MEMBERS ONLY

Leading Industry Prints Reversing Candle; Dow Jumps Over 300 Points

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 5, 2018

The Dow Jones surged on Monday, gaining 337 points (+1.37%) to lead all of our major indices higher. Two stalwarts - Caterpillar (CAT, +3.24%) and Boeing (BA, +2.34%) - were the leaders, but we saw 29 of the 30 Dow...

READ MORE

MEMBERS ONLY

Medical Supplies Print Reversing Candle, Small Caps Surge And Monday Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 2, 2018

The Dow Jones finished with a 71 point loss on Friday, thanks in part to another very weak performance by McDonalds (MCD). Apparently, their $1, $2, $3 menu is falling short of expectations and it's clearly reflected in recent price action....

READ MORE

MEMBERS ONLY

Is A Bear Market Underway? No And Here's My Argument

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

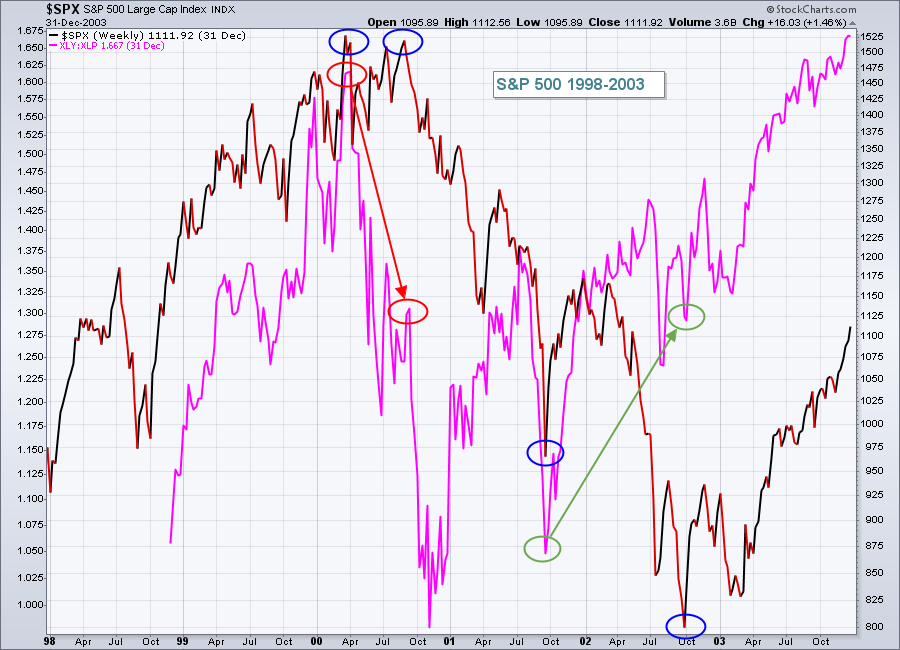

THE Question

Is this a correction within a bull market or is it the beginning of a bear market? That is THE question that everyone is debating and hoping to answer correctly. There's no crystal ball to know for sure the correct answer. However, the market does provide...

READ MORE

MEMBERS ONLY

S&P 500 Loses Key Support, Odds Of A Bottom Retest Grow

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

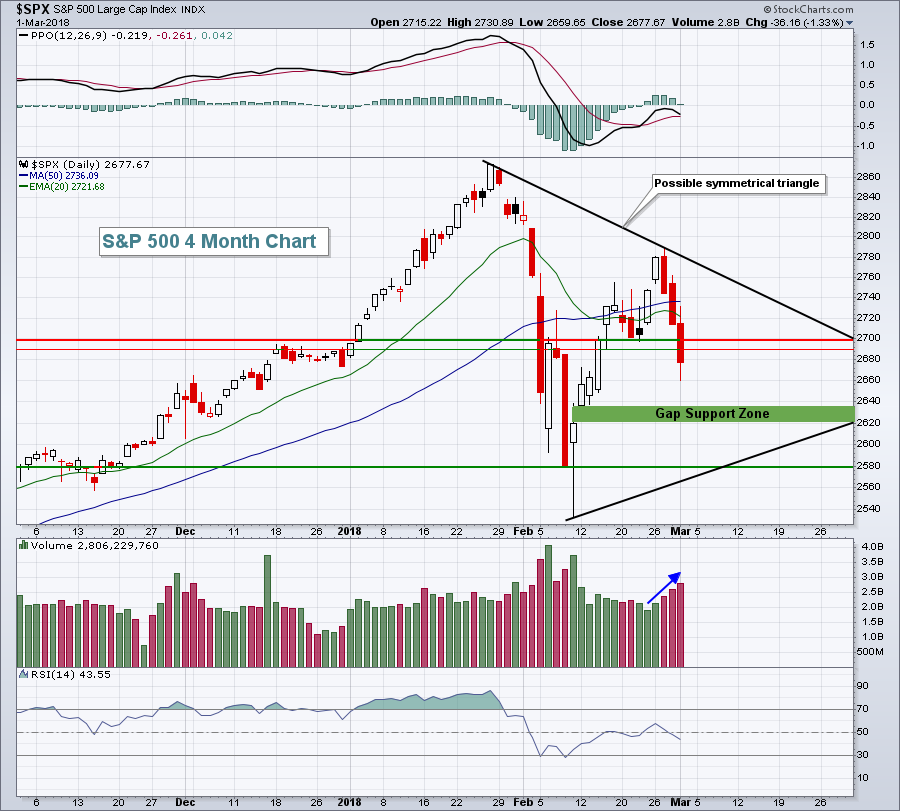

Market Recap for Thursday, March 1, 2018

Any time the Volatility Index ($VIX) rises 13%, it's not going to be a great day on Wall Street. Fear equals selling and selling is exactly what we saw on Thursday. There was a bit of a late day rally, but...

READ MORE

MEMBERS ONLY

Looking For Seasonal Strength? Check Out This Leading Stock From A Leading Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 28, 2018

Outside of the final two hours on Wednesday, it was a fairly boring day. We gapped higher at the open, sold off to fill the gap, and then moved back into positive territory.....until the final two hours. Selling returned in a big...

READ MORE

MEMBERS ONLY

3 Takeaways From Tuesday's Renewed Selling...And Why I'd Avoid Gold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 27, 2018

During a day filled with renewed selling, especially in the final 10 minutes, there were 3 key takeways as far as I'm concerned. First, the short-term uptrend appeared to have been broken at the end of the day as gap, price...

READ MORE

MEMBERS ONLY

Software Breaks Out; Semis, Computer Hardware Next In Line

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 26, 2018

Monday was a very solid day for U.S. equities. All of our major indices roared to higher levels, led by the 400 point gain on the Dow Jones Industrial Average ($INDU). Eight of nine sectors advanced, with only the defensive utilities group...

