MEMBERS ONLY

A Deep Look Into Healthcare And Its Bullish Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 10, 2017

The energy sector (XLE, +1.32%) was very strong on Wednesday as crude oil ($WTIC) bounced more than 3%. With crude oil up nicely again this morning, we should see more strength and leadership from the XLE today. Technology (XLK, +0.38%) and...

READ MORE

MEMBERS ONLY

Performance Drags with Biotech, Healthcare and Transports - Refiners Perk Up - Plus AES, EMR, FLIR and NTAP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

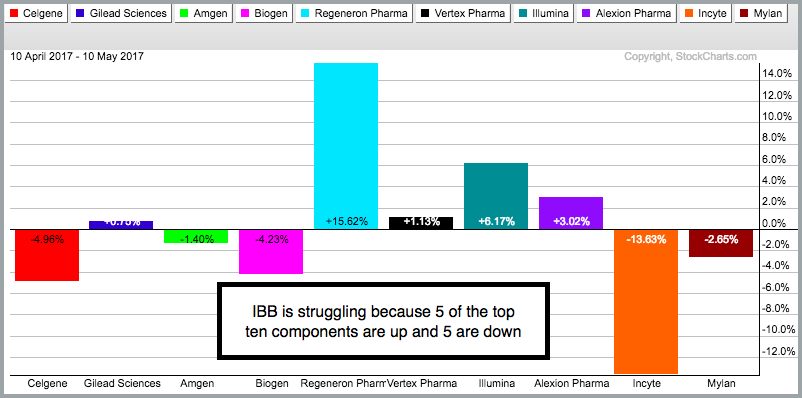

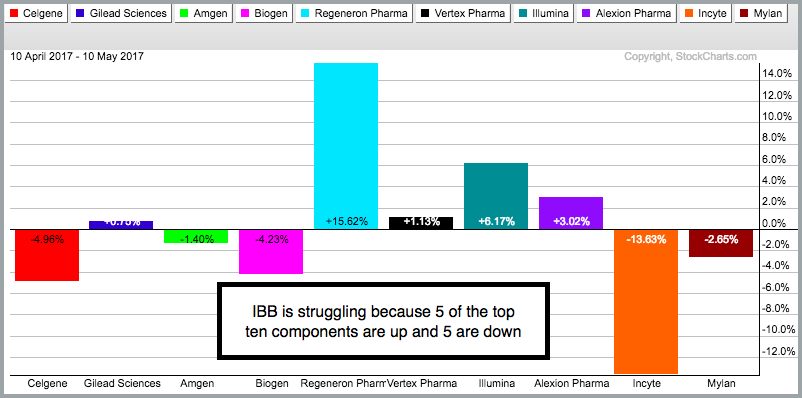

.... Split Performance Hinders Biotech ETF

.... Amgen Lagging Biotechs and Market

.... HealthCare SPDR Holds Breakout

.... Pfizer Slows to a Crawl

.... Delivery and Trucking Weigh on Dow Transports

.... Use Sector Summary to Drill Down

.... Refiner Stocks Catch a Bid

.... Stocks to Watch: AES, EMR, FLIR, NTAP

Split Performance Hinders Biotech ETF

The...

READ MORE

MEMBERS ONLY

Catching Up with Small- and Mid-Cap ETFs (IJH, IJR, IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

I realized that I haven't really reviewed the small and mid-cap ETFs in some time. You'll find these charts in the DecisionPoint LIVE shared ChartList if you want to keep an eye on them with my annotations. The chart patterns for these ETFs aren't...

READ MORE

MEMBERS ONLY

Xerox Rises from the Ashes

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I was running through some charts today and came across and interesting setup - in Xerox of all names. It has been a long time since Xerox crossed my path. The company provides document management solutions with both hardware and services. It is a $7.2 billion company and part...

READ MORE

MEMBERS ONLY

Hotels And Gambling Stocks Lead Strong Discretionary Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 9, 2017

Consumer discretionary stocks (XLY, +0.58%) were easily the leading group on Tuesday as hotels ($DJUSLG) and gambling ($DJUSCA) stocks were outperformers. Automobiles ($DJUSAU), recreational products ($DJUSRP) and home construction ($DJUSHB) also performed quite well. The latter group held recent price support and...

READ MORE

MEMBERS ONLY

DP Alert: Indicators Mixed but Leaning Bullish - Record Lows for VIX

by Erin Swenlin,

Vice President, DecisionPoint.com

The DP Scoreboards continue to show bullishness in all three time frames as far as price trends and momentum. The only outcast is the Dow which is still waiting on the weekly PMO to have a positive crossover. Unfortunately, the PMO on the weekly chart is still in decline. It...

