MEMBERS ONLY

You Just Need To Beware One Week In July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 25, 2019

Sellers returned to the stock market yesterday as the NASDAQ posted a 1.51% drop, its largest decline since June 3rd. Volatility ($VIX, +6.68%) has been on the move higher as the market grows more nervous with the G-20 summit beginning later...

READ MORE

MEMBERS ONLY

Seasonality Suggests BIDU Could Be Ready To Launch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 24, 2019

The U.S. stock market waffled yesterday as the G-20 summit set to begin later this week. We know from history that any time the headlines are littered with US-China trade, we need to be vigilant. While there wasn't widespread selling...

READ MORE

MEMBERS ONLY

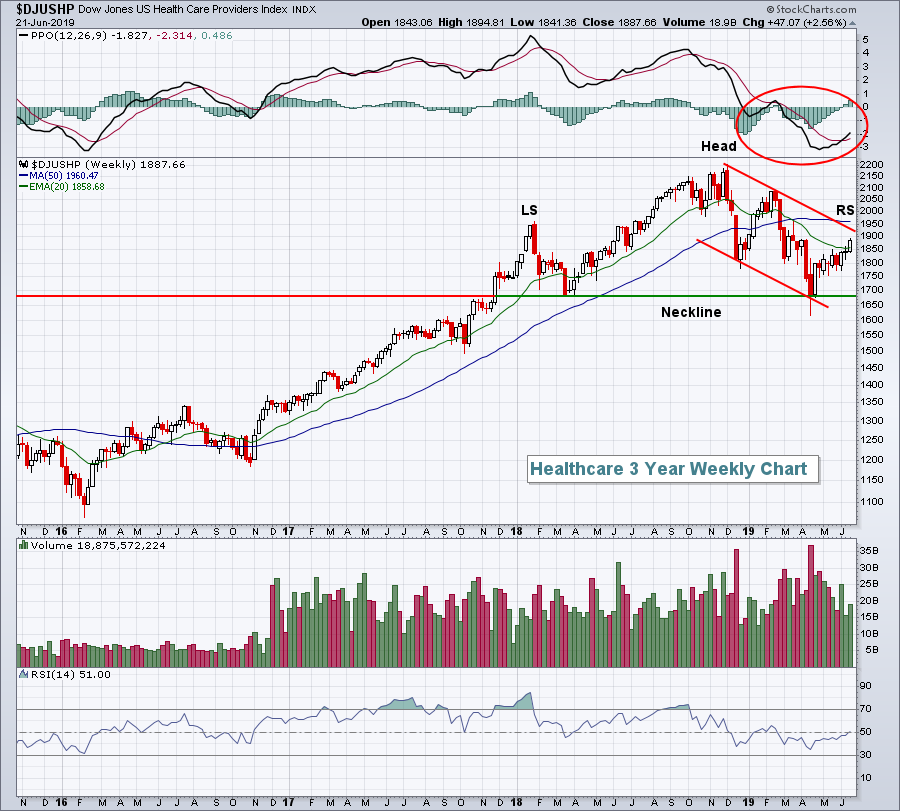

S&P 500 Flat But Healthcare Showing Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 21, 2019

The S&P 500 ended Friday's session relatively flat, but had a very solid week as it raced to an all-time high before sellers hit on quad-witching day. As usual, quad-witching day volume was extremely heavy. I wouldn't...

READ MORE

MEMBERS ONLY

The Bullish Case For Gold Isn't All That Strong

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The price of gold ($GOLD) closed on Friday at $1400.10 per ounce. The weekly gain of 4.14% was the best such weekly advance since April 2016 and the close above $1400 was the first such close since September 3, 2013. Since testing 2019 lows on May 21st, GOLD...

READ MORE

MEMBERS ONLY

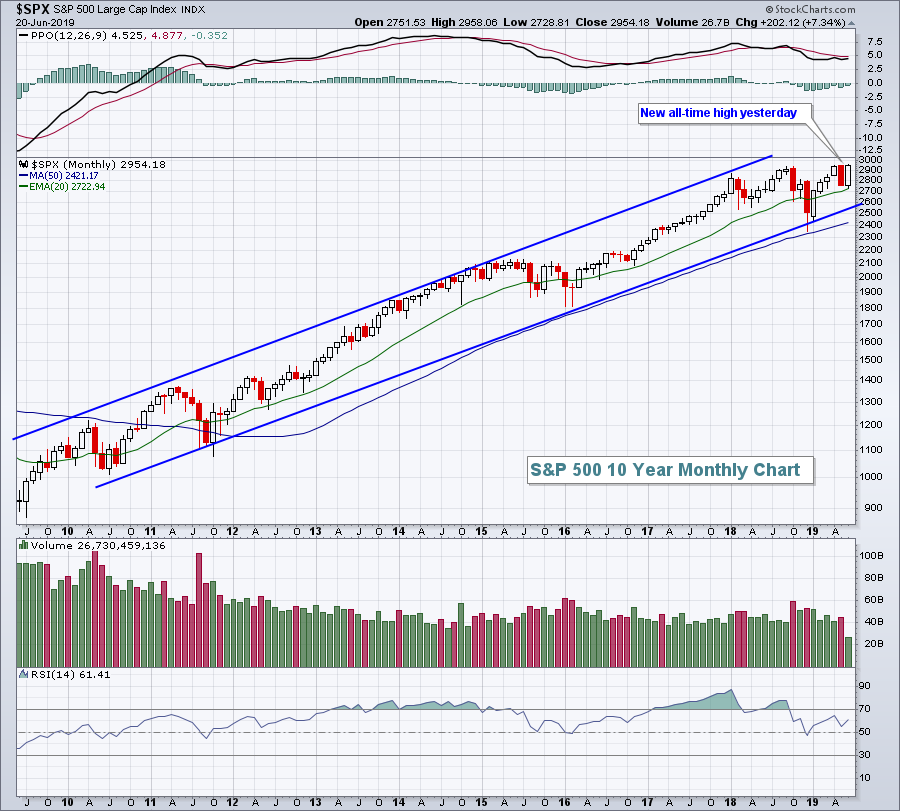

S&P 500 Breaks Record, Crude Oil Surges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 20, 2019

More dovish Fed policy is already having its effects. The anticipation of those changed policies has sent investors around the globe into U.S. treasuries, as yields have dropped precipitously since Q4 2018. But yesterday, U.S. equities climbed aboard as the S&...

READ MORE

MEMBERS ONLY

Fed Offers Traders Hope, Travel & Tourism Has Big Challenge Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 19, 2019

Yesterday was Fed day, or Fednesday as one MarketWatchers LIVE viewer said, and U.S. equities liked what the Fed had to say. What it had to say was essentially what most market pundits were expecting - that the word "patient"...

READ MORE

MEMBERS ONLY

Relative Strength In Two Key Sectors Says All We Need To Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 18, 2019

It was a day of rallying global equities, especially in the German DAX ($DAX, +2.03%). The DAX ($DAX) moves more in sync with U.S. equities than any other foreign equity market - in my opinion. The long-term positive correlation between the...

READ MORE

MEMBERS ONLY

Autos Back On The Road To Nowhere; Tesla Loves June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

