MEMBERS ONLY

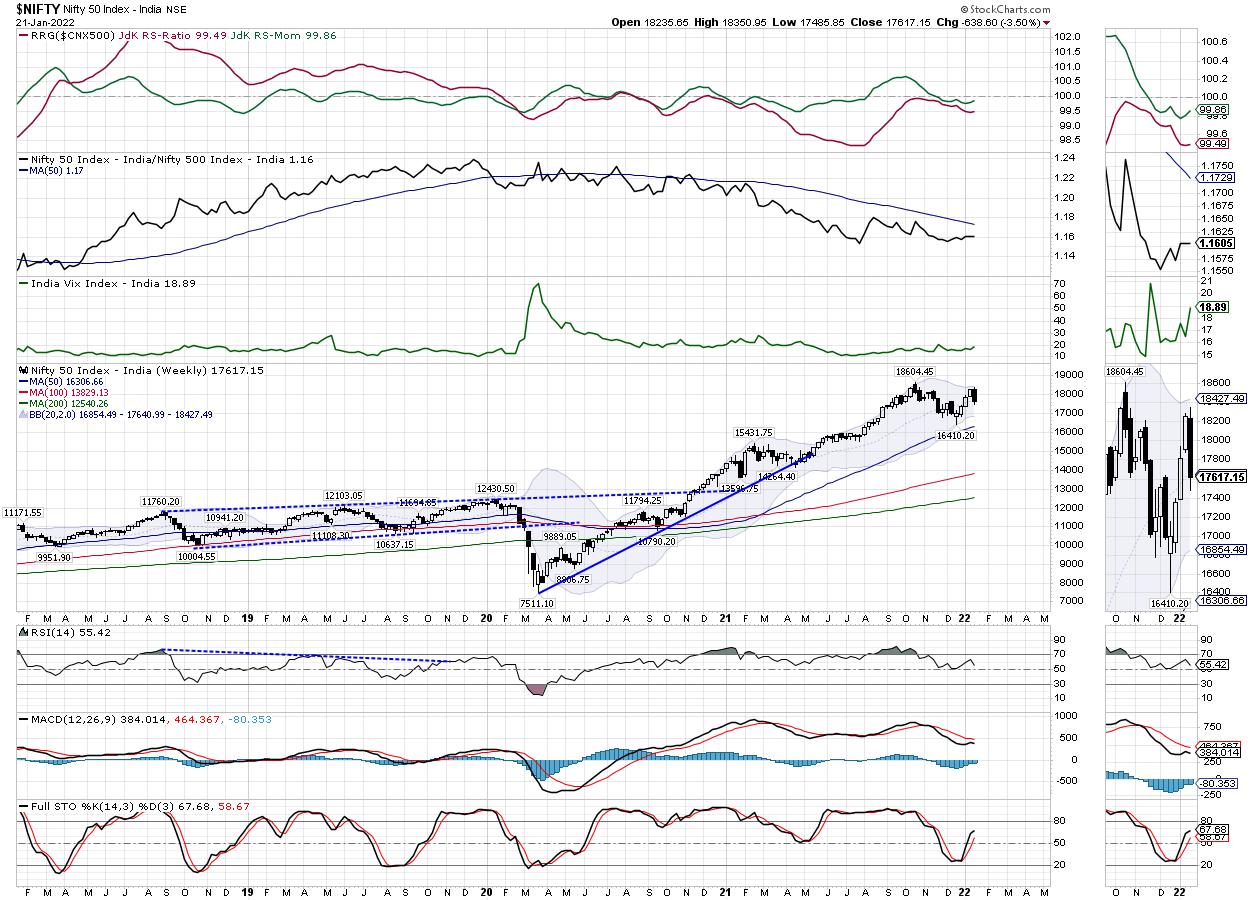

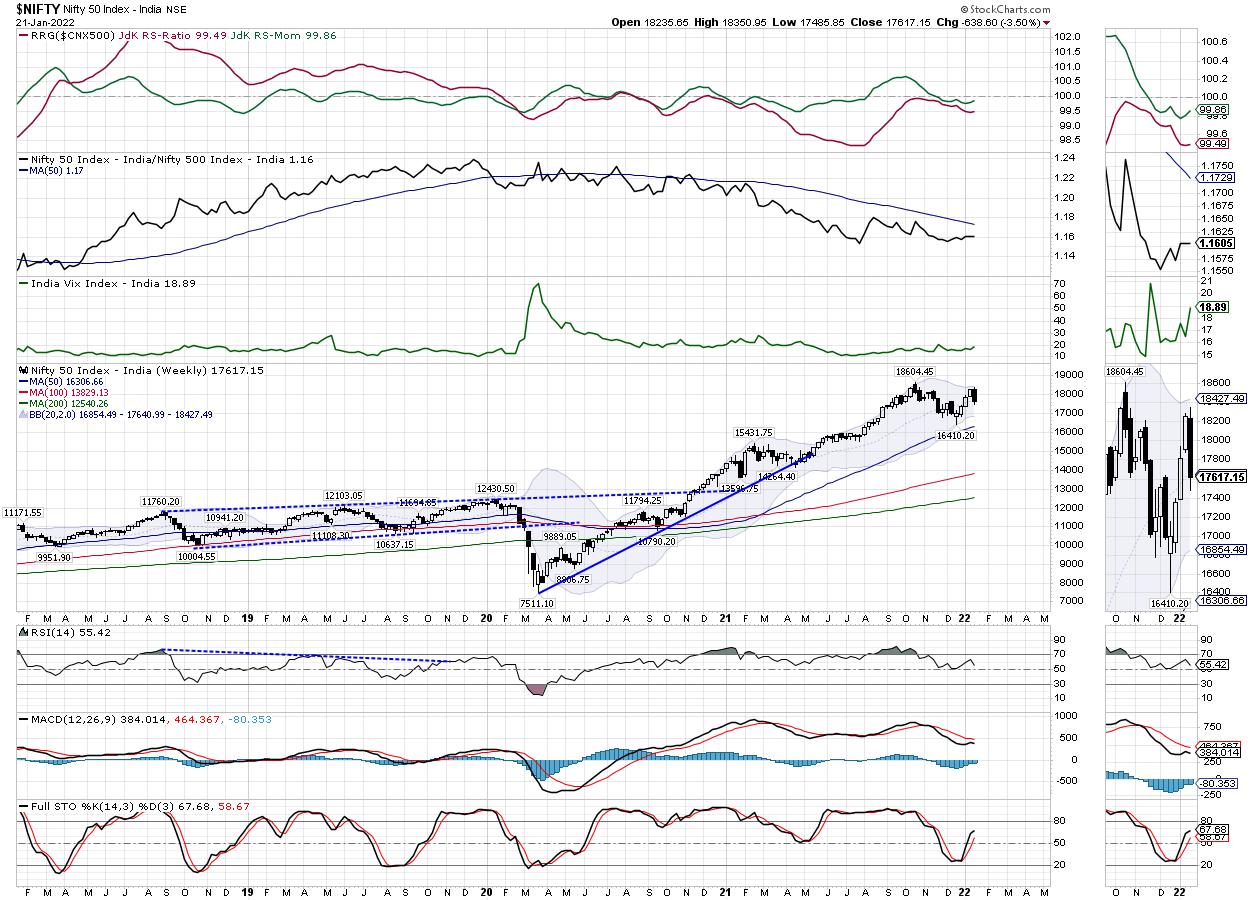

Week Ahead: NIFTY Badly Needs to Defend Key Levels in the Coming Week; RRG Charts Show No Major Change in Sectoral Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week where the trading range remained much wider on the expected lines, the Indian equity markets remained predominantly under pressure. For four out of five days, the NIFTY remained under sustained corrective pressure, as it ended each of the past four days in a "measured" corrective...

READ MORE

MEMBERS ONLY

Evidence for a Bear Market

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's subscriber-only Diamond Mine trading room, I was asked why Carl and I think we are on the first leg of a bear market. I'm sure we're not alone in our bearish stance, but I have a few charts to provide our evidence...

READ MORE

MEMBERS ONLY

Is a Bear Market Ahead?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's driving these markets lower and what to be on the lookout for as we move forward. She also shares ETFs that can help hedge against further downside.

This video was originally recorded on January...

READ MORE

MEMBERS ONLY

Do You Have a Solid Trading Plan?

As the stock market corrects and potentially forms a new trend, traders who don't have strict plans might be wondering what to do next. So far, many symbols, along with the market, are not dipping like many expected and people are either realizing large losses or sticking to...

READ MORE

MEMBERS ONLY

THE STOCK MARKET'S TECHNICAL CONDITION CONTINUES TO WEAKEN -- IMPORTANT SUPPORT LEVELS ARE BEING TESTED OR BROKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ CONTINUES TO LEAD MARKET DECLINE...Stocks are suffering through another bad week, with the Nasdaq market continuing to lead the decline. The Nasdaq Composite Index has also suffered the most technical damage. It fell below its 200-day moving average last week. Chart 1 shows the COMPQ falling below its...

READ MORE

MEMBERS ONLY

Weak Market Sentiment Warning

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG talks about the weakness of the market. What is working? What isn't working? He then walks you through areas that might go long, as well as where he thinks the market could be headed next.

This video...

READ MORE

MEMBERS ONLY

The Tail is Wagging the Dog; Big Plunge Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Normally, the stock market is humming along and we have indicators all supporting the sustainability of that move higher. But things aren't normal right now.

