MEMBERS ONLY

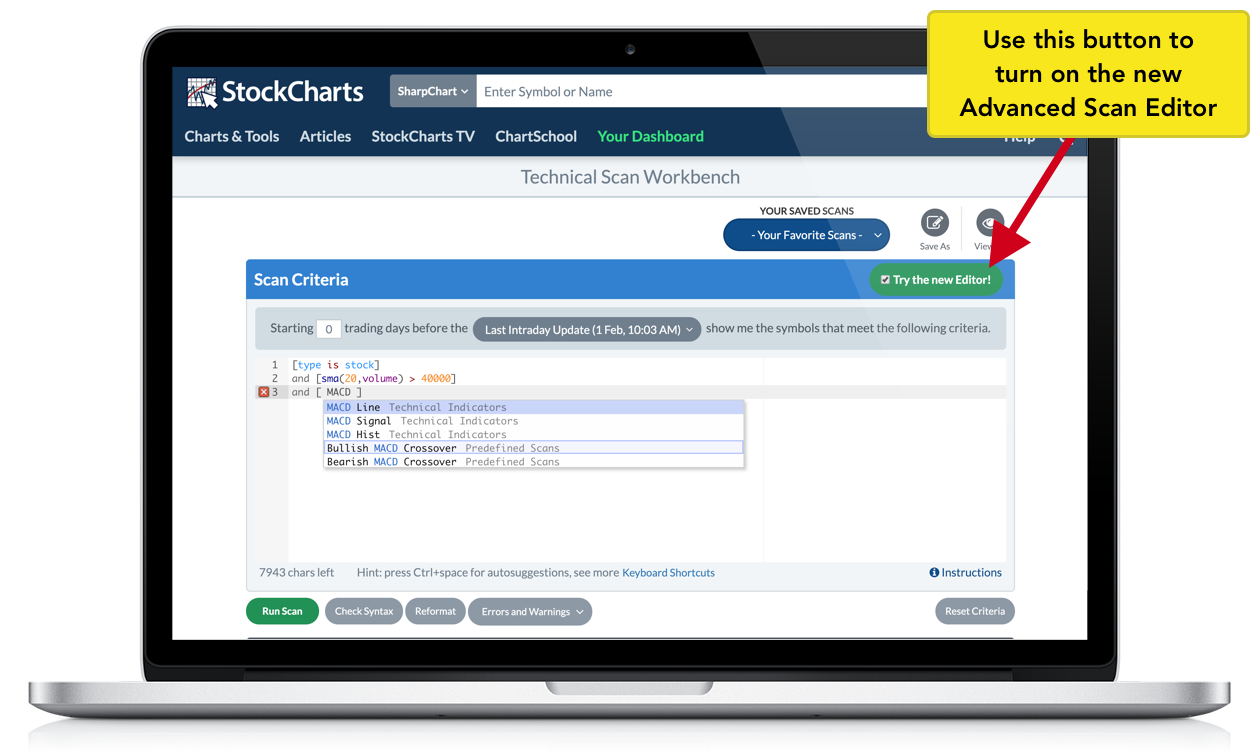

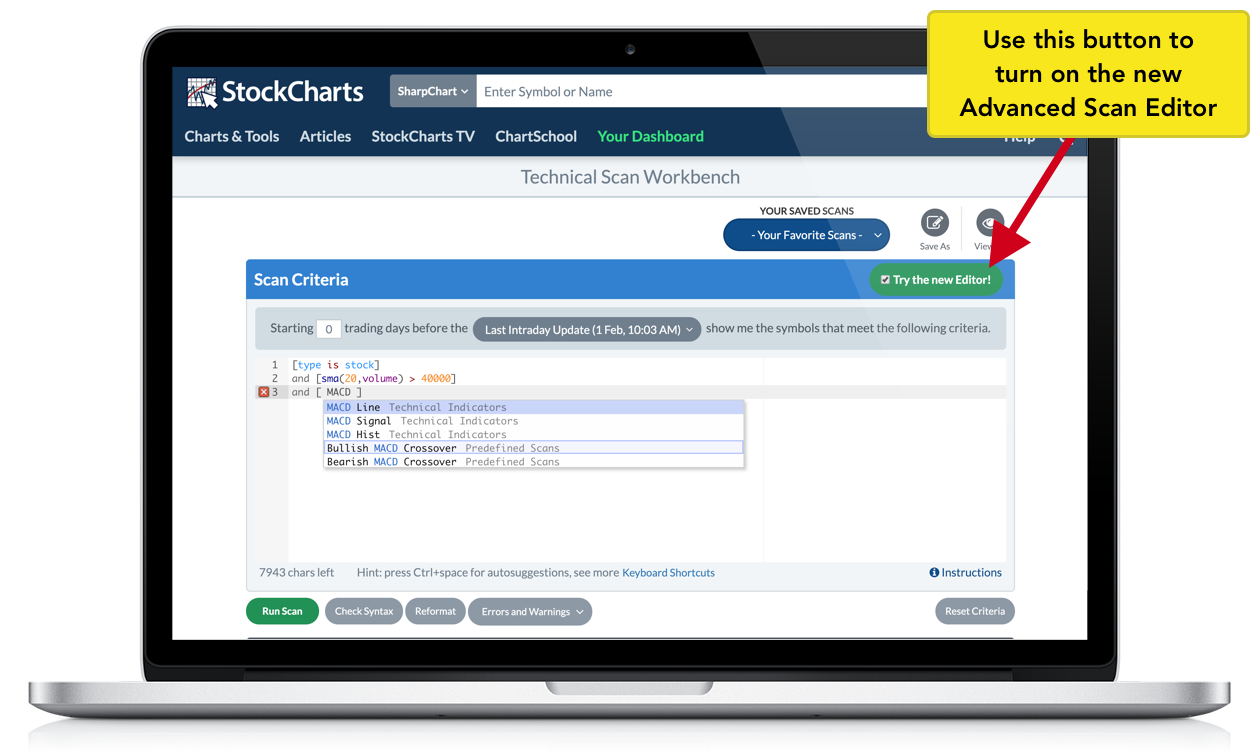

New Feature Alert! Introducing The Advanced Scan Editor

by Grayson Roze,

Chief Strategist, StockCharts.com

Calling all scanners! The biggest thing since sliced bread has just hit the Advanced Scan Workbench.

Last week, we released a major upgrade to our premier scanning tool – the Advanced Scan Editor. This useful addition to the Advanced Scan Workbench is designed to make it both easier and faster to...

READ MORE

MEMBERS ONLY

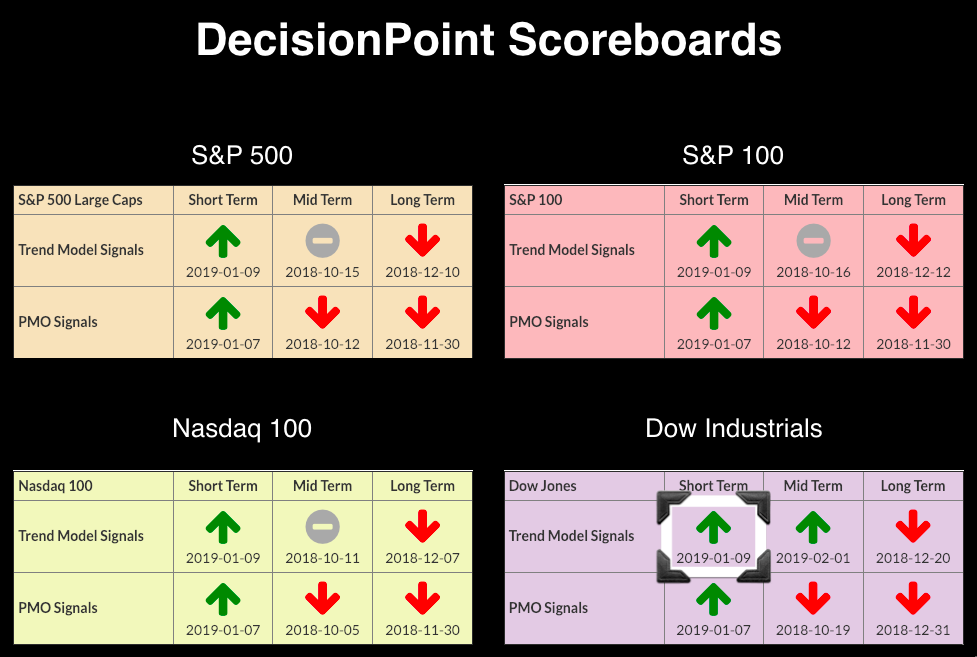

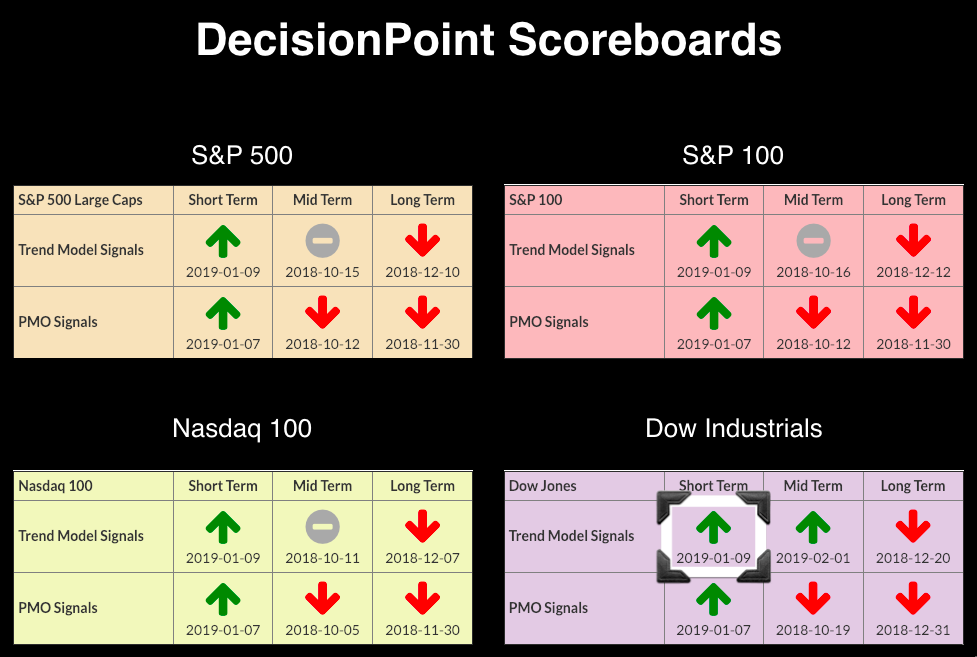

New IT Trend Model for Dow - Rising Trend Channels Replace Ascending Wedges

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, we had a new Intermediate-Term Trend Model (ITTM) BUY signal trigger on the Dow Industrials ($INDU). Additionally, the SPY (which is not on the Scoreboards) triggered a new ITTM BUY signal as well. Be sure to read Carl's DP Weekly Wrap for this week to read about...

