MEMBERS ONLY

The Fed Cut Discount Rate | Larry's "Family Gathering" September 19, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Interest rates have been cut -- what now? Larry presents his thoughts in this edition of the Family Gathering video.

In this month's Family Gathering video, Larry begins with what he calls the "Fed Cut Discount Rate" and what it means. What does history make of...

READ MORE

MEMBERS ONLY

Stock Market Today: Fed Cuts Rates and Market Makes Last Minute U-Turn

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Fed cut interest rates by 50 basis points and shifts focus to the economy.

* Stock market rallied after the Fed's interest rate cut decision but closed lower.

* Treasury yields rose while bond prices fell.

The stock market received what it expected from the Federal Reserve—...

READ MORE

MEMBERS ONLY

Here's My Most-Likely Scenario for QQQ

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the S&P 500 finished the week once again testing new all-time highs around 5650, the Nasdaq 100 remains rangebound in a symmetrical triangle or "coil" pattern. While this pattern does not necessarily suggest a potential next move for the QQQ, it did lead me to...

READ MORE

MEMBERS ONLY

Four Intermarket Confidence Relationships that Aren't Confident

by Martin Pring,

President, Pring Research

Most of the primary trend indicators I follow are in a bullish mode and show few signs of flagging. That said, some intermarket relationships, which help to indicate whether the environment is risk-off or risk-on, have started to move in a risk-off direction. That's usually a bearish omen...

READ MORE

MEMBERS ONLY

Is It Time to Buy Intel?

by Carl Swenlin,

President and Founder, DecisionPoint.com

I've been around long enough to remember when Intel (INTC) was the NVIDIA of the day. Now, INTC is under severe pressure, having suspended its dividend, and is currently being considered for removal from the Dow 30 Industrial Average. Oh, how the mighty have fallen!

With INTC having...

