MEMBERS ONLY

Ciena Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The ideal scenario for traders is to buy after a pullback for a good reward-to-risk ratio. When the long-term trend is up, I look for indications of support and signs that an upturn is in the making. The chart for Ciena sports a classic setup with a confluence of indicators...

READ MORE

MEMBERS ONLY

Small-caps Lag, but Large-caps Keep Market Bullish - ChartList Update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

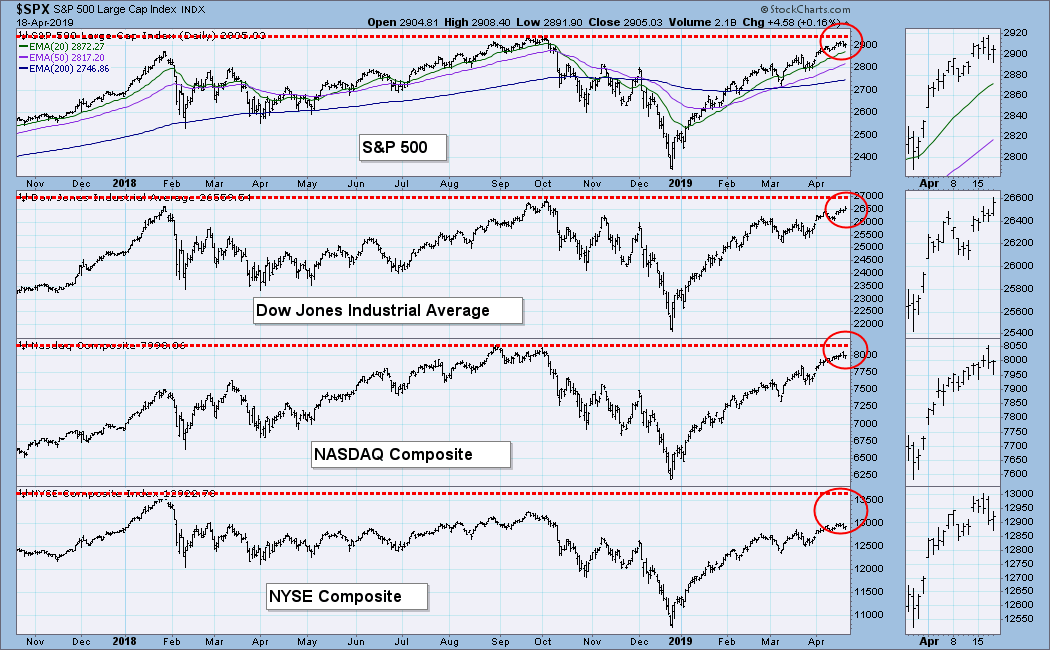

* Small-caps Continue to Lag.

* S&P 500 Nears All Time High.

* IWM Tests Breakout Zone.

* Index Breadth Table Update.

* Industrials and Finance Come to Life.

* Art's Charts ChartList Update.

Back in the Saddle

After a vacation and market hiatus, today's commentary will review the broader...

READ MORE

MEMBERS ONLY

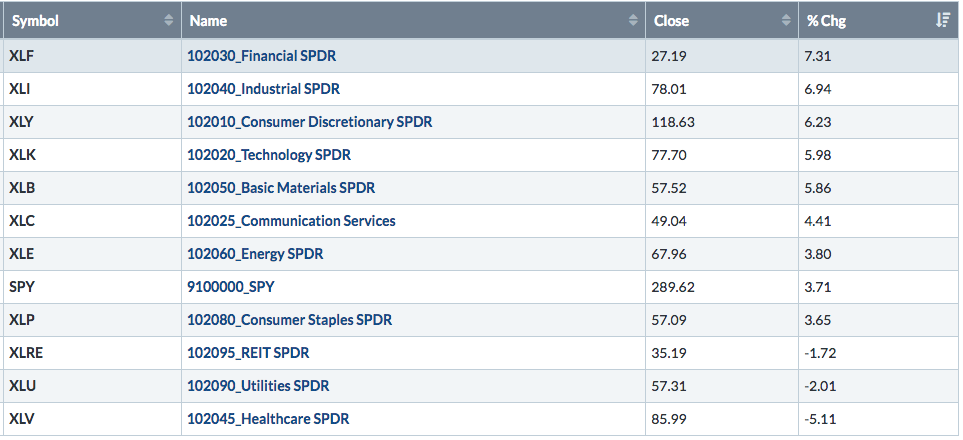

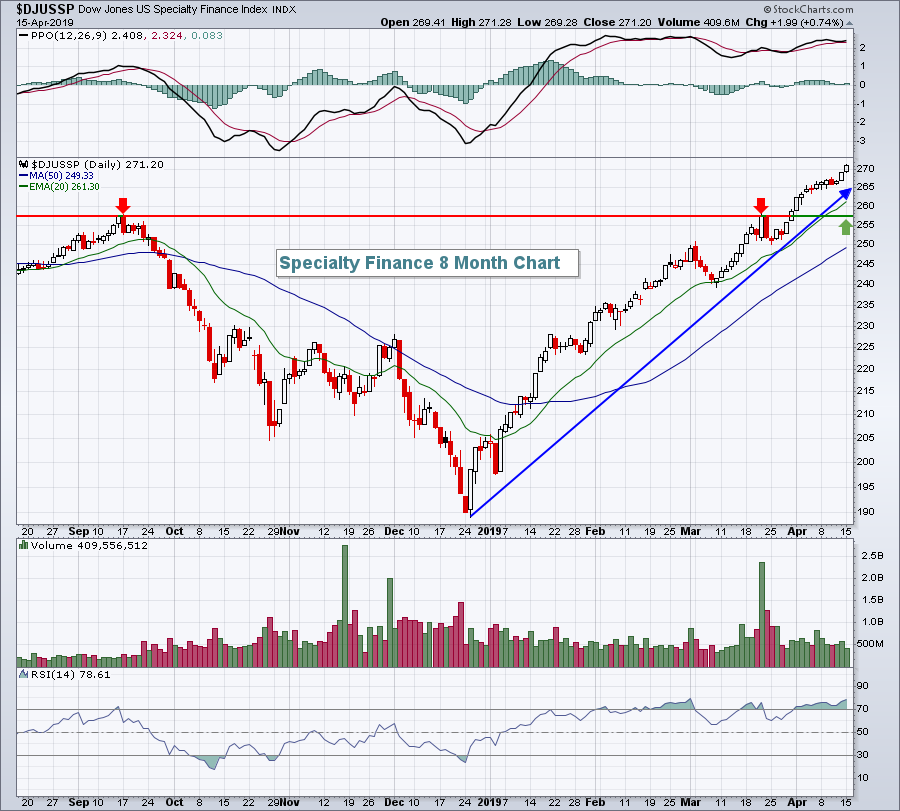

An Analysis Of Financials And Why We're Going Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

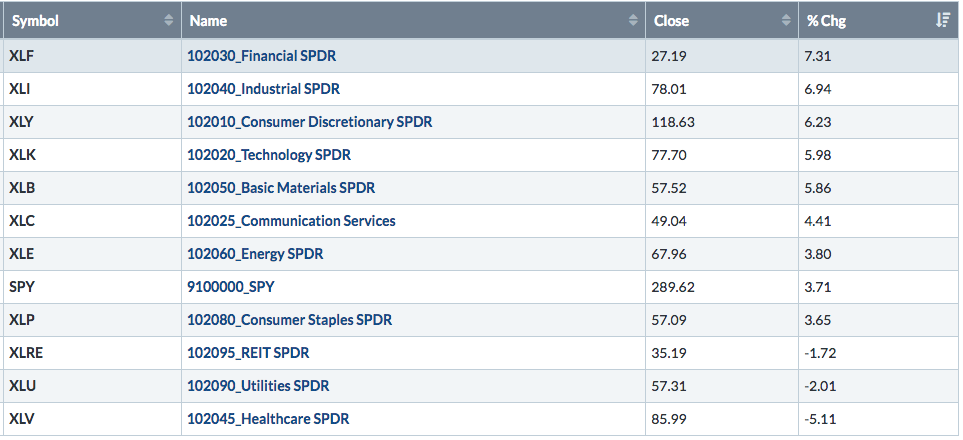

Market Recap for Thursday, April 18, 2019

Railroads ($DJUSRR, +2.37%) were led higher by Union Pacific's (UNP, +4.36%) strong quarterly earnings report and outlook. The DJUSRR has been a leader among industrials (XLI, +1.15%) for more than three years and that trend is easily continuing...

