MEMBERS ONLY

The Magic and Power of a "Four Leaf Clover" Investor

by Gatis Roze,

Author, "Tensile Trading"

In my commentary to the 1,400 investors participating in ChartCon 2016, I reinforced an essential investing insight that I had many years ago which has served me well for over two decades.

If I focused on the execution of my methodology instead of meditating on profits, the bottom line...

READ MORE

MEMBERS ONLY

Charts I'm Stalking Action Practice #3

by Gatis Roze,

Author, "Tensile Trading"

Please refer to the charts of Charles Schwab (SCHW), PayPal (PYPL) and Morgan Stanley (MS/RA) that I presented to you in the Action Practice #2 blog I wrote on September 16, 2016.

https://stockcharts.com/articles/journal/2016/09/charts-im-stalking-action-practice-2.html

Just for fun , you might revisit Intersil Corp....

READ MORE

MEMBERS ONLY

Thrive as an Investor, Don't Just Survive

by Gatis Roze,

Author, "Tensile Trading"

Jonathan Wendel earned $454,544. He is very similar to us investors / traders in many ways despite being a professional video gamer. Academics have in fact identified the roles that gamers adopt — such as Explorers, Sentinels, Analysts and Campaigners. Not that dissimilar to the tribes academics assigned us investors. The...

READ MORE

MEMBERS ONLY

Charts I'm Stalking Action Practice #2

by Gatis Roze,

Author, "Tensile Trading"

This blog is in the new bi-weekly format where we’ll first analyze the charts I presented to you in my September 2, 2016 blog. After that, we’ll present new charts.

https://stockcharts.com/articles/journal/2016/09/charts-im-stalking-action-practice.html

As I wrote previously, this “Action Practice” only benefits...

READ MORE

MEMBERS ONLY

How I Use My Personal Pocket Pads to Produce Profits

by Gatis Roze,

Author, "Tensile Trading"

As many of you know, American composer extraordinaire Richard Rodgers collaborated with Oscar Hammerstein to produce some of the greatest musicals of the 20th century. Discussing their success, he once explained his thoughts on what it takes to be a superb songwriter. In his marvelous quote, I took the liberty...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice

by Gatis Roze,

Author, "Tensile Trading"

This “Charts I’m Stalking” blog is the second in a new series which will be a bi-weekly feature of The Traders Journal. I’ve decided to actually take it one step further than I initially explained in my August 19th blog.

“Perfection is not attainable, but if we chase...

READ MORE

MEMBERS ONLY

Fundamentals versus Technicals: This Ends the Debate!

by Gatis Roze,

Author, "Tensile Trading"

In one corner, you have investors. In the other corner, you have the stock market. When the two communicate accurately, you make money. Yes, it is that simple. Stay with me and I’ll make it worth your while.

Investors, stock pickers, traders – pick a label – all sit somewhere along...

READ MORE

MEMBERS ONLY

New Direction, New Feature for The Traders Journal

by Gatis Roze,

Author, "Tensile Trading"

Announcing a new direction for The Traders Journal. Since 2012, I’ve been delving into my own trading journals every week and sharing with my readers what I found there. I will continue to do so, but on a bi-weekly basis. My revised plan is to alternate that with a...

READ MORE

MEMBERS ONLY

All Successful Investors Need an EDGE: Here's Mine

by Gatis Roze,

Author, "Tensile Trading"

All successful investors must have some type of “edge”. If you don’t know what yours is, odds are you don’t have one.

Not long ago, I heard an address by Ben Bernanke, the former Fed Chairman, who said, “it’s not illegal to make stupid investments.” I submit...

READ MORE

MEMBERS ONLY

One + One = Three/Analogue + Digital/ Fundamentals + Technicals

by Gatis Roze,

Author, "Tensile Trading"

If there’s a better way, take it.

If there’s a bar, raise it.

If there’s a methodology, stake it.

If there’s a dream, chase it.

(paraphrased from an Acura advertisement)

I met a digital trader on the streetcar last month in Toronto. I’ll call him...

