MEMBERS ONLY

When Facing a Market Pullback, RUN THESE SCANS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a big up day for TSLA and bearish engulfing pattern for energy stocks. He answers viewer questions on growth stocks during rising rate environment and shares two scans to identify potential opportunities during corrective periods.

This video originally...

READ MORE

MEMBERS ONLY

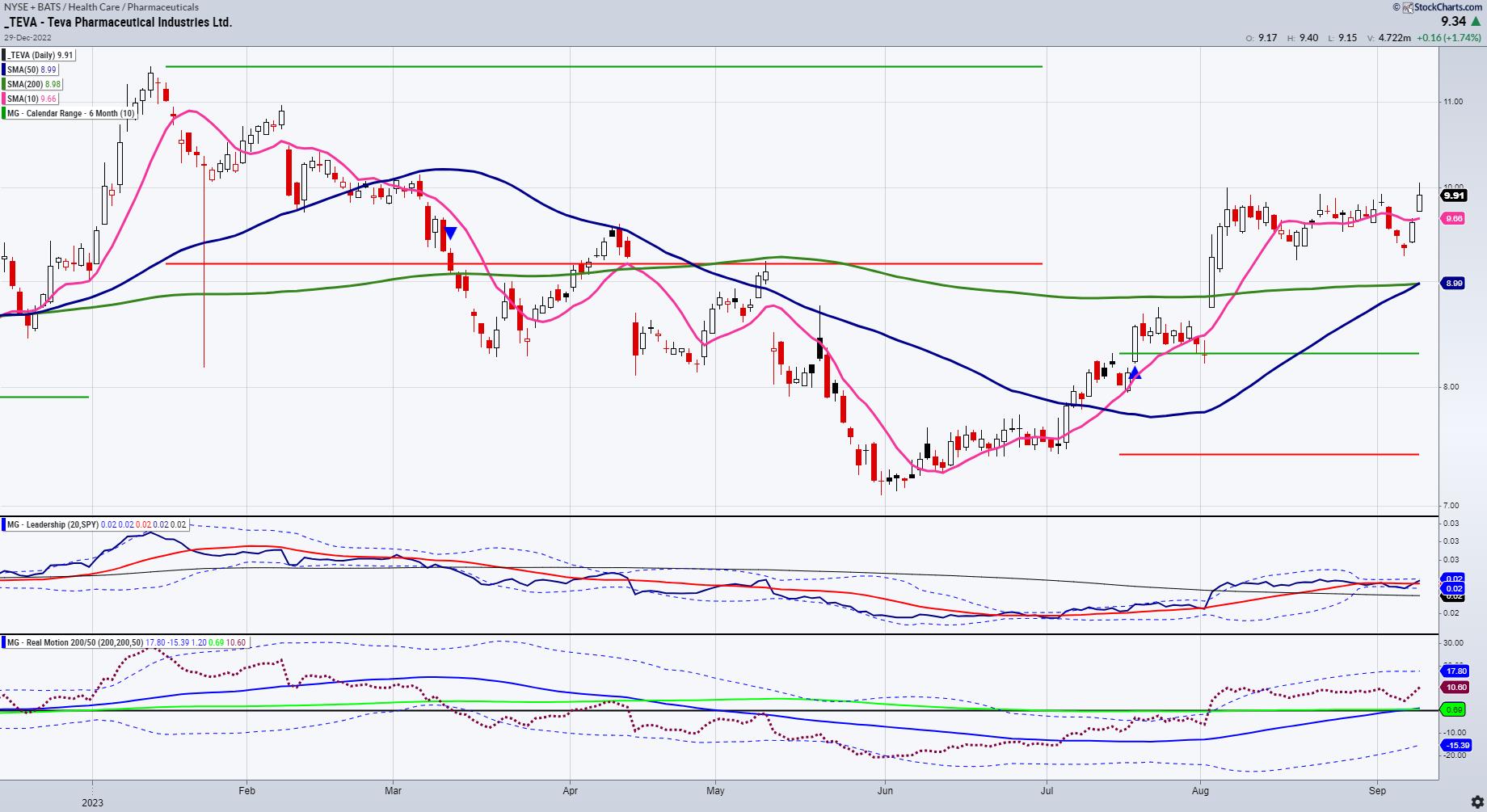

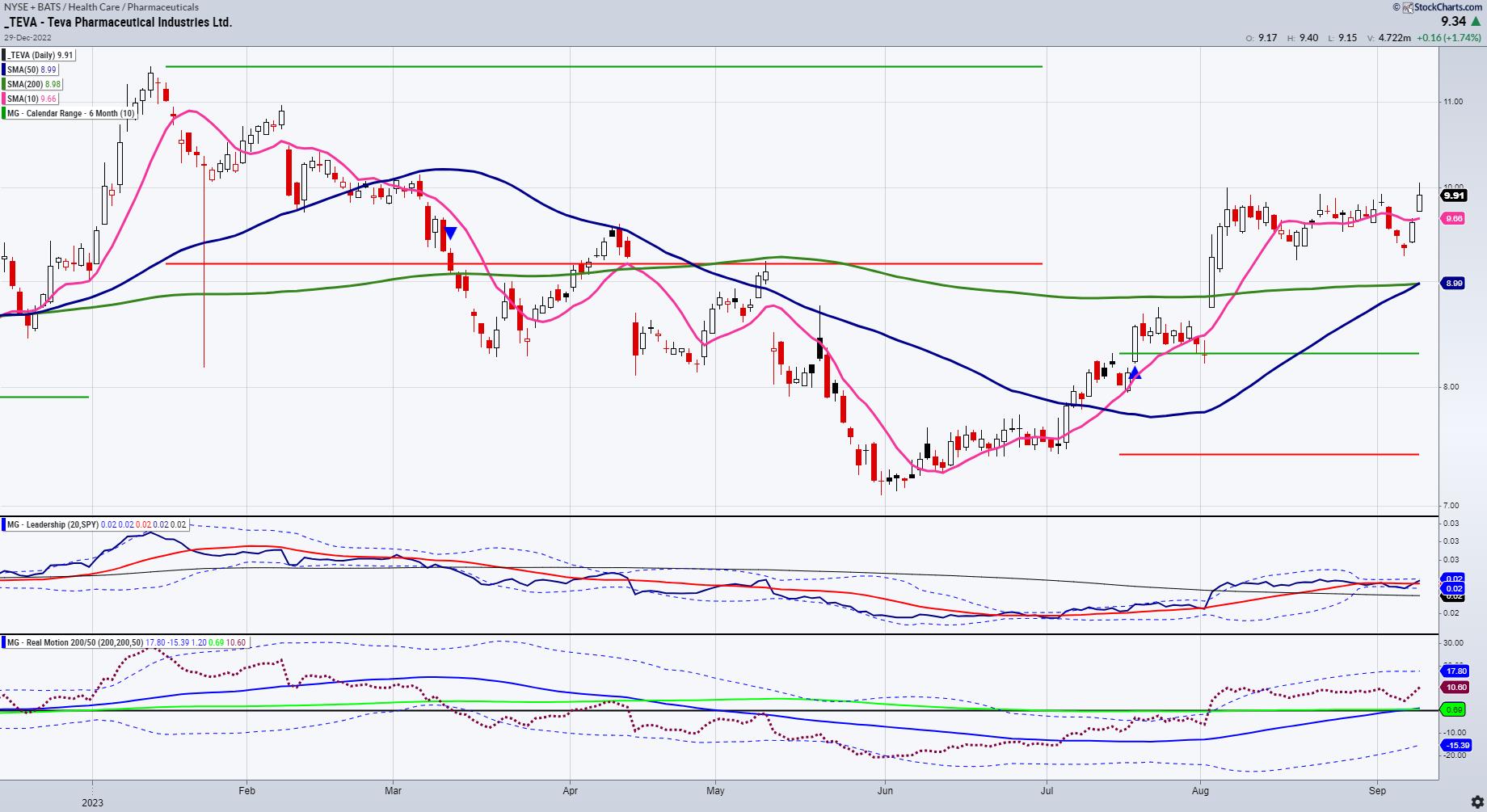

TEVA: A Pharma Stock to Watch

Every week, I am invited on Business First AM with Angela Miles to discuss the market and give a stock pick. This week, I covered TEVA, a stock I have talked about a few times and one, full disclosure, we are positioned in.

First, about the company:

Teva Pharmaceuticals is...

READ MORE

MEMBERS ONLY

Called It! The Drop in AAPL Before the Bell

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG presents a perfect example of what it is like being in the Moxie trading room, and the benefits the subscribers get from my trading methodology. TG was able to point out that AAPL was most likely going to pullback,...

READ MORE

MEMBERS ONLY

Percent Scale PnF Technique. Nvidia Case Study.

by Bruce Fraser,

Industry-leading "Wyckoffian"

A project that I have been working on in recent years is Horizontal PnF Counting using Percent Scaling. The method has generated promising results. Here we look at two case studies that illustrate the techniques value. Using the ‘Percentage Chart Scaling' Method in StockCharts.com Point & Figure charting...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Forms a Key Support; These Sectors Set to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, the importance of the support level of 19250 was discussed; it was mentioned that, if this level stands protected for NIFTY, the Index can rebound and inch higher towards 19700+ levels. While trading along these lines, the markets enjoyed trending sessions throughout the week. It...

READ MORE

MEMBERS ONLY

StyleButtons: The Key to an Optimized Charting Process! Here's How I Use ‘Em

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares one of the simplest yet most effective ways to streamline and enhance your charting routines on the SharpCharts workbench: StyleButtons. By assigning your favorite "ChartStyles" (chart templates that include all of the indicators,...

READ MORE

MEMBERS ONLY

MEM TV: Major Tech Group Turns Negative

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen McGonagle reviews the weakness in the broader markets while highlighting bright spots amid base breakouts. She also shares best ways to prepare your watch list and why the Dow Industrial Index outperformed.

This video originally premiered September 8,...

