MEMBERS ONLY

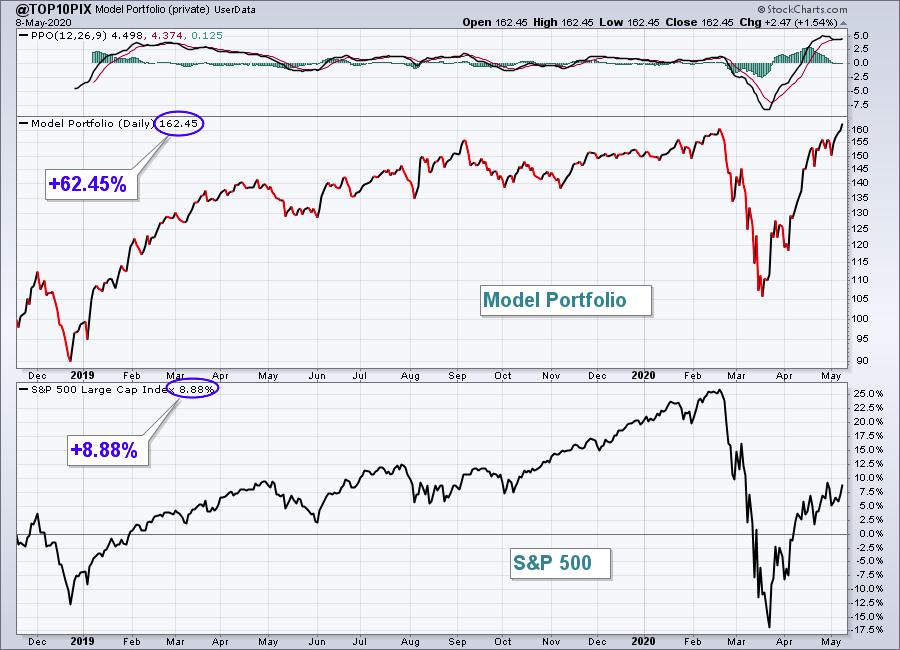

My Model Portfolio Hit an All-Time High Friday - Here are its 10 Component Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 closed at an all-time high on February 19, 2020 when it reached 3386.15. At its Friday close of 2929.80, the benchmark index remained 456.35 points, or 13.48%, shy of that high. February 19th was also the date that I announced our...

READ MORE

MEMBERS ONLY

Another Explosive Move Due To Extreme Short Squeeze

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading success, to some degree, is simply understanding the laws of supply and demand. There is a finite supply of shares available to buy of every stock traded on the various public exchanges. When the demand to buy those shares exceeds the supply available, price rises. Many of those involved...

READ MORE

MEMBERS ONLY

Here's The Most Proven Method I Know To Catch Key Market Tops And Bottoms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy Cinco de Mayo to all! Below is my Daily Market Report that is sent out every day to EarningsBeats.com members. If you'd like to subscribe, I'd love to have you join our growing community! Here's a link:

Fully refundable $7 30-day trial...

READ MORE

MEMBERS ONLY

Will The S&P 500 Be Able To Clear This Key Level? And What Will Next Week's Big Winner Be?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 has rallied more off the March 23rd bottom than just about anyone could have predicted and it's done it in record time. I've remained bullish from a longer-term perspective, relying on the secular bull market advance that began in 2013 when...

READ MORE

MEMBERS ONLY

Creating A ChartList To Identify Excellent Reward To Risk Trading Candidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I haven't abandoned my philosophy of trading stocks of companies whose recent quarterly revenues and EPS beat Wall Street consensus estimates. Such companies are included on my Strong Earnings ChartList (SECL), which up until recently, I traded from exclusively. I still believe it's incredibly important for...

READ MORE

MEMBERS ONLY

Stop Listening To The Pessimists; Wall Street Continues To Accumulate Your Shares

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is the Daily Market Report (DMR) that I send out to EarningsBeats.com members every day that the stock market is open. I keep our members posted as to key developments, including what's driving the stock market in both the short-term and long-term. One key factor is...

READ MORE

MEMBERS ONLY

This Stock Could Be Setting Up For A Mammoth Short Squeeze

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always love having the added bonus of guaranteed buyers when I see a stock that's broken out. That's what happens when a huge percentage of a company's float is short. In December 2019, I wrote a ChartWatchers article, "Here's A...