READ MORE

MEMBERS ONLY

Flopping in Sports Can Make One Millions / Flopping in Investing Can Cost You Millions

by Gatis Roze,

Author, "Tensile Trading"

As an investor, there is only one day a year that you are unable to do anything about the stock market’s behavior, and that is yesterday. Any other day, your action or inaction will determine your bottom line. As a trader, the two things I must do each day...

READ MORE

MEMBERS ONLY

ChartPack Quarterly Updates & Insights 200 New Enhancements (Version 8.25)

by Gatis Roze,

Author, "Tensile Trading"

The last three months since Wiley published our book, Tensile Trading, has given us a unique opportunity to talk with many investors. In doing so, we’ve been able to discuss with them the big picture challenges of managing one’s assets, as well as hear unique testimonials extolling the...

READ MORE

MEMBERS ONLY

Investorship, like Citizenship, Must Have Parameters

by Gatis Roze,

Author, "Tensile Trading"

“Friends don’t let friends drink and drive.” We have all been exposed to this public service advertisement since it was first broadcast in 1983. This simple slogan has been embedded in our collective consciousness, and research has proven that its impact has saved thousands of lives. It really works....

READ MORE

MEMBERS ONLY

The Single Most Important Lesson I've Learned Trading the Markets for 25 Years

by Gatis Roze,

Author, "Tensile Trading"

My Thesaurus lists the same two words – enhance and augment – as synonyms for both words “improve” and “more”. The mantra of today’s global society could indeed be “improve and more” with all the corresponding complexity that it brings with it.

I merely have to look in my garage at...

READ MORE

MEMBERS ONLY

You Bought It...But Here's How You Increase Your Probabilities of Making Profits!

by Gatis Roze,

Author, "Tensile Trading"

I think of this weekly blog as a sort of view from the kitchen. Mine is not some candy-coated representation of a non-existent financial Valhalla being peddled by someone who is trying to sell his black box with the holy grail formula.

This is a weekly experience where I invite...

READ MORE

MEMBERS ONLY

A Through Z of Investing: The Essentials

by Gatis Roze,

Author, "Tensile Trading"

Fair warning: everyone has some comments to offer when you write an investment book. And they do.

For 25 years now, I’ve operated under the caveat: “if it ain’t broken, don’t try to fix it.” As a former entrepreneur, my customers reviewed my performance daily. As an...

READ MORE

MEMBERS ONLY

The Four Crucial Beliefs Necessary to Achieve Stock Market Mastery

by Gatis Roze,

Author, "Tensile Trading"

Galloping through the markets without recognizing the impact of your essential beliefs is an investing tragedy of Shakespearean proportions. If this describes your style, money management will be like trying to nail Jello to the wall.

We use to joke that my high school buddy, Brian Maxwell, was a force...

READ MORE

MEMBERS ONLY

Precisely How I Bought the 4 'FANG' Stocks Before Their Run-Up

by Gatis Roze,

Author, "Tensile Trading"

Put your hands up if you can remember the big money we made in the ‘Nifty Fifty' – those stocks from the ‘60s and ‘70s. Or what about the Four Horsemen from 1999 to 2001? The famous FANG stocks of 2015 – Facebook, Amazon, Netflix and Google – had many of the...

READ MORE

MEMBERS ONLY

7 Reasons Why Investing/Trading is the Best Pastime in the World

by Gatis Roze,

Author, "Tensile Trading"

Trading the stock market is not the blood sport that many in the press portray it to be. That sentiment is just part and parcel of Wall Street’s sophisticated disinformation machine which preaches a familiar old sermon to individual investors. The market pitch goes something like this: “the market...

READ MORE

MEMBERS ONLY

Stalking the "Best of Breed" Equities

by Gatis Roze,

Author, "Tensile Trading"

The same investment analysis seldom yields consistent conclusions over a period of time. As much as investors would like to believe they are predictably consistent in their analysis, I’d be willing to wager that this is seldom the case.

This is especially true if you are stalking similar equities,...

