MEMBERS ONLY

This Industry Group Tries To Clear Resistance For The 23rd Time; Dow Futures Tumble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 18, 2018

Trade war fears are picking up again this morning and it's rattling equities worldwide. It created a bit of a stir on Monday morning as futures were weak, signaling a rough start for U.S. equities. That's exactly what...

READ MORE

MEMBERS ONLY

Energy Leads Market Lower, Watch These Two Support Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 15, 2018

We finished Friday's action with lower major indices, primarily the result of a very weak energy sector (XLE, -2.15%). Unfortunately, that masked one of the best absolute and relative performance days in consumer staples (XLP, +1.28%) since the January...

READ MORE

MEMBERS ONLY

Relative Strength Is Your Guide To A Winning Stock Portfolio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It seems simple enough. Buy stocks/ETFs that are outperforming the benchmark S&P 500. Well, that's part of it for sure. But it really goes a lot deeper than that. StockCharts.com provides you a myriad of ways to evaluate relative strength. I tend to use...

READ MORE

MEMBERS ONLY

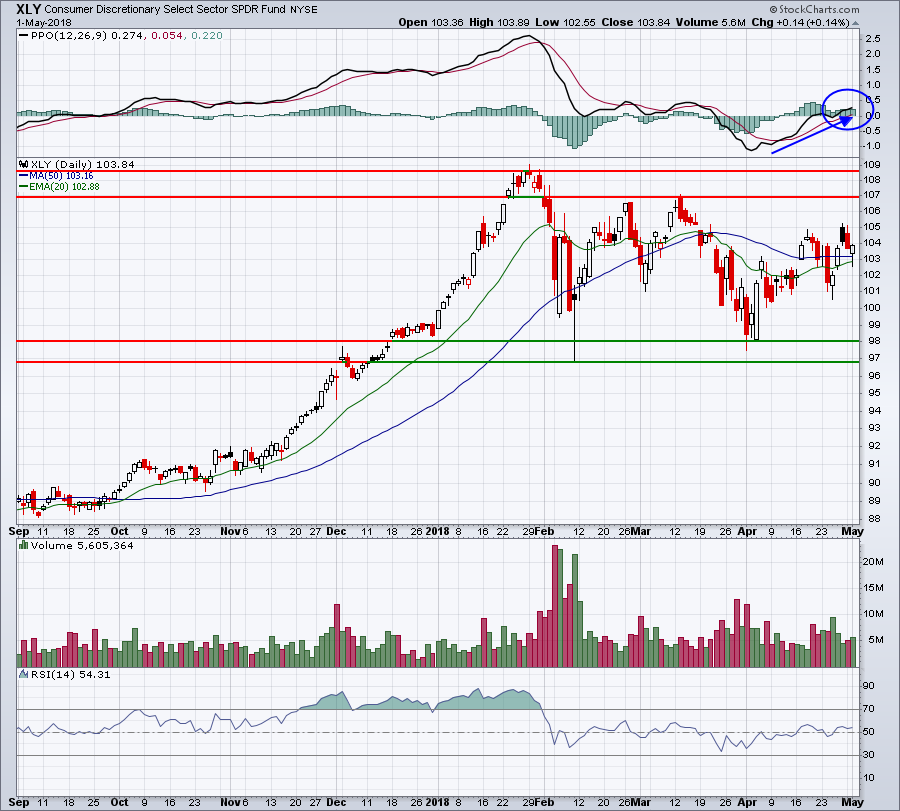

Talk About Hot? This Sector Has Risen Every Day In June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 14, 2018

Utilities (XLU, +1.24%) led a bifurcated market on Thursday, but the real story of June has been consumer discretionary (XLY, +1.04%). The XLY has not only posted gains each of the 10 trading days in June thus far, but it'...

READ MORE

MEMBERS ONLY

Netflix Jumps To Record, But Fed Rate Hike Weighs On Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 13, 2018

Another Fed day is in the rear view mirror and now we know the following. The Fed expects to raise interest rates two more times in 2018, bringing the total number of hikes to 4, as opposed to the 3 they discussed in...

READ MORE

MEMBERS ONLY

Bull Market Resumption Awakens The Hibernating Industries; We're Going Higher Folks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

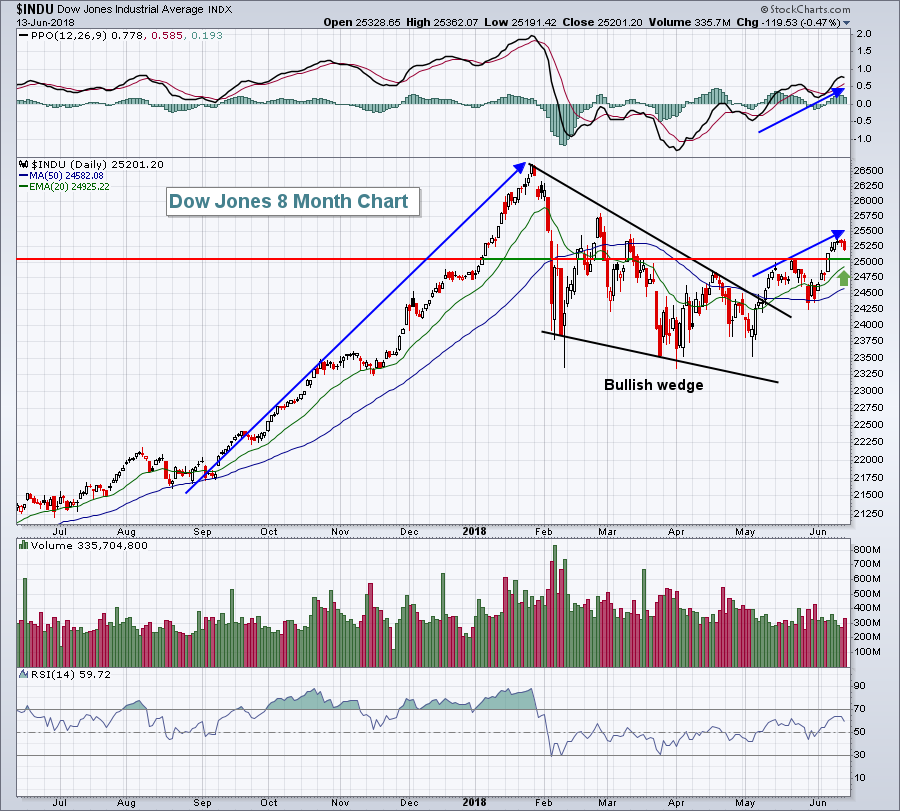

Market Recap for Tuesday, June 12, 2018

The Dow Jones lost one point yesterday, but our other key indices finished with gains, led higher by the NASDAQ (+0.57%) and small cap Russell 2000 (+0.46%). It was another boring day of bullish action with perhaps one slight negative -...

READ MORE

MEMBERS ONLY

Expect Small Caps To Continue To Provide Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 11, 2018

U.S indices finished with across-the-board gains on Monday despite a final 30 minute selloff that saw the Dow Jones trim a 70 point gain down to just 5 points. Still, stocks managed to start the week with minor gains ahead of a...

