MEMBERS ONLY

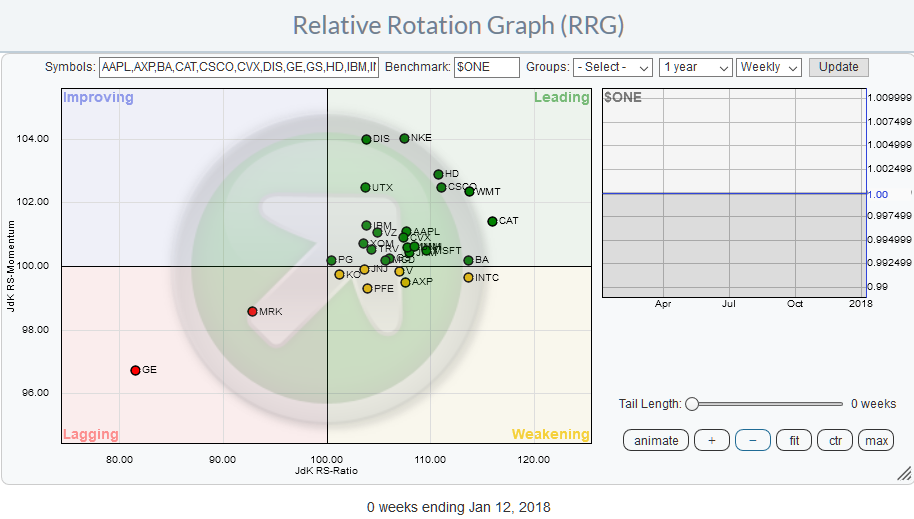

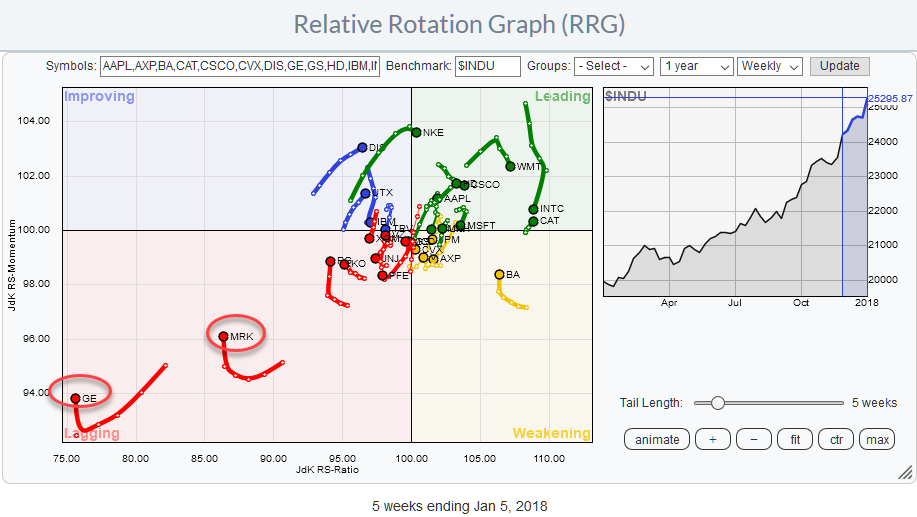

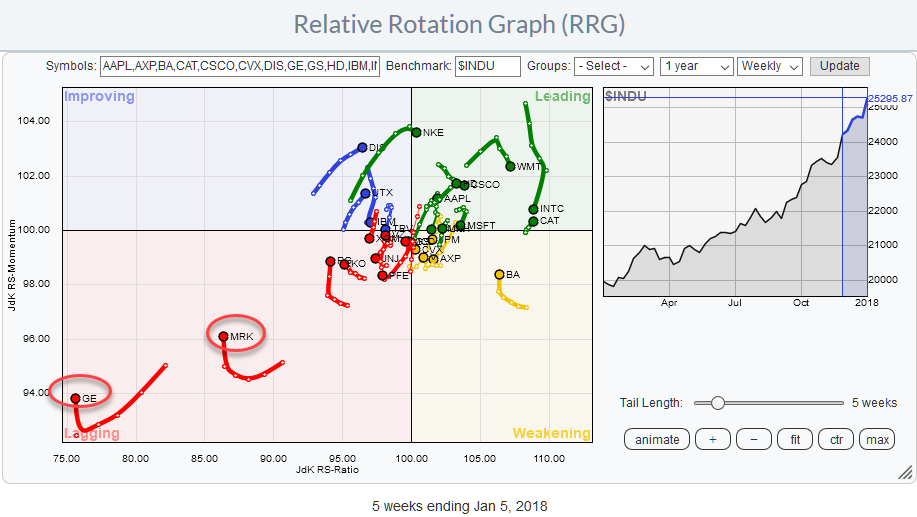

Using Relative Rotation Graphs(R) to get a handle on both price- and relative rotation in ONE picture

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

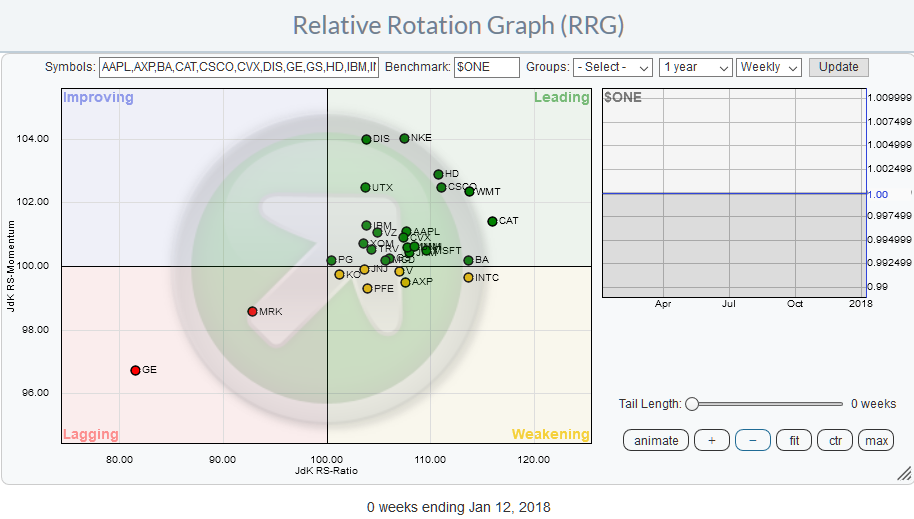

In my last blog, we looked at the 30 components of the Dow Jones Industrials Index and more specifically at the relative positioning and relative rotation of these 30 stocks around their common denominator the DJ Industrials index ($INDU).

