MEMBERS ONLY

This Inverse Head & Shoulders Pattern Is Breaking Out On Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Chart Industries (GTLS) was mired in a downtrend for two years, shedding 90% of its market value, but things have changed and the upward momentum is quickly building for this equipment maker for the energy sector. They blew top and bottom line estimates out of the water and shareholders are...

READ MORE

MEMBERS ONLY

Facebook Delivers On Earnings But Futures Sour

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 27, 2016

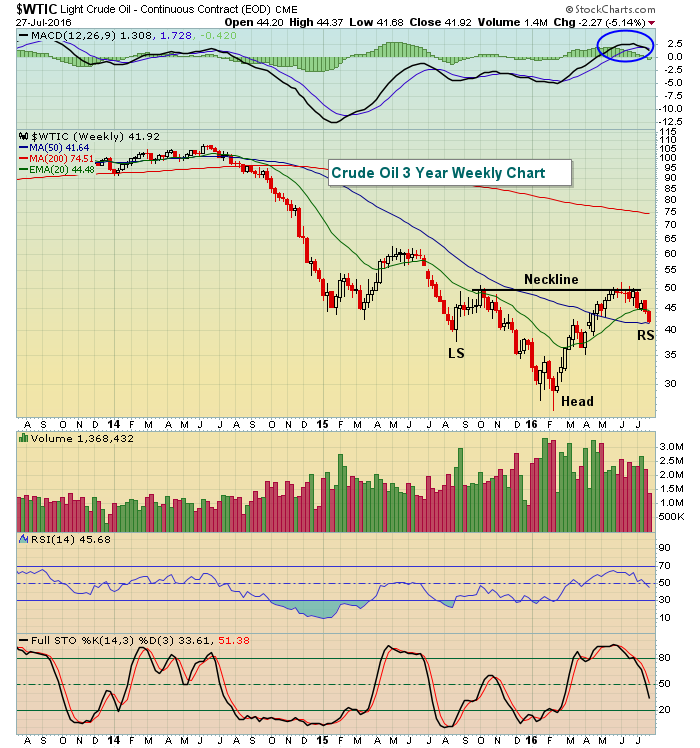

Crude oil ($WTIC) continues to remain under pressure with its fifth consecutive drop on Wednesday. Crude oil has now fallen nearly 20% since topping at $51.53 per barrel on June 8th. From a technical perspective, it shouldn't really be all...

READ MORE

MEMBERS ONLY

Industrials Led By A Breakout In This Industry Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 26, 2016

Commercial vehicles & trucks ($DJUSHR) surged 3.34% on Tuesday, leading a rally in industrials (XLI, +0.83%) that once again sustained the advance in the benchmark S&P 500 despite weakness during the first couple hours of the trading session. The...

READ MORE

MEMBERS ONLY

Here Are Key Support And Resistance Prior To AAPL's Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 25, 2016

It was a quiet session for most areas of the market. Consumer discretionary (XLY, +0.16%) was the only sector to finish in positive territory, but most of the other sectors lost fractional amounts and it did little to change their technical pictures...

READ MORE

MEMBERS ONLY

Look Out, Earnings Season Is In Full Swing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 22, 2016

