MEMBERS ONLY

Three Stocks With Post-Earnings Upside Potential

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the major averages logging a strong up week across the board, and with the Nasdaq 100 finallyretesting its 200-day moving averagefrom below, it can feel like a challenging time to take a shot at winning charts. You may ask yourself, "Do I really want to be betting on...

READ MORE

MEMBERS ONLY

Stock Market Wrap: Stocks Rebound as May Kicks Off with a Bang—What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* A strong jobs report sparked a stock market rally, with major indexes closing the week higher.

* Positive earnings from Microsoft and Meta Platforms took the Nasdaq Composite above its 50-day moving average.

* Financials, Industrials, and Technology were the leading sectors this week, with Financials showing technical strength.

We...

READ MORE

MEMBERS ONLY

Stocks In Focus This Week: Palantir, Uber, and Coinbase

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Palantir stock nears breakout as AI revenue and government contracts drive growth.

* Uber stock signals strength ahead of earnings report.

* Coinbase eyes reversal as crypto trading volume increases.

This week, we're watching three high-profile names--Palantir (PLTR), Uber (UBER), and Coinbase (COIN)--as they gear up for...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts For May 2025: Breakouts, Trends & Big Moves!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. They break down breakout strategies, moving average setups, and technical analysis strategies using relative strength, momentum, and trend-following indicators. This analysis covers key market trends that could impact your trading decisions. You don&...

READ MORE

MEMBERS ONLY

Master the 18/40 MA Strategy: Spot Trend, Momentum & Entry

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe demonstrates how to use the 18-day and 40-day moving averages to identify trade entry points, assess trend direction, and measure momentum. He breaks down four key ways these MAs can guide your trading decisions—especially knowing when to be a buyer. Joe also analyzes commodities, noting...

READ MORE

MEMBERS ONLY

The SCTR Report: Why PLTR Stock Remains a Top Contender in a Volatile Market

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* PLTR stock dropped sharply in February 2025 but rebounded in April, thanks to easing trade tensions and new government contracts.

* RSI and Accumulation/Distribution Line (ADL) suggest bullish momentum, but valuations remain stretched.

* Watch the May 5 earnings report and geopolitical developments for PLTR stock's next...

READ MORE

MEMBERS ONLY

Ready To Level Up Your Options Trading?

by Tony Zhang,

Chief Strategist, OptionsPlay

Grow your trading account using proven options strategies, right from your StockCharts ChartLists, with the help of this powerful educational webinar!

In this session, Tony Zhang, Chief Strategist of OptionsPlay, will show you how to:

* Scan your ChartLists for top-performing trade setups

* Identify income-generating and directional opportunities

* Use OptionPlay'...

READ MORE

MEMBERS ONLY

Personalized Options Trading Strategies: Discover High-Yield Covered Calls and Spreads with the OptionsPlay Add-On

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* OptionsPlay now integrates with your StockCharts ChartLists.

* Focus on only the most promising setups tailored to your directional bias and risk tolerance.

* Make faster, smarter, and personalized trading decisions with the OptionsPlay Add-On.

If you've been exploring ways to take your options trading to the next...

