MEMBERS ONLY

The First Chart of the Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

What was the first chart you looked at today? Was it for a stock that you read about in a blog or the newspaper? Was it for a company that was mentioned in that e-mail newsletter you saw? Was it for one of your holdings that you're concerned...

READ MORE

MEMBERS ONLY

FOMC Meets, Will They Get It Right This Time?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

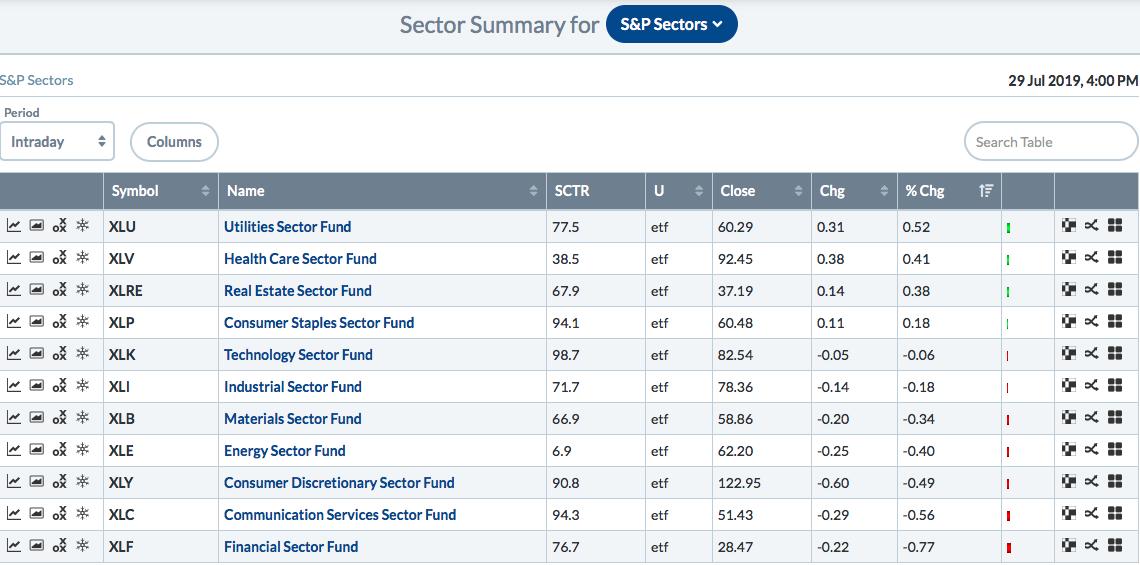

Market Recap for Monday, July 29, 2019

I am not at all surprised by Wall Street's action on Monday. The current Fed has not exactly been dependable in terms of following the lead of the treasury market, so short-term trading ahead of this week's Fed meeting...

READ MORE

MEMBERS ONLY

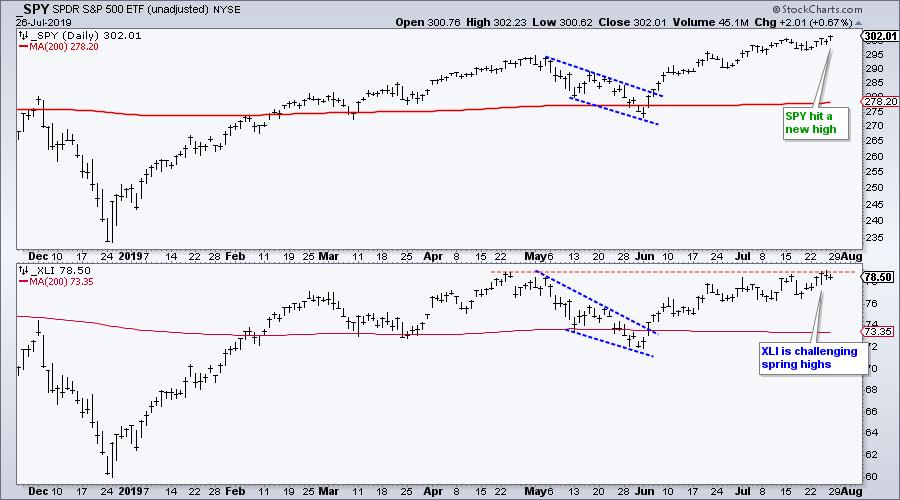

All Time Highs, Sector Leadership, Wedges and Throwbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This post will update some prior setups that are still working as we start the week. As noted in the State of the Stock Market on Friday, we are in a bull market right now and have been since mid February. Anyone basing their decisions on the current trend, aka...

READ MORE

MEMBERS ONLY

The Stars Are Aligning; Look Out Above

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 26, 2019

Communication services (XLC, +2.86%) exploded higher on Friday, thanks in large part to a blowout quarterly earnings report from Alphabet (GOOGL, +9.62%) after the bell on Thursday. They apparently kept their good news to themselves because Wall Street didn't...

READ MORE

MEMBERS ONLY

Fastenal Reverses off Key Level with RSI Failure Swing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Fastenal, an industrial staples company, is reversing off a key level with an RSI failure swing working. Never heard of that sector? Let me explain. The company is a wholesale distributor for industrial and construction supplies, including nuts, bolts, screws, washers and fasteners. It does not get much more basic...

READ MORE

MEMBERS ONLY

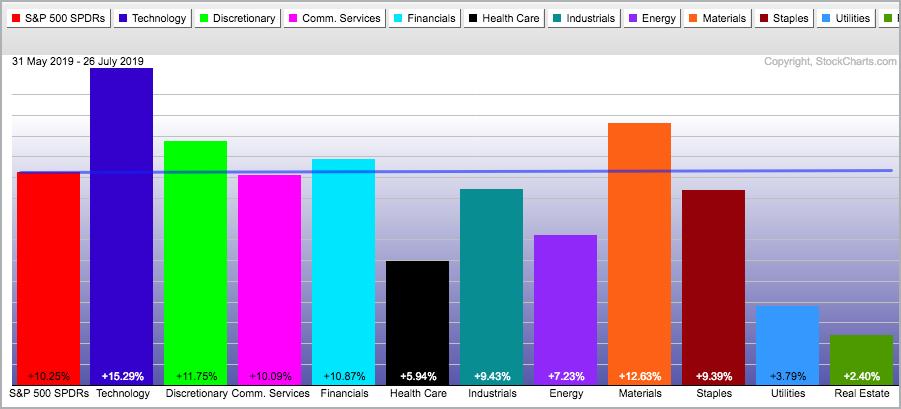

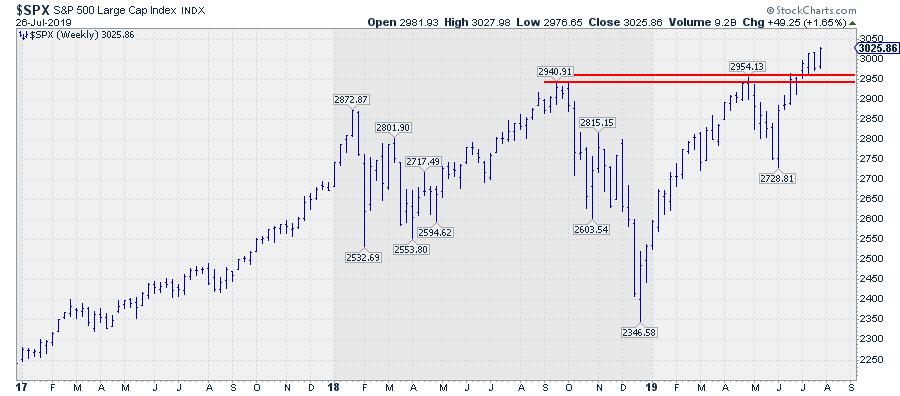

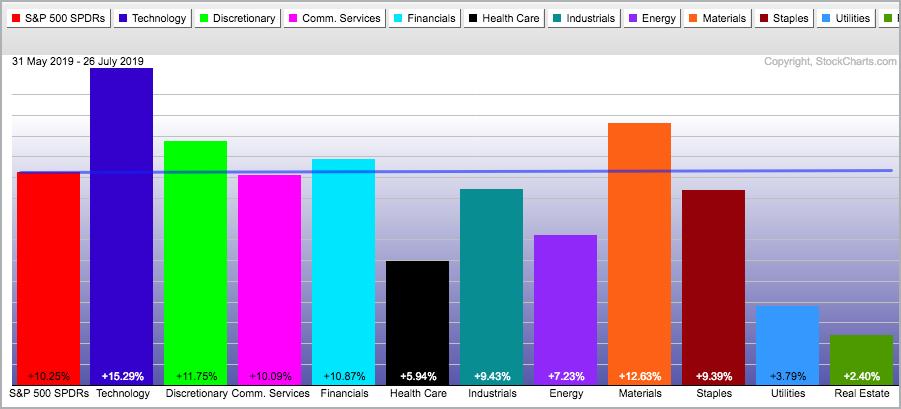

The Break to New Highs in the S&P 500 is Now Getting Support From Rotation To Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the run-up to its resistance level (around 2950), along with first two weeks after breaking that barrier while pushing to new highs, more defensive sectors like Utilities and Consumer Staples were leading the market higher.