READ MORE

MEMBERS ONLY

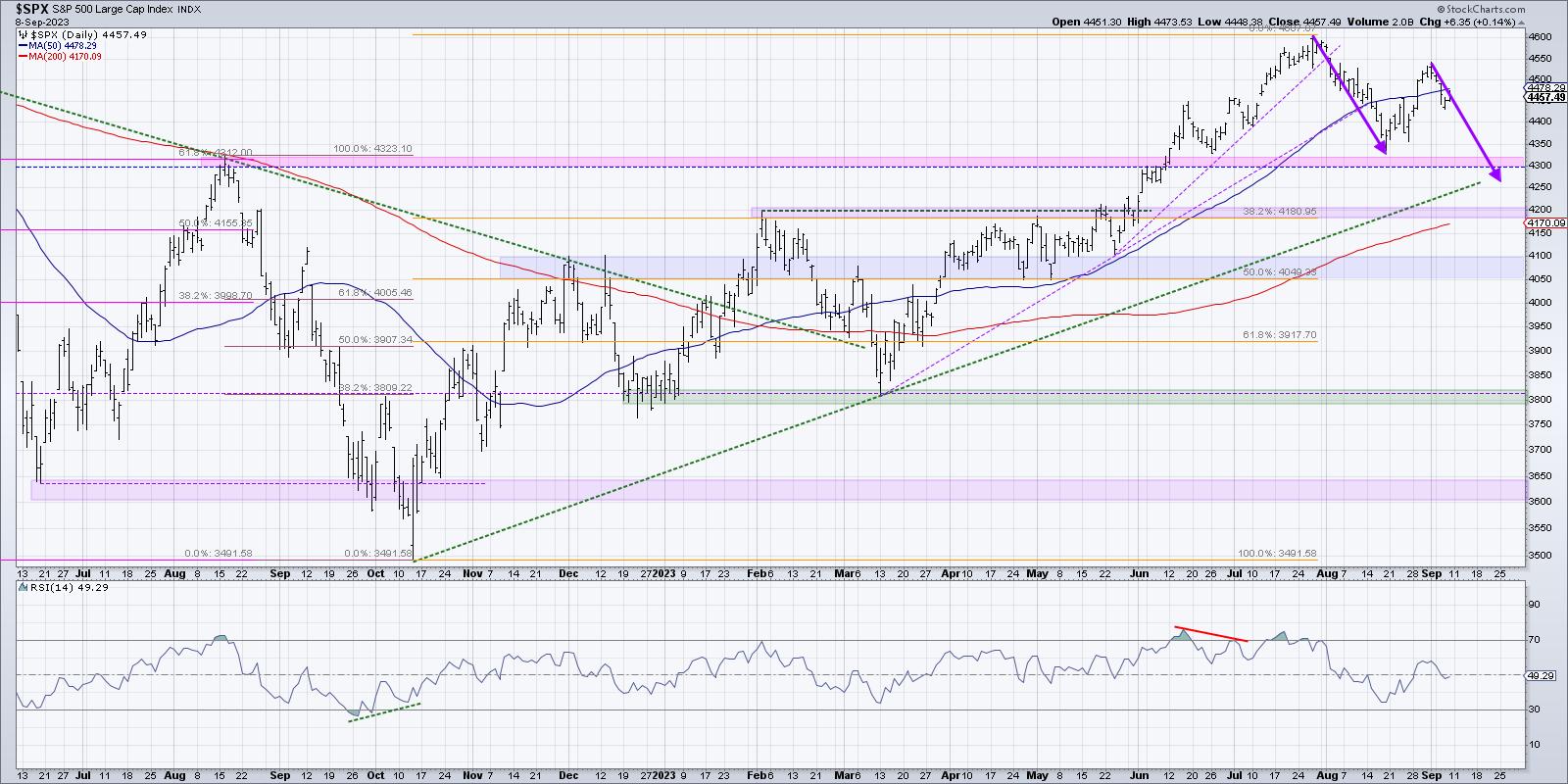

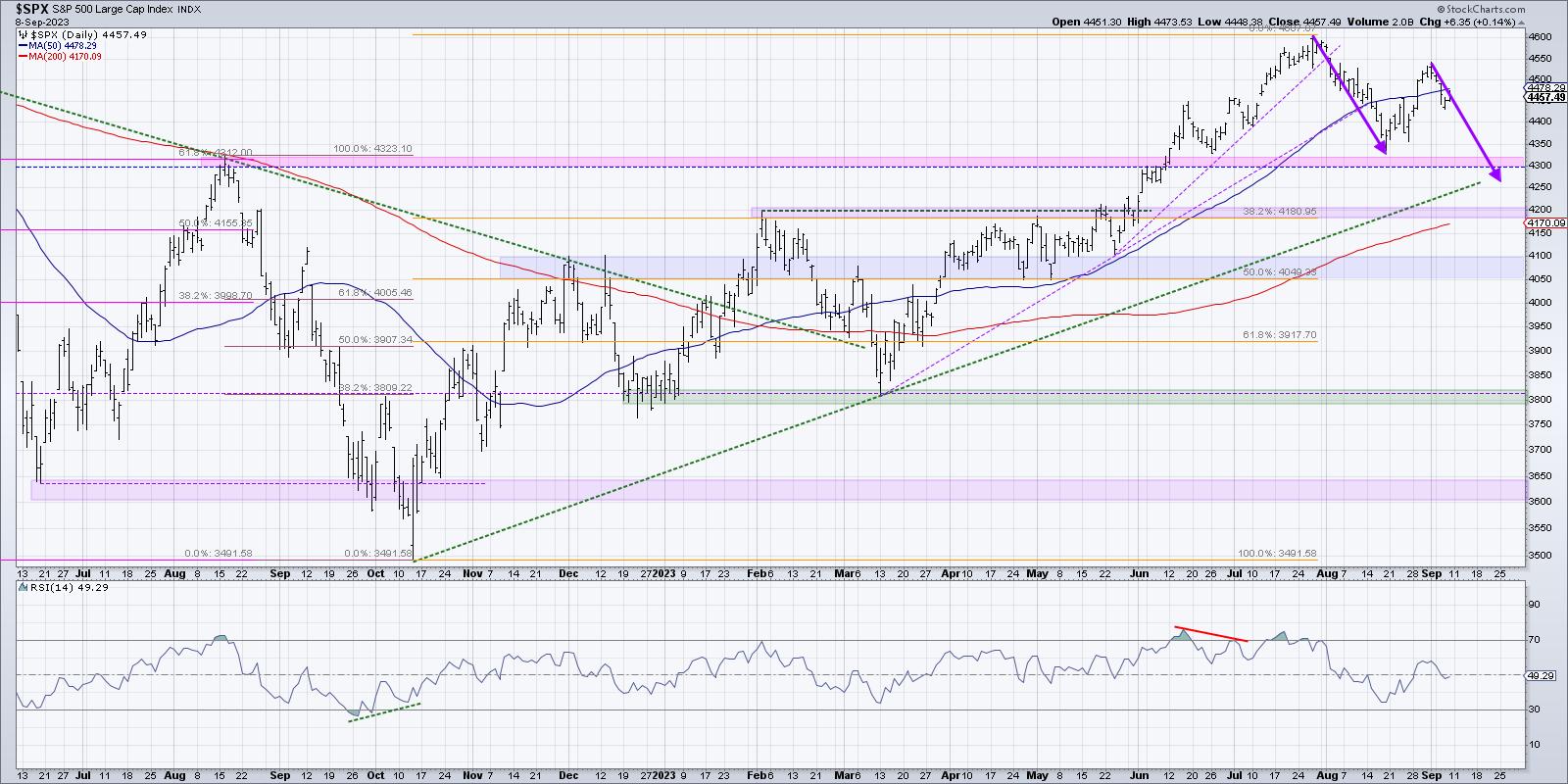

Which is More Likely -- SPX Over 4600 or Below 4200?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Top investors use probabilistic analysis to think through different scenarios to determine which appears the most likely.

* By thinking through each of four potential future paths for the S&P 500, we can be better prepared for whichever scenario actually plays out in the coming weeks.

We...

