MEMBERS ONLY

Sector Spotlight: Explosive Move in Stock/Bond Ratio Coming?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at last week's performance and rotations for asset classes and stock sectors. After the break, I move on to share my views on various levels of the investment pyramid, highlighting the possibility for an explosive move in the stock/bond...

READ MORE

MEMBERS ONLY

DISH is a New Short in the RRG L/S Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I present Long/Short or Pair Trading ideas in my weekly Sector Spotlight show on StockCharts TV. During the past few months, I have started to track these ideas as a portfolio. This is by no means an advisory service or a model portfolio of any...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG L/S Basket Update

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I cover rotational developments over the last two weeks for asset classes and sectors. After that, I take a look at the current positions in the Long/Short basket, which is up well over 10% since March.

This video was originally broadcast on October...

READ MORE

MEMBERS ONLY

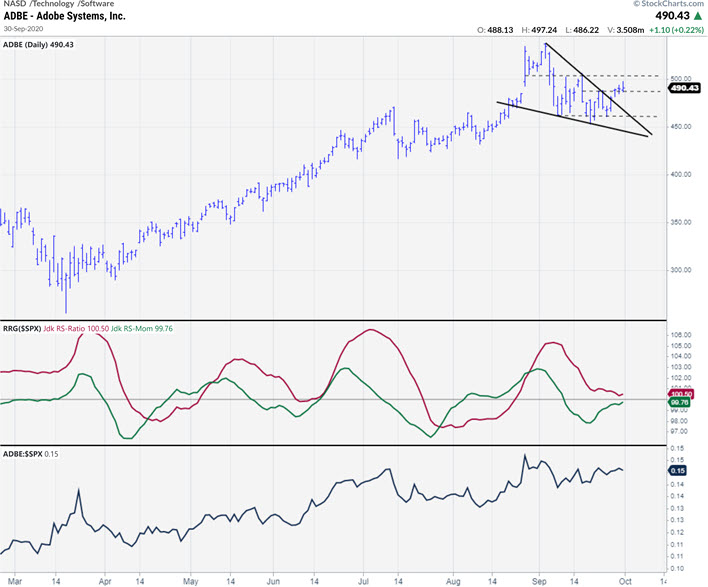

ADBE Setting Up For a New Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the daily price bars for ADBE, in combination with the RRG-Lines and raw Relative Strength.

There are two reasons to use this chart today. The first is to make sure all of you are aware of the rapid further development of the new ACP platform here...

READ MORE

MEMBERS ONLY

Sector Spotlight: Tech & Comm Rally Into October

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, with September drawing to an end, I dive into the monthly seasonality, finding some very interesting seasonal patterns for Technology and Communication Services on the one hand and Energy and Health Care on the other. History suggests a 2% out-performance for Technology in October,...

