MEMBERS ONLY

Best Practices For Spotting a Winning Stock Within a Top Industry Group

by Mary Ellen McGonagle,

President, MEM Investment Research

Every investor dreams of finding that next big stock before it takes off. The good news is that there’s a proven system that helps take a lot of the guesswork out of it.

The system I’m talking about? None other than William O’Neil’s methodology, developed after...

READ MORE

MEMBERS ONLY

Uptrends Expand; Tech Consolidates, Cybersecurity Breaks Out; A Classic Trading Setup; Big Banks Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Market breadth is strengthening as more stocks move into long-term uptrends. The percentage of S&P 500 stocks above their 200-day moving average hit 70%. small and mid-caps are driving this expansion, signaling broad market strength....

READ MORE

MEMBERS ONLY

Is Consumer Discretionary About to Take Over the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius breaks down the latest asset class and sector rotations in order to show where real market strength is building. Stocks continue to outperform bonds, but the spotlight is on sectors: technology remains strong, financials and industrials are gaining, and consumer discretionary is accelerating with broad participation. Meanwhile, defensive groups...

READ MORE

MEMBERS ONLY

Dow Jones 53k?! Why Small Caps Surge on Powell’s Rate Cut Hints

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom Bowley, EarningsBeats.com, as he recaps a week where major indices posted gains, the Dow Jones confirmed a bullish breakout above 45,000, and small-caps surged on Powell’s rate cut comments. Tom highlights the relative strength of the Russell 2000, leadership from regional banks, and strong moves...

READ MORE

MEMBERS ONLY

Is It Time to Think Small in a Big Way?

by Martin Pring,

President, Pring Research

The NYSE/S&P ratio has been in a downtrend for seventeen years, but is a reversal finally underway? What does the picture look like for small-caps going forward?...

READ MORE

MEMBERS ONLY

Unlock Explosive Breakouts with NR7 Bars!

by Joe Rabil,

President, Rabil Stock Research

Joe explains the NR7 compression bar pattern, showing how it builds energy for explosive breakout trading opportunities and how to apply it in swing trading and longer-term setups. He reviews the S&P (SPY) market conditions, covering sentiment, volatility, overbought/oversold signals, trend, and momentum. From there, he analyzes...

READ MORE

MEMBERS ONLY

Mapping the Road Ahead: Four Scenarios for the Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While August and September are traditionally a weak period for stocks, the Nasdaq 100 has continued to drive higher. We lay out four potential scenarios for the QQQ over the next six weeks, from the very bullish to the super bearish....

READ MORE

MEMBERS ONLY

Discretionary vs. Staples: Why ETFs are Flashing a Bullish Signal for 2025

Consumer Discretionary ETFs are outperforming Staples across large-cap, small-cap, and global markets. See why XLY, RSPD, PSCD, and RXI signal a bullish risk-on trend in 2025....

READ MORE

MEMBERS ONLY

Stocks Look Stalled: These Charts Point to Where the Market Could Head Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

From NVIDIA earnings to small-cap momentum, here's what could drive the market's next move. Here are the charts that tell the story....

READ MORE

MEMBERS ONLY

Two Volume Indicators Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave explains why volume indicators, including the Accumulation/Distribution Line and Chaikin Money Flow, still matter in today’s markets. Using NVDA’s earnings, the S&P 500, WMT, and EAT as examples, he shows how volume trends can reveal accumulation or distribution beneath the surface, even when price...

READ MORE

MEMBERS ONLY

China Stocks Step Back Into the Spotlight: Here's What Investors Need to Know

China stocks are surging, with FXI up 55% year-on-year. Learn what’s driving the rally, key technical levels, and what it means for retail investors....

READ MORE

MEMBERS ONLY

Week Ahead: Strong Start Expected To The Week; Moving Past This Zone Crucial To Build Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty is trading within a narrow band and testing the 25,100–25,150 resistance zone. Investors should look for a break above this resistance zone before considering long positions....

READ MORE

MEMBERS ONLY

Sectors Shift After Powell’s Speech: Where to Focus Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen reviews the market’s latest moves following Fed Chair Powell’s Jackson Hole comments, inflation concerns, and key earnings reports. Discover which areas are gaining strength as interest rate expectations shift, with energy, banks, homebuilders, and regional names all showing leadership. In addition, Mary Ellen highlights constructive setups...

