MEMBERS ONLY

These HOT Industry Groups are Fueling This Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he covers key inflation data, earnings season highlights, and sector rotation trends. He breaks down recent price action in major indexes like the S&P 500 and Nasdaq, with a close look at the 20-day moving average as a support gauge. Tom spotlights standout industry groups...

READ MORE

MEMBERS ONLY

Is It Time to Lower Our Market Expectations?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain very bullish and U.S. stocks have run hard to the upside off the April low with growth stocks leading the way. I expect growth stocks to remain strong throughout the summer months, as they historically do, but we need to recognize that they've already seen...

READ MORE

MEMBERS ONLY

How I Triple My Returns With 3x Leveraged ETFs!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video.

Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark...

READ MORE

MEMBERS ONLY

Don't Overlook This Lagging Industry; I Believe It's Set To Explode!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I like to trade stocks that are relative leaders and belong to industry groups that are leaders as well. For the past 2-3 months, much has been written about and discussed with respect to semiconductors ($DJUSSC), software ($DJUSSW), electrical components & equipment ($DJUSEC), electronic equipment ($DJUSAI), recreational services ($DJUSRQ), travel...

READ MORE

MEMBERS ONLY

Money's Not Leaving the Market - It's Rotating!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities.

In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom...

READ MORE

MEMBERS ONLY

Is This Rally Sustainable? You Better Bet Your Bullish Sweet Dollar It Is!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is the EB Weekly Market Report that I sent out earlier to our EarningsBeats.com members. This will give you an idea of the depth of our weekly report, which is a very small piece of our regular service offerings. We called both the stock market top in February...

READ MORE

MEMBERS ONLY

All-Time Highs and An Upcoming Rate Cut: We're Just Getting Started on This Move Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The bears are now left grasping at straws. What about tariffs? What about inflation? What about recession? What about the Fed? What about interest rates? What about the Middle East? What about the deficits? Blah, blah, blah.

When it comes to the media, you need to bury your head in...

READ MORE

MEMBERS ONLY

US Strikes Iran: What Comes Next For Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In today's "Weekly Market Recap", EarningsBeats.com's Chief Market Strategist Tom Bowley looks ahead to determine the likely path for U.S. equities after the weekend bombing of Iran nuclear sites. Are crude prices heading higher? Will energy stocks outperform? What additional roadblocks might...

READ MORE

MEMBERS ONLY

The NASDAQ 100, On The Brink Of A Breakout, Needs Help From This Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. stocks are on the cusp of a very impressive breakout to all-time highs, but are still missing one key ingredient. They need help in the form of a semiconductors ($DJUSSC) breakout of its own. When the DJUSSC reached its all-time high on June 20, 2024, one year ago,...

READ MORE

MEMBERS ONLY

The Fed Is Getting It Wrong AGAIN As They Hold Rates Steady

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Fed should absolutely stop talking about being "data dependent". That's so far from the truth. If they were data dependent, we'd have either seen a rate cut today or Fed Chief Powell would have been discussing one for the next meeting. Inflation reports...

READ MORE

MEMBERS ONLY

Big Rally Ahead Should Yield All-Time High on This Index

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All of our major indices continue to rally off the April 7th, cyclical bear market low. A couple, however, have broken out of key bullish continuation patterns that measure to all-time highs. I'll focus on one in today's article.

Russell 2000

The IWM is an ETF...

READ MORE

MEMBERS ONLY

Learning Painful Lessons is the Start to Building a Successful Trading or Investing Strategy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In order to invest or trade successfully, you have to have conviction. Conviction does not equal stubbornness. It's very important to remain objective and occasionally question your conviction and adjust your strategy from time to time if signals warrant it. But I cannot trade personally if I believe...

READ MORE

MEMBERS ONLY

Market Maker Manipulation; Oops, They Did It Again!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's be honest. Did anyone think a little more than a month ago that the S&P 500 was primed for a 1000-point rebound? I turned bullish at that April 7th bottom a month ago, but I did not see this type of massive recovery so quickly....

