MEMBERS ONLY

DOLLAR INDEX HAS A STRONG WEEK AS EURO FALLS -- GLOBAL INVESTORS ARE FAVORING U.S. ASSETS -- STRONGER $ WEAKENS COMMODITIES -- AND FOREIGN STOCK ETFS

by John Murphy,

Chief Technical Analyst, StockCharts.com

US DOLLAR INDEX TURNS UP... My Thursday message showed the Invesco US Dollar Index ETF (UUP) hitting a four month high and challenging its previous peak formed during October. It cleared that barrier on Friday. Chart 1, however, plots the US Dollar Index ($USD) which I prefer using to track...

READ MORE

MEMBERS ONLY

Consolidation May Spill Over To The Coming Week; RRG Chart Show These Pockets Staying Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained a six-day trading week for the markets. Saturday, February 01, 2020, was a full-trading day because of the Union Budget that was presented. The day turned out to be a wide-ranging day for the markets on expected lines as Union Budget is one of the most...

READ MORE

MEMBERS ONLY

Earnings Shine, Helping to Power Market Higher

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has shown incredible resiliency lately, shaking off the coronavirus epidemic, any negative economic reports, an impeachment trial and other developments that one would think could derail stocks. Yet here we are, with the market near record highs with traders seeming to "care less" about anything but...

READ MORE

MEMBERS ONLY

DecisionPoint Sentiment Update

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been some time since I revisited my sentiment charts. I used to do a weekly sentiment update on MarketWatchers, but since then I haven't written or talked about sentiment much, so it is long overdue.

Sentiment is a measure of how bullish and bearish participants...

READ MORE

MEMBERS ONLY

MEM Edge TV: Uncovering Top Prospects in a Remarkable Recovery Rally

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares how to quickly find the best picks in the fallout of the coronavirus pullback, as well as how to find and best play current pockets of strength. She also discusses what chart to use to trade Tesla...

READ MORE

MEMBERS ONLY

Travel Stocks Under Pressure Again

by John Murphy,

Chief Technical Analyst, StockCharts.com

My Tuesday message showed a number of travel and tourism stock groups with heavy exposure to China finding support near moving average lines; or regaining them. Today's message shows those same groups under pressure again today. Let's start with airlines. Chart 1 shows the Dow Jones...

READ MORE

MEMBERS ONLY

Welcome To "Symbol Summary", Your New Favorite Research Tool On StockCharts

by Grayson Roze,

Chief Strategist, StockCharts.com

"This new Symbol Summary is a game changer!"

-----

"Holy smokes! The new Symbol Summary page is amazing. Like WOW. StockCharts is now truly my one-stop shop for everything stock related."

-----

"I just wanted to tell you how much I am enjoying the new...

READ MORE

MEMBERS ONLY

A Bullish Hat-Trick for the Aerospace & Defense ETFs - But One is Seriously Lagging

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are three ETFs covering the defense and aerospace group and all three recorded new highs. Even though these ETFs cover the same industry group and have similar price charts, they are quite different when we look under the hood and one is seriously underperforming the other two.

The Aerospace...

READ MORE

MEMBERS ONLY

Preparation Pays Profits, Randomness Ruins Riches - Deal With Both!

by Gatis Roze,

Author, "Tensile Trading"

Does your investing ecosystem look like meteorological chaos? Remember the three R's — Randomness Ruins Riches. You may recall Warren Buffett saying that he doesn't invest in anything he can't explain to a 10 year old. So here's my Buffett 3-R Challenge to...

READ MORE

MEMBERS ONLY

TRAVEL STOCKS UNDER PRESSURE AGAIN -- AIRLINES, GAMBLING STOCKS, AND CRUISE LINERS RETEST MOVING AVERAGE LINES -- PLAYING SOME DEFENSE GOING INTO WEEKEND

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRAVEL STOCKS UNDER PRESSURE... My Tuesday message showed a number of travel and tourism stock groups with heavy exposure to China finding support near moving average lines; or regaining them. Today's message shows those same groups under pressure again today. Let's start with airlines. Chart 1...

READ MORE

MEMBERS ONLY

A Sharp "Hook" on the RRG and a Completed Wedge Suggest This Stock is Ready to Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some RRGs, my eye fell on a rare rotation in the Financial sector.

AIG, on the daily RRG, was coming from leading through weakening and just hit the lagging quadrant a few days ago. Then, just yesterday, the stock "hooked" back aggressively, taking it from...

READ MORE

MEMBERS ONLY

When a Strong Stock in a Leadership Group Pulls Back

by Mary Ellen McGonagle,

President, MEM Investment Research

Software stocks got hit yesterday, with the group down over 3% and many individual stocks seeing losses as high as 10% for the day. While the decline was due to lowered guidance from one of the faster movers in the group, realistically, many of these stocks were due a pullback...

READ MORE

MEMBERS ONLY

DOLLAR RALLIES TO A FOUR MONTH HIGH -- MOST MAJOR CURRENCIES ARE DROPPING -- THE EURO IS THREATENING CHART SUPPORT -- A STRONGER DOLLAR COULD SIGNAL GLOBAL INVESTORS ROTATING BACK INTO U.S. MARKETS -- BUT COULD BE NEGATIVE FOR COMMODITY PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX NEARS TEST OF EARLY OCTOBER HIGH...While recent volatility in stocks, commodities, and bonds has received a lot of attention, currency trading has been relatively quiet. But that may be changing. Chart 1 shows the Invesco US Dollar Index (UUP) climbing this week to the highest level in...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Difference Between Price Ratios and RRG-Lines

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I cover Asset Classes and Sectors using monthly charts, as usual given the start of the new month. After the break, I answer a question on the difference between a simple price ratio and the RRG-Lines.

