MEMBERS ONLY

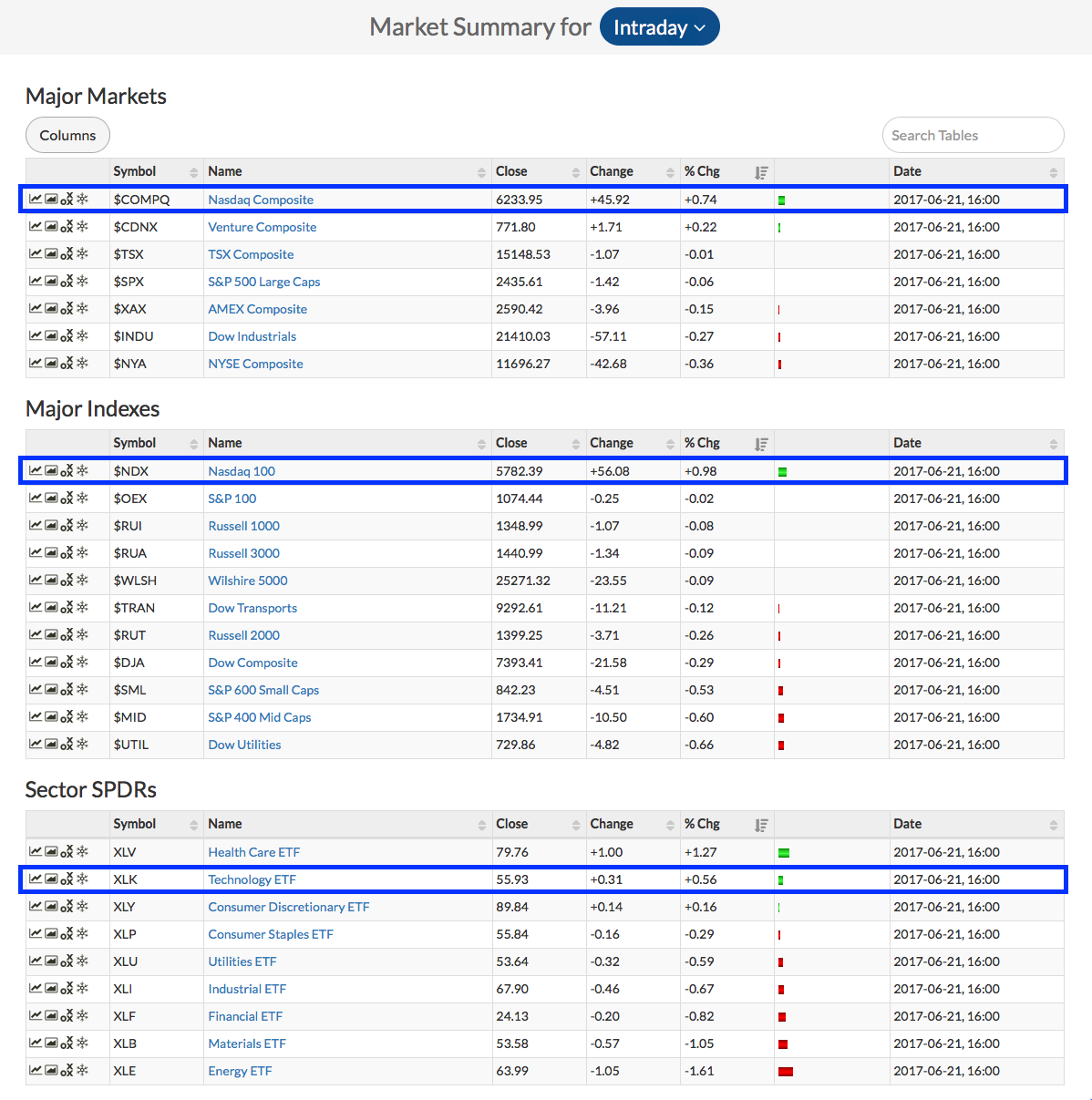

Weekly Market Review & Outlook (w/ Video) - Two of Nine Sector SPDRs Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

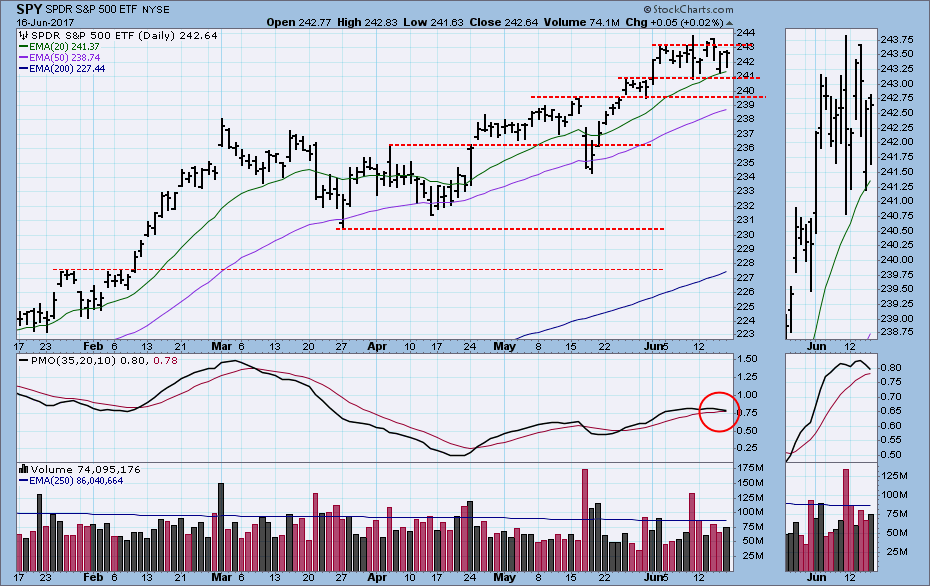

.... SPY Breaks out of Flag Pattern

.... QQQ Holds the Gap as IJR Forms Bull Flag

.... Industrials and Healthcare Lead with New Highs

.... Tech, Discretionary and Finance Lag a Bit

.... First Supports for Materials, Staples and Utilities

.... Energy - Enough Said

.... Tech ETF Bounce from Oversold Levels

.... Insurance and Regional Banks...