READ MORE

MEMBERS ONLY

Wall Street Ends Week With Gains, Home Construction Leads

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

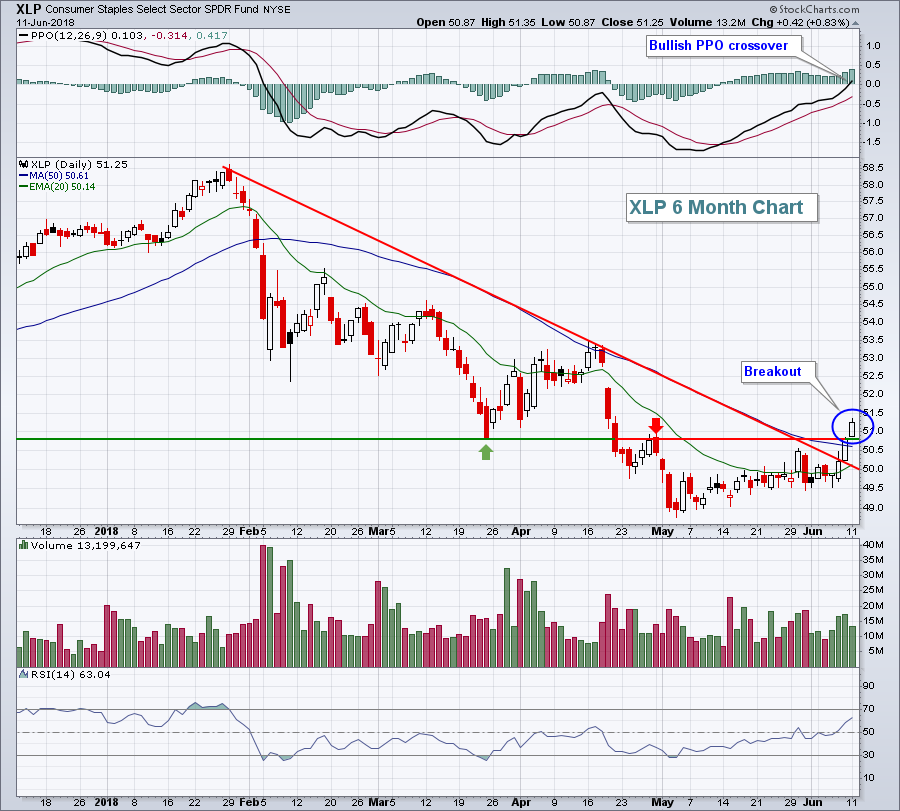

Market Recap for Friday, June 8, 2018

In a rare development, consumer staples (XLP, +1.23%) led Wall Street higher on Friday. Over the past three months, the XLP has fallen 5.78% and no other sector is close to consumer staples' ineptitude. The XLP has been the shunned...

READ MORE

MEMBERS ONLY

Dow Jones Leads Bifurcated Market; McDonalds Soars On Announced Layoffs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

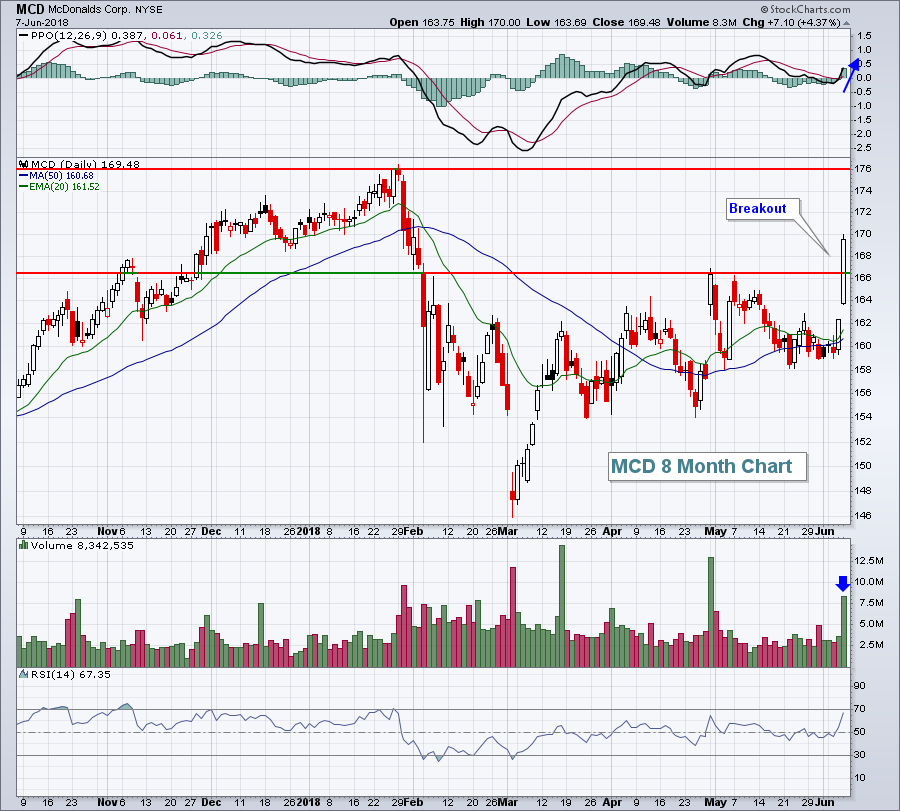

Market Recap for Thursday, June 7, 2018

The Dow Jones gained 95 points, extending its recent rally, on the strength of McDonalds Corp (MCD) and Chevron Corp (CVX). MCD announced layoffs and Wall Street cheered the likely improvement to its bottom line by sending MCD higher by 4.37%:

MCD...

READ MORE

MEMBERS ONLY

Materials And Financials Lead Strong Rally; Tesla Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

