MEMBERS ONLY

This Report Might Self Destruct in 5 Days

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* With fast-moving markets, this report is vulnerable to self-destruction within 5 days.

* The bond vigilantes sent a message as long-term yields surged and bonds plunged.

* Unless reversed, these developments are negative for stocks, especially rate sensitive stocks.

In the opening scene of Mission Impossible 2, Ethan Hunt receives...

READ MORE

MEMBERS ONLY

Key Levels for the S&P 500: Has It Bottomed?

by Joe Rabil,

President, Rabil Stock Research

Is the stock market on the verge of crashing or has it bottomed?

In this video, Joe Rabil uses moving averages and Fibonacci retracement levels on a longer-term chart of the S&P 500 to identify support levels that could serve as potential bottoms for the current market correction....

READ MORE

MEMBERS ONLY

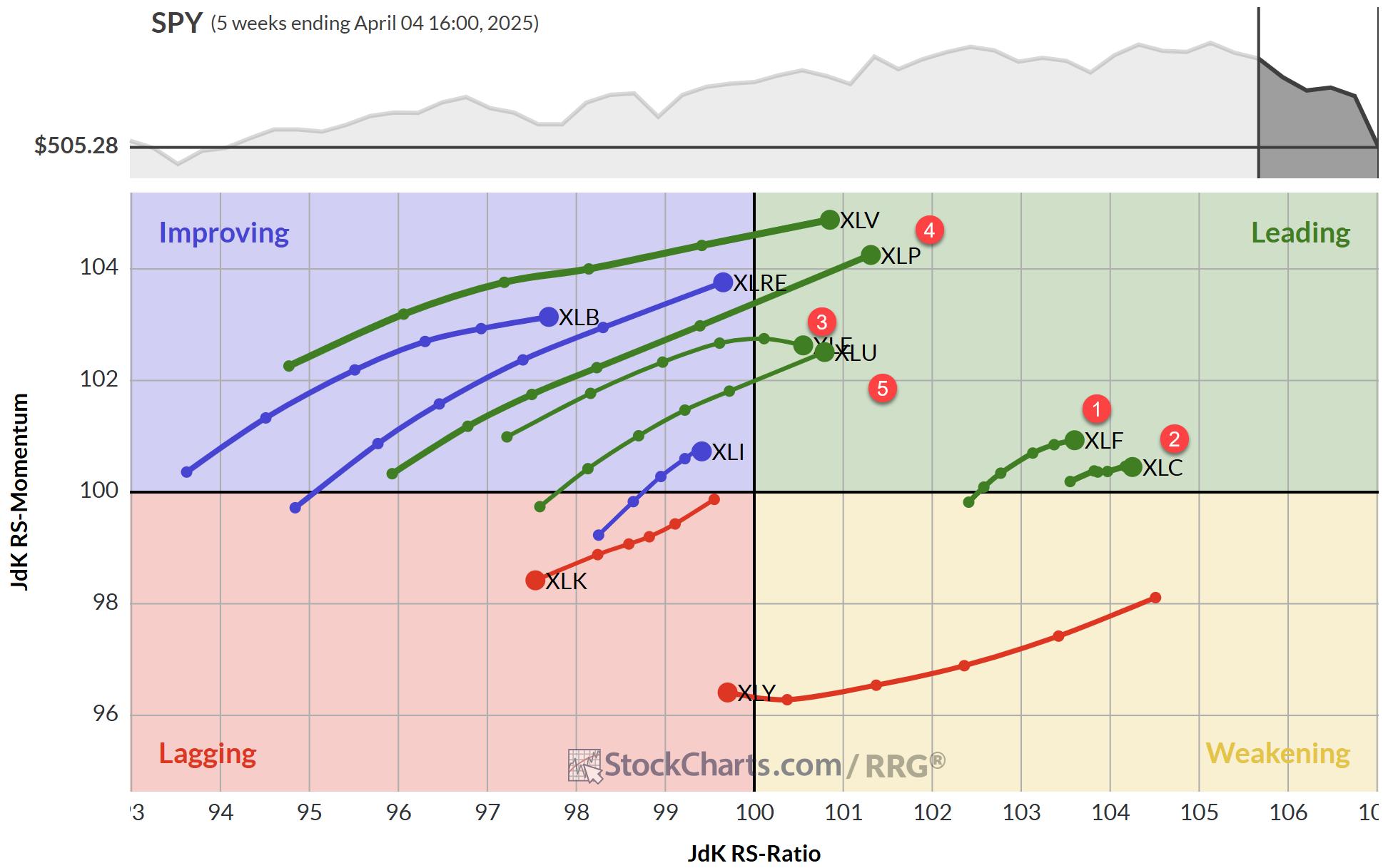

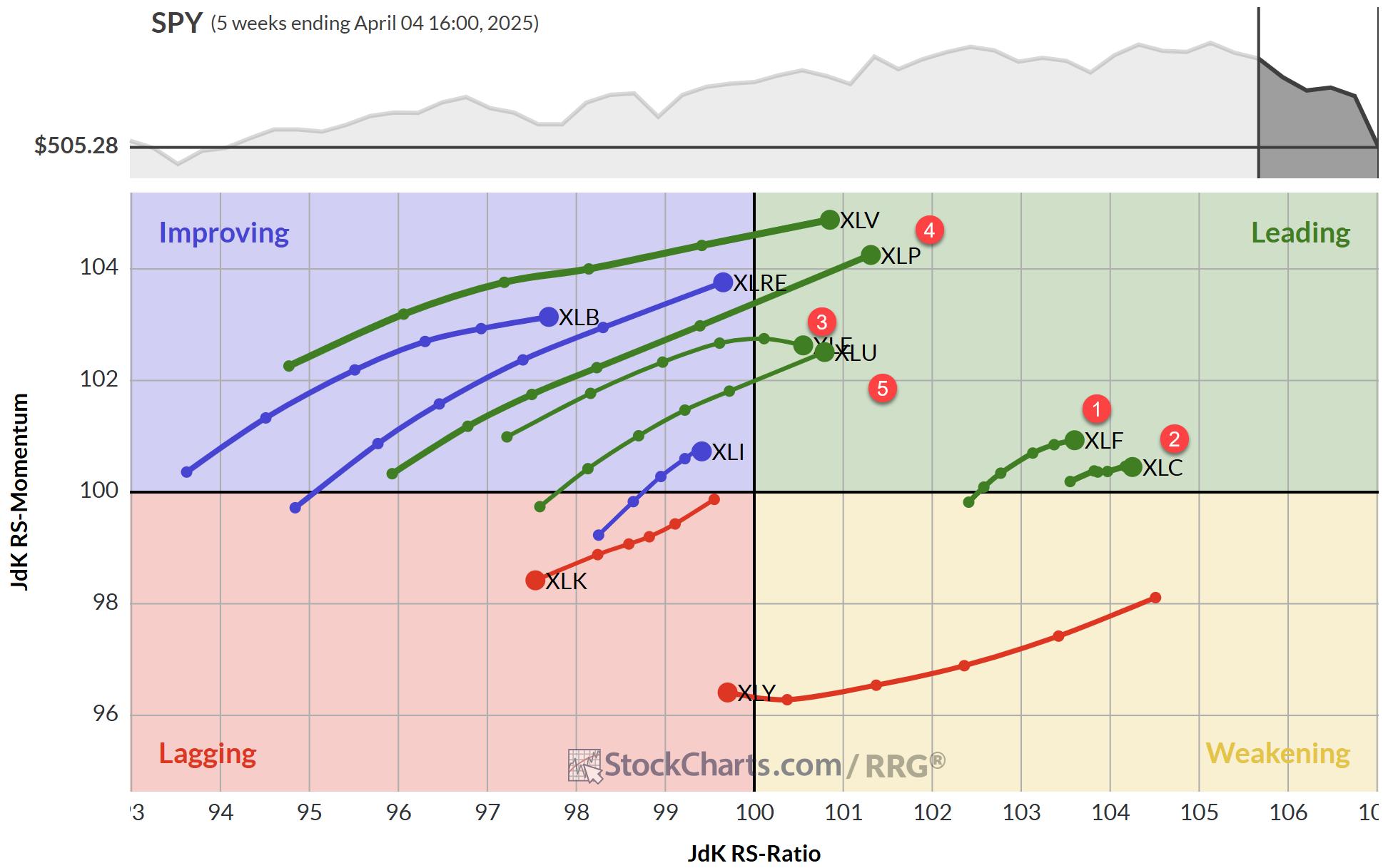

The Best Five Sectors, #14

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Staples replaces Healthcare in top 5

* More defensive rotation underway

* RRG portfolio remains in line with market performance

This article was first posted on 4/4/2025 and contained only rankings and charts. Then updated with comments 4/7/2025

I am attending and speaking at the...

READ MORE

MEMBERS ONLY

Market Drop Compared to 2020: What You Need to Know Now

by Mary Ellen McGonagle,

President, MEM Investment Research

How low can the S&P and the Nasdaq fall? More importantly, how can an investor navigate this volatile environment?

In this eye-opening video, Mary Ellen McGonagle delves into the stock market's fall, identifies key support levels, and compares them to past bear markets. She also discusses...

READ MORE

MEMBERS ONLY

Three Defensive Plays for Post-Tariff Survival

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Kroger remains in a primary uptrend of higher highs and higher lows, a rare feature for S&P 500 members in April 2025.

* Keurig Dr Pepper has overcome gap resistance and now demonstrates strong technical characteristics.

* The Utilities sector has show improving relative strength in 2025, outperforming...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for April 2025: Big Breakouts Ahead?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Finding stocks that show promising opportunities can be challenging in a market that goes up and down based on news headlines. But, it's possible.