READ MORE

MEMBERS ONLY

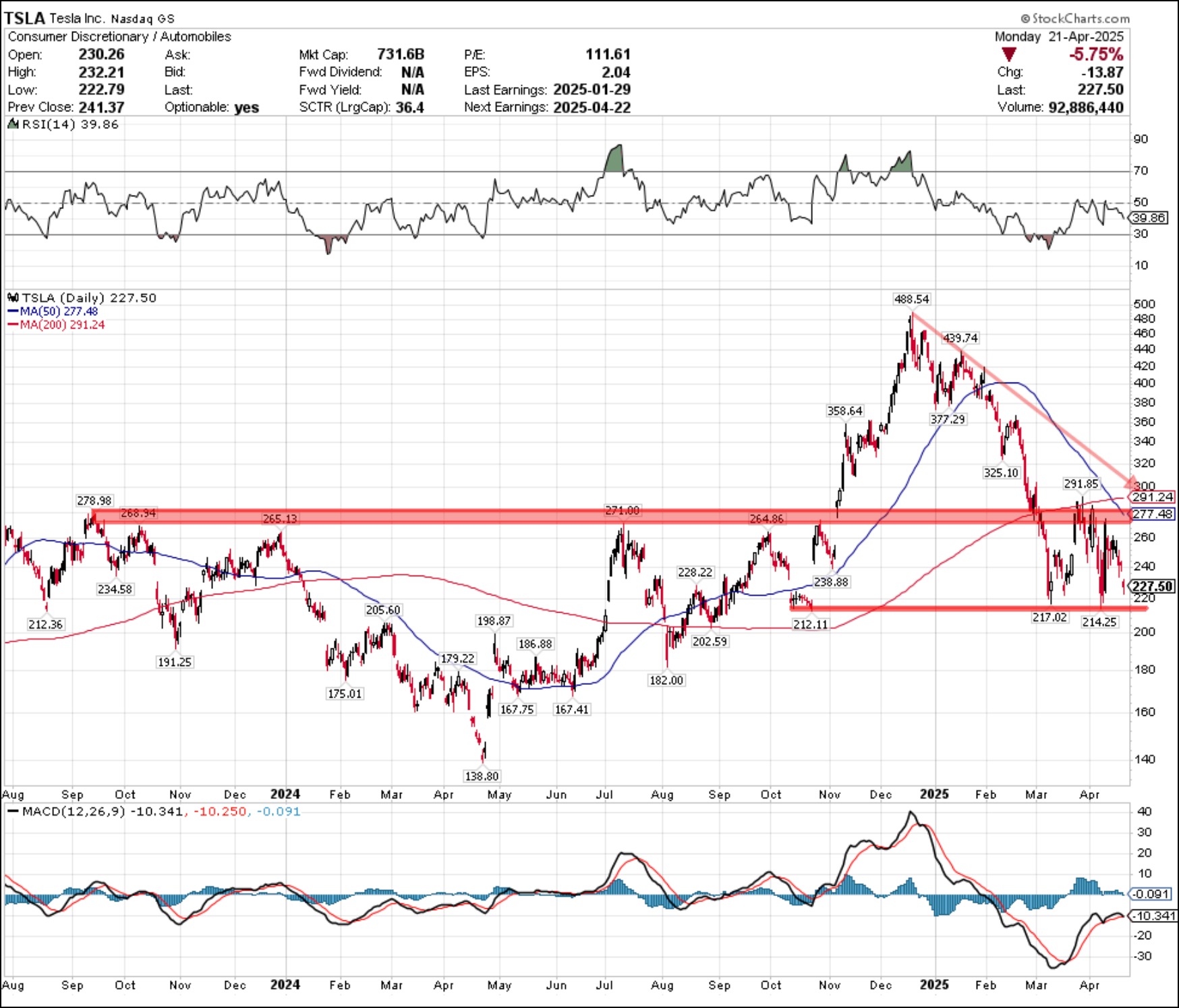

Tesla: The Breakout to Bolster the Bulls

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* An absence of strong momentum tells us to be patient and wait for a better entry point on the chart.

* Momentum indicators like RSI can help us define the trend phase and better identify when buyers are taking control.

* A breakout above $290 could indicate a new accumulation...

READ MORE

MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

Week Ahead: RRG Indicates Sector Shifts; NIFTY Deals With These Crucial Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong move the week before, the markets took on a more consolidatory look over the past five sessions. Following ranged moves, the Nifty closed the week on just a modestly positive note. From a technical standpoint, the Nifty tested a few important levels on both daily and weekly...

READ MORE

MEMBERS ONLY

Top Stock Areas After the Rally: What Smart Money Is Buying

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, after last week's sharp market rally, Mary Ellen breaks down where the markets stand now, which leading sectors are showing the most strength, and how to recognize if your stocks are entering a new uptrend. Get expert insights on market leadership, sector rotation, and key...

READ MORE

MEMBERS ONLY

S&P 500 Rises from Bearish to Neutral, But Will It Last?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* This week's rally pushed the S&P 500 above an important trendline formed by the major highs in 2025.

* Improving market breadth indicators confirm a broad advance off the early April market low.

* Using a "stoplight" technique, we can better assess risk and...

READ MORE

MEMBERS ONLY

Earnings Week in Full Swing: Don't Overlook These Three Stocks

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week will be the biggest week of earnings season and yes, all eyes will be on the heavy-hitters: META, AMZN, MSFT, and AAPL. These names dominate headlines, and their charts are practically seared into our brains.

But let's look at some solid companies that might fly under...

READ MORE

MEMBERS ONLY

How to Shield Your Stocks During a Market Decline

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* When stock markets decline, you can protect your positions with options.

* Buying puts on stocks you own can help protect your position if the stock falls further.

* A put vertical spread is another strategy to protect your portfolio holdings.

When the stock market is turbulent, it makes sense...

READ MORE

MEMBERS ONLY

Hidden Gems: Bullish Patterns Emerging in These Country ETFs

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe highlights key technical setups in select country ETFs that are showing strength right now. He analyzes monthly and weekly MACD, ADX, and RSI trends that are signaling momentum shifts. Joe also reviews the critical level to watch on the S&P 500 (SPX), while breaking...

