MEMBERS ONLY

The Market's Muscle: What Broad Tech Strength Says About This Bull Run

Mega-cap tech stocks powered markets higher, but strength across the sector shows this rally is strong. Learn how to track it with these charts.... READ MORE

Mega-cap tech stocks powered markets higher, but strength across the sector shows this rally is strong. Learn how to track it with these charts.... READ MORE

As the Magnificent 7 dictate the tone for the S&P 500, their charts reveal early signs of fatigue amid mixed earnings reactions. Technical discipline remains essential as investors assess whether these former leaders can sustain their uptrends into year-end.... READ MORE

Grayson Roze shows how to become the laziest chartist possible—without losing performance. Learn how StockCharts’ sample charts, chart packs, and scans can instantly build a pro-level setup in your account.... READ MORE

The primary driving forces in the stock market are the QQQ and key mega-cap companies. In this article, Arthur Hill shares his insights and observations on the technical price action in the Mag7 ETF and QQQ. ... READ MORE

Before We Dive In… For every story a chart tells, there are stories hidden from plain view. One story tends to repeat itself almost like clockwork, though it also comes with variations. That’s what seasonality is all about: odd months where stocks tend to shine, stumble, or stall. In... READ MORE

Earnings are surging, rates keep falling, and tech stocks are exploding higher. Tom Bowley breaks down the rally driving the Nasdaq to new highs and the sectors powering the market into year-end.... READ MORE

Dave Keller explores the classic head and shoulders top, breaking down its three key phases with examples from JNJ and Dominion, plus a failed pattern in Nucor that turned into a bullish reversal.... READ MORE

Joe Rabil explains how to use ADX to spot strength, trend, and breakout setups across different timeframes. He highlights five stocks with strong ADX patterns and reviews the latest S&P market conditions and stock requests to watch.... READ MORE

NVIDIA shares reached a record $5 trillion in market cap. Here's a deep dive into the stock's price action and what could keep it in the driver's seat.... READ MORE

Explore what market breadth, S&P 500 trends, and tech earnings say about the strength behind today's rally and what to watch in the days ahead.... READ MORE

Before We Dive In… You’re about to see why traders obsess over 52-week highs, and why not all highs are created equal. I’ll break down what really happens when a stock hits (or hovers just below) that milestone. Even better, I’ll show you how to scan for... READ MORE

With U.S.-China trade talks on the immediate horizon, Martin Pring takes a look at commodities poised to benefit. He also presents an update on $GOLD.... READ MORE

Learn how to spot valid head and shoulders patterns and when to walk away. David Keller, CMT, shows how failed setups can signal strength and potential bullish reversals.... READ MORE