In this video, watch how Grayson Roze and David Keller, CMT use the tools available in StockCharts to find stocks that are breaking out,...

READ MORE

MEMBERS ONLY

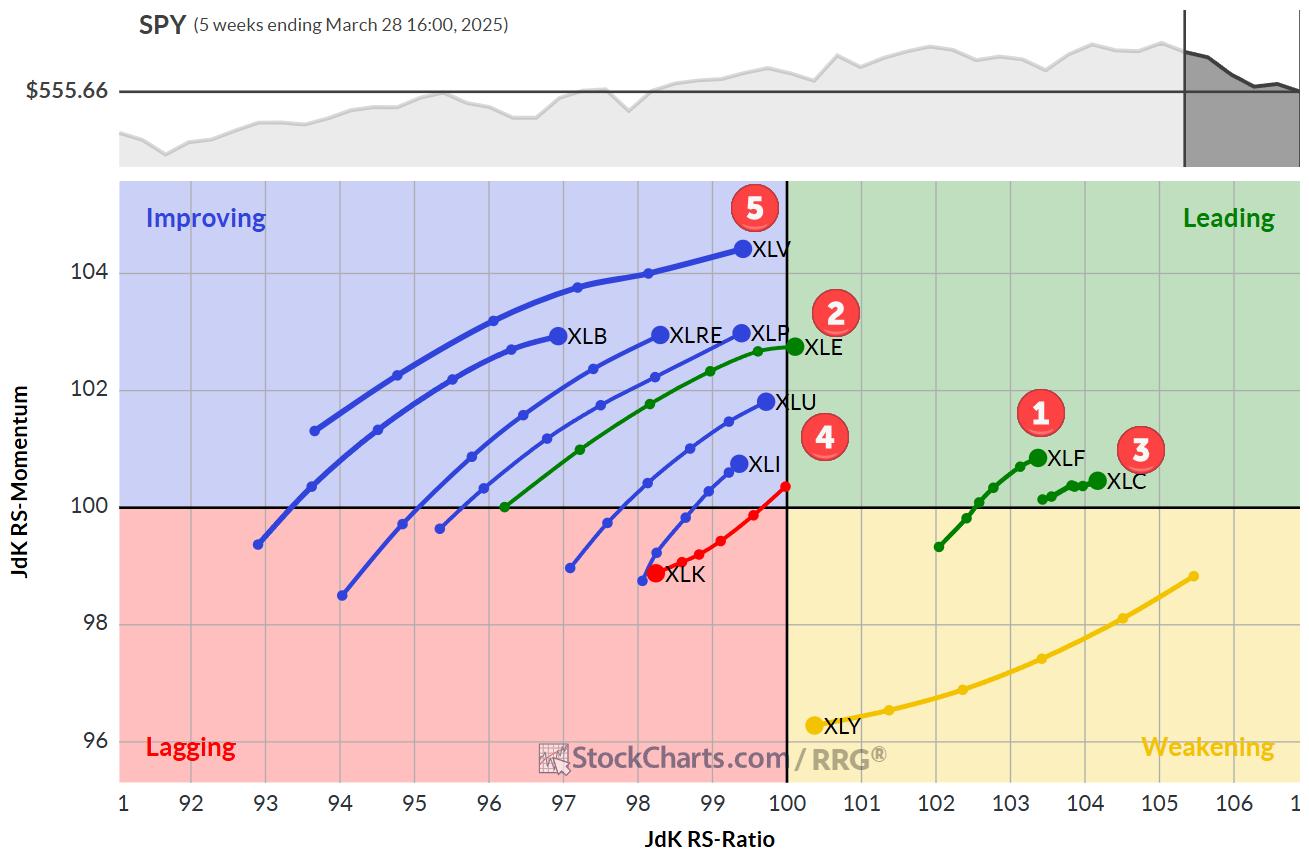

The Best Five Sectors, #13

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

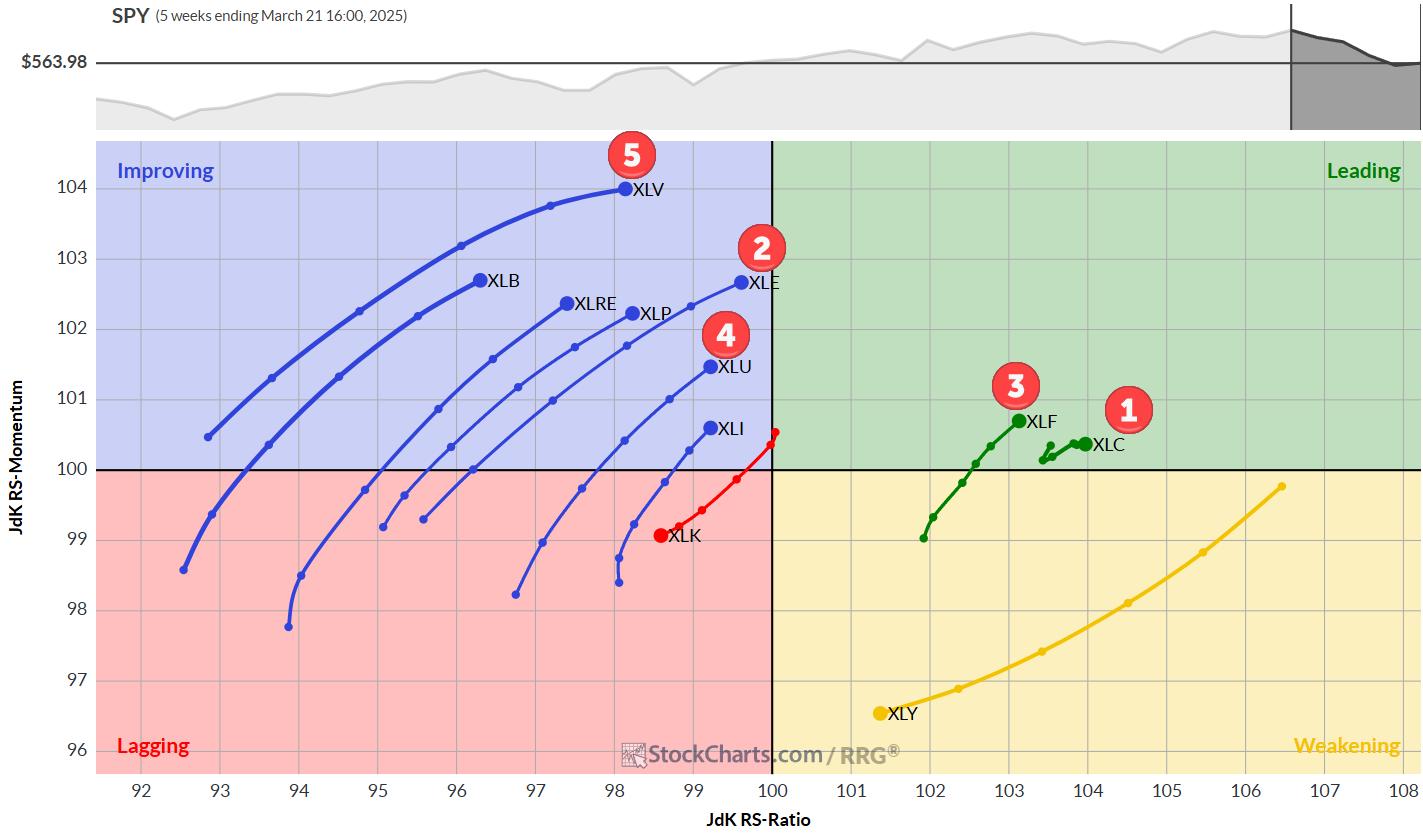

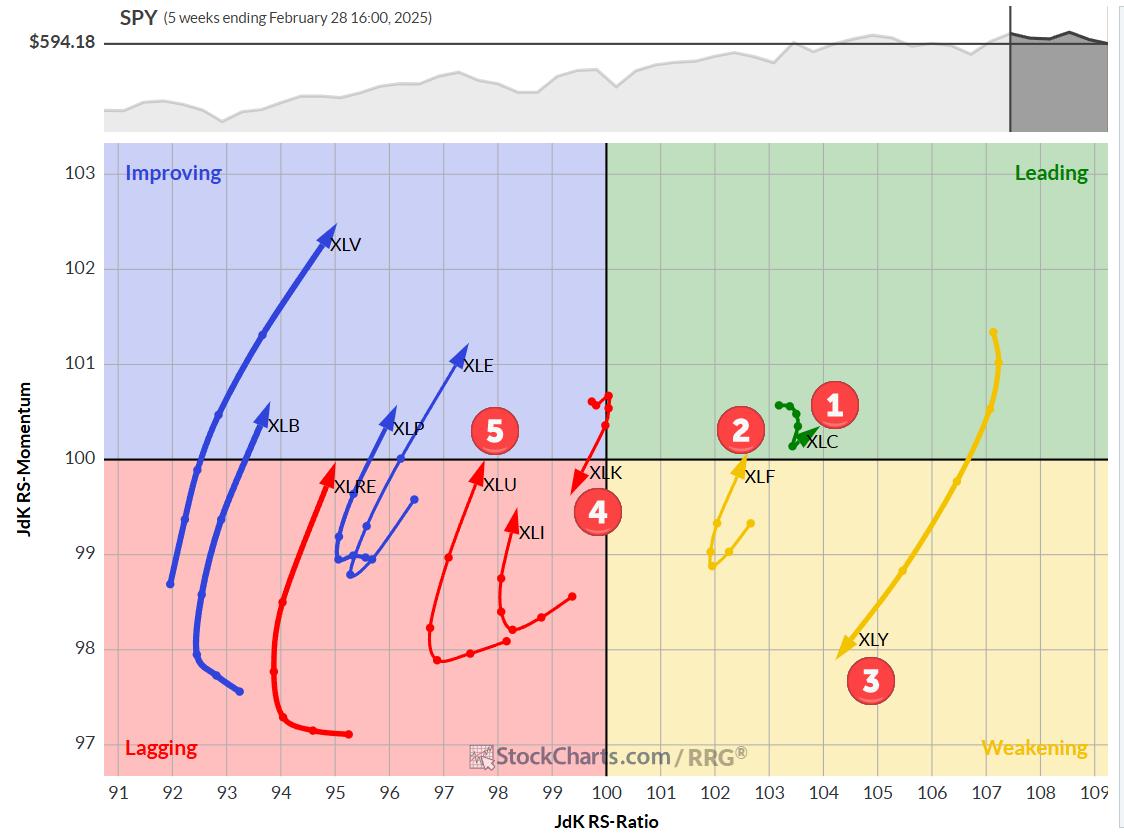

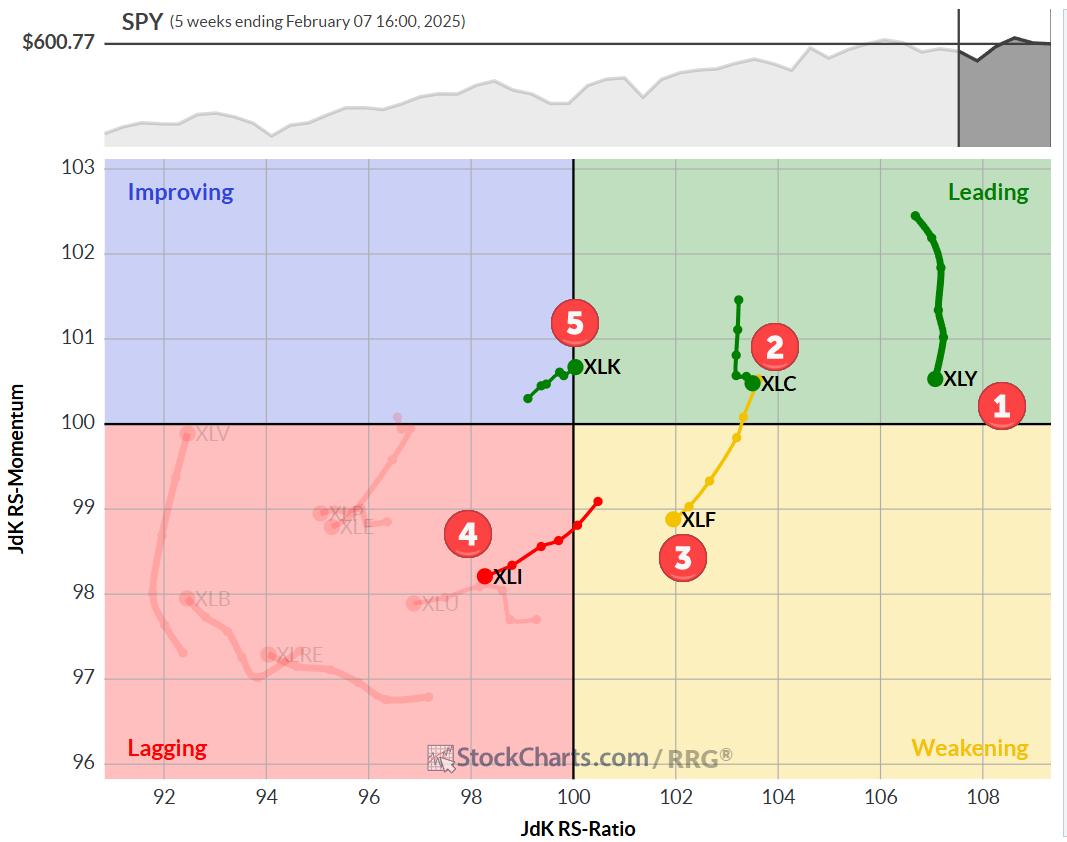