And despite the fact that this is valuable information you may...

READ MORE

MEMBERS ONLY

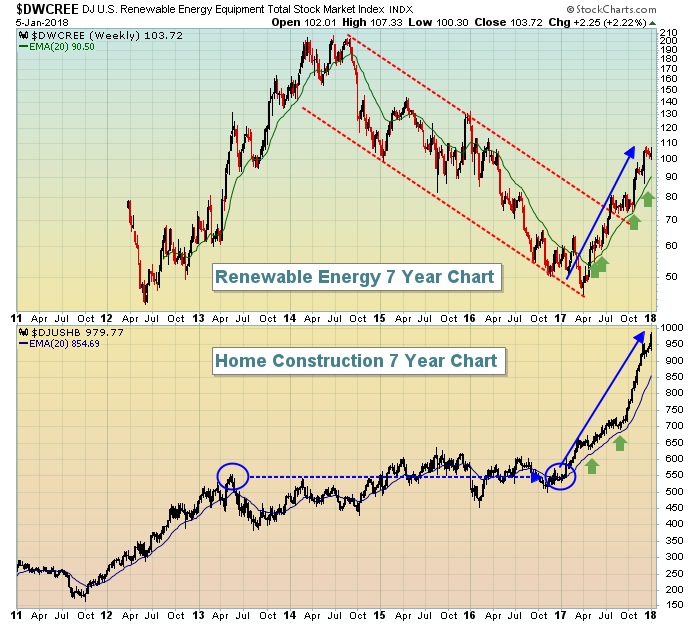

Several Intermarket Relationships Are Forecasting Higher Commodity Prices

by Martin Pring,

President, Pring Research

* CRB Composite nudging through mega resistance

* Key intermarket relationships starting to point in an inflationary direction

* Inter-asset ratios also confirm the inflationary scenario

* Euro breaks to the upside

CRB Composite nudging through mega resistance

Late last month I wrote about several charts I was watching for a possible breakout in...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In my first article of this series I outlined the concepts that would be discussed in this series. See HERE. In this article we need to discuss some of the building blocks that will be used and how to interpret them.

Description of Binary and Analog Measures

I actually prefer...

READ MORE

MEMBERS ONLY

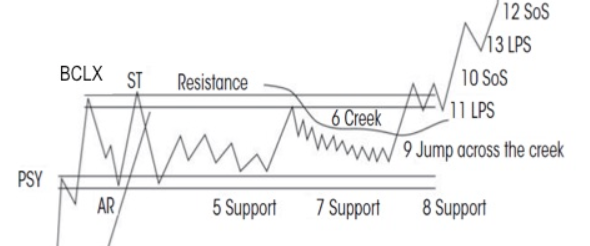

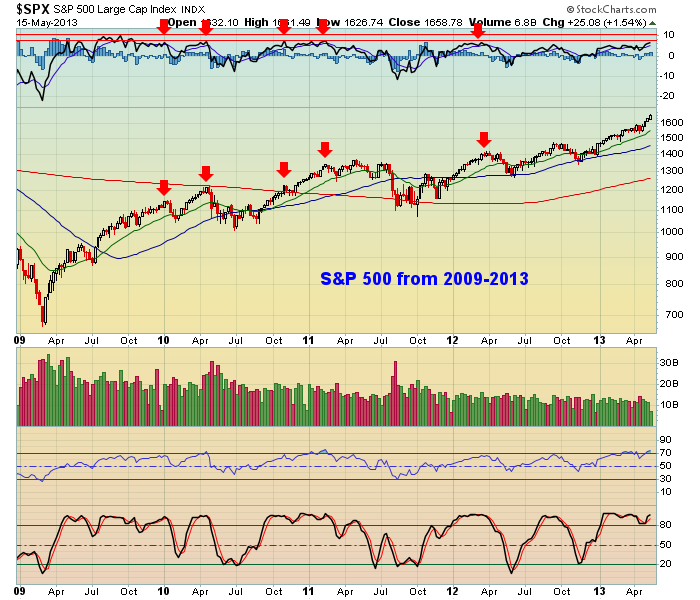

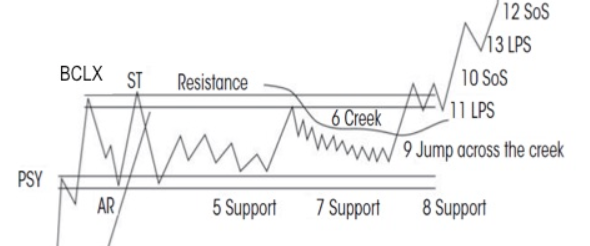

Reaccumulation Review

by Bruce Fraser,

Industry-leading "Wyckoffian"

A big thank you to Erin Swenlin and Tom Bowley for hosting me on MarketWatchers LIVE this past Wednesday. I had a blast being on their excellent (and Live) market program. The Wyckoff topic we covered was Reaccumulation structures. There were a few interesting intra-day charts that we did not...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Zoom!

by Carl Swenlin,

President and Founder, DecisionPoint.com

Positive events resulting from the recent tax cut legislation continued to lift the market this week, bonuses and pay raises being most prominent in the headlines. I'm sure that there is a substantial element of anticipation as to the positive effects of corporate taxes being cut by 40%...

READ MORE

MEMBERS ONLY

EURO REACHES THREE-YEAR HIGH AGAINST DOLLAR -- THAT'S GOOD FOR COMMODITIES -- ENERGY SPDR BREAKS OUT TO THE UPSIDE -- DECEMBER CPI ABOVE 2% SECOND MONTH IN A ROW -- CORE CPI HAS BIGGEST JUMP IN 11 MONTHS -- WHAT ENERGY DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO REACHES THREE-YEAR HIGH ... Yesterday's message showed the euro on the verge of a new three-year high. The weekly bars in Chart 1 show the eurozone currency achieving that bullish breakout in today's trading. I also mentioned yesterday that a move above 1.20 would push...