READ MORE

MEMBERS ONLY

What They Don't Teach You About Investing at Harvard and Stanford Business Schools

by Gatis Roze,

Author, "Tensile Trading"

I was recently discussing trading and investing with Carlos Obando, former portfolio manager and graduate of a famous east-coast Business School – yes, Harvard. And as regular readers know, my MBA is from Stanford. Both schools are famous for their respective teaching methods, but as investment professionals, Carlos and I agreed...

READ MORE

MEMBERS ONLY

Warren Buffett Would Be Proud of Us!

by Gatis Roze,

Author, "Tensile Trading"

The legendary Warren Buffet once said, “You only have to do a few things right in your life so long as you don’t do too many things wrong.” Co-authoring an investment book alongside my son, Grayson Roze, stands out as one of the most profoundly “right” things I’ve...

READ MORE

MEMBERS ONLY

ChartPack Quarterly Update: Over 100 New Enhancements (v 8.0)

by Gatis Roze,

Author, "Tensile Trading"

Visual Analysis on Steroids

I am a big believer that investing should be fun and need not eat up all my time. One element I’ve found that makes it more so is creating colorful and visually alluring charts. To this end, present ChartPack users will therefore notice that over...

READ MORE

MEMBERS ONLY

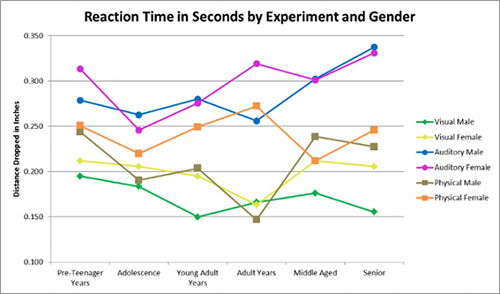

Here's How Your Buying & Selling RT (Reaction Time) Flows Through to Your Bottom Line

by Gatis Roze,

Author, "Tensile Trading"

I’ve been told I’m a little unusual in that I rate my trades on a scale of 1 – 5 stars depending on my reaction time (RT). My reaction time rating is merely a measure of the quickness an investor responds to some sort of market stimulus. I rate...

READ MORE

MEMBERS ONLY

The Secret of Success Is...

by Gatis Roze,

Author, "Tensile Trading"

This past February, John Elway, General Manager of the Denver Broncos, achieved the pinnacle of success when his team won the 2016 Super Bowl. When I was a graduate student in business school, I had the privilege and good fortune of watching Elway play football as the quarterback for Stanford...

READ MORE

MEMBERS ONLY

Wall Street's Free Lunch... But Investors Must Still Read the Menu

by Gatis Roze,

Author, "Tensile Trading"

To paraphrase Bill Murray from the movie “Aloha,” the future is not something that just happens. It’s a brutal force with a great sense of humor that will nickel and dime your investments until it’s totally steamrolled your portfolio if you aren’t watching.

I will concede that...

READ MORE

MEMBERS ONLY

The "WHY" Investors Versus The "WHAT" Investors: And The Winner Is...

by Gatis Roze,

Author, "Tensile Trading"

Highly educated people are, for the most part, trained to ask the question “Why?” Engineers, accountants, doctors, lawyers and the like invariably want to know all they can about why certain things happen. The assumption is, of course, that knowing why will help you do the right thing in your...

READ MORE

MEMBERS ONLY

The Most Profitable Correlation in the Stock Market

by Gatis Roze,

Author, "Tensile Trading"

Whether it’s life or investing, if you ignore the reality of correlations – be they positive or negative – you are literally engaged in paradigm shifting. This is the equivalent of trying to put the milk back into the cow.

We all witness examples of positive correlations in our daily lives....

READ MORE

MEMBERS ONLY

The #1 Indicator Professionals Focus On

by Gatis Roze,

Author, "Tensile Trading"

A week doesn’t go by without some investor asking me “which one single indicator do you recommend above all others?” When I answer this question, the indicator I speak of is never the one they expect. The most important indicator – the one that will determine the majority of your...