READ MORE

MEMBERS ONLY

Two-for-One: How to Live Longer and Pass the Financial Baton to Future Generations

by Gatis Roze,

Author, "Tensile Trading"

“Yes, the fountain of youth really does exist, and academic research is increasingly proving it to be found amidst your investment portfolio. A growing body of scholarly research shows that, in many ways, life can get better as we get older and being an active investor can contribute in significant...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ video) - The Broken Record

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

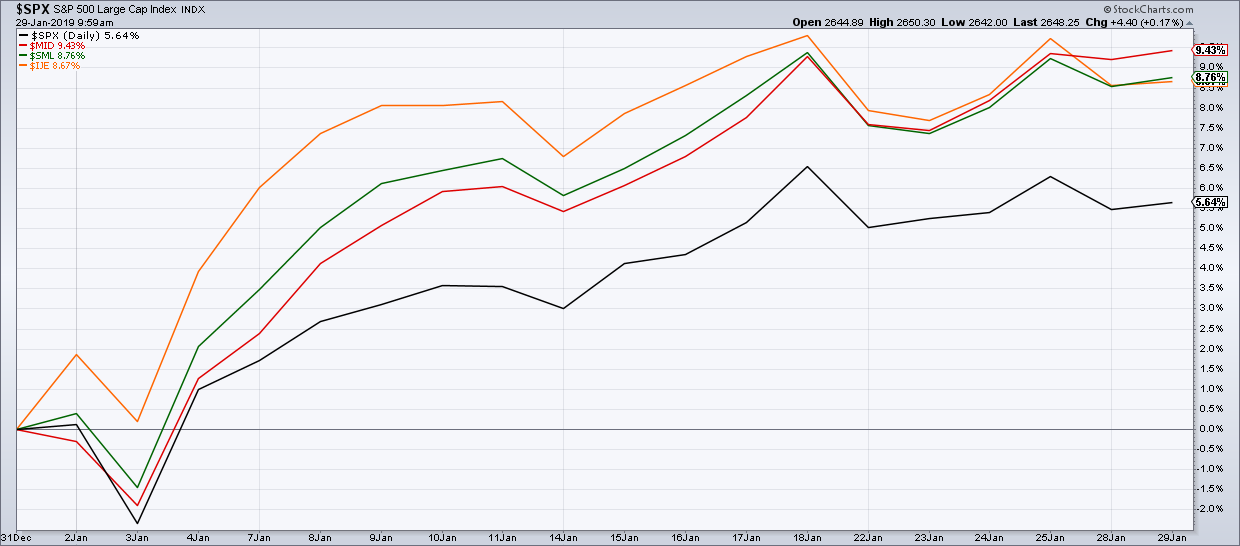

* Putting January Into Perspective.

* Still Below December High.

* Another Reversal Zone Appears.

* SPY and the Pennant Breakout.

* Participation begins the Wane.

* REITs, Utes and Healthcare Lead New Highs.

* XLU Extends on Breakout.

* Charts that Make me Throw my Hands Up.

* Choosing Another Timeframe.

* The Powell Put Comes to Life.

* Homebuilders...

READ MORE

MEMBERS ONLY

Bond Market Issues Major Warning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 31, 2019

Wall Street surged again on Thursday, buoyed by additional strong earnings reports and surprisingly strong forecasts by a couple of influential names. Facebook (FB, +10.82%) and General Electric (GE, +11.65%) were two of the leaders on the S&P 500....

READ MORE

MEMBERS ONLY

STOCK RALLY CONTINUES -- DOW IS THE FIRST INDEX TO REACH ITS 200-DAY AVERAGE -- CYCLICALS AND BIOTECHS ARE TRADING ABOVE THEIR 200-DAY LINES -- BIG DROP IN BOND YIELDS BOOSTS STAPLES, UTILITIES, AND REITS -- LOWER YIELDS ARE HURTING BANK STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS THE FIRST TO REACH ITS 200-DAY AVERAGE... The stock rally that began right after Christmas is continuing today. Major stock indexes have been heading up to challenge potential overhead resistance at their 200-day moving averages. Chart 1 shows the Dow Industrials being the first major stock index...

READ MORE

MEMBERS ONLY

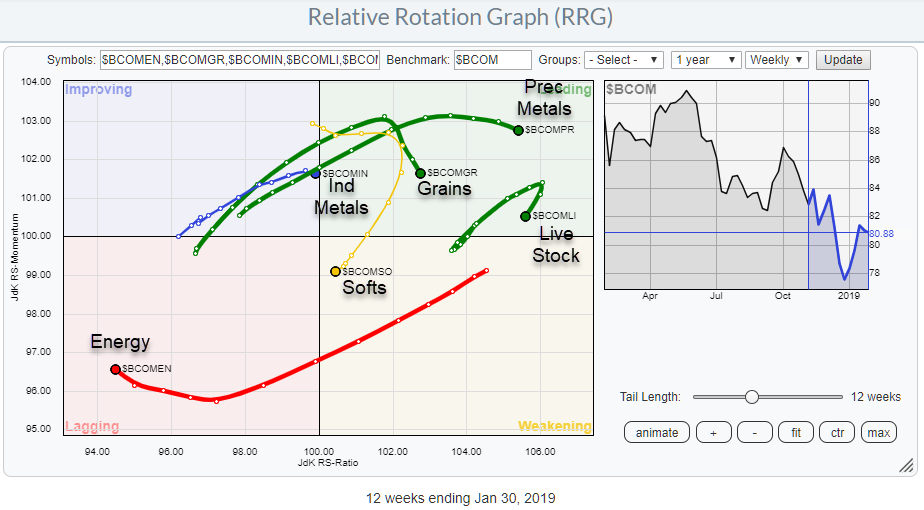

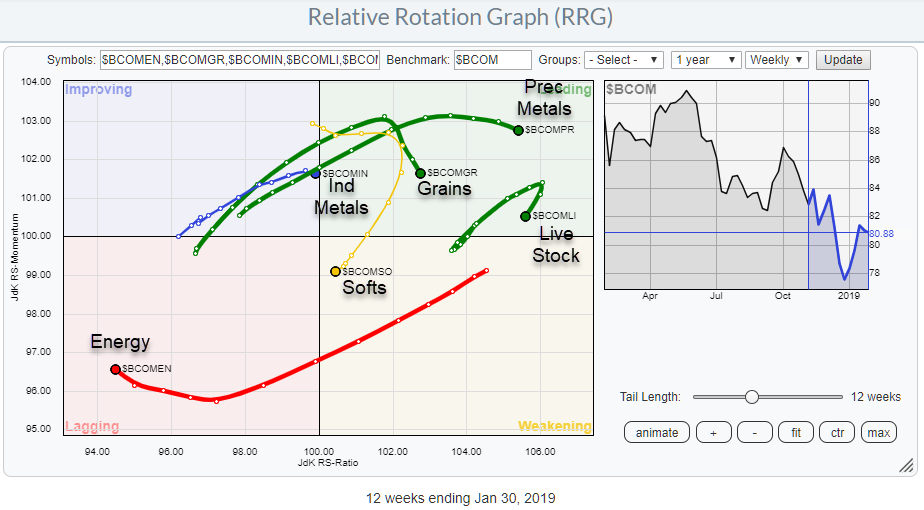

Breaking Down The Bloomberg Commodity Index Family On RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this article, we are going to take a look at commodities using Relative Rotation Graphs and the Bloomberg commodity index family.

When possible, I prefer to use data-sets that come from the same family and creating a "closed universe." This is a universe where all securities on...

READ MORE

MEMBERS ONLY

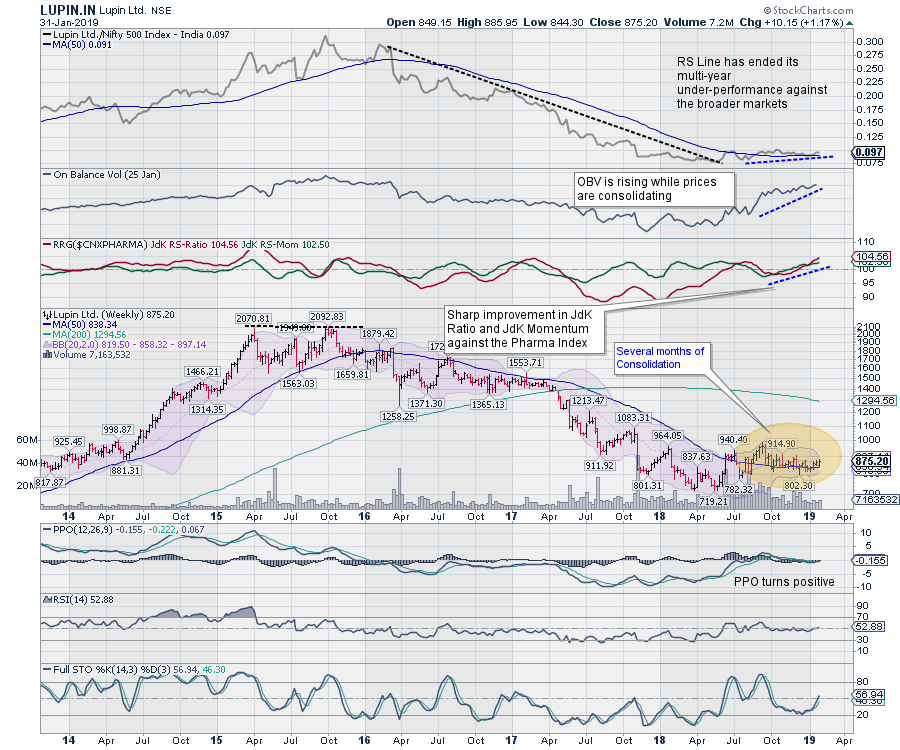

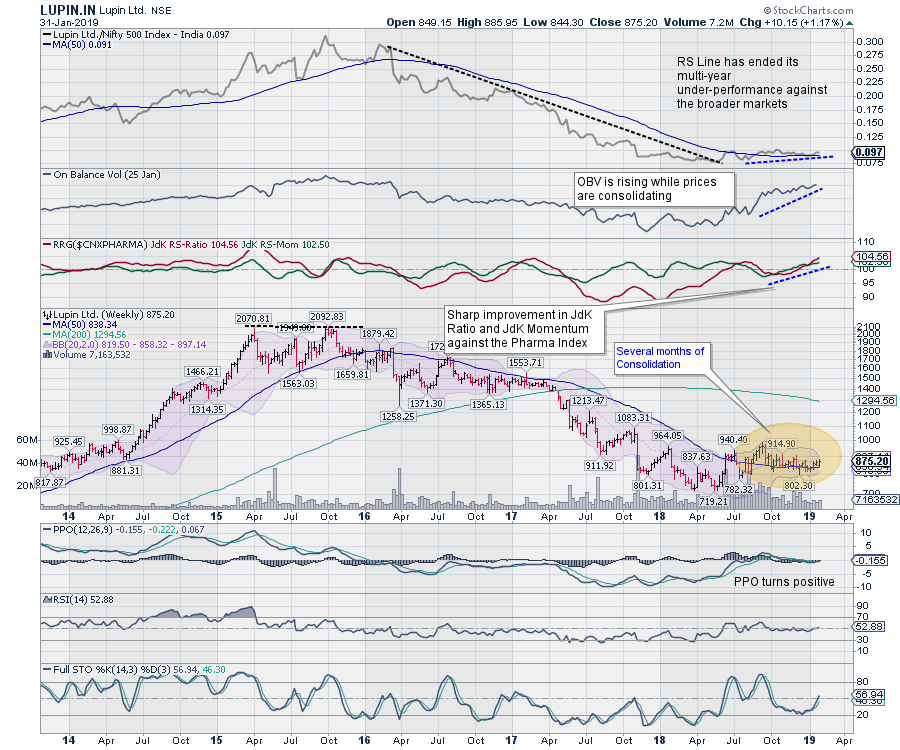

This Pharma Stock Is Set For A Good Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Lupin Limited (LUPIN.IN)

* LUPIN.IN marked a double top at the 2070-2092 level in October 2016 and has since remained in a corrective downtrend. After trading in a falling channel during this corrective phase and wiping out over 50% of its value, the stock has attempted to find a...

