MEMBERS ONLY

Do You Need Direction for 2025? Here Are 3 Charts You Should NOT Ignore

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A little less than a week ago, I wrote an article about inflation and how it's nothing more than a pipe dream in Fed Chief Jay Powell's head. Let me expand on that article, maybe from a slightly different approach this time. The inflation rhetoric just...

READ MORE

MEMBERS ONLY

Is This ADX Pattern a Warning Sign for Investors?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shares a specific ADX pattern that's signaling potential exhaustion in the momentum right now. Joe analyzes three other market periods that displayed this pattern and the resulting correction which followed. He then discusses some of the most attractive looking cryptos, as well...

READ MORE

MEMBERS ONLY

These Bars and Candles May Hold the Key for 2025

by Martin Pring,

President, Pring Research

Most of the time, when we study bars or candlesticks, our attention is focused on daily and intraday charts, since they give early warnings of a possible change in the short-term trend. Nonetheless, it occasionally makes sense to step back and take a look at monthly bars and candlesticks. Not...

READ MORE

MEMBERS ONLY

Strongest Top 3 S&P 500 Stocks: Will They Lead the Pack in 2025?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market's annual performance has been stellar, with the S&P gaining over 23%.

* Take care to monitor the three S&P 500 stocks with the strongest technical rank in 2025.

* Make use of scanning tools to help filter stocks that meet your...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Breaks Out!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's an interesting market day with the market moving lower despite positive seasonality. Natural Gas (UNG) broke out in a big way up over 15% at the time of writing. Is it ready to continue its big run higher?

Carl took the day off so Erin gave us...

READ MORE

MEMBERS ONLY

Swing Trading with Point & Figure

by Bruce Fraser,

Industry-leading "Wyckoffian"

There are a number of effective swing trading systems being used today. Let's explore one that is popular among Wyckoffians. It uses two inputs: Point and Figure charts and volume. Let's review this system with a case study of Charles Schwab Corp. (SCHW).

As markets are...

READ MORE

MEMBERS ONLY

Wall Street Sees No Threat of Inflation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Generally, there are 3 key hedges against inflation - gold ($GOLD), commodities ($XRB), and real estate (XLRE). While the Fed has taken a renewed interest in the short-term rising inflationary picture, which, by the way, is in direct contrast to what Fed Chief Powell said in late August and September,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Consolidates, Must Close Above This Level Crucial to Avoid Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After suffering a brutal selloff in the week before this one, the Nifty spent the truncated week struggling to stay afloat just below the key resistance levels. With just four working days, the Nifty resisted each day to the 200-DMA and failed to close above that point. The trading range...

READ MORE

MEMBERS ONLY

Trump's Policy Shift Reveals Potential Big Winner!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights whether to buy last week's pullback. She discusses the rise in interest rates and why, as well as which areas are being most impacted. Last up, she reviews potential winners with new Trump policy, how to spot a downtrend reversal, and the...

READ MORE

MEMBERS ONLY

5 New Year's Resolutions to Transform Your Financial Well-Being in 2025

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* As 2024 winds down, it's time to set some financial resolutions for 2025.

* Always look at long term charts before making investment decisions.

* Be flexible, organized, and disciplined when managing your investment portfolio.

Are you ready to make 2025 a financially healthy year?

The beginning of...

READ MORE

MEMBERS ONLY

Quantum Computing Stocks: Why You Should Invest in Them Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Quantum computing stocks have been rising since November.

* Four quantum computing stocks were in the "Small-Cap, Top 10" category in the StockCharts Technical Rank (SCTR) report.

* You can also gain exposure to quantum computing stocks by investing in the Defiance Quantum ETF.

Qubits, quantum advantage, gate...

READ MORE

MEMBERS ONLY

Is this Bounce a Robust Rebound or a Dead-Cat Bounce?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Short-term breadth becomes most oversold in a year.

* Bounce ensues, but has yet to show material increase in participation.

* Setting key levels to identify a robust rebound.

Breadth became oversold last week and stocks rebounded this week. Is this a robust rebound or a dead cat bounce? Today&...

READ MORE

MEMBERS ONLY

MUST SEE Options Trade Ideas! DIS, AAPL, META, BA, LULU

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, after a rundown of the general markets and sectors, Tony brings you the latest options trade ideas. These include a number of bullish and bearish ideas, including DIS, AAPL, META, BA, LULU, and many more.

This video premiered on December 23, 2024....

READ MORE

MEMBERS ONLY

Why Now Might Be the Best Time to Invest in META Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After a pullback, META's stock price could be ready for a reversal.

* The uptrend is still on from a weekly perspective, but the daily chart shows the price is at a crossroads and could move in either direction.

* If META's stock price is too...

READ MORE

MEMBERS ONLY

DP Trading Room: Deceptive Volume Spikes

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room Carl discusses volume spikes and how we have to analyze big volume spikes carefully to determine whether they express a confirmation of a move or whether they are a special case and do not really provide insight.

Carl goes over the signal...

