MEMBERS ONLY

Breaking Down Europe (On the Charts, That Is...)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my article for the ChartWatchers newsletter this weekend, I wrote about the rotation of various stock markets against the DJ Global Index. On that Relative Rotation Graph, Europe had moved into the leading quadrant, but has since almost immediately started to lose relative momentum. The US market (SPY) had...

READ MORE

MEMBERS ONLY

DP TV: "Russia Effect" on Energy and Solar

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this episode of DecisionPoint, Carl opens with a look at the Russia ETF (RSX) to help viewers visualize the impact the war sanctions are having on the Russian market. Not only is Russia's market affected, but the effects are pushing Crude Oil to the roof, so the...

READ MORE

MEMBERS ONLY

Regional Banking ETF (KRE) Confirmed a Bullish Phase Change

The Regional Banking ETF (KRE) has made two consecutive closes over its 50-day moving average, confirming a bullish phase change. KRE is also the only ETF in Mish's Economic Modern Family that is holding a bullish phase on a daily chart. Therefore, we should keep an eye on...

READ MORE

MEMBERS ONLY

Flight Path: "Tweezer Bottom" or "Dead Cat Bounce"?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

If you've been away, really away, and all you know is that US Equities were up ~1% last week, then you've been extremely disciplined about your New Year's digital detox resolution!

The S&P 500 began the holiday-shortened week with a 1% decline...

READ MORE

MEMBERS ONLY

Charting a Future Possibility versus the Current Reality

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows the Cybersecurity ETF (CIBR) with two sets of annotations: a future possibility and the current reality. The future possibility shows that a bullish reversal could be in the making as the ETF held the January low and surged late last week. The current reality, however, is...

READ MORE

MEMBERS ONLY

Wall Street Will Sees His Charts And Predicts 4-6 More Weeks Of Bad Market Weather

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's no denying it was a super rally to end last week. Any time you see stocks jumping like they did on Thursday's reversal and Friday's follow through, it's easy to become much more optimistic. But during periods of high volatility, the...

READ MORE

MEMBERS ONLY

STOCKS REGAIN EARLIER LOSSES FOLLOWING OUTBREAK OF WAR IN EUROPE -- LONGER-RANGE TREND NOT ENCOURAGING

by John Murphy,

Chief Technical Analyst, StockCharts.com

SELLING THE RUMOR AND BUYING THE FACT... Thursday morning's heavy selling of stocks and the buying of traditional safe havens like bonds, gold, and oil reversed sharply that same afternoon. Stocks rose while safe havens lost most of their morning's gains. That more positive trend continued...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Remains Below Crucial Resistance Levels; RRG Chart Shows These Sectors Rolling Into the Improving Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past several days, the global equity markets were highly affected by the escalated geopolitical tensions between Russia and Ukraine, with Russia ultimately ending up invading Ukraine. This spooked the global equity markets, and India was no exception. On Thursday, NIFTY witnessed one of its worst performances of the...

READ MORE

MEMBERS ONLY

Russia's Invasion Poses Big Risks For The U.S. Is There A Silver Lining For Investors?

by Mary Ellen McGonagle,

President, MEM Investment Research

Russia's invasion of Ukraine is expected to create a sudden shortage of key products in the U.S. that in turn, will aggravate already high inflation rates. A hard pressed Federal Reserve will now have to prevent consumer prices from rising out of control while lowering their rate...

READ MORE

MEMBERS ONLY

Breakouts Galore in This Suddenly Surging Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a fan of relative strength and, even in a market that's been whipsawing back and forth, leaders emerge and you need to be vigilant in seeking them out. One such group hadn't shown relative strength in many months, but that changed in 2022...

READ MORE

MEMBERS ONLY

Have the Markets Bottomed?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets following the sharp rally into the week's close. She also shares hot spot areas and stocks being pushed into uptrends due to the conflict between Russia and Ukraine.

This video was originally...

