MEMBERS ONLY

Megaphone Pattern + Death Cross: Bitcoin’s Technicals Flash a Warning

Cryptocurrencies have been under pressure, and two key chart developments indicate further downside. Here's what you need to watch as the year-end approaches....

READ MORE

MEMBERS ONLY

Charting the Week Ahead: Where Is Nifty Headed Next?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty's current technical setup reflects a strong market, steadily grinding higher. What does the coming week have in store?...

READ MORE

MEMBERS ONLY

The Market’s Stuck in Neutral: What Could Break the Standstill?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market churned but went nowhere this week as breadth held steady and rate-cut odds shifted. Here's what investors should watch next week....

READ MORE

MEMBERS ONLY

Fed Jitters Shake the Market – Where are Investors Finding Shelter?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how hawkish Fed comments and rising yields rattled the markets this week. See where investors are finding opportunity — and which sectors are offering shelter as volatility returns....

READ MORE

MEMBERS ONLY

How to Read the Market When Nothing Seems to Add Up

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When you get used to a resilient stock market, it can feel a little disorienting when things suddenly start to zig instead of zag. We got a taste of that this week, as some days the market marched higher, and other days it sold off sharply. If you felt like...

READ MORE

MEMBERS ONLY

Market Rotation: What’s Really Happening Beneath the Surface

by Mary Ellen McGonagle,

President, MEM Investment Research

While the stock market indexes are looking range-bound, there's a shift in what's driving the market's performance. Find out what's going on beneath the surface....

