MEMBERS ONLY

Wall Street Doesn't Want You to See These S&P 500 Performance Numbers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

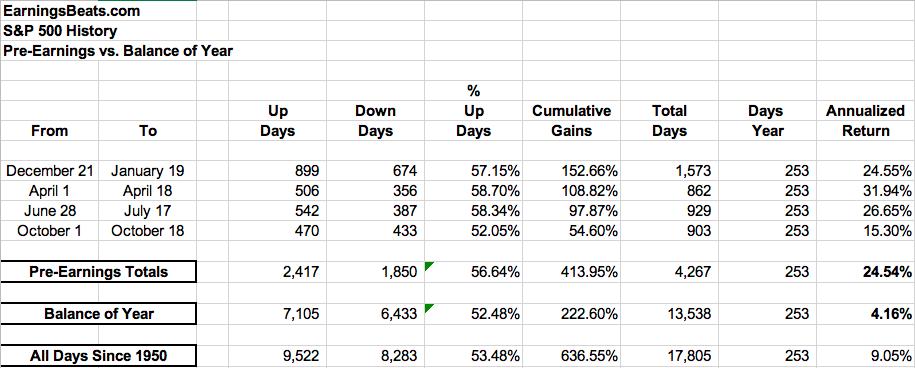

The stock market has a history of running higher in anticipation of earnings season. On the S&P 500, for instance, here are the annualized returns for the following periods since 1950:

This is 71 years of daily data, which is certainly statistically relevant. I don't believe...

READ MORE

MEMBERS ONLY

Be Wary AMC at This Resistance Level and with Options Set to Expire

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, anything can happen in the stock market, but AMC Entertainment Holdings (AMC) has a short-term issue to worry about. Options expire on Friday and there are a TON of options bets placed on AMC for May. At the moment, millions of dollars of net in-the-money call interest exists, and...

READ MORE

MEMBERS ONLY

The Up and Comers and the Stay Away Fromers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Rotation is always a part of a secular bull market. It's honestly the glue that holds everything together. During bear markets, when money rotates away from an area of the market, it usually just moves to the sidelines. Bull markets are different, however, as money typically finds its...

READ MORE

MEMBERS ONLY

And The Most Accumulated Industry During Earnings Season Is.....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

So let me set the stage. At EarningsBeats.com, we're tracking every earnings reaction for companies with $1 billion or more in market capitalization. Through yesterday's close (May 7th), we've now reviewed about 1600 earnings reactions. We've studied them by sector and...

READ MORE

MEMBERS ONLY

One Industry That's Failed Miserably During Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I could provide a solid list of earnings season failure nominees like semiconductors ($DJUSSC), software ($DJUSSW) and medical equipment ($DJUSAM). However, I'm going to give the award to gambling ($DJUSCA). Since the big banks kicked off earnings season on April 14th, we've seen 8 gambling stocks...

READ MORE

MEMBERS ONLY

Is This A "Sell On News" Top? Five Warning Signs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It very well could be. In my Daily Market Report (DMR) to EarningsBeats.com members on Thursday, I discussed this very possibility. I do not believe we're at any MAJOR top, but our major indices have had a significant "pre-earnings" run higher since late March and...

READ MORE

MEMBERS ONLY

How To Keep Up With Hundreds Of Daily Earnings Reports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Right now, we're seeing dozens of companies report quarterly results each day. That's going to change this week as hundreds of companies get set to report earnings every day. How can you keep up with all of it? Well, StockCharts.com's platform provides the...

READ MORE

MEMBERS ONLY

NIO Takes First Few Steps to Reverse Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Once a previously-leading stock begins a journey to the downside, you want to be careful pulling the buy trigger too soon. These downtrends can last awhile, so expecting a quick recovery and buying a pullback can create a lot of short-term pain in your pocketbook. The better option is to...

READ MORE

MEMBERS ONLY

Earnings Drive Equity Prices; Here Are My Two Favorite Earnings Reports This Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the long haul, earnings and Fed policy have more to do with stock market direction than anything. Focus on these two and you'll be just fine. Tune everything else OUT. President Biden's possible tax hike on capital gains was a problem..... for an hour on...