READ MORE

MEMBERS ONLY

Here's Why A Short-Term Top Might Be Nearing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I feel like the short-term risk is turning once again and I'll explain why in my analysis below. Please don't misunderstand. I suggested a bottom was in place a few weeks ago and I LOVE what has been happening in terms of manipulation/accumulation and I...

READ MORE

MEMBERS ONLY

This is the Group to Watch for the Next Bull Market Phase and Separating Noise from Reality

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technically, it's rather clear that we remain in a downtrend. However, not all downtrends are created equal. Some are built to last, while others can turn around quickly. Recognizing the difference is obviously quite important. What most traders/investors cannot grasp is that secular (long-term) bull markets often...

READ MORE

MEMBERS ONLY

The Bottom is Here or Rapidly Approaching

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

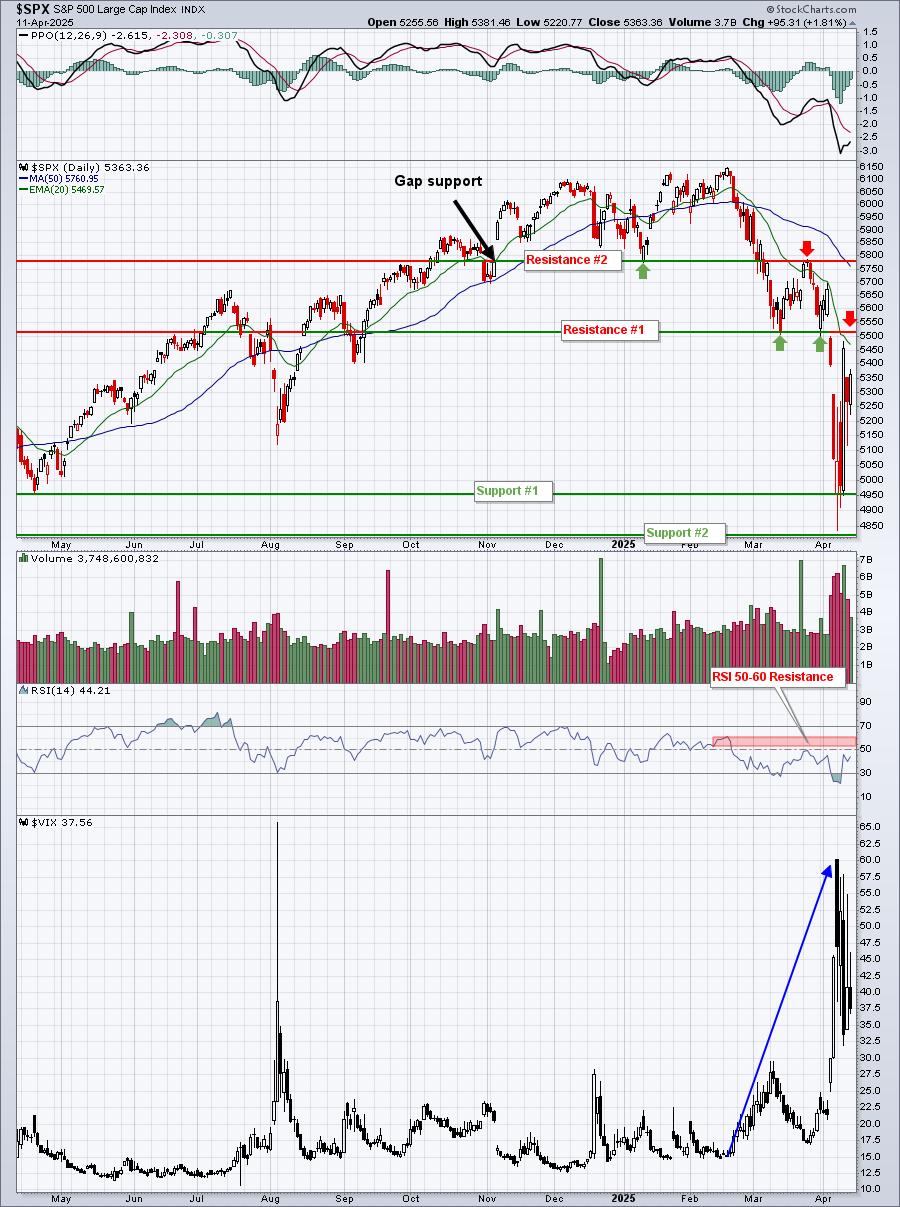

I pay attention to technical support levels as the combination of price support/resistance is always my primary stock market indicator. We're in a downtrend and, in my opinion, the trading range is very, very clear on the S&P 500 right now:

I think most everyone...

READ MORE

MEMBERS ONLY

S&P 500 Drops Quickly to Test Key Support Amid Rising Volatility

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Thank You!

I've been writing at StockCharts.com for nearly 20 years now and many of you have supported my company, EarningsBeats.com, and I certainly want to show my appreciation for all of your loyalty. I believe we're at a major crossroads in the stock...

READ MORE

MEMBERS ONLY

S&P 500 Dives After Failed Test of Price Resistance; Bears Are in Control

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The key resistance level I've been watching on the S&P 500 hasn't wavered. It's 5782. The bulls had a real chance this past week to clear this important hurdle and they failed. Badly. If this was a heavyweight fight, the ref would...

READ MORE