READ MORE

MEMBERS ONLY

Zooming In On A GREAT Investment....or 5....or 20!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Zoom Video Communications, Inc. (ZM) broke out technically just before the start of the NFL Draft and continued its stealth move higher on Friday - that is, until Facebook (FB) announced that they wanted to join the video meeting party. ZM traded as high as 181.50 intraday on Friday,...

READ MORE

MEMBERS ONLY

There's Nothing Wrong With WING'n It During The Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A few weeks ago I joined David Keller, Chief Market Strategist of StockCharts.com and host of SCTV's "The Pitch", to explore opportunities created by the COVID-19 panic. I explained at that time that my analytical background led me to research the massive rotation that took...

READ MORE

MEMBERS ONLY

Here's A Potential New Leader In 5G And Cloud Technology That You May Not Have Heard Of

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In the land of trillion dollar companies, it may seem difficult to find new and exciting young companies to invest in. But if you do some research, you can find them. When I was running scans and doing homework a couple weeks to uncover stocks for my Strong AD ChartList...

READ MORE

MEMBERS ONLY

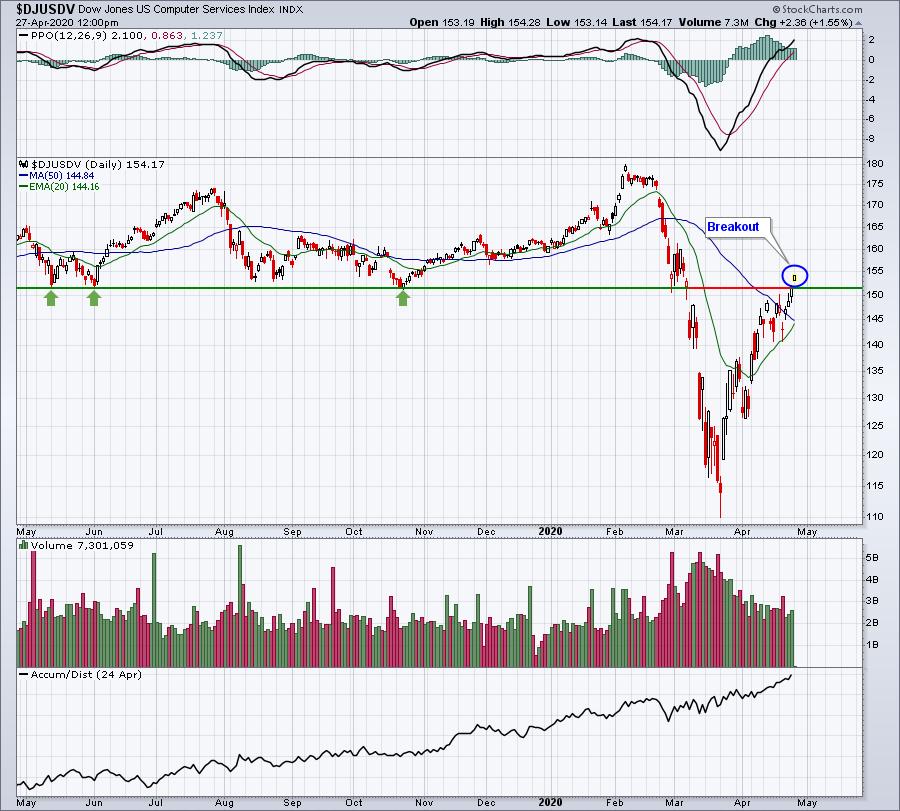

This Industry Just Keeps On Strengthening

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

COVID-19 has lit a fire under one industry group that already was showing relative strength. Now its relative strength is off the charts and showing no signs of slowing. In fact, it closed at its highest level in more than two years and is within a whisker of a MASSIVE...

READ MORE

MEMBERS ONLY

Here Are The Two Best ChartLists I've Ever Created

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The volatility has been extreme and the back and forth action has been dizzying at times. But there have been a couple common denominators throughout this 7-8 week up-and-down roller coaster ride that allow us to improve our odds of trading success. And all the tools you need are right...

