MEMBERS ONLY

Money's Not Leaving the Market - It's Rotating!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn't fleeing the market; it's simply moving around, creating fresh opportunities.

In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom...

READ MORE

MEMBERS ONLY

Missed Disney's Rally? Grab This Defined-Risk Put Spread for a Second Chance

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Stocks keep notching record highs. If you're like most investors, you're probably wondering, "Should I really chase these prices or sit tight and wait for a pullback?"

Instead of overthinking and ending up in Analysis-Paralysis land, however, it may be worth exploring other avenues...

READ MORE

MEMBERS ONLY

Should You Buy Roblox Stock Now? Key Levels to Watch

by Karl Montevirgen,

The StockCharts Insider

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn't the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank(SCTR) above 90, aside from a few dips, since last November....

READ MORE

MEMBERS ONLY

Top 10 July 2025 Stock Picks You Shouldn't Miss

by Grayson Roze,

Chief Strategist, StockCharts.com

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you'll also gain insight into key market...

READ MORE

MEMBERS ONLY

Tech Stocks Lead the Charge: What's Driving the Momentum?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The last day of trading for the first half of 2025 ended with a bang. The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) closed at record highs - an impressive finish, given the year has seen significant swings.

We saw signs of investors rotating into technology stocks last...

READ MORE

MEMBERS ONLY

Pullbacks & Reversals: Stocks Setting Up for Big Moves!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the bullish momentum in economically-sensitive sectors, including software, regional...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

Week Ahead: As NIFTY Breaks Out, Change of Leadership Likely to Keep the Index Moving

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing to edge higher. The trading range was wider than anticipated;...

READ MORE

MEMBERS ONLY

3 Stock Setups for the Second Half of 2025

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

As we head into the second half of 2025, here are three stocks that present strong technical setups with favorable risk/reward profiles. One is the largest market cap stock we're familiar with, which bodes well for the market in general. The second is an old tech giant...

READ MORE

MEMBERS ONLY

Fibonacci Retracements: The Key to Identifying True Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you've looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements on that list, because before I ever...

READ MORE

MEMBERS ONLY

SMCI Stock Surges: How to Invest Wisely Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Over a month ago, Super Micro Computer, Inc. (SMCI) appeared on our StockCharts Technical Rank(SCTR) Top 10 list. SCTRs are an exclusive StockCharts tool that can help you quickly find stocks showing strong technical strength relative to other stocks in a similar category.

Now, the stock market is dynamic,...

READ MORE

MEMBERS ONLY

From Drift to Lift: Spotting Breakouts Before Momentum Hits

by Joe Rabil,

President, Rabil Stock Research

MACD, ADX and S&P 500 action frame Joe Rabil's latest show, where a drifting index push him toward single-stock breakouts. Joe spotlights the daily and weekly charts of American Express, Fortinet, Parker-Hannifin, Pentair, and ServiceNow as showing strong ADX/MACD characteristics. He outlines how the patterns...

READ MORE

MEMBERS ONLY

Breakdown of NVDA's Stock Price and S&P 500: Actionable Technical Insights

by Frank Cappelleri,

Founder & President, CappThesis, LLC

The S&P 500 ($SPX) just logged its second consecutive 1% gain on Tuesday. That's three solid 1% advances so far in June. And with a few trading days remaining in the month, the index has recorded only one 1% decline so far.

A lot can still...

READ MORE

MEMBERS ONLY

Find Highest Probability Counter-Trend Setups

by Tony Zhang,

Chief Strategist, OptionsPlay

Think trading against the trend is risky? You may want to reconsider. When a stock or ETF is trending lower, the smart money watches for signs of a reversal; those early signals can get you into a trend before everyone else and lead to favorable risk-to-reward ratios.

In this video,...

READ MORE

MEMBERS ONLY

Shifting Tides in the Stock Market: A New Era for Bulls?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market has been on quite the rollercoaster of late, thanks to news headlines. But investors seem to have shrugged off the past weekend's geopolitical tensions, at least for now.

On Tuesday, we saw a surge of enthusiasm. Investors were diving back into stocks and selling off...