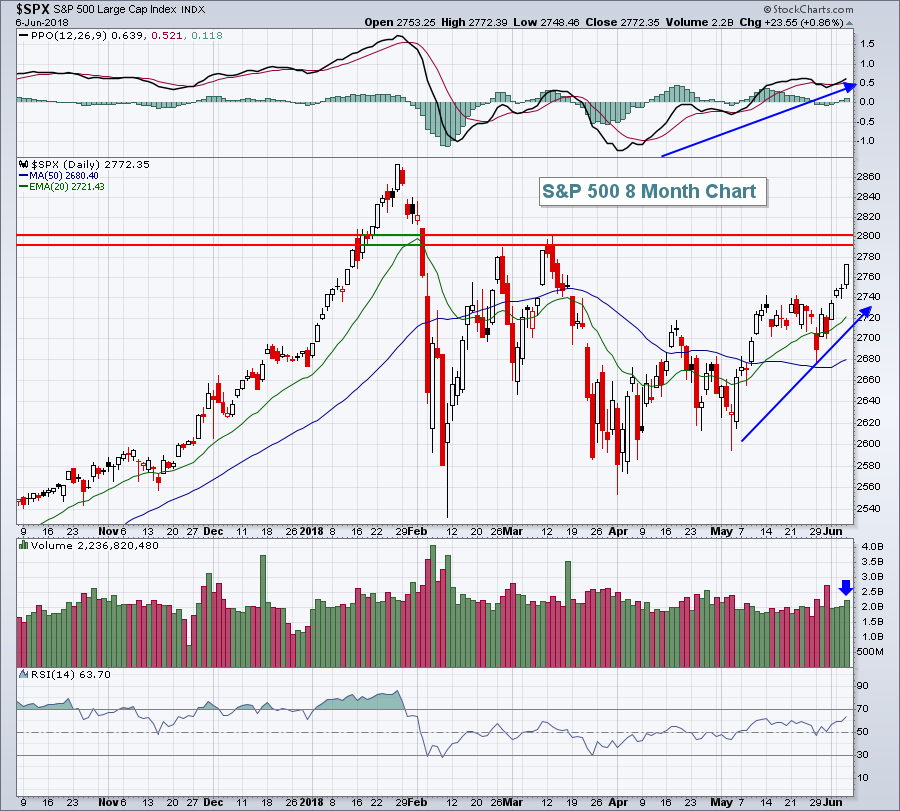

Market Recap for Wednesday, June 6, 2018

It was another solid bull market rally on Wall Street on Wednesday, this time with the Dow Jones conglomerates leading the action. The Dow Jones Industrial Average gained 346 points, or 1.40%, topping 25,000 and closing at its highest level since...

READ MORE

MEMBERS ONLY

Retail And Small Cap Industrials Helping To Feed This Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 5, 2018

It's the perfect storm. Technology (XLK, +0.35%) sets another all-time high record close to lead the NASDAQ to the same. Strengthening economic conditions are creating a higher interest rate environment. That means money rotates from bonds to stocks. The dollar...

READ MORE

MEMBERS ONLY

Consumer Stocks Roll; NASDAQ Breaks 7600

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 4, 2018

Consumer stocks - discretionary (XLY, +1.12%) and staples (XLP, +0.83%) - led Wall Street higher on Monday, especially the NASDAQ, which closed above 7600 for the first time in its history. The highest candle body on the NASDAQ, however, is at...

READ MORE

MEMBERS ONLY

Strong Jobs Report Powers NASDAQ To Near Record Close

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 1, 2018

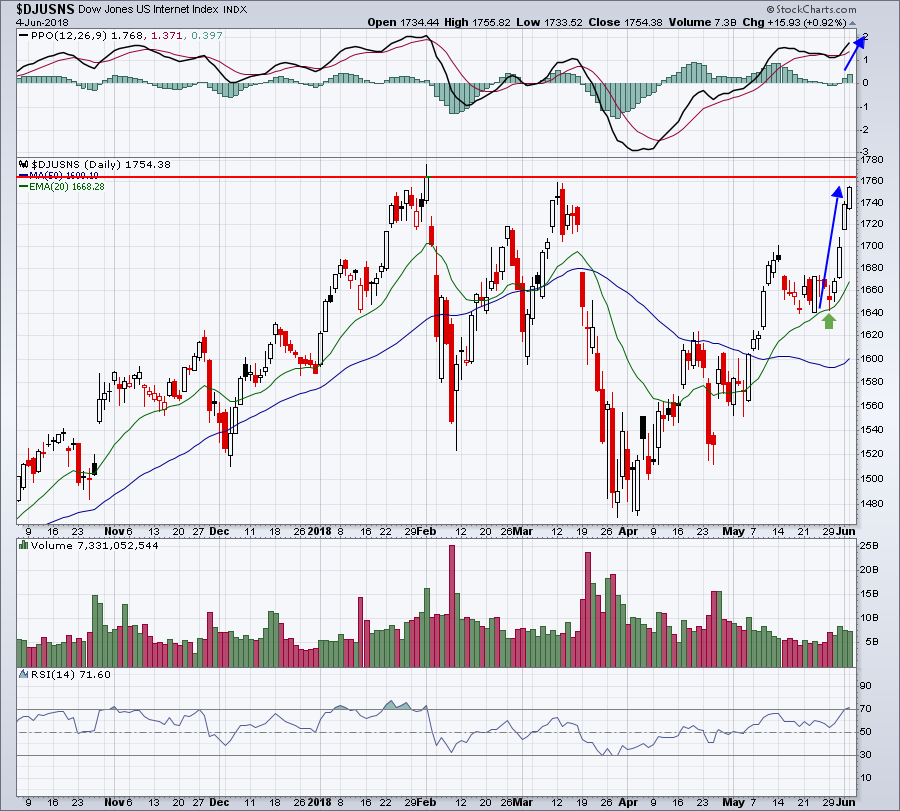

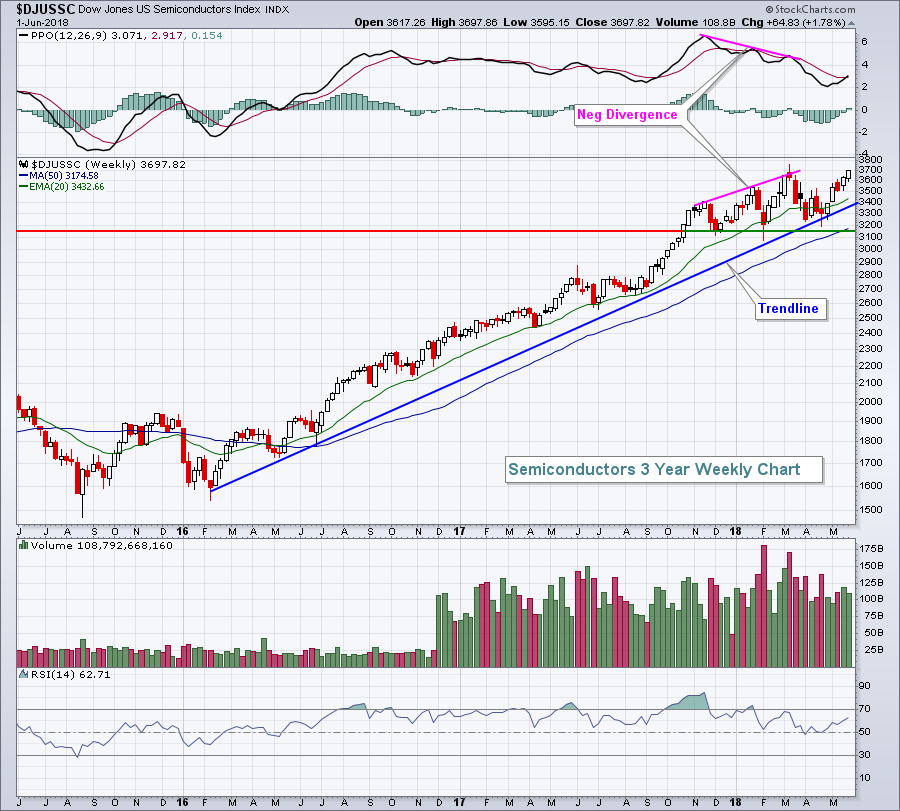

Technology (XLK, +1.70%) and materials (XLB, +1.53%) led Wall Street higher on Friday after the May nonfarm payrolls beat expectations, providing a lift for those anticipating further economic strength in the months ahead. Semiconductors ($DJUSSC, +2.42%) and internet stocks ($DJUSNS,...

