MEMBERS ONLY

Stock Market Dips Below 200-Day Moving Average: Are Your Investments Ready for a Shift?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader indexes are breaking down technically, but their one-year performance is in positive territory,

* Percentage performance charts give a different perspective on the stock market's performance.

* Monitor percentage performance and market breadth to look for any signs of reversal.

The S&P 500 ($SPX)...

READ MORE

MEMBERS ONLY

5 Strong Stocks Defying the Bearish Market!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes the bearish rotation in his Market Trend Model, highlighting the S&P 500 breakdown below the 200-day moving average and its downside potential. He also identifies five strong stocks with bullish technical setups despite market weakness. Watch now for key technical analysis insights to...

READ MORE

MEMBERS ONLY

Transform Your Investing Strategy: Uncover the 3 Game-Changing Rules

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Setting some investing rules before investing in a stock or ETF is critical.

* Basic principles, such as knowing a security's long-term trend, market participation, and watching shorter-term trends, simplify the investing process.

* Having the discipline to follow your rules makes you a smarter investor.

"The...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Sell-Off

by Erin Swenlin,

Vice President, DecisionPoint.com

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls!...

READ MORE

MEMBERS ONLY

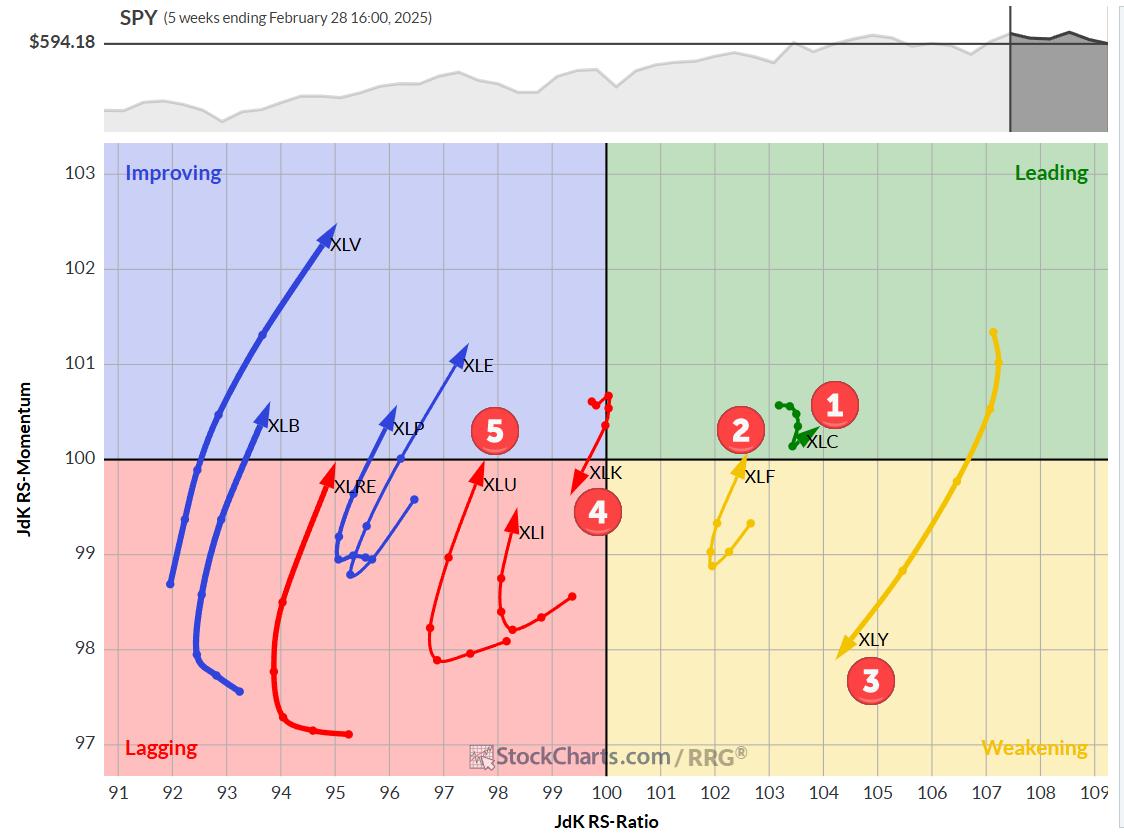

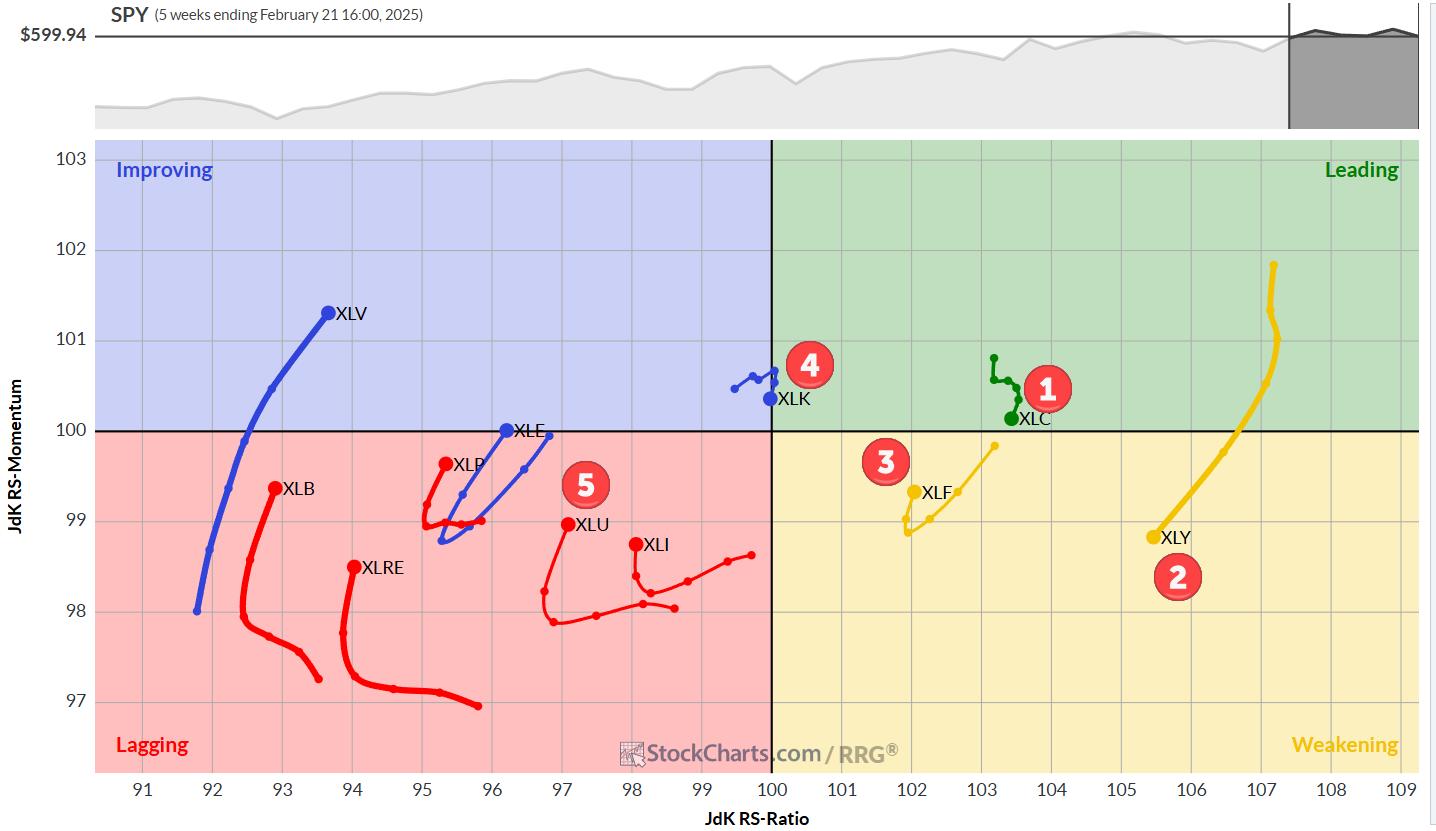

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

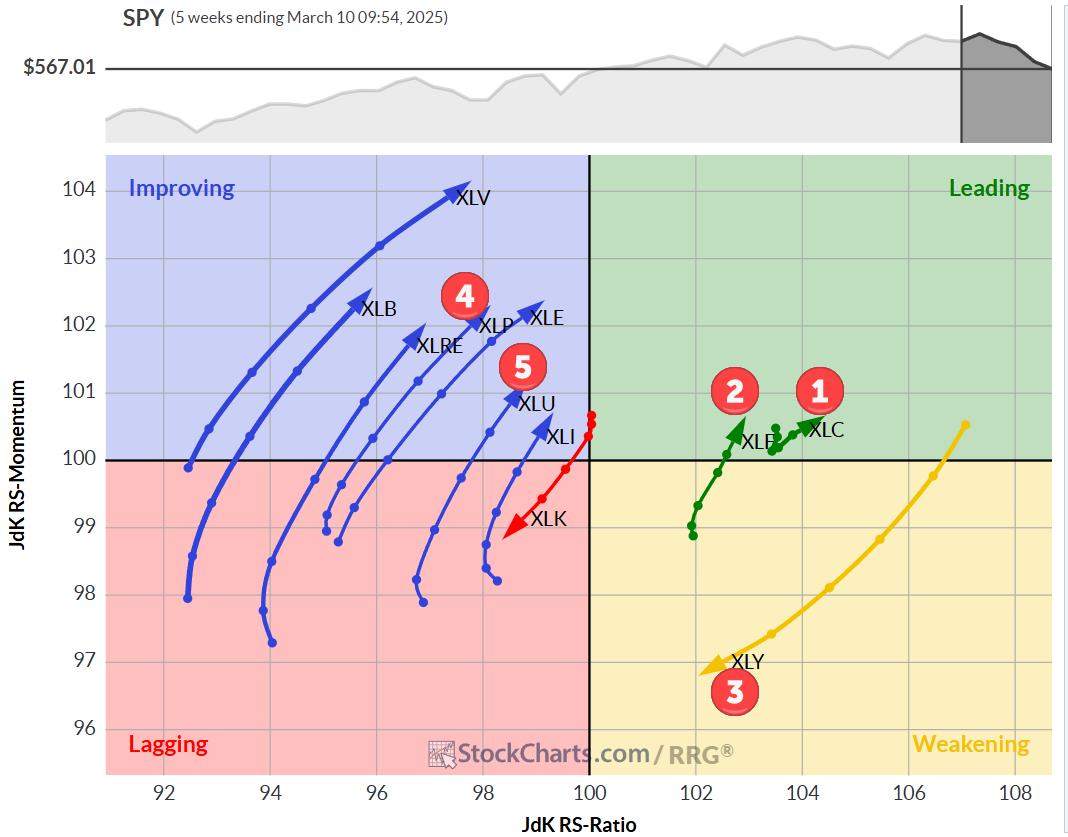

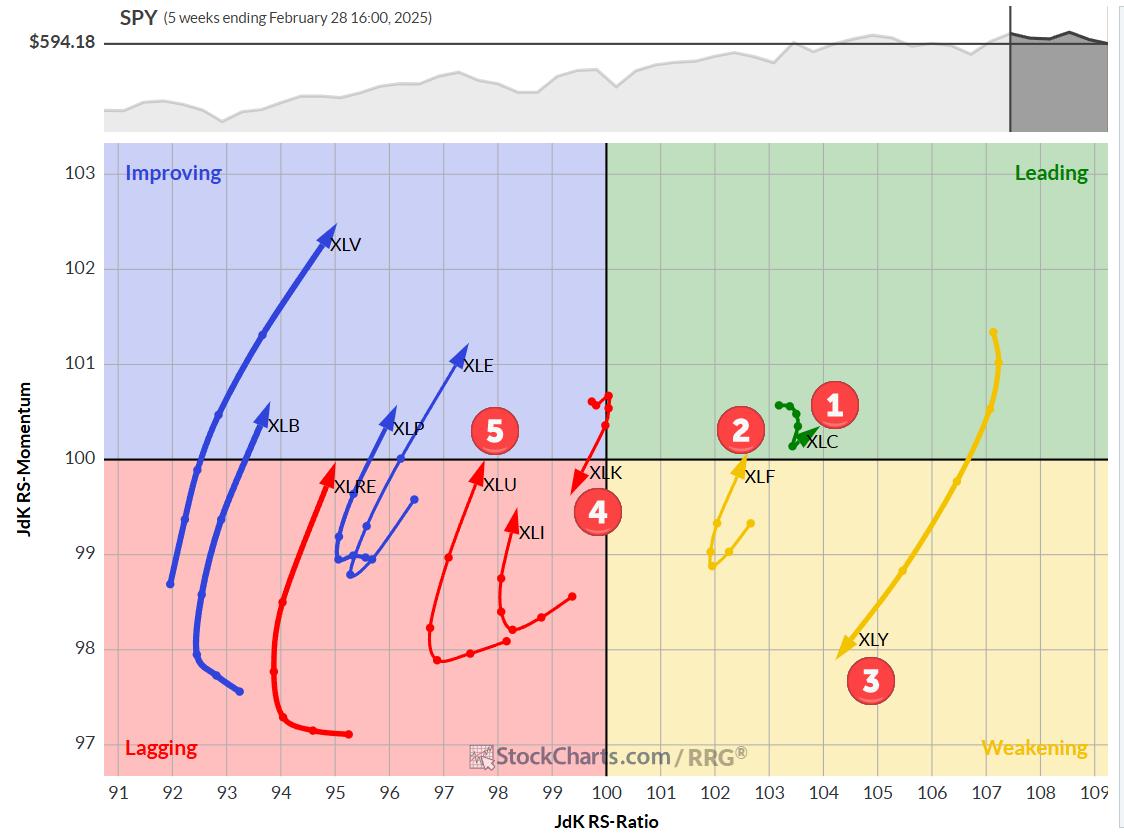

KEY TAKEAWAYS

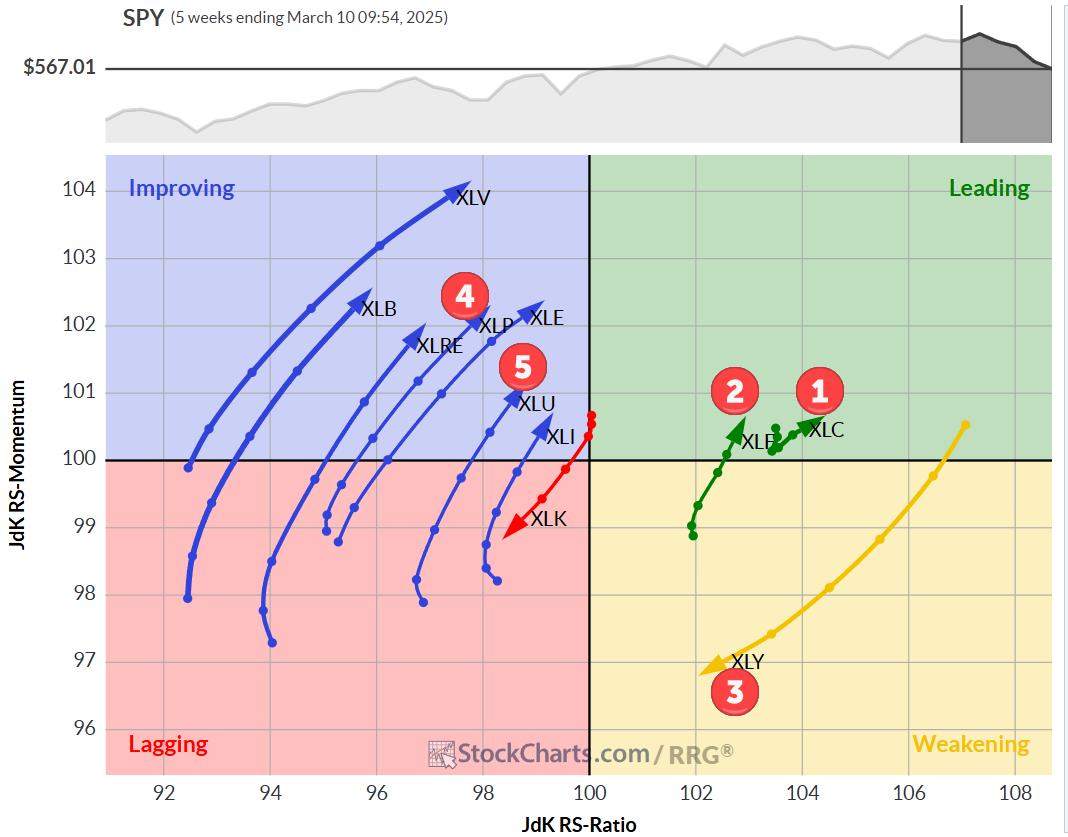

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

Up Now, Down Later?

by Martin Pring,

President, Pring Research

The Hysteria

Last week I saw more references to the stock market and its sharp drop on cable TV than I can ever recall.

Normally, as Humphrey Neil, the father of contrarian thinking put it, "When everyone thinks the same, everyone is usually wrong." That's because...

READ MORE

MEMBERS ONLY

Did Friday's Reversal Mark A Major Bottom?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The next step in the stock market will be very interesting. I've been discussing a potential Q1 correction since our MarketVision event the first week of January and it's here. The NASDAQ 100 ($NDX), from its high on February 19th (22222.61) to its low on...

READ MORE

MEMBERS ONLY

Sector Rotation Warning: More Downside Ahead for US Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes sector rotation in US markets, assessing recent damage and potential downside risks. He examines the Equal Weight RSP vs. Cap-Weighted SPX ratio and the stocks vs. bonds relationship to identify key market trends. Don't miss this deep dive into market rotation...