READ MORE

MEMBERS ONLY

Stock Market Recap: The Bull Still Has Some Kick

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

It was another interesting week on Wall Street. Just when things were looking rough, Fed Chairman Jerome Powell stepped in and gave the market just what it wanted; his comments brought investors back in, and the bulls showed they’re still in charge.

The broader indexes closed higher on Friday,...

READ MORE

MEMBERS ONLY

From Slump to Surge: Why Investors Are Smiling Again

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks surged as Powell's rate-cut hints lifted markets. Dow hit a record, Nasdaq rebounded, and small caps rallied. Here's what it means for investors....

READ MORE

MEMBERS ONLY

QQQ/SPY Targets, IWM Best Hold, NDX Dominance Quantified, Bitcoin/QQQ Relationship, Costco Holds Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Signs of correction and rotation emerged this week as money moved out of tech-related groups and into defensive groups. Here's a perspective on this week's rotation with some year-to-date performance metrics....

READ MORE

MEMBERS ONLY

New Stocks Breaking Out While Big Tech Falters!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Mega-cap growth stocks like META, MSFT, and AAPL are showing weakness, but breadth conditions remain strong as other areas of the market push higher. In this episode, David Keller, CMT explores leadership rotation in August 2025, highlighting failed breakouts, key breadth indicators, and how to use scans on StockCharts to...

READ MORE

MEMBERS ONLY

Is The Growth Stock Bubble Bursting?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he recaps the last week’s stock market action in this new video. Tom reviews the performance of the major indices, points out the relative strength in the Dow Jones last week, and comments on the high-growth NASDAQ 100 taking a well-deserved breather. From there, he breaks...

READ MORE

MEMBERS ONLY

How to Use the 4 MA for Better Timing in Trading & Investing

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe demonstrates how to apply the 4 simple moving average (4 MA) as both a short-term trading tool and a longer-term timing guide. He explains how this moving average can help identify opportunities, manage pullbacks, and improve decision-making across multiple time frames. Joe then reviews the current...

READ MORE

MEMBERS ONLY

S&P 500 Breakouts, Bitcoin Risks & Uber’s Next Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank takes a close look at the S&P 500, key indices, ETFs, crypto, and a recent trade idea. Frank compares the 2025 market to 2020 patterns, reviewing corrections and highlighting bullish and bearish setups. He focuses on weekly Bollinger Bands, GoNoGo charts, sector performance...

READ MORE

MEMBERS ONLY

Financials and Industrials Are Key to the Rally as Tech Takes a Breather

What to watch ahead of Powell: S&P 500 RSI divergence, NVDA under 20-day MA, key levels at 6212/6025/5852; can Financials and Industrials lead?...

READ MORE

MEMBERS ONLY

Tech Stumbles, Market Widens: What Savvy Investors Should Watch Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks wobble while other sectors firm up. Learn how breadth, equal-weight trends, and small/mid-cap strength can guide your investment decisions....

READ MORE

MEMBERS ONLY

StockCharts Insider: What’s the Deal with the S&P 100, 400, and 600 in the Market Summary?

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Have you ever wondered why the S&P 100, 400, and 600 show up in the Market Summary? They serve a purpose, mainly to give you a quick read on investor sentiment: whether Wall Street is favoring large-, mid-, or small-caps. Today, I’m going...

READ MORE

MEMBERS ONLY

Bitcoin Fails at a New All-Time High; What’s Next?

by Martin Pring,

President, Pring Research

Earlier this summer, I pointed out that Bitcoin had experienced a bearish shooting star on the day it experienced a new all-time high, and noted that this probably foreshadowed some short-term weakness. I pointed out that no damage whatsoever had been done to the basic uptrend, as the consensus of...

READ MORE

MEMBERS ONLY

Jackson Hole 2025: Investors Stay Calm as Bond Volatility Hits Lows

Despite rising inflation pressures and fresh Fed minutes, Treasury volatility and credit spreads remain near multi-year lows ahead of Powell’s speech....