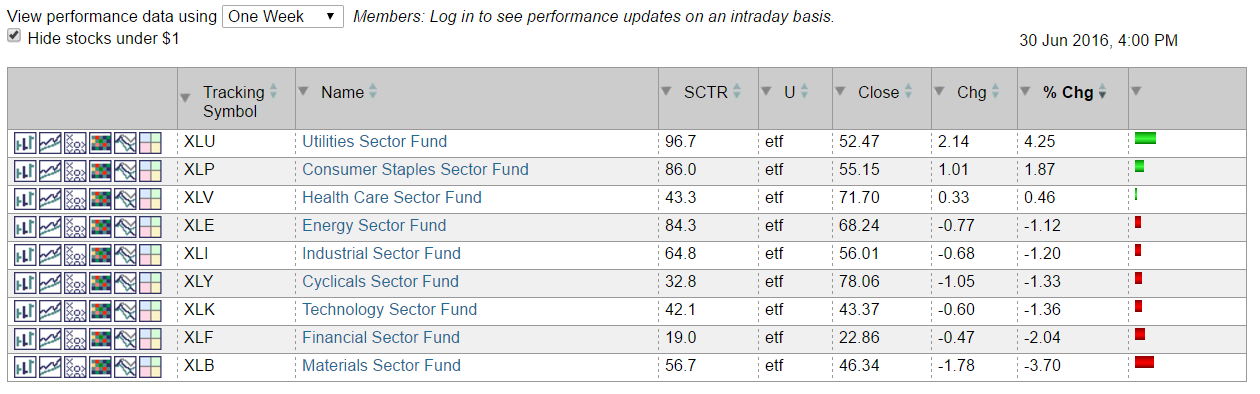

Utilities (XLU, +1.33%) surged on Friday to lead all nine sectors higher. All of our major indices also finished higher with most of the gains generated in the afternoon session as traders went home happy for the weekend. Many of the same...

READ MORE

MEMBERS ONLY

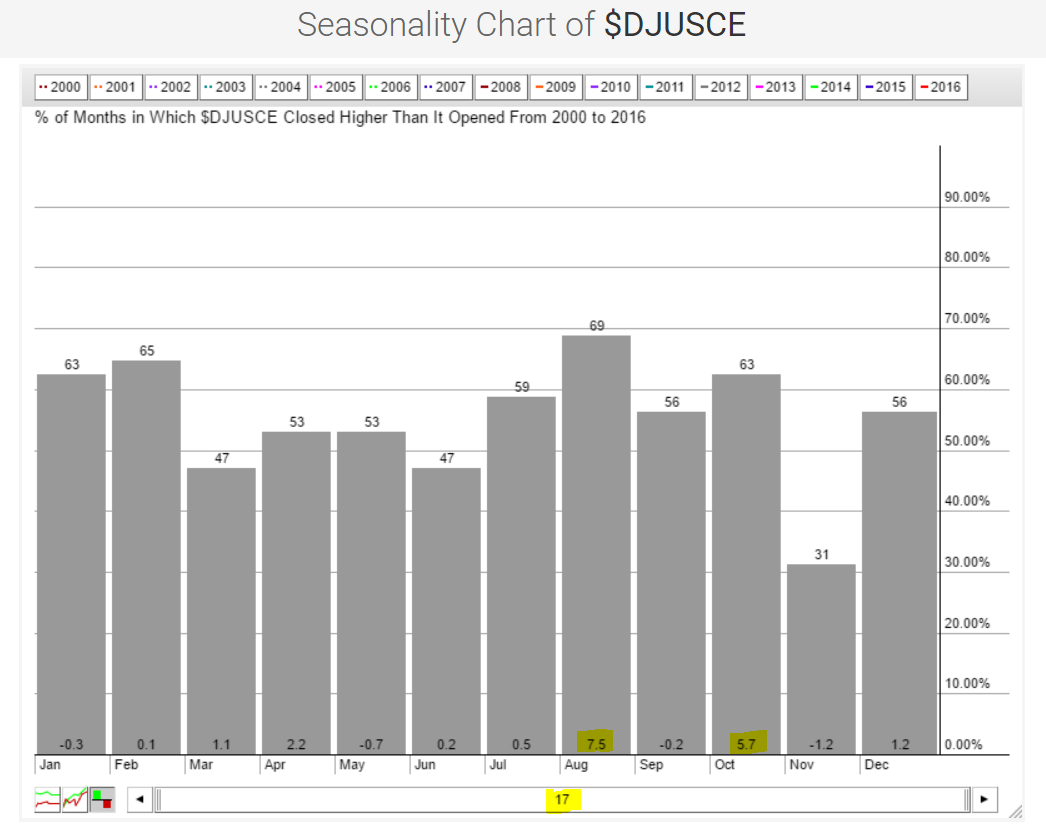

Here Are The Two Best Performing Industry Groups In August

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The summer months can be very difficult for U.S. equities, as history has proven over time. But there's always a bull market somewhere and the consumer electronics space seems to find a sweet spot in August. There are only two industry groups that average more than 5%...

