MEMBERS ONLY

Why Looking At Germany Provides Us An S&P 500 Crystal Ball

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

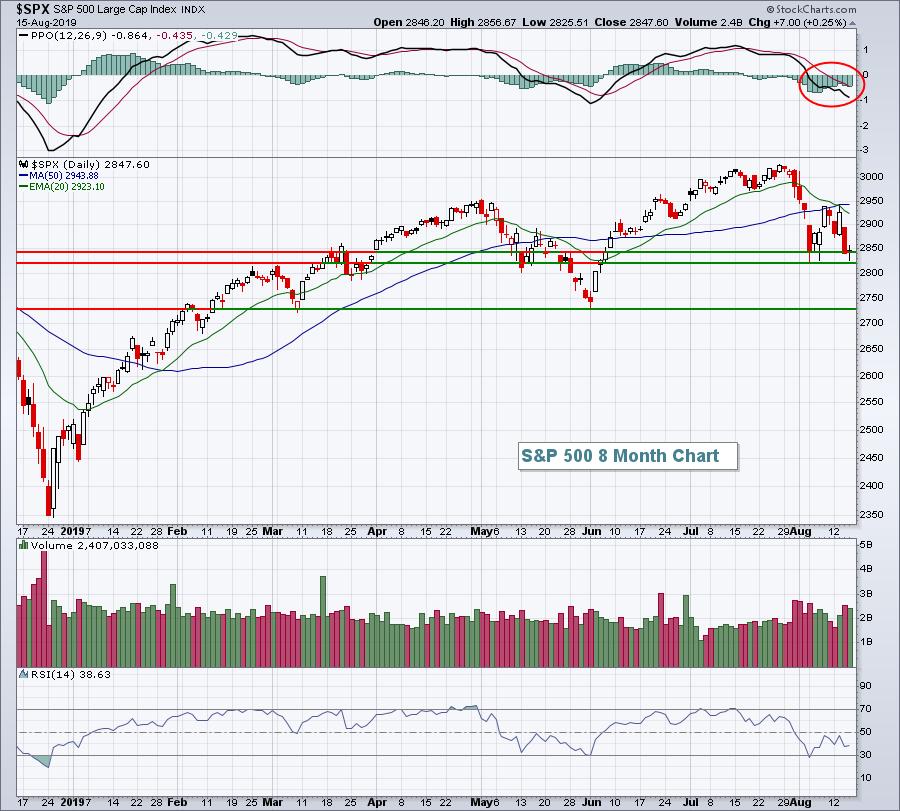

Market Recap for Thursday, August 15, 2019

There were a ton of economic reports out on Thursday, mostly positive, and that seemed to slow the onslaught of selling as our major indices finished mixed on the session. Walmart, Inc. (WMT, +6.11%) surged following better-than-expected earnings to lift the Dow...

READ MORE

MEMBERS ONLY

Futures Rally As Wall Street Tries To Show A Little "Sole"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Event

I am hosting a HUGE event on Monday, August 19th at 4:30pm EST as I release my Top 10 Stocks for my Model, Aggressive and Income portfolios. Each of these portfolios has crushed the benchmark S&P 500 since their respective inceptions and for a mere...

READ MORE

MEMBERS ONLY

Tuesday Was Nothing More Than A Bounce In A Market Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 13, 2019

I received an email the other day after I discussed the rising volatility ($VIX) and likely move lower and it stated "Tom, I thought you were bullish. Why the bearish view now?". Let me address this because maybe some others are...

READ MORE

MEMBERS ONLY

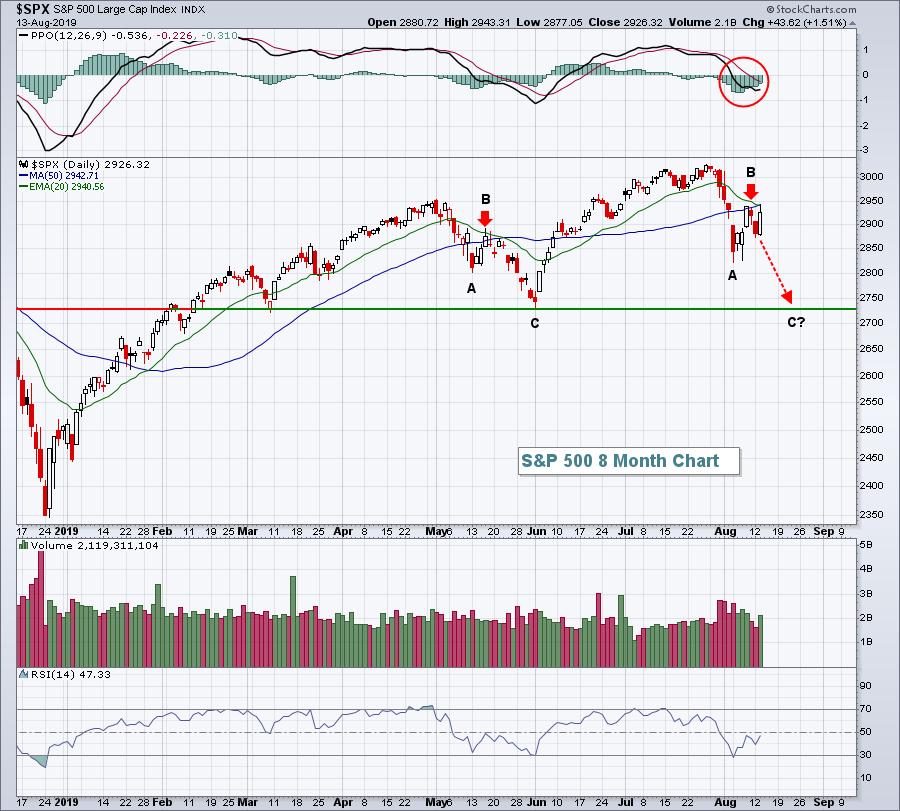

Starting To Shape Up Like An ABC Correction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 12, 2019

The flight to safety was clear on Monday. The 10 year treasury yield ($TNX) tumbled once again, falling 9 basis points to 1.63%, inching closer and closer to the historic TNX lows that were set in 2012 and 2016. The all-time low...

