MEMBERS ONLY

UPS vs. FedEx: It's Like Splitting Hairs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earlier today, I was a guest on "Your Daily 5" and I featured 5 charts that I believe we should all be focused on right now. One of the charts I discussed was the Dow Jones U.S. Delivery Services Index ($DJUSAF), which has exploded higher after two...

READ MORE

MEMBERS ONLY

The Aftermath of 2020: What Will It Look Like?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Somehow, we've been able to weather the storm that's called 2020. I'm speaking from a stock market perspective. The health care crisis has taken its toll and continues to take its toll and impact our everyday lives. But if you pulled up an S&...

READ MORE

MEMBERS ONLY

Waters Corp (WAT) Tests Key Gap Support - Could be a Great Trading Opportunity!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When a stock gaps higher and keeps running, it generally tells me that the top of gap support is what we need to concern ourselves with. It's definitely not a guarantee that it holds, but the odds are greater. When I trade stocks, it's all about...

READ MORE

MEMBERS ONLY

Here's Another Stock Setting Up Exactly Like AMD Did, Just Before Its 70% Rise In 5 Weeks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a big fan of buying stocks at support. On June 29th, Advanced Micro Devices (AMD) tested a very important price support level and printed a reversing hammer candlestick that same day. In my Daily Market Report to EarningsBeats.com members, I suggested mid-day that a bottom could...

READ MORE

MEMBERS ONLY

Building Our 6 Pillars (ChartLists) Of Trading

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, welcome to August! It's hard to believe that we're into our 8th month of 2020. It's been a very difficult year on a number of fronts, but I hope that EarningsBeats.com has at least been able to help you navigate through the...

READ MORE

MEMBERS ONLY

Our Model Portfolio Is +118% In 21 Months; Here Are The 10 Equal-Weighted Stocks That Comprise It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every three months, we fill out our four portfolios with 10 equal-weighted and leading stocks, mostly in leading industries. We combine fundamental research and technical analysis to make our money work harder, which is the whole idea. We know there's a strong correlation between earnings growth rates and...

READ MORE

MEMBERS ONLY

A Solid Way To Find Great Short Squeeze Candidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Too many traders focus on the wrong things when looking for a big short squeeze. It's not about how many short shares there are for a particular stock. And it's not about high short percentage of float. And, quite honestly, it's not even about...

READ MORE

MEMBERS ONLY

Two Of The Strongest Industry Groups Just Keep Getting Stronger

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's no secret that I like finding leading stocks in leading industry groups. In my view, however, THAT is the secret sauce in building a portfolio to outperform the benchmark S&P 500 over time. Of course, there will be hiccups along the way and we'...

READ MORE

MEMBERS ONLY

TSLA Has Likely Topped, But How Far Could It Fall?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been one common denominator thus far in earnings season: high-flying stocks have seemed to hit a brick wall after posting earnings - even spectacular, way-above-consensus-estimates earnings. That was my biggest question as we headed into earnings season. I knew the numbers would be incredible across several different...

READ MORE

MEMBERS ONLY

To Buy Or Not To Buy?? That Is The Gap Question

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading earnings-related gaps is what I like to do. It's what we do at EarningsBeats.com. Well, we do lots of things at EarningsBeats.com, but doing our homework and preparing our members to trade earnings-related gaps is certainly high on our list. It always amazes me to...

READ MORE

MEMBERS ONLY

Raising Guidance Can Result In A BIG Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That seems rather plausible. After all, earnings are one key factor that drives stock prices. But, in this case, I'm referring specifically to Big Lots, Inc. (BIG). It's part of a very strong industry group, broadline retail ($DJUSRB), which set a new 52-week relative high vs....

READ MORE

MEMBERS ONLY

Internet Stocks Remain Strong And This One Could Explode Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We can talk about earnings, the economic outlook, technical conditions, etc., but to be quite honest, the real keys to successful investing/trading come down to timing, patience, and managing risk. At EarningsBeats.com, we do all the research for our members. We provide so many trading opportunities and literally...

READ MORE

MEMBERS ONLY

These 3 Industries are Poised to Deliver Companies with Blowout Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been patiently waiting for the BIG breakout, the one that really kickstarts this group. I believe we just saw it on Friday. Health Care (XLV) definitively made its move after already recently providing some very bullish clues. After weeks and weeks of sideways action, in which the...

READ MORE

MEMBERS ONLY

Health Care Is Starting Another Leg Higher; Here Are A Few Trading Candidates To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is today's Daily Market Report (DMR) that I send to EarningsBeats.com members every day. Today's focus was definitely on health care (XLV). I've been waiting for a few months for its sideways consolidation to resolve and we're getting that now:...

READ MORE

MEMBERS ONLY

Will Truckers Live Up To Their Pre-Earnings Hype? This Week Provides Our First Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When a stock, industry group, or sector breaks out before earnings season, that's generally a signal that Wall Street is anticipating solid results. Whether the breakout is sustained, however, boils down to the actual earnings results. In the case of trucking ($DJUSTK), the breakout has been made. This...