READ MORE

MEMBERS ONLY

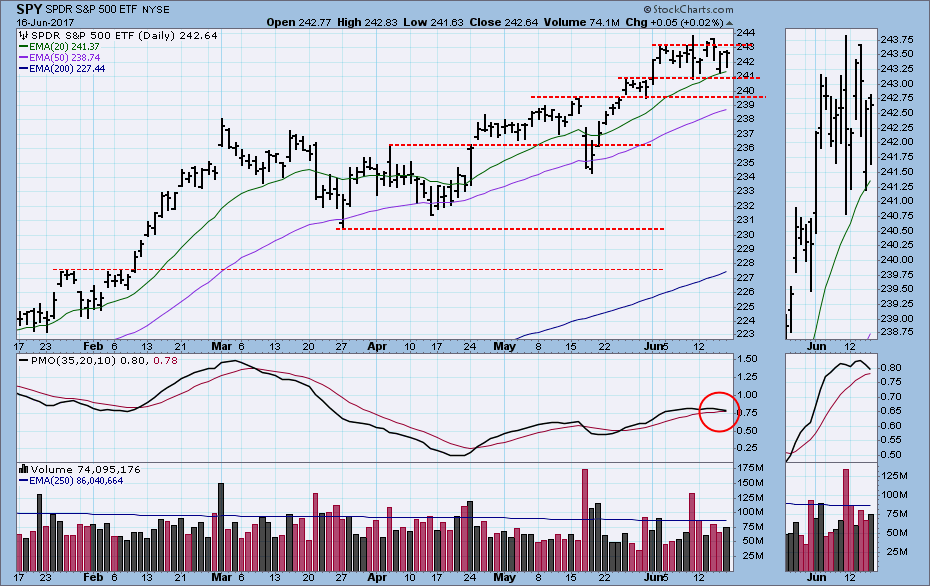

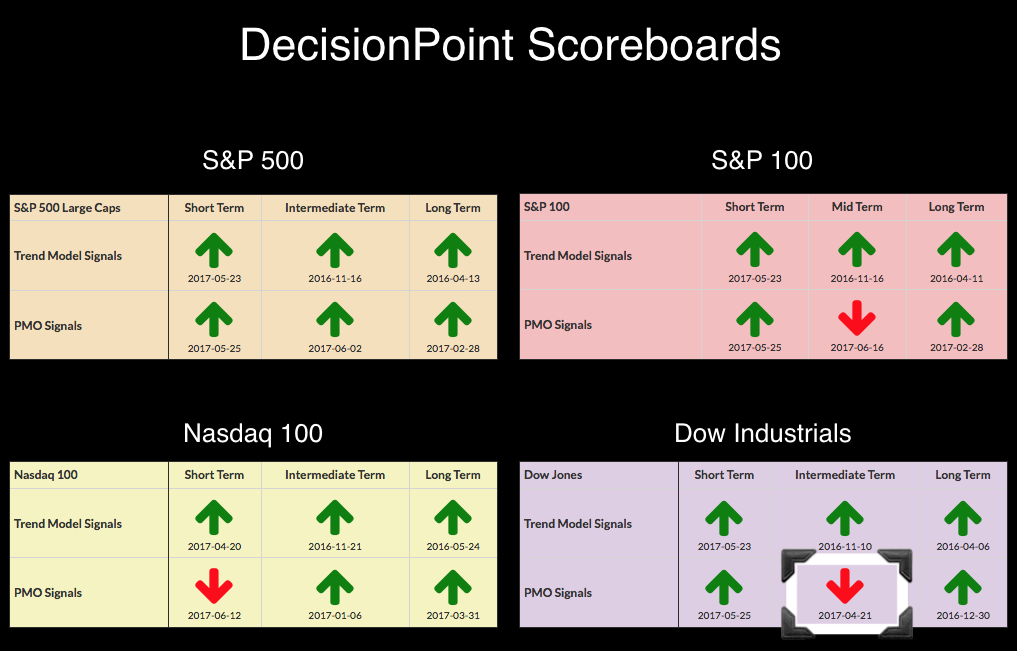

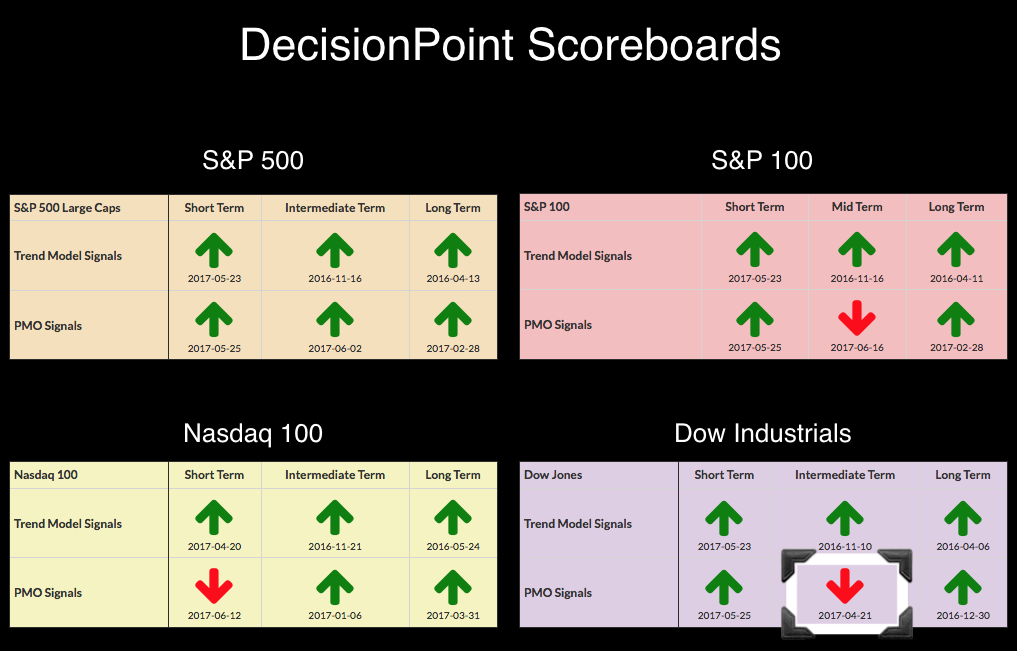

DP Alert: NEW PMO SELL Signals on $OEX and $SPX - TLT Closing the Gap

by Erin Swenlin,

Vice President, DecisionPoint.com

The S&P 500 triggered a new PMO SELL signal yesterday at the close. Today, the S&P 100 joined in with its own PMO SELL signal. At this point, the Dow is the only one holding onto a PMO BUY signal, but a quick peek at the...

READ MORE

MEMBERS ONLY

BioMarin Next In Line For Breakout Among Biotechs?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

BioMarin Pharmaceutical (BMRN), like the overall biotech industry ($DJUSBT), has struggled for the past 18 months to clear overhead price resistance. But over the past couple trading sessions, we have seen one biotech company after another clear resistance on strong volume and accelerate. It appears that BMRN is awaiting its...

READ MORE

MEMBERS ONLY

FALLING ENERGY PRICES ARE AFFECTING BOND RELATIONSHIPS -- LONGER MATURITIES ARE RISING FASTER -- AND INFLATION PROTECTED BONDS ARE LAGGING BEHIND -- ENERGY RELATED HIGH YIELD BONDS ARE ALSO WEIGHING ON THAT SECTOR -- CRUDE OIL IS TESTING NOVEMBER LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONGER MATURITY BONDS ARE RISING FASTER ... We can often get clues about market sentiment by comparing different parts of the fixed income universe. A lot has been written about the falling yield curve, which plots the difference between 10-Year and 2-Year Treasury yields. That usually signals expectations for lower inflation....