READ MORE

MEMBERS ONLY

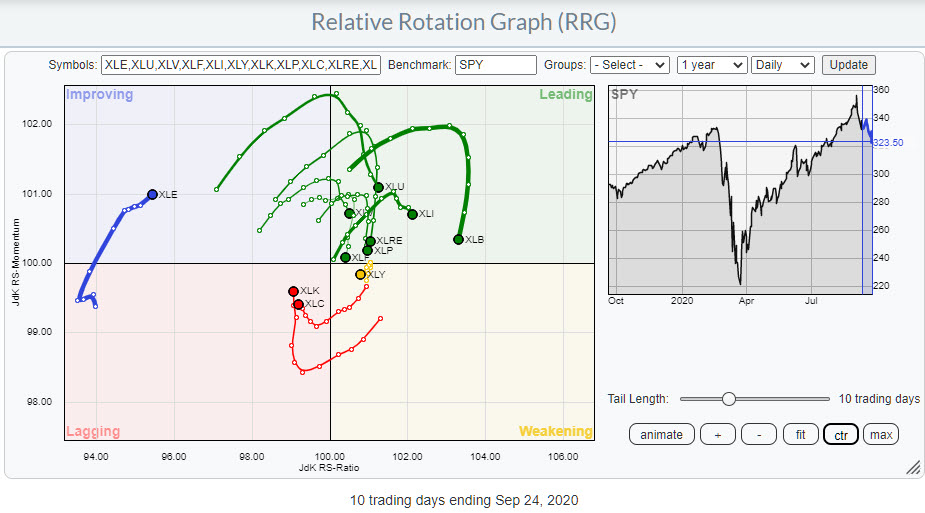

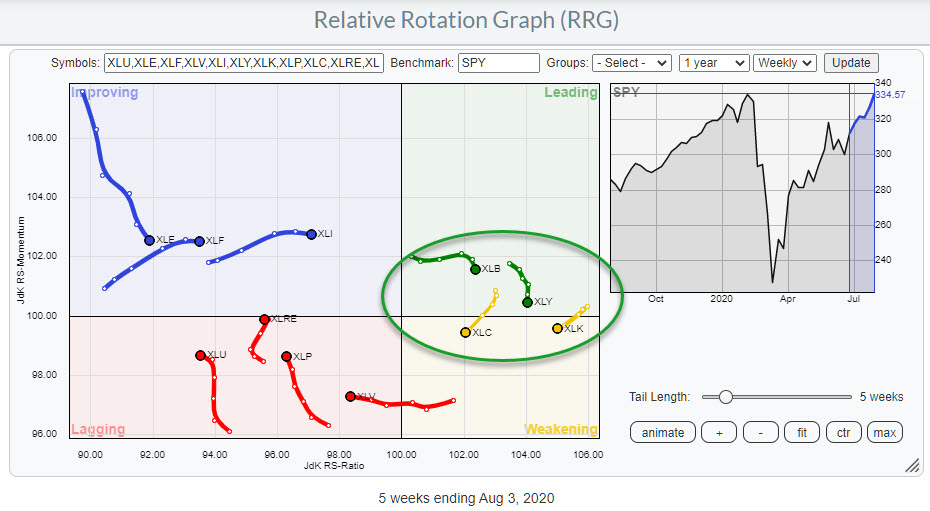

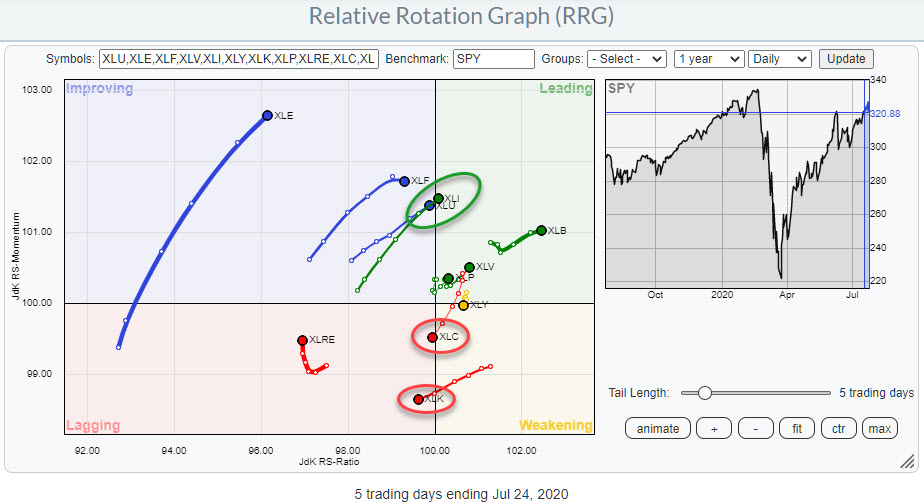

Short Term Rotations Put XLC and XLK Back in Favor Again on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The erratic rotations that we discussed last week are still ongoing. Looking back at the rotational action on the RRG for US sectors last week shows that the focus of investors is shifting back to Technology and Communication Services again.

Despite being inside the lagging quadrant, XLK showed the strongest...

READ MORE

MEMBERS ONLY

What Does It Mean When Sectors Fly All Over the Place?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation for US sectors on a daily basis over roughly the last two weeks.

The most important observation that we can make from this image is that the rotation currently is very erratic. The tails do not last very long in one quadrant...

READ MORE

MEMBERS ONLY

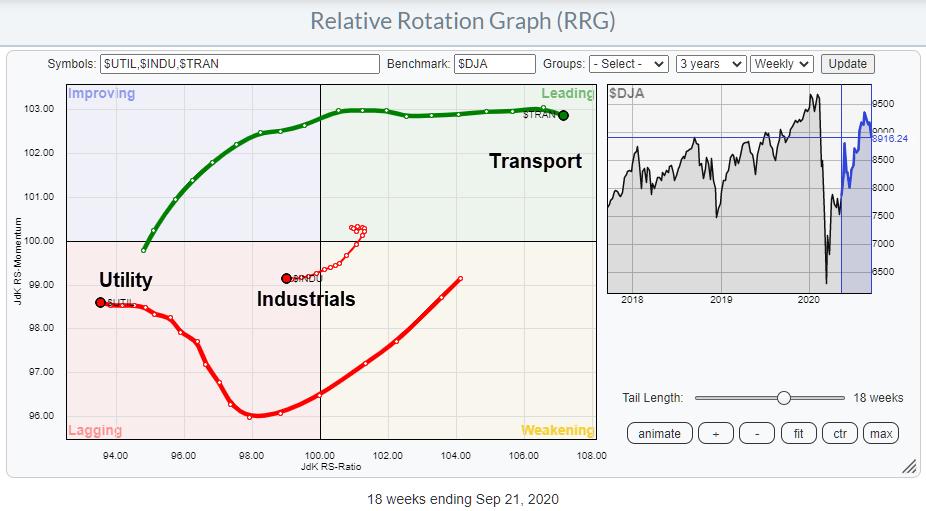

Breaking Down the Dow Jones Composite Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The S&P 500 and the Nasdaq 100 are probably the most discussed charts/indexes. The Dow Jones Industrials is probably the most well known index. From an RRG point of view, the breakdown of the S&P 500 into its sectors is probably the most-watched RRG.

But,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Erratic Rotation Signals Uncertainty

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I spend the show talking about current market rotations. I begin with the overview of last week's rotations in asset classes and US sectors, then switch to weekly charts to step away from the erratic daily rotations; this way, I can get...

READ MORE

MEMBERS ONLY

Daily Rotations Look Erratic

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation for US sectors on a daily basis at the start of this new week (20.09.21).

The most important observation that we can make from this image is that the rotation currently is very erratic. The tails do not last very...