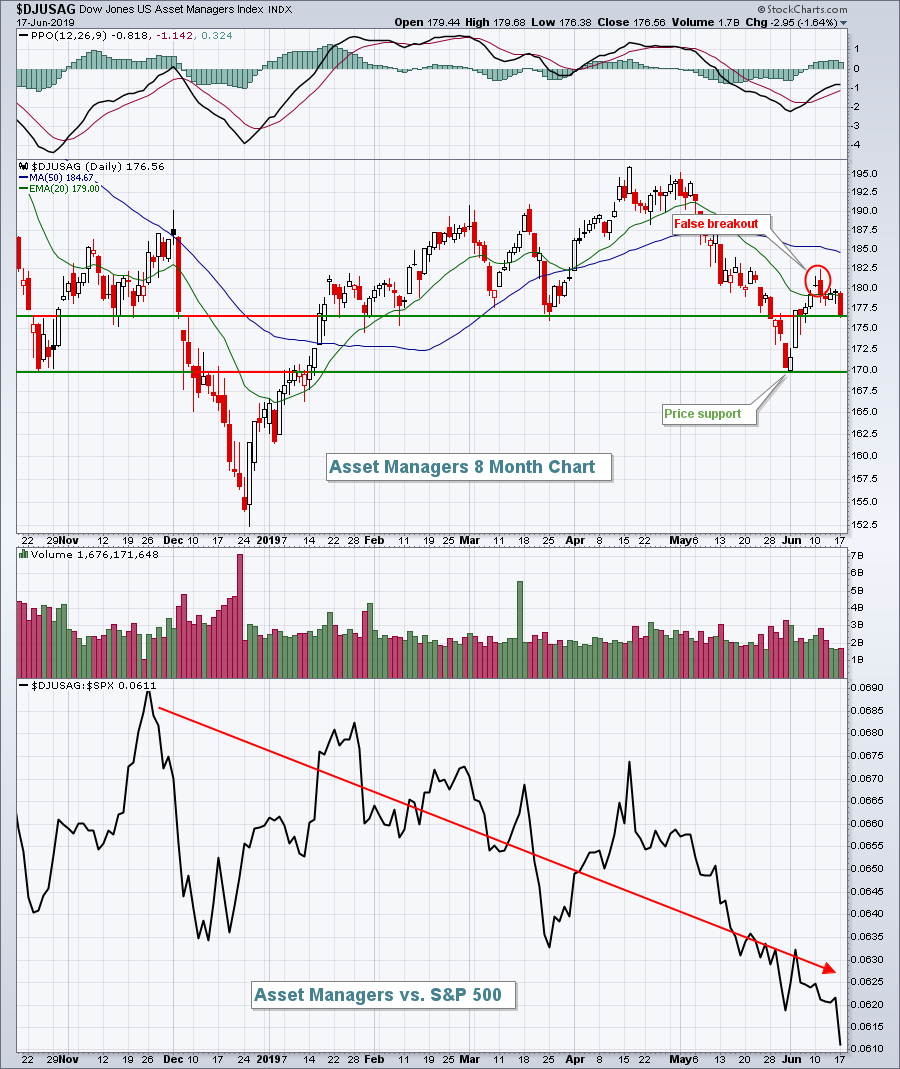

Market Recap for Monday, June 17, 2019

Facebook (FB, +4.24%) announced a platform cryptocurrency with a white paper due out today, while Netflix (NFLX, +3.21%) received positive comments from a Piper Jaffray analyst looking for solid results out next month. That combination lifted communications services (XLC, +1.14%...

READ MORE

MEMBERS ONLY

Home Construction Breaks Out As S&P 500 Consolidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

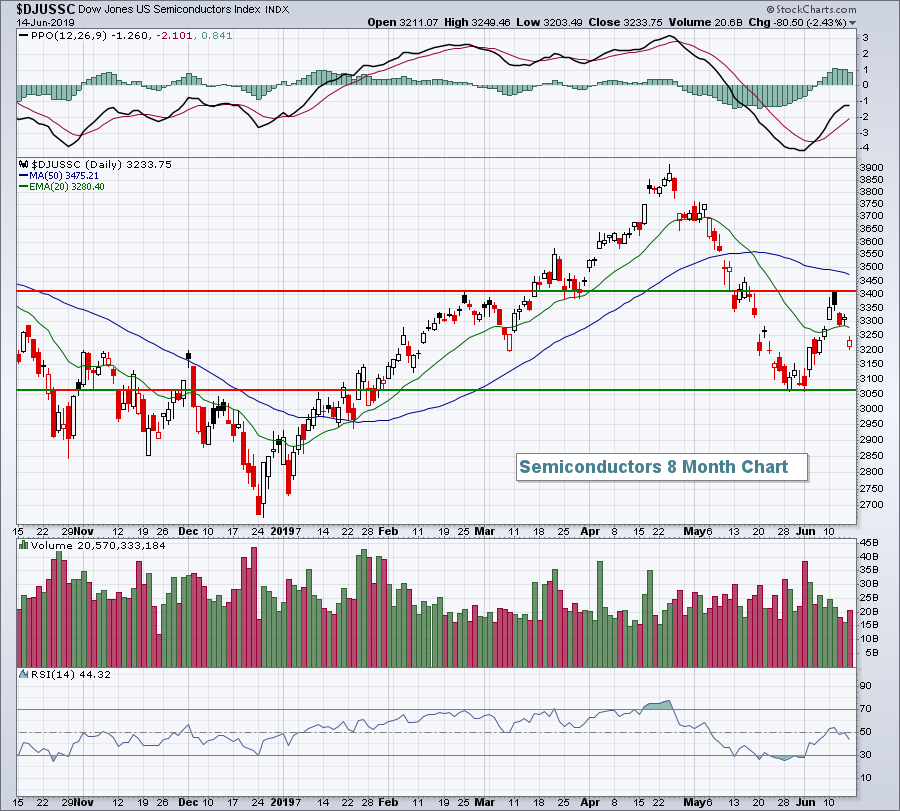

Market Recap for Friday, June 14, 2019

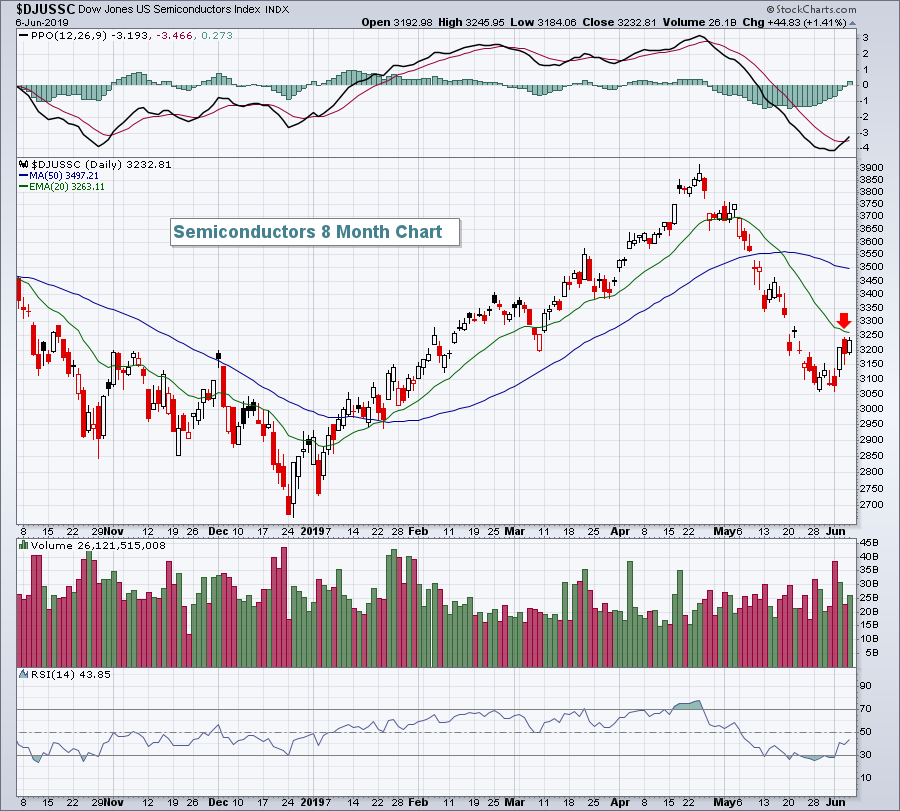

The big news on Friday was Broadcom's (AVGO, -5.57%) quarterly results and outlook, neither of which were particularly good. AVGO fell short of its revenue estimate and offered a very broad warning regarding upcoming revenues in the semiconductor industry ($DJUSSC,...

READ MORE

MEMBERS ONLY

Transports Vs. Utilities Ratio Supports The Bearish Argument

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

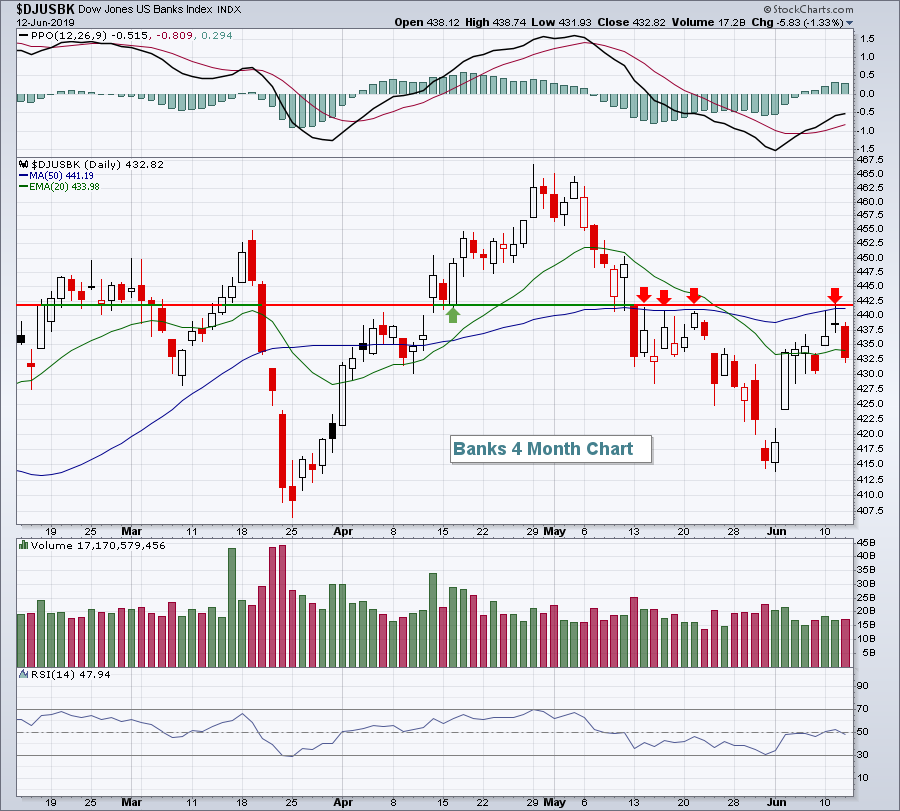

Market Recap for Thursday, June 13, 2019

A nice rally to end the session lifted all of our major indices into the close. The Russell 2000 led on a relative basis, gaining 1.05%. The NASDAQ, S&P 500 and Dow Jones climbed 0.57%, 0.41%, and 0....