READ MORE

MEMBERS ONLY

The Stock Market Will Go Much Higher And Its Strength Will Be Shocking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While many market pundits seemed to grow very concerned about the 10 year treasury yield ($TNX) rising to 7 year highs at its recent 3.11% peak, I only grow nervous when the TNX falls. Why? Well, rising rates are typically a precursor to economic strength. The S&P...

READ MORE

MEMBERS ONLY

Small Caps Enter Their Best Relative Strength Month On A Roll

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 31, 2018

The roller coaster ride of 2018 has suddenly re-emerged this week. After considerable weakness on Tuesday to open this holiday-shortened week, we saw a beautiful bounce-back rally on Wednesday. That felt pretty good from a bullish perspective.....until yesterday's renewed selling....

READ MORE

MEMBERS ONLY

Health Care Providers Could Cure Your Portfolio Woes

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 30, 2018

Remember that Tuesday weakness? Yeah, I didn't think so. Poof!!! It took the U.S. stock market all of one day to essentially erase the scars of that Tuesday selling. The NASDAQ broke out of a bullish flag pattern and the...

READ MORE

MEMBERS ONLY

Treasury Yields Tumble Amid European Political Uncertainty

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

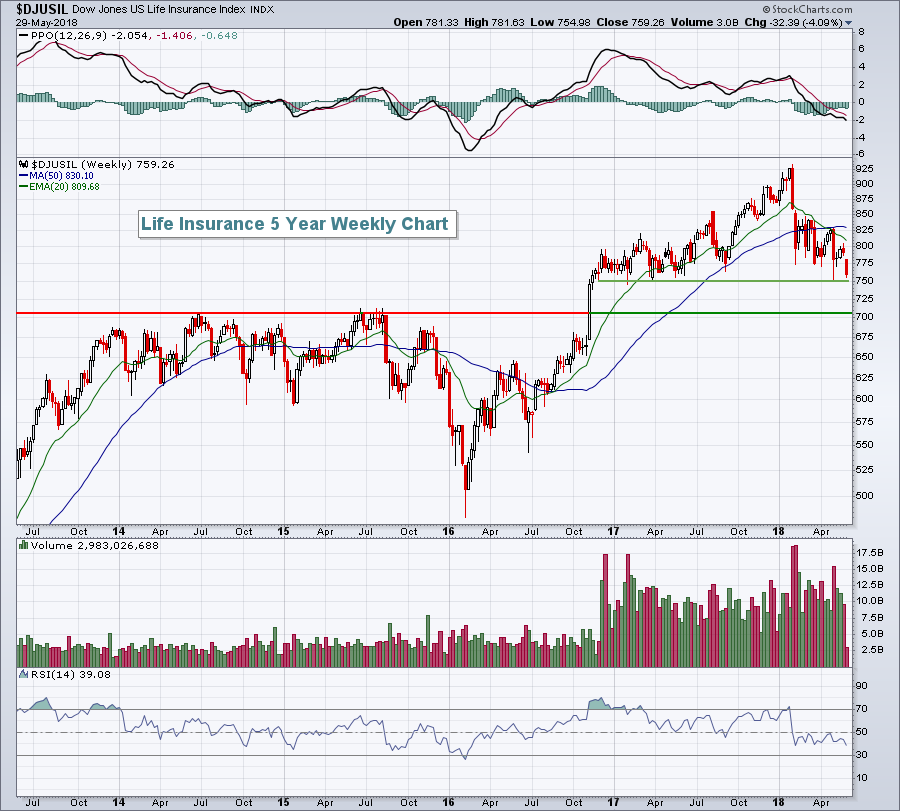

Market Recap for Tuesday, May 29, 2018

Political uncertainties in Italy and Spain rattled global markets on Tuesday, leaving the Dow Jones with a loss of nearly 400 points on the session. There was a clear flight to safety, underscored by a massive 16 basis point drop in the 10...

READ MORE

MEMBERS ONLY

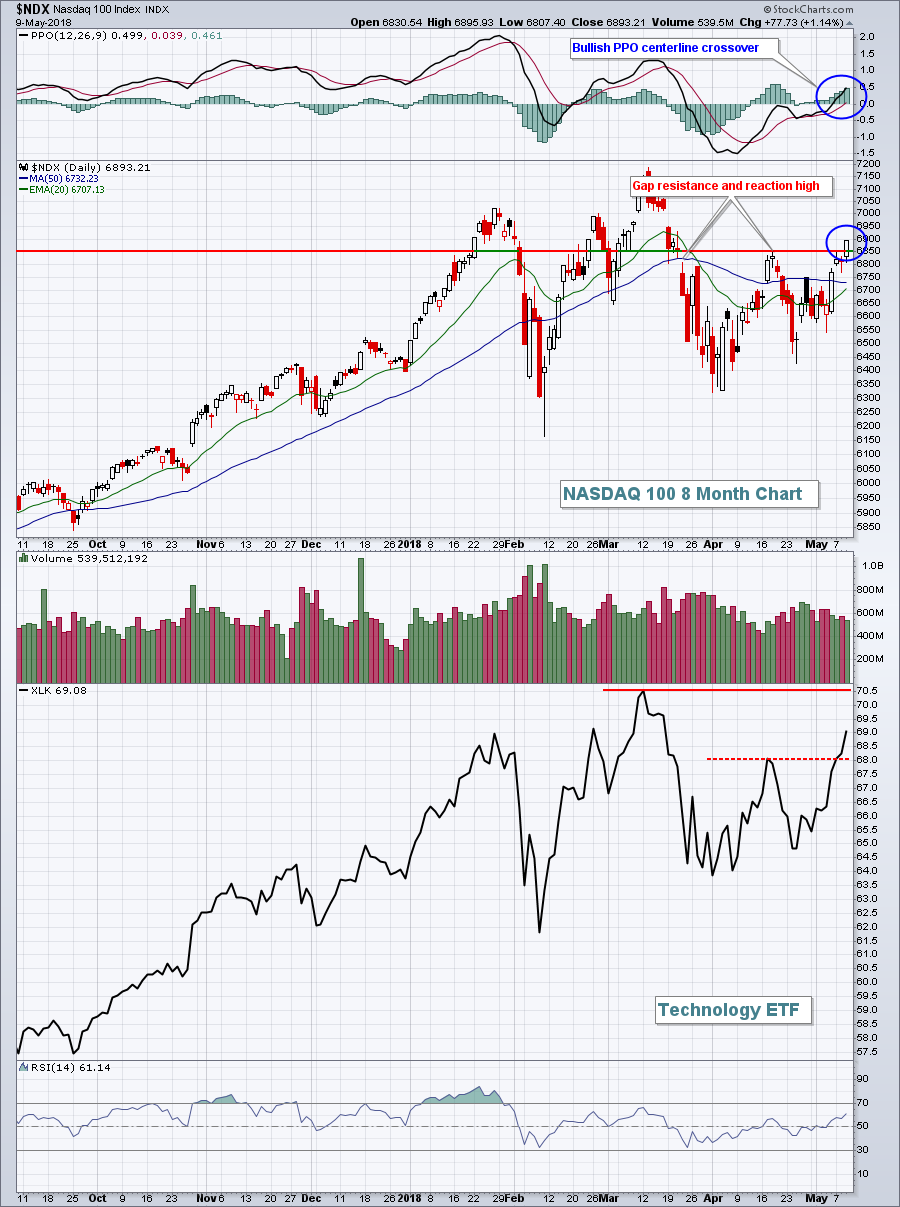

NASDAQ 100 Subscribes To NFLX And INTC Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 25, 2018

The NASDAQ 100 ($NDX) led the action on Friday and last week, thanks in large part to Netflix (NFLX) and a couple of chipmakers - Intel Corp (INTC) and Micron Technology (MU). NFLX surged to an all-time high earlier in the week, easily...

READ MORE

MEMBERS ONLY

Retail Says We're Going Higher.....Much Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 24, 2018

The U.S. stock market will be closed on Monday in observance of Memorial Day. Thanks to all of the veterans, current and past, for their service to our country. :-)

Wall Street traded much lower in the opening 90 minutes, then spent...

READ MORE

MEMBERS ONLY

Software, Internet Stocks Bounce Off 20 Day EMAs, Lead Technology Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 23, 2018

Technology (XLK, +0.74%) rallied on Wednesday to move back near two month highs and creep closer to its all-time high close. Both software ($DJUSSW) and internet stocks ($DJUSNS) performed well to lead the rally:

The green arrows highlight the rising 20 day...

READ MORE

MEMBERS ONLY

Here's A Seasonal Winner For June And July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

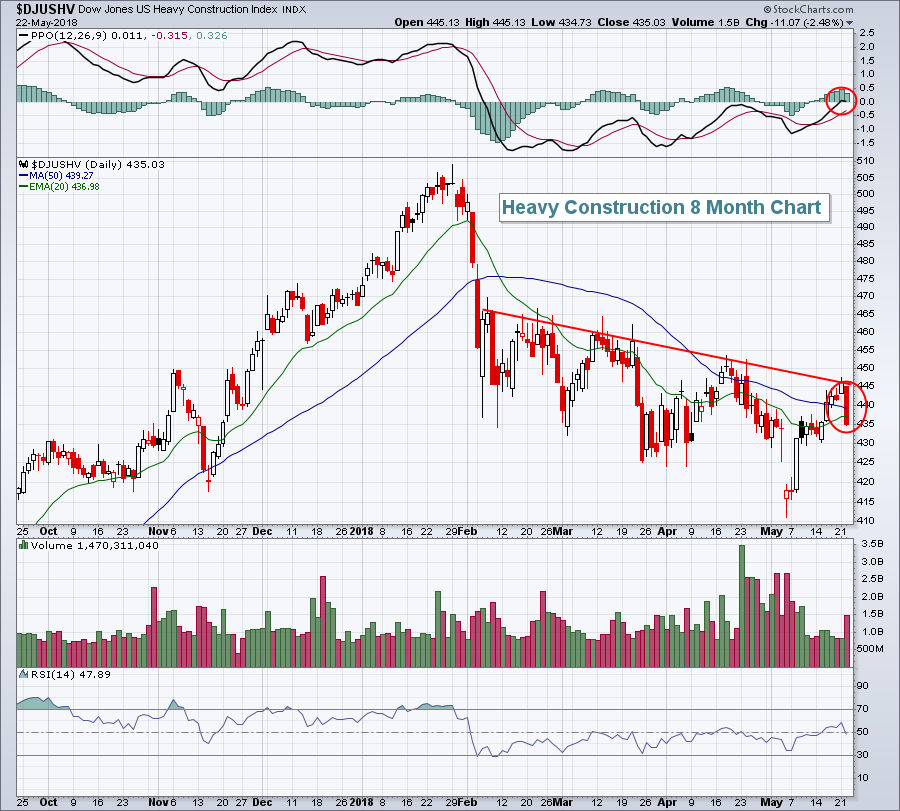

Market Recap for Tuesday, May 22, 2018

After early morning strength, Wall Street sellers returned and took their toll on many areas of the market, but most notably energy (XLE, -1.33%) and industrials (XLI, -1.23%). Heavy construction ($DJUSHV) was a key casualty in the industrials after trying to...

READ MORE

MEMBERS ONLY

Aerospace, Transports Lead Surge In Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

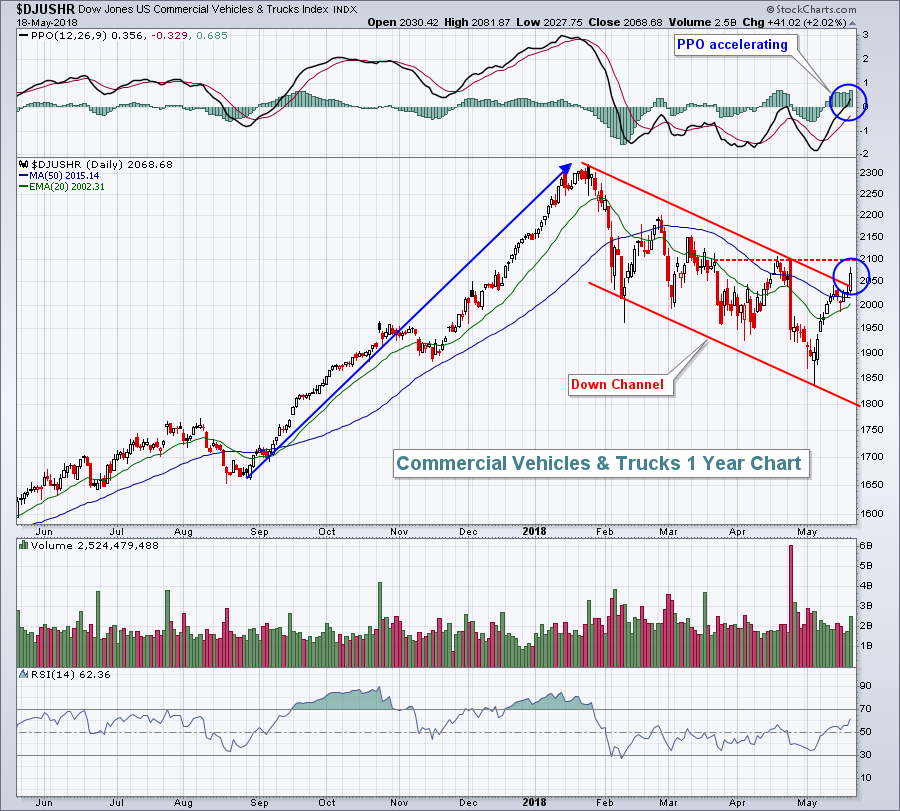

Market Recap for Monday, May 21, 2018

Until recently, the industrials (XLI, +1.51%) had been lagging its aggressive sector counterparts rather badly. That has definitely changed in May and we now have all key sectors with buy signals. Relative weakness remains in the defensive healthcare (XLV, +0.10%), consumer...

READ MORE

MEMBERS ONLY

Monday Trade Setup - Garmin Fills Gap, Looks To Head Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 18, 2018

Last week ended with plenty of bifurcation. Strength was once again seen across the small cap universe as the S&P 600 SmallCap Index and Russell 2000 both finished the week at all-time high closing levels. The larger cap Dow Jones and...