It started with the rotation into defensive sectors to lead the S&P 500 higher on that last final leg in December....

READ MORE

MEMBERS ONLY

An Indicator to Keep you on the Right Side of the Trend (QQQ)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) reversed its uptrend signal from April 17th, 2020 as two trend-following indicators turned bearish this week. The chart below shows QQQ with the deepest decline from a high since the 10.9% decline in February-March 2021. Prior to that, the deepest decline was in September...

READ MORE

MEMBERS ONLY

Chartwise Women: How to Be Proactive in Your Investing

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of Chartwise Women, Erin and Mary Ellen talk about being proactive in your investing while the markets are still volatile. They also expound on how taking no action can sometimes be the best strategy.

This video was originally broadcast on January 20, 2022. Click...

READ MORE

MEMBERS ONLY

Choppy Markets = Potential for Trend Change

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler look at several critical inflection points in the markets. They note key levels of support breaking in tech stocks, growth/value ratios and a continued selloff in US Government Treasuries driving rates on the 10-year above...

READ MORE

MEMBERS ONLY

Wyckoff, Accumulation/Distribution and ADX

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses Accumulation and Distribution as a part of the 4 phases of the market using the classic Wyckoff approach to the markets. In addition, he explains how the ADX/DI can be used in conjunction with these...

READ MORE

MEMBERS ONLY

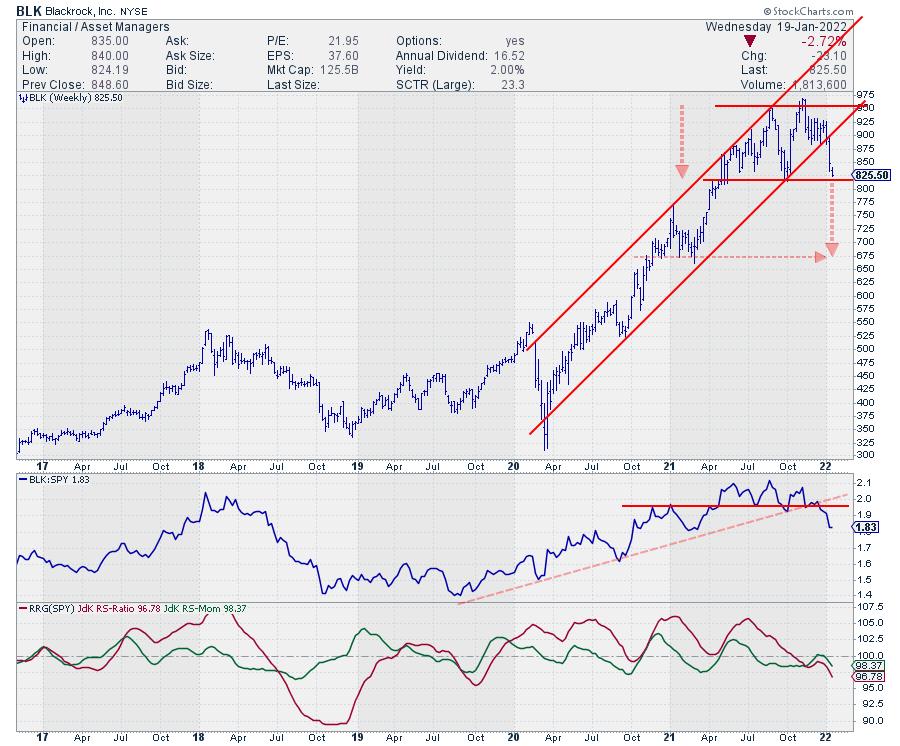

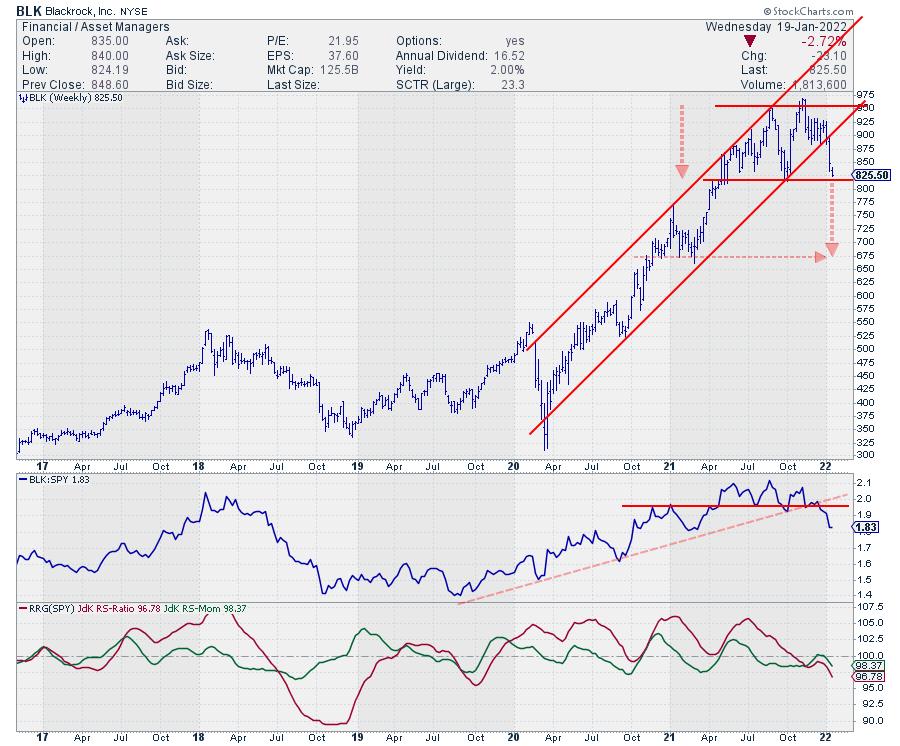

This Big Boy is in Trouble

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While looking at the Financial sector, I noticed that the group Asset Managers is currently at a very weak rotation against the S&P, as well as its sector index XLF.

After returning into the leading quadrant from weakening, which is usually a strong sign, $DJUSAG rapidly hooked back...