MEMBERS ONLY

Is the Correction Over? Or Are We Still Looking at a Bear Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

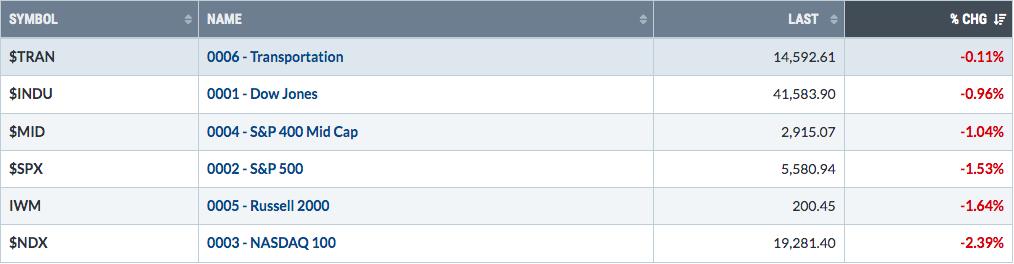

The S&P 500, NASDAQ 100, and Russell 2000 fell 10.5%, 13.8%, and 19.5%, respectively, from their recent all-time highs down to their March lows. Each index paused long enough and deep enough for a correction, with the Russell 2000 nearly reaching cyclical bear market territory...

READ MORE

MEMBERS ONLY

Did Friday's Reversal Mark A Major Bottom?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The next step in the stock market will be very interesting. I've been discussing a potential Q1 correction since our MarketVision event the first week of January and it's here. The NASDAQ 100 ($NDX), from its high on February 19th (22222.61) to its low on...

READ MORE

MEMBERS ONLY

Financials' Strong Week Lifts Them to Within a Whisker of an All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many are watching the disaster in growth stocks unfold, including us at EarningsBeats.com, but the reality is that many other areas of the stock market represent a silver lining. When growth stocks sell off, essentially two things can happen. One, the rest of the stock market sells off as...

READ MORE

MEMBERS ONLY

The Top is Confirmed and Now It's Just a Matter of How Low We Go

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me start by reminding everyone that I believe the most important relationship in the stock market is how consumer discretionary stocks (XLY) perform relative to consumer staples stocks (XLP). This ratio (XLY:XLP) has a VERY strong positive correlation with the S&P 500. In other words, when...

READ MORE

MEMBERS ONLY

Here Are Two Great Earnings Reports This Past Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For us at EarningsBeats.com, earnings season is the time to do our research to uncover the best stocks to trade over the next 90 days, or earnings cycle. We do this in various ways. Our flagship ChartList is our Strong Earnings ChartList (SECL), which honestly is nothing more than...