READ MORE

MEMBERS ONLY

FALLING COMMODITIES AREN'T DRIVING EMERGING MARKETS HIGHER -- TECHNOLOGY IS -- THAT'S ESPECIALLY TRUE IN SOUTH KOREA AND TAIWAN WHICH ARE EEM LEADERS -- TAIWAN SEMICONDUCTOR IS LEADING SEMICONDUCTOR ETF TO NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES DIVERGE FROM EEM... One of the long-held principles of emerging market behavior is that they're closely correlated to the direction of commodity prices. That's because several large emerging markets are exporters of commodities (like Brazil and Russia). China is the world's biggest importer...

READ MORE

MEMBERS ONLY

Know Thyself IV

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is the fourth article dealing with cognitive biases that totally screw up your decision making. The first article, Know Thyself, covered anchoring, confirmation bias, herding, hindsight bias, overconfidence, and recency. The second article, Know Thyself II, covered availability, calendar effects, cognitive dissonance, disposition effect, and loss aversion/risk aversion....

READ MORE

MEMBERS ONLY

Truckers: Short-Term Sell Signal Setting Up Long-Term Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 8, 2017

The small cap Russell 2000 lagged on Monday with the other major indices tacking on minor gains. Energy (XLE, +0.71%) was the leader with coal ($DJUSCL) jumping 3.50%. The DJUSCL, however, is hitting major trendline resistance after kick-saving at price support....

READ MORE

MEMBERS ONLY

IJR and MDY Tests their Breakout Zone - Watching the Banks and 8 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... IJR and MDY Tests their Breakouts

.... Stocks and Junk Outperforming Treasuries

.... Watch BAC, C, GS and JPM for Big Banks

.... Watch USB, FITB, HBAN and ZION for Regionals

.... Aroons Signal Consolidaiton for Arconic

.... A Small Correction for Natty?

.... BHI and XOM Held Up Better than their Peers

.... Charts to Watch:...

READ MORE

MEMBERS ONLY

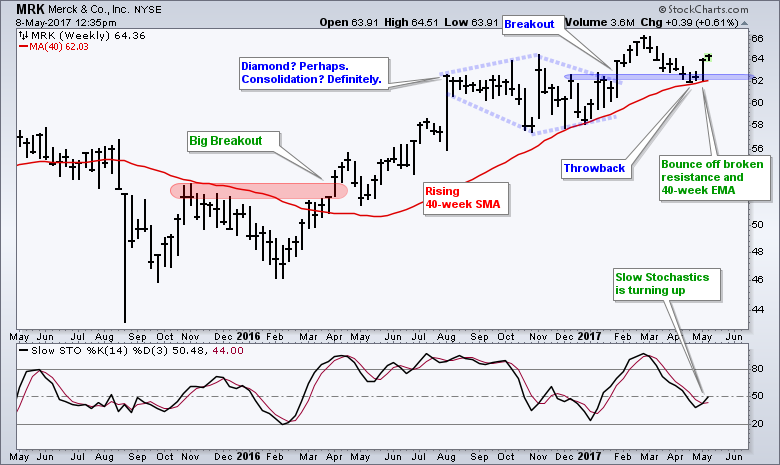

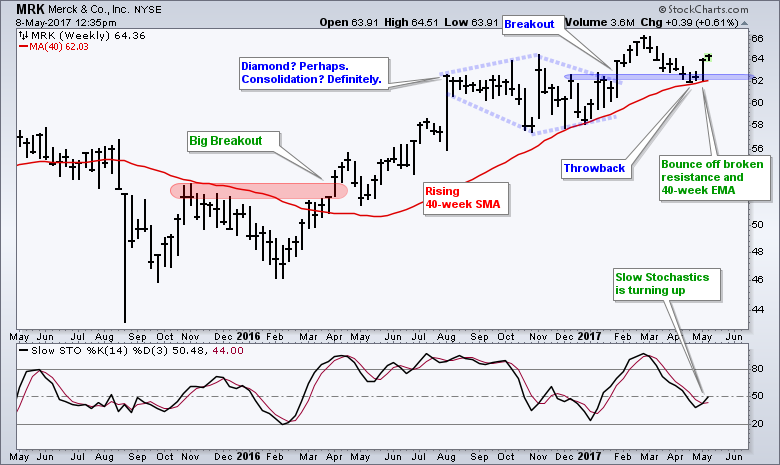

Merck Makes a Move $MRK

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Merck is showing signs of life as it bounces off a breakout zone and the Stochastic Oscillator turns up. The overall trend is up because the stock hit a 52-week high in February and is above the rising 40-week moving average. After a breakout surge earlier this year, the stock...