This video was originally recorded...

READ MORE

MEMBERS ONLY

Trading Resolutions for 2020, Part 4

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave finishes his 20 trading resolutions for 2020, then discusses some mystery charts. He also presents a new "Best and Worst Trades of the Week" and talks OGRE and trend trades.

This video was originally recorded on February 5th, 2020. Click anywhere...

READ MORE

MEMBERS ONLY

Electrifying Tesla

by Carl Swenlin,

President and Founder, DecisionPoint.com

TSLA short-sellers no doubt feel that they have stuck their fingers into a light socket, or perhaps I should say they have been hot-wired to a charging station. Since last June's low, the value of TSLA stock has increased about four-and-a-half times. This week it advanced almost +50%...

READ MORE

MEMBERS ONLY

Is This Bullish or Bearish?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Earlier today, I was preparing for my weekly Sector Spotlight show on StockCharts TV (airing every Tuesday at 10:30am ET), and, as today is the first Tuesday of the month, that meant looking at monthly charts for Asset Classes and US sectors. This routine gives me a good (forced)...

READ MORE

MEMBERS ONLY

It's Still a Bull Market, But More Corrective Activity is Likely

by Martin Pring,

President, Pring Research

* Why the Correction Will Likely be Contained

* More Corrective Action Likely

* One Indicator Flashes a Buy Signal

* Conclusion

Why the Correction Will Likely be Contained

A couple of weeks ago, I wrote that a correction was inevitable, and presented a couple of indicators to suggest that it might be close....

READ MORE

MEMBERS ONLY

BIG JUMP IN ASIA BOOSTS GLOBAL STOCKS -- AIRLINES, CRUISE LINES, HOTELS, AND GAMING STOCKS ARE REGAINING MOVING AVERAGE SUPPORT -- COPPER STOCKS ARE ALSO FINDING SUPPORT -- DOW REGAINS ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING ASIA LEADS GLOBAL STOCKS HIGHER...A strong rebound in Asia today is giving a big boost to global stocks. Emerging markets in Asia led the rest of the world lower over the last two weeks. And are leading it higher today. Chart 1 shows the MSCI Asia ex Japan...

READ MORE

MEMBERS ONLY

DP Show: Coronavirus, Oil, Materials and Confirmations vs. Divergences

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin analyze the news regarding the coronavirus and its effects in China, including the side effect of depressed oil prices. Carl covers Oil, the Dollar and Bonds, while Erin zeroes in on the materials sector. Carl caps off the show with a discussion...

READ MORE

MEMBERS ONLY

High Returns and Low Correlations: The Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With stock markets in rapid decline this week, mindful investors should be looking around for opportunities. What asset classes are thriving while others are struggling?

A quick survey of the asset allocation will indicate that, while oil has been in freefall and stocks are now testing and failing at support,...

READ MORE

MEMBERS ONLY

Energy Is Now Primed For A Big Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know. I know. It's been the worst sector and the second worst sector isn't even close. Look at this sector leaderboard for the past six months:

The XLE is the ONLY sector in negative territory. Its SCTR score is 2.3. What the heck could...