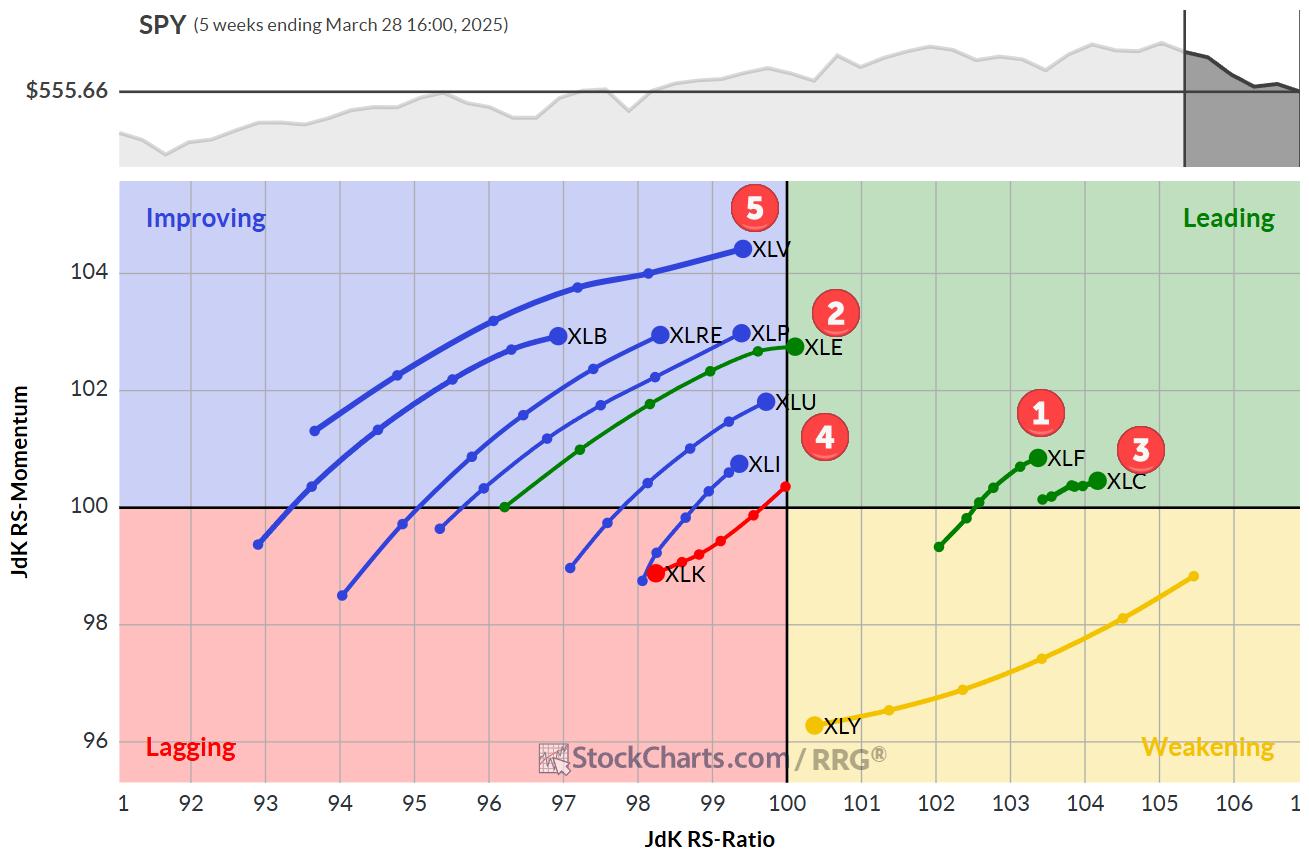

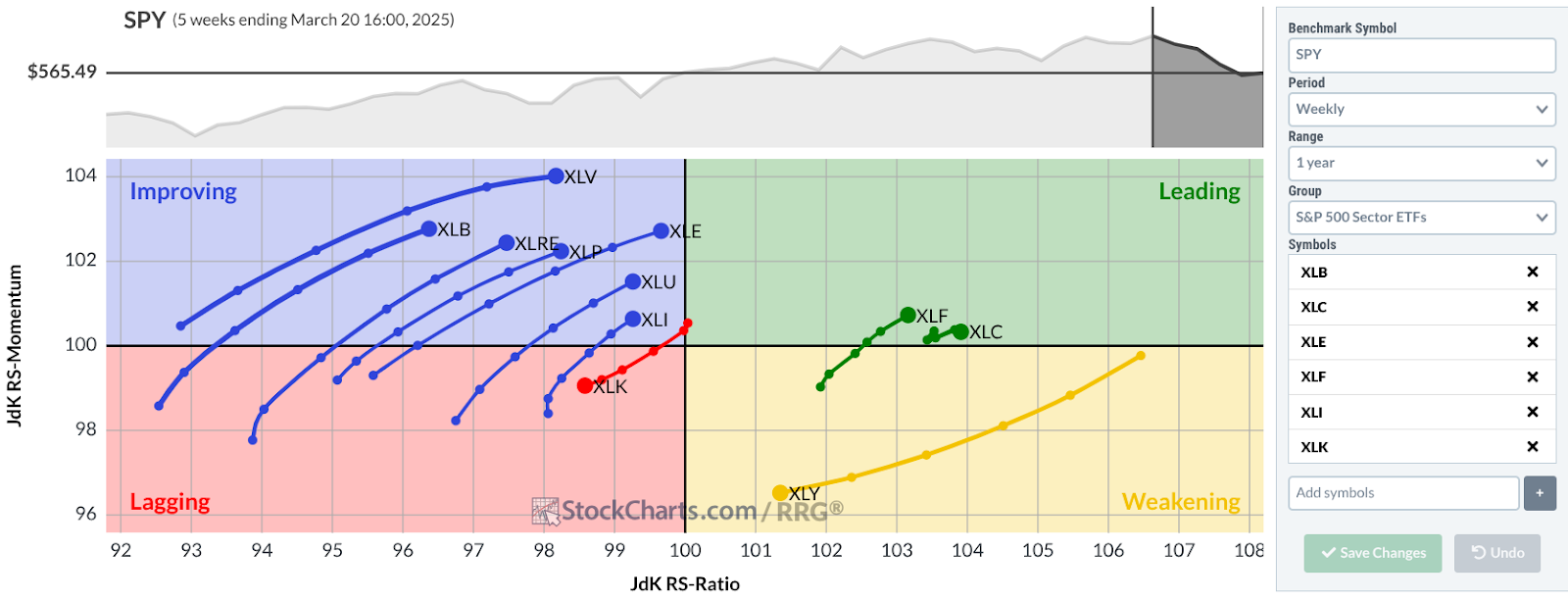

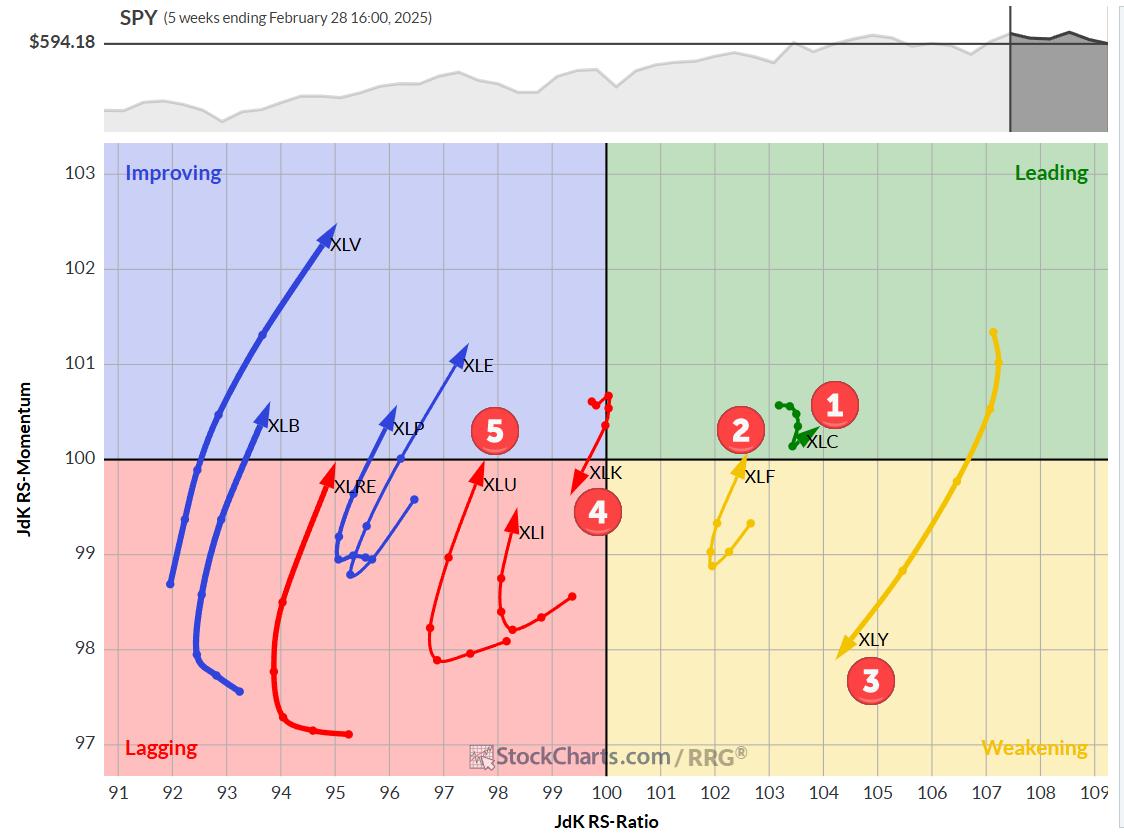

KEY TAKEAWAYS

* Financials jump to #1 spot in S&P 500 sector rankings.

* Three sectors now in leading quadrant on weekly RRG

* Only Tech and Consumer Discretionary showing negative RRG headings

* RRG portfolio outperforming S&P 500 YTD by 10 basis points

Financials take the lead.

No changes...