The situation is changing now, adding more reliability to this important breakout.

RRG Positions...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Critically Poised; Breaks Weekly Pattern Support, but Oversold on Short-Term Charts

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week before this past week, the NIFTY rested itself and took support on the lower rising trend line of the nine-month-long secondary channel that had been formed. This secondary channel was formed after the index breached its three-year-long upward rising channel in October 2018. In the previous weekly...

READ MORE

MEMBERS ONLY

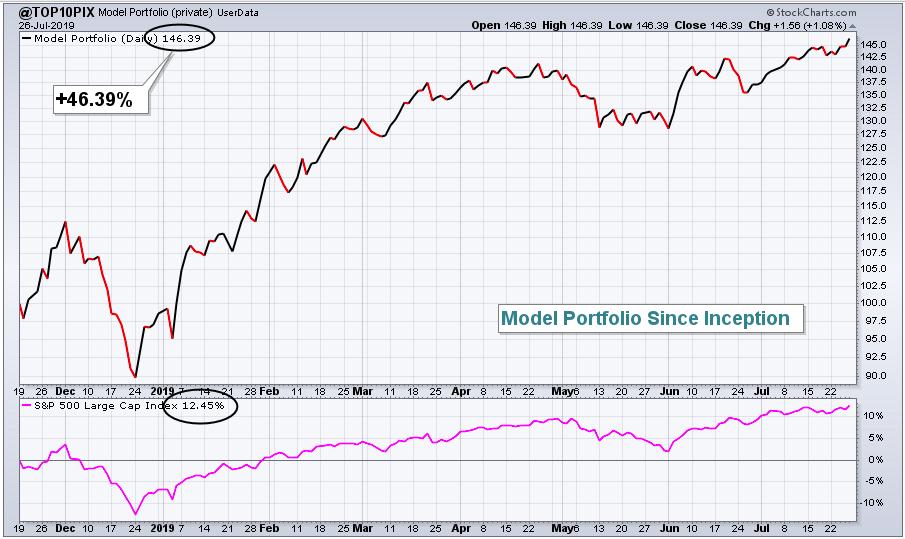

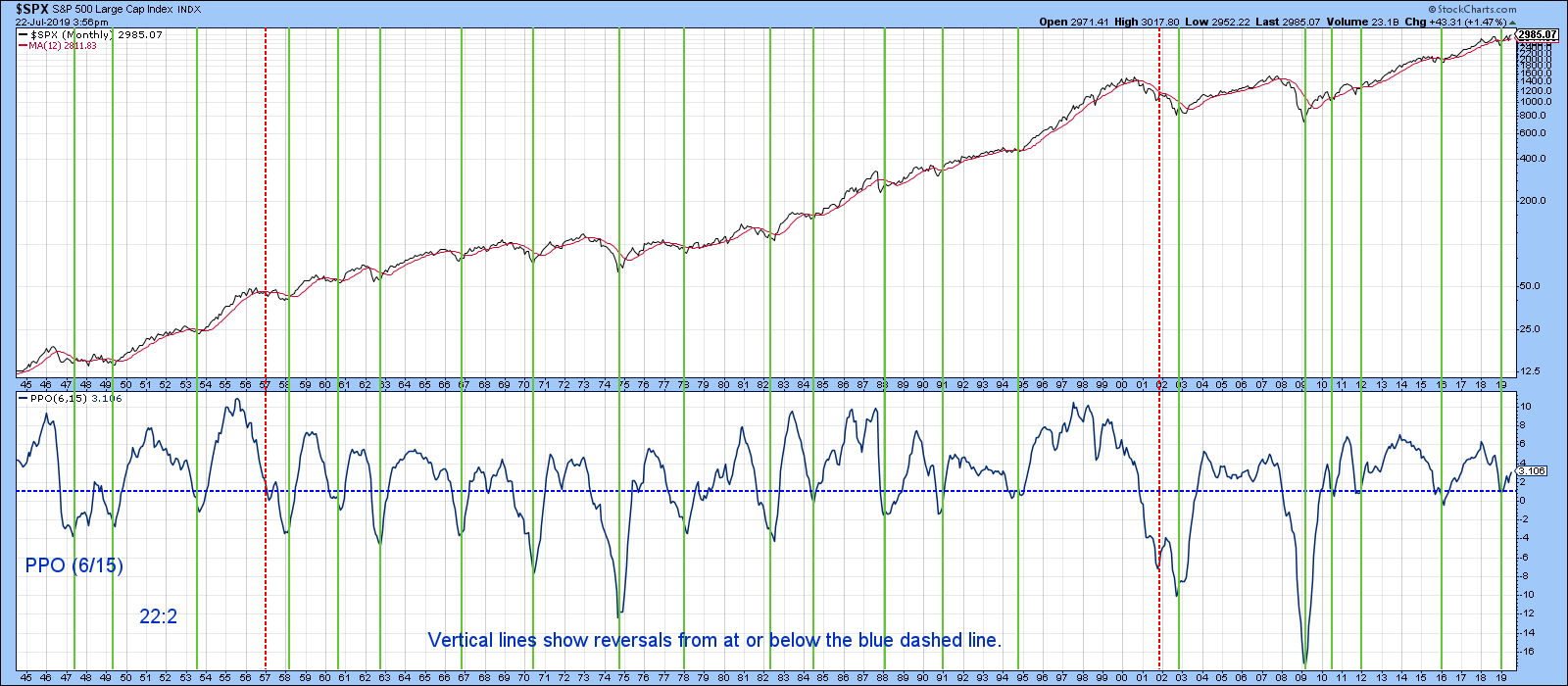

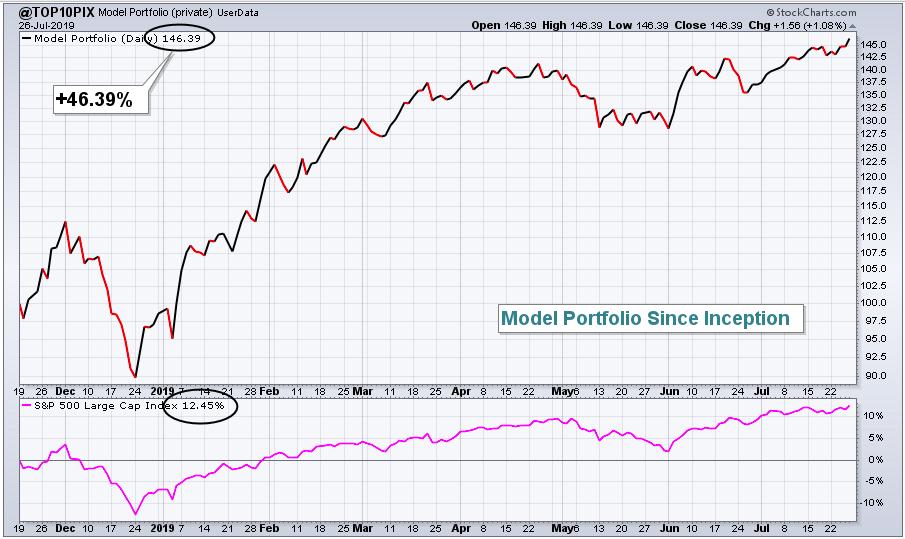

My Philosophy: Creating Portfolios To Beat The Benchmark S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That is my #1 goal. If I didn't believe I could beat the S&P 500, I'd simply buy the SPY (ETF that tracks the S&P 500) and call it a day. But I know I can beat the S&P 500...