READ MORE

MEMBERS ONLY

Big Drop In Crude Oil Prices Crush Energy Shares.....Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 12, 2019

We ended Wednesday with bifurcated action as the small cap Russell 2000 ($RUT, +0.05%) was able to eke out a tiny gain. The other major indices, however, were not so fortunate with the NASDAQ ($COMPQ, -0.38%) falling a bit more than...

READ MORE

MEMBERS ONLY

Big Reversal May Mark Short-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

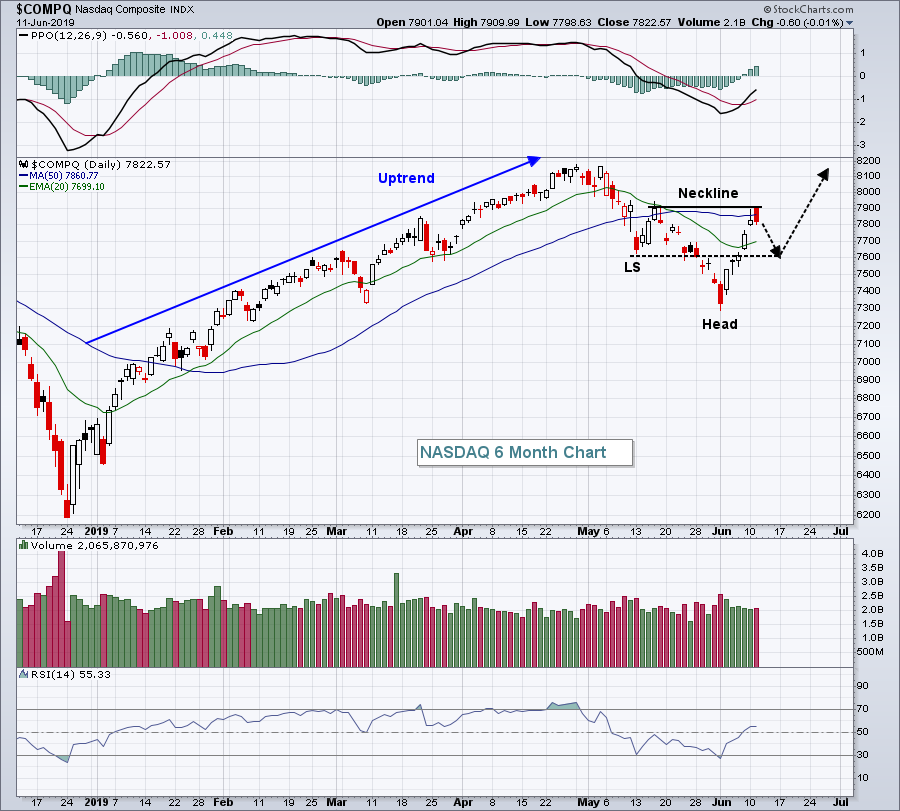

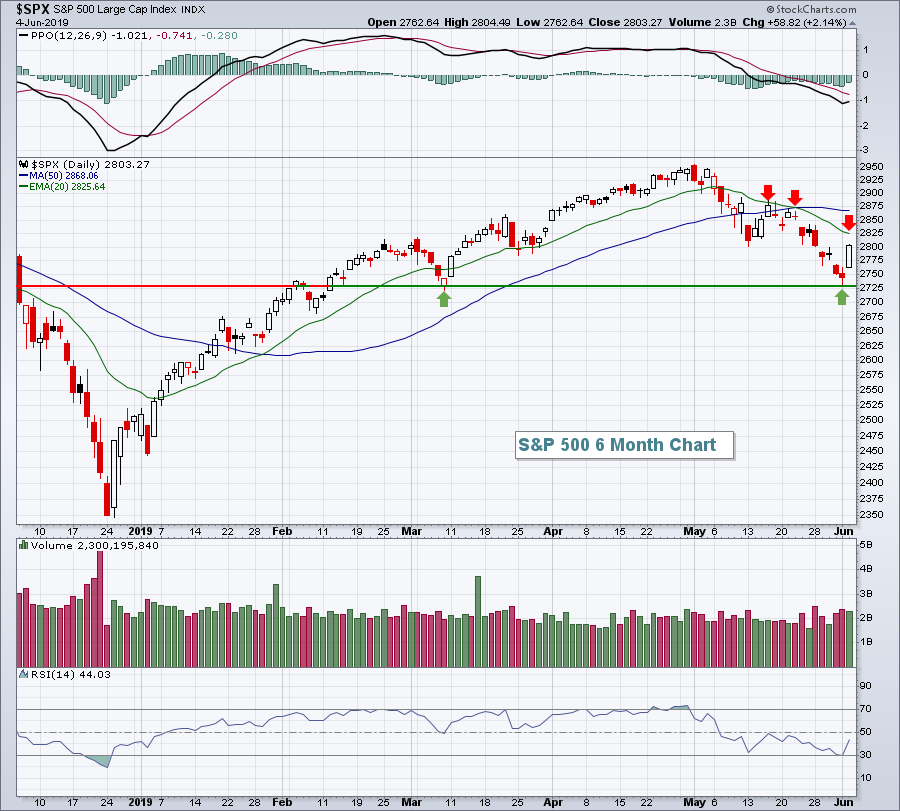

Market Recap for Tuesday, June 11, 2019

It wasn't a big down day, but it certainly felt like it. It started off so promising. Right out of the gate, the NASDAQ surged more than 1% in the opening minutes. However, by day's end, it closed in...

READ MORE

MEMBERS ONLY

Mergers And Averting Mexico Tariffs Bolsters Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 10, 2019

U.S. equities were buoyed by resolution to the 5% Mexico trade tariff announced recently by President Trump to encourage Mexico to slow the pace of illegal immigrants entering the U.S. That tariff was set to take effect yesterday, but never materialized....

READ MORE

MEMBERS ONLY

3 Monday Setups To Start The Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 7, 2019

U.S. indices capped off a very solid week with more gains on Friday. The more aggressive NASDAQ trounced the other key indices, climbing 1.66%. The S&P 500, Dow Jones, and Russell 2000 added 1.05%, 1.02%, and 0....

READ MORE

MEMBERS ONLY

Relative Strength Or Diversification? You Better Choose Carefully

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to say that you need elements of both, although you're going to want a much bigger helping of relative strength. Too much diversification can be extremely unhealthy, there needs to be a balance. Let me give you a quote about diversification from one of...

READ MORE

MEMBERS ONLY

Advanced Micro Devices (AMD) Loves June, But What's Going On With Transports?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 6, 2019

It was another solid day on Wall Street as the recent bounce continued. Unfortunately, it was also another day where investors/traders were seeking some safety. It's like ordering pizza, but adding a diet coke to watch your weight. The Dow...

READ MORE

MEMBERS ONLY

Defensive Sectors Power S&P 500 Back Above 20 Day EMA

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 5, 2019

The good news is that the U.S. stock market advanced on Wednesday and that both the Dow Jones (+0.82%) and S&P 500 (+0.82%) were able to clear their respective declining 20 day EMAs. Another piece of good news...

READ MORE

MEMBERS ONLY

An Industry Group To Buy And One To Avoid

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 4, 2019

A big turnaround occurred on Tuesday as many beaten-down stocks and industries from the May drubbing led a market rally. The NASDAQ and Russell 2000 led the rally with gains of 2.65% and 2.62%, respectively, but it was a wide-participation advance...

