MEMBERS ONLY

PSX Replacing ETR as a New Short in the RRG Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The last update on the RRG baskets goes back to 20 July. In that post, I did a big clean up and left the basket with the following positions:

LONG: EXR, WM, CRM

SHORT: ETR, XLY, SWKS

LONG Basket

The RRG for the three stocks on the long side shows...

READ MORE

MEMBERS ONLY

Chartwise Women: Find the Best Chart Setups For You Right Now!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Mary Ellen and Erin share the best chart set-ups that are working in the current markets. They also review stocks that have those characteristics, as well as historical precedent stocks that uncover how to trade with success.

This video was originally...

READ MORE

MEMBERS ONLY

Want to Determine the Depth of a Pullback? Learn How ADX Can Help

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses ADX slope to determine how deep of a pullback to expect in a trending stock or market. He explains how an extra moving average can be used to see this more clearly. Then,...

READ MORE

MEMBERS ONLY

Will the Russell 2000 (IWM) Break to New Highs?

Recently, the small-cap index Russell 2000 (IWM) cleared $225. This was a main resistance level dating back to early August. Now that IWM had cleared resistance, will it make new highs?

One way we can judge the odds of IWM's continued rally is by checking its underlying momentum...

READ MORE

MEMBERS ONLY

Utilities and Staples at Opposite Rotations on RRG; What Does That Tell Us?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I focused on the long-term trends using monthly charts. For several months already, most sectors have been in an uptrend on these charts; only the energy sector and the utilities sector did not qualify as such (higher highs and higher lows...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships are Signaling Danger for Commodities

by Martin Pring,

President, Pring Research

When considered in their own right, commodities, as represented by the CRB Composite, are in a primary bull market. Chart 1, for instance, shows that the Index is above its 12- and 24-month moving averages and the long-term KST is also in a bullish trend. That said, this momentum indicator...

READ MORE

MEMBERS ONLY

How to Navigate September Trading with Gold, Junk Bonds, and Long-Term Bonds

The market is about to enter the month of September, which many investors view as a historically negative month in the trading year. Also called the September effect, some analysts attribute a selling from investors rebalancing their portfolios at the end of the summer. However, is the September effect something...

READ MORE

MEMBERS ONLY

Participation Somewhat Improved, But Still Poor

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

When the 20-EMA crosses up through the 50-EMA, we consider it to be an intermediate-term BUY signal (aka Silver Cross, as opposed to the Golden Cross, to be discussed later). A few years ago, we developed the Silver Cross Index (SCI), which shows the percentage of stocks in a given...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Break in Utilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Did you see the break in Utilities? On this edition of StockCharts TV's Sector Spotlight, it's all about the monthly charts. As the last Tuesday of this month (August) also happened to be the last day of the month, I decided to push things forward a...

READ MORE

MEMBERS ONLY

Are These 5 Key Sectors and Small-Cap Index Lagging or Leading the Market Higher?

On Monday, both the S&P 500 (SPY) and the Nasdaq 100 (QQQ) climbed to new highs once again.

While the large-cap indices continue to lead the market, the Economic Modern Family made little progress. However, each Family member is standing its ground and may only be lagging when...