READ MORE

MEMBERS ONLY

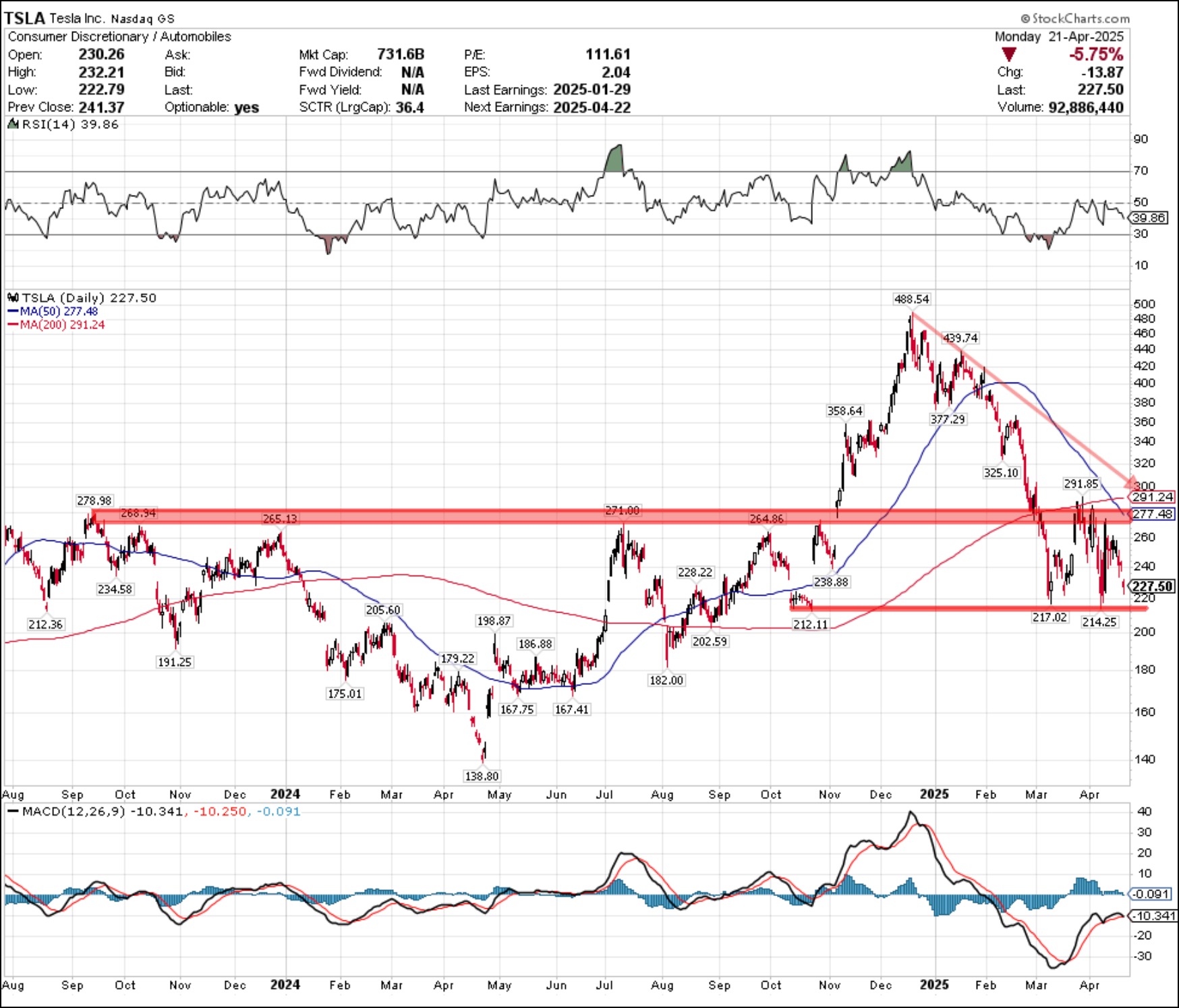

Three Stocks to Watch This Earnings Week

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Tesla's daily chart displays key support levels to monitor after the company reports earnings.

* Service Now is showing signs of a bottom, which could mean a reversal depending on earnings results.

* Watch for Alphabet, Inc. shares to hit specific support levels, which could give traders favorable...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

Safer Stock Picks for an Uncertain Market (High Yield + Growth)

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, as earnings season heats up, Mary Ellen reviews current stock market trends, highlighting top-performing stocks during past bear markets that are showing strength again today. She also shares a proven market timing system that's signaled every stock market bottom, helping investors stay ahead of major...

READ MORE

MEMBERS ONLY

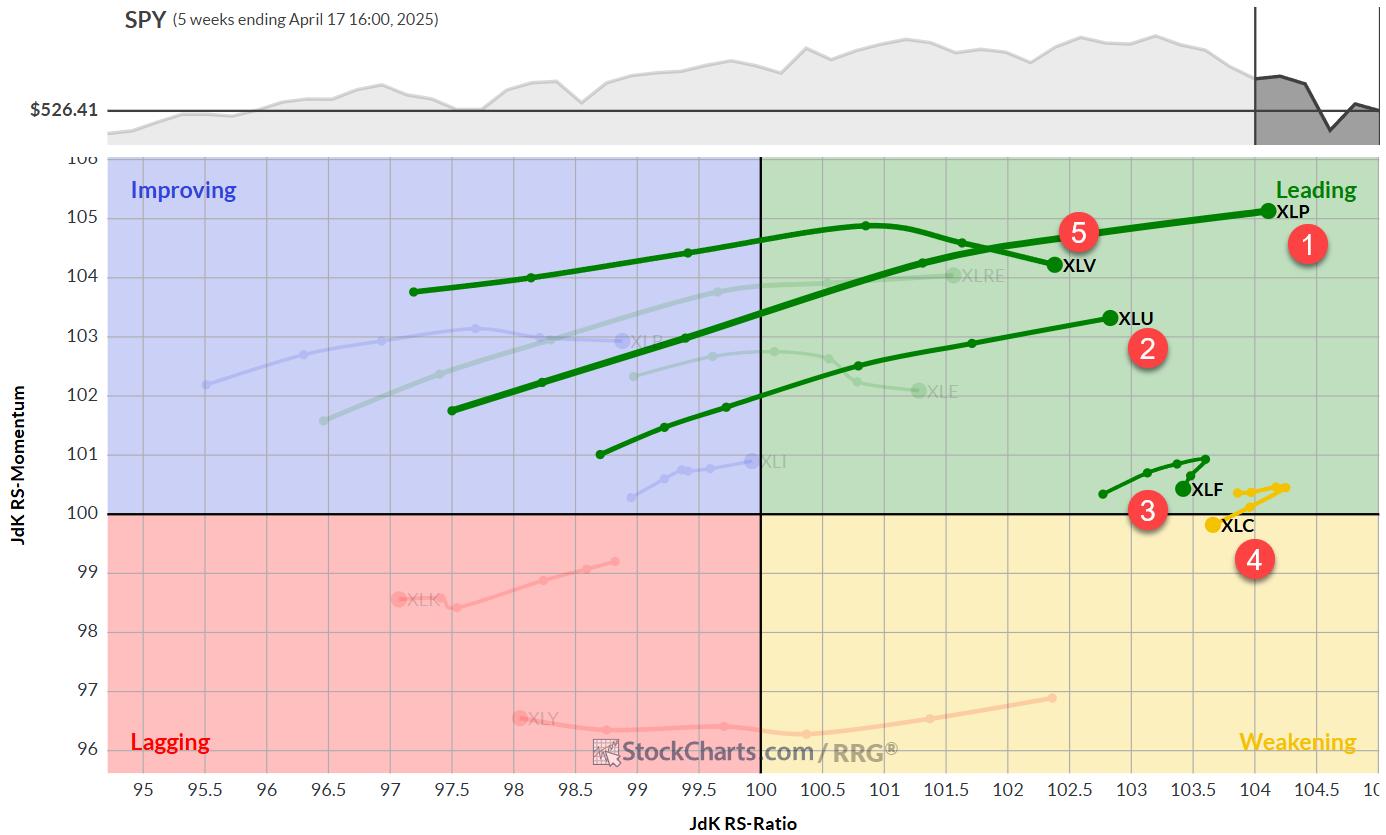

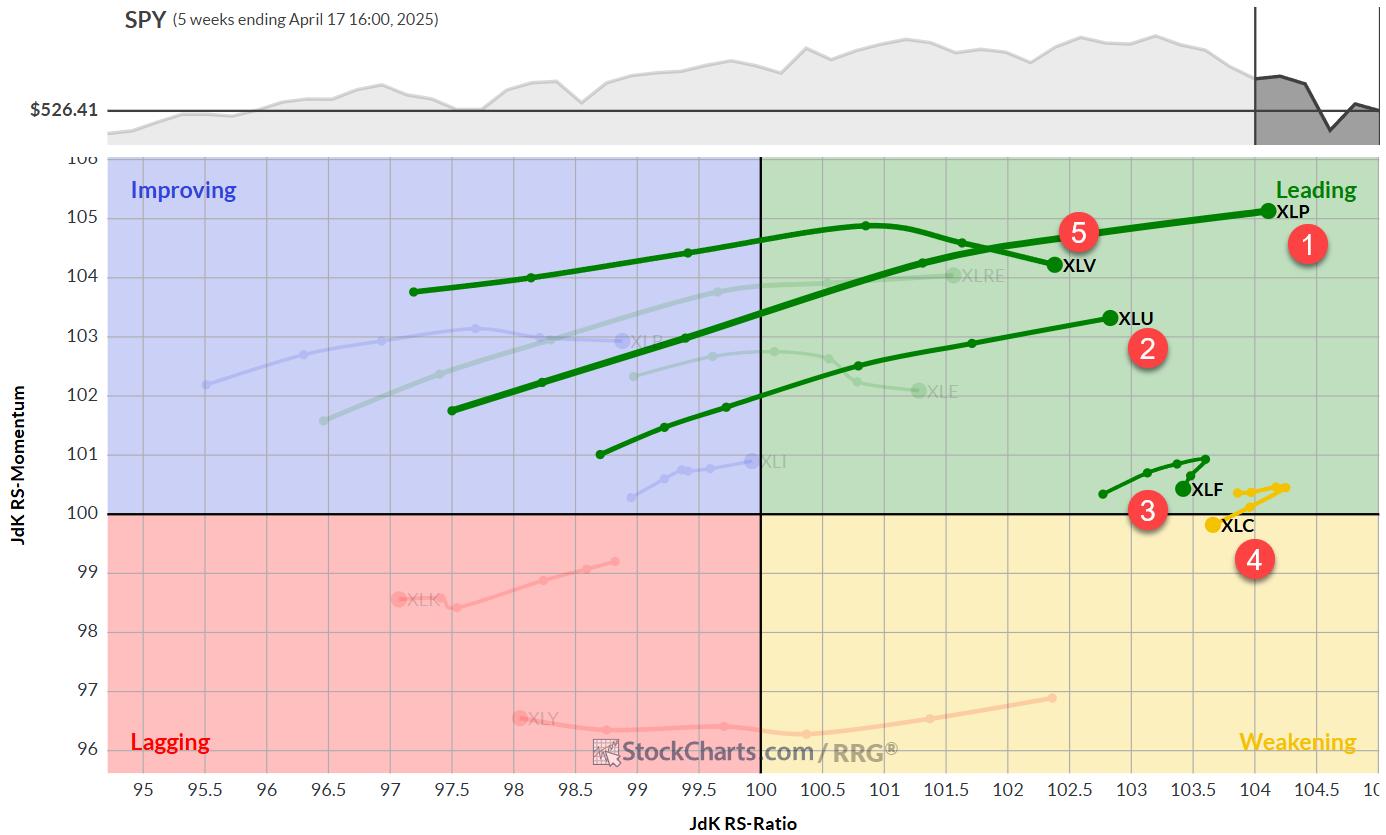

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

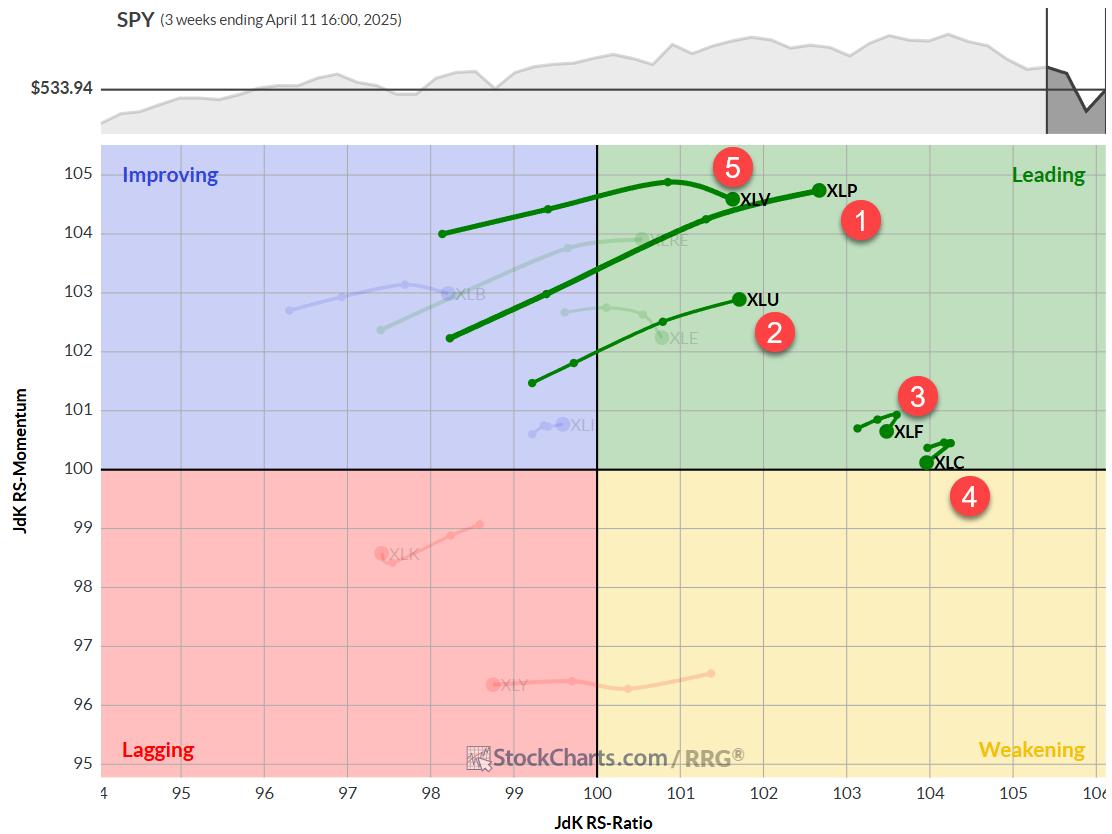

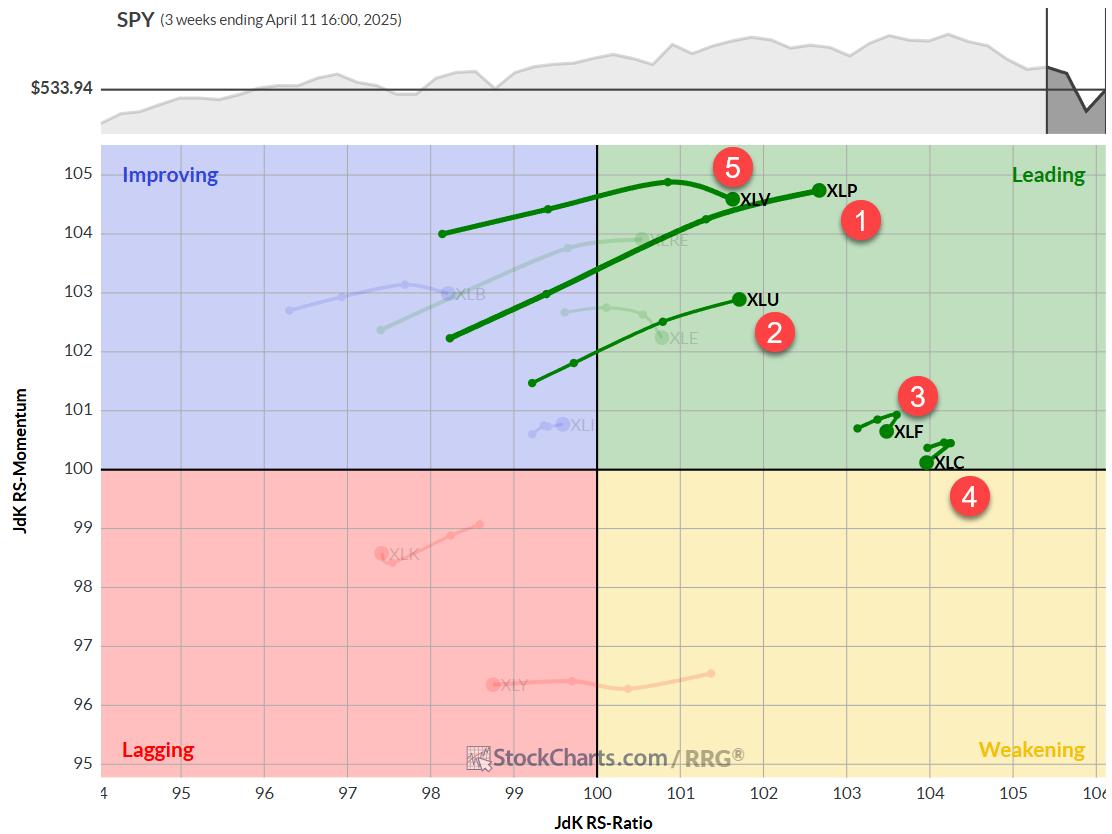

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

Week Ahead: What Should You Do as Nifty Marches Higher Towards the Resistance Zone?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was a short trading week with just three trading days. However, the Indian equities continued to surge higher, demonstrating resilience, and the week ended on a positive note.

During the week before last, the Nifty was able to defend the 100-week MA; last week, it...

READ MORE

MEMBERS ONLY

When in Doubt, Follow the Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Consumer Discretionary sector has underperformed the Consumer Staples sector since February, indicating defensive positioning for investors.

* The Relative Rotation Graphs (RRG) show a clear rotation from "things you want" to "things you need" as investors fear weakening economic conditions.

* We remain focused on...

READ MORE

MEMBERS ONLY

Breadth Maps Are A Bloodbath, BUT Has The Bounce Begun?

by Grayson Roze,

Chief Strategist, StockCharts.com