READ MORE

MEMBERS ONLY

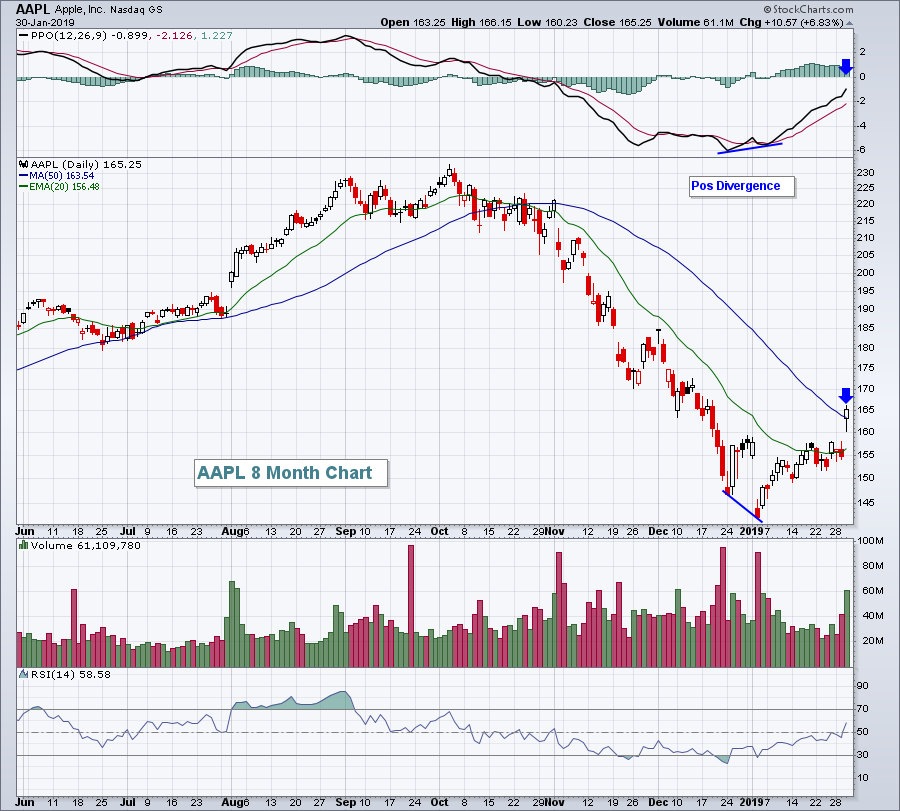

Consumer Stocks Are Painting A Bullish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 30, 2019

Wall Street had much to digest yesterday. There was fresh jobs data as the January ADP employment report was released. The news was much better than anticipated. There was the Apple (AAPL) earnings report from Tuesday evening. While the numbers reported were mostly...

READ MORE

MEMBERS ONLY

Pair Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I remember following Martin Zweig years (decades) ago and in fact used one of the techniques he described in his book, “Winning on Wall Street,” in the mid-1980s' (1984 to be exact). In it he described a really simple technique using his unweighted index (ZUPI); trading it on a...

READ MORE

MEMBERS ONLY

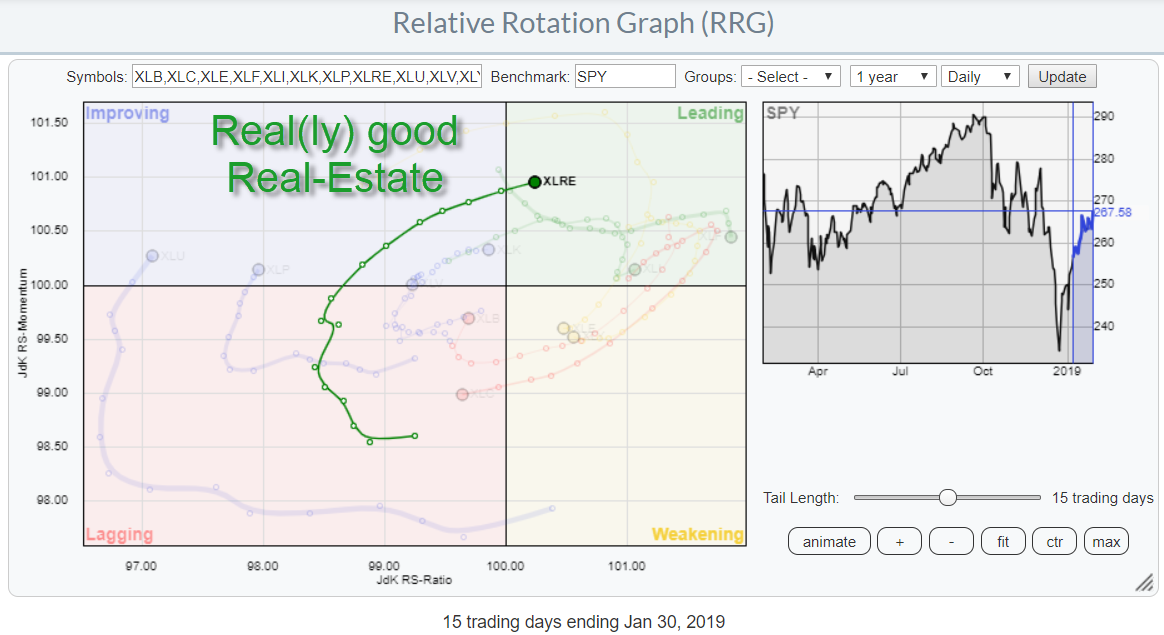

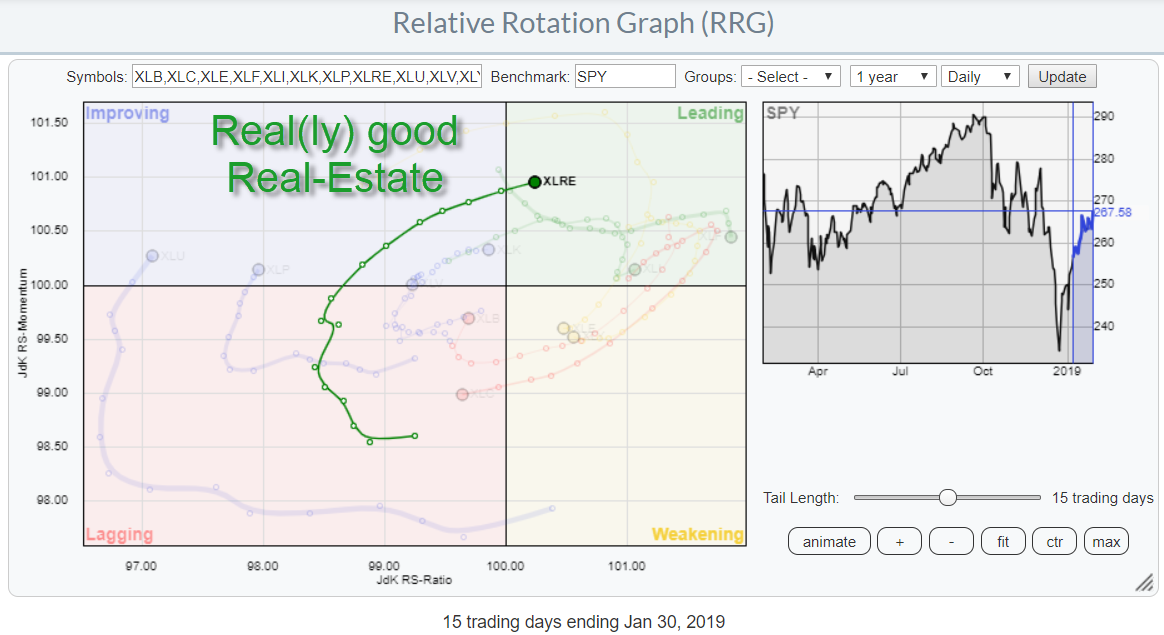

Real(ly) Good Real-Estate (XLRE) But It Needs To Break Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows a remarkably steady rotation for the Real-Estate sector. This is a daily RRG showing a 15 day tail, or three weeks. Yesterday XLRE crossed over into the leading quadrant and is now the only sector inside the leading quadrant at a solidly...

READ MORE

MEMBERS ONLY

DP Alert: Gold Breaks Out and Adds PMO BUY Signal - Dollar PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rallied nicely this morning. It started by pulling back slightly, before the less hawkish announcement that came out of the FOMC resulted in the rally pushing higher. DecisionPoint Scoreboards point to short-term strength, with BUY signals in the short term. The IT Trend Model BUY signal became official...

READ MORE

MEMBERS ONLY

GOLD IS STARTING TO GAIN SOME UPSIDE ATTENTION -- SO ARE GOLD MINERS -- THAT MAY REFLECT EXPECTATIONS FOR A MORE DOVISH FED, A WEAKER DOLLAR, AND LOWER INTEREST RATES -- WEAKER GLOBAL STOCKS ALSO MAKE GOLD ASSETS A MORE ATTRACTIVE ALTERNATIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ETFS ARE IN RALLY MODE ... Today is Fed day which could have an impact on several markets. The Fed isn't expected to raise its short-term rate today. But what it says after the meeting could have an impact. Two things are being watched very closely. The first...

READ MORE

MEMBERS ONLY

Autozone Gets Back in Gear

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Autozone (AZO) is a leading stock because it recorded a 52-week high in December and remains above the rising 200-day SMA. The S&P 500, on the other hand, recorded a 52-week low in December and remains below its 200-day SMA.

The chart below shows AZO with a falling...

READ MORE

MEMBERS ONLY

FAANG Stocks Weak, Drag Down Influential NASDAQ 100

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 29, 2019

It was a bifurcated and trying day on Wall Street. Bifurcation isn't necessarily a bad thing as some indices will simply outperform others on certain days and short-term trends in that regard can mostly be ignored. But one problem throughout this...

READ MORE

MEMBERS ONLY

Short-Term Consolidations Unfold within Conflicting Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Moving into the Prior Battle Zone.

* Pennant versus Gap for SPY.

* Lowest Close in two Weeks for QQQ.

* IWM Holds Up the Best.

* Divide and Conquer with Sector Analysis.

... Moving into the Prior Battle Zone

... It's a mixed-up world out there as two trends compete and the major...

READ MORE

MEMBERS ONLY

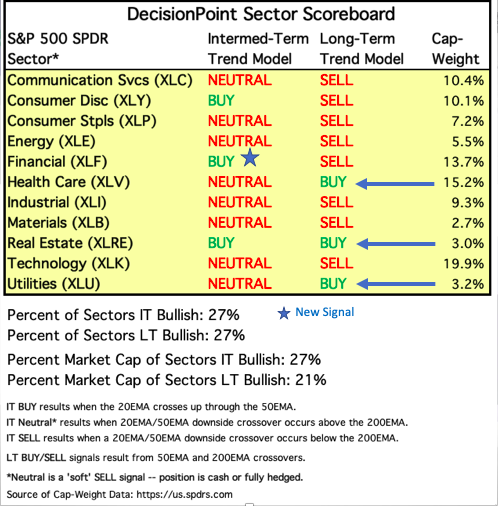

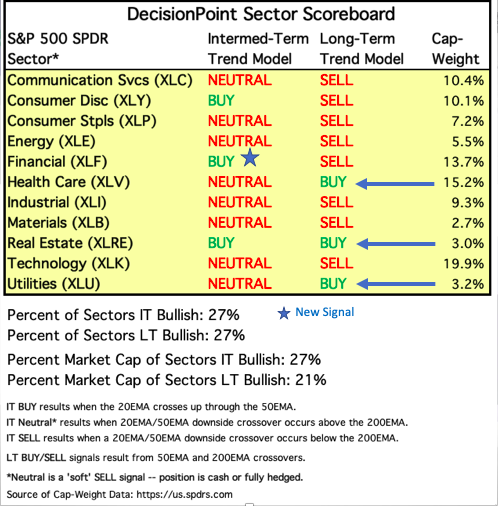

Financial SPDR (XLF) Adds New IT Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Last week, the Consumer Discretionary/Cyclicals SPDR posted a new Intermediate-Term Trend Model (ITTM) BUY signal. Today, the Financial SPDR (XLF) joined in with its own ITTM BUY signal. In the long term, we can see that the only sectors with Long-Term Trend Model (LTTM) BUY signals are the defensive...

