MEMBERS ONLY

Is This the Magic Upward Break Everybody Was Waiting For?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation still pointing to defense

* Upward break in SPY not supported by volume

* Asset class rotation starting to rotate in favor of bonds

No Confirmation In Volume

This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the...

READ MORE

MEMBERS ONLY

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Dow Jones Industrial Average, and the Nasdaq Composite close at all-time highs

* Bond prices also moved higher, as did gold and silver

* The VIX remains low, indicating investors are complacent

The bull market hasn't gone anywhere. Despite of worrying about the...

READ MORE

MEMBERS ONLY

China Tariffs Drive Upside for Rare Earth Minerals

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024. David charts the S&P 500'...

READ MORE

MEMBERS ONLY

Salesforce Falls Out of Favor: Trade the Bear Put Spread Options Strategy

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Salesforce stock will likely trade within the $210 to $220 area.

* A bear put spread is a strategy to consider if you want to take advantage of the stock trading between $210 and $220.

* With CRM's earnings about three weeks away, a bear put spread could...

READ MORE

MEMBERS ONLY

Meme Stock Frenzy Back In the Spotlight: Are Traders Losing Patience?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors look like they're keeping their powder dry until key economic data is released this week

* The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite are trading close to their highs, but are hesitant to reach it

* Meme stocks showed their might today,...

READ MORE

MEMBERS ONLY

Watch for Higher Lows in These Three Tech Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

DP Trading Room: Bonds & Yields At An Inflection Point

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's focus was on the current and long-term conditions of Bonds and Yields which are at an inflection point. Yields are attempting to hold onto a rising trend and Bonds are plodding along to the upside for now. One reader asked if it is time to start dollar...

READ MORE

MEMBERS ONLY

Week Ahead: Markets to Stay Tentative; This Defensive Sector May Start Showing Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, we had expressed concerns over the Nifty and VIX rising in the same direction simultaneously. As mentioned earlier, in such circumstances, the VIX often ends up acting as a leading indicator and a precursor to an impending corrective move. The previous week had seen VIX...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Bullish Flags

* Momentum Confirmation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

MEM TV: This Stealth AI Stock is Ready to EXPLODE Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias in the broader markets, along with the sector rotation into cyclical areas as growth areas languish. She then highlights the perils of buying, or holding, stocks around earnings releases, and shares a high-yielding stock...

READ MORE

MEMBERS ONLY

Stocks Pop Higher as Defensive Sectors Thrive

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an unusual day for stocks. The S&P 500 and Nasdaq closed higher, but the top sectors were defensive - real estate and utilities! He shares key levels to watch for NVDA, AAPL, TSLA, and more,...

