MEMBERS ONLY

A Deep Look Into Healthcare And Its Bullish Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 10, 2017

The energy sector (XLE, +1.32%) was very strong on Wednesday as crude oil ($WTIC) bounced more than 3%. With crude oil up nicely again this morning, we should see more strength and leadership from the XLE today. Technology (XLK, +0.38%) and...

READ MORE

MEMBERS ONLY

Hotels And Gambling Stocks Lead Strong Discretionary Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 9, 2017

Consumer discretionary stocks (XLY, +0.58%) were easily the leading group on Tuesday as hotels ($DJUSLG) and gambling ($DJUSCA) stocks were outperformers. Automobiles ($DJUSAU), recreational products ($DJUSRP) and home construction ($DJUSHB) also performed quite well. The latter group held recent price support and...

READ MORE

MEMBERS ONLY

Truckers: Short-Term Sell Signal Setting Up Long-Term Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 8, 2017

The small cap Russell 2000 lagged on Monday with the other major indices tacking on minor gains. Energy (XLE, +0.71%) was the leader with coal ($DJUSCL) jumping 3.50%. The DJUSCL, however, is hitting major trendline resistance after kick-saving at price support....

READ MORE

MEMBERS ONLY

Dow Jones Tops 21000 For Second Time

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

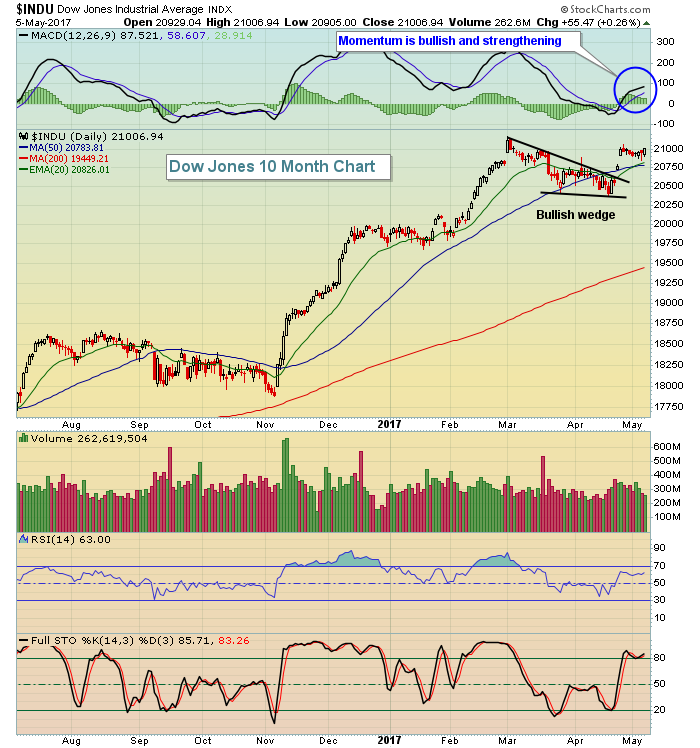

Market Recap for Friday, May 5, 2017

The headline news from Friday is that the Dow Jones was able to clear psychological overhead resistance at 21000 for only the second time in history (March 1st was the other) and that the S&P 500 managed to clear its all-time...

READ MORE

MEMBERS ONLY

Did Nike Bottom on Friday?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As technicians, we look for prior price resistance to act as solid support once the resistance has been broken. That principle came into play on Nike, Inc. (NKE) as it tested a major price support just beneath 54.00 on Friday. NKE gapped down in the latter part of March...

READ MORE

MEMBERS ONLY

Bifurcated Action Stymies Global Markets - For At Least One Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 4, 2017

Happy Cinco De Mayo!

Cuatro De Mayo turned out to be a very flat day, with bifurcated action throughout the market. Even global markets were bifurcated. I counted 13 international ETFs higher yesterday with 10 lower. Markets everywhere are consolidating after mostly higher...

