MEMBERS ONLY

Are Gold (GLD) and Silver (SLV) Poised for a Rebound?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* US job numbers have stirred up worries about interest rates increasing, impacting the dollar and pushing down gold and silver prices

* Despite the downturn, gold and silver are showing signs of a potential comeback, given their resilience at key price levels

* The bull-bear battlefield can be seen in...

READ MORE

MEMBERS ONLY

Does Japan's Bullish Resurgence Have Staying Power?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* After three quiet decades, Japanese stocks are making a comeback

* The rise is powered by factors like improved company management, cheaper stock prices compared to the US, a weaker yen, and companies giving more money back to shareholders

* The $64 price level is key for the MSCI Japan...

READ MORE

MEMBERS ONLY

A Few Bitcoin Buy Targets (If You're Betting On a Thaw)

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Institutional interest signals end of crypto winter

* Technical indicators show strong bullish momentum in Bitcoin, but also suggest a potential near-term pullback

* Bitcoin is a speculative trade driven largely by sentiment in absence of real fundamentals

Bitcoin has been on a strong but volatile uptrend over the last...

READ MORE

MEMBERS ONLY

Homebuilder Stocks are Soaring, But Is It a Good Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

The May Housing Starts and Permits released this past Tuesday was quite eye-popping, despite riding the back of a disappointing market drop in the Dow, S&P, and Nasdaq.

How so? If you think about it, mortgage rates are averaging a painful 7%+. And still demand for homes rebounded,...

READ MORE

MEMBERS ONLY

How's the US Dollar Reacting to the Fed's Rate Hike Skip?

by Karl Montevirgen,

The StockCharts Insider

Maybe you were expecting the dollar to fall a bit more dramatically (and for gold to rise) when,after the FOMC meeting yesterday, the Federal Reserve announced that it was holding interest rates steady for the first time after 10 consecutive hikes. But the bearish response was a bit lackluster....

READ MORE

MEMBERS ONLY

Unlocking Strong AI Investments: You Need To Analyze These ETFs

by Karl Montevirgen,

The StockCharts Insider

Artificial intelligence (AI) stocks have become popular, almost fashionable. AI is a new frontier, an emerging technology offering unique opportunities and risks -- but is it a smart investment?

Why invest in AI?

AI has the capacity to revolutionize industries, drive economic growth, impact global challenges, and unlock scalable efficiency....

READ MORE

MEMBERS ONLY

Ichimoku Cloud: Looking to the Past to Find Future Trades

by Karl Montevirgen,

The StockCharts Insider

Note: For the sake of brevity, this article will take a bullish and long-only approach. If you're interested in going short, you can apply this information, but in reverse.

How can you efficiently use the Ichimoku Kinko Hyo (aka Ichimoku Cloud) indicator to find trading opportunities, especially when...

READ MORE

MEMBERS ONLY

Scanning for Bearish Engulfing Candlestick Patterns

by Karl Montevirgen,

The StockCharts Insider

It's tempting to think of Bearish Engulfing patterns as the negative counterpart to the Bullish Engulfing pattern because, technically, they sort of are. But the Bearish Engulfing pattern also presents a trading opportunity that's unique to the downside: Stocks tend to fall three times faster than...

READ MORE

MEMBERS ONLY

The AI Boom That Catapulted Tech's Impressive Weekly Outperformance

by Karl Montevirgen,

The StockCharts Insider

It's no surprise that the Technology sector was the most talked-about sector of the past several weeks. AI FOMO was everywhere on Wall Street as Nvidia (NVDA) and other AI stocks pulled ahead of their non-AI counterparts. In the end, Tech stocks, in general, kept the Nasdaq well...

READ MORE

MEMBERS ONLY

Scanning for Strong Reversals via Bullish Engulfing Patterns

by Karl Montevirgen,

The StockCharts Insider

The market's pulling back, but you expect the decline to be short-lived. You believe it's a mere dip, so you're scanning the market for a few stocks that might be on the verge of a strong upside reversal. One pattern you might want to...

READ MORE

MEMBERS ONLY

Is This BUD Still For You?

by Karl Montevirgen,

The StockCharts Insider

BUD's stock price has fallen hard, but it may be at a critical buy point.Is the king of beers (or rather, its parent company) a good buy, or is it something to avoid for now? Let's take a closer look.

What Happened to BUD?

In...

READ MORE

MEMBERS ONLY

Gold's Wild Ride: A Bullish Uptrend or a Bearish Freefall?

by Karl Montevirgen,

The StockCharts Insider

A couple of weeks ago (early May), the price of spot gold reached a high of $2085 an ounce, nearly challenging its all-time high of around $2089 last reached in 2020. Since then, gold's had a rough ride. Last week, prices plummeted almost $30 per ounce thanks to...