READ MORE

MEMBERS ONLY

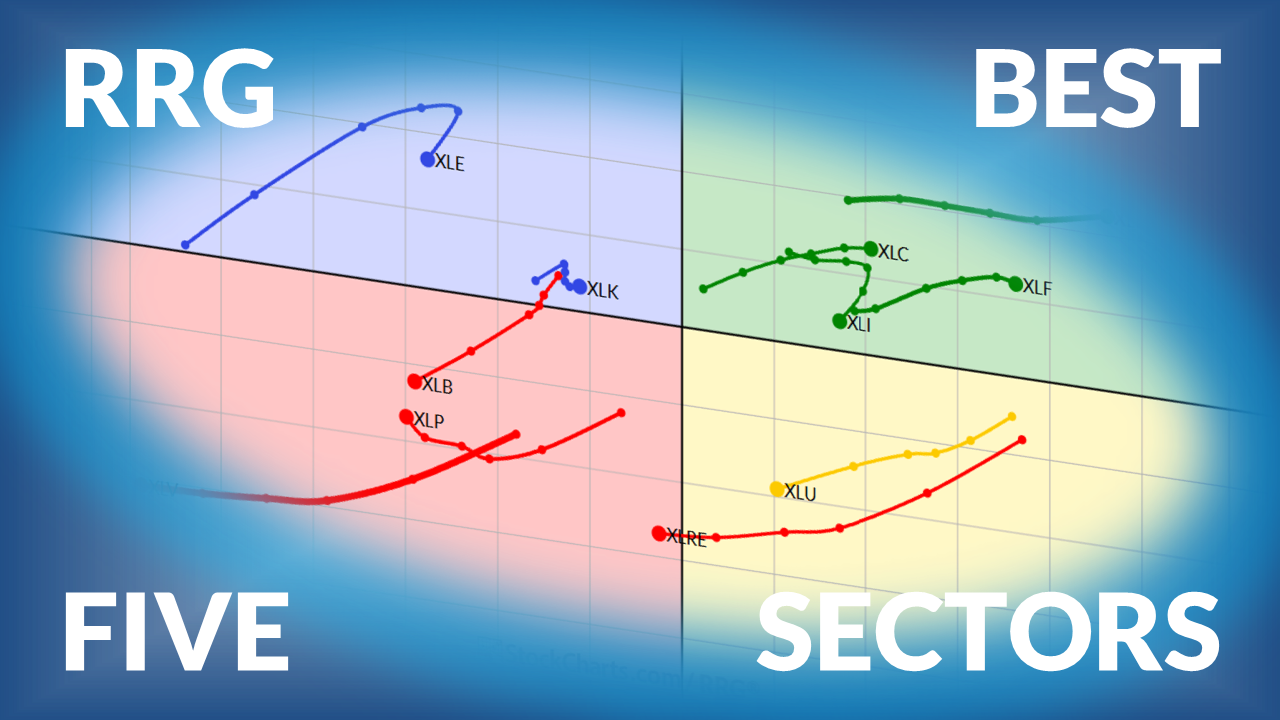

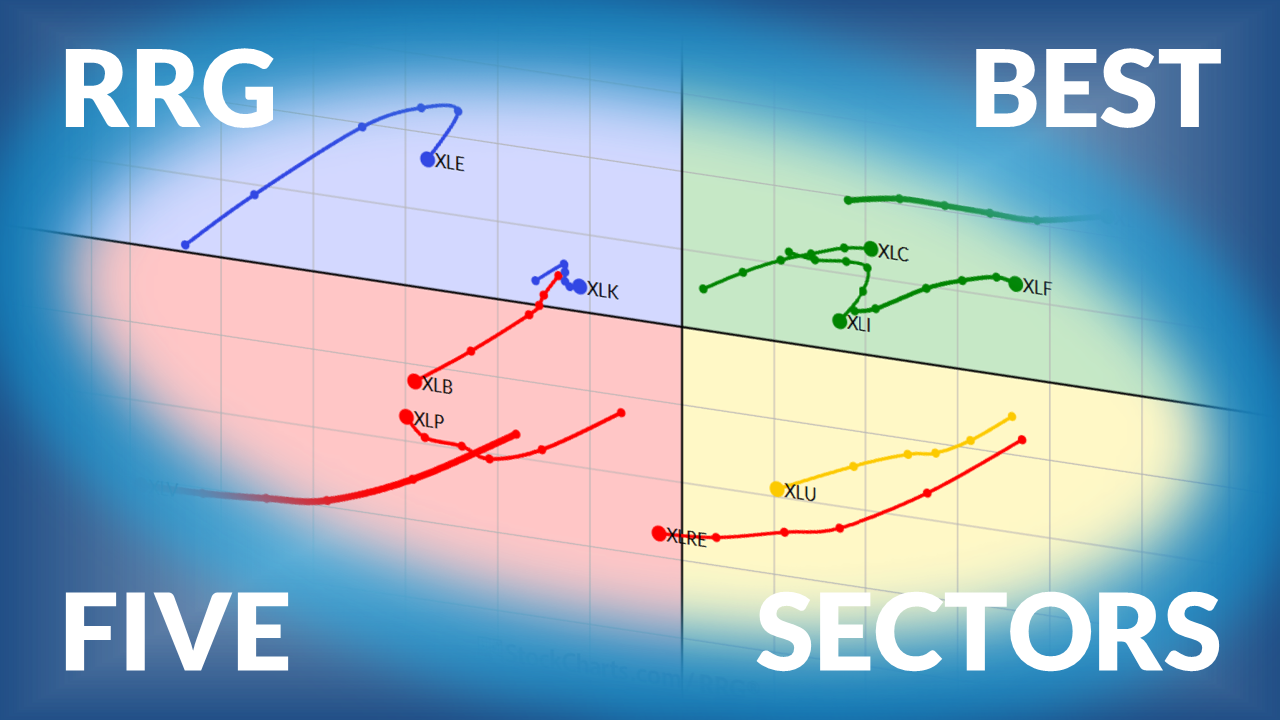