READ MORE

MEMBERS ONLY

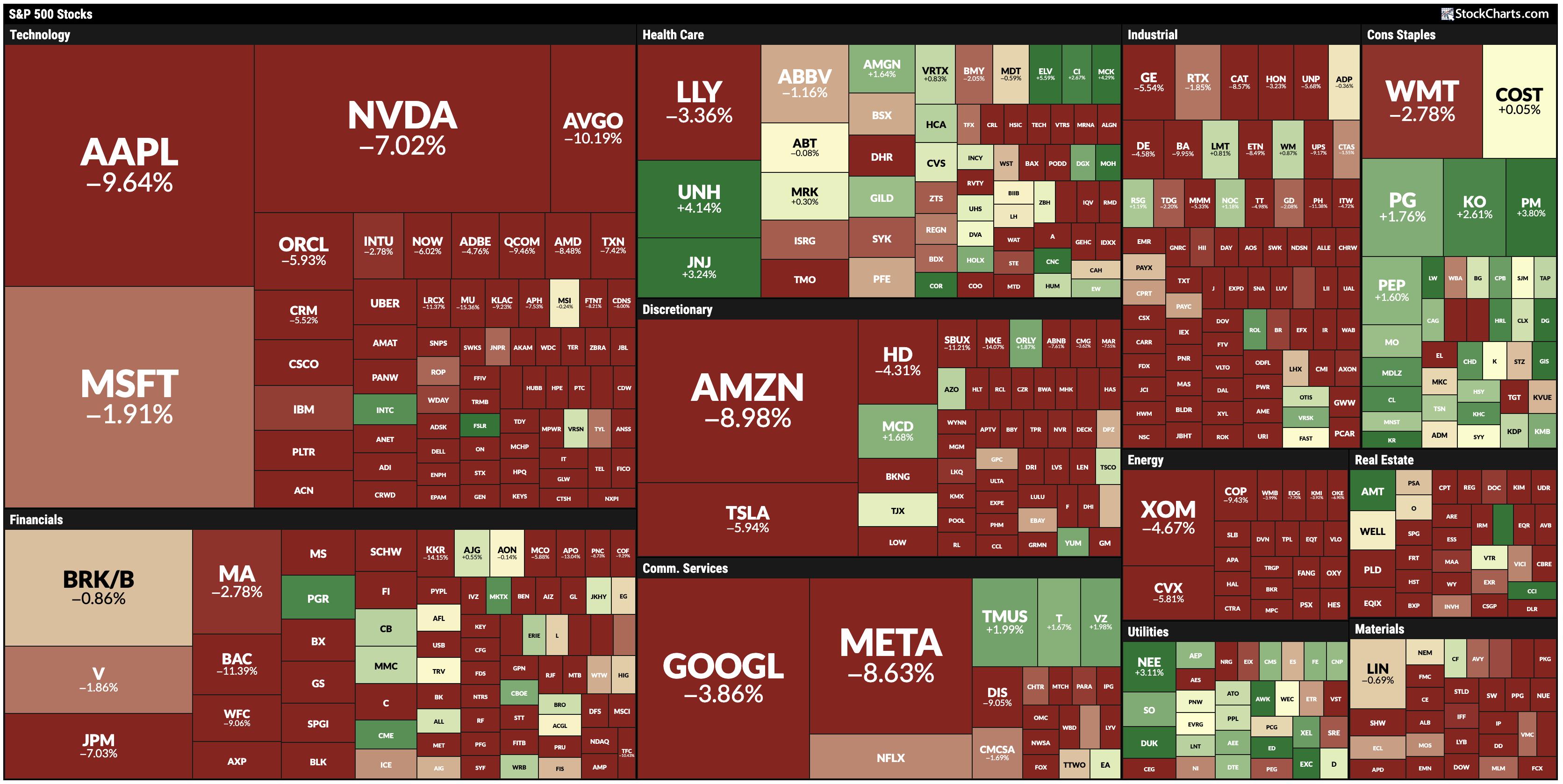

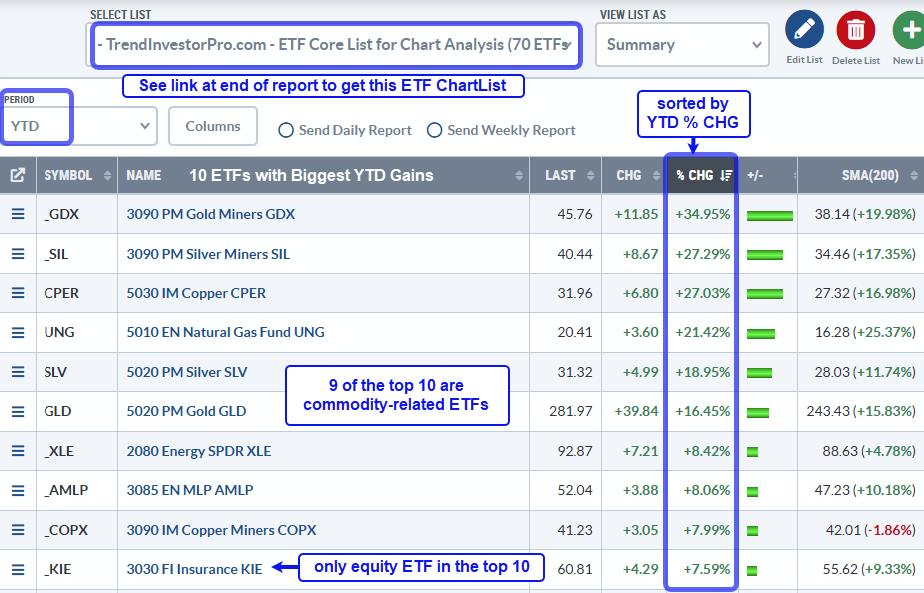

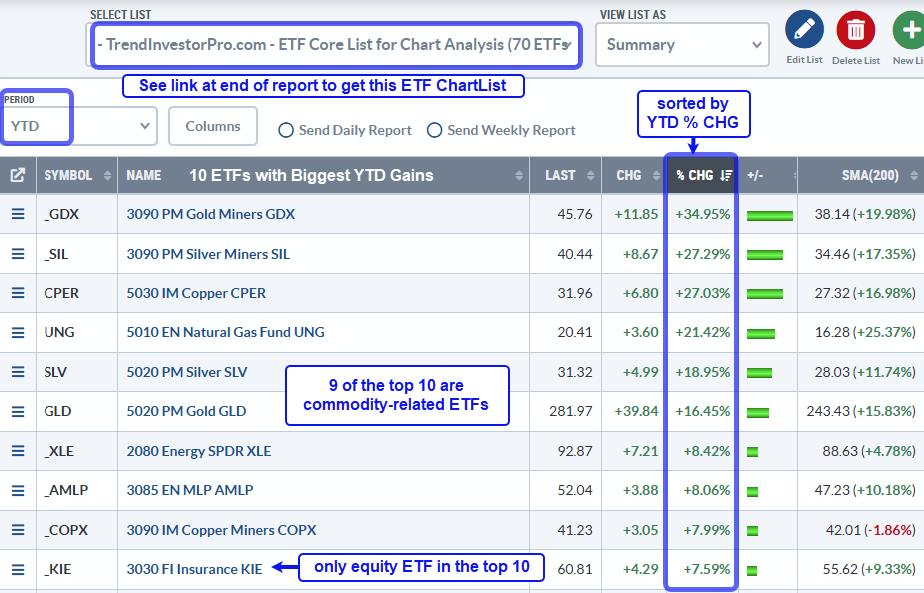

Performance Profile Paints Different Pictures for Commodity and Equity ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Among equity ETFs, non-cyclical groups are holding up the best.

* Cyclical names have the most pronounced downtrends.

The performance profile for 2025 says a lot about the state of the market. Commodity-related ETFs are leading, non-cyclical equity ETFs are holding up the best and cyclical names are performing...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #12

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

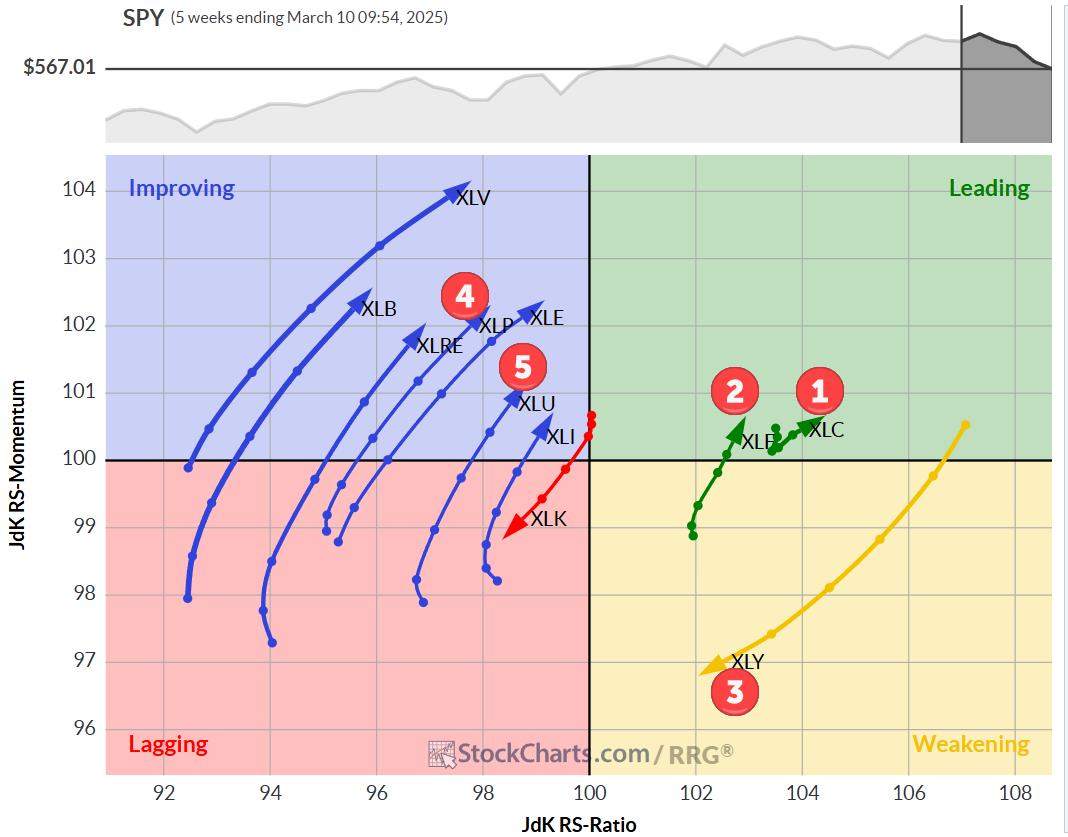

KEY TAKEAWAYS

* Energy sector jumps to position #2 in top 5

* Consumer Staples drops out of portfolio

* Communication Services remains at #1 spot

* Modest pick up of relative momentum for XLK and XLY not enough yet

Energy Jumps to #2

A big move for the energy sector last week as...

READ MORE

MEMBERS ONLY