READ MORE

MEMBERS ONLY

The Fed Is The New Waffle House

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I had no idea the Fed could be such expert wafflers. But, as each month passes, it's becoming clearer. The overall stock market trend, despite all the back-and-forth, yo-yo Fed decisions over the past 6 months, remains to the upside. Need proof? Check out this weekly S&...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level To Influence Trends For The Coming Weeks

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After staying in the green following a sharp rebound the week before this one, the markets finally succumbed to selling pressure after failing to cross above crucial resistance levels. The Nifty stayed under strong selling pressure over the past five sessions and violated key support levels on the daily charts....

READ MORE

MEMBERS ONLY

Will the Stock Market's Santa Rally Bring Holiday Cheer to Investors?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher on Friday but lower for the week.

* Market breadth continues to be weak despite Friday's rally.

* More follow-through next week is required to confirm a reversal and the hope for a Santa Claus rally.

A smart investor listens to...

READ MORE

MEMBERS ONLY

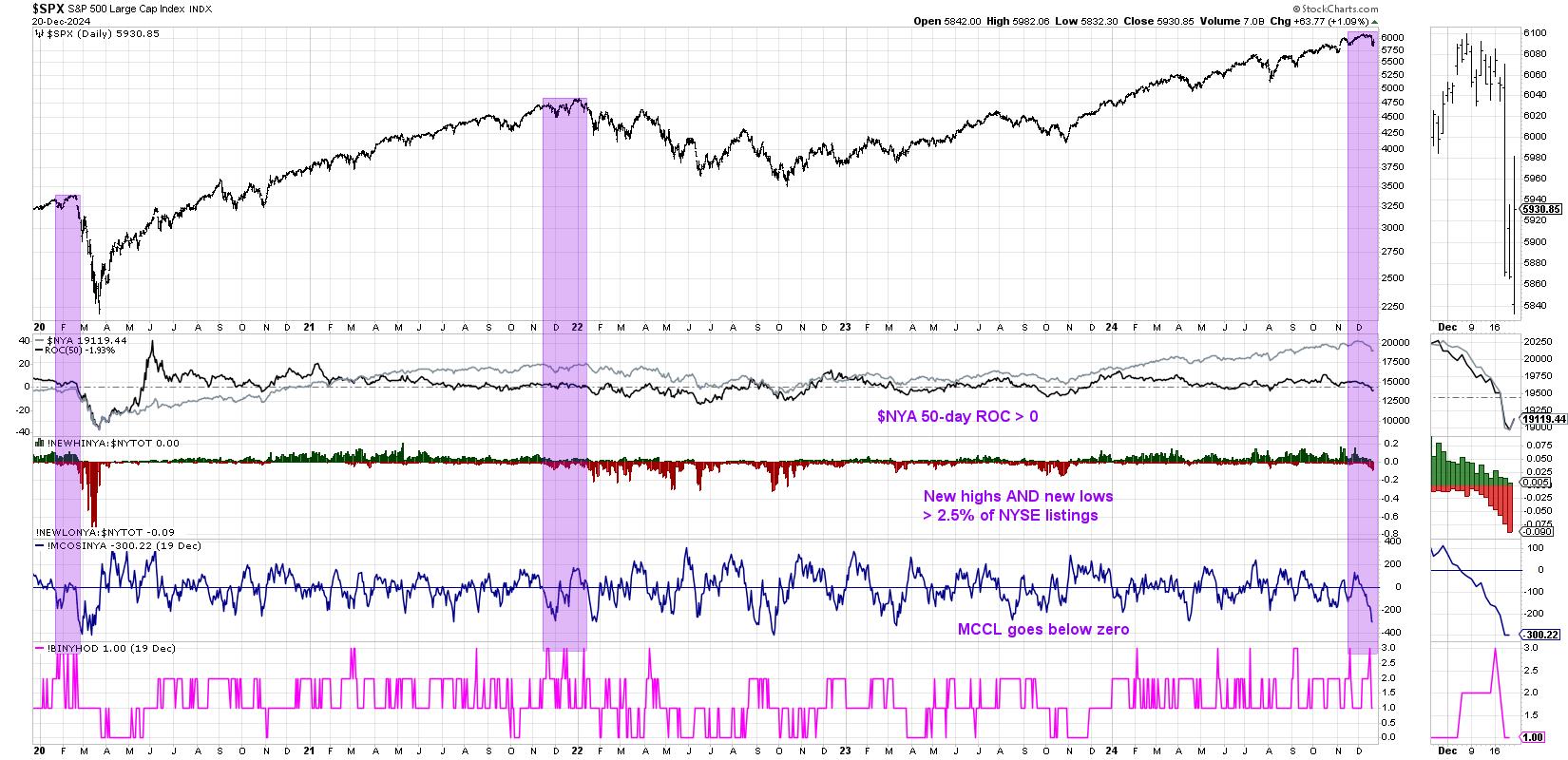

2024's Big Bang: A Deeper Dive Into the Hindenburg Omen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