READ MORE

MEMBERS ONLY

Waking Up in Europe on Thursday Morning

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What a surreal experience it was waking up on Thursday morning. Switching on the news and seeing that Russia has actually invaded Ukraine. For us Europeans, wars since WWII have always been fought far away from home in Afghanistan, former Yugoslavia, Iraq, Iran, Kuwait, etc. But this is literally in...

READ MORE

MEMBERS ONLY

Question the Crowd and Look for the Market's Hints

At the beginning of the week, investors worried as the market sold off. Then, on Thursday, the major indices made a large gap lower, igniting many to believe we had entered the beginning of a bear market. Though investors are still worried about geopolitical pressure, along with worries about rising...

READ MORE

MEMBERS ONLY

Playing Price Swings and the Risks of Leverage

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"There is nothing more painfully bullish than a bear market rally."

- Dave Keller, The Final Bar, February 24, 2022

We've been tracking the signs of distribution since November of last year. As the S&P 500 made new highs into December and January, the...

READ MORE

MEMBERS ONLY

S&P 500 NoGo Trend for 2022 YTD

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

For the third week in a row, the major U.S. stock indexes appeared to be on the verge of an overall gain at midweek, only to end up negative after declining on Thursday and Friday. The invasion of Ukraine has made Thursday's selloff even more dramatic, but...

READ MORE

MEMBERS ONLY

Use ADX/DI to Improve Your Exits

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses the ADX/DI lines to help with aggressive exits. This tool works best when a stock has a nice trend in place and we are looking for an early exit rather than being...

READ MORE

MEMBERS ONLY

Noise is Deafening!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

With the media constantly blaming this down market on Ukraine, I thought this article would be timely.

Just in the course of a normal week, we are bombarded with information from sources such as the FED, television analysts, brokerage firm analysts, economists' projections, newspapers, junk mail, neighbors, war reporters,...

READ MORE

MEMBERS ONLY

STOCK INDEXES BREAK JANUARY LOWS -- GOLD AND OIL SPIKE HIGHER WHILE BONDS REBOUND -- WE MAY BE HEADING INTO STAGFLATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES REACH NEW LOWS ON RUSSIAN INVASION... News of a full-scale Russian invasion of Ukraine is pushing global stocks sharply lower and pushing money into traditional safe havens like gold, oil, and bonds. The price of West Texas crude oil spiked to $100 this morning while gold prices also...

READ MORE

MEMBERS ONLY

This Great Big Bear is Gaining A Great Big Grip

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technical analysis pays off. Thank you John Murphy for all the wisdom and inspiration. The warning signs that I see from time to time don't always pay off and that's really not what technical analysis is all about. It's never a guarantee. I use...

READ MORE

MEMBERS ONLY

Six Bear Markets and Five Bull Markets In Under Three Years

by Carl Swenlin,

President and Founder, DecisionPoint.com

Periodically, to scare the kiddies we bring out the boogie man chart of the 1929-1932 Bear Market. It is a stunning picture upon which I have gazed many times. A decline of nearly ninety percent in just under three years. Recently,it occurred to me that there is much more...

READ MORE

MEMBERS ONLY

Why you Must Choose a Trading Timeframe

Many traders actively watch the market and believe there are always opportunities to make money. It can seem that way, as there is almost always a symbol sitting in the new 52-week high list or another symbol making a great intra-day move. However, this type of thinking can be dangerous,...

READ MORE

MEMBERS ONLY

Major Top or Double Bottom?

by Martin Pring,

President, Pring Research

In a recent late January article,I pointed out that many market averages had fallen to key support levels at a time when a lot of them were experiencing selling climaxes. This kind of condition is usually followed by a rally or basing period, but I also noted that other...

READ MORE

MEMBERS ONLY

SPY Closing in on Important Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this week's episode of Sector Spotlight, I discussed the chart of SPY, as it is approaching an important support area between 420-425. The updated version of this chart is printed above and, as you can see, the market is getting closer and closer to this important support...