Will QQQ Retest All-Time Highs By End of April?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

After reaching an all-time around $540 in mid-February, the Nasdaq 100 ETF (QQQ) dropped almost 14% to make a new swing low around $467. With the S&P 500 and Nasdaq bouncing nicely this week, investors are struggling to differentiate between a bearish dead-cat bounce and a bullish full...

READ MORE

MEMBERS ONLY

The Ultimate Guide to Building a Sector-Diversified Stock Portfolio

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Building a diversified portfolio takes a lot of planning, but it doesn't have to be complicated.

* Diversification helps you manage risk, though it can't eliminate it entirely.

* StockCharts has all the tools you need to construct a sector-diversified portfolio.

You already know about diversification....

READ MORE

MEMBERS ONLY

Stock Market Shifts Gears: Indexes Plunge After Climb

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

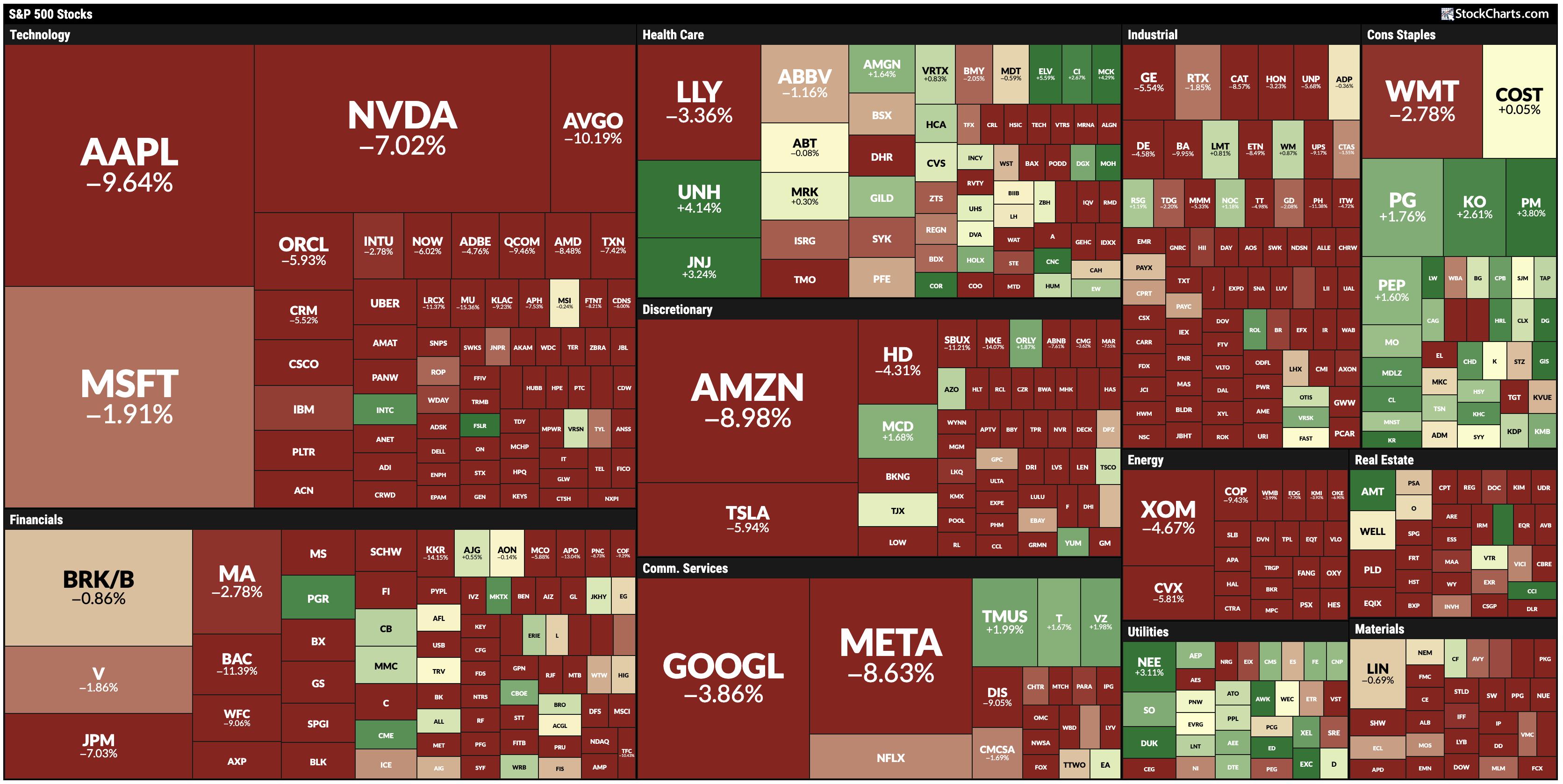

* The broader stock market indexes break their two day winning streak.