READ MORE

MEMBERS ONLY

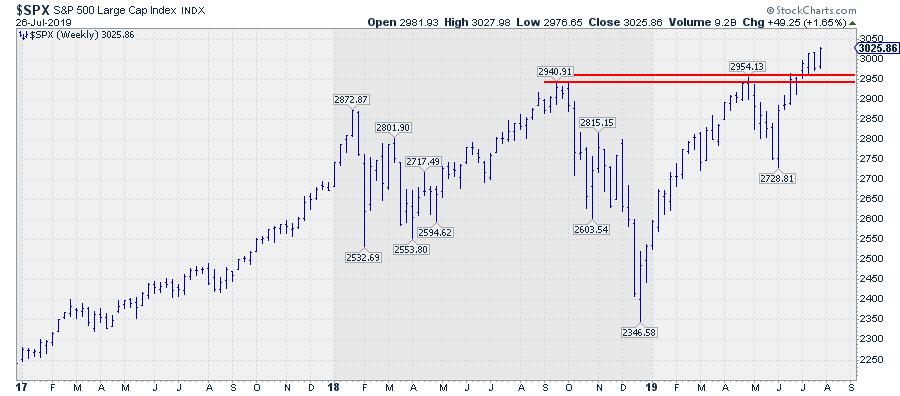

NASDAQ AND S&P 500 HIT NEW RECORDS -- SMALLER STOCKS AND TRANSPORTS HAVE A STRONG WEEK -- COMMUNICATIONS WERE WEEK'S TOP SECTOR -- BANKS LED FINANCIALS HIGHER -- KBW BANK INDEX MAY BE NEARING UPSIDE BREAKOUT -- EURO AND BRITISH POUND TOUCH TWO-YEAR LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND S&P 500 HIT NEW RECORDS... SMALLER STOCKS AND TRANSPORTS STRENGTHEN... Stocks ended the week on a strong note. Charts 1 and 2 show the Nasdaq Composite Index and the S&P 500 closing at record highs on Friday. A report showing 2.1% GDP growth...

READ MORE

MEMBERS ONLY

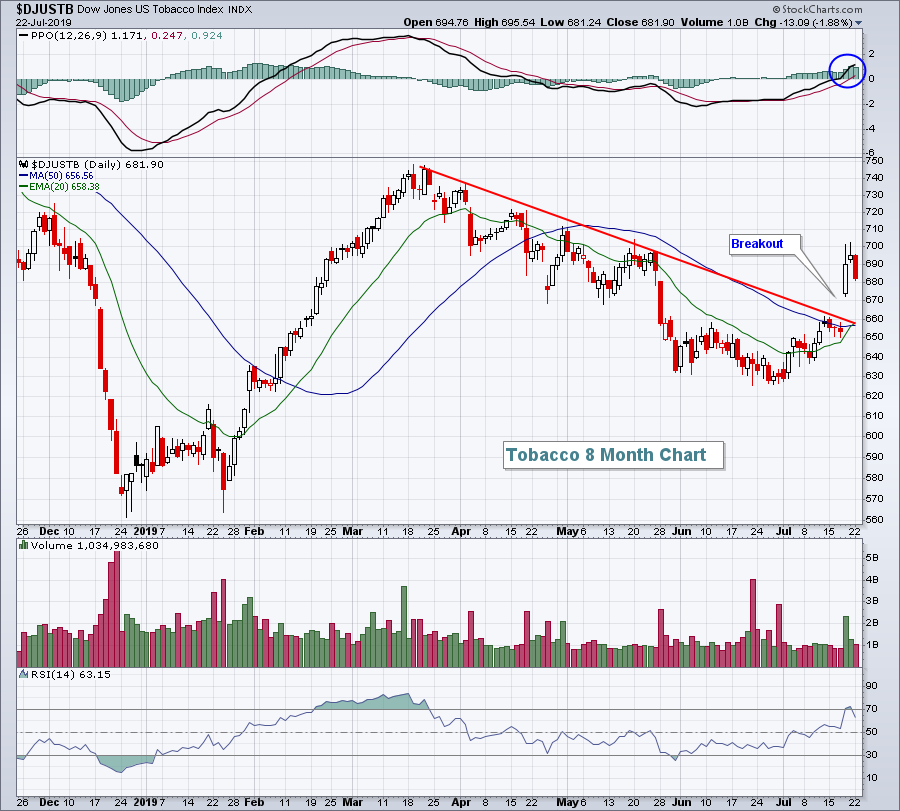

Emerging Leadership From Two Key Groups - On Your Mark, Get Set, TRADE!!!

by John Hopkins,

President and Co-founder, EarningsBeats.com

With a new earnings season comes new leadership, and I'm already beginning to see a shifting of industry winds. Sure, some of the prior leaders continue to show leadership - software ($DJUSSW), financial administration ($DJUSFA), renewable energy ($DWCREE), and restaurants & bars ($DJUSRU) - but, as the current...

READ MORE

MEMBERS ONLY

DP Bulletin! Negative Divergences on Major Indexes Flag an IT Decline

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint show, we looked at some of the intermediate-term analysis charts and found some disturbing negative divergences. Below are the charts you need to see.

Starting off with the NYSE Composite, price has been flat, which explains the flat reading for percent above 200-EMA. However, there...

