MEMBERS ONLY

Fed Leaves Rates Unchanged, Equities Drop

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 16, 2016

The much-awaited FOMC policy statement was released at 2pm EST on Wednesday afternoon and the market collectively yawned for an hour before selling kicked in during the final hour. Beneficiaries on the session included basic materials (XLB, +0.45%) and the defensive REITs...

READ MORE

MEMBERS ONLY

Watch These Key Support Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 14, 2016

It was more of the same on Tuesday. Most of the selling took place in the first hour and then our major indices rallied. The problem, once again, was that leadership came in the form of utilities (XLU, +0.53%) and consumer staples...

READ MORE

MEMBERS ONLY

VIX Soars, More Losses Likely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 13, 2016

It was not a good day for the bulls. Global markets were weak and that set the stage for selling here in the U.S. Losses were fairly contained throughout the early part of the day, but the final hour saw the losses...

READ MORE

MEMBERS ONLY

Crude Oil Reversal Last Week Troubling For XLE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 10, 2016

Consumer staples (XLP, +0.07%) eked out a tiny gain on Friday, but otherwise sector performance was weak. The eight remaining sectors all finished in the red with energy (XLE, -2.16%) leading the pack. The weekly candle on crude oil prices ($WTIC)...

READ MORE

MEMBERS ONLY

Ligand's Bullish Wedge Touches Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ligand Pharmaceutical (LGND) broke out above price resistance in April with solid volume confirmation. But the stock was extremely overbought and in need of a pullback to unwind its momentum oscillators. RSI had touched the 80s with stochastic elevated in the 90s. LGND has lost approximately 12%-13% over the...

READ MORE

MEMBERS ONLY

Rotation Towards Defense A Big Problem

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 9, 2016

Utilities (XLU, +0.86%) and consumer staples (XLP, +0.39%) - two defensive sectors - led the action on Thursday and contributed heavily to the reversal in U.S. equities after a weak opening hour. Unfortunately, we want to see traders turn more...

READ MORE

MEMBERS ONLY

Amazon's Negative Divergence Could Spell Trouble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Amazon.com (AMZN) has been one of the strongest performers in 2016 and just recently broke out on a relative basis vs. the S&P 500 when it impressed Wall Street with its latest quarterly earnings results. But there are now a couple warning signs that indicate AMZN may...

READ MORE

MEMBERS ONLY

Is The VIX Warning Us?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 8, 2016

Our major indices pushed higher once again on Wednesday with the S&P 500 climbing within 12 points of its all-time high close of 2131. But the strongest index was clearly the small cap index, or Russell 2000, which gained 0.76%...

READ MORE

MEMBERS ONLY

Late Day Selling Leaves Bifurcated Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 7, 2016

Our major indices were strong throughout much of the day on Tuesday, only to see most of those gains vanish by the close. The NASDAQ was the target of most of the selling as this tech-influenced index finished in negative territory. The other...

READ MORE

MEMBERS ONLY

S&P 500 Closes At Highest Level Since Early November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 7, 2016

The benchmark S&P 500 closed at 2109.41 on Monday, it's highest close since November 3, 2015 when it finished at 2109.79. This finish is just 1% away from its all-time high close of 2130.82 on May...

READ MORE

MEMBERS ONLY

Worst Jobs Report In Six Years Sends U.S. Stocks Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 3, 2016

The nonfarm payrolls report on Friday was horrid. Wall Street was expecting 158,000 jobs and the government reported 38,000. It was the lowest number in six years and futures immediately dropped on the news at 8:30am EST Friday morning. The...

READ MORE

MEMBERS ONLY

Sina Might Be Best Internet Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sina (SINA) has just seen its SCTR rank break above 70 as its price has broken above multiple tops near 52. Volume on the breakout was very strong, topping 3 million shares for the first time since July 2015. Any period of selling or consolidation should hold support that now...

READ MORE

MEMBERS ONLY

Technology Leading With The Help Of Semiconductors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past month, the Dow Jones U.S. Semiconductor Index ($DJUSSC) has risen more than 8% and helped to strengthen the technology sector (XLK) relative to the S&P 500. The XLK has been very strong on a relative basis since the middle of 2013 and just recently...

READ MORE

MEMBERS ONLY

Small Cap Stocks Are Leading This Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 2, 2016

It was mostly a broad based rally on Thursday as all of our major indices finished higher. Seven of nine sectors ended the day higher as well, with technology (XLK, -0.09%) and energy (XLE, -0.13%) the two weak links. Key areas...