READ MORE

MEMBERS ONLY

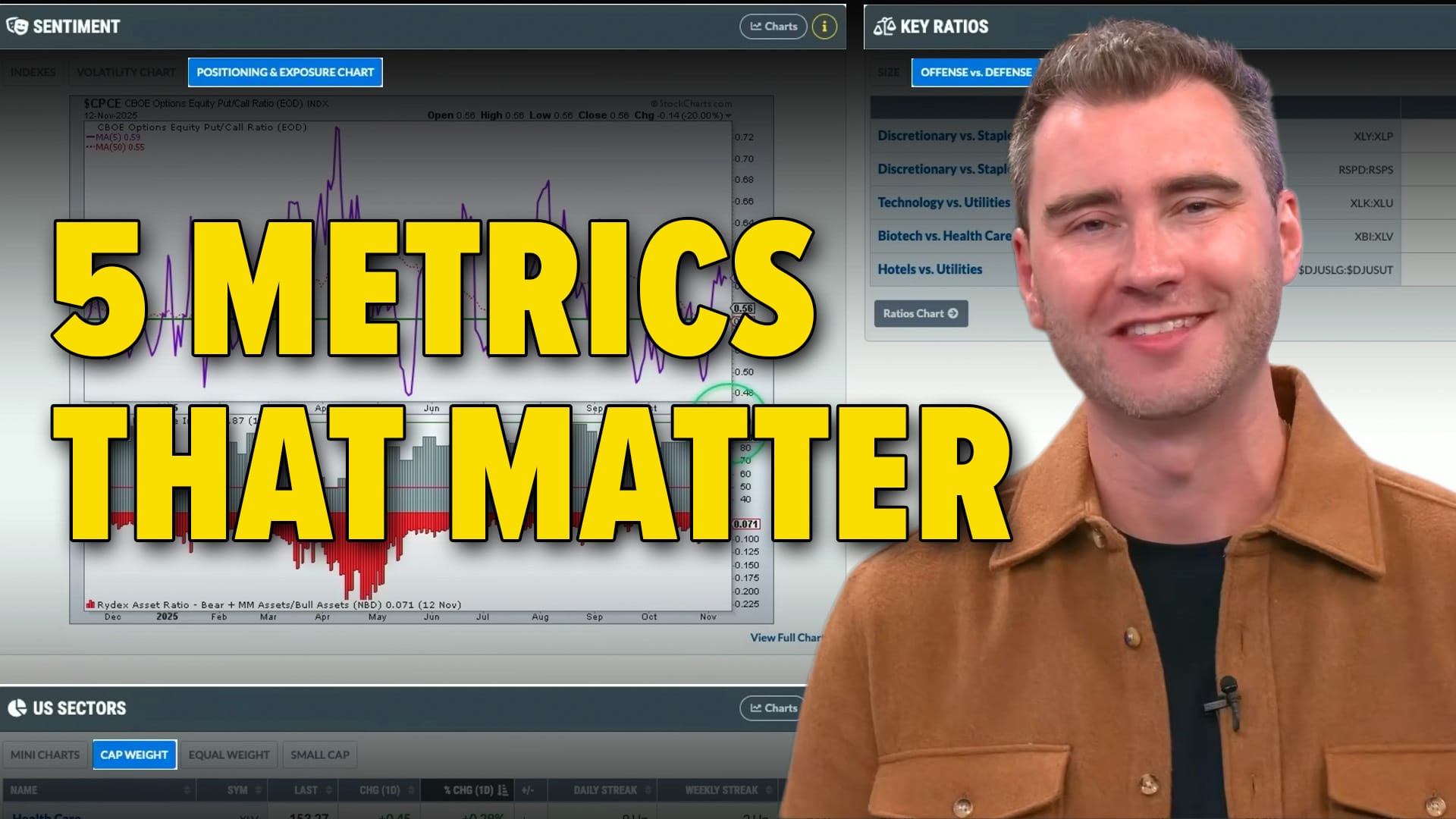

Market Top or Bullish Bounce? Watch These Top 5 Crucial Market Metrics to Decide!

by Grayson Roze,

Chief Strategist, StockCharts.com

With the market just a shout away from its all-time highs, Grayson Roze shares five market metrics every trader should watch using StockCharts’ Market Summary Dashboard. Learn how he tracks trends, breadth, sentiment, and sector strength to uncover what’s really driving the market....

READ MORE

MEMBERS ONLY

Small Caps Break Down, VIX Surges. What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Small-cap stocks have broken below a key support level. Volatility is also creeping higher. Tom Bowley shares his views by breaking down several charts....

READ MORE

MEMBERS ONLY

Cracks within Tech; Bonds Outperform, Bitcoin; Insurance Names Catch a Strong Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When technology ETFs are breaking down, insurance stocks and bonds are showing strength, and Bitcoin is triggering a downtrend, it means the stock market is showing signs of risk aversion. Arthur Hill analyzes charts of these asset groups and identifies the signals they are sending....

READ MORE

MEMBERS ONLY

Healthcare Stocks Are Breaking Out — But Why Now?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Healthcare stocks are breaking out as biotechs and pharmaceuticals surge to new highs; Tom Bowley highlights the rotation into healthcare and explains how this emerging leadership is helping drive the market higher going into year-end....

READ MORE

MEMBERS ONLY

The Sneaky Bull Market Nobody’s Talking About: Commodities

Commodities are making a bullish run in a seasonally weak period. Keep an eye on this potentially leggy asset class and find out how you can take advantage of the commodity run....

READ MORE

MEMBERS ONLY

StockCharts Insider: 10 Laws Every Chartist Should Know

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Markets change. Principles don’t. More specifically, the way we deal with markets evolves, but the factors driving markets remain consistent. Famed technical analyst John Murphy distills these factors into 10 Laws. These are timeless lessons that cut through the market noise and reveal how price,...

READ MORE

MEMBERS ONLY

Three Ways to Trade NVIDIA: Which One Gives You the Best Risk/Reward

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech took a hit, but all's not lost. Here's what NVIDIA's chart is indicating and how you can use options to trade the pullback with confidence....

READ MORE

MEMBERS ONLY

Three Stocks That Could Benefit Most from Tariff Relief — If the Charts Agree

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With talk of tariffs being rolled back, stocks like Best Buy, Stanley Black & Decker, and Nike could benefit from renewed optimism. But, as Dave, explains, the charts tell the real story, revealing which names are technically ready to lead the next move higher....

READ MORE

MEMBERS ONLY

The Tariff Relief Playbook: 10 Stocks with Upside Potential

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Which stocks could benefit the most if trade tariffs are rolled back? Dave highlights ten potential winners—including CAT, NKE, and more—and shows how to use StockCharts tools to uncover trend strength and opportunities....