READ MORE

MEMBERS ONLY

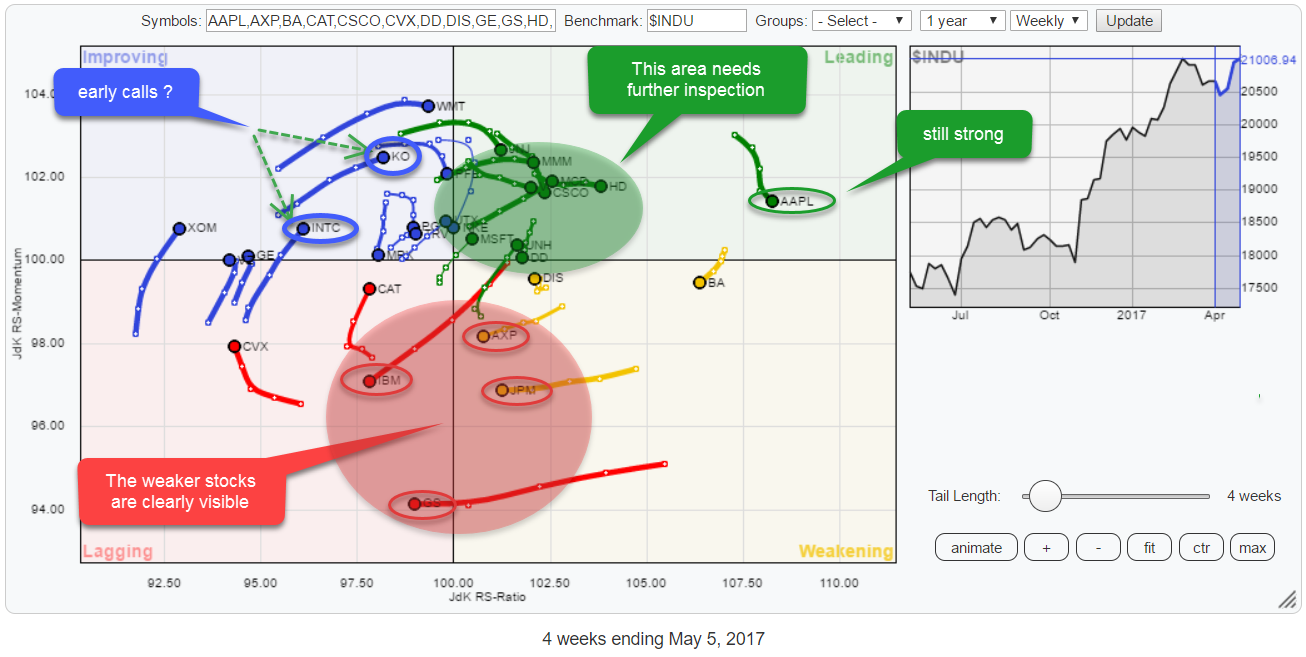

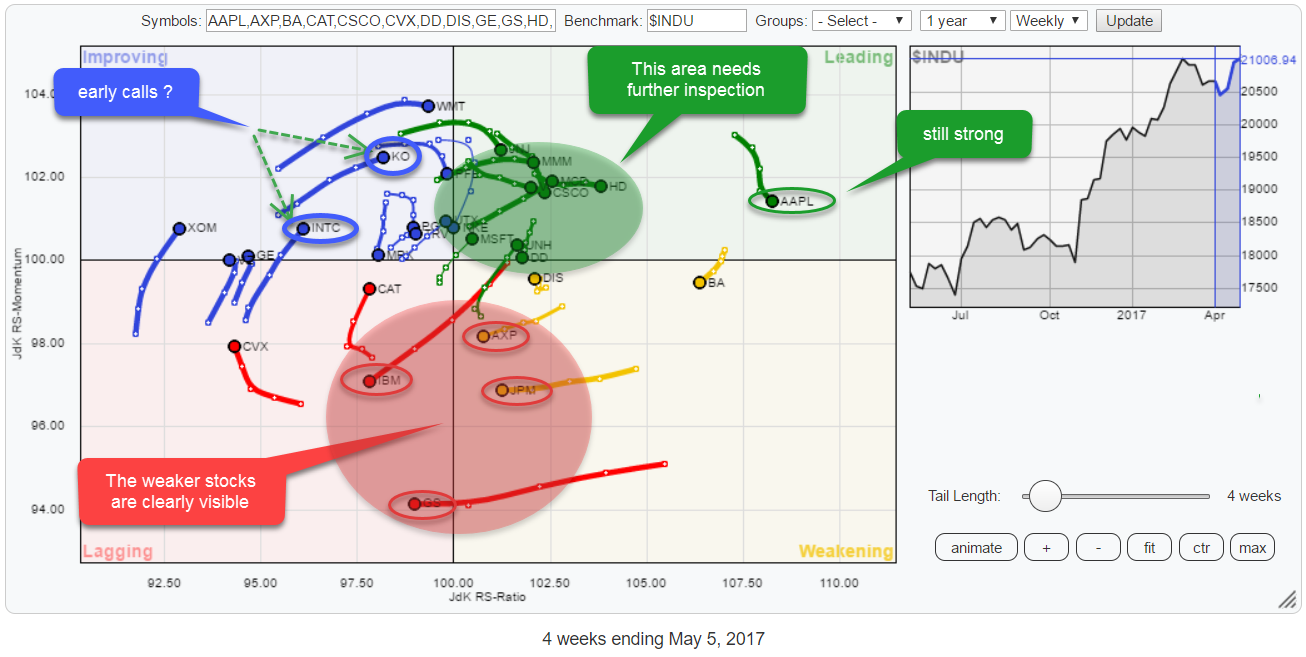

Tech stocks inside $INDU looking good on RRG but avoid IBM and financials.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for the 30 DJ Industrials (INDU) stocks once again presents us with some interesting insights.

From the picture above we can read that AAPL is still the strongest stock in this universe with the highest JdK RS-Ratio reading and still inside the leading quadrant. Inside the...

READ MORE

MEMBERS ONLY

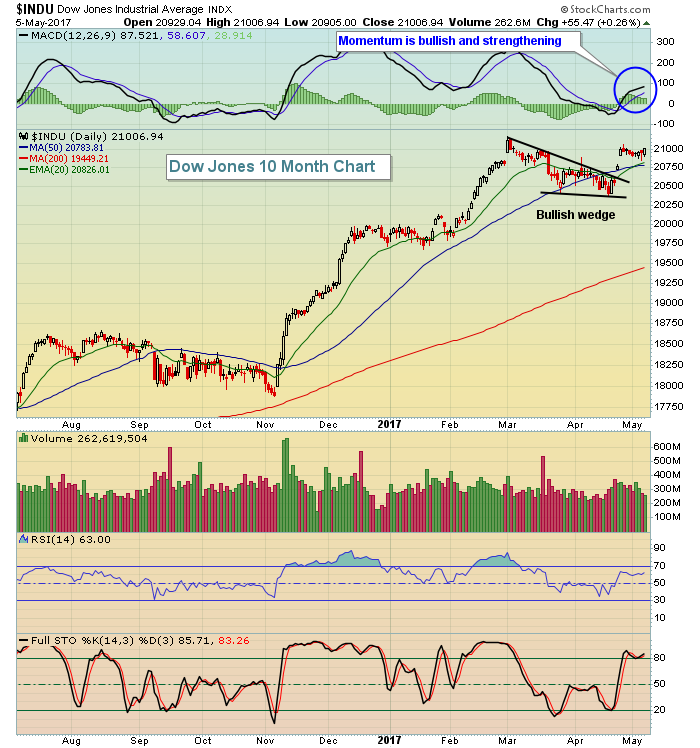

Dow Jones Tops 21000 For Second Time

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 5, 2017

The headline news from Friday is that the Dow Jones was able to clear psychological overhead resistance at 21000 for only the second time in history (March 1st was the other) and that the S&P 500 managed to clear its all-time...

READ MORE

MEMBERS ONLY

Did Nike Bottom on Friday?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As technicians, we look for prior price resistance to act as solid support once the resistance has been broken. That principle came into play on Nike, Inc. (NKE) as it tested a major price support just beneath 54.00 on Friday. NKE gapped down in the latter part of March...

READ MORE

MEMBERS ONLY

Sell In May And Go Away? Forget Stocks But How About Commodities?

by Martin Pring,

President, Pring Research

* $CRB and oil break to the downside

* The stock market says commodities are headed lower

* Bond market participants leaning in a deflationary way

* Watch those commodity currencies

The usual “Sell in May and Go Away” articles are starting to appear bigly, and a case can indeed be made in that...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Bad Week for Gold and Crude

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote regarding SPY: "Consolidation may continue for a bit, and it is possible that price will move lower toward the point of the breakout and fill Tuesday's gap; however, the charts in all three time frames are bullish, and I favor a breakout to...

READ MORE

MEMBERS ONLY

Junk is in the Eye of the Beholder

by Bruce Fraser,

Industry-leading "Wyckoffian"

High yield bonds came into their own in the 1980’s and have become ever more important to the functioning of the economy. They are often referred to as ‘Junk Bonds’ because they are bonds of lower quality. Investors are attracted to them for the higher yields offered over treasury...

