MEMBERS ONLY

Jobs Strong On Friday But China Trade Weighs On Futures

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 3, 2019

April nonfarm payrolls were much stronger than expected, jumping to 263,000 and well ahead of the 180,000 consensus estimate. The unemployment rate fell to 3.6%, the lowest its seen in 50 years. The bond market wasn't impressed, however,...

READ MORE

MEMBERS ONLY

Energy Remains A Drag And Seasonality Suggests It Could Get Worse

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 2, 2019

Energy (XLE, -1.74%) took yet another tumble on Thursday, which dampened an otherwise decent recovery from intraday morning lows in our major indices. The Dow Jones was the big loser, dropping 0.46%, while the small cap Russell 2000 index rebounded nicely,...

READ MORE

MEMBERS ONLY

Banks Vs. REITs Provide Bullish Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 1, 2019

Fed Chair Jerome Powell ruined the bull market party on Wednesday afternoon, effectively suggesting that the Fed would not be lowering rates in response to low inflation data of late. The bond market has been screaming for a rate cut, not a hike,...

READ MORE

MEMBERS ONLY

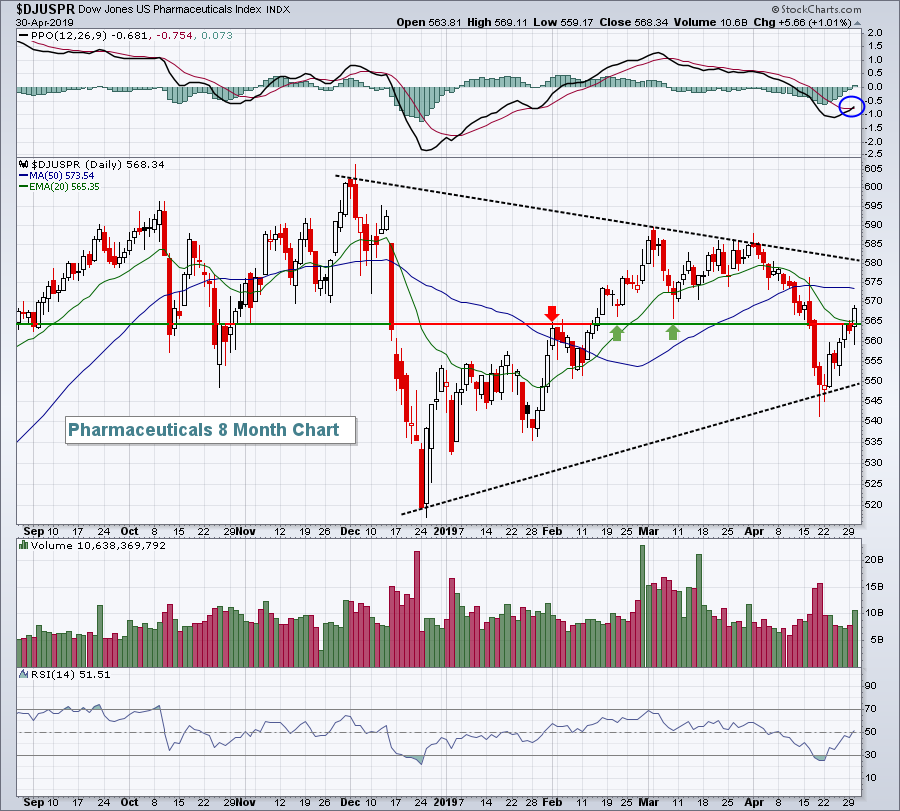

Go Away In May? More Like "Time To Fly Is Mid-July"

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 30, 2019

Alphabet (GOOGL, -7.50%) set the stage for a rough day on the NASDAQ (-0.81%) as the internet giant posted quarterly results that didn't impress Wall Street. The small cap Russell 2000 lost 0.45%, losing ground vs. the benchmark...

READ MORE

MEMBERS ONLY

Watch This Transportation Ratio Very, Very Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 29, 2019

A bull market is comprised of a number of things, but two are wide participation and rotation of strength. We've been seeing both. Yesterday, it was financials (XLF, +1.01%) and communication services (XLC, +0.91%) that led the S&...

READ MORE

MEMBERS ONLY

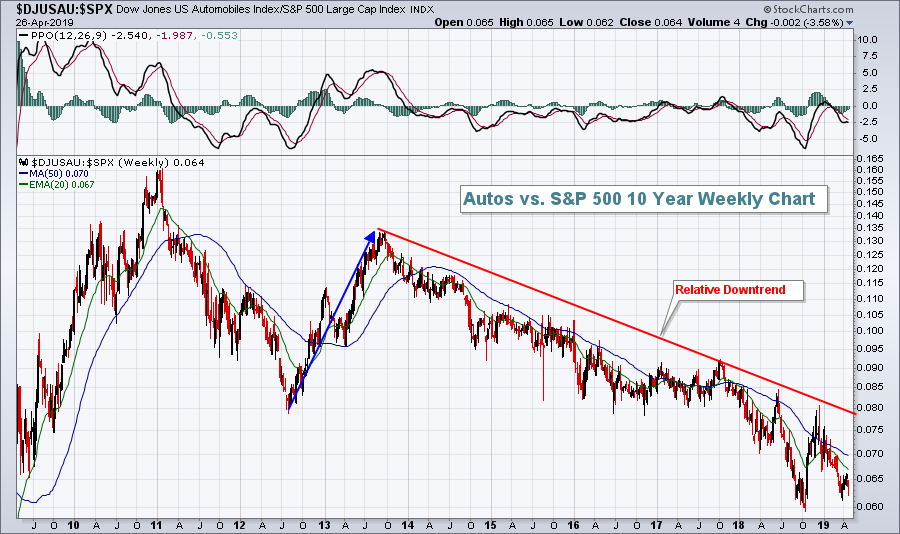

Ford Lifts Autos, Healthcare Advances, And Consumer Stocks Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 26, 2019

When was the last time I suggested Ford Motor Co (F, +10.74%) was a catalyst for any bull market advance? Ummm, probably never. But F was exactly that on Friday as much better than expected earnings lifted the stock and the automobile...