READ MORE

MEMBERS ONLY

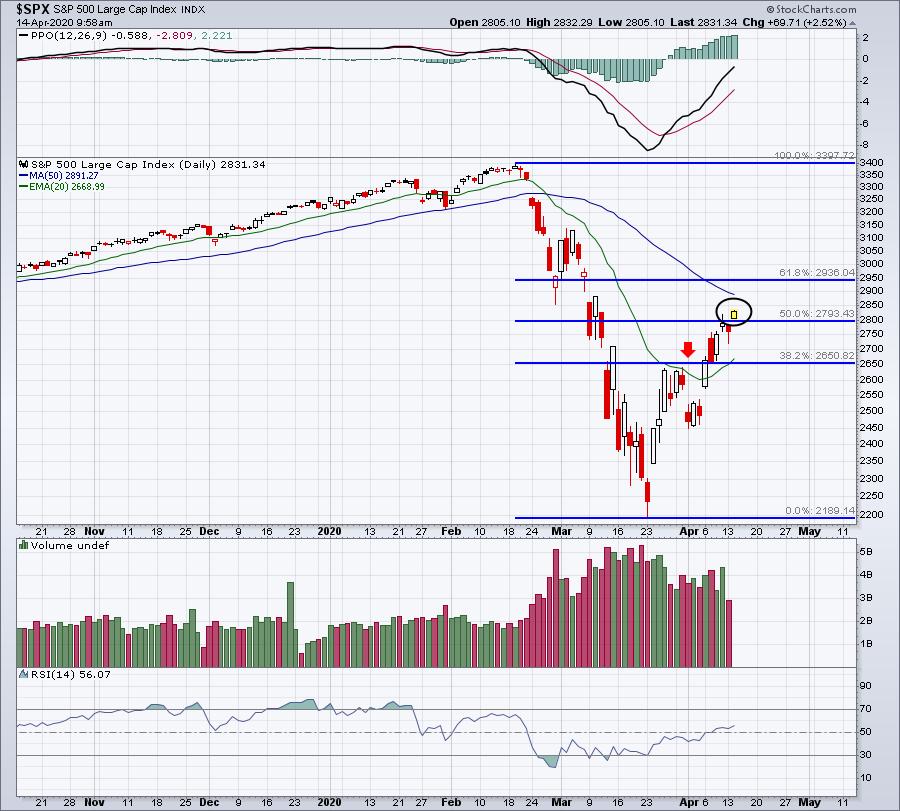

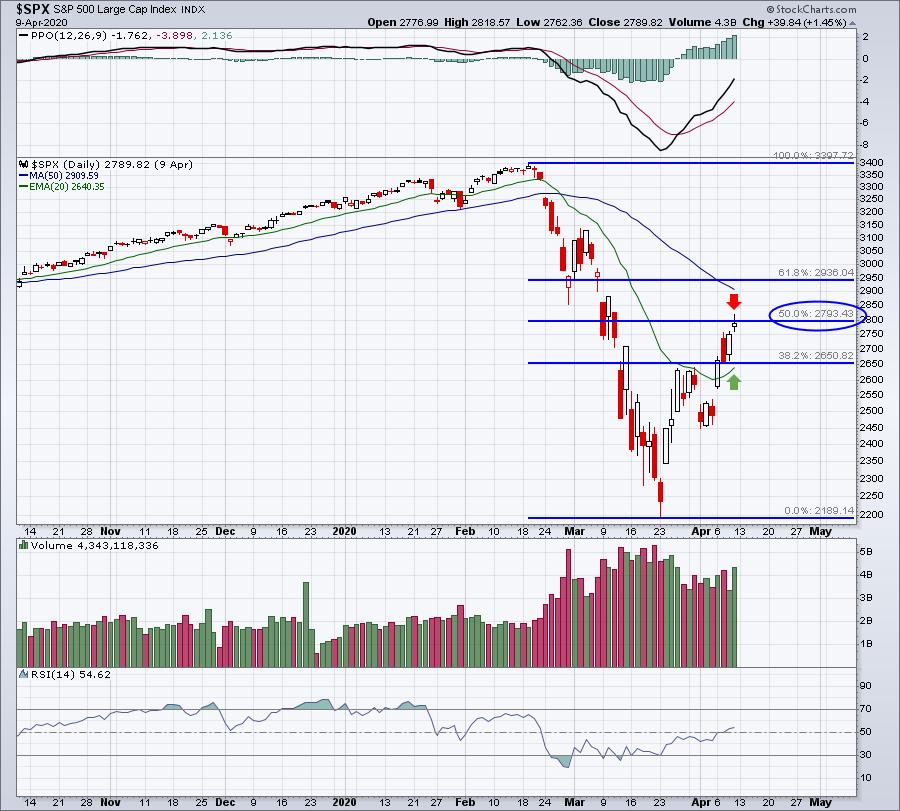

Even The Most Bullish Traders Must Beware This Short-Term Obstacle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not that surprised at the continuing rally. Yes, prior extreme selloffs like 1987 and 2008 resulted only in 38.2% and/or 50.0% Fibonacci retracement rebounds and, when we look at the S&P 500 currently, we're right at that major resistance area:...