READ MORE

MEMBERS ONLY

How to Use Fibonacci Retracements to Spot Key Levels

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares how he uses the power of Fibonacci retracements to anticipate potential turning points. He takes viewers through the process of determining what price levels to use to set up a Fibonacci framework, and, from there, explains what Fibonacci retracements are telling him about the charts...

READ MORE

MEMBERS ONLY

AI Stocks Ignite Again—Where Smart Money is Heading Next

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen opens with a look at the S&P 500, noting that the index remains above its 10-day average despite a brief pullback—a sign of healthy market breadth. She points to ongoing sector leadership in technology, while observing that energy and defense stocks are...

READ MORE

MEMBERS ONLY

This Week's Earnings Watch: Turnarounds and Momentum Plays

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, we're keeping an eye on three major stocks that are reporting earnings. Two of them have been beaten down and are looking to turn things around, while the third has had a tremendous run and is looking to keep its extraordinary momentum going. Let's...

READ MORE

MEMBERS ONLY

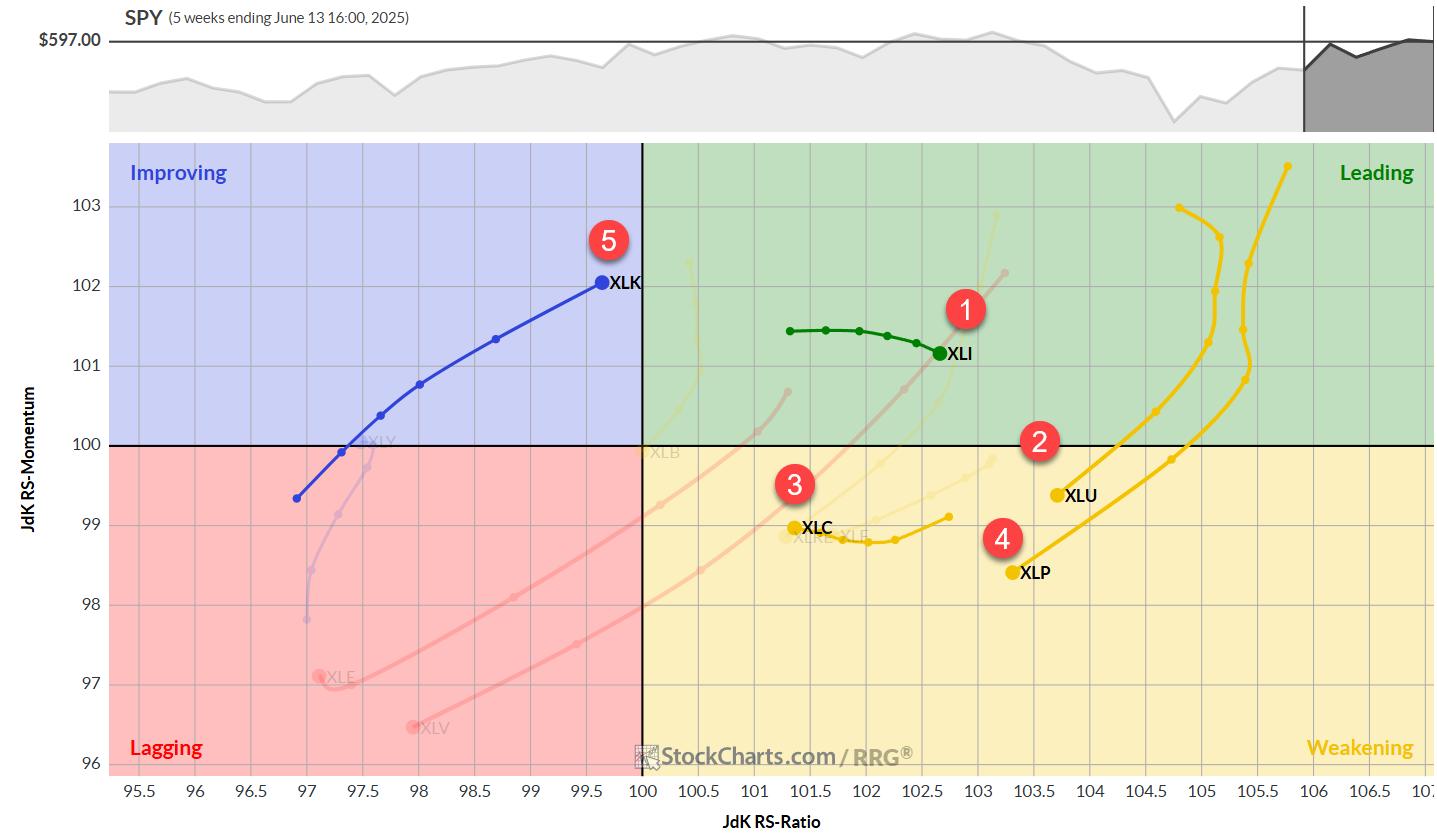

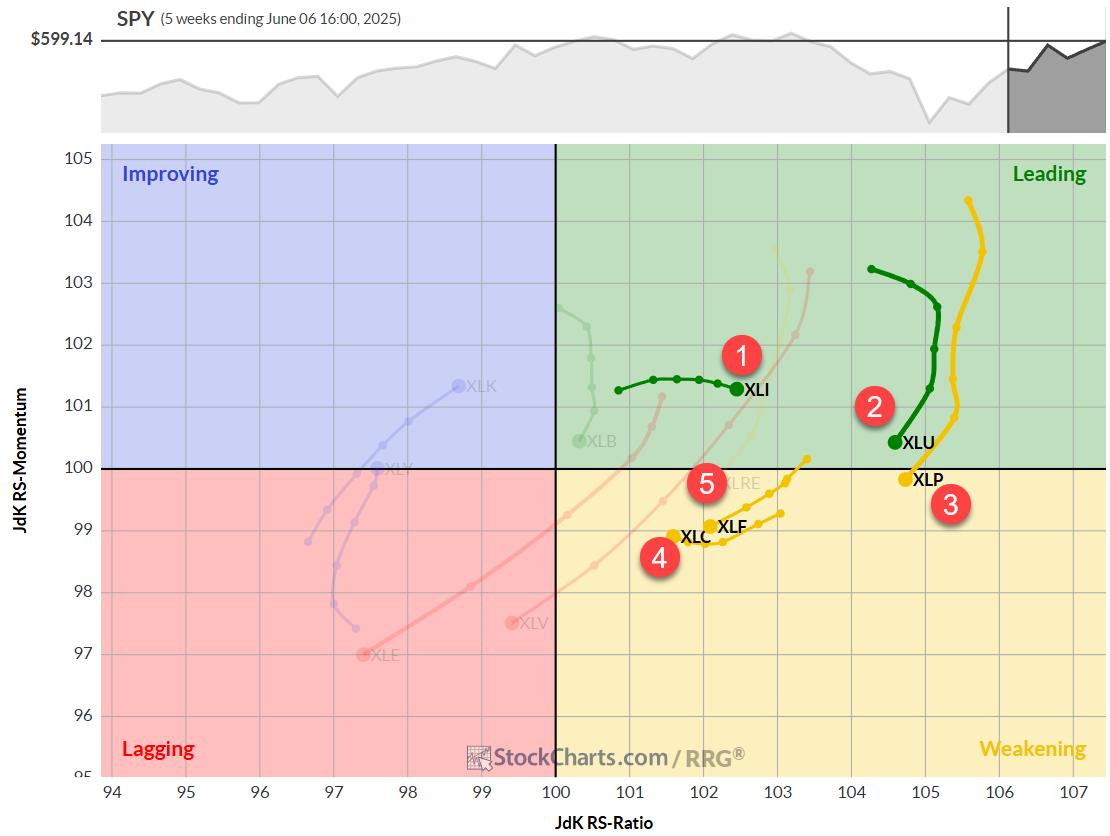

The Best Five Sectors, #24

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Some Sector Reshuffling, But No New Entries/Exits

Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're...