READ MORE

MEMBERS ONLY

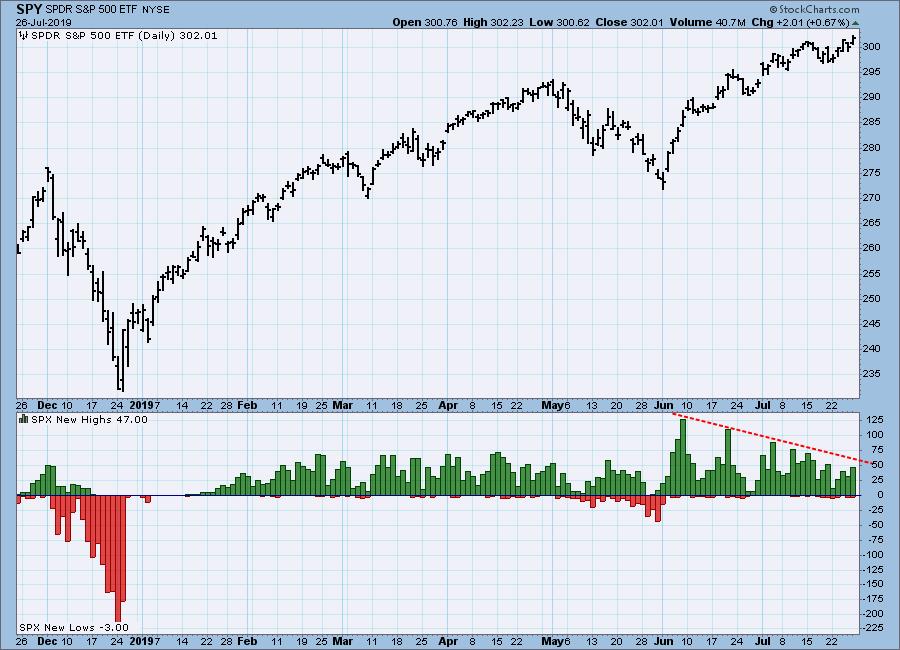

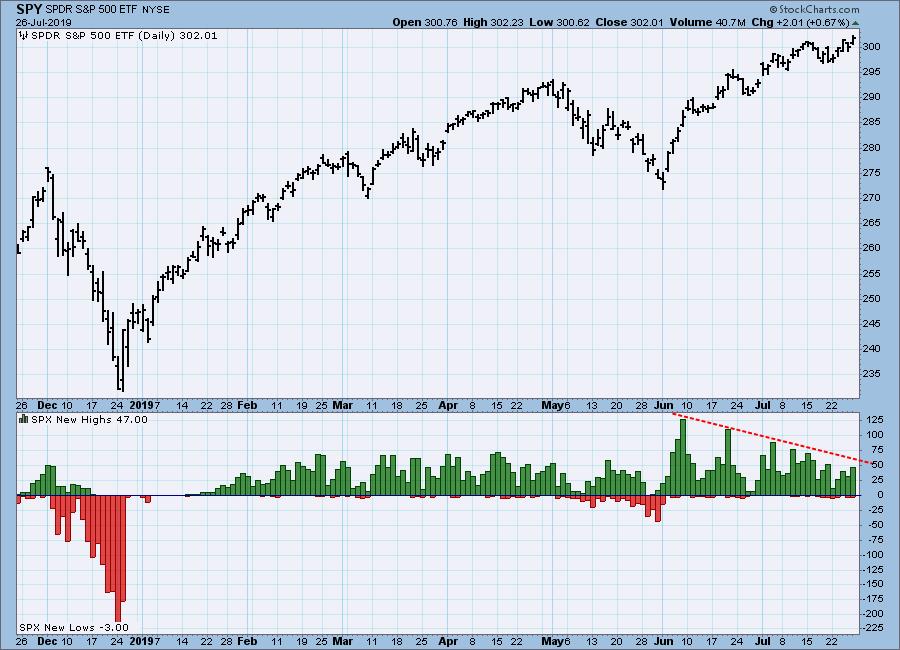

DP WEEKLY WRAP: While S&P 500 Index Makes Record Highs, Index Component New Highs Fade

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 Index has been making all-time highs for over a month, but new highs for S&P 500 component stocks has been fading since the rally initiation spike in early-June. This indicates that participation is narrowing and that largest-cap stocks are doing most of the...

READ MORE

MEMBERS ONLY

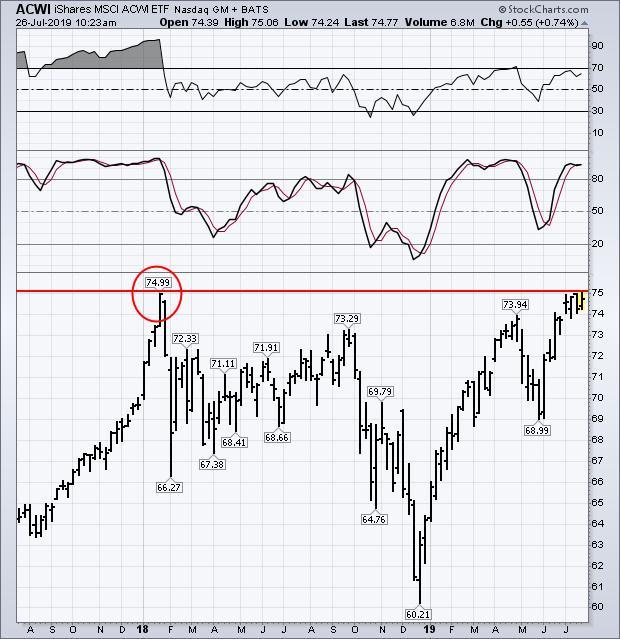

The MSCI All-World Stock Index is Testing its Early 2018 High

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, July 26th at 11:16am ET.

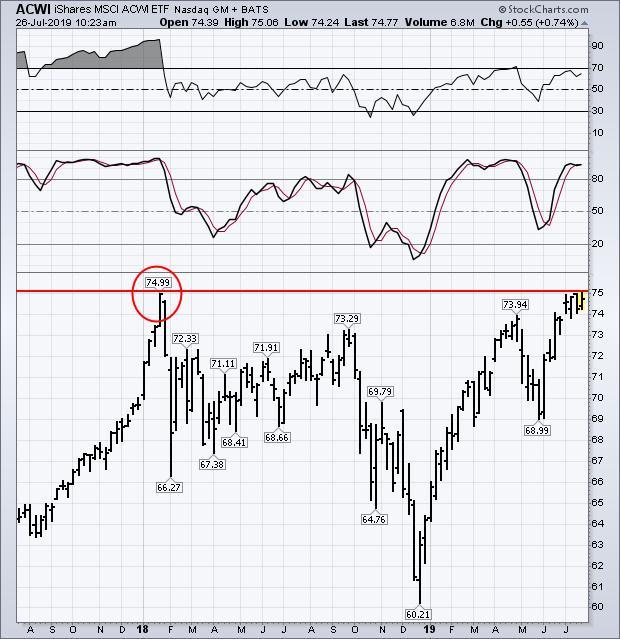

Global stock indexes are once again testing overhead resistance barriers. The weekly bars in Chart 1 show the MSCI All Country World Index iShares (ACWI) in...

READ MORE

MEMBERS ONLY

Relative Strength Based on Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Price action is not everything, it's the only thing. This is what Vince Lombardi might have said were he a trader or investor. Indicators are great for scans and sorting through hundreds of stocks, but nothing takes the place of price action. Moreover, our profits and losses are...

READ MORE

MEMBERS ONLY

THE MSCI ALL-WORLD STOCK INDEX IS TESTING ITS EARLY 2018 HIGH -- ITS FOREIGN STOCK INDEX IS LAGGING WAY BEHIND -- AND IS TESTING RESISTANCE OF ITS OWN -- GLOBAL CENTRAL BANKERS ARE IN A NEW RACE TO PUSH HISTORICALLY LOW RATES EVEN LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL COUNTRY WORLD INDEX TESTS PREVIOUS HIGH...Global stock indexes are once again testing overhead resistance barriers. The weekly bars in Chart 1 show the MSCI All Country World Index iShares (ACWI) in the process of testing its previous high set at the start of 2018 (see red circle). Any...

READ MORE

MEMBERS ONLY

140 New Reasons to Join the ChartPack Investing Ecosystem - ChartPack Update #24 (Q2, 2019)

by Gatis Roze,

Author, "Tensile Trading"

Once again, a big shout-out to our Tensile Trading ChartPack User community. This has become a sensational crowd-sourced collection of the best-of-the-best charts and ChartList organization. We’re all profiting handsomely from improving this collaborative investing tool. Don’t be bashful. We invite you to be a “commentariat” as well....