READ MORE

MEMBERS ONLY

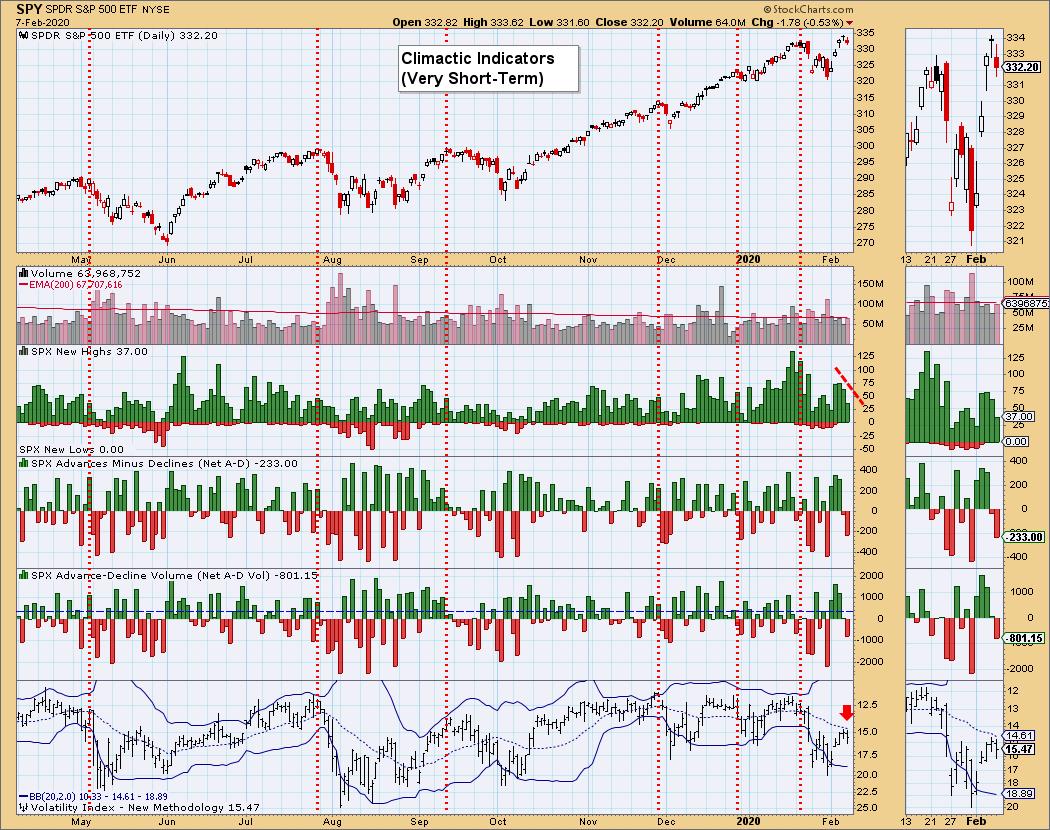

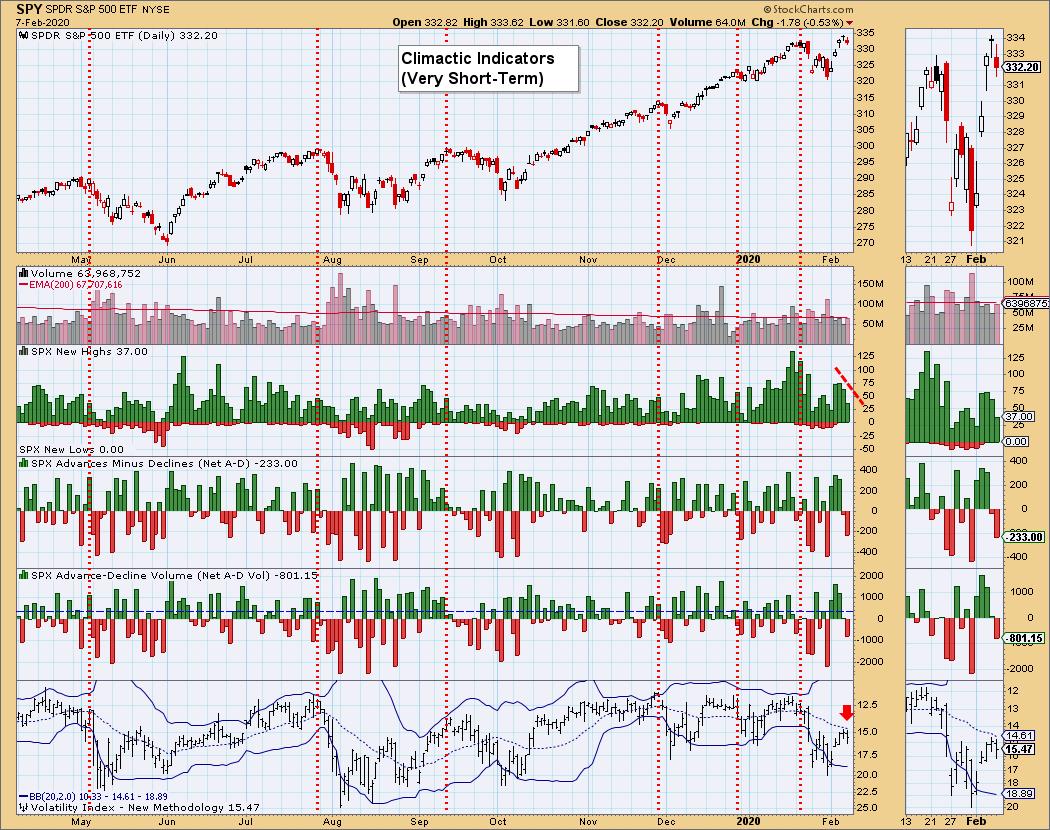

Another Triple 90% Down Day - What is it and what does it mean for stocks going forward?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure was extremely broad in Friday with all sectors declining and more than ninety percent of stocks in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 declining. While this kind of broad selling pressure creates a short-term oversold condition, it also...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS WERE DUE FOR A PULLBACK -- THE CORONAVIRUS IN CHINA IS JUST THE CATALYST FOR AN OVERDUE GLOBAL CORRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS WERE ALREADY STRETCHED TOO FAR...The coronavirus outbreak in China has rattled global markets all over the world, and rightly so. Fears of an economic slowdown in the world's second biggest economy is something to be concerned about. And market reactions certainly suggest that investors are...

READ MORE

MEMBERS ONLY

Key Support Levels To Watch On S&P 500 During This Correction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The selling was coming, we just weren't quite sure when. Well, it's here now, so how long might it last and how much pain might we endure? Both questions are difficult to answer, but I do know the 3-4 month channel has been broken. That tells...

READ MORE

MEMBERS ONLY

The Selling Wasn't Due To The Coronavirus; Here's What No One Is Talking About

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The selling that we saw last week was long overdue. Many are panicking over the coronavirus, which is easy to do when it's the only thing that the media is covering. After all, there has to be some fundamental reason that will lead to the next market collapse,...

READ MORE

MEMBERS ONLY

A Proven Method To Better Predict Earnings Results and Free Webinar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Relative strength.

It seems easy enough. Wall Street meets with management teams continuously throughout the year (except during quiet periods). Analysts evaluate not only business strategy, but also business integrity. It's an opportunity for executives to lay out their business plans and strategies to the people that matter...