READ MORE

MEMBERS ONLY

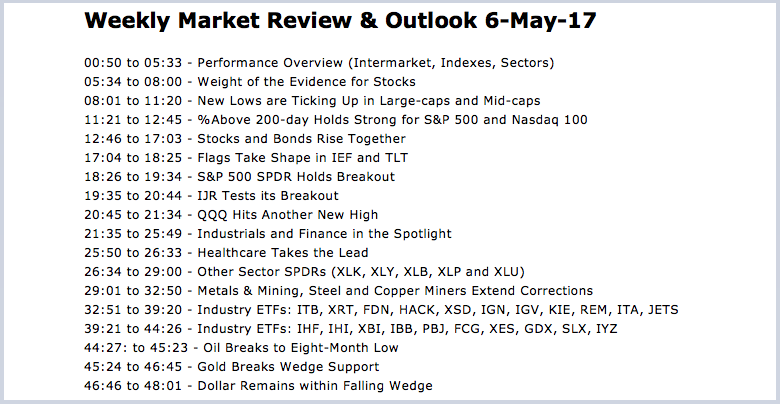

Video - Weekly Market Review & Outlook - The Relationship between Stocks and Bonds, and Bonds and Oil

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 6-May) -----

Stocks were mixed this past week as the S&P 500 SPDR (SPY) and Nasdaq 100 ETF (QQQ) moved higher, while the Russell 2000 iShares (IWM) and S&P SmallCap iShares (IJR) edged lower. SPY is...

READ MORE

MEMBERS ONLY

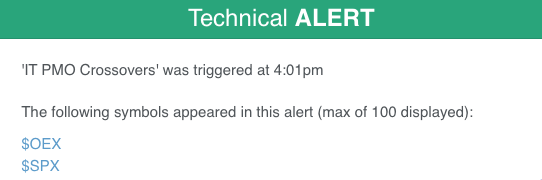

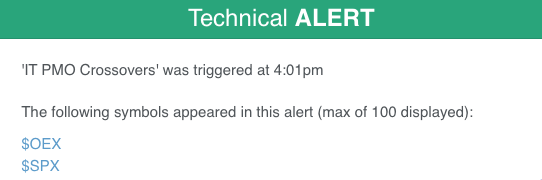

Whipsaw Intermediate-Term PMO BUY Signals on SPX and OEX

by Erin Swenlin,

Vice President, DecisionPoint.com

I had already figured out what I would write about in today's ChartWatchers article, but that was put on hold when I received a Technical Alert in my email box telling me that we had IT Price Momentum Oscillator (PMO) signal changes on both the S&P...