READ MORE

MEMBERS ONLY

My Downside Target for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Once our "line in the sand" of SPX 5850 was broken, that confirmed a likely bear phase for stocks.

* We can use Fibonacci Retracements to identify a potential downside objective based on the strength of the previous bull trend.

* A confirmed sell signal from the Newer...

READ MORE

MEMBERS ONLY

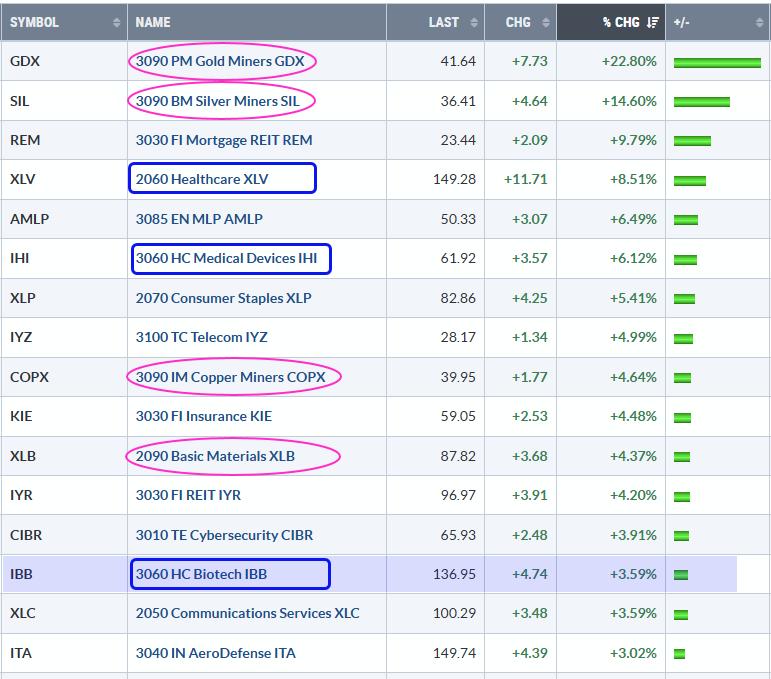

Commodity and Healthcare Related ETFs Lead in 2025 - Bullish Breakout in Biotechs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

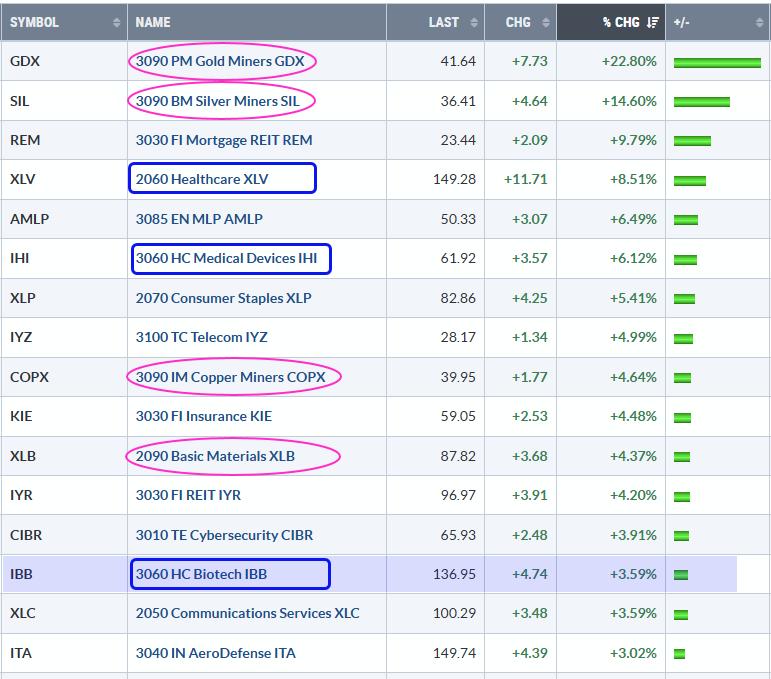

KEY TAKEAWAYS

* 2025 is off to a rough start with SPY, QQQ and IWM sporting losses.

* ETFs with gains are bucking the market by showing relative and absolute strength.

* The Biotech ETF broke out in January and is battling its breakout zone.

2025 is off to a rough start for...

READ MORE

MEMBERS ONLY

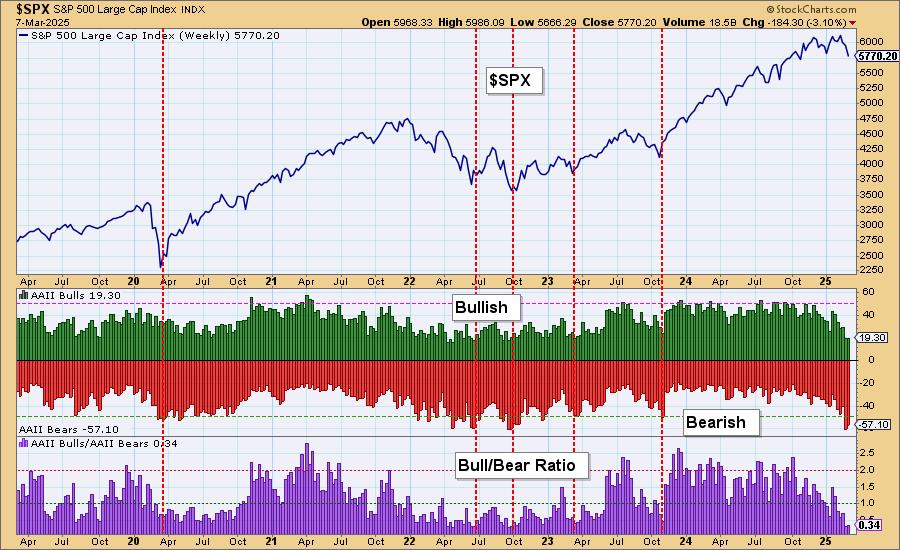

American Association of Individual Investors (AAII) Hitting Bearish Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

