MEMBERS ONLY

Sector Spotlight: Energy & Tech's Opposite Seasonal Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this last day of July, I look at the expected seasonal patterns for the coming month of August and examine whether the current sector rotation, as seen on the Relative Rotation Graphs for any of the sectors, lines up...

READ MORE

MEMBERS ONLY

Week Ahead: VIX at a New Multi-Year Low; Exercise Caution at Higher Levels by Staying Defensive

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After closing with gains for four weeks in a row, the markets finally took a breather on the expected lines.

In the previous weekly technical note, it was mentioned that the formation of a Shooting Star on candles has the potential to temporarily halt the present rally. Since then, the...

READ MORE

MEMBERS ONLY

MEM TV: Strong Upside Potential in These Two Mega-Caps

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews how to trade stocks that have gapped up into a base breakout after reporting positive earnings results. She also shares which areas are poised to trade higher as the markets reset following Thursday's downside reversal....

READ MORE

MEMBERS ONLY

Macro to Micro -- Seasonals, Trends and Momentum

For the weekend, we invite you to listen to Mish's live coaching session, for Complete Trader members only.

During the 45-minute session, you will hear and see:

1. The Indices, along with Calendar Ranges and Momentum Indicators

2. The Economic Modern Family in 2 timeframes

3. The Outliers...

READ MORE

MEMBERS ONLY

5 Key Ways to BOOST Your Trading Process and Maximize Your StockCharts Toolkit!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you 5 of his favorite, must-know ways to get more value of the StockCharts feature set. He'll show you how to create your own custom chart templates with ChartStyles, discuss the importance of...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch in August 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, Dave shares the ten charts he'll be watching as we continue into the seasonally weakest part of the year. Will the mega-cap growth trade falter, putting downside pressure on the S&P 500 and Nasdaq?

StockCharts memberscan...

READ MORE

MEMBERS ONLY

Earnings Momentum May Push the Stock Market to New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market ended on a positive note in spite of a hiccup

* Strong earnings and softer PCE helped push the stock market higher

* Volatility showed some erratic movement but settled down at the end of the week

"Bearish engulfing pattern," "outside day," "...

READ MORE

MEMBERS ONLY

Is This a Federal Open Market Committee Shake and Bake?

by TG Watkins,

Director of Stocks, Simpler Trading

The market overall is strong, but it's getting to a point where we should be on the look out for a pullback. And then we had Thursday, where the market started out strong with a gap up, but it proved a fake out and sold off hard for...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 11

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave continues to show the methodology in action, presenting a new mystery chart, revealing an old one, and conducting a walk-through on a recent big winner that paid off twice. He then continues his series on Jesse Livermore. This week, he...

READ MORE

MEMBERS ONLY

MARKET BREADTH IMPROVES -- SMALL CAPS TEST RESISTANCE -- ENERGY AND MATERIALS HAVE STRONG MONTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE ADVANCE-DECLINE LINE BREAKS OUT... Stocks gained more ground this week to continue their uptrend. What's helping keep the rally going is the fact that more individual stocks are joining the uptrend. Chart 1 shows the NYSE Advance-Decline line rising above several previous peaks to the reach the...

READ MORE

MEMBERS ONLY

Watch Out! Growth Stocks Can Be Threatened in a Rising Rate Environment

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe Final Bar, guest host Mary Ellen McGonagle (MEM Investment Research) gives an insightful market recap and assesses the potential impact of rising interest rates on growth stocks. She also shares the effects of the earnings reports for Meta Platforms (META), Ebay (EBAY)...

READ MORE

MEMBERS ONLY

GNG TV: Goodbye Growth and Hello Cyclicals

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Tyler and Alex take a top-down approach looking at the markets in terms of trend, momentum, volume, and volatility. Starting with the major asset classes and the macro factors, they look at treasuries, the dollar, gold, oil, and even emerging market equities....

READ MORE

MEMBERS ONLY

Is Gold Headed for New All-Time Highs?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Wednesday, the SPDR Gold Shares ETF (GLD) 20-day EMA crossed up through the 50-day EMA, generating an IT Trend Model BUY Signal. This means that GLD is bullish in the intermediate-term. GLD was already in a long-term bull market when, in January, the 50-day EMA crossed up through the...