READ MORE

MEMBERS ONLY

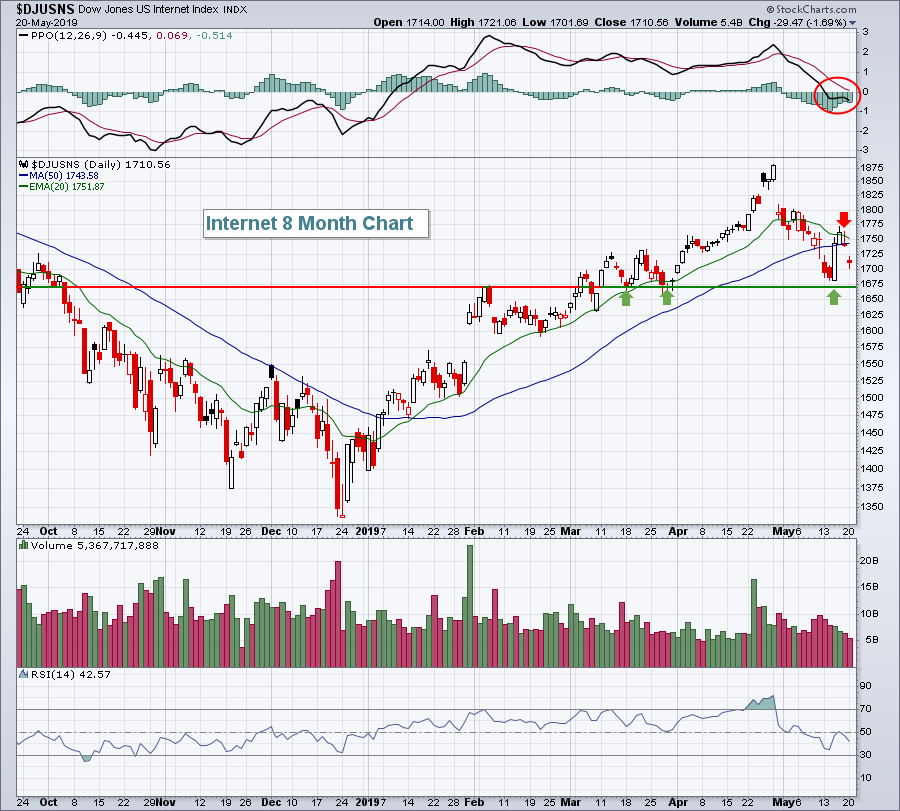

Late Afternoon Buying Does Little For NASDAQ Shares

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 3, 2019

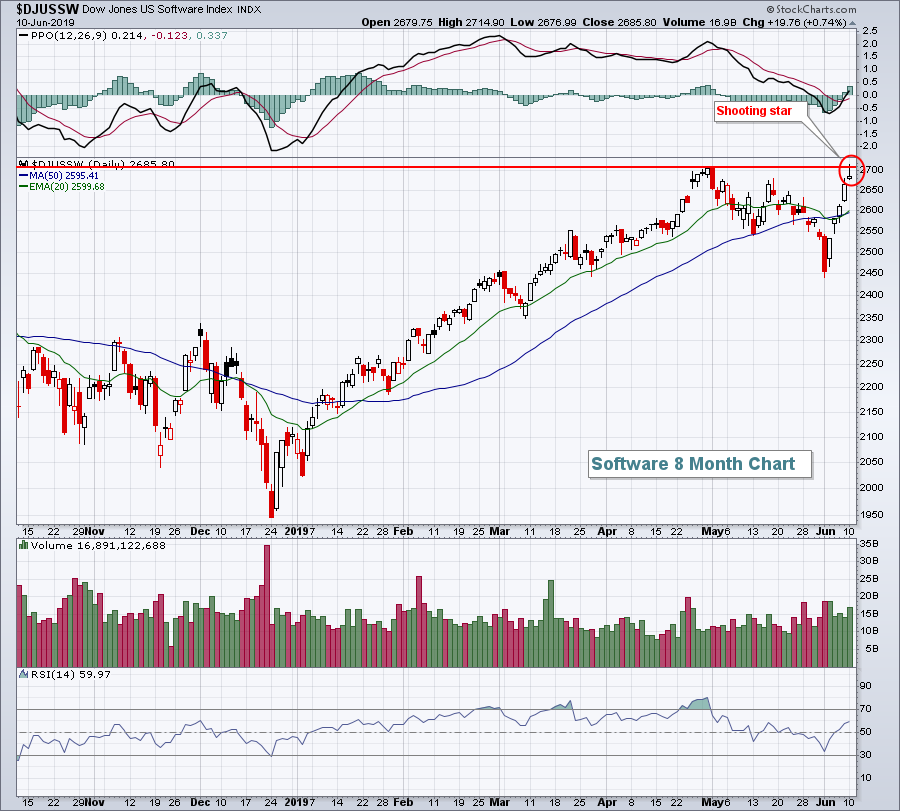

I've had lots of positives for software stocks the past few years, but yesterday we saw a rare short-term breakdown that will test the mettle of traders. The Dow Jones U.S. Software Index ($DJUSSW, -3.17%) joined internet stocks ($DJUSNS,...

READ MORE

MEMBERS ONLY

Don't Gamble On This Industry In June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

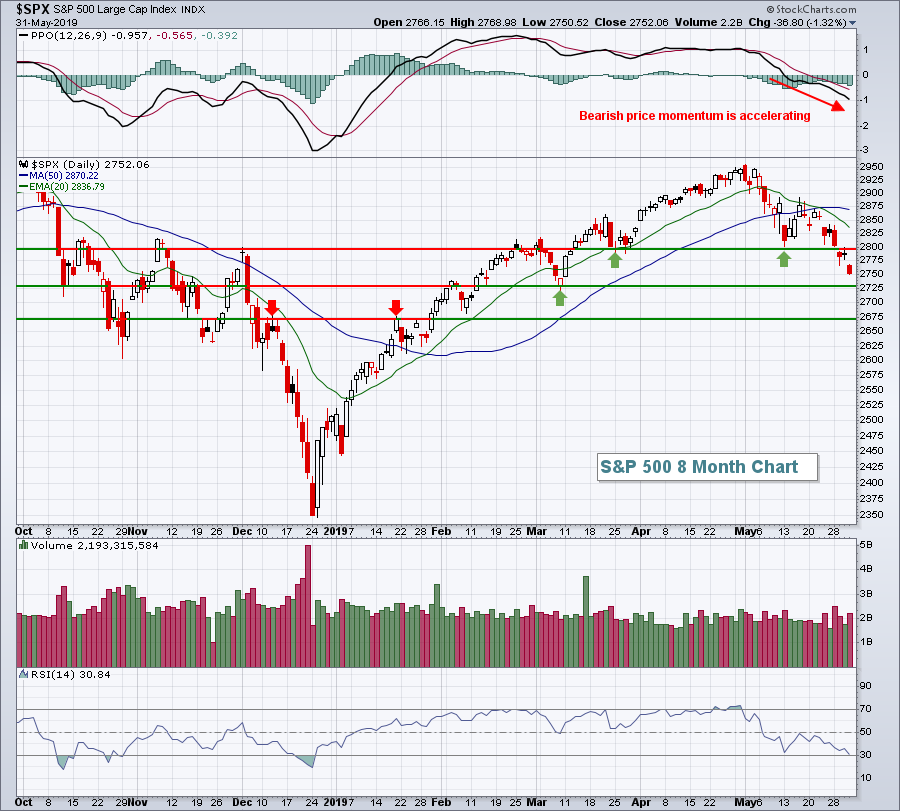

Market Recap for Friday, May 31, 2019

The U.S. stock market was in no mood for any negative surprises, yet it received one when President Trump slapped a 5% tariff on all products from Mexico (effective June 10th) to try to control illegal immigration. While it may seem as...

READ MORE

MEMBERS ONLY

The Charts Do Not Say Recession Is Likely....At Least Not Yet

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

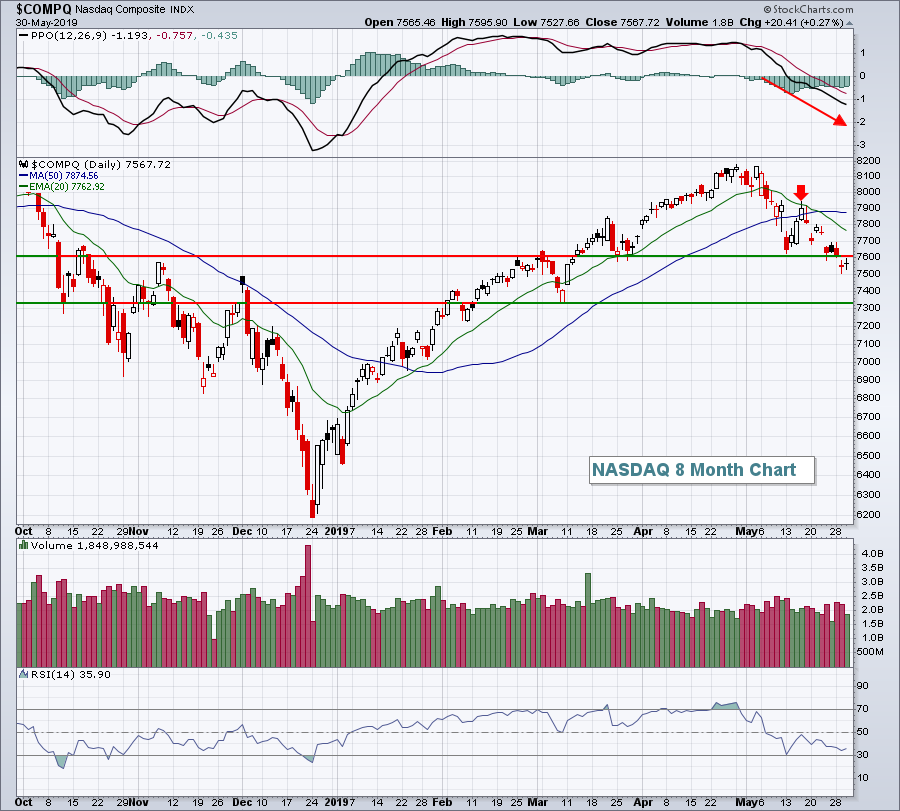

Market Recap for Thursday, May 30, 2019

Dollar General (DG, +7.16%) and Dollar Tree (DLTR, +3.14%) provided a lift to consumer discretionary stocks (XLY, +0.65%) after releasing their latest quarterly results, but PVH Corp (PVH, -14.87%) tumbled, further compromising an already-weak clothing & accessories group ($DJUSCF,...

