MEMBERS ONLY

These Commodities are On Track for Mega Breakouts in May

by Martin Pring,

President, Pring Research

It's rare when you see a multi-year breakout take place, but, when several materialize more or less at the same time, that should really get our attention. That's not simply because of the opportunities being presented, but also because several simultaneous breakouts indicate a broader participation...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 6: Putting It All Together

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-second in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Hedging the S&P 500 All-Time Highs With Options

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* As stock market indexes hit all-time highs, you may want to consider hedging your portfolio with options.

* Since volatility is low, buying puts can be a relatively inexpensive way to protect your positions while remaining invested in the stock market.

As equity markets print new all-time highs and...

READ MORE

MEMBERS ONLY

MEM TV: Here's How to Trade Explosive Stocks After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the current market conditions and key areas of growth that are in new uptrends. She then shares how to trade downtrend reversals and stocks that gap up after reporting strong earnings. She then reviews the decline in...

READ MORE

MEMBERS ONLY

Gold Is Doing Great!

by Carl Swenlin,

President and Founder, DecisionPoint.com

While we don't typically begin with a monthly chart, it seems like a good place to start, as most of the good news is present there.

Beginning on the left side, we can see how gold made a parabolic advance into an all-time high in 2011. Parabolic advances...

READ MORE

MEMBERS ONLY

Is This the Magic Upward Break Everybody Was Waiting For?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation still pointing to defense

* Upward break in SPY not supported by volume

* Asset class rotation starting to rotate in favor of bonds

No Confirmation In Volume

This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the...

READ MORE

MEMBERS ONLY

Powerful Entry Strategy Using One Moving Average

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways. He shows 3 different types of setups in the price action and its relationship to...

READ MORE

MEMBERS ONLY

MEM TV: This Stealth AI Stock is Ready to EXPLODE Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias in the broader markets, along with the sector rotation into cyclical areas as growth areas languish. She then highlights the perils of buying, or holding, stocks around earnings releases, and shares a high-yielding stock...

READ MORE

MEMBERS ONLY

Six Leaders, but One Is Getting Real Frothy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Chartists can measure performance by comparing highs and lows

* Defense groups are leading SPY because they hit new highs already.

* XLU is looking frothy because it is over 13% above its 200-day SMA.

After sharp declines into mid April, stocks rebounded over the last three weeks and the...

READ MORE

MEMBERS ONLY

Silver Cross BUY Signals on the Dow (DIA) and Russell 2000 (IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow Jones Industrial Average ETF (DIA) 20-day EMA crossed up through the 50-day EMA (a Silver Cross), generating an IT Trend Model BUY Signal. The Dow saw a better rally today than the SPY, but, under the hood, it isn't quite as strong as the SPY. We...

READ MORE

MEMBERS ONLY

NYSE and Global A/D Lines Trade at New All-Time Highs

by Martin Pring,

President, Pring Research

The magnitude and duration of corrections are largely determined by the direction of the prevailing primary trend. If it's bearish, they tend to be more severe and last longer. In a bull market, it's just the opposite, as they are generally short and sweet, if you...

READ MORE

MEMBERS ONLY

MEM TV: NVIDA is Setting Up To SURGE

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Technology Stocks Back In the Lead: Are Inflation Fears Behind Us?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher, but failed to show enough follow through to the upside

* Technology stocks were in the lead today and led the stock market higher

* The CBOE Volatility Index is back below 15, indicating lack of fear among investors

The weaker-than-expected jobs report...