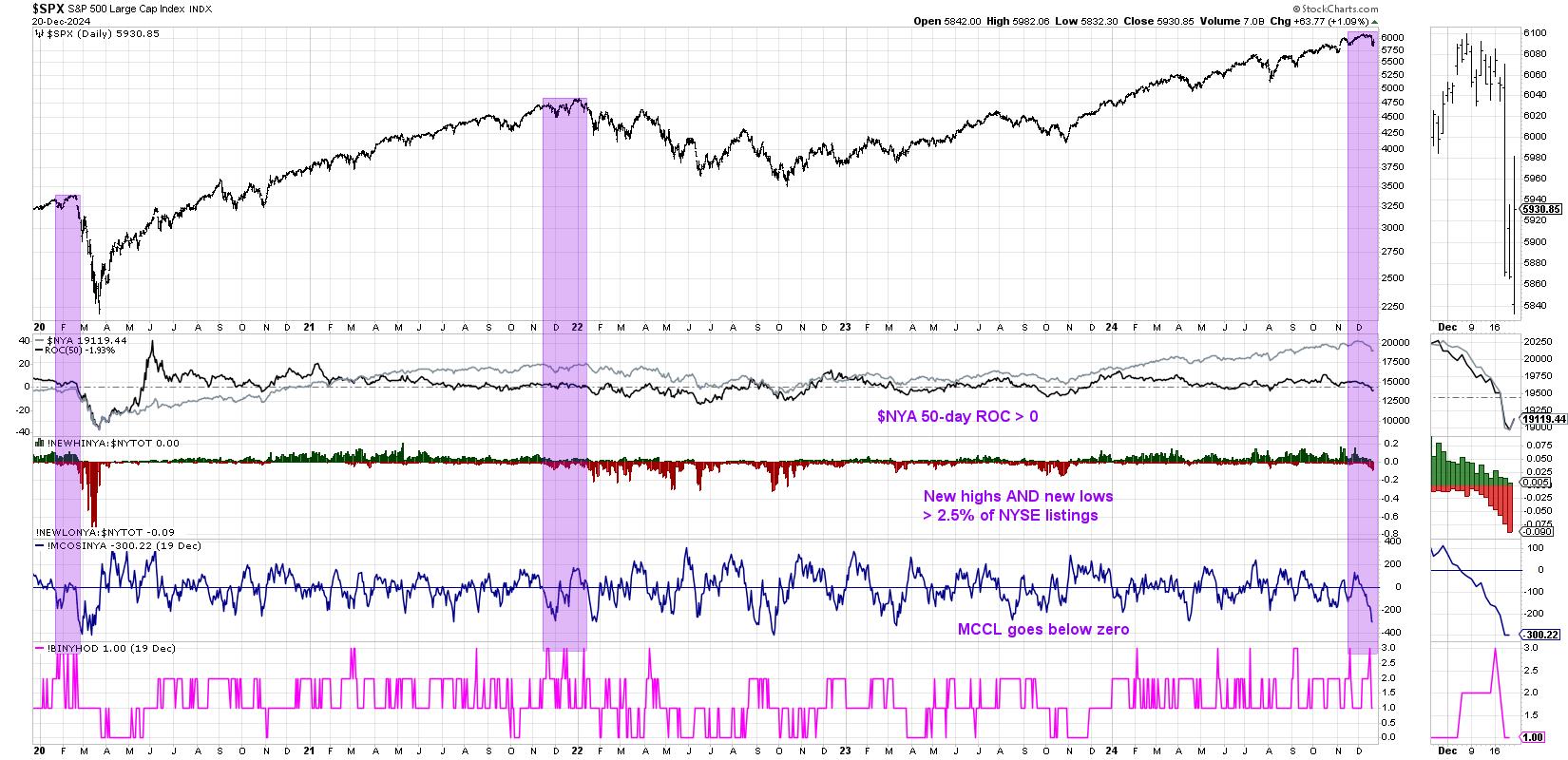

KEY TAKEAWAYS

* The Hindenburg Omen looks for patterns that have consistently shown at major market tops.

* Using trend-following techniques like support and resistance levels can help to improve accuracy of macro indicators.

* S&P 5850 remains the most important level in our view going into year-end 2024.

This week...