READ MORE

MEMBERS ONLY

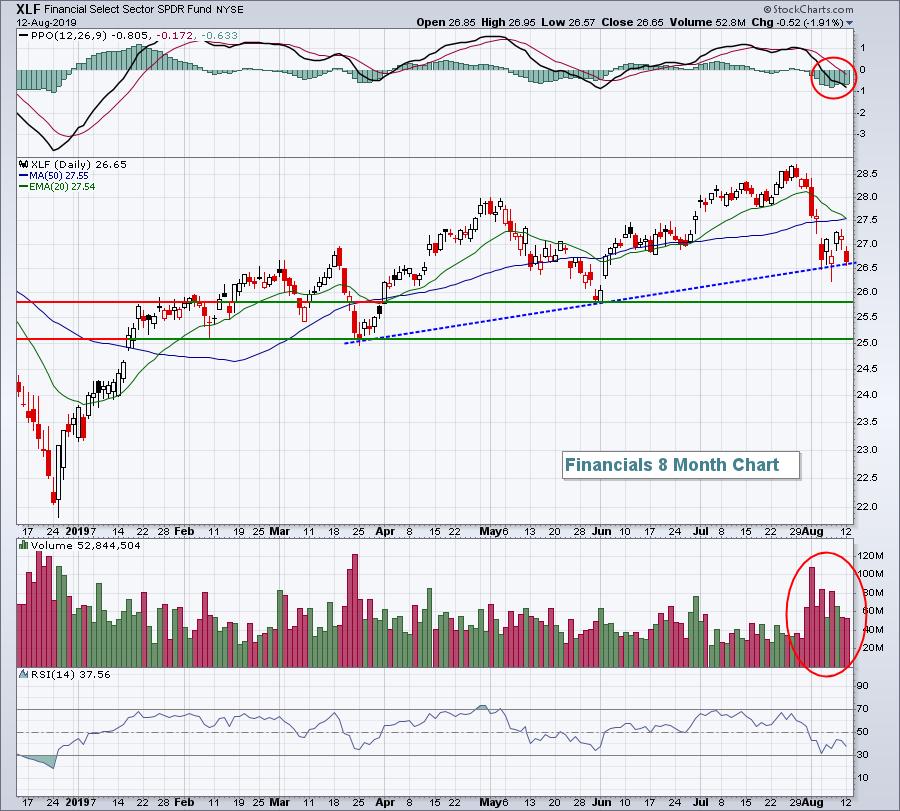

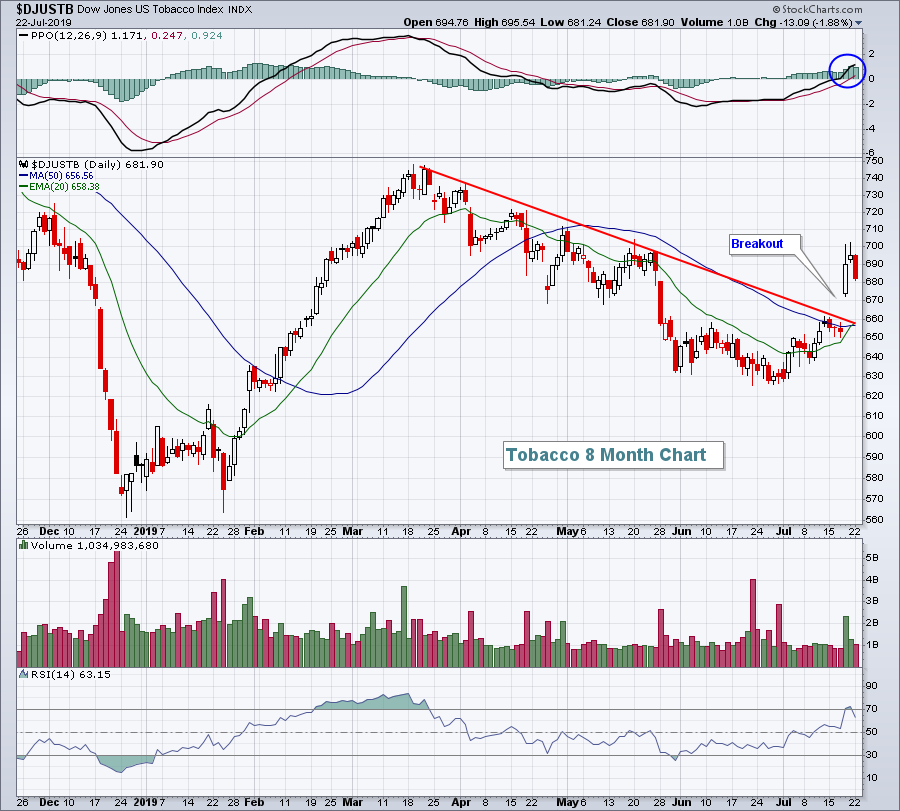

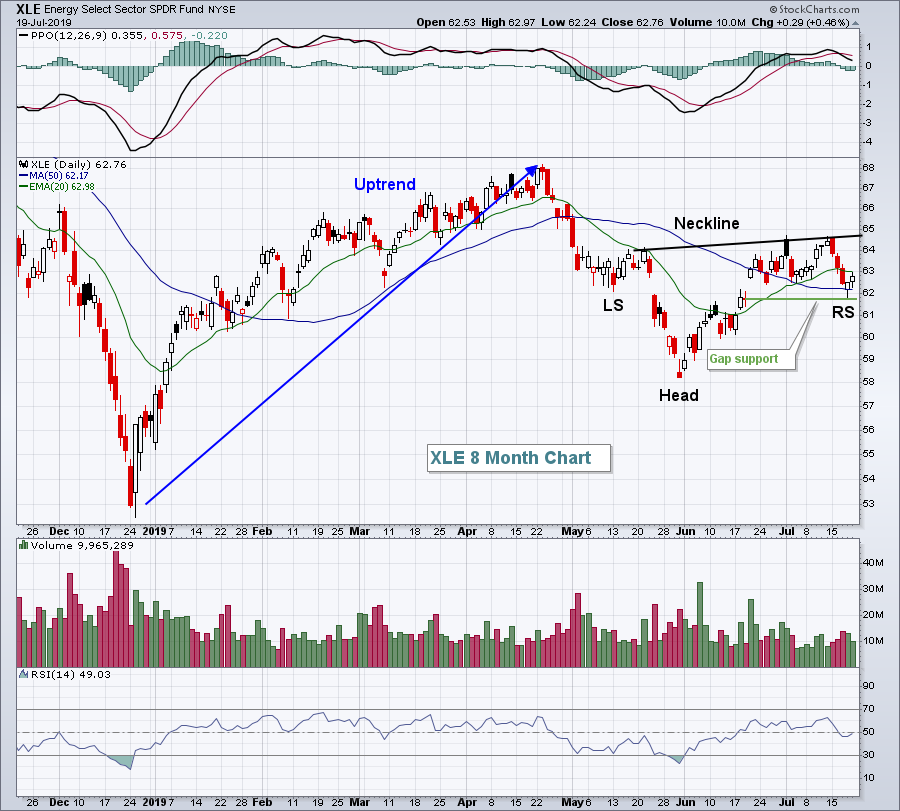

Energy Failing To Show Absolute Or Relative Strength....With One Exception

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

If you didn't have a chance to read my blog post from Saturday, "I'm Returning To My Roots At EarningsBeats.com", be sure to check it out. I'll be explaining a lot more about my decision and discussing my three...

READ MORE

MEMBERS ONLY

I'm Returning To My Roots At EarningsBeats.com!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, it's been a great ride here at StockCharts.com!

The ride's not completely over, but I'm making a big change (and with mixed emotions) as I leave my role as Sr. Technical Analyst at StockCharts.com, effective September 15, 2019, and return to...

