MEMBERS ONLY

A Nasdaq 100 Stock Showing Relative Strength in August

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard in August with QQQ leading the way lower and breaking its July low. Stocks that did not break their July lows are holding up better and showing relative strength. These are the stocks I want on my WatchList for tradable pullbacks and short-term breakouts. AMAT is...

READ MORE

MEMBERS ONLY

Today's Price Action Could Be the Start of a Rally Attempt

by Mary Ellen McGonagle,

President, MEM Investment Research

The market's August slump deepened this past week, with each of the major Indexes dropping more than 2% as Treasury yields hit a 15-year high. That said, today's price action could signal the start of a rally attempt, after the broader markets closed in the upper...

READ MORE

MEMBERS ONLY

Are You Ready for a Huge Selloff?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The major equity benchmarks have broken initial support levels, fueled by weakening momentum and declining breadth conditions.

* A break below trendline and moving average support could indicate a high likelihood of further potential downside.

* Seasonal studies suggest a strong 4th quarter, so look for a hold of the...

READ MORE

MEMBERS ONLY

MEM TV: Should You Buy the Dip? Here's How to Prepare Your Watchlist!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's driving these markets lower, as well as key areas of support. She also shared best practices for putting your watchlist together so you can participate in the market's new uptrend.

This video...

READ MORE

MEMBERS ONLY

How High Will U.S. Yields Fly?

On Thursday, August 17th, I sat down with Maggie Lake and Real Vision. During the 36-minute interview, the overriding theme continues to be one of "Stagflation".

Here are the main points:

1. Rates: We don't really know yet the impact of the rapid rate rise.

2....

READ MORE

MEMBERS ONLY

Unlocking Insights: Your Top Questions Answered! Q&A with Dave

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special "all-mailbag" edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on trailing stop techniques, when to consider over-weighting small cap stocks, using the MACD indicator for market timing, and much more!

This video originally premiered on August 18, 2023. Watch on our...

READ MORE

MEMBERS ONLY

Stock Market Rebounds: After Volatile Week Market Beats Bearish Pressure

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market was hit hard by China's economic woes but rebounded

* Technology and Communication Services sectors were hit hard this week

* Bitcoin shares fall to June levels

This week's stock market activity gave us an unpleasant reminder of how equities can turn on a...

READ MORE

MEMBERS ONLY

US Stocks Are Lagging The World For Now, But This Alternative Could Skyrocket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* US stocks are lagging the world on RRG

* The Indonesian stock market looks ready to jump

* The iShares EIDO (MSCI Indonesia) ETF can be used to play that market

Let's take a look at the rotation of stock markets around the world. The Relative Rotation Graph...

READ MORE

MEMBERS ONLY

TEN-YEAR BOND YIELD NEARS UPSIDE BREAKOUT -- NEXT UPSIDE TARGET COULD BE 2007 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR YIELD TESTING OCTOBER HIGH... Last week's message suggested that rising bond yields (along with rising energy prices) was one of the factors that could push an overbought stock market into a downside pullback. More on that shortly. The big story of the week, however, was how much...