READ MORE

MEMBERS ONLY

From The Mailbag: When Should I Chase A Gap And When Should I Wait For A Gap Fill?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a question directly from one of our EarningsBeats.com members and it honestly goes right to the heart of my trading strategy, so I thought it was a great question to answer and share with everyone. Because I deal so closely with earnings, gaps are a huge part...

READ MORE

MEMBERS ONLY

This Relative Strength Configuration In An Industry Group Tells Us Everything We Need To Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm constantly discussing relative strength, and I don't just discuss it with respect to individual stocks. I want to know where money is rotating to among industry groups. It's why I keep an industry group relative strength ChartList at EarningsBeats.com. I view every...

READ MORE

MEMBERS ONLY

Will 2020's 2nd Half Be Strong? Watch This Chart for a Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Transportation stocks ($TRAN) are important because they tend to go higher and drive the S&P 500 higher when the economy is strong, expected to strengthen, or both. Off of the 2009 market bottom, the best advances on the S&P 500 during this secular bull market have...

READ MORE

MEMBERS ONLY

Are You An Aggressive Trader? If So, You Might Like These 2 Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I try to minimize risks as best I can. That means generally trading only companies that are in Wall Street's good graces. In order to get there, I believe it's really important for companies to deliver on their promises. It's called "under promise...

READ MORE

MEMBERS ONLY

One Thing Always Drives Stocks Higher..... And It'll Happen Again During 2020's Second Half

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fear is an almost uncontrollable emotion. And when you combine that with financial anxiety, it typically results in predictable fashion - a "throw the baby out with the bath water" selling event. But the good news is that, once the masses grow fearful enough, stock markets rally. After...

READ MORE

MEMBERS ONLY

As July 4th Approaches, Watch the PEs Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats, we've been trying to tell anyone willing to listen why the stock market is going higher. I was definitely among the tiny minority back in March and April when I suggested that this downturn was a cyclical bear market within a secular bull market. I think...

READ MORE

MEMBERS ONLY

Tesla (TSLA) Is Driving Through Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tesla has been a leading auto stock ($DJUSAU) since it bottomed at 176.99 on June 3, 2019, but few traders expected the stock to clear the $1,000 barrier in just over a year. It's been a crazy run, but Wall Street continues to support the stock...

READ MORE

MEMBERS ONLY

NASDAQ, Internet, Software All Facing Critical Tests

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

June has been fairly kind to the NASDAQ 100 index ($NDX), technology (XLK), software ($DJUSSW), and internet ($DJUSNS) and these have all been leaders, but the combination of overbought, negative divergences and a weak seasonal period has sent all four down to areas not seen recently. Let's start...

READ MORE

MEMBERS ONLY

Wall Street Is POURING Money Into This Industry Group, Don't Miss Out!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I am constantly performing research, using my analytical skills to uncover the best stock market opportunities. At EarningsBeats.com, we have a proven process of identifying leading stocks in leading industries. It all starts with fundamental research, which helps us to limit the number of stocks in our trading universe...

READ MORE

MEMBERS ONLY

Zoom (ZM) Helps To Lead Our Model Portfolio To Nearly 100% Gain In 19 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I think most market participants would agree that the past 19 months, which has included 2 cyclical bear markets, have been trying, to say the least. At the time our Model Portfolio was created on November 19, 2018, the S&P 500 stood at 2690.73. At Thursday'...

READ MORE

MEMBERS ONLY

7 S&P 500 Stocks That I'm Stalking Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're just showing up at 9:30am ET and deciding last minute which stocks to trade, I think you're doing yourself a major disservice. You also are likely allowing the market to dictate to you which stocks you're interested in. There may be...

READ MORE

MEMBERS ONLY

The U.S. Stock Market Is Becoming One Giant Short Squeeze

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've never understood the attraction to short selling, especially in a secular bull market. I get it - March and April didn't really feel like a big time bull market. But it was still part of one. March represented a cyclical bear market in a massive...

READ MORE

MEMBERS ONLY

Major Rotation Is Taking Place; Short-Term Traders Beware

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a shocking rebound to many, but I believe this party is just getting started. Fortunately, we were able to see the increase in the Volatility Index ($VIX) in late-February as an appropriate warning signal and then quickly realized that much of the selling was nothing more...

READ MORE

MEMBERS ONLY

The Bulls Have Spoken, Now Will Earnings Confirm?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite stocks throughout this pandemic has been Zoom Video Communications (ZM). It's been wildly volatile, but also extremely profitable - if you can hang on through all the ebbs and flows. Bulls' patience is currently being rewarded as ZM absolutely flies into its earnings...

READ MORE

MEMBERS ONLY

Latest Short Squeeze Call Is Strangling The Bears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In developing our Short Squeeze ChartList, which is a fancy name for doing our homework and organizing potentially explosive stocks into one ChartList for our members, we were looking for companies that traders are betting against. When traders believe a company is overpriced, for whatever reason, they sell that stock...