READ MORE

MEMBERS ONLY

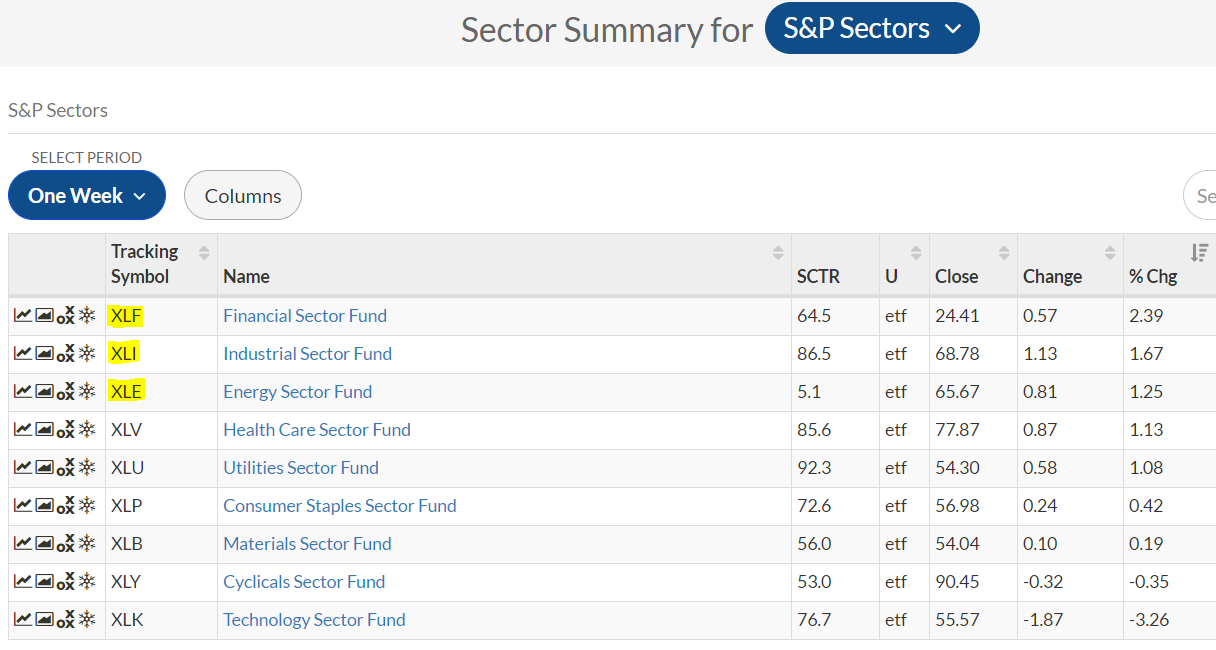

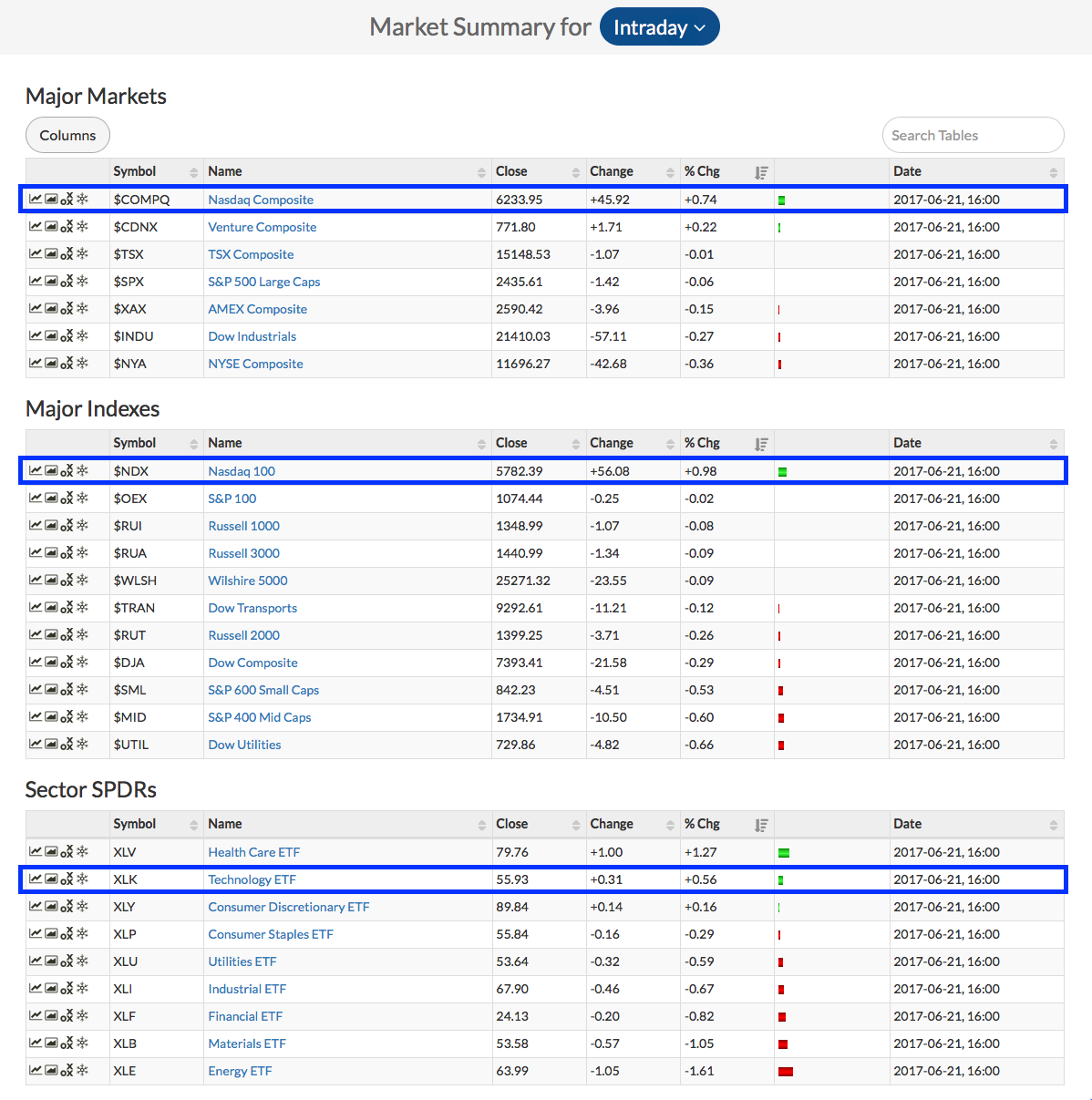

Biotechs Explode, Send Healthcare To Leadership Role; Energy Runs Out Of Fuel

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 21, 2017

Biotechs ($DJUSBT) are the "semiconductors of healthcare". When they move, they move! Healthcare (XLV, +1.27%) was easily the best performing sector on Wednesday as the DJUSBT soared 3.43%. Unless we see a major reversal between today and tomorrow, we&...

READ MORE

MEMBERS ONLY

ADRs, ETFs and Currency - Analysis for EEM, Poland, China, Italy and Spain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Vodafone in Dollars vs Pounds

.... Index versus ETF versus Currency

.... Emerging Markets ETF Hits Top of Channel

.... Poland ETF Stalls within Uptrend

.... China A-Shares ETF Breaks Out

.... Italy and Spain Consolidate Gains ....

Vodafone in Dollars vs Pounds

Today I will take a look at some international ETFs. Before looking at...