READ MORE

MEMBERS ONLY

If The Economy Is Truly Weakening, Commodities Should Be Vulnerable

by Martin Pring,

President, Pring Research

* The Long-Term Trend for Commodities Remains Bearish

* What the Stock Market is Telling Us About Commodities

* Short-Term Picture Not So Strong

Recently, we have seen several reports of a weakening economy. These include a sharp drop in both the University of Michigan and Conference Board consumer sentiment and confidence numbers,...

READ MORE

MEMBERS ONLY

Defrosting the Markets: Thoughts on the January Barometer

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I’ve written several articles regarding seasonal trends in the markets, including the four-year Presidential Cycle, the “Sell in May” phenomenon, and even general thoughts on cyclical patterns in price.

This time of year, we’re faced with a very interesting anomaly known as the January Barometer.

This is different...

READ MORE

MEMBERS ONLY

Wall Street Averts Meltdown Despite CAT/NVDA Warnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 28, 2019

It seemed like the bears let a perfect opportunity slip right through their fingers yesterday. Caterpillar (CAT, -9.13%) reported their latest quarterly earnings before the bell and they weren't pretty. Despite beating revenue estimates, CAT posted EPS well below estimates...

READ MORE

MEMBERS ONLY

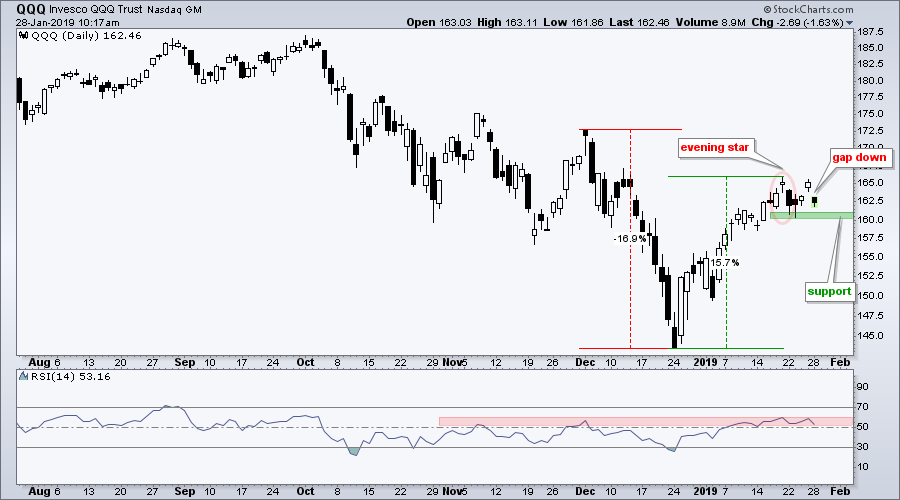

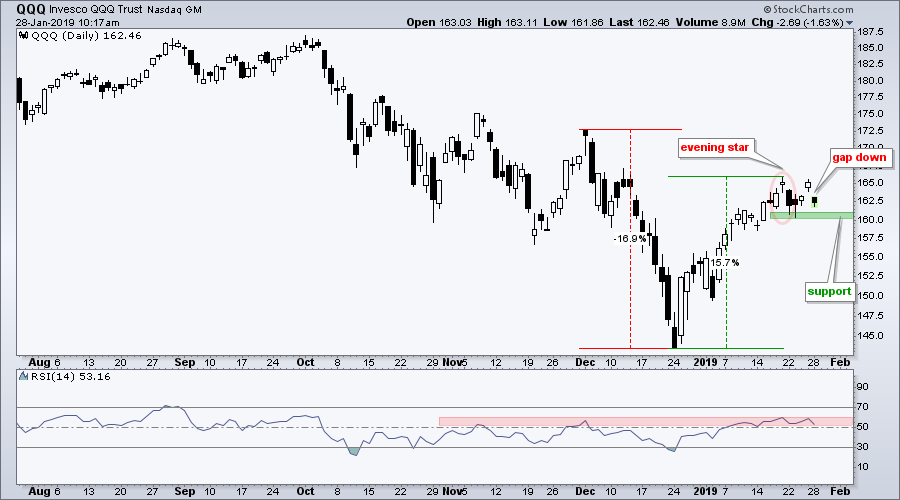

Another Gap for QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week (Monday) I featured an evening star reversal pattern in QQQ. This pattern did not foreshadow further weakness as QQQ firmed in the 161 area the next day and gapped up on Friday. This gap did not last long as QQQ gapped down on Monday morning and filled Friday&...

READ MORE

MEMBERS ONLY

Charts to Keep an Eye on this Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Big Four Retake 50-day SMAs.

* %Above 200-day Lags for XLP.

* 52-week Highs for 22 REITs.

* Jobless Claims Hit 40+ Year Low.

* TLT Stalls between Key Levels.

* Dollar Fails to Hold Breakout.

* Gold Breaks out of Small Consolidation.

* Shanghai Composite Forms Potential Double Bottom.

* Delta Turns Indecisive.

* Tesla Goes from Leader...

READ MORE

MEMBERS ONLY

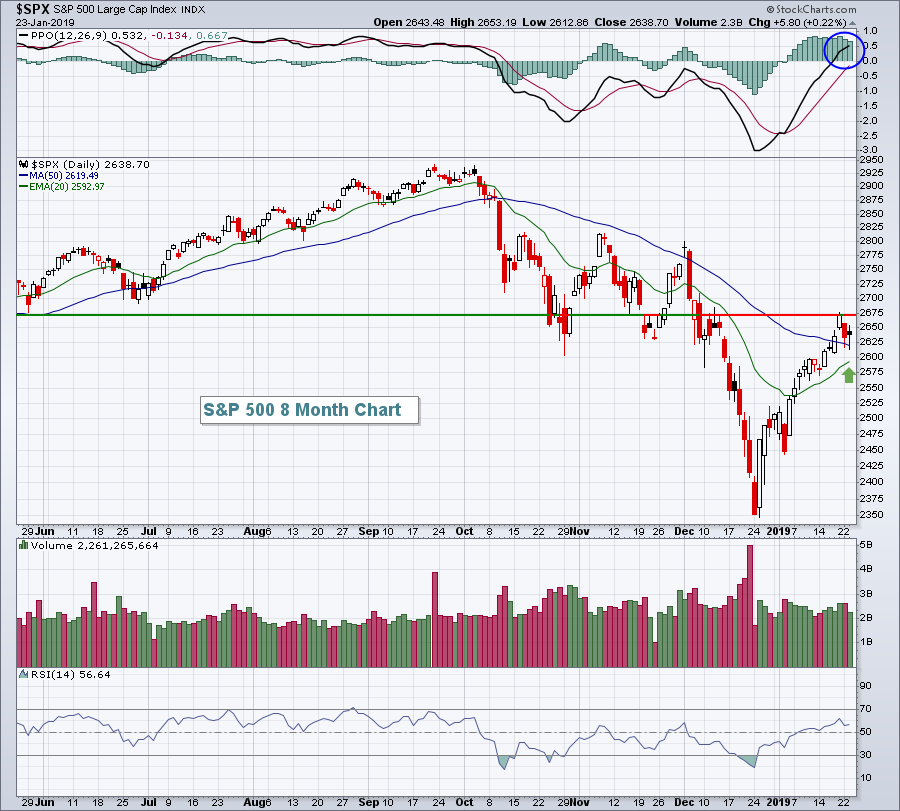

Stocks Finish The Week On A Positive Note, But Overhead Resistance Remains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 25, 2019

Our major indices rallied strongly on Friday, with 9 of 11 sectors rising to support the move. Only two defensive sectors - utilities (XLU, -1.37%) and consumer staples (XLP, -0.40%) failed to participate in the advance. Leading the charge was materials...

READ MORE

MEMBERS ONLY

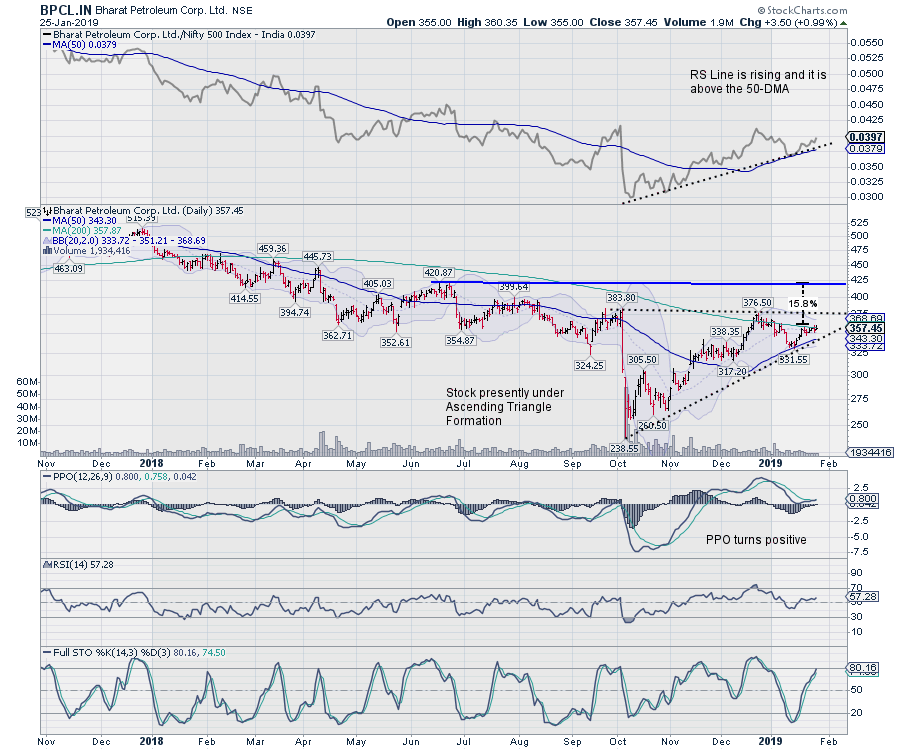

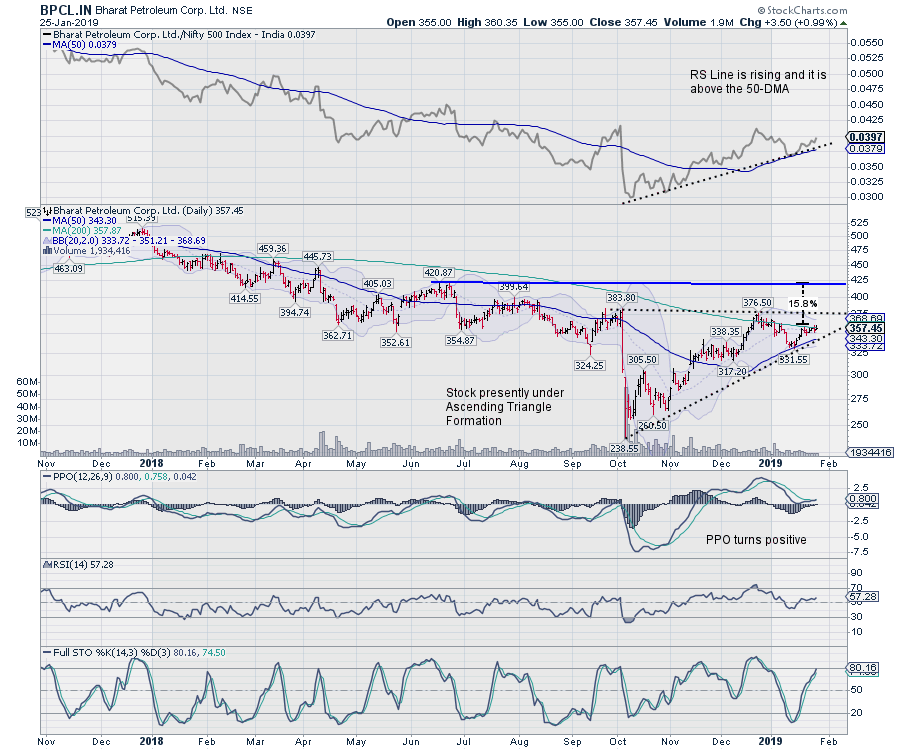

These Charts Show Some Likely Up-Moves Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Bharat Petroleum Ltd. (BPCL.IN)

* Having formed a bottom at 238.55 following a steep fall from 383.80, the stock has since formed gradual higher bottoms. Presently it remains in an Ascending Triangle pattern, which is a bullish formation.

* The RS Line, when compared against broader CNX500 is rising;...

READ MORE

MEMBERS ONLY

Week Ahead: With F&O Expiry and Interim Budget In The Tow, Markets Set To Remain Volatile

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In spite of all expectations, NIFTY remained volatile and did not make any directional call over the previous week, oscillating in a defined 230-point range throughout. However, on the weekly charts, the NIFTY has been able to keep its head above the 50-Week MA, which is 10757. Additionally, the market...

READ MORE

MEMBERS ONLY

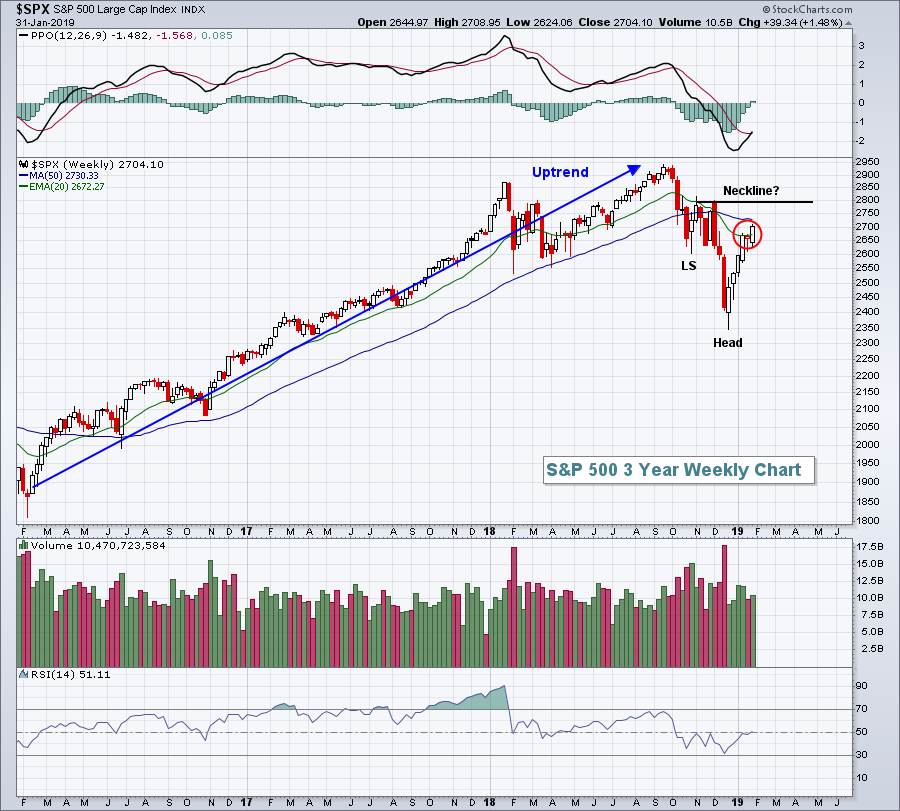

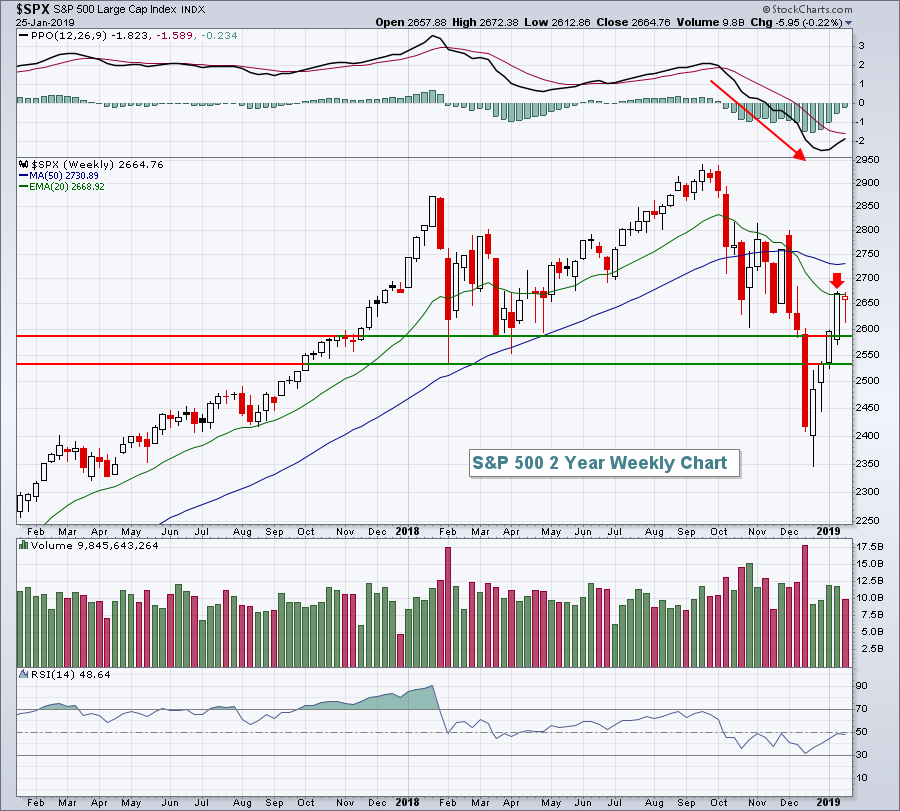

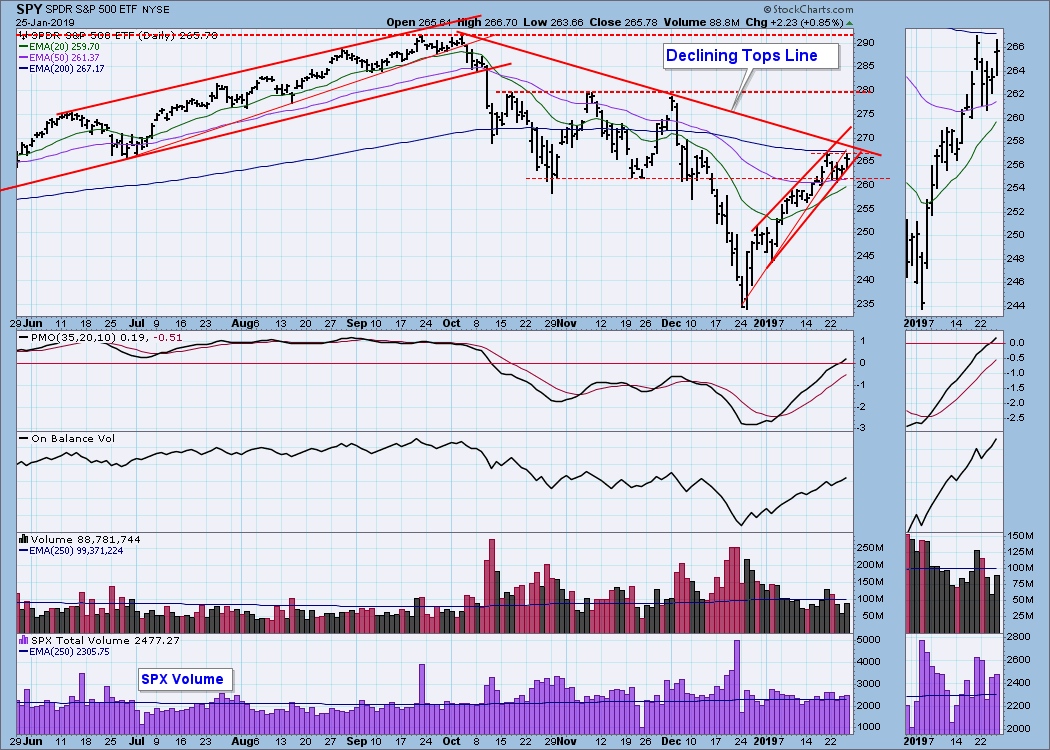

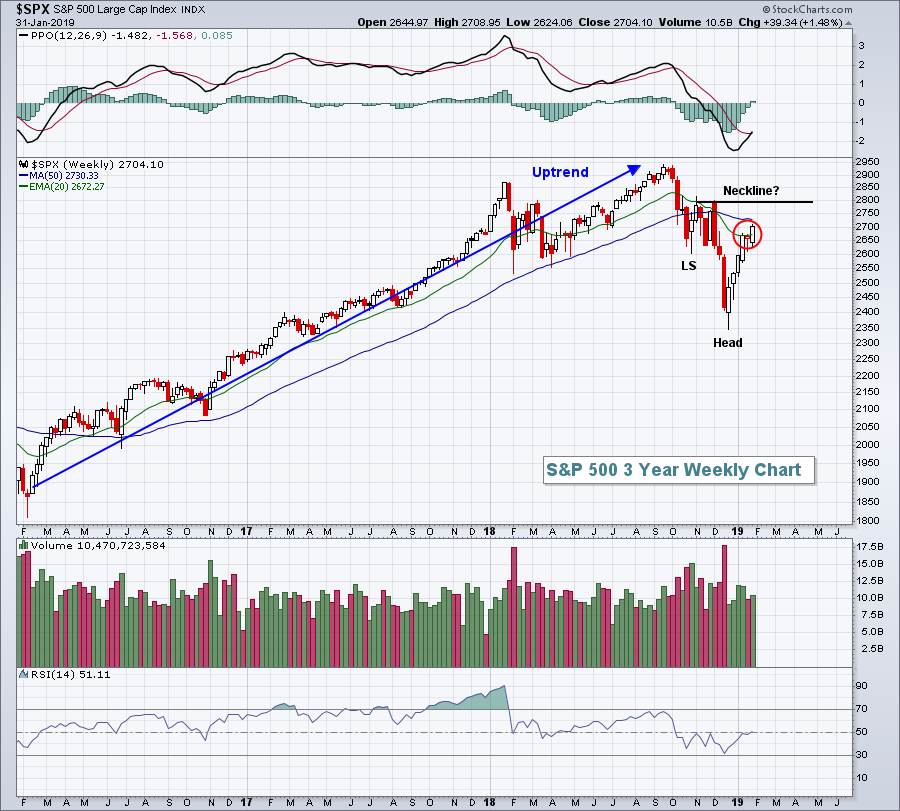

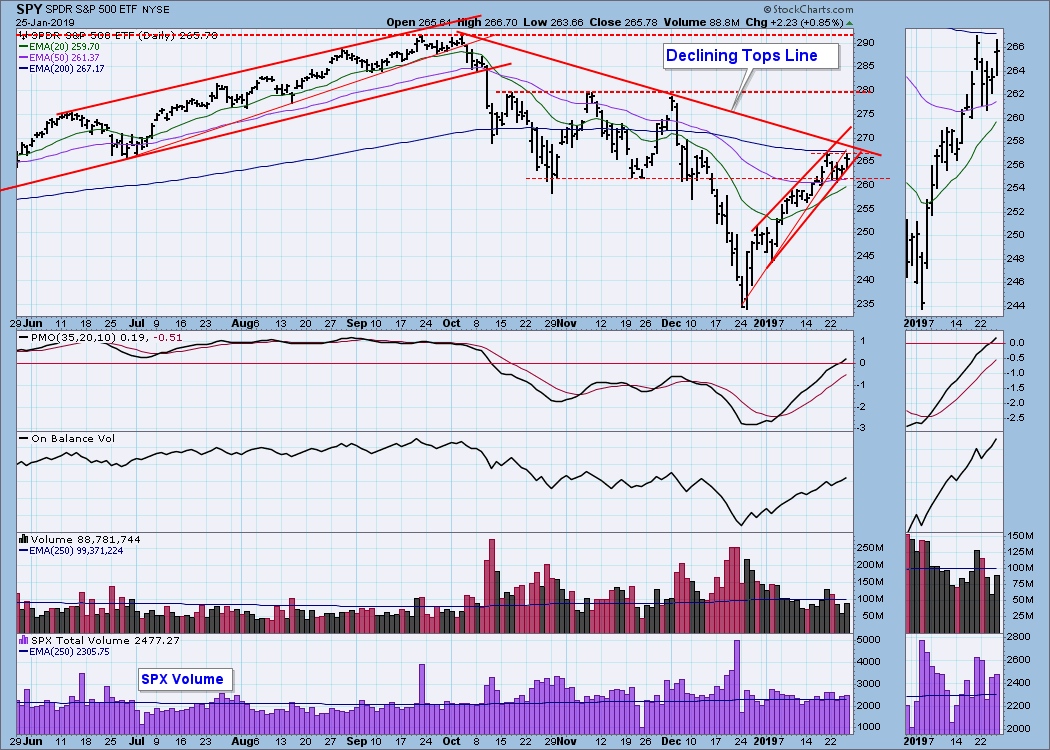

DP Weekly Wrap: Rising Wedge Breakdown Sets Less Accelerated Rising Trend Line

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week we were focused on the SPY rising wedge formation, the technical expectation for which was that it would break down. Well, on Tuesday it did break down, but there was no follow through afterwards. Instead, it moved sideways for two days, then rallied on Friday, challenging Monday'...

READ MORE

MEMBERS ONLY

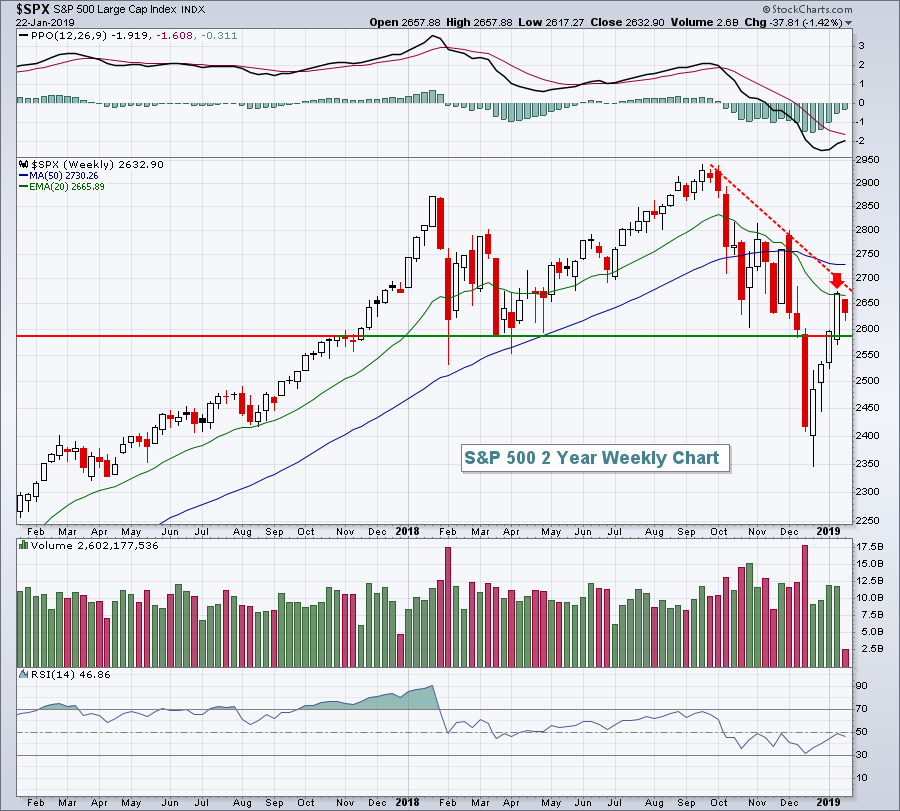

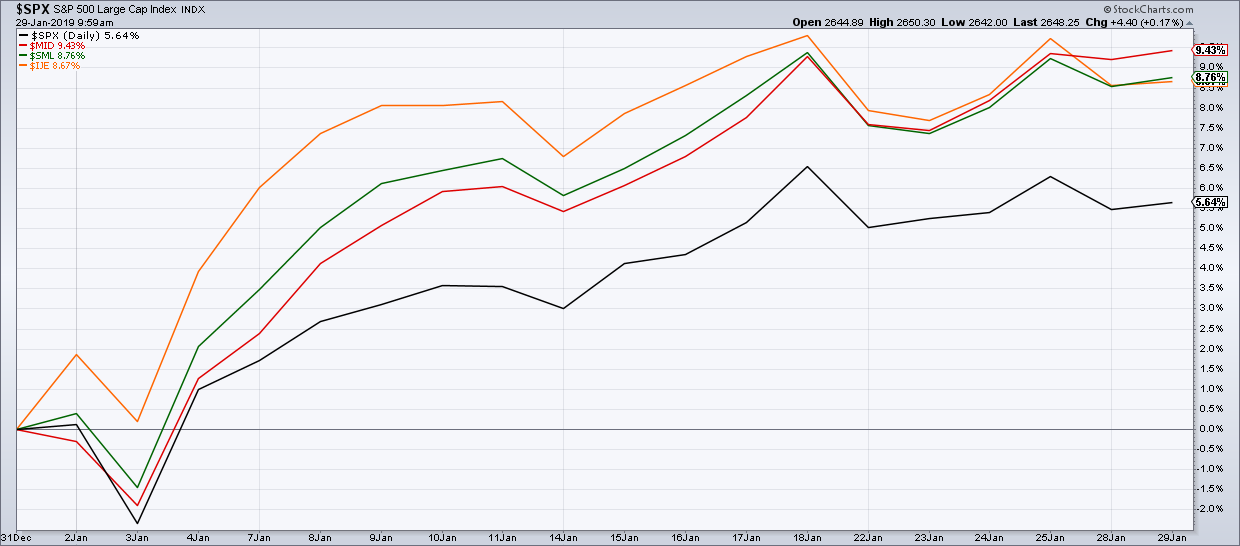

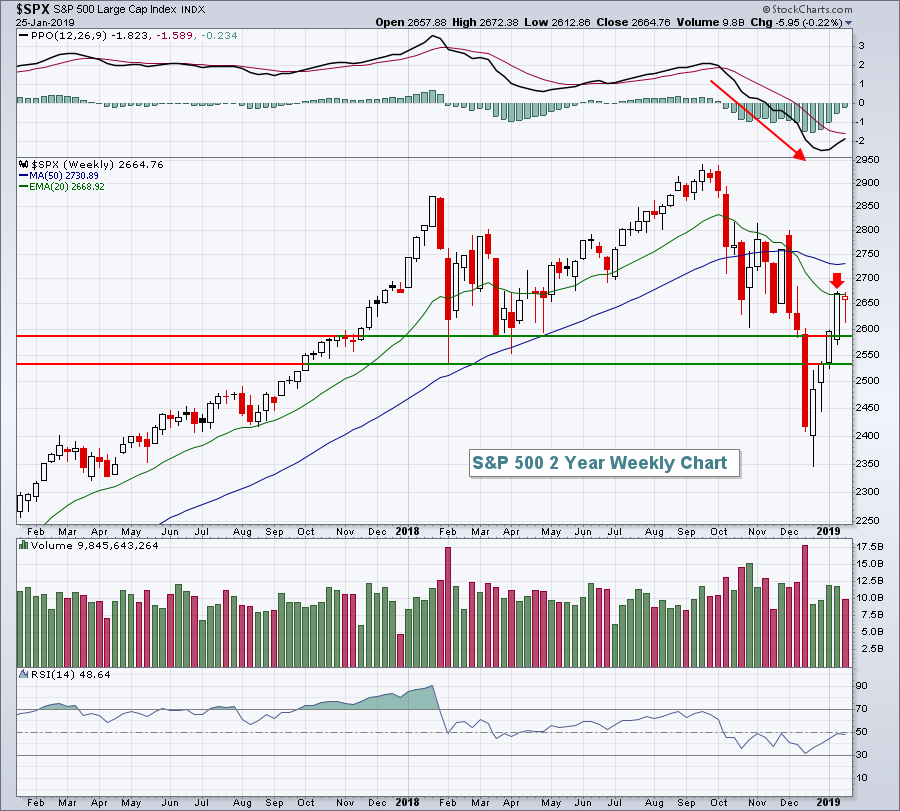

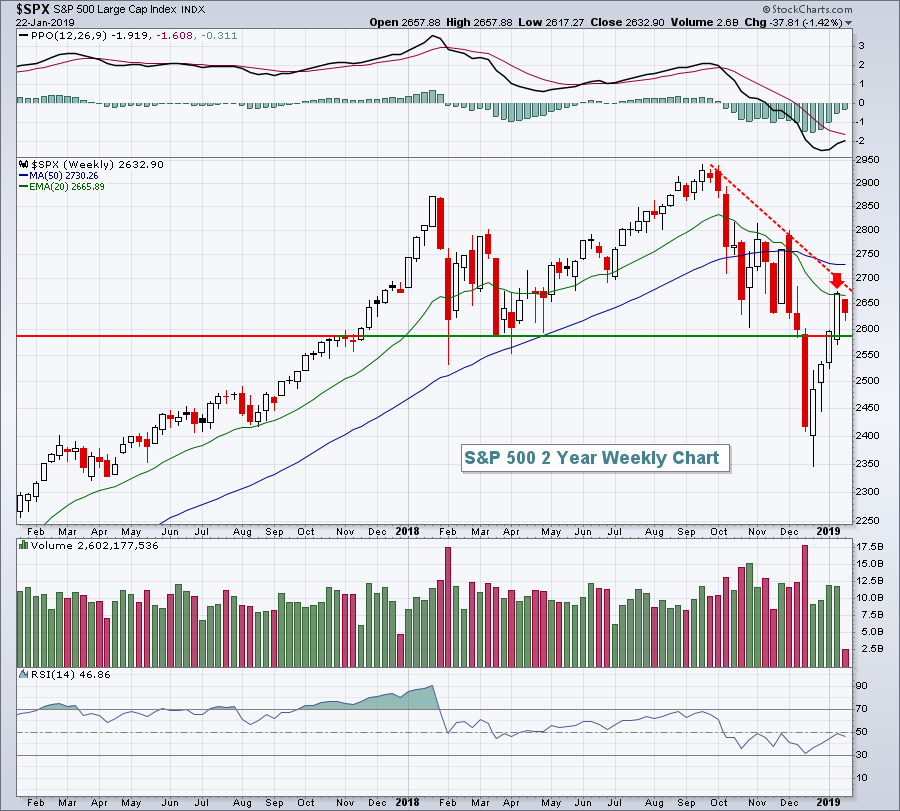

Weekly Market Review & Outlook - A Race to the 200-day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Big Move within Bigger Downtrend.