READ MORE

MEMBERS ONLY

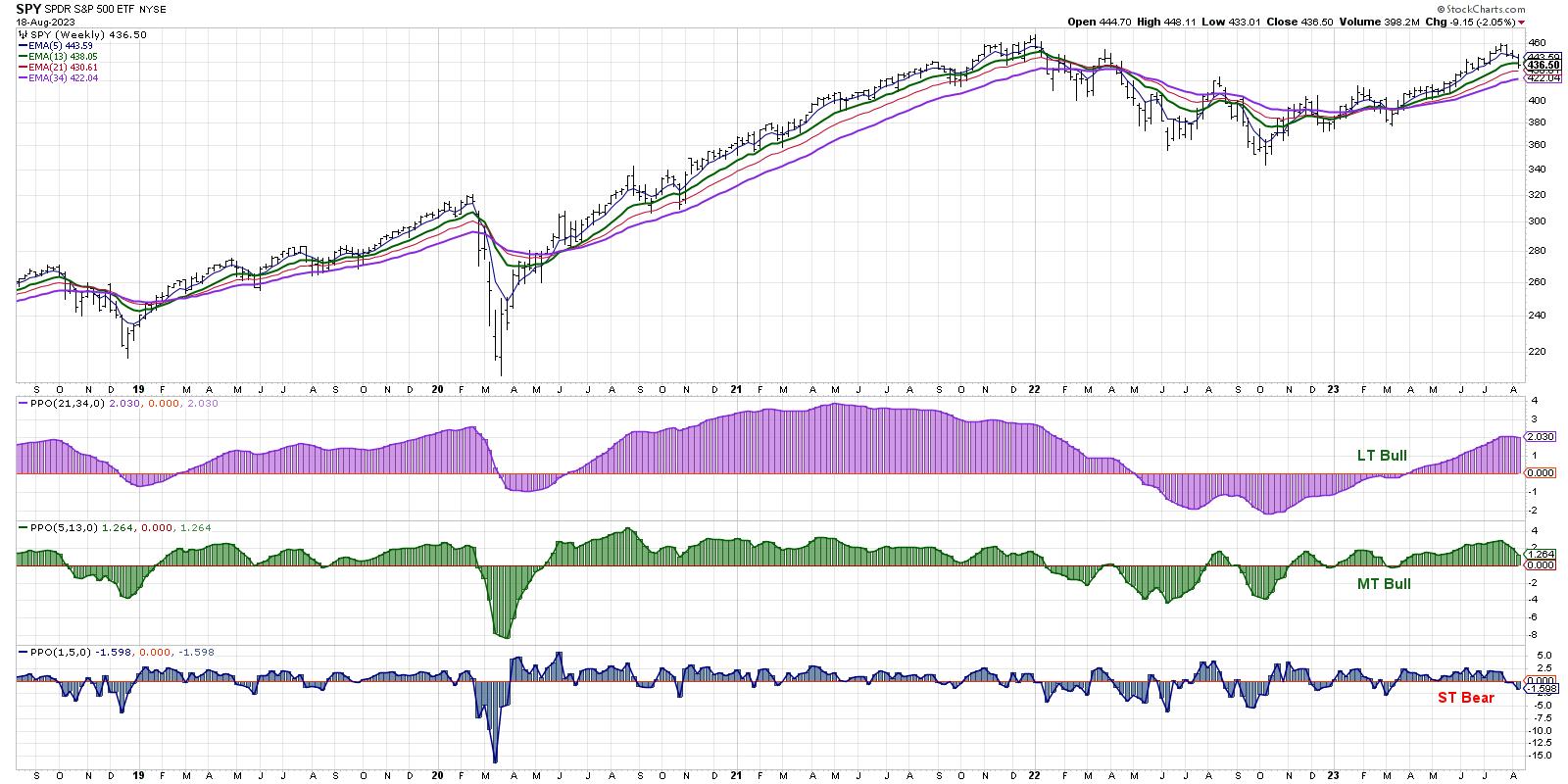

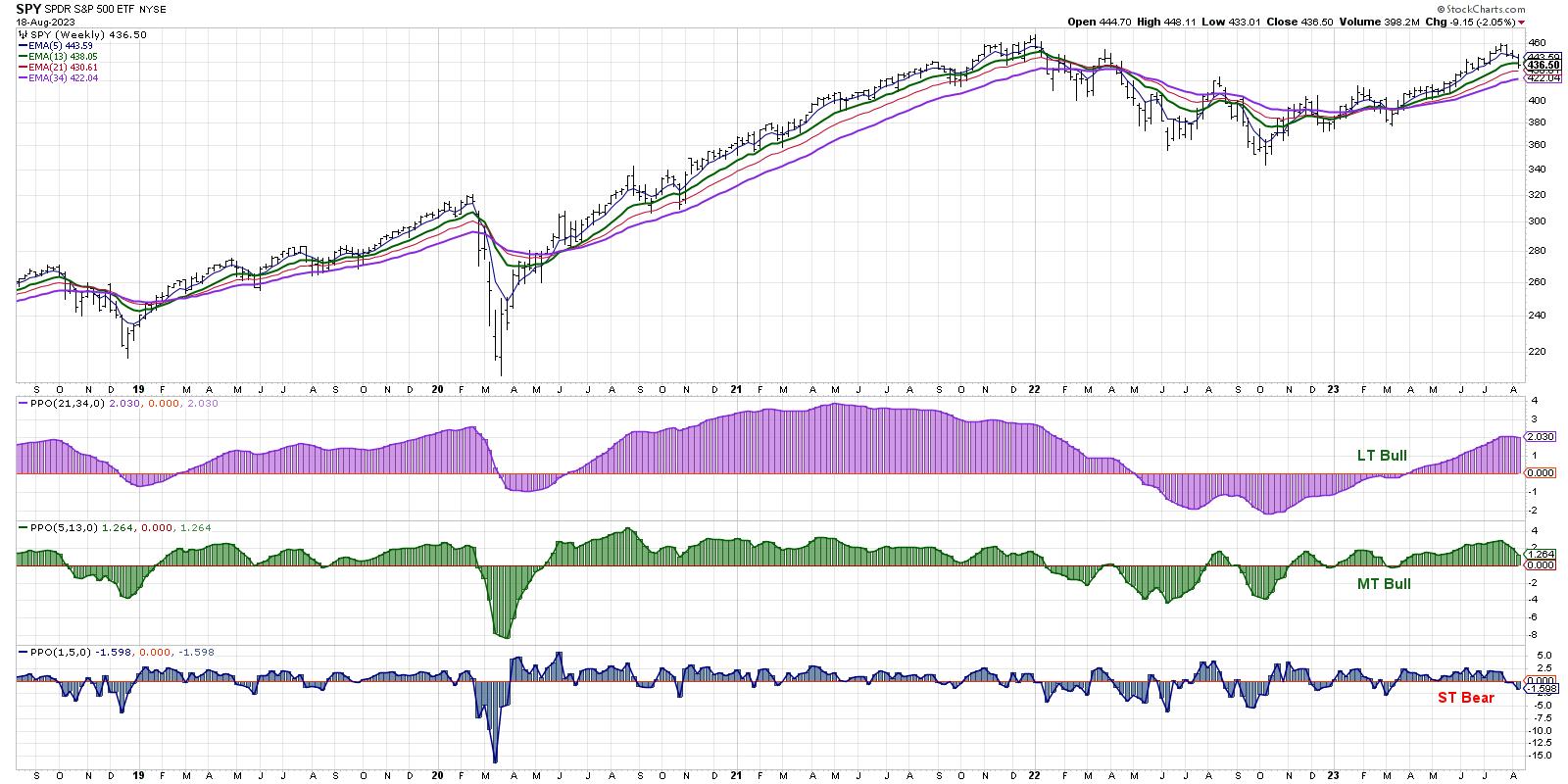

Are You Ready for a Huge Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was one month ago that I discussed the serious (short-term) warning signs that the stock market faced. I summed it up pretty well on a Your Daily Five recording that aired on July 19th. Calling weakness after it hits is easy, but discussing objectively the warning signs BEFORE the...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" Full Webinar -- AVAILABLE NOW!

by Larry Williams,

Veteran Investor and Author

Larry's "Family Gathering" webinar is now available! Whether you missed it and need to catch up, or just want to review the information Larry presented, you can now see the full recording below.

In this special presentation, Larry discusses market cycles in detail, outlines his proprietary...

READ MORE

MEMBERS ONLY

Heads Up! 10-Year Treasury Yield Could Go All the Way to FIVE Percent?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity talks Fed policy, corporate bond spreads, and why the level of interest rates is so important here. Host David Keller, CMT reviews the charts of the Magnificent 7 growth stocks and discusses downside objectives for...

READ MORE

MEMBERS ONLY

GNG TV: Does "NoGo" for the S&P = NEW Opportunities for Active Investors?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Passive investing and closet indexers beware; the S&P 500 (SPY) signaled strong-form NoGo trend conditions on a daily basis this Thursday. However, in this edition of the GoNoGo Charts show, Alex and Tyler look at how this has signaled some opportunities for active managers who have a tactical...

READ MORE

MEMBERS ONLY

How to Use the A-B-C Corrective Pattern to Improve Your Entry Points

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the aspects of multiple-timeframe trading using price, moving averages, MACD and ADX. He shows the key thing to monitor that will tell you which timeframe is most tradable. He then analyses the symbol requests that came...

READ MORE

MEMBERS ONLY

What Does Equal-Weight S&P 500 Tell Us About Market Strength?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Jessica Inskip of OptionsPlay breaks down her weekly charts of the Nasdaq 100, S&P 500, and equal-weight S&P 500 as the risk-off environment for stocks continues. Meanwhile, Dave highlights two stocks flashing the dreaded head-and-shoulders topping...