READ MORE

MEMBERS ONLY

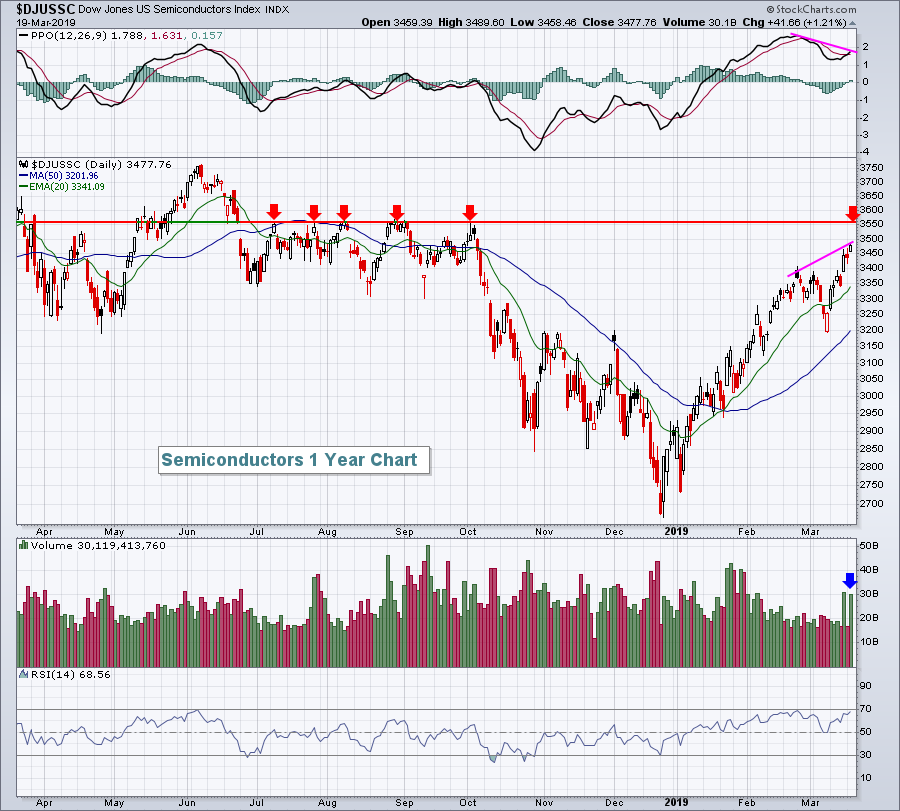

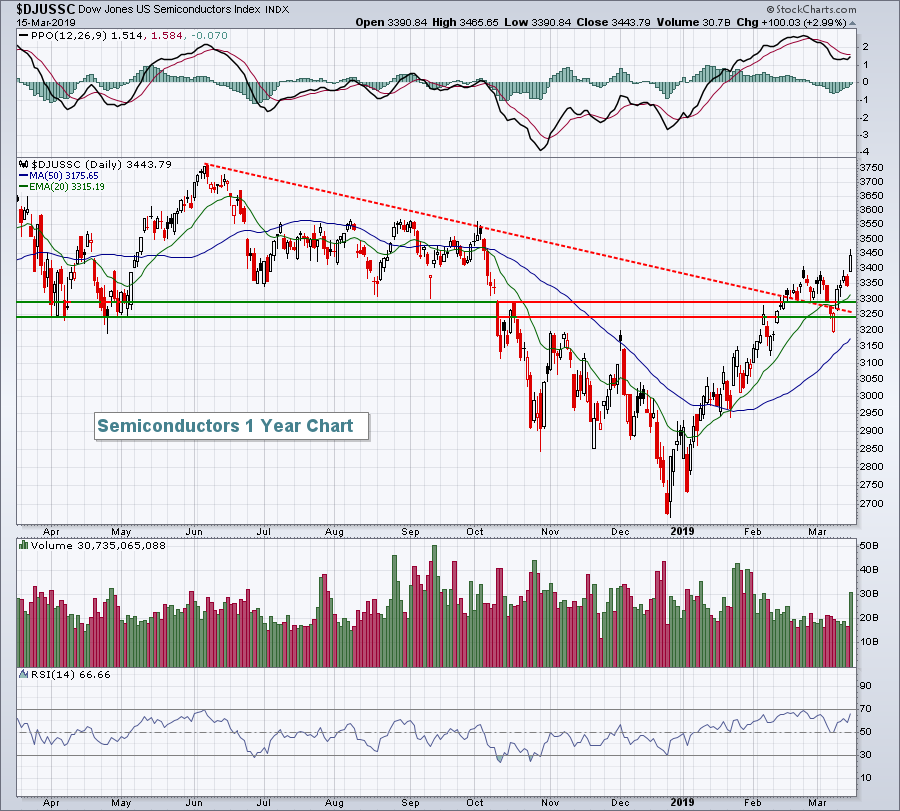

3 Reasons Why Semiconductors Are Poised To Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

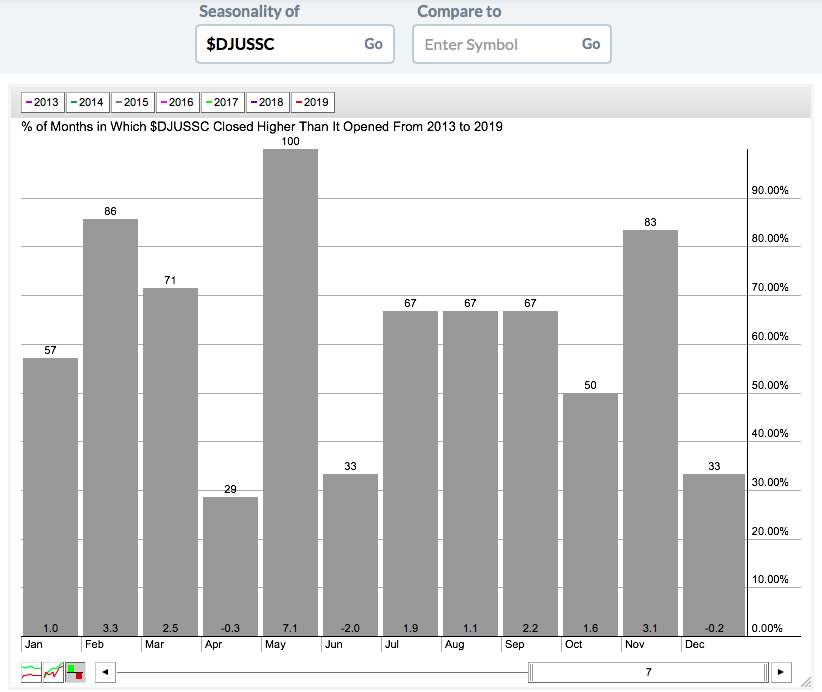

Okay, let's start with the short-term reason. Throughout much of this bull market, the month of May has been kind to semiconductors ($DJUSSC). In fact, the DJUSSC has advanced in each of the last 7 years during May. Check out this seasonal pattern:

Not only have semiconductors moved...

READ MORE

MEMBERS ONLY

Structuring A Sound Trade And Avoiding The Relative Bear Market In Materials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 25, 2019

Strong earnings from Microsoft (MSFT, +3.31%) and Facebook (FB, +5.85%) lifted the NASDAQ to gains on Thursday, while broader market bearishness carried the other major indices to losses. 3M Co (MMM, -12.95%) was a disaster on the Dow Jones, which...

READ MORE

MEMBERS ONLY

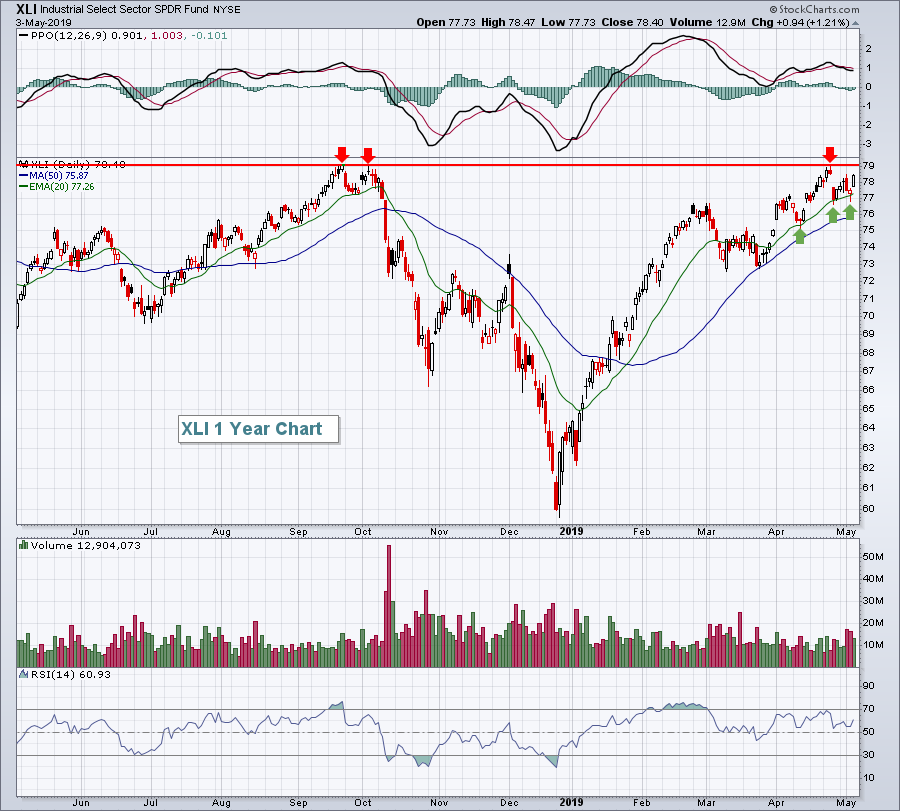

Industrials Set To Record All-Time Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

If you enjoy my daily blog articles, please subscribe (for FREE!) below. Simply scroll to the bottom of this article, type in your email address in the space provided and click the green "Subscribe" button. Once subscribed, my articles will be sent directly to the email address...