READ MORE

MEMBERS ONLY

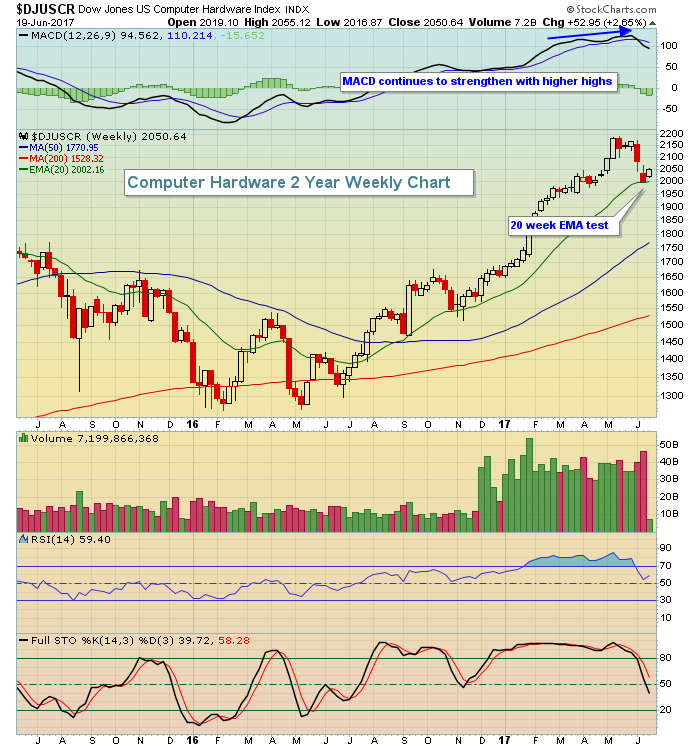

What's Up With Techs? Price

by Erin Swenlin,

Vice President, DecisionPoint.com

Today on MarketWatchers LIVE (airs M/W/F Noon - 1:30p EST) during the regular market updates, I noticed technology was rallying strongly. If you recall, the Nasdaq has been taking it on the chin more than the other major indexes on declines which is why the NDX is...

READ MORE

MEMBERS ONLY

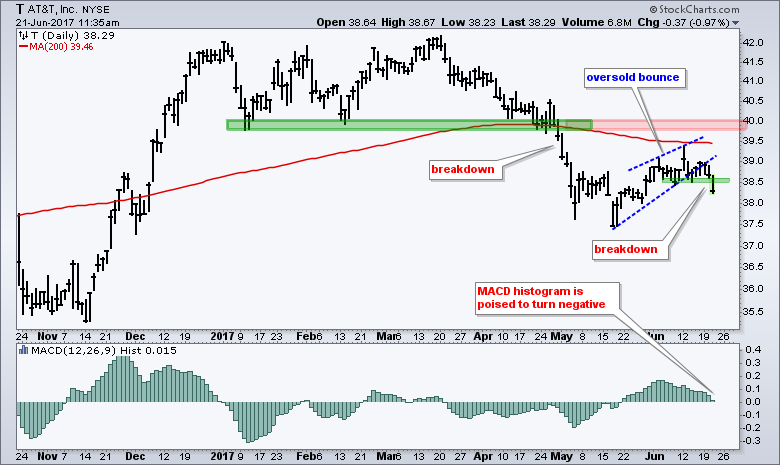

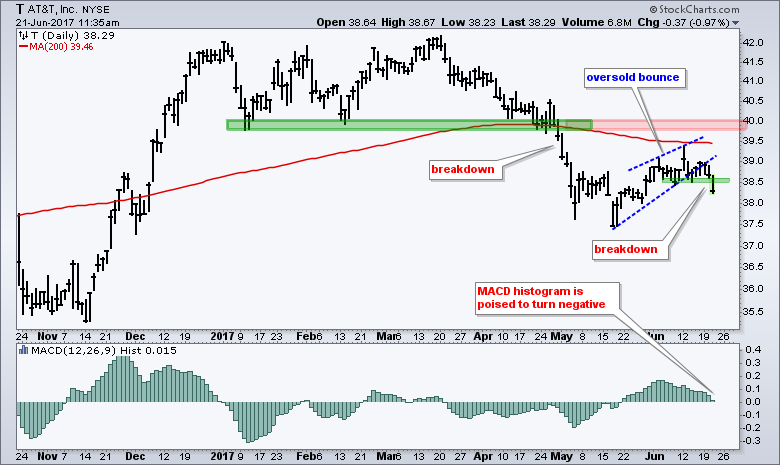

MACD Histogram Teeters as AT&T Breaks Wedge Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a strong stock market in 2017, AT&T ($T) is having a tough time with a breakdown in early May and a sharp decline below the 200-day SMA. The stock rebounded after a double-digit decline with a bounce back to the 200-day SMA, which is now falling. Thus,...

READ MORE

MEMBERS ONLY

Biotechs Breakout, Lead Healthcare Stocks Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 20, 2017

Healthcare (XLV, +0.33%) was one of just two sectors - utilities (XLU, +0.06%) was the other - to rise on Tuesday as much of Monday's gains was relinquished. The good news, however, is that biotechs ($DJUSBT) made a significant...

READ MORE

MEMBERS ONLY

DP Alert: Dollar (UUP) ST Trend Model BUY Signal - Oil Hits Last Chance Support

by Erin Swenlin,

Vice President, DecisionPoint.com

No new signals yet on the DecisionPoint Scoreboards, but with index PMOs in decline, I suspect we will see some more if the bulls can't get a rally to stick. Last Friday, the OEX weekly PMO had a negative crossover SELL signal.

The purpose of the DecisionPoint Alert...

READ MORE

MEMBERS ONLY

Is The Dollar Really In A Bear Market?

by Martin Pring,

President, Pring Research

* The long-term setting

* Short-term considerations

* Some individual currencies are vulnerable over the short-term

* Conclusion

The long-term setting

A few weeks ago I pointed out that the Dollar Index ($USD) had violated its bull market trendline, as well as the 65-week EMA and 12-month MA, two key long-term smoothings. That type...

READ MORE

MEMBERS ONLY

HEALTHCARE IS YEAR'S SECOND STRONGEST SECTOR -- IT ALSO OFFERS GREAT VALUE -- THE BEST HEALTHCARE VALUE NOW LIES WITH BIOTECHS AND PHARMA -- BIOTECH ISHARES ARE BREAKING OUT TO UPSIDE -- PHARMACEUTICAL ISHARES SHOULD BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE IS GETTING A LOT STRONGER ... I continue to believe that healthcare is one of the best values in the stock market. And it's attracting a lot of investor attention. Chart 1 shows the Health Care SPDR (XLV) trading at a new record high after clearing its mid-2015...

READ MORE

MEMBERS ONLY

Technology Stocks Rebound Sharply, Lift S&P 500 To Next Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 19, 2017

Technology (XLK, +1.48%), healthcare (XLV, +1.04%) and financials (XLF, +1.03%) led a broad-based rally on Monday that included seven of the nine sectors. Only energy (XLE, -0.63%) and the defensive utilities (XLU, -0.33%) failed to participate in the...

READ MORE

MEMBERS ONLY

Market Shows Broad Strength, Techs Get Mojo Back, Bank ETFs Stall and 12 Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Big Techs Regain their Mojo

.... Finance, Healthcare, Industrials and Materials Lead

.... Short-term Yields Diverge from Long-term Yields

.... Bank ETFs Stall after Breakouts

.... Two Big Pharma Stocks: BMY and MRK

.... 3 Hospital Stocks: HCA, LPNT, THC

.... Four Networking Stocks: ARRS, CIEN, CSCO, FNSR

.... XRX Breaks Out, FEYE Forms Flag and RLGY...

READ MORE

MEMBERS ONLY

WHILE TECHNOLOGY HAS SLIPPED, FINANCIALS AND HEALTHCARE HAVE BECOME MARKET LEADERS -- HEALTHCARE SPDR HITS RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY IS NOT THE STRONGEST SECTOR ... Although a rebound in technology is getting the most attention, it's not the main reason that stock indexes are hitting new highs. Most of that credit goes to financials and healthcare. The daily bars in Chart 1 show the Technology SPDR (XLK)...