READ MORE

MEMBERS ONLY

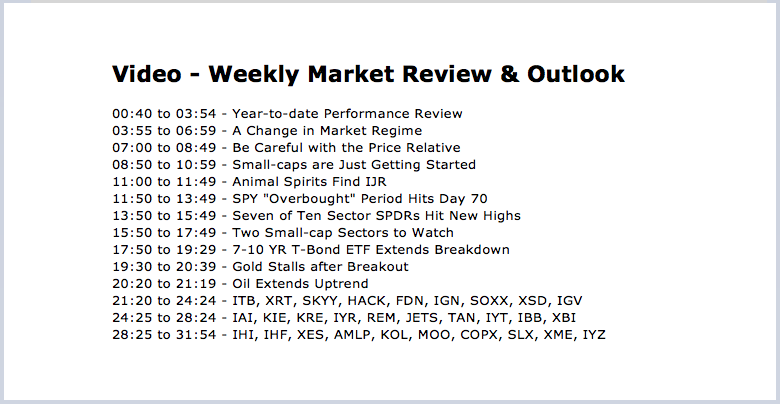

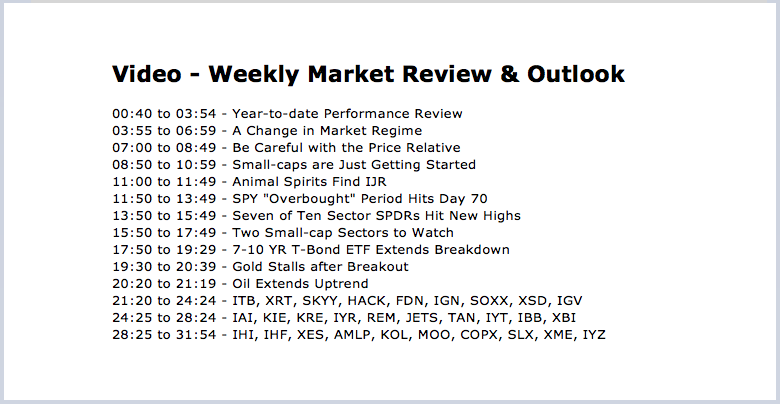

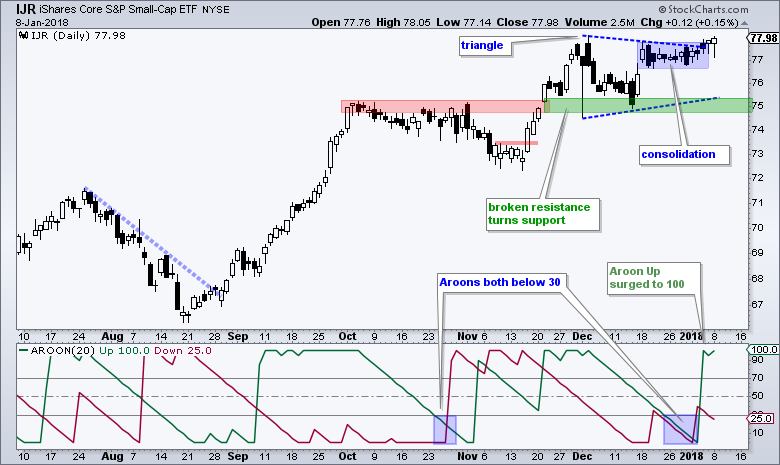

Weekly Market Review & Outlook (w/ Video) - Animal Spirits Coming to a Small Cap Near You

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Change in Market Regime.

* Be Careful with the Price Relative.

* Small-caps are Just Getting Started.

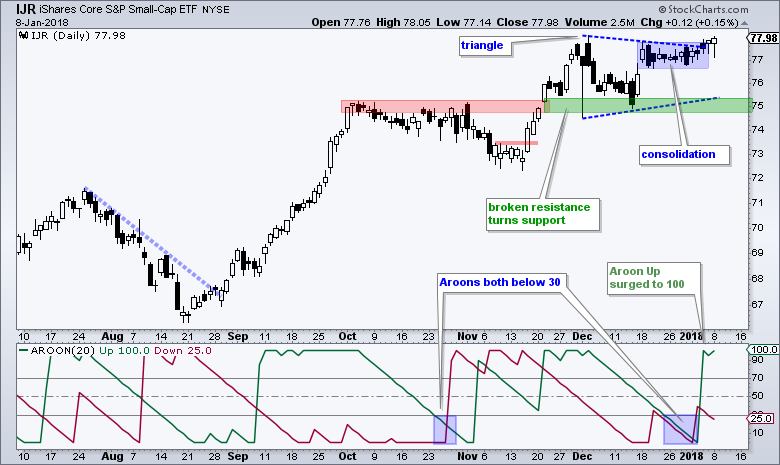

* Animal Spirits Find IJR.

* SPY "Overbought" Period Hits Day 70.

* Seven of Ten Sector SPDRs Hit New Highs.

* Two Small-cap Sectors to Watch.

* 7-10 YR T-Bond ETF Extends Breakdown.

* Gold Stalls after...

READ MORE

MEMBERS ONLY

Small Caps Lead With Powerful Rally; Airlines Prepared For Takeoff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 11, 2018

The small cap Russell 2000 ($RUT) led U.S. indices higher on Thursday with more across-the-board record highs being set. The RUT gained 1.73%, more than doubling the advance on any of the other major indices. There were plenty of reasons, but...

READ MORE

MEMBERS ONLY

Bad News for Bonds - New IT Trend Model Neutral - 30-Yr Yields Prepare for Breakout

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I received notice that TLT had triggered a new Intermediate-Term Trend Model (ITTM) Neutral signal. I decided to take a look at $TYX to see if yields were lining up with the action on TLT. Of course the relationship between TLT and $TYX is inverse, so a bearish TLT...

