA, and more,...

READ MORE

MEMBERS ONLY

The Top Performing Sector is Utilities?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session. He lays out a potential reversal in interest rates, what that could mean for growth stocks, and recaps earnings plays including WYNN,...

READ MORE

MEMBERS ONLY

Is the S&P 500 Forming a Bear Flag Pattern?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses in on price pattern analysis for the S&P 500, then reflects on the emergence of defensive sectors like consumer staples. He also recaps earnings movers, including DIS, SHOP, and more.

This video originally premiered on May...

READ MORE

MEMBERS ONLY

The Market Breadth Indicator You Should Be Following

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average. He then identifies key levels to watch for PLTR, LCID, NFLX, NVDA, and AAPL, and breaks down the latest market breadth indicator...

READ MORE

MEMBERS ONLY

Key Breadth Indicator Flashes Buy Signal for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent Index, the value of long-term technical analysis techniques, how sentiment indicators relate to the market trend, and how the CMT program helped him improve his...

READ MORE

MEMBERS ONLY

The Bull Case for Buffett's Biggest Holding

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors flock to Omaha, Nebraska in their annual pilgrimage to learn from the great Warren Buffett, it seems an opportune time to reflect on the technical evidence for Berkshire's biggest holding, Apple (AAPL).

Today, we'll consider AAPL using "multiple time frame analysis", in...

READ MORE

MEMBERS ONLY

The BULL Case for BITCOIN

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Adrian Zduńczyk, CMT of The ₿irb Nest. David recaps a busy earnings week, breaking down the charts of PTON, AAPL, and more. Adrian tracks the recent pullback for Bitcoin and why the long-term uptrend still remains the prevailing...

READ MORE

MEMBERS ONLY

Market Pops, Then Drops on Fed Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Adam Turnquist, CMT of LPL Financial. Dave debriefs on today's Fed meeting market reaction, reviewing concerning technical developments for NVDA, AMD, SMCI, NCLH, and MAR. Adam relates short-term weakness in growth stocks to long-term strength...

READ MORE

MEMBERS ONLY

Stocks Plunge with Key Earnings on Tap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Gina Martin Adams, CMT CFA of Bloomberg Intelligence. David highlights a spike higher in the VIX, and charts names for earnings including AMZN, AMD, SMCI, SBUX, MCD, PYPL, and ETN. Gina shows how rising interest rates continue to...

READ MORE

MEMBERS ONLY

Key Levels for AMZN, AMD, & AAPL Earnings!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the S&P 500's late inning rally to test the 50-day moving average from below. What levels could come into play with this week's Fed meeting on Wednesday? He also focuses on key...

READ MORE

MEMBERS ONLY

S&P 500 Makes a New All-Time High By End of June?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocksbreaking through their 50-day moving averages, to even thedramatic increase in volatilityoften associated with major market tops. While Q1 was marked by broad market strength and plenty of new...

READ MORE

MEMBERS ONLY

Spotting Downturns Early: Daily or Weekly Charts?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on spotting downturns in daily vs. weekly charts, using the Relative Rotation Graphs (RRG) to identify actionable ideas, and comparing the NYSE Composite Index ($NYA) to the S&P 500 Index ($SPX). He also shares...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

Buy the Dip or Sell the Rip?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Bret Kenwell of eToro. Bret shares the levels he's watching for AAPL and AMD, speaks to this week's bounce higher, and points out why Energy still shows long-term strength. David breaks down earnings names...

READ MORE

MEMBERS ONLY

Weak Charts Keep Getting Weaker

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE). Explore the world of equity benchmarks and learn how large caps, mid caps, and small caps can offer unique opportunities based on sector rotation...

READ MORE

MEMBERS ONLY

Breakdown in Mega-Cap Growth Confirms Bear Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Early breakdowns from AAPL and TSLA provided initial warnings of a late stage bull market.

* Exponential gains in stocks like SMCI and MSTR have now turned into steep pullbacks with both stocks breaking below moving average support.

* With AMZN and NFLX finishing the week below their 50-day moving...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson run through top 10 charts to watch in April 2024! Together they cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into market dynamics and chart...

READ MORE