READ MORE

MEMBERS ONLY

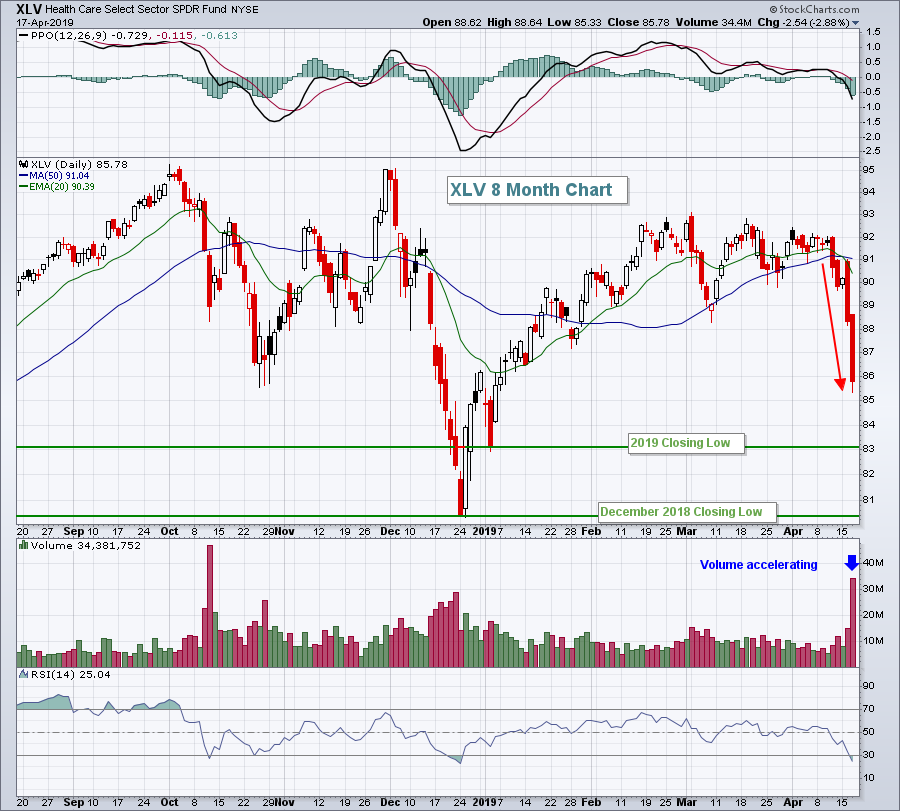

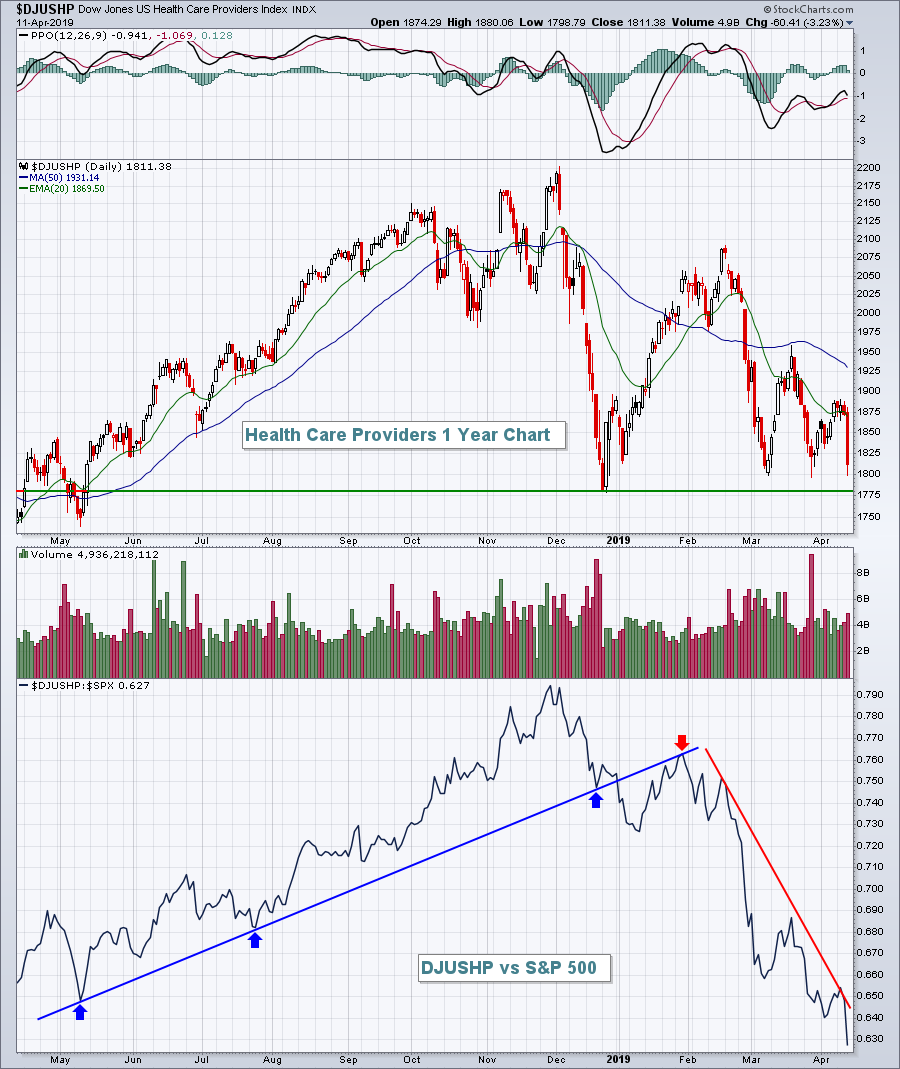

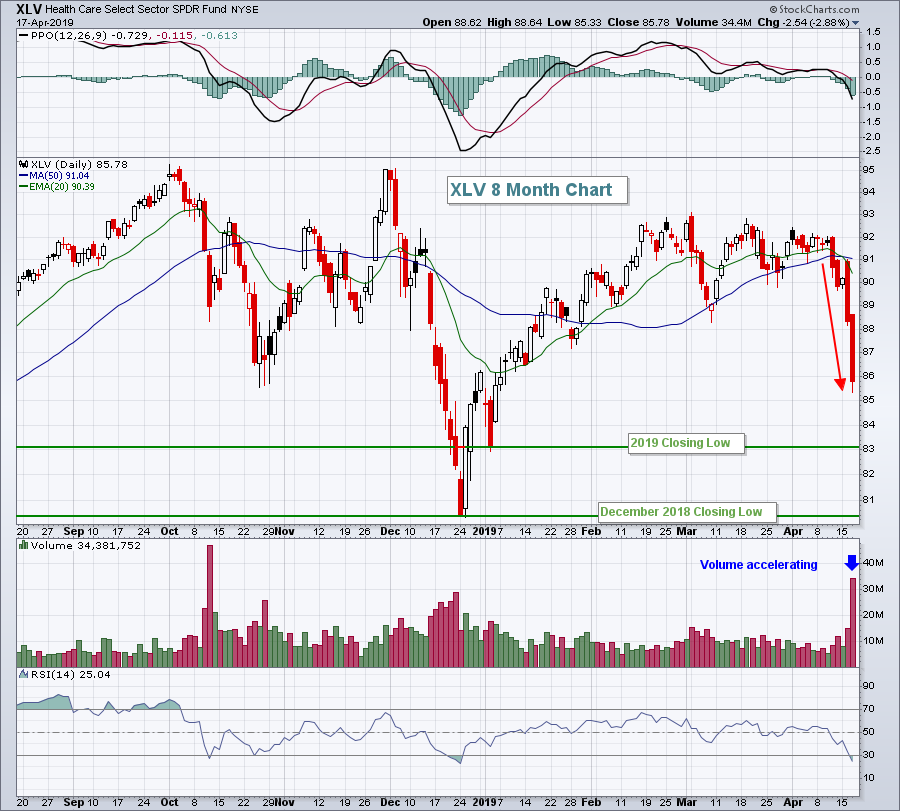

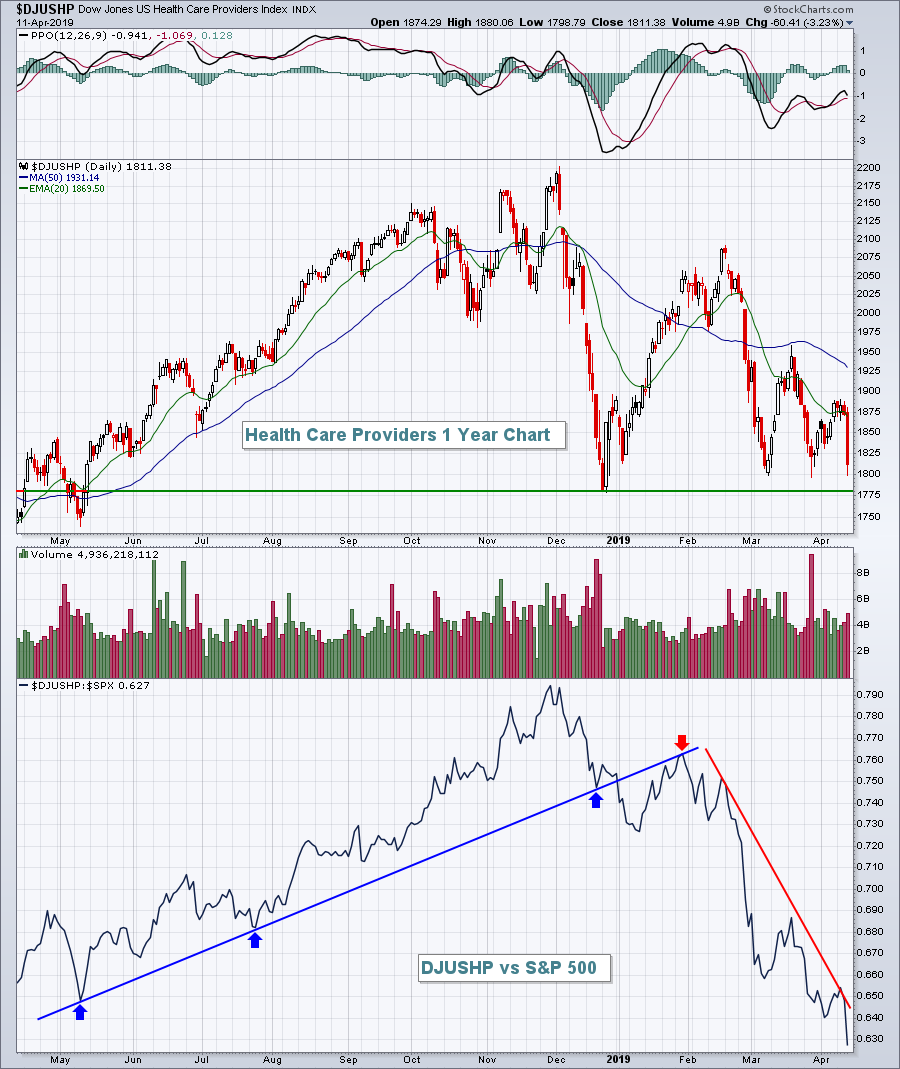

Health Care Crisis

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Health Care Sector (XLV) took a tumble this past week. In 2018 XLV was among the best leadership sectors of the stock market. Rotation is expected between sectors, industry groups and stocks throughout the business cycle. Were there technical clues that warned of the seemingly sudden weakness in the...

READ MORE

MEMBERS ONLY

Week Ahead: Odds Stacked Against A Sustainable Breakout; 11760 Still Remains Important To Watch

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week was quite eventful for the Indian equity markets. The short 3-day working week saw the benchmark index NIFTY50 marking a fresh high and attempting a breakout. Along with that, it also saw the NIFTY not confirming this breakout, slipping below the all-important 11760 mark once again. This...

READ MORE

MEMBERS ONLY

Five 5G Technology Stocks to Ponder

by Erin Swenlin,

Vice President, DecisionPoint.com

5G is the next generation of mobile broadband and will eventually replace (or augment) your 4G LTE connection. With 5G, we should see exponentially faster download and upload speeds. All eyes are now turning toward the companies that will help launch the advent of this exciting technology. I picked out...

READ MORE

MEMBERS ONLY

How to Approach Investing Like Pro Sports and Make the Playoffs! - ChartPack Update #23 (Q1, 2019)

by Gatis Roze,

Author, "Tensile Trading"

Pick the pro league of your choice. You can have the most expensive talent on one team, but without the right organization, routines and strategy, you won’t make the playoffs.(Presently, for example. you might consider the NBA’s Los Angeles Lakers with one LeBron James and friends).

Something...

READ MORE

MEMBERS ONLY

Profiting from Companies that Beat Earnings Expectations

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is off and running and already some companies that beat expectations could set up as high reward-to-risk trades. JP Morgan (JPM) is a perfect example of a company that reported stronger than expected numbers; you can see below the positive response from the market below.

In the week...

READ MORE

MEMBERS ONLY

Railroad Stocks Lead the Transports and Industrial Sector Higher

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, April 19th at 10:21am ET.

Two stock groups did better than the rest of the market this week. Transportation stocks had another strong week. As did the Industrial Sector SPDR (XLI)...

READ MORE

MEMBERS ONLY

RAILROAD STOCKS LEAD THE TRANSPORTS AND INDUSTRIAL SECTOR HIGHER -- WIDENING SPREAD BETWEEN 10-YEAR TREASURY AND GERMAN YIELD FAVORS THE DOLLAR -- A RISING DOLLAR IS HURTING GOLD MORE THAN COPPER -- A RISING COPPER/GOLD RATIO IS A SIGN OF CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RAILROAD STOCKS HAVE BECOME MARKET LEADERS... Two stock groups did better than the rest of the market this week. Transportation stocks had another strong week. As did the Industrial Sector SPDR (XLI) which was the week's strongest sector. Both have one group to thank for their strong performance....