READ MORE

MEMBERS ONLY

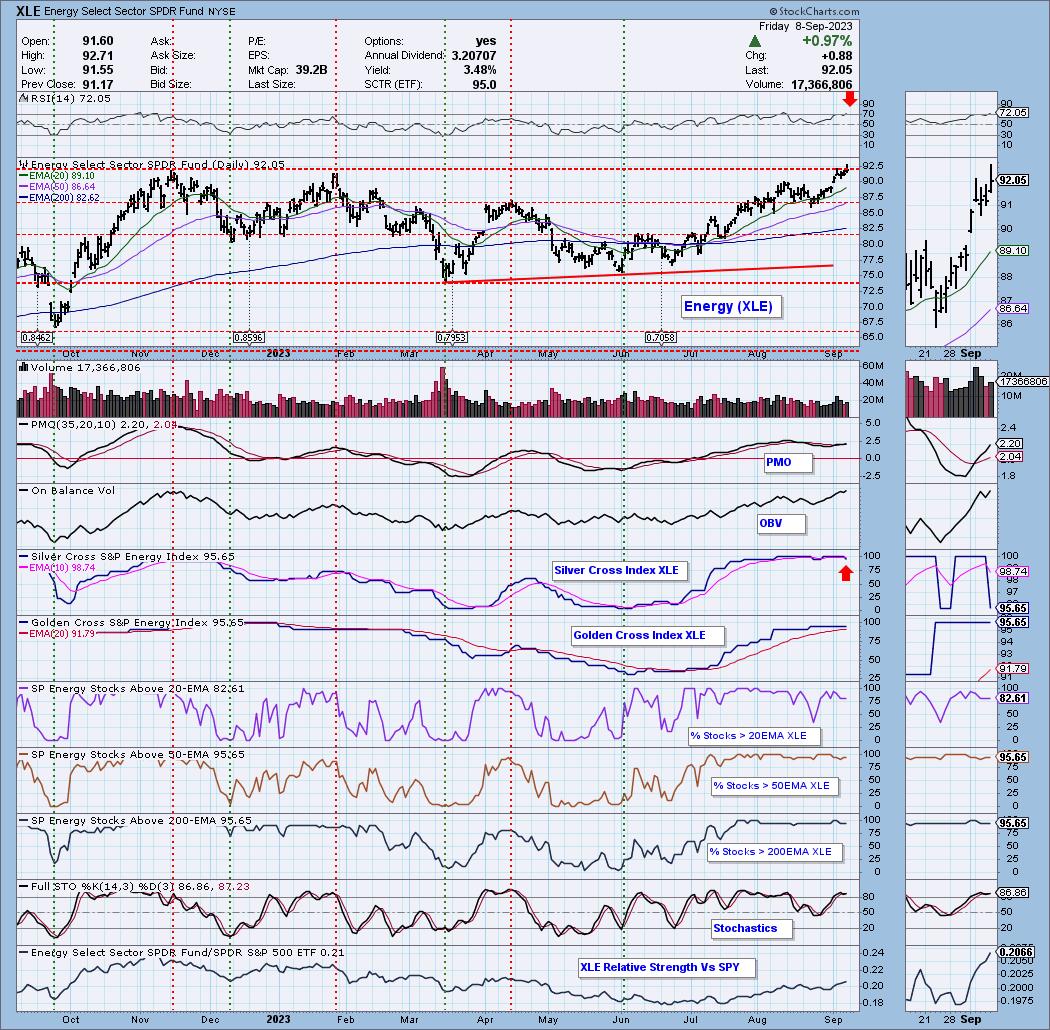

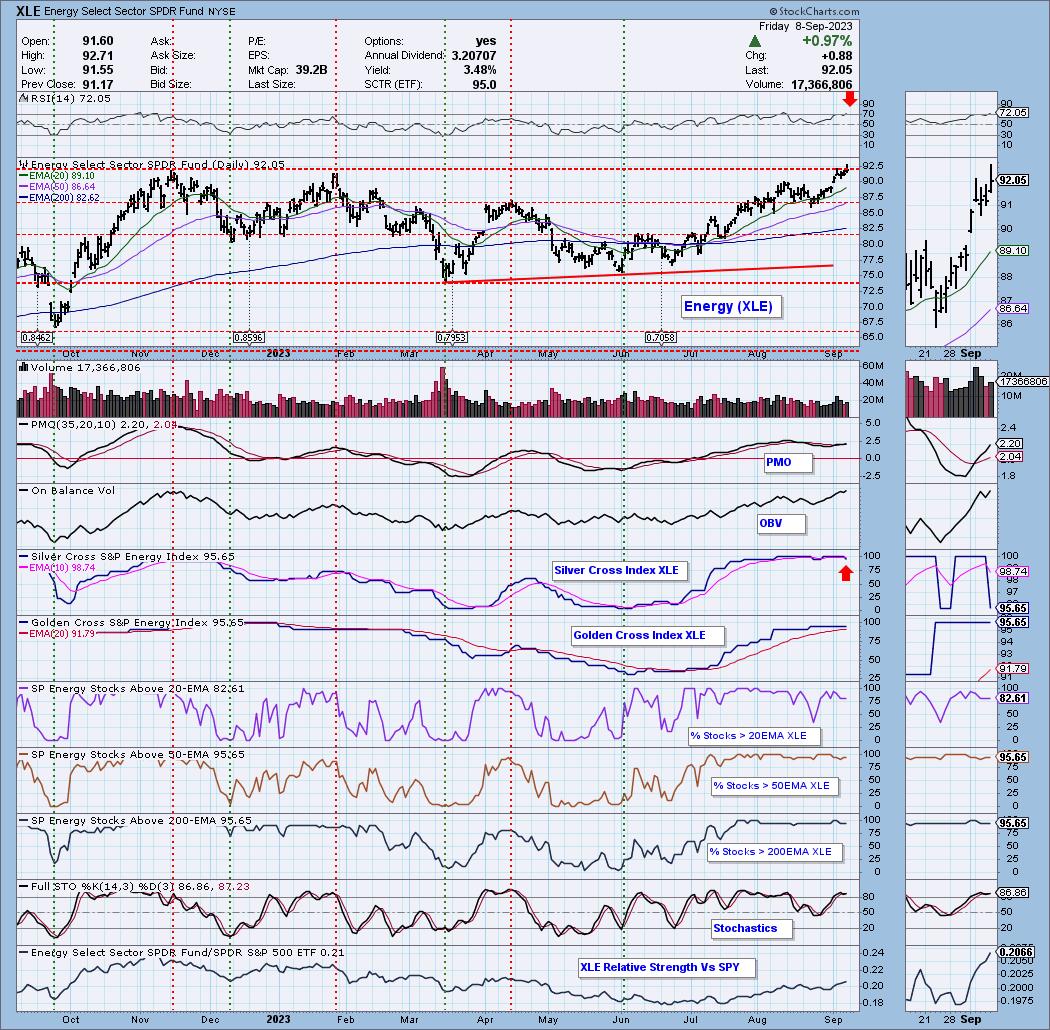

Energy Sector (XLE) Hits All-Time High, Should We Worry?

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* Energy (XLE) Logs New All-Time High

* XLE "Bearish Shift" on Silver Cross Index

The Energy sector (XLE) has been enjoying a rally throughout the summer. Today. it logged a new all-time high on a small breakout. While the sector looks impervious, there are a few concerns...

READ MORE

MEMBERS ONLY

BONDS & CASH - But Can We Find Better Income Alternatives?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps the week with a focus on weakening breadth conditions, the Russell 2000 and underperformance of small caps, and strong energy stocks driven by stronger crude oil prices. He answers viewer questions on using ETFs instead of bonds or...