READ MORE

MEMBERS ONLY

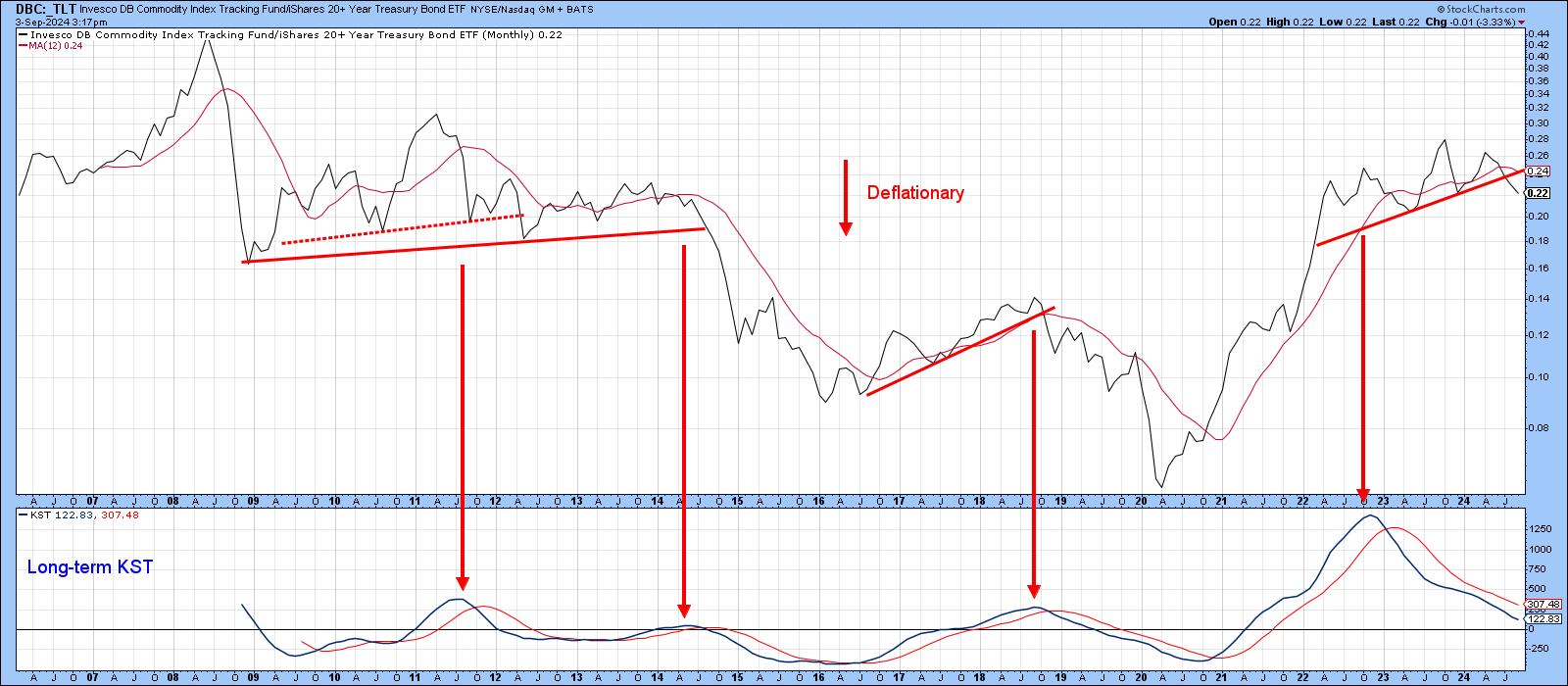

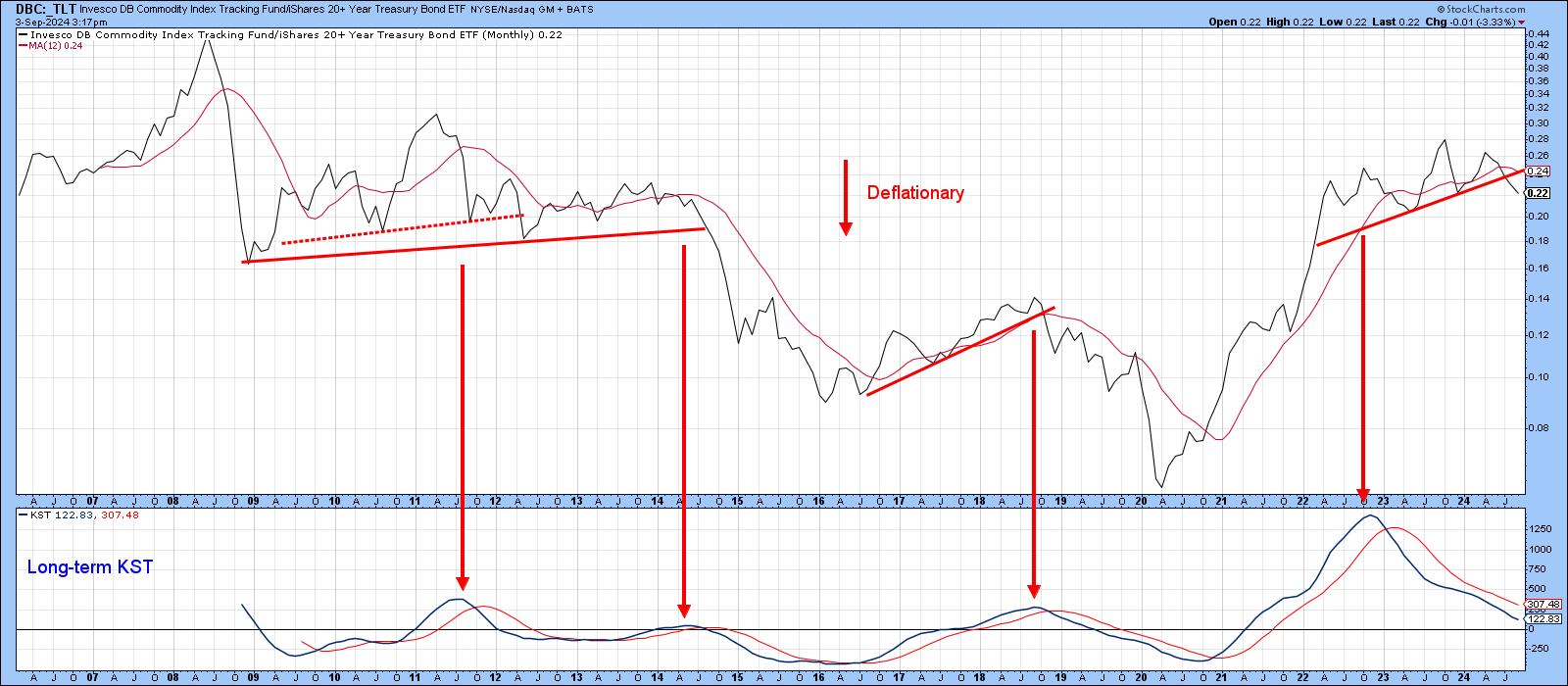

Is It Inflation or Deflation? What's in Your Wallet?

by Martin Pring,

President, Pring Research

Every business cycle has an inflationary and deflationary part, and it's very important for both traders and investors at least to try to have some understanding which has the upper hand at any particular point in time.

For example, when the economy is in a slowdown or recessionary...

READ MORE

MEMBERS ONLY

A New Way of Forecasting Crude Oil | Larry's "Family Gathering" August 22, 2024 Recording

by Larry Williams,

Veteran Investor and Author

What to make of the market as we near the end of August? Larry presents his thoughts in this edition of the Family Gathering video.

In this month's Family Gathering video, Larry begins by presenting a new way of forecasting for Crude Oil. After that, he follows up...

READ MORE

MEMBERS ONLY

Gold Miners' Performance vs. Gold -- Does It Say Sell Gold?

by Carl Swenlin,

President and Founder, DecisionPoint.com

In Monday's DecisionPoint Trading Room video, we were asked why we cover Gold Miners (GDX) as well as Gold (GLD). There are two reasons:

1. Some people prefer to own the commodity, Gold, and others prefer to own an operating company that benefits from the price of Gold,...

READ MORE

MEMBERS ONLY

What Does This Mean for the S&P 500 Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts. What does it mean for the current rally in the S&P 500, and what does it mean for the relationship...

READ MORE

MEMBERS ONLY

The Growth Trade is Back!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps an epic rally in mega cap growth stocks, with NVDA up over 6% and META threatening a new 52-week high. Dave highlights how gold and bond prices continue to rise in the face of stronger stocks, and breaks...