READ MORE

MEMBERS ONLY

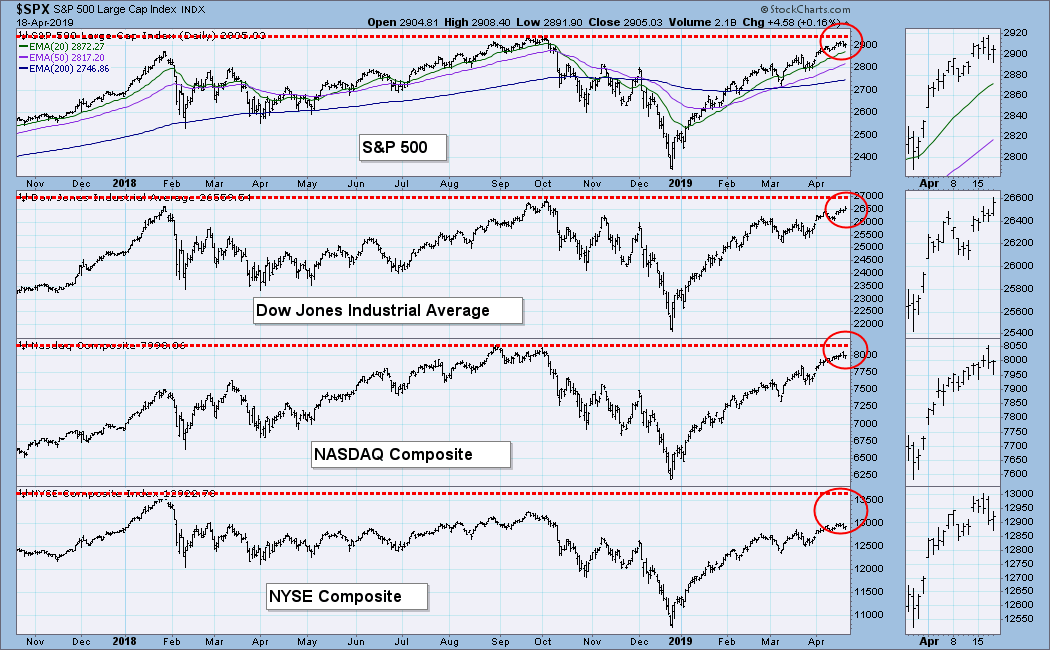

DP WEEKLY WRAP: New All-Time Highs, or Not?

by Carl Swenlin,

President and Founder, DecisionPoint.com

As we can see on the chart below, none of the major market indexes have exceeded their previous all-time highs. So why are we having this discussion? The point is that price history for traditional market indexes is not adjusted for dividends, so they do not reflect a true total...

READ MORE

MEMBERS ONLY

BANKS, ENERGY, AND SMALL CAPS TEST 200-DAY LINES -- DOLLAR HITS TWO-YEAR HIGH AS EURO WEAKENS -- THE RISING DOLLAR IS PUSHING GOLD MINERS LOWER -- WISDOM TREE EUROPE HEDGED EQUITY FUND COMPENSATES FOR WEAKER EURO

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS, ENERGY, AND SMALL CAPS STRUGGLE WITH THEIR 200-DAY LINES... Three stock groups are still struggling to clear their 200-day lines. Chart 1 shows the KBW Bank Index sitting just below its red line. Lower bond yields today may be holding it back. But the Financial Sector SPDR (XLF) has...

READ MORE

MEMBERS ONLY

Clothing Stocks Gearing Up For Q2

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 17, 2019

We saw mixed trading on Wednesday with the benchmark S&P 500 falling 0.23% to end the session at 2900, still roughly 1.5% beneath the all-time high set in 2018. Technology (XLK, +0.56%) and consumer staples (XLP, +0.50)...

READ MORE

MEMBERS ONLY

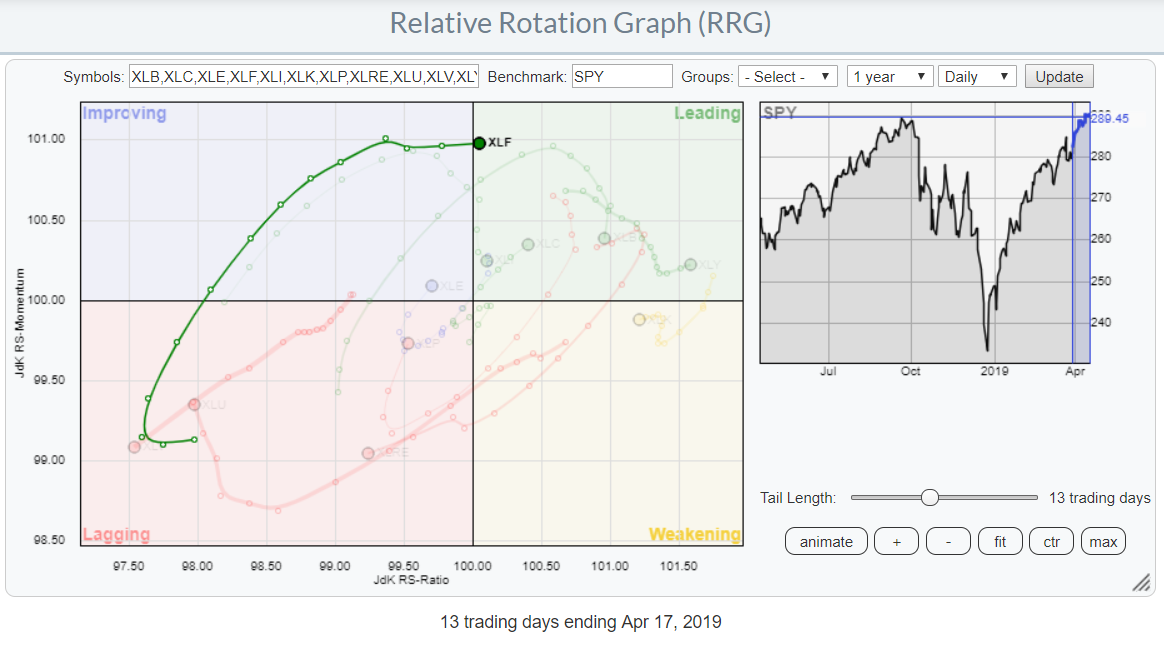

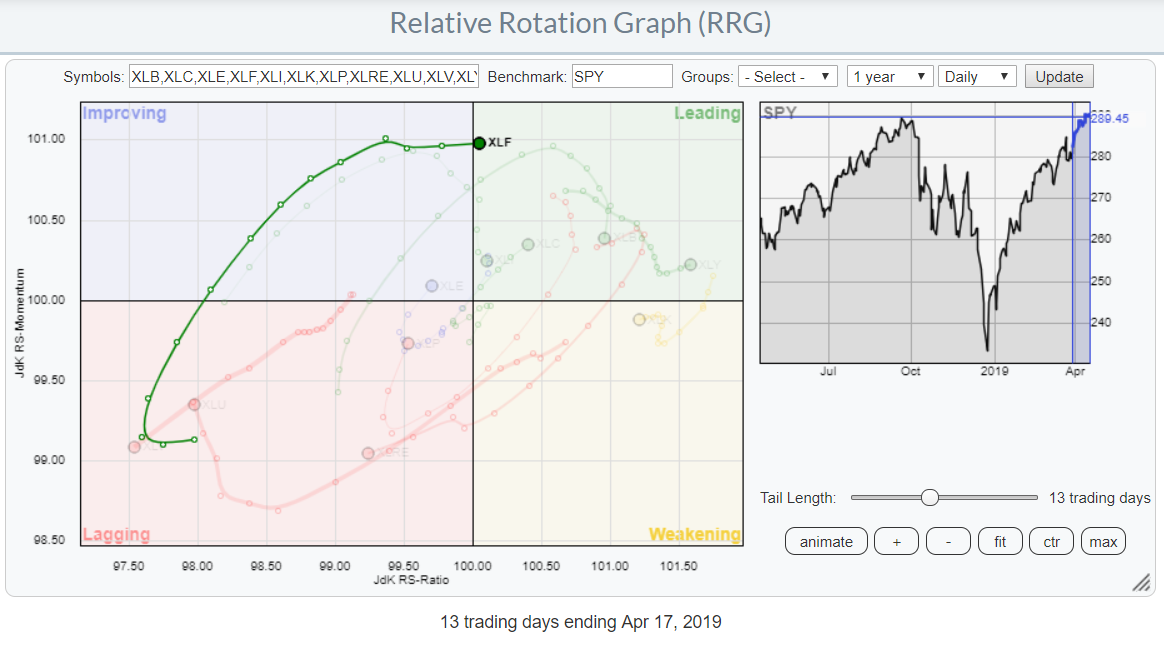

Financials Made It Into The Leading Quadrant, Now What?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At yesterday's close, the Financials sector (XLF) crossed over into the leading quadrant on the daily Relative Rotation Graph.

The tail of the sector started to curl upward inside the lagging quadrant roughly two weeks ago, before then proceeding to travel higher on both the Jdk RS-Ratio and...

READ MORE

MEMBERS ONLY

DP Alert: Buying Exhaustion Alongside a Broadening Pattern - XLV IT Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

At this point in the week, the SPX is down about 0.23%. I suspect there will be more downside to endure going into the last half of the week. We don't talk about broadening patterns too much, but, in the very short-term, those are what I'...

READ MORE

MEMBERS ONLY

Using Breadth Indicators to Weigh the Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This article will provide links and symbols for some of the charts used in the On Trend episode focusing on breadth indicators (Using Breadth Indicators to Weigh the Evidence). Episode details are shown below and you can watch a recording on our Youtube channel. The idea behind these indicators is...

READ MORE

MEMBERS ONLY

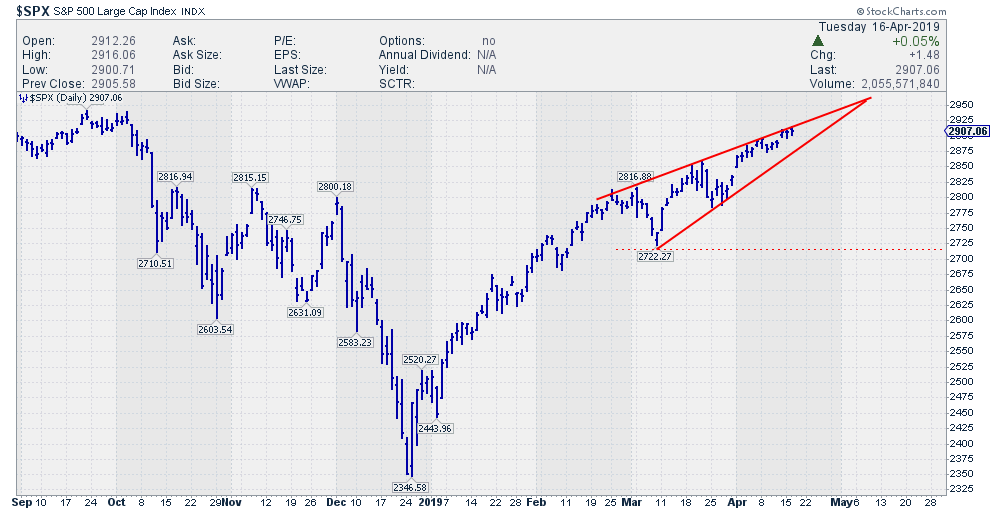

Respect That 2940 Top On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 16, 2019

It was just another day of boring gains. But that's what happens during bull market advances. The Volatility Index ($VIX, -1.14%) drifts lower and stock prices edge higher. Remember when the VIX topped out with a close above 36 on...