READ MORE

MEMBERS ONLY

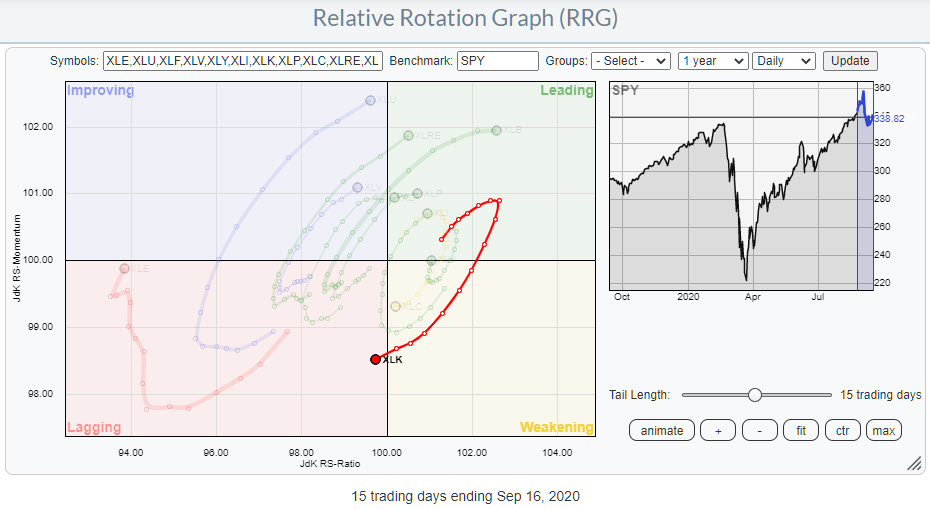

Is the Technology Sector at Risk?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At yesterday's close XLK, the technology sector, rotated into the lagging quadrant. This happened a few times since the market started to rally out of the March low. On the daily chart to be exact.

On the weekly RRG, XLK remained far to the right inside the leading...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Full Mailbag

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I present the usual look at the rotations for Asset Classes and US Sectors via Relative Rotation Graphs. In addition, the better part of the show is spent on answering questions from the mailbag. These questions range from slowing down animations on RRGs to...

READ MORE

MEMBERS ONLY

XLC and XLK Continue to Lose Relative Strength, Which is Picked Up by the Rest of the Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, the rotations for the Communication Services and Technology sectors continued on their trajectory deeper into the weakening quadrant, heading towards lagging. As always with relative strength, one sector's loss is another sector's gain - or, in this case three sectors' losses are the...

READ MORE

MEMBERS ONLY

Are We Just Coming Out of a Full Recession?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

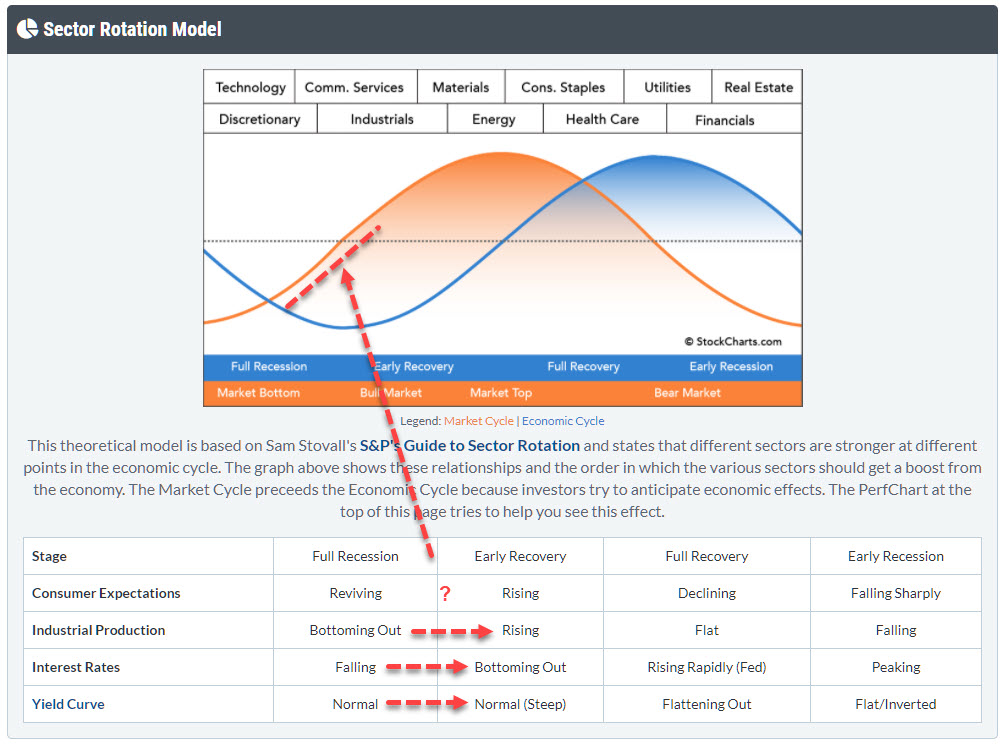

With markets flying everywhere from day to day, I want to take a step back in this article and look at the bigger economic cycle picture, in order to see if we can fit things into the "Sector Rotation Model" as it can bee seen under the PerfCharts....