READ MORE

MEMBERS ONLY

CRITICAL Week Ahead for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses various rotations using Relative Rotation Graphs, starting at asset class level and then moving to sectors. Julius zooms in on the industries of two sectors to get an idea of where pockets of out-performance may exist in the current market. He then...

READ MORE

MEMBERS ONLY

Why Bonds and Gold Are Outperforming Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy Monday for the equity markets, as gold tests new all-time highs and interest rates continue to plummet. He highlights the stock to bond ratio, revisits the classic 60:40 ratio favored by investors, and breaks down...

READ MORE

MEMBERS ONLY

TLT Turns the Corner and Starts to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Smoothing the signal thresholds help to reduce whipsaws.

* A new uptrend signaled for TLT as the 5-day exceeded the 200-day by more than 3%

* TLT also sports a classic breakout and continuation signal.

The 20+ Yr Treasury Bond ETF (TLT) is turning the corner as a long-term trend...

READ MORE

MEMBERS ONLY

Recession Fears Top of Mind As Tech Stocks Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Weak manufacturing and jobs data sends investors into panic mode

* All broader stock market indexes fall over 2%

* Bond prices rise

The dog days of summer are here. And the stock market gives us a brutal reminder of this.

The first trading day of August began on a...

READ MORE

MEMBERS ONLY

Bonds To Get Beat Up? | Focus on Stocks: August 2024

by Larry Williams,

Veteran Investor and Author

It looks to me like it's time for the bond market to take a breather, if not have a pullback from now into late October.