READ MORE

MEMBERS ONLY

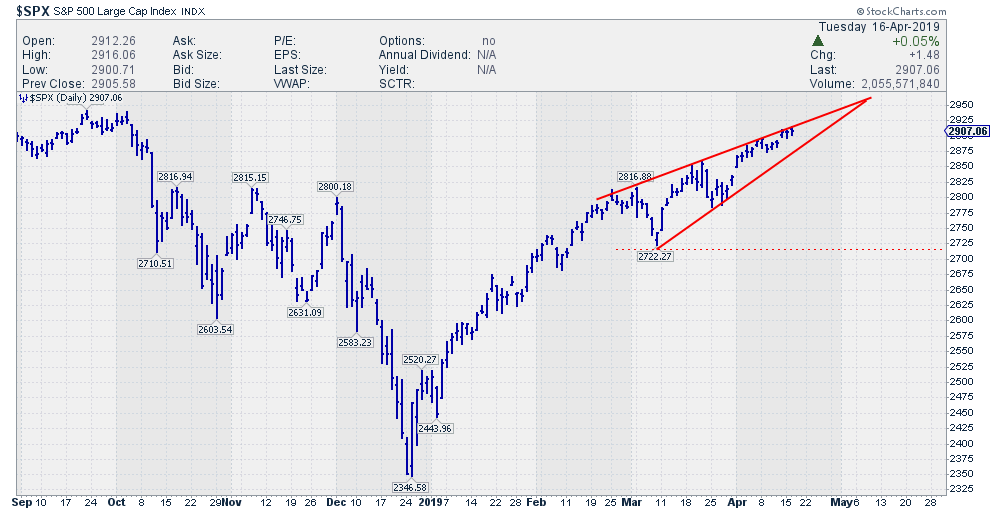

Are We Looking At A Wedge In The Making?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When acting in an environment of uncertainty (of which financial markets are a prime example) it is a good habit to double-check any findings. Think of it as an extra pair of eyes to confirm or deny what you (think you) are seeing.

In this process, please keep an open...

READ MORE

MEMBERS ONLY

Gold Loses Its Shine - IT Trend Model Neutral Signal - IT PMO SELL Signal Nearing

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, DecisionPoint reported a new Intermediate-Term Trend Model Neutral signal on Gold to Timer Digest. The signal was triggered when the 20-EMA crossed below the 50-EMA. It wasn't a SELL signal, as the 20/50-EMA crossover occurred above the 200-EMA. Don't let the "neutral"...

READ MORE

MEMBERS ONLY

Gold Starts To Break Down - But Is It For Real?

by Martin Pring,

President, Pring Research

* The Long-Term Picture Looks Positive

* Gold’s Tuesday Downside Breakout Could Be the Spoiler

* Platinum is Trying to Break Out Against Gold - Why That’s Important for the Economy

The Long-Term Picture Looks Positive

Over the last 6 years, it appears that the gold price has been trying to...

READ MORE

MEMBERS ONLY

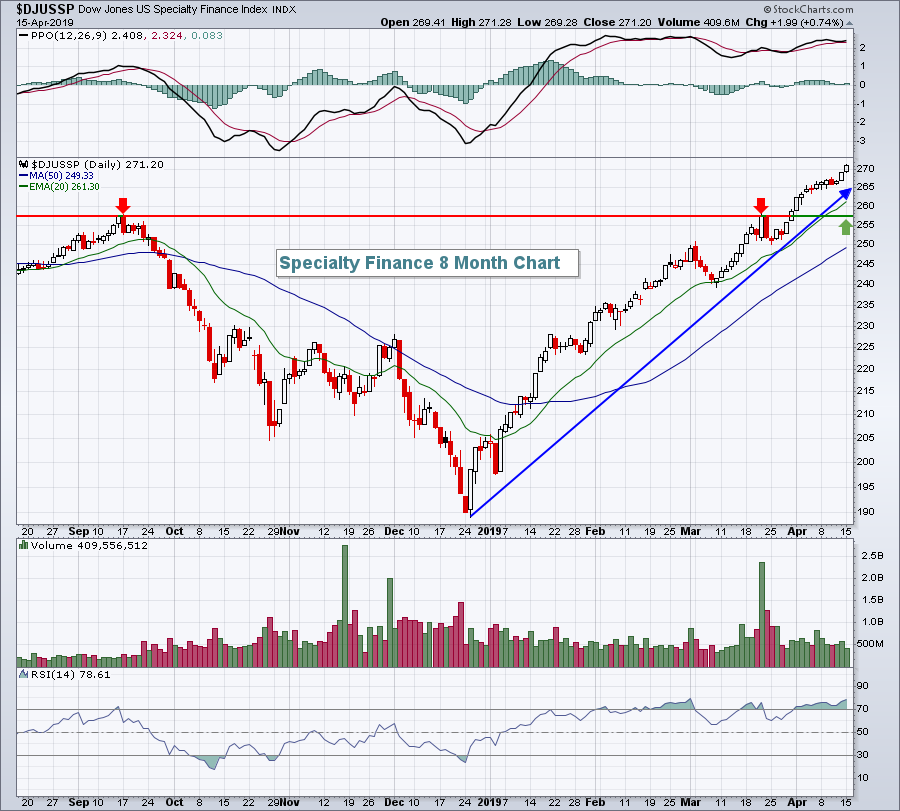

ASSET MANAGERS LEAD FINANCIALS HIGHER -- LED BY BLACKROCK, INVESCO, AND T ROWE PRICE -- HEALTHCARE SPDR FALLS BELOW 200-DAY AVERAGE -- LED LOWER BY HEALTH CARE PROVIDERS -- HCA TUMBLES, WHILE CIGNA, AND HUMANA HIT 52-WEEK LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ASSET MANAGERS LEAD FINANCIALS HIGHER ... Financials are the day's strongest sector. Chart 1 shows the Financial Sector SPDR (XLF) trading today at the highest level since last October. The solid gray line is a relative strength ratio of the XLF divided by the S&P 500; and...

READ MORE

MEMBERS ONLY

Rotation To Defense Isn't A Bad Thing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 15, 2019

Defensive groups took their turn leading the stock market, but on a down day that is generally to be expected. Consumer staples (XLP, +0.59%) and healthcare (XLV, +0.40%) were the two leading groups, while financials (XLF, -0.63%) backed off from...

READ MORE

MEMBERS ONLY

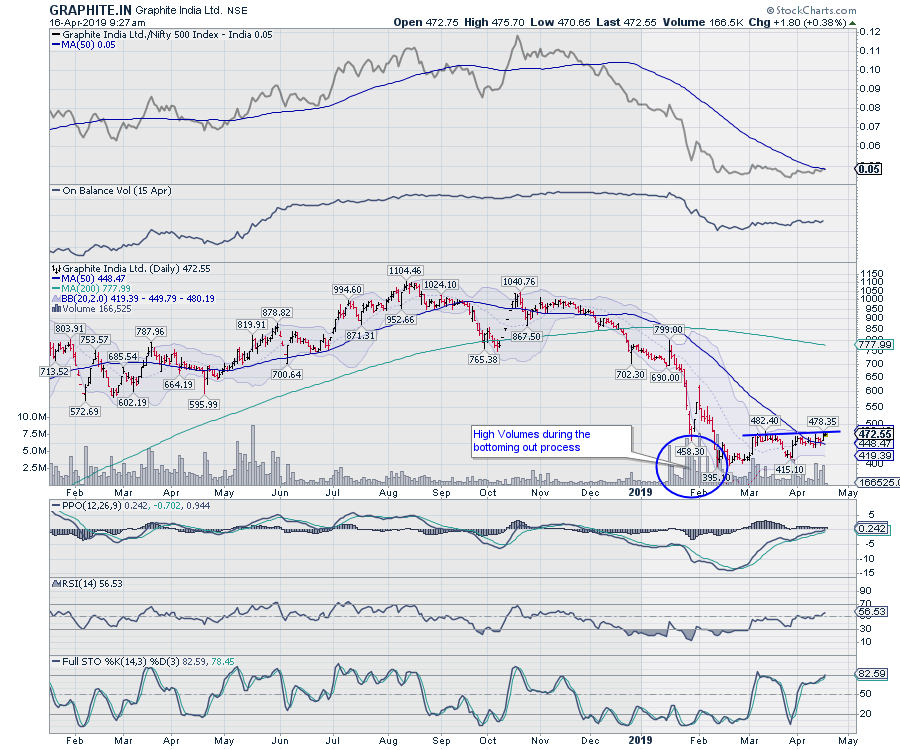

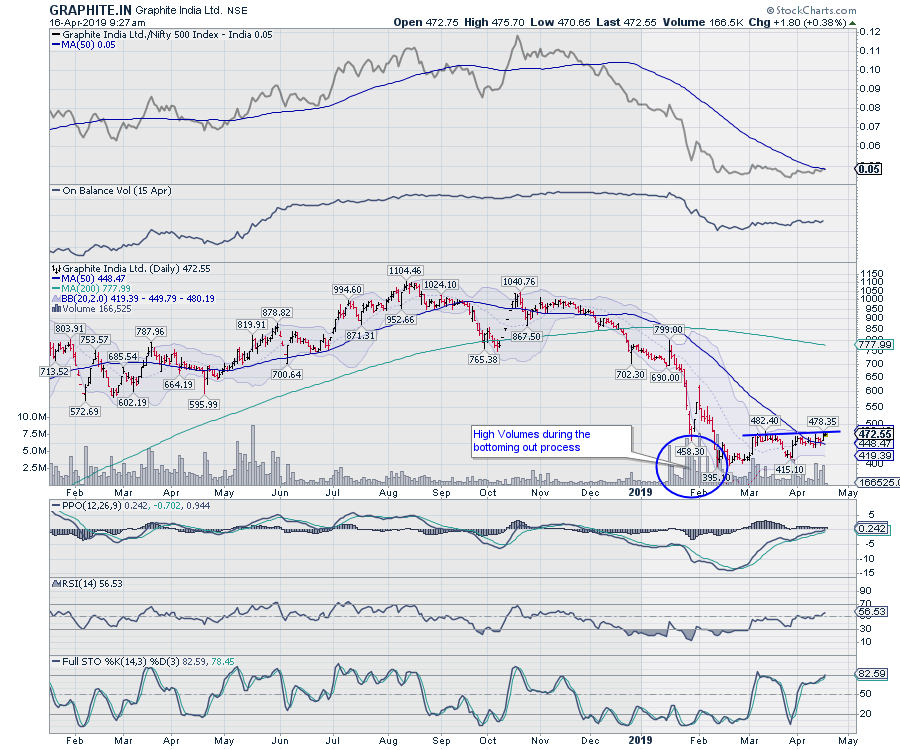

Graphite India - Showing Good Potential Among Non-Index Stocks

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Graphite India Limited - GRAPHITE.IN

GRAPHITE looks to be confirming its bottom in the 395-415 zone. After marking a low near 395, the stock has formed a base in the 395-415 zone; having experienced a sideways move over past couple of weeks, a breakout appears likely. The RSI, which...