In this video, Grayson unveils StockCharts' new Market Summary ChartPack—an incredibly valuable new ChartPack packed full of pre-built charts covering breadth, sentiment, volatility data and MUCH MORE!

From there, Grayson then breaks down what he's seeing on the current Market Summary dashboard, illustrating how he'...

READ MORE

MEMBERS ONLY

Sector Rotation Update: Value Stocks and Bonds Lead the Way!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market. He starts at the asset allocation level using Relative Rotation Graphs (RRGs) to analyze stocks vs bonds performance, then highlights the...

READ MORE

MEMBERS ONLY

200-Day Moving Average Confirms Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 currently sits about 8% below its 200-day moving average, even with a strong upswing on last week's tariff news.

* The newly updated Market Summary page on StockCharts.com allows investors to compare key market indexes to their 200-day moving averages.

* Three...

READ MORE

MEMBERS ONLY

Trade Pullbacks Like a Pro: Simple Moving Average Strategy That Works

by Joe Rabil,

President, Rabil Stock Research

Moving average strategy, trend trading, and multi-timeframe analysis are essential tools for traders. In this video, Joe demonstrates how to use two key moving averages to determine if a stock is in an uptrend, downtrend, or sideways phase. He then expands on applying this concept across multiple timeframes to gain...

READ MORE

MEMBERS ONLY

How to Time Your Trades For Faster Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

When working with probabilities, you want to place trades that maximize your returns while minimizing your risks.

In this OptionsPlay members-only video, Tony Zhang walks you through the techniques professional traders use to identify optimal entry points. Explore how you can apply those same strategies in the StockCharts.com OptionsPlay...

READ MORE

MEMBERS ONLY

Secure Your Retirement Happiness: Check Your 401(k) Now!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* When the stock market is erratic you should evaluate your 401(k).

* The S&P 500 is trading below its 200-day moving average.

* The general sentiment continues to be bearish.

With so many articles and videos on popular media channels advising you not to look at your...

READ MORE

MEMBERS ONLY

DP Trading Room: SPX Earnings Update

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been overvalued for some time but how overvalued is it? Today Carl brings his earnings chart to demonstrate how overvalued the market is right now. We have the final data for Q4 2024.

The market continues to show high volatility but it did calm down somewhat Monday....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #15

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

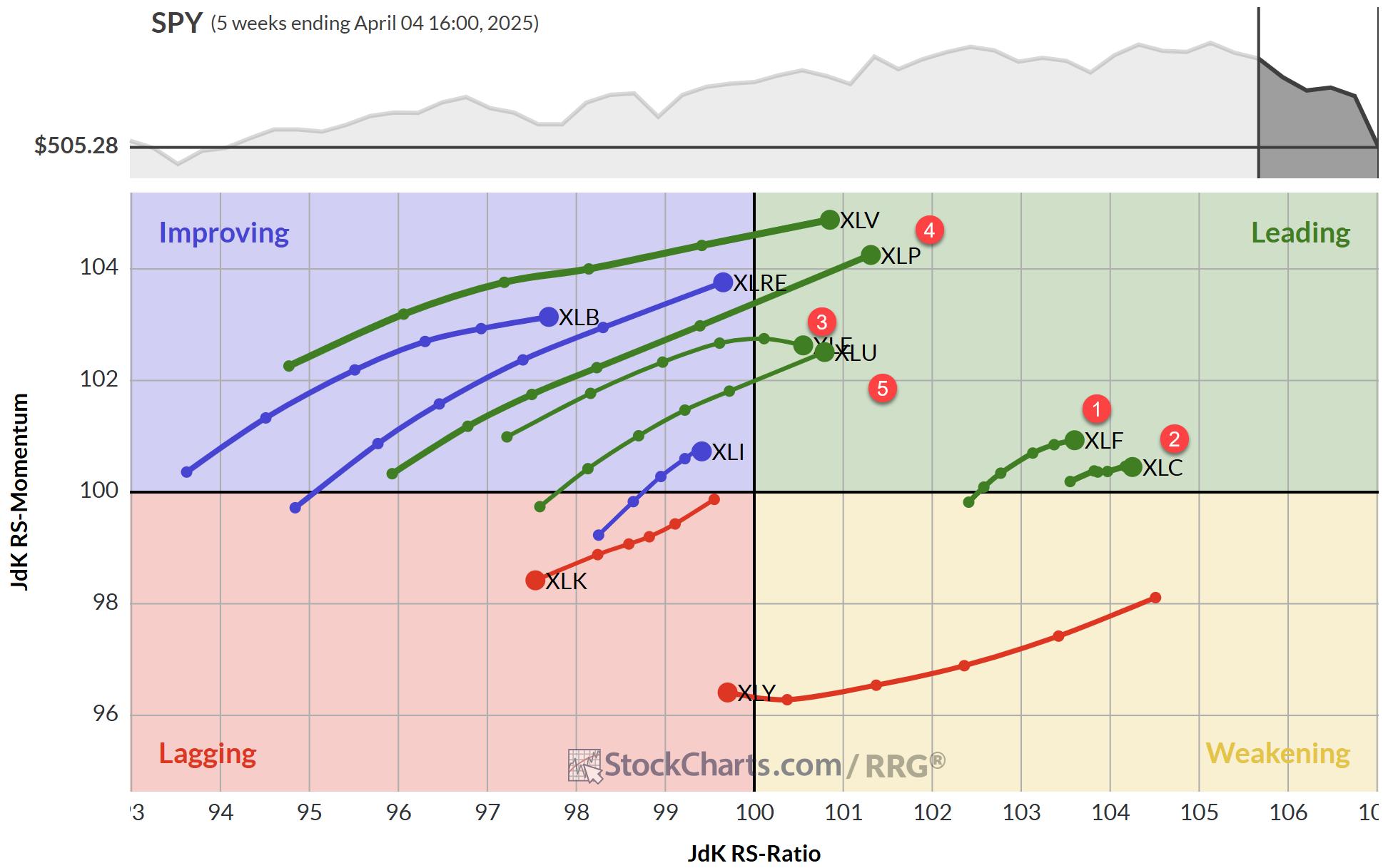

KEY TAKEAWAYS

* The entire top 5 has now changed positions.

* All defensive sectors are now in the top 5, while Healthcare has reentered.

* Portfolio is now lagging S&P 500.

Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up....

READ MORE

MEMBERS ONLY

New US Tariffs and Intensifying US–China Trade War: Economic Implications and Opportunities for India

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In 2024-2025, the United States significantly escalated its trade conflict with China through new tariffs, including a substantial 100% tariff on electric vehicles and 50% on essential technologies like semiconductors and solar products. These measures amplify the existing trade tensions and represent a profound shift towards economic decoupling between the...

READ MORE

MEMBERS ONLY

Investors on the Move: A Visual Guide to the Stock Market

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Declining equities, bonds, and the US dollar is making Wall Street nervous.

* Investors will need to look at market price action through the lens of macro factors.

* View longer-term charts, keep an eye on bond prices, and watch the US dollar's price action.

Another interesting week...

READ MORE

MEMBERS ONLY

Earnings From These 3 Stocks Could Be Key

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, we're getting back to earnings season during the shortened four-day period.

Goldman Sachs Group, Inc. (GS) reports on the heels of JP Morgan's solid results that saw its shares rally by 12.3% and recapture its 200-day moving average.

Watch the trading revenue numbers...

READ MORE

MEMBERS ONLY

Master the Market: A Guide to StockCharts' New Market Summary Page

by Grayson Roze,

Chief Strategist, StockCharts.com

Stock market analysis, technical indicators, and market trends are crucial for informed investing. StockCharts is making those things easier, and Grayson Roze is here to show you how.

In this video, Grayson provides an in-depth walk-through of the all-new Market Summary Page. This comprehensive tool offers a top-down overview of...

READ MORE

MEMBERS ONLY

Is the Stock Market Getting Ready to Bounce? Key Market Breadth Signal Explained

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When the stock market slides significantly, it's natural to question if the market has bottomed and getting ready to bounce.

In this video, David Keller, CMT highlights the Bullish Percent Index (BPI) as a key indicator to monitor during corrective moves. Learn more about how the BPI is...

READ MORE

MEMBERS ONLY

Mastering Stock Market Turbulence: Essential Insights for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes bounced back with the largest one-day gains.