READ MORE

MEMBERS ONLY

Looking For March Seasonal Strength? Check These Two Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 23, 2018

After a steady diet of afternoon flops recently, our major indices soared into Friday's close, clearing important overhead resistance in the process. All major indices finished with 1% gains or more, setting the stage for what could be a very solid...

READ MORE

MEMBERS ONLY

Higher Treasury Yields Crushing Last Year's Darling - Home Construction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 22, 2018

U.S. indices continued to tread water on Thursday, with mixed action among our major indices and sectors. The Dow Jones posted a triple digit gain (165 points), but the more aggressive NASDAQ and Russell 2000 indices both fell fractionally. Volatility ($VIX) subsided...

READ MORE

MEMBERS ONLY

FOMC Minutes Spook Traders, Equities Tumble In Final Two Hours

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

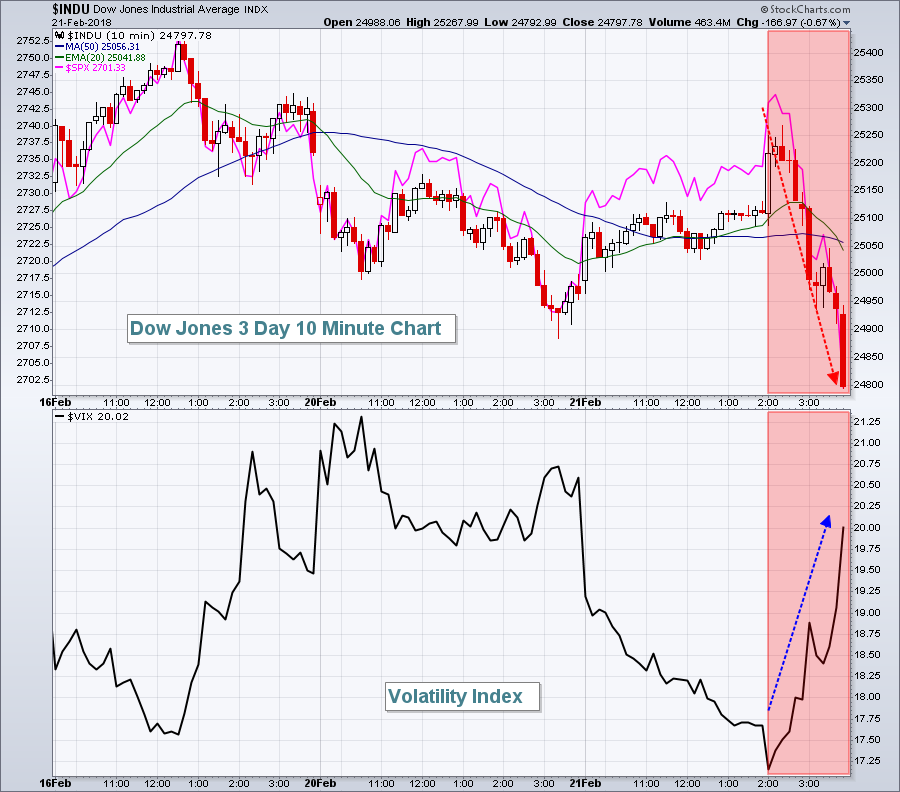

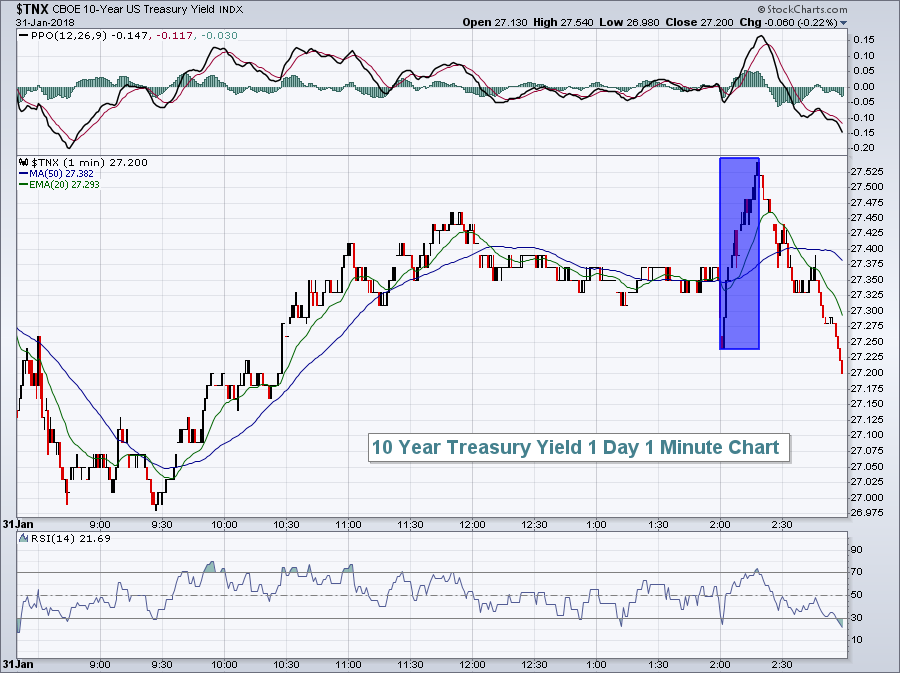

Market Recap for Wednesday, February 21, 2018

Well, the U.S. stock market was humming right along.....until the FOMC minutes were released at 2pm EST. Take a look at this intraday chart on the Dow Jones and S&P 500 and I think you'll fairly quickly...

READ MORE

MEMBERS ONLY

Walmart Results Take A Big Bite Out Of Dow Jones, Ends Winning Streak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 20, 2018

Selling returned to Wall Street as its six day winning streak came to an end. The Dow Jones was easily the biggest loser as Walmart, Inc (WMT) disappointed traders with its latest quarterly earnings report and had its worst trading day in many...