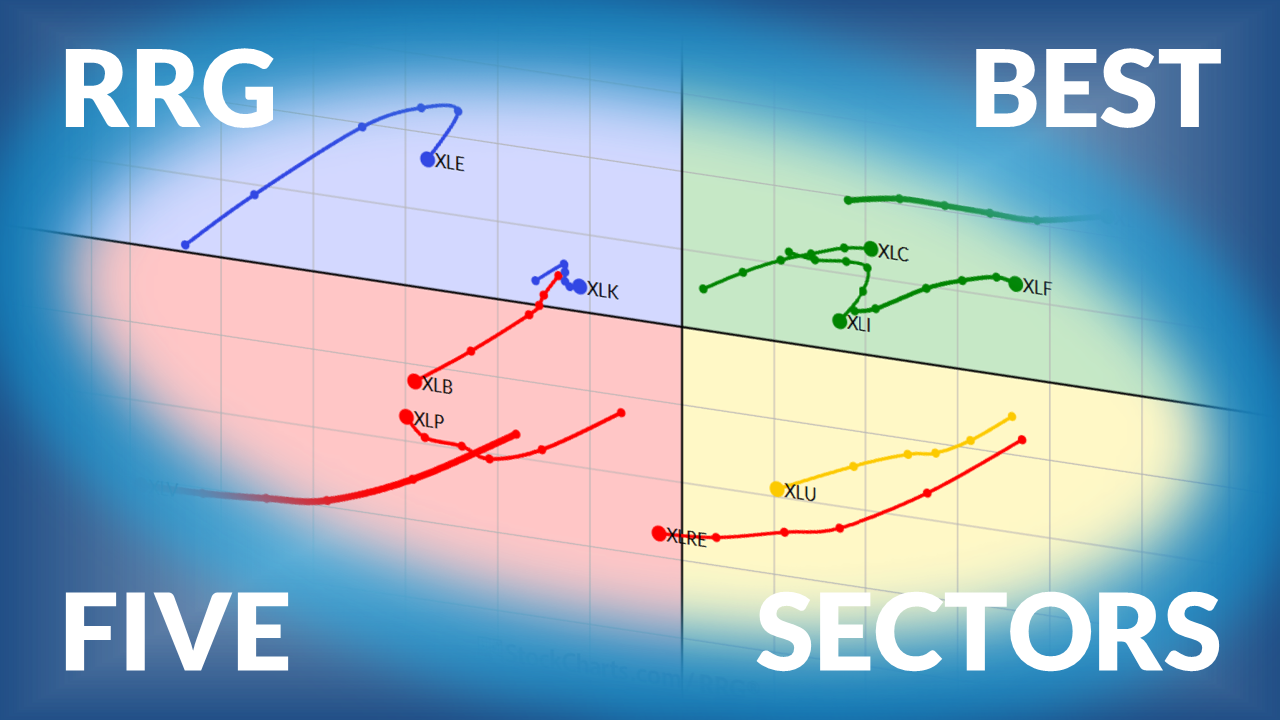

The Best Five Sectors this Week, #32

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

