MEMBERS ONLY

Gold Buyers Should Remember FDR

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the Federal Government piling on debt at a record rate, many investors are looking to gold as a way to protect against all the bad things that could happen as a result of the reckless spending. Part of the process would be deciding how much of a portfolio should...

READ MORE

MEMBERS ONLY

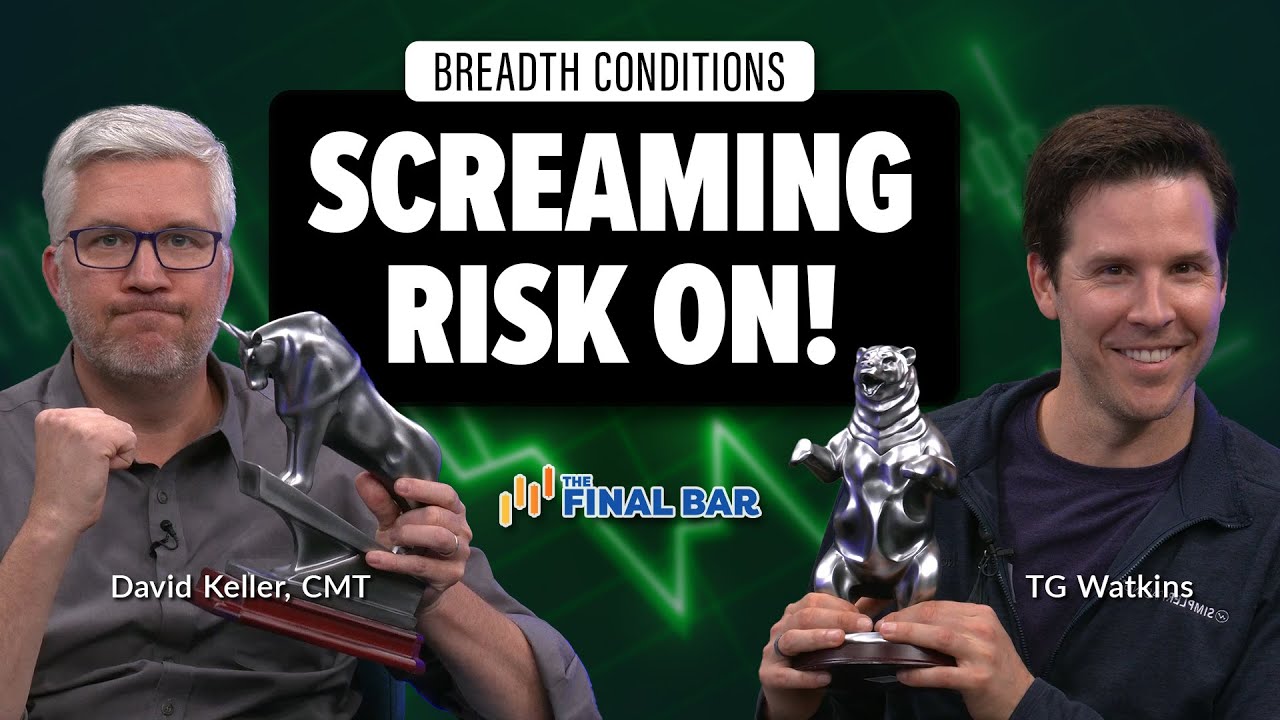

Every One of These Breadth Conditions are SCREAMING Risk On!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, TG Watkins of Simpler Trading shows how breadth conditions are very similar to previous bull market pullbacks. Dave focuses in on constructive setups in gold and crude oil, then highlights one semiconductor stock featuring a symmetrical triangle pattern.

This video...

READ MORE

MEMBERS ONLY

How to Spot the Early Signs of a Reversal Using ADX and DI Lines

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the importance of the DI lines when looking at the ADX indicator. He discusses how we can determine who is in control and when to be on the lookout for a reversal. Joe then analyses the...

READ MORE

MEMBERS ONLY

The Long-Term Bull Case for Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Adrien Zduńczyk of TheBirbNest charts Bitcoin's bounce off support at $25K and relates bullish Bitcoin trends to a broader risk appetite for investors. Host David Keller, CMT highlights the McClellan Oscillator breaking back above the crucial zero level...

