MEMBERS ONLY

A Debit Spread in American Express to Add Long Exposure

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* American Express (AXP) has pulled back and is in oversold levels, which may present a buying opportunity

* AXP has upside potential and, to take advantage of it, you could trade an ITM debit spread

* A debit spread has a favorable risk to reward potential that can add long...

READ MORE

MEMBERS ONLY

How to Stop the "Wealth Destroyers" by Deploying Your Sell Methodology

by Gatis Roze,

Author, "Tensile Trading"

"We are in the business of making mistakes. Winners make small mistakes. Losers make big mistakes."

There are zillions of cliches that paraphrase what Ned Davis said. The umbrella axiom with your portfolio should be to cut your losers.

Nude investing is what I label an investor without...

READ MORE

MEMBERS ONLY

Stock Market Pushes Higher, But Is There a Bond Market Surprise Brewing?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooler inflation data sees Treasury yields fall and bond prices rise

* The S&P 500 and Nasdaq Composite hit new highs as interest rate cuts could be on the horizon

* AAPL overcomes headwinds and is playing catchup while TSLA awaits results of a shareholder vote to approve...

READ MORE

MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

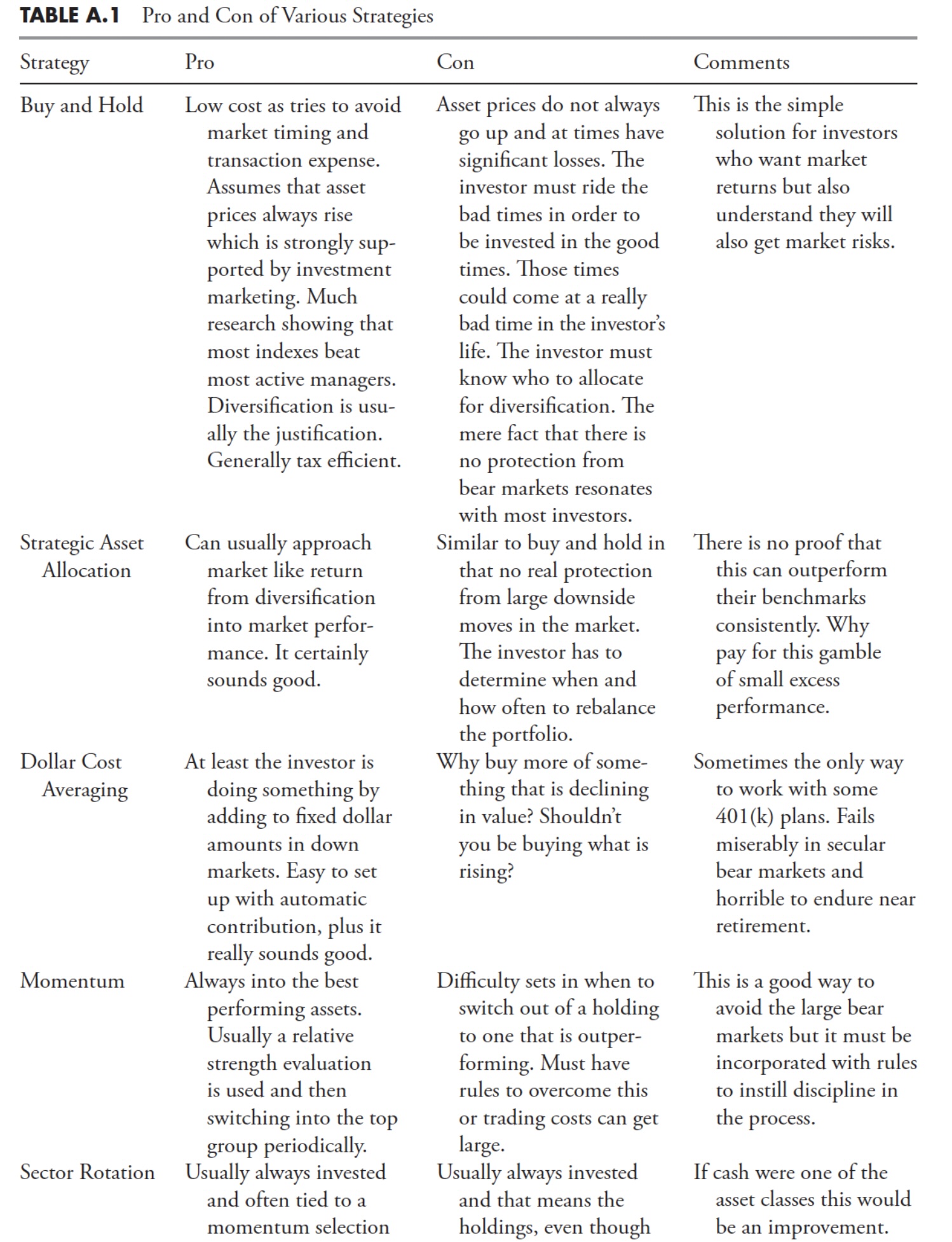

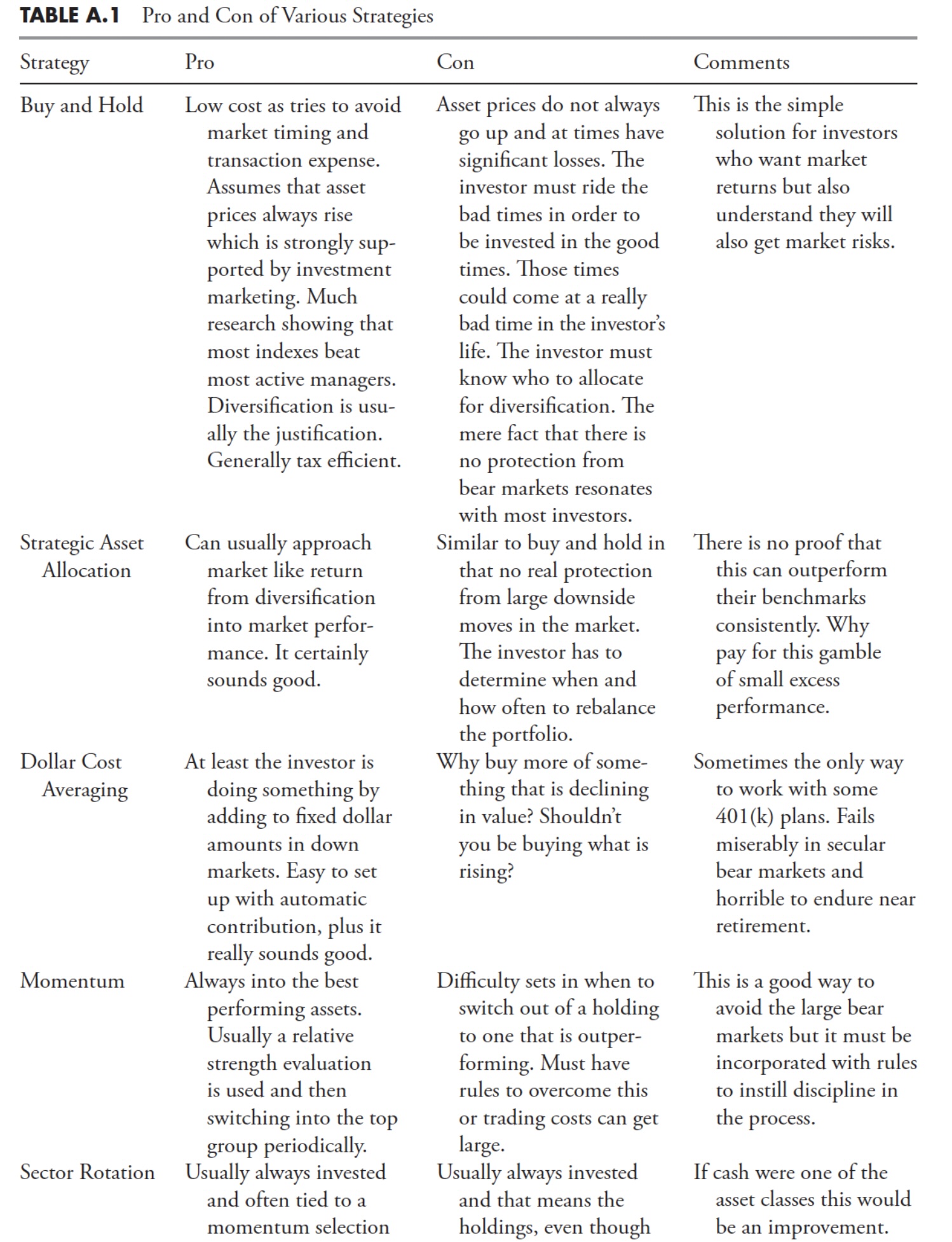

Investing with the Trend: Appendix

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Bitcoin, Politics, and Profits: What You Need to Know About CleanSpark and Riot Platforms

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A presidential contender expressed a desire to mine all remaining Bitcoin in the U.S.