READ MORE

MEMBERS ONLY

RISK

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Dictionary.com says: Risk is the exposure to the chance of injury or loss; a hazard or dangerous chance. American Heritage Dictionary says: Risk is the possibility of suffering harm or loss; danger. These are just two of the many entries and these were just for the noun. Risk in...

READ MORE

MEMBERS ONLY

Finding, Tracking and Analyzing Growth Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Learning about and tracking growth stocks in unique industry groups is an ongoing process that can help traders and investors outperform the broader market. This article will provide links to some of the resources from the On Trend episode focusing on growth stocks (Finding, Tracking and Analyzing Growth Stocks). A...

READ MORE

MEMBERS ONLY

All-Time Highs Approaching Plus 10 Trade Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 12, 2019

Who thought at our December low that the S&P 500 would rally well over 20% to above 2900 and within 1% of our all-time high in less than four months? Not this guy. The stock market can do anything, but if...

READ MORE

MEMBERS ONLY

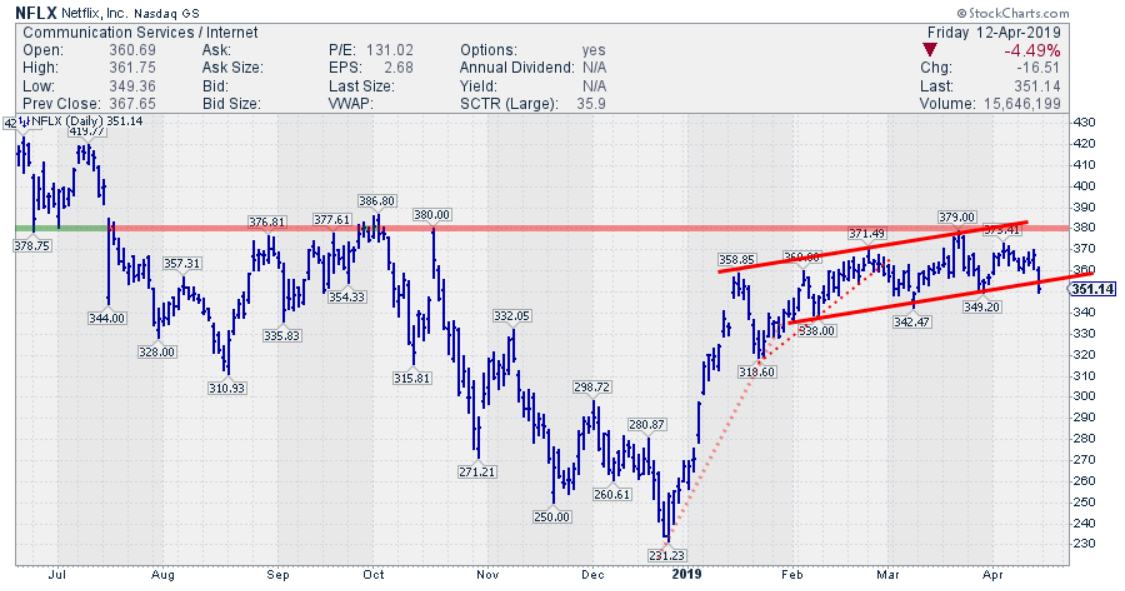

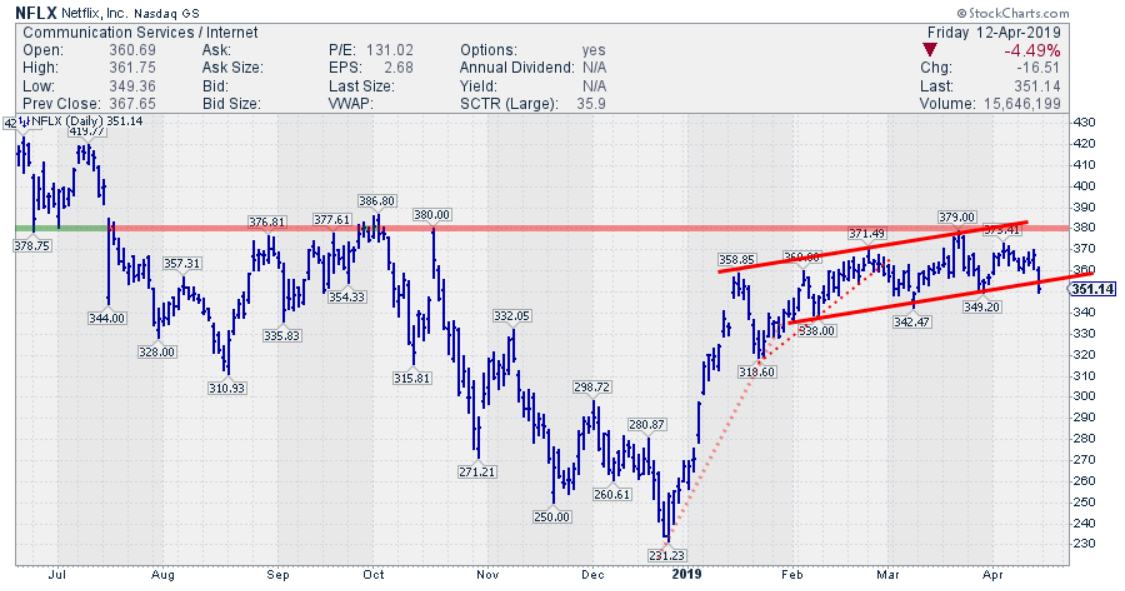

Three Breaks And You're Out For NFLX?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since the beginning of the month, NFLX is lagging the S&P 500 index by more than 5%.

This is following the relative weakness that entered this stock after a strong start of 2019, where NFLX initially ran from $230 to $370 but started to move sideways, facing heavy...

READ MORE

MEMBERS ONLY

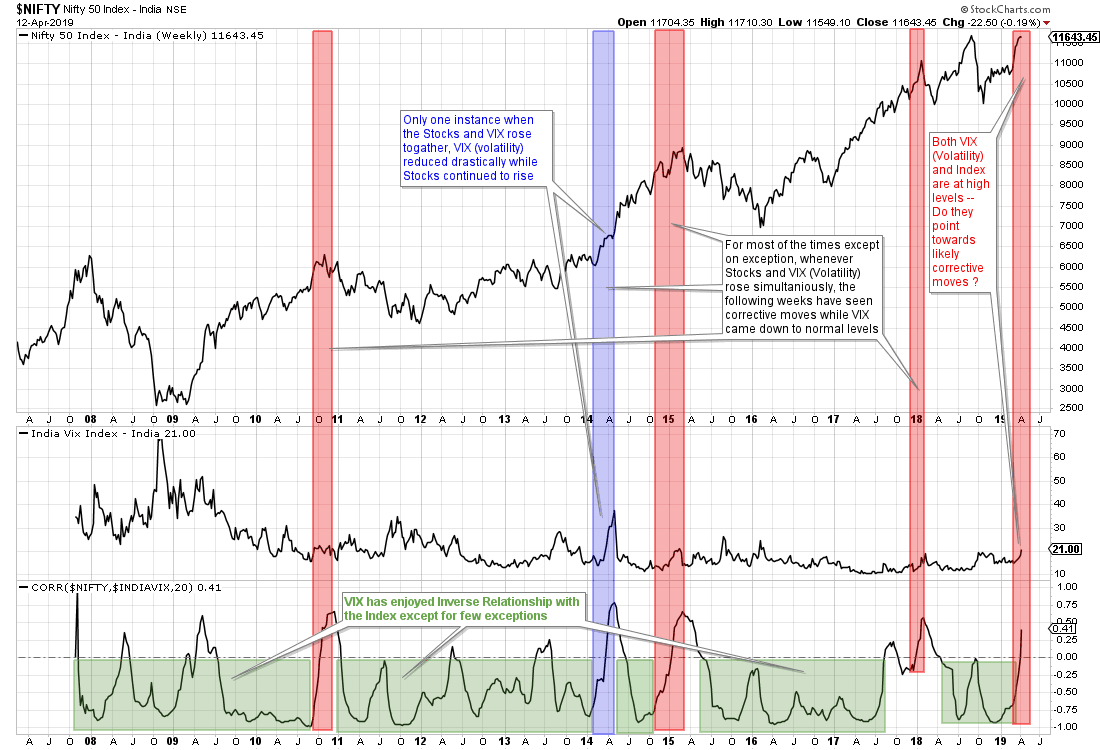

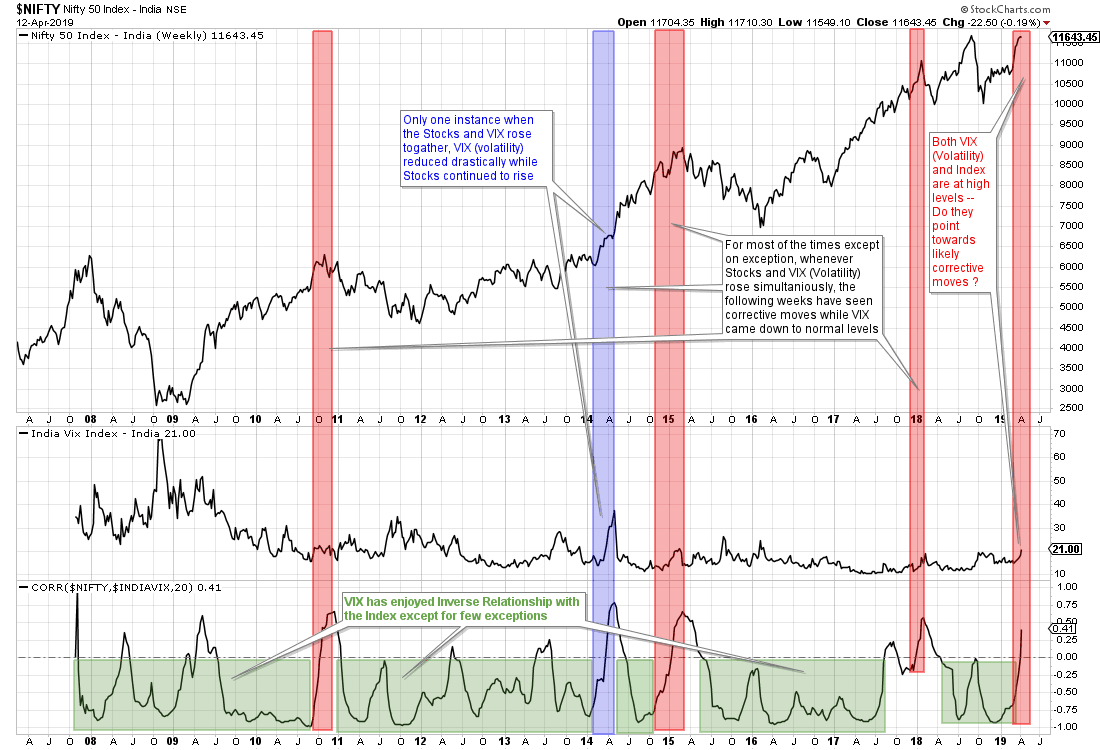

Special Note: When VIX Defies Its Inverse Relationship With NIFTY...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Volatility Index, more commonly known as the VIX, is a measurement of market's expected volatility in the future. Analysts and investors alike look at this tool to measure sentiment while making investment decisions. The VIX reflects the psychology of market participants' fear and greed and is...