READ MORE

MEMBERS ONLY

Banks Lead Rebound In Financials; IBN Breaks Out On Big Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 3, 2017

Financials (XLF, +0.80%) were easily the best performing sector on Wednesday as banks ($DJUSBK) led the rebound in interest-sensitive stocks. After gapping lower yesterday, the 10 year treasury yield ($TNX) climbed throughout the session and finished back above the 2.30% level....

READ MORE

MEMBERS ONLY

Apple iPhone Sales Disappoint, Could Lead To Short-Term Relative Weakness On NASDAQ

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 2, 2017

Traders weren't overly impressed with Apple's (AAPL) quarterly report last night and NASDAQ futures are suffering this morning. However, the NASDAQ 100 ($NDX) has been significantly outperforming the benchmark S&P 500 for months and a bit of...

READ MORE

MEMBERS ONLY

NASDAQ, Russell 2000 Flexing Their Relative Muscles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 1, 2017

The NASDAQ and Russell 2000 outperformed in a big, big way on Monday and that's always a very positive sign for equities. In addition, strength came from technology (XLK, +0.75%) and financials (XLF, +0.64%), two of the aggressive sectors....

READ MORE

MEMBERS ONLY

Commercial Vehicles Break Out To Lead Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 28, 2017

Equities sold off throughout the day on Friday, but no significant levels of support were lost. Starbucks (SBUX) jolted the market a bit, gapping down to test its rising 20 day EMA, but that support level held and while the internet group ($DJUSNS)...

READ MORE

MEMBERS ONLY

Exact Sciences Corp Posts Solid Results, Completes Right Side Of Cup

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Thursday morning, Exact Sciences Corp (EXAS) was the #1 percentage gainer on the NASDAQ, rising nearly 26%. While that's a massive move by any measure, I doubt that the move higher in EXAS has ended. If you look at a weekly chart, you'll see that...

READ MORE

MEMBERS ONLY

Consumer Discretionary Reasserting Leadership Role, Market Mixed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 27, 2017

Consumer discretionary (XLY, +0.53%) led the bifurcated action on Thursday as travel & tourism ($DJUSTT), gambling ($DJUSCA) and toys ($DJUSTY) all broke to fresh new highs helping to lead the sector higher. The XLY has broken out and is leading once again...

READ MORE

MEMBERS ONLY

Medical Equipment Breaks Cup Resistance, Latest To Confirm Bullish Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 26, 2017

A late day selloff on Wednesday left the small cap Russell 2000 as the only major index left standing with gains. The Dow Jones penetrated 21000 for a second consecutive session after not doing so for nearly two months. The S&P 500...

READ MORE

MEMBERS ONLY

Materials Break Out To Lead Another Market Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 25, 2017

U.S. indices closed significantly higher for a second consecutive session, this time with materials (XLB, +1.61%) leading eight of the nine sectors higher. Only utilities (XLU, -0.13%) failed to gain on the session. We are seeing breakouts one at a...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Downtrend, Financials Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 24, 2017

Global markets rallied on the heels of French election results and U.S. markets were no exception. We surged right out of the gate and didn't look back. The NASDAQ flirted with the 6000 level before settling for an all-time high...

READ MORE

MEMBERS ONLY

NASDAQ Poised To Set All-Time High After French Election

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 21, 2017

The S&P 500 trended lower from midday Thursday through Friday's close and that extended a much longer downtrend that began after the gap higher back on March 1st. Futures are very bright green this morning, however, so we could...