READ MORE

MEMBERS ONLY

This Is How I Created My All-Star Trading ChartList

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me give you an update as to how the SPY (ETF that tracks the S&P 500) and QQQ (ETF that tracks the NASDAQ 100) have performed since the top on February 19th, broken down by opening gaps (net) and intraday price action:

SPY:

* Closing price, 2/19/...

READ MORE

MEMBERS ONLY

Can You Name The 7 Industries That Have Lost Less Than 10% During This Crisis?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wall Street is betting on certain industry groups to weather this COVID-19 storm much better than others. Knowing which groups are favored is very important, especially if we suffer another bout of impulsive selling. Gold mining ($DJUSPM) and mining ($DJUSMG) are the two best performers, gaining 19.51% and 18....

READ MORE

MEMBERS ONLY

Making The Bullish Case for U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me first say that arguing the bullish case for U.S. equities immediately puts me in the minority, which also would be my first bullish argument. When the masses believe we have nowhere to go but down, that's typically a sign that a bottom is near. Extreme...

READ MORE

MEMBERS ONLY

Top 15 Industry Groups RIGHT NOW and How To Profit From Them

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm personally trading stocks in very limited circumstances, mostly because you can't trust what you see from one hour to the next. While the bigger-picture downtrend remains in play, there's a lot of rotation taking place in stocks beneath the surface. For instance, as...

READ MORE

MEMBERS ONLY

Realizing The Opportunities Ahead As A Result Of The Virus; Special Session at 10am EST

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been watching in horror at some of the recent economic reports, especially the initial jobless claims, which yesterday sported a second consecutive week above 3 million. It was just a few short weeks ago that we were seeing 200,000-220,000 every week. We live in a...

READ MORE

MEMBERS ONLY

A Recent Search Study Suggests That A Paradigm Shift Favors This Company

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been spending much of my time lately ignoring the recreational products group ($DJUSRP). And for good reason. This industry ranked 75th in performance out of 104 groups over the period February 19th through March 23rd - the period in which the S&P 500 fell from...

READ MORE

MEMBERS ONLY

An Industry Group That's Wildly Outperforming During This Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My background is in public accounting. I spent two decades there and I always like to say that "I never met a spreadsheet that I didn't like!" I love to analyze. I actually enjoy studying numbers and relationships and read into the subtleties of what'...

READ MORE

MEMBERS ONLY

Are You Prepared For Another Selling Episode?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