READ MORE

MEMBERS ONLY

It's Make Or Break Time For Telecommunications Equipment Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 8, 2019

Thursday was a trend day for U.S. stocks, one in which the action was positive from start to finish. It's generally viewed bullishly and as a sign of accumulation. However, I don't know if I'd grow...

READ MORE

MEMBERS ONLY

This Is How To Pick Relative Strength Stocks To Improve Your Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 7, 2019

It appeared as though we were heading for another big down day as our major indices opened down 2% or thereabouts. There was a huge rush into treasuries with the 10 year treasury yield ($TNX) dropping to an almost unfathomable 1.59% shortly...

READ MORE

MEMBERS ONLY

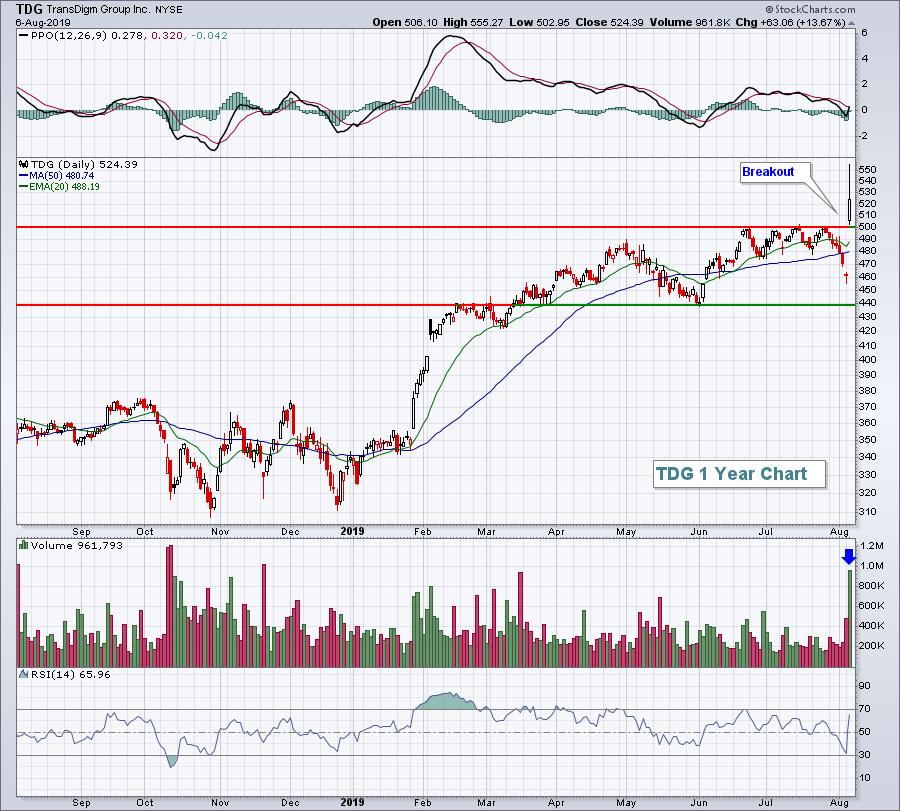

The S&P 500 Must Clear These 3 Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 6, 2019

Ok, let's start with the good news. Our major indices all finished higher on Tuesday, rebounding from their worst day of 2019. Every sector except energy (XLE, -0.12%) finished the day higher and our 5 aggressive sectors were the 5...

READ MORE

MEMBERS ONLY

Selloffs Are All About Emotion; Watch These Sentiment Readings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

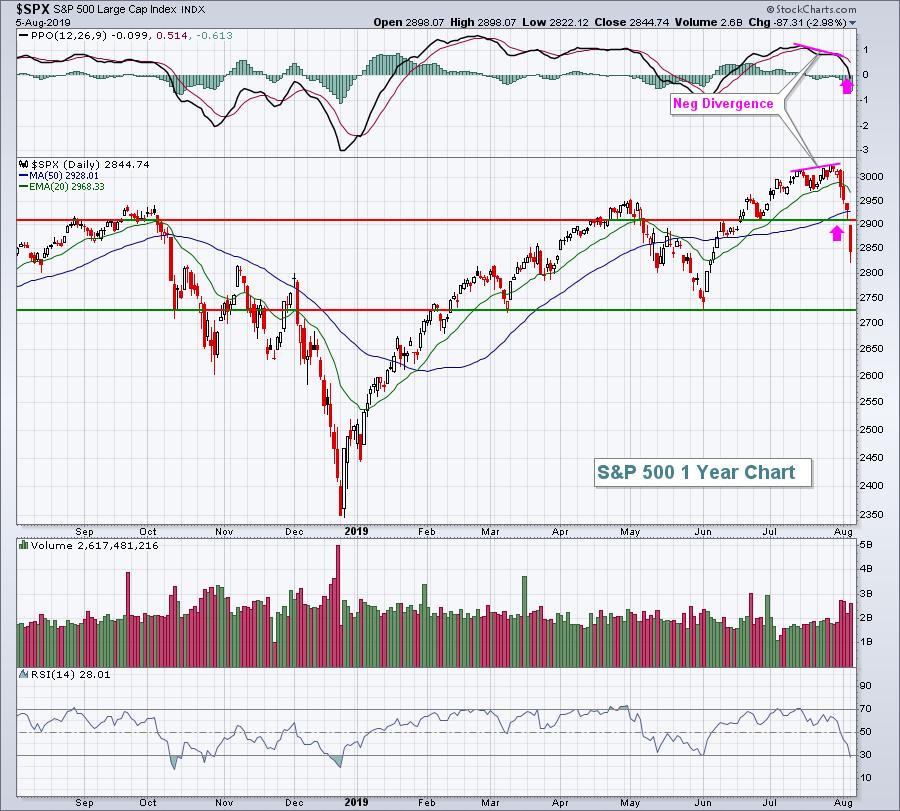

Market Recap for Monday, August 5, 2019

It was a very bad day on Wall Street with our major indices having their worst day of 2019. Panic is setting in as the U.S. and China shoot trade war bullets back and forth at each other. China's Shanghai...

READ MORE

MEMBERS ONLY

Growing Cautious Is Fine, But I'd Avoid Being Bearish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