READ MORE

MEMBERS ONLY

Investing Is To Trading Just As Style Is To Design

by Gatis Roze,

Author, "Tensile Trading"

In the automotive industry, a car designer begins his or her career as a automotive stylist. Over time, as their knowledge and experience grows, the most talented of the bunch are offered the chance to become a car designer. It can take many years to earn that title, and few...

READ MORE

MEMBERS ONLY

Driverless Trading and the Five Investor Personalities

by Gatis Roze,

Author, "Tensile Trading"

Pursuing a ‘driverless strategy’ – be it automobiles, hedge funds or individual investing – is counterfactual thinking, in my opinion. The new BMW iVision car has knob-less gesture controls, 3D displays and an auto function that switches the car into driverless mode. Perhaps this will work on highways of the future, but...

READ MORE

MEMBERS ONLY

Pulling the Trigger: Six Essential Rules

by Gatis Roze,

Author, "Tensile Trading"

Make no mistake about it: these are internet days and news circles the globe at the speed of light. Couple that with the fact that Wall Street is the world’s most sophisticated disinformation machine ever devised and you’ll appreciate why I believe technical analysis is an individual investor’...

READ MORE

MEMBERS ONLY

Your Survival and Success As An Investor Depends On This

by Gatis Roze,

Author, "Tensile Trading"

“The way to pick an investor’s pocket is through the ear.” – Jason Zweig

There is a direct correlation between an investor’s profitability and his or her communication skills. I would be willing to wager you that I could ascertain the degree of your success as an investor within...

READ MORE

MEMBERS ONLY

My Pal Warren on the 10 Stages of Investing

by Gatis Roze,

Author, "Tensile Trading"

I’m a big fan of pithy quotes. When I teach my college class “Tensile Trading”, I use quotes extensively to help illustrate each of the essential 10 stages of stock market mastery. This week, I thought I’d have a guest blogger share his wisdom with respect to each...

READ MORE

MEMBERS ONLY

This Investor's Personal Mantra

by Gatis Roze,

Author, "Tensile Trading"

Having traded the markets for over 25 years, I am still focused on ruthlessly driving mind-bending emotions from my investing efforts. With novice investors, the first and most significant speed bump seems to be simply acknowledging the fact that investors themselves are the speed bump.

We need to accept two...

READ MORE

MEMBERS ONLY

WOW! The 10th Tensile Trading ChartPack Update!

by Gatis Roze,

Author, "Tensile Trading"

This is the tenth update to the Tensile Trading ChartPack. When I look back at the initial version, let me just say I am astonished at how far we’ve come and how many improvements we’ve made over the past ten quarters. At this juncture, I think it’s...

READ MORE

MEMBERS ONLY

What I Learned from 30,874 Trades

by Gatis Roze,

Author, "Tensile Trading"

Thomas Edison said “Vision without execution is hallucination.” Real estate experts love to claim that success is based on “location, location, location.” For his recent book, The Art of Execution (Harriman House 2015), Lee Freeman-Shor analyzed over 30,000 trades by 45 professional investors and concluded that success in the...

READ MORE

MEMBERS ONLY

How I Deal with Trading Losses

by Gatis Roze,

Author, "Tensile Trading"

“I’m the only person I know that’s lost a quarter of a billion dollars in one year... It’s very character building.” -- Steve Jobs

I have to say this up front: I hate to lose. I work very hard not to lose. As Paul Newman said, “Show...

READ MORE

MEMBERS ONLY

Powerful and Profitable Pairings: 1 + 1 = 3

by Gatis Roze,

Author, "Tensile Trading"

For myself, one of the most momentous insights into life and investing happened over 25 years ago when Sir John Templeton, who was exceptional as both an investor and a human being, talked about the profound importance of pairings in determining the quality of one’s life. There are infinite...

READ MORE

MEMBERS ONLY

A Trader's Discipline: How I Stay the Course

by Gatis Roze,

Author, "Tensile Trading"

“A disciplined mind leads to happiness and an undisciplined mind leads to suffering.”

--Dalai Lama XIV,

The Act of Happiness

Investors don’t always have the discipline to act like a Nike ‘Just do it’ advertisement. I recently had a trading buddy of mine lament about his struggles to stay...

READ MORE