READ MORE

MEMBERS ONLY

Can Tires Rebound To Make It A Good Year?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 21, 2016

Aggressive sectors took a break on Thursday, as did the overall market. The S&P 500 saw its most intraday weakness since breaking out above 2131 to all-time highs more than a week ago. Technically, however, there was little damage done. In...

READ MORE

MEMBERS ONLY

Encana Breaks Downtrend On Strength Of Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Actually, Encana (ECA) has broken two downtrends - a short-term trend and a long-term trend. ECA hit its all-time high of roughly 42.50 just before this bull market began. Shareholders of ECA haven't seen much bullish action since this seven year bull market began, but technically things...

READ MORE

MEMBERS ONLY

Electronics And Software Lead Technology Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 20, 2016

Technology (XLK, +1.31%) had another huge day on Wednesday as consumer electronics ($DJUSCE) and software ($DJUSSW) paced the advance. It didn't hurt that biotechs ($DJUSBT) were up more than 1.50%, leading healthcare to outsized gains as well. But let&...

READ MORE

MEMBERS ONLY

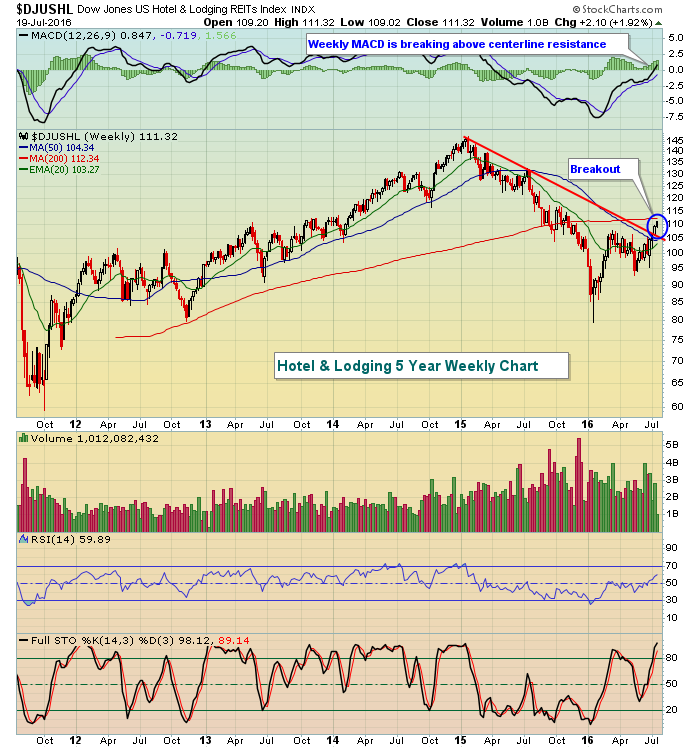

Dow Jones Sets Another Record High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 19, 2016

The Dow Jones managed to close at another all-time high on Tuesday despite seven of nine sectors falling. Most of the weakness, however, was confined to materials (XLB, -0.59%) and energy (XLE, -0.56%). None of the other sectors fell more than...