READ MORE

MEMBERS ONLY

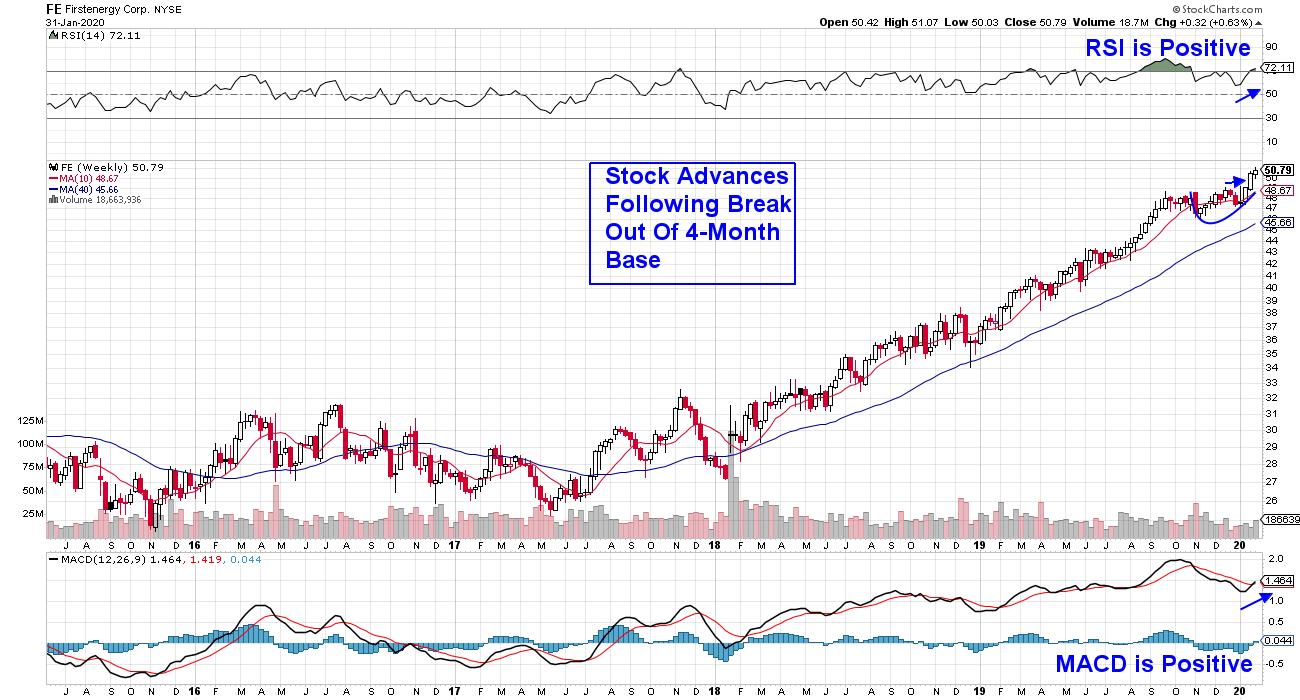

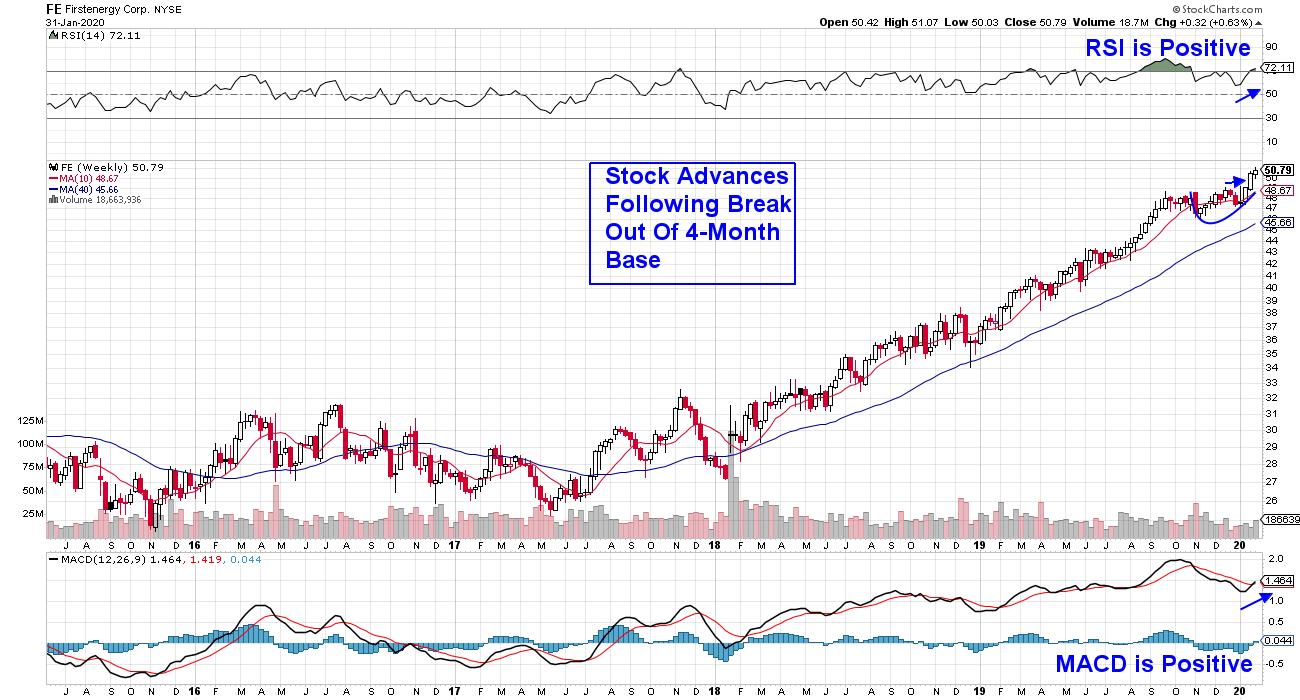

Putting Your Best Players on the Field in a Rocky Market Environment - Defensive Plays With Growth & Yield

by Mary Ellen McGonagle,

President, MEM Investment Research

The broader markets took it on the chin today as news of a sharp increase in the number of coronavirus cases brought fear-induced selling across most areas. Hardest hit were businesses that rely on healthy economic growth in China to buoy their bottom lines, while defensive areas held in well....

READ MORE

MEMBERS ONLY

The Shiny (and Bullish) Yellow Metal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With stock markets in rapid decline this week, mindful investors should be looking around for opportunities. What asset classes are thriving while others are struggling?