READ MORE

MEMBERS ONLY

NASDAQ Breaks Out, Sets New All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 23, 2019

The small cap Russell 2000 led our major indices higher, gaining 1.61%, but the day clearly belonged to the NASDAQ, which not only climbed 1.32%, but broke to new all-time intraday and closing highs. The NASDAQ pierced the 8109.69 level...

READ MORE

MEMBERS ONLY

Crude Oil Surge Sends Energy Shares Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

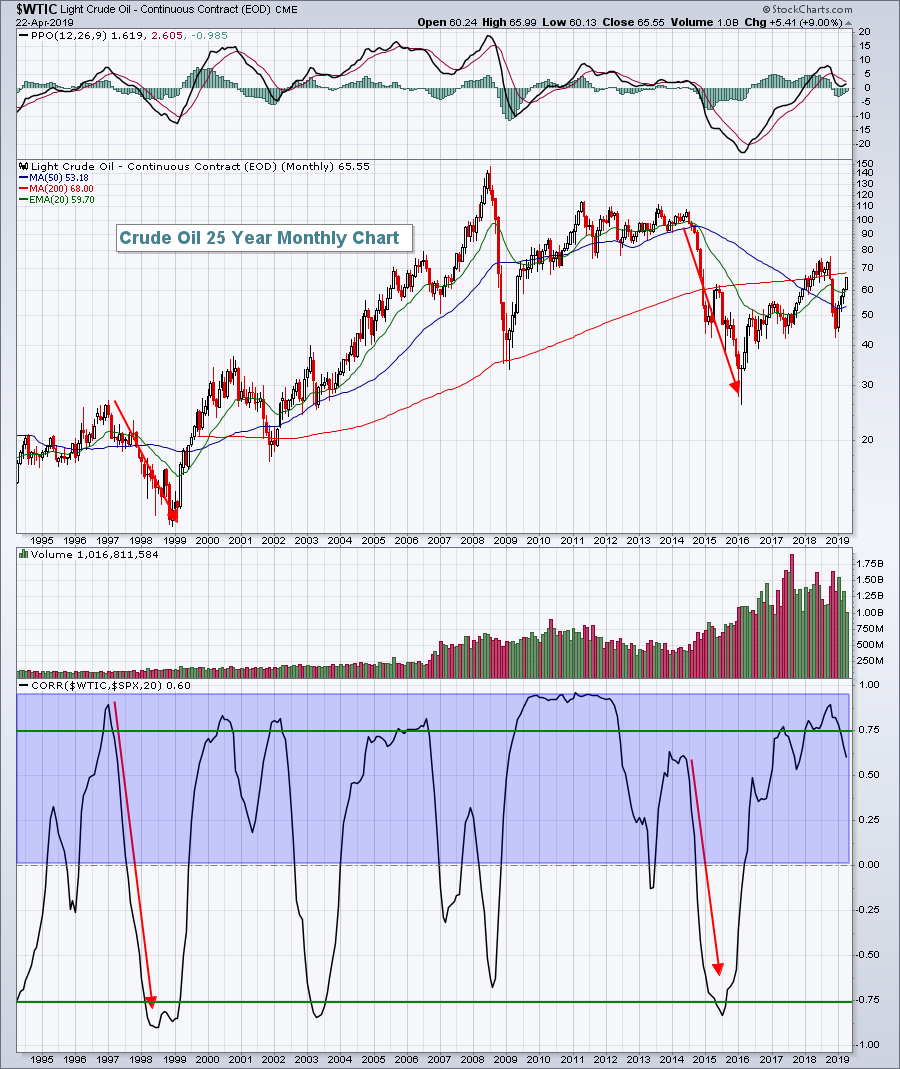

Market Recap for Monday, April 22, 2019

I'm sure you've noticed it at the pump lately. Gas prices are rising. Yesterday, crude oil prices ($WTIC, +2.31%) jumped to their highest level of 2019 and closed above $65 per barrel for the first time since breaking...

READ MORE

MEMBERS ONLY

An Analysis Of Financials And Why We're Going Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 18, 2019

Railroads ($DJUSRR, +2.37%) were led higher by Union Pacific's (UNP, +4.36%) strong quarterly earnings report and outlook. The DJUSRR has been a leader among industrials (XLI, +1.15%) for more than three years and that trend is easily continuing...

READ MORE

MEMBERS ONLY

Clothing Stocks Gearing Up For Q2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

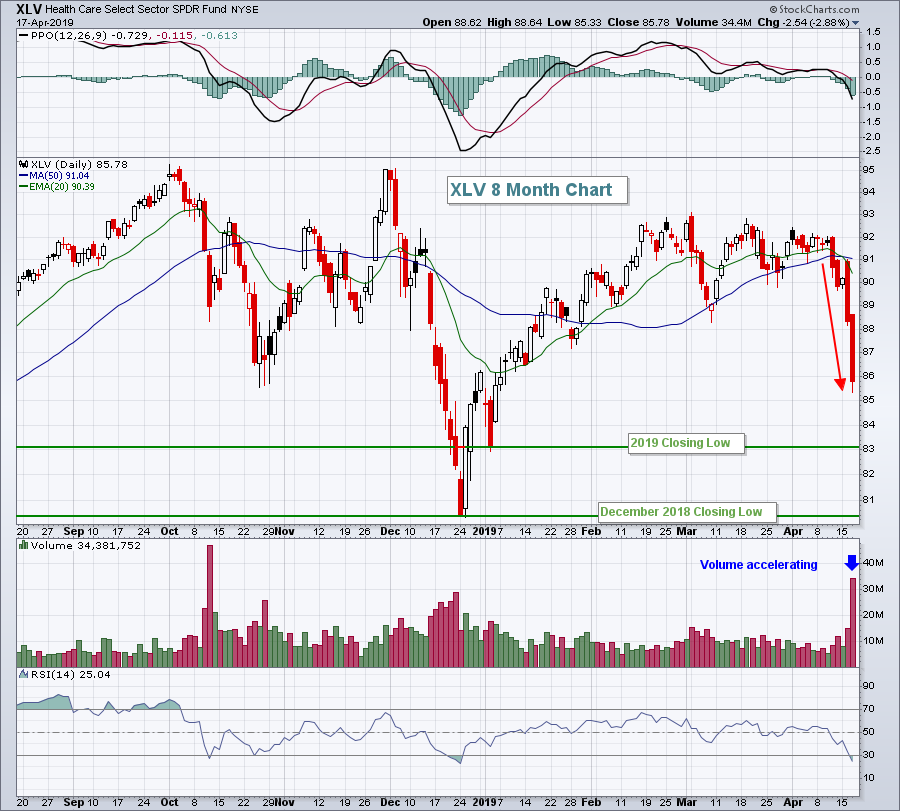

Market Recap for Wednesday, April 17, 2019

We saw mixed trading on Wednesday with the benchmark S&P 500 falling 0.23% to end the session at 2900, still roughly 1.5% beneath the all-time high set in 2018. Technology (XLK, +0.56%) and consumer staples (XLP, +0.50)...