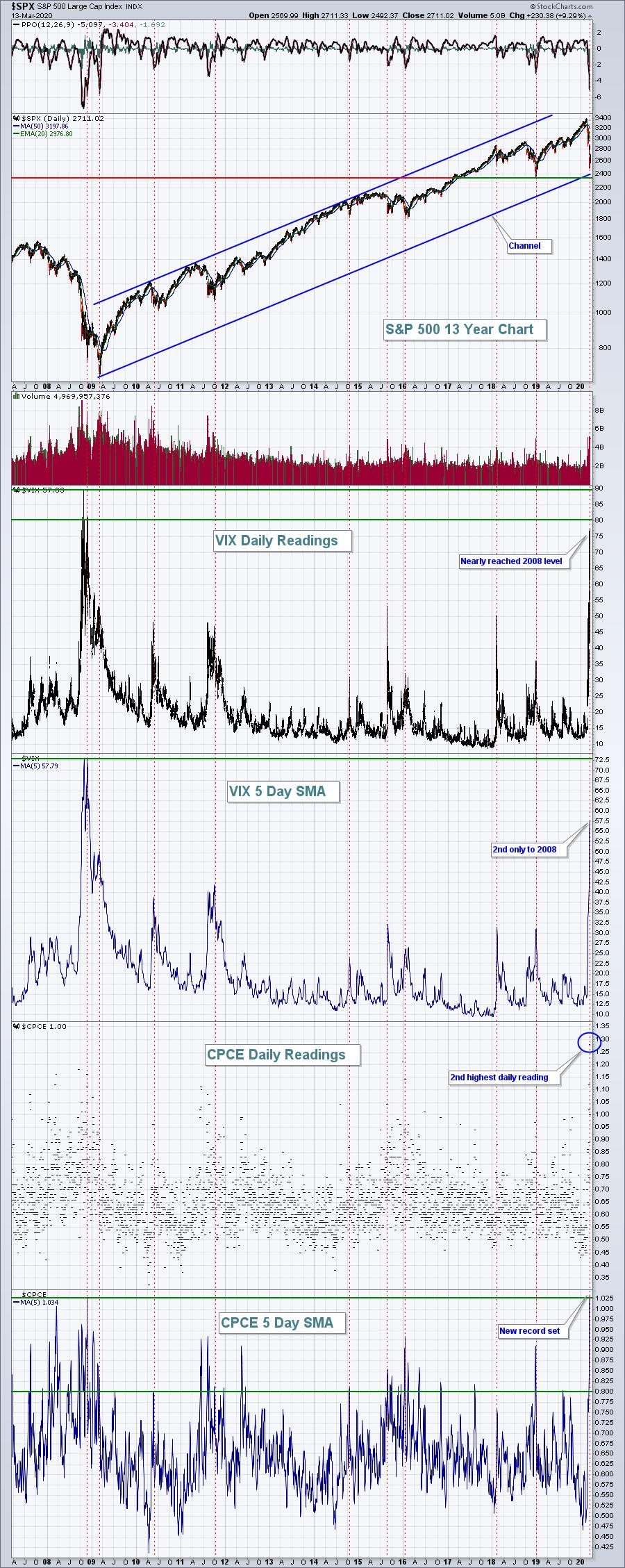

During tumultuous times like these, I pay particular attention to sentiment levels. Extreme fear tends to mark market bottoms, just as the recent Volatility Index ($VIX) reading above 80 coincided with this week's stock market bottom. It's simply the way bottoms form.

However, last week we...

READ MORE

MEMBERS ONLY

Is Gold Truly Our Safe Haven Right Now?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At this exact moment? Yes. Am I a fan longer-term? No. Gold ($GOLD) nearly always is a good choice during periods of anxiety and we sure have plenty of that right now. So owning a piece of it would make sense for anyone wanting a hedge against the stock market...

READ MORE

MEMBERS ONLY

History Says To Consider This Resistance Level As A Potential Bounce Area

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a historian at heart. I absolutely love analyzing history to see what makes the market tick. It's why I turned my attention from fundamentals to technicals a few decades ago. Technical analysis is the study of price action to help forecast future price action. The...

READ MORE

MEMBERS ONLY

A Paradigm Shift: Investing After COVID-19

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's time to take a new approach to the stock market. There are plenty of times where it's just "rinse and repeat" and we use the same old strategies we've always used. Well, those days are gone. For me, it's...

READ MORE

MEMBERS ONLY

Be Careful, This Could Be Options Manipulation; TSLA Is A Perfect Example

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Tuesday, I held a special webinar for EarningsBeats.com members to discuss the massive amount of net in-the-money put premium on major ETFs and many individual stocks. I can't say with any certainty, but I believe the current strength likely won't last. We could see...

READ MORE

MEMBERS ONLY

Extreme Bearish Sentiment Is Marking A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market has a mind of its own, so I never like to say that it MUST do one thing or another. But I'm firmly in the camp of this being a cyclical bear market, rather than a secular bear market. Historically, cyclical bear markets within secular...

READ MORE

MEMBERS ONLY

Sentiment Has Now Reached EXTREME Levels And This It What It Means

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trying to call bottoms is a difficult exercise, but human behavior can be quite predictable. Long-term investors are definitely long-term....as long as the market goes higher. But when we see the type of selling and panic that we've experienced these past few weeks, even the most disciplined...

READ MORE

MEMBERS ONLY

When Volatility ($VIX) Is This High, Wait For The Kitchen Sink

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Enjoying the ride? I've made a conscious decision to sit this wild ride out. I write a Daily Market Report (DMR) to our EarningsBeats.com members every day and last Tuesday (February 25th), I wrote the following (an excerpt):

"I'm bullish. I've remained...