READ MORE

MEMBERS ONLY

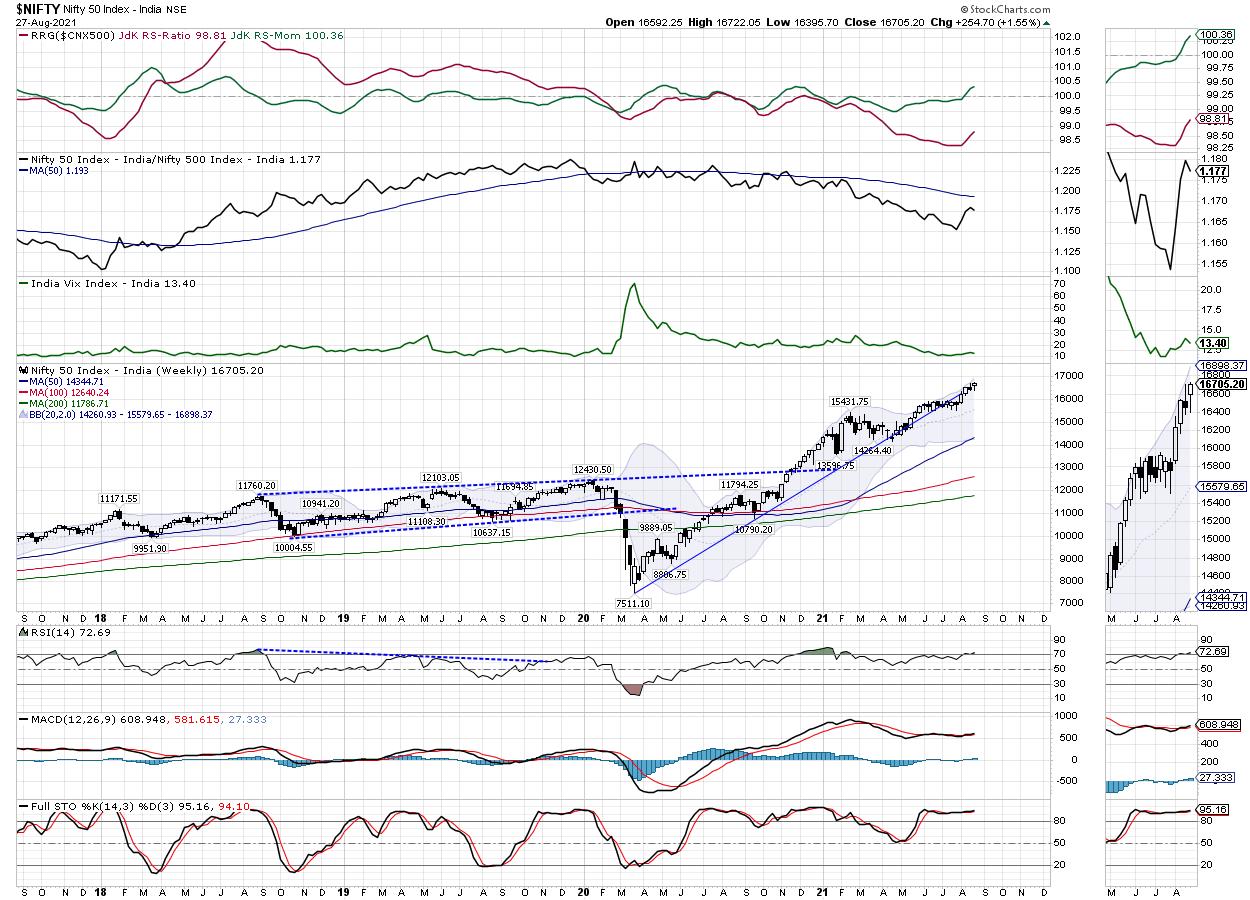

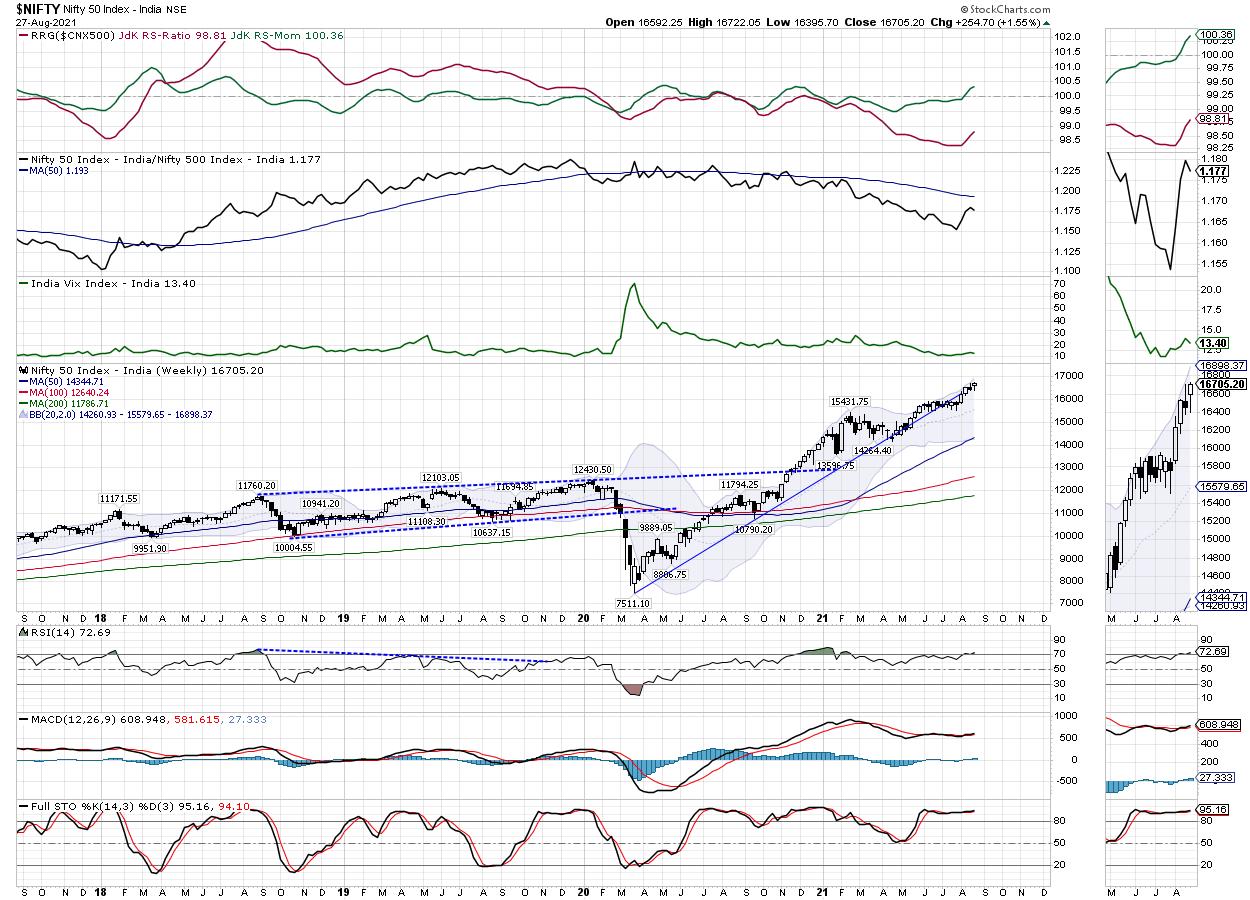

Week Ahead: NIFTY Makes Some More Room for Upside; Chase Momentum While Protecting Profits Vigilantly

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, it was mentioned that, although the markets are due for some range-bound consolidation, defending the zone of 16300-16450 will be crucial for the NIFTY. Over the past five days, the NIFTY kept marking intermittent highs with some consolidation in between. During some interim profit-taking pressure,...

READ MORE

MEMBERS ONLY

This Group Has Much Further Upside Ahead -- Here Are Stocks Set to Benefit

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week was an eventful period for the markets, as two highly impactful news items converged in a perfect storm that could push the markets higher over the near-term and beyond.

At the beginning of the week, Pfizer's COVID-19 vaccine was fully approved by the FDA. The news...