READ MORE

MEMBERS ONLY

Breakout in Biotech SPDR Signals Trend Continuation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech SPDR (XBI) is starting to lead the market again with a consolidation breakout and 52-week high. The chart shows the ETF hitting an initial 52-week high in February and then consolidating for four months. It looks like this consolidation is ending and the bigger uptrend is resuming with...

READ MORE

MEMBERS ONLY

Amazon Buys Whole Market.....Literally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

At 4:30pm EST this afternoon, just after the U.S. stock market closes, I'll be joining John Hopkins, President of EarningsBeats.com, for a special 90 minute presentation. John will discuss the benefits of trading companies that have reported strong quarterly revenues and earnings (ahead...

READ MORE

MEMBERS ONLY

Top 5 Investing Mistakes You Make When Young

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am not young anymore, so am going to reveal mistakes I made in the first half of my investing lifetime; about 1972 – 1990. Sadly, I did not learn lessons quickly so repeated some of them. These are not in any particular order. A better title might be True Confessions....

READ MORE

MEMBERS ONLY

Cerner Corp Tests Key Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's always nice to go back to the basics of technical analysis. Broken resistance becomes support. That's currently the case with Cerner Corp (CERN) where the stock recently cleared price resistance just above 65.00 and, with recent profit taking, we've seen a return...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Market Indicators Look Bad

by Carl Swenlin,

President and Founder, DecisionPoint.com

About three weeks ago I began looking for the market to consolidate or correct because of price being very overbought based upon its extreme departure from the 200EMA. So far we have two weeks of price churning sideways, and that has gotten the technical indicators in a condition that promises...

READ MORE

MEMBERS ONLY

Summer Generally Means Trading Quality, Not Quantity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

History tells us many things. One of the lessons is that making money on the long side is much more difficult during the summer months. Why? It's rather simple. On the S&P 500 since 1950, here are the annualized returns by calendar months over the summer:...

READ MORE

MEMBERS ONLY

More Pie. Bigger Sky!

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 2011 Dr. Hank Pruden published a remarkable Point and Figure chart study, which called for a new bull market in stocks. The horizontal PnF counting method, as applied by Dr. Pruden, revealed a price objective of 17,600 / 19,200. That count produced a whopping 11,100 Dow Jones...

READ MORE

MEMBERS ONLY

Charles Dow and Leonardo Fibonacci Walk into a Bar

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bar was 61.8 inches off the floor, but Leondardo still did not see it. All (bad) joking aside, I would like to look at corrections through the eyes of Charles Dow and Leonardo Fibonacci. These two may seem miles apart at first glance, but the numbers suggest otherwise....

READ MORE

MEMBERS ONLY

S&P 100 Flips Back to IT PMO SELL Signal - DP Scoreboard Weekly Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

On the last trading day of the week, the DecisionPoint IT Price Momentum Oscillator (PMO) signals go "final". Today saw a new weekly PMO SELL signal on the OEX. Some may recall that just last Friday the OEX triggered a weekly PMO BUY signal. Don't let...

READ MORE

MEMBERS ONLY

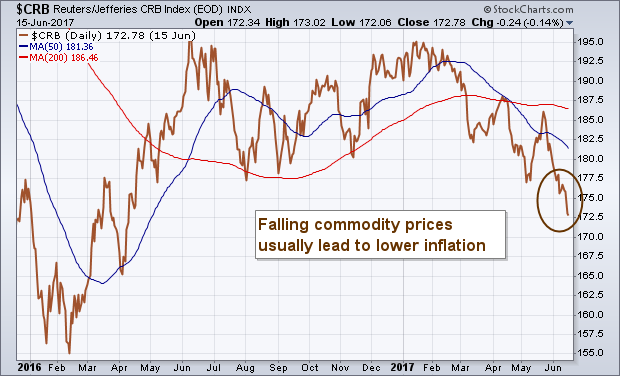

Falling Commodity Prices Are a Big Reason Why Inflation Is So Low

by John Murphy,

Chief Technical Analyst, StockCharts.com

Ever since Wednesday's Fed rate hike, and the press conference by Janet Yellen, I've been thinking a lot about inflation. I believe the Fed is underestimating how weak inflation really is. I also believe that's because it's looking in the wrong places....

READ MORE

MEMBERS ONLY

Managing Risk - Identifying Strong Reward to Risk Trading Candidates

by John Hopkins,

President and Co-founder, EarningsBeats.com

If you are looking for ways to manage risk in an increasingly volatile environment then you should start by searching for the "best of the best"; those companies that beat earnings expectations and have solid charts. This makes an awful lot of sense if you think about it;...

READ MORE

MEMBERS ONLY

The Albert Einstein Approach to Stock Market Investing

by Gatis Roze,

Author, "Tensile Trading"

Albert Einstein famously said, “If I had one hour to save the world, I would spend 55 minutes defining the problem and five minutes implementing the solution.” If you were in a life threatening situation and had only one hour before it proved fatal, what would you do? Einstein said...

READ MORE

MEMBERS ONLY

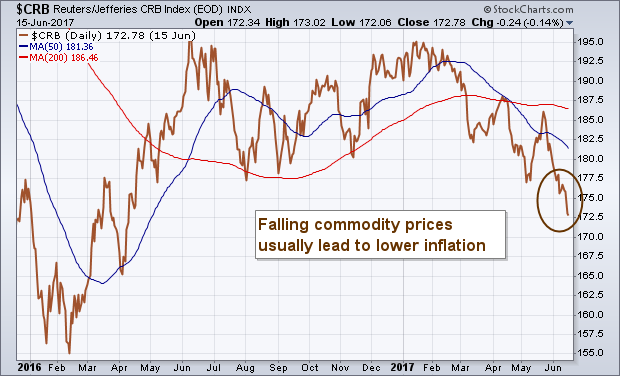

FALLING COMMODITY PRICES ARE A BIG REASON WHY INFLATION IS SO LOW -- CRB INDEX FALLS TO LOWEST LEVEL IN MORE THAN A YEAR -- FALLING COMMODITY PRICES ARE HELPING PULL YIELD CURVE LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX IS TRADING AT LOWEST LEVEL IN MORE THAN A YEAR... Ever since Wednesday's Fed rate hike, and the press conference by Janet Yellen, I've been thinking a lot about inflation. I believe the Fed is underestimating how weak inflation really is. I also believe...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - New Highs for Major Index ETFs and New Sector Leadership

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* New Highs in Six Major index ETFs

* Index AD Lines Hit New Highs

* Mid-cap and Small-cap AD Volume Lines Lag

* SPY Forms High Flag as QQQ Tests Support

* IJR Leads for Four Weeks

* Finance and Materials Lead New High List

* Finance and Regional Bank SPDRs Hold Breakouts

* Chemicals Lead Materials...

READ MORE

MEMBERS ONLY

Industrials Lead, Challenge December Relative Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 15, 2017

There's been marked improvement in the relative strength of industrials (XLI, +0.60%) in recent weeks and that was on full display Thursday. Despite all of our major indices finishing lower, the XLI managed to end the session in positive territory...

READ MORE

MEMBERS ONLY

DP Alert: Gold Triggers PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

No new signal changes to report, but I do want to mention that the PMO for the NDX continues lower with no hesitation. For the other three indexes, the PMO BUY signals are intact, but short-term PMOs are now all declining.