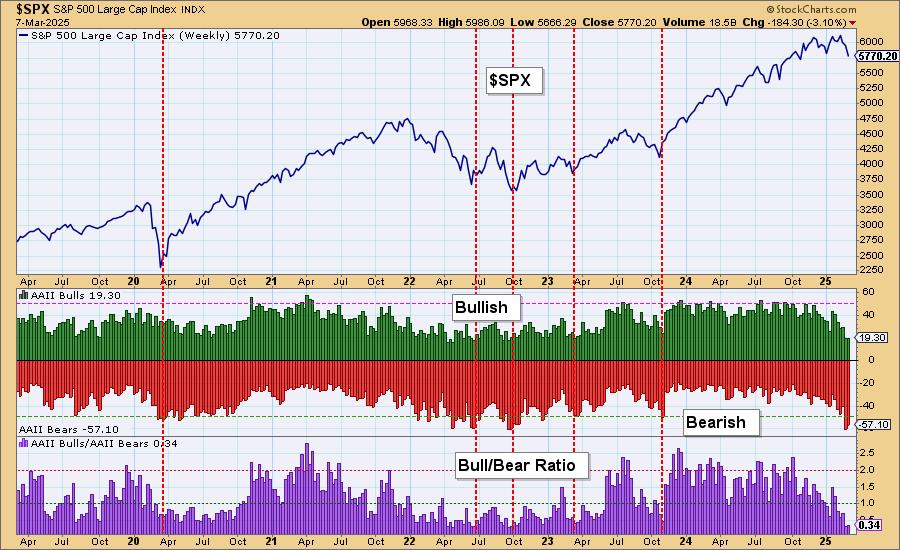

One thing to understand about sentiment measures is that they are contrarian. If investors are too bullish or too bearish, everyone has jumped on the bandwagon, and now it is time for the wheels to fall off.

Right now, we are seeing extraordinarily bearish sentiment coming out of the American...