READ MORE

MEMBERS ONLY

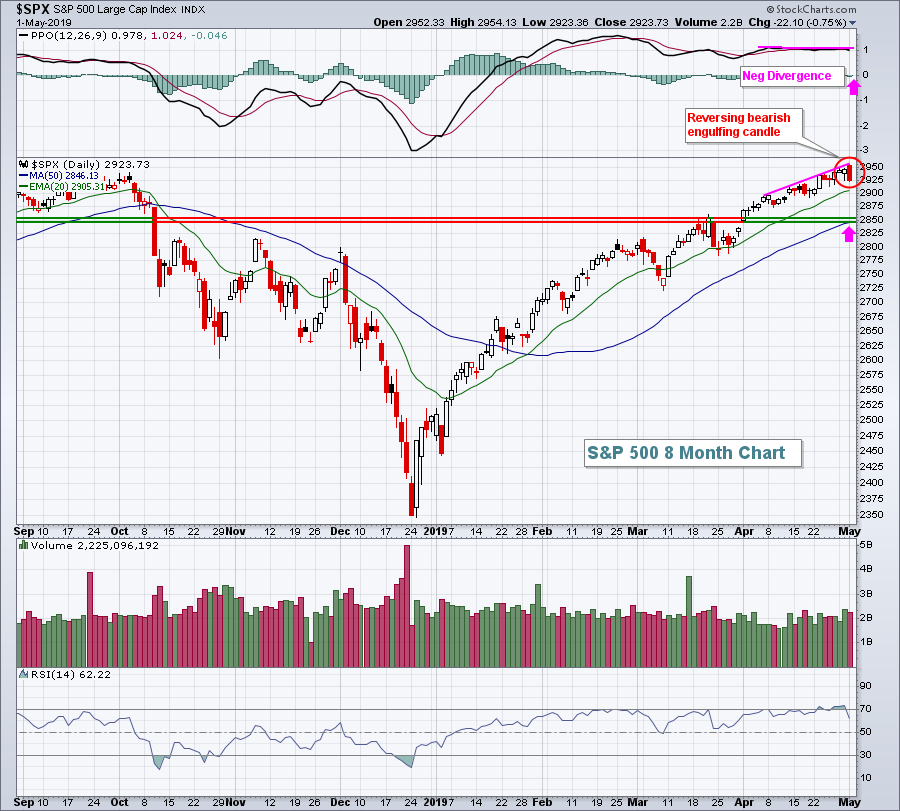

Respect That 2940 Top On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 16, 2019

It was just another day of boring gains. But that's what happens during bull market advances. The Volatility Index ($VIX, -1.14%) drifts lower and stock prices edge higher. Remember when the VIX topped out with a close above 36 on...

READ MORE

MEMBERS ONLY

Rotation To Defense Isn't A Bad Thing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 15, 2019

Defensive groups took their turn leading the stock market, but on a down day that is generally to be expected. Consumer staples (XLP, +0.59%) and healthcare (XLV, +0.40%) were the two leading groups, while financials (XLF, -0.63%) backed off from...

READ MORE

MEMBERS ONLY

All-Time Highs Approaching Plus 10 Trade Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 12, 2019

Who thought at our December low that the S&P 500 would rally well over 20% to above 2900 and within 1% of our all-time high in less than four months? Not this guy. The stock market can do anything, but if...

READ MORE

MEMBERS ONLY

Here Are The Industry Groups Flying Into Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Analysts routinely visit management teams of public companies to see how their quarters are progressing. Based on the knowledge they gain, they return to their offices and their firms issue recommendations to buy or sell. It's the reason that we do what we do. By analyzing price action,...

READ MORE

MEMBERS ONLY

J.P. Morgan Beats Earnings Expectations

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

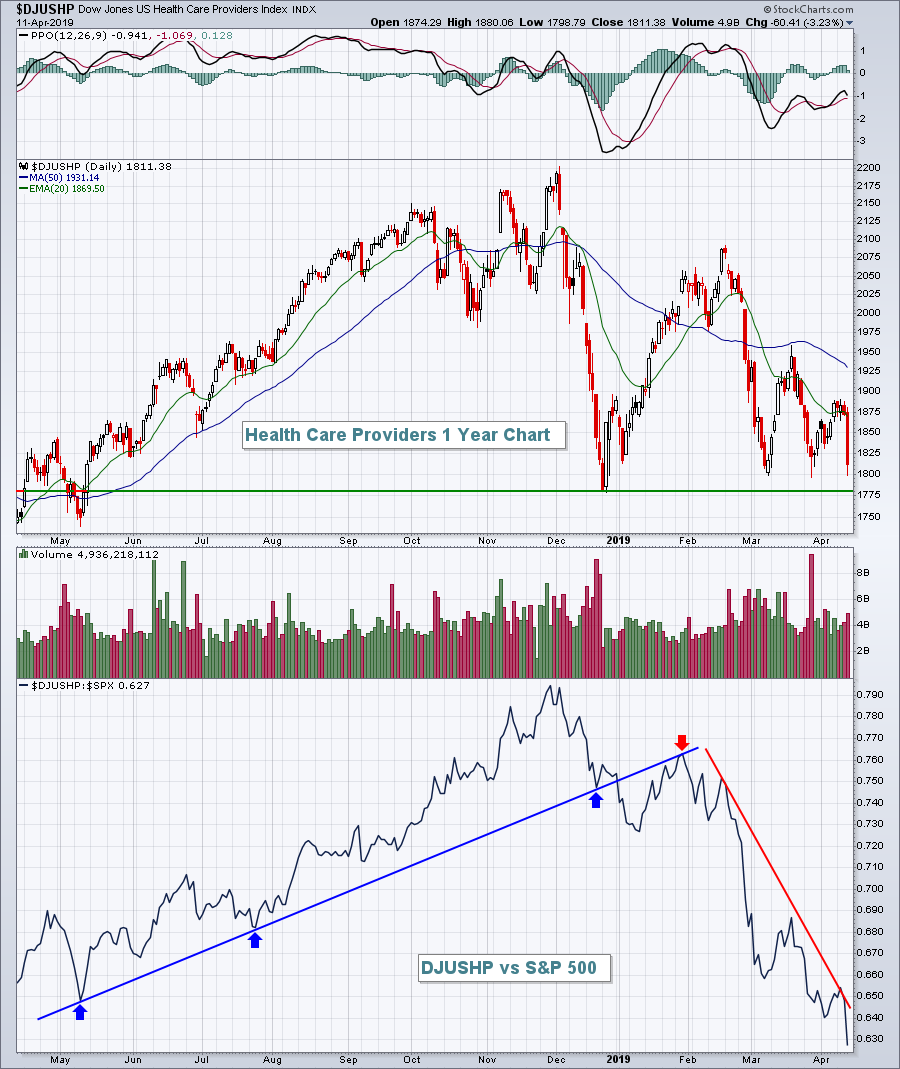

Market Recap for Thursday, April 11, 2019

U.S. equities finished in bifurcated fashion as a late day rally enabled the S&P 500 to eke out a miniscule 0.11 point gain (+0.00%). The other major indices finished in negative territory, led by the 0.21% decline...

READ MORE

MEMBERS ONLY

S&P 500 Channel Suggests We'll Bust Through 3000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