READ MORE

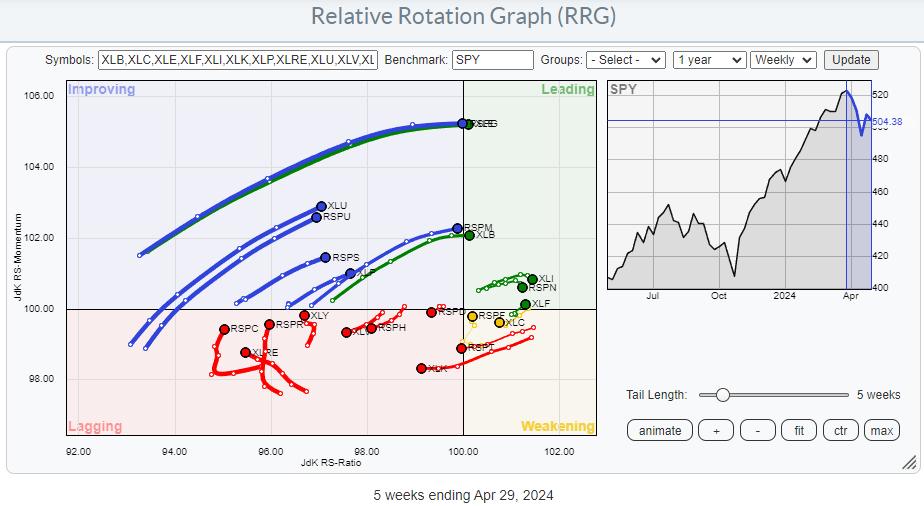

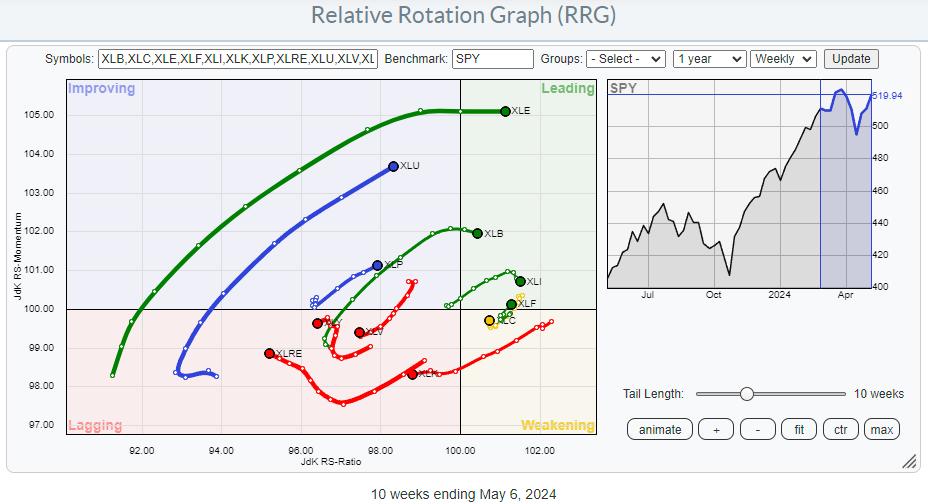

MEMBERS ONLY

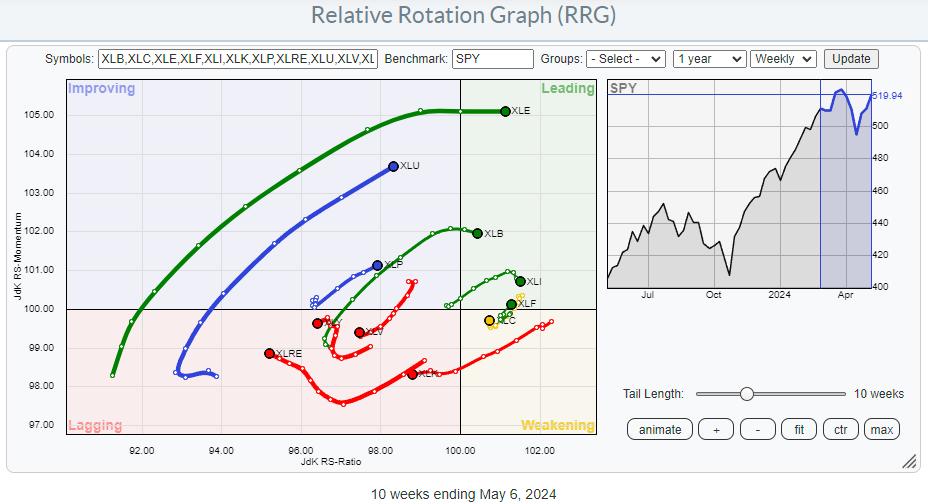

These Three Strong Financial Stocks Look Ready To Surge Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* XLF on strong RRG-Heading, rotating back into leading quadrant

* XLF price approaching overhead resistance after short setback

* Three major financial stocks ready for upward breaks to lead the sector higher

The Relative Rotation Graph for US sectors shows long tails for XLE and XLU. Both are on a...

READ MORE

MEMBERS ONLY

The Top Performing Sector is Utilities?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session. He lays out a potential reversal in interest rates, what that could mean for growth stocks, and recaps earnings plays including WYNN,...

READ MORE

MEMBERS ONLY

What Rising Volatility Means to the Current Market

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses a rising volatility condition to signal increased risk. He then discusses what needs to take place to offer a nice trading opportunity, and shows how to adjust your approach when volatility is increasing....