A quick survey of the asset allocation will indicate that, while oil has been in freefall and stocks are now testing and failing at support,...

READ MORE

MEMBERS ONLY

MEM Edge TV: How to Hedge Against the Coronavirus Pullback

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares select areas of the market that perform well during China-related market drops. She also reviews those areas in the direct line of fire and which could go much lower. This video was originally recorded on January 31st,...

READ MORE

MEMBERS ONLY

The Stock Market May Be Rattled by the Coronavirus, But Bond Yields Have a Battle of Their Own

by Martin Pring,

President, Pring Research

The stock market was roughed up by the coronavirus earlier in the week, but, under the surface, another battle has been going on -- the one between inflation and deflation, that is, as both yields and commodity prices have run up against key support levels. That's a dispute...

READ MORE

MEMBERS ONLY

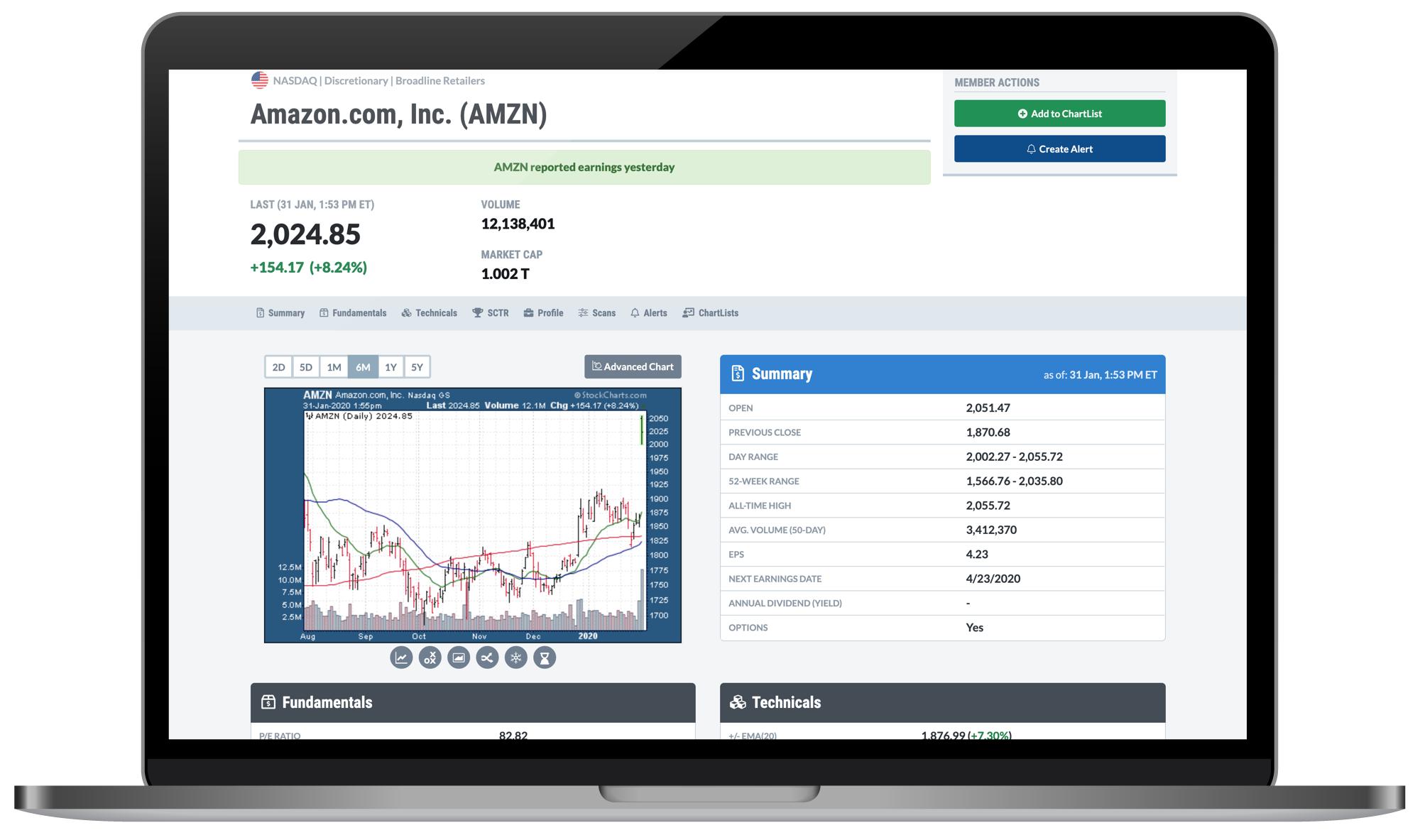

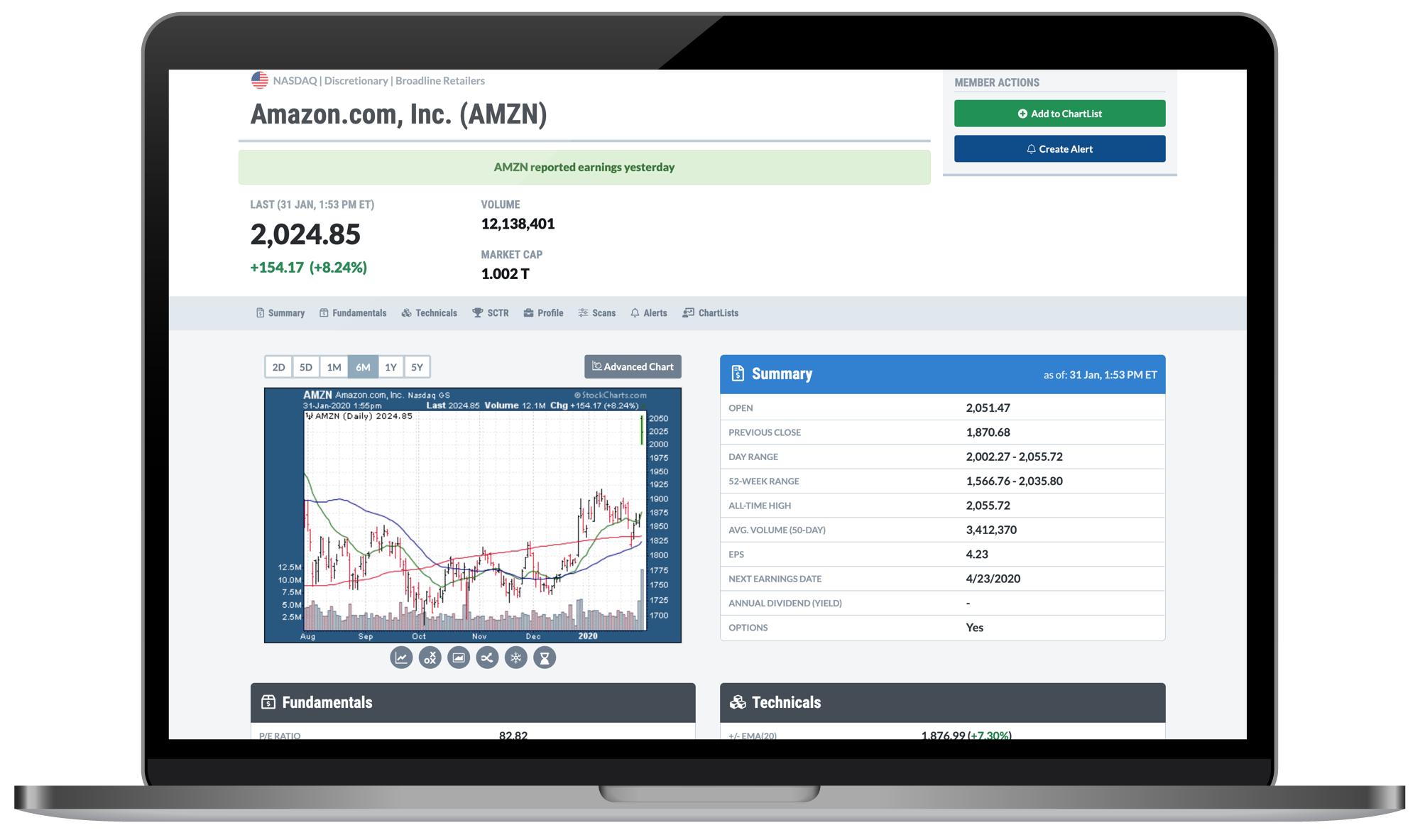

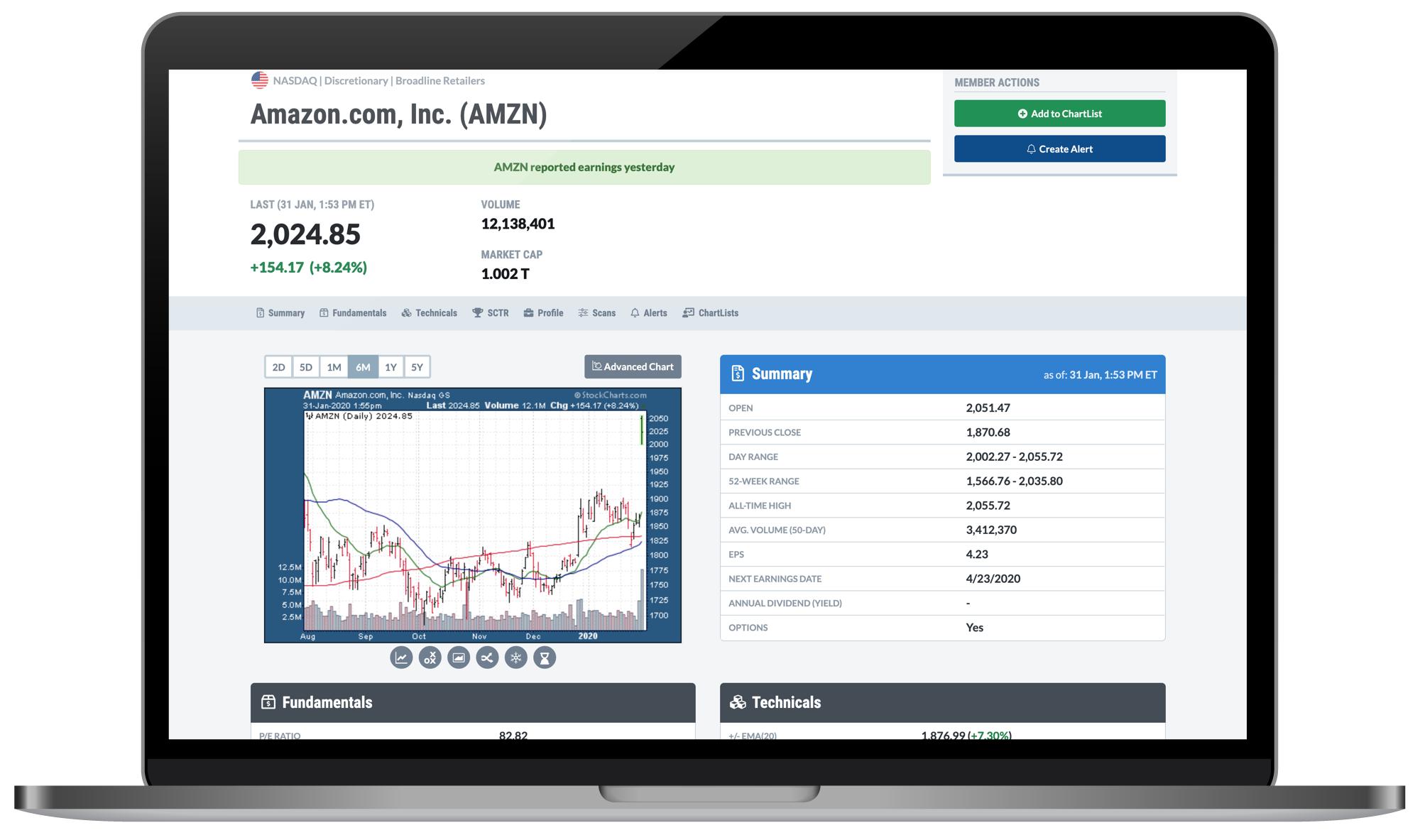