READ MORE

MEMBERS ONLY

Sizable Selloff: Fed Minutes Crushes Stock Market, Yields Rise

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes fall sharply on Fed minutes

* Treasury yields continue to rise

* S&P 500 index closes below its 50-day moving average

Better-than-expected earnings from Target (ticker symbol: TGT) and TJX Cos (ticker symbol: TJX), as well as better-than-expected US industrial output, threw some optimism...

READ MORE

MEMBERS ONLY

Top Three Things I Wish I Knew Before I Started Trading

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave Landry of DaveLandry.com shares hard-fought words of wisdom from his trading career, including a healthy mix of market knowledge, mental states, and money management tips. Meanwhile, Dave Keller tracks today's downside rotation as the Nasdaq 100...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, August 17th at 4:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, August 17th at 4:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

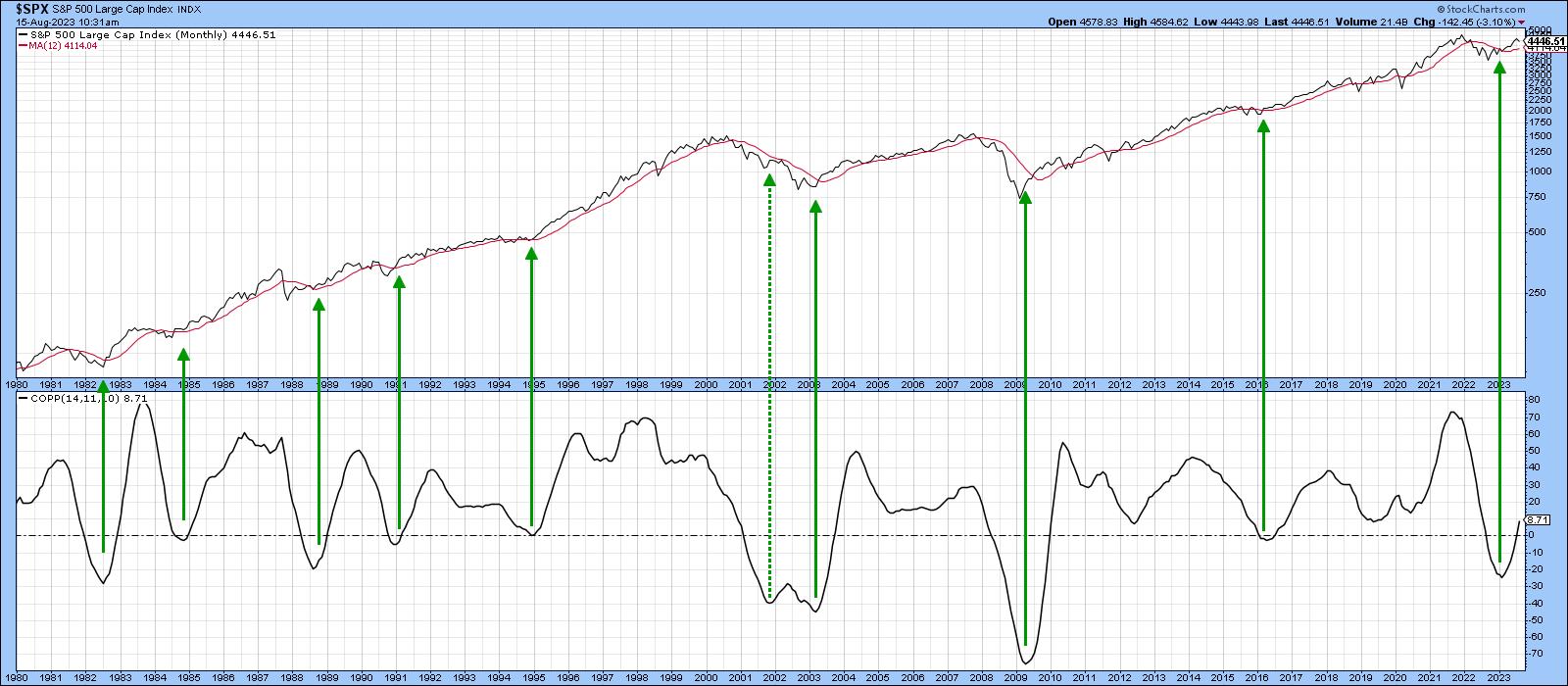

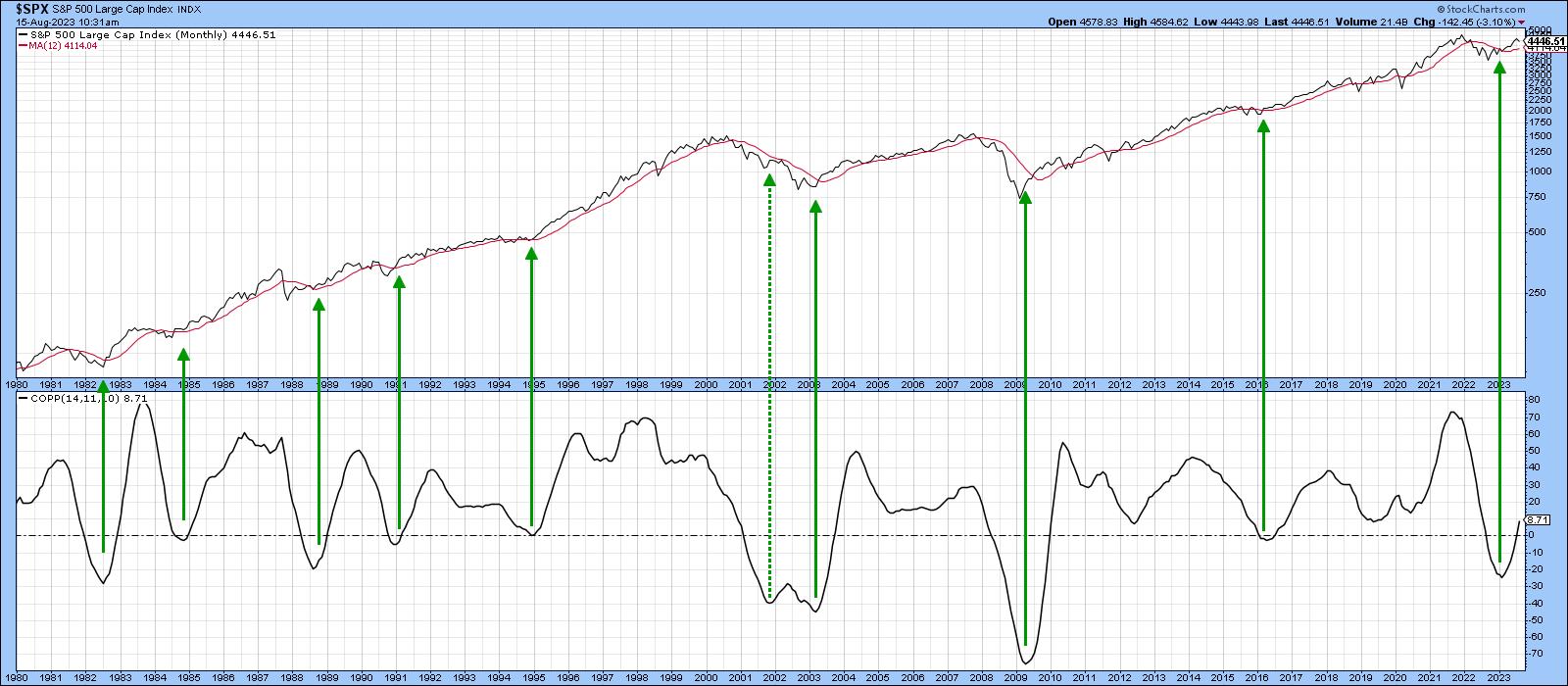

Is this a Normal Correction? Or Could It Be the Start of Something Much Bigger?

by Martin Pring,

President, Pring Research

The recent rise in interest rates and energy prices is certainly a cause for concern should these trends extend in any meaningful way over the next few months. After all, we are just about to enter September, which is seasonally the worst month of the year for stocks. Following that,...

READ MORE

MEMBERS ONLY

Trend (Re)Entry and You!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

This is the fourth video in a multi-part educational series from Tyler Wood, CMT and Alex Cole, co-founders of GoNoGo Charts®.

Trend-following investors lean heavily on money management practices that let winners run and cut losses short. This fourth video in the GoNoGo Charts® educational miniseries helps traders, analysts, and...