READ MORE

MEMBERS ONLY

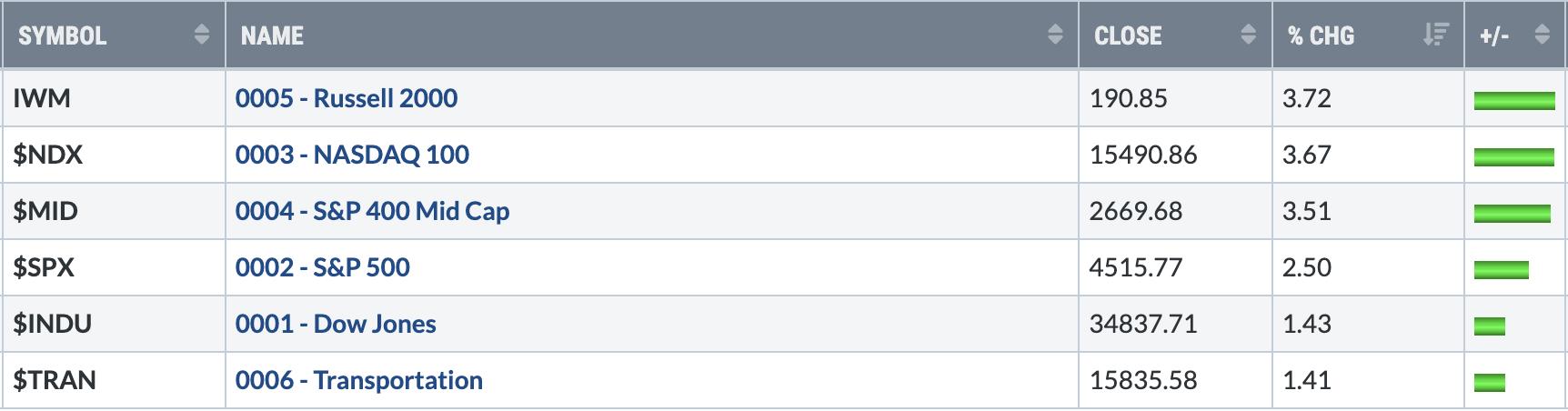

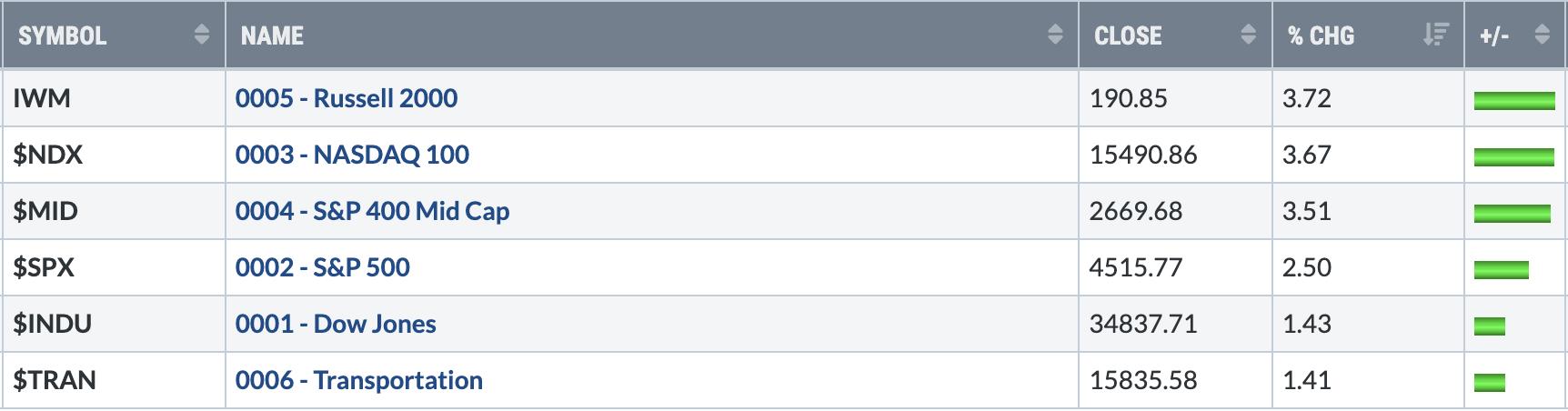

Stock Market Wrap-Up: Equities, Oil Close Higher While Treasury Yields Slightly Lower

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* September is usually a weak month in the stock market and this time it may be no different

* In spite of the selloff the broader equity indexes are still trending higher

* Rising oil prices and the US dollar may put some pressure on inflation

"September is when...

READ MORE

MEMBERS ONLY

Can the Windowmaker Natural Gas Resuscitate?

Probably the worst or at least one of the worst performers in the overall market and in the commodities market, natural gas is choppy and lifeless. So why write about it?

For starters, we love an underdog. Perhaps a bit too contrarian, as the reasons for the decline in natural...

READ MORE

MEMBERS ONLY

Optimizing Your Stock Selection With the Williams True Seasonal Indicator

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Williams True Seasonal is a unique tool that detects stocks via seasonality patterns

* The Williams True Seasonal indicator differs from other seasonality indicators in that it provides greater accuracy by tweaking the way it uses data

* The main benefit in using the Williams True Seasonal indicator is...

READ MORE

MEMBERS ONLY

ENERGY SPDR HITS RECORD HIGH AS OIL BREAKS OUT -- THAT COULD BE BAD FOR BONDS AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY BREAKOUTS... Several previous messages have talked about upside breakouts taking place in energy stocks. And that trend has only gotten stronger both in the stocks and the commodity. The upper box in Chart 1 shows the price of WTIC crude oil rising to the highest level since last November....

READ MORE

MEMBERS ONLY

Crucial Insights: How Rising Rates IMPACT You!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Willie Delwiche, CMT, CFA of Hi Mount Research outlines the long-term uptrend in interest rates and shares two sectors to focus on given the rising rate environment. Host David Keller, CMT tracks the sharp pullback for semiconductors and breaks...

READ MORE

MEMBERS ONLY

GNG TV: XOP's Strength vs. the S&P's Weakness

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Tyler examines a return to strong "Go" conditions in the US Dollar index (UUP) and US Treasury rates ($TNX) on both the daily and weekly timeframes. The trend following model is clearly to the upside, but momentum has not shown...

READ MORE

MEMBERS ONLY

How to Identify Great Trade Opportunities Using the MACD Zero Line

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the importance of the MACD Zero line. First, he discusses what the zero line is and why it is significant. Then, Joe shows how it can identify great trade opportunities when used in multiple timeframes. Joe...

READ MORE

MEMBERS ONLY

The Halftime Show: Energy Sector Continues Uptrend

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete goes over the usual suspects in the markets. He presents a review of both the SPX and the NDX indexes, followed by a review of the US Dollar and a quick look at bonds using the TLT ETF....

READ MORE

MEMBERS ONLY

Energy Stocks in the Spotlight: A Look at Diamondback Energy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Energy stocks are in focus as US crude oil prices continue rising higher

* Oil prices have more room to rise but if prices go too high there may be demand pressures

* Diamondback Energy is getting close to its 52-week high

With Labor Day weekend behind us, it'...

READ MORE

MEMBERS ONLY

FORGET Valuations, REMEMBER the Charts!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Ari Wald, CFA, CMT of Oppenheimer & Co. shows how energy stocks are taking a leadership role, with high beta sectors still outperforming low volatility defensive stocks. Host David Keller, CMT tracks the latest downswing and describes a potential...

READ MORE

MEMBERS ONLY

Technical Correction? Or Return of the Bear Market?

On July 5th, Mish wrote an article called "Sell in July and Go Away? Calendar Range Reset".

In that article, she noted, "should IWM fail to clear the calendar range high and worse, break down under a new 6-month calendar range low[...] it would be hard to...

READ MORE

MEMBERS ONLY

The Key to the August Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged in the second half of August with several ETFs breaking out of corrective patterns, such as falling flags or falling wedges. Even though September is a seasonally weak month, these breakouts are bullish until proven otherwise. Today's commentary will analyze the breakout in the Technology SPDR...

READ MORE

MEMBERS ONLY

Small-Caps Take BIG Plunge in Risk-Off Move

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave notes severe weakness in the small-cap space as the Russell 2000 forms a potential head-and-shoulders topping pattern. He answers viewer questions on index volume, Coppock curves and running oscillators on breadth indicators.

This video originally premiered on September 5,...

READ MORE

MEMBERS ONLY

It's Really All About the Retail Sector Now

This entire year, retail, as measured by the ETF XRT (a.k.a. the Granny of the Economic Modern Family), has underperformed the SPY and QQQs. Encumbered by higher interest rates, higher oil prices, higher inflation, higher insurance costs, and a burgeoning credit card debt, we have wondered many times...

READ MORE

MEMBERS ONLY

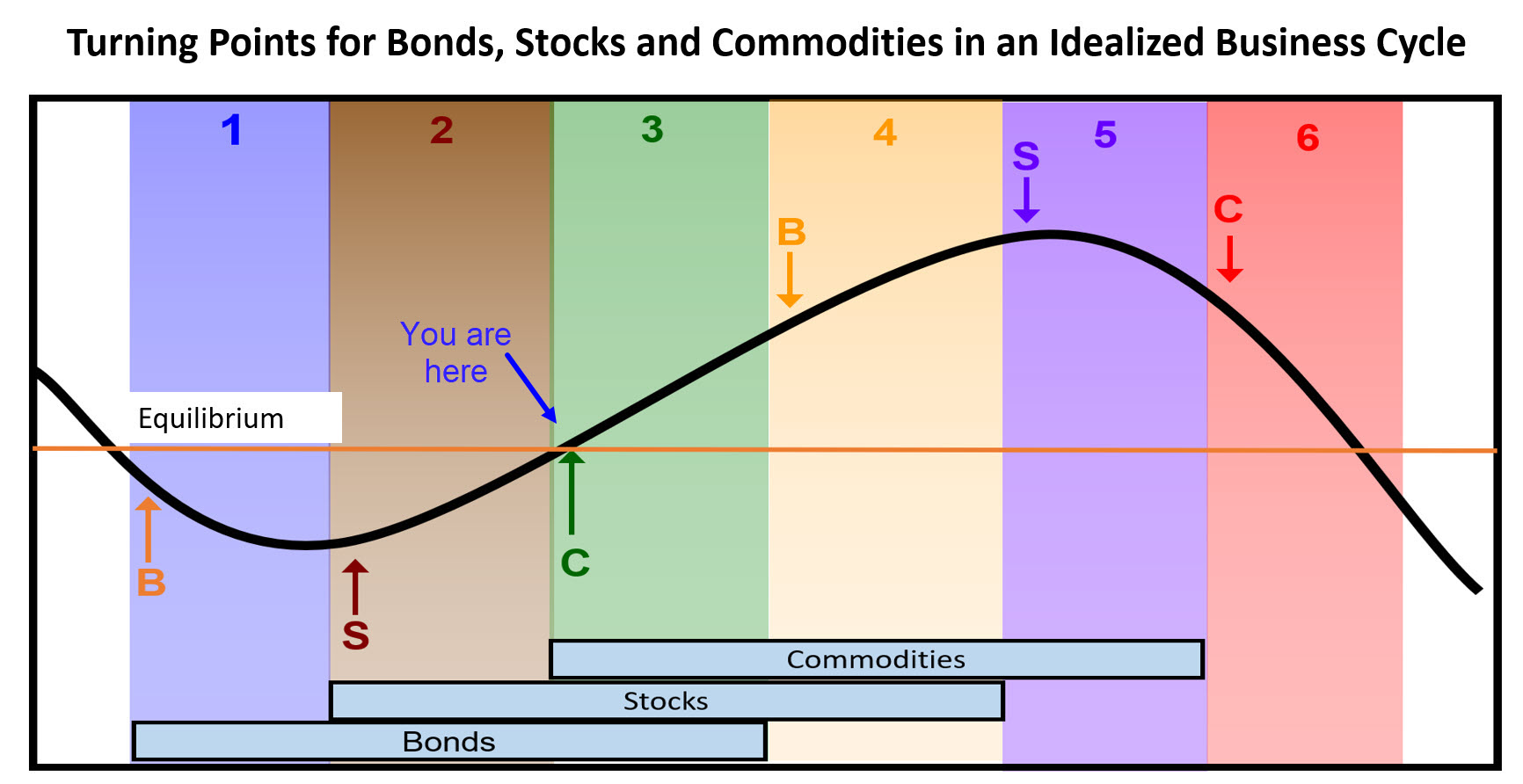

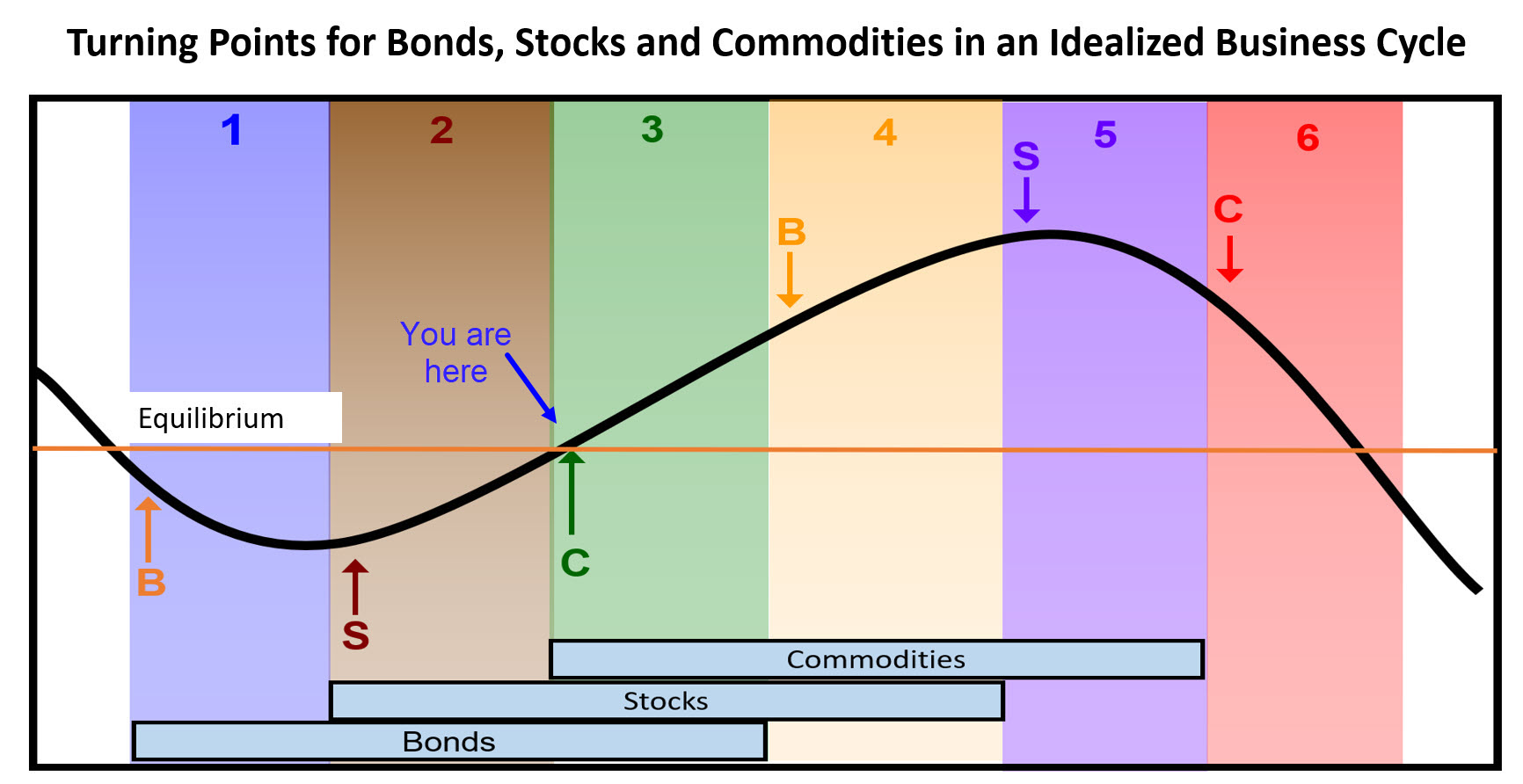

Some Investment Implications for Stage 3 of the Business Cycle

by Martin Pring,

President, Pring Research

The business cycle has been with us for as long as reliable financial records have been available, and that's at least 200 years. It may seem to be a mysterious force, but it is nothing more than a set sequence of chronological events that just keeps repeating. The...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch, September 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson co-host a special presentation, wherein they unveil the top 10 charts that are poised to shape the landscape of September 2023.

This video originally premiered on September 4, 2023. Watch on our dedicated Final Bar pageon StockCharts...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly RRG Shows Preference for Stocks Over Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The month of August has come to an end, and that means a focus on long-term trends, using monthly Relative Rotation Graphs in combination with the finalized price (bar-)charts for August, on this episode of StockCharts TV's Sector Spotlight. Julius de Kempenaer assesses the rotations of asset...

READ MORE

MEMBERS ONLY

Here's My Latest View of Current Market Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hello to all my StockCharts supporters! First of all, thank you for your readership of my Trading Places blog, which is now in its 8th year. Also, thanks to all of you that watch my Trading Places LIVE shows that air on Tuesdays, Wednesdays, and Thursdays at 9:00am ET....

READ MORE

MEMBERS ONLY

Week Ahead: Important for NIFTY To Stay Above This Level; Expect Outperformance in These Pockets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past five sessions of the week saw the Indian equities trading in a defined and narrower range. The first four sessions were seen leading the markets to a weekly loss, but the strong trading session on Friday saw NIFTY recouping its losses. The index oscillated in 234.90-point range,...

READ MORE

MEMBERS ONLY

You MUST Be Aware of This Seasonality Change

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love the seasonality information that StockCharts.com provides. It's important to keep in mind that seasonal tendencies are secondary indicators. I don't buy and sell based on them, because the price/volume combination will always be my primary indicator. But if technical indications point to...

READ MORE

MEMBERS ONLY

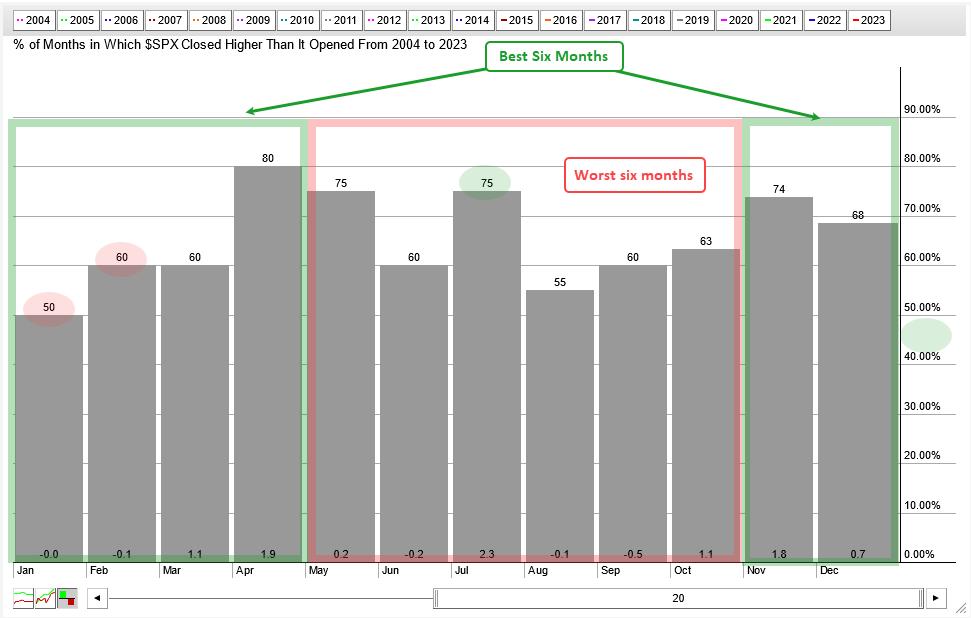

Seasonality versus Simply Market Timing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

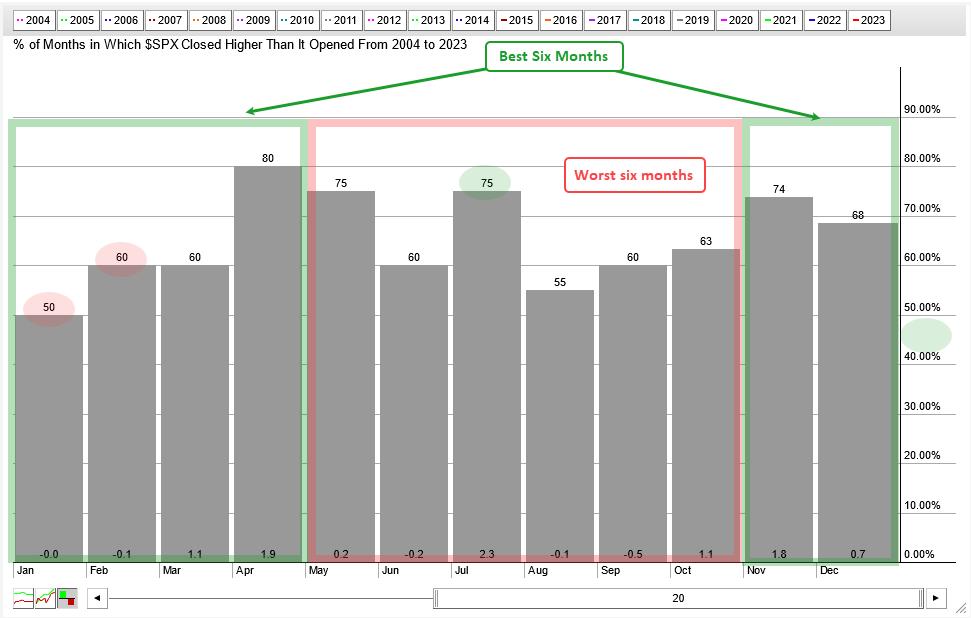

There is some validity to the best six months strategy, but investors would probably be better off with a simple timing tool. According to the Stock Trader's Almanac, the best six-month period runs from November to April. The worst six-month period runs from May to October. This is...