READ MORE

MEMBERS ONLY

After 30 Failed Attempts, This Breakout Was Finally Made

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 18, 2016

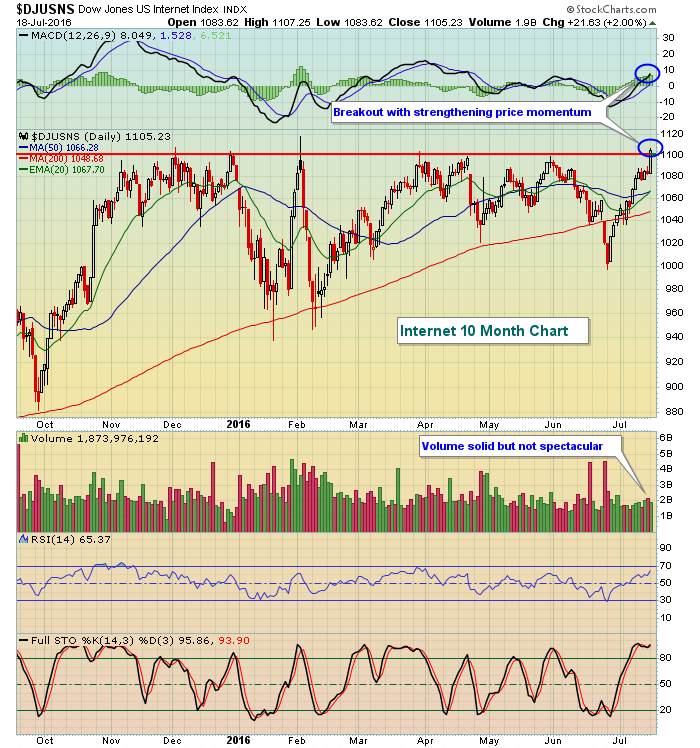

The action on Monday was led by the NASDAQ's 0.52% gain with technology (XLK, +0.67%) pacing the advance. One bullish piece of technical news within the technology space was the breakout of internet stocks ($DJUSNS), which gained 2.0%...

READ MORE

MEMBERS ONLY

VIX Approaching Bull Market Lows

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 15, 2016

It was another day of bifurcation on Friday as the Dow Jones and Russell 2000 were able to eke out gains while both the S&P 500 and NASDAQ finished in negative territory. Similar bifurcation was found among sectors with materials (XLB,...

READ MORE

MEMBERS ONLY

Prime Example Of An Untradable Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Prior to the opening bell on Tuesday, Fastenal (FAST) confessed to below consensus revenues and EPS, normally a big problem for a stock. Sure enough, FAST fell approximately 4% on the open Tuesday, providing short sellers a quick profit. The problem, however, is that FAST is trading within a multi-year...

READ MORE

MEMBERS ONLY

Seasonal Period Aiding Bulls Near-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note:

I will be traveling this weekend and unable to post here in my Trading Places blog on Friday. I hope everyone has a great weekend! Back on Monday!

Market Recap for Wednesday, July 13, 2016

The bullish run that began on June 28th continues despite Wednesday's pause....

READ MORE

MEMBERS ONLY

S&P 500 Extends Gains; Energy Leads

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 12, 2016

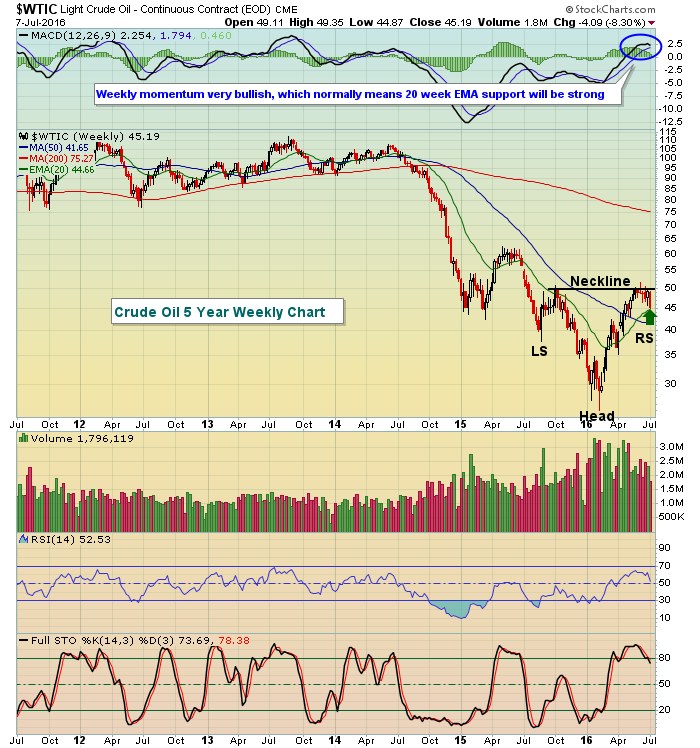

Energy (XLE, +2.48%) resumed its leadership role in a big way on Tuesday as rising crude oil prices ($WTIC) and a bullish pattern on the U.S. dollar provided energy bulls all they needed to send the XLE to its highest close...