READ MORE

MEMBERS ONLY

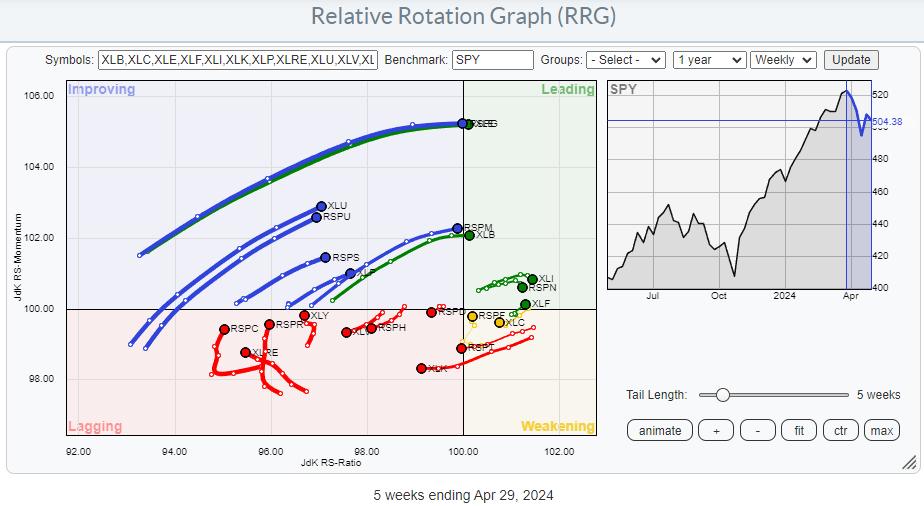

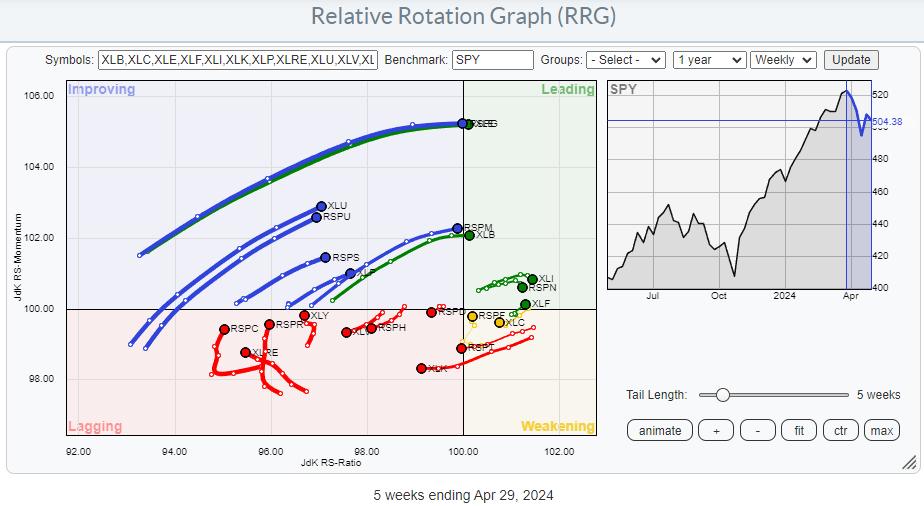

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

SPY's Pullback Continues: How To Know When It's Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) dipped lower after hitting resistance of its 50-day moving average

* There are three key turnaround levels to watch closely to determine if the pullback is over

* Breadth indicators can identify when the buyers are back

What's a trader...

READ MORE

MEMBERS ONLY

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

MEM TV: Wait For This Before Getting Back In

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Spotting Downturns Early: Daily or Weekly Charts?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on spotting downturns in daily vs. weekly charts, using the Relative Rotation Graphs (RRG) to identify actionable ideas, and comparing the NYSE Composite Index ($NYA) to the S&P 500 Index ($SPX). He also shares...

READ MORE

MEMBERS ONLY

Analyzing the SPY: How to Know When the Pullback is Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* SPY is trading within a downward channel in the daily chart and has equal odds of breaking out in either direction

* The weekly chart shows the uptrend is still in play and SPY is going through a healthy correction

* Analyze different index and sector exchange-traded funds to identify...