READ MORE

MEMBERS ONLY

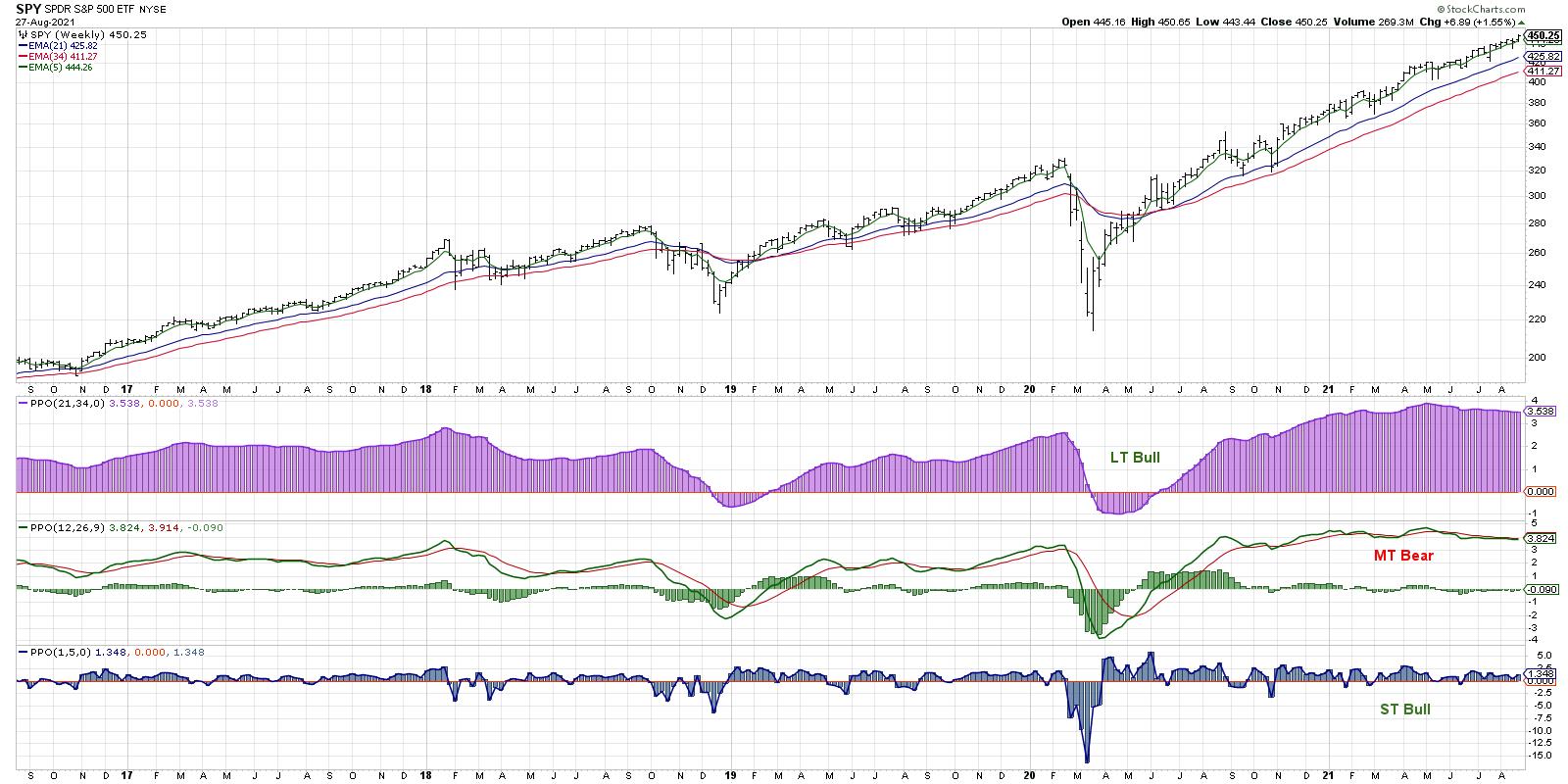

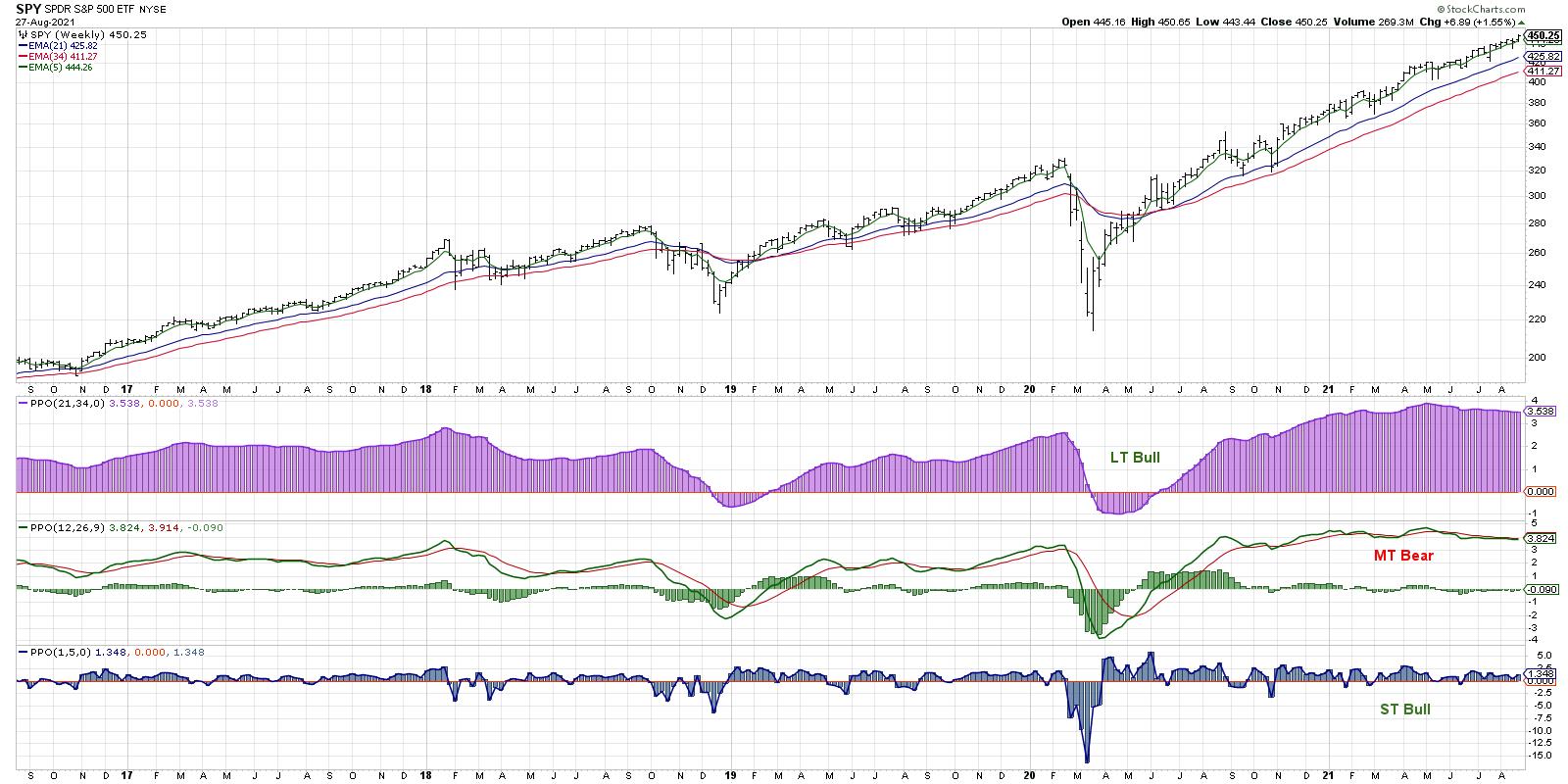

Three Reasons I'm a Little Less Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My medium-term Market Trend Modelturned bearish in May and has remained consistently bearish ever since. The market hasn't seemed to notice and has continued to make new all-time highs in every subsequent month.