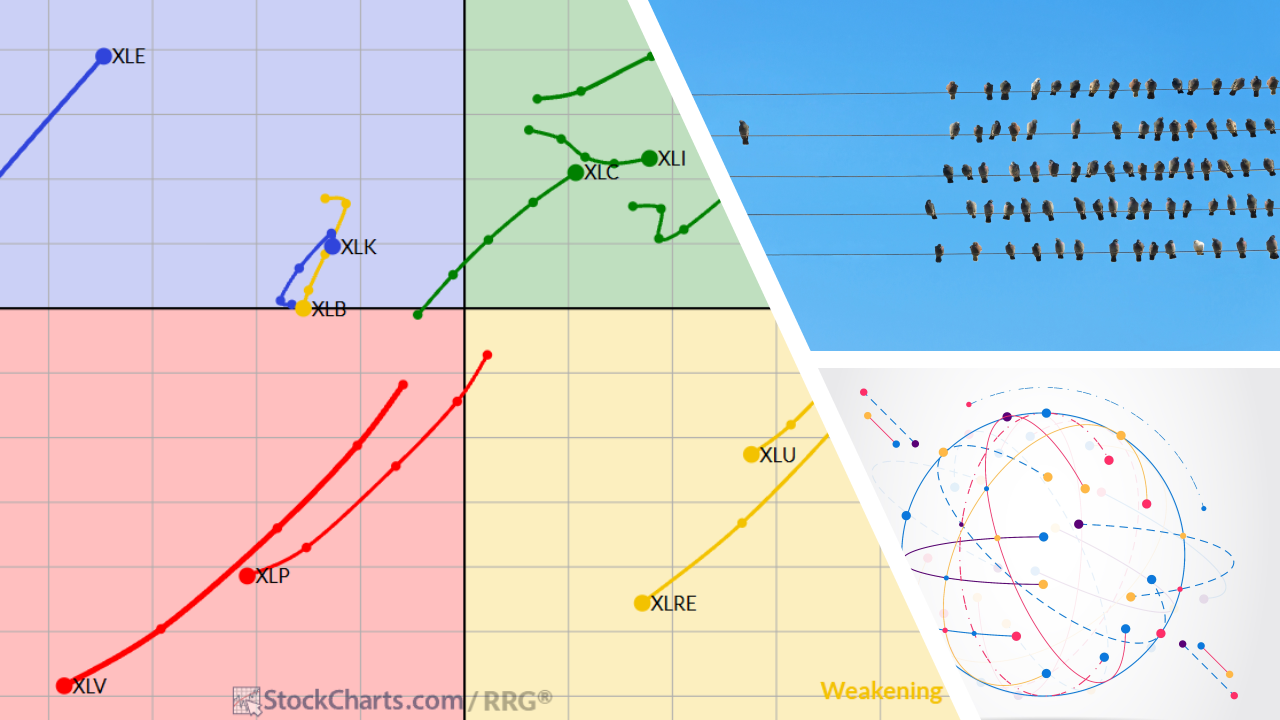

Weekly update on US sector rotation using Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