READ MORE

MEMBERS ONLY

Positive Confidence Ratios Argue for Higher Stocks

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Comparing risky asskets with more conservative ones can reflect investor confidence

* Negative divergences offer subtle indications of a deterioration of a stock market rally

* An upward trend indicates that investor confidence is positive

Traders and investors pay a lot of attention to surveys to assess swings in sentiment,...

READ MORE

MEMBERS ONLY

What NOT To Do as a Trader

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with a short side setup that recently triggered. He also touches upon a simple way to stay on the right side on the market - so far, so good! After that, he resumes expounding on...

READ MORE

MEMBERS ONLY

Find Reliable Entry Points With the Williams Insider Accumulation Index

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Get a macro view of the market by analyzing the broader indexes

* Identify stocks which show a divergence between price and the Williams Insider Accumulation Index

* If accumulation is increasing and the stock price starts moving higher, it could be an ideal entry point

Whether you're...

READ MORE

MEMBERS ONLY

ANOTHER LOOK AT MARKET BREADTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADVANCE-DECLINE LINE BOUNCING... A glance at various measures of market breadth offers good and bad news. All of them are lagging behind the S&P 500 which is a caution sign. The good news is that they're bouncing off potential support lines. Chart 1 compares the S&...

READ MORE

MEMBERS ONLY

The GDP PCE ADP Waltz

Conference Board Economic Forecast:

Looking into 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. In the second half of 2024, we forecast that overall growth will return to more stable pre-pandemic rates, inflation will drift closer to 2 percent, and the Fed...

READ MORE

MEMBERS ONLY

Growth Stocks Shine in Short-Covering Rally

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, Danielle Shay of Simpler Trading breaks down the current short-covering rally and walks through her current setups for QQQ, NVDA, MSFT, and TSLA. Host Dave tracks the recent drop in interest rates and shows how Bitcoin has bounced off...

READ MORE

MEMBERS ONLY

The Halftime Show: Deciphering the Fed After Jackson Hole

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete reexamines the chart he posted before the Jackson Hole meeting; Chairman Powell validated his thinking that the Fed Policy will remain tight until the unemployment rate increases. He then gives a quick review of the SPX and the...

READ MORE

MEMBERS ONLY

Predicting Tomorrow's Price Movements Today: Introducing the Williams Cycle Forecast

by Karl Montevirgen,

The StockCharts Insider

What if you had access to a forecasting tool capable of predicting the most likely path prices may take roughly in the next three months? The caveat here is that it can't accurately pinpoint the peaks and troughs, but it can approximate them with relative accuracy.

This is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Three Takeaways from Seasonal Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In August's last regular episode of StockCharts TV's Sector Spotlight, I address the seasonal patterns in sector rotation and looks to find alignment with the current rotations as they are playing out on the Relative Rotation Graph. September is not the strongest month in terms of...

READ MORE

MEMBERS ONLY

Will the Rotation to Small Caps Hold and Last THIS TIME?

In this special edition of StockCharts TV'sThe Final Bar, guest host Mish Schneider (MarketGauge) steps in for Dave. Mish puts her own spin on the Market Recap, starting with the indices and exploring sectors using her "Economic Modern Family" analysis.

Mish then sits down with Keith...

READ MORE

MEMBERS ONLY

Bonds, Secular Bear Market, and the Impact on Small Caps

Bonds have had one of the worst years in modern times and one of the fastest rates of interest rate rises.

The good news is the market has absorbed the bond's performance. A better risk-on environment is when the SPY outperforms the long bonds. The same is true...

READ MORE

MEMBERS ONLY

DP Trading Room: New Market Bias Assessment Table

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl introduces viewers to the new Market Bias table now included in the DecisionPoint Alert. This table covers all the major indexes, sectors, and select industry groups. He goes over how we determine the bias in the intermediate and...

READ MORE

MEMBERS ONLY

Week Ahead: Corrective Undertone To Persist So Long As Nifty Below These Levels; These Sectors To Stay Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a week that has gone by, Indian equities continued to heavily consolidate. They defended key levels for most of the week; it was in the last two trading sessions that the markets came off from their high point while giving up all their weekly gains. The trading range got...