READ MORE

MEMBERS ONLY

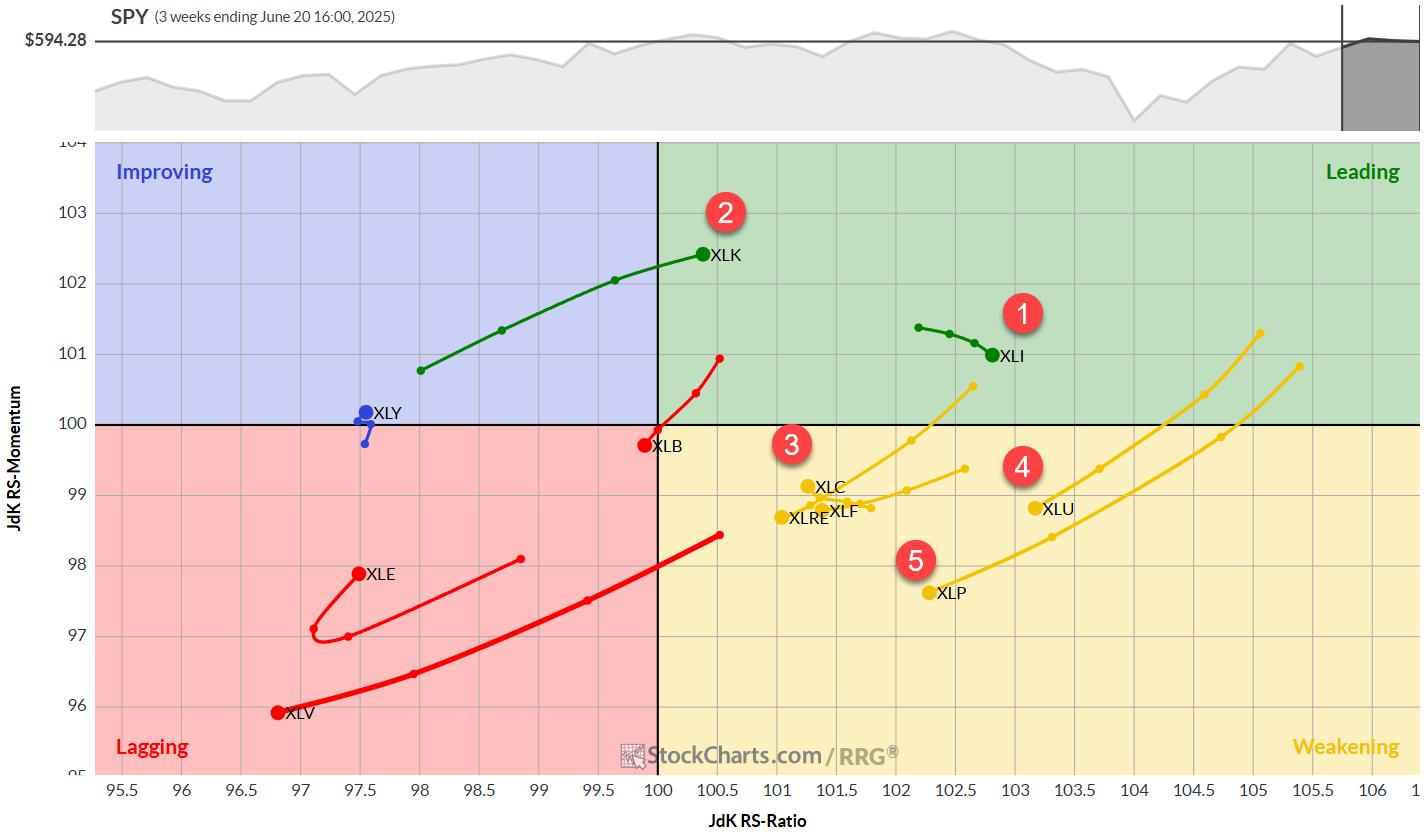

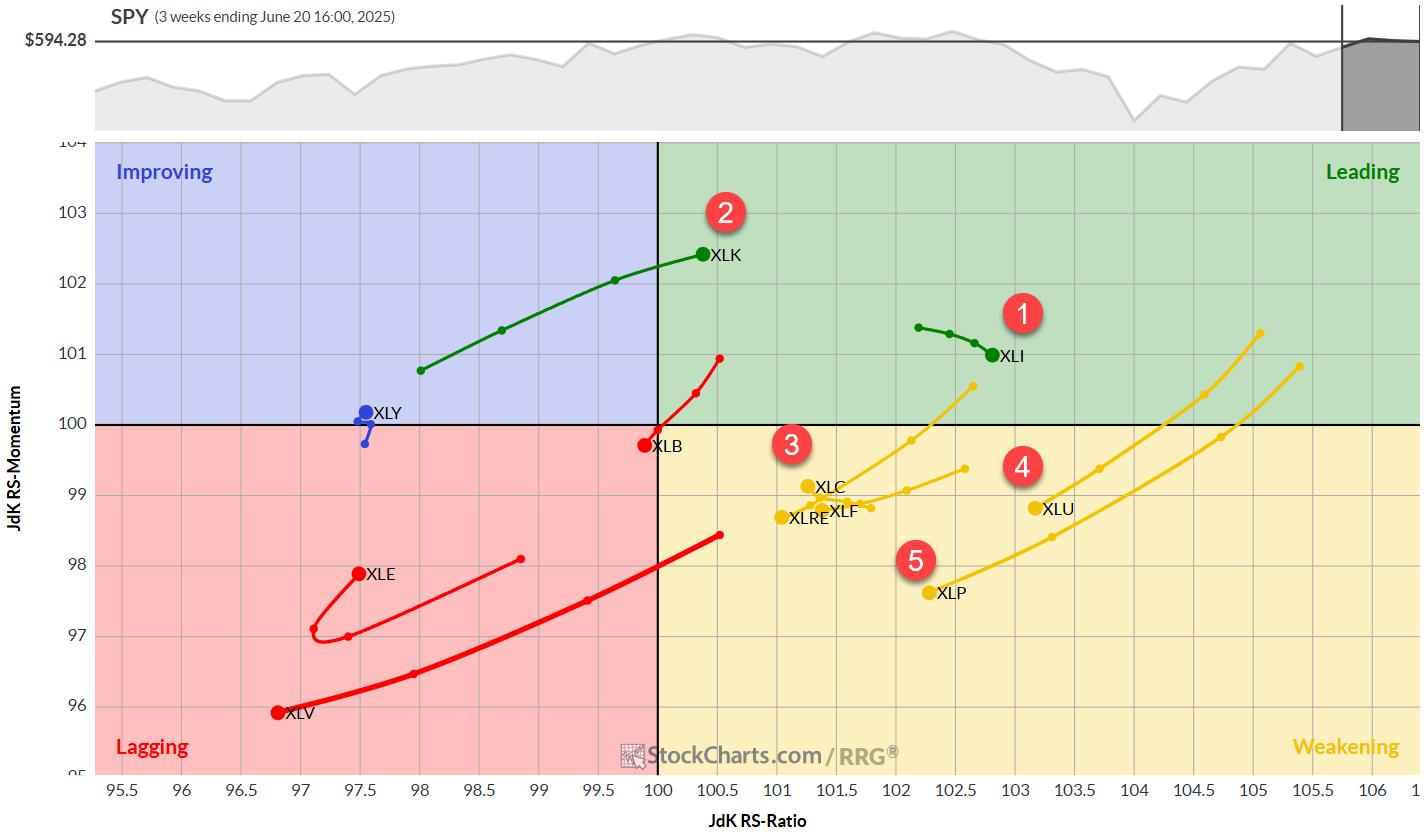

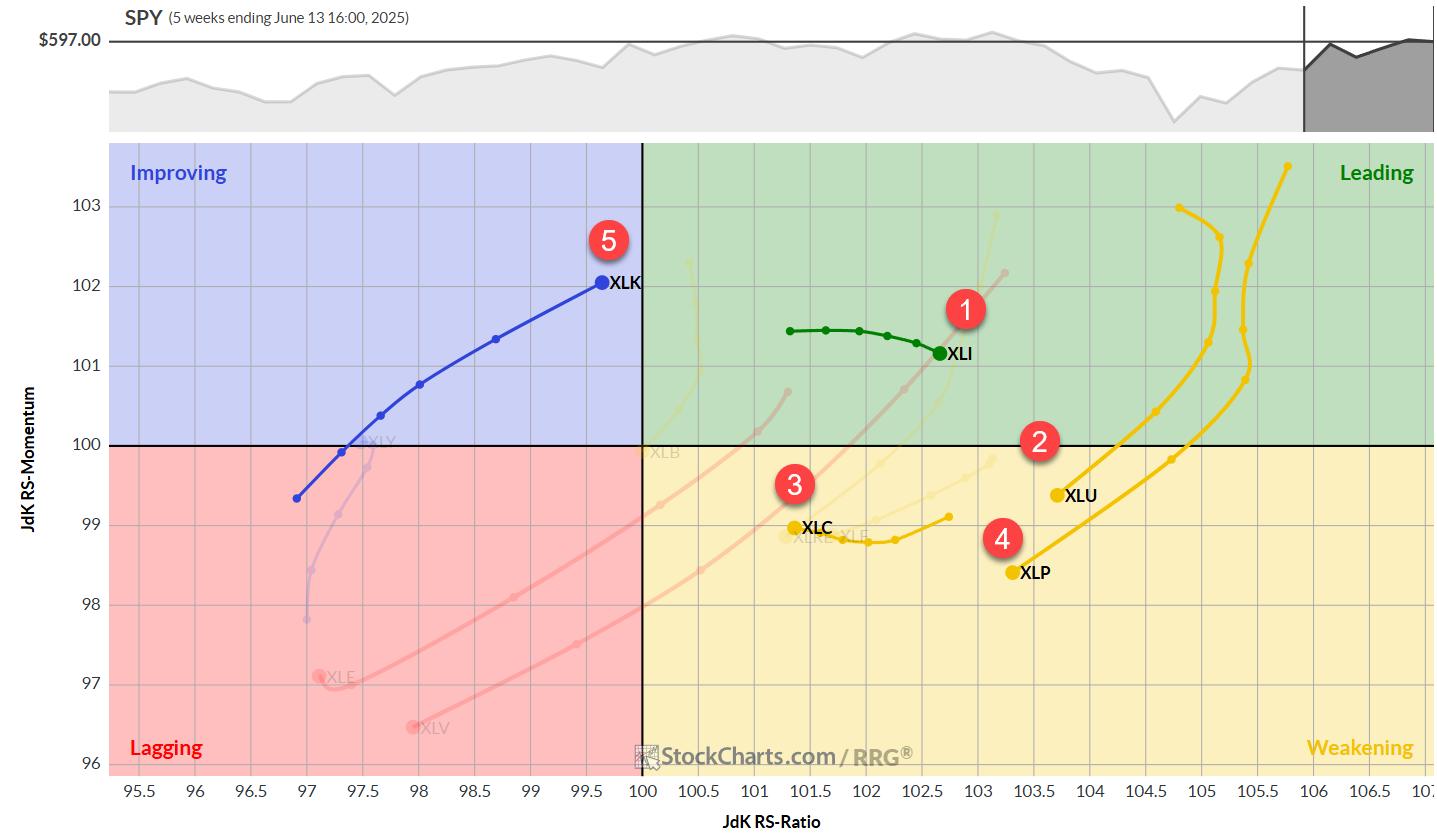

RRG Alert Tech Vaults to ‘Leading'—Is XLK Signaling a New Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights...

READ MORE

MEMBERS ONLY

Feeling Unsure About the Stock Market's Next Move? These Charts Can Help

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When the stock market seems to be drifting sideways without displaying a clear bullish or bearish bias, it's normal for investors to get anxious. It's like being at a crossroads, wondering whether to go left, right, or stay put.

The truth is nobody has a crystal...

READ MORE

MEMBERS ONLY

Joe Rabil's Undercut & Rally Pattern: From DROP to POP

by Joe Rabil,

President, Rabil Stock Research

Joe presents his game-changing "undercut and rally" trading pattern, which can be found in high volatility conditions and observed via RSI, MACD and ADX signals. Joe uses the S&P 500 ETF as a live case study, with its fast shake-out below support followed by an equally...

READ MORE

MEMBERS ONLY

3 S&P 500 Charts That Point to the Next Big Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Follow along with Frank as he presents the outlook for the S&P 500, using three key charts to spot bullish breakouts, pullback zones, and MACD signals. Frank compares bearish and bullish setups using his pattern grid, analyzing which of the two is on top, and explains why he&...