READ MORE

MEMBERS ONLY

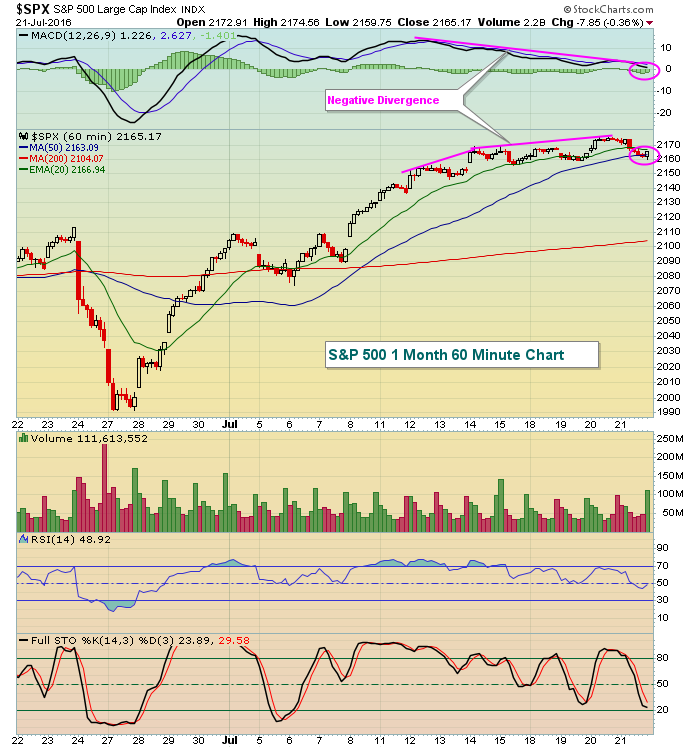

Top Three Reasons Why This Rally Won't Last

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 11, 2016

Despite all the reasons for being cautious at this stage of the current seven year bull market rally, nothing is more important than simple price action and yesterday the S&P 500 did what it had never done before - it closed...

READ MORE

MEMBERS ONLY

Up Next: Second Quarter Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Notes

Beginning today, I will be providing a "Monday setups" section every Monday, offering up potential trading candidates and technical reasons for possible entry. Please do your own due diligence - both technically and fundamentally - before you decide to trade any of these candidates. They will...

READ MORE

MEMBERS ONLY

Devry Breaks 18 Month Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Devry, Inc. (DV) topped at close to 50.00 during the fourth quarter of 2014 and it has spent the last 18 months declining steadily until reaching what now appears to be a bottom just above 15.00. A positive divergence has emerged on its weekly MACD and volume trends...

READ MORE

MEMBERS ONLY

June Payrolls Explode Higher, Futures Jump

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 7, 2016

Energy (XLE, -1.02%) was weak on Thursday as crude oil prices ($WTIC) tumbled 5.64% to lose near-term price support in the 46.00-46.50 range. Crude oil also lost both 20 day EMA and 50 day SMA support, both of which...

READ MORE

MEMBERS ONLY

UPS Delivers Better Relative Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past year, United Parcel Service (UPS) has gained 13.77% while FedEx Corporation (FDX) has lost 9.80%. Relative strength between these two air delivery and freight services companies has gone back and forth over the last decade, but currently UPS has the upper hand and is the...

READ MORE

MEMBERS ONLY

Resiliency Vs. Rotation....The Struggle Is Real

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 6, 2016

Bulls do not give up easy. Yesterday was a perfect example. Global indices have rolled over and have been struggling mightily this week, especially the key German DAX ($DAX). Brexit fears seemed to be building once again and the S&P 500...

READ MORE

MEMBERS ONLY

Russell 2000 Prints Bearish Right Shoulder

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 5, 2016

Tuesday represented a down day and a much-needed day of profit taking after the post-Brexit rebound, right? Well maybe. But if my pattern-seeking eyes are correct, the Russell 2000 may have just printed the right shoulder in a bearish topping head & shoulders...