READ MORE

MEMBERS ONLY

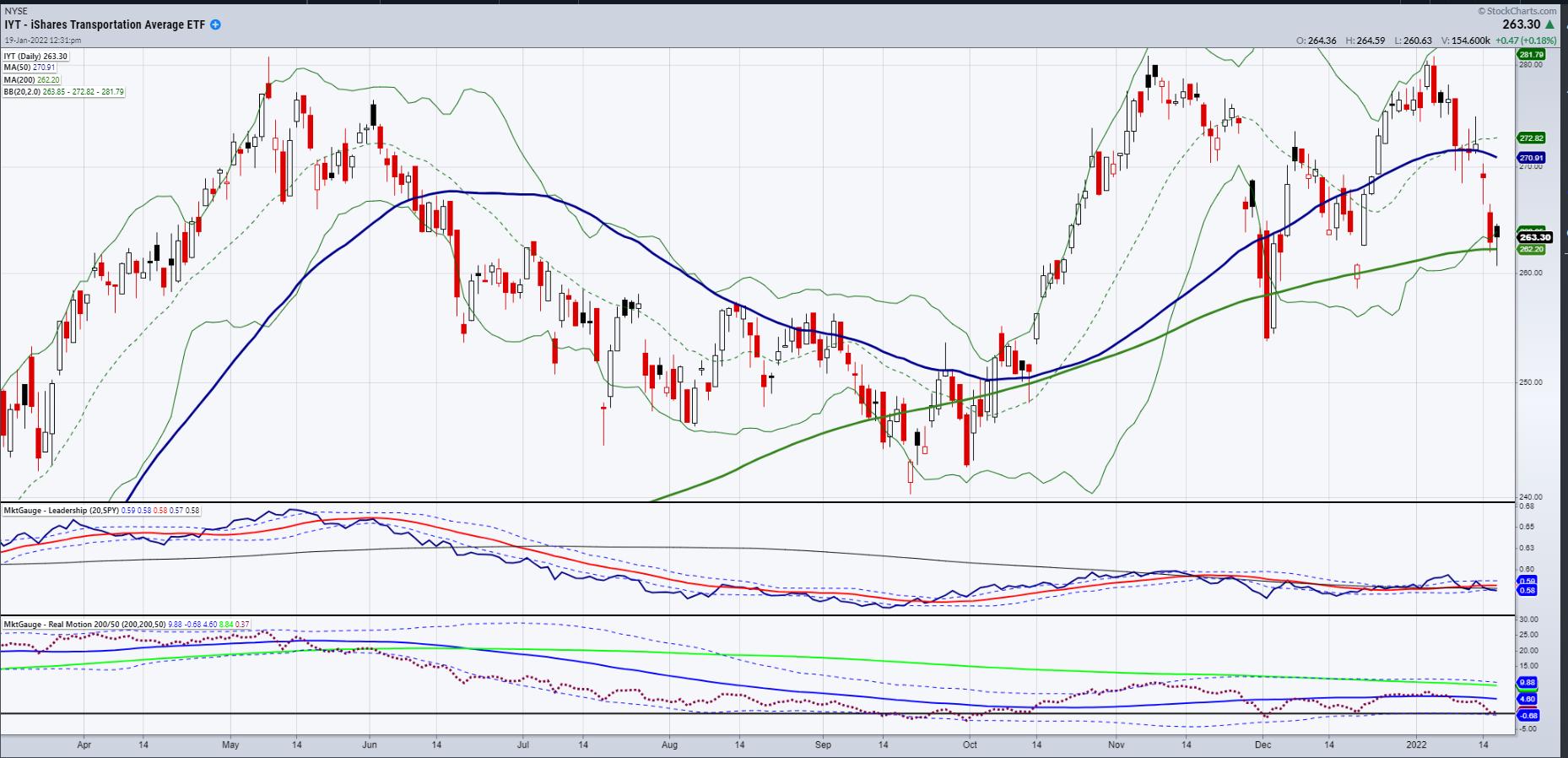

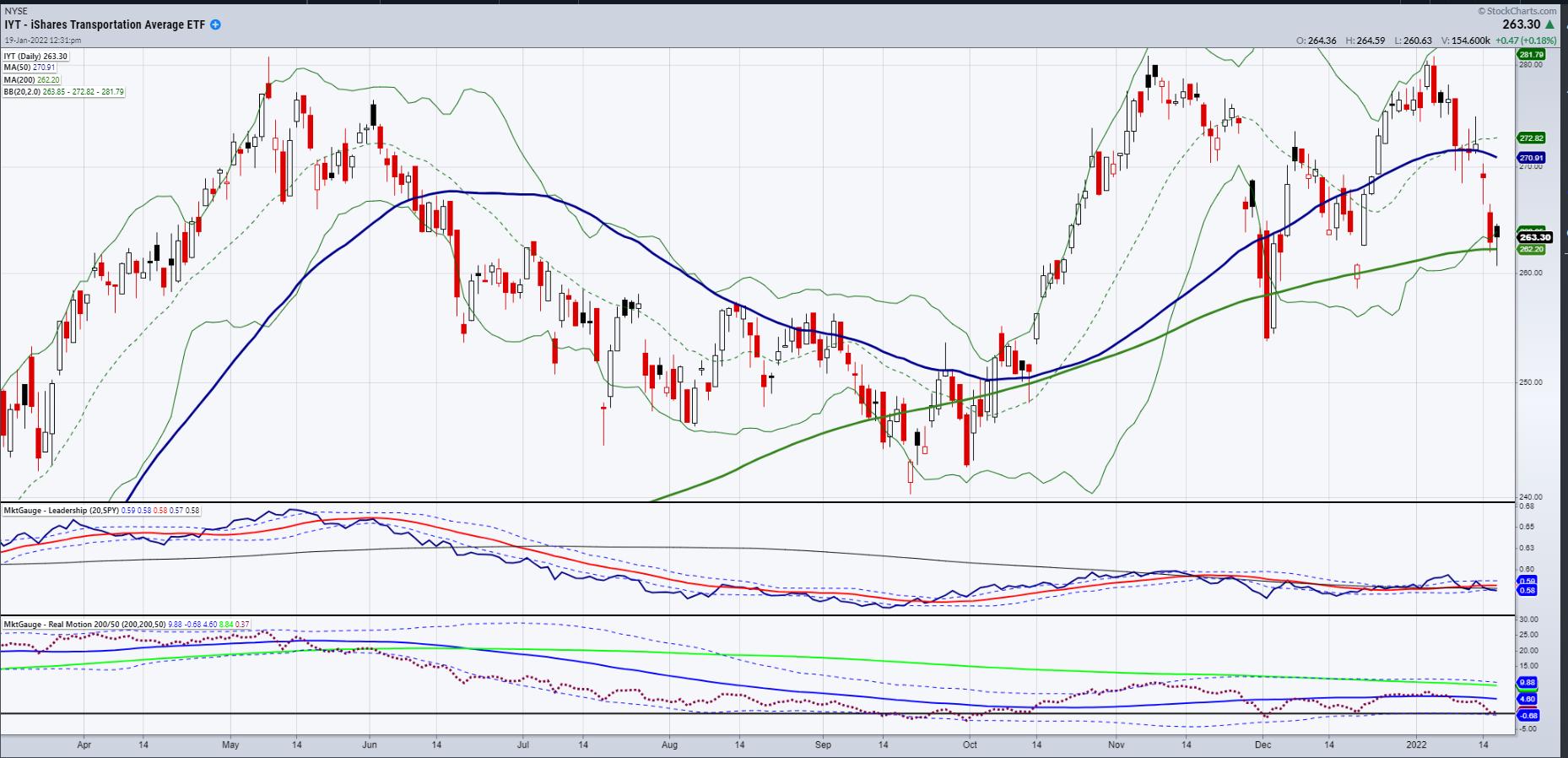

Mish: Transportation Sector (IYT) -- Way to Hold The Support Level!

So far these last couple of weeks, we have written and talked about trading ranges, January calendar ranges, inflation, stagflation and precious metals. We have also talked and written about the Transportation sector as the prime example of not only trading ranges, but also why we believe the market will...

READ MORE

MEMBERS ONLY

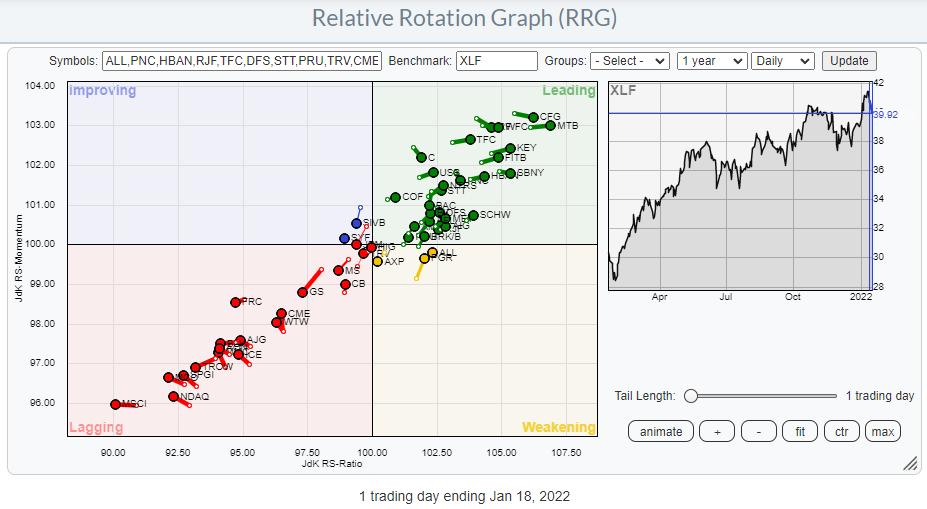

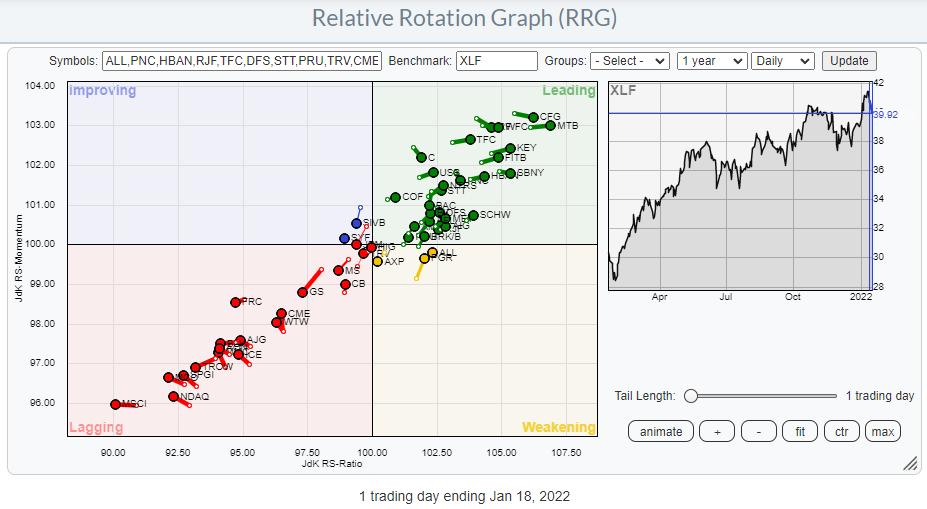

Financials are All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the back of a lot of earnings announcements, the financial sector is getting a lot of attention this week. A few stocks, led by SIVB, FRC and GS, got hurt pretty bad yesterday with >5% declines.

The RRG above shows the (top 50) stocks inside the financial sector....