READ MORE

MEMBERS ONLY

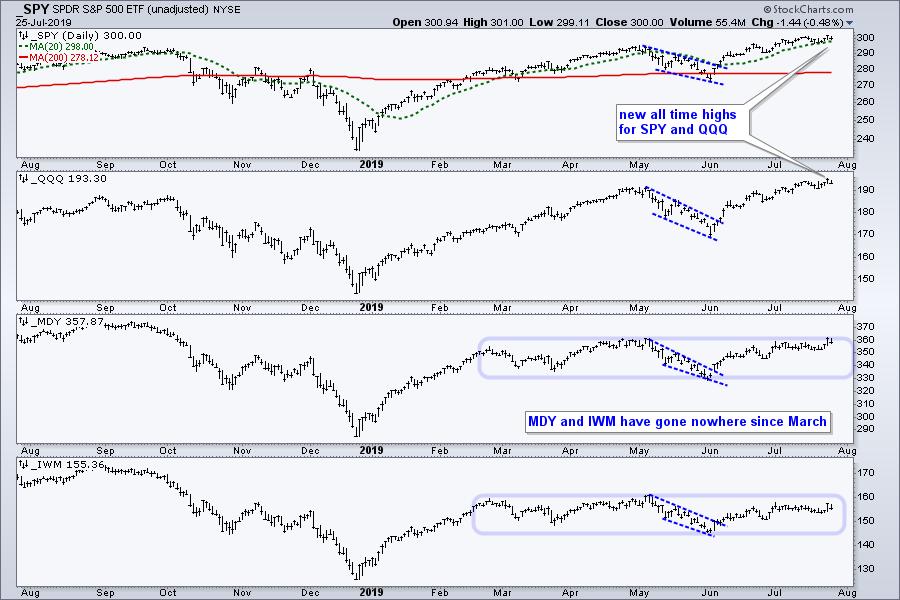

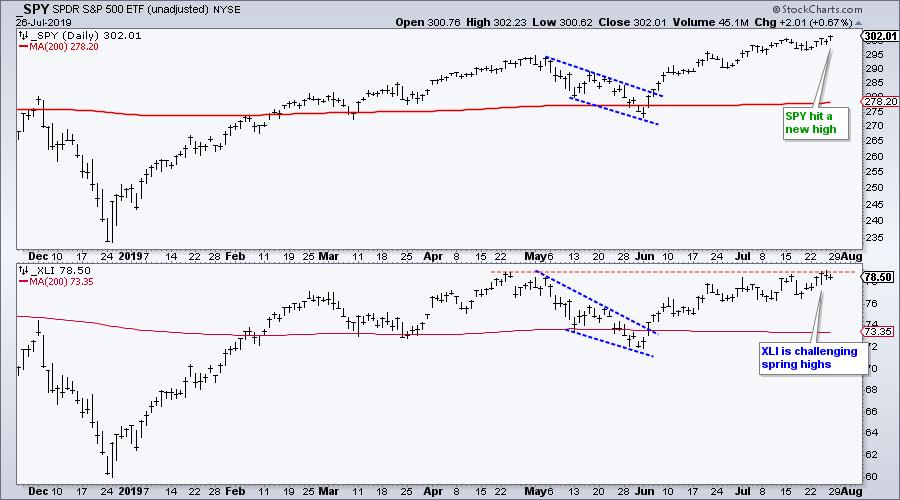

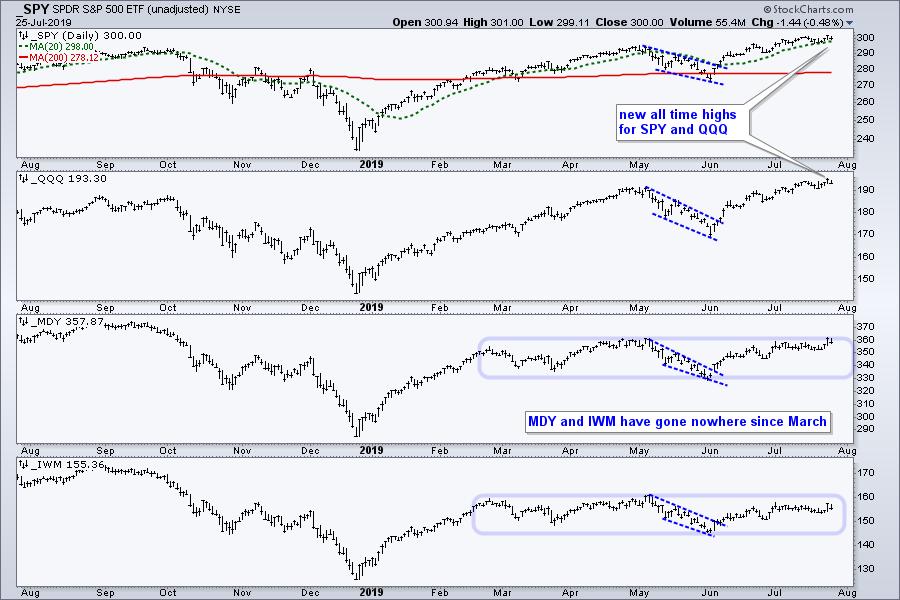

The State of the Stock Market - Large-caps Continue to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

... The S&P 500 SPDR hit another new all time high this week, while small-caps and mid-caps came alive, if just for one day. Even though small-caps and mid-caps are lagging since March, the new high in the S&P 500 affirms the bull market environment. Keep in...

READ MORE

MEMBERS ONLY

Blowout Earnings Overnight To Lift U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 25, 2019

Dow Holdings (DOW, -3.83%) and Boeing (BA, -3.69%) weighed on the Dow Jones ($INDU, -0.47%) on Thursday, but this index of conglomerates still managed to outperform its major index counterparts. The big technical issue with DOW is that it ran...

READ MORE

MEMBERS ONLY

Healthcare Holds Breakout as XBI Hits a RAZ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Healthcare is not exactly a leading sector right now, but the Health Care SPDR (XLV) sports a big triangle breakout on the weekly chart and this breakout is holding. Note that SPY, XLK, XLY and XLP hit new highs in July and these are the chart leaders right now. Even...