The purpose of the DecisionPoint Alert Daily Update is...

READ MORE

MEMBERS ONLY

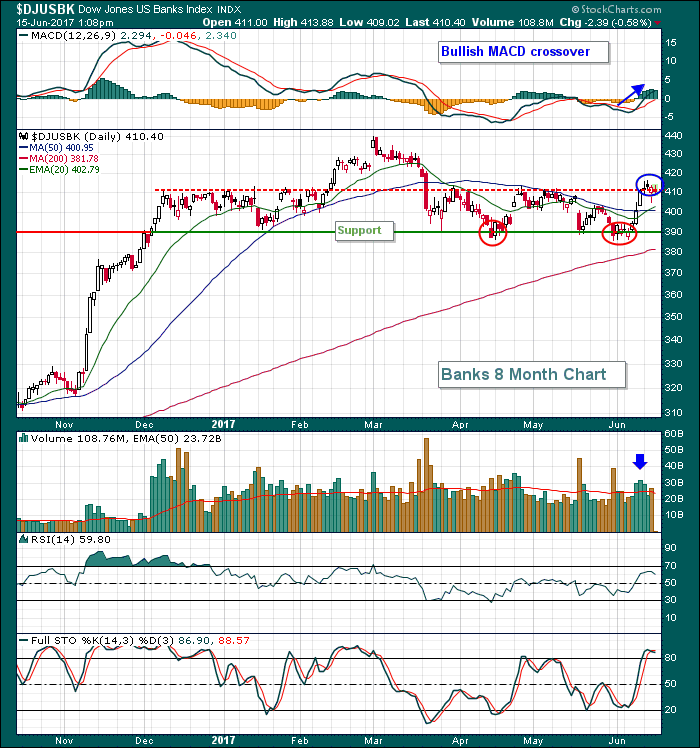

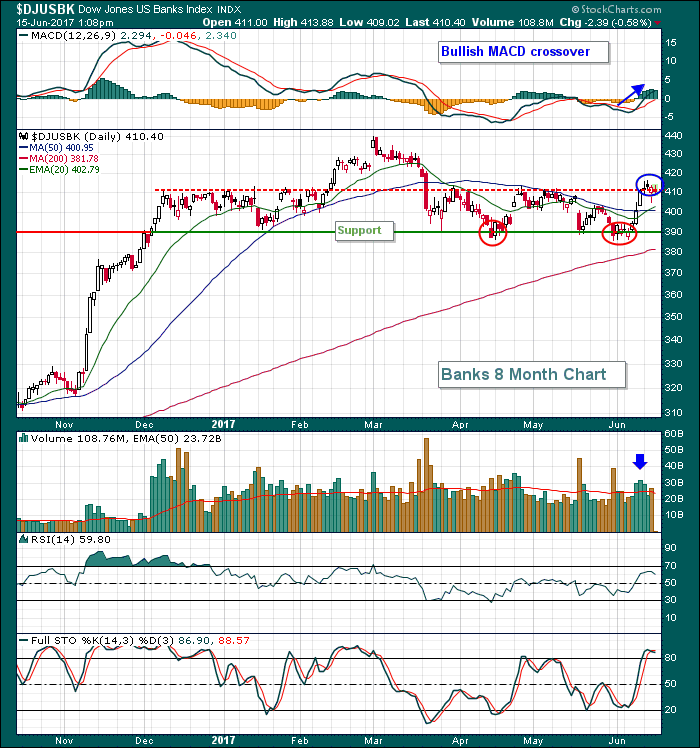

Would The Real Bank Trend Please Stand Up?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One look at the 10 year treasury yield's ($TNX) decline the past several months provides proof that the bond market isn't exactly agreeing with the Federal Reserve's stated position that they see economic improvement in the months ahead. The Fed announced on Wednesday that...

READ MORE

MEMBERS ONLY

SystemTrader - Putting the VIX Through the Wringer and Testing Signals with SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Does the VIX Add Any Value?

.... Setting the Benchmark

.... System Ground Rules

.... Consulting, Software and Data

.... Normalizing the VIX with the PPO

.... Testing Different PPO Extremes

.... Testing with the VIX PPO Histogram

.... Conclusions and Caveat Emptor ....

Does the VIX Add Any Value?

The S&P 500 Volatility Index ($VIX)...

READ MORE

MEMBERS ONLY

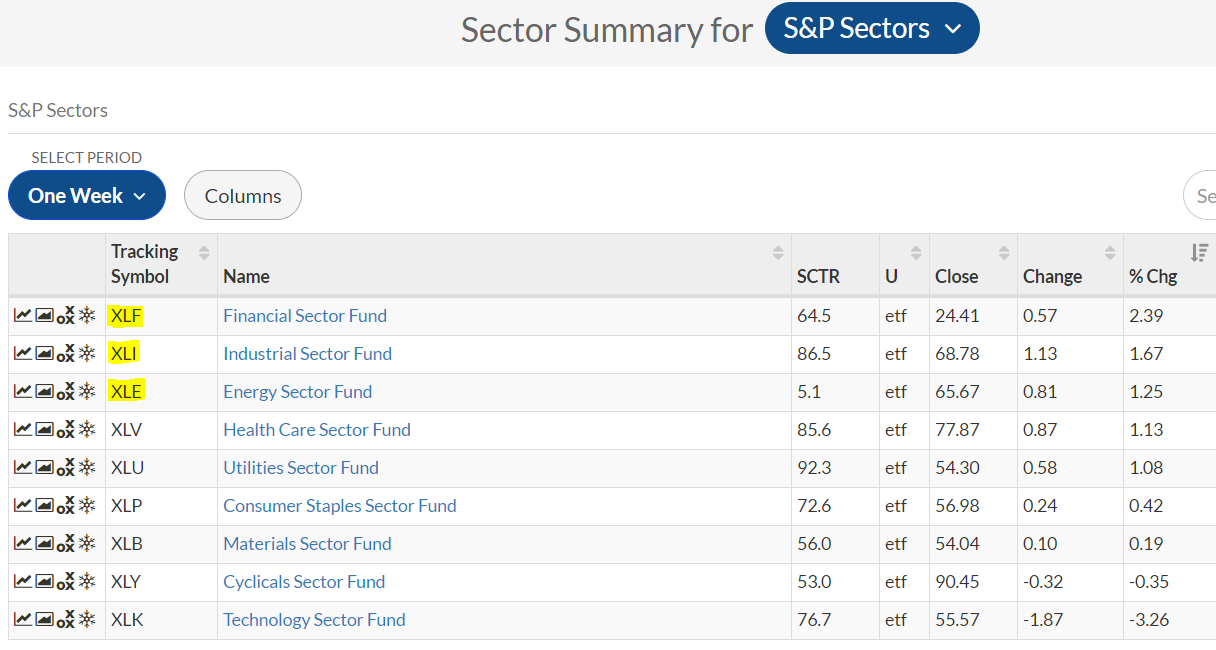

Defensive Sectors Lead As Fed Hikes And Maintains Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 14, 2017

The FOMC concluded its two day meeting on Wednesday afternoon and, for the most part, followed its prior script. They stuck to their previous plan to raise interest rates for a third time in six months and maintain their forecast for another rate...