READ MORE

MEMBERS ONLY

This is GOOD STUFF: A Bullish Engulfing Pattern for Semiconductors!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave recaps today's market action including a mean reversion move higher for technology, with NVDA up over 7%. Dave also answers questions from The Final Bar Mailbag, including why the 50-day moving average can be so important and...

READ MORE

MEMBERS ONLY

Sector Spotlight: Money Rotating Out of Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, after an assessment of weekly rotations on Relative Rotation Graphs for US sectors, I address the shorter rotations this week, trying to find whether some of these daily rotations managed to get in sync with their weekly counterparts (spoiler alert:...

READ MORE

MEMBERS ONLY

DP Trading Room: Mega-caps are Showing Bearish Bias

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a review of a very high-yielding ETF he recently became aware of. The "Magnificent 7" stocks all show bearish biases; SPY is holding support, but indicators are still quite weak. Erin Swenlin...

READ MORE

MEMBERS ONLY

The Halftime Show: What's the Fed's Next Move? Here's One Thing to Watch

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

The new narrative is that the Fed is done raising rates, so, in this week's edition of StockCharts TV'sHalftime, Pete shows you a correlation of two things to pay attention to to know the Fed's next move. He takes a look at the oil...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Tentative in Truncated Week; These Sectors Rolled Inside Leading Quadrant of RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In line with what was anticipated in the previous weekly technical note, the Indian equity markets witnessed profit-taking bouts from higher levels, along with spikes in the volatility, which is hovering around one of its lowest levels of recent months. It was also expected that the current uptrend might remain...

READ MORE

MEMBERS ONLY

Alibaba and China -- Can They Push Through Resistance?

On August 10, I appeared on CNBC Asia to discuss Alibaba (BABA)'s surprise beat on earnings and China's weak economic data.

I began the segment reminding investors (and myself) that regardless of the news, opinions of analysts and the talking heads, price pays. It is with...

READ MORE

MEMBERS ONLY

Charting the Great Rotation of 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Nasdaq 100 closed the week below its 50-day moving average, similar to recent breakdowns in leading stocks like MSFT and AAPL.

* Instead of a rotation from offense to defense, this feels more like a rotation from growth sectors to cyclical sectors.

* Energy-related ETFs including XOP and OIH...

READ MORE

MEMBERS ONLY

MEM TV: Check Out These Bright Spots in a Weak Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the downtrend taking place in the Nasdaq, as well as sharing what's driving weakness. She also highlights why the Dow is remaining positive as well as key Value stocks poised to trade higher.

This video...

READ MORE

MEMBERS ONLY

The Great Rotation of 2023 Continues: Latest Updates and Insights

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave wraps the week, reflecting on both stocks and bonds moving lower as the latest inflation data provides mixed evidence. He opens The Final Bar Mailbag to answer questions on Fibonacci Retracements, moving average support, and how institutions trade large...

READ MORE

MEMBERS ONLY

Patience is Key: Waiting for the Pullback to Run its Course

by TG Watkins,

Director of Stocks, Simpler Trading

The market continues to be heavy after having a great two-month winning streak. On this week's edition of Moxie Indicator Minutes, TG lets the indicators and individual stocks cycle back down, then watches to see if any green shoots start to appear. Patience is needed right now.

This...

READ MORE

MEMBERS ONLY

RISING ENERGY PRICES AND RISING BOND YIELDS MAY THREATEN OVERBOUGHT STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING ENERGY PRICES MAY BOOST YIELDS... This week's inflation reports sent a mixed message. July's CPI came in lower while July's PPI came in higher. Bond yields, however, gained more ground. The green bars in the upper box in Chart 1 show the 10-Year...