* Gold prices hit a new all-time high.

* European stocks are in a solid uptrend.

Tuesday's stock market action marked a reversal in investor sentiment, with the broader indexes closing lower. The S&P 500...

READ MORE

MEMBERS ONLY

Riding the Wave: What the Stock Market Rebound Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes rebounded with Real Estate, Energy, and Consumer Staples leading.

* Retail sales data for February were slightly below expectations but better than January's data.

* Investors are looking forward to Wednesday's FOMC meeting to hear what the committees thoughts are on economic...

READ MORE

MEMBERS ONLY

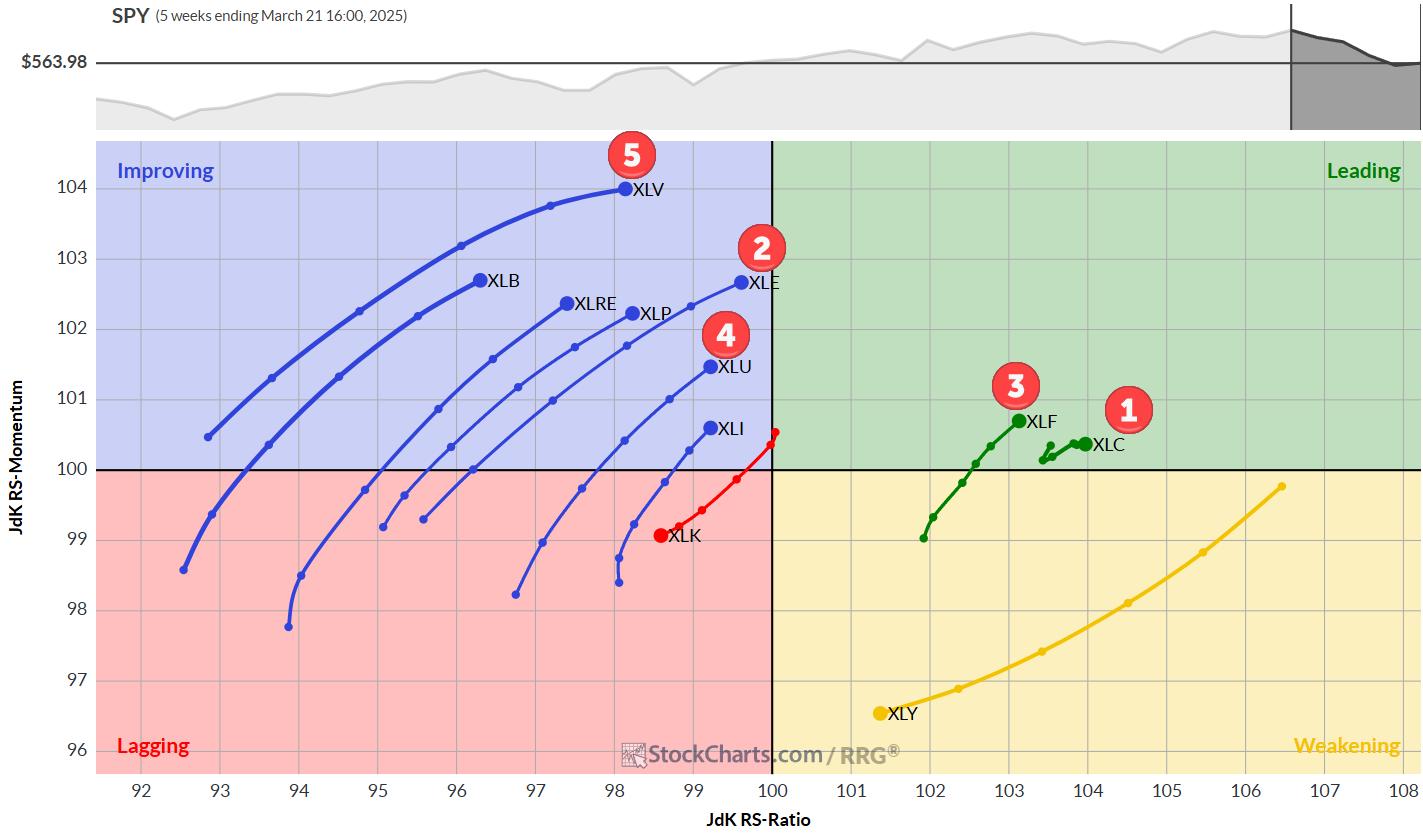

The Best Five Sectors, #11

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

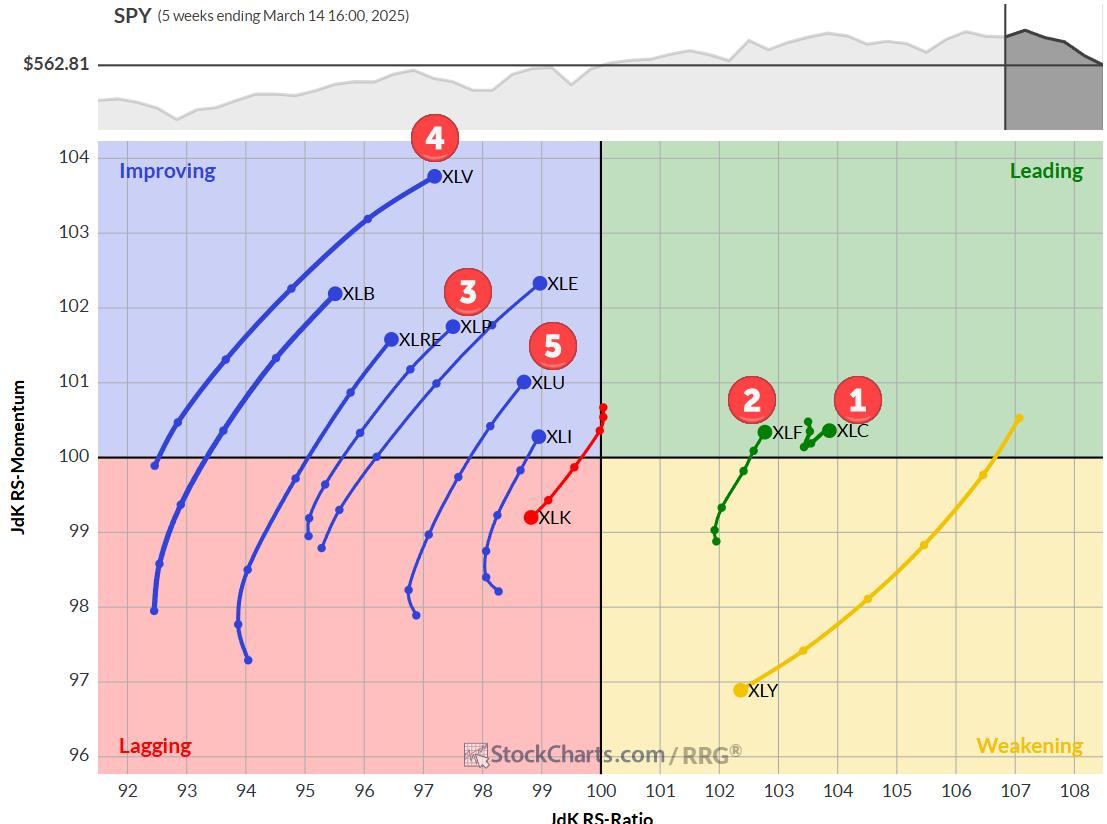

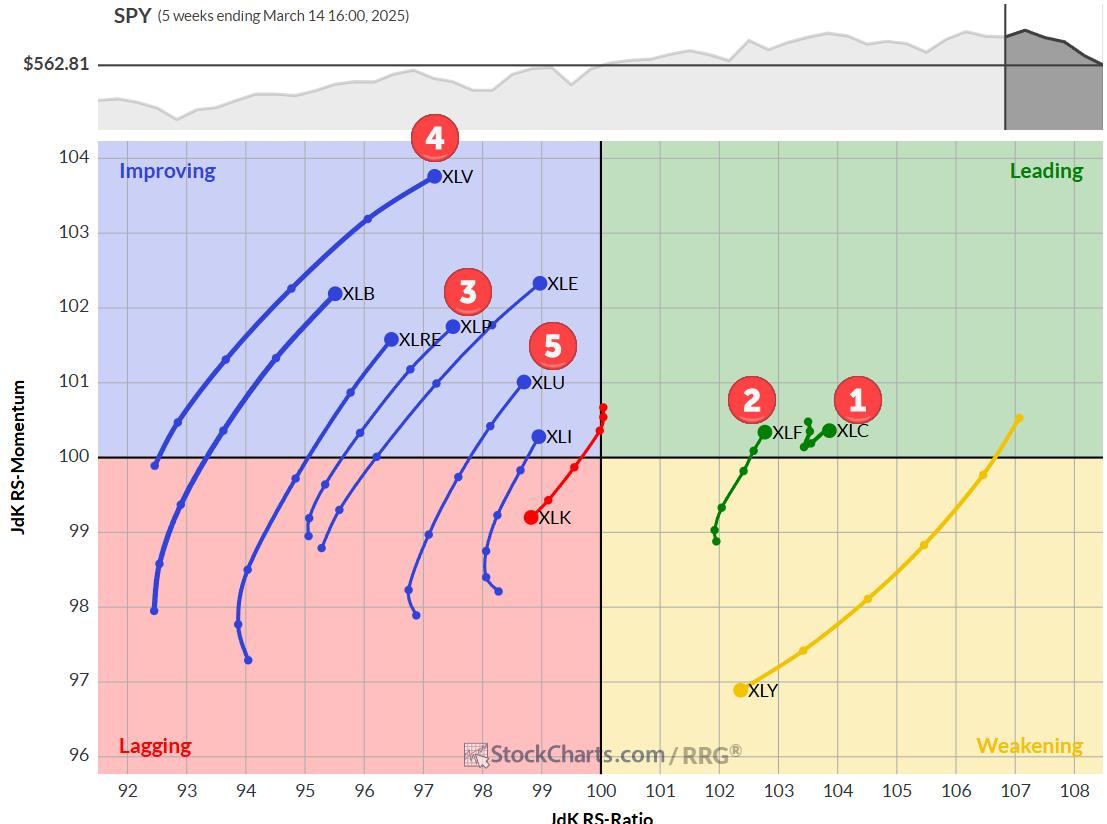

KEY TAKEAWAYS

* At the moment, we're seeing a big shakeup in sector rankings.

* Healthcare has entered the top five.

* Technology is dropping to last position.

* All defensive sectors are now in the top five.

Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At...

READ MORE

MEMBERS ONLY

Three Reasons to Consider Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Gold has dramatically outperformed the S&P 500 and Nasdaq in 2025.