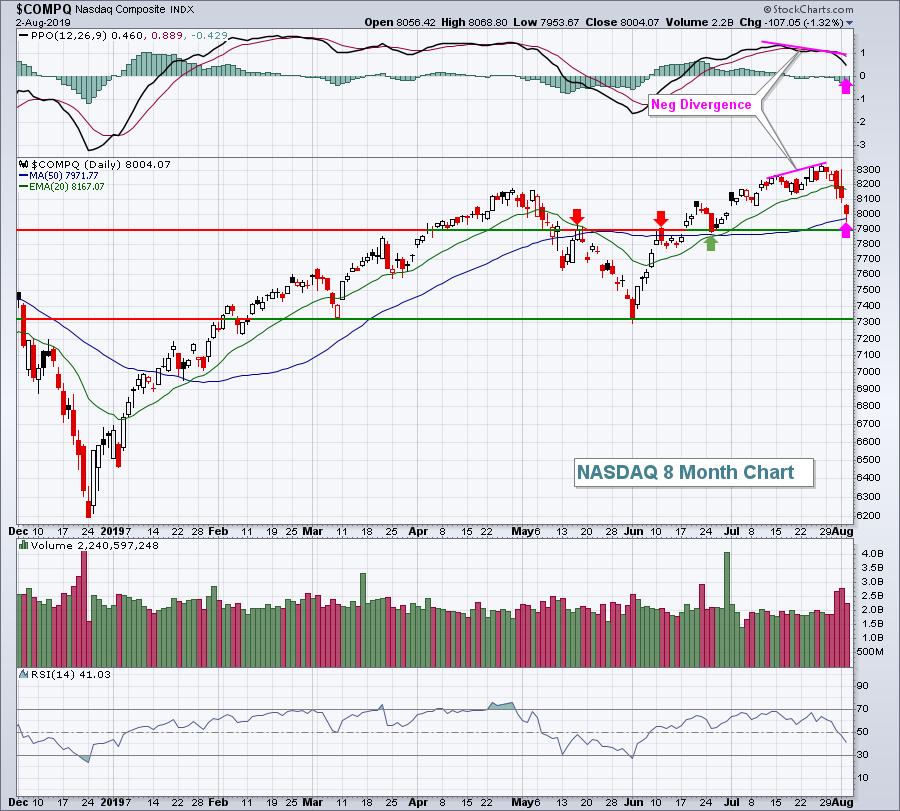

Market Recap for Friday, August 2, 2019

The latest nonfarm payrolls report came in, but quite honestly no one seemed to care. The Fed has already said its piece and was rather noncommittal to another rate cut and both bond and equity markets are fixated on the US-China trade war....

READ MORE

MEMBERS ONLY

My Philosophy: Creating Portfolios To Beat The Benchmark S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

(This is a reprint of a Trading Places blog article written a week ago. I've updated the performance and charts to include last week's selloff.)

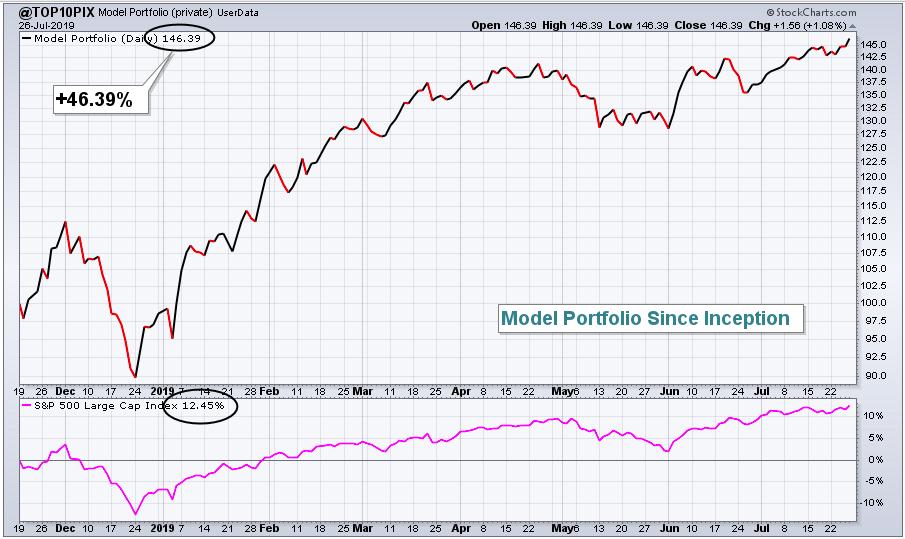

Beating the S&P 500 is my #1 goal. If I didn't believe I could beat the S&...

READ MORE

MEMBERS ONLY

Three Tweets And You're OUT

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for August 1, 2019

Today's article will be very brief.

The whole Fed deal and now another trade tweet. Really? Can we all just get along? It reminds me of that old Jackson 5 song, Rockin Robin (sing along if you'd like....and yes...

READ MORE

MEMBERS ONLY

Fed Lowers Rates, But Creates Utter Confusion; Thanks For Nothing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

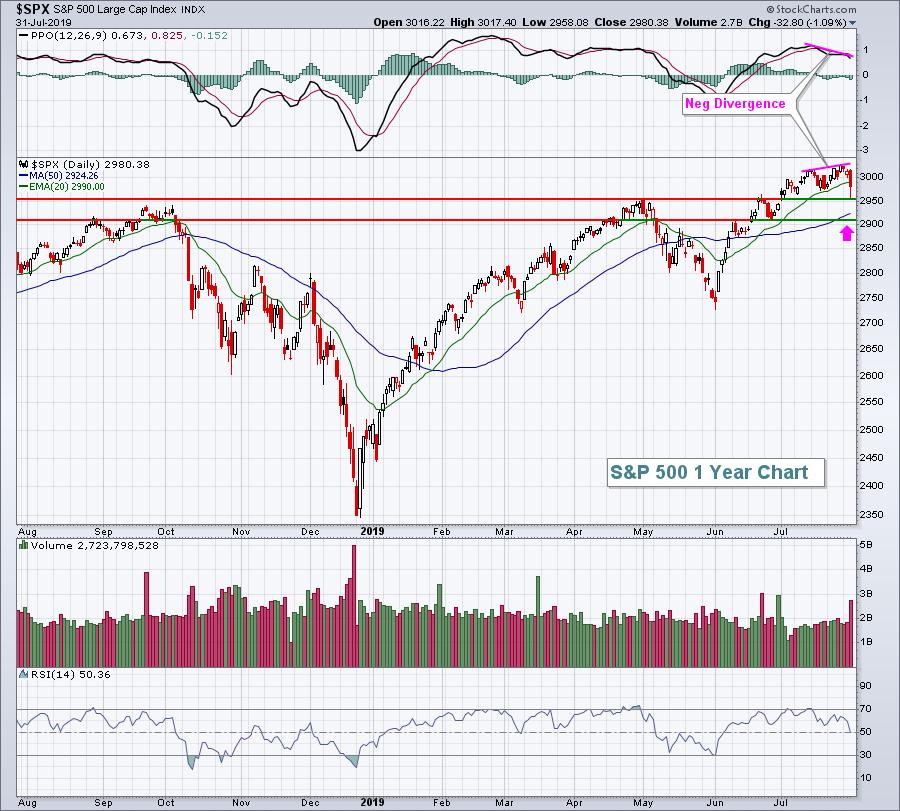

Market Recap for Wednesday, July 31, 2019

To say that this current Fed is transparent would be the equivalent of saying I'm a marine biologist (a Seinfeldism for those of you that are fans). What the heck are they doing? Seriously, what is going on in those meetings?...

READ MORE

MEMBERS ONLY

Traders Await Fed, Apple Blows Away Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 30, 2019

For a second straight day, traders opted for safety ahead of today's FOMC policy statement. It was once again apparent in the sector leaderboard, which ended the session on Tuesday as follows:

Industrials (XLI, +0.43%) became the first aggressive sector...