READ MORE

MEMBERS ONLY

Comcast's New Strategy May Give the Stock a Surge

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Comcast stock gapped higher on strong earnings

* The stock has several resistance levels to overcome before reaching its all-time high

* The 21-day exponential moving average could be the stock's first support level

Movies and streaming videos—they're here to stay, at least for a...

READ MORE

MEMBERS ONLY

How to Find the Best BUY ZONE Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to locate strong buy and sell zone areas. He shows how shorter timeframes can be used to help with the timing once a stock reaches a buy or sell zone. He covers the DJIA, ETH,...

READ MORE

MEMBERS ONLY

The July 6-Month Calendar Range -- SPY, QQQ, IWM, TLT

After the Fed meeting, we thought it would be useful to see the July calendar ranges and give you a brief lesson in how to use them. Who is this for?

The price levels defined by this trading method have proven to be insightful in all markets. Longer-term investors can...

READ MORE

MEMBERS ONLY

Will the Fed End Its Tightening Cycle in September?

by Karl Montevirgen,

The StockCharts Insider

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Fed raised interest rates 25 basis points but didn't indicate if this would be the last rate hike

* The Dow Jones Industrial Average came off its high but managed to close higher for its 13-day win streak

* There wasn't much reaction in the gold...

READ MORE

MEMBERS ONLY

BIG SURPRISE (Not)! The Fed Does Exactly What They Said They Would

by Joe Rabil,

President, Rabil Stock Research

In this episode of StockCharts TV'sThe Final Bar, special guest host Joe Rabil (Rabil Stock Research) dives into the highs and lows of the markets after today's Fed announcement. Afterwards, he demonstrates how to use the ADX indicator to help find the start and end points...

READ MORE

MEMBERS ONLY

Surging Trucks Are Driving The Industrials Sector Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Industrials sector XLI broke to new highs and is on a strong rotational path on the Relative Rotation Graph

* Within the sector the groups "Commercial Vehicles & Trucks" and "Trucking" stand out

* These groups are taking over from Airlines and Construction which have been...