READ MORE

MEMBERS ONLY

Here's The Only NASDAQ 100 Stock To Gain Ground Last Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

100 component stocks. 99 losers and 1 winner last week. That's how negative the breadth was for the week. I'm not surprised that a biotechnology stock ($DJUSBT) was the sole winner. While the coronavirus negatively impacted nearly all stocks last week, biotech names that offer potential...

READ MORE

MEMBERS ONLY

5 Key Takeaways From Last Week's Historic Drop

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

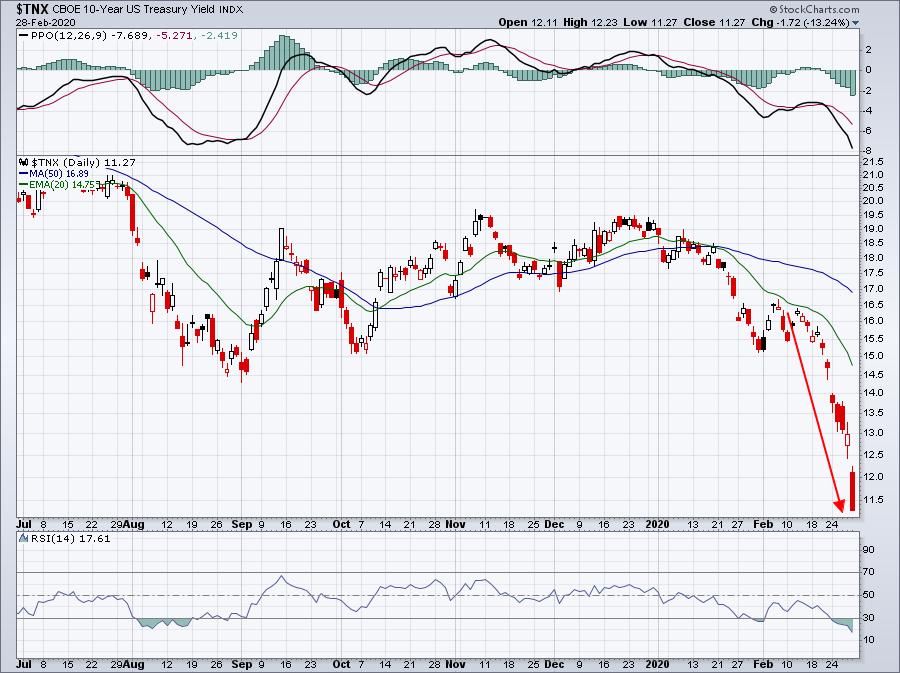

The selling we saw this week was one for the ages. Yes, I've been extremely bullish for a long time and it's primarily because of the economic environment. There's never been a time when we've been looking at moderate growth, historically-low interest...

READ MORE

MEMBERS ONLY

Best And Worst Performers During The Past Week's Coronavirus Market Attack

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The selloff has been sharp, it's been fast, and it's been severe. And it may not be over. Huge spikes in the Volatility Index ($VIX) establish major market bottoms and Thursday's VIX close at 39 certainly qualifies as that. The following chart shows you...

READ MORE

MEMBERS ONLY

What A Difference A Week Makes; Searching For A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One week ago, the U.S. stock market was euphoric and it had a right to be. Companies that have been able to grow earnings rapidly in a historically low interest rate environment, with rates likely to move even lower, were seeing those earnings valued at a record level. GDP...

READ MORE

MEMBERS ONLY

Market Makers Are Counting All Their Stolen Money This Weekend; The Selloff Will Be Short-Lived

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I heard one unmistakeable sound on Thursday and Friday. It was the sound of market makers driving away in Brinks trucks, you know, the kind that transports boatloads of money. Before I delve into the thievery that took place on Wall Street last week, let me first remind you of...

READ MORE

MEMBERS ONLY

Building A Solid Portfolio Starts With A Strong Foundation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I write about this a lot. Putting a group of stocks together that have (a) beaten Wall Street revenue and EPS estimates in its latest quarter, (b) belong to one of the "favored" industry groups on Wall Street, and (c) show strong technicals, including bullish volume trends leads...