READ MORE

MEMBERS ONLY

Look To This Industry Group For Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The S&P 500 continues to battle overhead price resistance that's been well established since closing at its all-time high on May 21, 2015. While a bullish advance typically requires strong and wide participation from many sectors and industry groups, there's one that I'...

READ MORE

MEMBERS ONLY

Brewers TAP On The Accelerator

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 1, 2016

Consumer staples (XLP, +1.03%) surged higher on Wednesday. Unfortunately, the other sectors didn't get the memo. Seven of the nine sectors did finish higher, but healthcare (XLV, +0.36%) was a distant second and the two sectors finishing in the...

READ MORE

MEMBERS ONLY

Railroads Strong But Face Seasonal Headwinds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

Today's article will be very brief with a recap of Tuesday's action. I'll return to my normal time and format on Wednesday. If you'd like to receive all of my blog articles the moment they're published, please scroll to...

READ MORE

MEMBERS ONLY

Late Friday Rally Keeps Bulls In Charge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 27, 2016

On a 10 minute chart, the S&P 500 bounced off its 50 period SMA and surged into the close, finishing near the 2100 level once again. Here's the latest intraday look at our benchmark index:

The attempt at clearing...

READ MORE

MEMBERS ONLY

Two Oil Stocks You Might Want To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Exploration & Production Index ($DJUSOS) is 39% higher since its January low and two mid-cap stocks that are outperforming include $4 billion QEP Resources (QEP) and $2.9 billion WPX Energy (WPX). They have both been overbought recently and now have printed negative divergences, but...

READ MORE

MEMBERS ONLY

Internet Stocks Approaching Major Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 26, 2016

Utilities (XLU, +1.13%) and consumer staples (XLP, +0.40%) are two defensive groups and they led the market action on Thursday. I'd be more concerned if these two groups led a significant breakout. But given that three of our four...

READ MORE

MEMBERS ONLY

SunTrust Faces Technical Moment Of Truth

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

SunTrust Banks (STI) looks very bullish on a longer-term weekly chart, awaiting a critical technical breakout. But on its daily chart, there are signs of slowing momentum and overbought conditions as price resistance nears. So what's a trader to do? Well, let's look at the two...

READ MORE

MEMBERS ONLY

Energy, Banks Lead Continuing Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 25, 2016

Energy (XLE, +1.58%), materials (XLB, +1.23%) and financials (XLF, +1.06%) were the three sectors that gained more than 1% on Wednesday as the U.S. stock market rally extended to almost a week. The S&P 500 climbed to...

READ MORE

MEMBERS ONLY

Semiconductors Close At 2016 High; Technology Leads Big Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 24, 2016

Tuesday was one of the best days of 2016. Technically, the jump in our major indices was large with the Russell 2000 and NASDAQ leading the charge with gains of 2.15% and 2.00%, respectively. Our four aggressive sectors performed extremely well...

READ MORE

MEMBERS ONLY

U.S. Stocks End Flat On Monday, Eye Housing Data

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 23, 2016

Despite seven of nine sectors finishing lower, the major U.S. indices managed to close near the flat line due to strength in basic materials (XLB, +1.17%). Consumer staples (XLP, +0.10%) was the only other sector in positive territory at the...

READ MORE

MEMBERS ONLY

Technology Leads Market As Applied Materials Buoys Semiconductors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 20, 2016

Applied Materials (AMAT) posted excellent quarterly earnings results on Thursday after the closing bell and that lifted semiconductors ($DJUSSC, +3.0%) on Friday. Technology (XLK, +1.21%) in general performed exceptionally well, leading all sectors. AMAT cleared short-term price resistance at the opening...

READ MORE

MEMBERS ONLY

This Small Semiconductor Stock Has A Big Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A little more than three weeks ago, a very small $435 million semiconductor company reported quarterly EPS that nearly tripled Wall Street consensus estimates. Quarterly revenues also beat estimates by roughly 3%. That combination sent Nanometrics (NANO) soaring on April 27th, at one point up 20% on the session. NANO...

READ MORE

MEMBERS ONLY

Defense Stocks Remain A Must Own

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Defense Index has been annihilating its competition for the past few years. It's very clear if you take a look at a longer-term relative performance chart. Check this out:

This is an interesting chart. During the bear market from 2007 to 2009, defense...

READ MORE

MEMBERS ONLY

Defensive Stocks Fuel Bounce Off Key Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 19, 2016

Utilities (XLU, +1.01%) and consumer staples (XLP, +0.98%), two defensive sectors, easily outdistanced all of the other sectors with respect to Thursday performance. So while the save of price support across all of our major indices was nice, keep in mind...