READ MORE

MEMBERS ONLY

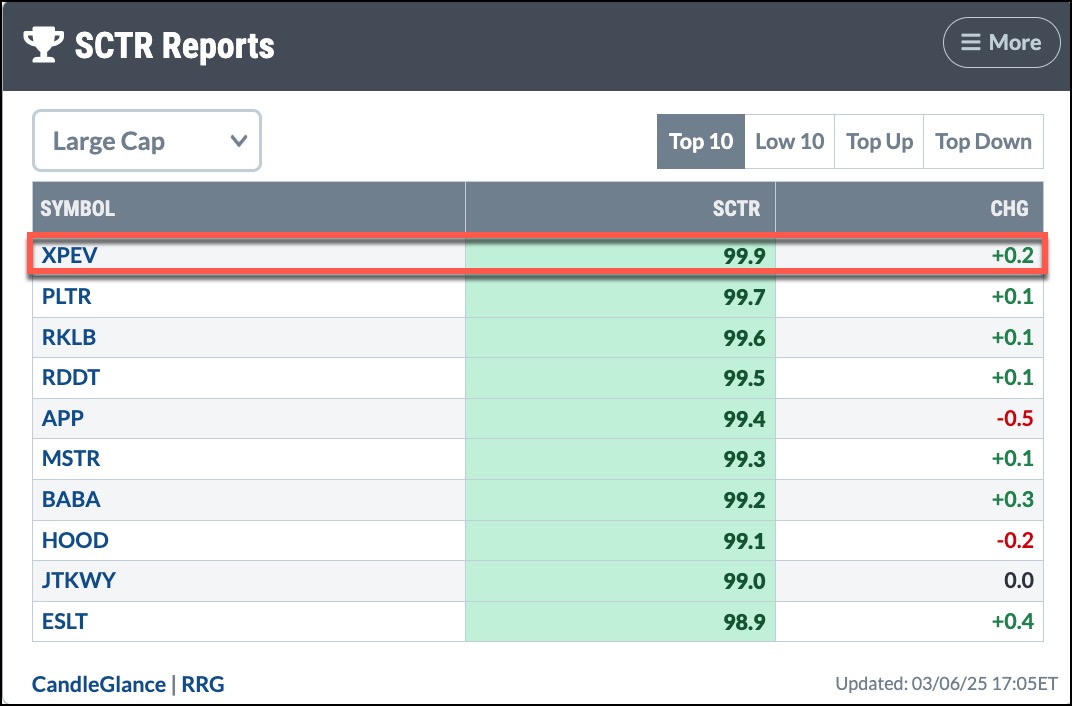

Why Investors Are Flocking to XPEV Stock: Decoding High SCTR Scores

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

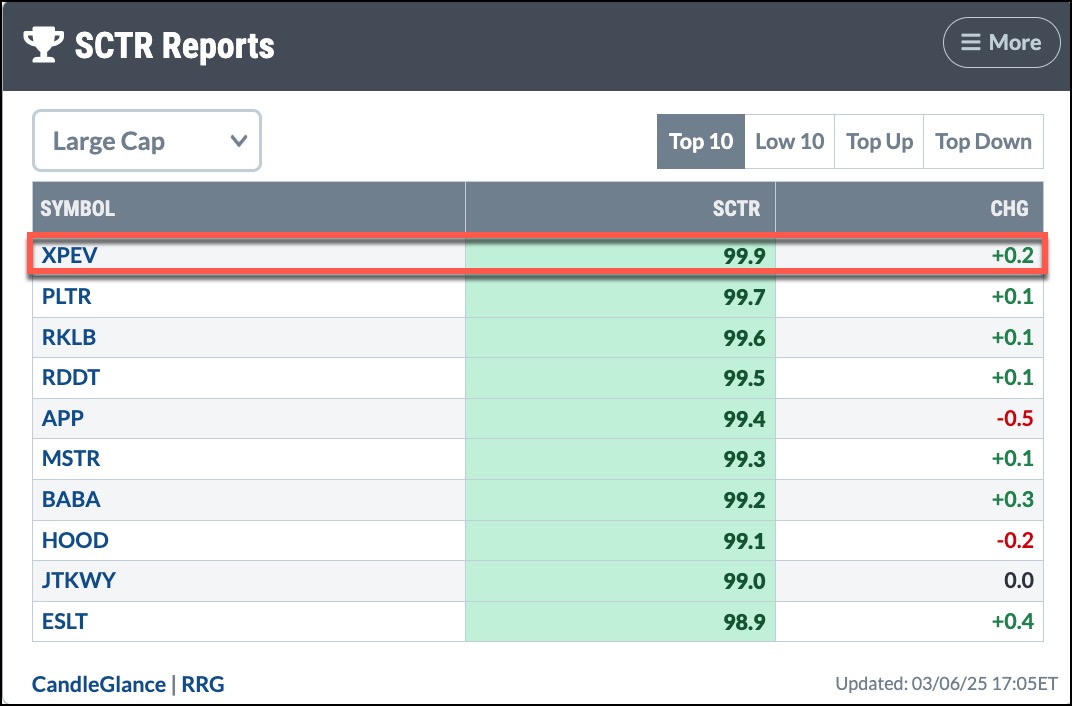

KEY TAKEAWAYS

* XPeng's stock price has been rising since 2023 and is approaching a resistance level.

* XPEV stock's high SCTR score indicates the stock is technically strong.

* A pullback in XPEV's stock price followed by a reversal and breakthrough its resistance level would be...

READ MORE

MEMBERS ONLY

Market Movers in Action: How to Identify High-Probability Dip-Buying Setups

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A successful buy-the-dip strategy starts with having the right tools to identify a broad range of opportunities.

* Market Movers paired with MarketCarpets is one approach that can help you spot potentially tradable stocks.

* Conduct a deep-dive analysis to reduce the odds of catching a falling knife.

If the...

READ MORE

MEMBERS ONLY

Simple Approach to Transform Your Trading

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe breaks down his trading strategy using multiple timeframes. He explains how to spot key patterns on higher timeframes and use lower timeframes for confirmation. Joe provides trading examples, including bearish setups, and analyzes the general market using the daily chart to predict the next...

READ MORE

MEMBERS ONLY

Elevate Your Options Trading!

by Tony Zhang,

Chief Strategist, OptionsPlay

Follow along with this must-see video, where Tony will show you how to use the tools in the OptionsPlay Add-on to help find winning trades with just a few clicks.

Enhance your trading performance and discover how you can do the following:

* Find winning trades by leveraging real-time strategy screening...

READ MORE

MEMBERS ONLY

Navigating Tariffs: Master the Charts to Outsmart Market Volatility

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs have caused shifts in investor sentiment.

* Investors are rotating out of offensive sectors and into defensive sectors.

* The US dollar has weakened relative to the Canadian dollar and Mexican peso.

Tariffs have thrown the stock market into dizzying moves, moving up and/or down based on whatever...

READ MORE

MEMBERS ONLY

How to Apply Top Options Strategies with the OptionsPlay Add-On

by Tony Zhang,

Chief Strategist, OptionsPlay

In this must-see video, Tony explains the top options strategies and shares the best practices for trade entries, exits, and optimal deployment conditions. As you watch along, you'll get a clear roadmap for confidently utilizing each option strategy. Check it out below!

Note: This video premiered on January...

READ MORE

MEMBERS ONLY

Trade War Panic: Are International Stocks the Safer Bet Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

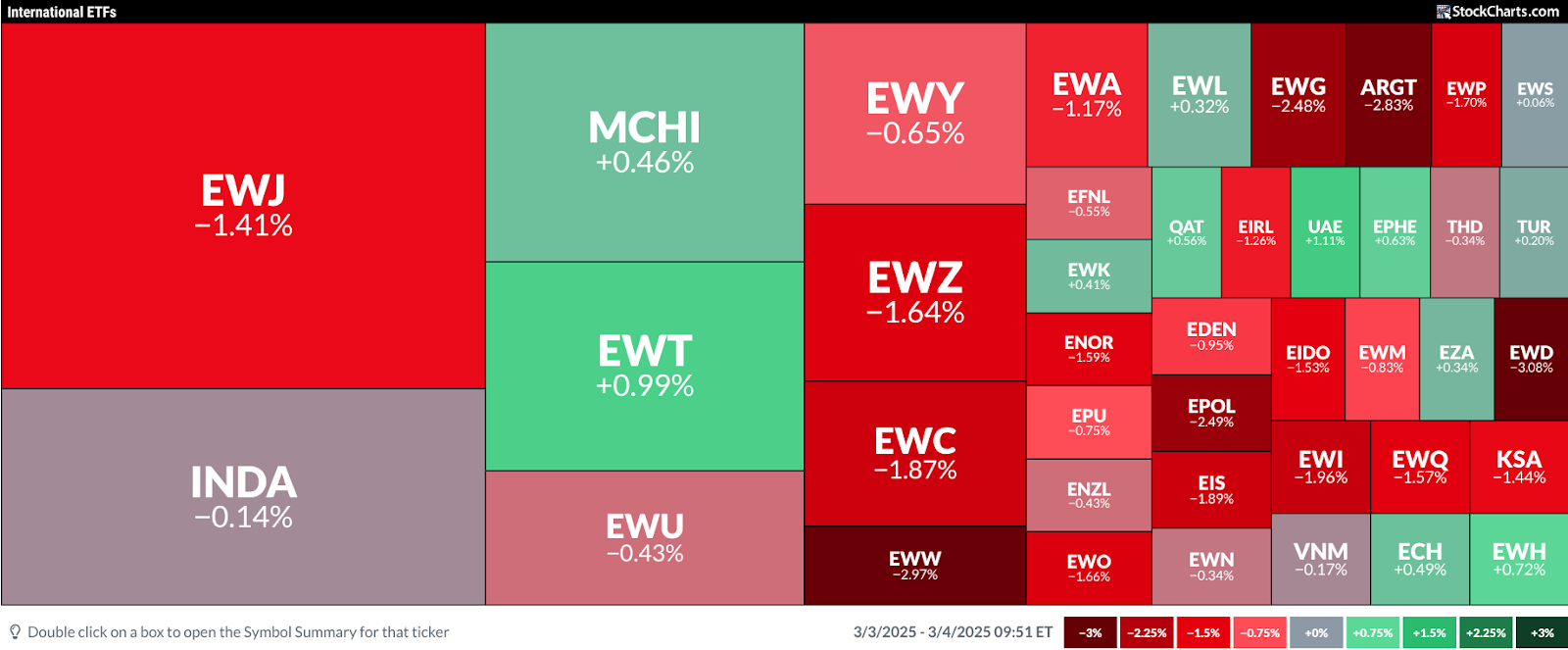

* Tariffs on China, Canada, and Mexico are officially in effect.