READ MORE

MEMBERS ONLY

Thursday's Rally Recipe Filled With Bullish Ingredients

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

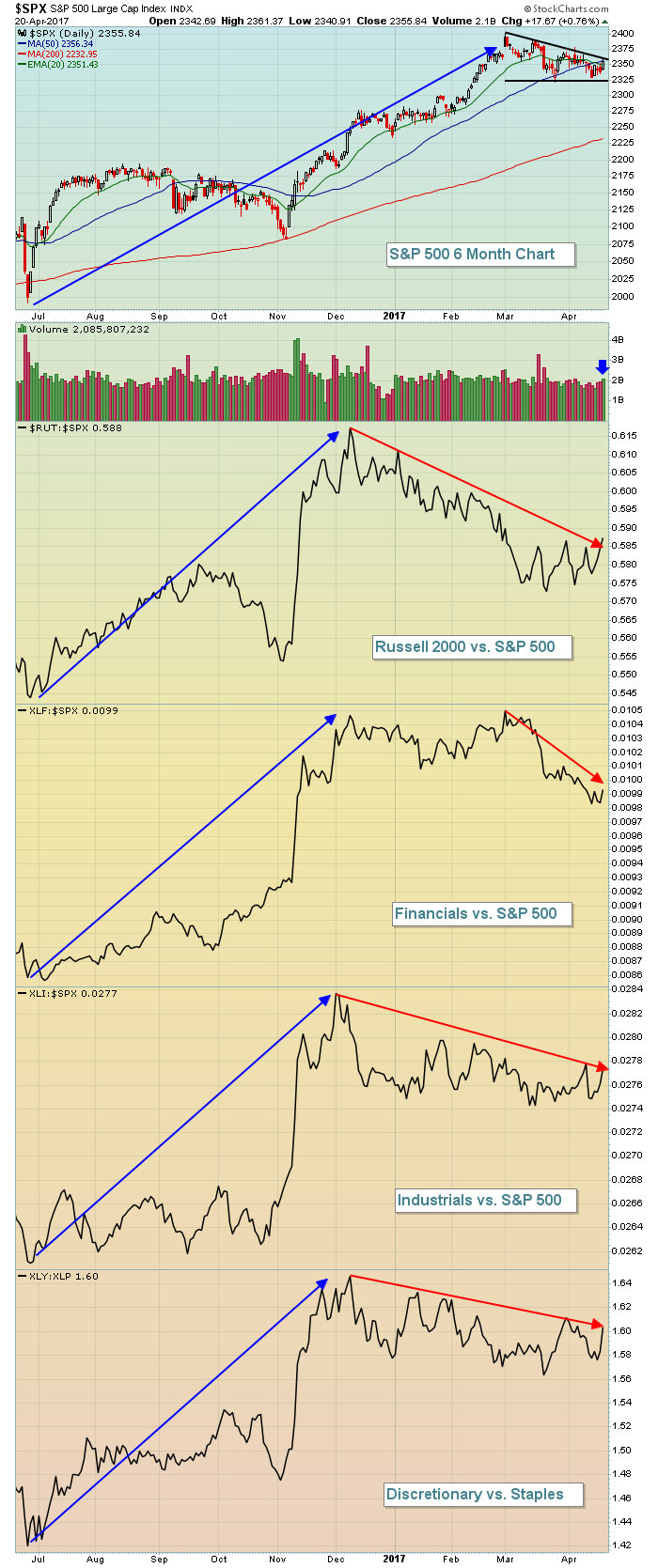

Market Recap for Thursday, April 20, 2017

We've yet to see the breakouts in our major indices that we're looking for, but yesterday's rally was quite bullish with leadership coming from the small cap Russell 2000 ($RUT, +1.24%), financials (XLF, +1.69%) and...

READ MORE

MEMBERS ONLY

Dycom Breaks Cup Resistance With Strong Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Our major indices have been consolidating for many weeks and that's enabled many individual stocks to consolidate in bullish continuation patterns. Dycom Industries (DY) is one such stock as it formed a long-term cup from early-August to late-February before printing a handle throughout March. The right side of...

READ MORE

MEMBERS ONLY

Rally In Semiconductors Looking Suspicious

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 19, 2017

The U.S. equity market enjoyed strong early gains on Wednesday only to see them mostly evaporate throughout the balance of the session. The Dow Jones lagged badly all day as one of its components - IBM (-4.92%) - disappointed Wall Street...