READ MORE

MEMBERS ONLY

How I Scan ChartLists For High Profit Trades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a routine that I've implemented where I typically review market action around 10:00am ET, 30 minutes after the market has opened. It's not at all unusual to see uptrending stocks down in the morning, so running scans at about that 30-minute mark can...

READ MORE

MEMBERS ONLY

NVDA Blows Away Estimates - Exactly What Wall Street Expected

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last night, after the closing bell, NVIDIA Corp (NVDA) did what Wall Street expected - it blew the doors off its earnings. Revenues were reported at $3,080.00 vs. its consensus estimate of $2,995.27 and EPS came in ahead of expectations at $1.80 vs. $1.69....

READ MORE

MEMBERS ONLY

I See An Index Breaking Out, But How Do I Find An ETF That Tracks It?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I review a lot of the Dow Jones industry indices, but one problem is that you cannot trade an index. Naturally, I receive plenty of questions like "how can I benefit from semiconductors if the Dow Jones U.S. Semiconductor Index ($DJUSSC) is breaking out? Obviously, one way would...

READ MORE

MEMBERS ONLY

Three Key Steps To Becoming A Better Investor Or Trader

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've coached sports much of my life and there are two key elements to succeeding in athletics: practice and confidence. Raw talent and athleticism don't hurt either, of course. I don't care how good you might think you are, to excel in sports, or...

READ MORE

MEMBERS ONLY

Stock Market Draft: T Minus One Day And Counting

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's the most exciting time of each quarter for EarningsBeats.com and its community members. We're one day away from the equivalent of the NFL Draft for equities. The beauty of our Stock Market Draft, however, is that no one else participates! We can literally select...

READ MORE

MEMBERS ONLY

This Aggressive Small Cap Stock Is Up 55% In Last 3 Months; More Upside Coming?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a very difficult environment for small caps ($SML) and mid caps ($MID) for quite awhile. We should take note of any stocks in these two asset classes that are moving higher because they're doing so completely against the grain. For instance, take a look...

READ MORE

MEMBERS ONLY

We Have A Raging Bull Market And Suffocating Bear Market Simultaneously; See The Difference

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One part of the U.S. stock market has been setting new highs and dragging other areas higher with it. Then we have groups reaching the depths of despair with little or no end in sight to their selling and misery. I've honestly never seen anything quite like...

READ MORE

MEMBERS ONLY

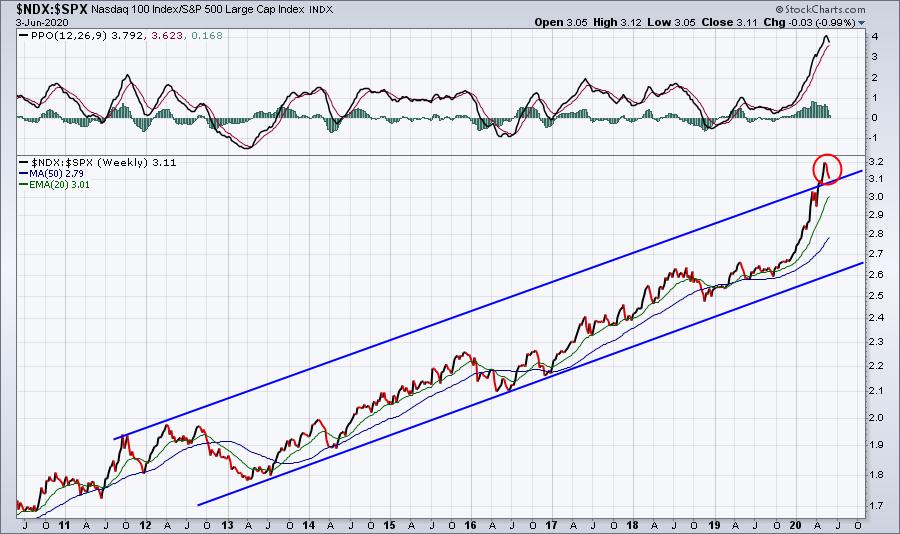

NASDAQ 100 Just Tested Big Short-Term Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Impulsive selling gripped the market yesterday afternoon for the first time in quite awhile and it came on the heels of a few warnings signs that I passed on to EarningsBeats.com members earlier this week. First, the accumulation/distribution line, which has been a HUGE friend of the bulls...

READ MORE

MEMBERS ONLY

Seeing A Short Squeeze Unfold Presents Huge Opportunities; Add This One To Your Watch List

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One thing that this pandemic has caused - and few would disagree - is an inordinate amount of fear. An easy way to depict this is simply to look at the Volatility Index ($VIX) and the equity only put call ratio ($CPCE). When these two spike, it's a...

READ MORE

MEMBERS ONLY

Limit Your Trading Universe To This Group Of Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've run into multiple friends of late, socially-distanced of course, who keep asking me, "Aren't the airlines a great value now?" Ugh. Really? What business can you think of that (a) has lost 95% of its customers AND (b) has little hope of attracting...

READ MORE