READ MORE

MEMBERS ONLY

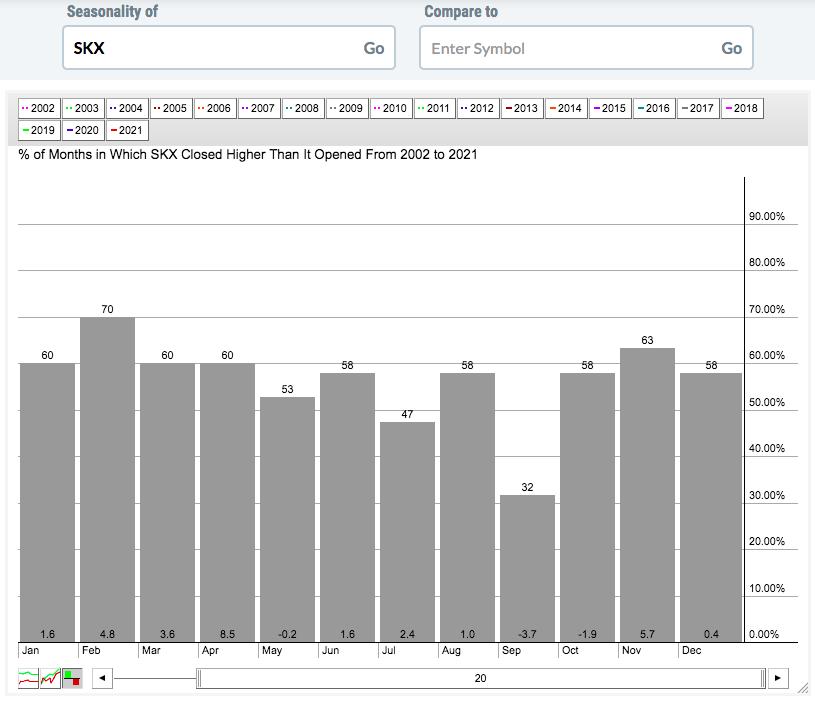

For Skechers (SKX), This Is Where The Rubber Meets The Road

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you held Skechers (SKX) into its quarterly earnings report, which was delivered after the bell on Thursday, congratulations! It was truly a blowout report, like so many others. Wall Street, however, has chosen to reward SKX and its shareholders with the stock up more than 16% at last check....

READ MORE

MEMBERS ONLY

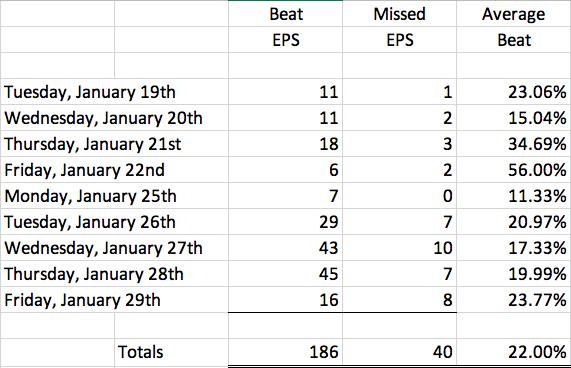

How Much Higher Can We Go? Earnings Will Provide The Answer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is underway and if the first few days are any indication, we're going to see a LOT of blowout numbers. Just since Wednesday, we've seen a couple dozen companies trounce Wall Street consensus estimates. One of the best earnings reports that I've...

READ MORE

MEMBERS ONLY

Why PLUG Could Be Bottoming This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not a big fan of catching a falling knife. And right now, Plug Power (PLUG) is more like a machete. But there are both short-term and long-term reasons why we could see a major bottom print on its chart. Let's start with the technical long-term...

READ MORE

MEMBERS ONLY

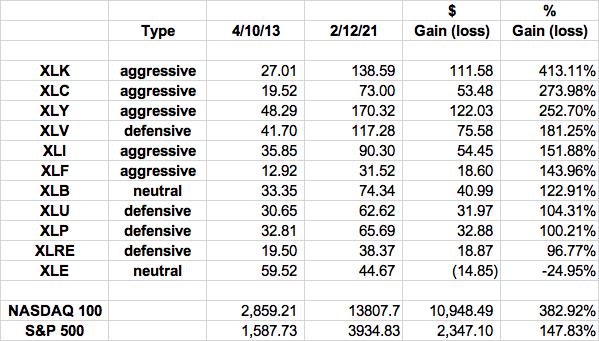

What Are The Best ETFs To Invest In Right Now?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing isn't easy and there are so many choices, even if you narrow your choices and are only looking at ETFs (Exchange-traded funds). The number of ETFs is staggering. How do you put a portfolio together to match your own personal investing style?

That's a difficult...