READ MORE

MEMBERS ONLY

Industrial Suppliers Have Had A Rough Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 18, 2017

The Dow Jones U.S. Industrial Suppliers Index ($DJUSDS) tumbled more than 6% on Tuesday as the group absorbed its second earnings shock in the past week. W.W. Grainger (GWW) came up short of its earnings expectations, then lowered guidance and traders...

READ MORE

MEMBERS ONLY

Financials And Transports Lead U.S. Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 17, 2017

If you're in the bullish camp, you have to be breathing a sigh of relief following yesterday's action. It was only one day, but after the bulls' grip on the market really seemed to be slipping at the...

READ MORE

MEMBERS ONLY

10 Year Treasury Breaks Down, Signals Potential Economic Weakness Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

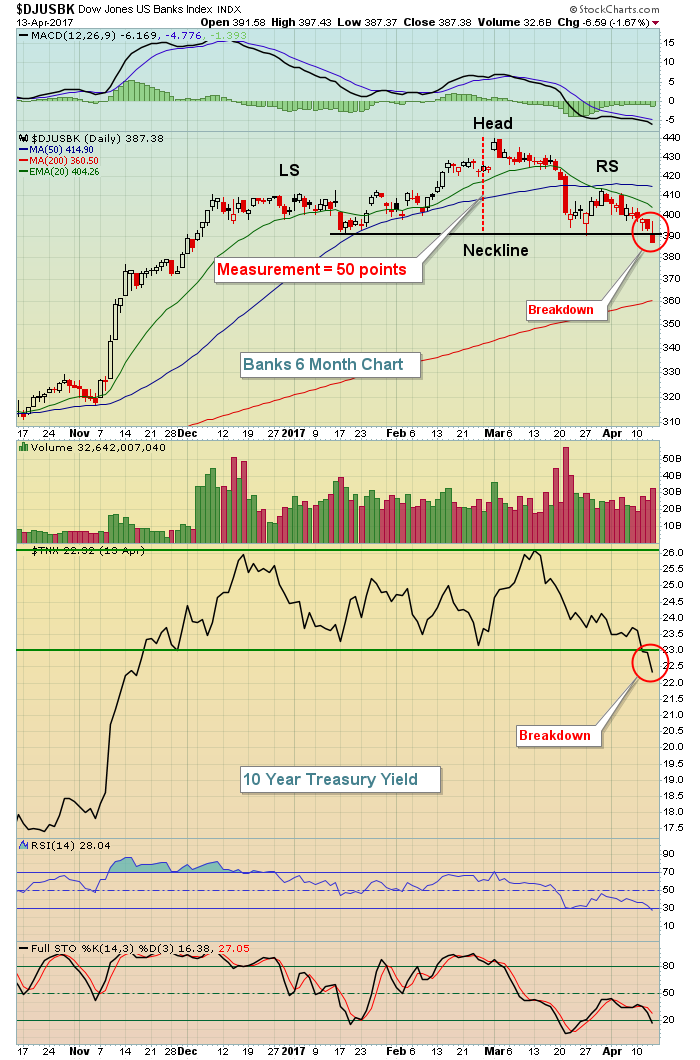

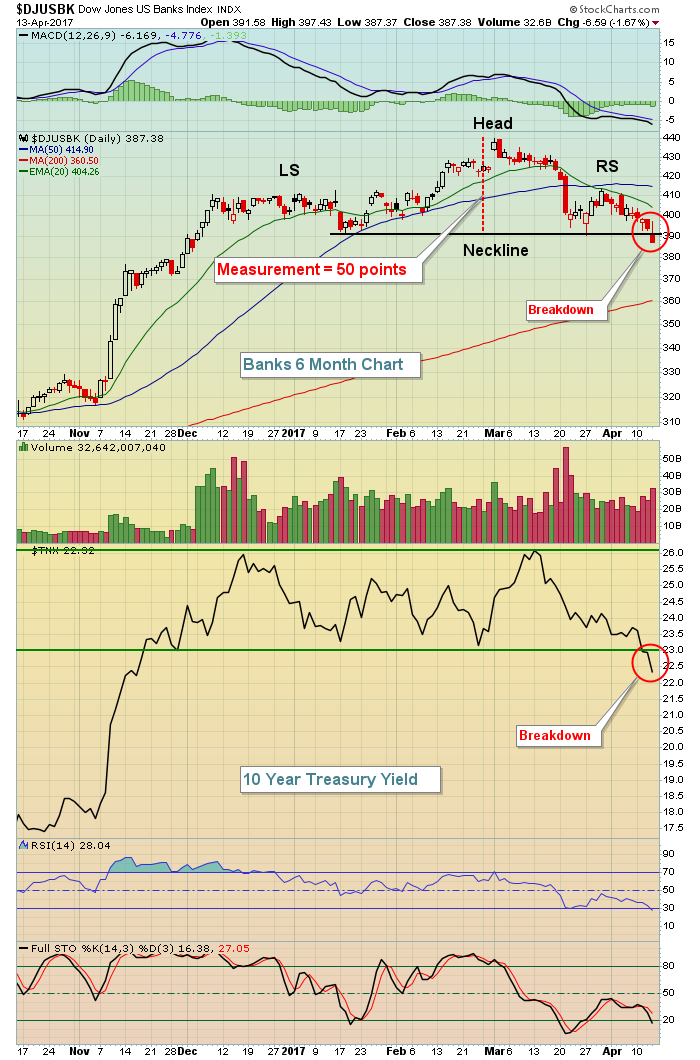

Market Recap for Thursday, April 13, 2017

The big news on Thursday - at least technically - was the breakdown in the 10 year treasury yield ($TNX) to its lowest close since early November. Most traders have been expecting continuing economic strength based on wisdom from the Federal Reserve. However,...

READ MORE

MEMBERS ONLY

Bank Profits Soar But Bank Stocks Sour

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

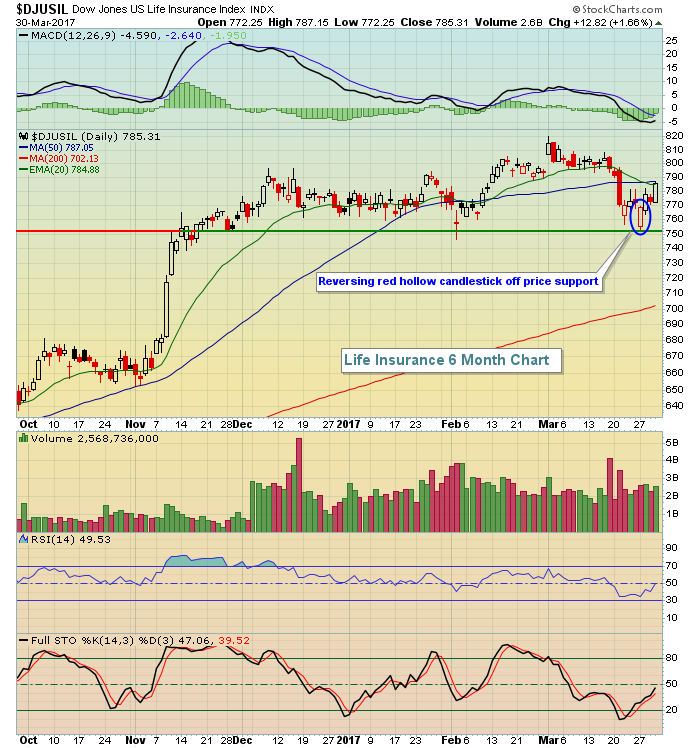

At the time of the last ChartWatchers article, I didn't really see a whole lot to be nervous about. However, the bullish picture certainly is getting a bit murkier based on developments since then. After a very strong ADP employment report on April 5th, most everyone was expecting...