READ MORE

MEMBERS ONLY

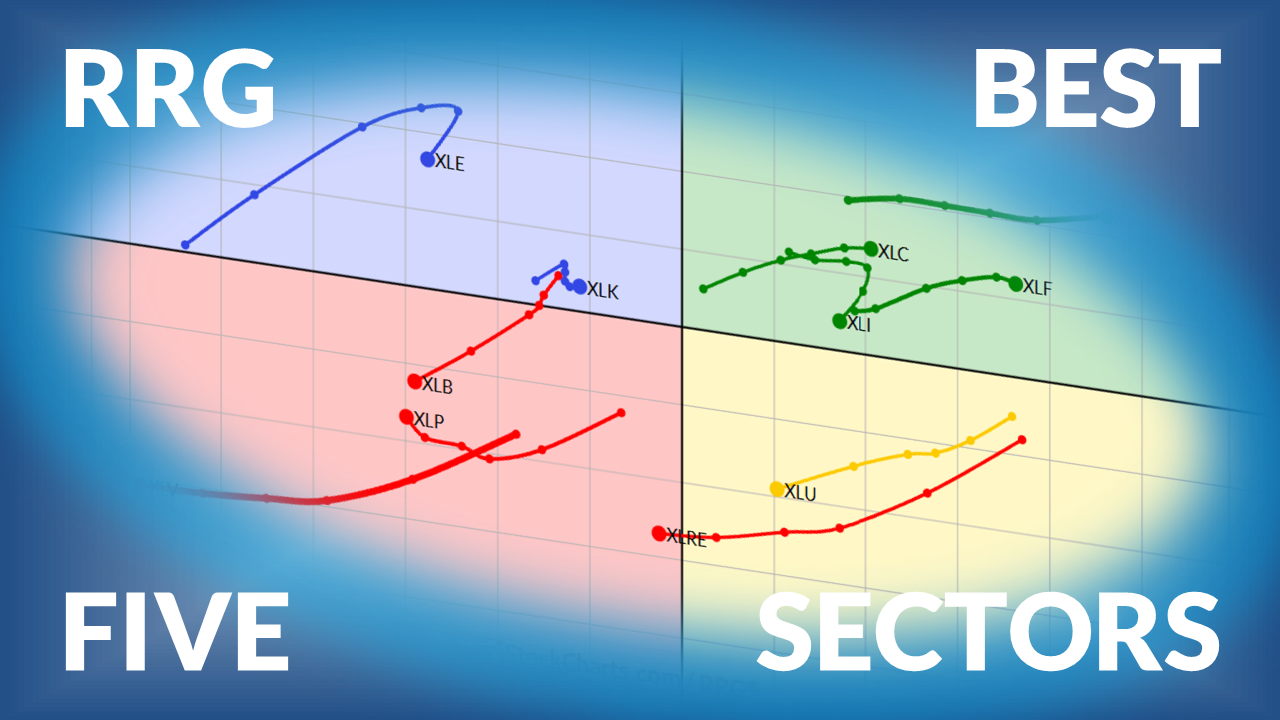

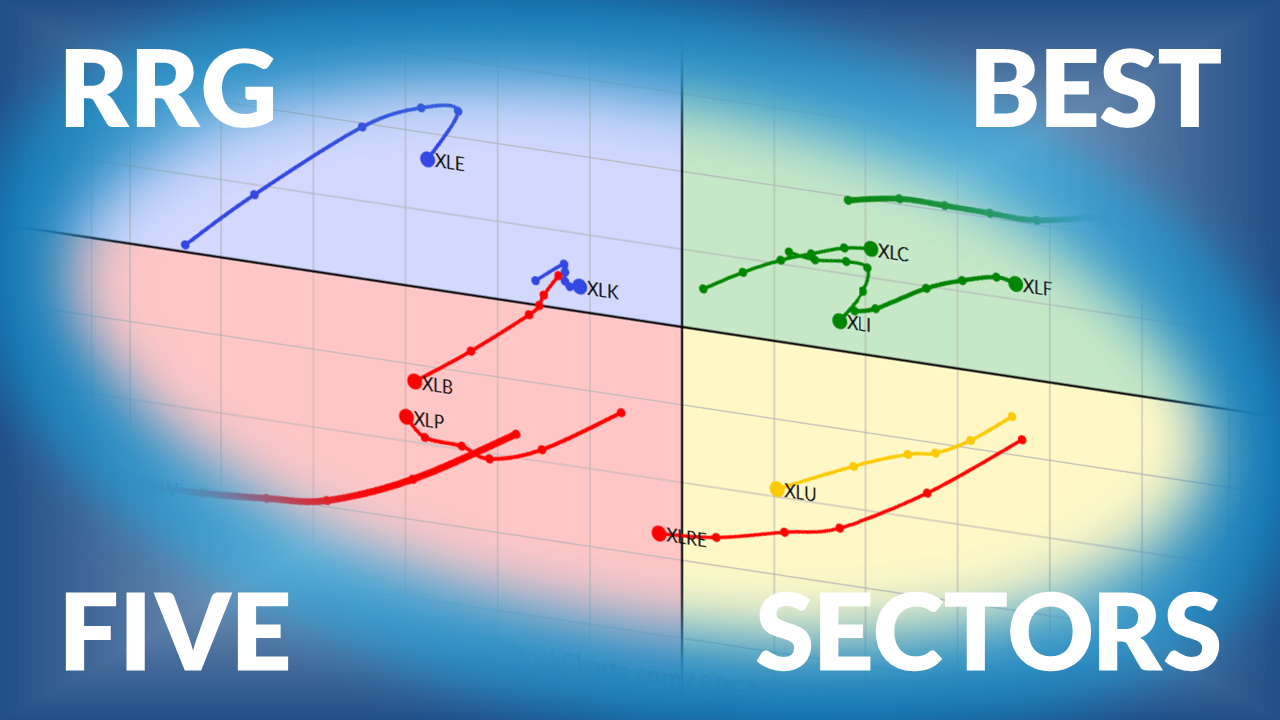

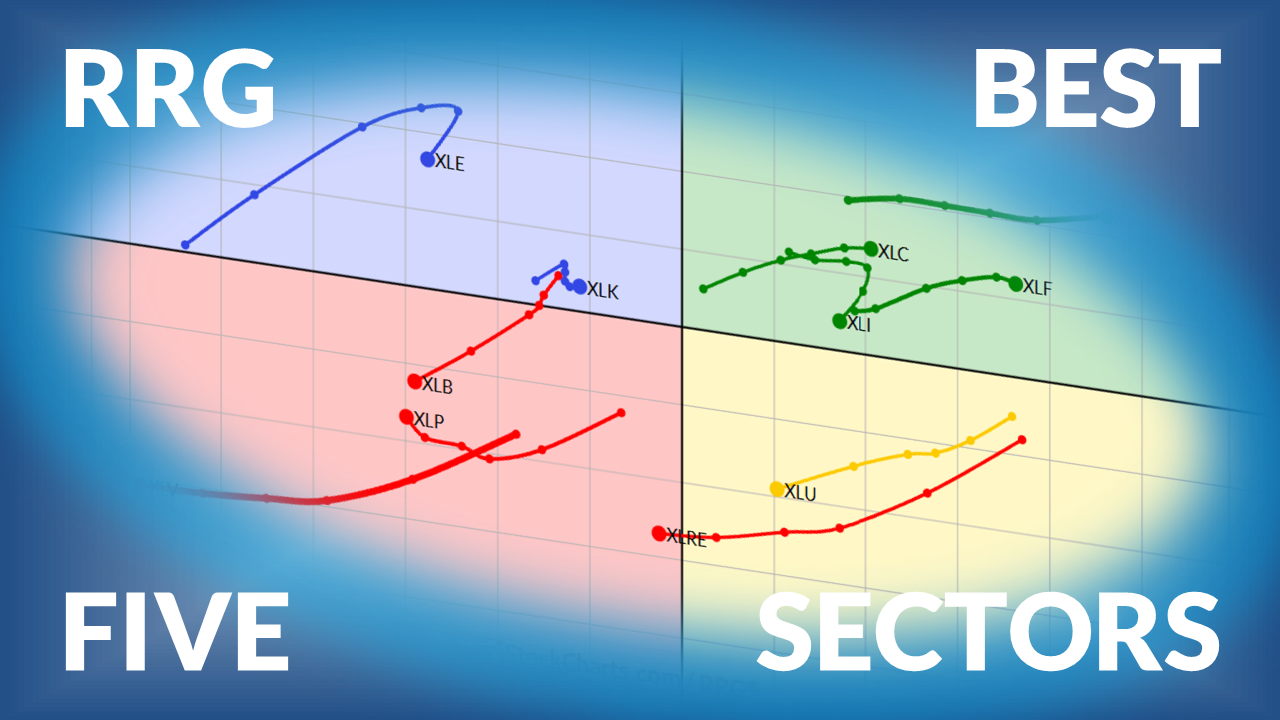

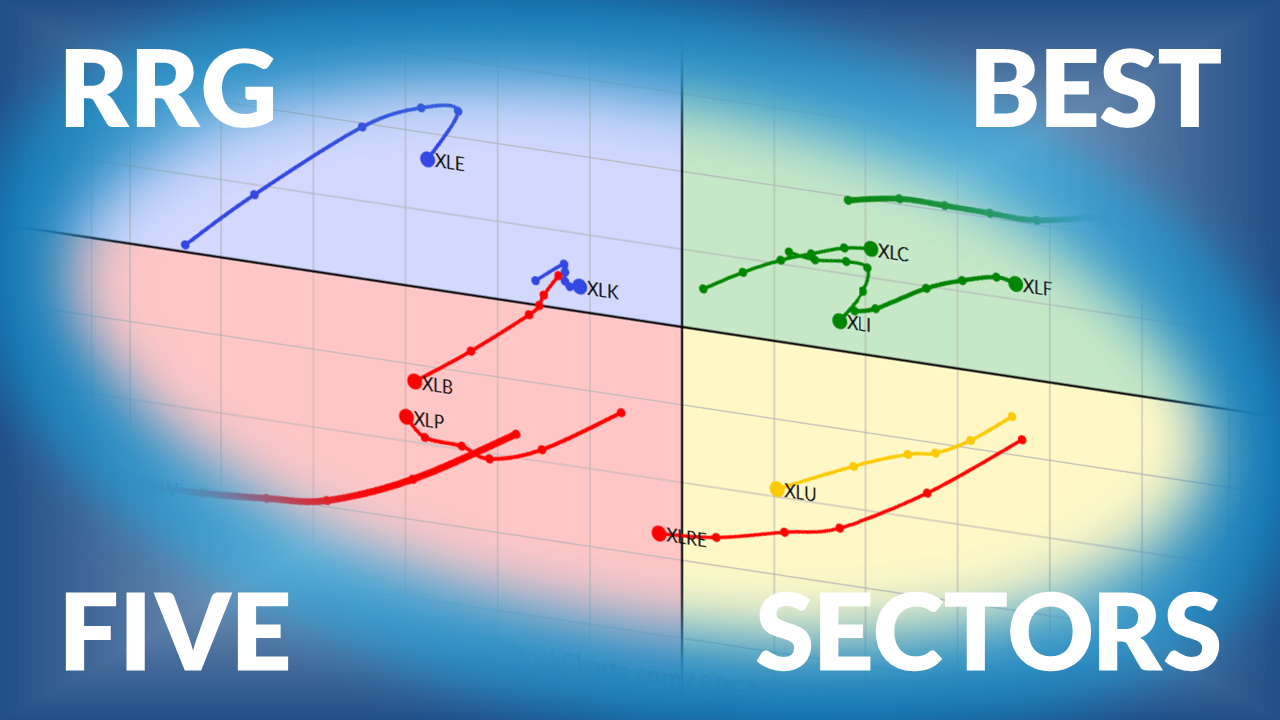

The Best Five Sectors This Week, #44

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Retail Stocks to Watch as Consumer Sentiment Collapses: Walmart, Target, and Home Depot

Key Q3 retail earnings reports are set to begin rolling in this week. Here's a look at charts of the consumer-related stocks that will give you a hint at how it will all shake out....

READ MORE

MEMBERS ONLY

What Lies Ahead for Nifty? A Look at the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty is in a state of flux, testing its symmetrical triangle pattern. Could an uptrend be on the horizon, or will we see incremental downside?...

READ MORE

MEMBERS ONLY

After a Volatile Week in the Markets, Here's Where I Found Strength!

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down this week’s volatile market action, highlighting areas where selective strength is showing up. Discover setups in energy, healthcare, and AI-linked names that are holding up as other areas weaken....