READ MORE

MEMBERS ONLY

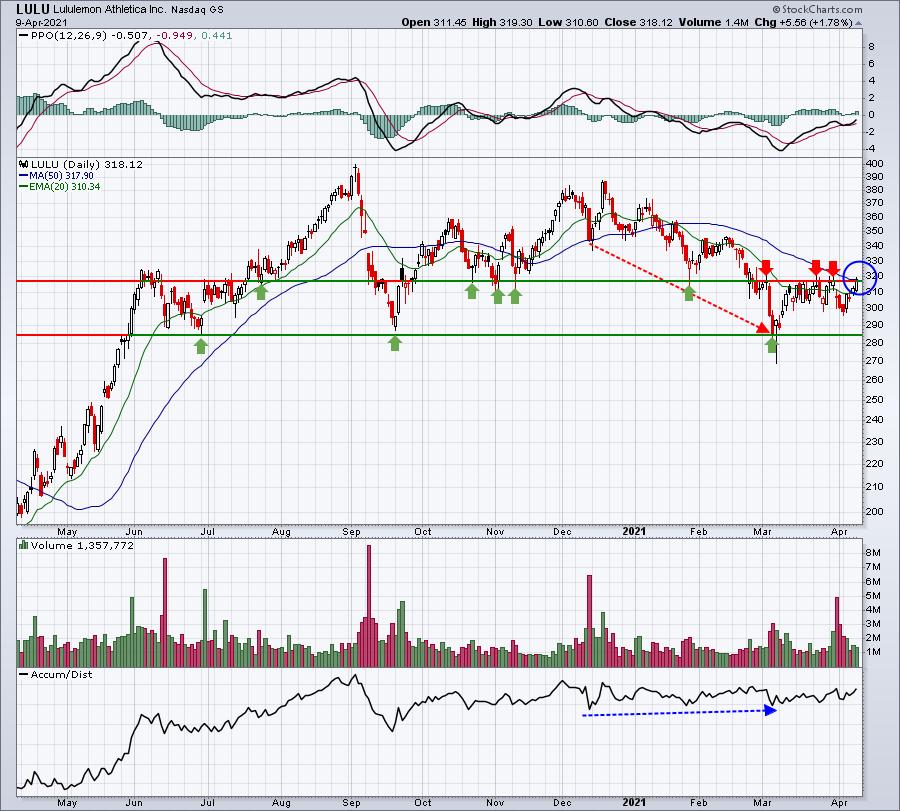

A Downtrending Stock Poised to Explode Higher - Get in Early

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I see a long-term winning stock sell off for a period of weeks, or even months, I always question the motive. If institutions want to buy a large position in a company, it takes time to do so. They don't simply put a market order in for...

READ MORE

MEMBERS ONLY

This Is The ONLY Technical Sell Signal I Use To Spot Secular Bear Markets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Why am I always so bullish? I'm asked this question in many different ways, but I'm very happy to explain my stance - and it's quite simple. Because the stock market goes up a WHOLE LOT MORE than it goes down. Instead of constantly...

READ MORE

MEMBERS ONLY

Here's What Great Earnings-Related Trade Setups Look Like

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love earnings season. Perhaps it's the CPA inside of me, having practiced in public accounting for a couple decades. Maybe it's the excitement of new fundamental information being released that alters the valuation of companies. But mostly, I think, it's the short-term inefficiency...

READ MORE

MEMBERS ONLY

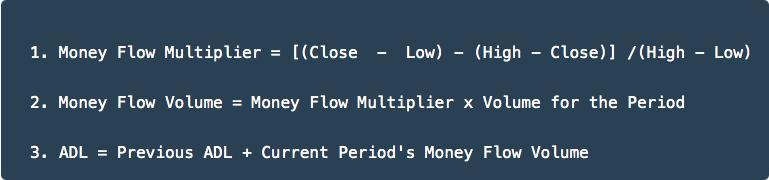

Will The AD Line Matter As We Speed Towards Earnings?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Growth stocks have been hammered on both an absolute and relative basis over the past several weeks, but as we move into earnings season, should we pay attention to rising AD lines? The accumulation/distribution line, developed by Marc Chaikin, doesn't really look at whether the stock is...

READ MORE

MEMBERS ONLY

One Of The Market's Biggest Mysteries..... Solved

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm sure that most of you have heard that old Wall Street adage "buy on rumor, sell on news." Well, it's never truer than with earnings. Wall Street meets with management teams prior to the end of the fiscal quarter and gathers a lot...

READ MORE

MEMBERS ONLY

NASDAQ Prepping For Continuation Breakout?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The NASDAQ has been the unwanted third wheel the past month or so as the Dow Jones has moved above 32000 and 33000 and the S&P 500 has approached 4000. Of course, it's all about perspective and the NASDAQ has been the leader since the pandemic...

READ MORE

MEMBERS ONLY

Options Expiration Inspires March Madness In Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a short-term trading perspective, options expiration presents a host of opportunities. The market makers were at it again this week, looking under every seat cushion for a few extra bucks. The key is to beat them to the seat cushion. Let's rewind to our EarningsBeats.com March...

READ MORE

MEMBERS ONLY

2 Breakouts That Could Provide Tremendous Upside

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've been in a solid secular bull market for years, but the past couple years have been difficult for sure. Still, we've seen plenty of stocks breaking out over and over again (ie, autos, renewable energy, etc.). But not all stocks have participated, even those in...

READ MORE

MEMBERS ONLY

Rising Inflation: It's Coming, But What Impact Will It Have on US Equities?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At the time of my last ChartWatchers article two weeks ago, the 10-year treasury yield ($TNX) had just closed at 1.46% after reaching an intra-week high at 1.61%. Well, we didn't stop there. The TNX had a big day on Friday, gaining nearly 11 basis points...

READ MORE

MEMBERS ONLY

Divergences Don't End The Long-Term Journey - Part 2 of 2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In last weekend's Part 1 of 2, I discussed what divergences are and provided an analogy. Divergences can flash a refueling warning light during a long-term journey higher. If you recall, I illustrated it by using Starbucks (SBUX) as an example:

Divergences can mark long-term tops, but I&...

READ MORE

MEMBERS ONLY

Divergences Don't End The Long-Term Journey - Part 1 of 2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When you look into a technician's "tool kit", you'll likely find a divergence analysis. Generally speaking, any time you have higher prices and lower (fill in the blank) or lower prices and higher (fill in the blank), there's either a negative divergence...

READ MORE

MEMBERS ONLY

This Time-Tested Theory is Screaming To Buy NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know it was a rough week last week; I only need to take one look at my own portfolio to figure that out. But the stock market doesn't go up in a straight line. There will ALWAYS be pullbacks. But be careful which "stories" you...

READ MORE

MEMBERS ONLY

It's DRAFT Day! Another Quarter Is In The Books

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

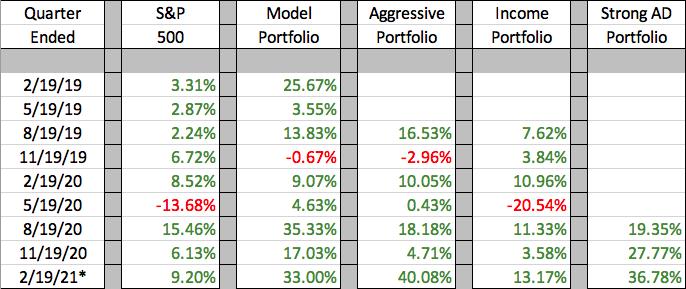

This is an exciting day for EarningsBeats.com and its members. It's the day when we select the 10 equal-weighted stocks for each of our 4 portfolios - Model, Aggressive, Income, and Strong AD. Portfolio results-to-date have been superb and you can check out our holdings the past...

READ MORE

MEMBERS ONLY

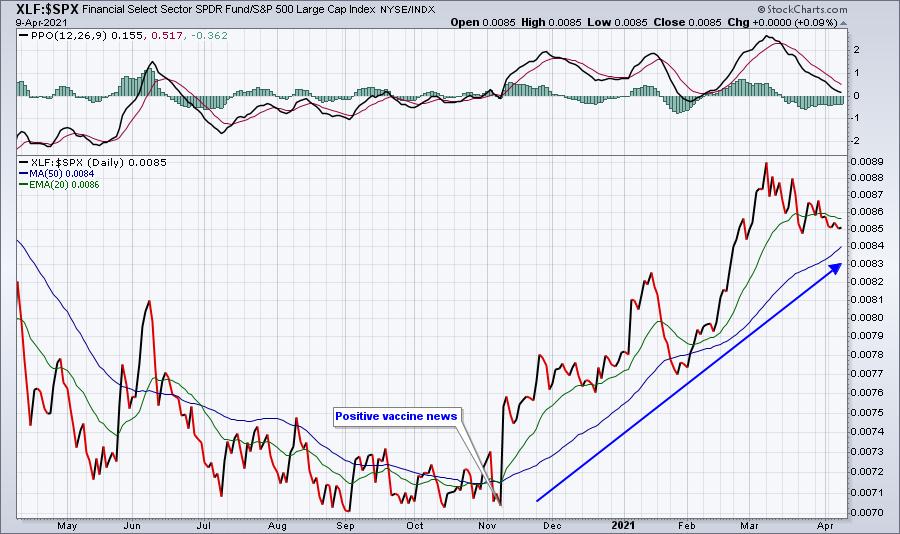

A Major Theme That Will Carry Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I believe the bull market vs. bear market debate has ended. We've been through a trade war, 100-year pandemic, an economic shutdown, a very divisive political battle, mountains of debt, etc., and where do we stand? At an all-time high. That should convince you that we're...

READ MORE

MEMBERS ONLY

Rotation To Small Caps Continues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've seen a hiccup the past few days, but overall money has rotated strongly into small caps. There are a couple ways to visualize this rotation. I tend to use price relative charts so that I can view the relative momentum on a historical basis. To do this,...

READ MORE

MEMBERS ONLY

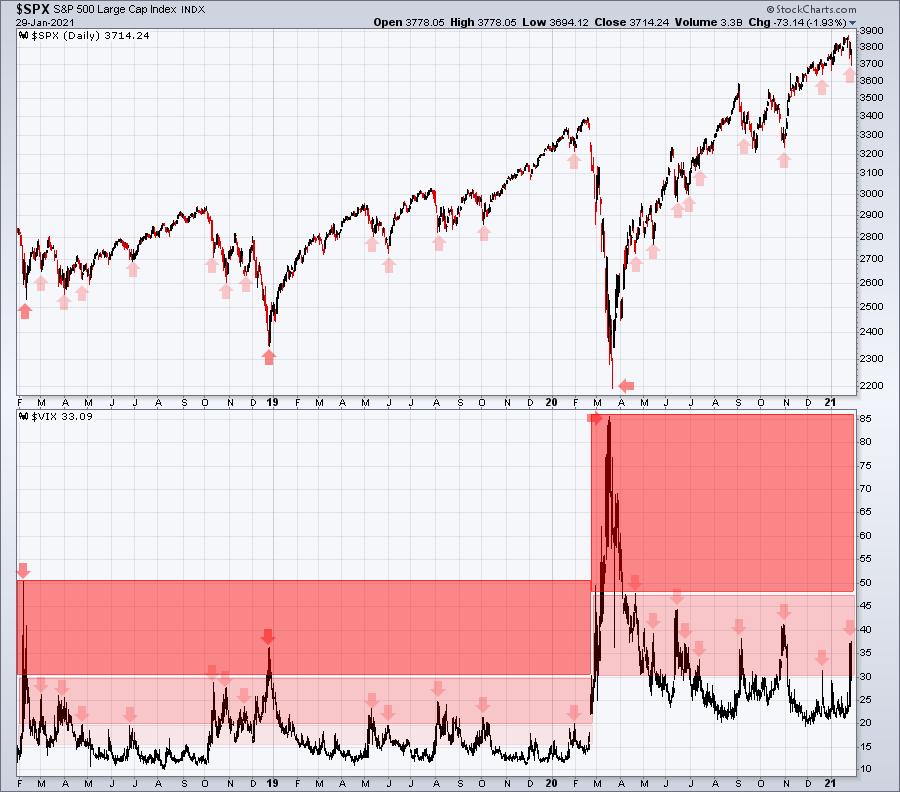

Why Friday's Drop On VIX Below 20 Is Significant

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy Valentine's Day!

The Volatility Index ($VIX) is one of the sentiment indicators that I pay close attention to. So many sentiment readings deal with "feelings", which I tend to discard. I want to know what is actually going on with THE MONEY. Don't...

READ MORE

MEMBERS ONLY

Explaining Our Investing Methodology Prior To Our Next "DRAFT"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When we go through our quarterly portfolio "draft" at EarningsBeats.com, we take a top down approach. We first evaluate the overall market to determine if we're bullish, neutral, or bearish. Clearly, we're bullish. The S&P 500 closed at an all-time high...

READ MORE

MEMBERS ONLY

Earnings are Driving the Market, But There are Two Road Blocks Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The quarterly earnings that have poured out are utterly amazing. We're not just talking slight beats; Corporate America is CRUSHING it and the pent up demand hasn't even kicked in yet. In the meantime, the Fed is content to sit idly by with interest rates hovering...

READ MORE

MEMBERS ONLY

Here Are All Of Our Portfolio Stocks And ETFs Powering Our Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's hard to believe, but our 9th quarter of Model Portfolio performance is nearing an end. Barring a last minute collapse, we will outperform the S&P 500 for the 8th time in those 9 quarters. I'm proud of the performance of all of our...

READ MORE

MEMBERS ONLY

Are You Ready For Another Short Squeeze Play?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know the Gamestop (GME) craze has slowed down considerably, but short squeezes will always be in play. When a stock's float has been heavily borrowed against and borrowed shares sold, those short sellers must buy those borrowed shares back at some point down the road. And when...

READ MORE

MEMBERS ONLY

Earnings Season Is Lighting A Fire Under This Industry Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I want you to look at a 5-year relative chart without titles and, before you look below the chart, see if you can name the industry group that's been responsible for this amazing long-term relative strength:

The relative price action (vs. the S&P 500) has remained...

READ MORE

MEMBERS ONLY

The Most Efficient Way To Track Earnings Reports Every Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Recently, we introduced a newer, very organized way of viewing earnings results at EarningsBeats.com. We call it our Upcoming Earnings ChartList, which our entire community can download into their own StockCharts.com account, assuming that you are either an Extra or Pro members. Others can still view the ChartLists,...

READ MORE

MEMBERS ONLY

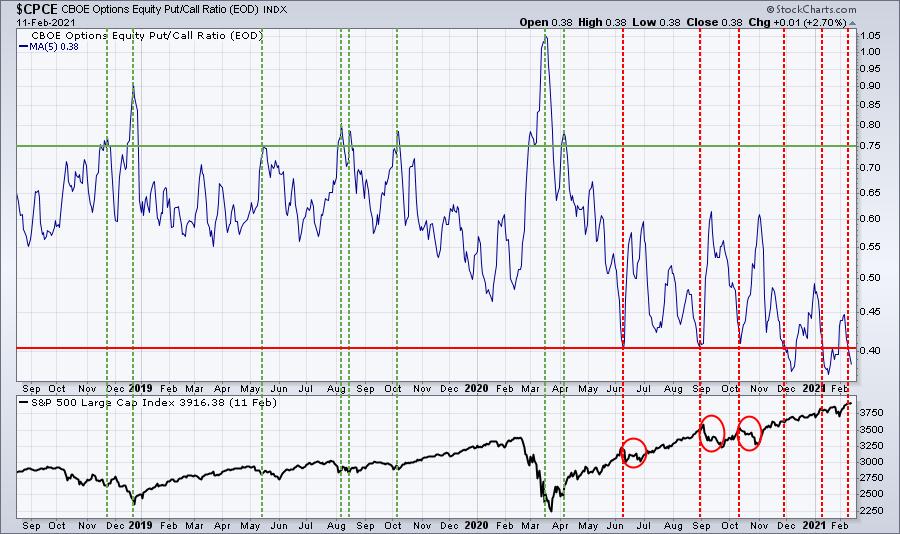

Let The VIX Mark The Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are a number of sentiment indicators in the stock market, but I prefer those that indicate the panic taking place "at the moment", rather than those depicting "feelings". So I've always used the Volatility Index ($VIX) and equity only put call ratio ($CPCE)...

READ MORE

MEMBERS ONLY

STOP Looking For Reasons to Exit The Best Bull Market of Our Lifetime

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just stop.

Listen, the two key drivers to the long-term direction of the stock market are (1) earnings growth and (2) monetary policy. That's it. The rest is completely noise that you need to tune out.

Most humans are innately pessimistic. It's how we're...

READ MORE

MEMBERS ONLY

3 Small Semiconductor Stocks Looking To Report Blowout Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You can usually tell whether a strong earnings report is upcoming simply by the way a stock is trading prior to earnings. Wall Street has one major advantage over the rest of us. They contact management teams throughout the quarter and they have a fairly strong idea how business conditions...

READ MORE

MEMBERS ONLY

The Bull Market Is Punishing Those Who Do Not Believe

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have written countless articles on the art of buying stocks in a short squeeze or on the verge of being in a short squeeze. The results can be truly astounding. I'm going to walk you through three recent short squeezes. If you owned ANY of these three...

READ MORE

MEMBERS ONLY

Short-Term Manipulation Hammers Enphase Energy (ENPH) On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Follow my logic:

You expect ENPH to go higher, so you buy 10 calls at XX strike price on ENPH. The market maker that sells you those 10 contracts employs a covered call strategy and buys 1000 shares of ENPH. (This protects the market maker as ENPH's stock...

READ MORE