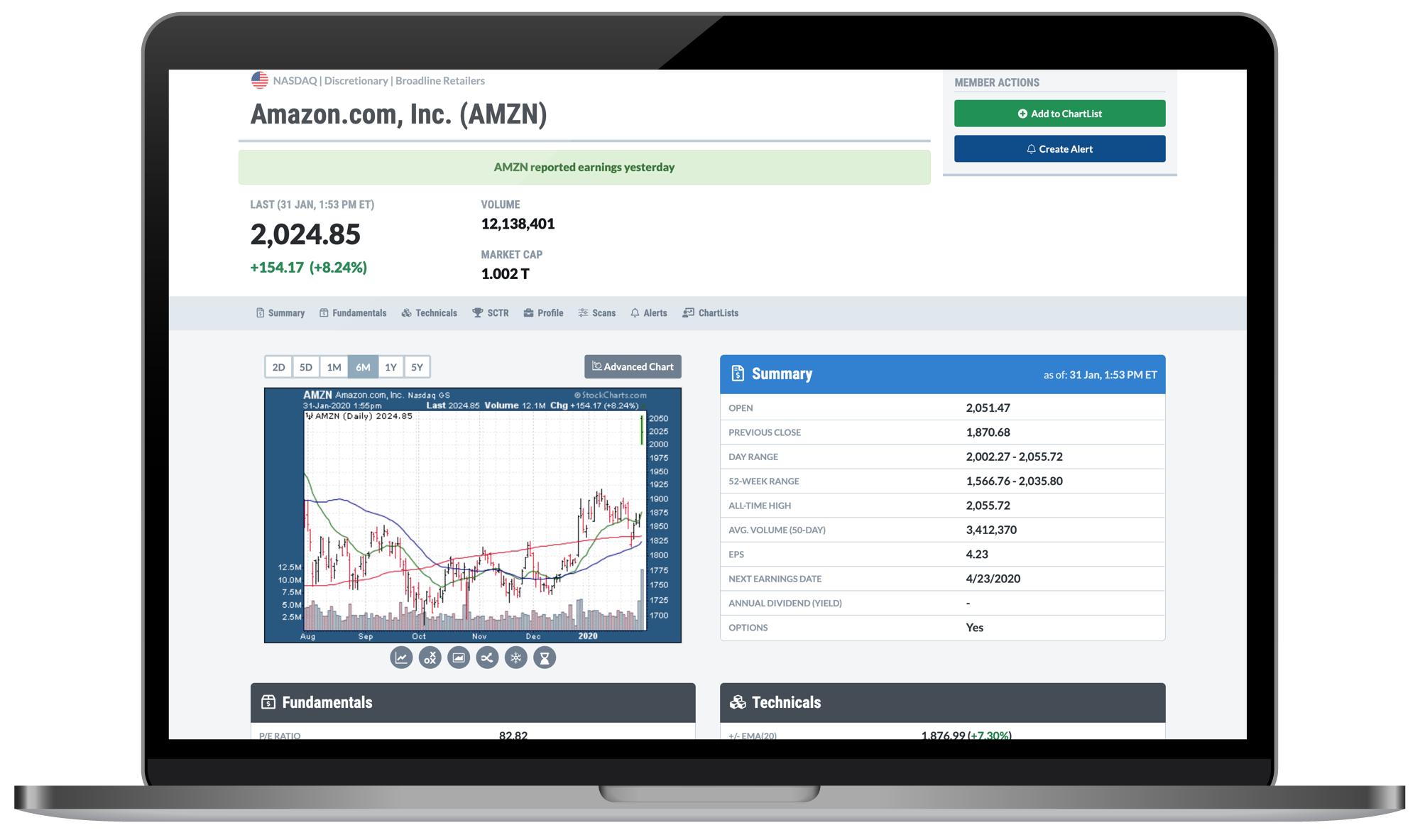

Introducing "Symbol Summary" - A New Full Quote View with Technicals, Fundamentals, Earnings, Dividends, Corporate Info and More, All In One Place

by Grayson Roze,

Chief Strategist, StockCharts.com

AMZN reported earnings yesterday.

Wondering how I know that? You probably think it's because my Twitter feed was blowing up or some notification came across my screen after the close. But here's the real answer...

I know that AMZN reported earnings yesterday because I saw it...