READ MORE

MEMBERS ONLY

Where Is All That Money Going To?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week's selloff primarily hit some mega-cap names in Technology, Communication Services and Discretionary stocks. For sure, it shook up markets pretty well and, as usual, the selling of risk assets led to an inflow into risk-off assets like bonds and more defensive sectors.

Another ways of breaking...

READ MORE

MEMBERS ONLY

Sector Spotlight: Long/Short Basket Up 8%

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I break down the events of last week's volatile price action and how that translates into the tails on the Relative Rotation Graphs; I then put these price moves into a slightly longer-term perspective. Julius also dives into the Long/Short baskets,...

READ MORE

MEMBERS ONLY

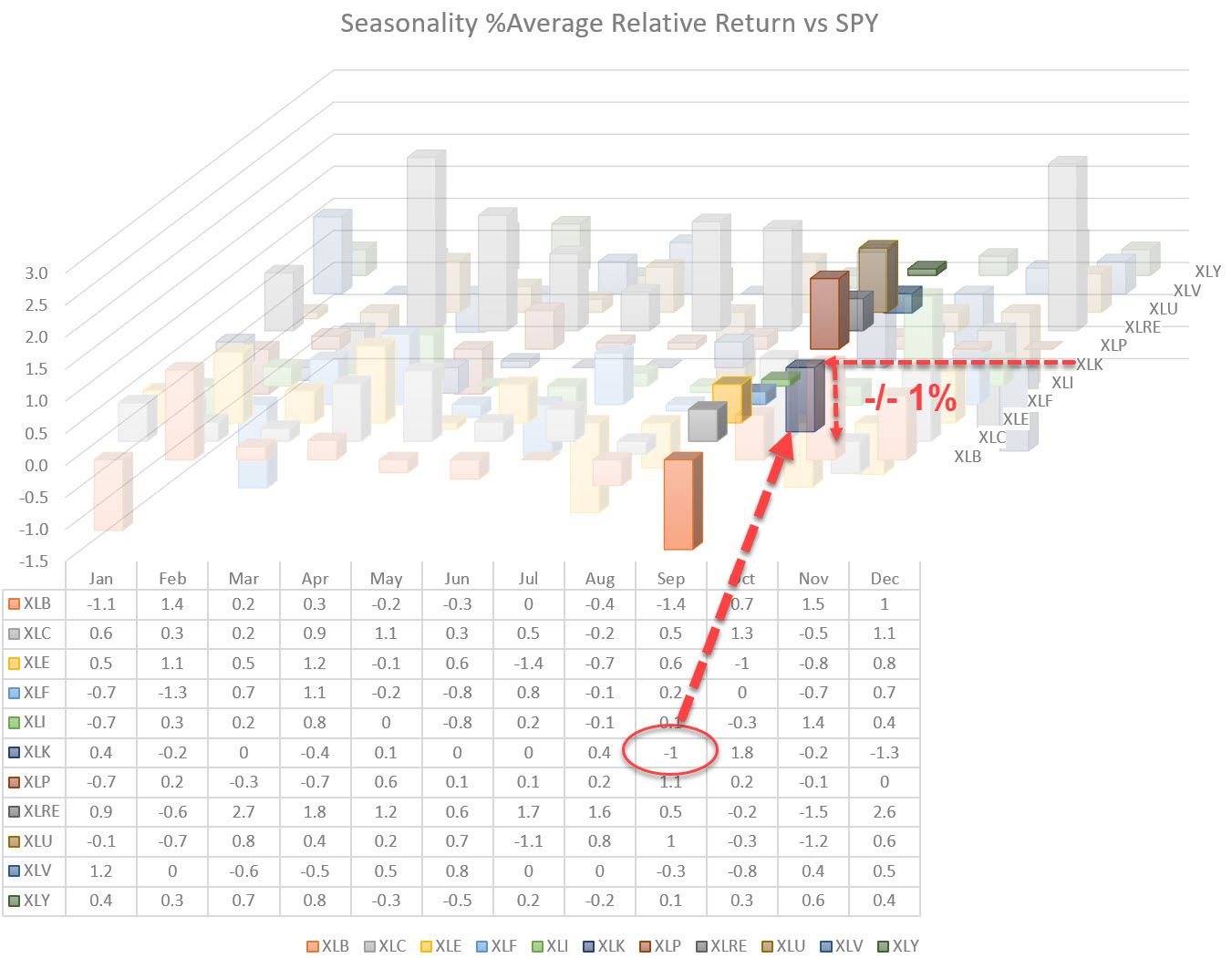

Seasonality Expects a Decline For SPY in September and an Underperformance for Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Tuesday in Sector Spotlight, as well as in my last article of the RRG blog, I discussed seasonality for US sectors. While going over the table showing the average returns per sector per month, my eye fell on another number... the minus-one percent (-1%) for the Technology sector. This...

READ MORE

MEMBERS ONLY

Sector Spotlight: Avoid Materials in September

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at last week's rotations using daily Relative Rotation Graphs and go over the completed monthly charts for August to catch up on the long-term trends. After the break, I analyze the seasonality for US sectors and look for alignment of...

READ MORE

MEMBERS ONLY

September Seasonality Points to Sector Rotation from Materials into Communication Services

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The graph above shows the percentage of months in which sectors have outperformed the S&P 500 in the past. For most sectors, the data go back 20 years, with the exceptions of XLC and XLRE, as these sectors were only introduced more recently and the historical data does...