READ MORE

MEMBERS ONLY

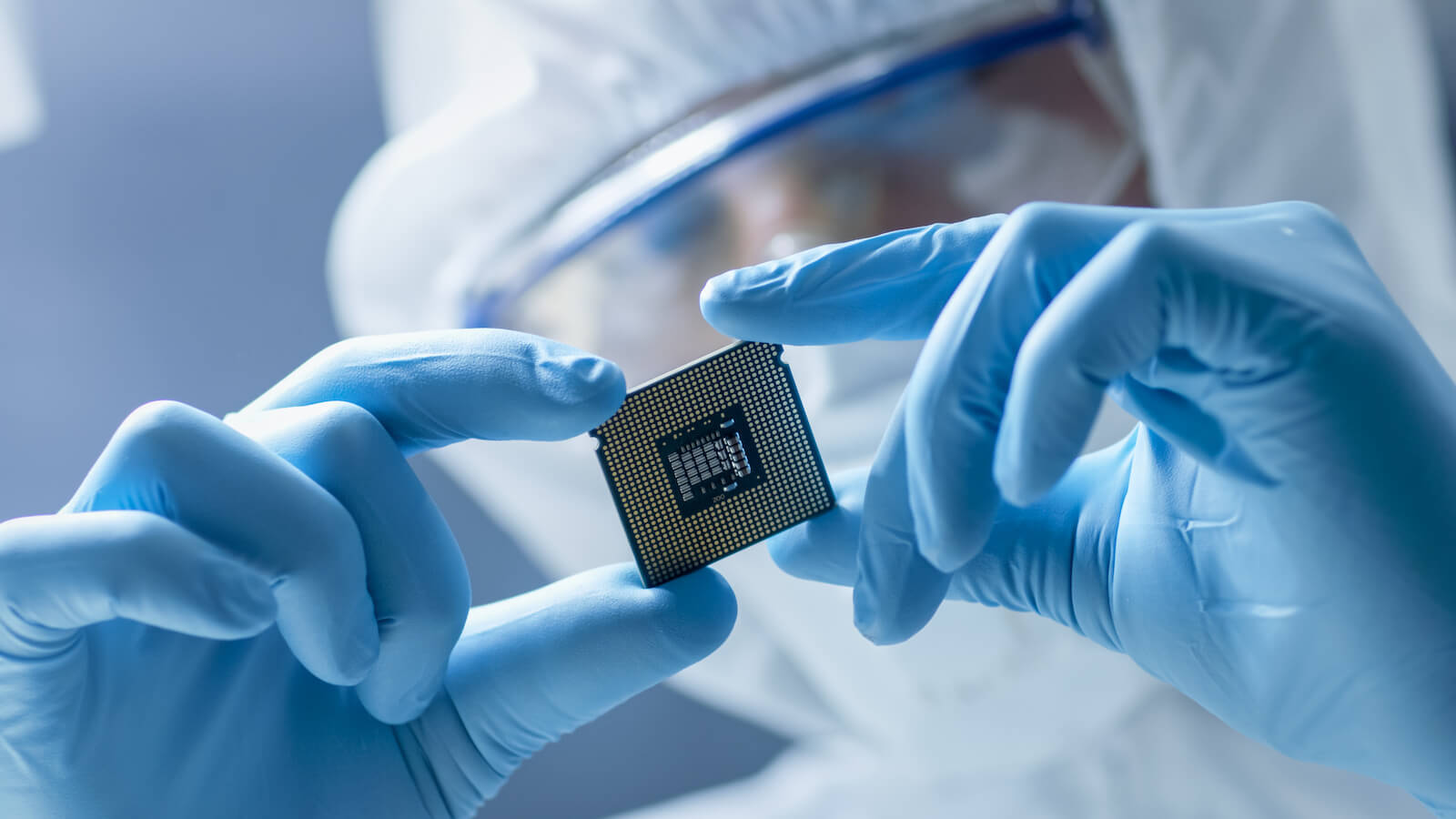

AI Boom Meets Tariff Doom: How to Time Semiconductor Stocks

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Semiconductors are caught in a tug-of-war with AI demand on one side and tariff fears on the other.

* The industry's technical performance shows a narrow standstill that can break either way.

* Watch SMH and its top three holdings—NVDA, TSM, and AVGO—for insights into timing...

READ MORE

MEMBERS ONLY

Oversold Conditions Not Always a Friend

by Erin Swenlin,

Vice President, DecisionPoint.com

Nearly all of our charts currently show deeply oversold conditions. While this is usually a good thing, in a market downturn, it isn't necessarily your friend. As you can guess, we believe that Wednesday's big decline was the beginning of something more serious. But the question...

READ MORE

MEMBERS ONLY

The Trump Trade? Not All as MAGA as You Might Think

by Martin Pring,

President, Pring Research

The "Trump Trade" refers to the market reaction and investment strategies that emerged following Donald Trump's election victories and his economic policies. It describes the shift in market sentiment driven by anticipated pro-business policies, tax cuts, and deregulation under his administration.

Investors initially rushed into sectors...

READ MORE

MEMBERS ONLY

Three Big Negatives Overshadow the Uptrends in SPY and QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY and QQQ are still in long-term uptrends, but the red flags are rising.

* Housing and semis, two key cyclical groups, are in downtrends.

* Interest rates are rising as the 10-yr Yield reversed a 13 month downtrend.

SPY and QQQ remain in long-term uptrends, but three big negatives...

READ MORE

MEMBERS ONLY

Navigating the Indecisive SPY: What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) was flagged as a technically strong chart.

* An analysis of the SPY chart shows the ETF is being indecisive.

* Monitor the chart of SPY for indications of a decisive move in either direction.

When running my StockCharts Technical Rank (SCTR)...