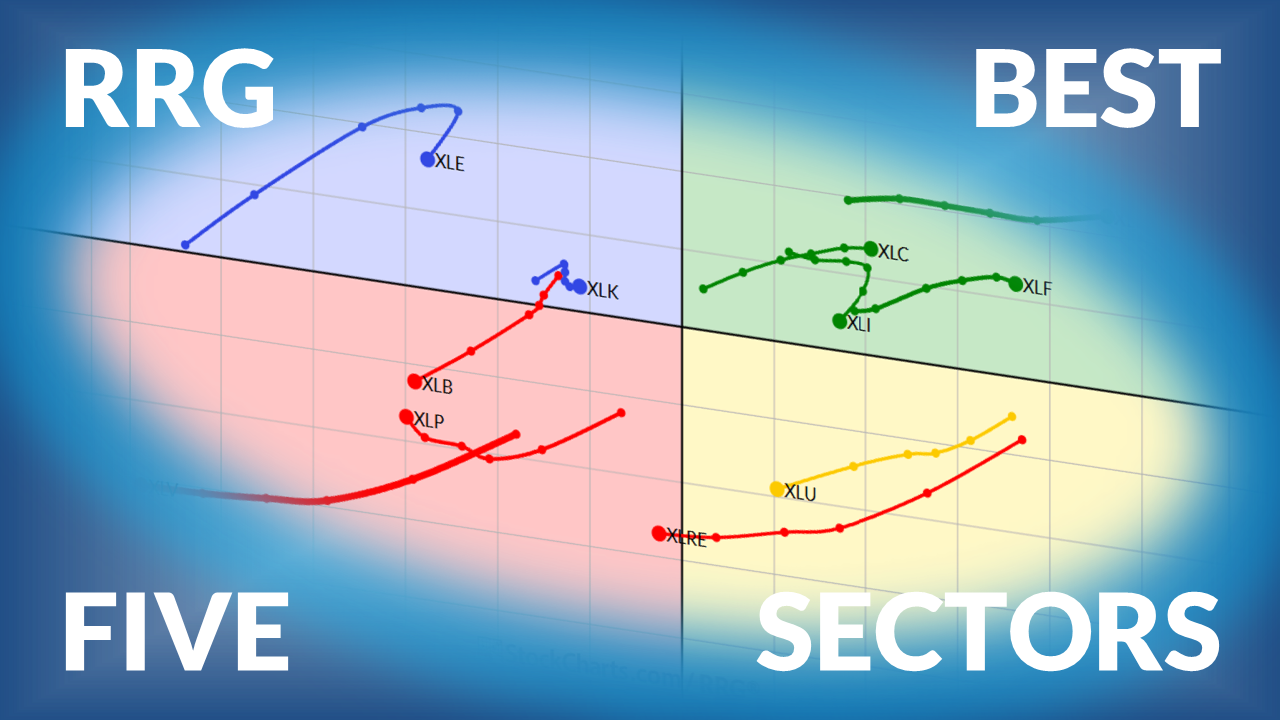

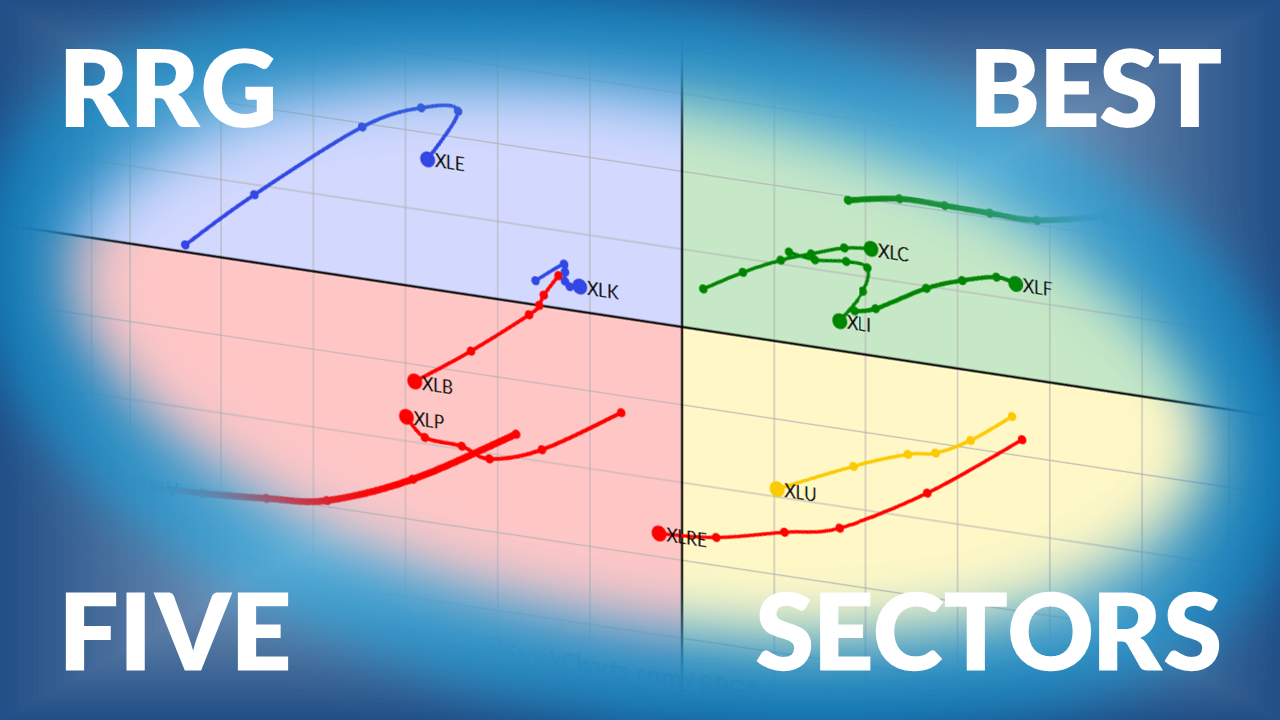

Weekly update on US sector rotation based on Relative Rotation Graphs.... READ MORE

It's a market-moving week with the FOMC meeting, mega-cap earnings, and global trade headlines taking place. These tools will help you keep track of sector rotation, yield trends, and the next potential leg of the rally.... READ MORE

The Indian markets remained within a narrow range, but the NIFTY is making a breakout attempt. Can it move from consolidation to a trending phase?... READ MORE