READ MORE

MEMBERS ONLY

Where to Watch for a Market Buy Signal

By the end of Tuesday, the S&P 500 (SPY) and the Nasdaq 100 (QQQ) were able to rally off support from lows found in late January. If they can hold their current prices, we can next watch for each to run back towards their range highs near $370...

READ MORE

MEMBERS ONLY

Flight Path: February 22, 2022

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Run Lola Run! It's Groundhogs' Day All Over Again

For the second week in a row, the major U.S. stock indexes appeared to be on the verge of an overall gain at midweek, only to end up negative after declining on Thursday and Friday. Indexes fell...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking Abroad for Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I take on the rotations in asset classes and US sectors as they unfolded last week. Because it is the last Tuesday of the month, a look at seasonality, in combination with current rotations, is also on the menu. I...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely To Stay Largely in a Range; RRG Chart Shows Energy Sector Gaining Relative Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Despite the past five days being immensely volatile, with the markets oscillating back and forth in a wide range, they still ended the week on a relatively flat note. The markets saw the opening of the week with a serious gap-down following geopolitical tensions between Russia and Ukraine; the very...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Key Support

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the markets closed and what to be on the lookout for going forward. She also highlights Consumer Staples stocks trending higher, as well as high yield themes on the move in an otherwise tough market.

This...

READ MORE

MEMBERS ONLY

How Will We Know the Coast is Clear?

by Erin Swenlin,

Vice President, DecisionPoint.com

A common question I am receiving via email and the Monday free DecisionPoint Trading Rooms (register here to be a part and/or receive the recordings): "How will we know it is safe to expand exposure or when seas aren't so stormy?" In this week'...

READ MORE

MEMBERS ONLY

Can the Major Indices Hold Key Support Levels?

The Russell 2000 (IWM), S&P 500 (SPY), Dow Jones (DIA) and the Nasdaq 100 (QQQ) have all broken their previous minor support levels from Monday, February 14th's low as seen in the above chart. While the break under Monday's low makes the market look...

READ MORE

MEMBERS ONLY

Are You Ready for a Market Meltdown? It's Coming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I am rarely dramatic, but 2022 is an exception. I believe we are in the type of bear market that we haven't seen in a long, long time.

The pandemic-driven cyclical bear market in 2020 was a health care crisis, not a financial crisis. I wrote about it...

READ MORE

MEMBERS ONLY

A Winner is Emerging in the Battle for the Large-cap Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Buyers and sellers are slugging it out for control of the long-term trend for the S&P 500. This battle is raging near the 200-day SMA, which is perhaps the most widely followed long-term moving average. The S&P 500 is also the most widely followed benchmark for...

READ MORE

MEMBERS ONLY

A Secret Bear Market

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG talks about current market conditions by first showing you the SPY and how it has been behaving. Then, he becomes more granular and takes a look at individual tickers, including AAPL, HD and more, to see just how far...

READ MORE

MEMBERS ONLY

Chartwise Women: Tips to Stay Nimble in Volatile Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, Mary Ellen and Erin discuss using intraday charts to take advantage of volatility and capitalize on a tough market period.

This video was originally broadcast on February 14, 2022. Click on the image above to watch on our dedicated Chartwise Womenpage,...