READ MORE

MEMBERS ONLY

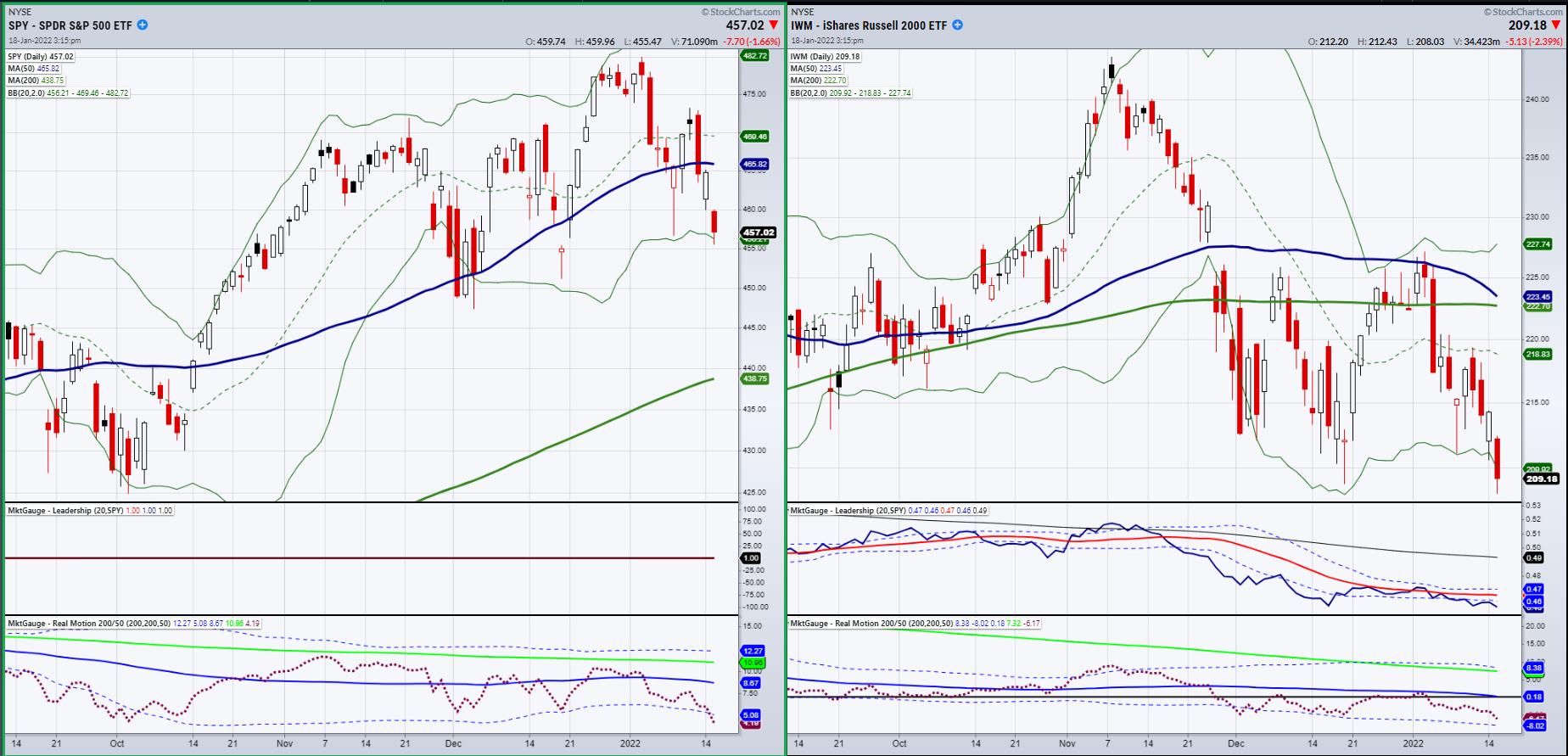

Mish: A Trading Range Within a Trading Range

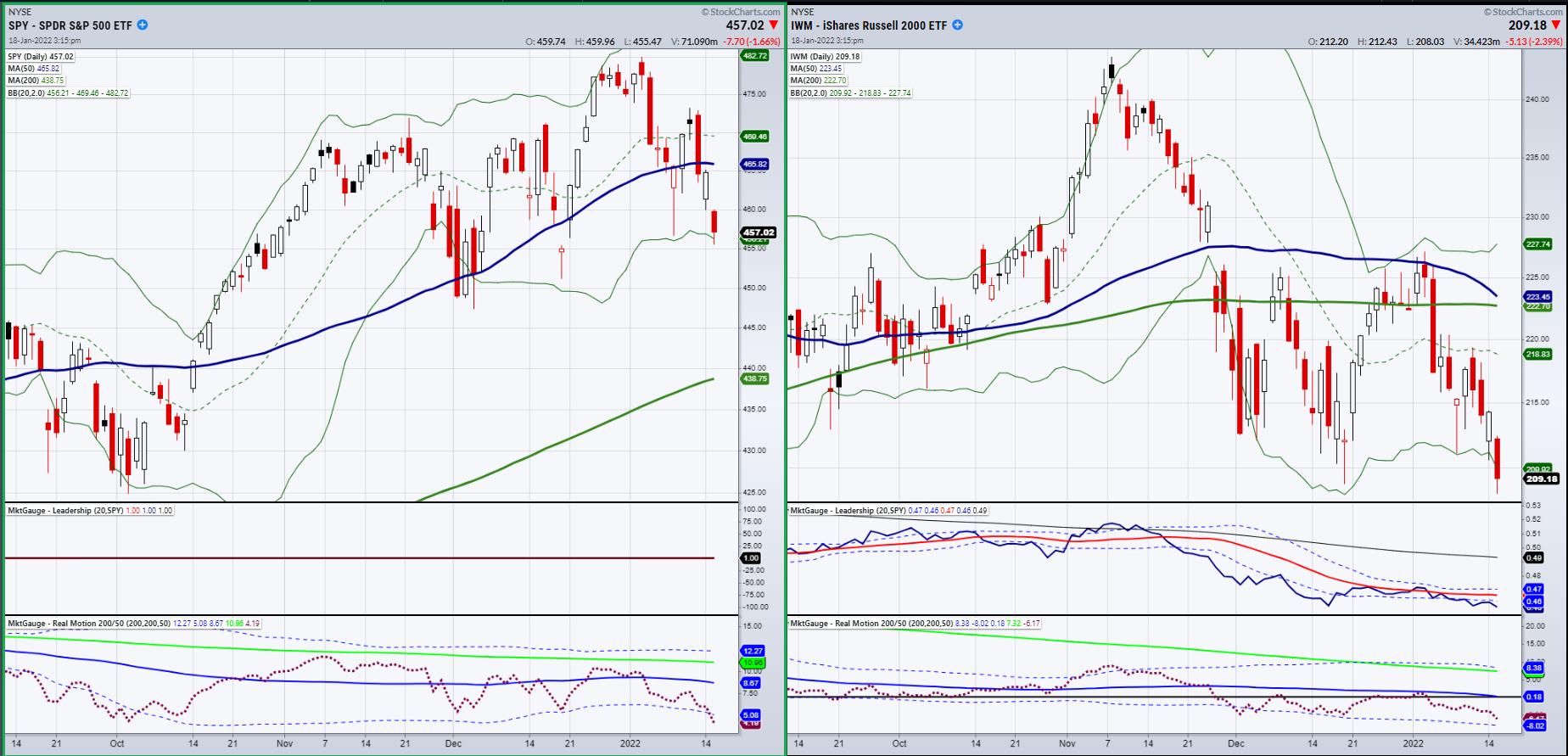

As we now enter the second half of January in a new year, the persistent trading range continues. Particularly in the small caps or Russell 2000 (IWM), the trading range has been from 204-233 since February 2021.

As we begin this week, IWM is tackling the December 2021 low and,...

READ MORE

MEMBERS ONLY

Two Market Segments That Look Set for a Big Move

by Martin Pring,

President, Pring Research

Recently, I have been drawn to two specific-but-unrelated areas of market activity. Both are experiencing an extremely fine balance between buyers and sellers and, as a result, are likely to experience a big move in one direction or the other. These are the copper price and small cap stocks. Let&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Cycle Shifting Towards Full Recovery/Top

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after going over the current rotations for asset classes and sectors, I use the Equal Weight sectors to update and gauge the current position of the market in relation to the economic cycle. Since December, things seem to have shifted...

READ MORE

MEMBERS ONLY

Another Bullish Pattern for the Agriculture ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The DB Agriculture ETF (DBA) was featured in ChartWatchers on October 1st as it formed a large cup-with-handle pattern, which is a bullish continuation pattern. The ETF battled its resistance zone the rest of the month and broke out to new highs in November. Flash forward to January and we...

READ MORE

MEMBERS ONLY

Here Are The Two Most Important Ratios Before Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As our name would imply at EarningsBeats.com, we focus a lot on quarterly earnings reports. We've studied them every which way possible. As a former practicing CPA, it's in my blood. Yes, I'm a technician that understands the importance of technical analysis. But...

READ MORE

MEMBERS ONLY

Power Charting TV: Scanning for Springs and Upthrusts

by Bruce Fraser,

Industry-leading "Wyckoffian"

Join Johni Scan and me on our quest to develop a library of Wyckoff Scans during 2022. Context is a term often used with chart analysis employing the Wyckoff Method. Understanding the chart attributes during the various phases of Accumulation, Distribution and Trend Analysis is a cornerstone of the Methodology....

