MEMBERS ONLY

Top Five Investing Mistakes Made Preparing for Retirement

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

After 20 years in the money management business I saw these mistakes all too often.Fortunately, this time, I’m not reciting the mistakes I have made in the past.I certainly made some, but not these.I’ll share those another time.

1 – The biggest and probably most common...

READ MORE

MEMBERS ONLY

Top 5 Investing Mistakes You Make When Young

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am not young anymore, so am going to reveal mistakes I made in the first half of my investing lifetime; about 1972 – 1990. Sadly, I did not learn lessons quickly so repeated some of them. These are not in any particular order. A better title might be True Confessions....

READ MORE

MEMBERS ONLY

Will You Know When the Market Peaks?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The first thing you must realize is that you won’t know it is peaking until the decline is well underway. Market tops are extremely difficult to identify. That might seem hard to believe if you watch the financial media as those 'experts' are calling the top multiple...

READ MORE

MEMBERS ONLY

A Reading List

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In the 1970s there were very few books on technical analysis. Now there a many great books available in the field of technical analysis and finance. However, I’m going to keep these lists short and focused. These lists contains many other wonderful books on technical analysis, finance, and behavioral...

READ MORE

MEMBERS ONLY

You Need to Understand What Market Breadth Offers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Early in writing these articles I talked a lot about market internals or market breadth. As a refresher, I’ll review the basics and then offer an opinion on why breadth is so important.

Breadth Components

Breadth components are readily available from newspapers, online sources, etc. and consist of daily...

READ MORE

MEMBERS ONLY

Know Thyself IV

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is the fourth article dealing with cognitive biases that totally screw up your decision making. The first article, Know Thyself, covered anchoring, confirmation bias, herding, hindsight bias, overconfidence, and recency. The second article, Know Thyself II, covered availability, calendar effects, cognitive dissonance, disposition effect, and loss aversion/risk aversion....

READ MORE

MEMBERS ONLY

Academia

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m on record in my book, “Investing with the Trend,” and probably in this blog of stating that Financial Academia is nothing more than the marketing department for Wall Street. When I do presentations about technical analysis and / or money management, I always begin with this slide:

Slide A...

READ MORE

MEMBERS ONLY

Filtering the Noise III

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

First of all, I must apologize for my lack of creativity for these article titles. The previous two “Filtering the Noise” and “Filtering the Noise II” were about moving averages and suggesting a better way to use a relationship between two moving averages, similar to the ubiquitous MACD. In this...

READ MORE

MEMBERS ONLY

Filtering the Noise II

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The first article of Filtering the Noise dealt with smoothing the data with moving averages. Here I want to discuss a really popular concept popularized by an indicator called Moving Average Convergence Divergence or MACD. MACD is a concept using two exponential averages developed by Gerald Appel. It was originally...

READ MORE

MEMBERS ONLY

Filtering the Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have mentioned many times I that I basically only work with daily market data. I do not have the personality to deal with intraday data and weekly data is only good for long term use. I do have a few weekly data indicators that I use as overlays to...

READ MORE

MEMBERS ONLY

My 100th Blog Article

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is funny. A few articles ago I commented on the foolishness of the media’s focus on Dow 20,000 and now I’m focusing on my 100th blog article. Is that being a hypocrite or what? I have been racking my feeble brain trying to think of an...

READ MORE

MEMBERS ONLY

Wall of Worry

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The “Wall of Worry” has been used for many decades to identify the period of time in the latter stages of a bullish run in the stock market, when all the naysayers start talking about a top. I have witnessed this often. As the bull ages, many start to think...

READ MORE

MEMBERS ONLY

Article Summaries - 11-2016 to 2-2017

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

The Reign of Error

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In 1987 a book was written, entitled “The Great Depression of 1990,” by Dr. Ravi Batra, an SMU professor of economics. Sadly, I bought and read that book back then. Batra was claimed as one of the great theorists in the world and ranked third in a group of 46...

READ MORE

MEMBERS ONLY

0100111000100000

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are 10 types of people in this world, those who understand binary and those who do not. Yes, the title is binary for 20,000. I knew the title of this article would get your attention. The financial media is possessed with round numbers more than I can remember....