READ MORE

MEMBERS ONLY

Plenty of Setups Emerge as Bulls Regain Control

by Mary Ellen McGonagle,

President, MEM Investment Research

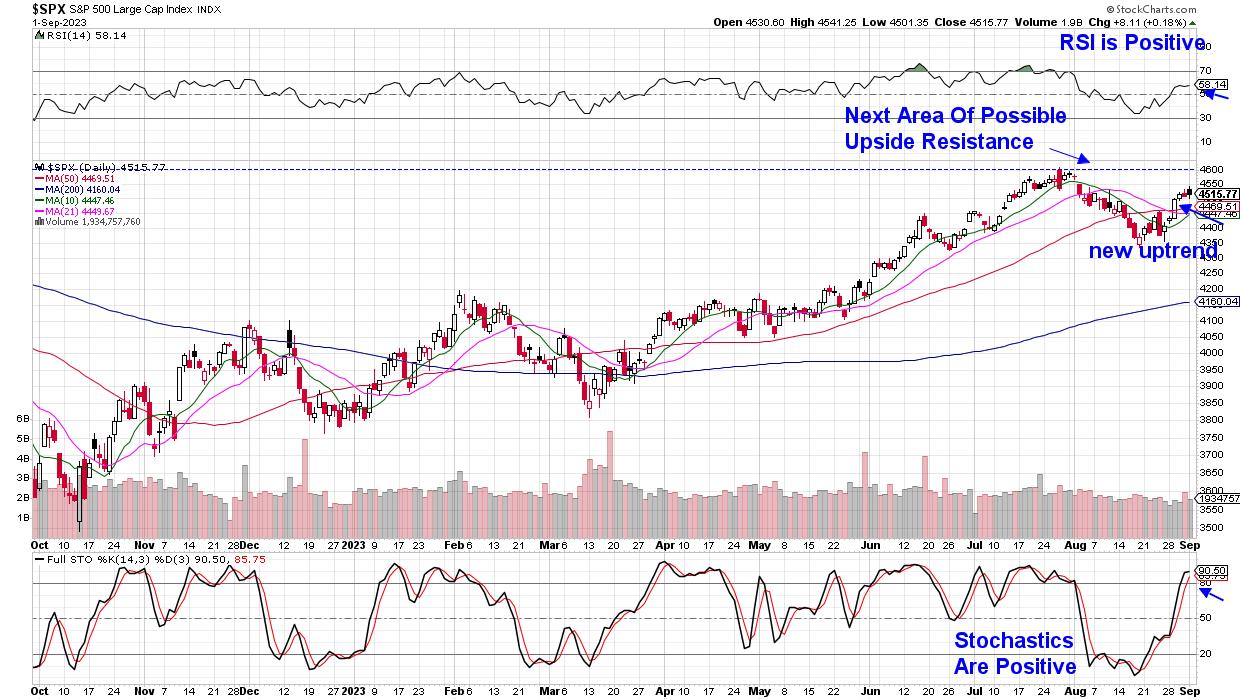

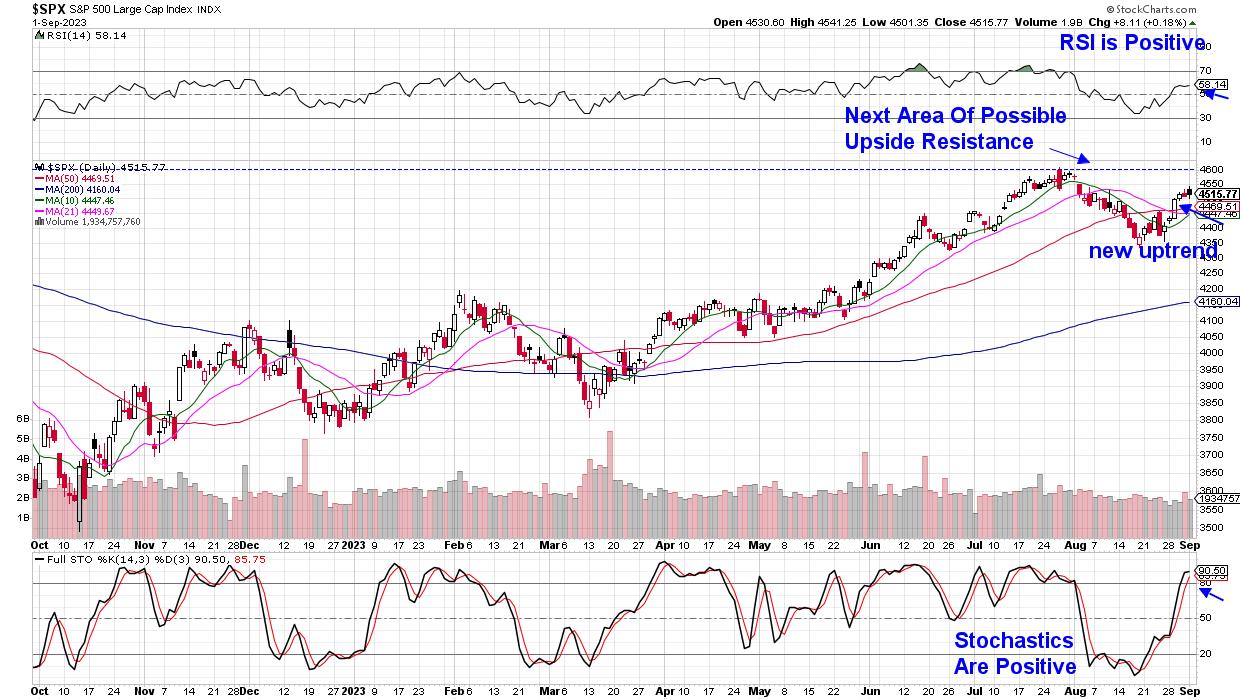

Last week, the broader markets regained their uptrend, with the S&P 500 and Nasdaq Indexes both closing above their key 50-day moving averages on Tuesday. In addition, the RSI and Stochastics turned positive as well. This price action indicates that the 3-week pullback which began in late July...

READ MORE

MEMBERS ONLY

Three Ways I Use RSI To Analyze Trends

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Momentum indicators like RSI can indicate overbought and oversold conditions, suggesting a short-term reversal.

* A bearish divergence, with higher prices and a lower RSI, often occur at the end of a bullish phase.

* By analyzing the range of the RSI, investors can confirm the overall trend phase and...

READ MORE

MEMBERS ONLY

MEM TV: Bullish Week Provides Perfect Setups!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the new uptrend in the markets and shares where the current strength is, as well as the best ways for you to participate. She also highlights the move back into earnings winners from last month as the...

READ MORE

MEMBERS ONLY

Yields, Oil, US Dollar Rise, Equities Tepid: Stock Market Starts the Month With Mixed Signals

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Overall, the stock market has managed to hold on to its upward rally even in spite of a pullback

* Crude oil prices rose on news of production cuts

* Treasury yields rose on the jobs report data

The much-awaited August jobs report was released on Friday. While it came...

READ MORE

MEMBERS ONLY

Typical Tesla STALLS Out at 50-Day Moving Average

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps the market week with a discussion of higher interest rates, their implication for growth stocks, and why charts like TSLA shouldn't get an "all clear" until they break above the 50-day moving average. He...

READ MORE

MEMBERS ONLY

Bottom-Up Stock Picking Made Easy with This Automated Scanning Set-Up

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson walks you through a "bottom-up" stock-picking approach that he uses daily on StockCharts, which helps him find the strongest stocks and best technical setups out there in the market. Learn how to customize your...

READ MORE

MEMBERS ONLY

GNG TV: Examining MAJOR Pullbacks within Secular "Go" Trends

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

GoNoGo Charts help investors retain an objective evidence-based view on what is actually happening in the markets, and this week has shown the weight of the evidence on the side of the bulls. In this edition of the GoNoGo Charts show, Alex and Tyler examine the fade of US Dollar...

READ MORE

MEMBERS ONLY

Focus on Stocks: September 2023

by Larry Williams,

Veteran Investor and Author

Cycle Deep Dive

At times, it seems there are as many cycles as there are traders. I have been focusing on the shorter-term ones, those ranging from 2 to 5 years.

Recently, I pondered on the clear fact that cycle forecasts work far better to spot market bottoms than tops....

READ MORE

MEMBERS ONLY

Trading Against the Crowd with the Williams Sentiment Index

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Contrarian investing wisdom suggests that opposing the general market sentiment can lead to viable market opportunities

* The Williams Sentiment Index measures the prevailing opinions and sentiment of financial advisors and offers insights into potential market turns

* The Williams Sentiment Index indicates when investor sentiment is exceedingly bullish or...

READ MORE