READ MORE

MEMBERS ONLY

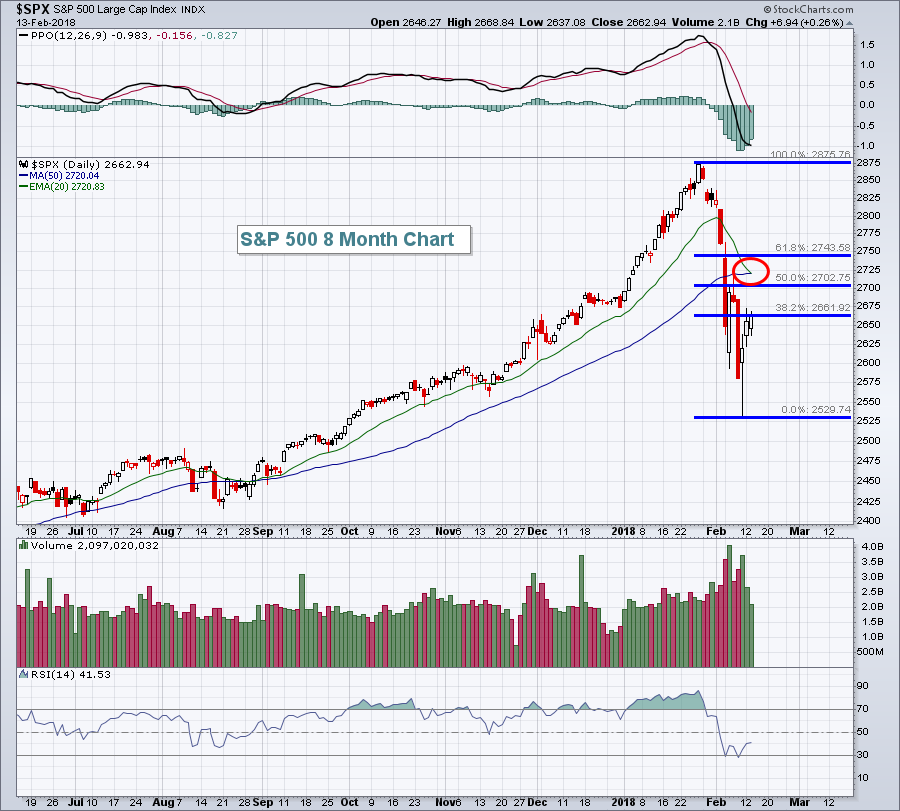

Traders Turn Defensive As Key Fibonacci Retracement Level Reached - Bearish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 16, 2018

On the surface, Friday's action didn't seem all that bad. While there was bifurcated action, three of our four major indices did finish in positive territory. The aggressive small cap Russell 2000 ($RUT) led the advance. Only the NASDAQ...

READ MORE

MEMBERS ONLY

History And Fibonacci Say We Topped On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

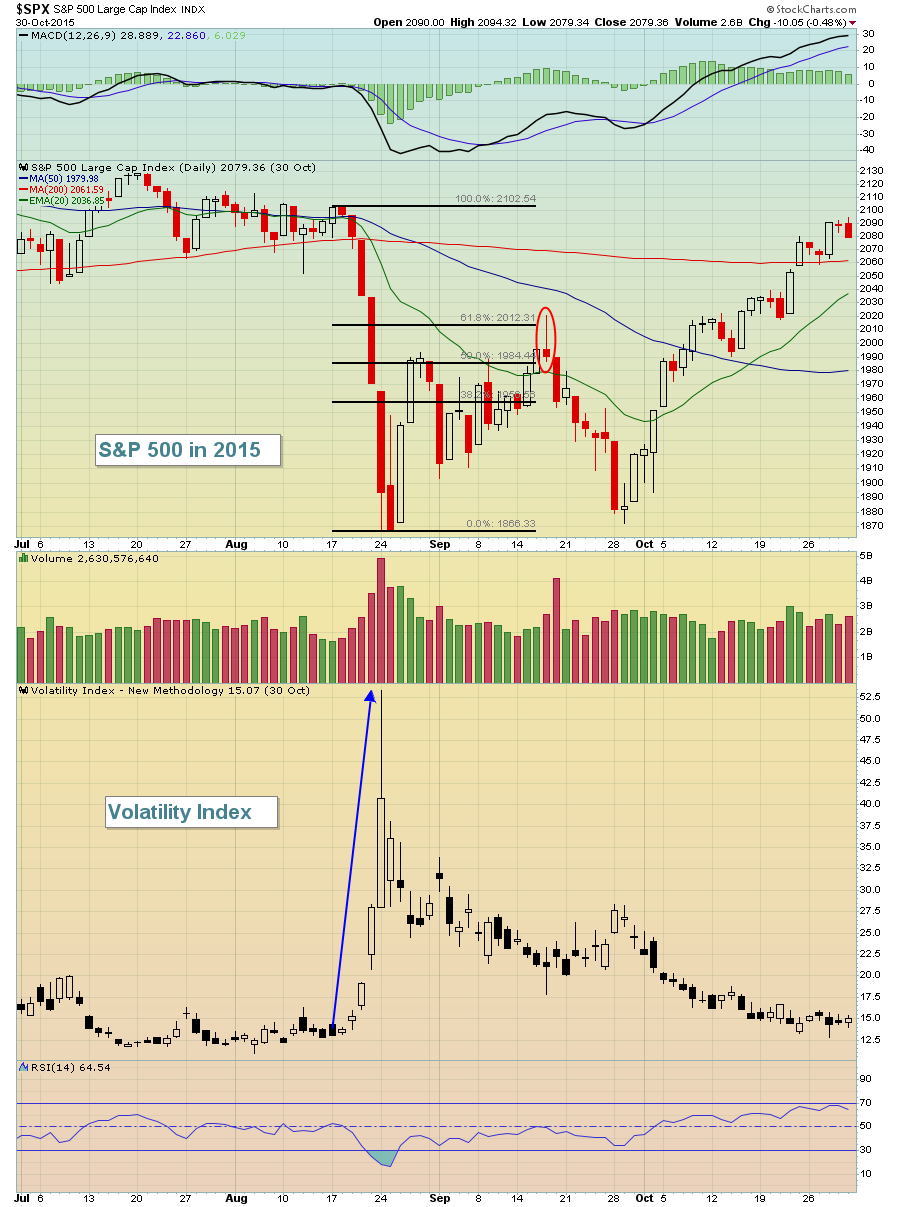

Fear ramped up with the early February selling and a capitulatory bottom (at least short-term) printed. The Volatility Index ($VIX) doesn't hit the 40-50 zone often and, when it does, it typically coincides with a panicked selloff and bottom. The last time we saw panicked selling (before the...

READ MORE

MEMBERS ONLY

Grading The Current Rally - Is It Sustainable?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

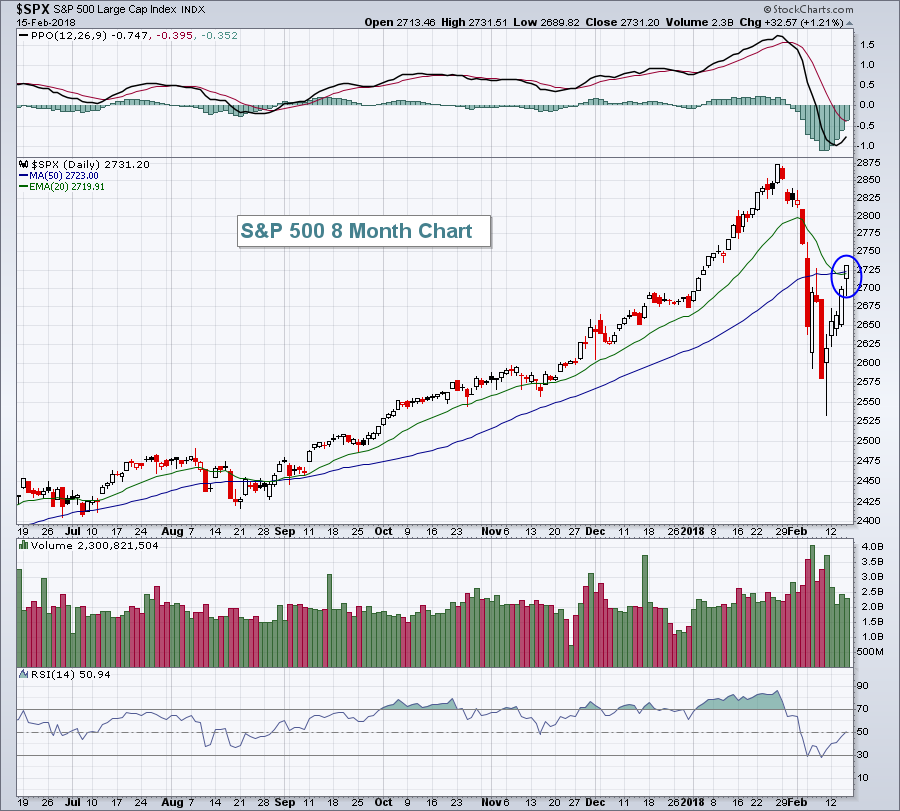

Market Recap for Thursday, February 15, 2018

Selling is inevitable during bull markets. After each leg higher, there's typically a period of selling/consolidation. The bulls were spoiled for several months, as the bull market advance continued nearly uninterrupted. There really hadn't been any notable selling...

READ MORE

MEMBERS ONLY

Wall Street Shakes Off Inflation Worries, Retail Slump; Rallies For 4th Straight Session

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 14, 2018

Wall Street sure did look like it was heading for a very rough day at 8:30am EST on Wednesday. Very poor economic news hit traders with a 1-2 punch as the consumer price index jumped 0.5% instead of the 0.3%...

READ MORE

MEMBERS ONLY

This Might Very Well Be The Best Investment Over The Next 6-12 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 13, 2018

The U.S. stock market settled down on Tuesday, trading in a much narrower range, and finished with gains across its major indices for the third consecutive day. While it was good to see the market stabilize after such panicked selling, there remains...

READ MORE

MEMBERS ONLY

Apple Rebounds, Leads Technology Higher As Wall Street Gains For Second Straight Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 12, 2018

Wall Street saw more gains on Monday, continuing the strength we saw late during the Friday session. Most of the strength, however, came during the morning session as the benchmark S&P 500 hit 2660, rising 130 points or approximately 5%, off...

READ MORE

MEMBERS ONLY

U.S. Equities Recover, Stocks To Consider On A Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 9, 2018

For the first time in 18 months, the Dow Jones, S&P 500 and NASDAQ all closed out a week beneath their rising 20 week EMAs. After not seeing a meaningful pullback (more than 3%) for well over a year, our major...

READ MORE

MEMBERS ONLY

A High VIX Means Irrational Market Swings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 8, 2018

For now, forget about the strong earnings season that we just witnessed. Also, forget about bond yields rising, which I view as a very bullish development generally-speaking as it allows money to rotate from the more defensive bond market to the more aggressive...

READ MORE

MEMBERS ONLY

Copper Prices Remain In Strong Uptrend And That's Bullish For The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

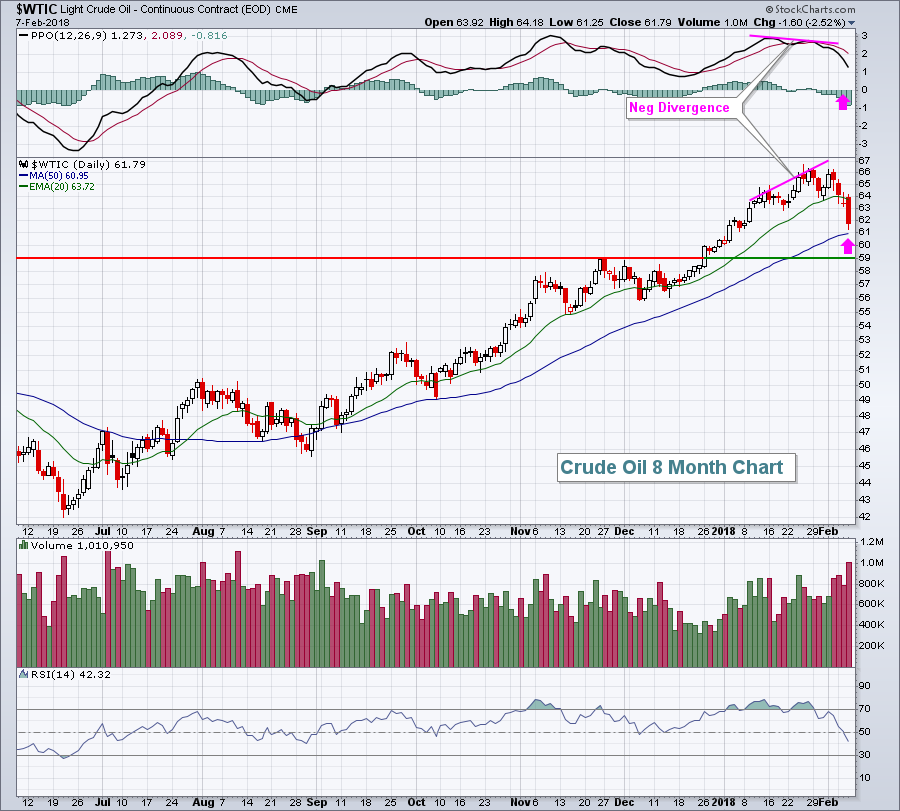

Market Recap for Wednesday, February 7, 2018

With the exception of a fractional gain in the small cap Russell 2000, late day selling resulted in losses on each of our major indices. The Dow Jones spent much of the day in positive territory and sported a 270 point gain with...

READ MORE

MEMBERS ONLY

I'll Step Out On That Limb, The Bottom Is In

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 6, 2018

Volatility is the name of the game right now and big swings - both up and down - should be expected in the near-term. Yesterday was the bulls' turn as our major indices rallied back, led by the Dow Jones' 567...

READ MORE

MEMBERS ONLY

Look To VIX To Call Market Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 5, 2018

What a day and especially what a final hour! It was very reminiscent of selling episodes in 2008 where our major indices were losing a percent every few minutes. From a bullish perspective, there's little defense from panicked selling other than...

READ MORE

MEMBERS ONLY

Stocks Slammed, Futures Lower; Here's A Possible Support Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 2, 2018

It was an ugly day on Wall Street. In fact, it was the ugliest day on Wall Street since June 24, 2016, when the Dow Jones last fell more than 600 points. Friday's drop was 665 points and the technical damage...

READ MORE

MEMBERS ONLY

The NASDAQ 100 And Its Best Seasonal Candidates In February

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Identifying The Candidates

I've included the month-by-month seasonal information for all NASDAQ 100 ($NDX) stocks in an Excel spreadsheet. In an effort to identify the best seasonal stocks on the NDX, I first considered the number of years history for each stock. For instance, I eliminated JD.com...