READ MORE

MEMBERS ONLY

With The First Pick In The U.S. Stock Market Draft, EarningsBeats.com Selects...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've never really thought about it before, but putting together a portfolio is very similar to drafting NFL or NBA players. The idea in professional sports is to select someone who you believe will provide a major positive impact on your organization and to establish a winning tradition,...

READ MORE

MEMBERS ONLY

How High Might the S&P 500 Go? History Provides Us Clues

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

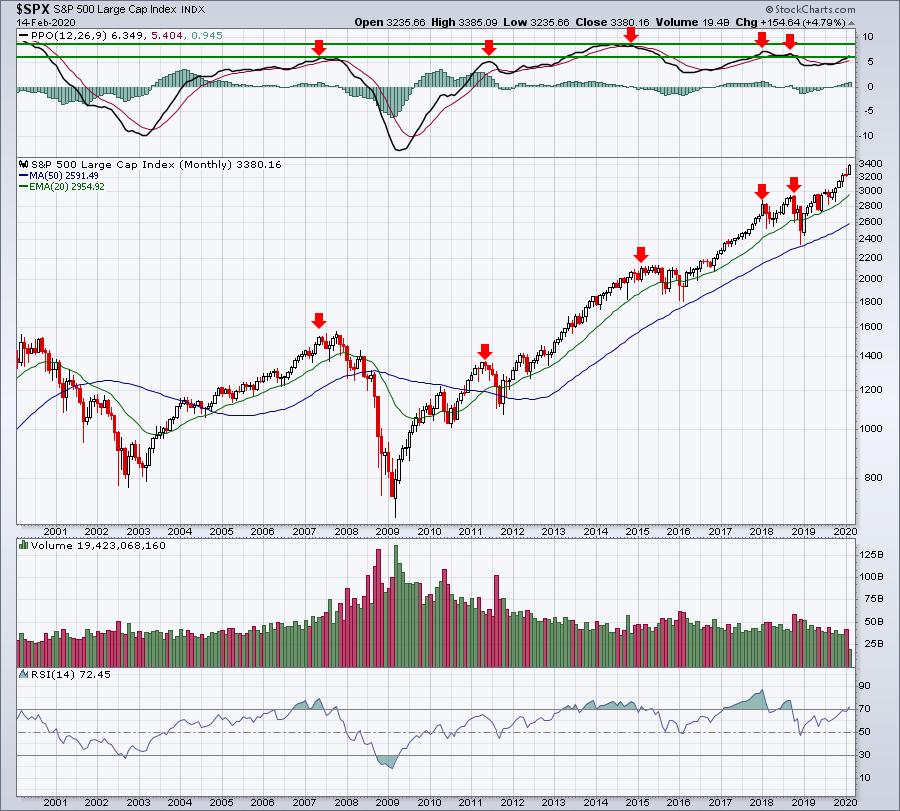

Embrace this rally.

As far as bull markets go, this is truly the Perfect Storm. Never in my lifetime have I seen a stock market environment where we're experiencing modest growth, strong jobs, lower-than-target inflation, historically-low treasury yields and a Fed that honestly should cut rates again. If...

READ MORE

MEMBERS ONLY

Consumer Stock Ratio Breaks Out To Support Higher Prices Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is today's Daily Market Report that I send out to EarningsBeats.com members every day, usually between noon and 1pm EST. Enjoy!

Executive Market Summary

* Wall Street opened lower, but key indices are now flirting with positive territory

* January CPI indicated inflation remains modest

* The 10 year...

READ MORE

MEMBERS ONLY

The Next Big Breakout Is Happening Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've written about this industry group on many, many occasions, but up until today, we've simply seen a bunch of false hopes. Today is THE BREAKOUT. We gapped above resistance and, thus far, are adding to early gains. A strong afternoon would seal the deal -...

READ MORE

MEMBERS ONLY

Perspective: That's What The Bull Market Naysayers Are Lacking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I see so many comparisons to what was happening in 2007, as if the current market environment somehow should be compared to 2007. It shouldn't. 2007 was part of a 12-13 year secular bear market. 2020 is part of a lengthy secular bull market. The bullish boundaries of...

READ MORE

MEMBERS ONLY

Energy Is Now Primed For A Big Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know. I know. It's been the worst sector and the second worst sector isn't even close. Look at this sector leaderboard for the past six months:

The XLE is the ONLY sector in negative territory. Its SCTR score is 2.3. What the heck could...

READ MORE