READ MORE

MEMBERS ONLY

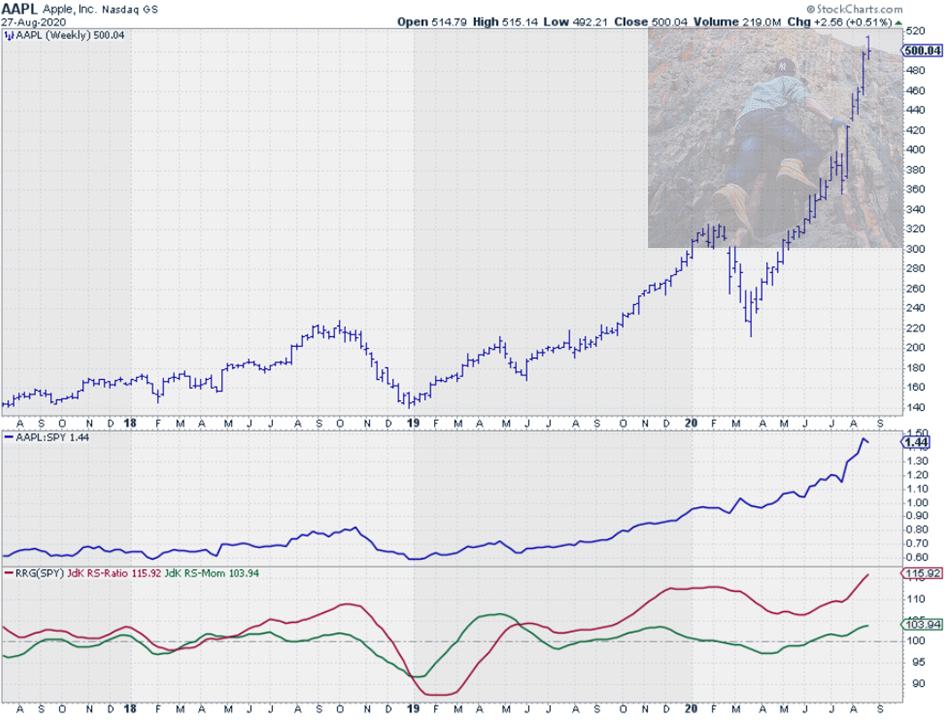

Swap From XLK to RYT to Mitigate The Increasing Risk For AAPL

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, I wrote an article titled "What Can We Learn From Equal Weight vs. Cap Weighted Rotations on RRG". In that article, I touched upon distortions between EW and CW sector ETFs because of the large and increasing weight of a few Mega-Cap stocks.

In this week&...

READ MORE

MEMBERS ONLY

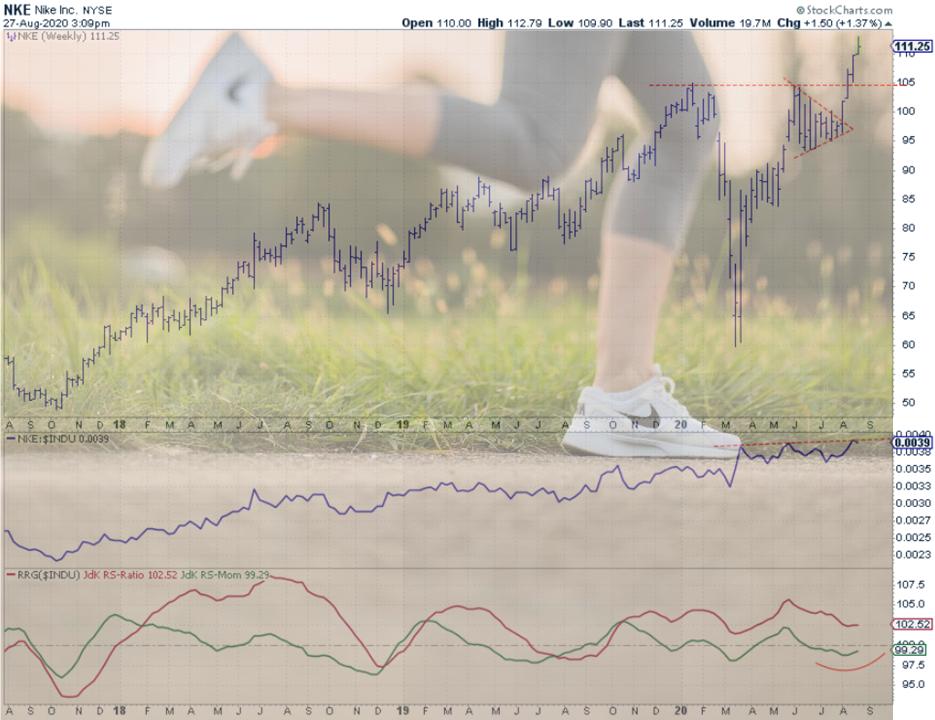

NKE Starts Running!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for the DJ Industrials universe, NKE is inside the weakening quadrant following a completed rotation on the right side of the graph (Leading-Weakening-Leading). And over the last few weeks, the tail on NKE has again started to curl back up. These sort of rotations...