* While US stocks have declined in response, might there be investing opportunities in international markets?

With US tariffs on Canada, Mexico, and China having taken effect at midnight on Tuesday, US indexes extended their Monday losses, deepening concerns...

READ MORE

MEMBERS ONLY

S&P 500 Selloff: Bearish Rotation & Key Downside Targets!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes market conditions, bearish divergences, and leadership rotation in recent weeks. He examines the S&P 500 daily chart, highlighting how this week's selloff may confirm a bearish rotation and set downside price targets using moving averages and Fibonacci retracements. To validate a...

READ MORE

MEMBERS ONLY

Bitcoin Faces Important Technical Test

by Martin Pring,

President, Pring Research

Over the weekend, Donald Trump declared the creation of a U.S. strategic crypto reserve, which will include Bitcoin and four other cryptocurrencies. The price immediately responded with a substantial rally over the weekend, but, by the close of business on Monday, had given up all of those gains. That...

READ MORE

MEMBERS ONLY

DP Trading Room: Bitcoin Surges!

by Erin Swenlin,

Vice President, DecisionPoint.com

The news is that the United States will have a Cryptocurrency reserve. How this will occur is still murky, but Bitcoin surged on the news. Carl and Erin give you their opinion on Bitcoin's chart setup and possible future movement.

Carl opens the trading room with a review...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

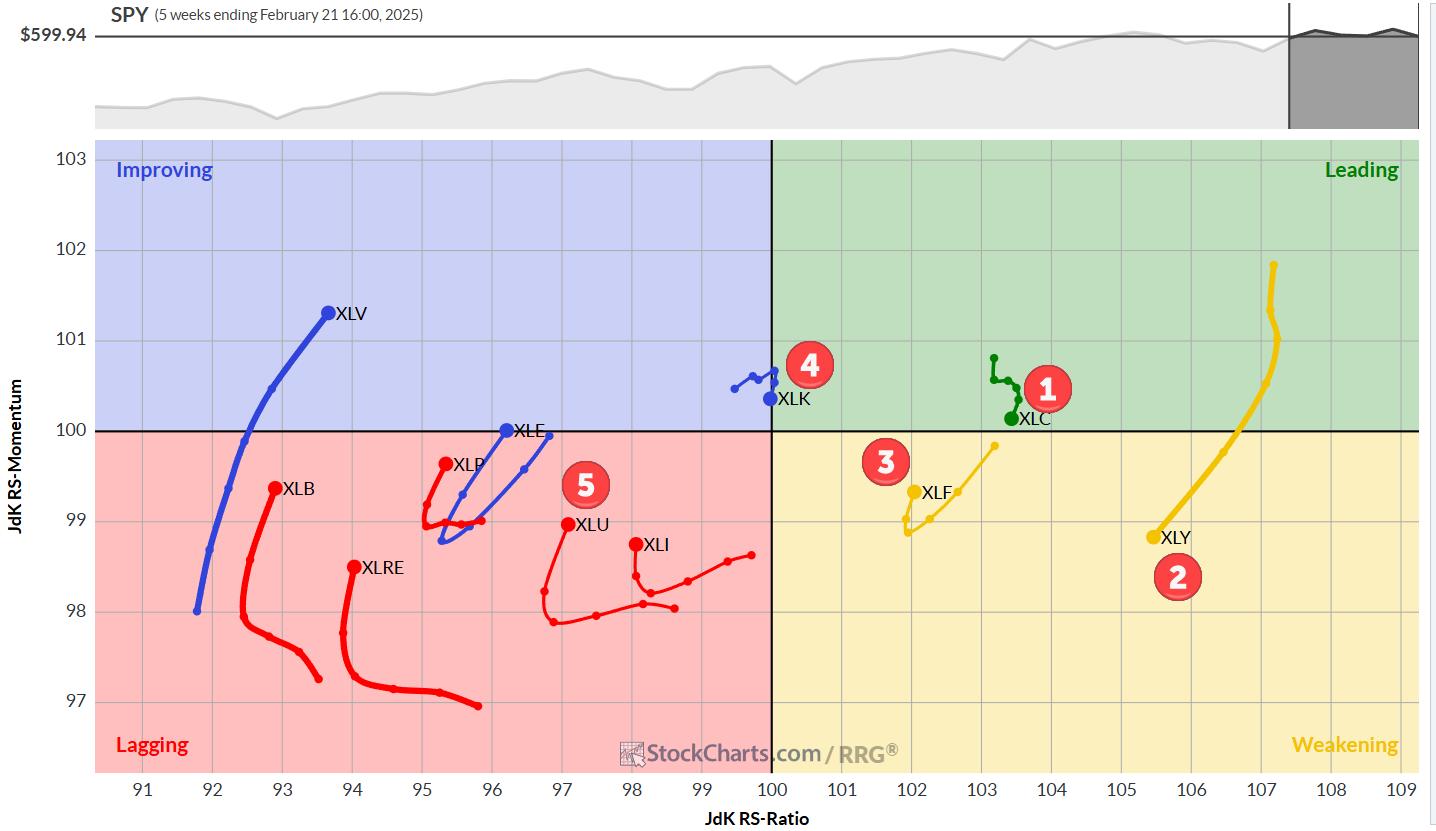

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

Financials' Strong Week Lifts Them to Within a Whisker of an All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many are watching the disaster in growth stocks unfold, including us at EarningsBeats.com, but the reality is that many other areas of the stock market represent a silver lining. When growth stocks sell off, essentially two things can happen. One, the rest of the stock market sells off as...