READ MORE

MEMBERS ONLY

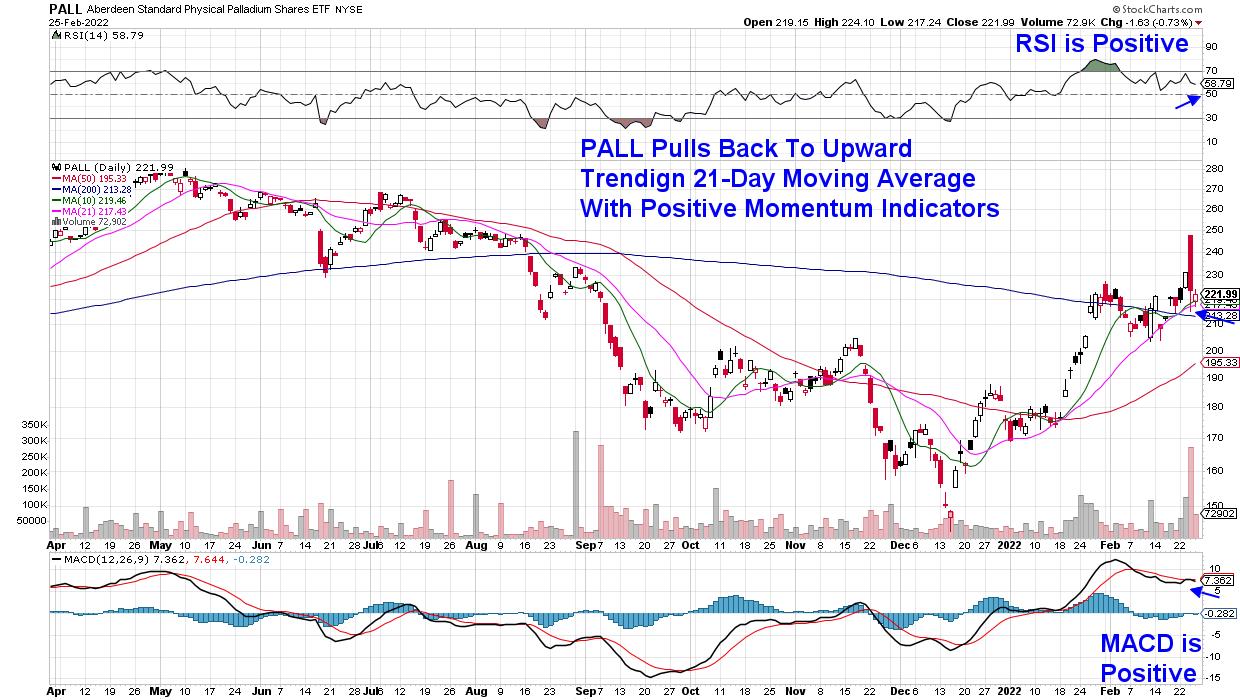

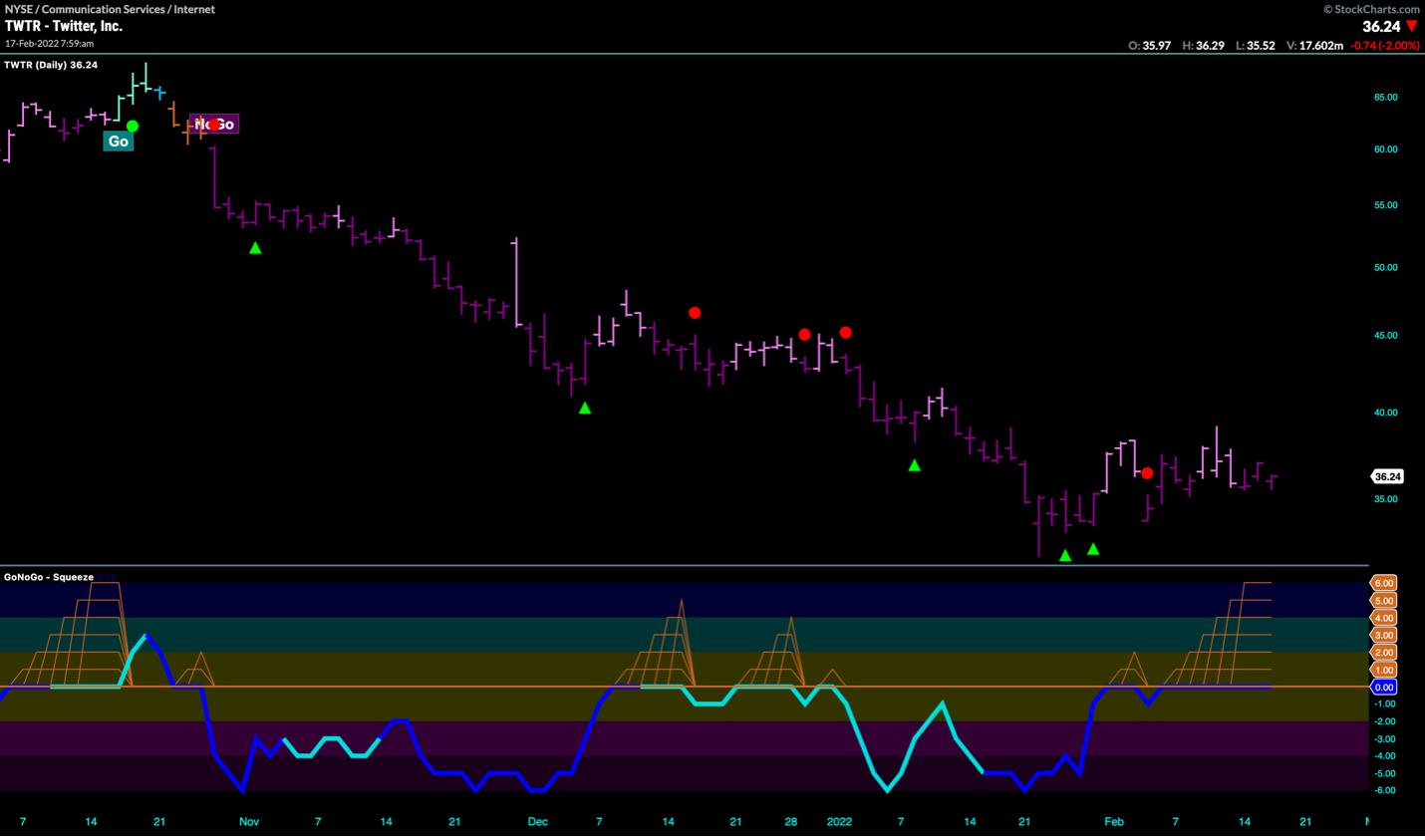

TWTR Analysis + New Video: S&P Hovering at Critical Inflection Point

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Twitter (TWTR) has been in a strong "NoGo" trend since October of last year. While there hasn't been much for bulls to get excited about, we are looking at a pause in the bearish price activity. The GoNoGo Oscillator has been riding the zero line as...

READ MORE

MEMBERS ONLY

Powerful MACD Signals You Can Use in Your Trading

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe uses his extensive 30 years of experience to explain his favorite signals in the MACD indicator. He covers Momentum Divergence, Pinches and Reverse Divergence, along with Zero Line Reversals and their typical sequence. He then analyzes all...

READ MORE

MEMBERS ONLY

RISING UKRAINE TENSIONS ARE PUSHING GOLD TO THE HIGHEST LEVEL IN EIGHT MONTHS -- GOLD MINERS ARE ALSO RALLYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING TENSIONS BOOST GOLD... With increased warnings that a Russian invasion of Ukraine is likely, investors are selling stocks around the world. And they're buying gold which is usually viewed as a traditional safe haven in times of heightened global tensions. Chart 1 shows the Gold Shares SPDR...

READ MORE

MEMBERS ONLY

Let's Build a Shopping List of Stocks and Areas to Watch

Wednesday's FOMC minutes release sparked a late-day rally in the stock market. If the rally continues into Thursday, this could be a great area to watch for trade setups in some of our favorite sectors.

Even with the market in a pivotal area, we need to stay quick...

READ MORE

MEMBERS ONLY

Gold Breaks Out for the Fourth Time in the Past Year -- But is it for Real this Time?

by Martin Pring,

President, Pring Research

Since its August 2020 high, gold has been a very tricky market to call. Let me put it another way; it has been easy to call, but exasperatingly difficult to call correctly because of the numerous false breakouts that have taken place in the last 18 months-or-so. Monday's...

READ MORE

MEMBERS ONLY

State of the Market + 22 Trading Resolutions, Part 5

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave discusses the state of the market and where the markets are, illustrating how you could use that information for later on. He then continues with his 22 trading resolutions for 2022.

This video was originally broadcast on February 16, 2022....

READ MORE