READ MORE

MEMBERS ONLY

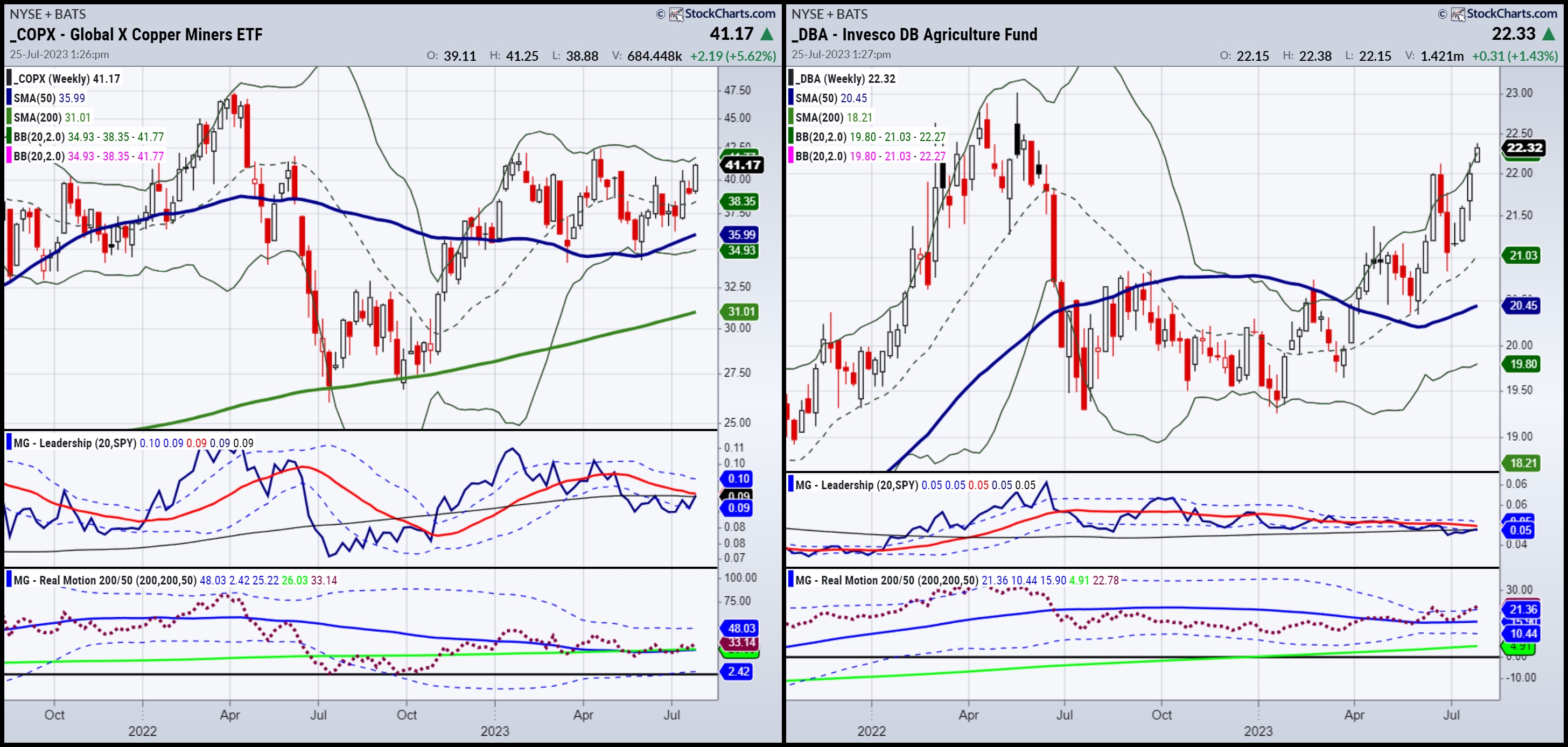

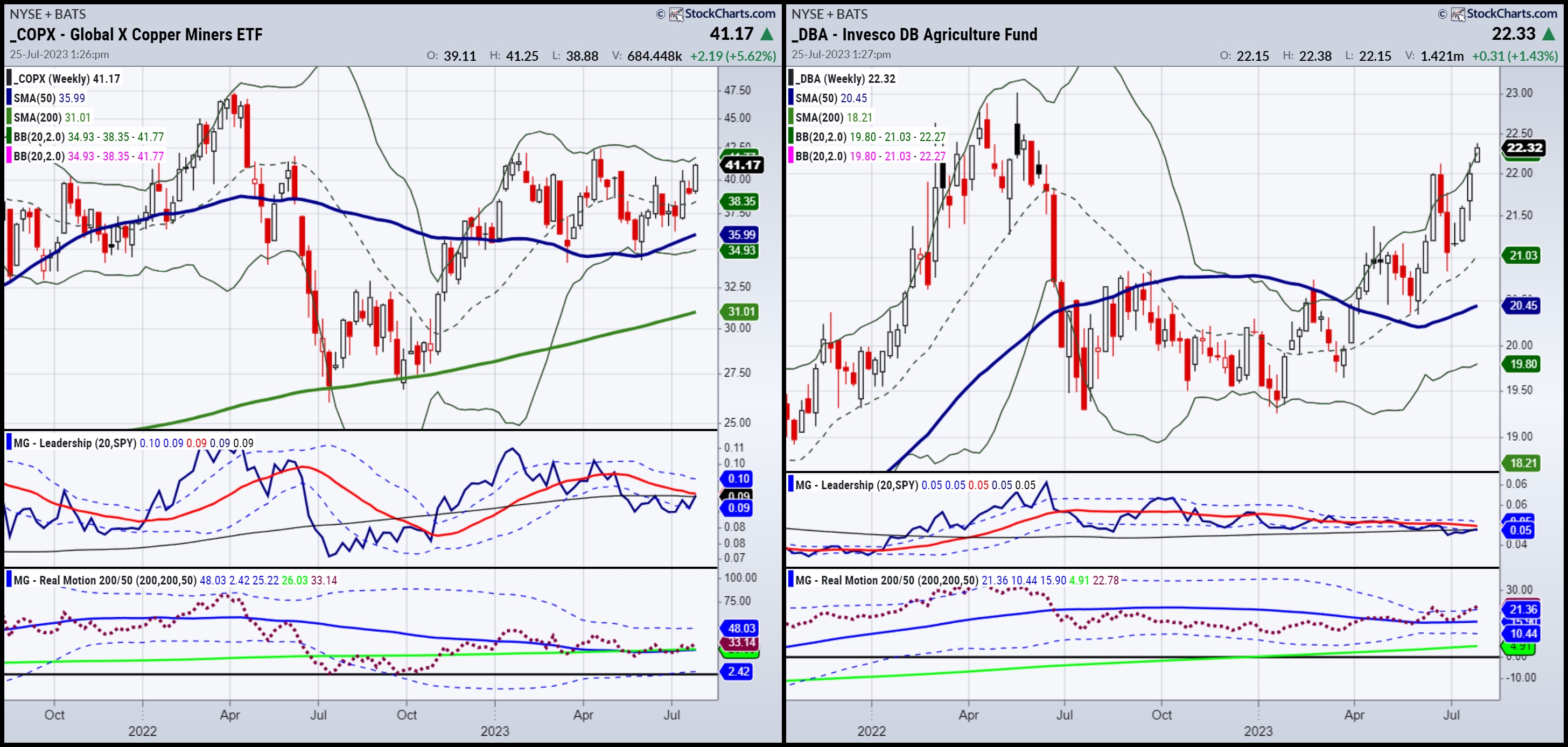

Commodities are the Best Investments

For today, I used ChatGPT to ask which companies store raw materials. After all, you cannot have capital investing in infrastructure without raw materials. You cannot have geopolitical issues without concerns about oil and energy. You cannot have weather issues without worrying about supply and supply chain.

How do we...

READ MORE

MEMBERS ONLY

The Banking Crisis is Over... Or Is It?

by Martin Pring,

President, Pring Research

Last April, I wrote about the SVB (SVIB) banking crisis, using the KBW Regional Banking Index ($KRX) as a proxy, and suggested the price action in the right hand part of Chart 1 had the potential to be a double bottom formation. Double bottoms are characterized by heavy activity on...

READ MORE

MEMBERS ONLY

Why Sector Rotation Matters NOW! And What You NEED to Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In this episode of StockCharts TV'sThe Final Bar, guest host Tom Bowley discusses how, though sector rotation is displaying a slight shift towards bullish sentiments, things have still been rough. Acknowledging the recent rough patch in the market, Tom believes that market manipulation through options expiration might be...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Says Bull Market in Full Swing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, using the sector rotation model, I make an assessment of the current economic phase and how that aligns with the current sector rotation and alignment of four macroeconomic indicators. Along the way, I also show you where you can find...

READ MORE

MEMBERS ONLY

The Halftime Show: Defense and Value on the Move

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete reviews the US Dollar in relation to the Emerging Market ETF (EEM), then takes look at WTIC crude and the US Dollar. Pete gives a quick take on growth retreating from leadership and value taking the lead as...