READ MORE

MEMBERS ONLY

Volatility Tumbles Again On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 1, 2016

Bull markets do the unthinkable and last week was a perfect example. After Brexit, which seemed to confirm global stock markets' worst fear, we saw a very sudden drop in equity prices around the world and a surge in the Volatility Index...

READ MORE

MEMBERS ONLY

This Energy Stock May Not Be A Pipe Dream

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past six months, the Dow Jones U.S. Pipelines Index ($DJUSPL) has gained 25.03% and has been among the best performing industry groups. But it hasn't been favorable for all pipeline stocks as Williams Companies (WMB) can attest. While its peers have risen 25%, WMB...

READ MORE

MEMBERS ONLY

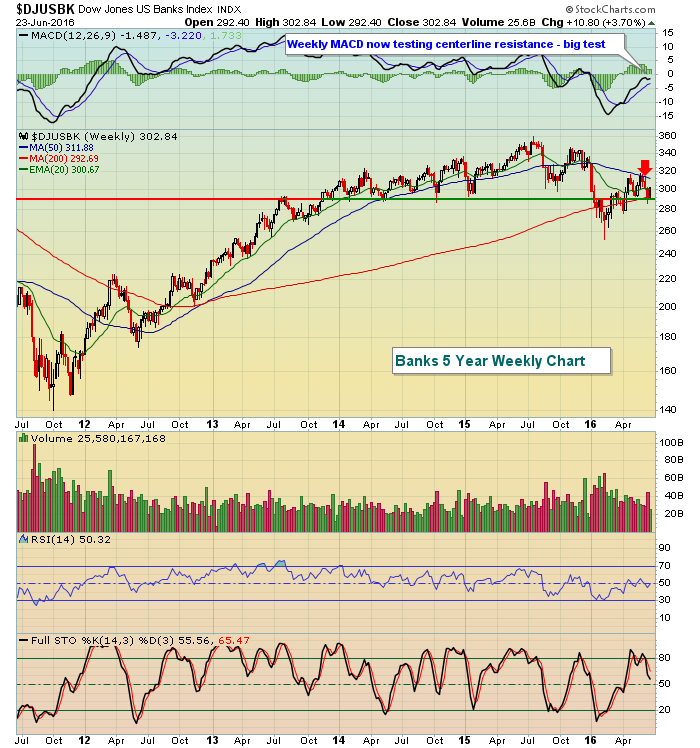

Rotation Is Painting A Very Bearish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Here we go again.

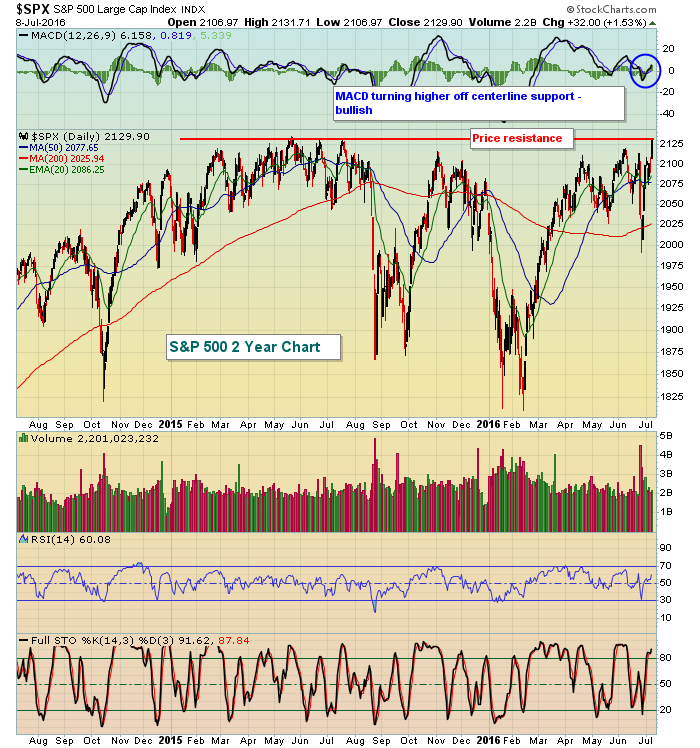

It seems as though every time the S&P 500 challenges the 2100 level and its all-time high close (2131), another aggressive area of the market falls apart and the rally is not sustainable. Below is a two year weekly chart of the S&...