READ MORE

MEMBERS ONLY

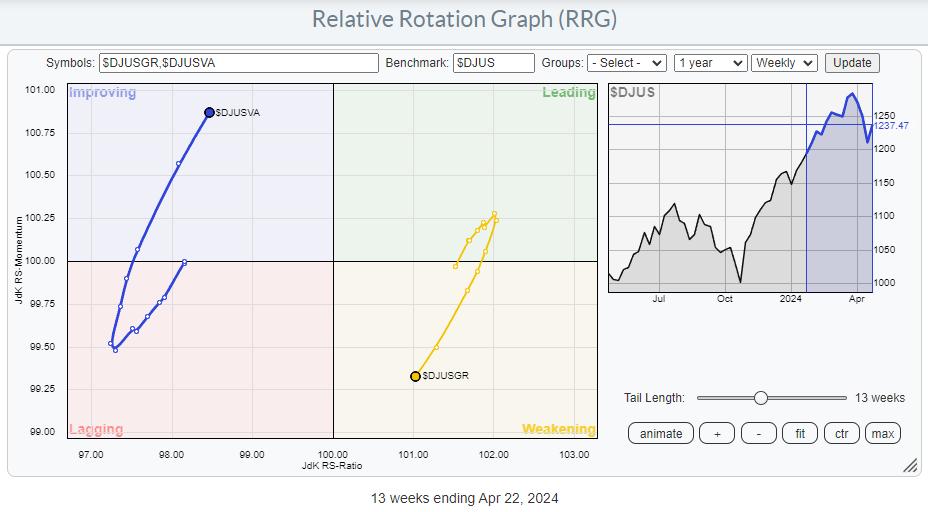

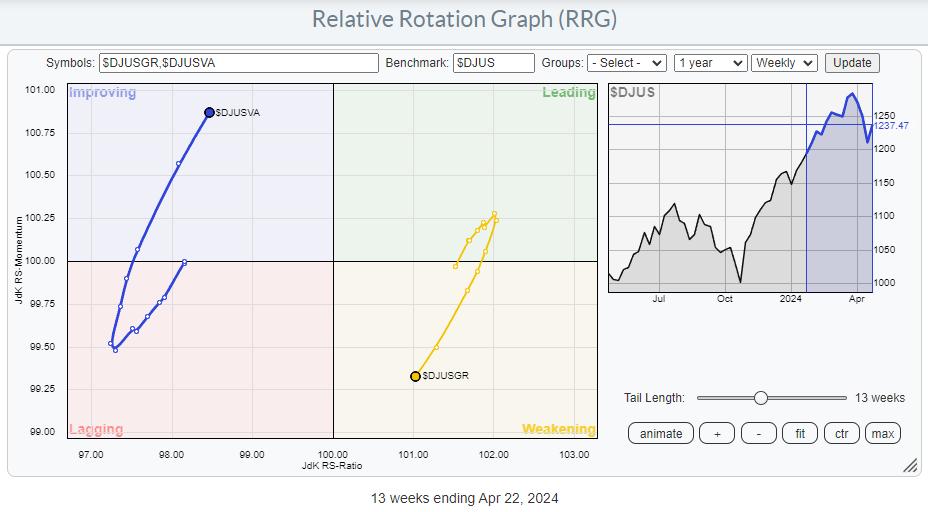

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

Pinpoint the Next Buying Opportunity in SPY

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses the MACD to analyze SPY and shares what to look for to find the next buy point. Joe then analyzes stocks including ADBE, XOM, and CRM.

This video was originally published on April 24, 2024. Click...

READ MORE

MEMBERS ONLY

MEM TV: Capitulation Signals for a Market BOTTOM

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the negative shift that's evolved over the past week in the market and highlights key signals of capitulation you should be watching for. She then shares the move into Value stocks she's seeing...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson run through top 10 charts to watch in April 2024! Together they cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into market dynamics and chart...

READ MORE

MEMBERS ONLY

Semiconductors are at CRITICAL Level!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH. Dave highlights the recent downswing for Bitcoin,...

READ MORE

MEMBERS ONLY

Bitcoin Halving Could Bring Massive Upside!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a brief history of Bitcoin halving and relates it to the short-term and long-term technical outlook on this significant development for cryptocurrencies. He also focuses on stocks testing their 50-day moving averages, including NFLX, SMCI, and MSTR.