READ MORE

MEMBERS ONLY

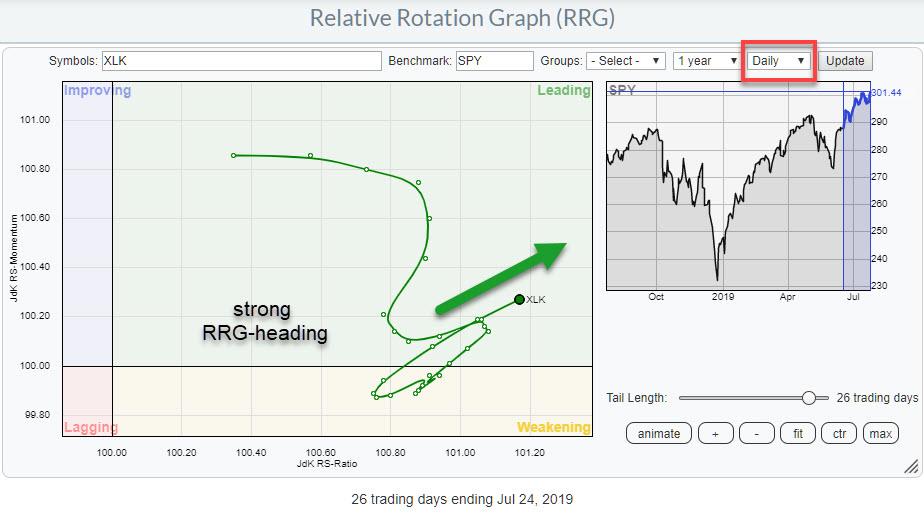

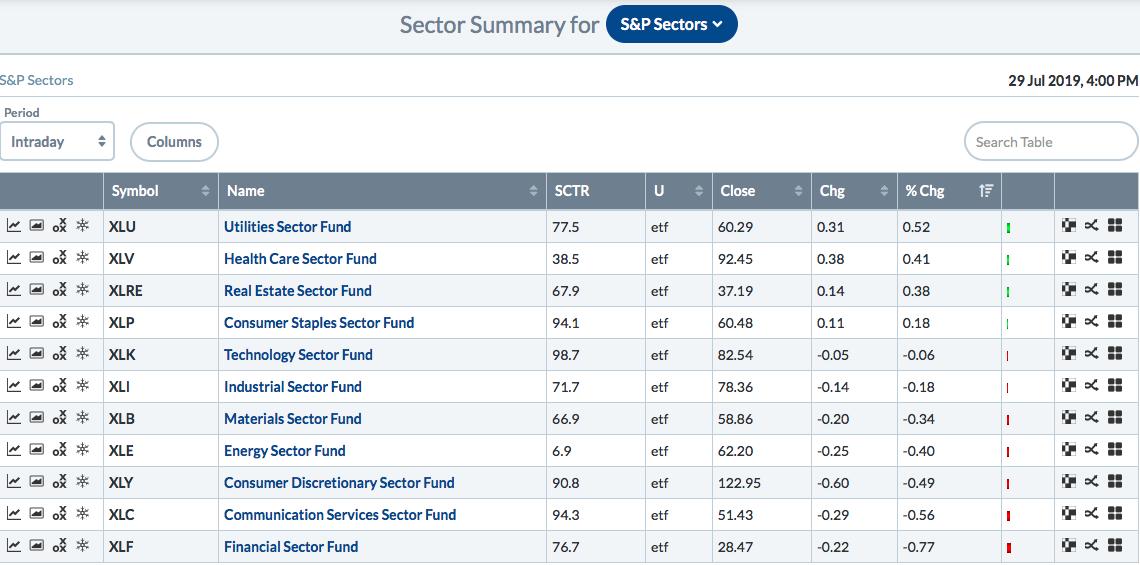

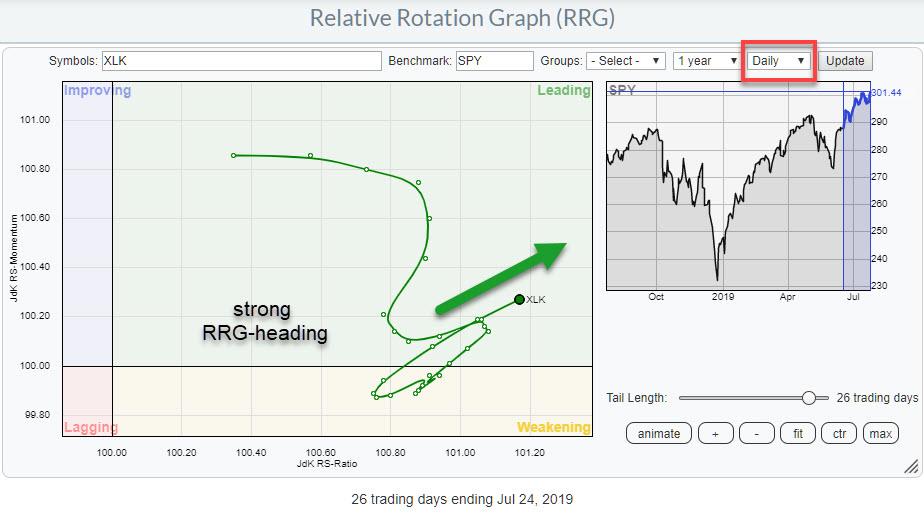

Strong Rotation For Technology Amid Shift To More Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I opened up the Relative Rotation Graph for US sectors (weekly version), the position and the current rotation for the Technology sector caught my attention.

If you are a regular reader of articles you will know that my default time frame is weekly. On that weekly RRG, XLK is...

READ MORE

MEMBERS ONLY

Earnings And Semiconductors Drive New Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be joining John Hopkins of EarningsBeats.com for a webinar on Monday, July 29th after the bell. It's the quarterly earnings webinar where I'll point out some of the biggest winners of earnings season to date. Those will be stocks that you...

READ MORE

MEMBERS ONLY

DP Mid-Week Alert: DP Indicators Pop!

by Erin Swenlin,

Vice President, DecisionPoint.com

Last week, I wrote about the bearishness of our indicators, excepting our very short-term analysis of breadth and the $VIX, which were pointing to higher prices this week. Well, there's been a character change on our short- and intermediate-term indicators that you should see. There were no real...

READ MORE

MEMBERS ONLY

UPS IS LEADING TRANSPORTS HIGHER TODAY -- SO ARE CH ROBINSON AND AMERICAN AIRLINES -- SMALL AND MIDSIZE STOCKS ARE ATTRACTING NEW BUYING -- SEMICONDUCTOR ISHARES HIT A NEW RECORD -- SO ARE TEXAS INSTRUMENTS AND LAM RESEARCH

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPS GIVES BIG BOOST TO TRANSPORTS...The recent upturn in transportation stocks is starting to gain more traction. Chart 1 shows the Dow Transports rebounding nicely from last week's late selloff; that's helping to restore the bullish upturn that occurred at the start of last week....

READ MORE

MEMBERS ONLY

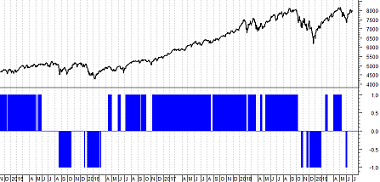

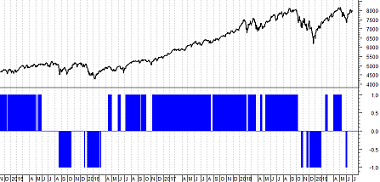

Trend Gauge

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A concept that was introduced to me long ago by my good friend Ted Wong is the use of multiple market indices and measuring their relationship to their moving average. Trend Gauge is comprised of two indicators; Mega Trend Plus and Trend Strength. A concept that attempts to identify overall...

READ MORE

MEMBERS ONLY

Two Bearish Continuation Patterns for BioMarin

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech ETFs, XBI and IBB, have underperformed the broader market the entire year. The chart below shows the S&P 500 SPDR (SPY) with higher highs in early May and July. The ETF also recorded fresh 52-week highs in May and July. The Biotech iShares (IBB) and Biotech...

READ MORE

MEMBERS ONLY

Facebook, Internet Stocks Looking To Provide Catalyst For Big Market Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 23, 2019

Utilities (XLU, -0.63%) was the only sector to end Tuesday's session in negative territory as most groups and stocks advanced. The XLU has been faltering on a relative basis ever since the overall market bottomed in early June. That has...

READ MORE

MEMBERS ONLY

BANKS HAVE A STRONG DAY -- KBW BANK INDEX REACHES THREE MONTH HIGH -- REGIONAL BANK LEADERS ARE FIFTH THIRD, KEYCORP, AND REGIONS FINANCIAL -- JPM NEARS A NEW RECORD -- GOLDMAN SACHS RESUMES UPTREND -- BAC REACHES THREE MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANK INDEX TURNS UP...Stocks are having another strong day, with sector leadership coming from materials (led by commodity chemicals) and industrials (with help from airlines). Semiconductors continue to lead technology higher. Financials are also having a strong day, led by banks. We're going to focus on banks...

READ MORE

MEMBERS ONLY

Silver Standard

by Bruce Fraser,

Industry-leading "Wyckoffian"

An important oversold condition and Point and Figure objective were reached in August of 2018 for Gold ($GOLD). A Last Point of Support (LPS) formed at the Support line generated by the Selling Climax (SCLX) low in 2013 (to see the chart analysis – click here and click here). Since this...

READ MORE

MEMBERS ONLY

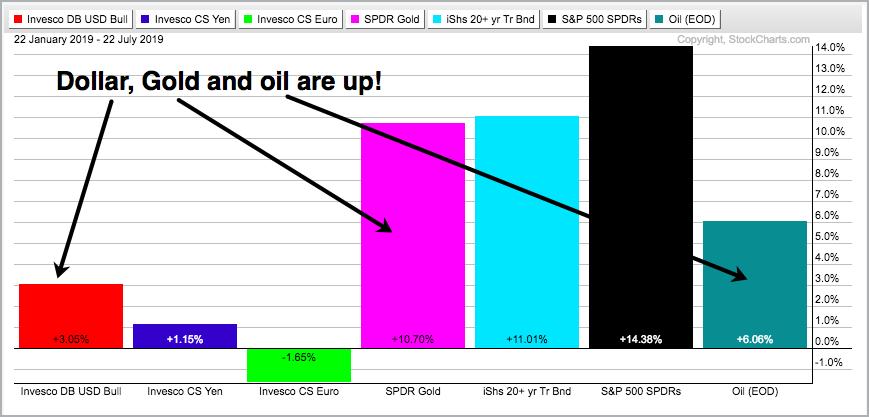

Gold, the Dollar and their Strange Correlation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

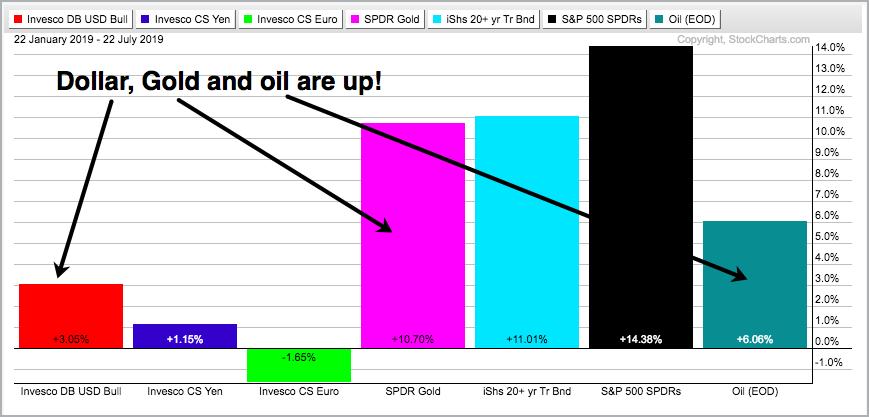

What if you knew the Dollar would be up 3% over the last six months? What would your prognosis be for oil and gold? Most pundits would not have a bullish forecast for gold and not expect much from oil. Nevertheless, the Gold SPDR (GLD) is up 10.70% the...