READ MORE

MEMBERS ONLY

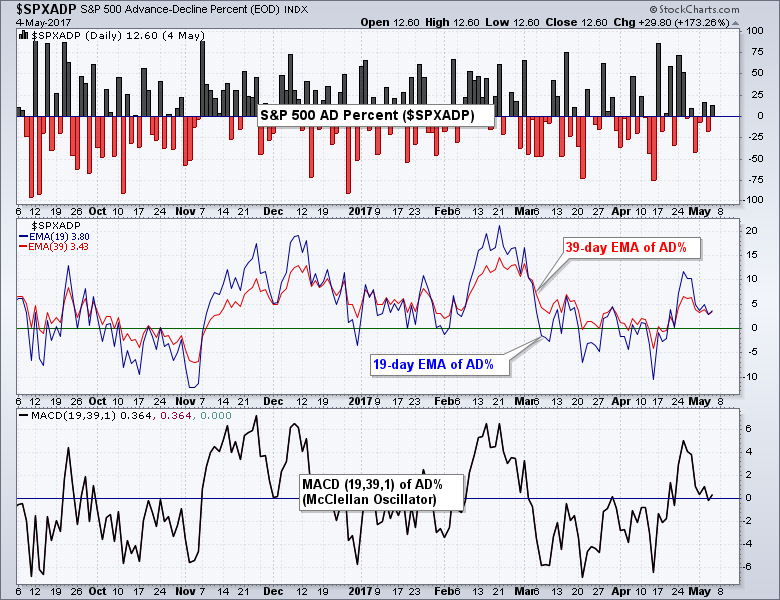

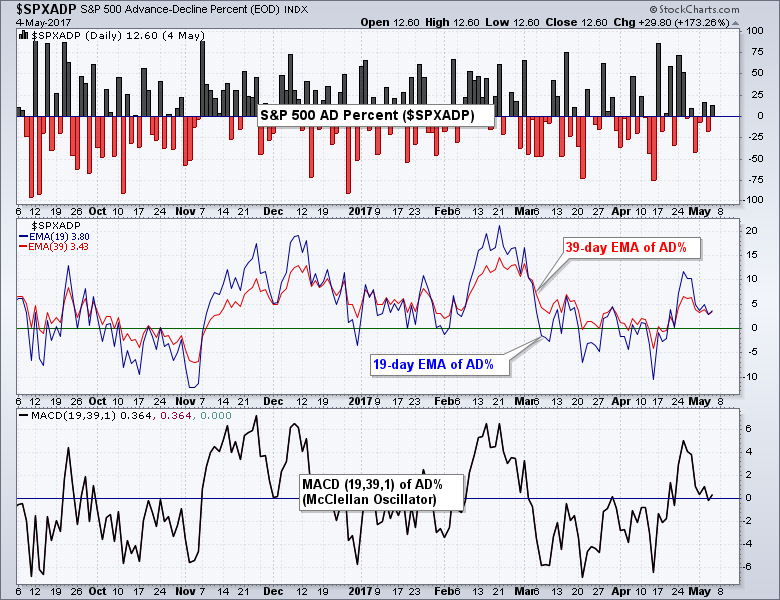

Create McClellan Oscillators for the Nine Sector SPDRs and the Gold Miners

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The McClellan Oscillator is a breadth indicator that Chartists can use to enhance their analysis of an index. StockCharts carries the McClellan Oscillator for dozens of broad market indexes, but not for the S&P sectors. There is no need to fret because StockCharts users can create the McClellan...

READ MORE

MEMBERS ONLY

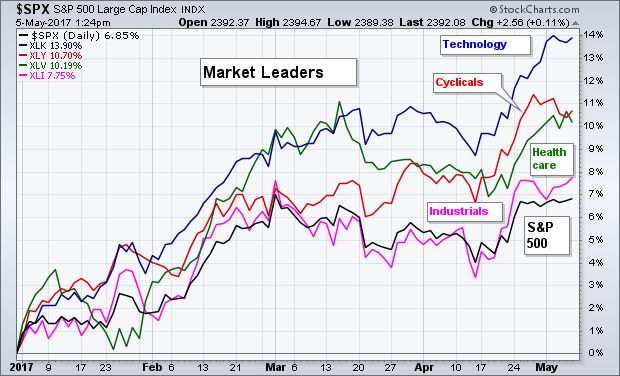

Sector Rankings and Weightings Are Still Market Positive

by John Murphy,

Chief Technical Analyst, StockCharts.com

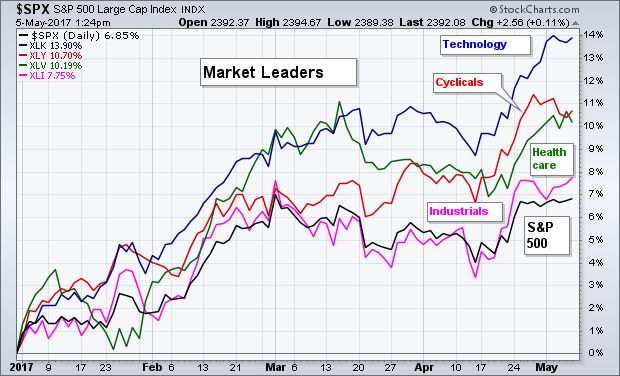

SECTOR LEADERSHIP...One of the problems facing the current stock market is that some sectors have been rising, while others have suffered large losses. Since the start of the year, for example, technology has gained nearly 14% versus a 6.7% gain for the S&P 500. Energy stocks,...

READ MORE

MEMBERS ONLY

Where My Best Investments & Trades Came From These Past 25 Years Part 1

by Gatis Roze,

Author, "Tensile Trading"

Approximately every five years, I dig into my Trading Journal with the specific mandate to unearth and review where I’ve earned my profits and losses. This is not a small project. I do it on an ongoing basis with all individual trades, but when taken in the 5-year aggregate,...

READ MORE

MEMBERS ONLY

Earnings Season Favors the Bulls

by John Hopkins,

President and Co-founder, EarningsBeats.com

Recent headlines have focused on tax reform, health care reform, partisan bickering, the president's first 100 days. But in the background many companies have been coming up big when reporting earnings which is why the market has been so strong of late.

While the bears have been hoping...

READ MORE

MEMBERS ONLY

SECTOR RANKINGS AND WEIGHTINGS ARE STILL MARKET POSITIVE -- THE YEAR'S TOP FOUR SECTORS ACCOUNT FOR MORE THAN HALF OF THE S&P 500 -- ANOTHER 15% ARE MATCHING S&P 500 PERFORMANCE -- ENERGY IS THE BIGGEST LAGGARD BUT ACCOUNTS FOR ONLY 8% OF S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR LEADERSHIP... One of the problems facing the current stock market is that some sectors have been rising, while others have suffered large losses. Since the start of the year, for example, technology has gained nearly 14% versus a 6.7% gain for the S&P 500. Energy stocks,...