READ MORE

MEMBERS ONLY

Week Ahead: Truncated Short Week To See Capped Upsides; Charts Offer Important Signals To Read

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

This was the second week in a row where the Indian equity markets did not make any significant directional move. The week that went by remained particularly volatile, as the market oscillated back and forth on each side in a defined range while continuing to resist to the lower trend...

READ MORE

MEMBERS ONLY

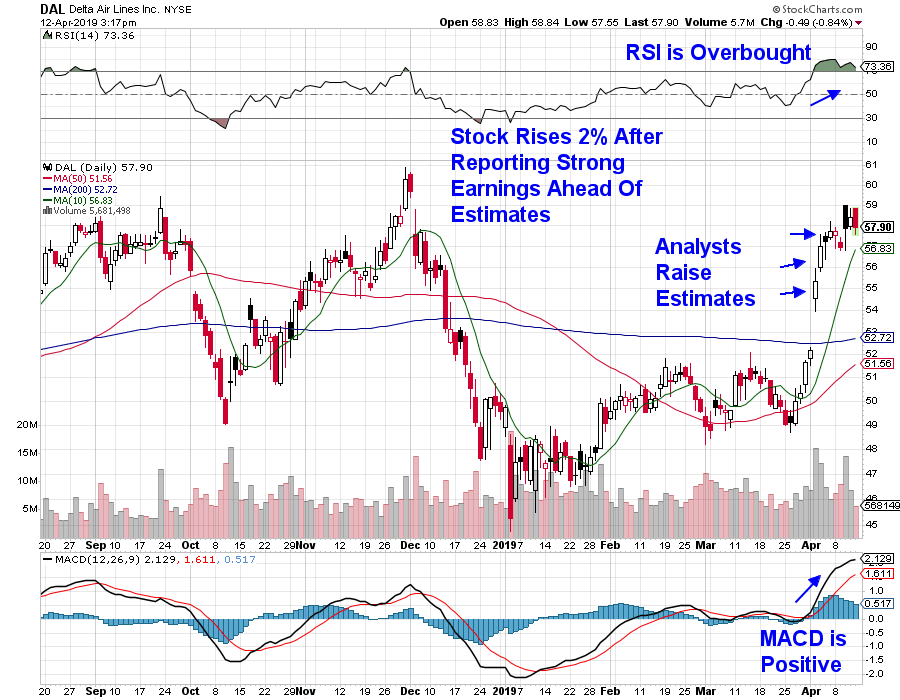

Here Are The Industry Groups Flying Into Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Analysts routinely visit management teams of public companies to see how their quarters are progressing. Based on the knowledge they gain, they return to their offices and their firms issue recommendations to buy or sell. It's the reason that we do what we do. By analyzing price action,...

READ MORE

MEMBERS ONLY

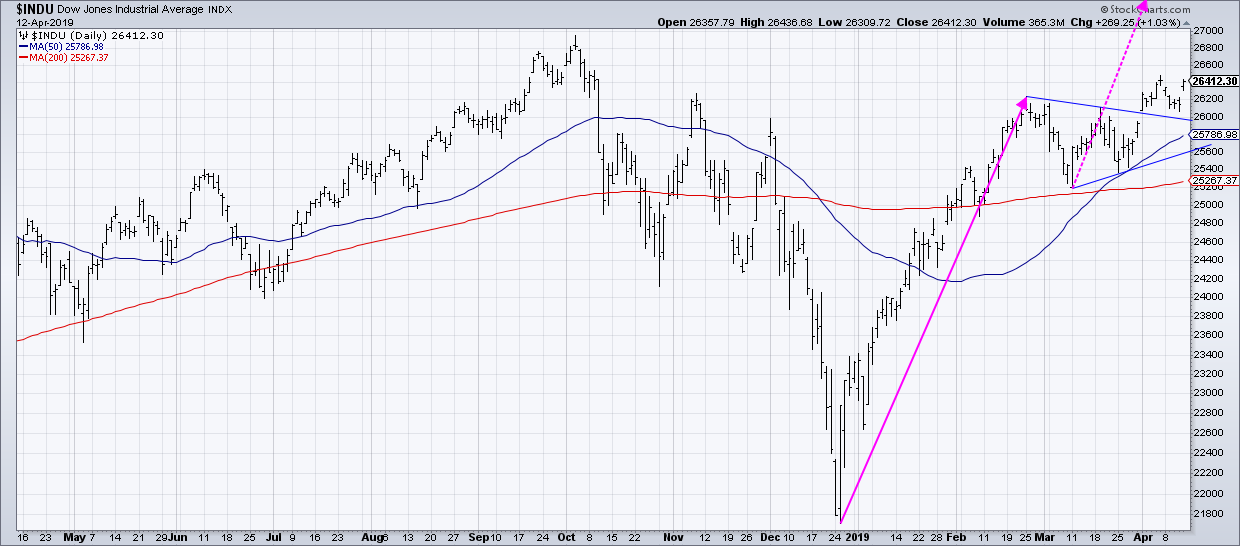

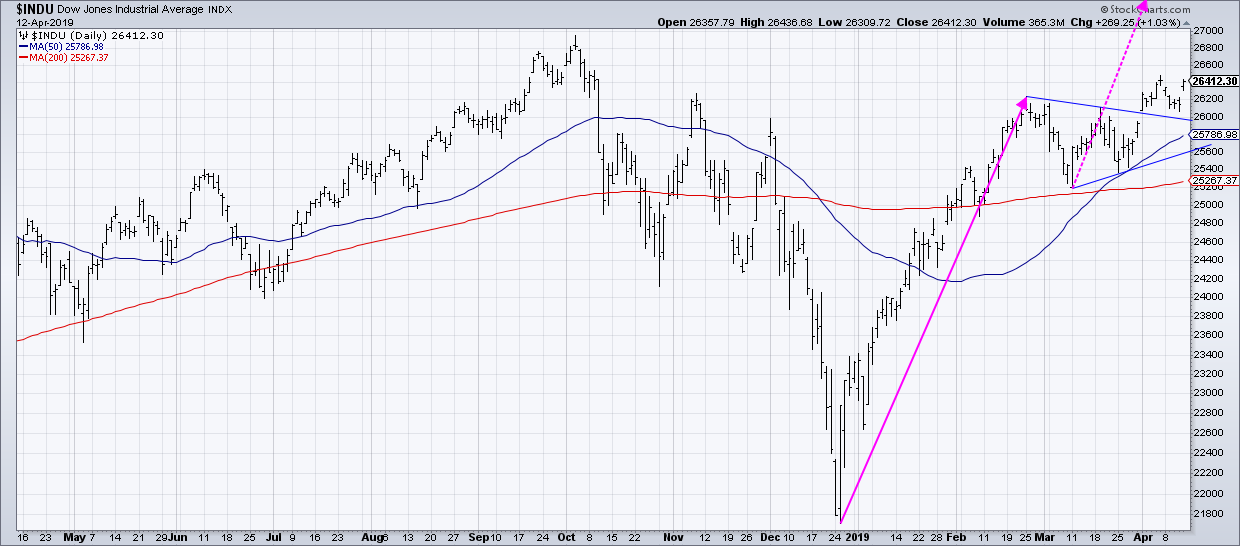

An Aggressive Projection for the Dow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Have you ever played devil’s advocate in a group discussion? That's the situation where everyone comes to one conclusion, so you take the opposite side just to provide an alternative hypothesis and argue its merits.

We often avoid this sort of “outside the box” thinking because of...