READ MORE

MEMBERS ONLY

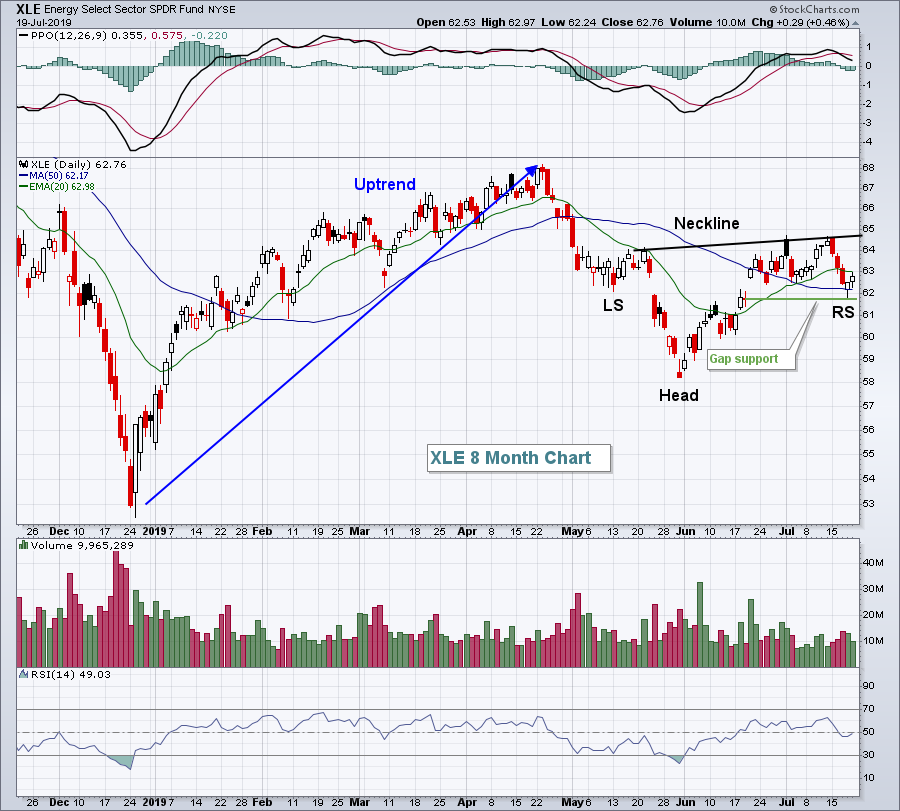

Truckers And Airlines Sending Bullish Market Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 22, 2019

Technology (XLK, +1.15%) was the undisputed leader on Monday, helping the NASDAQ gain 0.71% and within 1% of its all-time high. There were several reasons for the strength, but Goldman Sachs had positive commentary for the semiconductors ($DJUSSC, +2.03%), which...

READ MORE

MEMBERS ONLY

Is It Time For A Contra Trend Correction?

by Martin Pring,

President, Pring Research

* Major Trend Remains Positive

* Weekly Bar and Candle Charts Offer a Warning

* Reliable Short-Term Indicators, like Sentiment, are Overstretched

Major Trend Remains Positive

Each weekend, I go through a ChartList featuring weekly bar and candle charts of key markets. The idea is to spot technical events that appear on the...

READ MORE

MEMBERS ONLY

Ebay Holds the Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A consolidation within an uptrend is considered the pause that refreshes. Stocks often become overbought after a sharp advance in a short period of time and need to work off these overbought conditions with a correction. Corrections are of two types: price or time. The stock can decline and retrace...

READ MORE

MEMBERS ONLY

Keep An Eye On Short-Term NASDAQ Support In This Zone

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 19, 2019

Wall Street finished on a very weak note on Friday as hopes for a 50 basis point reduction in the fed funds rate decreased. There is now a much stronger likelihood of a 25 basis point drop when the Fed meets for two...

READ MORE

MEMBERS ONLY

Crucial Week Ahead For Markets; Need To Defend These Levels To Avoid More Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had raised concerns as the NIFTY had slipped below its 20-Week MA and the volatility index, VIX, traded at a multi-month low. It was expected that the volatility was likely to increase while there are chances of markets drifting lower. The week that went...

READ MORE

MEMBERS ONLY

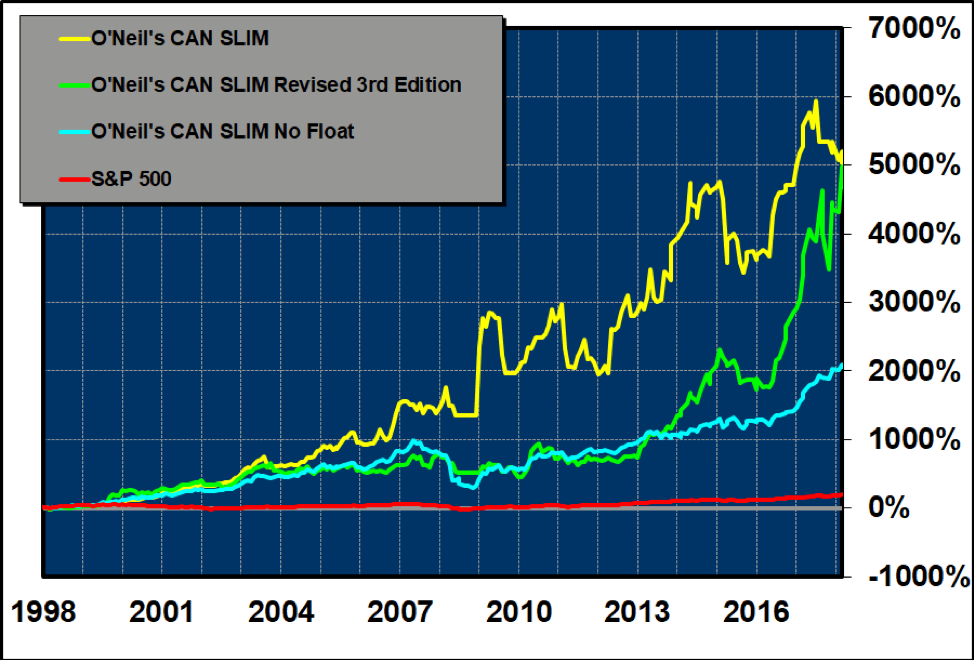

The Sweet Spot - 2 Stocks Reporting Soon That Are Poised For Big Moves

by Mary Ellen McGonagle,

President, MEM Investment Research

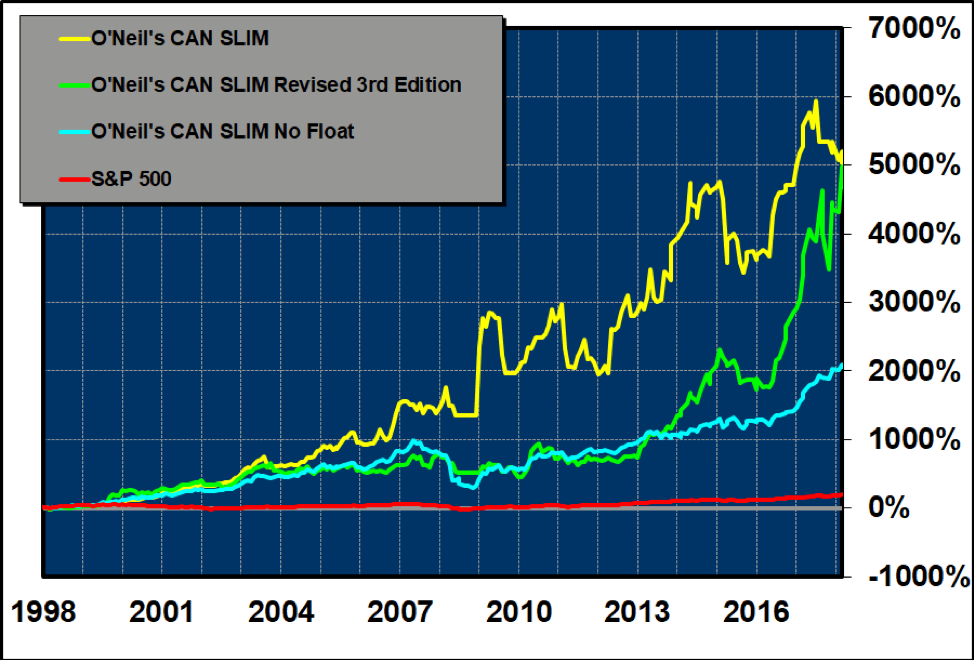

Historically, stocks that report strong earnings and sales results go on to outperform the broader markets - and not just by a little. Using William O’Neil’s famous CANSLIM formula, which emphasizes faster-growing companies, these stocks can outperform the S&P 500 by as much as 6,000%...