READ MORE

MEMBERS ONLY

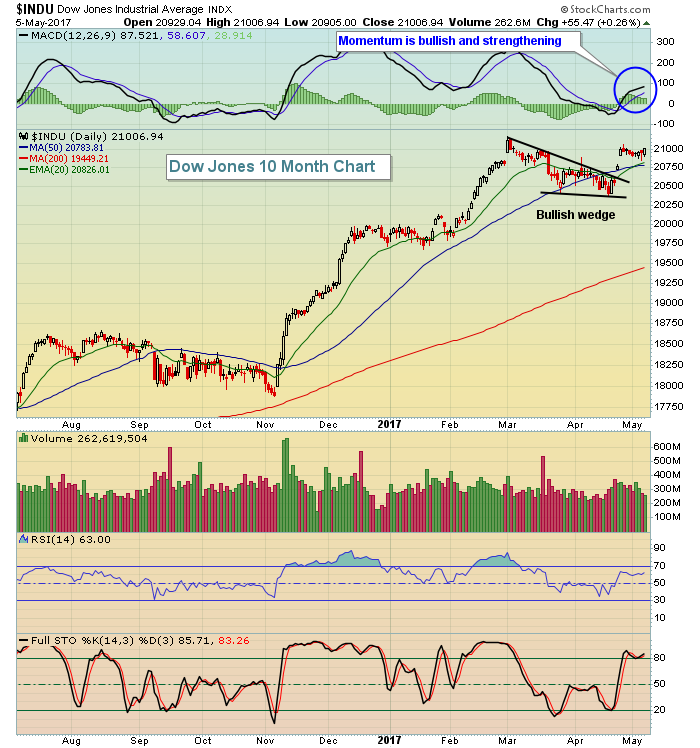

Weekly Market Review & Outlook - New Lows Expand, but Weight of the Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

... Weight of the Evidence for Stocks

.... New Lows are Ticking Up in Large-caps and Mid-caps

.... %Above 200-day Holds Strong for SPX and NDX

.... Stocks and Bonds Rise Together

.... Flags Take Shape in IEF and TLT

.... S&P 500 SPDR Holds Breakout

.... IJR Tests its Breakout

.... QQQ Hits Another New...

READ MORE

MEMBERS ONLY

Bifurcated Action Stymies Global Markets - For At Least One Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 4, 2017

Happy Cinco De Mayo!

Cuatro De Mayo turned out to be a very flat day, with bifurcated action throughout the market. Even global markets were bifurcated. I counted 13 international ETFs higher yesterday with 10 lower. Markets everywhere are consolidating after mostly higher...

READ MORE

MEMBERS ONLY

DP Alert: Flat Trading - USO Crash - Gold Correcting

by Erin Swenlin,

Vice President, DecisionPoint.com

The market hasn't really done much this week which is keeping the DP Scoreboards in a holding pattern. I've been getting regular 'technical alerts' that the OEX IT Price Momentum Oscillator (PMO) signal has changed, meaning that whipsaw is happening daily. We won'...

READ MORE

MEMBERS ONLY

RISING RATES PUNISH GOLD -- BASE METALS AND MINERS ARE ALSO FALLING -- CHINA WEAKNESS MAY EXPLAIN WHY -- FALLING COMMODITIES AND WEAK CANADIAN DOLLAR PUSH CANADA ISHARES BELOW 200-DAY AVERAGE -- INSURANCE ETF GETS A BOOST FROM RISING BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ASSETS ARE ALSO FALLING... Add gold and gold miners to the list of former safe havens that are weakening. Chart 1 shows the Gold SPDR (GLD) falling to a seven-week low today and back below its moving average lines. Gold miners are doing even worse. Chart 2 shows the...

READ MORE

MEMBERS ONLY

SystemTrader - How to Sell in June and Avoid a Swoon

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Sell in June to Avoid a Swoon

.... Testing the Best Six Months Strategy

.... A Twenty Year Testing Period

.... Best versus Worst Six Months

.... Four Months Stand out on Seasonality Chart

.... Testing the Strongest Eight Months

.... Seasonality Plus Timing Improves Returns

.... Conclusions ....

Testing the Best Six Months Strategy

Seasonal patterns are...