READ MORE

MEMBERS ONLY

Is the S&P 500 Forming a Bear Flag Pattern?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses in on price pattern analysis for the S&P 500, then reflects on the emergence of defensive sectors like consumer staples. He also recaps earnings movers, including DIS, SHOP, and more.

This video originally premiered on May...

READ MORE

MEMBERS ONLY

Why Novo Nordisk's Stock Price Recovery Makes It a Promising Buy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Novo Nordisk's stock price fell after its Q1 earnings report, but pivoted and reversed

* NVO stock could break above its all-time highs

* A couple of technical indicators can help confirm your buy decision

Novo Nordisk (NVO) reported Q1 earnings on May 2. Even though it was...

READ MORE

MEMBERS ONLY

The Market Breadth Indicator You Should Be Following

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average. He then identifies key levels to watch for PLTR, LCID, NFLX, NVDA, and AAPL, and breaks down the latest market breadth indicator...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Vulnerable to Disruption of Primary Trend; Volatility Likely to Stay

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and the VIX inching higher, i.e. moving in the same direction. In the previous technical note, we had expressly mentioned this concern, as instances of VIX...

READ MORE

MEMBERS ONLY

Technology Stocks Back In the Lead: Are Inflation Fears Behind Us?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher, but failed to show enough follow through to the upside

* Technology stocks were in the lead today and led the stock market higher

* The CBOE Volatility Index is back below 15, indicating lack of fear among investors

The weaker-than-expected jobs report...