READ MORE

MEMBERS ONLY

How William O'Neil - The Legendary Investor - Changed My Life

by Gatis Roze,

Author, "Tensile Trading"

I felt it only right to publicly acknowledge and thank William J. O'Neil for the lifestyle I enjoy today. He passed away in May at the age of 90, and I wanted to wait until now to explain how he changed my life.

William O'Neil was...

READ MORE

MEMBERS ONLY

MEM TV: Nasdaq Close to New Uptrend with These Bullish Signals

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the strength in Tech-heavy Nasdaq and highlights what to be on the lookout for to signal a new uptrend. She also reviews positive high yield stocks for those more cautious on the markets.

This video originally premiered...

READ MORE

MEMBERS ONLY

Watch These Four Horrible Charts in the Dow Jones Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* $INDU chart resting at double support and likely to bounce higher

* Outperform the index by avoiding four stocks

The Relative Rotation Graph above, which shows the rotations inside the DJ Industrials index, exhibits an evenly-spread-out universe of stocks. This is primarily the result of $INDU being a price-weighted...

READ MORE

MEMBERS ONLY

Can Small Caps Lead the Market Higher? A Video Analysis

Small caps, as measured by IWM, are key for the fall and heading into 2024. You can also look at the S&P 600 (SML).

IWM could be forming an inverted head-and-shoulders bottom, going back from the start of 2023. (See the rectangle area of the IWM chart). SPY...

READ MORE

MEMBERS ONLY

The Five Ratios ALL Investors Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, join Dave as he breaks down the power of ratio analysis and reveals why it's an essential tool for every savvy investor.

This video originally premiered on August 25, 2023. Watch on our dedicated Final Bar pageon...

READ MORE

MEMBERS ONLY

How the Market is Shaping Up After 3 Weeks Down

by TG Watkins,

Director of Stocks, Simpler Trading

The market had a really stiff downside move that lasted three weeks, with a capitulation bounce finally happening last Friday. On this week's edition of Moxie Indicator Minutes, TG explains why, at this point, he would assume the market needs to take time and figure out if it...

READ MORE

MEMBERS ONLY

What FIRST STEPS You Need to Take When Things Get "Iffy"

by Dave Landry,

Founder, Sentive Trading, LLC

With the market potentially topping out, now's the time to review what to do when the market gets "iffy." In this week's edition of Trading Simplified, Dave walks you through how he handles the inevitable drawdowns and shares some of his favorite performance-based metrics....

READ MORE

MEMBERS ONLY

Trading With the Williams Money Flow Index

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Large pools of "informed money" have a significant impact on price movements in the market

* The Williams Money Flow Index is designed to reveal "institutional" buying and selling activity that may sway the longer-term price direction

* The Williams Money Flow Index can be applied...

READ MORE

MEMBERS ONLY

SELL The News! NVDA Trades Lower After Strong Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Sean McLaughlin of All Star Charts shares best practices for trading options during periods of price consolidation. Host Dave highlights bearish engulfing patterns for the SPY and QQQ, as well as leading growth stocks like MSFT and META.

This...

READ MORE

MEMBERS ONLY

GNG TV: On the Lookout for LOVE with GoNoGo Charts

by Tyler Wood,

Co-founder, GoNoGo Charts®

As all eyes watch the Fed in anticipation of this week's Jackson Hole Summit, GoNoGo Charts help investors retain an objective, evidence-based view on what is actually happening in markets. In this edition of the GoNoGo Charts show, Tyler examines US Dollar strength (UUP) and the rally in...

READ MORE

MEMBERS ONLY

The Top 3 Reasons Why THIS is My Favorite Entry Trigger

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe answers a viewer question about entry signals. He gives a detailed example of what his favorite trigger signal is for entering a trade, then shows how MACD, ADX and trend analysis can help support this entry. Afterwards,...

READ MORE

MEMBERS ONLY

Growth Stocks Seen THRIVING in Anticipation of NVDA Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Callie Cox of eToro talks growth vs. value in the face of a rising interest rate environment, and why this is the most important "hurdle" for investors to watch. Dave focuses in on the technical picture for...