READ MORE

MEMBERS ONLY

10 Year Treasury Yield Closes At Lowest Level Since November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 13, 2017

It was another day of not-so-great action in the U.S. stock market on Wednesday as our major indices finished lower as this lengthy period of frustrating consolidation continues. A problem is definitely brewing, though, as the Volatility Index ($VIX) pushes higher and...

READ MORE

MEMBERS ONLY

Fear Is Rising As Gold Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 11, 2017

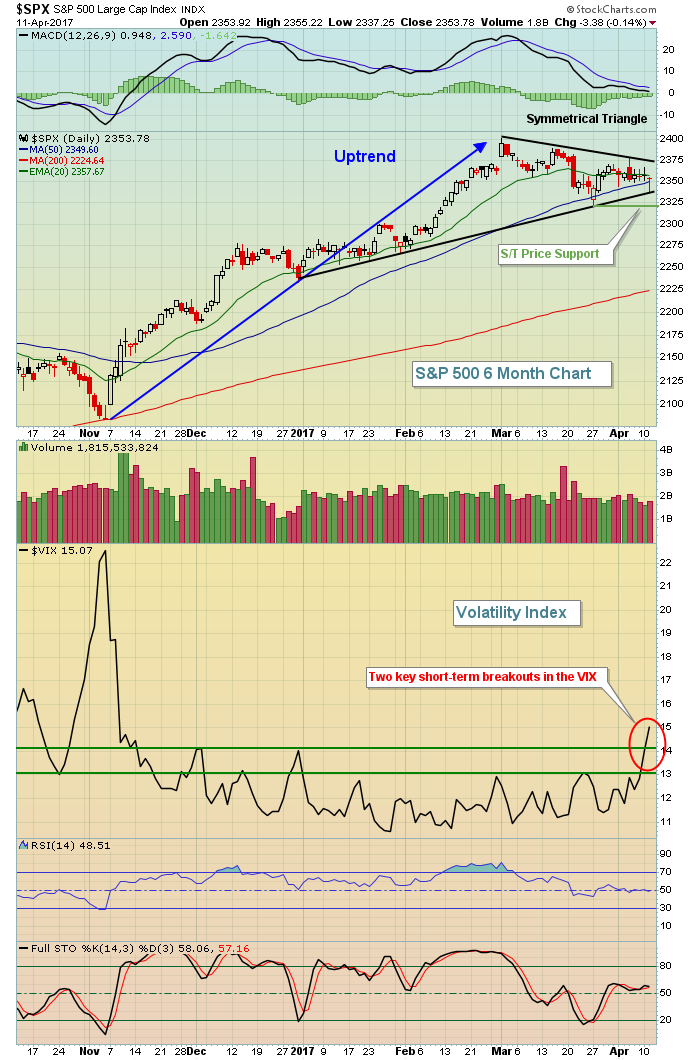

The Volatility Index ($VIX) hit its lowest level since mid-November on Tuesday, nearly reaching 16 before backing off and closing at 15.07 and up 7.26% on the session. That development is significant because the S&P 500 has remained above...

READ MORE

MEMBERS ONLY

The VIX Signals No Bear Market On The Horizon......Yet

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 10, 2017

It was a back and forth kinda day on Wall Street with the finish coming up fairly flat with minor gains across the board. Tesla (TSLA) and Harley Davidson (HOG) were winners and helped lead automobiles ($DJUSAU) to leadership in the consumer discretionary...

READ MORE

MEMBERS ONLY

Biotechs Consolidating But Technicals Improving

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 7, 2017

Consumer staples (XLP, +0.27%) and healthcare (XLV, +0.18%) were the sector leaders on Friday as our major indices finished near the flat line. Money rotated a bit towards defensive stocks, although utilities (XLU, -0.43%) failed to follow its defensive counterparts...

READ MORE

MEMBERS ONLY

Looking For A Bottoming Reverse Head & Shoulder Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Kratos Defense & Security Solutions (KTOS) has been in a steady uptrend for the past 15 months and its SCTR (StockCharts Technical Rank) has risen back above 70, suggesting that KTOS is becoming more attractive relative to its peers. It does still have plenty of technical work to do as...