READ MORE

MEMBERS ONLY

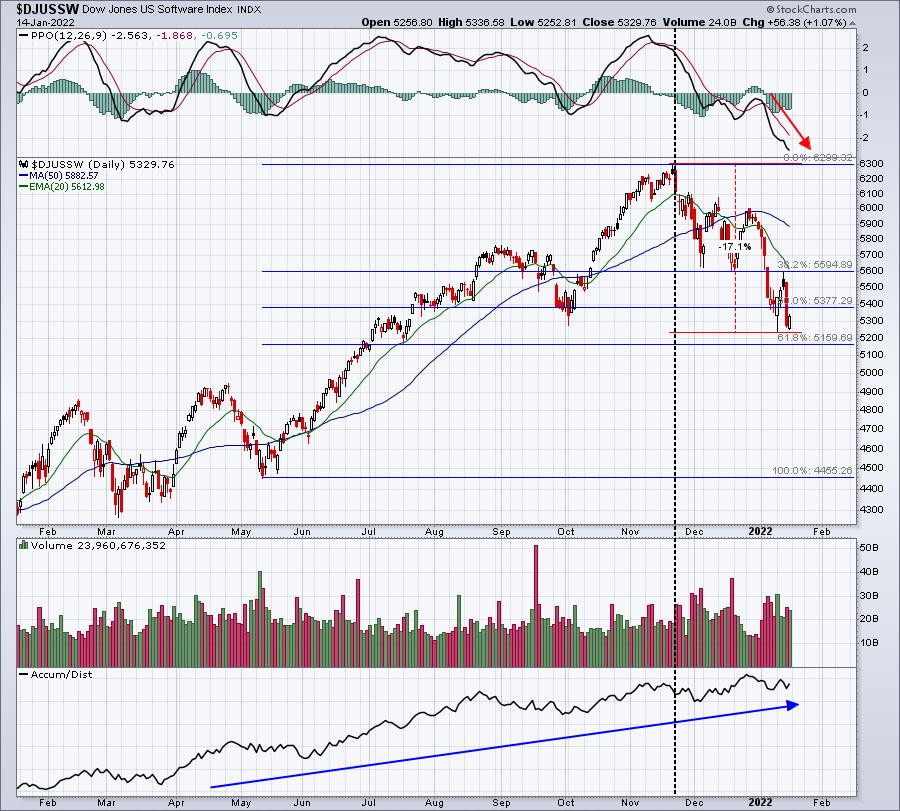

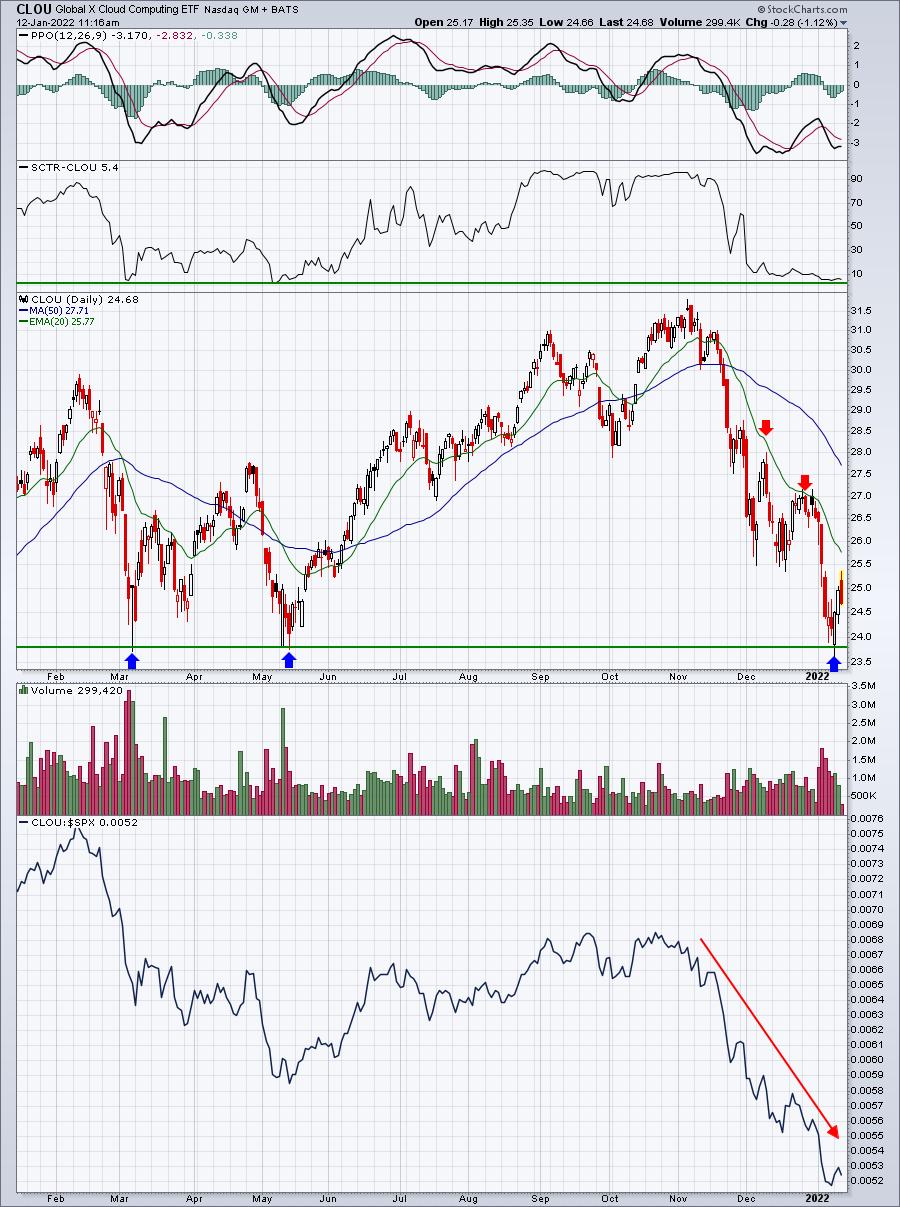

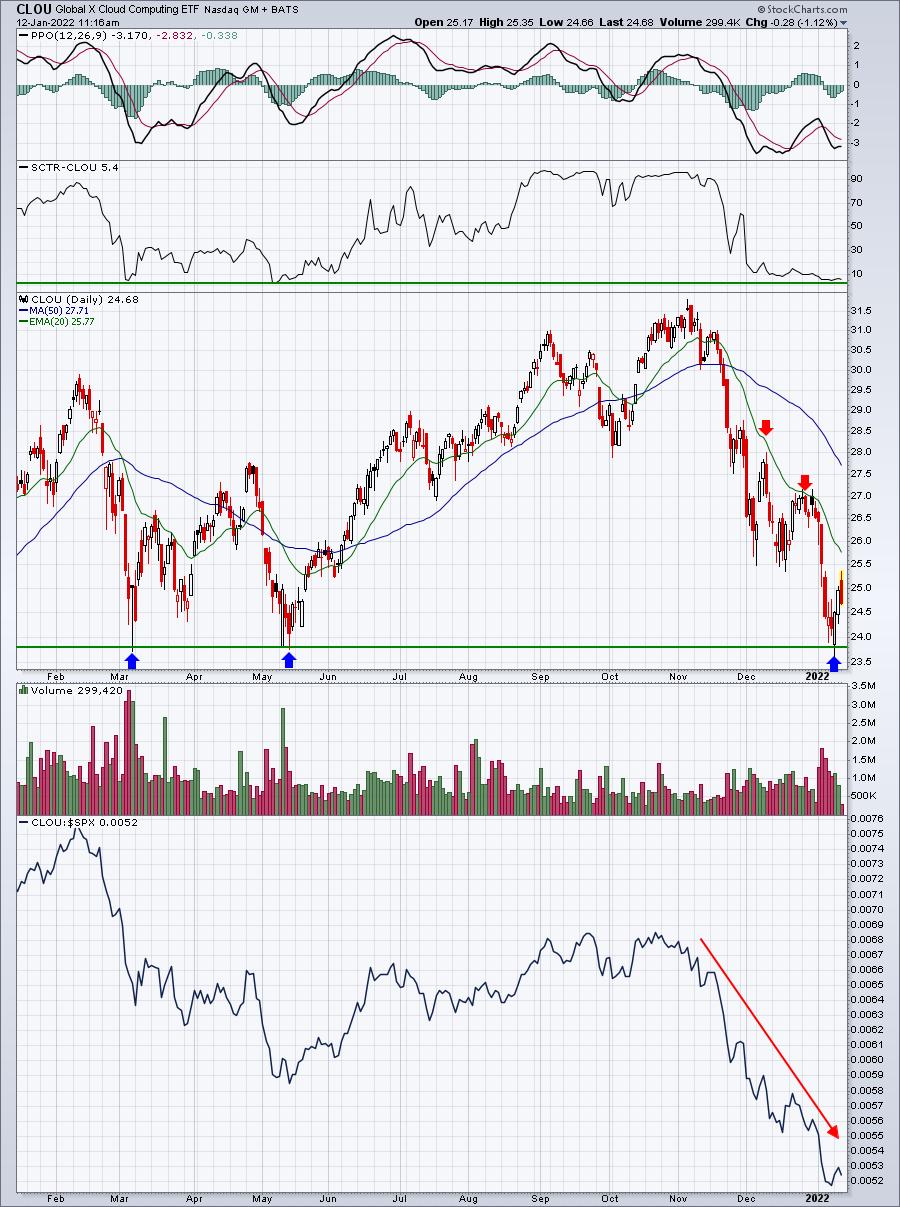

Short Sellers of Technology Stocks Have A Big Problem This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