READ MORE

MEMBERS ONLY

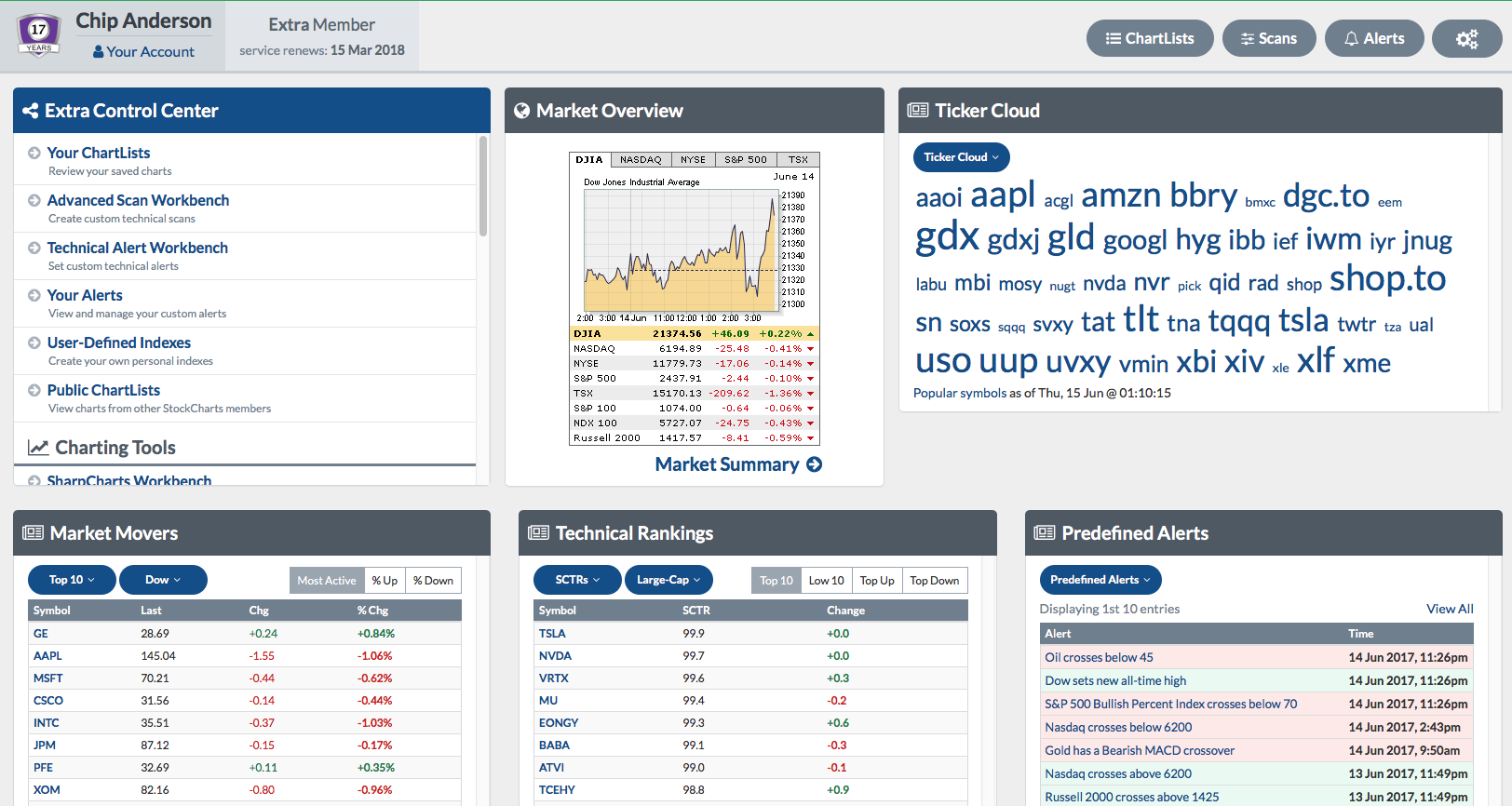

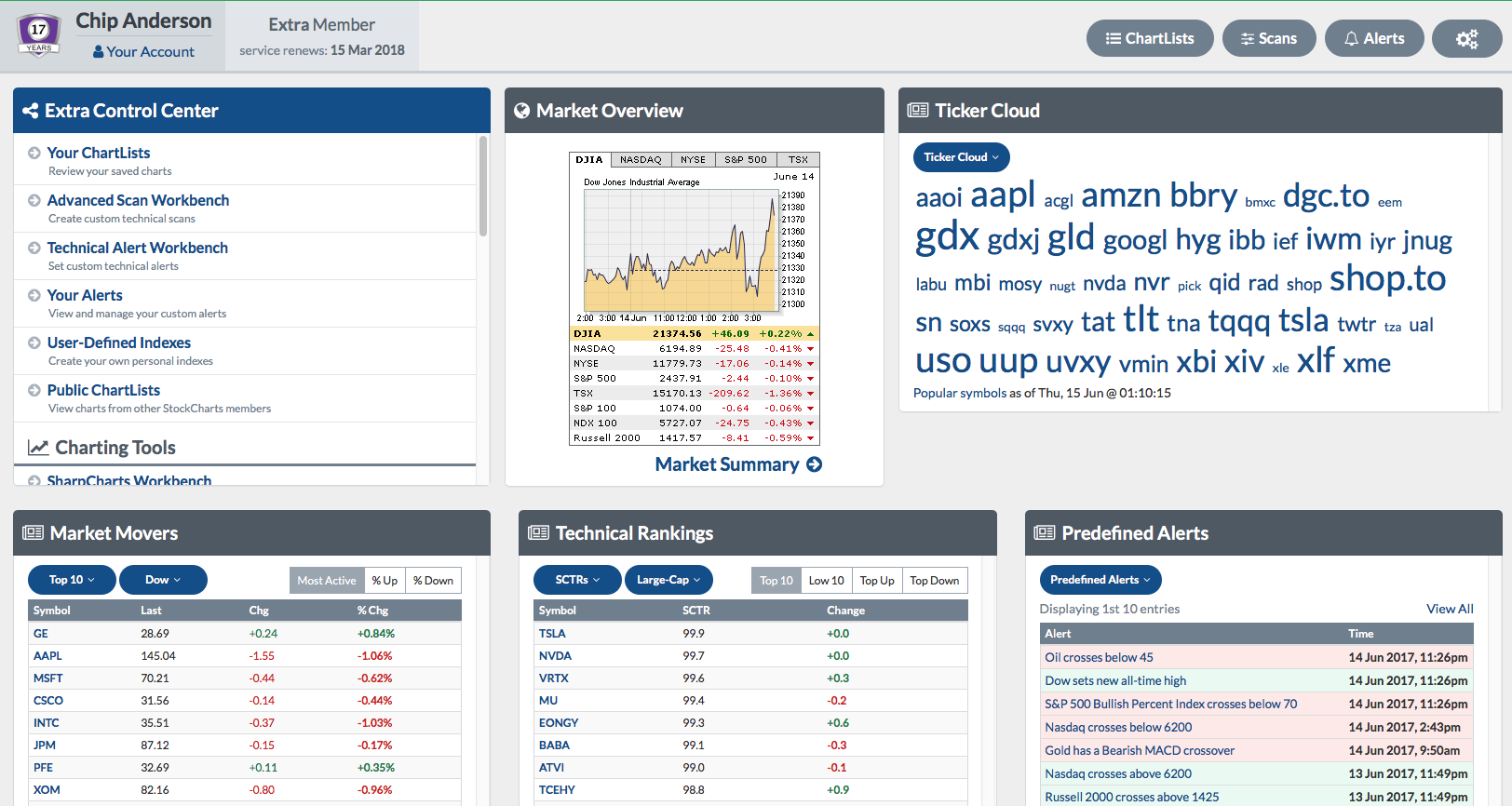

Latest Members Dashboard Update - #AWESOME!