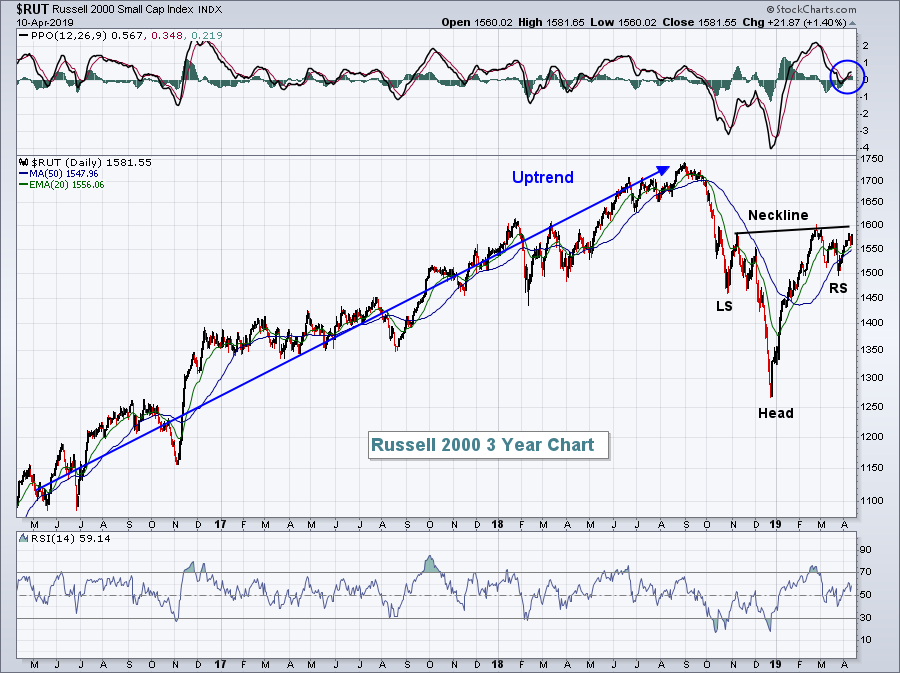

Market Recap for Wednesday, April 10, 2019

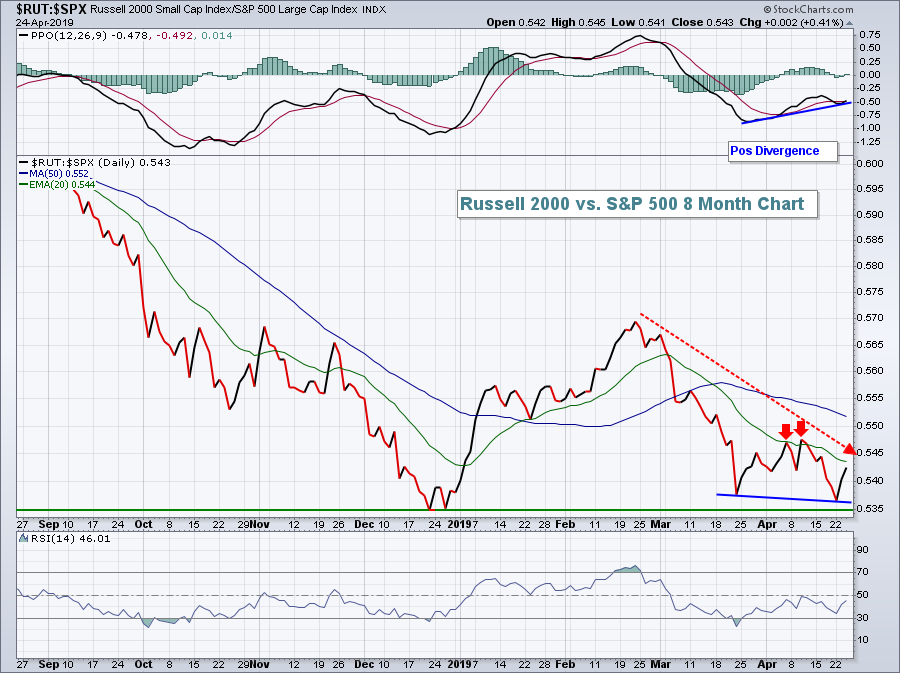

Small cap stocks enjoyed a huge day, carrying Wall Street higher. The Russell 2000 surged 1.40% and is nearing a major neckline resistance that, if broken, would suggest much higher prices for small caps:

Clearing 1600 would be a big deal technically...

READ MORE

MEMBERS ONLY

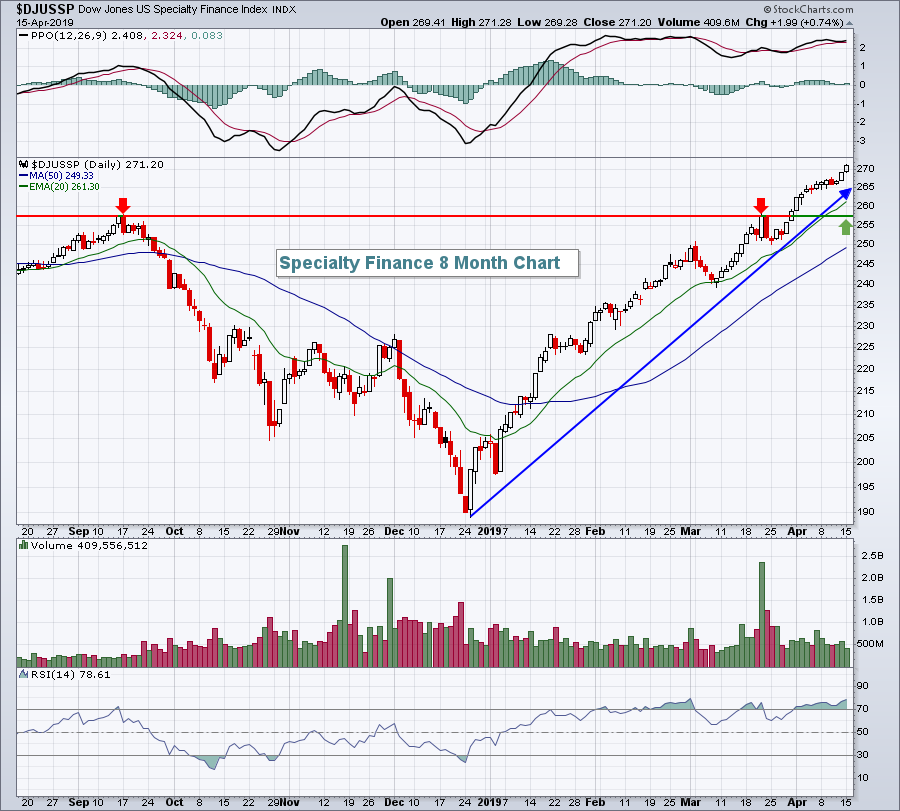

Financials Do Have Pockets Of Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 9, 2019

Profit taking dominated Tuesday's action with the small cap Russell 2000 leading the list of losers, dropping 1.22%. But sellers were most everywhere as the Dow Jones, S&P 500 and NASDAQ fell 0.72%, 0.61% and 0....

READ MORE

MEMBERS ONLY

Energy At 5 Month High As Crude Prices Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 8, 2019

Crude oil prices ($WTIC, +2.09%) surged once again on Monday, and have now climbed 50% off their December low. While energy (XLE, +0.44%) has been a major beneficiary, as we would expect, the XLE has been mired in a downtrend vs....

READ MORE

MEMBERS ONLY

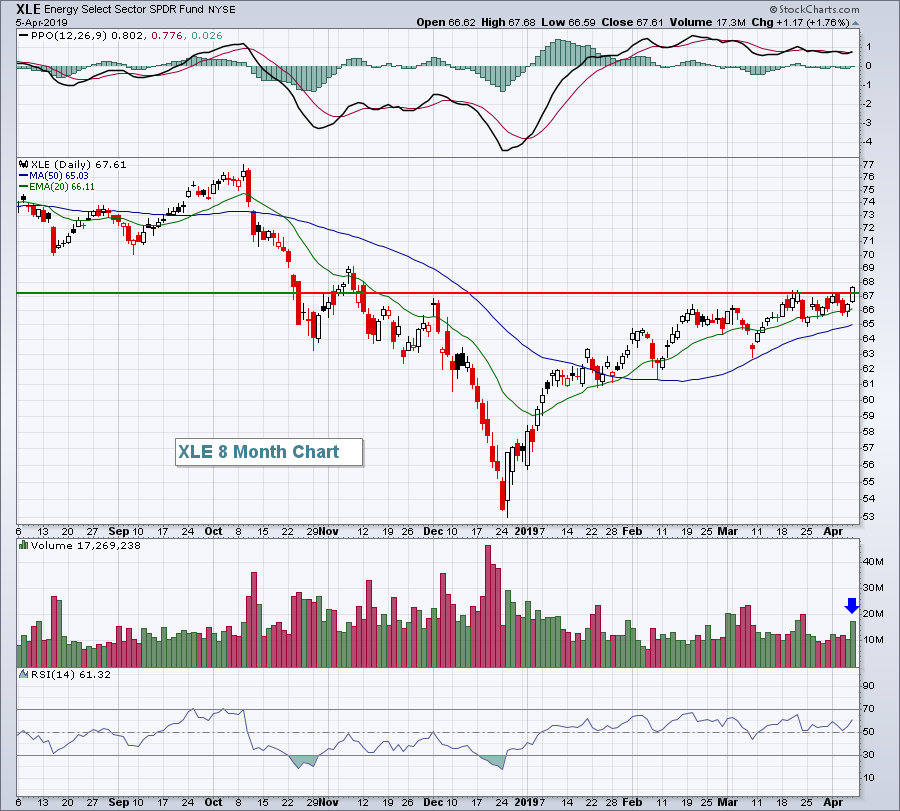

Energy Rebounds Plus 10 Trade Setups For Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 5, 2019

Energy stocks (XLE, +1.76%) were the clear leader on Friday as Wall Street climbed once again. Recently, crude oil prices ($WTIC, +1.58%) opened April by posting new 2019 highs, but the XLE failed to follow suit, instead falling back to test...