So how do we reconcile these two conflicting signals, with a model turned negative and...

READ MORE

MEMBERS ONLY

Making the Case for This Small Cap Software Stock to Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It wasn't too long ago that a $5 billion market cap company was considered a "mid-cap". But in today's mega-cap world of Apple (AAPL) and Microsoft (MSFT) sporting $2.46 trillion and $2.25 trillion market caps, respectively, $5 billion to them is spare...

READ MORE

MEMBERS ONLY

RRG's Road to StockCharts.com

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This month marks exactly seven years ago that I started contributing to the StockCharts website, after Relative Rotation Graphs were added to the graphical toolbox in July 2014.

As the number of eyeballs on RRGs, the blog and the weekly episodes of Sector Spotlight has grown substantially over these years,...

READ MORE

MEMBERS ONLY

A Pivotal Week for the Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

This week on StockCharts TV'sThe MEM Edge, Mary Ellen reviews shifting dynamics in the market after several impactful news items were released. She also shares a major group that's just now turning bullish, with much further upside ahead.

This video was originally recorded on August 27,...

READ MORE

MEMBERS ONLY

The Market Boasts Strength While the Dollar Drops and Gold Rises

On Friday, the Fed's Jackson Hole symposium stimulated the market, with all 4 major indices closing positive. Due to the improvement in the economy, the Fed feels more comfortable with tapering monetary policy possibly near the end of 2021. This means the Fed would begin to reduce the...

READ MORE

MEMBERS ONLY

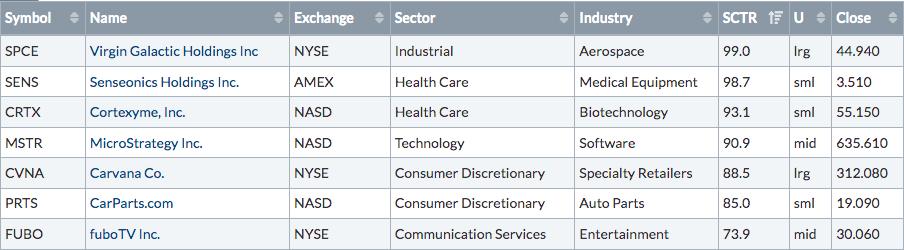

Sample: EB Monthly Short Report - August 2021

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading stocks with a lot of short interest is a risky proposition. Many are being shorted for a reason and they drift lower and lower over time. However, not all short sellers are correct, and when a stock begins to break out and forces short sellers to cover (buy), that&...

READ MORE

MEMBERS ONLY

Multiple Timeframe Price Structure

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses how to view Price Structure in multiple timeframes. He shows how each time frame provides its own insight into improving your stock selection and timing. He also explains how it can be used to confirm Moving...