READ MORE

MEMBERS ONLY

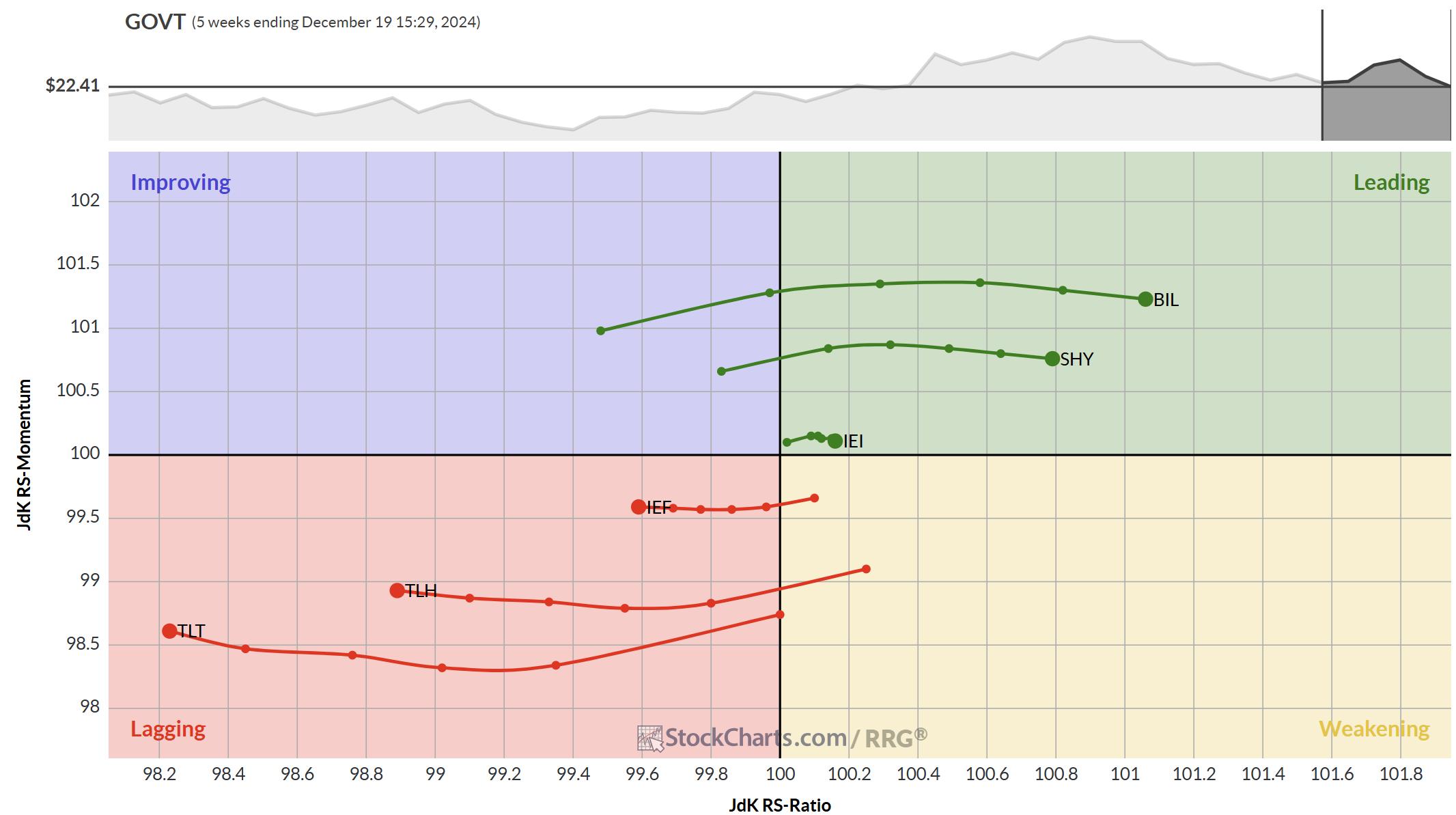

Three RRGs to Keep You on Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

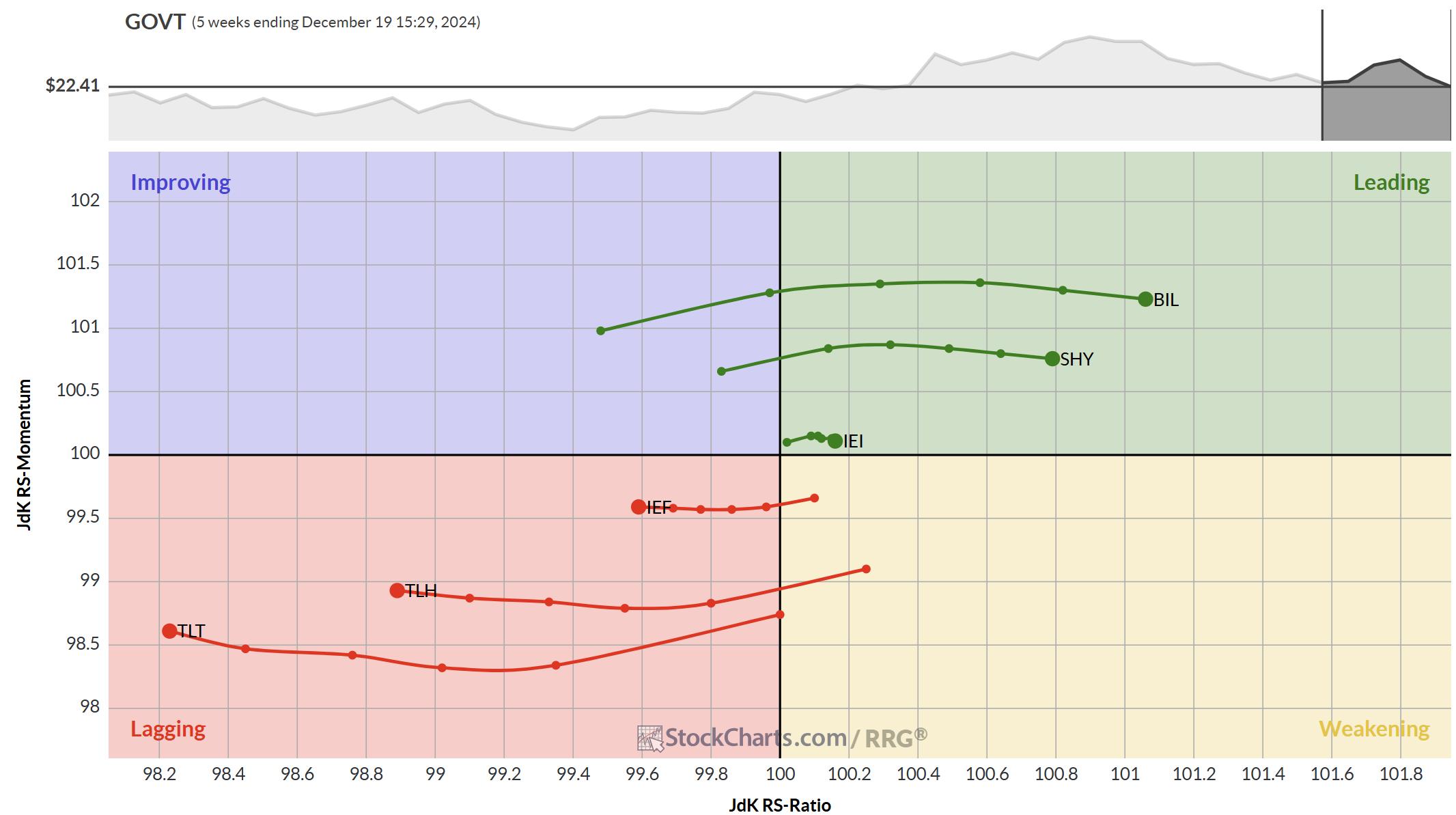

KEY TAKEAWAYS

* Track the Yield curve moving back to normal on RRG

* USD showing massive strength against all currencies

* Stock market drop not affecting sector rotation (yet)

The Yield Curve

The RRG above shows the rotations of the various maturities on the US-Yield Curve.

What we see at the moment...

READ MORE

MEMBERS ONLY

Stock Market Sell-Off: Is the Bull Market Over?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes got a bearish jolt on Wednesday.

* Gold, silver, and cryptocurrencies joined the equity selloff.

* Treasury yields and the US dollar jump higher.

Uncertainty in the stock market makes it difficult to make investment decisions. When investors sell off stocks, everyone follows without giving it...

READ MORE

MEMBERS ONLY

The Big Divergence in Bullish Percents

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 and Nasdaq 100 have been holding steady into this week's Fed meeting, warning signs under the hood have suggested one of two things is likely to happen going into Q1. Either a leadership rotation is amiss, with mega-cap growth stocks potentially taking...

READ MORE

MEMBERS ONLY

Don't Be Surprised by an Early 2025 Pullback

by Martin Pring,

President, Pring Research

This year has been a very good one for stockholders. Come to think of it, 2023 wasn't so bad either. After an extended period of gains, it's natural for investors to become complacent, especially as they head home for the holidays.

This is the kind of...

READ MORE

MEMBERS ONLY

Communications Trying to Prop Up Equity "Go" Trend

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The "Go" trend in equities continued again this past week but we saw some weakness as GoNoGo trend painted a few weaker aqua bars. Treasury bond prices experienced a change in trend as a few bars of...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Broadcom (AVGO) the New NVIDA (NVDA)?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin looks at the Broadcom (AVGO) chart and compares it to the NVIDIA (NVDA) chart. She shows us the differences between the two and tells you whether she believes AVGO will be the new NVDA, meaning it will perform as NVDA used to perform with a concerted move up...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Halts at Crucial Levels; Staying Above This Point Necessary to Extend The Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had a wide-ranging week once again; however, they ended near its high point this time. The Nifty had ranged sessions for four out of five days; the last trading day of the week saw the Nifty swinging wildly before closing near its high point. The trading range also...

READ MORE

MEMBERS ONLY

How to Buy WINNERS When They Pull Back!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights how select M7 stocks, mostly TSLA, propped the markets up while some sectors continued to trend lower. She reviews how to find entry points in winning stocks, and also discusses why Small Caps are falling.

This video originally premiered December 13, 2024. You can...