READ MORE

MEMBERS ONLY

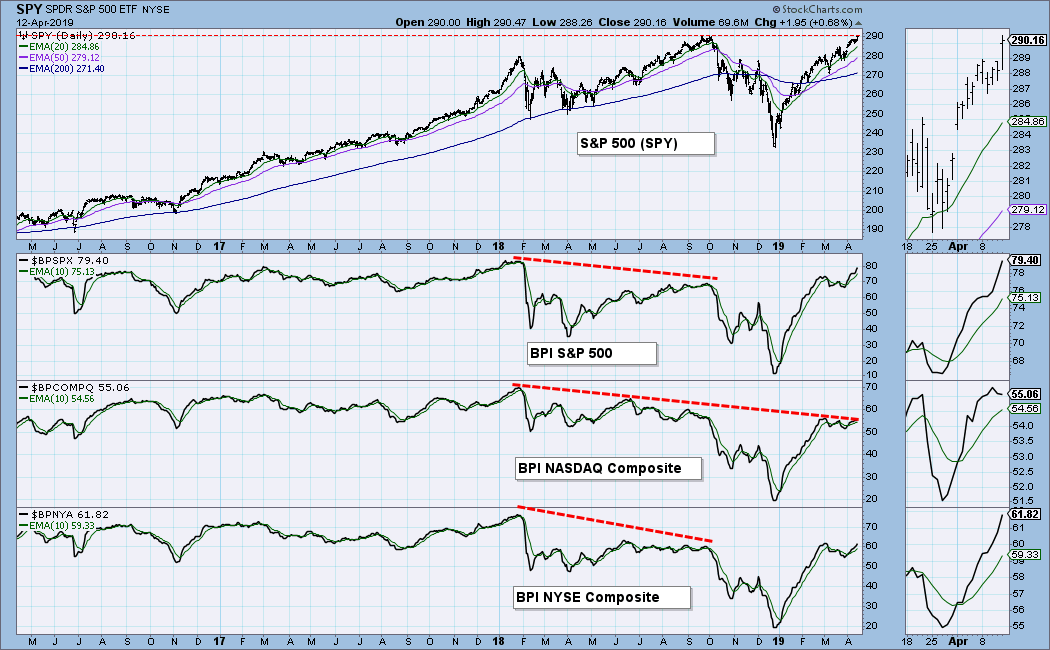

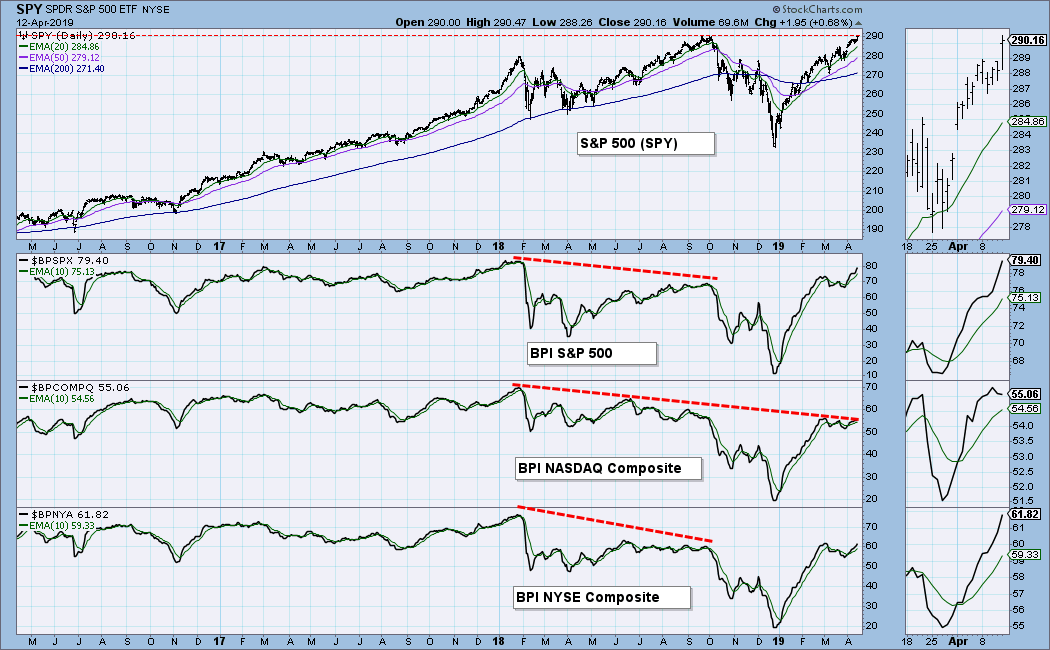

DP WEEKLY WRAP: Nasdaq and NYSE Bullish Percent Lagging Behind

by Carl Swenlin,

President and Founder, DecisionPoint.com

One of the market indicators available on StockCharts.com is the Bullish Percent Index (BPI), which calculates the percentage of stocks in a given index that are on point and figure BUY signals. On the chart below we can see the BPI for the S&P 500, the Nasdaq...

READ MORE

MEMBERS ONLY

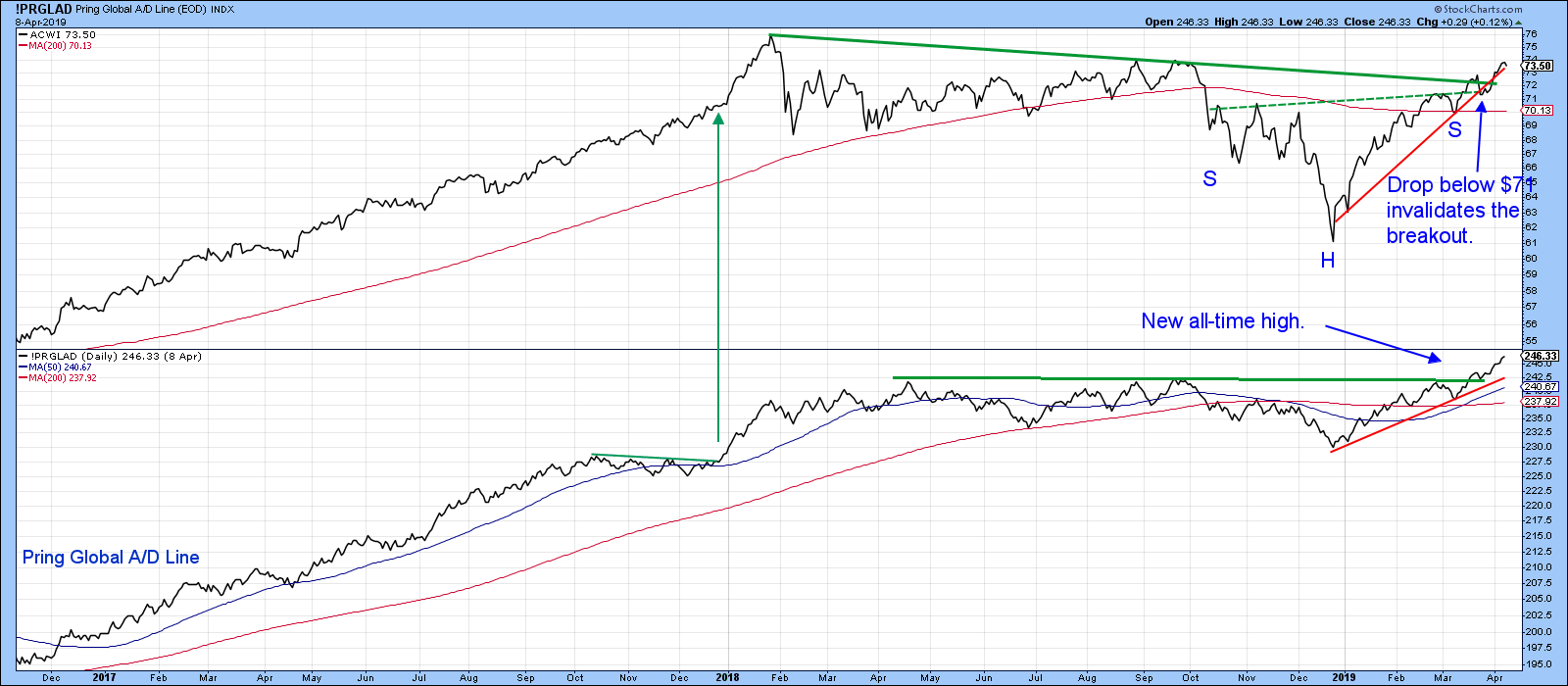

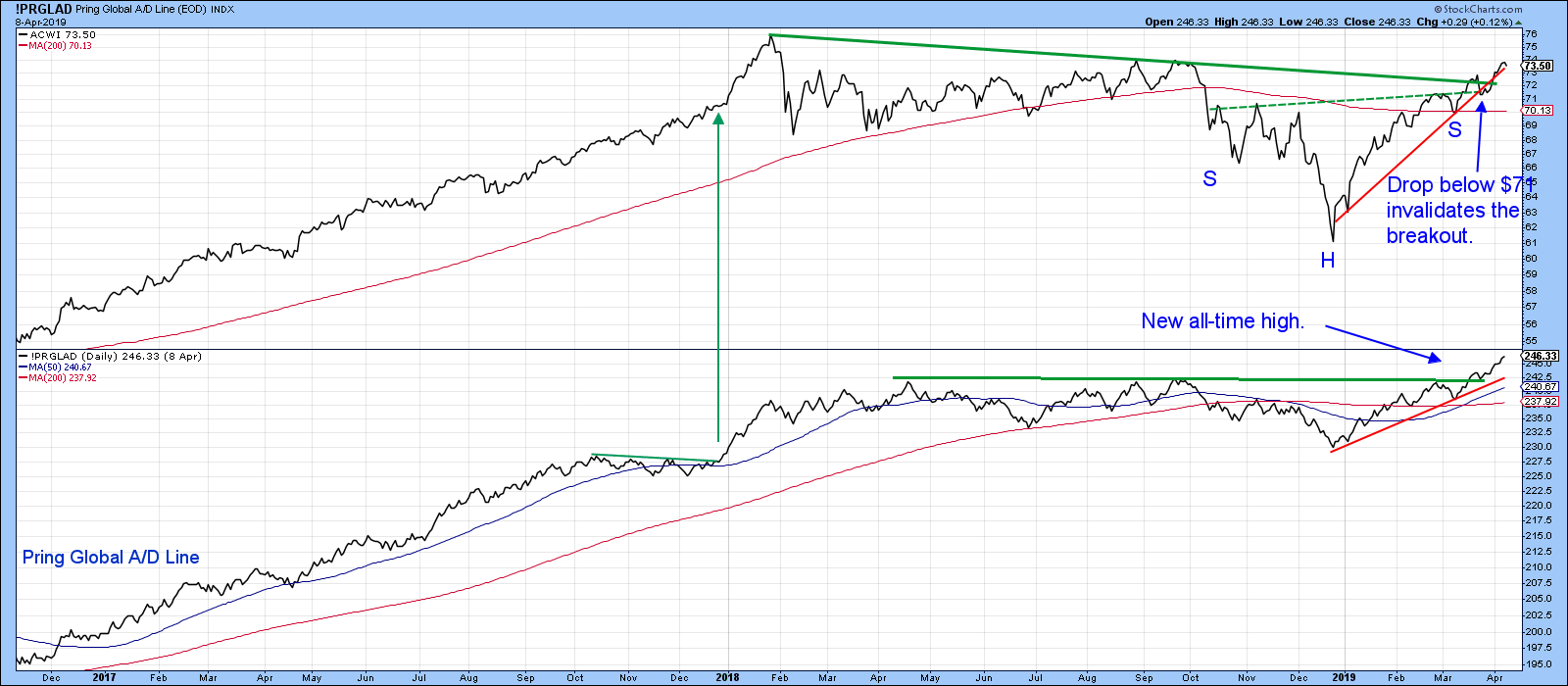

Global Stocks Join Global A/D Line Above Key Trend Lines

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, April 9th at 1:08pm ET.

Global stocks, represented in the form of the MSCI World Stock ETF (ACWI), peaked in January of last year and gradually worked their way lower into...

READ MORE

MEMBERS ONLY

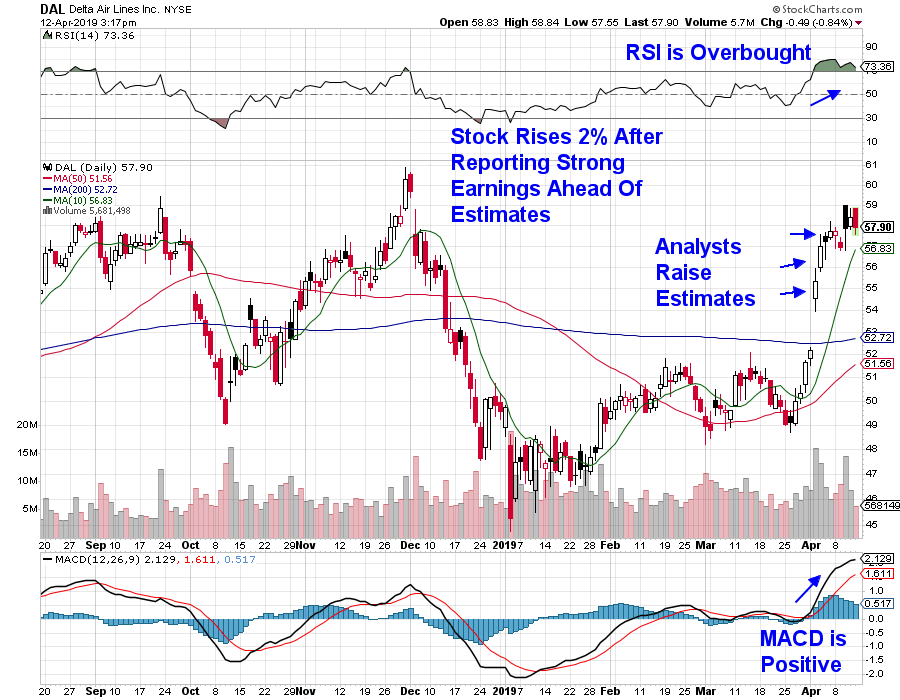

Trading Stocks Before They Report Earnings - Tips to Improve Your Success Rate

by Mary Ellen McGonagle,

President, MEM Investment Research

Earnings surprises can move a stock substantially, leading to either huge gains or big losses in your portfolio. Today, I’ll be reviewing how you can trade during earnings season to your benefit. There is no single absolute way to do this; rather, as you’ll see, it will depend...