READ MORE

MEMBERS ONLY

Treasury Yield Nears Support, Financials Wavering

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 6, 2017

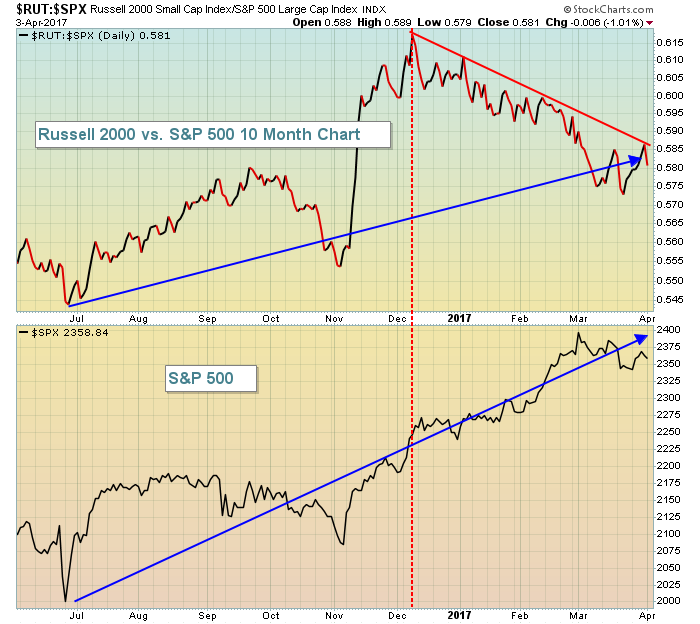

Yesterday, we saw better relative action on the Russell 2000, a positive for equities. However, that has not been the case over the past week as you can see from the chart below:

There's been a slight uptrend in Dow stocks...

READ MORE

MEMBERS ONLY

Charter Forms The Right Side Of A Cup

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Charter Communications (CHTR) extended its multi-year uptrend in late January with a heavy volume gap higher. CHTR spent the next several weeks consolidating and unwinding very overbought conditions. But the stock began to resume its prior strength after its RSI touched the 40s (black arrow below) and its MACD hit...

READ MORE

MEMBERS ONLY

Fed Minutes Spook Traders; Afternoon Selloff Spoils Big Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 5, 2017

The release of the FOMC minutes was widely anticipated to see if there were any hidden nuggets of information from the last Fed meeting. Traders apparently were not happy that the Fed is discussing an unwinding of its balance sheet earlier than expected. That...

READ MORE

MEMBERS ONLY

Retailers Continue To Hold Back Consumer Discretionary Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 4, 2017

U.S. equities opened lower on Tuesday, but steadily marched higher throughout the day, finishing with mostly small gains across the board. The small cap Russell 2000 was an exception as it fell for a second consecutive session. That follows a winning streak...

READ MORE

MEMBERS ONLY

Tesla Charged Up To Lead Automobiles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 3, 2017

It was a rough day on Wall Street to open the month of April, but an afternoon rally did minimize any damage technically. The Russell 2000, the recent leader among our major indices, was trampled and lost 1.17%, while the Dow Jones...

READ MORE

MEMBERS ONLY

MarketWatchers LIVE Starts Today!!!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

I'm very excited to announce the beginning of our new StockCharts.com show featuring me and Erin Heim. We'll have fun covering the global markets, discussing stocks on the move, providing technical analysis education and highlighting the various tools available here at StockCharts, among...

READ MORE

MEMBERS ONLY

Defense Stocks Resolve Momentum Issues, Poised To Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bullish rotation continues in most areas of the market and we saw a perfect example of that last week in the Dow Jones U.S. Defense Index ($DJUSDN). The DJUSDN had a HUGE month in February, gaining roughly 6.5% in that month alone. That swamped the benchmark S&...