* The Bullish Turn of the Month.

* S&P 500 Could Challenge 200-day.

* Junk Bonds Surge to Breakdown Zone.

* Key Supports for Big Six Sectors.

* Bull Flags in ITB and XHB.

* Bonds Turning Up ahead of Fed.

* International ETFs Outperforming S&P.

... Big Move...

READ MORE

MEMBERS ONLY

STOCK ADVANCE CONTINUES AS 50-DAY AVERAGES HOLD -- 200-DAY AVERAGES ARE NOW IN SIGHT -- EMERGING MARKETS ISHARES REACH SEVEN-MONTH HIGH AND ARE CHALLENGING 200-DAY AVERAGE -- CONSUMER DISCRETIONARY SPDR IS ALSO CHALLENGING ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR U.S. STOCK INDEXES HEAD TOWARD 200-DAY AVERAGES ... My Wednesday message expressed concern that several stock indexes were in danger of falling back below their 50-day averages, which would have put their January rebound in jeopardy. As today's first three charts show, however, the blue 50-day lines...

READ MORE

MEMBERS ONLY

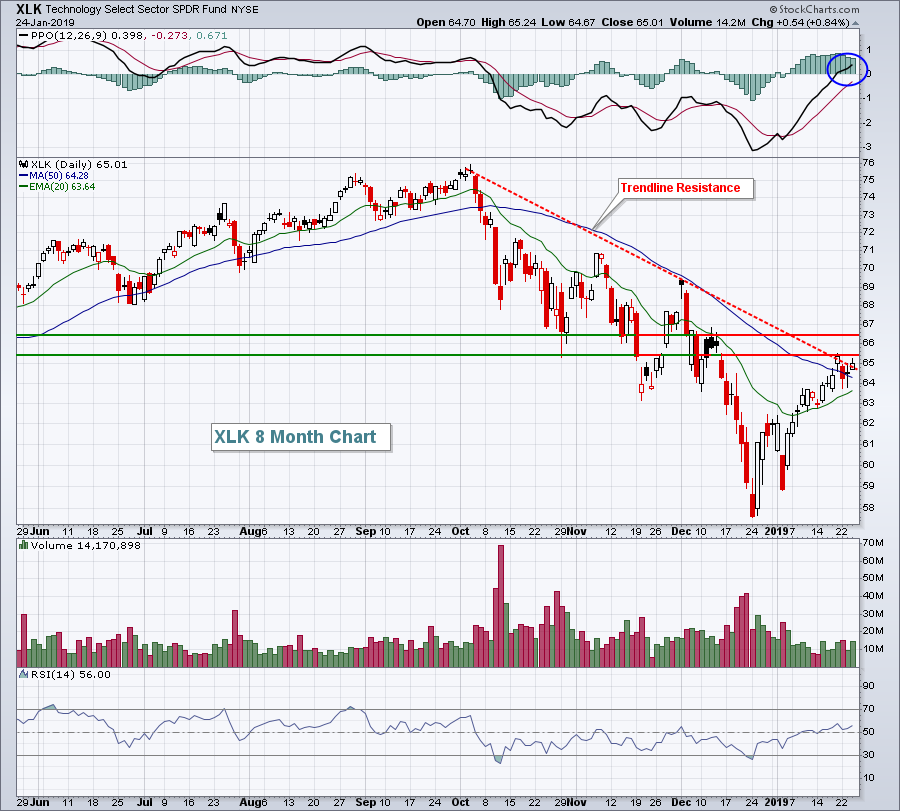

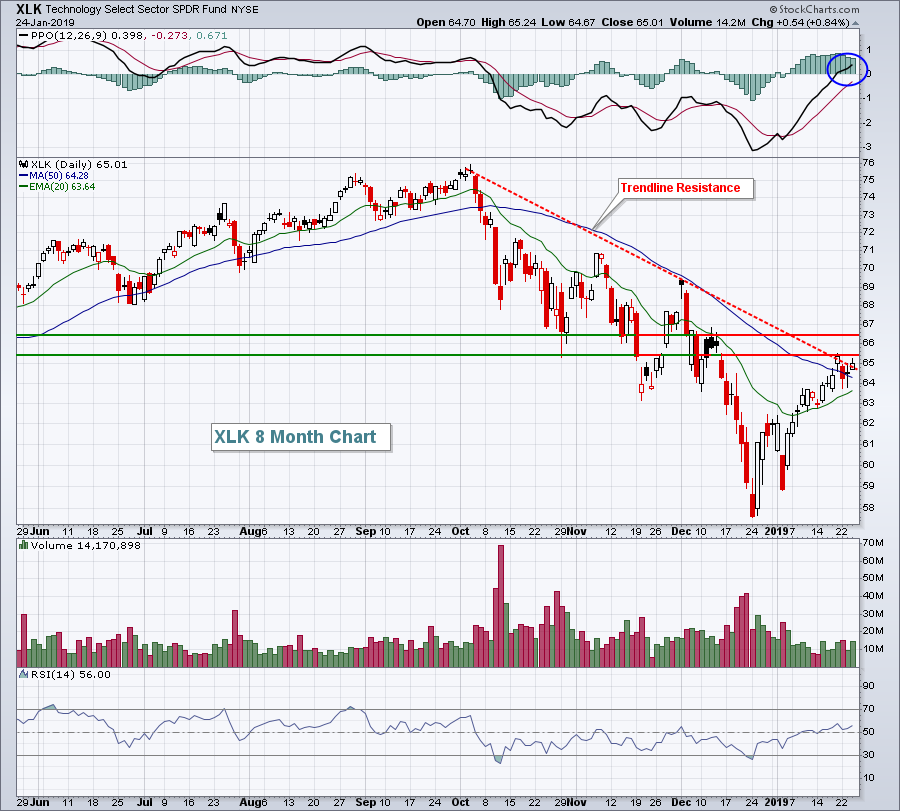

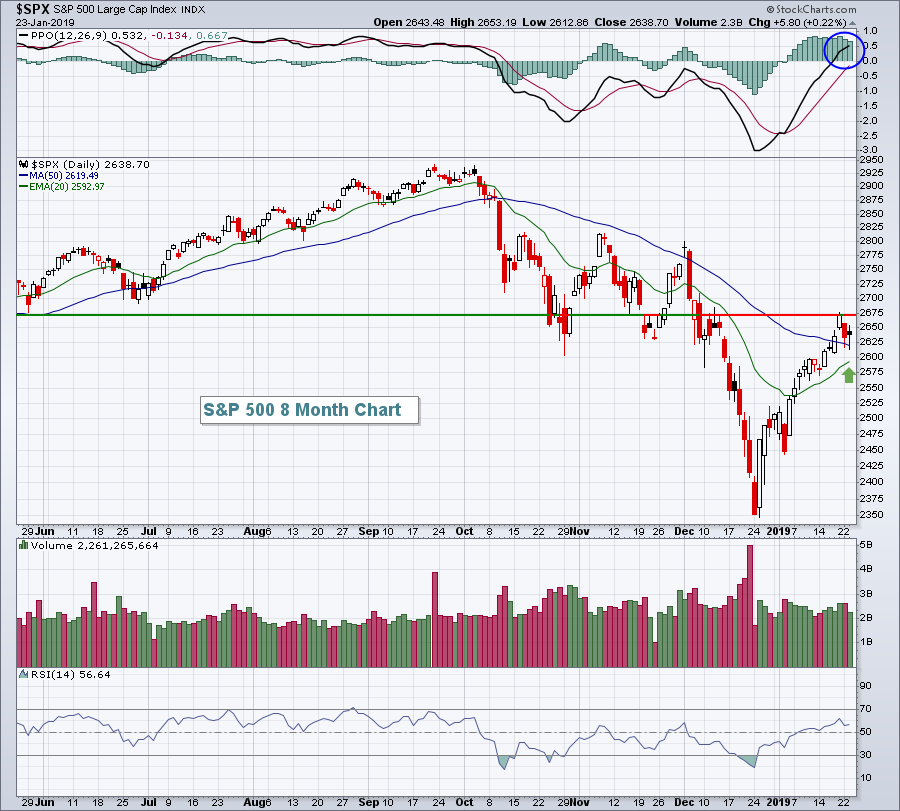

Technology Leads Stocks Higher, But Faces Trendline Resistance Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 24, 2019

Semiconductor stocks ($DJUSSC, +5.10%) soared after a few key earnings reports in the group came in better than expected. Xilinx (XLNX, +18.44%) and Lam Research (LRCX, +15.70%) were two of the best performers, but their results lifted much of the...

READ MORE

MEMBERS ONLY

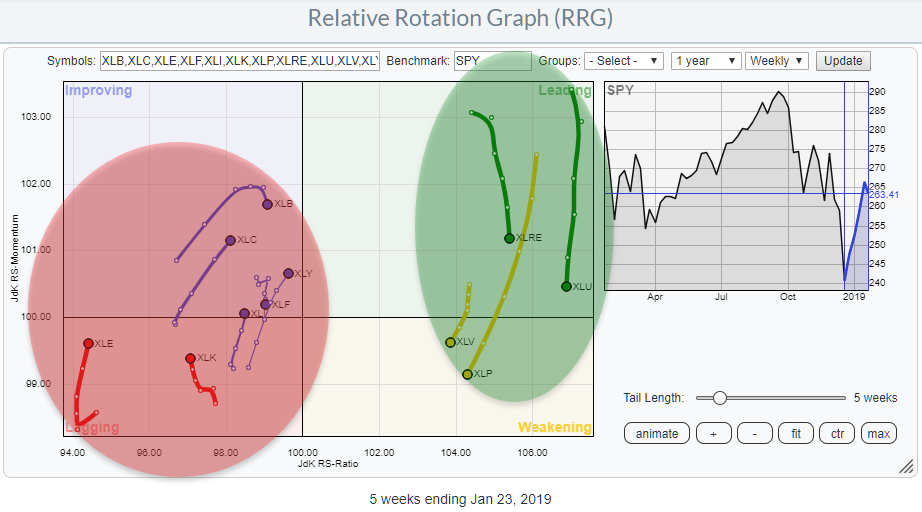

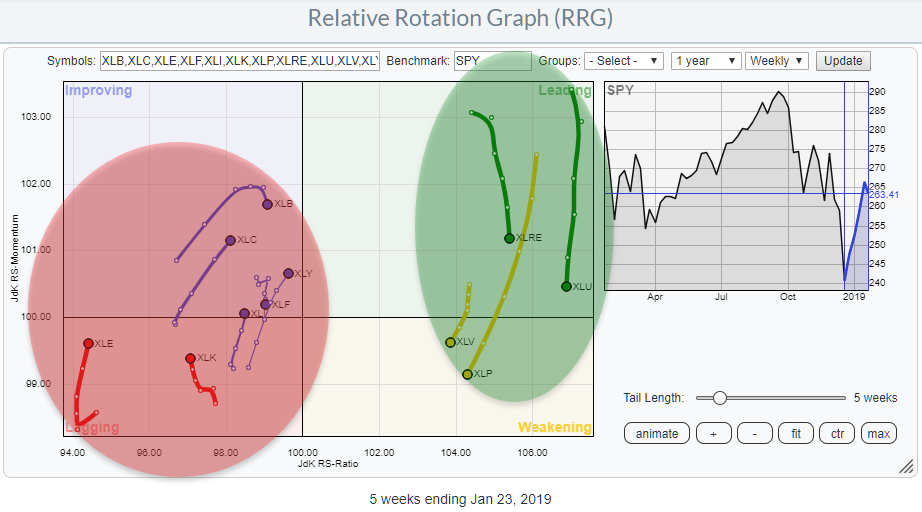

Defensive Sectors Starting Positive Rotations Again On Daily Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors is showing a split picture. On the right, we have Utilities, Real-Estate, Consumer Staples and Healthcare. With the exception of Real-Estate maybe, these are generally accepted as "defensive" sectors.