READ MORE

MEMBERS ONLY

EARNINGS: 2018 Q4 Finalized; S&P 500 Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings for 2018 Q4 have been finalized, and with a P/E of 21.4, the market is above the normal value range and very overvalued. The following chart shows us the normal value range of the S&P 500 Index. It shows us where...

READ MORE

MEMBERS ONLY

When Tails Remain On One Side Of A Relative Rotation Graph, What Does That Mean?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to use to visualize sector rotation, along with other asset rotations in various universes.

If you have used RRGs regularly and have monitored multiple rotational patterns, you may have noticed that the rotations do not always travel through all four quadrants in sequential...

READ MORE

MEMBERS ONLY

BANKS LEAD FINANCIALS AND THE MARKET HIGHER -- FINANCIAL SPDR HITS NEW 2019 HIGH -- WHILE S&P BANK ISHARES CLEAR THEIR 200-DAY LINE -- BANK LEADERS INCLUDE JPM, BAC, AND PNC -- S&P 500 NEARS TEST OF LAST SEPTEMBER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS LEAD FINANCIALS HIGHER ... Strong earnings from three banks this morning have helped push that group sharply higher; and they're leading the financial sector and the market higher. Chart 1 shows the Financial Sector SPDR (XLF) gapping up to the highest level of the year (after regaining its...

READ MORE

MEMBERS ONLY

J.P. Morgan Beats Earnings Expectations

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 11, 2019

U.S. equities finished in bifurcated fashion as a late day rally enabled the S&P 500 to eke out a miniscule 0.11 point gain (+0.00%). The other major indices finished in negative territory, led by the 0.21% decline...

READ MORE

MEMBERS ONLY

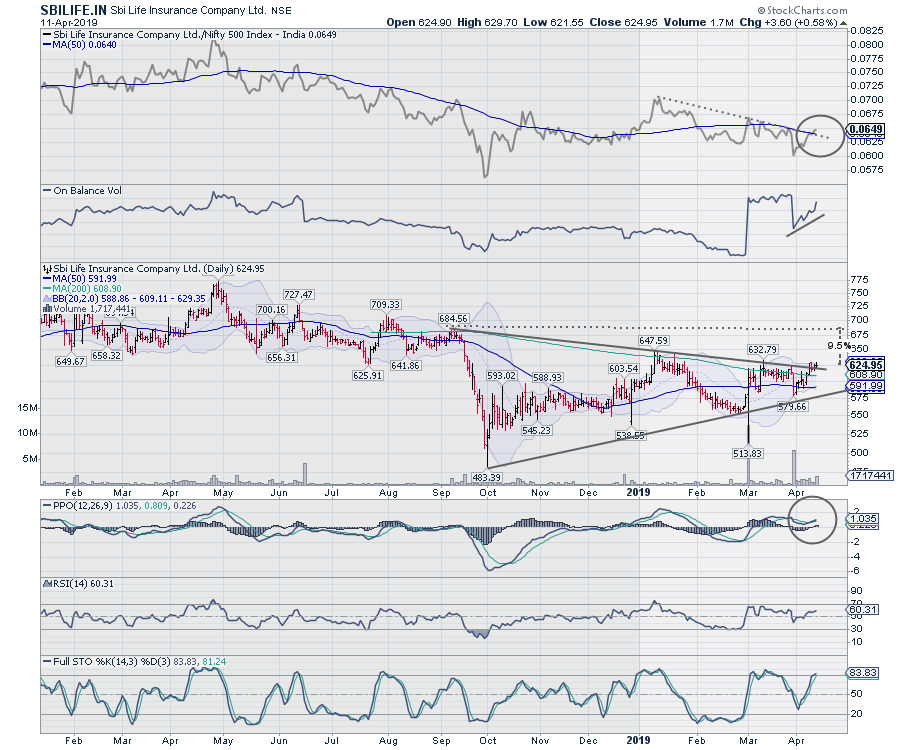

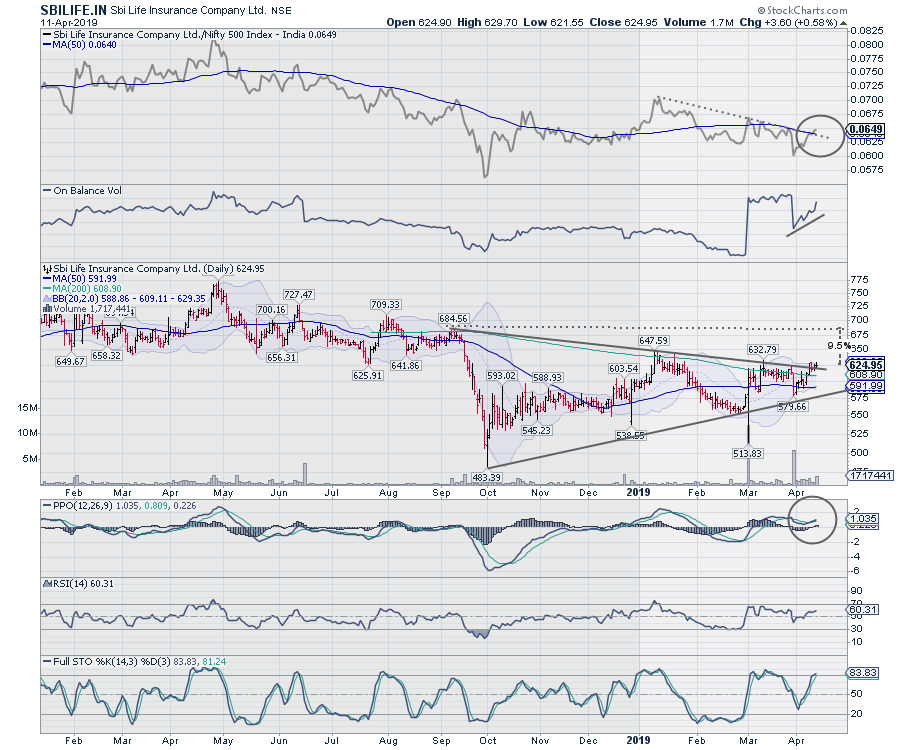

SBILIFE Offers Some Upside Potential

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

SBI Life Insurance Company Ltd (SBILIFE.IN)

This stock has a relatively short listing history. It originally listed in October 2017 and marked its high near 772 in middle of 2018, with a subsequent low near 483 in the corrective move that followed in late 2018. Presently, the stock is...

READ MORE

MEMBERS ONLY

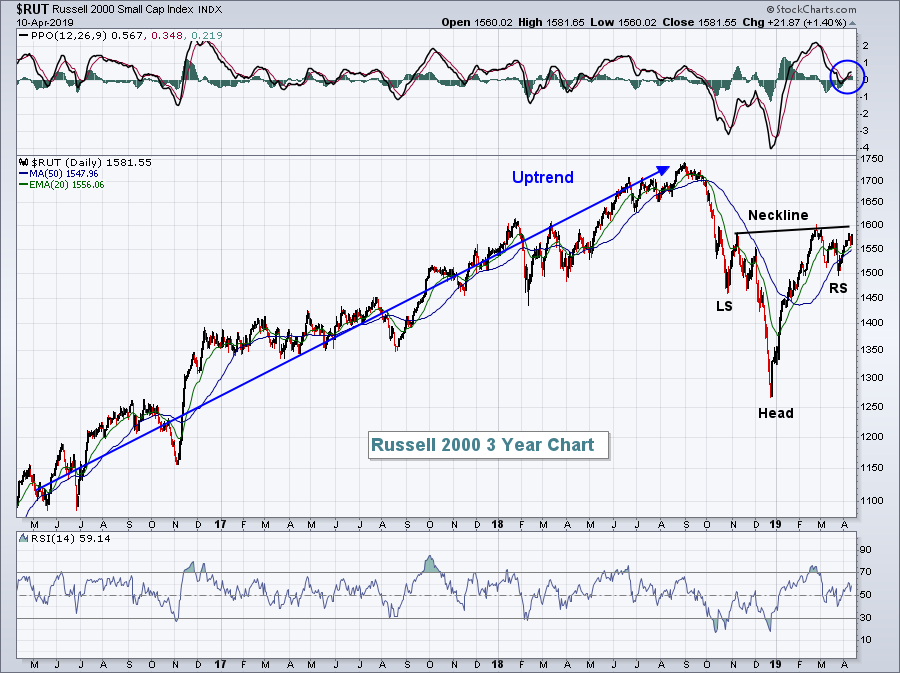

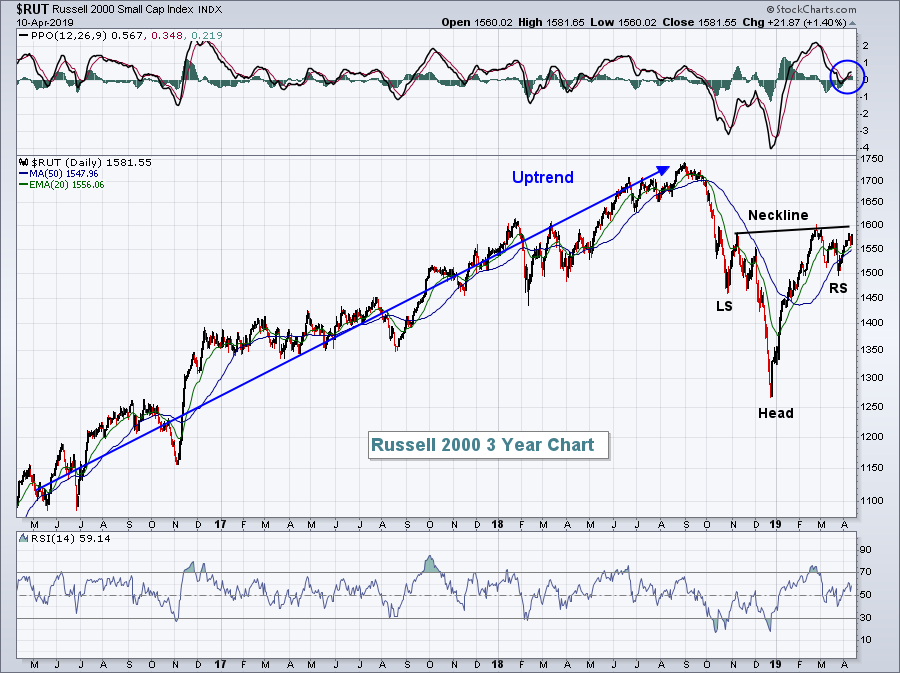

S&P 500 Channel Suggests We'll Bust Through 3000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 10, 2019

Small cap stocks enjoyed a huge day, carrying Wall Street higher. The Russell 2000 surged 1.40% and is nearing a major neckline resistance that, if broken, would suggest much higher prices for small caps:

Clearing 1600 would be a big deal technically...

READ MORE