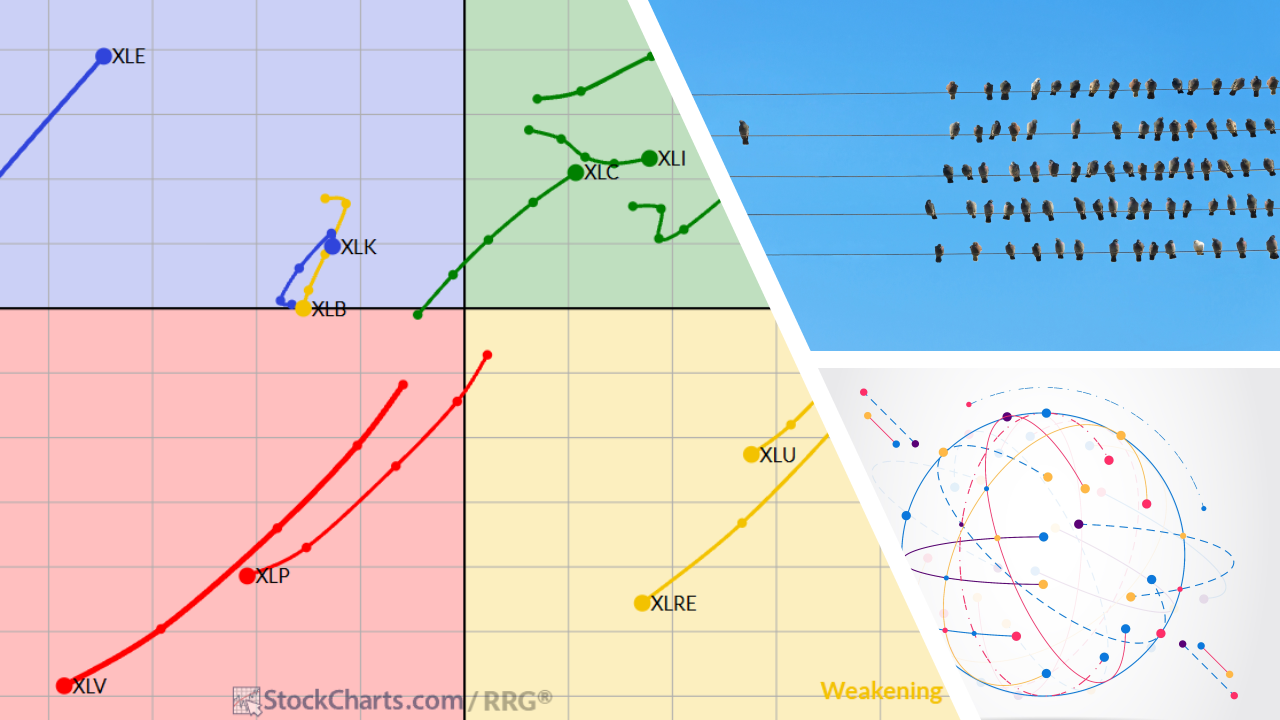

Visualizing Breadth and Rotation Using RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When it comes to understanding what’s really going on beneath the surface of the market, two key concepts come to mind: breadth and rotation. Breadth helps us gauge the participation behind a trend, while rotation reveals where the strength is moving within the universe we’re analyzing. Combine both,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Snaps 6-Week Losing Streak; Trend Intact as Long as This Level Stays Protected

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty breaks its weeks-long loss streak, and many sectors are experiencing strengthening relative momentum....

READ MORE

MEMBERS ONLY

Surprise Sector Surge as Market Leaders Stall!

by Mary Ellen McGonagle,

President, MEM Investment Research

On this week’s show, Mary Ellen McGonagle analyzes a notable shift in market leadership as former top sectors slow and new areas step up. She covers the latest sector performance — from healthcare and biotech to home builders, retail, and small caps — and shows you how to navigate the changing...

READ MORE

MEMBERS ONLY

This Week in Charts: Surprises Ahead?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Wow! What a Week on Wall Street!

The S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and the Dow Industrials ($INDU) all flirted with record highs at some point during the week, small caps stole the spotlight for a couple of days, and some beaten-down names like UnitedHealth Group (UNH)...

READ MORE

MEMBERS ONLY

Short-Term Market Swings: A Gentle Rhythm of Short-Term Bounces

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Get the latest S&P 500 analysis with a focus on RSI negative divergence, short-term swing setups, and market breadth trends. Learn what current patterns mean and how to spot the next move....

READ MORE

MEMBERS ONLY

Friday Chart Fix: QQQ Overtakes QQEW, GOOGL Near New High, Groups with Most Highs, Verizon Gaps Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Which charts stand out this week? Arthur Hill analyzes the market and does a deep dive into the charts with price action that's not to be ignored....

READ MORE

MEMBERS ONLY

Can Gold Defy Gravity and Break to the Upside?

by Martin Pring,

President, Pring Research

Why does gold look ready to "defy gravity"? Martin Pring explains the technical signs....

READ MORE

MEMBERS ONLY

Rate Cut Rally: Stocks & Sectors Poised to Surge!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Join Tom as he reviews the explosive gains in small-cap stocks following the July CPI report. He also looks at the breakout in the Russell 2000, along with strength across key sectors like transports, biotechs, regional banks, and home construction. From there, he covers major index performance, key technical breakout...

READ MORE

MEMBERS ONLY

Consumer Discretionary Breakouts — 3 Stocks to Watch Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Discover which sectors are leading — and which to avoid — with Julius' latest RRG analysis. Follow along as he breaks down weekly and daily sector rotations, revealing technology’s dominance, potential in consumer discretionary, and why some defensive sectors are showing unexpected strength. Julius then dives deeper into the consumer...