READ MORE

MEMBERS ONLY

A TEN-YEAR TREASURY YIELD MOVE ABOVE 2.62% WOULD PAVE THE WAY FOR 3% YIELD LATER THIS YEAR -- THAT WOULD PUT THE THIRTY-FIVE YEAR DECLINE IN BOND YIELDS IN JEOPARDY -- GERMAN YIELD NEARS TWO-YEAR HIGH ON HAWKISH ECB HINT

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LONGER TERM LOOK AT RISING BOND YIELDS... Chart evidence of a major upturn in Treasury bond yields continues to grow. The weekly bars in Chart 1 show the 10-Year Treasury yield ($TNX) nearing a test of its late 2016 intra-day peak at 2.62%. A decisive move above that...

READ MORE

MEMBERS ONLY

Major Indices Fall, But Pare Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 10, 2018

We saw losses across our major indices on Wednesday, but the bulls spent most of the day recovering from steeper losses just after the opening bell. Losses were inconsequential as they ranged from 0.02% on the aggressive Russell 2000 (small caps) to...

READ MORE

MEMBERS ONLY

Focusing on Cyber Security with Two Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Cyber Security ETF Surges to New High.

* Two Cyber Security Stocks to Watch.

* Finisar Bounces off Key Retracement.

* Win Some and Lose Some (AYI, BLL).

Cyber Security ETF Surges to New High

The Cyber Security ETF (HACK) lagged the broader market from June to mid November, but caught fire and...

READ MORE

MEMBERS ONLY

Ready to Roll the Dice with MGM?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

MGM Resorts (MGM) is gearing up for a resistance challenge and the speculator in me expects a breakout. First and foremost, MGM is in a long-term uptrend with the September 7th spike marking a 52-week high. The 50-day EMA is also above the 200-day EMA and price is well above...

READ MORE

MEMBERS ONLY

JNJ Breaks Out; Why Pharmas Could Lead The Market In 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

At the bottom of this article, you can type in your email address and hit the green "Notify Me" button to subscribe to my blog for FREE! Then my article will immediately be sent to your email address upon publishing. Thanks!

Market Recap for Tuesday, January 9,...

READ MORE

MEMBERS ONLY

Bond Yields Are Breaking Out All Over

by Martin Pring,

President, Pring Research

* Basic changes in long-term momentum

* The five-year maturity is signalling an end to the secular decline in yields

* Twenty-year yield showing signs of basing

* Ten-year attacking mega down trend line

* From a short-term aspect bond prices look vulnerable

* Utilities about to crash?

Basic changes in long-term momentum

Since the beginning...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD JUMPS TO NINE MONTH HIGH -- BANK OF JAPAN CUTS BOND PURCHASES -- THAT'S BOOSTING BANKS WHILE HURTING UTILITIES -- A DRAMATIC ROTATION OUT OF UTILITIES INTO TRANSPORTS POINTS TO A STRONGER ECONOMY AND HIGHER RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES HIGHEST LEVEL SINCE MARCH ... Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing 5 basis points to 2.53% which is the highest level since last March. That leaves little doubt that the trend for Treasury yields is upward. Part of the reason for today'...

READ MORE

MEMBERS ONLY

Small Caps and Banks Looked Poised to Move - Plus Three Bullish Healthcare Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-cap ETF Triggers a Signal.

* Regional Bank SPDR Gaps within a Triangle.

* Earnings Season Starts Soon.

* Five Automakers Hit New Highs - Who's Next?

* Three Healthcare Stocks Setting Up Bullish.

Small-cap ETF Triggers a Signal

The S&P SmallCap iShares (IJR) hit a 52-week closing high on...

READ MORE

MEMBERS ONLY

The Dow Jones Ends Its 2018 Winning Streak.....Barely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 8, 2018

After mostly a weak start on Monday, our major indices resumed their bullish ways and finished with positive returns. The lone exception was the Dow Jones, which dropped 13 points to end its impressive winning streak to open 2018. Weakness in Unitedhealth Group...

READ MORE

MEMBERS ONLY

DP Alert: Bullish Indicators, But isn't it Time for a Pause? - Flag or Island Reversal on USO?