* 90% of Bitcoin's total supply of 21 million has been mined

* If the remaining Bitcoin gets mined, it presents an unprecedented opportunity for two of the largest Bitcoin miners in the...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Tuesday, June 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Tuesday, June 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

S&P 500 Above 5400: Economic Optimism or Irrational Exuberance?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the continued optimism for technology shares following this morning's bullish CPI data and the Fed's statements suggesting a Goldilocks scenario for risk assets. He also breaks down key technical signals and levels for AAPL,...

READ MORE

MEMBERS ONLY

5 Simple and Powerful Uses for Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a...

READ MORE

MEMBERS ONLY

Sector Rotation Model Flashes WARNING Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius examines the theoretical sector rotation model and aligns it with current state of sector rotation on Relative Rotation Graphs, and the phase of the economy. He makes some interesting observations and highlights some flashing warning signals.

Check out Julius' Macroeconomic Variables/Metrics...

READ MORE

MEMBERS ONLY

Apple Blasts Through $200 On AI Optimism

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave reviews key charts from a technical analysis perspective, including AAPL, FSLR, MSTR, and STT. He also addresses the potential bearish momentum divergence for the S&P 500 index and reviews the negative breadth conditions, with new 52-week lows...

READ MORE

MEMBERS ONLY

The Next Direction for Interest Rates Is...?

by Martin Pring,

President, Pring Research

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week. Most observers of the US expect the Federal Reserve to...

READ MORE

MEMBERS ONLY

NVDA Stock Split Launches S&P 500 Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a bullish day for stocks, with 8 out of 11 S&P 500 sectors finishing higher. He breaks down the charts of NVDA, ENPH, FSLR, and AMD, and reviews a potential upside reversal in gold.

See Dave&...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point.

Next up Carl covers the market in general followed...

READ MORE

MEMBERS ONLY

Equities Hit New All-Time Highs as Communications Joins Leadership Party

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities rebounded this week as we saw a string of strong blue "Go" bars and price hit a new higher high. Treasury bond prices returned to a "Go" trend with their own week of strong...

READ MORE

MEMBERS ONLY

Week Ahead: Despite Pullback, Breadth Remains a Concern; Nifty Still Prone to Retracement

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets had an incredibly eventful week as they reacted to the exit polls and general election results. All happened in the same week; the Nifty saw itself forming a fresh lifetime high, and also came off close to 8% from its peak. A remarkable recovery also followed, which led...

READ MORE

MEMBERS ONLY

Alibaba Returns to the Scene of the Crime

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Big breakouts are bullish, but sometimes traders miss the breakout.

* A throwback is a decline back to the breakout zone, which turns support.

* Throwbacks offer traders a second chance to partake in breakouts.

Chinese stocks wet on a tear from mid April to mid May with the China...

READ MORE

MEMBERS ONLY

Tracking the Three Signs of the Bear

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024. But what about the conditions "under the hood" of the major benchmarks? Today, we'll highlight three "signs of the bear&...

READ MORE

MEMBERS ONLY

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points. Mary Ellen also takes a close look at why stocks did not respond to today'...

READ MORE

MEMBERS ONLY

NVIDIA's Stock Split and Potential Correction

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

When Nvidia (NVDA) opens on Monday, it will have experienced a 10:1 split, and we should remember that one of the purposes of stock splits is to facilitate distribution. That is to say that the lower price after the split attracts investors who avoided the stock at the higher...

READ MORE

MEMBERS ONLY

S&P 500 Still Bullish: This Is What You Should Watch For

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market unfazed by today's jobs data

* Yields rise, US dollar rises, and equities close the week relatively flat

* Market breadth continues to be strong, indicating the stock market is still chugging along

It was a bit of a seesaw week in the stock market, but,...

READ MORE

MEMBERS ONLY

Only One Pocket of Strength Left in US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Only Large-Cap Growth is on a positive RRG-Heading

* No segment, except LC Growth, has managed to take out its late March high

* $DJUSGL setting up for negative divergences

Breaking Down Into Growth / Value

Using Relative Rotation Graphs to help break down the US stock market into various segments...