READ MORE

MEMBERS ONLY

The Dollar Index Goes to Missouri

by Martin Pring,

President, Pring Research

The Dollar Index has experienced a nice rally since mid-July and now reached important resistance. It's time to show us whether it can push through, thereby signaling an important extension to the recent advance. Before we examine that possibility, however, let's briefly take a step backwards...

READ MORE

MEMBERS ONLY

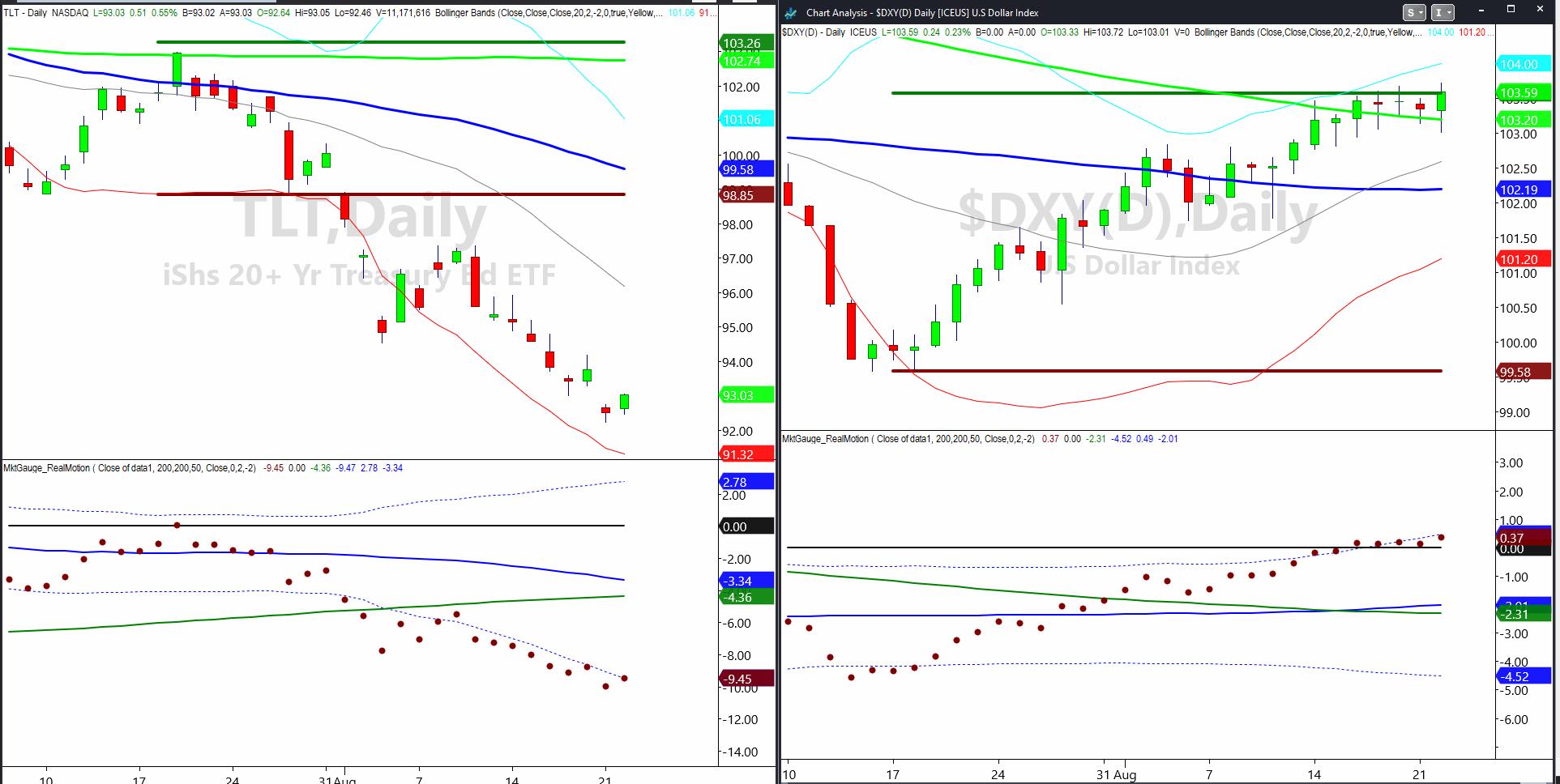

MarketGauge's Market Beat Rarely Misses a Beat!

Over the course of our writing the Daily, it has served as a reliable and remarkable guide for investors, traders, and investments.

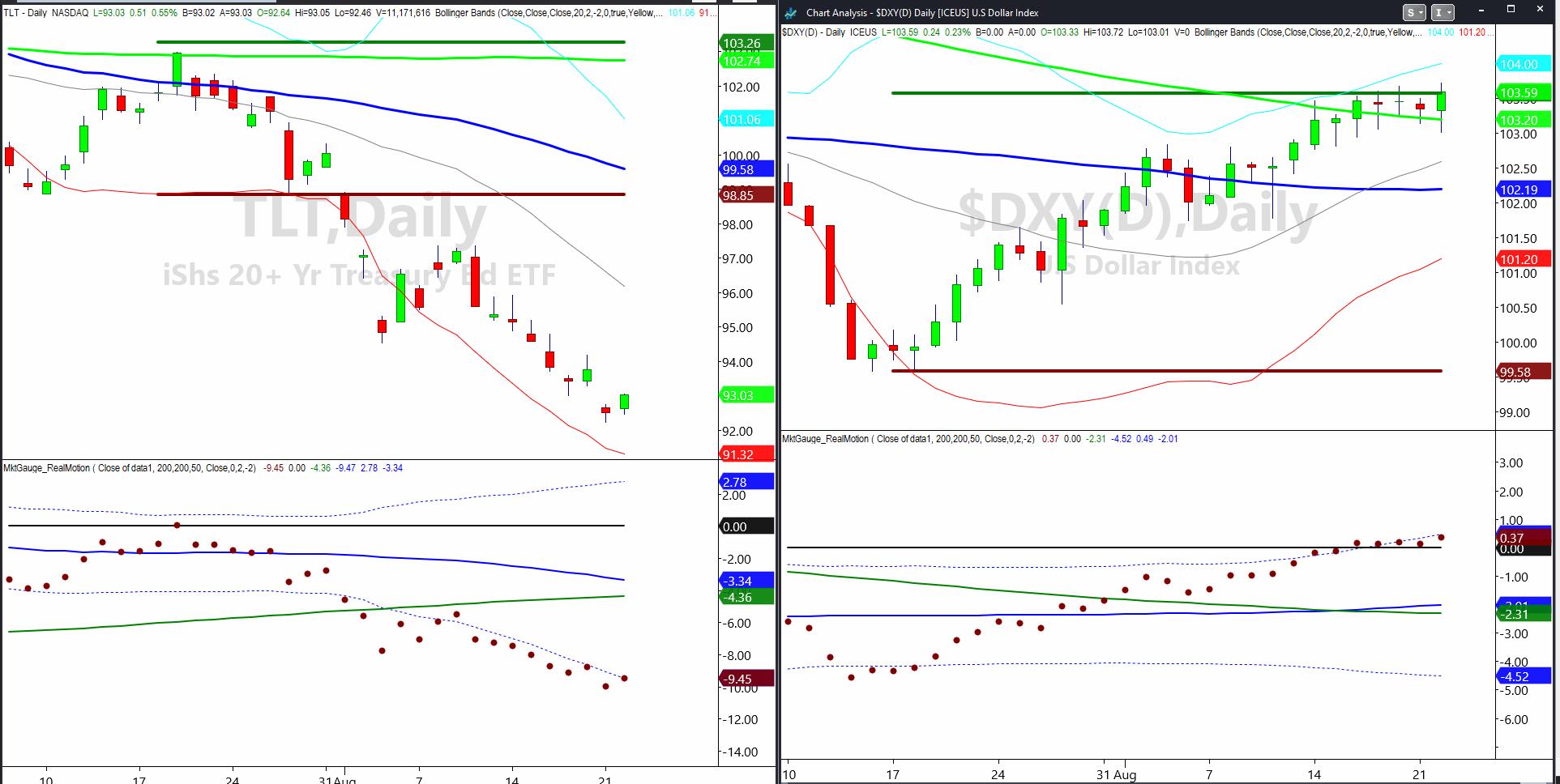

For example, looking most recently on August 22nd, we wrote about watching the dollar decline and TLTs rising. That is happening. Earlier this week, we wrote about Biotechnology...

READ MORE

MEMBERS ONLY

The US Dollar and Long Bonds Doing the Dosey Doe

With BRICS happening ahead of Jackson Hole, we thought it would be good to look at the technical charts on both the dollar and the long bonds.

The chart below shows that BRICS vs. G7 as a share of purchasing power has increased since 1995. With the number of countries...

READ MORE

MEMBERS ONLY

VIX Flashes a Key BEARISH Symbol for Stocks!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Doug Ramsey, CFA CMT of The Leuthold Group, laments the chronic underperformance of small-cap stocks and reveals a market indicator based on the VIX that gave a bearish signal this week. Dave prepares for NVDA's earnings this...

READ MORE

MEMBERS ONLY

Why You NEED to Be Practicing Evidence-Based Investing

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

This is the fifth video in a multi-part educational series from Tyler Wood, CMT and Alex Cole, co-founders of GoNoGo Charts®.

Alex and Tyler bring all the concepts from this series together to form a practical approach to market analysis and trading decisions. By answering just three simple questions, investors...

READ MORE

MEMBERS ONLY

Is There "Blood in the Streets" for August 2023?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the dramatic upswing in growth sectors as semiconductor names rally in anticipation of Nvidia's earning release. He answers viewer questions on multiple timeframe analysis and how to know when there is "blood in the streets&...

READ MORE

MEMBERS ONLY

Biotechnology on Drugs

Biotechnology has traded basically sideways since the start of 2023.

In the face of higher rates, stronger dollar, inflation, FDA approvals and busts, and an emerging winter season, the ETF IBB has a serenity to it that appears drug-induced, if you will.

Of the top 10 holdings, Regeneron is the...

READ MORE

MEMBERS ONLY

Sector Spotlight: This Powerful Use of RRG Will Make Your Head Spin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the Relative Rotation Graphs for cap-weighted and equal-weighted sectors side by side, then make an assessment regarding his preference for each of them. I then zoom in on the chart technical comparisons for four sectors. Finally, I...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Bullish Industry Groups

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl presents a thorough review of the markets, including Gold and Crude Oil. He also comments on the possibility that the housing market has hit rock bottom... though that's not likely. Erin digs out two industry groups...

READ MORE

MEMBERS ONLY

The Halftime Show: TSLA Review -- Anatomy of a Trade Setup

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete shares a review of the overall market, then digs into a setup in Tesla from April that resulted in a 50% move. The US Dollar is breaking out as rates move higher and, as a result, the 10-Year...

READ MORE

MEMBERS ONLY

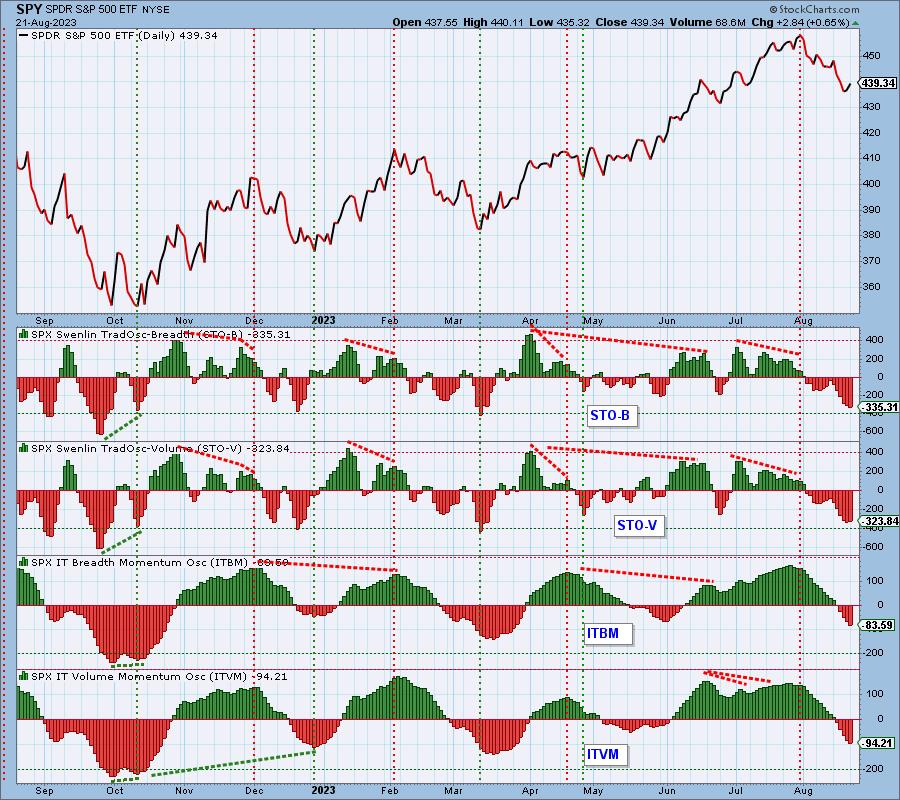

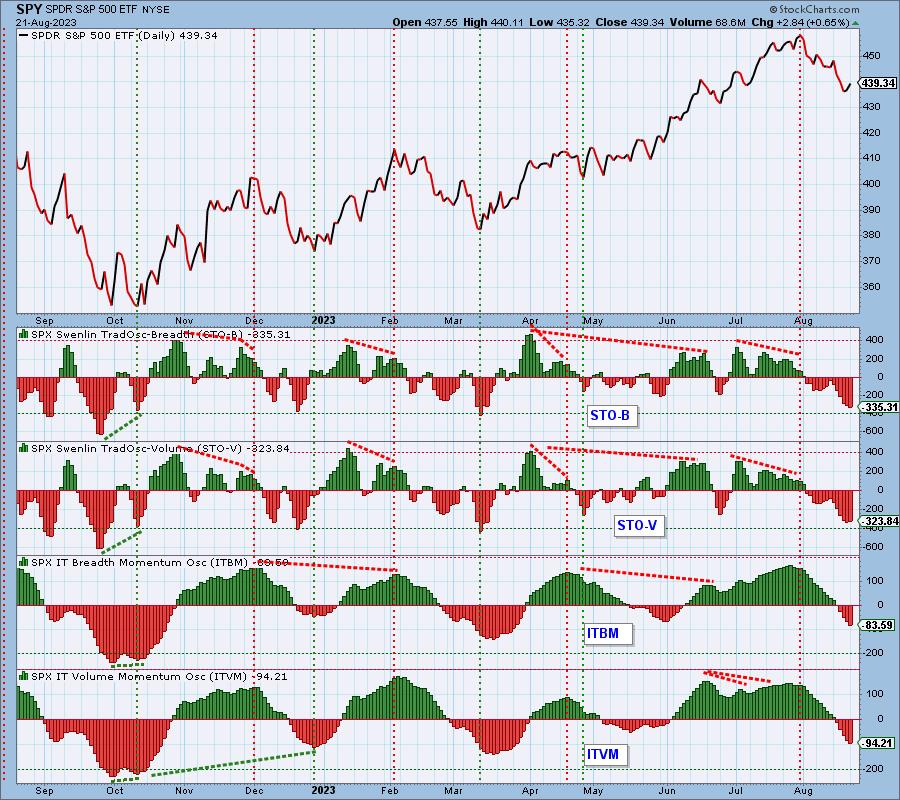

Swenlin Trading Oscillators Trying To Turn Up

by Erin Swenlin,

Vice President, DecisionPoint.com

It was ultimately a decent rally today on the SP500 with help from the tech heavy Nasdaq. Swenlin Trading Oscillators (STOs) are our primary short-term indicators. They have been in decline for all of the indexes, but we noted a few trying to turn up. The SPY saw a rise...

READ MORE