* Gold prices remain in a primary uptrend, with our Market Trend Model reading bullish on all time frames.

* Gold stocks are outperforming physical gold, and could represent a "catch up" trade going into...

READ MORE

MEMBERS ONLY

Is a New Market Uptrend Starting? Key Signals & Trading Strategies

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

Retail (XRT) Dropping Quickly

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been rocky for the S&P 500 and particularly rocky for some industry groups and sectors. The market does appear ready to give us a good bounce, but past that we aren't overly bullish.

Tariff talk has really pummeled the Retail (XRT) industry group...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

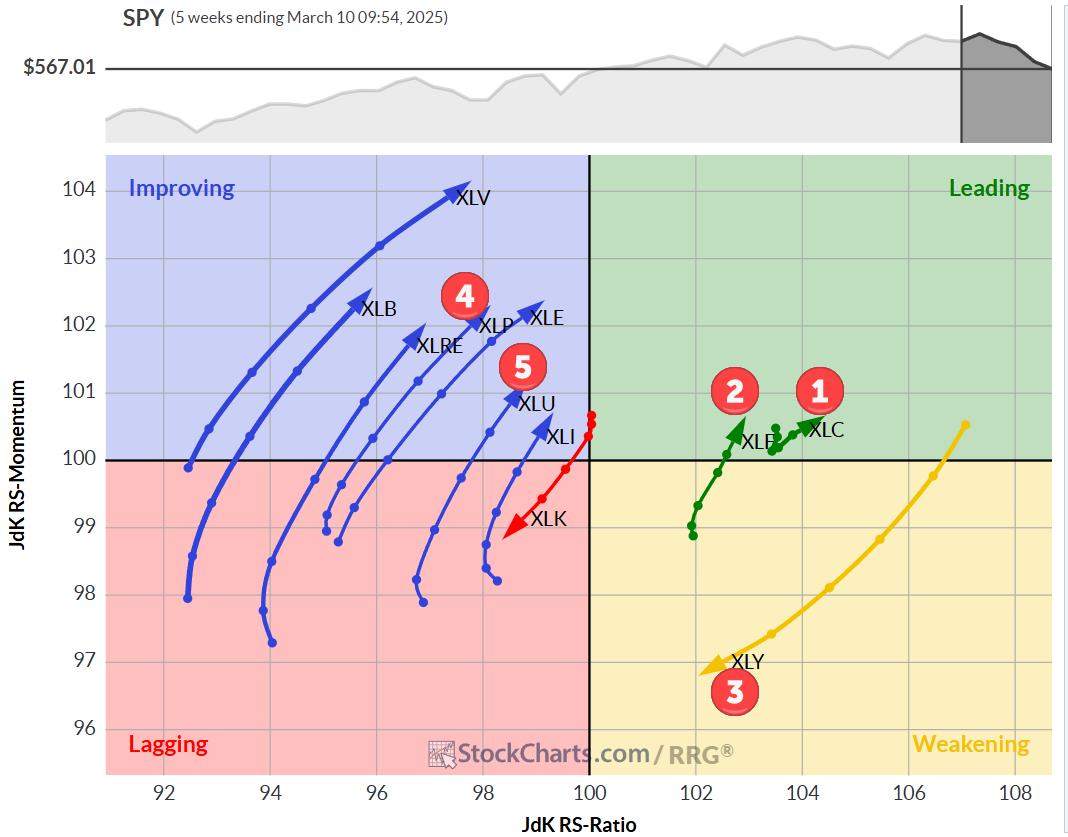

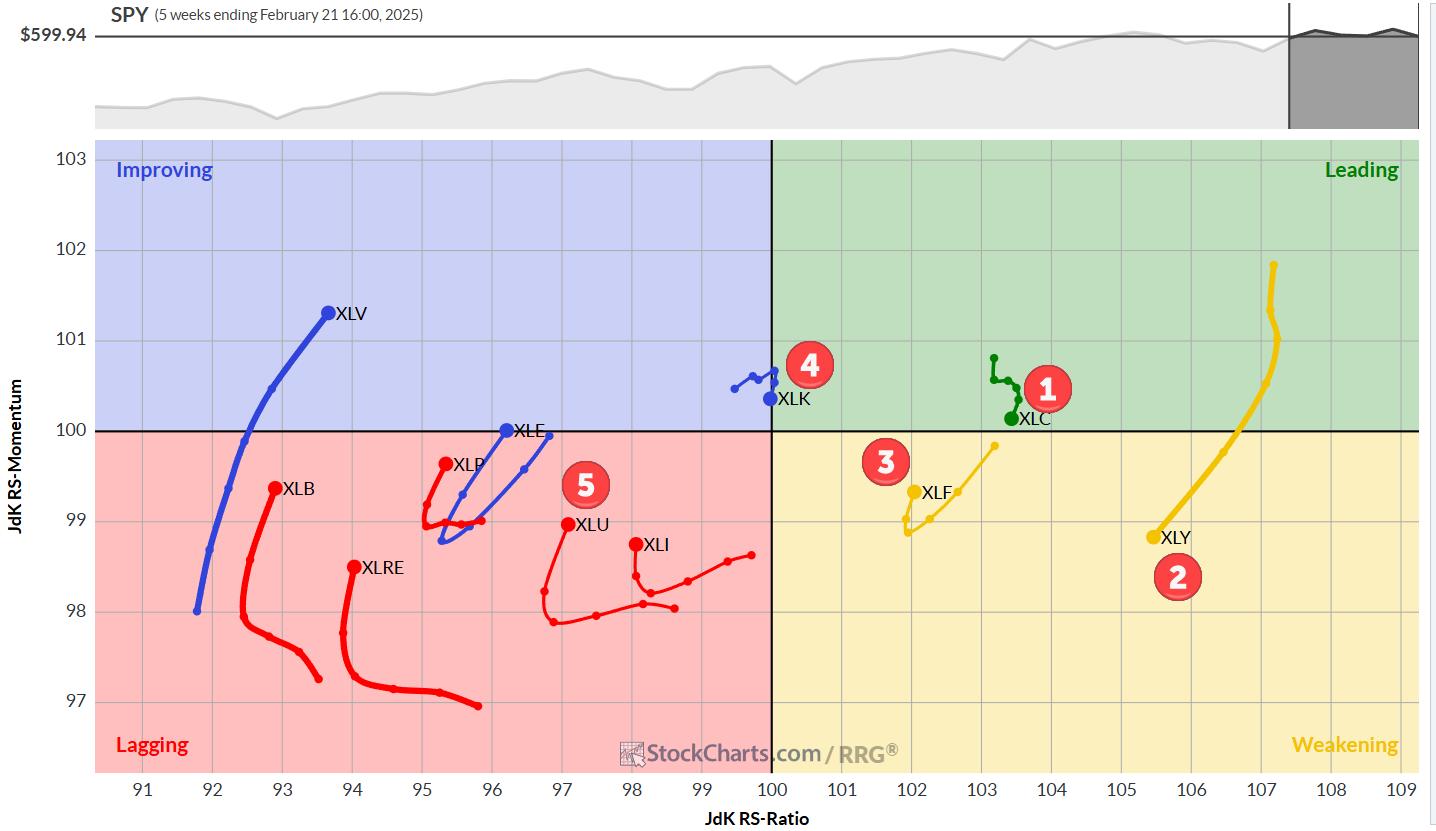

KEY TAKEAWAYS

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

My Downside Target for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Once our "line in the sand" of SPX 5850 was broken, that confirmed a likely bear phase for stocks.

* We can use Fibonacci Retracements to identify a potential downside objective based on the strength of the previous bull trend.

* A confirmed sell signal from the Newer...