All other sectors (7) are positioned to the left of the benchmark...

READ MORE

MEMBERS ONLY

XILINX LEADS SEMICONDUCTOR ISHARES TO THE HIGHEST LEVEL IN NEARLY TWO MONTHS -- LAM RESEARCH IS ALSO HAVING A VERY STRONG DAY -- INTEL CLEARS 200-DAY AVERAGE TO LEAD DOW HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ISHARES TURN UP... My message from yesterday showed semiconductor stocks under selling pressure. In today's trading, however, semis are having a very strong day and are the day's strongest stock group. Chart 1 shows the PHLX Semiconductor iShares (SOXX) jumping 5% to reach the highest...

READ MORE

MEMBERS ONLY

Volatile Session Ends Mostly In Bullish Fashion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'm traveling today so my article will be abbreviated.

Market Recap for Wednesday, January 23, 2019

It was a fairly volatile session on Wednesday as U.S. indices opened higher, but quickly fell fairly deep into negative territory before rallying in the afternoon. Only the small cap...

READ MORE

MEMBERS ONLY

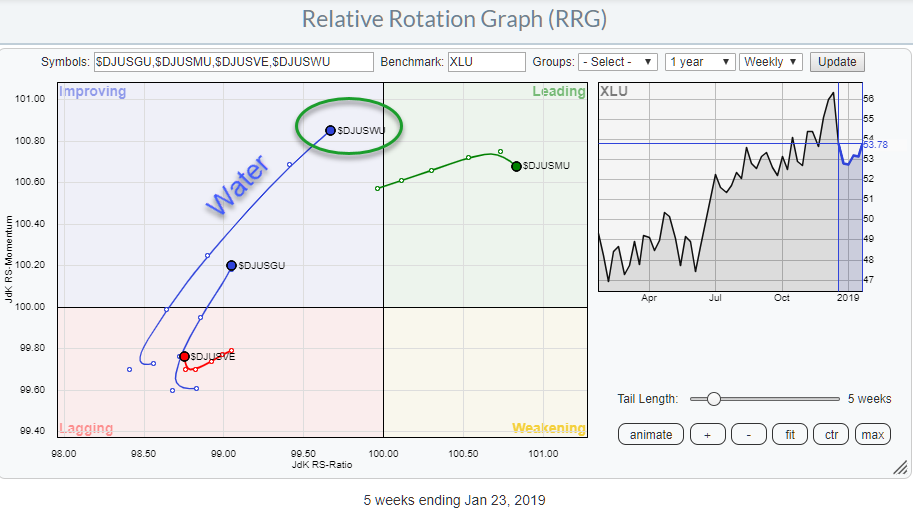

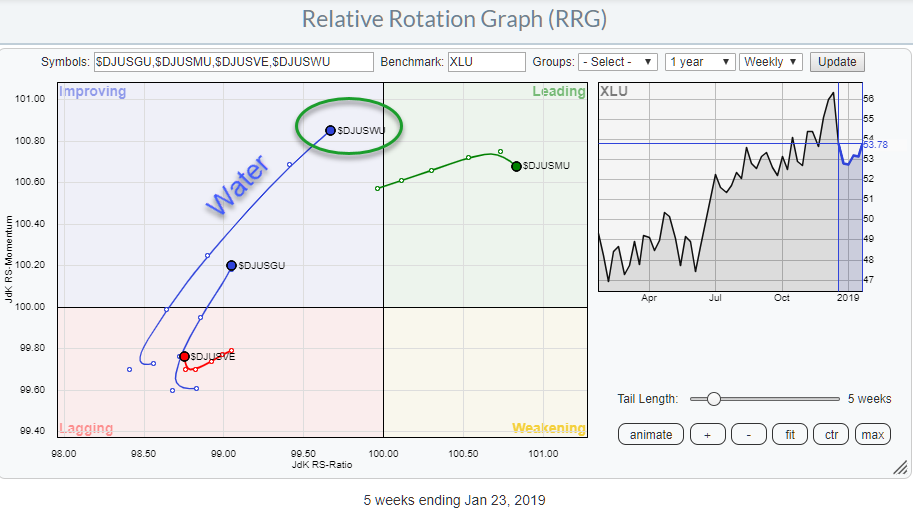

Water ($DJUSWU) Is The Leading Group Inside The Utilities Sector (XLU)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the pages that I often visit on Stockcharts.com is the sector summary. It gives a tabular overview of the price changes that occurred over a certain period (you can choose).

From that page, it is possible to open a Relative Rotation Graph that breaks the sector down...

READ MORE

MEMBERS ONLY

DP Alert: Selling Initiation Signals - Dollar (UUP) New PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards are all bullish in the short term. The bearish rising wedge executed yesterday and the indicators are supporting a decline in the shorter term.

The DecisionPoint Alert presents a mid-week assessment of the trend and condition of the stock market (S&P 500), the U.S....

READ MORE

MEMBERS ONLY

Reversal Signs Appearing in SPY and TLT - XLC is Leading Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Forges a Gap-Gap Reversal

* What Makes this Wedge Break Significant?

* TLT Turns up from Oversold Levels.

* XLC is the First to Break.

... The mood of the market appears to be changing as stocks weaken and bonds strengthen. It looks like short-term trends are trying to reverse. The first chart...

READ MORE

MEMBERS ONLY

SEVERAL STOCK INDEXES ARE TRYING TO STAY ABOVE MOVING AVERAGE LINES -- CYCLICALS AND BIOTECHS ARE STRUGGLING WITH 200-DAY LINES -- SO ARE EMERGING MARKET ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT OF MOVING AVERAGES ARE BEING TESTED... Recent messages have focused on major U.S stock indexes reaching overhead resistance barriers which could slow their January advance; or maybe even end it. All of those major stock indexes remain below their 200-day averages; while their 50-day lines remain below...

READ MORE

MEMBERS ONLY

Bearish Island Reversal Forms With Tuesday's Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 22, 2019

Energy (XLE, -2.18%), communication services (XLC, -2.07%) and industrials (XLI, -2.07%) all fell more than 2% on Tuesday as Wall Street had its first significant retreat since the day that Apple (AAPL) warned. Late day buying cut into losses as...

READ MORE

MEMBERS ONLY

A Rare Evening Star Forms in QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a 15% surge the prior 17 days, the Nasdaq 100 ETF (QQQ) remains below its flattening 200-day SMA and the ETF formed a rare evening star candlestick pattern over the last three days.

First and foremost, I think the long-term trend is down for QQQ. The ETF recorded a...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS DROP SHARPLY -- OVERBOUGHT S&P 500 BACKS OFF FROM TRENDLINE RESISTANCE -- WHILE AN OVERSOLD VIX INDEX BOUNCES OFF CHART SUPPORT -- TRADE AND ECONOMICALLY SENSITIVE STOCKS LEAD THE SELLING -- BIG DROP IN BOND YIELD BOOSTS BOND PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS SELL OFF WHILE BONDS RALLY... Stocks all over the world turned lower today. And they're doing it at a bad time. That's because the recent rebound has taken major U.S. stock indexes up to some formidable overhead resistance barriers. And they may be...

READ MORE

MEMBERS ONLY

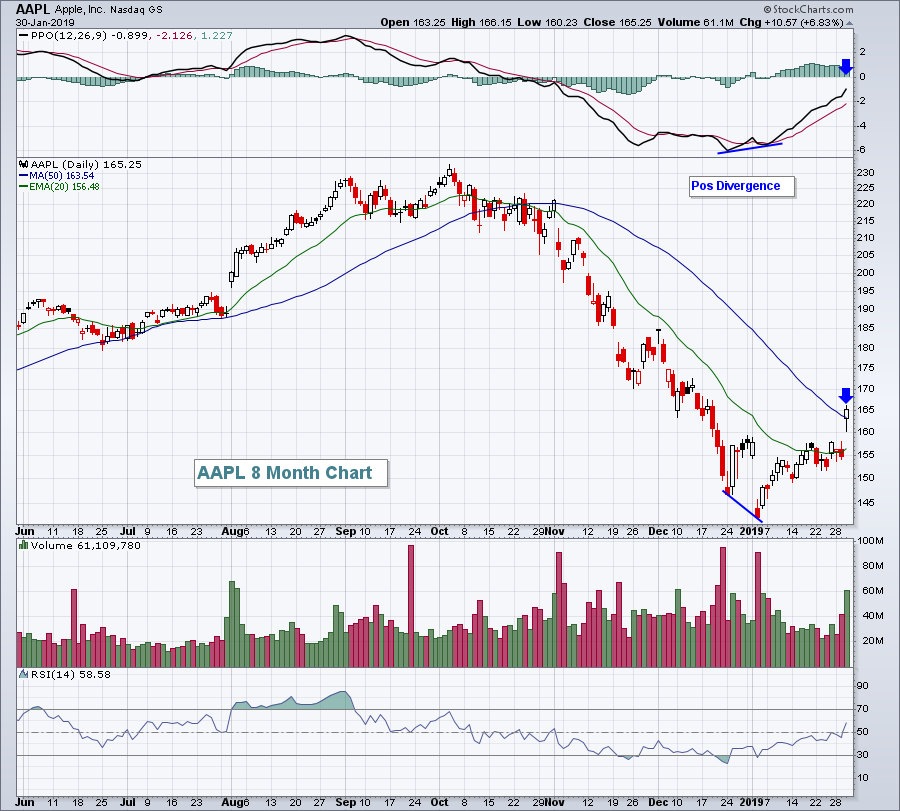

AAPL Campaign Completed

by Bruce Fraser,

Industry-leading "Wyckoffian"

Because the Wyckoff Methodology identifies elements of structure and context within price (Accumulation and Distribution schematics and Phase Analysis), it naturally strengthens the attribute of patience in its user. There is a time to watch, a time to act, and a time to sit in a trending trade. Horizontal Point...

READ MORE