READ MORE

MEMBERS ONLY

Sector Spotlight: Putting Industries Inside Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I work my way through the investment pyramid in a top-down fashion using RRGs. After the break, I analyze an RRG that holds the industry indexes that make up the technology sector to get a more granular handle on the rotations of various groups...

READ MORE

MEMBERS ONLY

What Can We Learn From Equal Weight vs. Cap Weighted Rotations on RRG?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

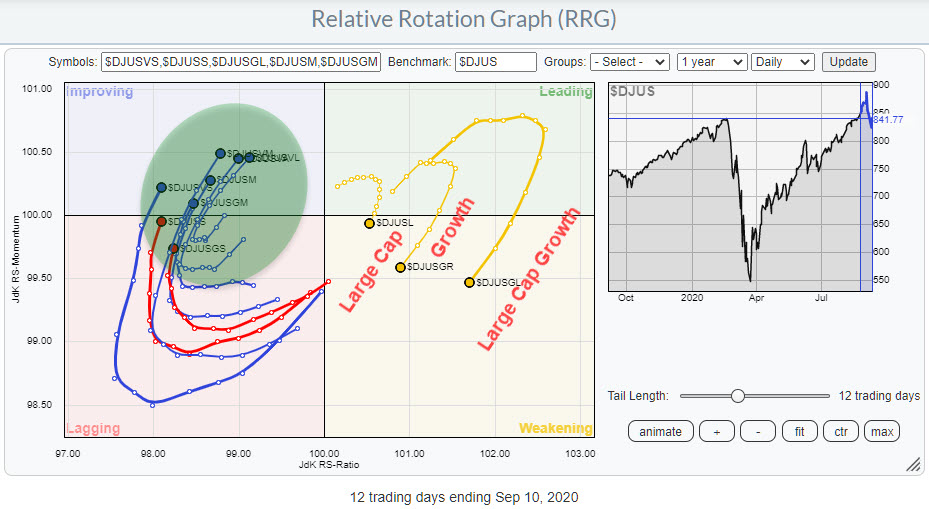

By far the most-watched Relative Rotation Graph is the one that shows the rotation for the 11 S&P sectors, and for good reason; it shows very clearly where the strengths and weaknesses in the various areas of the market are.

But we have to realize that some of...

READ MORE

MEMBERS ONLY

Trains Trump Planes!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Tuesday in Sector Spotlight, I covered the Industrials sector. While looking into the constituents of the sector and the group breakdown, it was pretty clear that the group "airlines" is not doing very well.

UAL, DAL and LUV are all inside the improving quadrant, but they also...

READ MORE

MEMBERS ONLY

Sector Spotlight: Opportunities in the Industrials Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I put last week's rotations for asset classes and sectors into a longer-term perspective. After the break, I perform a deep dive into the industrials sector, showing some stocks with potential but also a group that, as a whole, is better off...

READ MORE

MEMBERS ONLY

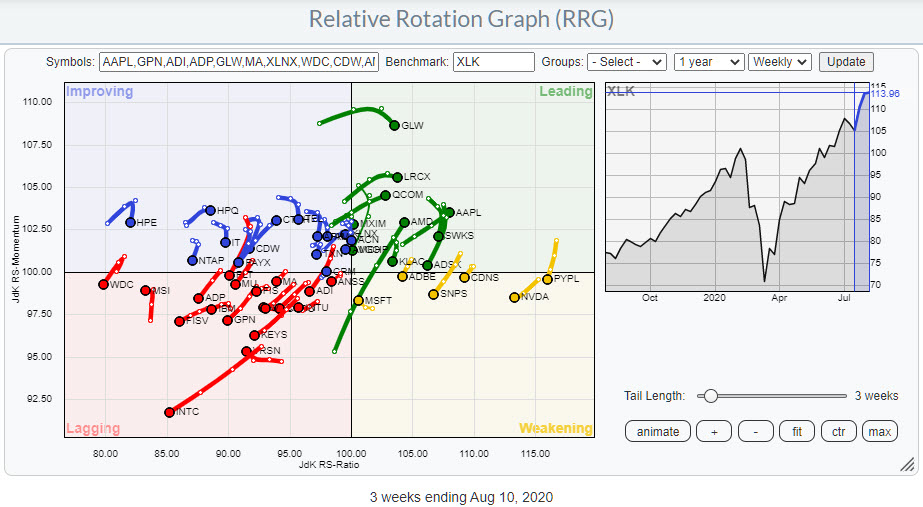

Not All Tech Stocks Look Good... But the Most Important Ones Still Do!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The technology sector sparks a lot of interest, and for good reason - it has turned into a safe(r) haven when things get rough in the markets, but it's also everybody's baby when the market goes up. "What could possibly go wrong?", one...