READ MORE

MEMBERS ONLY

G7 Meeting in Canada Could Be Opportune Time for Accumulating Canadian Dollar and Canadian Equities

by Martin Pring,

President, Pring Research

The Canadian dollar peaked in 2007 and 2011 at around $1.05, and it has been zig-zagging downwards ever since. Now at a lowly 73 cents USD, the currency looks as if it may be in the process of bottoming, or at the very least entering a multi-year trading range....

READ MORE

MEMBERS ONLY

Navigate the Stock Market with Confidence

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When you see headlines about geopolitical tensions and how the stock market sold off on the news, it can feel unsettling, especially when it comes to your hard-earned savings. But what you might not hear about in the news is what the charts are indicating.

Look at what happened in...

READ MORE

MEMBERS ONLY

Major Shift in the Markets! Here's Where the New Strength Is

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights breakouts in Energy and Defense, Technology sector leadership, S&P 500 resilience, and more. She then unpacks the stablecoin fallout hitting Visa and Mastercard, highlights Oracle's earnings breakout, and shares some pullback opportunities.

This video originally premiered June 13, 2025. You...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #23

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Time Technology Beats Financials

After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging.

This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Showing Resilience; Broader Markets May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

An attempt to break out of a month-long consolidation fizzled out as the Nifty declined and returned inside the trading zone it had created for itself. Over the past five sessions, the markets consolidated just above the upper edge of the trading zone; however, this failed to result in a...

READ MORE

MEMBERS ONLY

Bearish Divergence Suggests Caution For S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With Friday's pullback after a relatively strong week, the S&P 500 chart appears to be flashing a rare but powerful signal that is quite common at major market tops. The signal in question is a bearish momentum divergence, formed by a pattern of higher highs in...

READ MORE

MEMBERS ONLY

10‑Year Yield Warning! ADX + RSI Point to a Major Shift

by Joe Rabil,

President, Rabil Stock Research

Joe kicks off this week's video with a multi‑timeframe deep dive into the 10‑year U.S. Treasury yield (TNX), explaining why a sideways coil just below the 5% level could be "downright scary" for equities. From there, he demonstrates precise entry/exit timingwith a...

READ MORE

MEMBERS ONLY

Master Debit Spreads: Upgrade Your Options

by Tony Zhang,

Chief Strategist, OptionsPlay

Ready to elevate your options game?

In this must-watch video, options trading expert Tony Zhang dives deep into debit vertical spreads. He explains the key differences between single-leg options and debit vertical spreads, illustrates step-by-step how to set up these strategies, and teaches how you can master the art of...

READ MORE

MEMBERS ONLY

Is the S&P 500 Flashing a Bearish Divergence?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Unlock the power of divergence analysis! Join Dave as he breaks down what a bearish momentum divergence is and why it matters. Throughout this video, Dave illustrates how to confirm (or invalidate) the signal on the S&P500, Nasdaq100, equal‑weighted indexes, semiconductors, and even defensive names like AT&...

READ MORE

MEMBERS ONLY

Micron's Coiled for An Explosive Move (Up or Down): Here's What You Need to Know Now

by Karl Montevirgen,

The StockCharts Insider

Micron Technology, Inc. (MU) appears poised for an explosive breakout, both technically and fundamentally. While it remains to be seen whether this materializes by its Q3 earnings report on June 25, the setup suggests a high-probability move is about to happen, and soon.

The fundamental case for a breakout is...

READ MORE

MEMBERS ONLY

A Few Charts Worth Watching This Week

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

There are a few very different setups unfolding this week that are worth a closer look: two software-related names that are struggling to reclaim their winning ways, plus one lovable and reliable stock wagging its tail in the spotlight.

Let's break it down.

Adobe (ADBE): Mind the Gaps...