READ MORE

MEMBERS ONLY

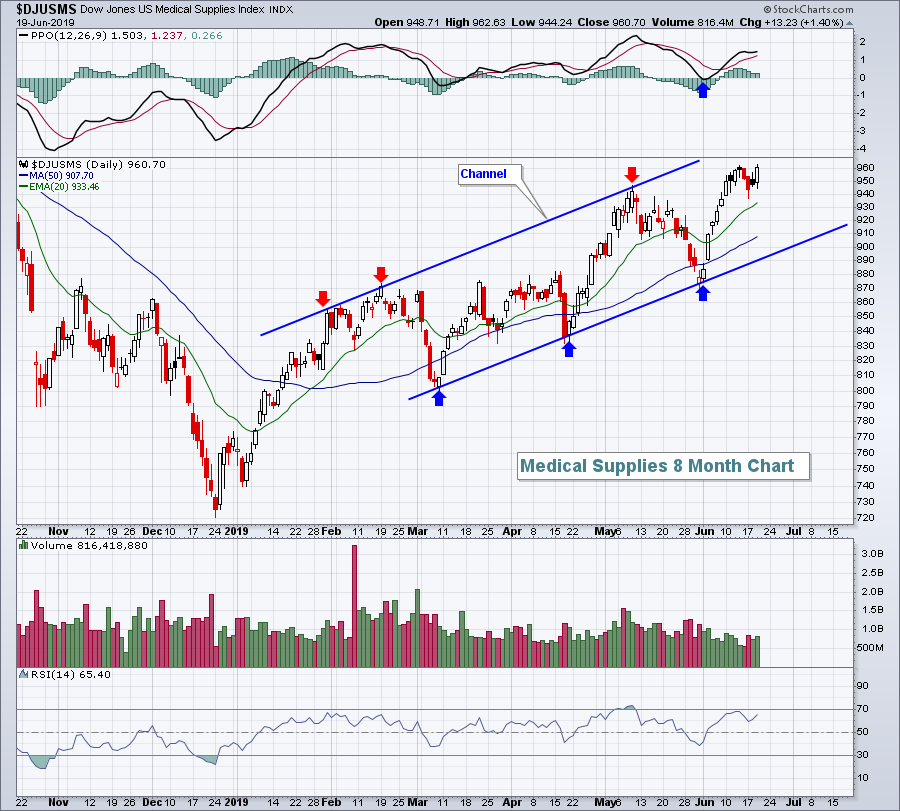

Trade War Negativity Hasn't Impacted This Industry Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 29, 2019

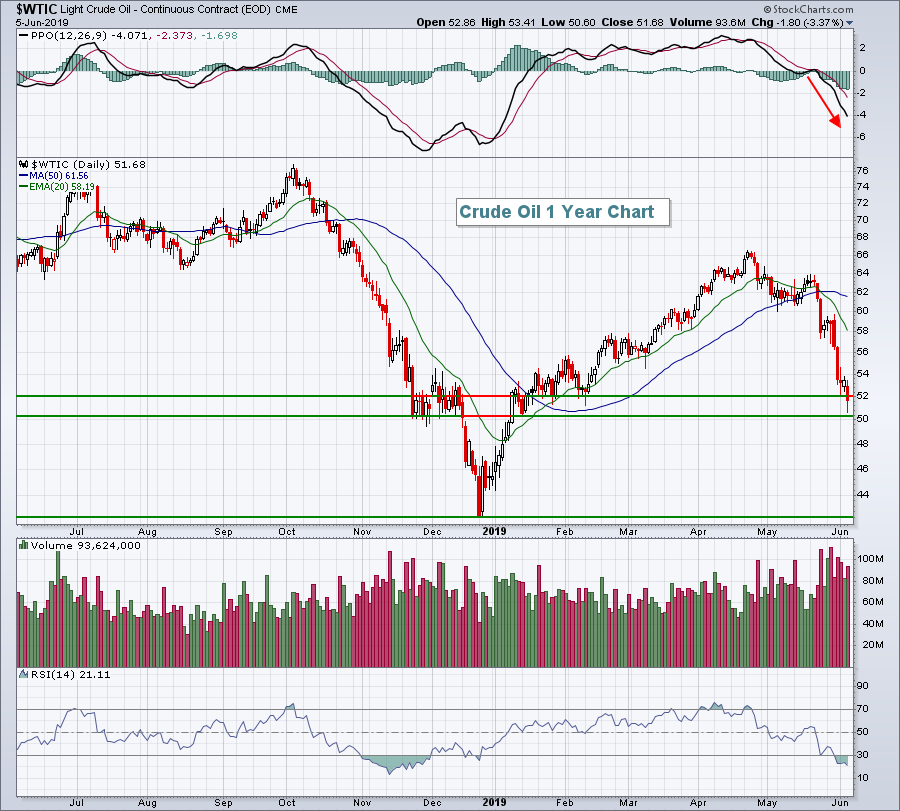

Trade and growth concerns, along with slumping crude oil prices ($WTIC), were mostly responsible for another bad day on Wall Street. There was across-the-board selling as all of our major indices fell from 0.69% (S&P 500) to 0.94% (Russell...

READ MORE

MEMBERS ONLY

Software's Been A Leader, Watch This Key Support Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

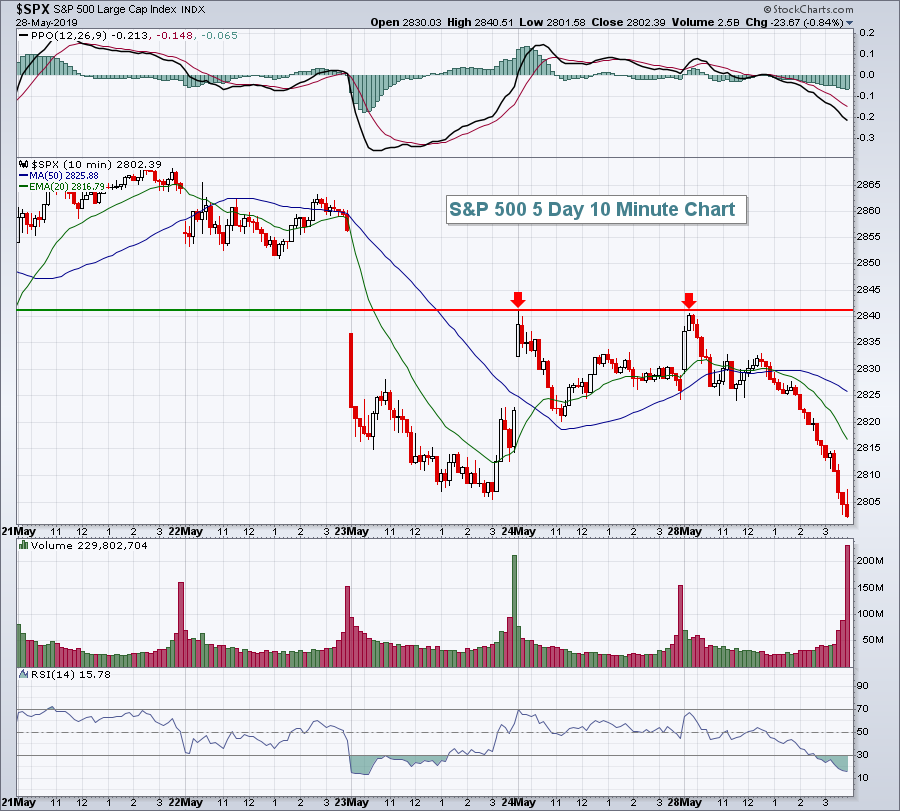

Market Recap for Tuesday, May 28, 2019

U.S. stocks jumped at the open, but then ran into sellers throughout the session. After gapping down at the open on Thursday, it's been difficult for the S&P 500 to clear the low 2840s and yesterday's...

READ MORE

MEMBERS ONLY

Consumer Staples Has Been A Leader In May, But Don't Expect It In June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