This...

READ MORE

MEMBERS ONLY

Stay Ahead of the Markets with AUTOMATED Portfolio Reports

by Grayson Roze,

Chief Strategist, StockCharts.com

Staying on top of your portfolio in a fast-moving market can be a challenge. On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to make things easier on yourself with automated ChartList Reports for your portfolio. You'll learn how to...

READ MORE

MEMBERS ONLY

MEM TV: Time To SELL EVERYTHING?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares key signals that it's time to sell a stock, using INTC as an example. She also reviews a key area of support for the markets, and new sectors that have entered a downtrend. She finishes...

READ MORE

MEMBERS ONLY

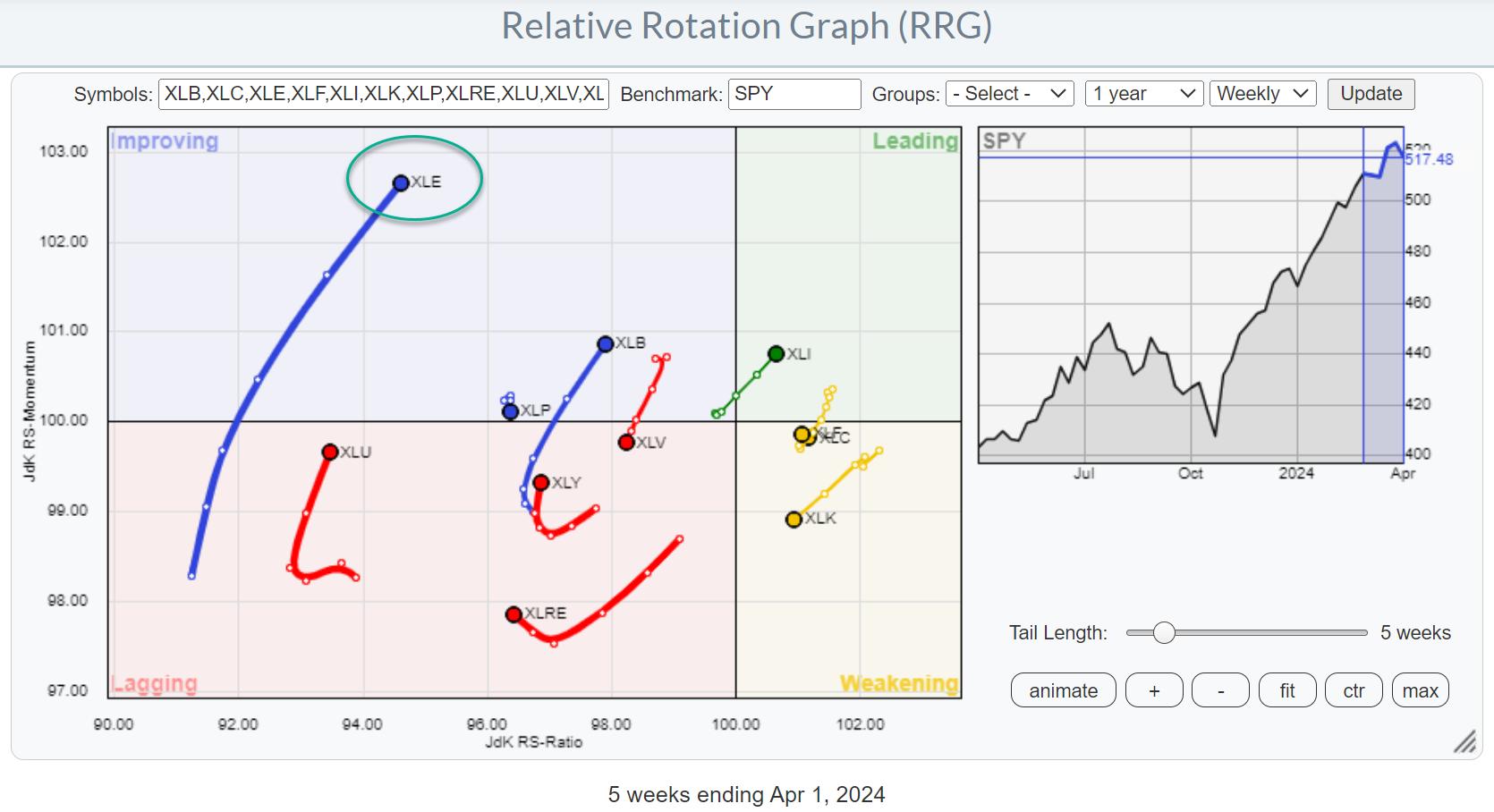

RRG Indicates That Non-Mega Cap Technology Stocks are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The energy sector remains on a very strong rotational path

* A completed top formation in Healthcare opens up significant downside risk

* Smaller Technology stocks are taking over from mega-cap names

A Sector Rotation Summary

A quick assessment of current sector rotation on the weekly Relative Rotation Graph:

XLB:...

READ MORE

MEMBERS ONLY

Master Market Entry with This RSI Strategy!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators. RSI is used as a timing tool when things are lined up. Joe goes through some of the key elements he looks for when...

READ MORE

MEMBERS ONLY

This Sector is Breaking Up and Down Simultaneously

by Martin Pring,

President, Pring Research

This may seem like a contradiction, but it is possible for two different things to be true at the same time.

What I am referring to is the fact that the health care sector (XLV) recently broke out from a consolidation reverse head-and-shoulders pattern, as we can see from the...

READ MORE

MEMBERS ONLY

MEM TV: Is It Safe To Reenter The Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares what to be on the lookout for to tell if it's safe to put new money to work. She also shares the weakness in select sectors and which areas she suggests to underweight. Last up,...