READ MORE

MEMBERS ONLY

Key Relative Ratio Not Supporting This Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 30, 2016

Over the past week - since Brexit - the S&P 500 has lost a mere 15 points because of the sizable rally enjoyed over the past three trading days. That's roughly a 0.75% loss. The NASDAQ, on the...

READ MORE

MEMBERS ONLY

Is This Data Storage Company Ready For A Breakout?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a potential bottoming reverse head & shoulders pattern in play on Western Digital's (WDC) three year weekly chart as it attempts to clear its downtrend on its SCTR. All of this comes on the heels of printing a positive divergence on its MACD. This alone...

READ MORE

MEMBERS ONLY

Rally Is Strong, But Can The S&P 500 Clear This Level?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 29, 2016

U.S. equities rallied strongly on Wednesday, following the lead of global indices as the shock of Brexit begins to wear off. The German DAX ($DAX) was able to close at its highest level since Brexit, clearing the 9557 close the day after...

READ MORE

MEMBERS ONLY

Banks And Oil Rally To Lead U.S. Market Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 28, 2016

Much technical damage has been inflicted over the past few trading days. So the obvious question is "how long might this current rally last?" We cleared the first technical hurdle when the S&P 500 yesterday closed back above 2025...

READ MORE

MEMBERS ONLY

Bond Market Says "Run, Don't Walk"!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 27, 2016

The U.S. bond market closed sharply higher on Monday, sending treasury yields tumbling to lows not seen since the post-QE (quantitative easing) days of 2012. Everyone is seeking safety and it was evident throughout trading on Monday. Money rotated into safety and...

READ MORE

MEMBERS ONLY

VIX Explodes Higher, German DAX Crumbles On Brexit Vote

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 24, 2016

The market has spoken and we need to listen. Volume on the S&P 500 totaled 4.5 billion shares and the index dropped a hefty 3.59% on Friday. The Brexit vote clearly caught global markets by surprise with most market...

READ MORE

MEMBERS ONLY

Nordson's Selling On Friday Could Be An Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After the stock market closed on May 23rd, Nordson Corp (NDSN) reported quarterly earnings results that absolutely blew away Wall Street's consensus estimates. The next morning, as you might expect, NDSN shareholders were rewarded with a huge gap higher and continuing interest throughout the trading day. Volume was...

READ MORE

MEMBERS ONLY

The Vote Is In....And Futures Are Tanking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 23, 2016

The Britons have voted and it's to exit the European Union. It's almost pointless to discuss what happened yesterday because any gains from Thursday will likely be long gone at the open this morning, unless you're holding...

READ MORE

MEMBERS ONLY

Broadcom Bouncing Off Gap Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Broadcom (AVGO) posted quarterly EPS in early June that topped Wall Street forecasts and the stock gapped higher from 155 to above 165. Now, just a few weeks later, AVGO has returned to the scene of the crime, testing gap support and its rising 20 day EMA. Volume has been...

READ MORE

MEMBERS ONLY

Gold Rises As Brexit Vote Looms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 22, 2016

Volatile action continued as the UK referendum day approached. Today, Britons are voting to determine whether Britain remains in or leaves the European Union. There has been lots of back and forth action this week, although trading has been contained within a fairly...

READ MORE

MEMBERS ONLY

Energy Leads Bifurcated Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 21, 2016

Small cap stocks did not participate in Tuesday's rally as the Russell 2000 finished lower by 0.33%. But our other major indices all gained, led by the S&P 500's 0.27% rise. Energy (XLE, +1.19%...

READ MORE

MEMBERS ONLY

Industrials Lead Rally, But Stay Away From This Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 20, 2016

Over the weekend, a poll indicated that the "remain" camp was winning the Brexit war, helping to relieve a bit of market anxiety that has been building as the UK referendum on whether the British will remain or leave the European...