We can sum it up with the cycle projections from Chart 1. I have highlighted, in red, the down leg of the 450-day...

READ MORE

MEMBERS ONLY

Big Tech Earnings, Fed Meeting, Jobs Report: Will They Add More Pressure to the Stock Market?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investor sentiment has turned more bearish with a continuation of a selloff in big tech stocks.

* More earnings, an FOMC meeting, and jobs report are adding to investor uncertainty.

* Keep an eye on bond prices as the data starts to unravel.

Last week, there was a noticeable change...

READ MORE

MEMBERS ONLY

Is the Bond Market About To Make a Big Move?

by Martin Pring,

President, Pring Research

The bond market experienced a secular bear between 1981 and the spring of 2020. Chart 1 offers three reasons why it has since reversed and given way to a secular uptrend or possibly multi-year trading range.

The first piece of evidence comes from violating the multi-decade trendline. Second, the price...

READ MORE

MEMBERS ONLY

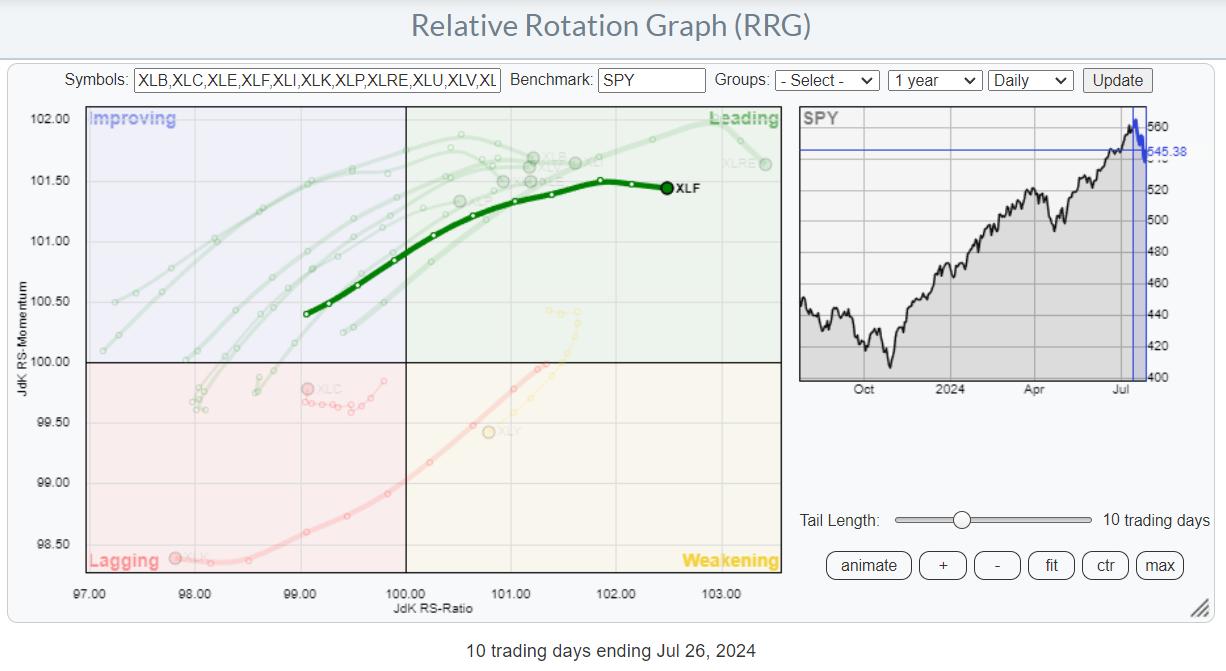

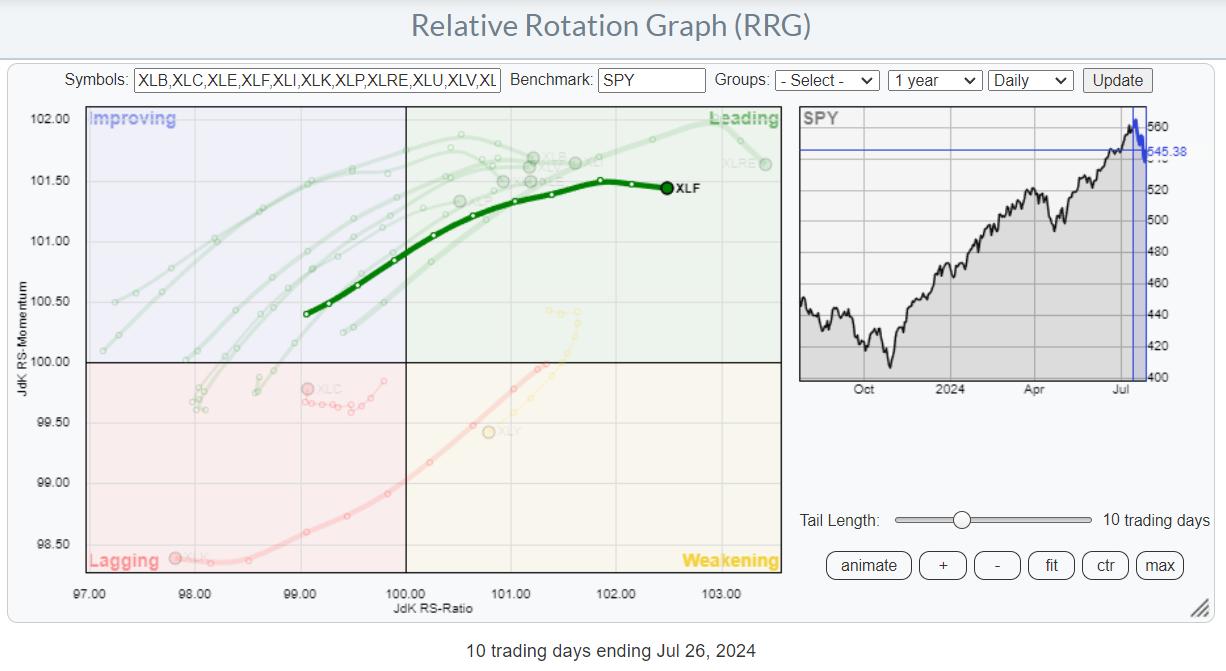

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE

MEMBERS ONLY

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn't have a chance to...

READ MORE

MEMBERS ONLY

Election Year Patterns | Larry's "Family Gathering" July 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

What stocks right now does Larry have his eye on? Which ones is he saying "see you later... for now"? And which ones does he not like very much at all?

In this month's Family Gathering video, Larry presents an in-depth discussion on the patterns we...