READ MORE

MEMBERS ONLY

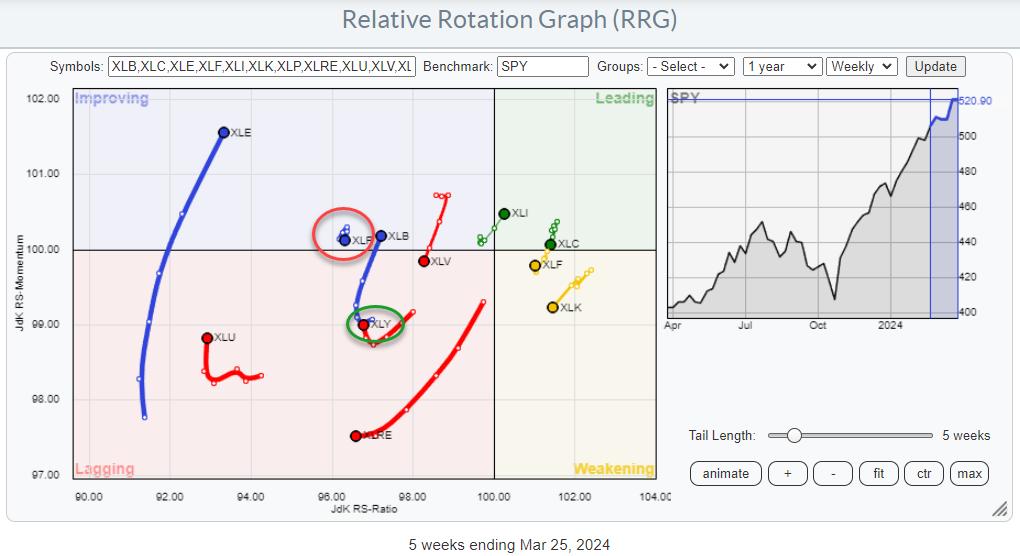

Energy is on Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

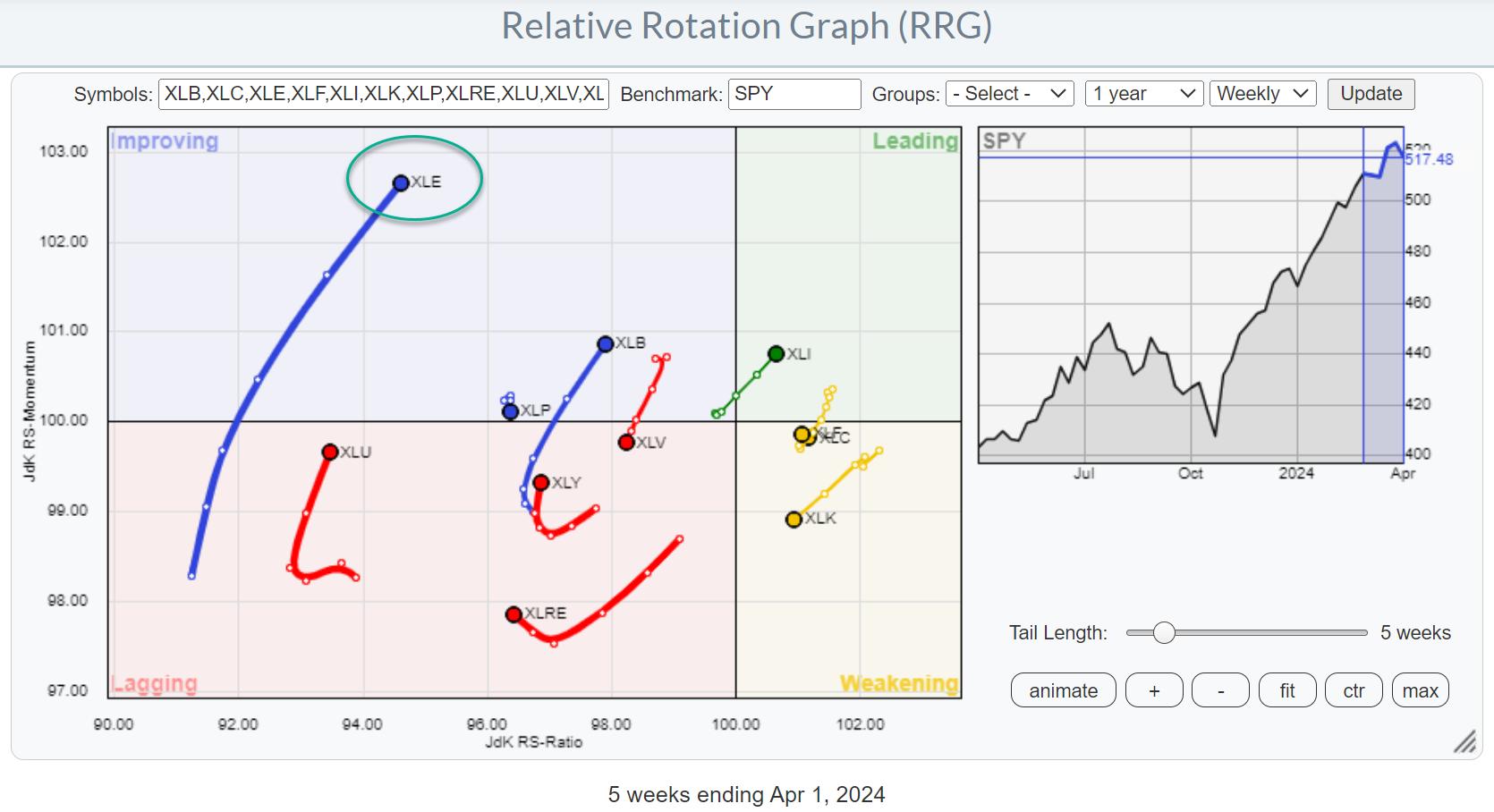

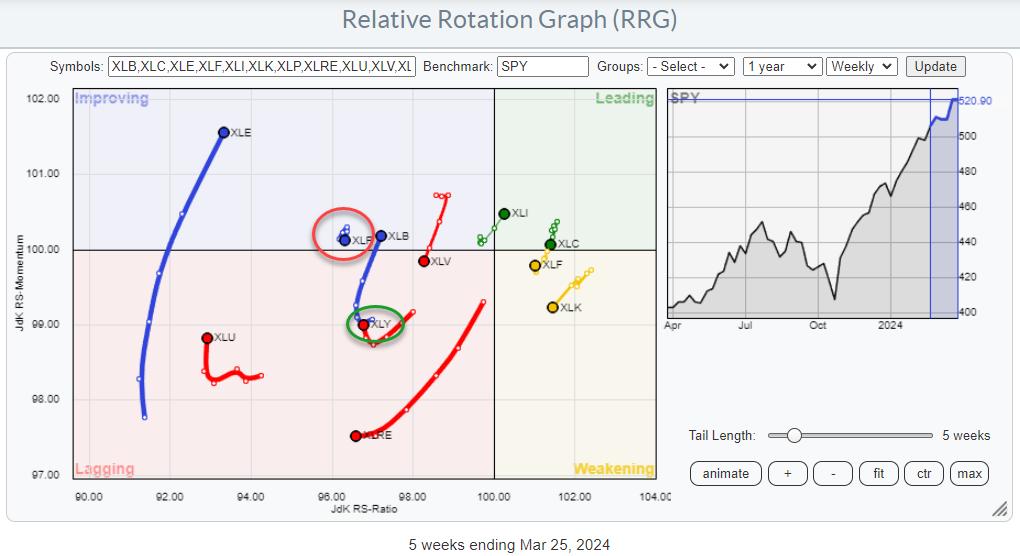

KEY TAKEAWAYS

* Energy sector is breaking higher on price chart

* XLE's RRG tail is continuing to pick up steam

* The exploration & production industry is leading inside the energy sector

Strong Rotation on the Weekly RRG

For a few weeks now, the improvement in the energy sector (XLE)...

READ MORE

MEMBERS ONLY

Two Options Plays Amid Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Sean McLaughlin of All Star Charts. Sean shares his outlook for the Ark Innovation Fund (ARKK) and energy stocks (XLE) and how to employ options strategies to bet on particular outcomes. David tracks the afternoon selloff which created...

READ MORE

MEMBERS ONLY

These Sectors are Poised to Lead in Q2