READ MORE

MEMBERS ONLY

Nonfarm Payrolls Hit A Sweet Spot This Morning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 4, 2019

Our major indices rallied again on Thursday with the benchmark S&P 500 rising for a 6th consecutive session and closing at a 2019 high. The S&P 500's close of 2879 was just 61 points shy of the...

READ MORE

MEMBERS ONLY

REITs Have Been Strong And This Group Loves April

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 3

Stocks rallied again on Wednesday, primarily on the heels of materials (XLB, +1.31%) and technology (XLK, +0.81%). The former saw relative strength in both commodity chemicals ($DJUSCC, +1.77%) and specialty chemicals ($DJUSCX, +1.39%). The strength in the DJUSCC was very...

READ MORE

MEMBERS ONLY

Internet Stocks Looking Good In A Variety Of Relative Strength Ways

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

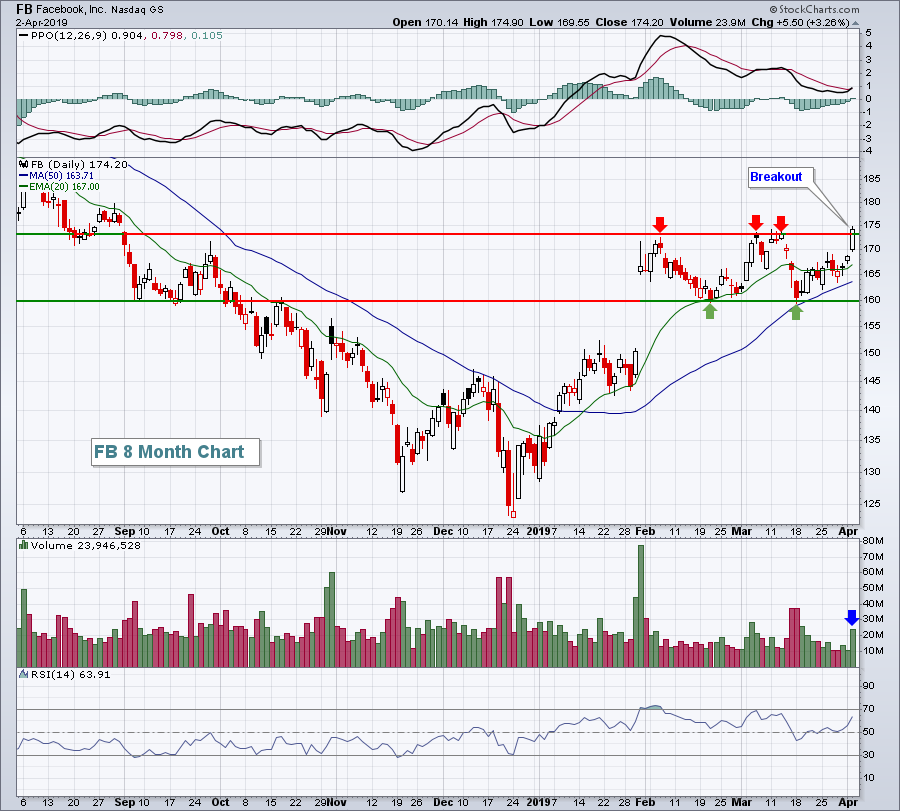

Market Recap for April 2, 2019

The NASDAQ was mostly higher and strengthening throughout the session on Tuesday as internet stocks ($DJUSNS, +1.41%) continued their recent advance to challenge 2019 highs. Facebook (FB, +3.26%) led internet stocks higher and broke out to close at its 2019 high on...

READ MORE

MEMBERS ONLY

Financials Benefiting From Rising Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 1, 2019

U.S. equities had a stunning first quarter and Monday was an encore to open up Q2. Keep in mind that we’ve entered the most bullish period within April historically as the NASDAQ has produced annualized returns of +21.45% from April...

READ MORE

MEMBERS ONLY

Key Relative Strength Signs Pointing To Higher Equity Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

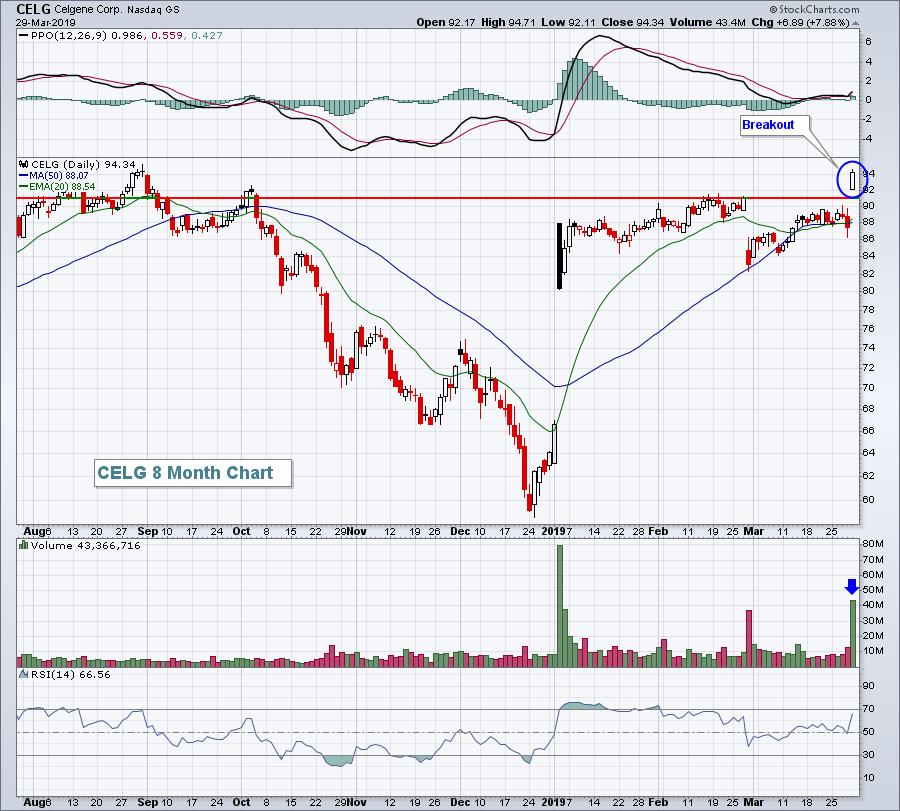

Market Recap for Friday, March 29, 2019

The U.S. stock market rallied on Friday, putting an exclamation point on its best calendar quarter in 10 years. Of course, this strength came on the heels of an incredibly dismal quarter to end 2018. Healthcare (XLV, +1.20%) and industrials (XLI,...

READ MORE

MEMBERS ONLY

Strong Earnings Lift Clothing Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 28, 2019

Lululemon Athletica (LULU, +14.13%), PVH Corp (PVH, +14.76%), and Movado Group (MOV, +22.77%) all surged after the clothing & accessories retailers all posted much better than expected quarterly earnings. The Dow Jones U.S. Clothing & Accessories Index ($DJUSCF, +5....