READ MORE

MEMBERS ONLY

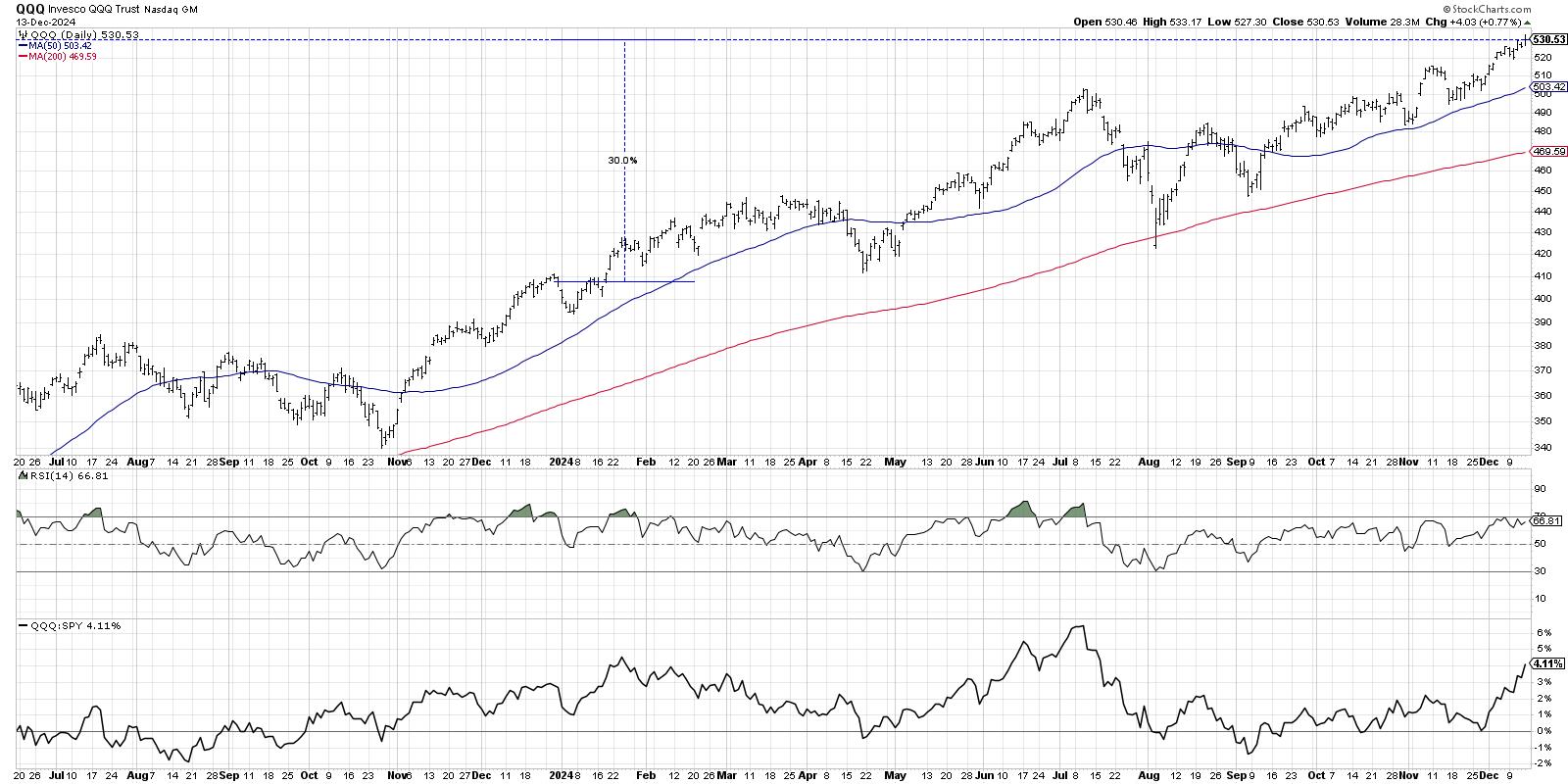

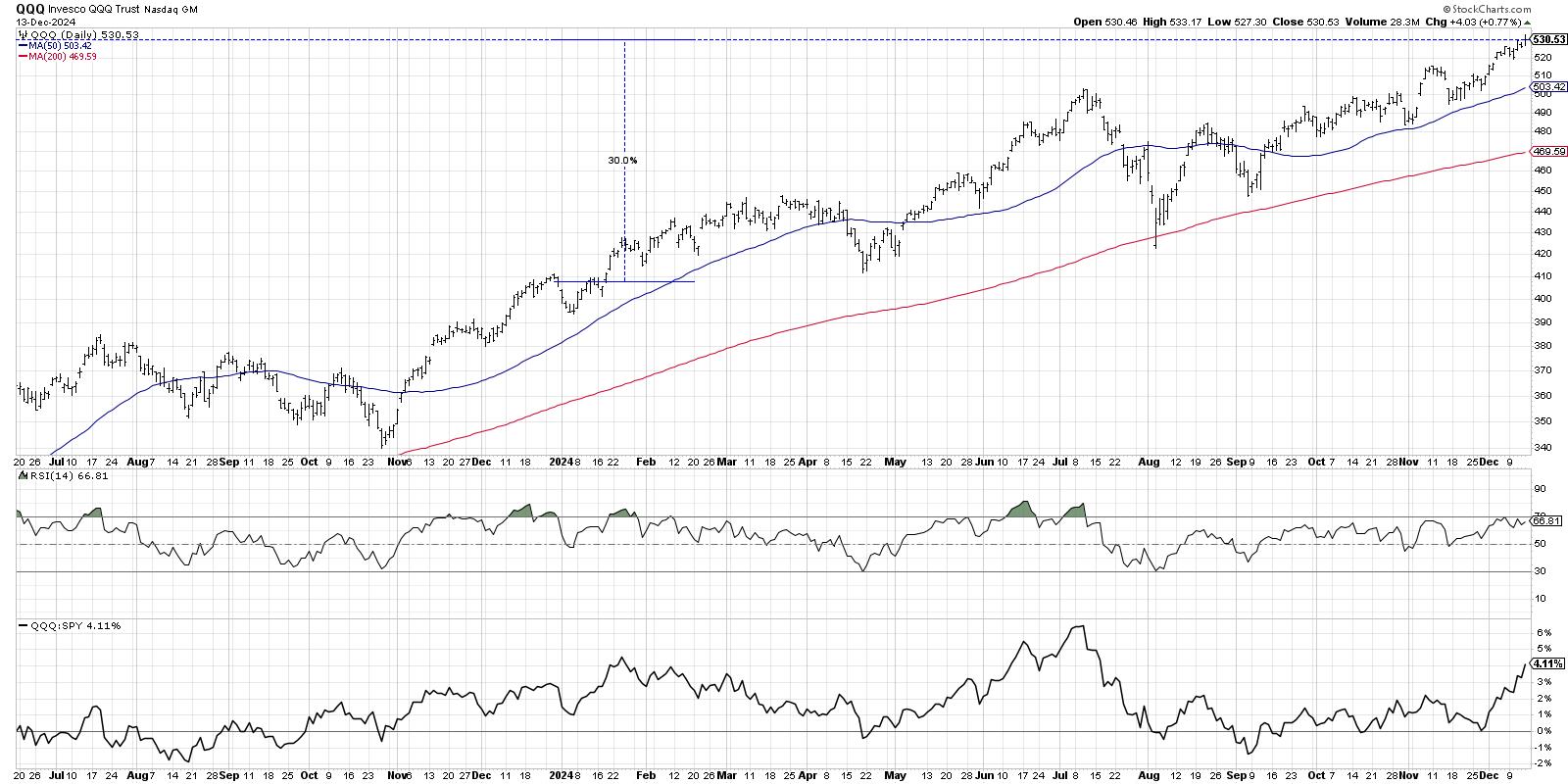

Will the QQQ Sell Off in January? Here's How It Could Happen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In recent interviews for my Market Misbehavior podcast, I've asked technical analysts including Frank Cappelleri, TG Watkins, and Tom Bowley what they see happening as we wrap a very successful 2024. With the Nasdaq 100 logging about a 30% gain for 2024, it's hard to imagine...

READ MORE

MEMBERS ONLY

Identifying GREAT Trades and Looking Ahead to 2025 Using RRG Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are a number of ways that you can find great trading opportunities. One way is to simply follow a chart on a WatchList and wait for certain indicators to reach "buy" points. For instance, an uptrending stock many times will find support as its 20-day EMA is...

READ MORE

MEMBERS ONLY

Bearish Formation Threatens Gold's Advance

by Carl Swenlin,

President and Founder, DecisionPoint.com

After the November pullback, GLD began to rally again. This week, on Wednesday, price exceeded the nearest November top, which made official the new rising trend from the November low. Brief celebration ends the following day as GLD tops, setting the top boundary for a bearish rising wedge formation. Rising...

READ MORE

MEMBERS ONLY

Pumping the Brakes on Ferrari (RACE)

by Tony Zhang,

Chief Strategist, OptionsPlay

Despite its position as a luxury automaker synonymous with prestige and performance, Ferrari N.V. (RACE) may be showing signs of a near-term downturn. Recent price action, coupled with stretched valuations and slowing shipment trends, suggests that RACE may face potential downside.