Hello again, everyone! Just a quick note to tell you about an awesome new feature that we just rolled out. We've updated the Members' Dashboard so that it is now even more customizable and useful. The change is subtle - you would probably miss it if you...

READ MORE

MEMBERS ONLY

Celgene Holds Breakout Zone and Turns Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Celgene (CELG) is a large biotech stock that is part of the Biotech iShares (IBB) and the Biotech SPDR (XBI). Overall, I would suggest that the long-term trend is up because the stock hit a 52-week high in mid-March and the 50-day EMA is above the rising 200-day EMA. The...

READ MORE

MEMBERS ONLY

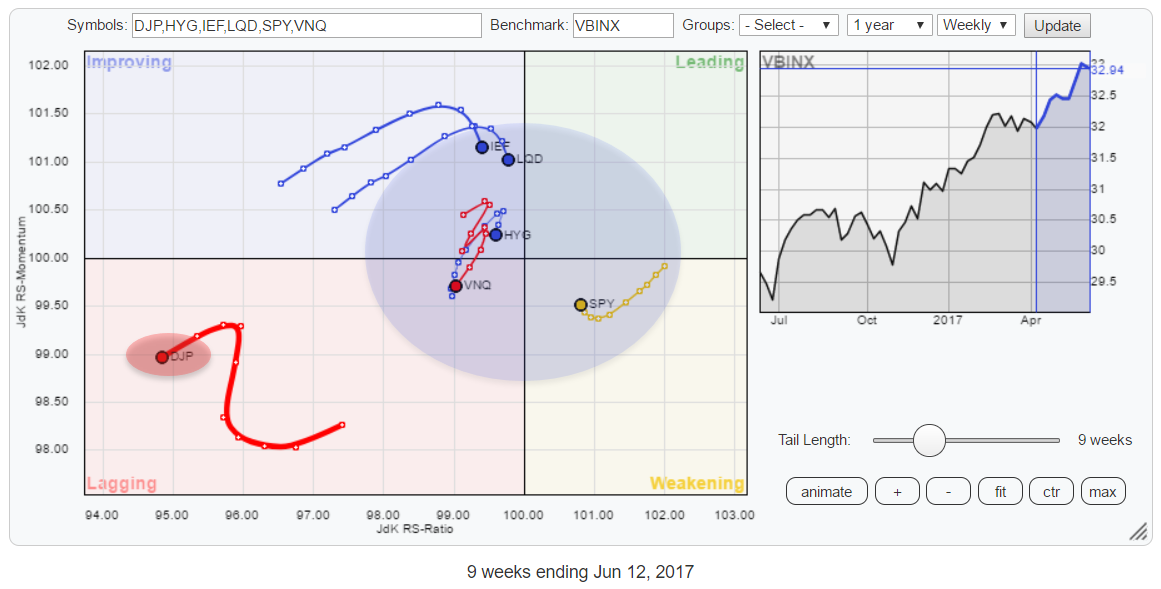

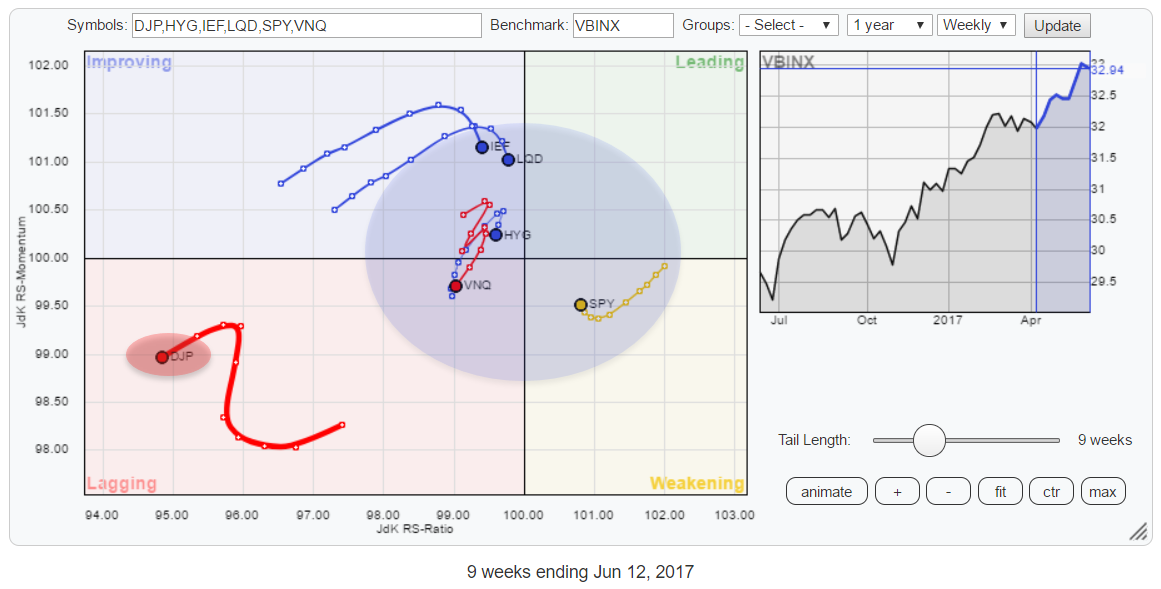

Commodities completely detached from other asset classes and equities picking up over bonds again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph for Asset Classes shows Commodities (DJP) far away in the bottom-left corner of the chart, completely detached from the others.

At, by far, the lowest readings on the JdK RS-Ratio axis, DJP moved higher on the JdK RS-Momentum axis for a few weeks but recently turned...

READ MORE

MEMBERS ONLY

Home Construction Breaks Out Ahead Of FOMC Announcement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 13, 2017

Technology (XLK, +0.72%) rebounded after two days of brutal selling. It occurred after a hammer printed off a 50 day SMA test on Monday. That was a relief for many market participants as the XLK has been the undisputed sector leader for...

READ MORE

MEMBERS ONLY

TREASURY YIELDS FALL BELOW 200-DAY AVERAGE ON WEAK INFLATION NUMBERS -- CRUDE OIL FALLS TO LOWEST LEVEL IN A YEAR -- LOWER FOREIGN BOND YIELDS ARE ALSO WEIGHING ON TREASURY YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD FALLS BELOW 200-DAY AVERAGE... Expectations are for another Fed rate hike this afternoon. Bond yields, however, are falling sharply. Chart 1 shows the 10-Year Treasury Yield ($TNX) falling 9 basis points to the lowest level since last November. The yield has also slipped below its 200-day average...

READ MORE

MEMBERS ONLY

DP Alert: Dollar Recovering - Gold and Bonds Lose Favor

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday saw the addition of a PMO SELL signal in the short term (daily chart) for the Nasdaq 100. Interestingly, if you look at the other three, their PMOs have turned up today. Despite a slowing market, Gold has struggled since its unsuccessful test of overhead resistance and now Bonds...

READ MORE