READ MORE

MEMBERS ONLY

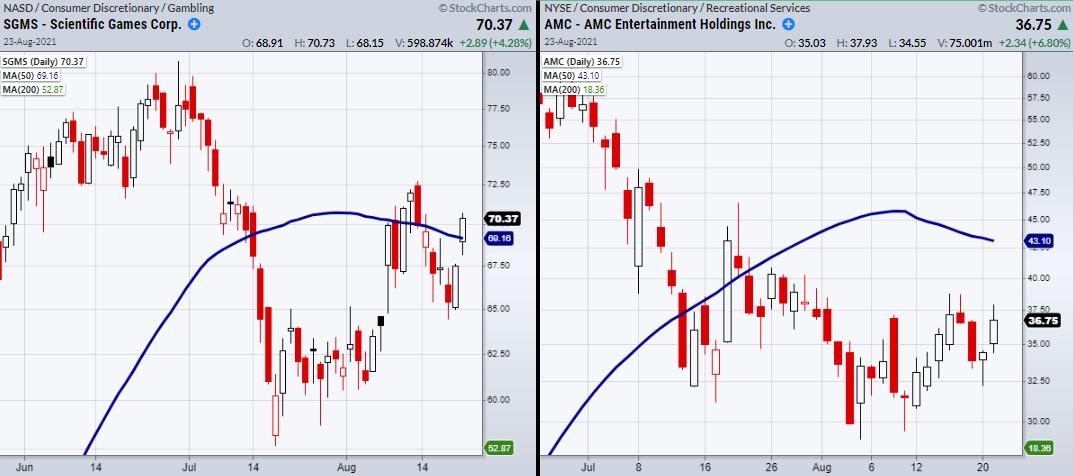

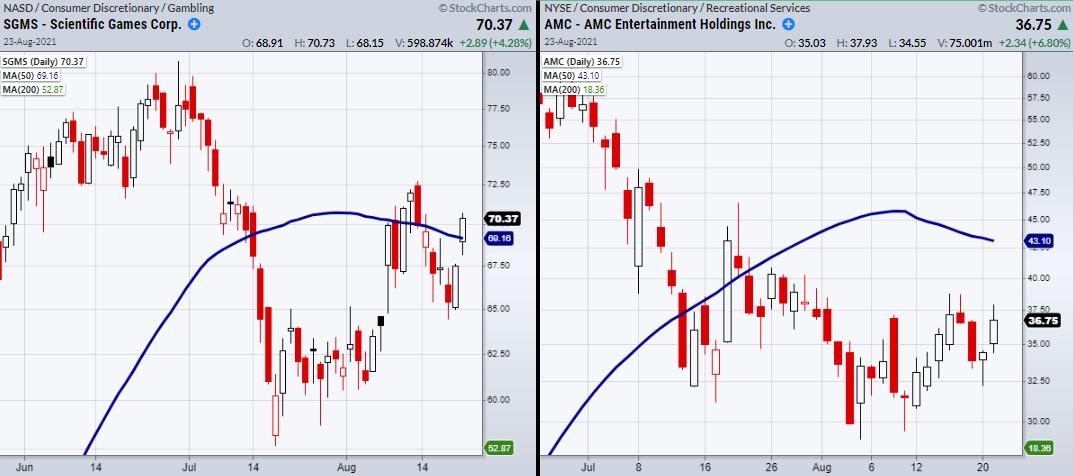

Chartwise Women: Meme Stocks are Back!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen discuss the rise in stocks that are getting social media hype. They also review the short squeeze concept and charts of names on the move, such as GME and AMC. In "Yeah... That Happened!", the...

READ MORE

MEMBERS ONLY

Great Buy Point Coming for Stocks?

by Larry Williams,

Veteran Investor and Author

October has historically been a seasonal sweet spot for stocks to stage substantial rallies. But will that be the case this year? In this special presentation, Larry looks to answer this question with facts and figures.

This video was originally broadcast on August 26, 2021. Click anywhere on the Larry...

READ MORE

MEMBERS ONLY

Dollar Index Breakout Trick or Treat?

by Martin Pring,

President, Pring Research

Back in June, I wroteabout the possibility that a major reversal in the dollar could be underway, but that certain things had to happen before we could come to a firm conclusion. One of those conditions was a Dollar Index daily close above 93.5, as that would complete what...

READ MORE

MEMBERS ONLY

Will the Upcoming Fed Meeting Affect the Market?

With the Jackson Hole Fed meeting coming up, the market could be expecting taper talks, as the Fed at some point will be looking to decrease their $120 billion monthly bond-buying program. However, the Fed has been very accommodating and with the COVID-19 delta variant, does not want to jostle...

READ MORE

MEMBERS ONLY

Before the Bomb Blows Up

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explains how, eventually, the stock market (or any market, for that matter!) will lose half or more of its value. Once this occurs, it's too late to do anything. The bomb's already blown up. Fortunately, you can learn while...

READ MORE

MEMBERS ONLY

Does Lower Bitcoin Volume Matter as $BTC Attempts to Clear 51K?

Bitcoin continues its rally up with a recent break over the 50K price level. However, many investors are watching for Bitcoin to clear 51K as the next hurdle. With that said, if we are expecting Bitcoin to run higher, we should keep in mind recent support levels, along with volume...

READ MORE

MEMBERS ONLY

EUR/USD Completes H&S Top Formation and Looks Ready For a BIG Move Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation for the G10 currencies against the USD, which is the base (=benchmark) for this universe. Or, better, it shows nine of the G10 currencies against the USD.

The general direction for this universe is pretty clear. The majority is moving inside the...

READ MORE

MEMBERS ONLY

Sector Spotlight: H&S Formation Calls for BIG Move

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take a chance and bring in seasonality for next month. Usually, we do that on the last Tuesday of the month, but this time the last Tuesday (next week) falls exactly on the last day of August and we...