by Erin Swenlin,

Vice President, DecisionPoint.com

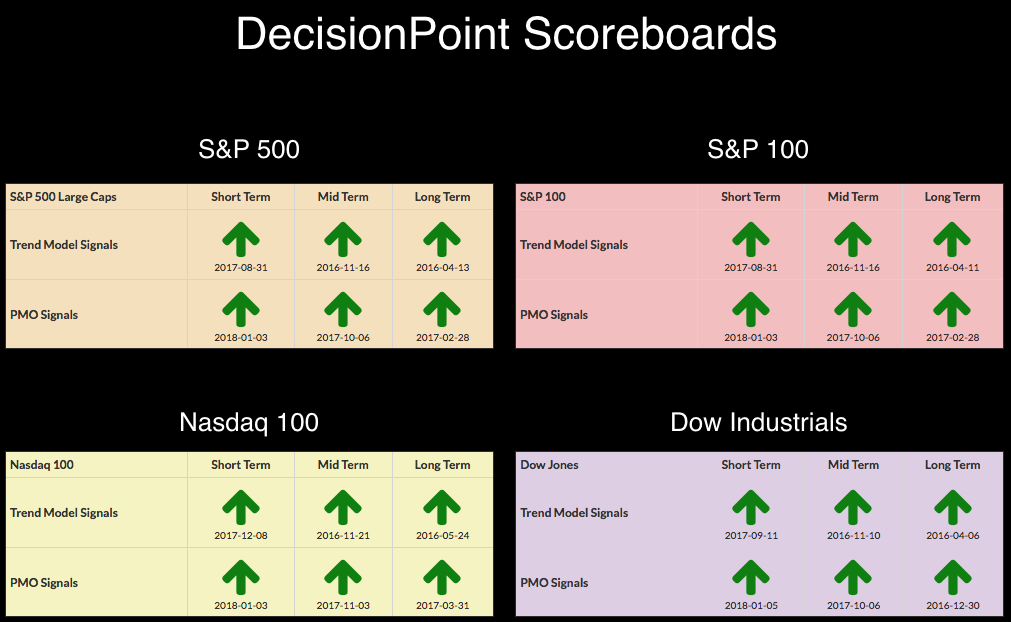

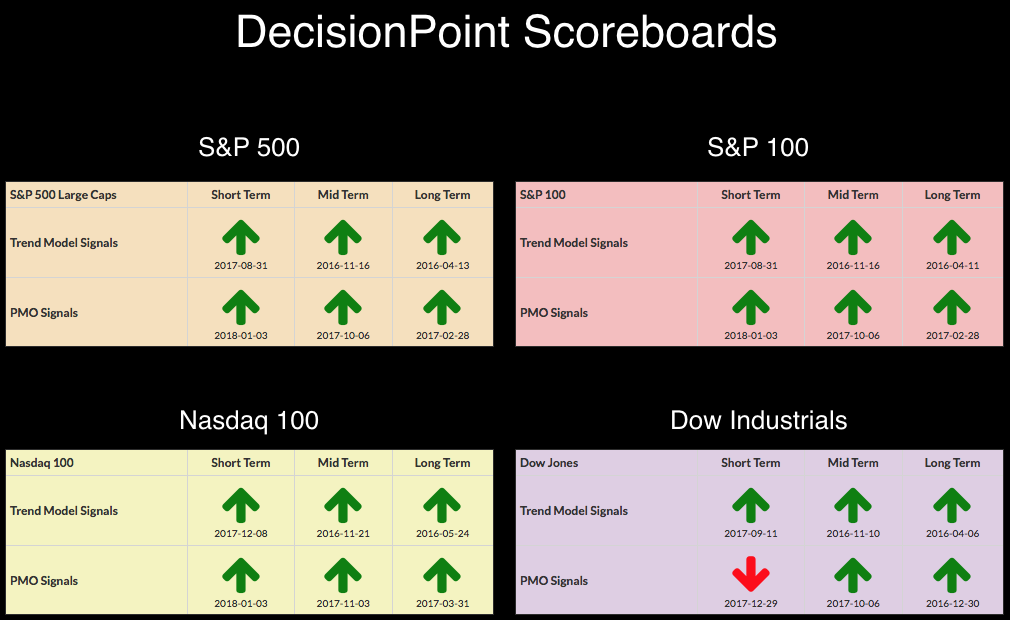

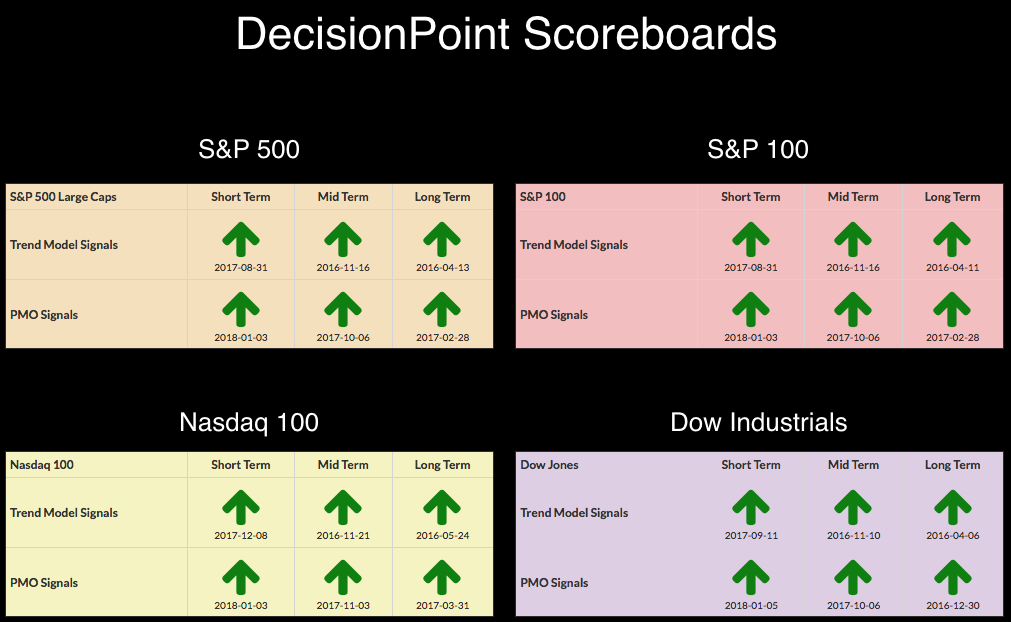

Carl always told me that you shouldn't put questions in the title of your articles unless you plan on answering them. I will. First, I want to point out the all green DecisionPoint Scoreboards. As I told listeners this morning, since I've been tracking these Scoreboards...

READ MORE

MEMBERS ONLY

Will Price Follow Volume for Broadcom?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broadcom (AVGO) fell on hards time in December with a decline to the breakout zone, but this zone ultimately held and it looks like the uptrend is ready to resume. First and foremost, AVGO is in a long-term uptrend after the big breakout in October and the 52-week highs in...

READ MORE

MEMBERS ONLY

Selecting stocks to watch (and avoid) in the Dow 30 using Relative Rotation Graphs(r)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the members of the DJ Industrials index against $INDU. This is a so-called closed universe which means that all elements that make up the universe are present in the plot. If we would calculate all the distances (vectors) from the center of the chart to...

READ MORE

MEMBERS ONLY

No Jobs? No Problem! U.S. Equities Soar Despite Weak Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 5, 2018

Not even a disappointing jobs report on Friday could slow down this bull market train. U.S. futures were strong before the release of December's nonfarm payrolls and they didn't give up a thing after the release, which showed...

READ MORE

MEMBERS ONLY

2018 Stock Market Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

HAPPY NEW YEAR!

In my first Trading Places blog article of 2018, "Here's One Chart That Screams BUY As We Begin 2018", I highlighted my favorite relative chart in the Current Outlook section. It's one of the biggest reasons why I believe 2018 will...