READ MORE

MEMBERS ONLY

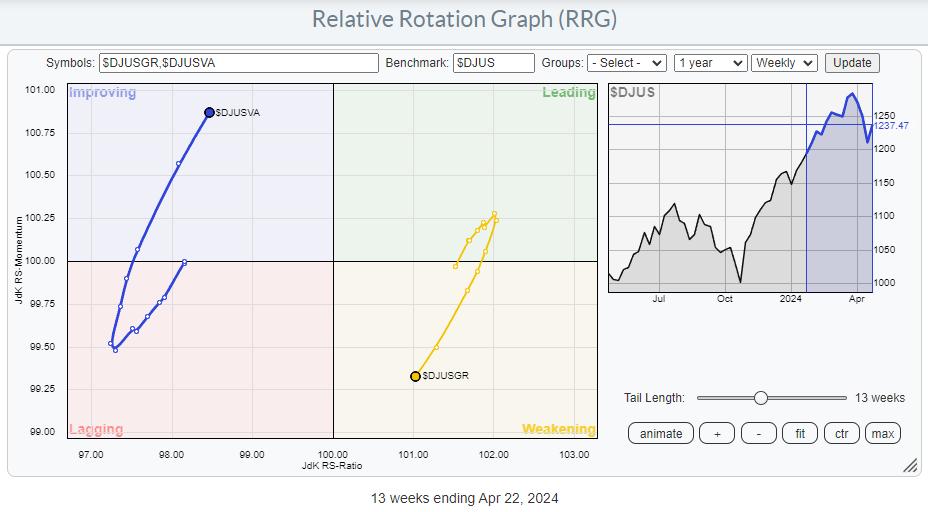

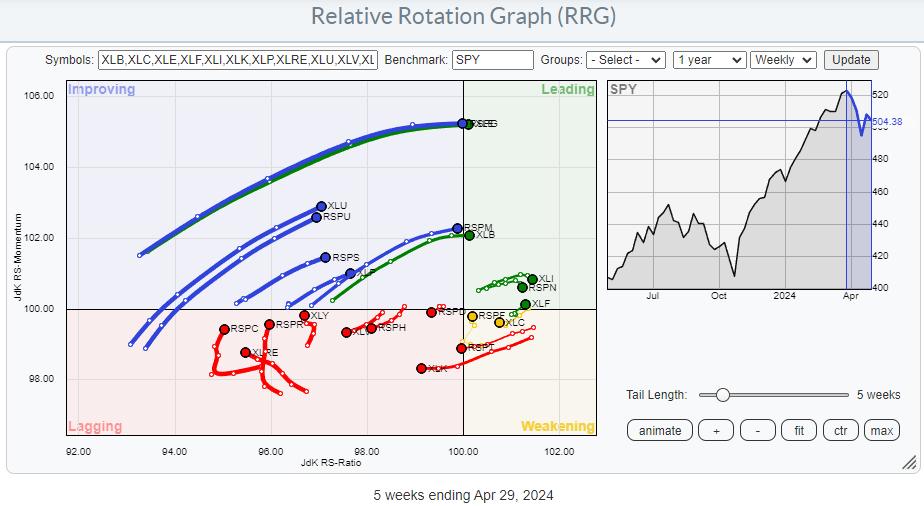

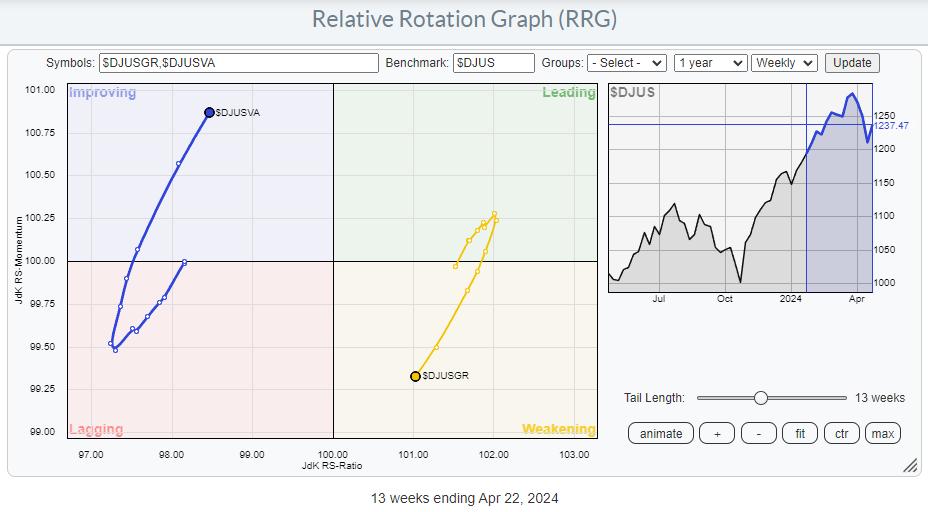

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

The BULL Case for BITCOIN

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Adrian Zduńczyk, CMT of The ₿irb Nest. David recaps a busy earnings week, breaking down the charts of PTON, AAPL, and more. Adrian tracks the recent pullback for Bitcoin and why the long-term uptrend still remains the prevailing...

READ MORE

MEMBERS ONLY

AMD at a Crossroads: Buy Now or Brace for More Losses?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMD stock plunged 7% after slightly topping Wall Street estimates

* There are three crucial turnaround levels to closely close monitor

* Momentum is key when deciding whether to go long, wait, or call off the trade

Advanced Micro Devices (AMD) slightly topped Wall Street's earnings and guidance...

READ MORE

MEMBERS ONLY

Market Pops, Then Drops on Fed Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Adam Turnquist, CMT of LPL Financial. Dave debriefs on today's Fed meeting market reaction, reviewing concerning technical developments for NVDA, AMD, SMCI, NCLH, and MAR. Adam relates short-term weakness in growth stocks to long-term strength...

READ MORE

MEMBERS ONLY

DP Trading Room: Intermediate-Term View of the Magnificent 7

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl puts the spotlight on the Magnificent 7 with a look at not only the daily charts, but also a review of the intermediate term using weekly charts. See where they are headed short-term and what are our expectations are in the intermediate term.

Carl also gave us his...

READ MORE

MEMBERS ONLY

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

Analyzing Alphabet's Surge — Here's How to Get In Earlier Next Time

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Alphabet shocked Wall Street on Thursday when it reported earnings, its first dividend, and a $70-billion buyback

* The stock gapped up 16%, its biggest since 2015

* Alphabet's technical "undervaluation" and quirks signaled the go-ahead to go long

Using technical indicators to identify stocks fundamentally...