READ MORE

MEMBERS ONLY

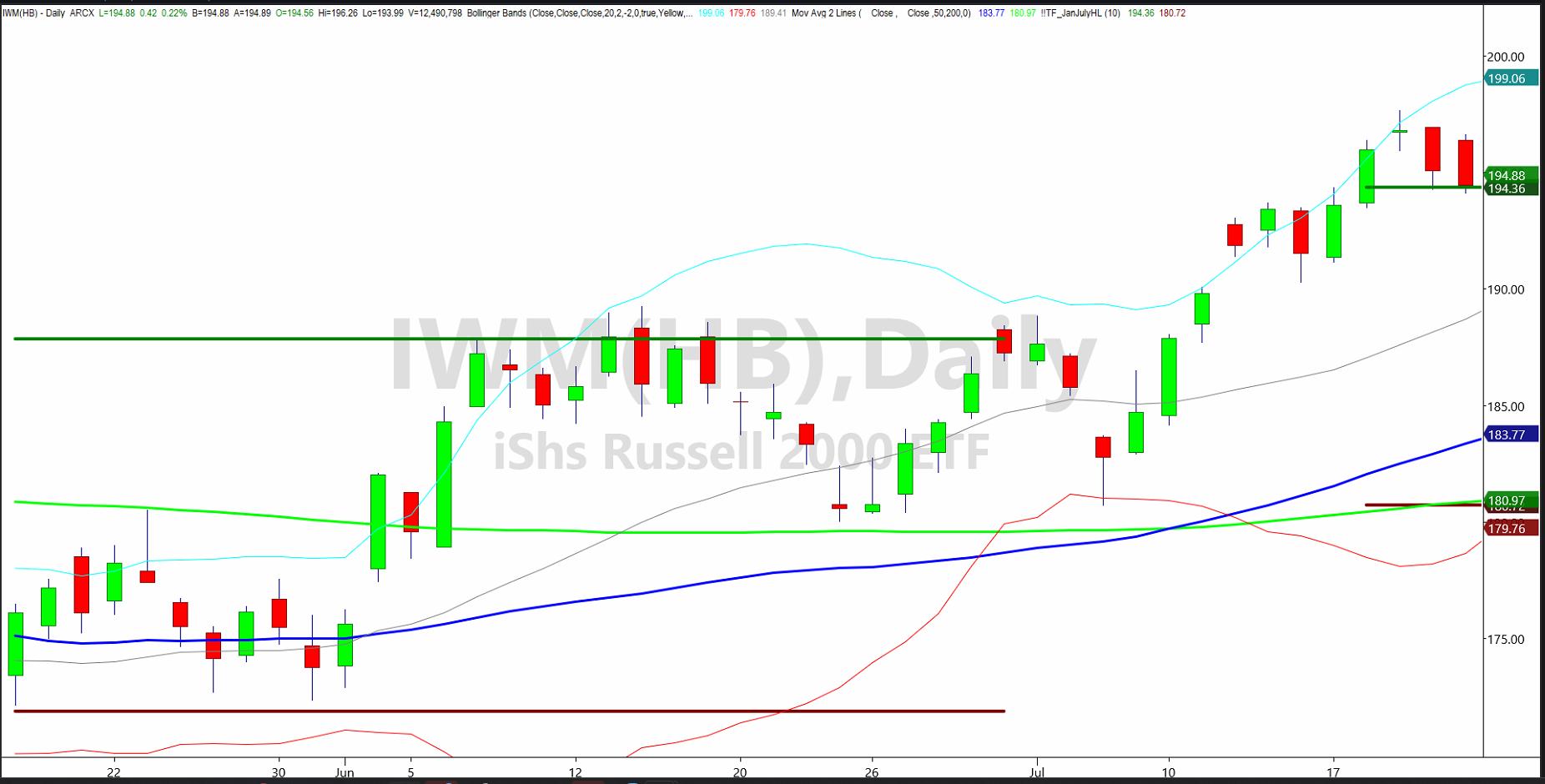

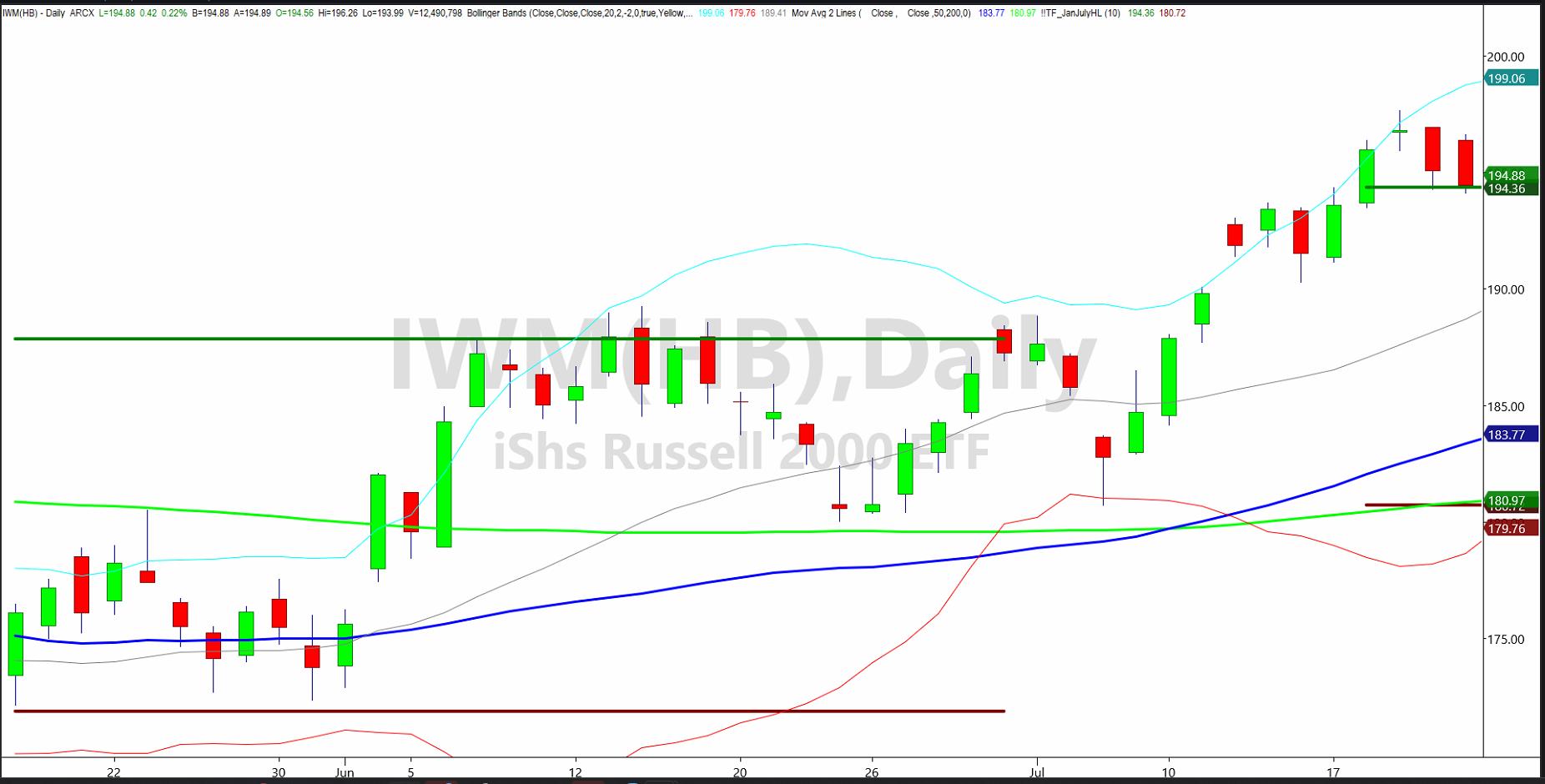

Now That The July 6-Month Calendar Range is Set

By now, you might have read either my or Geoff's articleon the July 6-month calendar range reset.If not, I highly recommend you click on Geoff's "Trades and Tutorials" above.

The chart of the Russell 2000 (IWM) shows a really wide July range. The...

READ MORE

MEMBERS ONLY

Is The S&P 500 Forming a Huge Double Top? A Q&A with David Keller, CMT

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, David Keller hosts a special all-mailbag edition of The Final Bar featuring questions on trailing stop techniques, MACD histograms, uranium stocks, and a potential double top formation for the S&P 500 index.

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

The Biggest Problem with Technical Analysis? Part 1: Trend Identification!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

This is the first video in a multi-part educational series from Tyler Wood, CMT and Alex Cole, co-founders of GoNoGo Charts®.

There's a key problem that technical analysis can present to investors. In using technical analysis, our goal is to remove emotion from our decision-making. However, with a...

READ MORE

MEMBERS ONLY

Cisco Takes the Lead with a Classic Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cisco (CSCO) is showing leadership qualities again as it breaks out of a classic bullish continuation pattern and hits a new high.

The chart below shows CSCO forming a cup-with-handle pattern, which was popularized by William O'Neil of IBD. This is a bullish continuation pattern, which means the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Prone to Consolidation at Higher Levels; Stay Selective and Protect Profits

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It is exactly a month from when the NIFTY staged a major breakout, crossing above the previous high point of 18887; this time, it was the fourth week in a row where the markets extended their gains. This has also led to the markets closing at their fresh record lifetime...

READ MORE

MEMBERS ONLY

Markets Flip as Earnings Season Heats Up

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, the number of companies reporting earnings expanded, with heavyweight names Tesla (TSLA) and Netflix (NFLX) getting the most attention. Both companies sold off sharply on Thursday despite beating estimates. The selling spread to other Nasdaq stocks after two heavyweight Semiconductor companies signaled continued weakness in the chip market....

READ MORE

MEMBERS ONLY

All That's Bullish is GLD as the Week Wraps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Jesse Felder of The Felder Report joins us in the studio to present the bullish case for gold based on price pattern analysis as well as a contrarian sentiment indicator. Dave wraps the week with a focus on bearish...

READ MORE

MEMBERS ONLY

MEM TV: Tech Stock Decline Spooks Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the impact of Tesla (TSLA) and Netflix (NFLX) earnings and how this may translate into next week, ahead of more mega-cap quarterly results. She also shares new areas of potential leadership and what drove money flows into...

READ MORE

MEMBERS ONLY

Stock Market on Its Way to Highs: Will Tech Earnings be the Catalyst?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Earnings results from Big Tech stocks MSFT, META, GOOGL on deck

* Strong earnings could push the Nasdaq 100 index to new highs

* Investors will be listening to what the Fed has to say about inflation

The next couple of weeks should prove to be an exciting time for...

READ MORE

MEMBERS ONLY

Watch the Ebb and Flow -- This Market NEEDS a Break!

by TG Watkins,

Director of Stocks, Simpler Trading

The market has been very strong -- even the DIA just broke out -- but we still need to know when tickers get overbought and its time to take profits. On this week's edition of Moxie Indicator Minutes, TG explains that it is the normal ebbing and flowing...

READ MORE

MEMBERS ONLY

GNG TV: Industrial "Go" Trends are a Big Help to a Bull Market

by Tyler Wood,

Co-founder, GoNoGo Charts®

The Home Construction Index (ITB) has been in a solid "Go" trend since June moving within a rising trend channel, and correcting today to the lower bound. In this edition of the GoNoGo Charts show, Tyler Wood, CMT talks through the tenets of trend -- after showing how...

READ MORE

MEMBERS ONLY

A Painful Plummet for Netflix and Tesla; Is This Just the Beginning?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Danielle Shay of Simpler Trading breaks down today's Nasdaq bloodbath and focuses on potential support levels for TSLA, MSFT, TSM, and AMD. Host David Keller, CMT highlights one Health Care name showing a bullish momentum divergence.

This...

READ MORE

MEMBERS ONLY

How to Use Trend Alignment to Find the Best Entry Points

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains his favorite entry using price structure in multiple timeframes. He discusses how to use MACD and the Moving Average lines to confirm this sequence. He then shows this setup, using Amazon (AMZN) as an example. Joe...

READ MORE

MEMBERS ONLY

HEALTHCARE SECTOR NEARS UPSIDE BREAKOUT-- LED BY UNITEDHEALTH, JNJ, AND ABBOTT LABS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONEY ROTATES INTO HEALTHCARE... One of the most encouraging developments over the last month has been the rotation into formerly lagging sectors like industrials, financials, and materials. That rotation also includes this week's upside breakout in the Dow Industrials to the highest level in more than a year....

READ MORE

MEMBERS ONLY

Tired of Long Large-Cap Growth Stocks? Dave Shows His Top 2 Alternatives

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this episode of StockCharts TV'sThe Final Bar, guest Dana Lyons of J. Lyons Fund Management shares two ideas for investors looking to diversify away from the US large-cap growth space. Host David Keller, CMT highlights one key breadth indicator flashing a big time overbought signal as the...

READ MORE

MEMBERS ONLY

Hidden Gems: A Simplified Method to Find the Best Stocks

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* You want to invest in stocks and ETFs in the best-performing sector

* Within the best performing sector, find the top sub industry

* Identify stocks and ETFs with promising charts and find an opportune entry point

When broad equity indexes move higher and higher and you don't...

READ MORE