READ MORE

MEMBERS ONLY

AAPL, AMZN And GOOGL Report Results; Futures Tumble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 1, 2018

We saw a lot of bifurcation in the market on Thursday. The more aggressive NASDAQ and Russell 2000 rebounded and finished in positive territory, while both the Dow Jones and S&P 500 fell on the session. Four sectors finished higher, while...

READ MORE

MEMBERS ONLY

U.S. Equities Bounce; Small Caps Face Stiff Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 31, 2018

Following the heavy selling on Tuesday, the bulls were just hoping to stop the bleeding. I'd say they had some success as the Dow Jones, S&P 500 and NASDAQ all finished in positive territory. Overall action was bifurcated, however,...

READ MORE

MEMBERS ONLY

Sellers Stampede Wall Street; Dow Jones Tumbles 362 Points

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

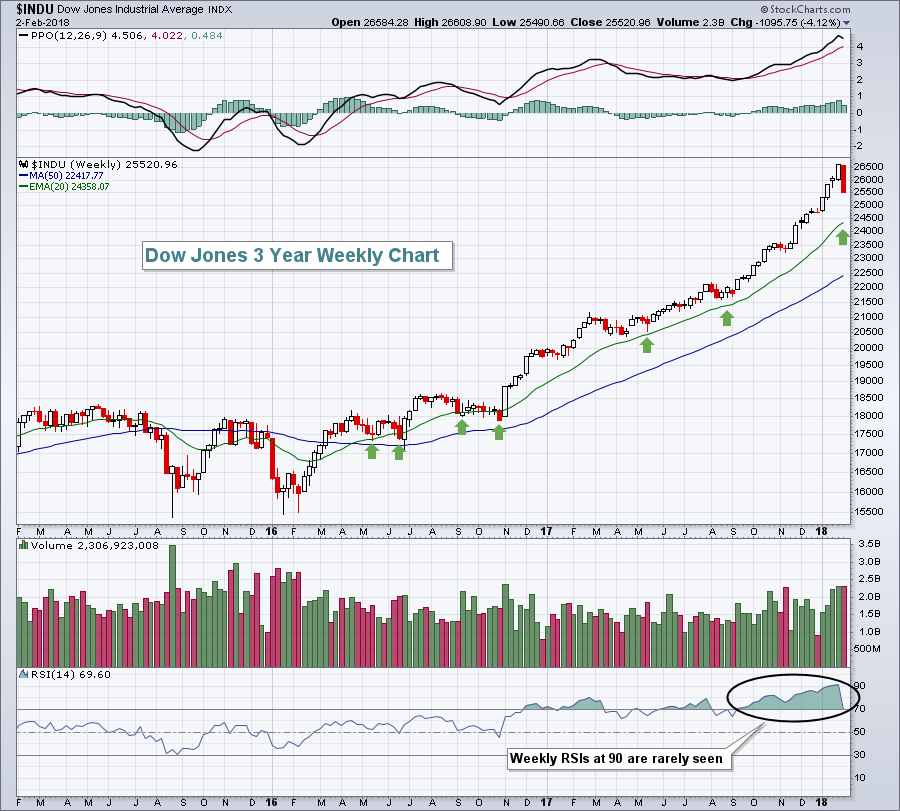

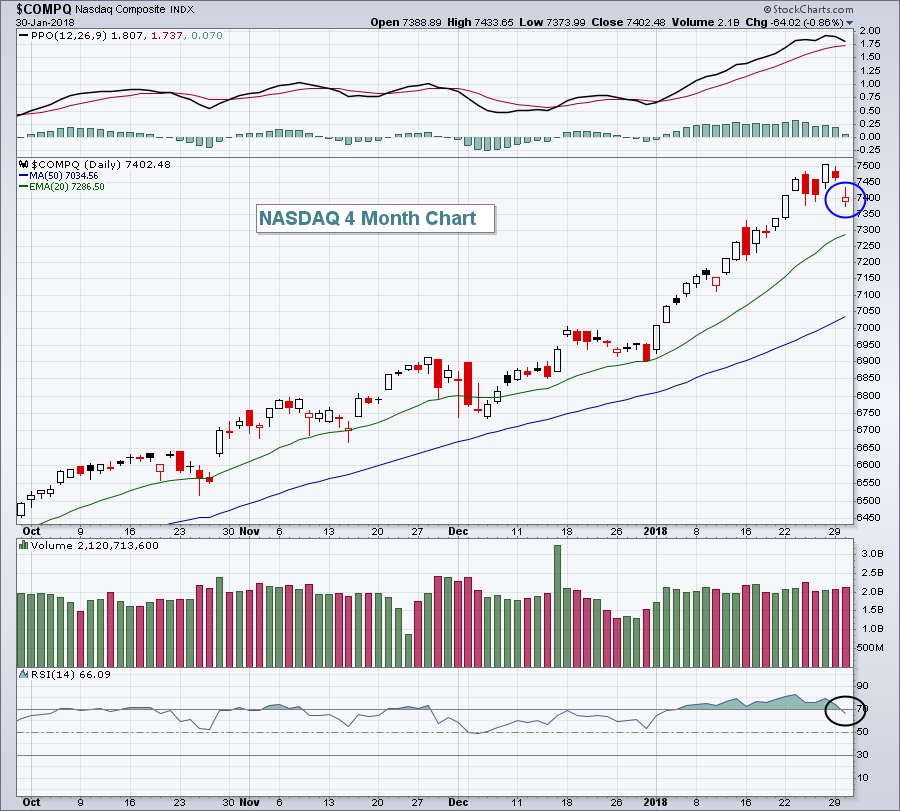

Market Recap for Tuesday, January 30, 2018

This day was a long time coming. The U.S. stock market's uninterrupted surge to record all-time highs day after day, week after week and month after month needed a break. It needed relief. Yesterday that relief was found....and it...

READ MORE

MEMBERS ONLY

Apple Tests Major Support As Its Earnings Report Nears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 29, 2018

We saw something different in the U.S. stock market on Monday. We closed in negative territory on all of our major indices and we closed at or near lows for the day. There was little or no bargain hunting at the end...

READ MORE

MEMBERS ONLY

Bulls Stomp On The Gas, Biotechs Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 26, 2018

The bears were absolutely stymied on Friday as the major indices surged to unprecedented levels. Despite the very overbought conditions that have persisted on many indices for four months now, bulls dominated the action and show no signs of letting up. When you...