READ MORE

MEMBERS ONLY

Dorman Bounces Off Flag Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Dorman Products (DORM) touched price support near 51.00, which is technically significant as DORM has been trading in a continuation pattern for the past several weeks and 51.00 has marked flag support. There was a prior uptrend (flag pole) in play off the February low and DORM longs...

READ MORE

MEMBERS ONLY

Fed Minutes Suggest Possible Rate Hike, Banks Bounce Off Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 18, 2016

It was an interesting day on Wall Street on Wednesday. Once the FOMC minutes were released at 2pm EST, traders panicked as the Fed signaled the possibility of a June interest rate hike. They said what they've been saying, that a...

READ MORE

MEMBERS ONLY

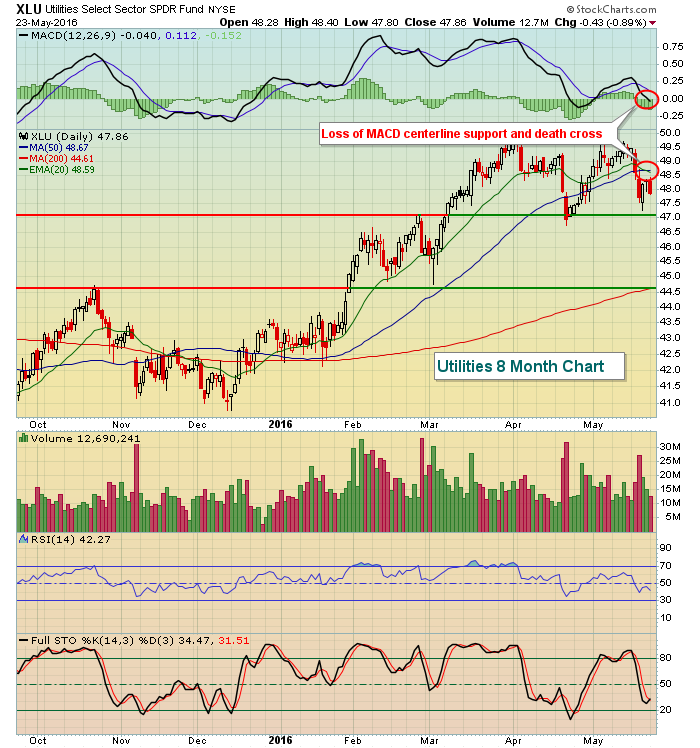

Defensive Utilities And Consumer Staples Spearhead Tuesday's Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 17, 2016

The wishy-washy, back and forth, yo-yo action continued on Tuesday as Monday's gains were completely erased by Tuesday's close. The culprits? Well, eight of the nine sectors finished lower after all nine rose on Monday, but the primary weakness...

READ MORE

MEMBERS ONLY

Critical Short-Term Support Holds As All Sectors Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 16, 2016

Monday saw a very solid advance across the board, but clearly was led once again by materials (XLB, +1.72%) and energy (XLE, +1.69%). These two sectors were not only the leaders yesterday, but they also represent the top two performing sectors...

READ MORE

MEMBERS ONLY

Major U.S. Indices All Lose 50 Day Moving Averages

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 13, 2016

I suppose it's only fitting that all of our major indices close beneath their 50 day SMAs simultaneously for the first time on Friday the 13th. The NASDAQ has been trading beneath its 50 day SMA for the past several trading...

READ MORE

MEMBERS ONLY

Huntsman (HUN) Pulls Back To Key Support Zone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Not many stocks have been spared the past few weeks as our major indices have trended lower. Huntsman Corp (HUN) doubled in a little more than two months, but became very overbought in late April. Since that time, HUN has fallen 15% and its overbought oscillators have seen relief with...

READ MORE

MEMBERS ONLY

In One Word, This Market Is.....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 12, 2016

Defensive. That's the best way to describe it. With consumer stocks, traders are choosing staples. If it's a question of transportation vs. utilities, it's really not a question. Utilities rule. Small caps or the S&P...