Mary Ellen McGonagle highlights the new market leaders emerging as earnings season intensifies. Find out which setups and sectors are showing strength as the rally broadens beyond the mega-caps.... READ MORE

The Health Care sector is emerging as the next area of strength. Mary Ellen presents a deep dive into the sector and a stock that could break out.... READ MORE

After taking a little breather, the market is back to setting new records. The Dow just topped 47,000 for the first time, and the S&P 500 and Nasdaq weren’t slackers either. Here’s how the major indexes wrapped up the week. * Dow Jones Industrial Average ($INDU)... READ MORE

The bull's still running, but for how long? We break down what momentum, breadth, and key indicators say about the stock market's next move.... READ MORE

In a bullish market environment, with the technology sector leading the way and cybersecurity stocks in an uptrend, Arthur presents a couple of stocks that may be poised to break out.... READ MORE

Technical analysis is about having a consistent process of evaluating the evidence. Dave revisits three charts he highlighted at the end of September, reviews how the technical picture has changed, and updates his thesis using price and momentum techniques.... READ MORE

Falling U.S. Treasury yields have contributed to the bullish rally in equities. Here's an analysis of how the bull market can help identify leading industry groups and the stocks that lead the groups.... READ MORE

Julius de Kempenaer reveals how to use Relative Rotation Graphs as a complete portfolio framework. Discover how his top-down approach can help you spot leadership shifts across stocks, bonds, and commodities.... READ MORE

Catch market reversals before the crowd! Tony Zhang reveals how to scan, rank and trade high-probability options setups with the OptionsPlay Add-on for StockCharts.... READ MORE

Frank Cappelleri analyzes the S&P 500, small-cap value, gold, and Bitcoin after October's pullback. He explores chart patterns, momentum, and divergences to reveal what may come next for key markets.... READ MORE

Blue-chip stocks have performed well as Q3 earnings kick into high gear. Learn how the absolute and relative strength of the Dow Jones Industrial Average can offer clues about market direction.... READ MORE

Before We Dive In… You’re about to learn something unique: how to gauge trend strength and seize market opportunities using two sets of eyes. The GMMA splits price action into short-term and long-term views, giving you two perspectives on the same market. With one eye on fast-money moves and... READ MORE

Bearish momentum divergences can help provide a game plan for confirming potential price breakdowns. We review three charts to see how they have evolved since a bearish rotation, and focus on identifying potential entry points for the next rally phase.... READ MORE

Dave Keller, CMT, uses his go-to StockCharts tools to identify which stocks are displaying technical strength, which ones are testing support, and which ones are trending. Learn how to manage your positions, identify reversals, and know when it's time to reevaluate your portfolio holdings.... READ MORE

The Dow hits a record high while gold pulls back. Learn what these moves signal for investors and how to manage risk in a volatile market.... READ MORE

Weekly update on Sector Rotation based on Relative Rotation Graphs... READ MORE

Last week was pretty wild. Mary Ellen McGonagle breaks down the latest swings and shows where the real strength is starting to shine through. She analyzes the ups and downs, points out which areas are showing real strength, and highlights the sectors quietly coming back to life. From defensive plays... READ MORE

October tends to be a volatile month in the stock market. Here's a look at what the charts of VIX, KRE, Mag 7, and gold are indicating. ... READ MORE

Before We Dive In… Here’s today’s play: you’ll run the Entered Ichimoku Cloud scan to spot buy-the-dip candidates, use the SCTR to find the strongest stocks, and then you’ll flip to the charts to see which candidates may be worth pursuing. Plus, you’ll learn how... READ MORE

The Nifty broke out above a long-running symmetrical triangle pattern. But with weak market breadth and a spike in volatility, how vulnerable is this rally?... READ MORE

It was one of those weeks! The stock market traded in a relatively flat range, although there were a few bursts of volatility. Overall, things were relatively stable, with the broader indexes staying within last Friday’s trading range. We did get a little bit of a scare on Thursday... READ MORE

The Hindenburg Omen is a macro technical indicator which was designed by reviewing the common characteristics of previous bull market tops. Dave breaks down the components of this indicator, reviews signals from the last 10 years, and discusses implications for the S&P 500 in Q4 2025.... READ MORE

Gold is completing multi-year consolidation or reversal patterns relative to different asset classes, setting the stage for significant breakouts. Here's an analysis of these different intermarket relationships.... READ MORE

Grayson Roze hosts Tom Bowley and Julius de Kempenaer in a fast-paced StockCharts Game Show showdown! See who dominates in this fun, competitive battle of charting tools, trading terms, and quick wit.... READ MORE