READ MORE

MEMBERS ONLY

Utilities Rebound; Dow Jones Sets Fresh Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

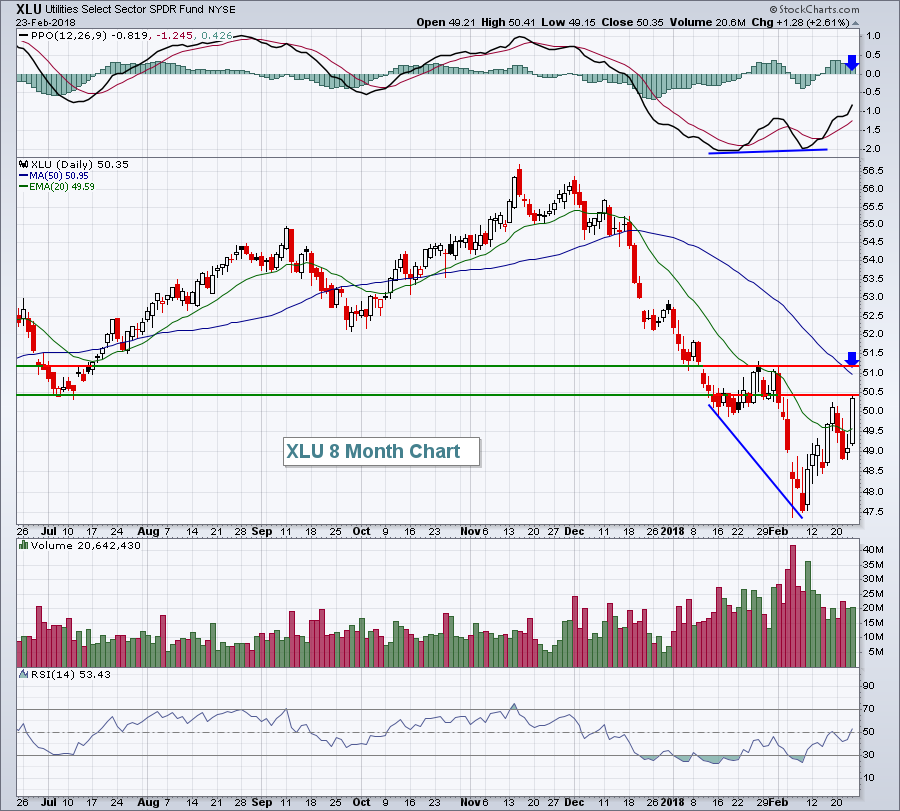

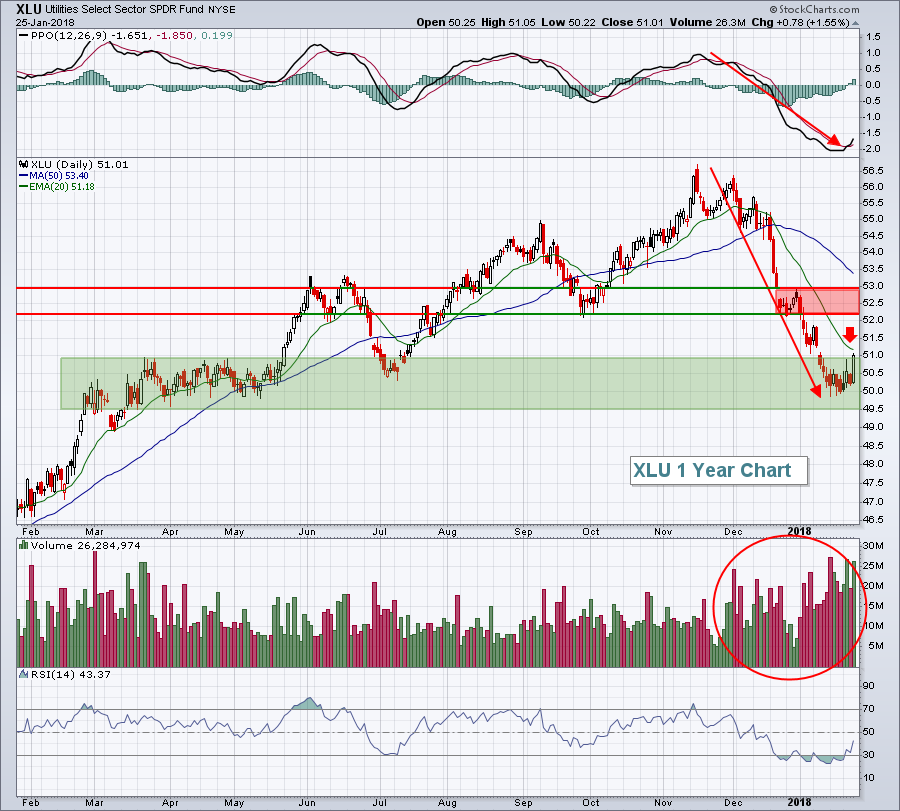

Market Recap for Thursday, January 25, 2018

Utilities (XLU, +1.55%) easily enjoyed its best day of 2018 on Thursday as significant price support, combined with falling treasury yields, triggered an explosive move higher as buyers could not get enough of the beaten-down sector. Here's the chart:

The...

READ MORE

MEMBERS ONLY

Strength In Banks And Insurance Lead Bifurcated Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

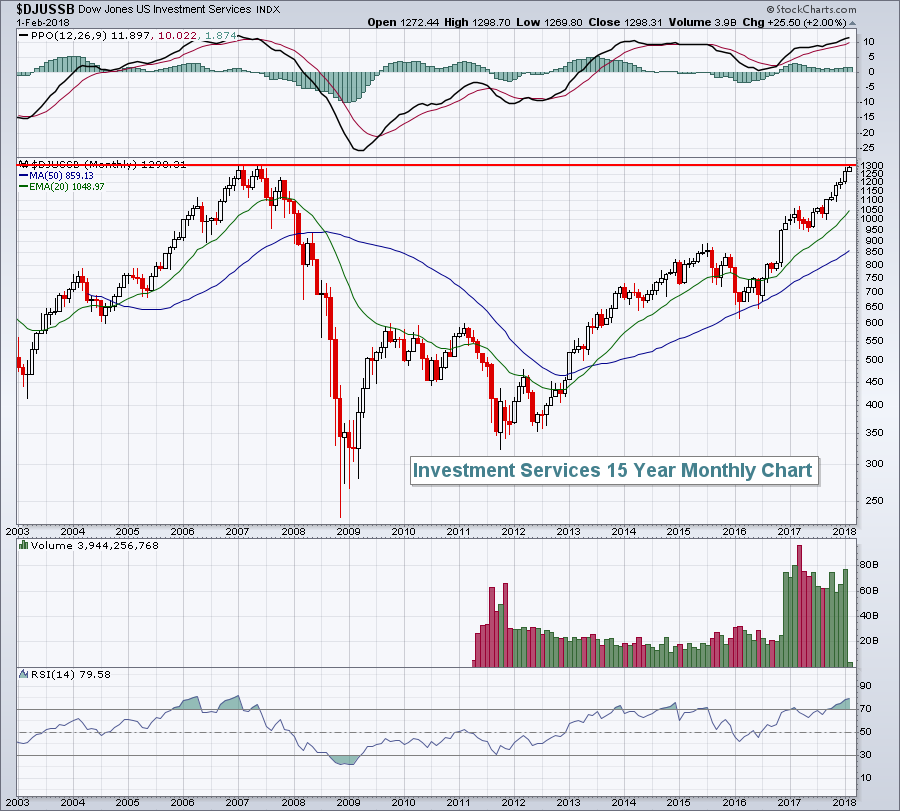

Market Recap for Wednesday, January 24, 2018

Only the Dow Jones was able to end Wednesday's session in positive territory, but all of our major indices remain very strong with accelerating bullish price momentum. Sectors and industries have taken their turns leading U.S. stocks higher and yesterday...