READ MORE

MEMBERS ONLY

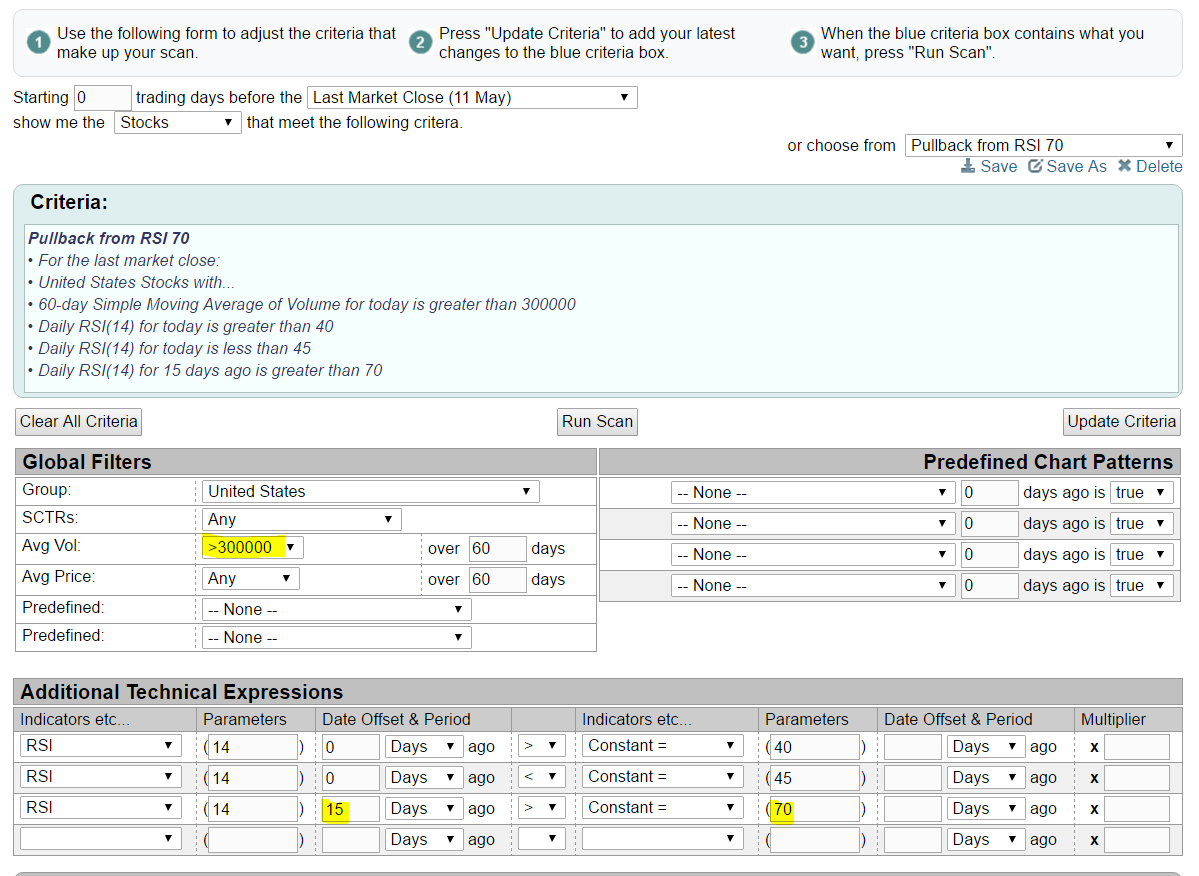

Looking To Find Healthy Stocks During Pullbacks? Consider This Scan

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Overbought stocks frequently move above RSI 70, but during periods of selling or consolidation, it's fairly routine to see the RSI dip back to the 40-45 area. Here's a simple scan from the Standard Scan Workbench to find stocks that could be great trading candidates (from...

READ MORE

MEMBERS ONLY

Retail Stocks Get Pounded After Macy's Disappoints

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 11, 2016

It was a bad day for consumer discretionary (XLY, -2.01%) and, in particular, retail stocks (XRT, -4.44%). Macy's (M) delivered an opening blow when their latest quarterly earnings report disappointed Wall Street. On the surface, it didn't...

READ MORE

MEMBERS ONLY

Tuesday Rally Supported By Wide Participation - Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 10, 2016

Energy (XLE, +1.76%), industrials (XLI, +1.72%) and basic materials (XLB, +1.67%) led a wide participation rally on Tuesday that finished with all of our major indices up at least 1% (the Russell 2000 was the lone exception at +0.95%...

READ MORE

MEMBERS ONLY

Industry Groups That Look Primed For Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for May 9, 2016

Biotechnology stocks ($DJUSBT) gained more than 2% on Monday, leading the healthcare sector (XLV, +1.14%) to the top of the sector leaderboard, doubling the one day return of the next best sector, utilities (XLU, +0.57%). While Monday's strength was a...

READ MORE

MEMBERS ONLY

Key Reversals Take Place On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 6, 2016

We saw several successful tests of key price, gap and moving average support on Friday. The price action into the close was bullish with our major indices finishing on or near their highs of the session. Money rotated much more aggressively as well...

READ MORE