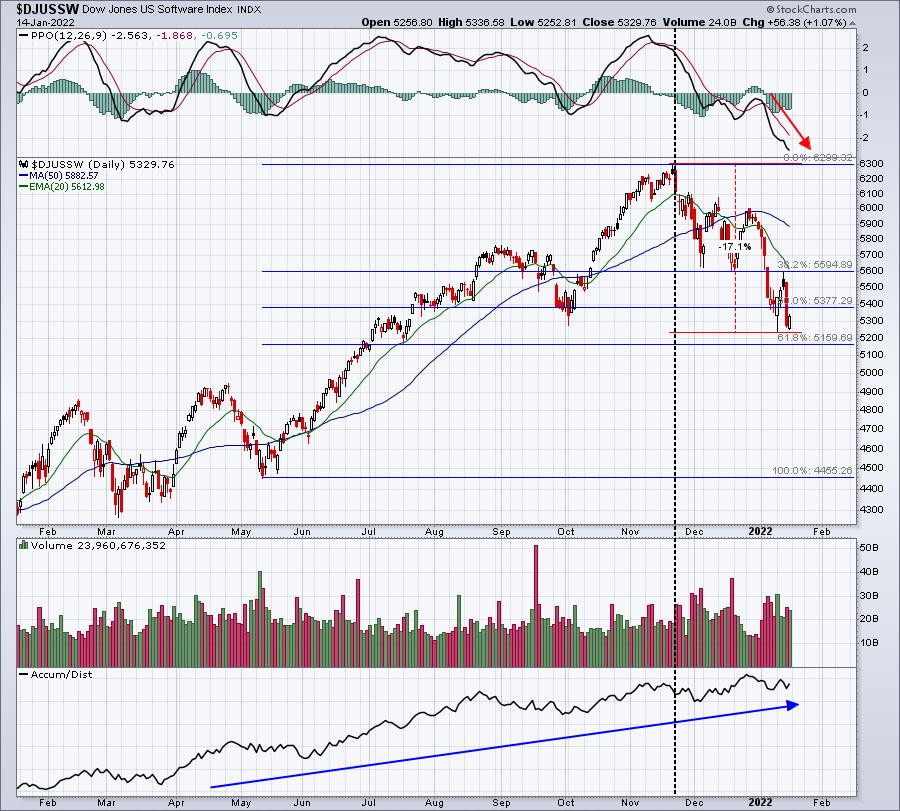

Renewable energy ($DWCREE) and software ($DJUSSW) have been absolutely smoked since November. In the case of software, the selling has accelerated in January with its PPO falling off a cliff:

This group had declined more than 17% off its recent high - before the rally from Monday's low....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Inherently Buoyant But Prone to Some Consolidation; Watch These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In strong but modestly-ranged sessions over the past five days, the Indian equity markets extended their up move for the fourth week in a row while posting gains. All five sessions were strong; the markets traded with a positive bias and used each of the consolidation times to just strengthen...

READ MORE

MEMBERS ONLY

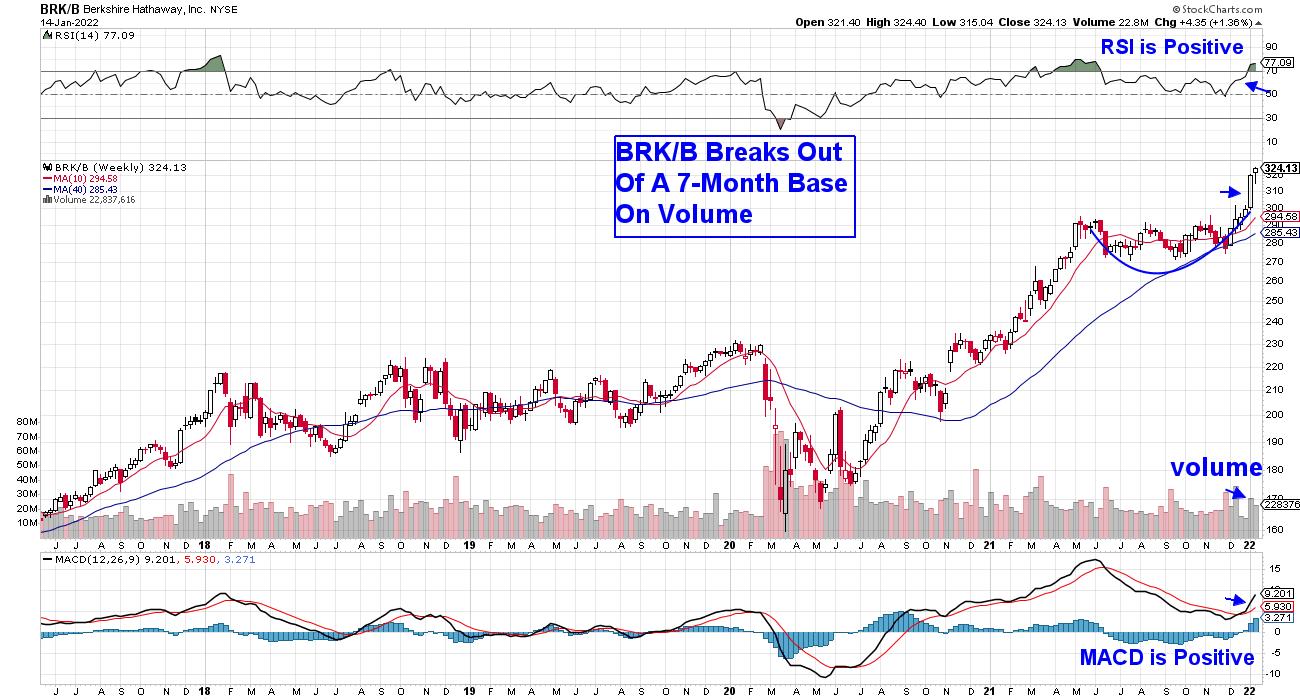

This Investment Vehicle Has Plenty Of Stocks To Hedge Against Inflation - Here Are 2 Top Holdings

by Mary Ellen McGonagle,

President, MEM Investment Research

Inflation has hit a 40 year high due to strong customer demand amid ongoing labor and supply shortages.

While economists are mixed regarding how close we may be to a peak in inflation readings, it's generally agreed that the main drivers of this currently high cost of living...

READ MORE

MEMBERS ONLY

What Do Staples, Energy and Financials Have in Common?

by Martin Pring,

President, Pring Research

Technology outperformed throughout the second decade of this century, but the times they are a-changin', as it is obvious that this sector has lost enough mojo in the last year to indicate that a basic transformation in market leadership is underway. Just to be clear, I am not saying...

READ MORE

MEMBERS ONLY

Are These Markets Safe?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets, as well as the underlying sectors, to reveal where the markets stand. She also shared select ETFs that are benefiting from a focused group of stocks that are on the move higher.

This video...

READ MORE

MEMBERS ONLY

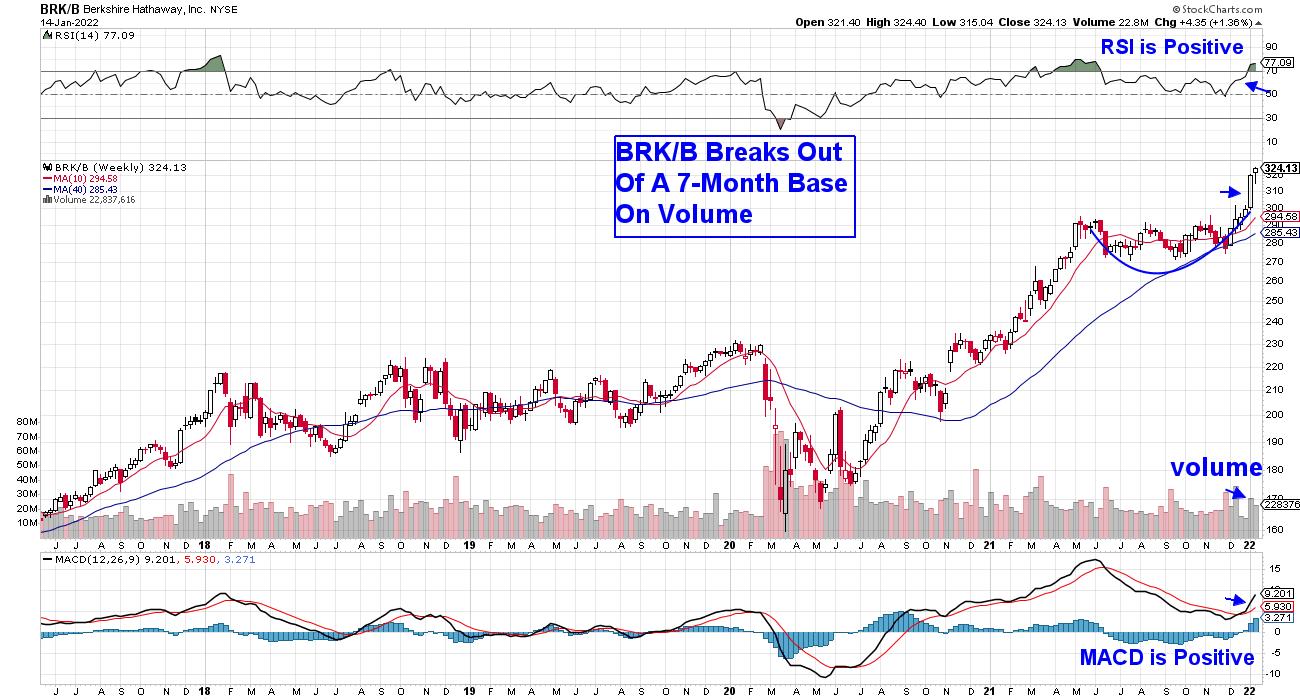

As Earnings Season Begins, Opportunities Abound

by John Hopkins,

President and Co-founder, EarningsBeats.com

All we've been hearing about lately are Fed rate increases and inflation. This has, in turn, cast a cloud over the market as many traders head to the sidelines. But, from my perspective, the recent pullback in the market has created some unbelievable opportunities in beaten-down stocks. Case...

READ MORE

MEMBERS ONLY

Hindenburg Omen Signals Downside Potential

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The Hindenburg Omen is a bit of a controversial indicator. I often get asked about it from financial media outlets, as the name itself is enough to stir up investor fear. What is this indicator, and what can it tell us about current market conditions?

The Hindenburg Omen was developed...

READ MORE

MEMBERS ONLY

Using RRG for Visual Inspection of Market and Sector Breadth

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are mostly used to show exactly that -- the RELATIVE Rotation of securities against a benchmark and against each other. However, they offer many more possibilities.

One of the options is to change the benchmark to $ONE. That is essentially a straight line at value 1. This...

READ MORE

MEMBERS ONLY

Is the Market Falling into a Rangebound Trap?

To get a quick overview of the markets direction, let's look at Mish's Economic Modern Family (MF).

Also, if you haven't picked up Mish's 2022 Yearly Outlook, here is a full report that not only shows an in-depth view of the market,...

READ MORE

MEMBERS ONLY

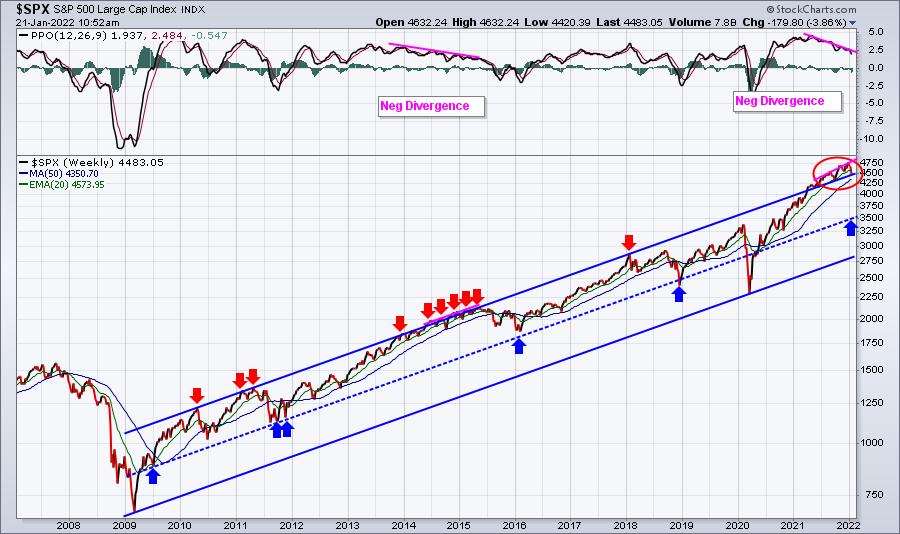

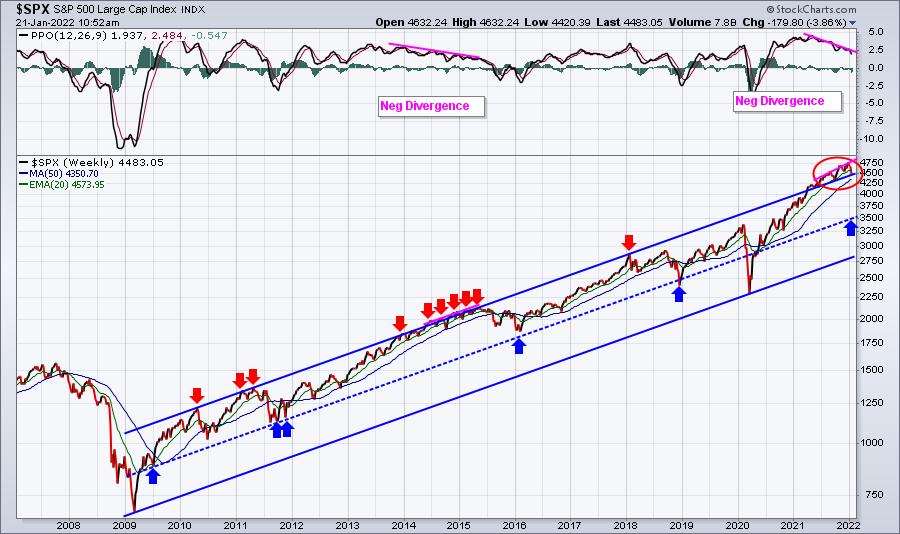

NEGATIVE DIVERGENCES WEIGH ON STOCKS -- NASDAQ COMPOSITE TESTS ITS 200-DAY AVERAGE -- SMALL CAPS CONTINUE TO UNDERPERFORM -- ENERGY SECTOR LEADS WHILE TECHNOLOGY LAGS.

by John Murphy,

Chief Technical Analyst, StockCharts.com

NEGATIVE DIVERGENCES ON SPX... A number of negative divergences have shown up on the major stock indexes which have weakened the market's technical condition. Those divergences are showing up mainly in daily momentum oscillators. Chart 1 shows the S&P 500 rallying to a new record at...

READ MORE

MEMBERS ONLY

Watching Market Choppiness

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG talks about the strength in the small caps and the weakness in the tech sector. Then, he covers the most recent market behavior and walks viewers through the choppy last few days.

This video was originally broadcast on January...

READ MORE

MEMBERS ONLY

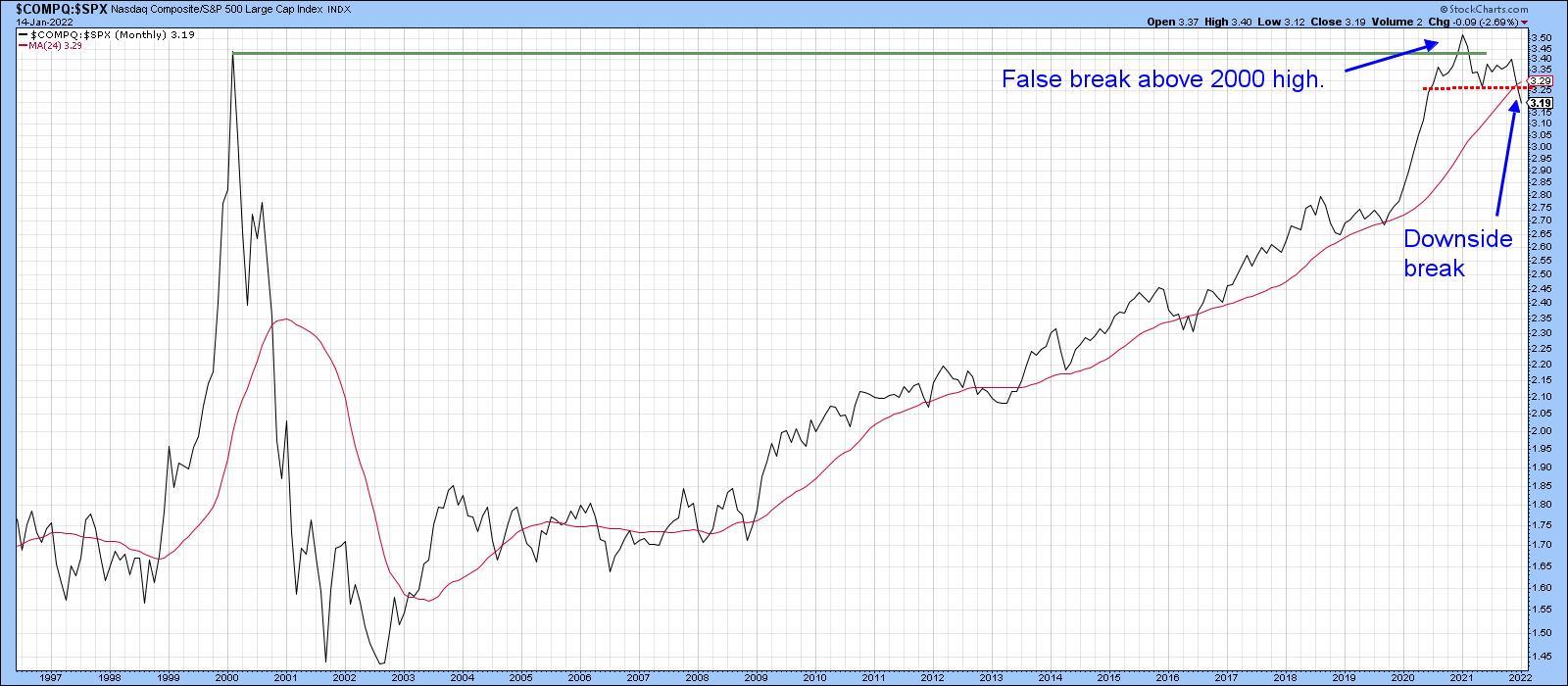

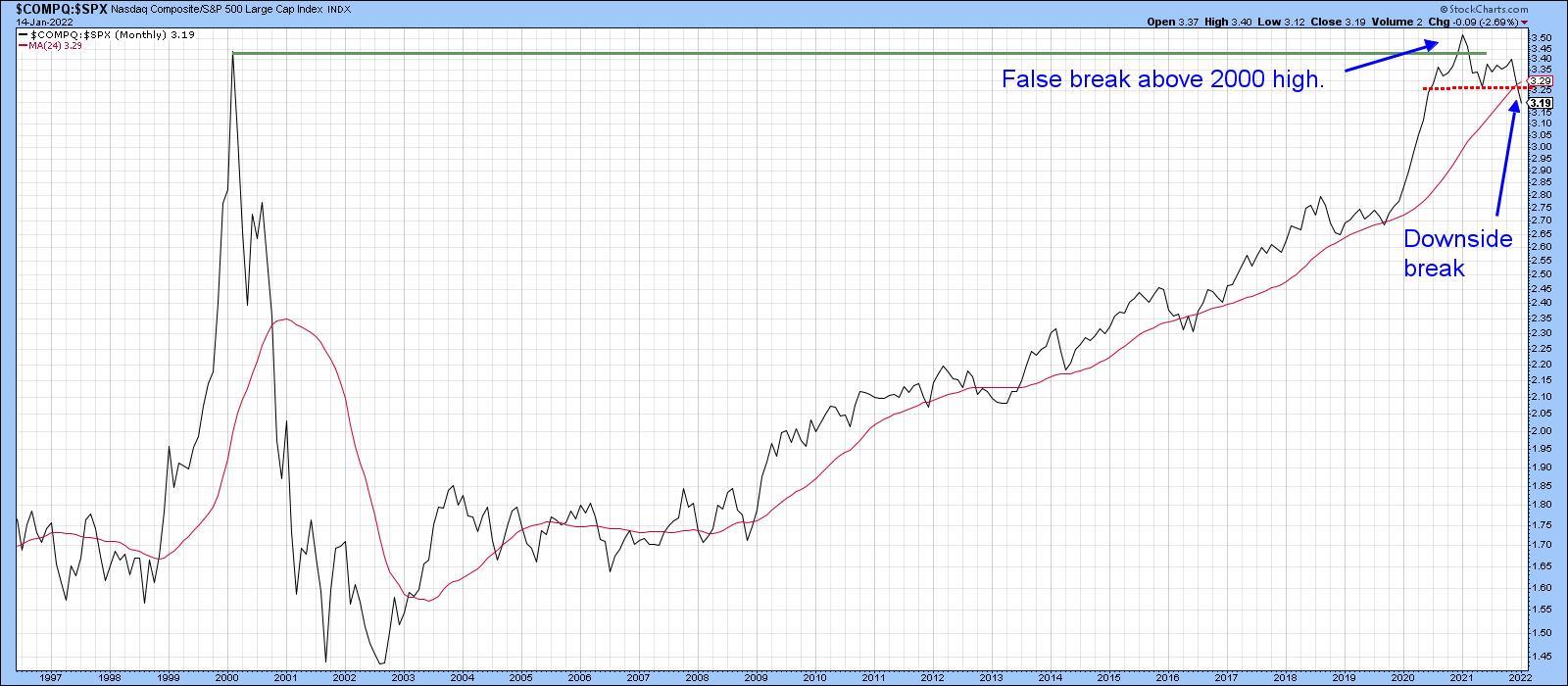

NASDAQ Under Performance And Where We Now Stand In Historical Terms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know I'm beating a dead horse, but rotation has been brutal, so timing key reversals in that rotation will be one key to trading success in 2022. Historically, when we compare NASDAQ performance vs. S&P 500 performance, there is a key threshold where we typically...

READ MORE

MEMBERS ONLY

2021 Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

My trend following strategy delivered a net return after fees of 1.6% during 2021, while a 60/40 portfolio was up about 14% and the S&P 500 was up 26.9%. Underperforming the broad market or benchmark portfolios can be very frustrating to investors, but as we&...

READ MORE

MEMBERS ONLY

Chartwise Women: Patience is a Virtue in Rocky Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

For this week's edition of Chartwise Women, Mary Ellen and Erin Swenlin talk patience as a virtue, and how to use rules, system and historical precedents to help keep that patience during a rocky period in the markets.

This video was originally broadcast on January 13, 2022. Click...

READ MORE

MEMBERS ONLY

Rising Rates Fuel a Fresh Rotation into Cyclicals

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler discuss the selloff in equities, which was strong in the first trading week of the year. The continuation on Monday, Jan 10th was short-lived, offering investors yet another "buy-the-dip" opportunity at the index level....

READ MORE

MEMBERS ONLY

How to Avoid Bad Trades by Using Multiple Timeframe Analysis

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe shows how he would use one more additional time frame in his multiple timeframe approach. He explains how the 18MA on the Upper TF can be valuable at avoiding bad trades. He then analyzes the stock requests...

READ MORE

MEMBERS ONLY

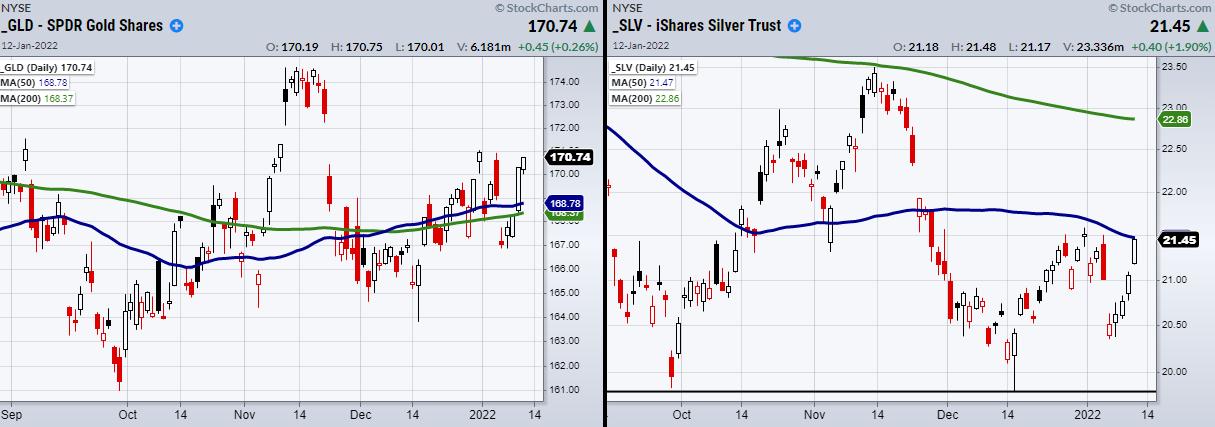

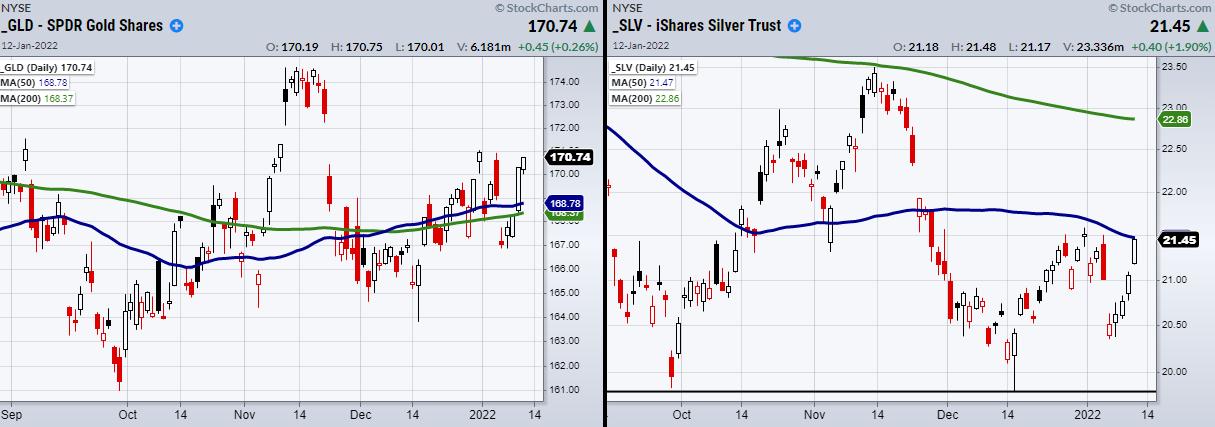

Can Silver and Gold Break Out from Stagnant Price Action?

Everyone knows inflation is on the rise and, with the latest year-over-year inflation numbers up 7%, investors are finally getting the picture that market growth has challenges ahead. Now they are searching for the next areas to trade given the market's unfolding dilemma, with rates looking to increase...

READ MORE

MEMBERS ONLY

Useful Utes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The utilities sector is showing a strong rotation over the last weeks. The sector moved back into lagging from improving in the week starting 18 October, then rotated through lagging and re-entered the improving quadrant again in the week starting 13 December at a strong RRG-Heading.

The next Relative Rotation...

READ MORE

MEMBERS ONLY

22 Trading Resolutions for 2022, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave follows up his methodology in action with a Mystery Chart Reveal. Then, he continues his discussion on 2022 trading resolutions.

This video was originally broadcast on January 12, 2022. Click anywhere on the Trading Simplified logo above to watch on...

READ MORE

MEMBERS ONLY

ETF Trading Requires Some Homework - FREE Event Today!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Investing in ETFs (exchange-traded funds) is no different than trading stocks in many respects. We still need to plan the trade. The biggest difference, obviously, is that ETFs hold a basket of stocks so purchasing an ETF requires that you understand what the ETF holds. Or maybe you don'...

READ MORE