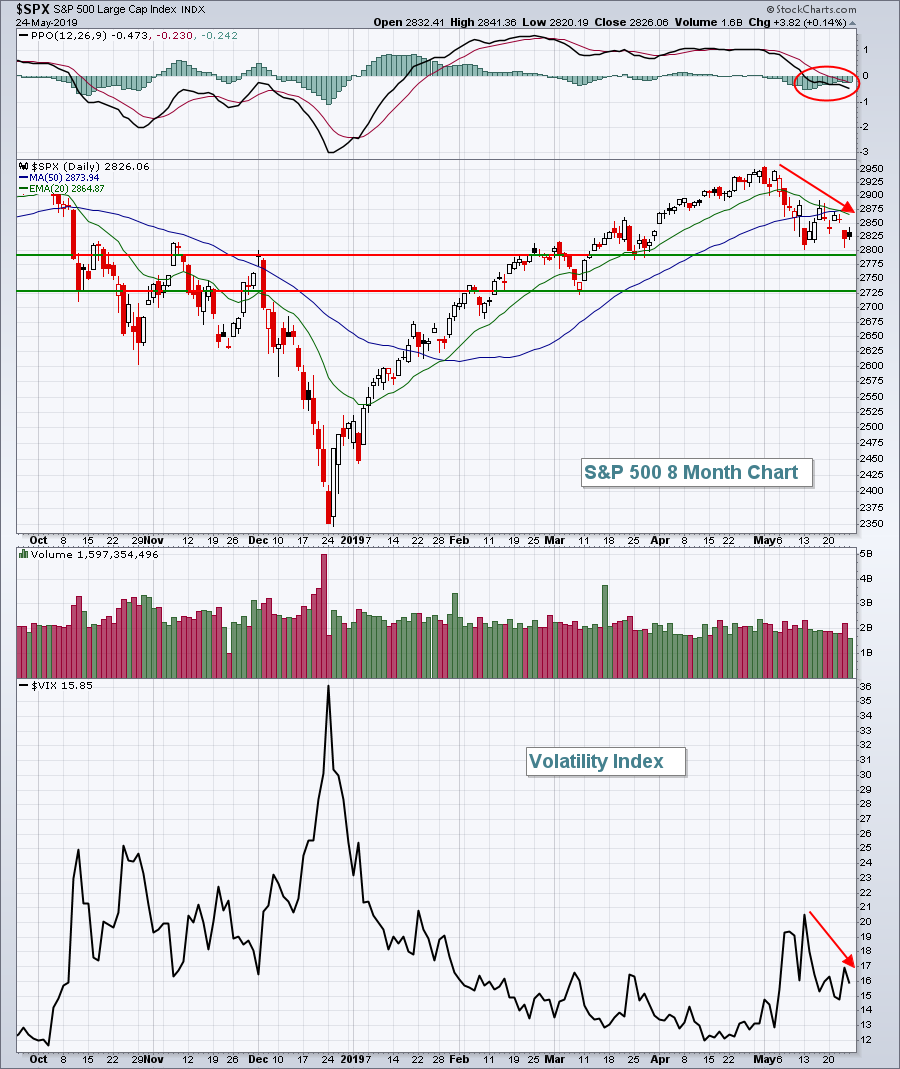

Market Recap for Friday, May 24, 2019

Before I summarize Friday's numbers, let me first say that the S&P 500 closed near a two-month low while the Volatility Index ($VIX) has been falling as well. I find this to be a very bullish development as nervousness...

READ MORE

MEMBERS ONLY

Calling Market Tops Is Easier Than You Think

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are no perfect signals that scream "GET OUT" of equities, but there are warning signs.....so long as you know where to find them. Most market participants believe in the random walk theory, which suggests that changes in stock prices have the same distribution and are independent...

READ MORE

MEMBERS ONLY

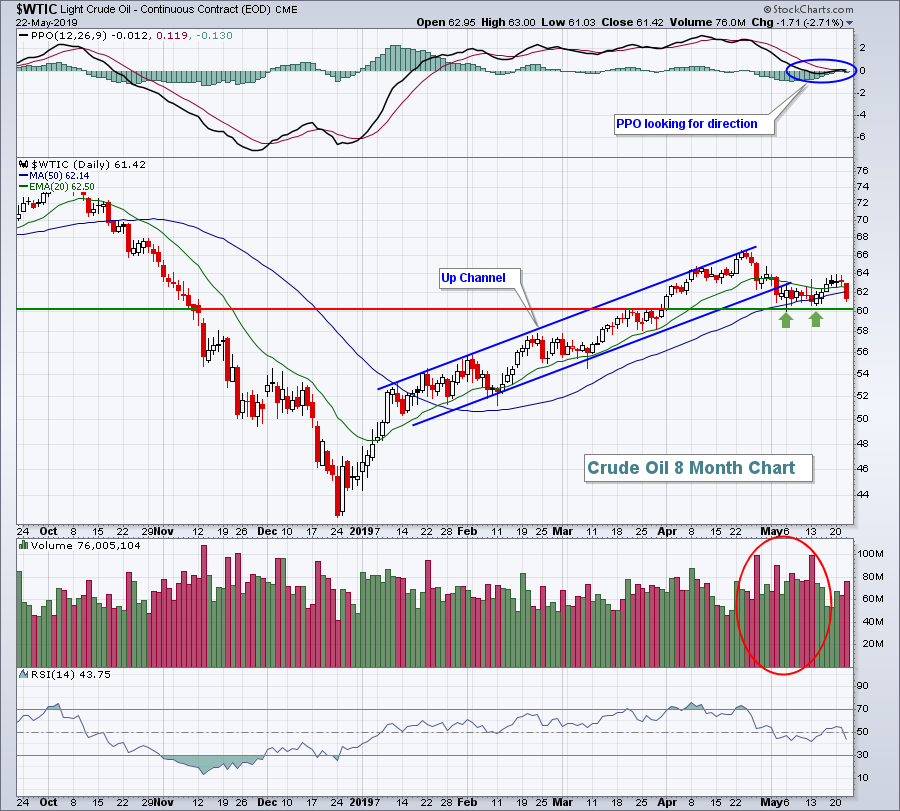

Crude Oil Plunges, Energy Crushed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 23, 2019

Energy (XLE, -3.35%) has been a relative laggard for the past 8 years, mostly due to a rising U.S. Dollar Index ($USD). The group took another big blow yesterday as crude oil prices ($WTIC, -5.71%) tumbled and had its worst...

READ MORE

MEMBERS ONLY

Apparel Retailers Sink To Four Month Low

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 22, 2019

Our major indices finished with losses on Wednesday, despite strength in defensive sectors. The S&P 500 and Dow Jones held up best, falling just 0.28% and 0.39%, respectively. The primary reason is that more defensive stocks are represented on...

READ MORE

MEMBERS ONLY

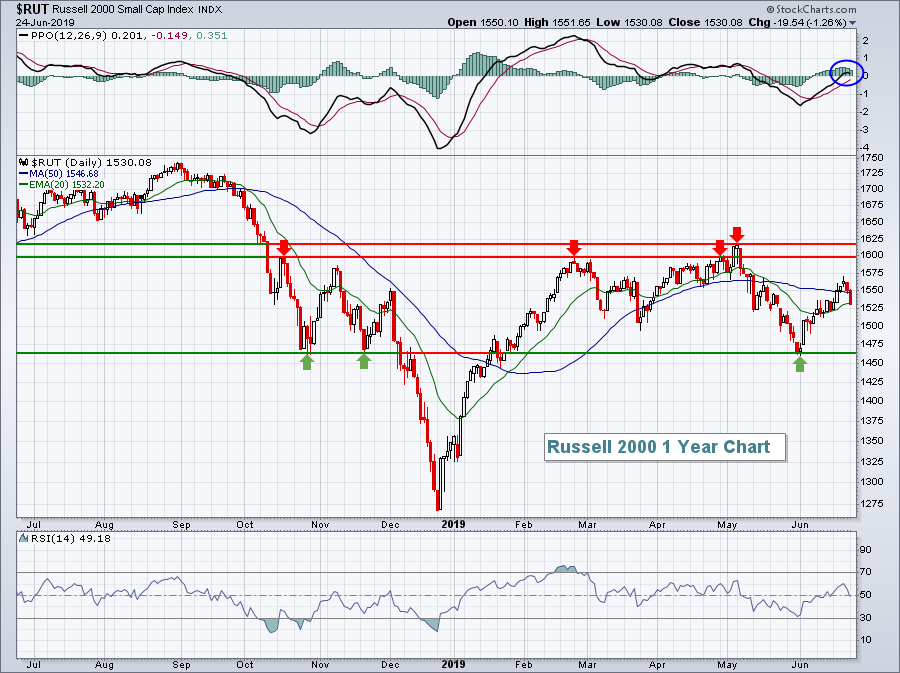

What's Wrong With Small Caps And Will June Seasonality Kick In?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 21, 2019

The U.S. stock market rebounded on Tuesday after a 90 day temporary license was granted by the U.S. Department of Commerce to Huawei, a Chinese multinational telecommunications equipment company. Technology stocks (XLK, +1.23%) were a primary beneficiary of this action...

READ MORE

MEMBERS ONLY

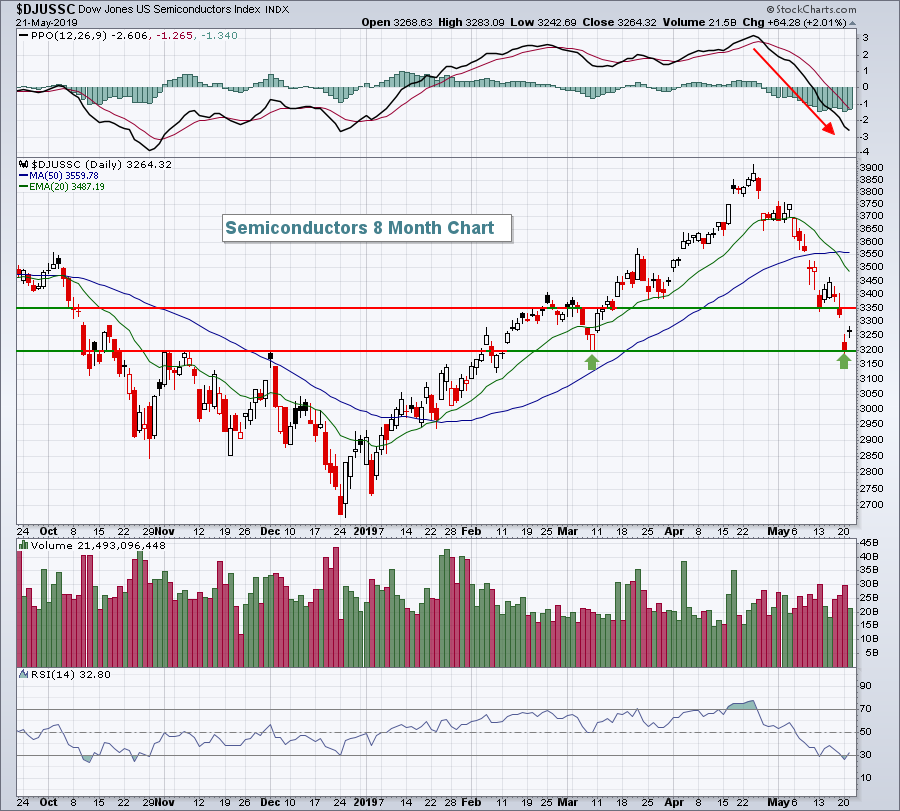

Semiconductors Take Another Big Hit, Support At Hand

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 20, 2019

Monday marked another rough May trading day, especially for the NASDAQ, which dropped 1.46%. The other major indices fell, but to a much lesser extent. Technology (XLK, -1.74%) and communication services (XLC, -1.65%) were hardest hit as weakness in semiconductors...