READ MORE

MEMBERS ONLY

5 Reasons Why This Isn't 2007

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many market pundits on CNBC continue to predict a market top, discussing how we've run too far too fast and that valuations are too high and blah, blah, blah. Fear sells and CNBC is all about their ratings and advertisements. There's an occasional nugget of solid...

READ MORE

MEMBERS ONLY

Banks At Critical Resistance Short-Term; Railroads Strengthening

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 30, 2017

It was another strong day on Wall Street Thursday as six sectors advanced while only three declined - utilities (XLU, -0.78%), consumer staples (XLP, -0.20%) and energy (XLE, -0.02%). The four "power" sectors, the aggressive groups, finished 1-2-3-4...

READ MORE

MEMBERS ONLY

ConocoPhillips Breaks Downtrend; SCTR Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

ConocoPhillips (COP) saw its SCTR soar nearly 47 points after an 8.81% increase in its stock price broke its four month downtrend. COP's strength began earlier this week on a reversing candle at gap support and culminated with today's breakout. Here's the chart:...

READ MORE

MEMBERS ONLY

Retailers Lead Bifurcated Rally; What We Should Look For In April

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 29, 2017

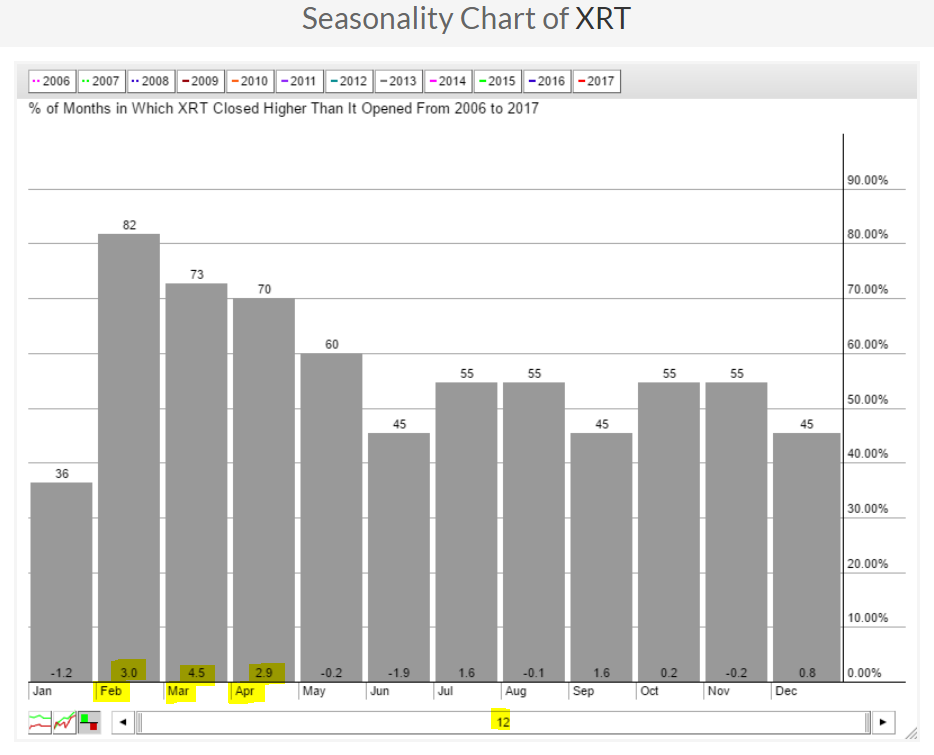

We haven't discussed leadership from retail (XRT) in quite some time, but we saw many retailers outperforming on Wednesday. The obvious question is whether this leadership will continue for an extended period. Well, first keep in mind that retail typically excels...

READ MORE

MEMBERS ONLY

Excellent Market Leadership Snaps Dow's 8 Day Losing Streak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 28, 2017

The bullish action couldn't have been much better on Tuesday. Money clearly rotated back to aggressive areas of the market as the Dow Jones advanced for the first time in the last nine trading sessions. This bullish rotation will be key...

READ MORE