READ MORE

MEMBERS ONLY

Technology Sector Participation Is Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA...

READ MORE

MEMBERS ONLY

Retail Stocks Caught in Limbo: Will RTH Break Free and Soar?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* VanEck Vectors Retail ETF (RTH) holds 70% discretionary and 30% staples retail stocks

* Retail stocks have been on a steady long-term uptrend over the last 10 years

* Traders are likely to accumulate or sell positions depending on the Fed's interest rate decisions

VanEck Vectors Retail ETF...

READ MORE

MEMBERS ONLY

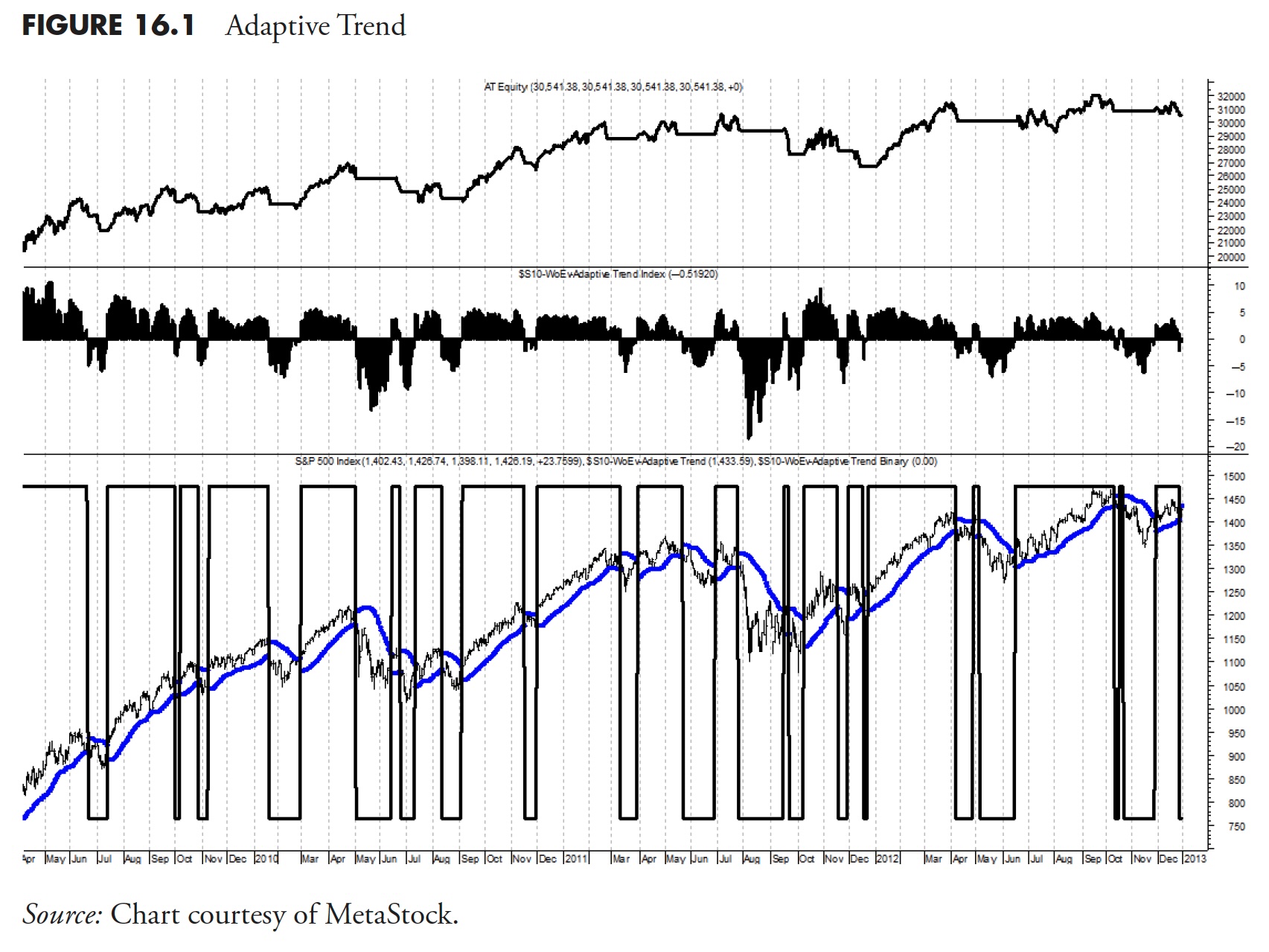

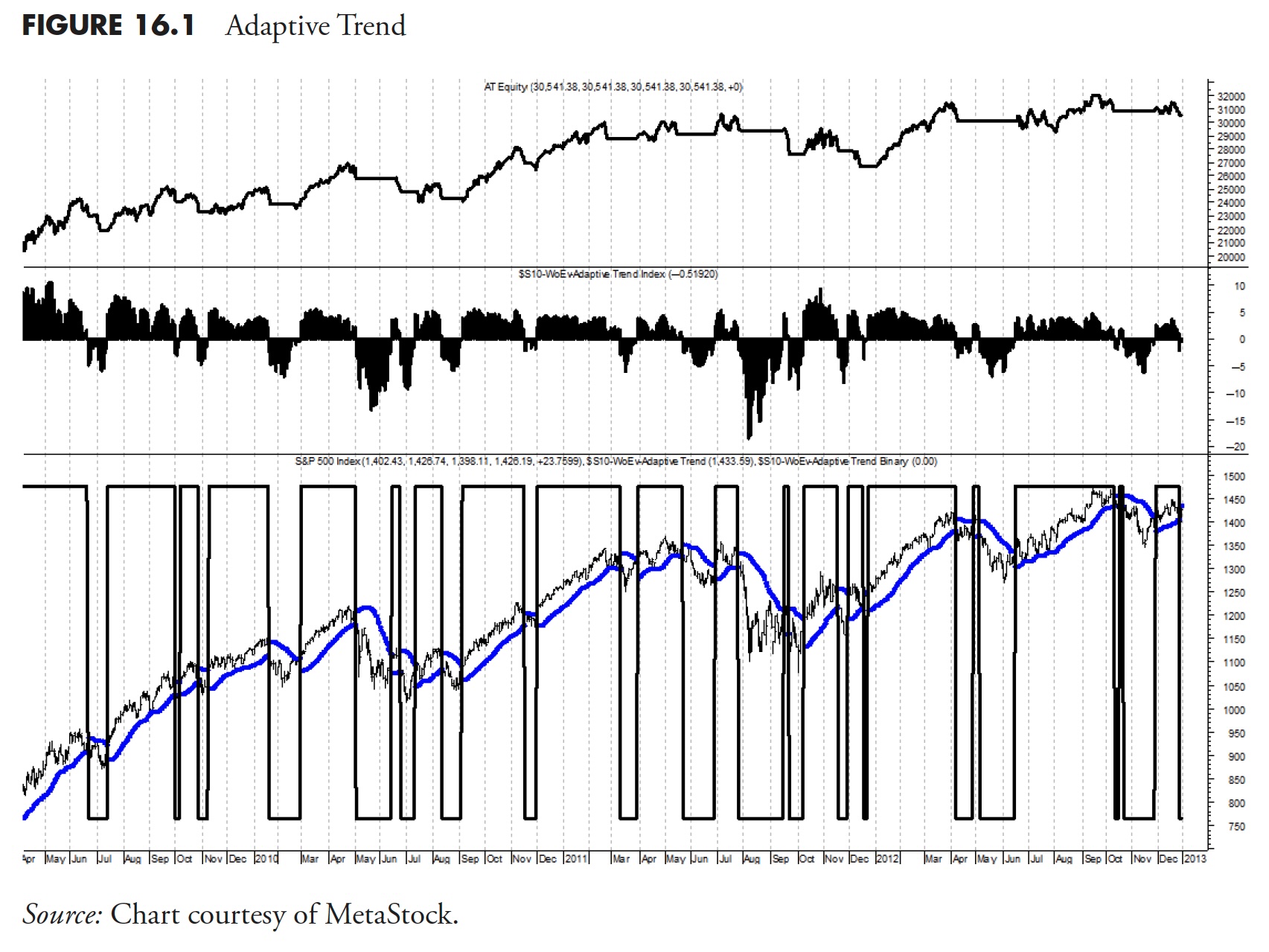

Rules-Based Money Management - Part 8: Putting Trend-Following to Work

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

3 Keys to Finding the Strongest Trends

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the three keys he hunts for when identifying reversals and strong trends, giving a few examples and then showing one that is developing now. He then highlights similar techniques he uses while reviewing the Sectors. In...