READ MORE

MEMBERS ONLY

This Is How I Crush The Benchmark S&P 500 In Any Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was another mildly bullish week as our major indices climbed very close to new, fresh all-time highs. We also saw a return to growth stocks as we approached breakout levels, which is a good signal as far as rally sustainability goes. Despite this, there remain reasons to be cautious...

READ MORE

MEMBERS ONLY

Here's a Group Ready To Set Sail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes an industry group looks good technically, sometimes fundamentally, and then other times seasonally. But what happens when they all line up simultaneously? Well, we're about to find out with the travel & tourism group ($DJUSTT). On Friday, Expedia (EXPE, +17.27%) soared after reporting blowout quarterly results...

READ MORE

MEMBERS ONLY

Volatility ($VIX) May Be Providing Clues of a Big Market Drop

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Secondary market signals are beginning to line up for a further drop, which can sometimes provide false signals. The primary indicator for me is always the combination of price/volume. When I only look at price/volume on the S&P 500, it still remains easy to be long...

READ MORE

MEMBERS ONLY

Be Careful With These Topping Candles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

"When do I sell?" is easily the most-asked question I've received over the years. There are multiple answers to this question based on certain variables. The first key variable is whether you're a day trader, short-term swing trader, or long-term buy and holder. I...

READ MORE

MEMBERS ONLY

We're Topping With BEARISH Action Ahead!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Listen, I'm generally a fairly optimistic guy. I tend to see the good in the stock market, while many others continuously focus on potential selloffs ahead. I remain mostly bullish for good reason as the S&P 500 has risen 75% of all years since 1950. It...

READ MORE

MEMBERS ONLY

What's the Secret to Crushing the S&P 500?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Remember that old commercial, "It's not nice to fool Mother Nature?" Well, there should be another one pertaining to the stock market, "Don't bet against a secular bull market advance!" We're all trained, or brainwashed, if you will, to believe...

READ MORE

MEMBERS ONLY

Here's How To Find The Best Upcoming Earnings Reports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Our strategy at EarningsBeats.com just simply makes good common sense. If you want to find the best earnings reports BEFORE they're reported, follow relative strength. I've explained this many times, but let me do it again. Wall Street firms talk to management of companies throughout...

READ MORE

MEMBERS ONLY

Only One Group Has Shown Consistent Relative Strength For The Past Year

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I look back at leading industry groups for the past day, week, month, 3-month, 6-month, and 1-year periods, only one industry group has been among the Top 20 industry groups for each of those 6 different periods. It's a group that I liked heading into 2024 and...

READ MORE

MEMBERS ONLY

Here's Why The Bottom Is Dropping Out of the Dow Jones

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

To understand what makes the Dow Jones tick, you have to first understand one of the key differences between the Dow Jones and the S&P 500 indices. There are a few, but none more critical than the following:

Index Weighting

The S&P 500 is market-cap weighted,...

READ MORE

MEMBERS ONLY

These 3 Charts Are Among The Most Critical To Start 2025

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Obviously, there will be many ups and downs in 2025 and no one chart or indicator can be relied upon 100% to help guide us throughout the year. But some key and very influential areas of the market do meet crossroads from time to time and it seems like one...

READ MORE

MEMBERS ONLY

Do You Need Direction for 2025? Here Are 3 Charts You Should NOT Ignore

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A little less than a week ago, I wrote an article about inflation and how it's nothing more than a pipe dream in Fed Chief Jay Powell's head. Let me expand on that article, maybe from a slightly different approach this time. The inflation rhetoric just...

READ MORE

MEMBERS ONLY

Wall Street Sees No Threat of Inflation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Generally, there are 3 key hedges against inflation - gold ($GOLD), commodities ($XRB), and real estate (XLRE). While the Fed has taken a renewed interest in the short-term rising inflationary picture, which, by the way, is in direct contrast to what Fed Chief Powell said in late August and September,...

READ MORE

MEMBERS ONLY

The Fed Is The New Waffle House

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

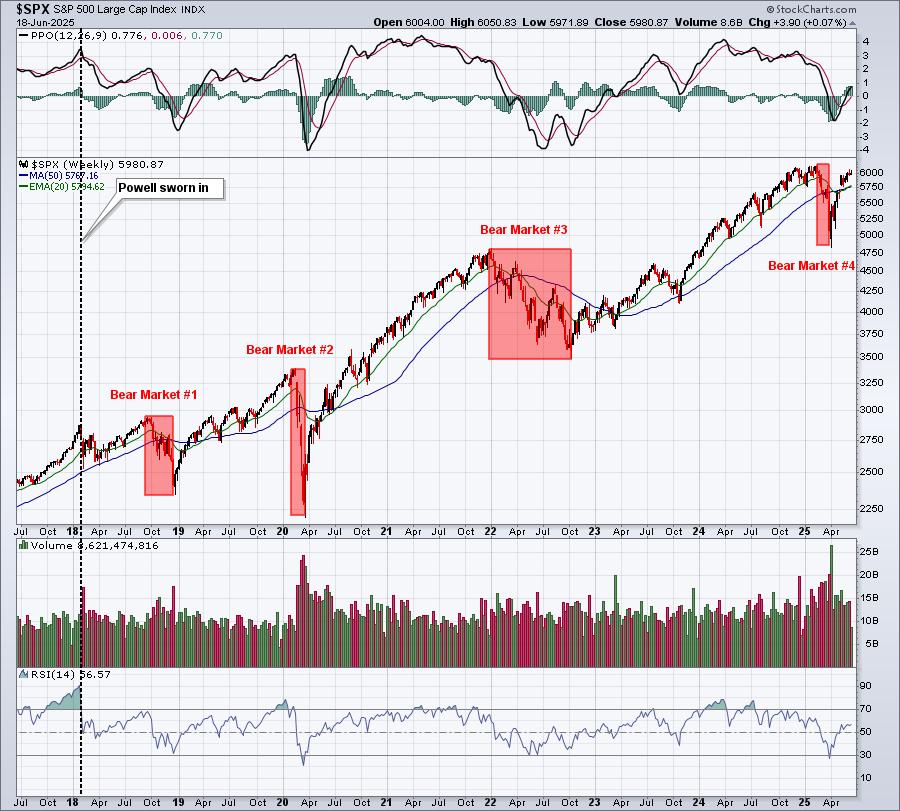

I had no idea the Fed could be such expert wafflers. But, as each month passes, it's becoming clearer. The overall stock market trend, despite all the back-and-forth, yo-yo Fed decisions over the past 6 months, remains to the upside. Need proof? Check out this weekly S&...

READ MORE

MEMBERS ONLY

Identifying GREAT Trades and Looking Ahead to 2025 Using RRG Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are a number of ways that you can find great trading opportunities. One way is to simply follow a chart on a WatchList and wait for certain indicators to reach "buy" points. For instance, an uptrending stock many times will find support as its 20-day EMA is...

READ MORE

MEMBERS ONLY

What's The Outlook For December AND For 2025?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Could we see a short-term shift towards defensive sectors? Real estate? Utilities? I haven't uttered these words in awhile. And why should I as our major indices have forged into new all-time record high territory? Well, I'm only talking about very near-term, maybe the next 1-3...

READ MORE

MEMBERS ONLY

Here's Why the Small Cap IWM Will Soar Nearly 70% by the End of 2025

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you want big returns, I'm convinced you'll find them in small caps. When I make bold predictions, and many of you know that I do fairly often, it's usually supported by long-term perspective. Most everyone has a negative bias towards small caps right...

READ MORE

MEMBERS ONLY

Small and Mid Caps: Turning Lemons Into Lemonade

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

No matter how you slice it, small and mid caps have been absolutely crushed on a relative basis since 2021. The unfortunate part about this is that most traders have recency bias. They believe whatever has been working will continue to work and things that haven't been working...

READ MORE