READ MORE

MEMBERS ONLY

FOMC Meets, Will They Get It Right This Time?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

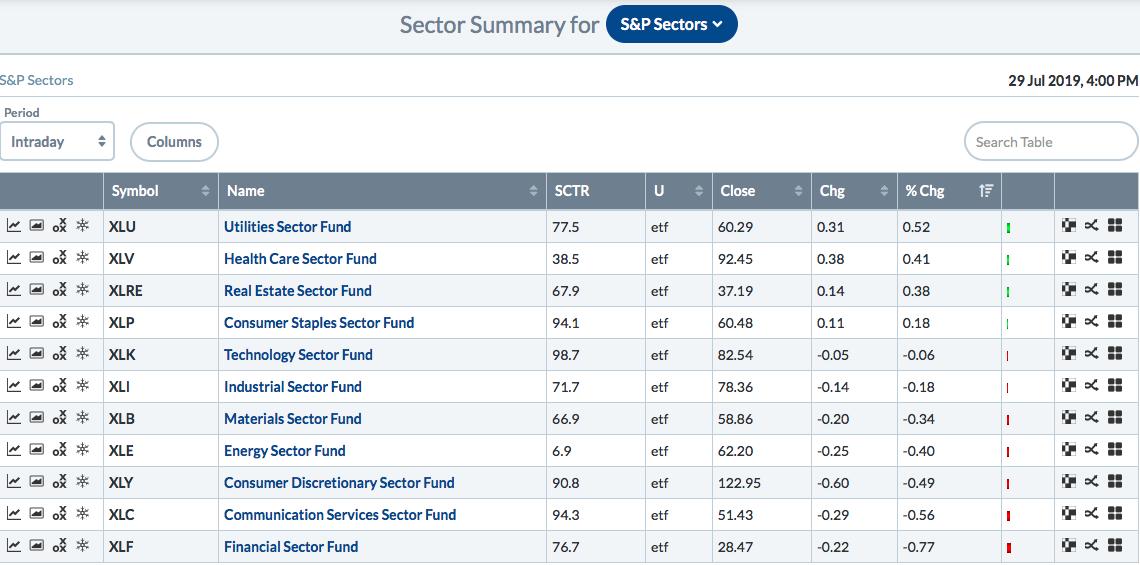

Market Recap for Monday, July 29, 2019

I am not at all surprised by Wall Street's action on Monday. The current Fed has not exactly been dependable in terms of following the lead of the treasury market, so short-term trading ahead of this week's Fed meeting...

READ MORE

MEMBERS ONLY

The Stars Are Aligning; Look Out Above

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 26, 2019

Communication services (XLC, +2.86%) exploded higher on Friday, thanks in large part to a blowout quarterly earnings report from Alphabet (GOOGL, +9.62%) after the bell on Thursday. They apparently kept their good news to themselves because Wall Street didn't...

READ MORE

MEMBERS ONLY

My Philosophy: Creating Portfolios To Beat The Benchmark S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That is my #1 goal. If I didn't believe I could beat the S&P 500, I'd simply buy the SPY (ETF that tracks the S&P 500) and call it a day. But I know I can beat the S&P 500...

READ MORE

MEMBERS ONLY

Blowout Earnings Overnight To Lift U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 25, 2019

Dow Holdings (DOW, -3.83%) and Boeing (BA, -3.69%) weighed on the Dow Jones ($INDU, -0.47%) on Thursday, but this index of conglomerates still managed to outperform its major index counterparts. The big technical issue with DOW is that it ran...

READ MORE

MEMBERS ONLY

Earnings And Semiconductors Drive New Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be joining John Hopkins of EarningsBeats.com for a webinar on Monday, July 29th after the bell. It's the quarterly earnings webinar where I'll point out some of the biggest winners of earnings season to date. Those will be stocks that you...

READ MORE

MEMBERS ONLY

Facebook, Internet Stocks Looking To Provide Catalyst For Big Market Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 23, 2019

Utilities (XLU, -0.63%) was the only sector to end Tuesday's session in negative territory as most groups and stocks advanced. The XLU has been faltering on a relative basis ever since the overall market bottomed in early June. That has...

READ MORE

MEMBERS ONLY

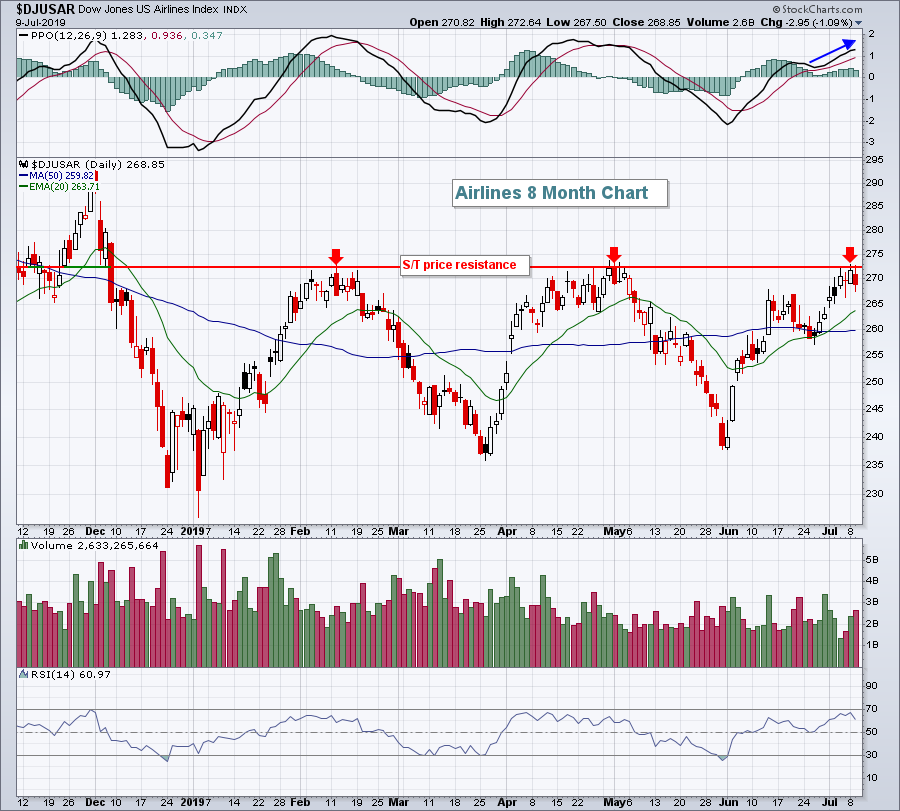

Truckers And Airlines Sending Bullish Market Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 22, 2019

Technology (XLK, +1.15%) was the undisputed leader on Monday, helping the NASDAQ gain 0.71% and within 1% of its all-time high. There were several reasons for the strength, but Goldman Sachs had positive commentary for the semiconductors ($DJUSSC, +2.03%), which...

READ MORE

MEMBERS ONLY

Keep An Eye On Short-Term NASDAQ Support In This Zone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 19, 2019

Wall Street finished on a very weak note on Friday as hopes for a 50 basis point reduction in the fed funds rate decreased. There is now a much stronger likelihood of a 25 basis point drop when the Fed meets for two...