READ MORE

MEMBERS ONLY

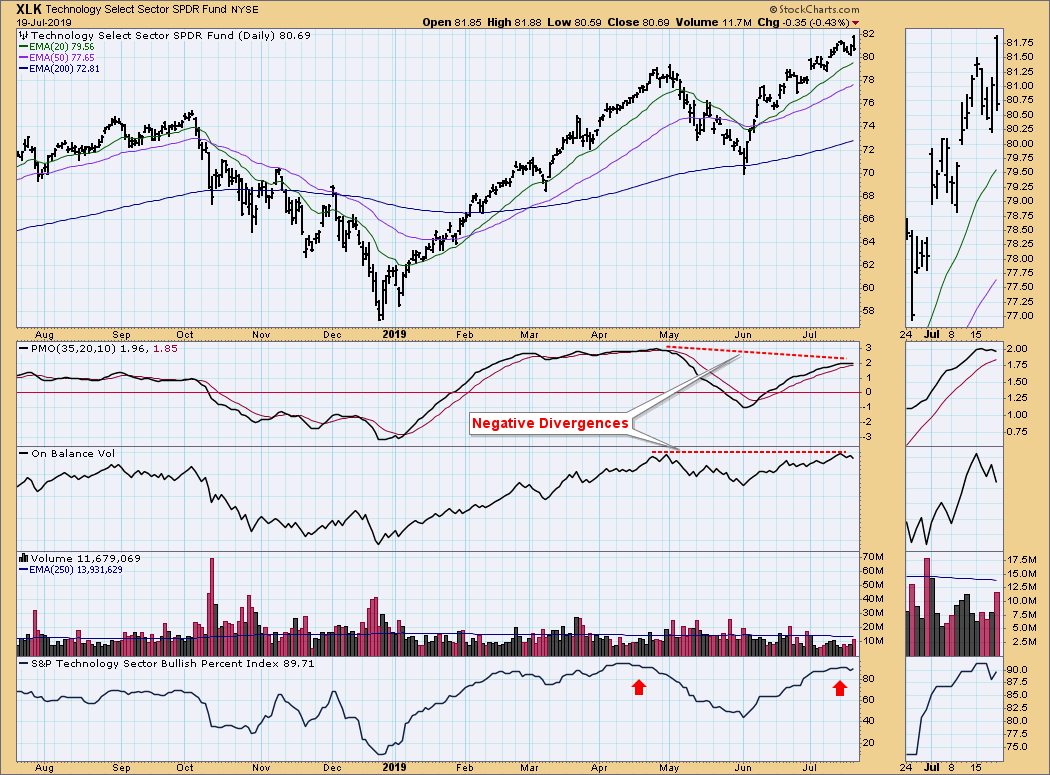

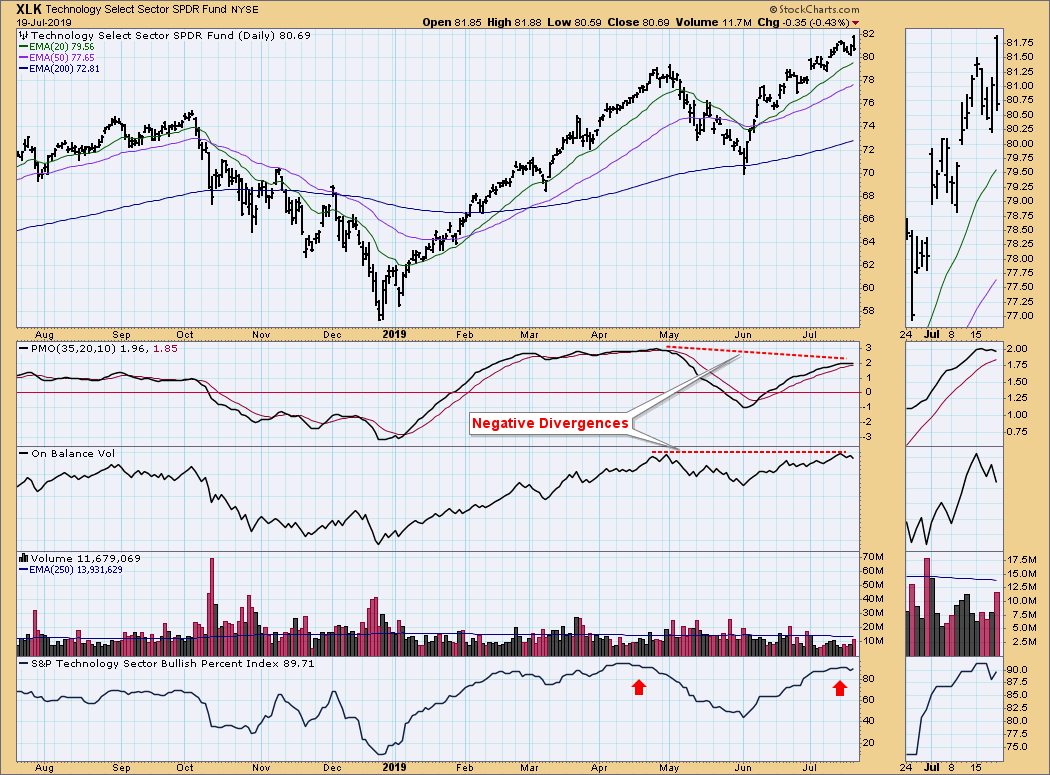

DP WEEKLY WRAP: Technology Sector Bullish Percent Seems Maxed

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Bullish Percent Index (BPI) shows the percentage of stocks in a given index with Point and figure BUY signals. Besides having a BPI for the major market indexes, StockCharts.com also has a BPI for each of the 11 Sector SPDRs, and I have started to display them with...

READ MORE

MEMBERS ONLY

The 5-Year Yield is in a Secular Uptrend

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 16th at 1:24pm ET.

When we get to longer-dated securities, that's where I start to question if yields are likely to move much lower. Let’s start with...

READ MORE

MEMBERS ONLY

How To Get From a Table of Market Movers To a Trading Idea Based on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

StockCharts.com has an incredible wealth of technical tools available both for free users as well as subscribers. That said, though, users who subscribe will have a greater amount of tools and functionality available to them.

Very recently, there was a panel discussion on MarketWatchers LIVE with Tom, Greg and...

READ MORE

MEMBERS ONLY

Building A Sound Portfolio Using Relative Strength Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As you may already know, I've developed multiple portfolios using fundamental strength and technical price action, including relative strength, that have wildly outperformed the benchmark S&P 500 since their inception dates. I'm very excited about that, as well as the prospect of helping thousands...

READ MORE

MEMBERS ONLY

Presenting the Bull Market Vacation Cheat Sheet

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I’m currently on a cruise ship docked in Naples, Italy, on a two-week vacation with my family, along with a good friend from college and his family. Today, we toured the ruins of Pompeii, which meant very high temperatures but fascinating history lessons.

Source: Pixabay

In preparing to write...

READ MORE