READ MORE

MEMBERS ONLY

Rising Treasury Yields And Dollar Completely Change Investment Themes

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

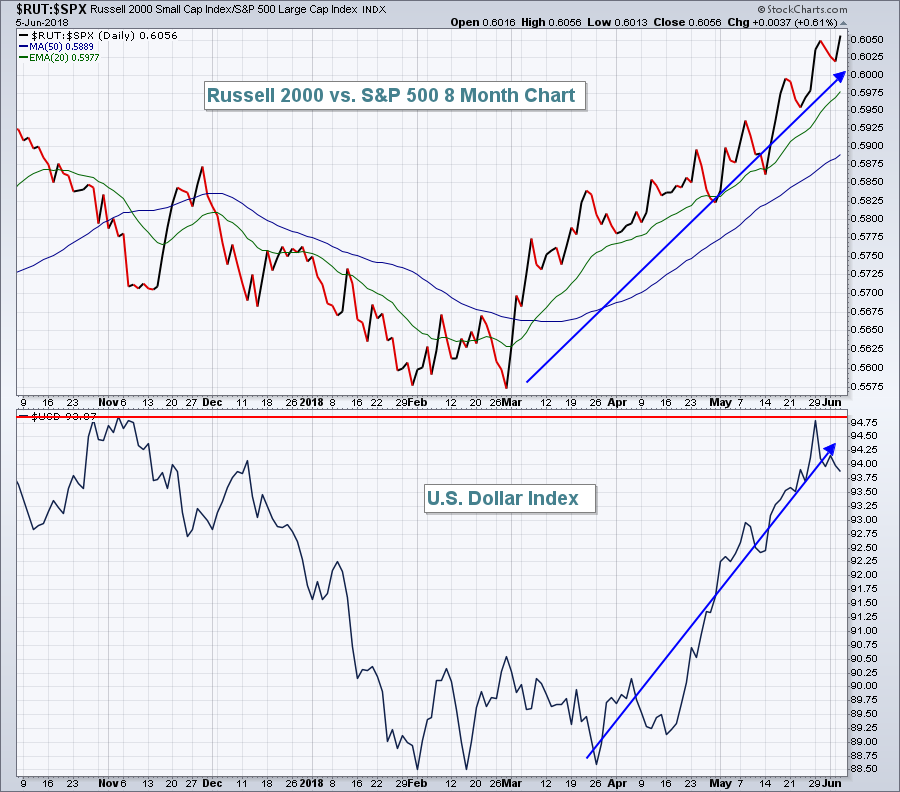

There's a raging bull market going on right now, but you might not realize it if you're stuck in the S&P 500. Take a look at the chart below of the large cap benchmark S&P 500 and its small cap counterpart, the...

READ MORE

MEMBERS ONLY

Energy Has All Guns Blazing, Leads Bifurcated Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 17, 2018

There's a new sheriff on Wall Street and it's the energy ETF (XLE, +1.51%). Its SCTR has soared to 97.1 with the second best SCTR (XLK - technology ETF) at 86.8. The distance between the two...

READ MORE

MEMBERS ONLY

Correlation Suggests This Financial Group Is About To Explode Higher, Get In Early

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

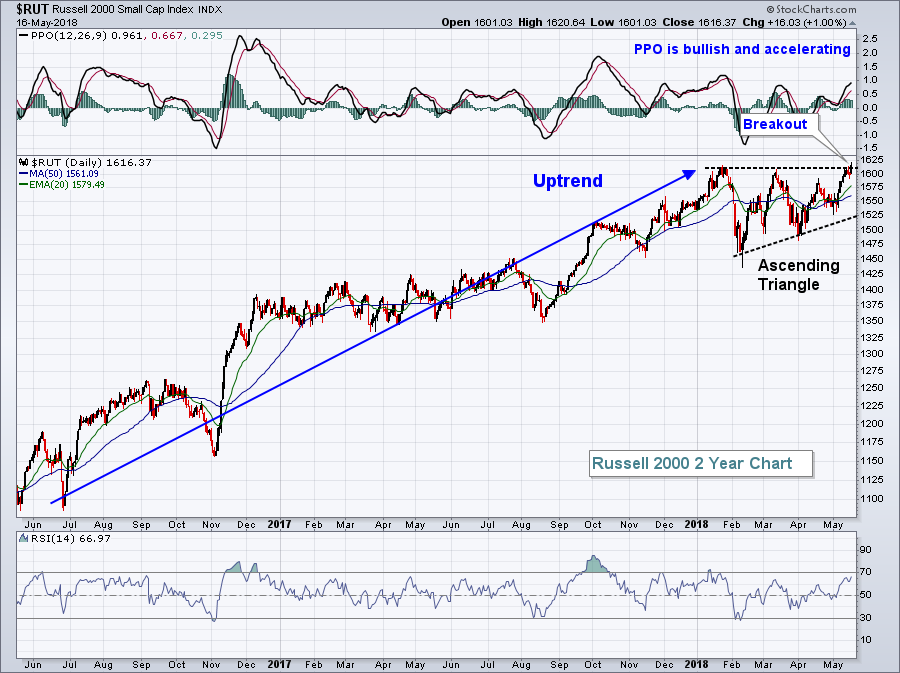

Market Recap for Wednesday, May 16, 2018

We saw another advance on Wall Street on Wednesday as key indices continue to clear important hurdles. Perhaps the most significant yesterday was the Russell 2000, which ended its bullish continuation pattern as expected - with a bullish breakout to the upside:

It&...

READ MORE

MEMBERS ONLY

The Four Decade-Long Downtrend In Interest Rates Is Over And This Is What It Means

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you like my daily Trading Places blog articles and you haven't done so already, please subscribe below. It's a great feature that StockCharts.com provides for all of the blogs here, and it's FREE and easy. Simply scroll to the bottom of...

READ MORE

MEMBERS ONLY

Transports Fail Again At Resistance, Watch Them Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 14, 2018

It was a day of bifurcated action, although the Dow Jones did manage to close higher for the 8th consecutive trading session, the longest such streak in 2018. One look at sector performance, however, illustrates the mixed action. Four sectors finished higher while...