READ MORE

MEMBERS ONLY

Building A Sound Portfolio Using Relative Strength Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As you may already know, I've developed multiple portfolios using fundamental strength and technical price action, including relative strength, that have wildly outperformed the benchmark S&P 500 since their inception dates. I'm very excited about that, as well as the prospect of helping thousands...

READ MORE

MEMBERS ONLY

Netflix (NFLX) Gets Crushed And Here Was Our Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week so I'm writing brief articles and in a different format. There will be no article tomorrow, Friday, July 19th.

Netflix (NFLX) Hammered In After Hours

Despite topping both revenue and EPS estimates, NFLX is trading lower by nearly 11%...

READ MORE

MEMBERS ONLY

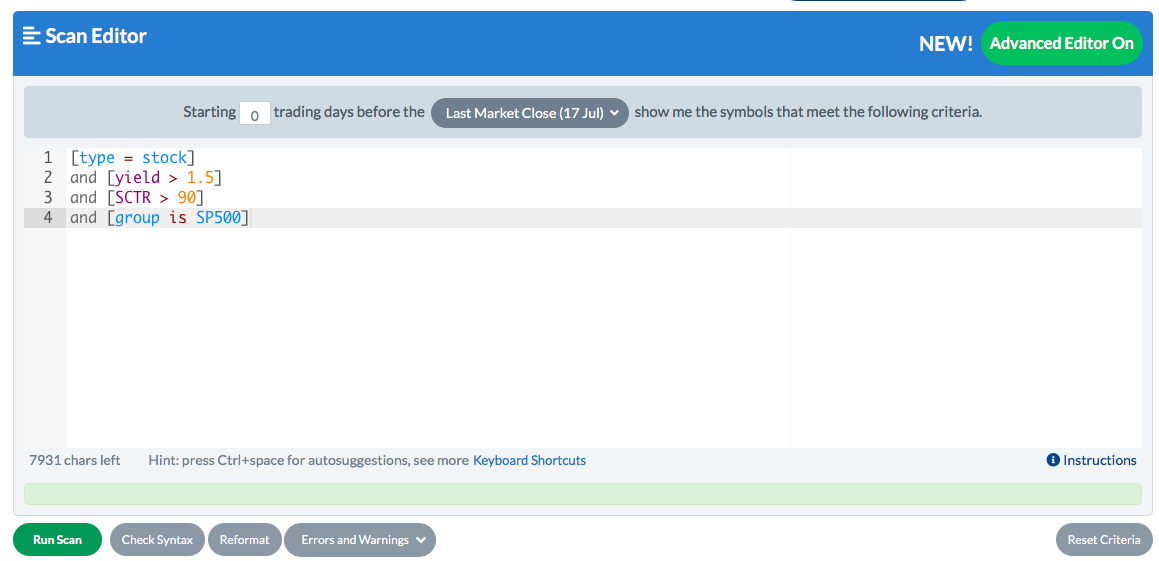

Scanning For High SCTRs And Dividend Yield

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week, so my articles are in a different format and generally shorter. There will be no blog article on Friday.

I've created three portfolios over the past year. My Model Portfolio began on November 19, 2018 and my Aggressive Portfolio...

READ MORE

MEMBERS ONLY

We're Off To The Races If These 3 Break Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week so I'll post mostly abbreviated articles. There will be no blog article on Friday.

Current Outlook

One confirmation signal that I always look for during a bull market is leadership from our 5 aggressive sectors - technology (XLK), consumer...

READ MORE

MEMBERS ONLY

Transports Soar To Lift Wall Street To Yet Another Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I am on vacation this week so I'll post mostly abbreviated blog articles. There will be no blog article on Friday morning.

Market Recap for Friday, July 12, 2019

Industrials (XLI, +1.75%) powered our major indices to fresh new all-time highs. Transports ($TRAN) were particularly...

READ MORE

MEMBERS ONLY

It Was A Record-Breaking Day On Wall Street

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 11, 2019

Dow Jones ($INDU, +0.85%) 27000 is in the record books as another milestone has been reached on Wall Street. The S&P 500 ($SPX, +0.23%) also set another record high close, but fell just short of closing above the psychological...

READ MORE

MEMBERS ONLY

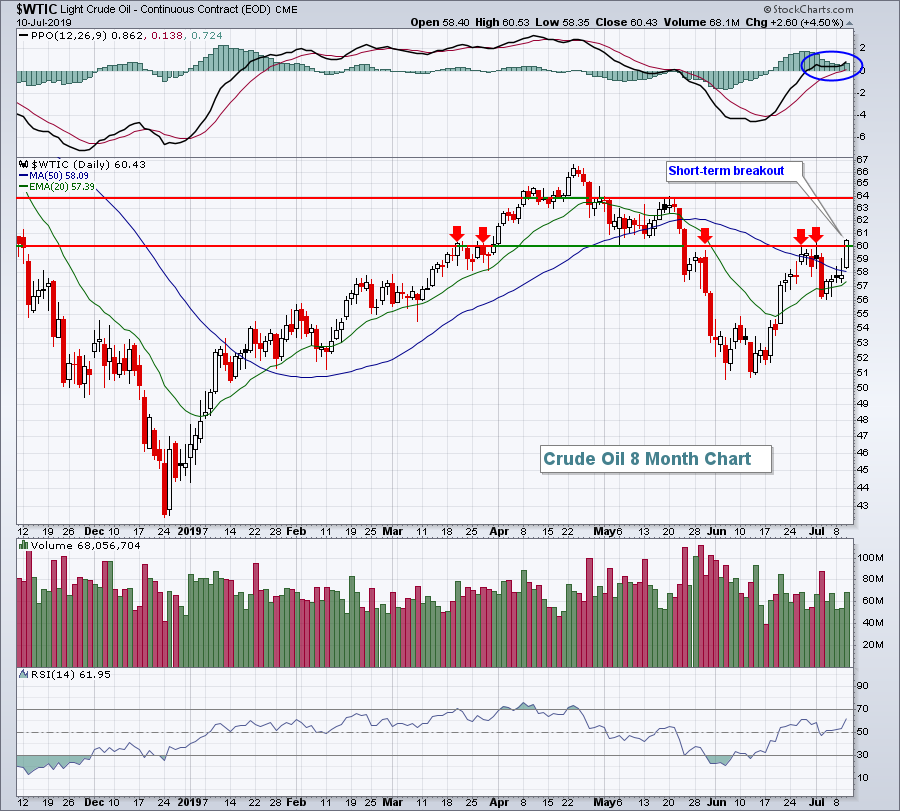

Why The Bullish Argument REQUIRES Strengthening Of Transportation Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 10, 2019

The S&P 500 ($SPX, +0.45%) surpassed 3000 on an intraday basis for the first time in history on Wednesday, although it failed to close there. Permabears don't understand how this is even possible, with the ongoing trade war...

