MEMBERS ONLY

SMALL AND MIDCAP STOCKS LEAD LARGE CAPS LOWER -- THE S&P 500 IS IN DANGER OF CLOSING BELOW ITS 50-DAY AVERAGE -- RISING DOLLAR PUSHES ENERGY SECTOR INTO ANOTHER TEST OF 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P SMALL AND MIDCAP INDEXES FAIL TEST OF 50-DAY AVERAGE... The pullback in stocks that started yesterday is continuing today. And it's being led down by smaller stocks. Chart 1 shows the S&P 600 Small Cap Index ($SML) falling decisively back its blue 50-day...

READ MORE

MEMBERS ONLY

Nine tech stocks to watch from an RRG perspective

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

An inspection of the weekly Relative Rotation Graph for US sectors at the beginning of this week (ending 2 March) reveals that we have:

* 3 sectors in leading

* 2 sectors in weakening

* 4 sectors in lagging

* 1 sector in improving

Out of these 10 sectors, we have only 2 at...

READ MORE

MEMBERS ONLY

P&G Weighs on Consumer Staples Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) is one of the worst performing sectors year-to-date with a loss greater than 8 percent. The sector is also the second weakest in February because it failed to hold its bounce over the last two weeks.

The chart shows XLP with its biggest component (P&...

READ MORE

MEMBERS ONLY

3 Takeaways From Tuesday's Renewed Selling...And Why I'd Avoid Gold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 27, 2018

During a day filled with renewed selling, especially in the final 10 minutes, there were 3 key takeways as far as I'm concerned. First, the short-term uptrend appeared to have been broken at the end of the day as gap, price...

READ MORE

MEMBERS ONLY

US Equities Emerging from The February Shakeout As A Global Leader Again

by Martin Pring,

President, Pring Research

* US is breaking out relative to the world

* Growth breaks decisively against value

* Blue Tuesday

US is breaking out relative to the world

Chart 1 shows that the ratio between the US stock market, in the form of the S&P Composite ($SPX), and the World Index (ACWI) often...