READ MORE

MEMBERS ONLY

Capitalization

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This will not be about punctuation. Have you ever wondered why most of the media focuses on the Dow Jones Industrial Index? Some would say it isn’t a good measure of the overall market, including me? Yet, it does a reasonable job of representing the overall market. Same goes...

READ MORE

MEMBERS ONLY

Diversification and Multicollinearity

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Di-ver-si-fi-ca-tion

1. the act or process of diversifying; state of being diversified.

2. the act or practice of manufacturing a variety of products, investing in a variety of securities, selling a variety of merchandise, etc., so that a failure in or an economic slump affecting one of them will not...

READ MORE

MEMBERS ONLY

Did 2016 Meet Your Expectations?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Welcome to 2017! For those of use born in the 1940s or earlier, we’re delighted to be here. In the US Equity markets, there were 3 fairly big pullbacks. They stand out in the performance chart of the S&P 500, Dow Industrials, Nasdaq Composite, Russell 2000. Looking...

READ MORE

MEMBERS ONLY

New Year Nonsense

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Each year for as long as I can remember pundits, experts, and talking heads are offering their projections (guesses) about the new year and what to expect from the market. There are a few ‘techniques’ that seem to be used each year such as the January Barometer, the Super Bowl...

READ MORE

MEMBERS ONLY

Wake Up so You Can Sleep!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Why is it that many will believe almost anything they hear or read? You need to learn to only pay attention to the facts. Let me offer a recent real-time event and some of the wild imagination used by the experts about what happened. Malaysia Airlines Flight 370, a scheduled...

READ MORE

MEMBERS ONLY

Tools of the Story Teller!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In an article, I published some time ago, The Many Faces of Technical Analysts, one example was the Story Teller. I captured this idea from Barry Ritholtz when he asked the question “Are you a Trader or a Story Teller?” Parts of that section are reproduced below. In that article,...

READ MORE

MEMBERS ONLY

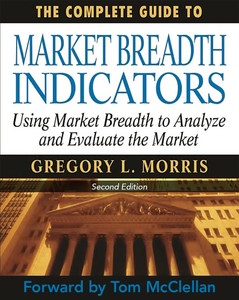

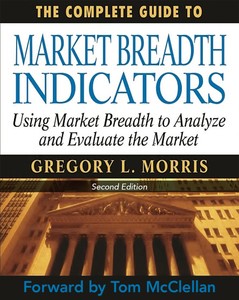

Market Breadth and Technical Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Some of the following is from my book, “The Complete Guide to Market Breadth Indicators,” published by McGraw-Hill in 2005, with the Second Edition now available in Amazon Kindle format.

“The noblest pleasure is the joy of understanding.” Leonardo da Vinci

Market Breadth

Market breadth indicators are those indicators that...

READ MORE

MEMBERS ONLY

Dancing with the One That Brung Ya!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

My apologies to the late Darrell Royal, the University of Texas football coach who used this saying often when defending his continued use of the “wishbone T,” an offensive football formation that some were always questioning. The saying has a valuable message that is applicable to many endeavors; simply, do...

READ MORE

MEMBERS ONLY

Hindenburg Omen

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are many who are now talking about the Hindenburg Omen so I thought I would explain what it is and where it now stands. This is easy since I knew Jim Miekka (creator of the Omen) as he offered to assist me when I included some of his material...

READ MORE

MEMBERS ONLY

Article Summaries 8-2016 to 10-2016

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Most blog authors on StockCharts.com are writing about the current markets and do an exceptional job. I do not write about the current markets as I wanted to share my experiences after 40+ years as a technical analyst. Not only experiences with trading and investing, but model building and...

READ MORE

MEMBERS ONLY

Time for Genuine Concern or just More Wall of Worry?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Is this a market correction? Generally accepted levels (-10%) that most deem as a correction versus just a market pullback (-5%). Is this going to become a bear market (-20%)? First, there is not a person on Earth that knows the answer (despite what you hear on TV), and I...

READ MORE

MEMBERS ONLY

WHY Are So Many Esoteric Things Attached to Technical Analysis II

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is the second in a series with the first few paragraphs the same as the first one. I am not sure why there are so many vague and totally subjective analysis techniques that have become part of technical analysis. Probably because the main stream Wall Street and their marketing...