READ MORE

MEMBERS ONLY

Contrarian Trading Strategy: Scanning For Stocks to Fade

by Karl Montevirgen,

The StockCharts Insider

Fading an overextended market move is always tricky. Risky too. To go long on something you estimate is oversold, or to go short on an asset you think might be overbought, means capitalizing on a market sentiment misstep. And it takes guts to make a contrarian trade—you're...

READ MORE

MEMBERS ONLY

Bitcoin's Tug-of-War: Navigating the Bearish Trend Amid Potential Bullish Outlook

by Karl Montevirgen,

The StockCharts Insider

Bitcoin bears currently hold a slight edge in the ongoing technical tug-of-war for prices. The 'OG' crypto is about to break below a two-month support level, leaving BTC bulls scouring the next series of local lows either to scoop up more of the crypto or to exit an...

READ MORE

MEMBERS ONLY

Harnessing Momentum: Jumping On the 52-Week Breakout (Before It Happens)

by Karl Montevirgen,

The StockCharts Insider

In the dynamic world of market prices, timing is often everything.

Knowing when to buy or sell is key to a successful trade. But how can you identify the opportune moment to make a move? One strategy many traders embrace involves focusing on stocks breaking their 52-week highs. This is...

READ MORE

MEMBERS ONLY

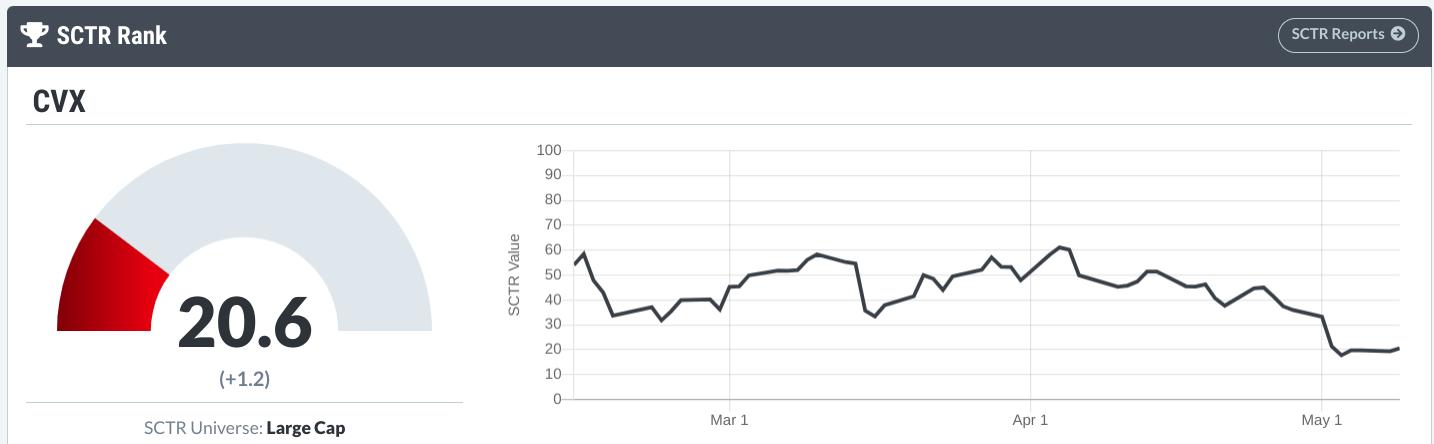

Chevron: Navigating the Intersection of Technical Uncertainty and Fundamental Strength

by Karl Montevirgen,

The StockCharts Insider

Chevron's (CVX) technical health could be in better shape according to numerous indicators best summed up by the StockCharts Technical Rank (STCR)score. Talking about underwhelming performance, CVX is clearly in decline.

But a decline from where and to what? (A better question, perhaps). CVX is declining from...

READ MORE

MEMBERS ONLY

Breakaway Gaps: Scanning for High-Probability Trading Opportunities

by Karl Montevirgen,

The StockCharts Insider

Scanning the market for a tradable "event" might get you an express ticket to the "fast money" line of opportunity and risk. Bear in mind that an "event" is something that has already happened. Jumping on the opportunity means you'll be a...

READ MORE

MEMBERS ONLY

Empowering Your Trading Journey: Handpicked Trading Books Every Trader Should Read

by Karl Montevirgen,

The StockCharts Insider

As a closing gesture to the end of April, which, as you know, was Financial Literacy Month, we're featuring a few trading books handpicked by some of the most respected traders and technical analysts in the field. These books had a strong impact on the people recommending them,...