READ MORE

MEMBERS ONLY

Financial Administration Relative Strength - When Will It End?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 17, 2019

Friday offered up a mixed bag. Our major indices were either higher or near the flat line with an hour left in the trading day. Then more discussion surfaced that US-China trade talks had stalled. That sent U.S. equities spiraling lower, especially...

READ MORE

MEMBERS ONLY

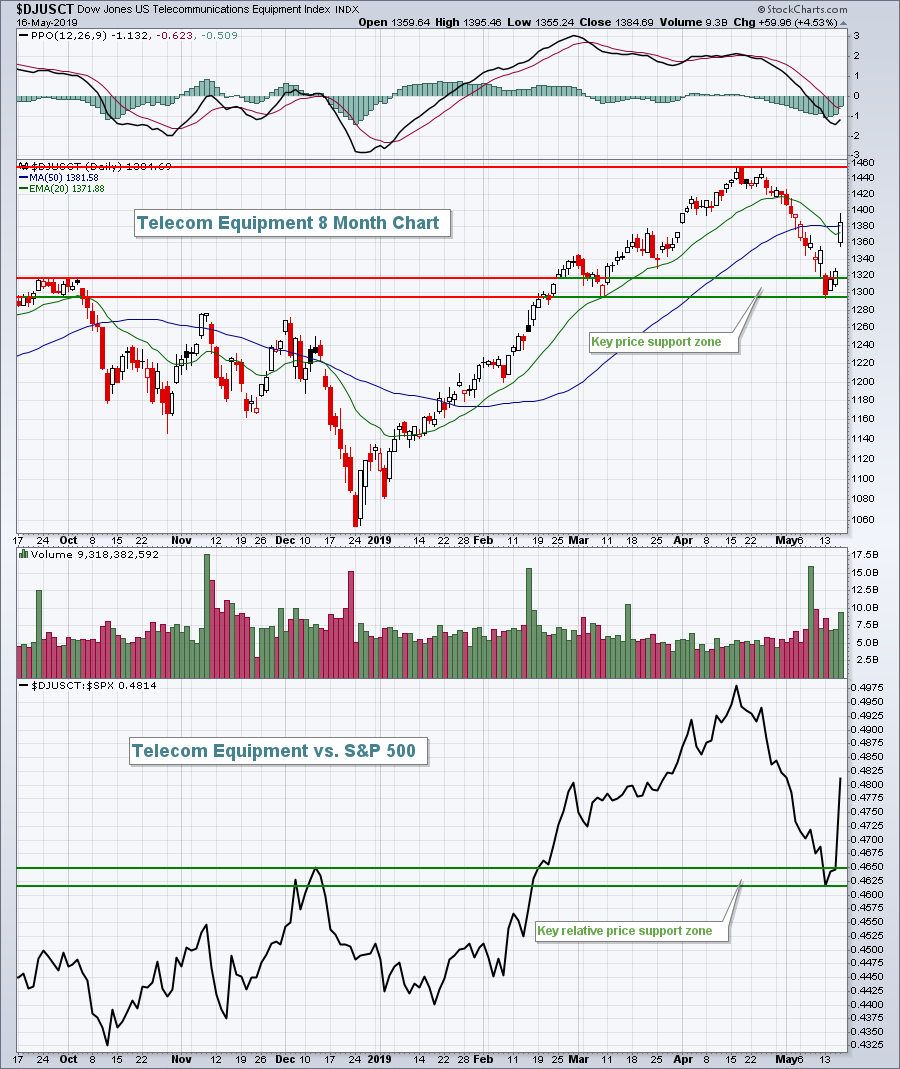

Cisco Earnings Drive Telecom Equipment Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 16, 2019

Cisco Systems, Inc. (CSCO, +6.66%) reported its latest quarterly results after the bell on Wednesday, beating both revenue and EPS estimates, and provided a solid outlook. It was just what the telecom equipment group ($DJUSCT, +4.53%) needed after trending lower for...

READ MORE

MEMBERS ONLY

Is The 6 Week Relative Outperformance In Financials Over?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 15, 2019

Falling treasury yields put a lid on many industries within financials (XLF, -0.37%), while renewed strength in the U.S. Dollar Index ($USD) kept pressure on materials (XLB, -0.26%). Other than those two sectors, it was primarily a very bullish day....

READ MORE

MEMBERS ONLY

April Retail Sales Are Out, But Will It Help?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 14, 2019

We've seen little economic or earnings news of late and that's beginning to show in the randomness of the huge S&P 500 moves based on President Trump's tweets regarding US-China trade. Sometimes it's...

READ MORE

MEMBERS ONLY

Seasonality Highlights An Average 36.3% Spring To Summer Gain For This Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