READ MORE

MEMBERS ONLY

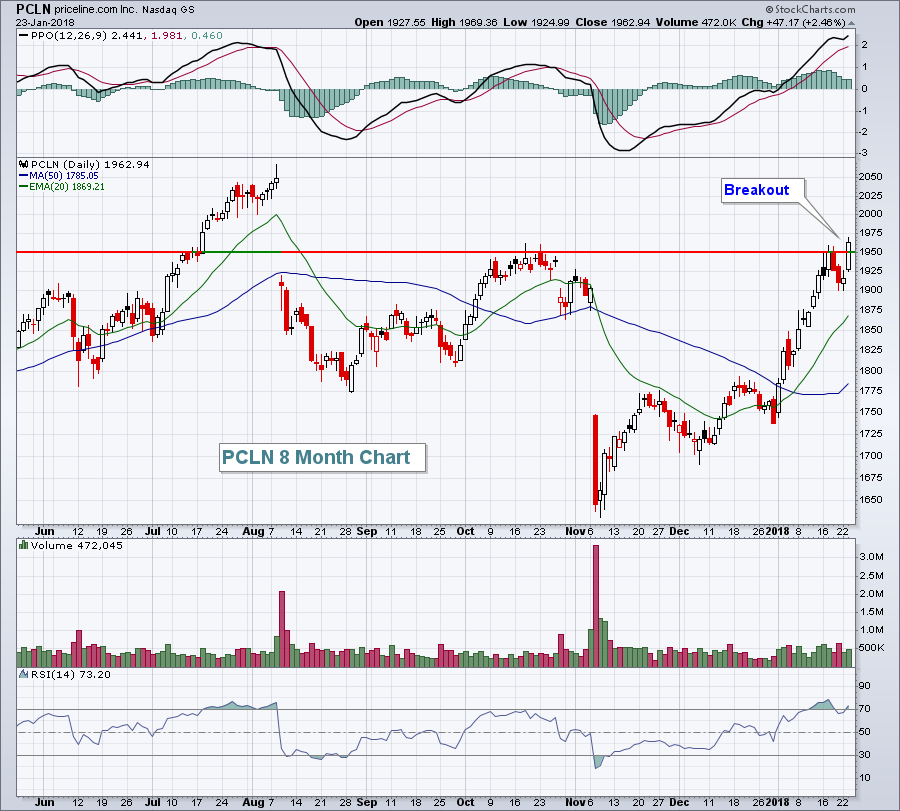

Utilities Lead As Market Rally Pauses; PCLN breaks out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 23, 2018

The tech-laden NASDAQ powered forward to new all-time highs on Friday, closing above 7400 for a second consecutive session and now approaching 7500. All of our major indices ended higher, except for the Dow Jones, which saw a last minute bout of selling...

READ MORE

MEMBERS ONLY

Energy Soars But Its Relative Strength Might Surprise You

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

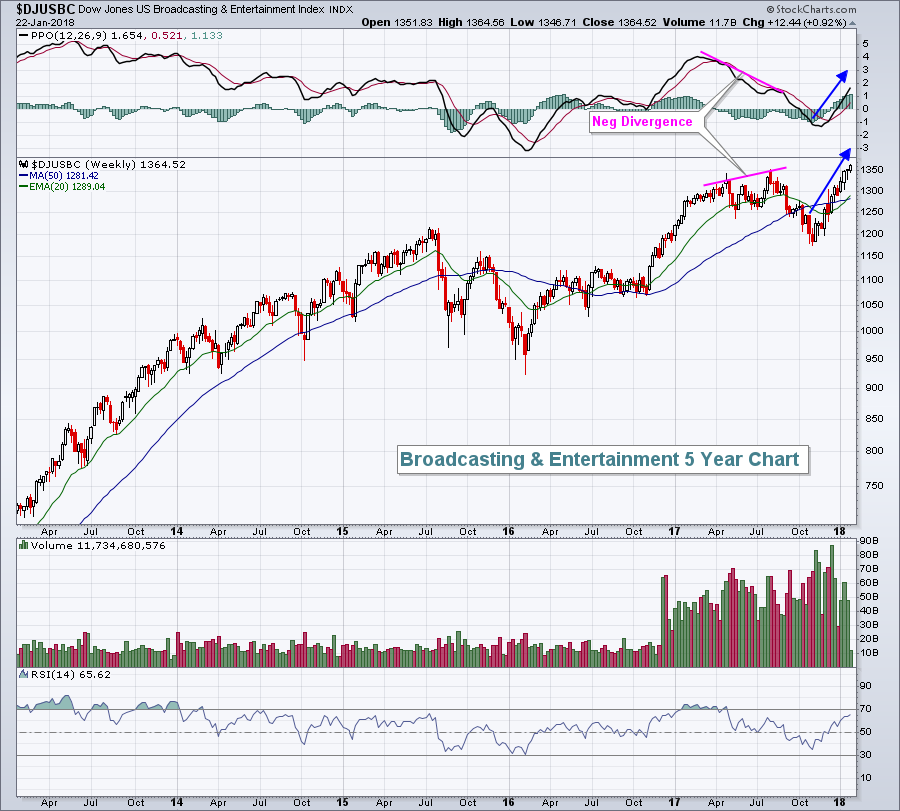

Market Recap for Monday, January 22, 2018

There was a lot of good things happening on Monday. First of all, one of the worst days historically has been the Monday after options expiration Friday. That historical weakness never materialized yesterday as all of our major indices trended up throughout the...

READ MORE

MEMBERS ONLY

Retail Jumps Again, Leads U.S. Stocks To More Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 19, 2018

Strength resumed on Friday, with three of our four major indices closing at record highs. Only the Dow Jones managed to come up short as losses in Dow components IBM, General Electric (GE) and American Express (AXP) held back the index, although it...

READ MORE

MEMBERS ONLY

What To Buy In An Overbought Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bull markets can advance very quickly and can become extremely overbought. It's a challenge psychologically at times to commit new money t0 a stock or ETF, knowing that just days or weeks ago prices were so much cheaper. So what the heck do you do when looking to...

READ MORE

MEMBERS ONLY

My Trading Strategy In An Overbought Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 18, 2018

Thursday was not a great day for the bulls. We haven't seen too many times since the August low where all of our major indices finished lower on the session. Yesterday, however, was one of those days. But the action recently...