READ MORE

MEMBERS ONLY

Why Stocks are STILL the BEST Investment

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the markets from an asset allocation perspective using various RRGs. Stocks are (still) beating bonds, while commodities are rotating out of favor and the USD is losing steam. BTC is jumping higher off support, and the Yield Curve is steepening against...

READ MORE

MEMBERS ONLY

When Will the Stock Market's Bullish Momentum Snap? Charts You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market could continue its bullish run on interest rate cut speculation

* The S&P 500 Equal-Weighted Index is a good indication of the health of the overall stock market

* Bond market action is often a leading indicator of stock market action

With the S&...

READ MORE

MEMBERS ONLY

An Awesome Breakthrough in S&P 500 and Nasdaq: Will the Momentum Continue?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* S&P 500 and Nasdaq Composite close at record highs

* Equities, precious metals, and bonds all rise, but Bitcoin shows weakness

* Keep an eye on the Equal Weighted S&P 500 and Nasdaq breadth to get early insight into stock market direction.

If you were taking...

READ MORE

MEMBERS ONLY

Stock Market's Choppy Action Continues: Focus is on Jobs Report, Powell Speech

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market continued to move sideways as investors continue to be indecisive

* Speech from Fed Chair Powell and Fed meeting minutes could send the market in either direction

* Friday's jobs report could impact price action in the stock market

The stock market's theme...