READ MORE

MEMBERS ONLY

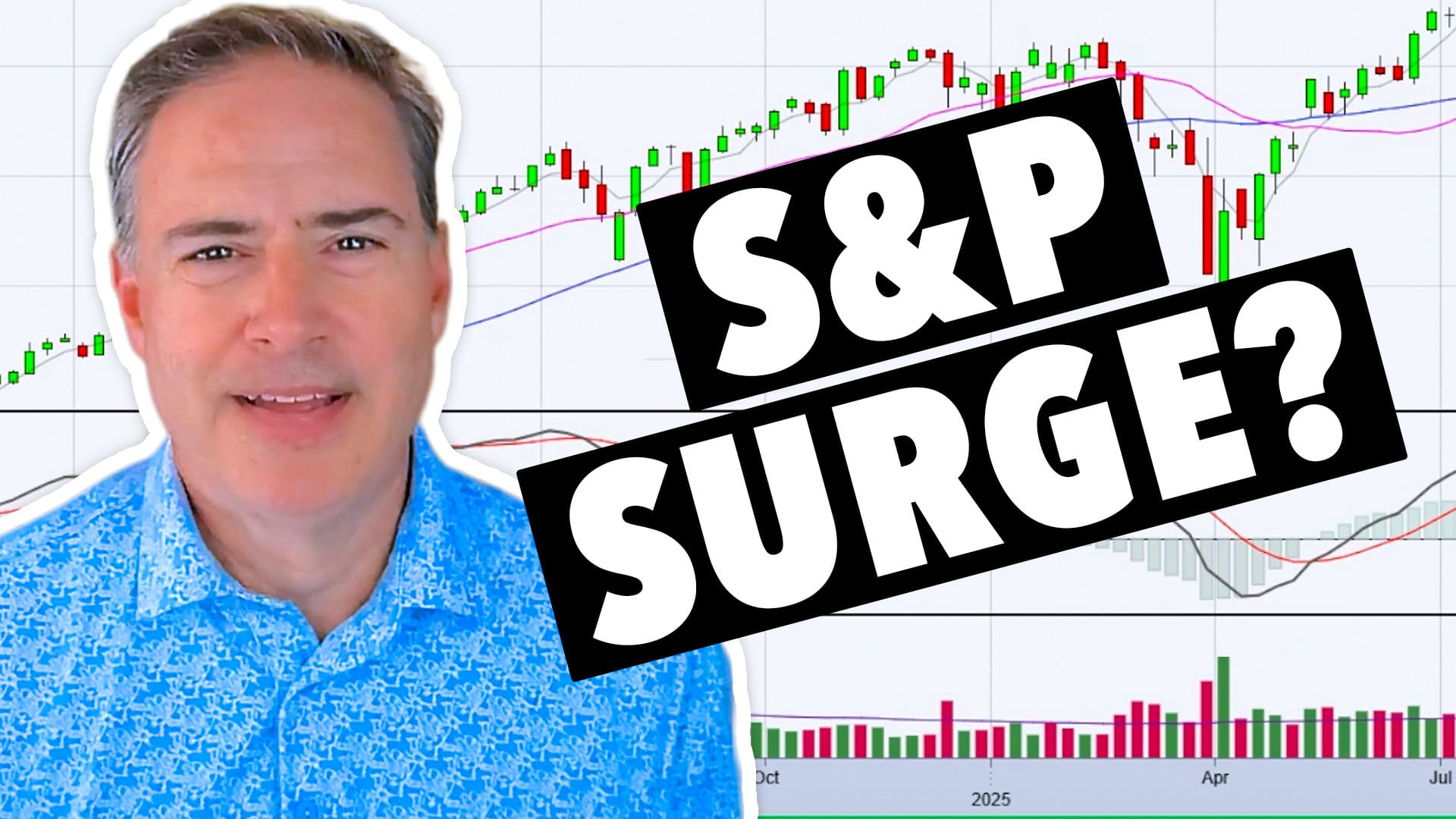

Is the S&P 500 About to Surge?

by Joe Rabil,

President, Rabil Stock Research

Joe analyzes the S&P 500’s current sequential wave pattern and, from there, explains how to spot a shift into a surging market phase. He breaks down key support and resistance levels on the SPY daily chart, evaluates the QQQ and IWM for signs of market strength, and...

READ MORE

MEMBERS ONLY

What to Make of the Small-Cap Rally: A Closer Look at IJR and IWM

Small-cap stocks are showing signs of strength. Investors should keep an eye on the performance of IWM and IJR, two small-cap ETFs, to determine if the small-cap rally has legs....

READ MORE