READ MORE

MEMBERS ONLY

Will The FAANG Stocks Report Blowout Earnings? 2 Will, But Not This One

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 9, 2019

Despite the Dow Jones ($INDU, -0.08%) finishing in negative territory, I'd argue it was a pretty solid day on Wall Street. All of our major indices opened lower, but there was buying throughout the session, much like Friday. We saw...

READ MORE

MEMBERS ONLY

Apple Downgraded To Sell, Likely Becomes A Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

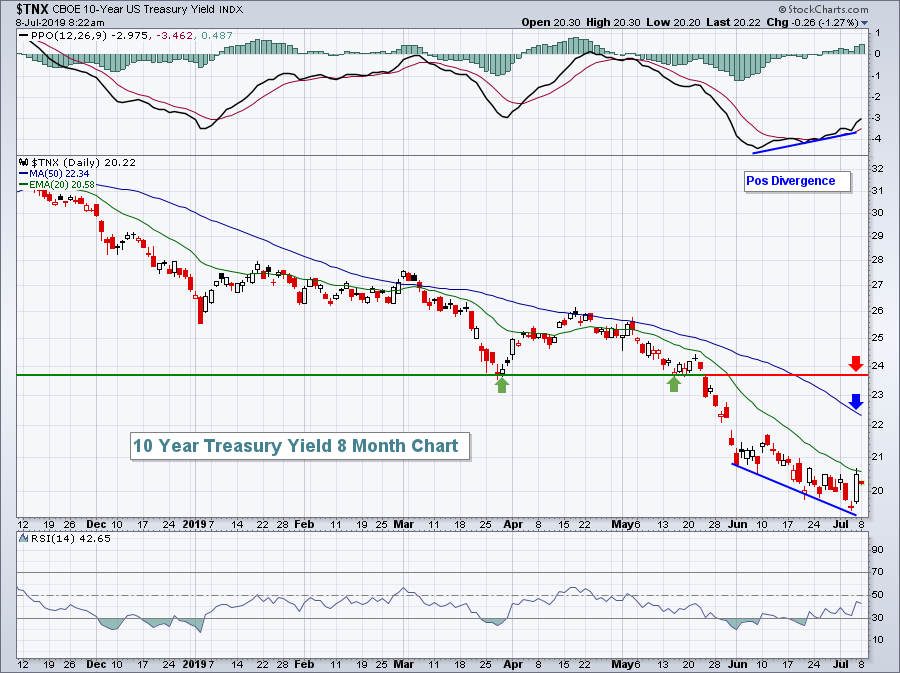

Market Recap for Monday, July 8, 2019

Materials (XLB, -1.15%) led the Monday decline as the U.S. Dollar Index ($USD, +0.10%) extended its recent gains, climbing for the 7th time in the last 9 sessions. Given the strong jobs report on Friday, fewer market participants are expecting...

READ MORE

MEMBERS ONLY

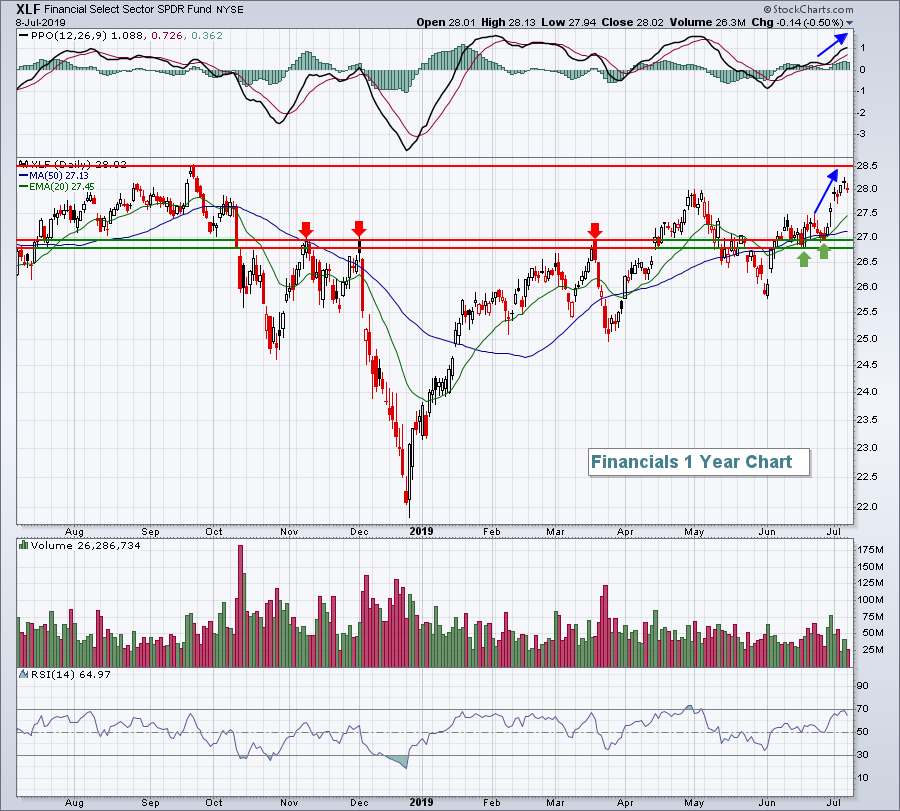

Leading 1st Half Industry Group Breaks Out Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 5, 2019

The small cap Russell 2000 ($RUT, +0.22%) led bifurcated action on a very quiet Friday as many market participants were on an extended vacation spanning the July 4th holiday. Strength was seen in financials (XLF, +0.28%) as the 10 year treasury...

READ MORE

MEMBERS ONLY

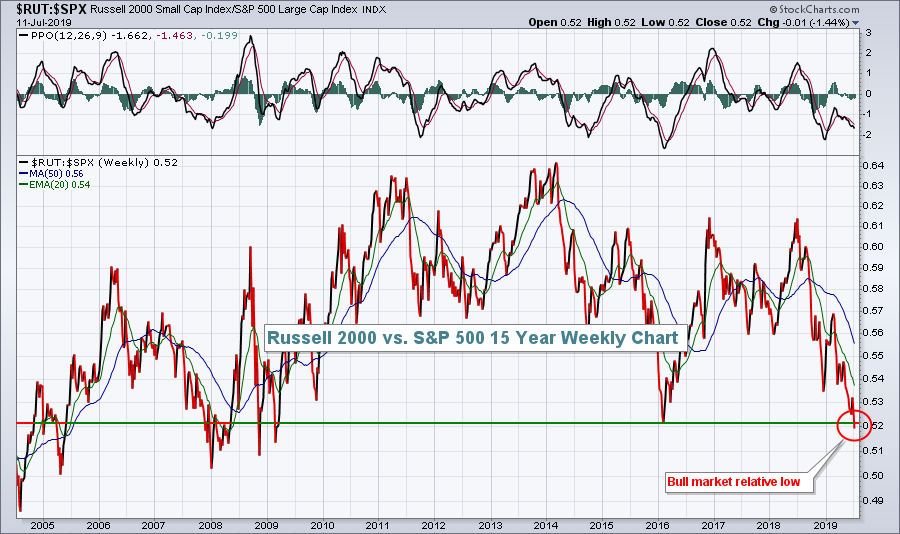

Why U.S. Equities Are Poised For Another 40-50% Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I want to discuss two charts that really need to be monitored closely as we enter the second half of 2019. A rise in these charts is synonymous with massive bull market rallies. They both make great common sense, so let's discuss them before visualizing the charts.