READ MORE

MEMBERS ONLY

Schwab: Surviving a Banking Bloodbath With a Smile and Swagger

by Karl Montevirgen,

The StockCharts Insider

Charles Schwab (SCHW)'s month-long freefall that started on March 9 was quite a spectacle. It took place amid the Silicon Valley Bank collapse, which triggered a shockwave that impacted the regional banking industry all the way to Wall Street and Main Street.

After the initial hit, SCHW got...

READ MORE

MEMBERS ONLY

The Battle for Burgerdom: McDonald's, Jack in the Box, and Burger King

by Karl Montevirgen,

The StockCharts Insider

Three beef-slinging behemoths are about to go toe-to-toe in an all-out brawl for supremacy over the grease-stained domains of Burgerdom.

Opening Moves

McDonald's (MCD) has deployed its long-slumbering anti-hero, the Hamburglar, to introduce its new menu lineup.

Jack in the Box Inc (JACK) aims to flank its fast-food...

READ MORE

MEMBERS ONLY

Nike Stock: Three Rising Valleys and Running

by Karl Montevirgen,

The StockCharts Insider

If you plan on running up that hill, a pair of Nikes (NKE) could be the right fit for the task. But now, Nike is tackling a similar scenario, running up a Three Rising Valleyspattern—three consecutive higher lows (more on that later). Does the company have enough momentum to...

READ MORE

MEMBERS ONLY

Mild Recession? Three Indicators That Can Offer Insights

by Karl Montevirgen,

The StockCharts Insider

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

It's all about inflation and earnings. Will the Fed continue to raise interest rates after two key gauges of prices came in lower than estimates? After the recent regional bank fallout, will bank earnings be strong enough to lift the Financial sector out of its doldrums?

The government&...

READ MORE

MEMBERS ONLY

Bitcoin Blitzes the $30K Line (But Can It Hold?)

by Karl Montevirgen,

The StockCharts Insider

Bitcoin is something of a paradox. Its name suggests a single and unified "object" (a type of cryptocurrency), yet it's essentially an umbrella term mixing together several conflated and perhaps conflicting views. In other words, there's a lot of sentiment and speculation surrounding a...

READ MORE

MEMBERS ONLY

Riding the Sector Rotation Wave: How to Seize Surging Stocks

by Karl Montevirgen,

The StockCharts Insider

Getting a jump on a sector rotation is like accelerating into a blind curve. What could go wrong? Well, your timing may be way too early. Your sector selection of sectors may be off. You may be pre-empting a false signal. And so on.

The good news is that some...

READ MORE

MEMBERS ONLY

Crude Oil: Obstacles Ahead of $100

by Karl Montevirgen,

The StockCharts Insider

The surprise OPEC+ production cuts last week had investors frantically positioning themselves in anticipation of the opportunities, risks, and opportunity risks surrounding crude oil exposure.

What Just Happened?

On Monday, OPEC+ announced it was reducing its output by 1.16 million barrels per day. The cuts are to begin in...

READ MORE

MEMBERS ONLY

A Quick Scan Tool for a Quick Swing Trade

by Karl Montevirgen,

The StockCharts Insider

There are times when technical merit alone can justify the case for a trade.

The reason for this is that many traders often stick with a familiar list or category of stocks, and for obvious reasons: to avoid trading a stock that you know very little about or to check...

READ MORE

MEMBERS ONLY

NVDA at a Crossroads: Decoding the Signals From Atop a Cloud

by Karl Montevirgen,

The StockCharts Insider

This is a follow-up to a piece published a week ago on Nvidia's (NVDA) strong runfollowing its stellar earnings report. It follows NVDA's price action, but from another angle, using the lesser-usedIchimoku Cloudindicator.

Revisiting NVDA's Price Action

NVDA began outperforming its fellow semiconductor industry...

READ MORE

MEMBERS ONLY

NVDA Stock: Waiting For a Big Plunge?

by Karl Montevirgen,

The StockCharts Insider

Racing ahead of the semiconductor pack, Nvidia (NVDA) appears to be edging toward the upper regions of a parabolic curve.

What Does This Mean for NVDA Stock Price?

It's a sign of confidence coming off a strong Q4 2022 earnings performance on top and bottom lines. NVDA surprised...

READ MORE

MEMBERS ONLY

Trading Legend Larry Williams' 2023 Market Forecast and Trading Setups

by Karl Montevirgen,

The StockCharts Insider

In a recent StockCharts special presentation, Larry Williams revealed his detailed forecast of the broader US market, gold, and stocks Apple (AAPL), AMD (AMD), and Amazon (AMZN).