By incorporating both technical and fundamental analysis, we...

READ MORE

MEMBERS ONLY

Why Cisco's Stock Reversal Could Be a Game-Changer

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* CSCO stock has pulled back to its 21-day exponential moving average and is poised for a reversal.

* Monitor the stochastic indicator to confirm a reversal in CSCO's stock price.

* If you enter a long position in CSCO, establish your stop loss and have the discipline to...

READ MORE

MEMBERS ONLY

SOFI Advances to SCTR's Top 10: Is Now the Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SOFI's stock price recently appeared in the SCTR Report's top 10 list in the large-cap category.

* After a strong two-month rally, the fintech stock is now pulling back.

* Monitor SOFI's chart and watch key levels closely as the stock approaches a potential...

READ MORE

MEMBERS ONLY

Small Caps are Set to Skyrocket in 2025—Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Small caps tend to outperform following an election year.

* In most annual cycles, small caps also have their seasonal tendencies.

* The chart of the iShares Russell 2000 ETF (IWM) is worth monitoring, especially as it approaches a buy point.

With an new administration inbound in Washington, D.C....

READ MORE

MEMBERS ONLY

Master the MACD Zero Line for a Trading Edge!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how to use the MACD zero line as a bias for a stock. As opposed to offering a buy signal, this Zero line level can provide insight into a market or stock's underlying condition; Joe shows how to refine that information...

READ MORE