* Technology and Consumer Discretionary stocks were the best-performing S&P sectors.

* Bonds had the most interesting price in Wednesday's trading.

Tariff turmoil continues sending the stock market into a turbulent spin. Tariffs went into...

READ MORE

MEMBERS ONLY

DP Trading Room: Key Support Levels for the SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market given key indexes like the Nasdaq are already in bear markets. It's time to consider where the key support levels are.

Carl addressed his...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #14

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

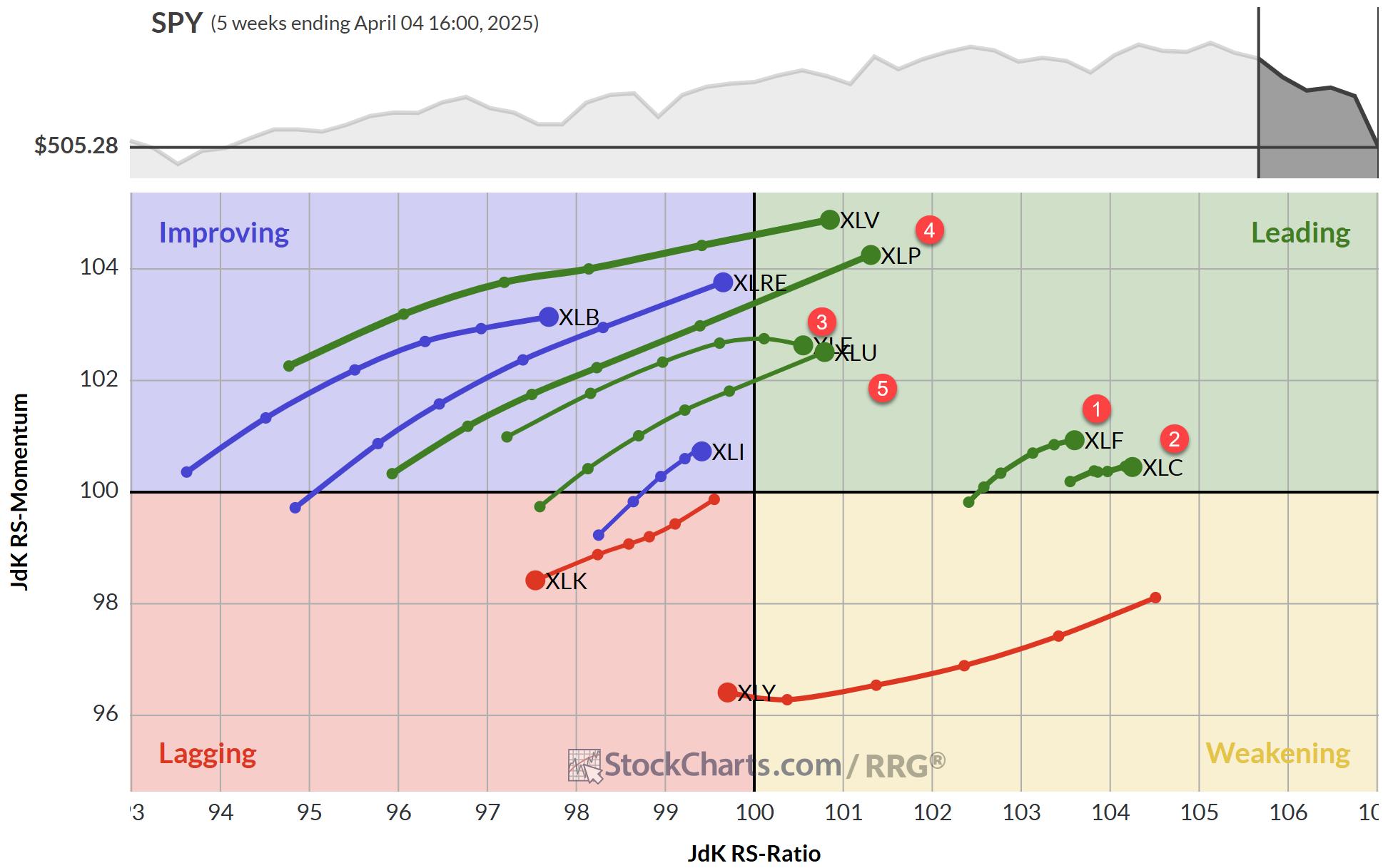

KEY TAKEAWAYS

* Consumer Staples replaces Healthcare in top 5

* More defensive rotation underway

* RRG portfolio remains in line with market performance

This article was first posted on 4/4/2025 and contained only rankings and charts. Then updated with comments 4/7/2025

I am attending and speaking at the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To Open Lower; Relative Outperformance Against Peers Expected To Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week was short; the Indian markets traded for four days owing to one trading holiday on account of Ramadan Id. However, while staying largely bearish, the markets weathered the storm inflicted by the US announcing reciprocal tariffs on almost everyone and kicking off a serious trade war. The...

READ MORE

MEMBERS ONLY

Three Stocks to Watch: Utilities, Banks, Airlines

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

When markets are sliding lower, where should you be investing? Here are three stocks to consider.

American Water Works (AWK)

Why focus on a utility company that isn't reporting earnings this week? It's because the biggest question of the week is where should you put your...

READ MORE