A Quick Preface to Larry Williams' Presentation

In the early 2000s, at the start of my finance-related career, I came across two...

READ MORE

MEMBERS ONLY

Silver: An Undervalued Monetary-Industrial Hybrid

by Karl Montevirgen,

The StockCharts Insider

Silver is like that drab and boring coworker who you say "hi" to, but never really care to engage.

It may not possess gold's glitz but... it's the only metal that has can boast both monetary and industrial-tech use cases. Its history as money...

READ MORE

MEMBERS ONLY

Campbell Soup: Warm Comfort for an Ailing Economy?

by Karl Montevirgen,

The StockCharts Insider

Two big things about Campbell Soup (CPB):

* First, the company crushed it in earnings last Wednesday. Its second-quarter FY23 results delivered an upside surprise, with an EPS that was 8.37% higher than analysts expected and revenue 2.21% higher than Wall Street estimates.

* Second, CPB is rising from the...

READ MORE

MEMBERS ONLY

Gold Rushed by a Wave of Economic Data

by Karl Montevirgen,

The StockCharts Insider

This week's a big one for gold. A steep wave of fear, greed, and data is about to hit the gold market. It begins with two Congressional testimonies by Fed Chair Jay Powell on Tuesday and Wednesday, the ADP Employment report and JOLTS report on Wednesday, the weekly...

READ MORE

MEMBERS ONLY

This Semiconductor ETF is Hitting a Critical Juncture

by Karl Montevirgen,

The StockCharts Insider

In the next few days, SMH (VanEck Semiconductor ETF), along with other similar "chip index" funds, may see a strong bounce toward the upside.

What's going on? Technically speaking, the semiconductor index just broke out of a head and shoulders bottomon January 23, and now the...

READ MORE

MEMBERS ONLY

Target: Poised for an Explosive Breakout?

by Karl Montevirgen,

The StockCharts Insider

Target (TGT)'s stock has been bouncing back and forth within a wide eight-month trading range. This happened right after its -44% plunge between April and May last year. Since then, it's been stuck in a $45 range, forming an extremely long rectangle pattern.

Why's...

READ MORE

MEMBERS ONLY

A Broad Market Bounceback or Bear Rally?

by Karl Montevirgen,

The StockCharts Insider

Driving into a dense fog of economic data can sometimes trigger something of an analytical spinout, where directionality and objects on the road are first felt, via gravity and impact, before they're seen. The January Personal Consumption Expenditure (PCE) report released this morning added another layer to this...

READ MORE

MEMBERS ONLY

Can Walmart Weather the Storm?

by Karl Montevirgen,

The StockCharts Insider

Walmart's (WMT) stock price jumped slightly over half a percent last Tuesday upon releasing its Q4 2022 earnings report. The retailer topped Wall Street's earnings and revenue estimates. And, despite expectations of a retail slowdown in the coming quarters, the company's guidance matched the...

READ MORE

MEMBERS ONLY

Roblox Bounces Back: Is It Worth Buying?

by Karl Montevirgen,

The StockCharts Insider

Roblox (RBLX) may still be considered by some on Wall Street as a relative "noob," but the company's plans and ambitions are catching the attention of investors as its most recent Q4 22 earnings and guidance laid out a much clearer picture of its perceived arena....

READ MORE

MEMBERS ONLY

Boeing: Taking Flight Amid Cloudy Conditions

by Karl Montevirgen,

The StockCharts Insider

When traders and investors brave the heights of speculative endeavor, clear conditions, fundamentally and technically, are the most you could ask for. But there are cases where fundamentals remain foggy and technical chart patterns seem almost hidden or questionable. This is certainly the case with Boeing (BA), as it took...

READ MORE

MEMBERS ONLY

Disney Stock: A "Small World" Worth Buying?

by Karl Montevirgen,

The StockCharts Insider

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Disney reported Q1 FY23 earnings on Wednesday, February 8, 2023, after the close. The company beat earnings per share and revenue estimates, and total Disney+ subscriptions were higher than expected.

Successive peaks and dips in rapid order may be thrilling for most roller coaster enthusiasts, but, on Wall Street, not...

READ MORE

MEMBERS ONLY

Will Shutterstock Buck the Bear Trend?

by Karl Montevirgen,

The StockCharts Insider

Shutterstock (SSTK), the American creative content solutions firm, has been riding a doozy of a downtrend from October 2021 to the end of 2022. Aside from the bear mauling, SSTK's fundamentals weren't entirely disappointing. There were two positive (yet dwindling) earnings and revenue "beats,"...

READ MORE