READ MORE

MEMBERS ONLY

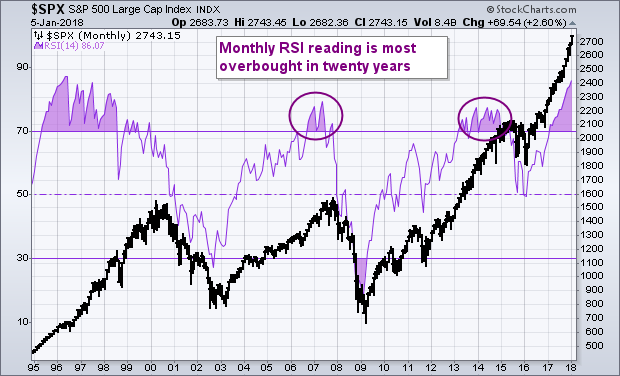

Global Stocks Start Year With a Bang, S&P 500 is Well Into a Five-Wave Advance

by John Murphy,

Chief Technical Analyst, StockCharts.com

Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also hit a new record. New records were set in North...

READ MORE

MEMBERS ONLY

Here's A Trading Strategy That Works In Any Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

Ultimately, the U.S. stock market lives and dies by the performance of its economy and how that translates into earnings growth of U.S. companies. Nearly every economic report that we've seen of late has been strong or strengthening. The number of companies that are performing well...

READ MORE

MEMBERS ONLY

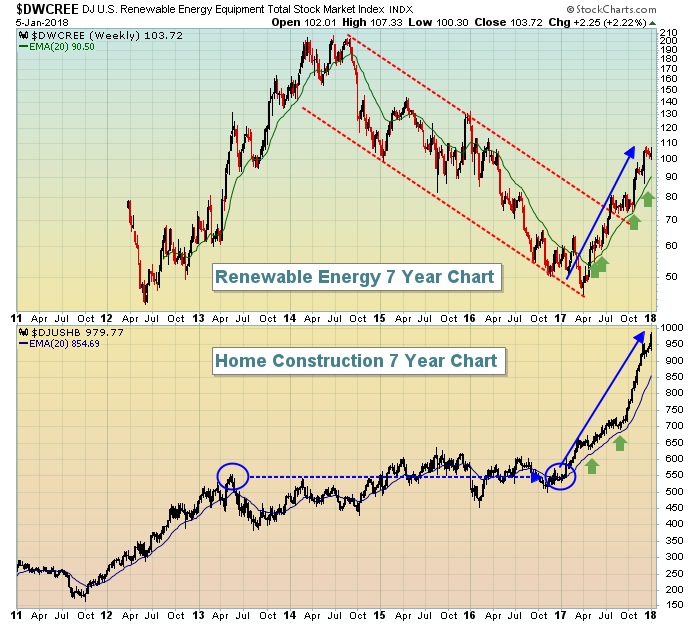

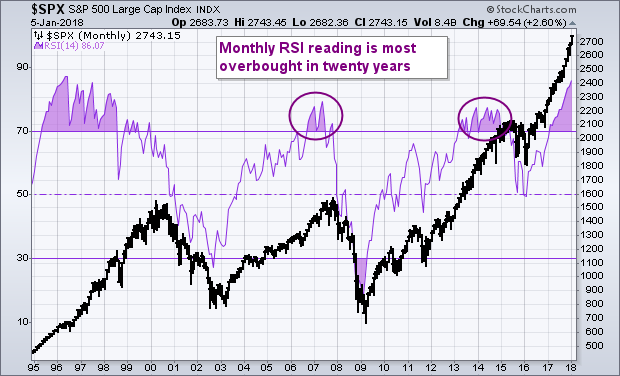

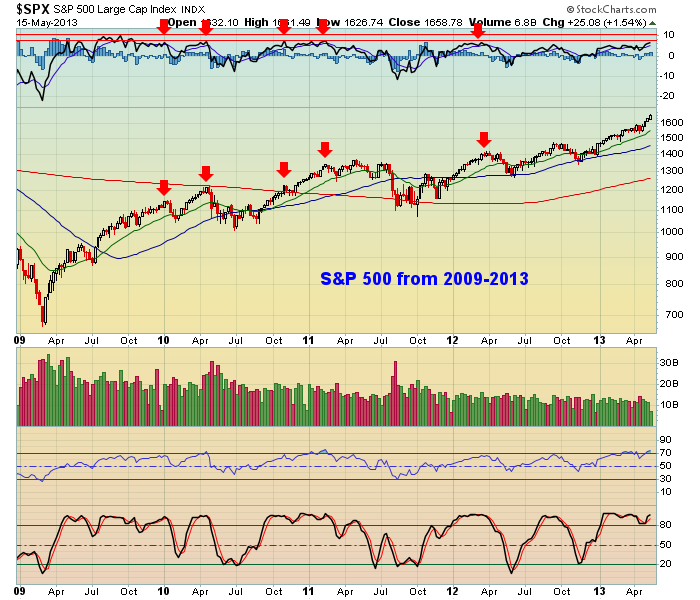

GLOBAL STOCKS START YEAR WITH A BANG WITH STOCKS AROUND THE WORLD HITTING NEW RECORDS -- BUT THE S&P 500 INDEX IS THE MOST OVERBOUGHT IN TWENTY YEARS -- AND IS WELL INTO A FIVE-WAVE ADVANCE -- THE CRB INDEX MAY BE NEARING AN UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS MOST OVERBOUGHT SINCE LATE 1990S... Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also...

READ MORE

MEMBERS ONLY

Schlumberger Rising

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Energy Sector lit up the final month of 2017. There are a number of dynamic stocks amongst this theme we can profile. Let’s choose one (and circle back to study others later on). This case study is a good way to begin our posts in the new year....