READ MORE

MEMBERS ONLY

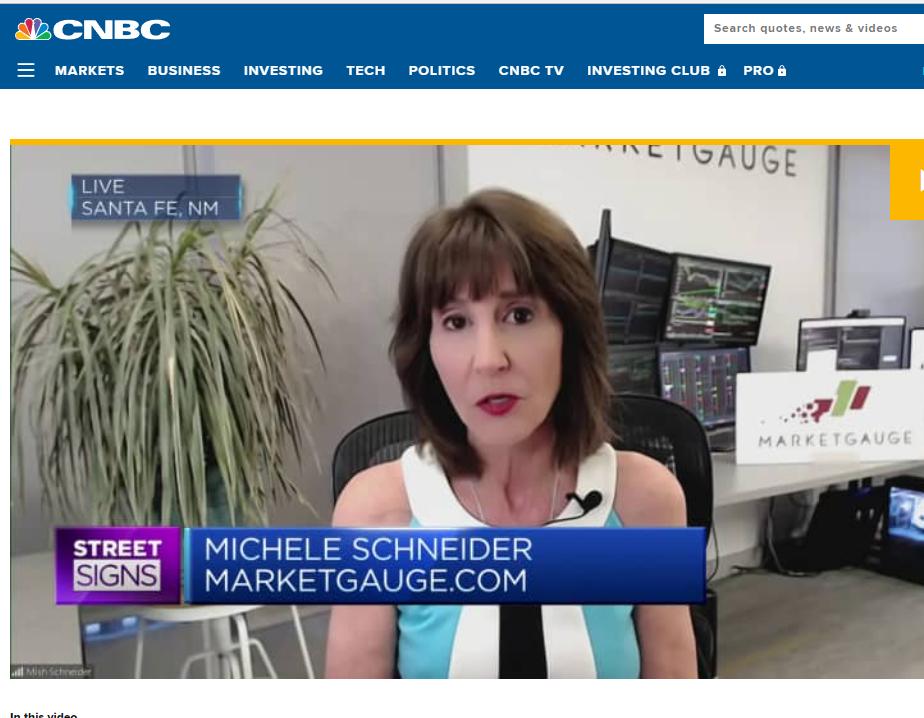

Market Update: CPI-Fueled Rally Fizzles Out as Stocks Sag

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Mish Schneider of MarketGauge talks higher rates and why China may deserve a second look for investors. Host David Keller, CMT highlights one key industry group feeling the pain as TSLA heads toward trend line support.

This video originally...

READ MORE

MEMBERS ONLY

Introducing Cash Secured Puts: Know When To Fold Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* If you have a short-term neutral bias and are bullish for the long-term, consider trading cash-secured puts

* Your max profit from selling the put is limited to the premium you collect and max loss could be significant

* Cash-secured puts can be used as an income generating strategy

Bummed...

READ MORE

MEMBERS ONLY

Improving Your Trading Performance Through Discretion

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave takes a break from his series on Jesse Livermore to discuss his methodology in action. He revisits his core methodology by showing the ultimate goal of catching longer-term trends and how money and position management can occasionally make that possible....

READ MORE

MEMBERS ONLY

GNG TV: Stocks Take a Break for That 7th Inning Stretch!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as US equities take a well deserved break from their strong rallies, Alex and Tyler quantify what investors can expect from both a trend and momentum perspective across the daily, weekly, and hourly timeframes.

This video originally premiered on August 10, 2023....

READ MORE

MEMBERS ONLY

Building and BUILDING! The Power of Momentum

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

This is the third video in a multi-part educational series from Tyler Wood, CMT and Alex Cole, co-founders of GoNoGo Charts®.

Momentum is the next step for technical analysts after identifying trend. This video will help traders, analysts, and investors understand how momentum studies are calculated and what they seek...

READ MORE

MEMBERS ONLY

Improve Your Entry Points

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses the A-B-C corrective pattern on the lower timeframe to improve entry. He first describes what we want on the higher timeframe, then shows examples of the A-B-C pattern and how to compare it...

READ MORE

MEMBERS ONLY

What's Up or Down with Long Bonds (TLT)?

Many, in fact most, retail investors that were surveyed believe that the bonds have bottomed. Bill Ackman came out last week extremely bearish.

Here's the technical skinny. Last week, TLT had a classic reversal bottom on very oversold conditions. Although TLT still underperforms SPY (risk on) according to...

READ MORE

MEMBERS ONLY

Stocks Selloff into Close After Failing at Resistance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, David Keller, CMT tracks the market's downside rotation as the S&P 4500 level once again serves as key resistance. He highlights semiconductor names, including NVDA and AVGO, that are breaking below their 50-day moving average, then...

READ MORE

MEMBERS ONLY

The Halftime Show: Are Broadline Retailers Starting to Turn?

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete reviews some retail names popping up on his screens. Before that, however, he reviews the US Dollar and other key assets classes, plus gives a refresher on the TLT and a 3-year look back on XLE, the top-performing...

READ MORE