READ MORE

MEMBERS ONLY

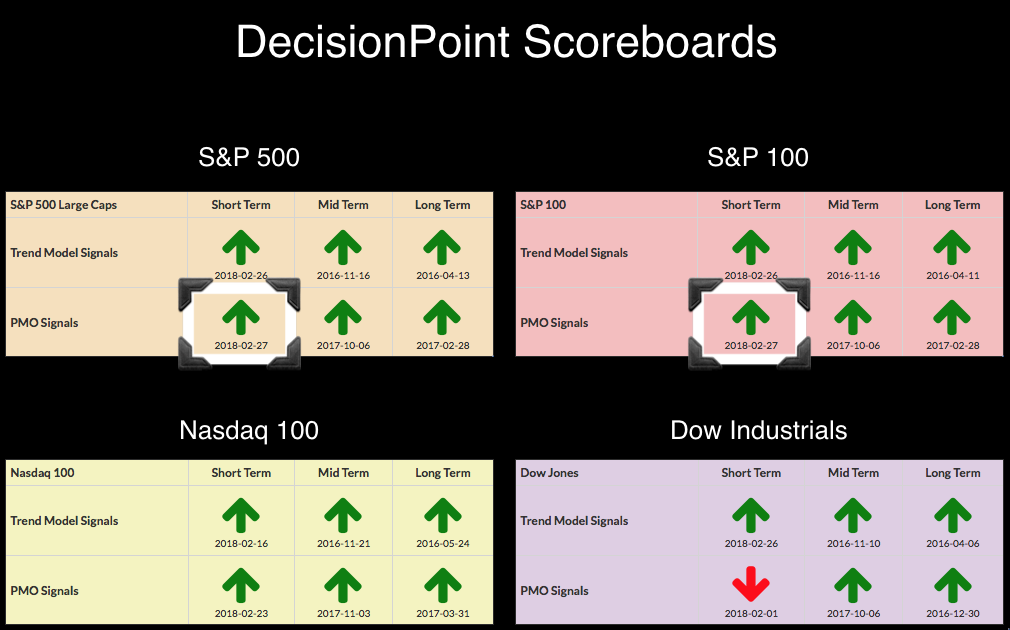

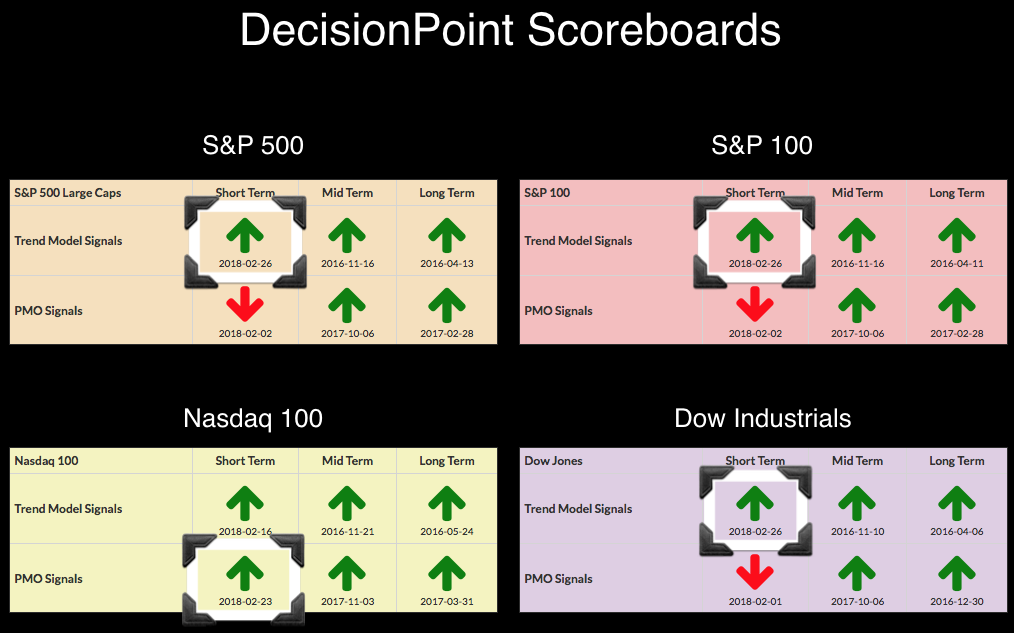

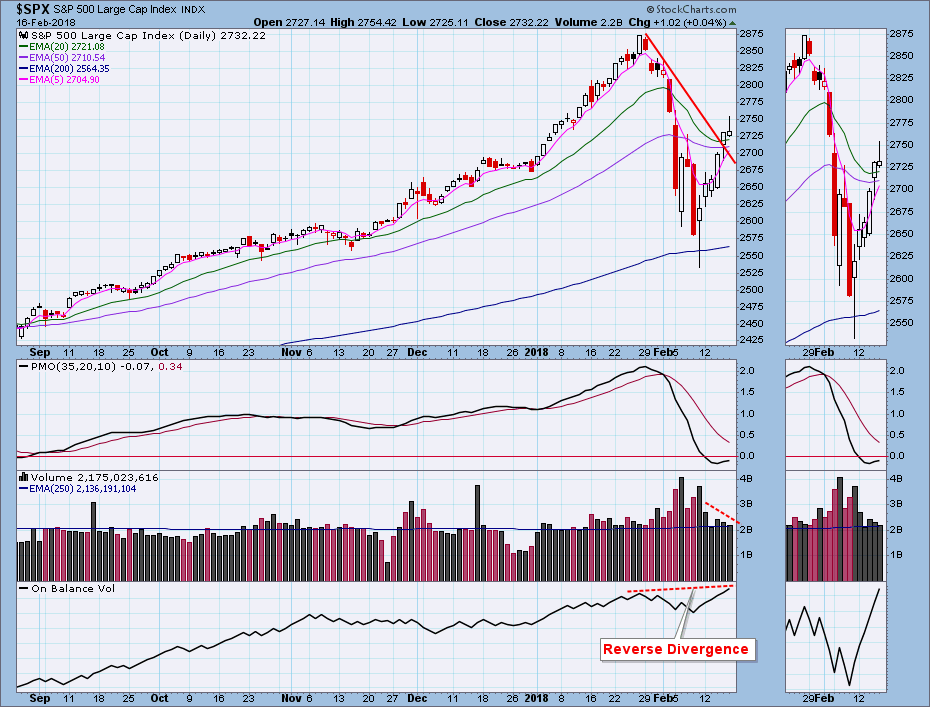

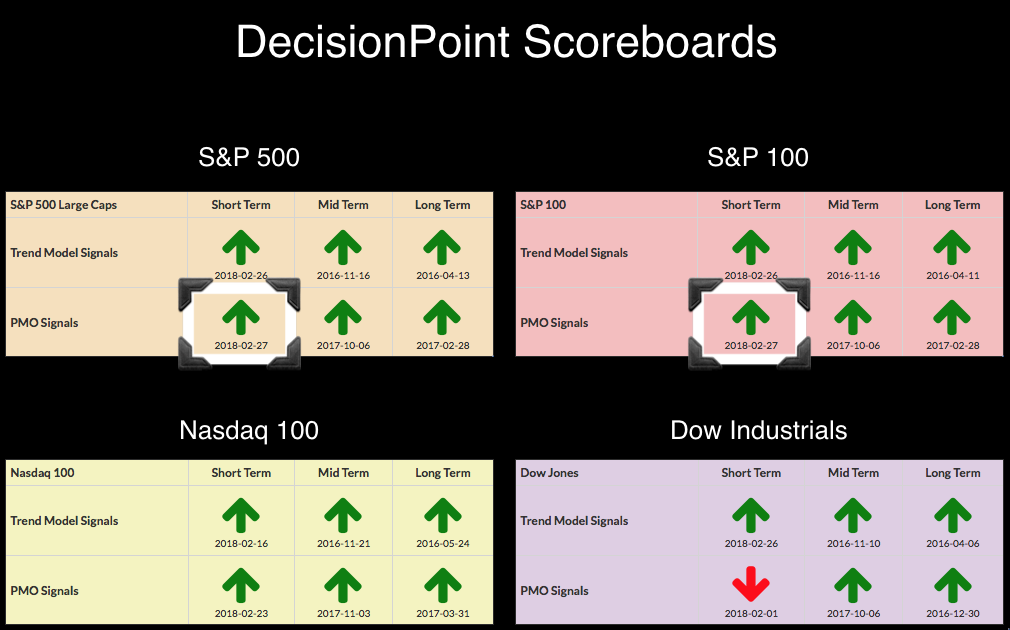

DP Bulletin: SPX and OEX New BUY Signals - Beware Outside Reversal Days

by Erin Swenlin,

Vice President, DecisionPoint.com

Two items I need to call your attention to. First, the PMOs crossed their signal lines on the SPX and OEX to trigger ST PMO (Price Momentum Oscillator) BUY signals. The Dow's PMO is stubbornly staying below its signal line, but that should disappear tomorrow given it'...

READ MORE

MEMBERS ONLY

JUMP IN BOND YIELDS PUTS STOCK REBOUND IN JEOPARDY -- QQQ IS PULLING BACK FROM TEST OF OLD HIGH -- S&P 500 LOOKS OVEREXTENDED -- BOUNCING DOLLAR WEAKENS GOLD -- EMERGING MARKETS ARE ALSO EXPERIENCING PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD IS BACK OVER 2.90% ... After a modest pullback that started last Thursday, bond yields are climbing again today. The daily bars in Chart 1 show the 10-Year Treasury Yield ($TNX) jumping 6 basis points to 2.92% and within striking distance of its four-year high reached...

READ MORE

MEMBERS ONLY

Software Breaks Out; Semis, Computer Hardware Next In Line

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 26, 2018

Monday was a very solid day for U.S. equities. All of our major indices roared to higher levels, led by the 400 point gain on the Dow Jones Industrial Average ($INDU). Eight of nine sectors advanced, with only the defensive utilities group...

READ MORE

MEMBERS ONLY

The 800-Pound Gorilla in the Market - Charting the Fab Five

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Leads with First Breakout.

* Small Caps and Mid Caps Still Lagging.

* Six Sectors and Six Upswings.

* Techs and Materials Lead New High List.

* The 800-pound Sector in the Market.

* Charting the Fab Five (AAPL, GOOGL, FB, AMZN, MSFT).

* Retail and Housing Lag.

SPY Leads with First Breakout...

For the...

READ MORE

MEMBERS ONLY

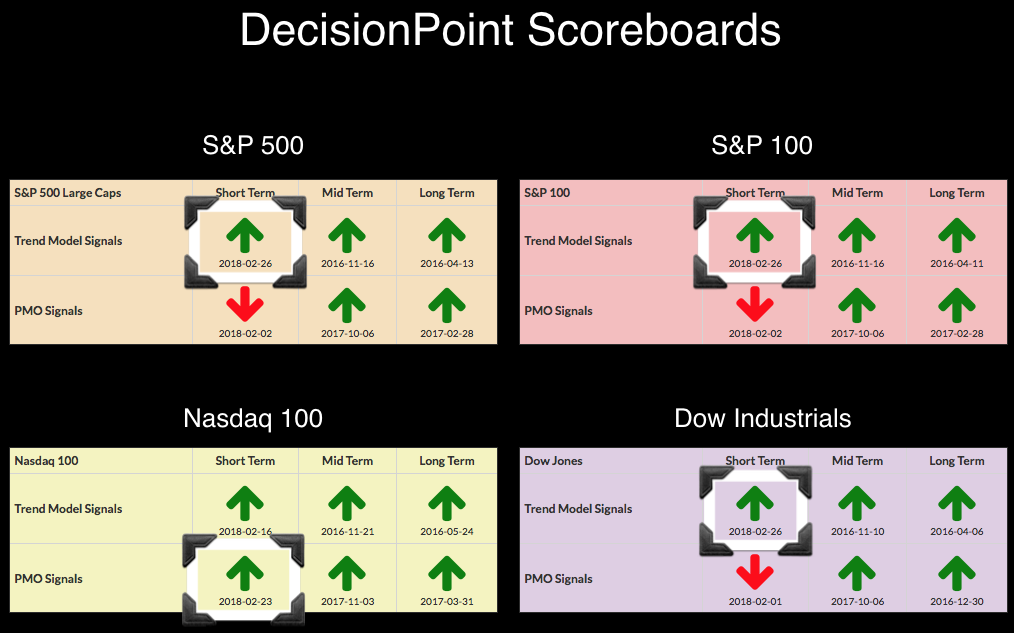

Flags Execute on Major Indexes - New BUY Signals on DP Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

The DP Scoreboard transformation actually began on Friday when the NDX grabbed a new PMO BUY signal after already logging a ST Trend Model BUY signal. It appears the other indexes are falling in line as their 5-EMAs crossed above 20-EMAs to generate ST Trend Model BUY signals too. When...