READ MORE

MEMBERS ONLY

June & Gloom | Larry's "Family Gathering" June 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

June is here! Will it be bloom or gloom for the stock market?

In this month's Family Gathering video, Larry examines the current averages in the market and what the advance-decline line is telling us. He explains the Trading Day of the Month (TDOM) concept and how you...

READ MORE

MEMBERS ONLY

Stock Market Pushes Higher, But Is There a Bond Market Surprise Brewing?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooler inflation data sees Treasury yields fall and bond prices rise

* The S&P 500 and Nasdaq Composite hit new highs as interest rate cuts could be on the horizon

* AAPL overcomes headwinds and is playing catchup while TSLA awaits results of a shareholder vote to approve...

READ MORE

MEMBERS ONLY

Bearish Divergences in 2 KEY Growth Stocks: BEWARE!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a fresh new all-time high for the S&P 500, a concerning "hanging man" candle for the SPY, and troubling bearish divergences on the charts of AMZN and GOOGL. He also breaks down short-term and...

READ MORE

MEMBERS ONLY

The Next Direction for Interest Rates Is...?

by Martin Pring,

President, Pring Research

In most cycles, central banks around the world raise and lower short-term interest rates in a rough synchronization. Last week, the European and Canadian central banks began lowering their rates, and the British are expected to follow suit this week. Most observers of the US expect the Federal Reserve to...

READ MORE

MEMBERS ONLY

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points. Mary Ellen also takes a close look at why stocks did not respond to today'...

READ MORE

MEMBERS ONLY

Technology Sector Participation Is Fading

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA...

READ MORE

MEMBERS ONLY

Tech Stocks Sell Off, But AI Shines!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish close in the markets while highlighting areas to stay away from. She also shares why AI-related areas of Tech remain positive and what drove the Retail sector into a new uptrend. The potential downtrend reversal...