READ MORE

MEMBERS ONLY

For The S&P 500, Today's Close Is Historically Significant

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

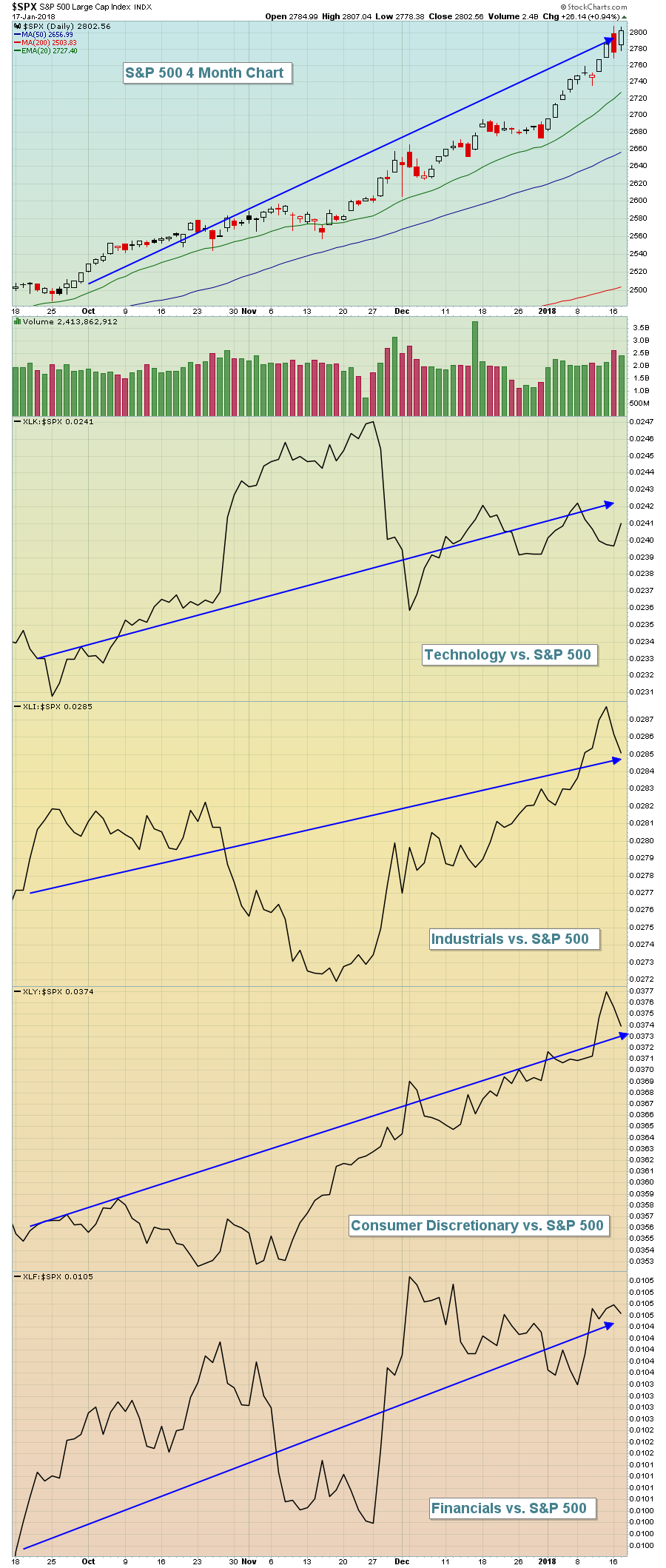

Market Recap for Wednesday, January 17, 2018

The Dow Jones didn't fail this time. After Tuesday's huge reversal from above the 26,000 level, there were a number of question marks about whether the current rally would continue. The Dow Jones answered those questions rather emphatically...

READ MORE

MEMBERS ONLY

Big Selling Hits Wall Street; Here's What To Watch On Wednesday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 16, 2018

Tuesday was perhaps the most bearish day we've seen in quite awhile. For starters, volume on our major indices was the heaviest in the past 6-7 weeks, excluding option expiration Friday on December 15th. But the heavy volume, by itself, wasn&...

READ MORE

MEMBERS ONLY

Media Agencies, Consumer Discretionary Lead Latest Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 12, 2018

U.S. equities had another nice rally on Friday, this time led by a very strong consumer discretionary sector (XLY, +1.29%). Eight of the nine sectors finished higher, with utilities (XLU, -0.57%) the only area failing to participate. The XLU tends...

READ MORE

MEMBERS ONLY

Small Caps Lead With Powerful Rally; Airlines Prepared For Takeoff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

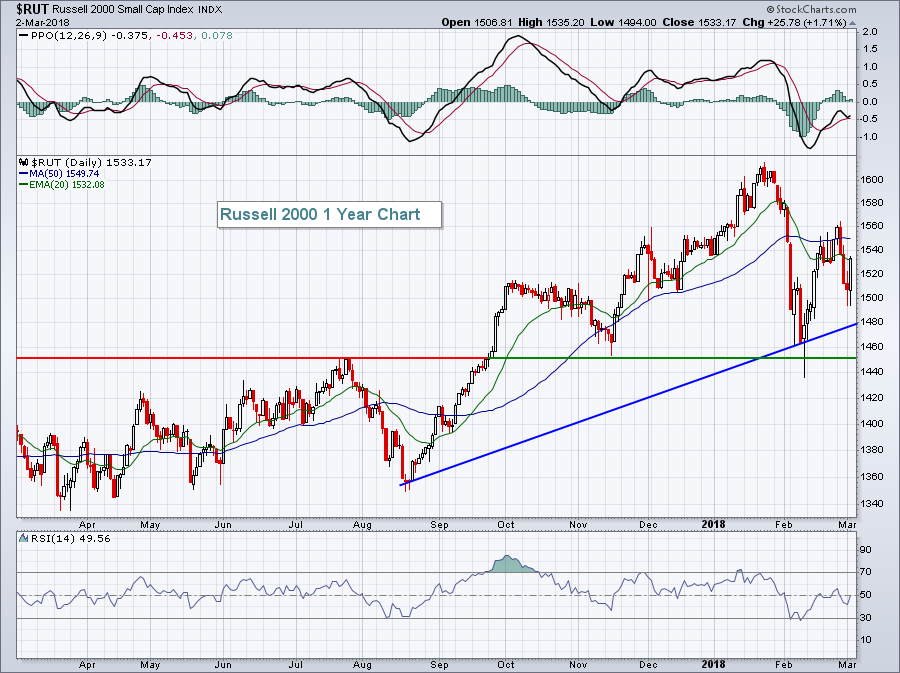

Market Recap for Thursday, January 11, 2018

The small cap Russell 2000 ($RUT) led U.S. indices higher on Thursday with more across-the-board record highs being set. The RUT gained 1.73%, more than doubling the advance on any of the other major indices. There were plenty of reasons, but...

READ MORE