READ MORE

MEMBERS ONLY

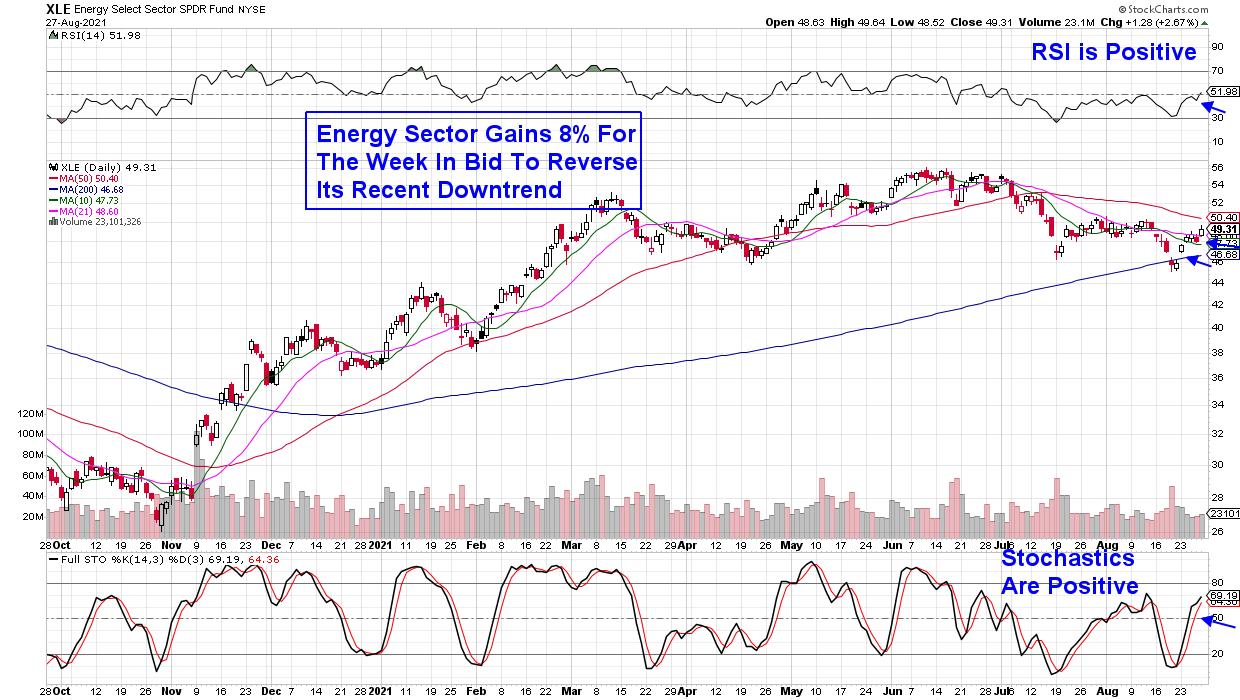

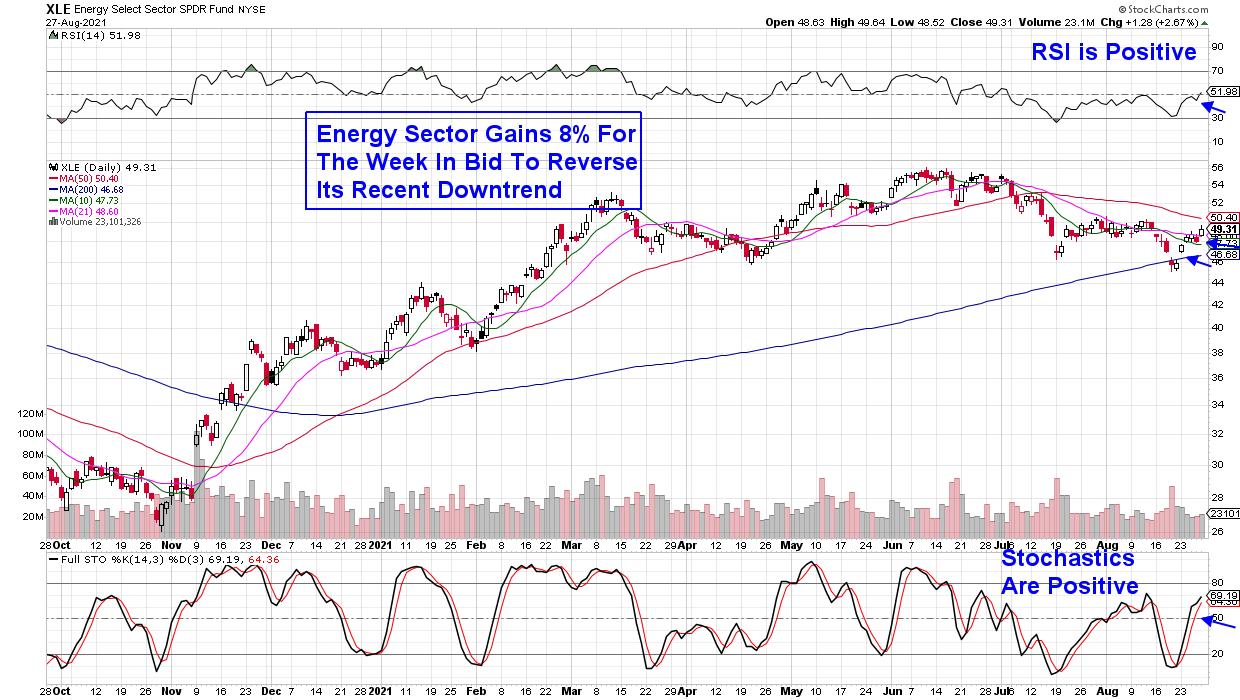

DP TV: Healthcare Momentum Sleepers

by Erin Swenlin,

Vice President, DecisionPoint.com

In this episode of DecisionPoint, Erin gives us an in-depth overview of the markets. Bitcoin is poised to move higher, Oil and Gold are rebounding and we have an outlook on the Dollar. Erin then spotlights Healthcare (XLV), Communications Services (XLC), Energy (XLE) and Utilities (XLU). To finish, she takes...

READ MORE

MEMBERS ONLY

Which Symbols to Watch if Russell 2000 (IWM) Clears Key Resistance

On Monday, the market continued its rally from Friday of last week, with the S&P 500 (SPY) and Nasdaq 100 (QQQ) clearing all-time highs. Again, the tech sector and large-cap stocks are leading the market higher.

However, we should not forget about the Russell 2000 small-cap index (IWM)...

READ MORE

MEMBERS ONLY

Two Scorching-Hot Groups Are Set Up For A Significant Decline - SELL NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the biggest developments in recent weeks has been the breakout in the U.S. Dollar Index ($USD). I've been expecting it and it happened last week:

The black arrows are marking all of the RSI tops at 65 and above and all the bottoms at 35...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Ranged; Approach Markets in a Highly Stock-Specific Way

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned that the only trouble with the otherwise buoyant NIFTY is that it is overextended on the daily chart. The week that went by saw the markets consolidating at higher levels. On the global landscape, the "taper tantrums" from the Fed...

READ MORE

MEMBERS ONLY

Total Volume is Troubling

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, we have a possible "upside exhaustion climax." We didn't get confirmation of the climax because Total Volume was so low today. This is a problem. Today was options expiration -- we should have seen more volume. Additionally, it was a strong rally day and Total...

READ MORE

MEMBERS ONLY

Michigan Consumer Sentiment Drops 13.5% in July; What Does that Mean for US Equities?

by Martin Pring,

President, Pring Research

Last Friday (August 13), the University of Michigan released the initial August response to their consumer sentiment survey. A sharp 13.5% retreat was recorded. The Expectations Index fared even worse, with a 17.5% drop. According to the summary report, only six of these monthly surveys since the late...

READ MORE

MEMBERS ONLY

AMD Shows Patience is a Virtue as Opportunities Abound