1....

READ MORE

MEMBERS ONLY

Dow Jones Sets New Record To Join S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 3, 2019

26 of 30 Dow Jones component stocks advanced as the most widely known stock index set all-time intraday and closing highs one day before Independence Day and during an abbreviated session. It gives traders an extra day to relax and reflect on the...

READ MORE

MEMBERS ONLY

S&P 500 Sets A New All-Time High; Get Used To It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 2, 2019

I saw a headline Tuesday morning when all of our major indices were lower that suggested "renewed trade fears" were impacting the stock market in negative fashion. When will the insanity stop? So Monday the market moved higher on trade relief...

READ MORE

MEMBERS ONLY

Semiconductor Stocks Open Door To Further Gains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 1, 2019

The S&P 500 ($SPX, +0.77%) closed once again at an all-time high and all of our major indices ended Monday's session with gains. Leadership came in the form of the NASDAQ, which rang up a 1.06% gain....

READ MORE

MEMBERS ONLY

2019 Second Half Outlook Plus 8 Monday Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 28, 2019

I'm posting this early (and on Sunday) this week because I did a lot of chart-reviewing this weekend and there's a lot to digest here. Before I get into my Market Outlook for the second half of the year,...

READ MORE

MEMBERS ONLY

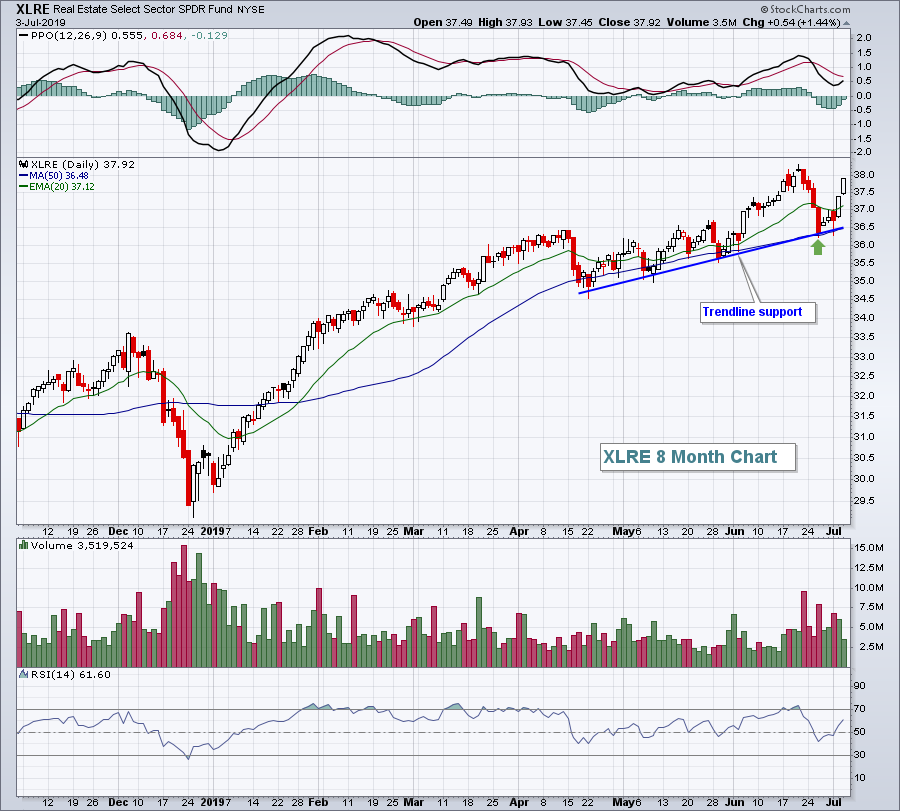

Real Estate Poised To Bounce After Rough Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 27, 2019

It was mostly a solid day on Wall Street, except for the late selling that carried the Dow Jones to a slight 10 point loss. The problem child for the Dow Jones was Boeing (BA, -2.91%), which fell after providing an update...

READ MORE

MEMBERS ONLY

This Industry Group Is Printing A Handle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

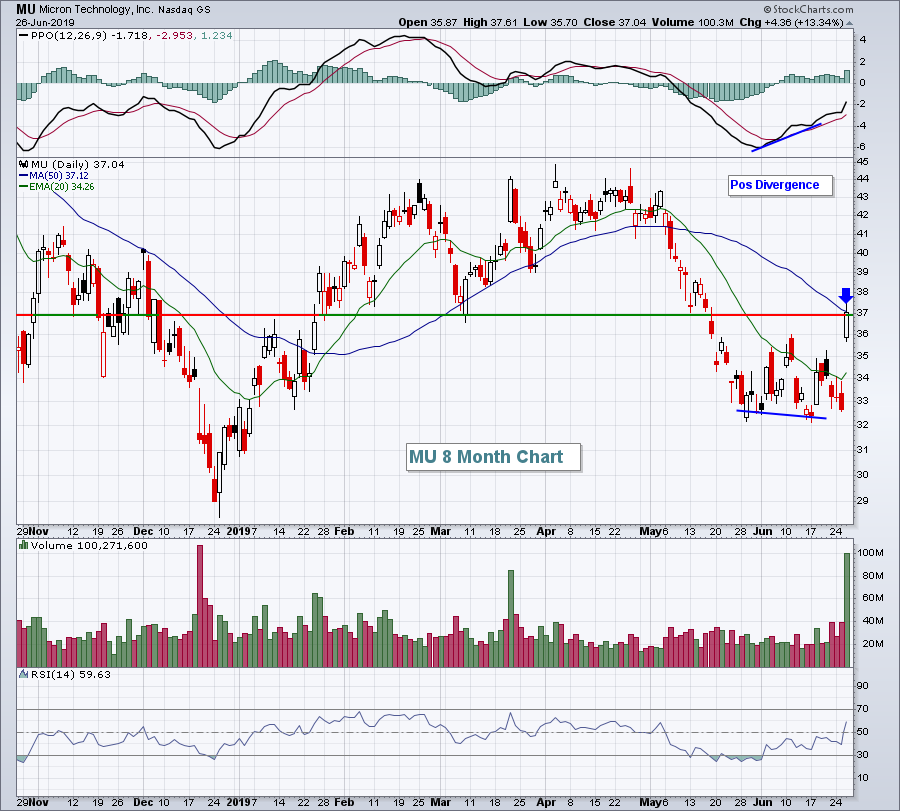

Market Recap for Wednesday, June 26, 2019

It was a day of bifurcated action as the NASDAQ was able to cling to a 0.32% gain, but the other major indices fell. Honestly, it felt like a down day on the NASDAQ as well. This tech-laden index surged to a...

READ MORE