READ MORE

MEMBERS ONLY

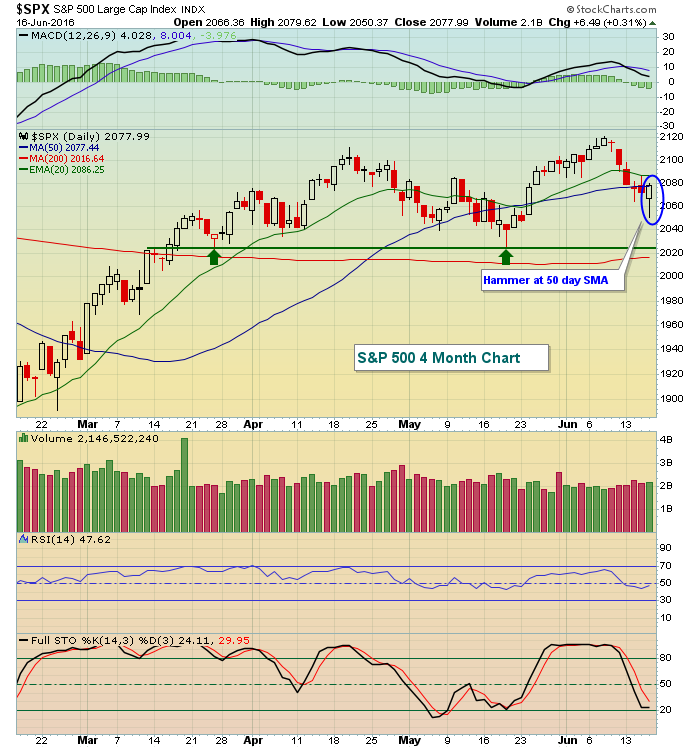

Energy Rises After Hammer Prints On 50 Day SMA

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 17, 2016

It was more of the same on Friday. Our major indices fell despite a rally that took place late in the morning session. Early losses were cut, but overall the bulls weren't able to totally recover from the morning weakness. The...

READ MORE

MEMBERS ONLY

Defense Leads Thursday Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 16, 2016

Okay, this really is getting old. Early in the session, it appeared as if the U.S. would follow the lead of global markets and sell....and sell....and sell. Volatility ($VIX) hit an intraday high of nearly 23, its highest level since...

READ MORE

MEMBERS ONLY

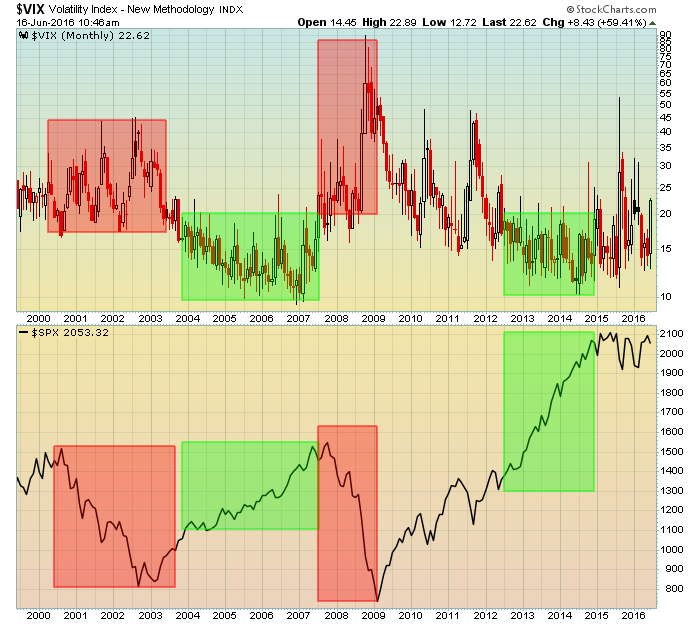

VIX Over 20 Can Be A Huge Problem

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Volatility Index ($VIX) is often times referred to as the fear index and fear is a necessary component of bear markets. So the recent surge in the VIX should not be taken lightly. We can and do see the VIX spike quickly during bull markets - only to settle...

READ MORE