by John Hopkins,

President and Co-founder, EarningsBeats.com

In my last ChartWatchers article, I discussed ways to profit from the terrific earnings season that we just experienced. So many companies put up solid numbers which led to the market reaching an all-time high.

I'm referencing my article from two weeks ago because it's a...

READ MORE

MEMBERS ONLY

Can the Markets Trade Higher from Here?

by Mary Ellen McGonagle,

President, MEM Investment Research

This week on StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's pullback and whether the markets can recover. She also shares dynamics taking place after companies report earnings as we go into next week's 2nd quarter release from well-known names.

This video was...

READ MORE

MEMBERS ONLY

How Strong is Russell 2000's (IWM) Current Rally?

Above is a chart of the Russell 2000 (IWM), which is one of the most valuable indices as it tracks 2000 small-cap companies and, therefore, gives a great picture of the overall market direction.

Since the beginning of 2021 IWM has been mostly rangebound. The high of the range is...

READ MORE

MEMBERS ONLY

Finance Sector Holds Breakout and Establishes Line in the Sand

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) is one of the leading sectors and recently broke out of a falling wedge correction. There was a little throwback this week, but the breakout is holding and remains bullish until proven otherwise. Let's see what it would take to prove otherwise.

First and...

READ MORE

MEMBERS ONLY

Chartwise Women: Chain Reaction - Why Stocks Move!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Mary Ellen and Erin review what a rising dollar or lower interest rates means for certain areas of the market. They also share impactful headlines that will drive the markets higher.

This video was originally broadcast on August 19, 2021. Click...

READ MORE

MEMBERS ONLY

Powerful Momentum Divergence

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe shows how momentum divergence is often used to look for changes in trend. He describes how he would use this type of analysis. Then, he explains how to use momentum divergence in a powerful way to get...

READ MORE

MEMBERS ONLY

Taper Talk: Smoke and Mirrors to Drive Prices Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One key element of our service at EarningsBeats.com is to address monthly max pain, which I define as the point at which in-the-money call premium completely offsets in-the-money put premium. As of Tuesday's close, there was a TON of net in-the-money call premium. On the SPY alone,...

READ MORE