READ MORE

MEMBERS ONLY

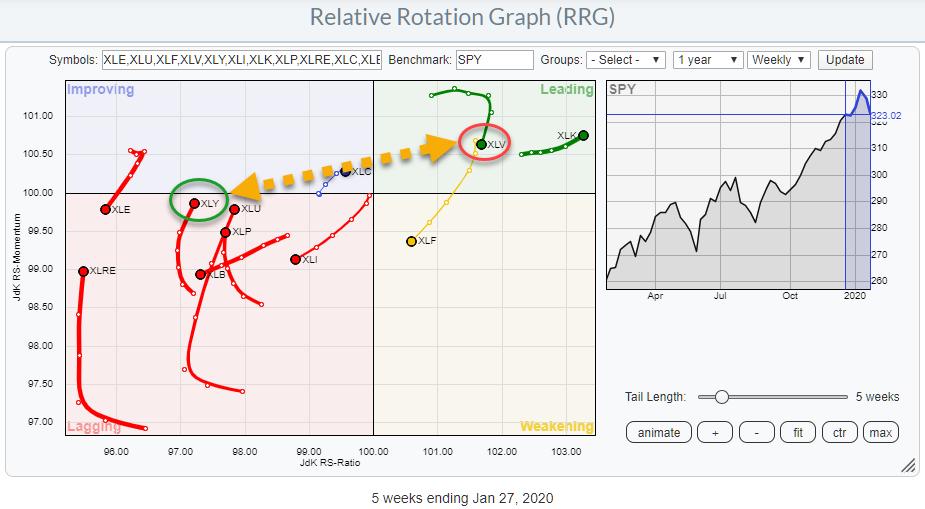

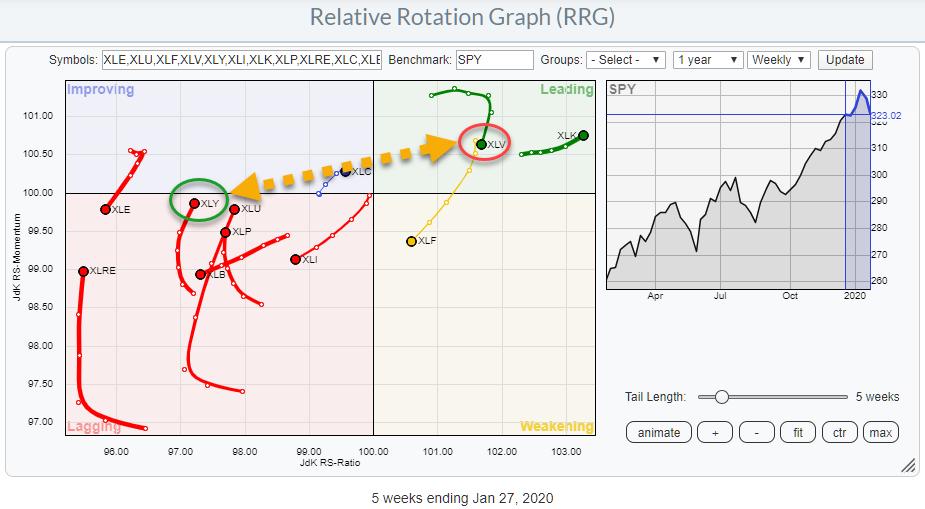

RRG Suggests Aggressive Trade Setup for XLY vs. XLV

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the weekly rotation for US sectors against SPY (S&P 500). While the S&P 500 chart is deteriorating and seems to be going into a correction, there are two tails on the RRG that suggest an interesting trade setup. (I already...

READ MORE

MEMBERS ONLY

CHINESE STOCKS LEAD EMERGING MARKETS LOWER -- THAT'S ALSO HURTING AUSTRALIAN MARKETS -- U.S. STOCKS REMAIN UNDER PRESSURE -- THE DOW IS THREATENING ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW THREATENS 50-DAY MOVING AVERAGE...Global stocks remain under pressure. My last message on Wednesday suggested that the continuing drop in bond yields and economically-sensitive commodities put the mid-week stock rebound in doubt. That still remains the case, not just here in the states; but even more so in foreign...

READ MORE

MEMBERS ONLY

Want To Better Predict Earnings Results BEFORE They're Released? Check This Out...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At the start of the week, I held a members-only webinar at EarningsBeats.com to provide my "predictions" of upcoming earnings reports based off of the charts. I've turned it into a formal study where I've been summarizing results all week. The best charts...

READ MORE

MEMBERS ONLY

Are People Queueing Up For a Big Mac?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors (XLY), the Consumer Discretionary sector started to curl up and move higher while inside the lagging quadrant. After a weak performance against SPY for months, XLY started to improve on the JdK RS-Momentum scale a few weeks ago and, very recently, also...

READ MORE

MEMBERS ONLY

Fantastic Trading Lessons

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave presents some examples of the best opening gap reversals (OGRes). He also covers intraday trading, this week's mystery chart and his eleventh 2020 resolution: "I will seek excitement and entertainment outside of the market." This video was originally recorded...

READ MORE

MEMBERS ONLY

LOWER BOND YIELDS AND WEAK COMMODITY PRICES CAST DOUBT ON STOCK MARKET REBOUND --

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS AND COMMODITIES CONTINUE TO WEAKEN...One of the recent warnings that I wrote about was the drop in bond yields that has taken place since the start of January. Most of that drop in yields took place last week when a flight to the safety of government bonds...

READ MORE

MEMBERS ONLY

The Stock Market May Be Rattled by the Coronavirus, But Commodities and Bond Yields Have Battles of Their Own

by Martin Pring,

President, Pring Research

* Bond Yields are Just Above Support

* Commodities are at Support

The stock market was roughed up by the coronavirus earlier in the week, but, under the surface, another battle has been going on -- the one between inflation and deflation, that is, as both yields and commodity prices have run...

READ MORE

MEMBERS ONLY

I Love Natural Gas

by Carl Swenlin,

President and Founder, DecisionPoint.com

Living in California, we pay a premium on just about everything, especially utilities in the summer. The monthly electric bill approaches $600, and water $300, but we do get relief with natural gas, which comes in at around $10. But don't say anything or our politicians will work...

READ MORE