READ MORE

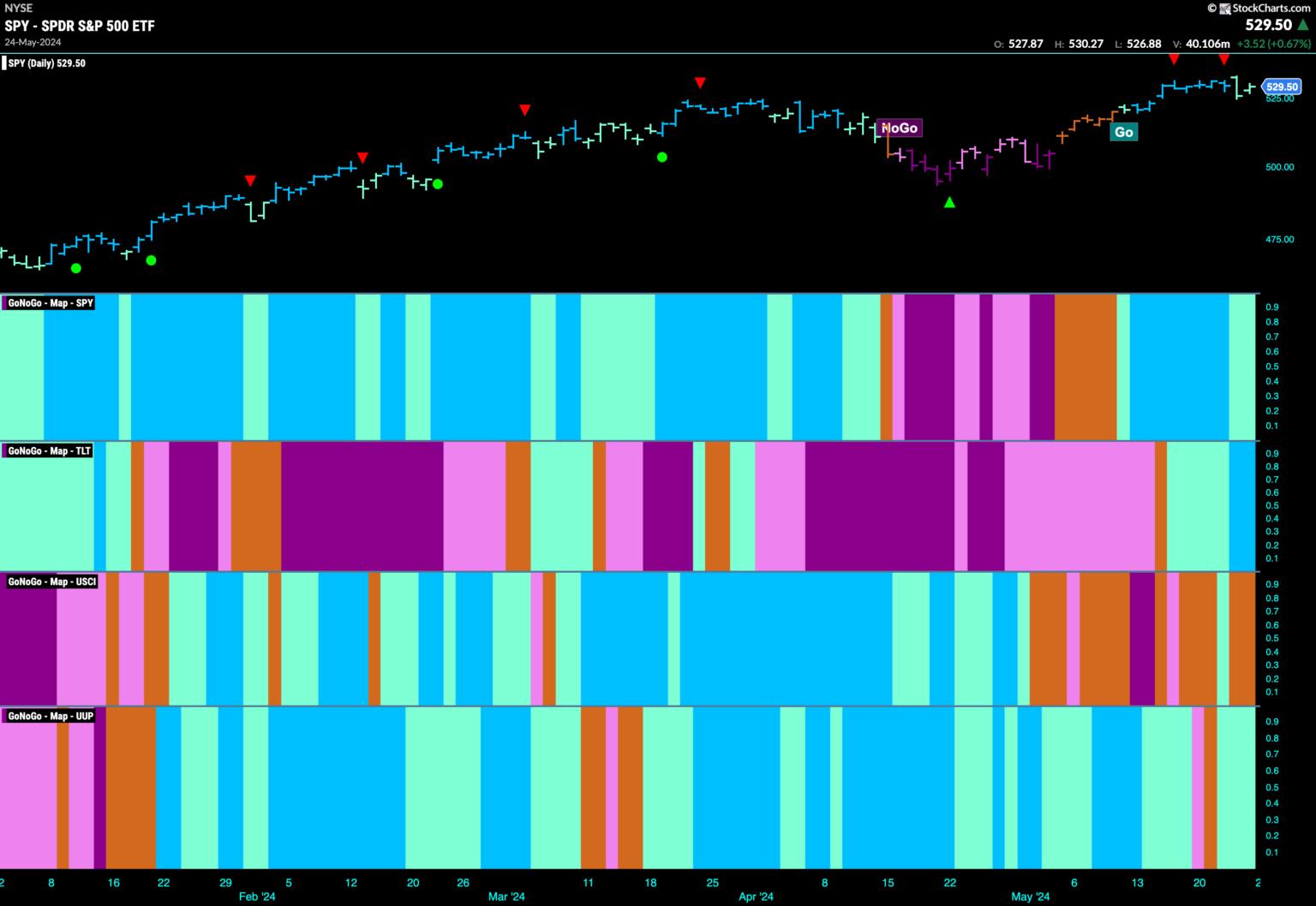

MEMBERS ONLY

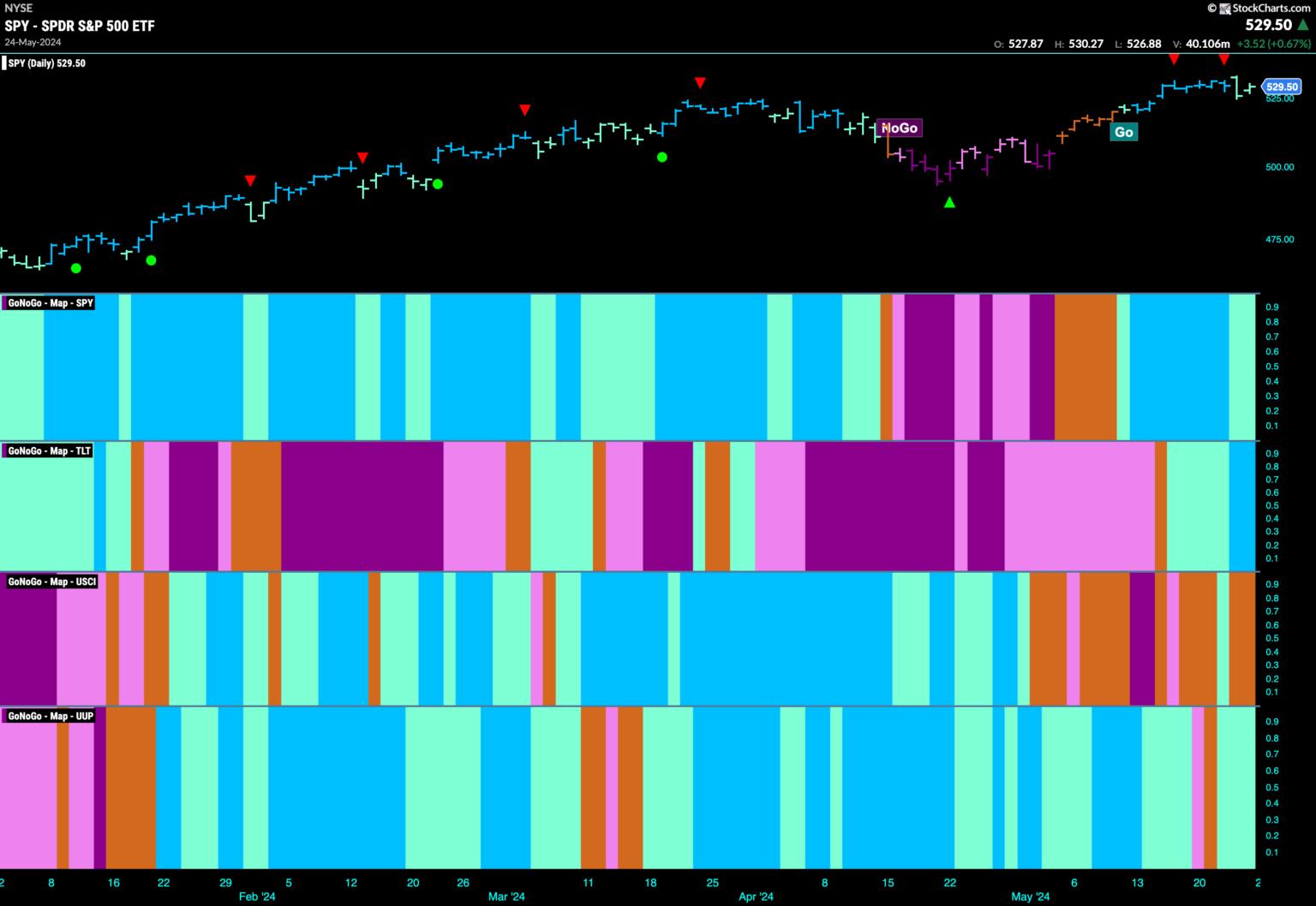

EQUITIES REMAIN IN "GO" TREND WITH SPARSE LEADERSHIP FROM TECH AND UTILITIES

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Relative Strength

* Market Trend

* Narrow Breadth

Good morning and welcome to this week's Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows)...

READ MORE

MEMBERS ONLY

MEM TV: How to Trade Nvidia After Its 15% Gain

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets and the rotation that's taking place amid a rise in interest rates. She also takes a close look at NVDA and shares how you should handle the stock after last week'...

READ MORE

MEMBERS ONLY

S&P 500 Breakout: Here to STAY or Heading for a FALL?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the quality of the breakout in the S&P 500, using sector rotation on Relative Rotation Graphs, the volume pattern in the S&P 500 and the relationship between stocks and bonds.

This video was originally broadcast on May 20,...

READ MORE

MEMBERS ONLY

DP Trading Room: What's Up With Semiconductors?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin takes a deep dive into the Semiconductors (SMH). She goes over the "under the hood" health of the industry group and then takes us within the industry group to find the leadership stocks in that area.

Carl shares his wisdom on the current conditions of the...

READ MORE

MEMBERS ONLY

The One Chart to Watch as S&P 500 Makes New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the S&P 500 and Nasdaq 100 have once again made new all-time highs, and the Dow Jones Industrial Average has briefly broken above the 40,000 level for the first time, how should we think about further upside for our equity benchmarks?

There are two general ways...

READ MORE

MEMBERS ONLY

Is This the Magic Upward Break Everybody Was Waiting For?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation still pointing to defense

* Upward break in SPY not supported by volume

* Asset class rotation starting to rotate in favor of bonds

No Confirmation In Volume

This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the...

READ MORE

MEMBERS ONLY

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and the Nasdaq Composite close at all-time highs

* Bond prices also moved higher, as did gold and silver

* The VIX remains low, indicating investors are complacent

The bull market hasn't gone anywhere. Despite of worrying about the...

READ MORE

MEMBERS ONLY

Powerful Entry Strategy Using One Moving Average

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways. He shows 3 different types of setups in the price action and its relationship to...

READ MORE

MEMBERS ONLY

The Top Performing Sector is Utilities?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session. He lays out a potential reversal in interest rates, what that could mean for growth stocks, and recaps earnings plays including WYNN,...

READ MORE