READ MORE

MEMBERS ONLY

Home Construction Is Loving This Treasury Yield Decline

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

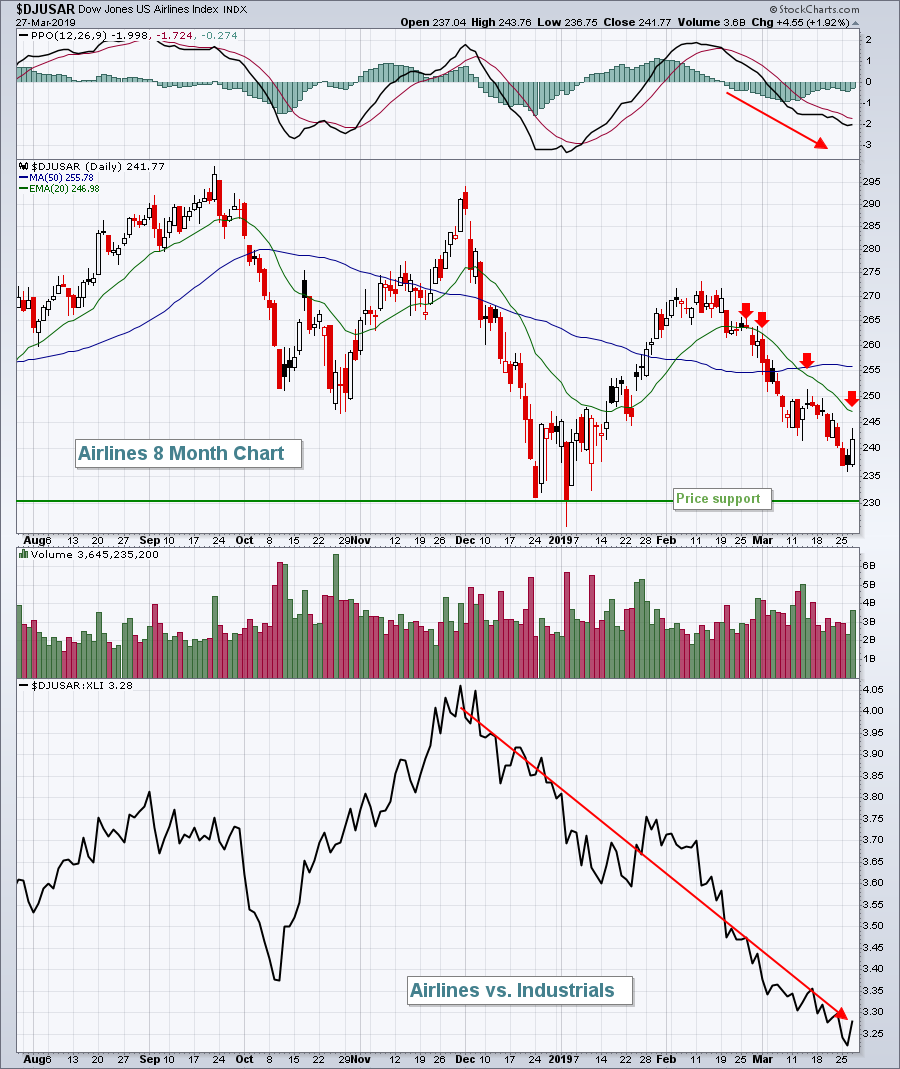

Market Recap for Wednesday, March 27, 2019

Wall Street rebounded from steep intraday losses, but still ended the session in negative territory. The NASDAQ was the weakest index, falling 0.63%. The S&P 500, Russell 2000 and Dow Jones dropped 0.46%, 0.39%, and 0.13%, respectively....

READ MORE

MEMBERS ONLY

Crude Oil, Energy Lead Wall Street Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

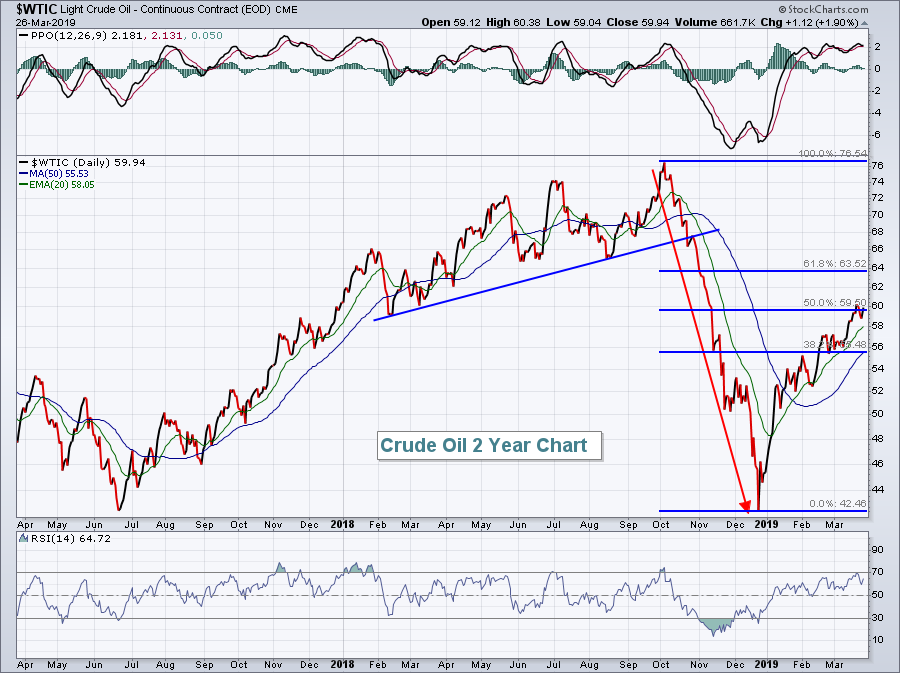

Market Recap for Tuesday, March 26, 2019

Strength in global markets seemed to influence the U.S. market at the open as equities surged higher. But sellers dominated most of the balance of the day as gains evaporated. A final 30 minute surge just before the close restored some of...

READ MORE

MEMBERS ONLY

Seasonality And Price Support Suggest TSLA Is A Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 25, 2019

U.S. stocks finished in bifurcated fashion on Monday as the S&P 500 and NASDAQ lost 0.08% and 0.07%, respectively, while the Dow Jones tacked on 0.06%. The small cap Russell 2000 was a relative outperformer, gaining 0....

READ MORE

MEMBERS ONLY

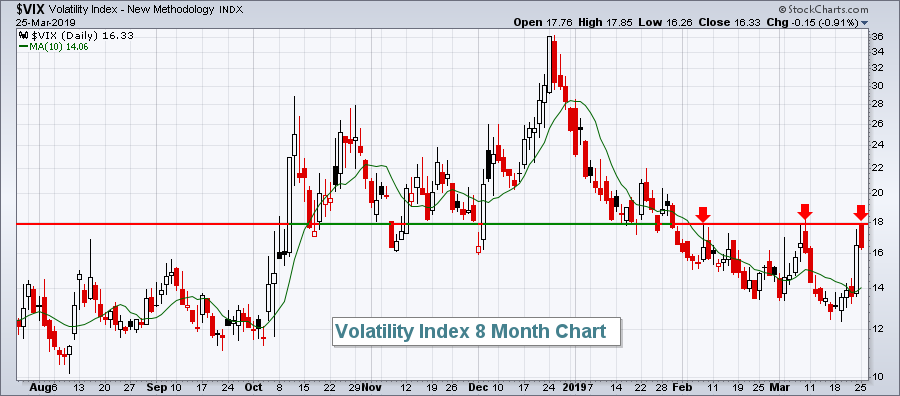

The VIX And S&P 500 Positive Correlation Predicted Friday's Drop

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 22, 2019

Investors were worried on Friday and it was reflected in the Volatility Index ($VIX), which rose more than 20%, and sharply lower U.S. equity prices. The small cap Russell 2000 was hit hardest, dropping 3.62%. The weakness, however, was felt just...

READ MORE

MEMBERS ONLY

Apple Leads Big Technology Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 21, 2019

Technology stocks (XLK, +2.51%) carried Wall Street higher on Thursday as computer hardware ($DJUSCR, +3.56%), semiconductors ($DJUSSC, +3.13%), and software ($DJUSSW, +2.20%) all surged to fresh 2019 highs. Apple, Inc. (AAPL, +3.68%), which has regained its title of...

READ MORE

MEMBERS ONLY

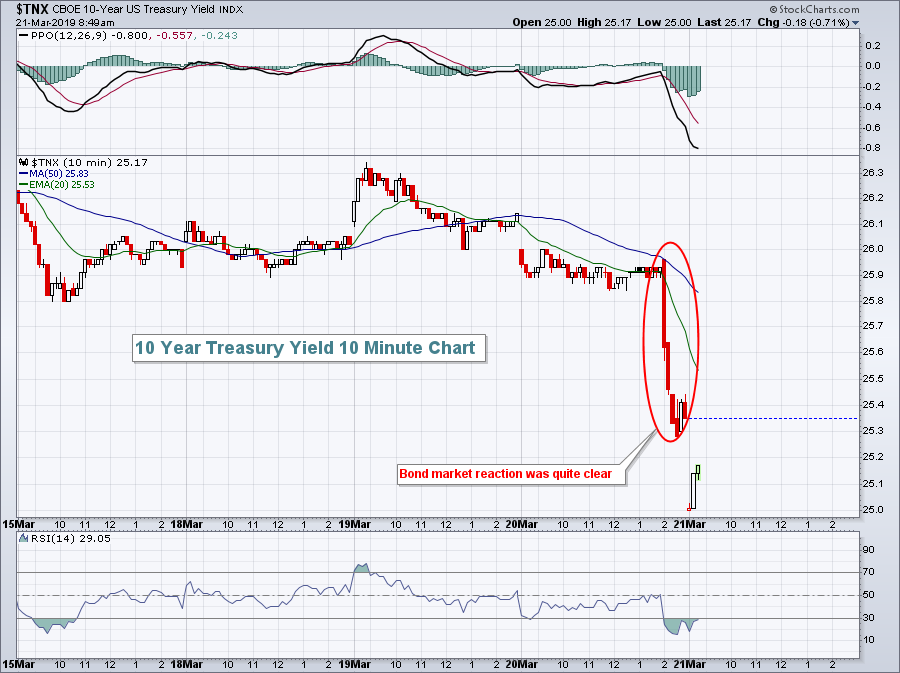

The Bond Market Is Sending Us The Most Bearish Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 20, 2019

Yesterday was all about the Fed and what it might say. It was essentially a foregone conclusion that there'd be no rate hike, so traders were on edge anticipating what might change in the Fed's policy statement. Stock traders...

READ MORE

MEMBERS ONLY

U.S. Dollar Index Drops For 8th Straight Day, Awaiting Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 19, 2019

The U.S. stock market finished the day in bifurcated fashion as the NASDAQ (+0.12%) clung to a relatively minor gain, while the aggressive small cap Russell 2000 index lost 0.57%. The Dow Jones and S&P 500 barely finished...

READ MORE

MEMBERS ONLY

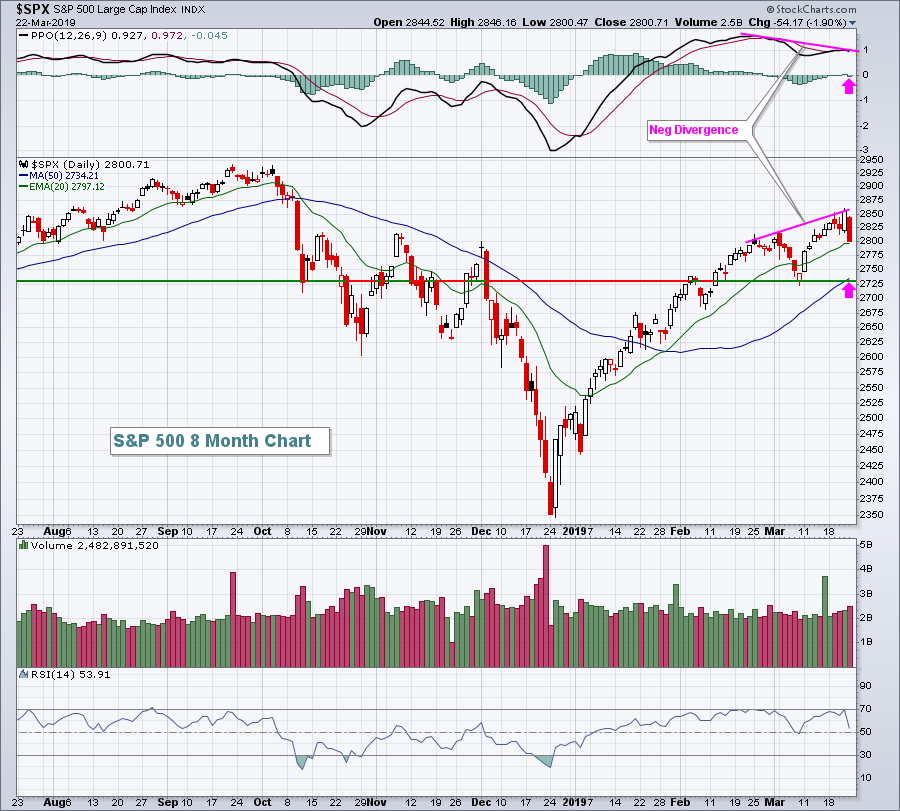

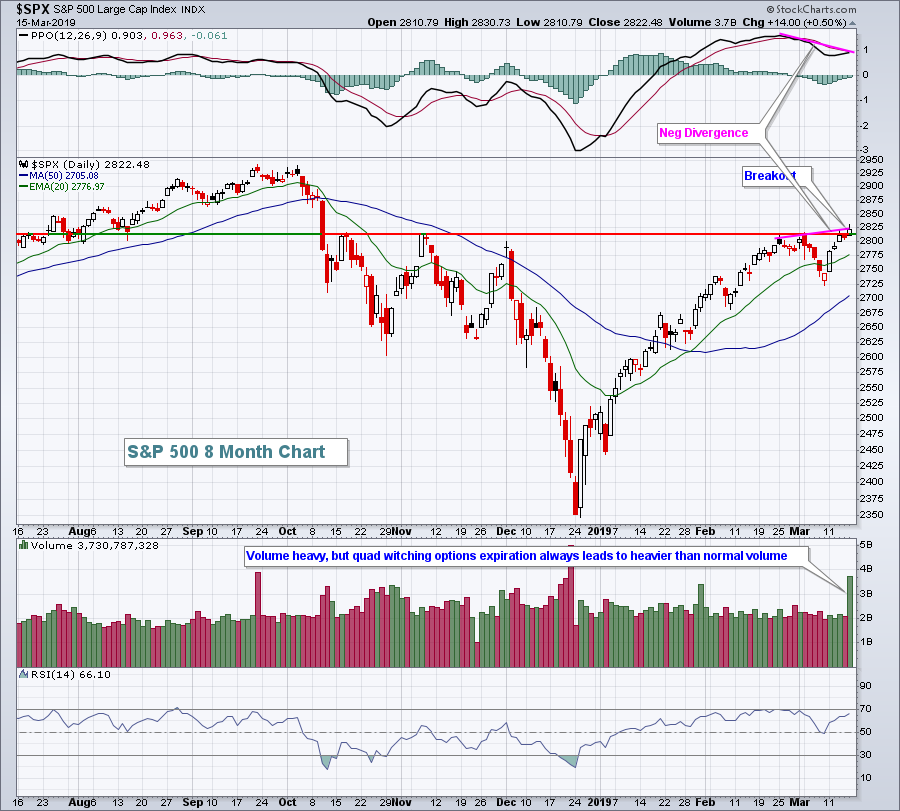

Negative Divergences Could Wreak Havoc On U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 18, 2019

U.S. stocks moved modestly higher on Monday, extending Friday breakouts on both the S&P 500 (+0.37%) and NASDAQ (+0.34%). The Russell 2000 gained 0.67% to lead the action. Crude oil prices ($WTIC, +1.47%) topped $59 per...

READ MORE

MEMBERS ONLY

Here's A Gem In Apparel Retail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 15, 2019

It was another solid day for the bulls to close out last week. It was also quad-witching options expiration Friday, which typically results in much-heavier-than-usual volume. Volume was certainly heavy on Friday. Leadership was found in the aggressive NASDAQ, which jumped 0.76%...

READ MORE

MEMBERS ONLY

Could The S&P 500 Fall 2.6% Every Year For 16 Straight Years?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In a sense, it already has. Well, maybe not 16 straight years, but play along.

I've done a lot of historical stock market research over the years and several patterns really stand out. But one in particular always keeps me on edge as a short-term trader. The week...

READ MORE

MEMBERS ONLY

Transports Going Along For The Ride

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 14, 2019

Thursday was a day of rest and bifurcated action. The Dow Jones gained ground, albeit a rather miniscule 7 points, but the other major indices fell. The Russell 2000, NASDAQ and S&P 500 dropped 0.40%, 0.16%, and 0.09%...

READ MORE

MEMBERS ONLY

Earnings Could Send ULTA Flying

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 13, 2019

It was another strong day on Wall Street. All 11 sectors moved higher for the second time this week. Industrials (XLI, +0.88%) represent the only sector to have posted a daily loss this week. The other 10 sectors have shown gains all...

READ MORE