READ MORE

MEMBERS ONLY

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

What's Really Driving Tesla's Surprising Stock Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* TSLA has been riding a long and volatile downtrend since 2021

* Tuesday's earnings were dismal, yet the stock jumped 16% after an announcement about near-term EV production

* The big question is if the gap up in TSLA's stock price has any substance or if...

READ MORE

MEMBERS ONLY

Weak Charts Keep Getting Weaker

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE). Explore the world of equity benchmarks and learn how large caps, mid caps, and small caps can offer unique opportunities based on sector rotation...

READ MORE

MEMBERS ONLY

DP TRADING ROOM: Find Shorts Using the Diamond Dog Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin shared her Diamond Dog Scan that she uses to find shorting opportunities. She was able to uncover five possible shorts. She discusses each chart and let's you know what she looks for in a good short.

Carl did the market overview with special attention paid to...

READ MORE

MEMBERS ONLY

Breakdown in Mega-Cap Growth Confirms Bear Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Early breakdowns from AAPL and TSLA provided initial warnings of a late stage bull market.

* Exponential gains in stocks like SMCI and MSTR have now turned into steep pullbacks with both stocks breaking below moving average support.

* With AMZN and NFLX finishing the week below their 50-day moving...

READ MORE

MEMBERS ONLY

META Stock in Limbo: What You Need to Know Before the Next Big Price Swing

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Meta's prospects look bullish mostly due to the rollout of Meta AI, which is expected to lead to substantial growth in ad revenue

* While analyst price predictions show a wide range, consensus ratings lean towards a "Buy" to a "Strong Buy"

* Technically,...

READ MORE

MEMBERS ONLY

Charts Flashing "No Go" for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Tyler Wood, CMT of GoNoGo Charts. Tyler walks through their proprietary momentum model which confirms a bearish rotation for the major equity benchmarks yet a bullish rotation for the commodity space. David walks through key earnings names...

READ MORE

MEMBERS ONLY

Will NFLX Pierce Through Resistance With Breakthrough Earnings? Here's What You Need to Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NFLX is close to a strong resistance level and could break above it if the company beats earnings estimates

* Netflix's stock price has been trending higher since July 22 after the stock took a deep plunge

* Expect a lot of volatility after NFLX announces earnings on...

READ MORE

MEMBERS ONLY

AMD Plunges to a Critical Support Level: Is Now the Time to Go Long?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMD is in a technical (near-term) downtrend, but its fundamentals promise otherwise

* AMD's stock price is trailing NVDA, though its lead over the rest of the industry appears to be waning

* AMD is in a technical "buy" range and the potential for a bullish...

READ MORE

MEMBERS ONLY

DP Trading Room: Final Earnings are In for 2023 Q4!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl opens the show with a view of the final earnings results for 2023 Q4! His chart reveals whether stocks are fair valued, overvalued or undervalued. Get his take on the current readings.

Carl gave us his market overview including Bitcoin, Gold Miners, Gold and Crude Oil and many more....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Subdued Over the Truncated Week; Defensive Play May Seem Evident

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Going into the previous week, the markets had been expected to inch higher; however, at the same time, while it was believed that incremental highs may be formed, it was also expected that a runaway move would not happen. Over the past four trading sessions, the markets traded precisely on...

READ MORE

MEMBERS ONLY

Stock Market Indexes Plunge After Hitting Resistance -- Support Levels You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average, S&P 500, and Nasdaq Composite dropped

* Gold keeps hitting new highs

* The VIX spiked above 18 but closed at 17.31

Now that earnings season has begun, what can you expect the stock market to do, especially after its stellar Q1 run?...

READ MORE

MEMBERS ONLY

RRG Indicates That Non-Mega Cap Technology Stocks are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The energy sector remains on a very strong rotational path

* A completed top formation in Healthcare opens up significant downside risk

* Smaller Technology stocks are taking over from mega-cap names

A Sector Rotation Summary

A quick assessment of current sector rotation on the weekly Relative Rotation Graph:

XLB:...

READ MORE