READ MORE

MEMBERS ONLY

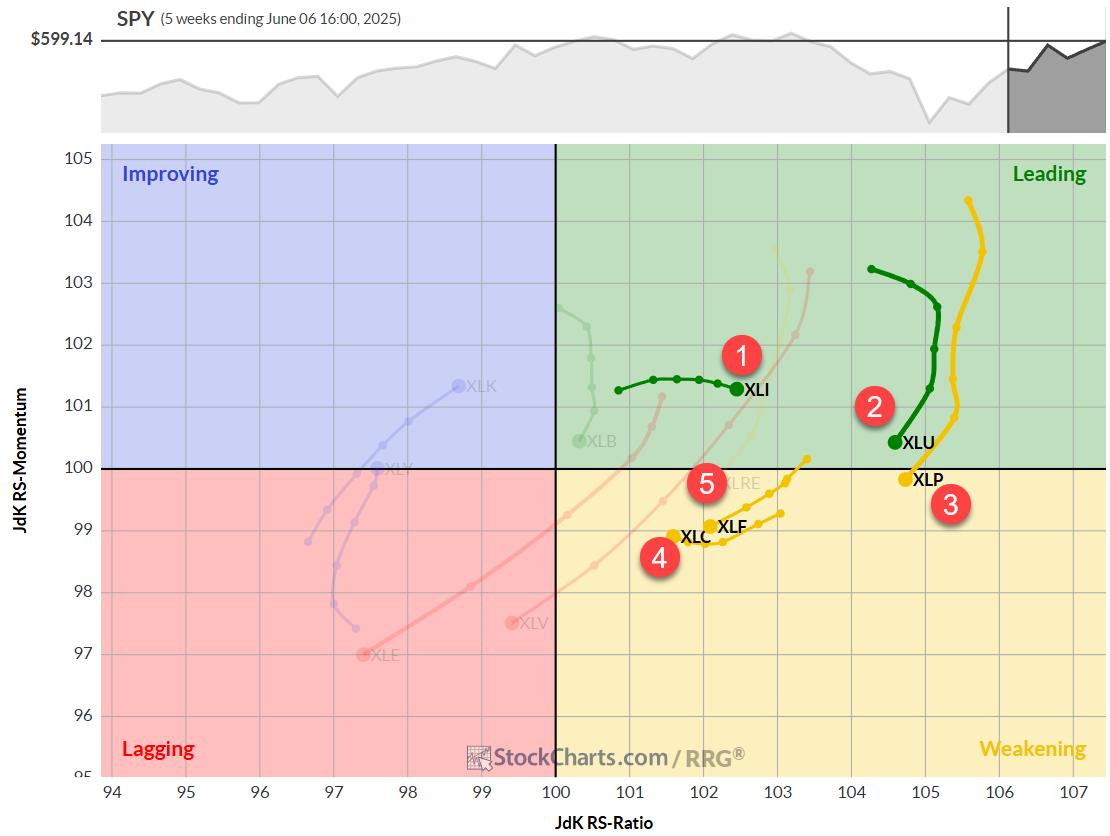

The Best Five Sectors, #22

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector Rotation: A Week of Stability Amidst Market Dynamics

Last week presented an intriguing scenario in our sector rotation portfolio.

For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings.

1. (1) Industrials - (XLI)

2. (2) Utilities...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level Crucial as Index Looks at Potential Resumption of Up Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions, the Nifty traded with an underlying positive bias and ended near the week's high point while also attempting to move past a crucial pattern...

READ MORE

MEMBERS ONLY

From Tariffs to Tech: Where Smart Money's Moving Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which sectors are truly leading (industrials, technology & materials), and what next week's inflation data could mean for your portfolio.

This video originally...

READ MORE

MEMBERS ONLY

Your Weekly Stock Market Snapshot: What It Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday's NFP, the big one the market was waiting for, showed that 139,000 jobs were added in May, which was better than the expected 130,000. Unemployment rate...

READ MORE

MEMBERS ONLY

Three Charts Showing Proper Moving Average Alignment

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I'm a huge fan of using platforms like StockCharts to help make my investment process more efficient and more effective. The StockCharts Scan Enginehelps me identify stocks that are demonstrating constructive technical configuration based on the shape and relationship of multiple moving averages.

Today, I'll share...

READ MORE

MEMBERS ONLY

Clusters of Long Winning Streaks: What They're Telling Us

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Recently, the S&P 500 ($SPX) has been racking up a good number of wins.

Since late April, the index has logged its third winning streak of at least five: a nine-day streak from April 22–May 2 and a six-day streak from May 12–May 19. That makes...

READ MORE