READ MORE

MEMBERS ONLY

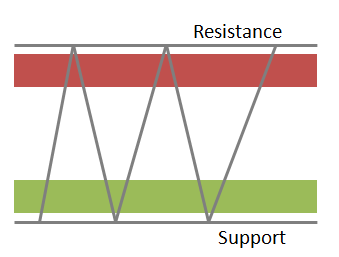

WHY Support and Resistance Works

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Support and resistance are mainstays in technical analysis; sadly, misused and abused by many. The purpose of this article is to hopefully explain why they work when used properly. I have to admit that when I first got interested in technical analysis and charting, I drew trendlines all over the...

READ MORE

MEMBERS ONLY

High Low Validation

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is an attempt to help validate new high and new low data and, to be honest, is still a “work in progress.” If you consider the facts relating to new highs and new lows, you will see the necessity for this. A new high means that the closing price...

READ MORE

MEMBERS ONLY

Scrambling to Safety

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Once a bear market gets underway (nautical term), few will make adjustments to their portfolio. Usually it is well into the decline before most even begin to get concerned, and then they are convincing themselves that it is too late and they might sell right at the bottom. That is...

READ MORE

MEMBERS ONLY

Technical Analysis and Its Return to Prominence

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

When I started in this business, most of my analysis was done with graph paper, colored pencils, and a very expensive red LED calculator (mid-1970s). I subscribed to Barron’s and on Sunday afternoon would sit at my desk (which looked a lot like a kitchen table) and calculated various...

READ MORE

MEMBERS ONLY

The Sales Pitches of Wall Street

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am on record for saying that academic finance is the marketing department for retail (sell side) Wall Street. Note: Sell side is the secondary market where you buy and sell stocks; versus the primary market where capital is raised. Over the years (notice I use that phrase often?) I...

READ MORE

MEMBERS ONLY

Information - Actionable or Observable?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Back in the days of printed newspapers, magazines, and newsletters the acquisition of news and information was easier, or so it seemed. The reason it seemed easier is that there was much less of it. Today, with the internet, 24-hour financial media, blogs, and every conceivable method of acquisition, information...

READ MORE

MEMBERS ONLY

Survivorship Bias

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The story about Abraham Wald’s work as a member of the Statistical Research Group during World War II can shed some light into money management (widely disseminated as Abraham Wald’s Memo). Wald was tasked with damage assessments to aircraft that returned from service over Germany, and determine which...

READ MORE

MEMBERS ONLY

Article Summaries 4-2016 to 7-2016

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Most blog authors on StockCharts.com are writing about the current markets and do an exceptional job. I do not write about the current markets as I wanted to share my experiences after 40+ years as a technical analyst. Not only experiences with trading and investing, but model building and...

READ MORE

MEMBERS ONLY

Know Thyself III

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is the third article dealing with cognitive biases that totally screw up your decision making. The first article, Know Thyself, covered anchoring, confirmation bias, herding, hindsight bias, overconfidence, and recency. The second article, Know Thyself II, covered availability, calendar effects, cognitive dissonance, disposition effect, and loss aversion/risk aversion....

READ MORE

MEMBERS ONLY

WHY the Gap Between Analysis and Action?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

When I started getting interested in technical analysis, there was no internet, no Amazon, only bookstores. The investing section was usually quite small and the technical analysis sub-section only had a few books. Fast forward today and things have changed considerably. Fewer bookstores and most available online. Amazon seems to...

READ MORE

MEMBERS ONLY

WHY Are So Many Esoteric Things Attached to Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am not sure why there are so many vague and totally subjective analysis techniques that have become part of technical analysis. Probably because the main stream Wall Street and their marketing department, academic finance, does not follow technical analysis like they do the accepted rubbish from the ivory towers....

READ MORE

MEMBERS ONLY

Overbought / Oversold

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Overbought / Oversold – These terms have got to be the most over-used terms when talking about the markets. Overbought refers to the time in which the prices have risen to a level that seems as if they cannot go any higher. Oversold is the opposite, prices have dropped to a point...

READ MORE

MEMBERS ONLY

WHY I Have Faith in Technical Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are many reasons I use technical analysis instead of some of the other analysis methods, but more importantly I have faith in it. Read on!

The other popular discipline is called fundamental analysis. This method of investing is essentially based upon fundamental ratios or as they are often called...

READ MORE