READ MORE

MEMBERS ONLY

Will Spotify Smash Its All-Time High of $387?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Spotify's stock price has been trending higher for the last 16 months

* Spotify's stock price could reach its all-time high

* Analysts project Spotify's stock price to reach $400 in 2024 and $485 in 2025

Music streamer Spotify Technology (SPOT) isn't...

READ MORE

MEMBERS ONLY

A Practical Options Strategy to Trade Home Depot

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* To take advantage of Home Depot's stock price decline, try implementing the put vertical spread

* The put vertical spread can lower your risk while you capitalize on the downside move in HD

* By going out to the August expiration, you can open a put vertical for...

READ MORE

MEMBERS ONLY

These SURPRISING Sectors are Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius uses the S&P 500 Sector Indexes to assess the long term price trends on the completed monthly charts for May, then discusses the long-term relative trends on a monthly RRG. Julius highlights the continued relative strength for Technology, Communication Services and...

READ MORE

MEMBERS ONLY

It's Time to Take a Look at the Canadian and Australian Dollars and What They Imply for Inflation

by Martin Pring,

President, Pring Research

The Canadian and Aussie dollars have been confined between two converging trendlines since the beginning of the century, as we can see from Chart 1. The moment of truth appears to be close at hand, as both are approaching the apex of a giant potential symmetrical triangle.

One usually consistent...

READ MORE

MEMBERS ONLY

Wyckoff at Work in the Intraday Timeframe

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is well known that stock market indexes are fractal. Demonstrating repeatable price structures in all timeframes. In the intraday timeframe these price structures repeat frequently. The Wyckoff characteristics of Accumulation, Markup, Distribution and Markdown are constantly at work in smaller periods of time. Wyckoff students will study such structures...

READ MORE

MEMBERS ONLY

UTILITIES TRYING TO "POWER" UP EQUITY MARKETS

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. We saw continued weakness this week in U.S. equities although there was a big rebound on Friday's bar. Treasury bond prices entered a period of uncertainty as we see GoNoGo Trend paint successive amber "Go...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax (Should We Trust It?)

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode Carl and Erin discuss Friday's "Upside Initiation Climax" and whether it can be trusted. With market follow through tepid, they discuss the implications of this very bullish signal.

Carl reveals his sentiment of the overall market and covers...

READ MORE

MEMBERS ONLY

Visualizing the Holdings for a Dual Momentum Rotation Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Absolute momentum defines trend direction.

* Relative momentum quantifies the strength of the uptrend.

* Take together, these two form the basis for a Dual Momentum Rotation Strategy.

As the name suggests, Dual Momentum Rotation Strategies focus on stocks that are in absolute and relative uptrends. This is a two-step...

READ MORE

MEMBERS ONLY

Week Ahead: Markets' Reaction to Exit Poll and General Election Results

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities experienced a notably eventful previous week, marked by a fresh lifetime high and a subsequent decline of over 400 points within the same week. Over the past five sessions, the Nifty 50 index fluctuated within a 693.80-point range before closing with a net weekly loss of...

READ MORE

MEMBERS ONLY

One MAJOR Concern About Friday's Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm all for a big rally with a hammer printing on the long-term weekly chart, especially at 20-week EMA support. That's exactly what happened on Friday on the Dow Jones Industrial Average ($INDU). This index of conglomerates had been underperforming other areas of the stock market...

READ MORE

MEMBERS ONLY

Hindenburg Omen Flashes Initial Sell Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 did manage to finish the week above tactical support at 5250, one of the most widely-followed macro technical indicators recently registered an initial sell signal for the second time in 2024. Today we'll explain the three components of the Hindenburg Omen, show...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri May 31, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Tech Stocks Sell Off, But AI Shines!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish close in the markets while highlighting areas to stay away from. She also shares why AI-related areas of Tech remain positive and what drove the Retail sector into a new uptrend. The potential downtrend reversal...

READ MORE

MEMBERS ONLY

Stock Market Shows Its Magic: An Exciting Finish

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has wrapped the week on a positive note

* Consumer Staples stocks may start to show strength in the near future

* More macro data is on deck for next week

What a turnaround! Today's PCE data, which was in line with expectations, initially sent...

READ MORE