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge as she walks through charts of the Swiss Franc, solar stocks, and uranium, with a focus on price momentum and multiple time frame analysis. Dave breaks down the S&P 500 sectors into...

READ MORE

MEMBERS ONLY

Business Confidence and Stocks | Focus on Stocks: April 2024

by Larry Williams,

Veteran Investor and Author

Here comes the answer to a very old question, "Do stocks lead the economy, does the economy lead the stock market, or is there something else?"

My work has shown numerous times that GDP is not a good predictor of the Dow Jones. Also, business inventories and a...

READ MORE

MEMBERS ONLY

MEM TV: Small Cap STOCKS SHINE! 4 Names to Play the Strength

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE

MEMBERS ONLY

When These Levels Break, The S&P 500 is Going to Explode Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Discretionary Beating Staples

* Sectors Pushing Against Major Resistance Levels

Summary

The Relative Rotation Graph for US Sectors for this week mainly shows a continuation of the rotations as they were underway last week.

XLB: This is moving from lagging into improving at a strong RRG-Heading, underscoring the...

READ MORE

MEMBERS ONLY

KRE's Impending Plunge: What This Emerging Crisis Means

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* KRE (the SPDR S&P Regional Banking ETF) is trading within a fairly wide uptrend channel

* Momentum in KRE appears to be waning which could uncover short-term trading opportunities

* Many regional banks can face increasing debt delinquencies and may be on the brink of collapse

Full disclosure:...

READ MORE

MEMBERS ONLY

MEM TV: Get In EARLY! These Areas Are Seeing LIFT OFF

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE