MEMBERS ONLY

This Stock Should Blow Away Earnings Tomorrow Morning (Plus One That Won't)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wall Street has been accumulating stocks over the past few weeks in anticipation of strong results. That doesn't necessarily mean we'll see a positive reaction to those earnings, because there's the old "buy on rumor, sell on news" adage that frequently comes...

READ MORE

MEMBERS ONLY

Here's How I'd Build A Portfolio Of ETFs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

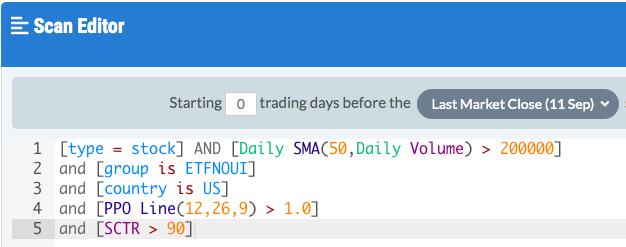

Selecting and investing in ETFs is a daunting task. I ran a very basic scan to identify all of the ETFs to consider and this is what was returned:

There were 999 ETFs returned. That's helpful. NOT! The 999 ETFs returned were listed in alphabetical order by ticker...

READ MORE

MEMBERS ONLY

How Does A SCTR Score Go From 50 To 95 In A Month? Here's The Only Company To Do It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

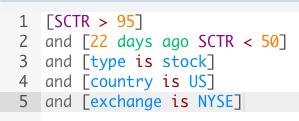

I ran a very simple scan, searching for companies that have been able to make the almost impossible jump in SCTR score from less than 50 to greater than 95 in just one month (22 trading days). Here's the scan I ran:

There were 2 results:

Eaton Vance...

READ MORE

MEMBERS ONLY

Trying to Outperform the S&P 500? You Gotta Pick the Right TEAM

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's not much I'd rather see than a heavy volume breakout in a consolidating stock within a strong industry. Enter Atlassian Corp (TEAM). Some traders let their guard down when a stock consolidates, and it's easy to do because consolidation normally leads to relative...

READ MORE

MEMBERS ONLY

Don't Look Now, But We're Seeing a New Leading Industry Group Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Those who follow me know that I'm constantly monitoring the current leaders and watching for new leadership. It's one piece of technical analysis that helps in selecting our portfolio stocks. The best way to beat the benchmark S&P 500 is to follow the strength...

READ MORE

MEMBERS ONLY

Auto Strength Resuming, These Two Leaders Breaking Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we like to line our portfolios with leaders, and I believe the following chart of autos ($DJUSAU) qualifies as leadership:

We're seeing weakness today in our major indices, but not in autos. Two leaders in this space currently reside in our portfolios and are helping...

READ MORE

MEMBERS ONLY

Evaluating The Likelihood Of An Earnings Beat, PLUS One Company That's Benefiting From The Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If there's one thing we do really well at EarningsBeats.com, it's evaluate earnings reports and the stock market's reaction to them. I'd even take it one step further. I believe we anticipate upcoming earnings very well. There's a lot...

READ MORE

MEMBERS ONLY

Be VERY Careful If You're Trading Peloton (PTON)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, I'm a big fan of PTON. It was one of my 5 stock picks from StockCharts TV's "The Pitch", which aired on April 1st of this year. It traded at near 27 at the time. Yesterday, PTON closed above 127. That's...

READ MORE

MEMBERS ONLY

Finding The Right ETFs To Manage Risk And Beat The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Starting today at 4:30pm ET, EarningsBeats.com is excited to unveil a Sneak Preview of its latest product, the Model ETF Portfolio. The concept is rather simple. We plan to do the research to provide our members with a Strong ETF ChartList, highlighting the best performing ETFs from a...

READ MORE

MEMBERS ONLY

It's Baaaackkkkk! Top 5 Stocks For Q4 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Back on April 1st, in the midst of the COVID-19 pandemic, the initial episode of The Pitch was aired on StockCharts TV. Grayson Roze, VP of Operations here at StockCharts.com, Mary Ellen McGonagle, President of MEM Research, and I joined host David Keller and provided our Top 5 stocks...

READ MORE

MEMBERS ONLY

Ready For a Melt UP? Bears, It's Checkmate!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain firmly in the secular bull market theory camp. We're going higher. Forget about politics, civil unrest, the virus, the deficit, the economy, blah, blah, blah. Money flow, the Fed and historically-low interest rates will fuel higher prices. While each of those is extremely important in the...

READ MORE

MEMBERS ONLY

Transportation Stocks Are Confirming More Bullish Action Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's generally a very good sign to see transportation stocks ($TRAN) breaking to new highs. Currently, the TRAN is at an all-time high and all signs are pointing to continuing strength, as far as I can tell. Transports do well when our economy is strong or when it&...

READ MORE

MEMBERS ONLY

My 10 Favorite Stocks On An RRG Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

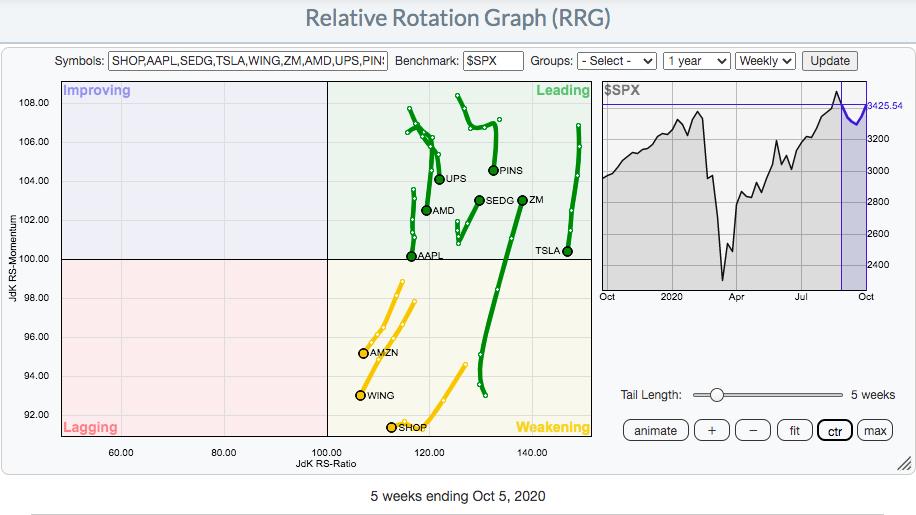

A week ago, I published an article here in the Don't Ignore This Chart blog highlighting two renewable energy stocks ($DWCREE) - SEDG and ENPH. Both have gained in the 25%-30% range in one week. It illustrates how trading leading stocks in leading industry groups can pay...

READ MORE

MEMBERS ONLY

Are We Seeing Significant Rotation? Check Out These 3 Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The secular bull market is alive and well and the list of industry groups in breakout mode is growing. In addition, there are a few on the cusp of a breakout that bear watching. When a group breaks out, money flows to that area, creating tons of trading/investing opportunities....

READ MORE

MEMBERS ONLY

How Can We Tell When The Pandemic-Stricken Groups Begin To Lead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a really good question and one that I'm researching. My view has been (and remains) that the stock market is in a multi-decade secular bull market, one that will carry us into the 2030s. There will be cyclical bear markets along the way, similar to...

READ MORE

MEMBERS ONLY

Ever Wondered How To Create A User-Defined Index (UDI) At StockCharts.com?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, I plan to host a free webinar on Saturday to demonstrate how we use this cool StockCharts.com feature to track our portfolios at EarningsBeats.com. In the StockCharts.com "Support Center", you'll find many examples of why you might want to consider using a...

READ MORE

MEMBERS ONLY

Solar Edge (SEDG) and Enphase Energy (ENPH) Break Out, Lead Renewables

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Leading stocks in leading industry groups.

If you've struggled with your investments, read that line over and over again. Investing in leaders will change your returns and likely alter your opinion about your chances to outperform the overall market. Our Model Portfolio has now returned +148.21% in...

READ MORE

MEMBERS ONLY

Q4 Holds Big Challenges, Are You Ready For Them?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We held a "Market Vision 2020" event at EarningsBeats.com back on January 5th and were joined by several long-time StockCharts.com contributors, including John Murphy. I credit John for a lot of my intermarket relationship knowledge as his work over the years truly inspired me to learn...

READ MORE

MEMBERS ONLY

Bullish Rotation Suggesting Bottom Is In; 2 Downtrend Reversal Candidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

First, just over one year ago, I returned to EarningsBeats.com as its Chief Market Strategist. I want to thank all of you that have supported me in my return. I think we've weathered a brutal year in great fashion. Here are the one year returns on...

READ MORE

MEMBERS ONLY

Buy on Rumor? I'm Expecting A BIG Pre-Earnings Surge in These 3 Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ever heard of the old Wall Street adage, "buy on rumor, sell on news"? You most likely have and, in my opinion, it applies more to earnings season than anything else. Wall Street firms send their analysts out to meet with management teams prior to the end of...

READ MORE

MEMBERS ONLY

Tesla (TSLA) Is Being Accumulated, Not Distributed - Check Out These 2 Indicators!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I think it's fair to say that most investors look at whether their stock is going up or down in determining whether a stock is being cumulatively bought or sold. That was a big, big mistake back in March as fear-mongering headlines created panic at the opening bell,...

READ MORE

MEMBERS ONLY

Running a Scan to Find a Potential Short Squeeze

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Short squeezes can result in explosive upside moves. We saw it at the end of 2019 with Tesla (TSLA). Once the stock broke 400, it absolutely flew to the upside. One reason why was that breakout triggered buying from short sellers, who realized that their losses were unlimited as TSLA...

READ MORE

MEMBERS ONLY

Is The Bottom In On The NASDAQ?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I believe it could be.

In my Daily Market Report to EarningsBeats.com members, I pointed out a couple very positive short-term developments. First, the S&P 500 pulled back to 3229 yesterday, EXACTLY a 10% correction from its recent all-time high. Extremely bullish sentiment readings suggested that September...

READ MORE

MEMBERS ONLY

A Massive Short Squeeze Has Sent This Stock Higher By 75% In 3 Weeks!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stocks that are heavily shorted are stocks that we should generally avoid. There are normally very good reasons, both technically and fundamentally, why a company has so many bets placed against it. Buying stocks that are not performing well simply because they're heavily shorted makes about as much...

READ MORE

MEMBERS ONLY

Sentiment Issues Have Evolved Into Technical Issues - Be Careful!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

This is a copy of today's DMR that I just sent to our members. I believe we're setting up for a HUGE rally in Q4 and the current weakness will provide tremendous opportunities. In the very short-term, however, we need to get through the next...

READ MORE

MEMBERS ONLY

What Impact Will Monthly Options Expiration Have In September?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's max pain time.

Every month as we approach monthly options expiration, I go through an exercise to evaluate the open interest of puts and calls to help determine the likely short-term direction of equities. It provides me no guarantee. Rather, it serves as another tool in my...

READ MORE

MEMBERS ONLY

Building A Winning Portfolio Of ETFs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we provide market guidance and analysis of the major indices, sectors, industry groups, and individual stocks. Our research provides our members with various ChartLists to organize strong trading candidates by categories such as Strong Earnings, Strong AD, Short Squeeze, etc. Over the years, I've never...

READ MORE

MEMBERS ONLY

The Importance of Rising Growth vs. Value Ratio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I follow a very simple ratio every day, which is the iShares Russell 1000 Growth ETF vs. the iShares Russell 1000 Value ETF (IWF:IWD). This ratio tells us whether traders have the necessary risk appetite that typically drives equity prices higher, especially the NASDAQ, which is littered with high-growth...

READ MORE

MEMBERS ONLY

Here are 3 Ways to Calculate S&P 500 Downside Targets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Despite remaining very bullish, I've written several short-term bearish articles lately, mostly dealing with extreme sentiment issues. Those sentiment extremes have been rectified and are no longer a problem, but they've now changed the mentality in the market from "buy on the dip" to...

READ MORE

MEMBERS ONLY

This Short Squeeze Stock Has Gained 170%+ In A Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When you own a stock in a short squeeze, your investing world looks a lot brighter. There are many traders that live and die with short positions, which I'll never understand. But hey whatever works, right? I'm not an advocate of blindly buying heavily shorted stocks...

READ MORE

MEMBERS ONLY

2 Sentiment Indicators Are Suggesting Extreme Caution - BEWARE!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me start with the fact that I'm as bullish as they come in the long-term, so everything written here is for short-term traders only. Many times the market ignores short-term sentiment warning signals, so please don't misconstrue anything I'm about to write as...

READ MORE

MEMBERS ONLY

This is Why I'm Not Impressed with FSLR's Near 7 Year Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's always important to be prepared when a stock has challenged a key price resistance level multiple times and it's testing it again. First of all, if a stock does make a breakout technically, it's normally followed later by the fundamental news that triggered...

READ MORE

MEMBERS ONLY

4 Breakouts Last Week That You Need To See

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A secular bull market runs on all cylinders. I'm a believer that we remain in the early stages of a bull market that will likely last another decade or longer. How else can you explain the S&P 500's move to an all-time high in...

READ MORE

MEMBERS ONLY

Key Sentiment Indicator is Flashing a Major Short-Term Warning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you've followed my work, you know three things. First, I'm one of the few analysts that kept my long-term secular bull market call intact despite the pandemic-induced selloff back in March. Second, while my big picture view is firmly bullish, my primary focus is on...

READ MORE

MEMBERS ONLY

Biotechs Are Trending Lower BUT Sending A Major Bullish Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

During the midst of the financial blow in March due to the pandemic, I realized that not all stock selloffs were created equal. While most stocks moved lower at the open, many were being bought, or accumulated, throughout the trading day. It was at that point that I ditched the...

READ MORE

MEMBERS ONLY

Here Are The Biggest Concerns I Have Heading Into My Quarterly "Draft Day"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we announce the portfolio stocks for each of our 4 portfolios on February 19th, May 19th, August 19th and November 19th. We then hold those 10 equal-weighted stocks in each portfolio until it's time to announce new stocks.

Well, it's August 19th. It&...

READ MORE

MEMBERS ONLY

Amazon.com (AMZN) Makes a Delivery to Investors - A Continuation Pattern Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After an uptrend, I always look for a continuation pattern, especially when I believe we're in a major secular bull market advance. Well, look no further than Amazon.com (AMZN), which doubled in price from its March low to its early-July high. Since that stunning advance, AMZN had...

READ MORE

MEMBERS ONLY

Delivery Services Is Dropping This Small Cap Winner Off At Your Door

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not sure if there's a hotter group right now than delivery services ($DJUSAF). Both United Parcel Service (UPS) and FedEx Corp (FDX) blew earnings right out of the park. They crushed both revenue and EPS estimates and the market has responded with institutions seemingly accumulating...

READ MORE

MEMBERS ONLY

Here are 3 of the Fastest-Gaining Momentum Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past five months, since that March low, we've enjoyed many stocks' relentless pursuit to the upside. I know it's hard, however, to keep chasing those stocks as their prices move into what seems the stratosphere. So I set out to find stocks that...

READ MORE

MEMBERS ONLY

Gambling Stocks Are Looking For A WYNN-Win

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many of the worst-hit stocks during the pandemic are leading this latest rally and, among those, are gambling stocks ($DJUSCA). The group broke out yesterday above July highs and now has its collective sight set on the June 8th closing high of 747. Wynn Resorts (WYNN), one of the bigger...

READ MORE