READ MORE

MEMBERS ONLY

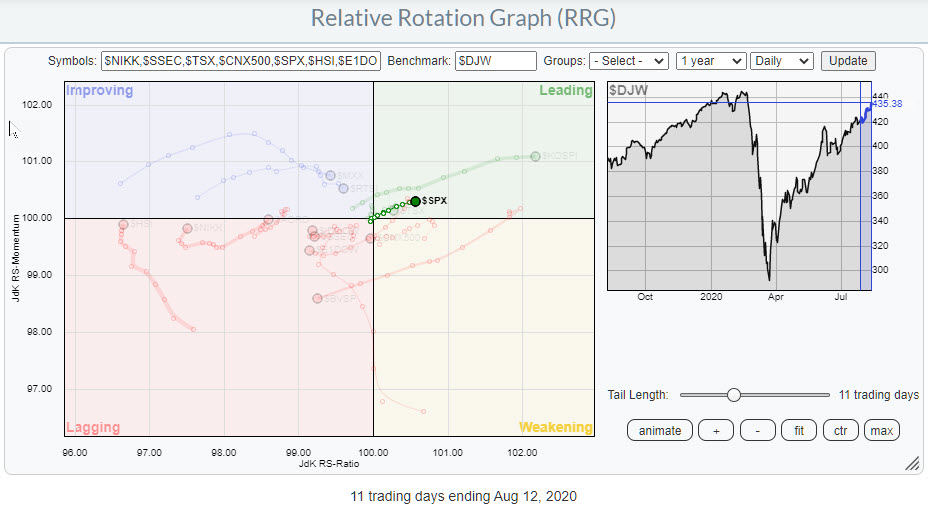

Break to New Highs in $SPX is Crucial for Leadership vs. Rest of the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Towards the end of May, the US stock market ($SPX) started to lose relative strength vs. other major world market stock indexes.

Around that time the $SPX tail vs. $DJW, the Dow Jones Global Index, rolled over inside the leading quadrant and started to rotate into and through weakening. This...

READ MORE

MEMBERS ONLY

Sector Spotlight: Four Interesting Sector Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at the rotations for Asset Classes and US sectors, zooming in on the combination of weekly and daily rotations for Consumer Discretionary, Materials, Communication Services and Technology. After the break, I touch on the current positions in the long short baskets and...

READ MORE

MEMBERS ONLY

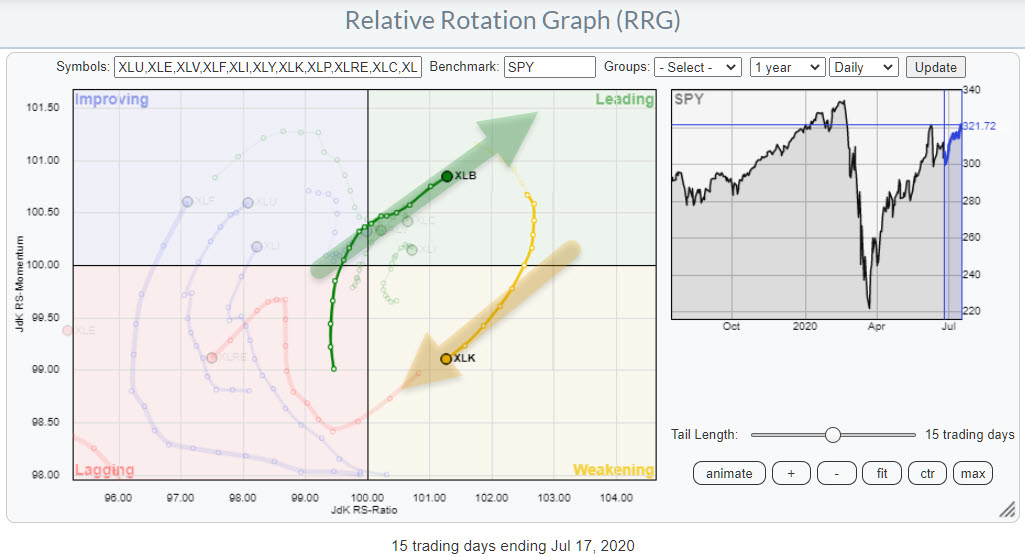

Sector Rotation From Materials and Discretionary to Tech and Communication

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The weekly Relative Rotation Graph for US sectors shows four sectors at the right-hand side of the plot, JdK RS-Ratio > 100 and all seven other sectors at the left-hand side. This indicates that, from a relative strength perspective, the market is driven by only four sectors. But those four...

READ MORE

MEMBERS ONLY

Break from "Pennant" Targets $500 for AAPL

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

To get some inspiration for a nice subject or stock to show in this article, I went to my dashboard, on which I have one widget that shows the most actively traded stocks in the Dow Jones Industrials index.

A nice little gimmick is that you can run an RRG...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds are Looking Good

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As is usual for the first episode of Sector Spotlight of a new month, I take an in-depth look at developments on the monthly charts for Asset Classes and Sectors. There's also a short intermezzo on Flag patterns and a book suggestion!

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

Watching Rotations into Real Estate and Technology (again)...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At the start of the week, two tails on the Relative Rotation Graph for US sectors are showing interesting rotations. These are the tails for for XLRE and XLK.

Real Estate

The positive rotation for the daily tail on the RRG coincides nicely with the improvement for XLRE on a...

READ MORE

MEMBERS ONLY

Will The Next Big Move Be in Bonds?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

(Financial) Markets rotate, that's a given. When we look at the stock market, we call it sector rotation, which is probably the most widely-used term. But there is definitely also rotational action going on in other markets or cross assets. Think in terms of country or regional stock...

READ MORE

MEMBERS ONLY

Real Estate Emerging Out of Doldrums

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Ok, the header image may not be entirely accurate to the message of this article, as it deals with the Real Estate sector which is all about listed REITs, but I could not resist using it ;)

When I looked at the Relative Rotation Graphs for sectors this morning, I noticed...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality and RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's a very full show on this episode of Sector Spotlight. After a quick overview of what happened in asset classes and sectors last week, I take a look at seasonality combined with rotations on the RRG. Finally, I finish up the show by answering two mailbag questions...