READ MORE

MEMBERS ONLY

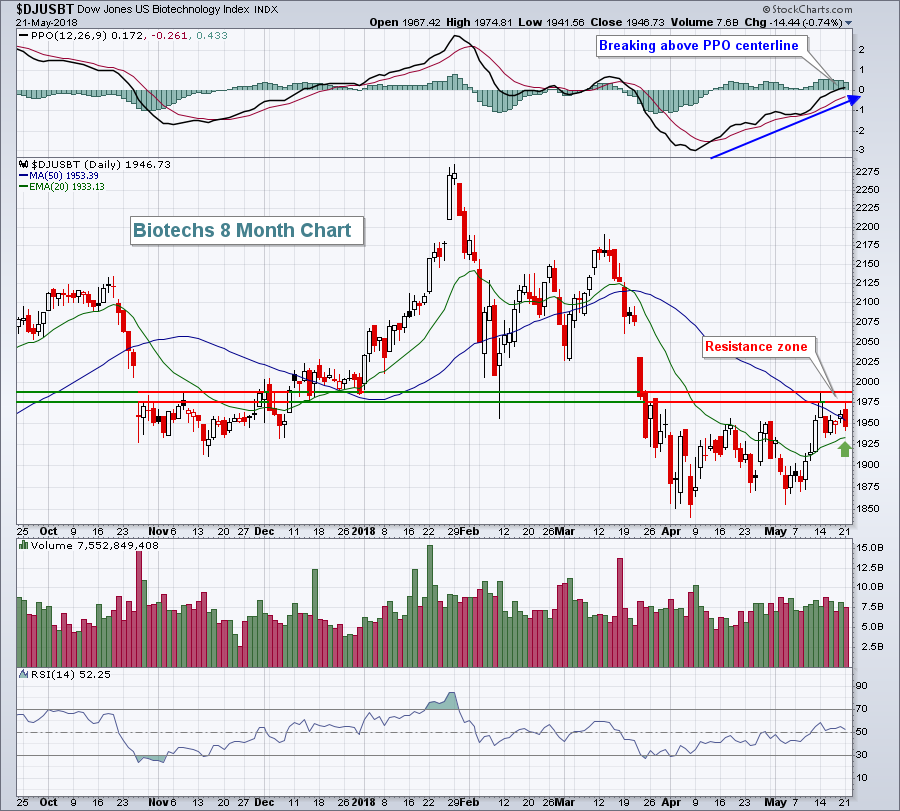

Biotechs Break To Six Week High As Healthcare Advances; Biotechs Poised To Lead Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 11, 2018

Considering the gains that the bulls enjoyed earlier in the week, Friday's end-of-day numbers weren't too shabby. Only the NASDAQ (-2.09 points) lost ground. Over the six prior sessions, the NASDAQ moved from its intraday low on May...

READ MORE

MEMBERS ONLY

Treasury Yields, Dollar Take Breather; Utilities Rise

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 10, 2018

It was a very bullish day on Wall Street. I suppose you could nit pick and point to utilities (XLU, +1.41%) outperforming on an up day, but it's difficult to ignore the solid participation during yesterday's rise. All...

READ MORE

MEMBERS ONLY

S&P Small Caps Close At All-Time High; Falling VIX Says NO To Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 9, 2018

Was Wednesday the day that marked the resumption of the 9 year bull market? Some might argue it began with the bottom last week, while others might argue it hasn't begun because the Dow Jones and S&P 500 are...

READ MORE

MEMBERS ONLY

Bullish Rotation Continues On Tuesday Despite Flat Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 8, 2018

There are days when the stock market seems to go nowhere and are relatively meaningless. Tuesday wasn't one of those days. While the Dow Jones and NASDAQ gained a measly 2.89 and 1.69 points, respectively, and the S&...

READ MORE

MEMBERS ONLY

Gains Moderate, But Relative Strength Felt In Key Areas

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 7, 2018

There was plenty of green on Monday, adding to the gains we saw late last week. The only areas of the market that struggled were the defensive consumer staples (XLP, -0.62%) and utilities (XLU, -0.52%). On the flip side, money rotated...

READ MORE

MEMBERS ONLY

Jobs Come Up Short, But Technology And Consumer Stocks Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 4, 2018

For many weeks, we've seen the stock market seemingly ignore great earnings news and retreat. Highly visible companies like Boeing (BA), Caterpillar (CAT), Intel (INTC) and Microsoft (MSFT) gained initially after blowout earnings, then stumbled after traders attempted to figure out...

READ MORE

MEMBERS ONLY

Rising Dollar Should Change Your Investment Strategy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Throughout 2017 the U.S. Dollar Index ($USD) was falling and aiding profits on multinational companies found on the S&P 500. But it was time for the dollar to rise, as evidenced by a surging U.S. 10 year treasury yield ($UST10Y) vs. Germany's 10 year...

READ MORE

MEMBERS ONLY

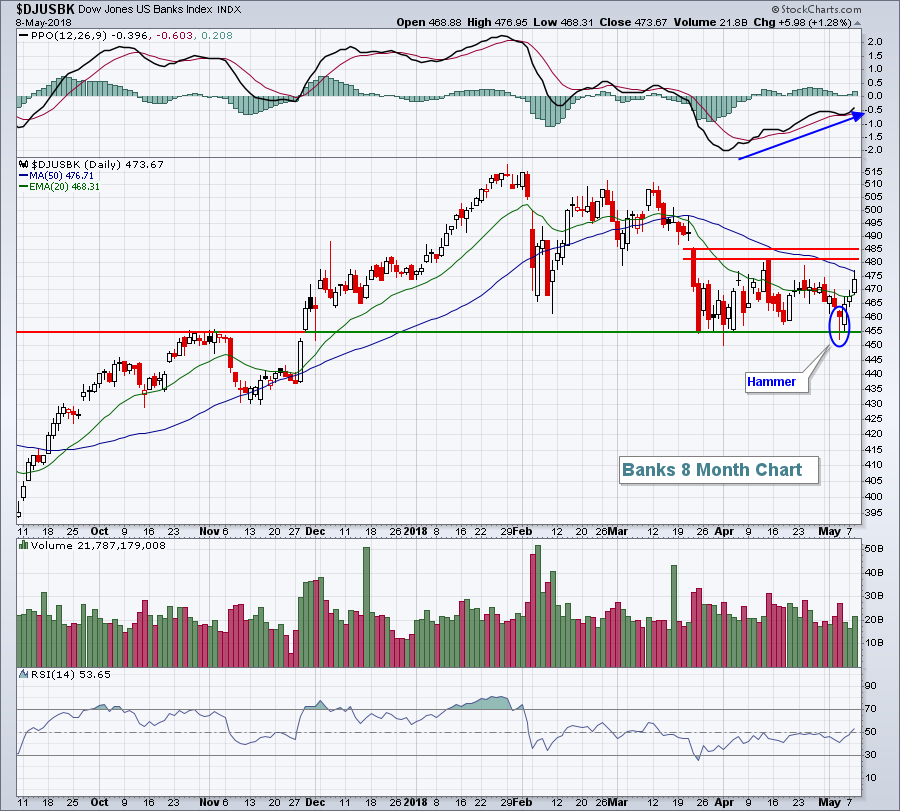

Banks Lead Reversal Off Major Support And UNH Could Be Ripe For A Strong May

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 3, 2018

The Dow Jones was the only major index to finish in positive territory on Thursday, but it could have been so much worse. In the first 90 minutes of trading, the S&P 500 found itself back below 2600 and within just...

READ MORE

MEMBERS ONLY

Fed Talks Inflation, Traders Head For The Hills

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for May 2, 2018

Well, the Fed spoke and Wall Street listened. While there weren't any dire warnings from the Fed about inflation, simply acknowledging that inflation could be returning to its target 2% rate spooked traders for an afternoon. If you were wondering if the...

READ MORE

MEMBERS ONLY

Technology Leads Tuesday Turnaround

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for May 1, 2018

The Dow Jones led the early selling on Tuesday as traders were not impressed with quarterly earnings results from two pharma giants, Pfizer (PFE, -3.31%) and Merck (MRK, -1.51%). Both were down considerably more in the morning session, but rebounded to make...