READ MORE

MEMBERS ONLY

STOCKS REGAIN THREE-QUARTERS OF FEBRUARY SELLOFF -- QQQ NEARS TEST OF OLD HIGH -- AMERICAN AIRLINES AND UNION PACIFIC LEAD TRANSPORTS HIGHER -- COMMODITIES ARE ALSO RECOVERING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN MORE GROUND -- QQQ NEARS TEST OF OLD HIGH... U.S. stock indexes continue to gain more ground today and have now regained about three-quarters of their recent correction. Charts 1 and 2 show the Dow Industrials and S&P 500 trading at three-week highs after...

READ MORE

MEMBERS ONLY

Humana Tests Breakout Zone as PPO Turns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Humana (HUM) is part of the HealthCare Providers ETF (IHF) and this group led the market from mid-October to late January with a 20+ percent surge to new highs. The group pulled back in February, but the long-term trend is up and this bodes well for stocks in the group....

READ MORE

MEMBERS ONLY

Looking For March Seasonal Strength? Check These Two Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 23, 2018

After a steady diet of afternoon flops recently, our major indices soared into Friday's close, clearing important overhead resistance in the process. All major indices finished with 1% gains or more, setting the stage for what could be a very solid...

READ MORE

MEMBERS ONLY

Whipsaws!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I had another article planned but think writing about something that just occurred in the market is a much better learning/teaching experience. Trend following has one issue that will constantly plague the investor and usually at the least expected time, and that is whipsaws. I must admit, I think...

READ MORE

MEMBERS ONLY

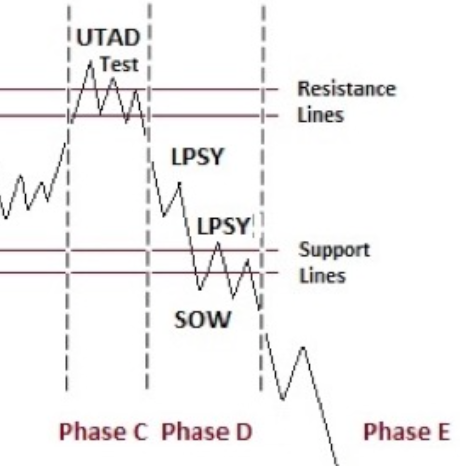

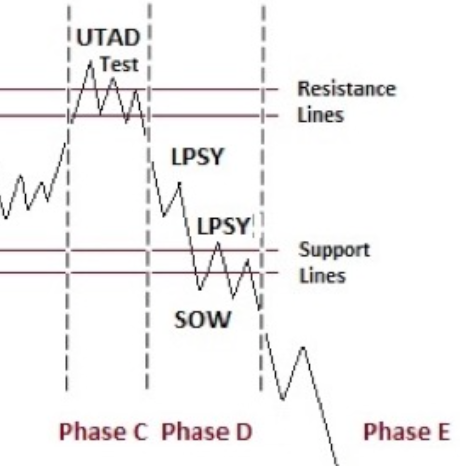

Distribution Review

by Bruce Fraser,

Industry-leading "Wyckoffian"

It has been a long time since we have explored the intricacies of the Wyckoff Distribution structure. But since 2018 has opened with a Bang, by going straight up in January and then early February’s retracement of the prior month’s advance, it is time to review. The year...