READ MORE

MEMBERS ONLY

Growth Stocks Tumbling; Where to Find Safe Havens Now!

by Mary Ellen McGonagle,

President, MEM Investment Research

Growth stocks just took a sharp hit—what does it mean for the market? In this video, Mary Ellen breaks down the impact, reveals why NVDA could soar higher, and highlights safer stocks with strong upside potential!

This video originally premiered February 28, 2025. You can watch it on our...

READ MORE

MEMBERS ONLY

3 Compelling Charts in the Financial Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* ICE pushed to a new all-time high this week, completing a bullish rotation after finding Fibonacci support.

* V has experienced a series of bullish breakouts after completing a cup-and-handle pattern in 2024.

* JPM has pulled back to an ascending 50-day moving average, suggesting a potential short-term low during...

READ MORE

MEMBERS ONLY

New Indicator for Your Toolbox

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of our regular market review in the DP Alert, we have begun to notice a very good indicator to determine market weakness and strength. It may not be new to all of you, but we've found as of late that this indicator tells a story.

We...

READ MORE

MEMBERS ONLY

Sector Rotation & Seasonality: What's Driving the Market Now?"

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes seasonality for U.S. sectors and aligns it with current sector rotation. He explores how these trends impact the market (SPY) and shares insights on potential movements using RRG analysis. By combining seasonality with sector rotation, he provides a deeper look at market...

READ MORE

MEMBERS ONLY

Small-caps Trigger Bearish, but Large-caps Hold Uptrend and Present an Opportunity

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Long-term Keltner Channels are trend-following indicators that identify volatility breakouts.

* The Russell 2000 ETF triggered bearish this week and reversed a 14 month uptrend.

* The S&P 500 SPDR remains within an uptrend and the current pullback is an opportunity.

The Russell 2000 ETF triggered a bearish...

READ MORE

MEMBERS ONLY

Bristol Myers Squibb's Rising SCTR Score: Seize the Moment to Invest?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Bristol Myers Squibb's share price is gaining technical strength.

* Monitor the stock price of Bristol Myers Squibb, as it's on the verge of breaking out of its 52-week high.

Bristol Myers Squibb (BMY) reported strong Q4 earnings earlier in February, and prospects remain strong...

READ MORE

MEMBERS ONLY

Retail is at a Crossroads—Buy Now or Stay Away?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The retail sector has been trading sideways for almost three years.

* Wall Street sees moderate growth for retail in 2025.

* Retail may be presenting both swing trading and position trading opportunities right now.

As "economic softening" increasingly emerges as the prevailing narrative driving the markets, the...

READ MORE

MEMBERS ONLY

Hidden MACD SIGNAL? Key Trade Signals Explained!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe breaks down reverse divergences (hidden divergence), key upside & downside signals, and how to use ADX and Moving Averages for better trades! Plus, he examines market trends and viewer symbol requests!

This video was originally published on February 26, 2025. Click this link to...

READ MORE

MEMBERS ONLY

Sector Rotation: How to Spot It Early Using Four Tools

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Following the two "confidence" reports over the last few weeks, investors appear to be expecting a recession.

* Defensive stocks are starting to show early strength relative to cyclicals.

* If we're on the verge of a sector rotation, there are several tools you can use...

READ MORE

MEMBERS ONLY

Bearish Signals & Risk Management: Protect Your Portfolio!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down bearish macro signals and risk management using the "line in the sand" technique! Learn how to spot key support levels, set alerts on StockCharts, and protect your portfolio!

This video originally premiered on February 26, 2025. Watch on StockCharts' dedicated David...

READ MORE

MEMBERS ONLY

Decode the Stock Market's Health With This Key Indicator

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors are worried about a weakening economy and other headwinds.

* Looking under the hood can reveal the strength or weakness of the overall stock market.

* Investors are rotating out of technology stocks and into more defensive sectors.

The US Consumer Confidence Index® came in much lower than expectations,...

READ MORE

MEMBERS ONLY

Stocks Starting to Break Down Against This Key Asset

by Martin Pring,

President, Pring Research

The S&P Composite ($SPX) briefly touched a new all-time high last week, which sounds encouraging. However, that kind of action was limited, as neither the Dow Industrials nor the NASDAQ Composite reached record territory. Such discrepancies can always be cleared up, of course, but more troubling is the...

READ MORE

MEMBERS ONLY

Get The BEST Options Trade Ideas for This Week with Tony Zhang

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony breaks down the big-picture market trends before diving deep into bullish and bearish setups for META, BIDU, AMGN, NVDA, DAL, and more! Get expert insights and key analysis you won't want to miss!

This video premiered on February 24, 2025....

READ MORE

MEMBERS ONLY

DP Trading Room: Defensive Sectors Lead the Pack

by Erin Swenlin,

Vice President, DecisionPoint.com

The complexion of the market is changing. Aggressive sectors which have led the market higher are now beginning to show signs of strain as momentum slowly dissipates and prices turn lower. However, defensive sectors (XLP, XLRE, XLV and XLU) are now leading the market. Typically when this occurs the market...

READ MORE

MEMBERS ONLY

AMZN: A Case Study in Bearish Divergence

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the later stages of a bull market cycle, we will often observe a proliferation of bearish momentum divergences. As prices continue higher, the momentum underneath the advance begins to wane, representing an exhaustion of buyers.

We've identified a series of bearish momentum divergences in the early days...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #8

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Utilities entering the top-5

* Industrials dropping out of top-5 portfolio

* Real-Estate and Energy swapping positions in bottom half of the ranking

* Perfomance now 0.3% below SPY since inception.

Utilities enter top 5

Last week's trading, especially the sell-off on Friday, has caused the Utilities sector...

READ MORE

MEMBERS ONLY

The Top is Confirmed and Now It's Just a Matter of How Low We Go

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me start by reminding everyone that I believe the most important relationship in the stock market is how consumer discretionary stocks (XLY) perform relative to consumer staples stocks (XLP). This ratio (XLY:XLP) has a VERY strong positive correlation with the S&P 500. In other words, when...

READ MORE