READ MORE

MEMBERS ONLY

Correction or Opportunity? The Charts Have the Clues

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Tech stocks are tumbling. The AI rally just slammed the brakes. Investors are getting fearful. This week's headlines painted a picture of panic, but beneath the surface, something else may be unfolding.

When the stock market is overstretched, it’s not unusual for it to pull back. We’...

READ MORE

MEMBERS ONLY

Is The Sharp Advance In Technology Stocks Over?

by Mary Ellen McGonagle,

President, MEM Investment Research

Has the rotation into Tech peaked? Or is this just a pause within a longer-term leadership trend? Mary Ellen explores with a look at the sector chart and an individual stock....

READ MORE

MEMBERS ONLY

Change of Character: Why the S&P 500’s Uptrend May Be Breaking Down

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 has broken below its 21-day EMA and key trend channel support, testing its 50-day moving average as market breadth weakens. With tech leaders like NVDA and AVGO tumbling, investors should watch for a possible rotation toward defensive sectors....

READ MORE

MEMBERS ONLY

Technology Selling is Creating Huge Opportunities Elsewhere

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology stocks may be selling off, but money is rotating into other areas. Check out the charts of the industry groups that are indicating upside breakouts....

READ MORE

MEMBERS ONLY

One Sector Stands Strong as the Most Economically Sensitive Sector Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Arthur Hill analyzes the performance of the Health Care sector relative to other S&P 500 sectors. Find out why Health Care shows promise as we head into the end of the year. ...

READ MORE

MEMBERS ONLY

Market Rotation Update: Revealing the Strongest Areas Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius builds on his new portfolio framework to reveal where market strength is shifting across asset classes and sectors. While stocks and commodities continue to lead, Julius breaks down the changes happening beneath the surface....

READ MORE

MEMBERS ONLY

Money’s Moving Fast! New Market Leaders Are Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Money’s moving fast, with growth stocks cooling while healthcare and transports heat up. Tom Bowley breaks down the sector rotation creating new opportunities in names like GOOGL, AMD, and breakout healthcare leaders CAH and IDXX....

READ MORE

MEMBERS ONLY

Market Pullback or Pause? Inside the November Dip and What Comes Next for Stocks

Intermarket relationships between stocks, bonds, the US dollar, and commodities are unsettled at the moment. What happens next? Here are the charts investors should be watching for clues....

READ MORE

MEMBERS ONLY

Market Breadth Weakens — Is the S&P 500 in Trouble??

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Follow along as Frank Cappelleri breaks down the S&P 500’s pullback, small-cap growth momentum, biotech leadership, and Bitcoin’s key support test. See what patterns and sector shifts could define the next market move!...

READ MORE

MEMBERS ONLY

Will “Buy the Dips” Work Again in November 2025?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Identifying a true uptrend means watching for higher lows and key support levels. Charts of CELH, BAC, and CAT show how dip-buying and moving-average support reveal whether bullish momentum will continue or signal a shift toward a bearish phase....

READ MORE

MEMBERS ONLY

Breakouts, Pullbacks & Setups: 10 Must-Watch Charts for November

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Grayson Roze and David Keller share ten charts to watch for November, including setups in Celsius, Regeneron, Caterpillar, Eli Lilly, and Shopify. Learn how they use StockCharts tools and trend analysis to locate strength and manage risk in a stretched bull market....

READ MORE

MEMBERS ONLY

Fed Chair Says, “It’s Cloudy”; These Benchmarks Could Blow the Clouds Away

by Martin Pring,

President, Pring Research

Martin Pring analyzes charts of US Treasury yields, which suggest there may be some disagreement between the market and the Fed....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #43

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Retail Lags, Restaurants Sink: A Technical Check on the U.S. Consumer Story

November's focus will be on consumer-related company earnings, such as retail and restaurants. These will shed light on consumer confidence, an important data point as we head into the holiday season. Here's a technical deep dive into the health of the U.S. consumer....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stalls Near Highs, Awaits Breakout Confirmation

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following a rangebound week, the Nifty's technical structure remains bullish, but there's signs of fatigue. Will it breakout, or see corrective moves?...

READ MORE

MEMBERS ONLY

Earnings Shake Up the Market! Where Leadership Is Shifting Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how recent earnings results are shaking up market leadership and where new strength is emerging. Learn which sectors and stock setups are holding up as investors navigate mixed results and rising volatility....

READ MORE