READ MORE

MEMBERS ONLY

Banks Lead Rebound In Financials; IBN Breaks Out On Big Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 3, 2017

Financials (XLF, +0.80%) were easily the best performing sector on Wednesday as banks ($DJUSBK) led the rebound in interest-sensitive stocks. After gapping lower yesterday, the 10 year treasury yield ($TNX) climbed throughout the session and finished back above the 2.30% level....

READ MORE

MEMBERS ONLY

Another PMO Scan - Got You Covered MarketWatchers LIVE Fans!

by Erin Swenlin,

Vice President, DecisionPoint.com

During the MarketWatchers LIVE program (airs 12:00p - 1:30p EST M/W/F), Tom Bowley and I have started a segment called "Anatomy of a Trade" where we go through our process for identifying investment prospects. I use Price Momentum Oscillator (PMO) scans to start every...

READ MORE

MEMBERS ONLY

BOND YIELDS MAY BE BOTTOMING -- BOND ETF FAILS AT 200-DAY AVERAGE -- RELATIVE WEAKNESS IN UTILITIES AND REITS HINT AT LOWER BOND PRICES -- FINANCIALS MAY BE TURNING UP -- A HIGHER FINANCIALS/UTILITIES RATIO WOULD SIGNAL HIGHER YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD STILL IN UPTREND... Today's Fed announcement contained no surprises. However, the Fed's view that recent economic softness is "transitory" in nature appears to have caused an uptick in bond yields. Technical factors also appear to favor higher yields. I'll...

READ MORE

MEMBERS ONLY

Hartford Surges off Support with 7-day Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Hartford (HIG) is a big insurance concern and part of the Insurance SPDR (KIE), which is one of the best performing industry group ETFs over the last six months. The stock surged from late August to mid November and continued higher at a slower pace from January to March, hitting...

READ MORE

MEMBERS ONLY

Apple iPhone Sales Disappoint, Could Lead To Short-Term Relative Weakness On NASDAQ

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 2, 2017

Traders weren't overly impressed with Apple's (AAPL) quarterly report last night and NASDAQ futures are suffering this morning. However, the NASDAQ 100 ($NDX) has been significantly outperforming the benchmark S&P 500 for months and a bit of...

READ MORE

MEMBERS ONLY

DP Alert: Resistance Hit and Held - Energy Sector LT SELL Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to report on the DecisionPoint Scoreboards (found in the DecisionPoint Chart Gallery link on the homepage). The market has hit overhead resistance at all-time highs and is struggling to overcome. Meanwhile the defensive Energy Sector just logged LT Trend Model SELL signals, effectively moving them into an...

READ MORE

MEMBERS ONLY

Global Equities Trick or Treat?

by Martin Pring,

President, Pring Research

* A few words on long-term charts

* US equities starting a period of underperformance?

* Overcoming resistance

* Chinese equities look vulnerable

* Good looking country charts

A few words on long-term charts

I like looking at short-term charts because you can sometimes pick up some interesting psychological characteristics through divergences, candlesticks and one...

READ MORE

MEMBERS ONLY

Market Roundup Video For May 2017

by Martin Pring,

President, Pring Research

Here is the link to the Market Roundup Live by Martin Pring 2017-05-02.

Market Round Up Live With Martin Pring 2017-05-02 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

DEFENSIVE CONSUMER STAPLES ARE WEAKENING -- WHILE ECONOMICALLY SENSITIVE CONSUMER CYCLICALS ARE MARKET LEADERS -- CYCLICALS/STAPLES RATIO TURNS UP -- MARTIN MARIETTA AND VULCAN MATERIALS ARE HAVING A VERY STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES ARE WEAKENING... Defensive parts of the market are starting to weaken. That includes consumer staples. At the same time, money is flowing back into more economically sensitive stock groups like consumer discretionary stocks (more on that shortly). That's normally a good sign for the market. Chart...

READ MORE

MEMBERS ONLY

NASDAQ, Russell 2000 Flexing Their Relative Muscles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 1, 2017

The NASDAQ and Russell 2000 outperformed in a big, big way on Monday and that's always a very positive sign for equities. In addition, strength came from technology (XLK, +0.75%) and financials (XLF, +0.64%), two of the aggressive sectors....

READ MORE

MEMBERS ONLY

Identifying Corrections within a Bigger Uptrend (XME, COPX, IGN) - Do You Really Know what Drives Prices?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... XME - A Mere Correction or More? (plus COPX)

.... Steel Stocks Dominate XME

.... HACK and IGN Perk Up within Technology

.... Vanguard Finance ETF Stalls after Gap

.... Respect for Bank Analyst Dick Bové (plus GS)

.... Think you Really Know what Drives a Stock?....

XME - A Mere Correction or More? (plus...

READ MORE