READ MORE

MEMBERS ONLY

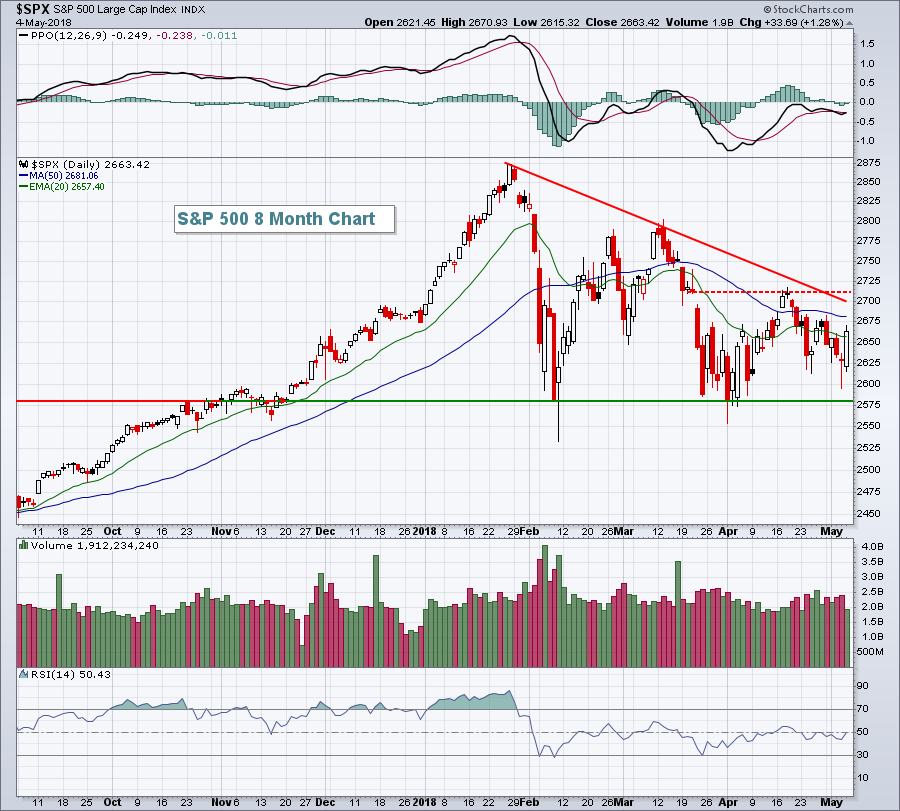

S&P 500 Stuck In Trading Range; AAPL, Then Fed, On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

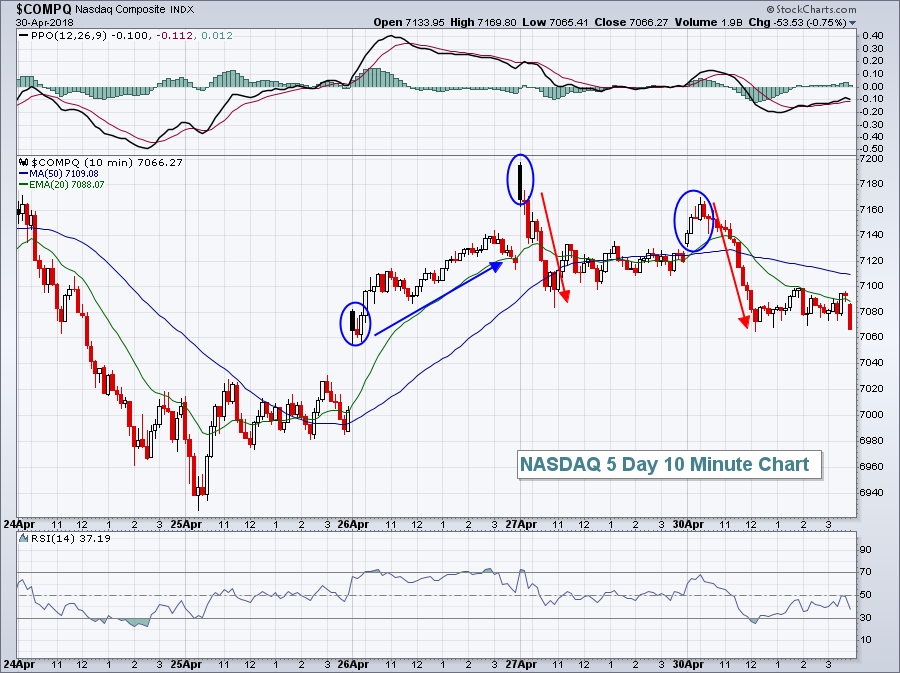

Market Recap for Monday, April 30, 2018

Monday was a "rinse and repeat" session from Friday. We opened higher, sold off for 90 minutes, then consolidated the balance of the day. Since Thursday's close, the NASDAQ has fallen 0.75%, but it seems like much more...

READ MORE

MEMBERS ONLY

Strong GDP And Blowout Earnings Fail To Inspire Bulls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

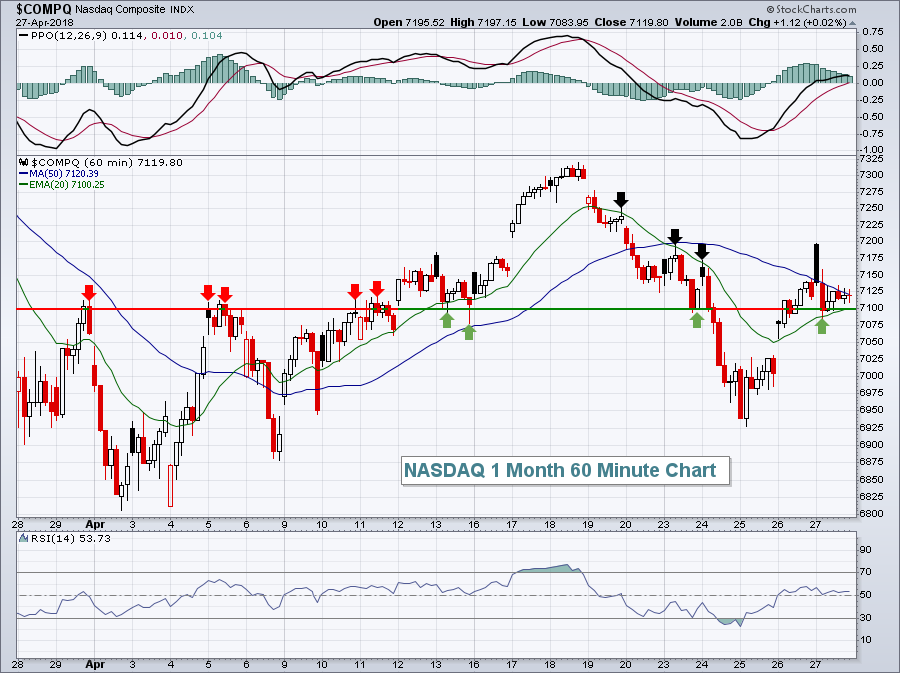

Market Recap for Friday, April 27, 2018

The news heading into Friday couldn't have been much better. The initial reading of Q1 GDP came in stronger than expected at 2.3% vs. 2.0%. We had blowout earnings from key leaders including Amazon.com (AMZN), Microsoft (MSFT) and...

READ MORE