READ MORE

MEMBERS ONLY

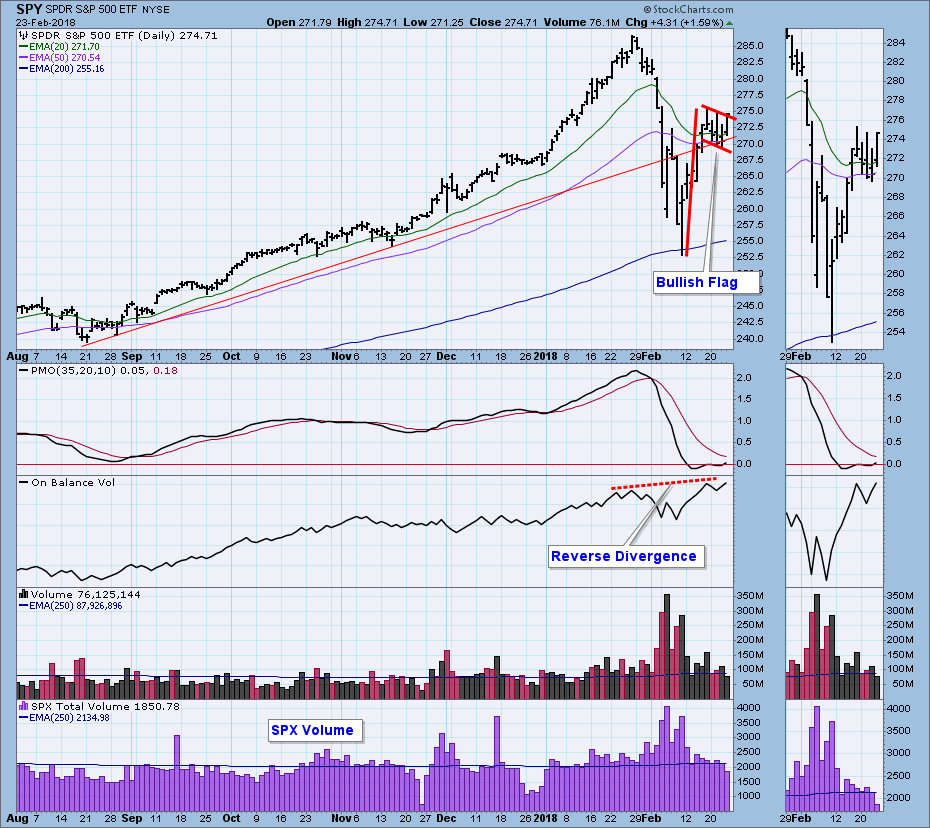

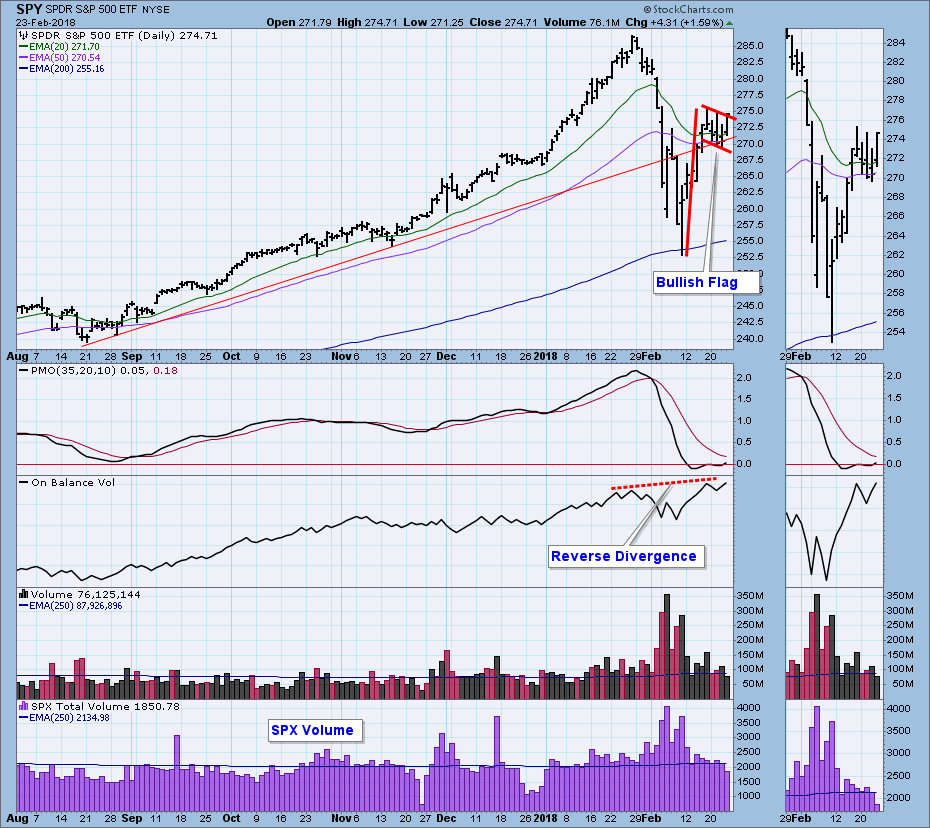

DP Weekly Wrap: Promising Flag Formation

by Carl Swenlin,

President and Founder, DecisionPoint.com

Nothing has happened this week to support my belief that we are in a bear market. If the market were in that much trouble, it seems to me that this week it should have headed lower. Instead, it has consolidated and formed a bullish flag formation. If the flag fulfills...

READ MORE

MEMBERS ONLY

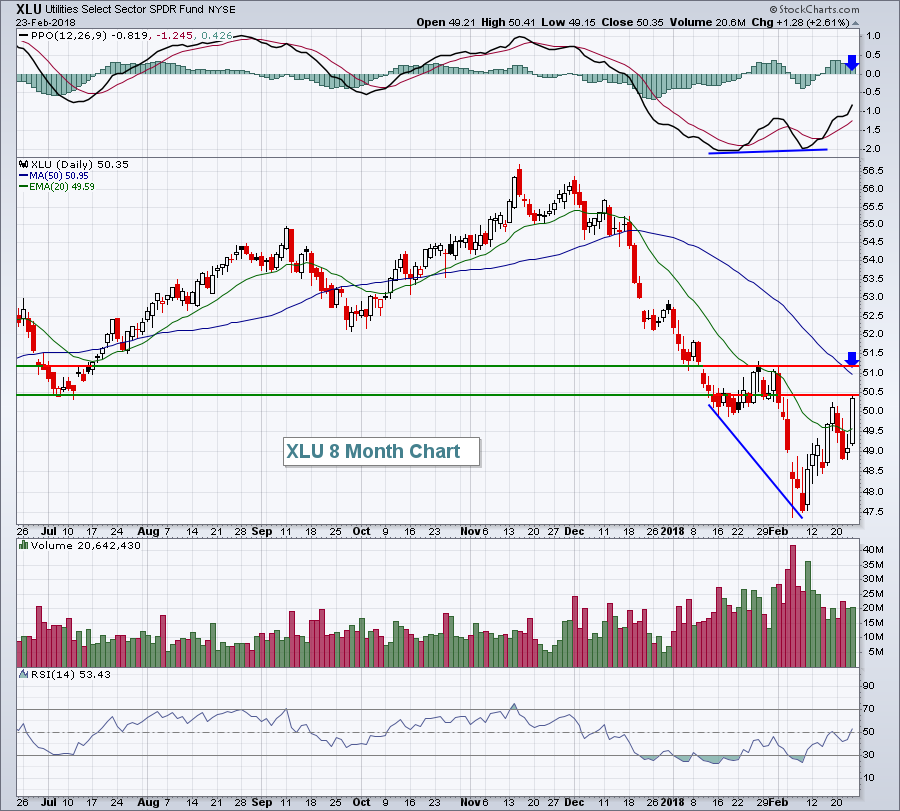

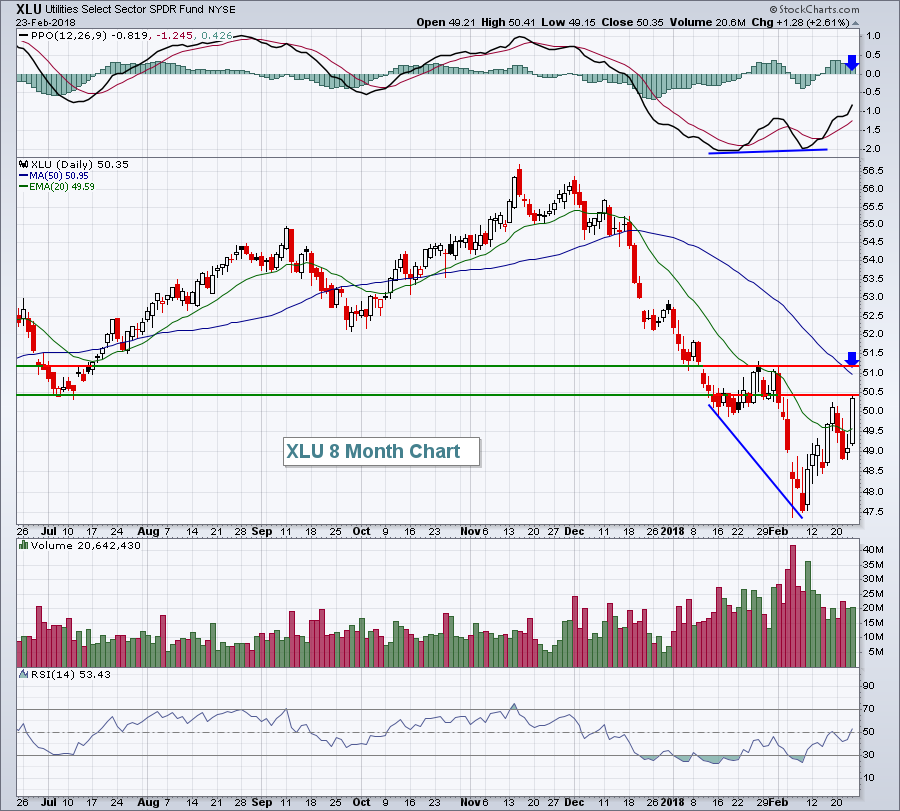

BOND YIELDS ARE STARTING TO WEAKEN FROM OVERBOUGHT CONDITION -- THAT'S GIVING A BOOST TO BOND PROXIES LIKE UTILITIES, REITS, AND TELECOM -- HIGH YIELD BONDS ARE BOUNCING BACK WHICH IS GOOD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD IS WEAKENING ... The uptrend in bond yields is starting to weaken. The daily bar in Chart 1 show the 10-Year Treasury yield falling 5 basis points to 2.87%. More importantly, its 14-day RSI line overlaid over the price bars is falling to the lowest level since...

READ MORE

MEMBERS ONLY

Free Style Tips: How I Organize My Custom ChartStyles!

by Grayson Roze,

Chief Strategist, StockCharts.com

Well, I did it again. Yesterday morning, I joined Tom Bowley and Erin Swenlin on MarketWatchers LIVE as part of the weekly "Everything StockCharts" segment, which covers important tips, tricks and other information that all StockCharts users can benefit from.

My appearance was a demonstration in style...ChartStyle!...