READ MORE

MEMBERS ONLY

Pockets of Strength Outweigh Pockets of Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

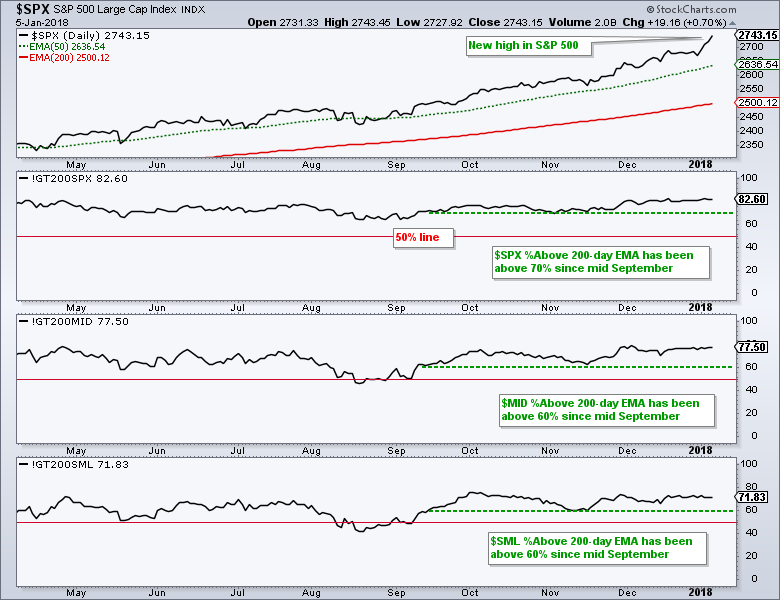

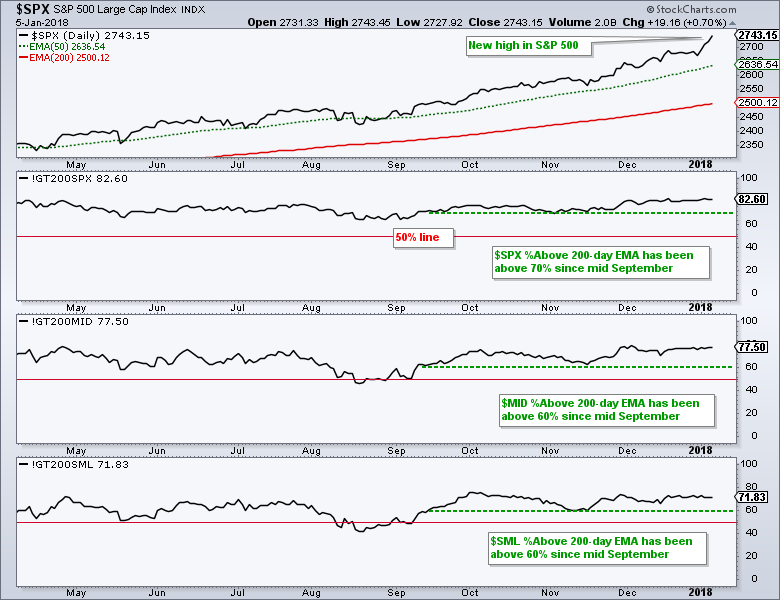

The stock market is never 100% bullish with all stocks participating in an uptrend. There are always some holdouts and pockets of weakness, but the broader market can continue higher as long as the pockets of strength are greater than the pockets of weakness.

The percentage of stocks above the...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: A Record of Our Own

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market was flat for the last two weeks of December, and I thought that might be a sign that it was hanging on by its fingernails until the first of the year, when we might see some profit taking. But, no. Why take profits when the market seems to...

READ MORE

MEMBERS ONLY

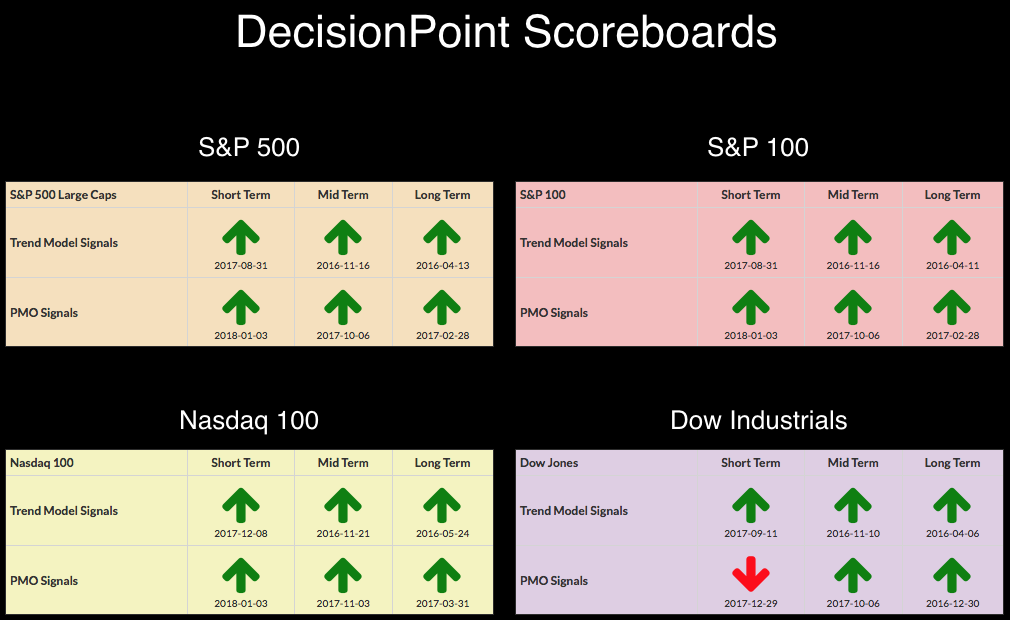

DP Bulletin: Dow Regains PMO BUY Signal - DP Scoreboards ALL Green

by Erin Swenlin,

Vice President, DecisionPoint.com

A quick bulletin to let you all know that we got a new PMO BUY signal on the Dow. I've been writing about this the past few days so no one should be surprised. At this point my concern again is for more whipsaw if the market takes...

READ MORE

MEMBERS ONLY

Market Still Overvalued, or Maybe Not

by Carl Swenlin,

President and Founder, DecisionPoint.com

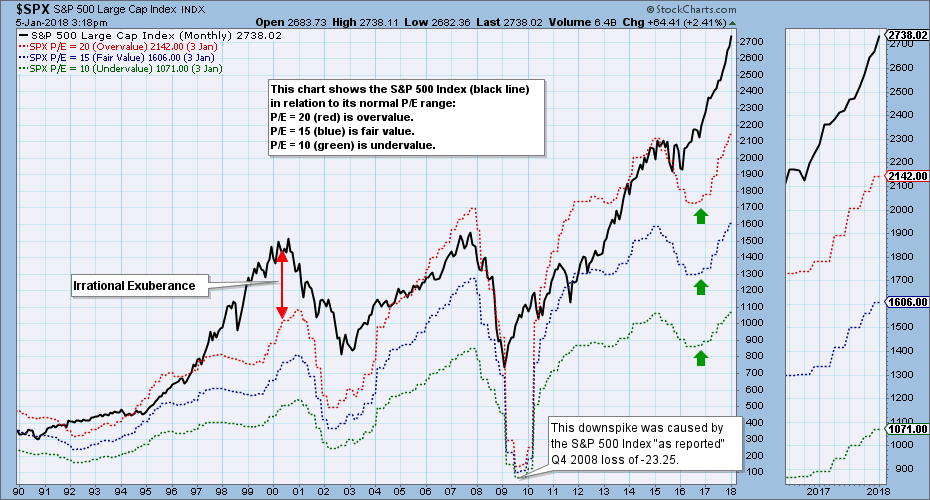

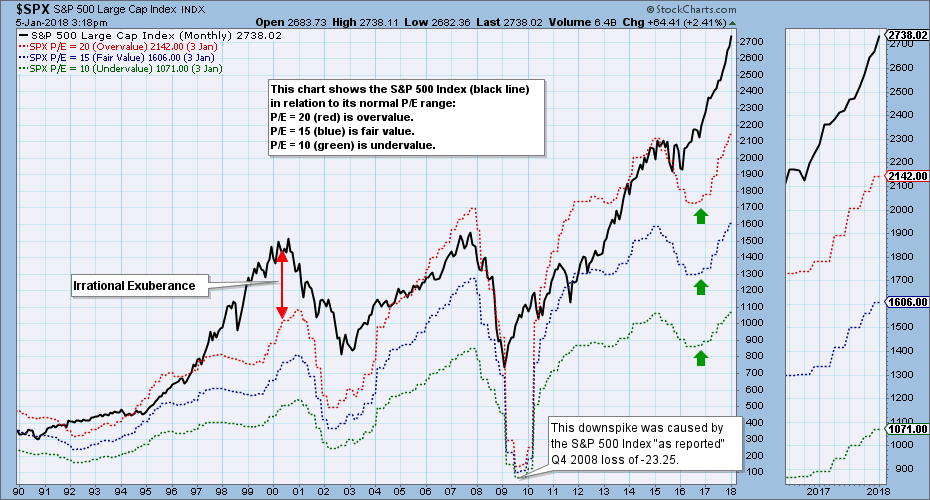

Earnings for 2017 Q3 will be finalized soon, but on a preliminary basis the S&P 500 has a P/E of 25, which is extremely overvalued. The chart below shows the S&P 500 Index (black line) in relation to where it would be if it were...

READ MORE

MEMBERS ONLY

The #1 Lesson Learned From All My 2017 Trades

by Gatis Roze,

Author, "Tensile Trading"

Over 25 years of full-time trading, it’s been my experience that, as an investor, one moves ahead by looking back. In other words, reviewing my 2017 Trading Journal will improve my 2018 results. Indeed, the tenth and final stage of Stock Market Mastery is to Revisit, Retune and Refine....

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Market Strength Broadens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Strong Pockets Outweigh Weak Pockets

---- Large-caps Lead New High Expansion

---- SPY Momentum Remains Strong

---- QQQ Continues to Lead

---- IJR Stalls Near Prior High

---- Seven of Ten Sectors Hit New Highs

---- Materials, Industrials and Finance Lead New Highs

---- MLP ETF Breaks Out

----...

READ MORE

MEMBERS ONLY

Global Markets Rally, U.S. Futures Higher; Nonfarm Payrolls On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 4, 2018

Where's the top? Who knows and the bulls don't seem to care. As of Wednesday, the Dow Jones was left out as the only index not to clear a psychological or significant price level for the first time ever...

READ MORE

MEMBERS ONLY

Dow Finally Breaks Out

by Erin Swenlin,

Vice President, DecisionPoint.com

If you look at the DP Scoreboards below, you'll note that the Dow is the only Scoreboard with "red" on it. It is highly likely that red arrow or PMO SELL signal will evaporate tomorrow if we see a follow-on rally or even a slight rise....

READ MORE

MEMBERS ONLY

Martin Pring's Market Roundup Video January 2018-01-03

by Martin Pring,

President, Pring Research

This months Market Roundup live video has a lot of information on the bond market. The six-stage cycle is currently in Stage 3. This large overview shows some of the major macro trends that are breaking right now.

Market Roundup With Martin Pring 2018-01-03 from StockCharts.com on Vimeo.

Good...

READ MORE

MEMBERS ONLY

Dollar Index Is Just Above Make Or Break Support--- Will It Bounce Or Break?

by Martin Pring,

President, Pring Research

Dollar Index is in a confirmed bear market

* Dollar sympathy indicators are close to a major breakdown

* Canadian and Aussie dollars are driven by commodity prices

* Emerging Market ETF benefiting from a weaker dollar

Dollar Index is in a confirmed bear market

As 2018 begins to unfold the Dollar Index...

READ MORE

MEMBERS ONLY

Finance Sector Springs to Life - Regional Banks Surge - Citigroup, Morgan Stanley and USB Break Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- S&P MidCap SPDR Catches a Bid

---- Finance SPDR Springs to Life

---- Citigroup and Morgan Stanley End Pullbacks

---- US Bancorp Leads Regional Bank SPDR

---- Broker-Dealer iShares Breaks Out of Flag ----

S&P MidCap SPDR Catches a Bid ----

Large-caps are leading so...

READ MORE

MEMBERS ONLY

Here's A Must-Own Industry Group For 2018 And A Very Bullish Relative Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 3, 2018

We're only two trading days into 2018 and already we've seen the S&P 500's first close ever over 2500, the NASDAQ's first close ever above 7000, the Russell 2000's first close...

READ MORE

MEMBERS ONLY

DP Alert: Whipsaw Back to BUY Signals - Dow Left Out

by Erin Swenlin,

Vice President, DecisionPoint.com

I had a bad feeling about the array of PMO SELL signals that appeared Friday and Tuesday. It wasn't worry about an upcoming decline, more the concern we'd see a whipsaw right back to BUY signals, which we did. Interestingly, the Dow was left out and...

READ MORE