READ MORE

MEMBERS ONLY

Sector Rotation Shows Weakness for Technology and Communication Services

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Following Friday's close, we are facing a daily Relative Rotation Graph with some interesting (sector) rotations underway.

Energy

The Energy sector had a pretty good week. This comes after I suggested more weakness for this sector in Sector Spotlight on Tuesday 7/21... I recorded that show on...

READ MORE

MEMBERS ONLY

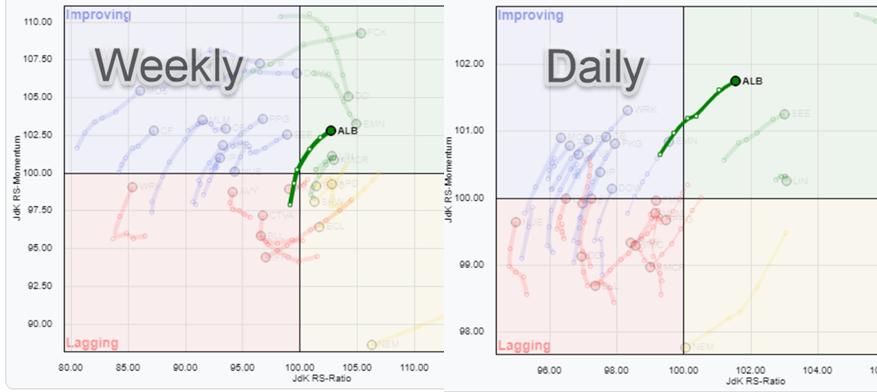

Here's a Materials Stock With Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the Materials sector (XLB) moving into the leading quadrant on the weekly RRG, it makes sense to look for some individual stocks that may offer upside potential. Using Relative Rotation Graphs, we can do just that by loading all members of the Materials sector and using XLBas the benchmark...

READ MORE

MEMBERS ONLY

Sector Spotlight: Short-Term Sector Rotation Out of Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, after a quick overview of Asset Class and Sector rotation, I go over and update my longer-term views using the investment pyramid. In the second half of the show, I give a thorough update of the Long/Short baskets while putting these picks in...

READ MORE

MEMBERS ONLY

XLB Picking Up More Strength as Sector Rotates Further into Leading; XLK Loses Relative Momentum inside Weakening

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for US sectors, there are five sectors rotating at the right hand side of the graph, either inside the leading quadrant (XLB,XLC,XLK,XLY) or inside the weakening quadrant (XLV). On the daily RRG, it's also only these sectors at the...

READ MORE

MEMBERS ONLY

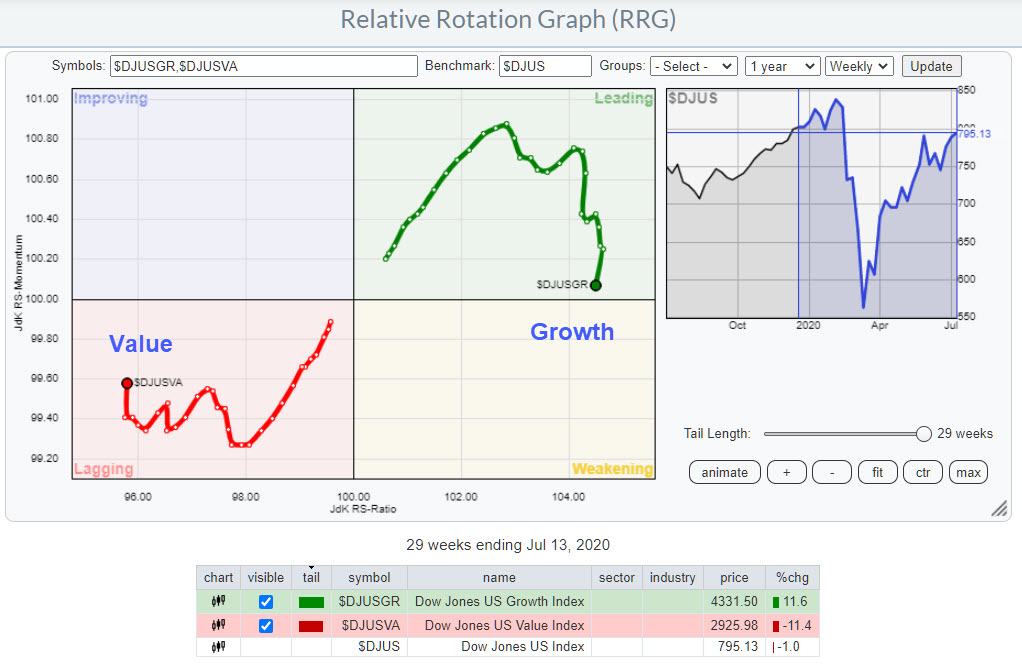

What About Growth vs. Value Going into the Second Half?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The last time Value took over from Growth was at the end of 2018, and even that was only for a short period going into and following the Christmas Crash. But that situation rapidly reversed a few weeks into 2019, when the uptrend in the Growth-Value ratio continued strongly.

If...

READ MORE