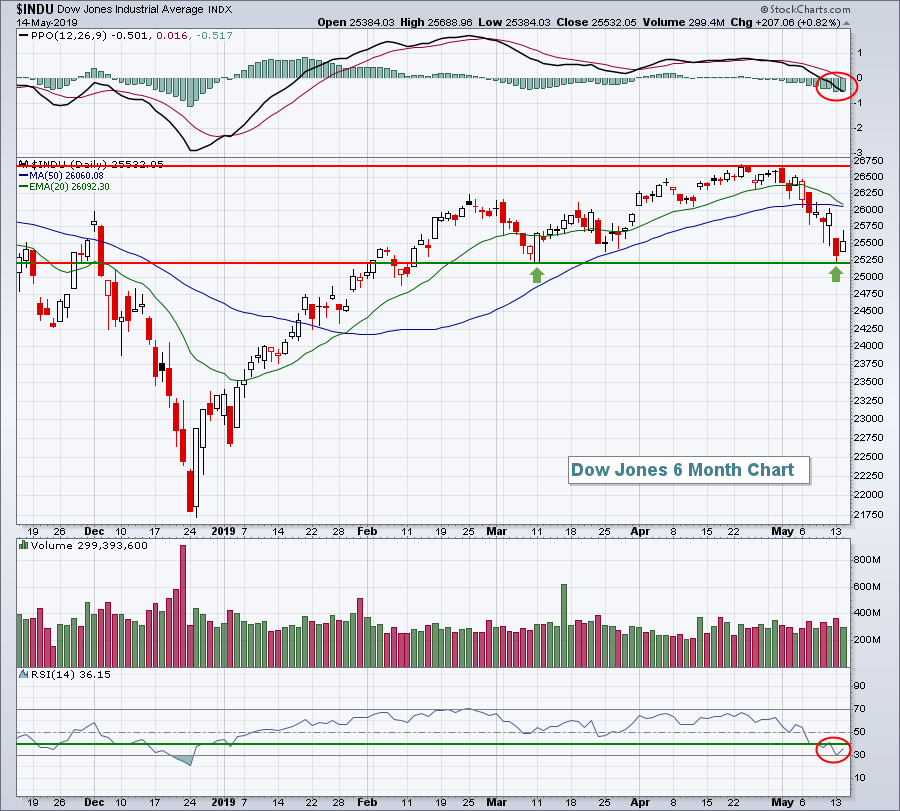

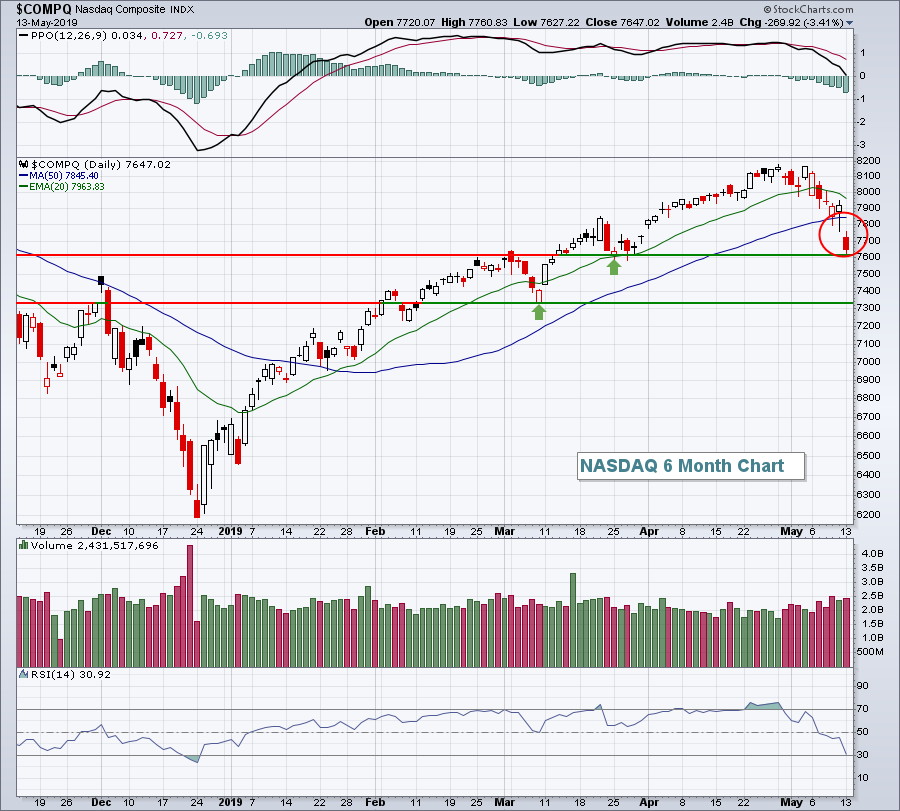

Market Recap for Monday, May 13, 2019

It was a very rough day on Wall Street yesterday. Mondays are historically the worst day of the week, but I doubt too many market participants were expecting the blood bath that we saw. Aggressive areas of the market were hit hardest, including...

READ MORE

MEMBERS ONLY

5 Monday Stocks With Strong Reward To Risk Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 10, 2019

After another morning of very weak action in U.S. stocks, we saw another afternoon recovery on Friday as all of our major indices finished in positive territory. It certainly felt good, but the truth of the matter is that nothing has been...

READ MORE

MEMBERS ONLY

S&P 500 Reverses Off Key Support, New Leadership Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

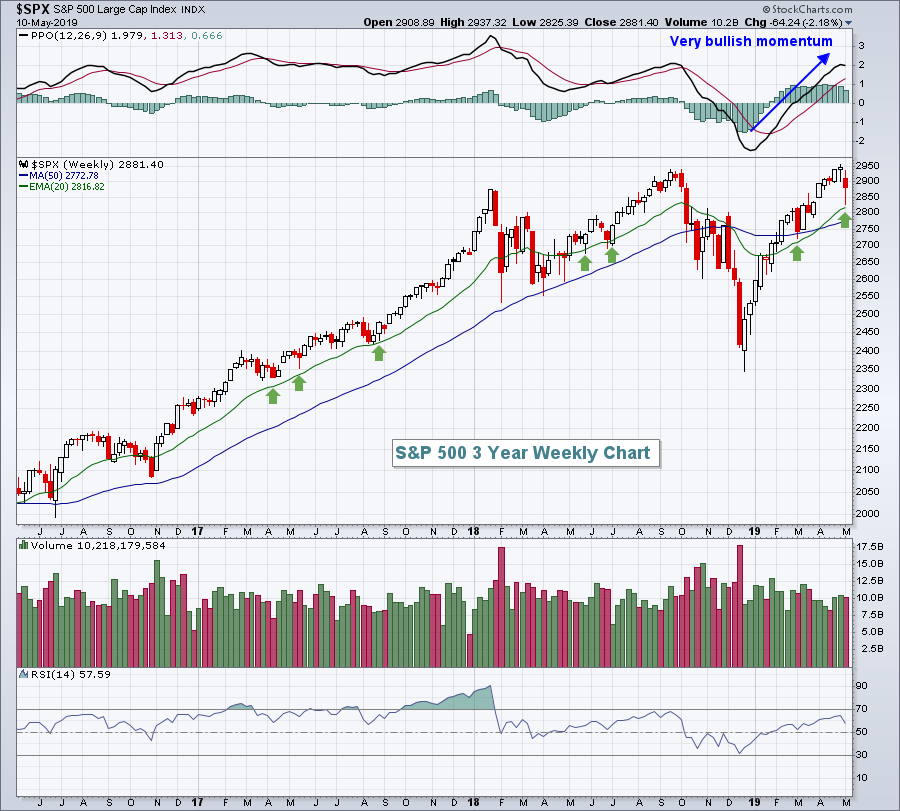

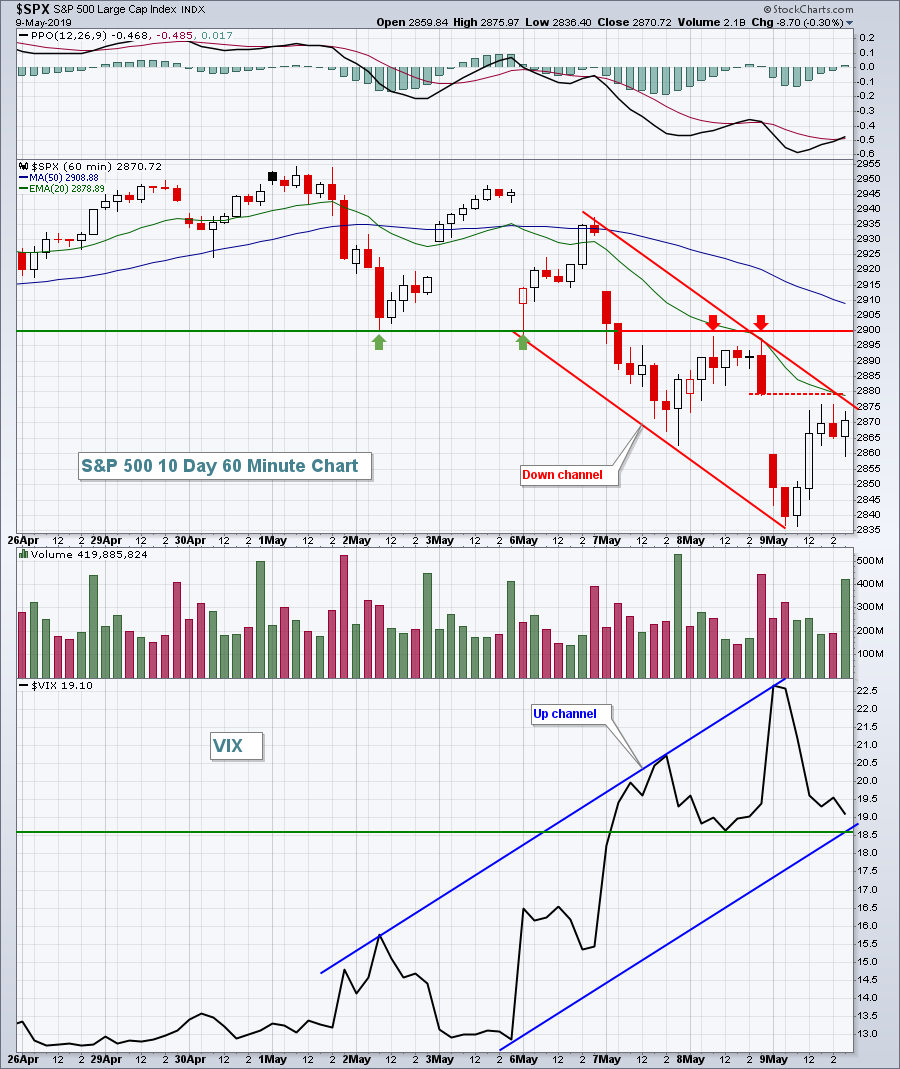

It was a brutal week, especially given the surging U.S. equity prices throughout 2019 thus far. The benchmark S&P 500 fell 2.18%, but intraweek losses were far steeper. There was a significant reversal on Friday as the Volatility Index ($VIX) appeared to confirm a near-term top...

READ MORE

MEMBERS ONLY

Here's A Defensive Health Care Stock That Loves The Next 3 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 9, 2019

Here's my takeaway from yesterday's action. We had a solid recovery off of earlier intraday lows, but the downtrend remains firmly in place and we need to respect that. Volatility ($VIX) is important to watch because spikes in this...

READ MORE

MEMBERS ONLY

Wall Street Gets Reprieve But Futures Are Red Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 8, 2019

It was a much quieter day on Wall Street and it showed across our major indices and sectors. We finished with bifurcated action as the Dow Jones managed to finish with a minor 2 point gain. The other major indices ended with losses,...

READ MORE

MEMBERS ONLY

How Much Selling Is Ok?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 7, 2019

It was a wicked day on Wall Street. It felt more like December 2018 than May 2019. Volatility surged for a second consecutive day and sellers swamped buyers. Volume accelerated as it generally does during market selloffs and a bit of panic was...

READ MORE

MEMBERS ONLY

Wall Street Shakes Off Trade Worries...For A Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 6, 2019

The session got off to a very rough start as global market were hit hard following word that US-China trade talks were off the tracks once again. President Trump warned of steeper tariffs and Chinese officials said they were considering abandoning talks altogether....

READ MORE