READ MORE

MEMBERS ONLY

Higher Treasury Yields Crushing Last Year's Darling - Home Construction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 22, 2018

U.S. indices continued to tread water on Thursday, with mixed action among our major indices and sectors. The Dow Jones posted a triple digit gain (165 points), but the more aggressive NASDAQ and Russell 2000 indices both fell fractionally. Volatility ($VIX) subsided...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Something for Everyone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Bulls, Bears and Fishermen.

* Long-term Picture Still Bullish.

* Rising SMAs for the S&P 500.

* A Short-term Bullish Pattern for SPY.

* Small-caps Show some Short-term RS.

* Lots of Little Consolidations.

* Oil Extends Bounce off Support.

* Energy Stocks are Not Impressed.

* Gold Miners Not Impressed Either.

* Notes from the Art&...

READ MORE

MEMBERS ONLY

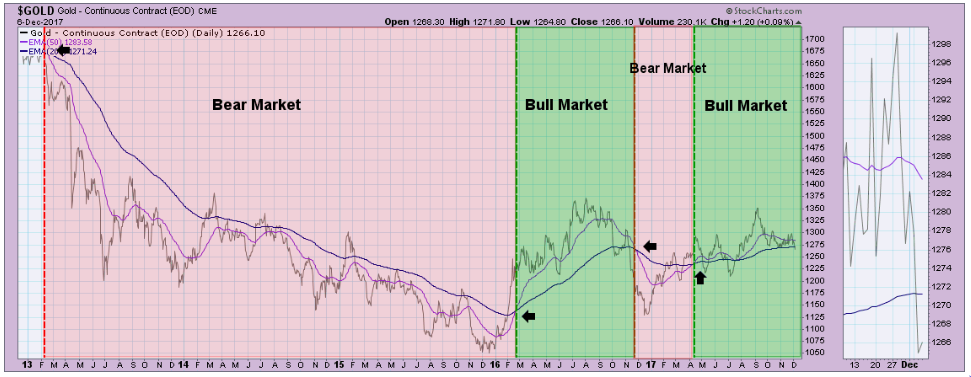

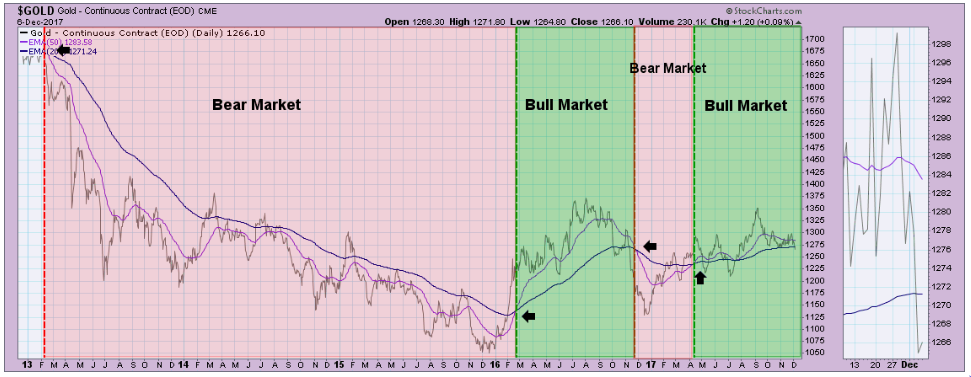

Why So Down on Gold?

by Erin Swenlin,

Vice President, DecisionPoint.com

I was asked during the MarketWatchers LIVE program today about my thoughts regarding Gold v. Dollar and particularly, why I'm bearish on Gold right now. I'll explain.

The chart for Gold is bearish on many counts. First there is the PMO with its "bear kiss&...

READ MORE

MEMBERS ONLY

SystemTrader - In-Sample and Out-of-Sample Results for Two Momentum Systems - Measuring Performance and Drawdowns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Revisiting Two Momentum Systems from 2017.

* A Simple Momentum Rotation System.

* Live by the Sword, Die by the Sword.

* A Trend-Momentum System with a Profit Target.

* Successful and Unsuccessful Trades.

* In-Sample and Out-of-Sample Performance.

* Drawdowns are Unavoidable.

* Conclusions and Takeaways.

* Consulting, Software and Data.

Revisiting Two Momentum Systems

I introduced...

READ MORE

MEMBERS ONLY

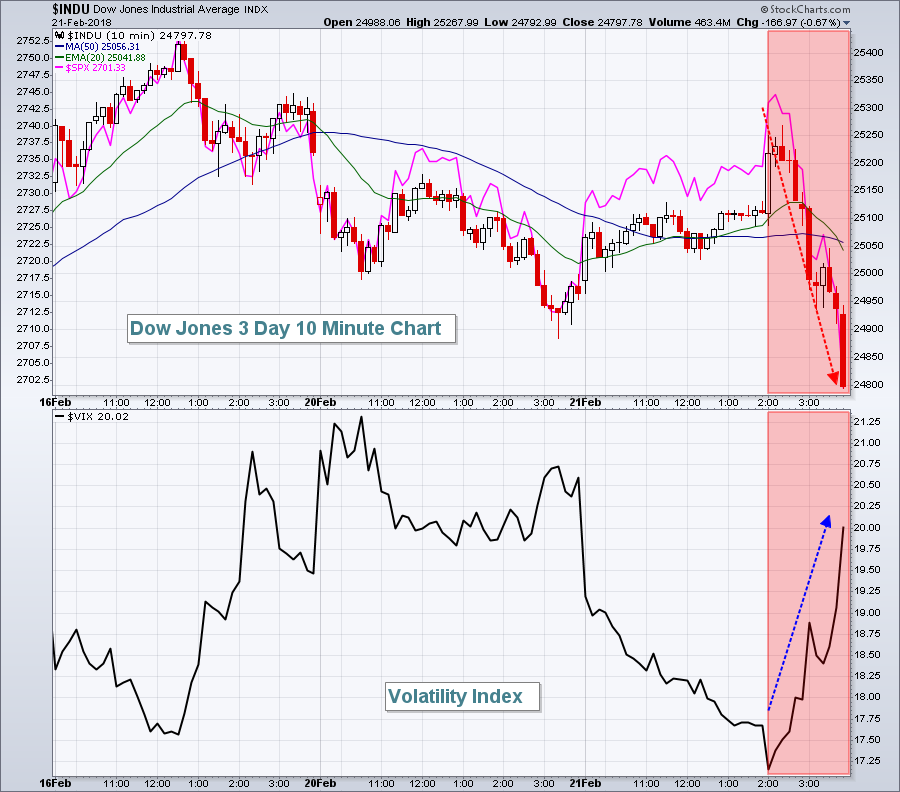

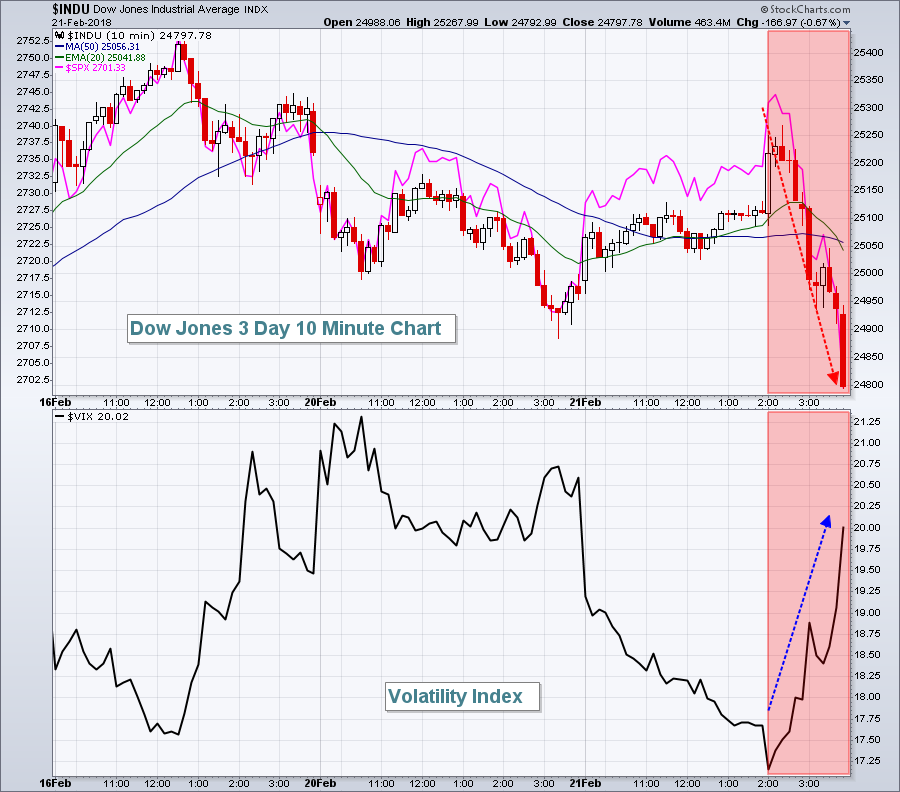

FOMC Minutes Spook Traders, Equities Tumble In Final Two Hours

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 21, 2018

Well, the U.S. stock market was humming right along.....until the FOMC minutes were released at 2pm EST. Take a look at this intraday chart on the Dow Jones and S&P 500 and I think you'll fairly quickly...

READ MORE

MEMBERS ONLY

DP Alert - ST Indicators Suggest Pullback

by Erin Swenlin,

Vice President, DecisionPoint.com

The NDX switched back to a Short-Term Trend Model BUY Signal on the DecisionPoint Scoreboards. The 5-EMA crossed above the 20-EMA which triggered the signal (the chart is below the scoreboards for your review).

The purpose of the DecisionPoint Alert Update is to quickly review the day's action,...

READ MORE

MEMBERS ONLY

Emerging From The Correction The Best And Worst Looking Sectors

by Martin Pring,

President, Pring Research

* General market thoughts

* Sectors under pressure

* Stronger looking sectors

General market thoughts

My thoughts on the recent correction is that we have likely seen the low, that more ranging action is likely, probably involving a test of that low, but that eventually US equities will see new bull market highs....

READ MORE

MEMBERS ONLY

STRONG TECH SECTOR CONTINUES TO SUPPORT MARKET -- FINANCIALS, CYCLICALS, AND INDUSTRIALS ARE ALSO LEADING -- SMALLS CAPS LOOK STRONGER -- AMERICAN AIRLINES AND KANSAS CITY SOUTHERN LEAD TRANPORTS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SECTOR CONTINUES TO SUPPORT MARKET ... My last sentence from yesterday's message was that the stock market was unlikely to suffer any serious short-term damage as long as technology stocks kept rising. That's because technology is such a big part of the stock market. And they&...

READ MORE

MEMBERS ONLY

Regional Bank ETF Rises to the Top

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though I am currently in the "correction" camp for the broader market, there are clearly pockets of strength in some key groups. The Software iShares (IGV), Cyber Security ETF (HACK), Internet ETF (FDN) and Networking iShares (IGN) are leading the technology rebound and all are close to...

READ MORE

MEMBERS ONLY

Walmart Results Take A Big Bite Out Of Dow Jones, Ends Winning Streak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 20, 2018

Selling returned to Wall Street as its six day winning streak came to an end. The Dow Jones was easily the biggest loser as Walmart, Inc (WMT) disappointed traders with its latest quarterly earnings report and had its worst trading day in many...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS LEAD THE NASDAQ AND TECHNOLOGY SECTOR HIGHER TODAY -- CHIP LEADERS INCLUDE APPLIED MATERIALS, KLA-TENCOR, AND LAM RESEARCH -- MOST OTHER SECTORS ARE IN THE RED -- DOW AND S&P 500 ARE STRUGGLING AT MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ISHARES HAVE A STRONG DAY... Semiconductor stocks are the strongest part of the market today. Chart 1 shows the PHLX Semiconductor iShares (SOXX) trading more than 2% higher today and moving further above its 50-day moving average. The SOXX has also risen above its 20-day moving average (green line)...

READ MORE

MEMBERS ONLY

Never Short a Dull Market or Go Long a Volatile One

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Go Long a Volatile Market?

* Setting Correction Targets for S&P 500.

* Leaders and Laggards During the Rebound.

* Scanning for Percent from High.

* Semis, Housing and Transports Lag.

"Never short a dull market" is an old Wall Street saying. Even though we cannot build a strategy on...

READ MORE

MEMBERS ONLY

Traders Turn Defensive As Key Fibonacci Retracement Level Reached - Bearish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 16, 2018

On the surface, Friday's action didn't seem all that bad. While there was bifurcated action, three of our four major indices did finish in positive territory. The aggressive small cap Russell 2000 ($RUT) led the advance. Only the NASDAQ...

READ MORE

MEMBERS ONLY

The Law of Cause and Effect in Action

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Law of Cause and Effect is a cornerstone principle of the Wyckoff Method. Cause building on the chart precedes the Effect of a Markup or a Markdown. Wyckoffians meticulously study trading ranges on the charts for Accumulation or Distribution characteristics. Analysis of Phases (Phases A thru E) track the...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 5

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The significant components of my Weight of the Evidence are Price Measures and Breadth Measures. All of my Price Measures use the Nasdaq Composite Index which I have written about many times. If using the same price, then the difference between most price indicators is to offer varying time periods;...

READ MORE

MEMBERS ONLY

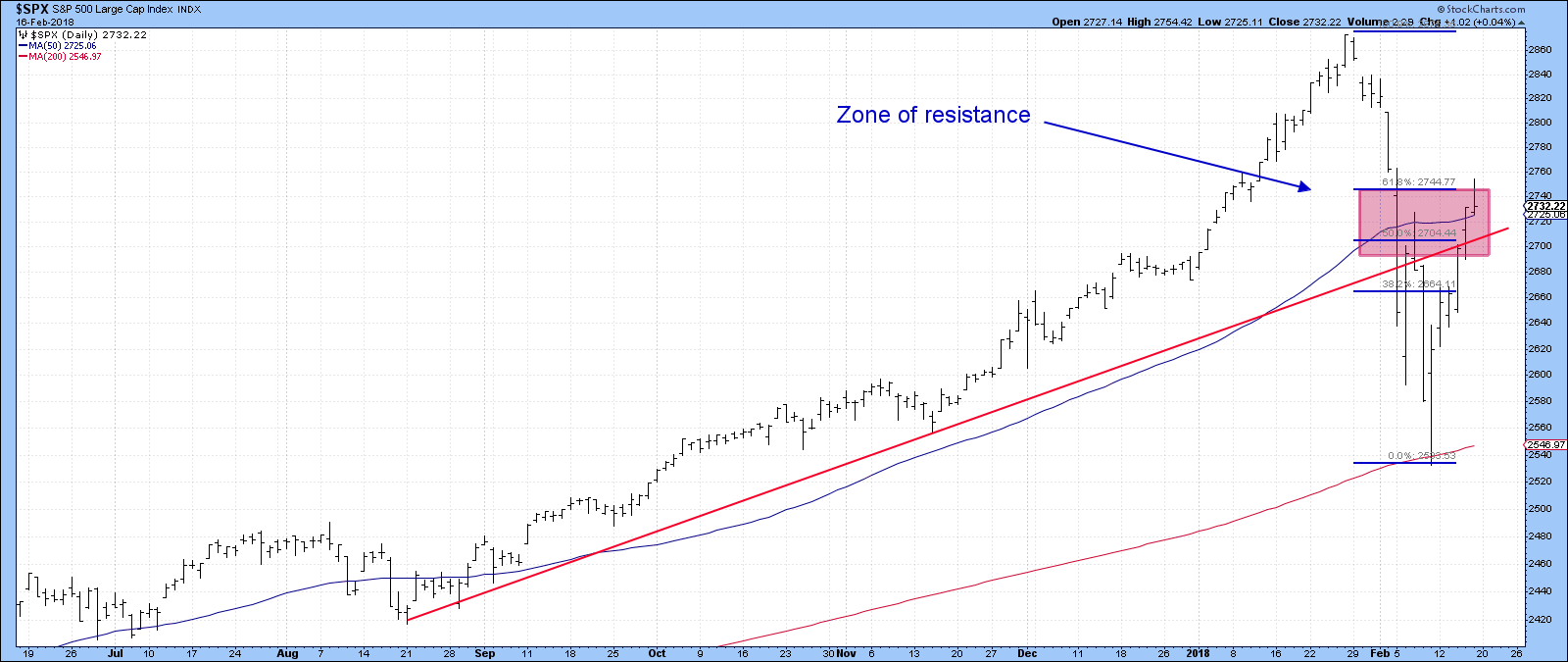

Some Equity Markets Showing Signs Of Long-term Vulnerability

by Martin Pring,

President, Pring Research

* Pinocchio argues for a test of the lows

* European equities are facing a big challenge

* Shanghai starting to look sick

Pinocchio argues for a test of the lows

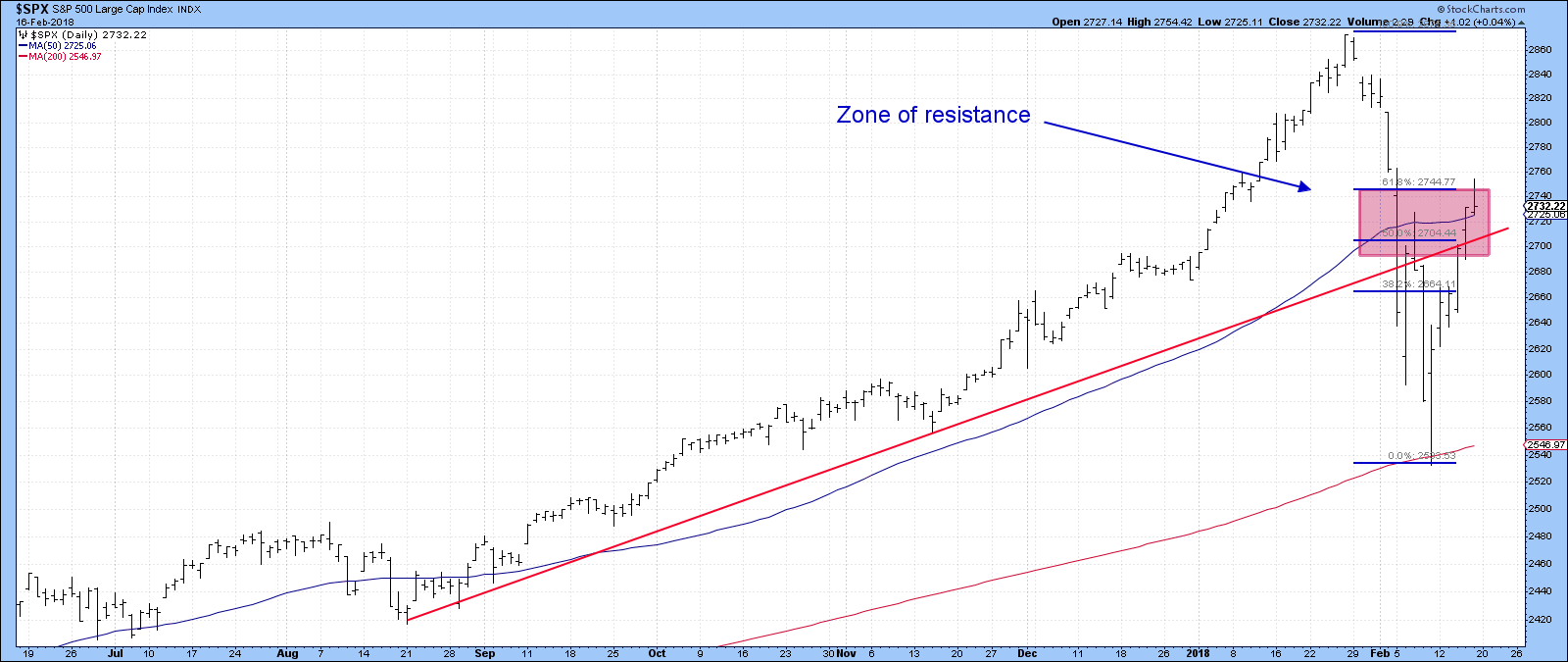

Last week I suggested that the S&P had reached a resistance zone following its bounce from the early February panic...

READ MORE

MEMBERS ONLY

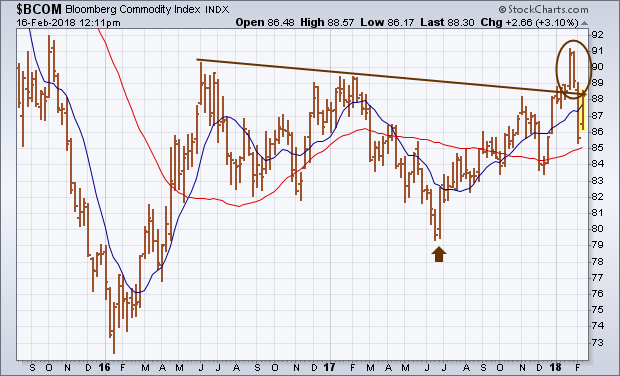

Recent Pullback in Commodities Is Likely Tied to Stock Correction

by John Murphy,

Chief Technical Analyst, StockCharts.com

My January 27 message wrote about a bullish breakout in commodity prices to the highest level in two years. I took that as another sign that inflation pressures were starting to build. The weekly bars in Chart 1 show that bullish breakout taking place in the Bloomberg Commodity Index (circled...

READ MORE

MEMBERS ONLY

Big Scores Made Possible through Extreme Patience

by John Hopkins,

President and Co-founder, EarningsBeats.com

I'm sure most traders get tired of being told to be patient when the market or a specific stock is climbing day after day. Missing out on nice rallies can be extremely frustrating. But if there ever was a time when patience paid off big time it was...

READ MORE

MEMBERS ONLY

History And Fibonacci Say We Topped On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

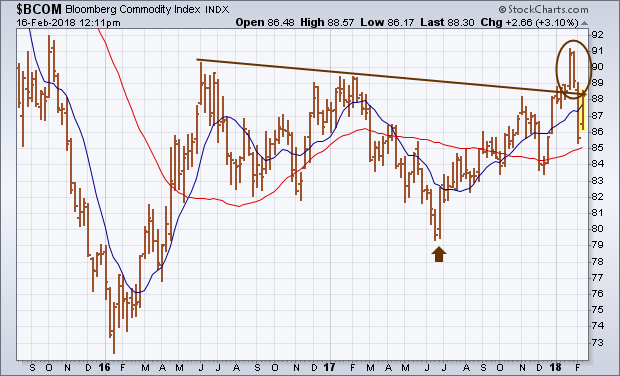

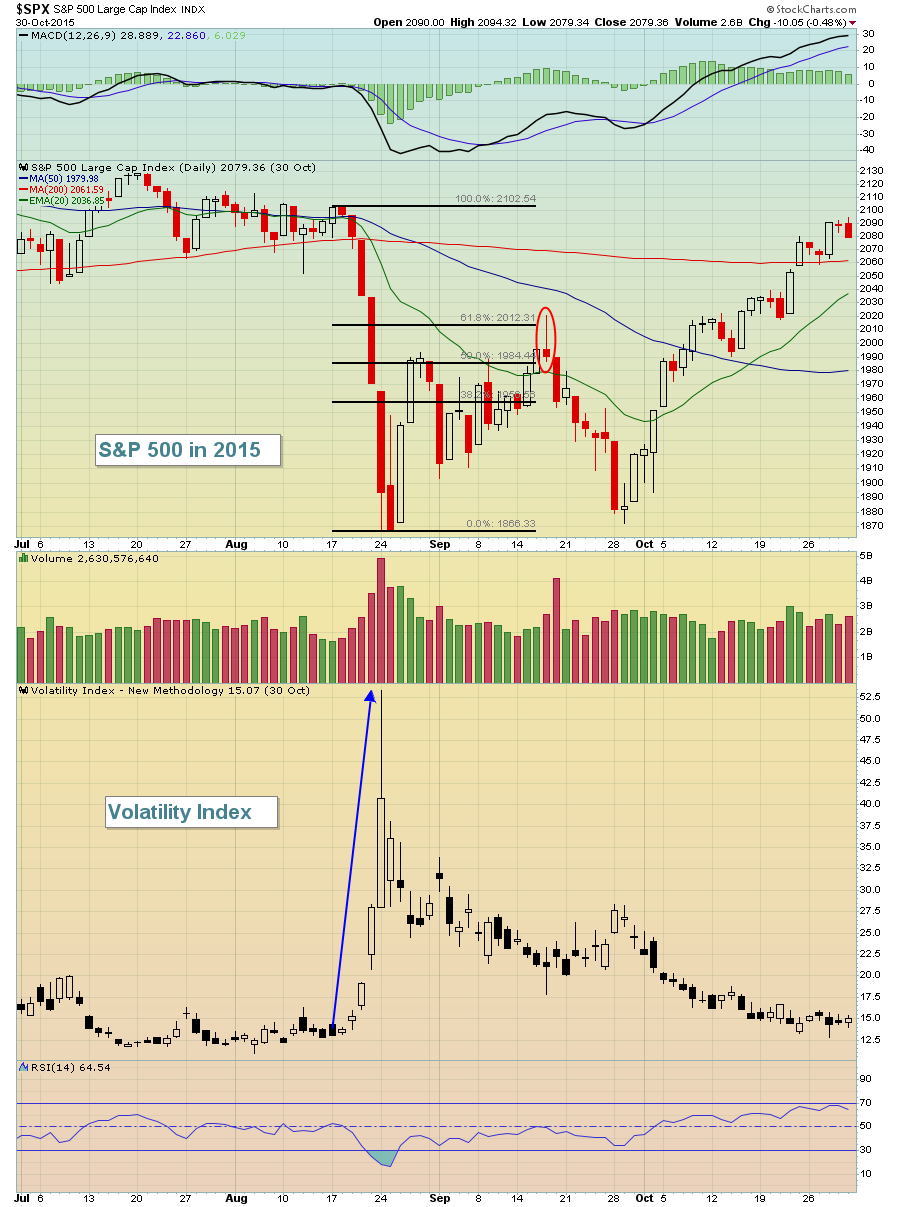

Fear ramped up with the early February selling and a capitulatory bottom (at least short-term) printed. The Volatility Index ($VIX) doesn't hit the 40-50 zone often and, when it does, it typically coincides with a panicked selloff and bottom. The last time we saw panicked selling (before the...

READ MORE

MEMBERS ONLY

Where Did All Those New Lows Come From?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded this week as the S&P 500 Equal-Weight Index ($SPXEW) recovered most of the losses from the previous week. On a closing basis, the index fell around 10% in nine days and then recovered around half of this loss with a 5.4% gain the last six...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bear Market Rally Over?

by Carl Swenlin,

President and Founder, DecisionPoint.com

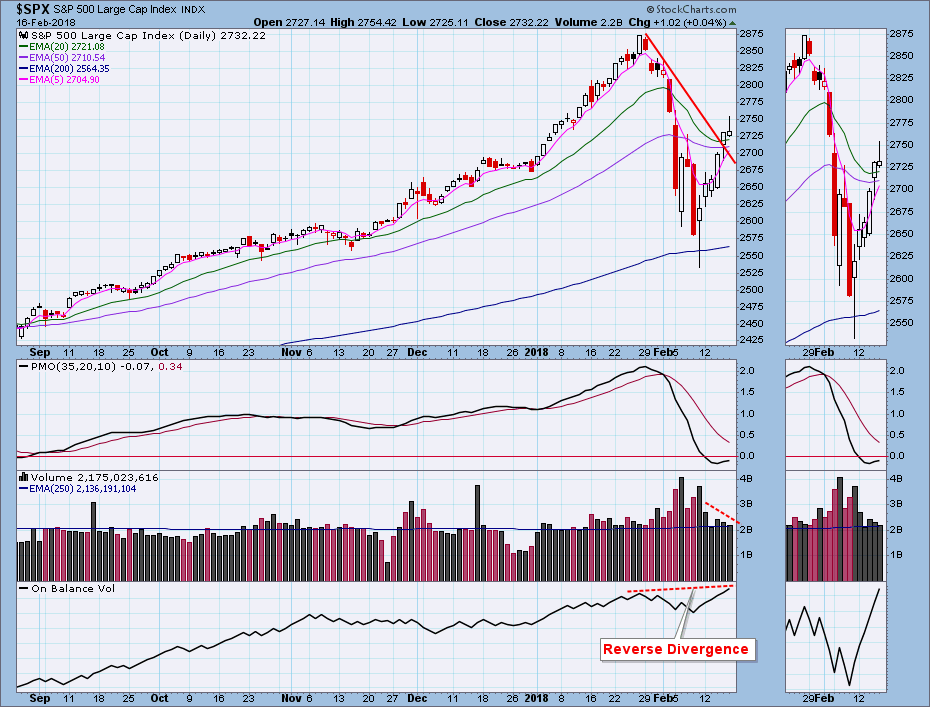

Last Friday the market executed a bullish intraday reversal, and this week it rallied five days straight; however, there were some problems. S&P 500 volume contracted into the rally, and Friday's candlestick was a bearish shooting star. I don't really use candlesticks much, but...

READ MORE

MEMBERS ONLY

Bull or Bear Market Rules?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today on MarketWatchers LIVE, I did a workshop on bull and bear market rules. You'll hear many technicians discuss "bull market rules apply" or vice versa. The question is pertinent and timely right now. The jury is still out on whether we are about to enter...

READ MORE