READ MORE

MEMBERS ONLY

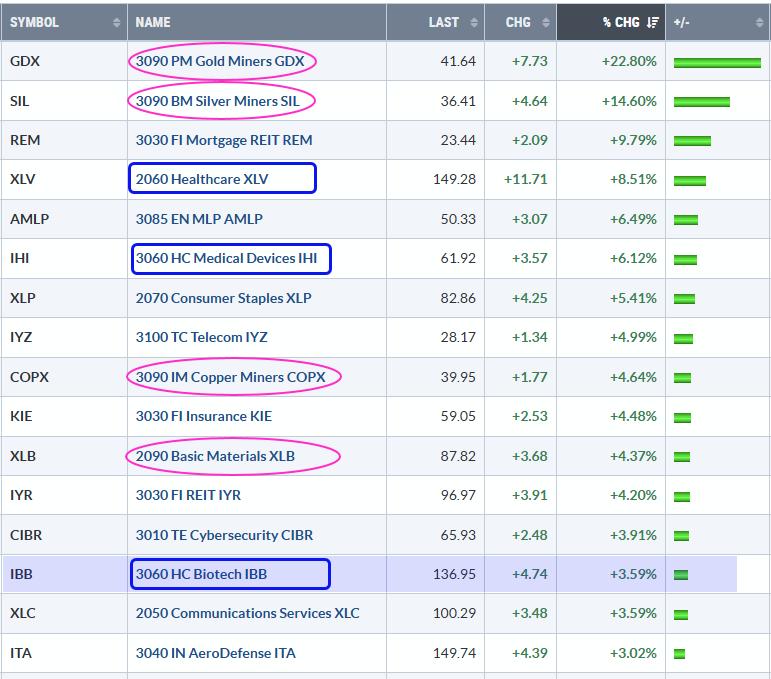

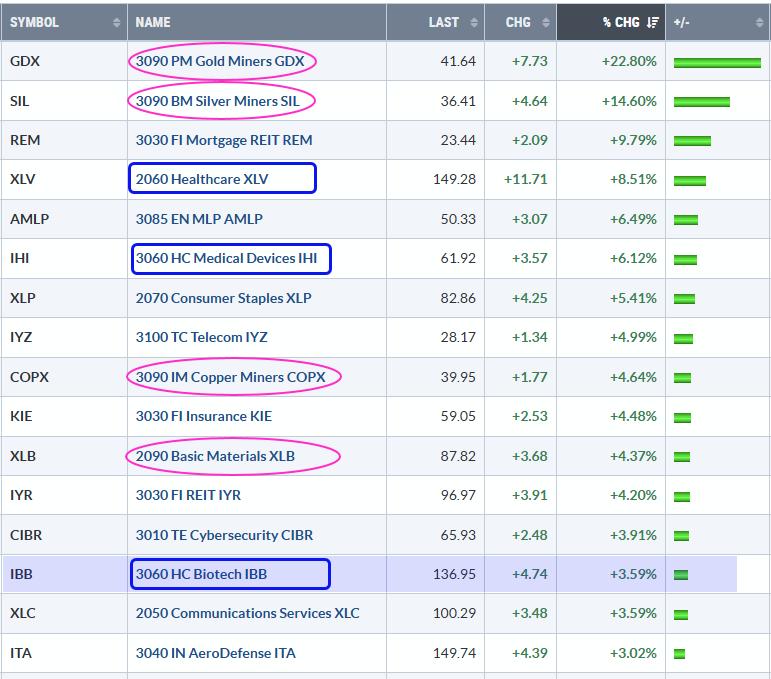

Commodity and Healthcare Related ETFs Lead in 2025 - Bullish Breakout in Biotechs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* 2025 is off to a rough start with SPY, QQQ and IWM sporting losses.

* ETFs with gains are bucking the market by showing relative and absolute strength.

* The Biotech ETF broke out in January and is battling its breakout zone.

2025 is off to a rough start for...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

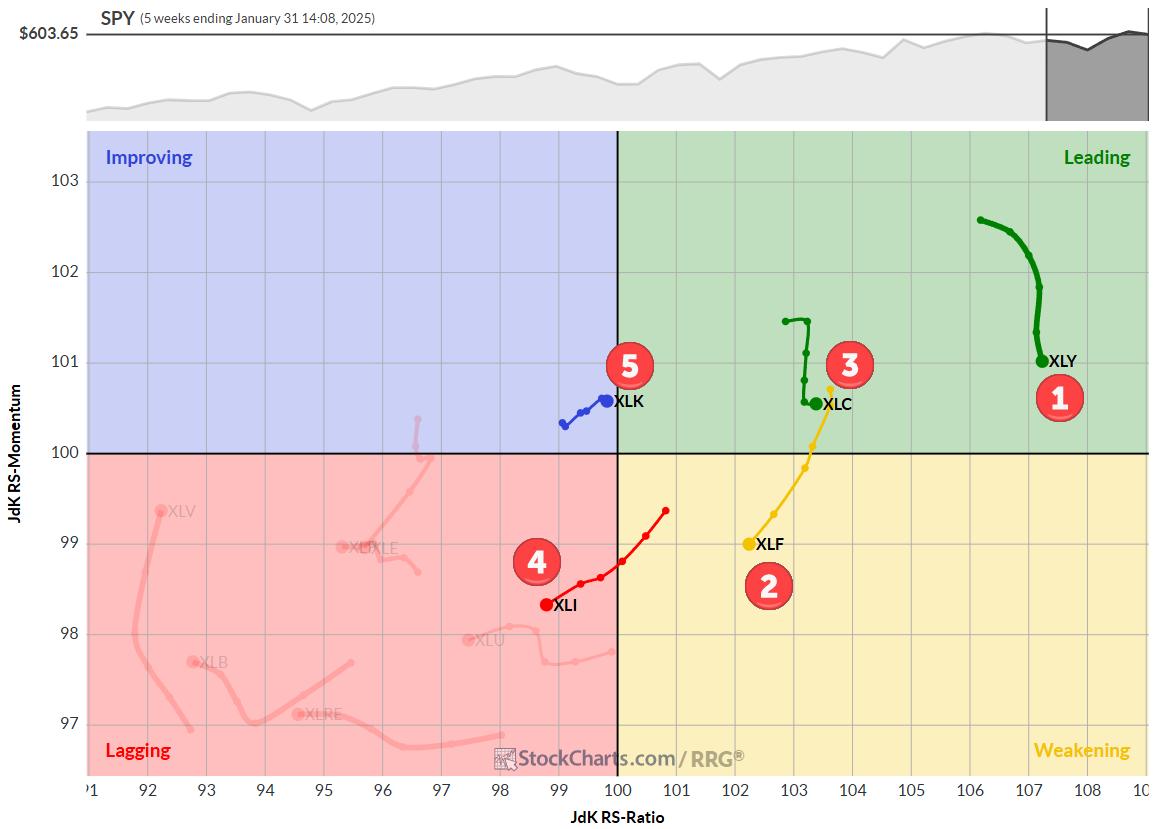

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

Growth Stocks Tumbling; Where to Find Safe Havens Now!

by Mary Ellen McGonagle,

President, MEM Investment Research

Growth stocks just took a sharp hit—what does it mean for the market? In this video, Mary Ellen breaks down the impact, reveals why NVDA could soar higher, and highlights safer stocks with strong upside potential!

This video originally premiered February 28, 2025. You can watch it on our...

READ MORE

MEMBERS ONLY

Small-caps Trigger Bearish, but Large-caps Hold Uptrend and Present an Opportunity

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Long-term Keltner Channels are trend-following indicators that identify volatility breakouts.

* The Russell 2000 ETF triggered bearish this week and reversed a 14 month uptrend.

* The S&P 500 SPDR remains within an uptrend and the current pullback is an opportunity.

The Russell 2000 ETF triggered a bearish...

READ MORE

MEMBERS ONLY

Retail is at a Crossroads—Buy Now or Stay Away?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The retail sector has been trading sideways for almost three years.

* Wall Street sees moderate growth for retail in 2025.

* Retail may be presenting both swing trading and position trading opportunities right now.

As "economic softening" increasingly emerges as the prevailing narrative driving the markets, the...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #8

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Utilities entering the top-5

* Industrials dropping out of top-5 portfolio

* Real-Estate and Energy swapping positions in bottom half of the ranking

* Perfomance now 0.3% below SPY since inception.

Utilities enter top 5

Last week's trading, especially the sell-off on Friday, has caused the Utilities sector...

READ MORE

MEMBERS ONLY

Market Rotation and Cap-Weight Dynamics: A Closer Look

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large cap growth stocks regaining favor as market faces pressure

* Cap-weighted sectors outperforming equal-weighted counterparts

* S&P 500 struggling to break above 610, suggesting potential trading range

* Exceptions in mega-cap dominated sectors (Communication Services, Technology, Consumer Discretionary)

With the market selling off into the close today, it&...

READ MORE

MEMBERS ONLY

Gold and Silver Are Crushing the S&P 500! Here's What You Need To Know Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold and silver are crushing the commodities markets and the S&P 500.

* Gold is hitting record highs, fueled by sentiment and speculation.

* Consider the key levels to watch for investment opportunities in gold and silver.

There's been a lot of wild speculation surrounding gold&...

READ MORE

MEMBERS ONLY

Unleash the Power of BPI: The Key to Boosting Your Investment Returns

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Market breadth is improving in some stock market sectors.

* Monitoring the Bullish Percent Index (BPI) can help you strategize your investments.

* The broader stock market indexes are still bullish.

On Wednesday, the Federal Reserve released minutes from its January 28–29 meeting. There weren't any surprises...

READ MORE

MEMBERS ONLY

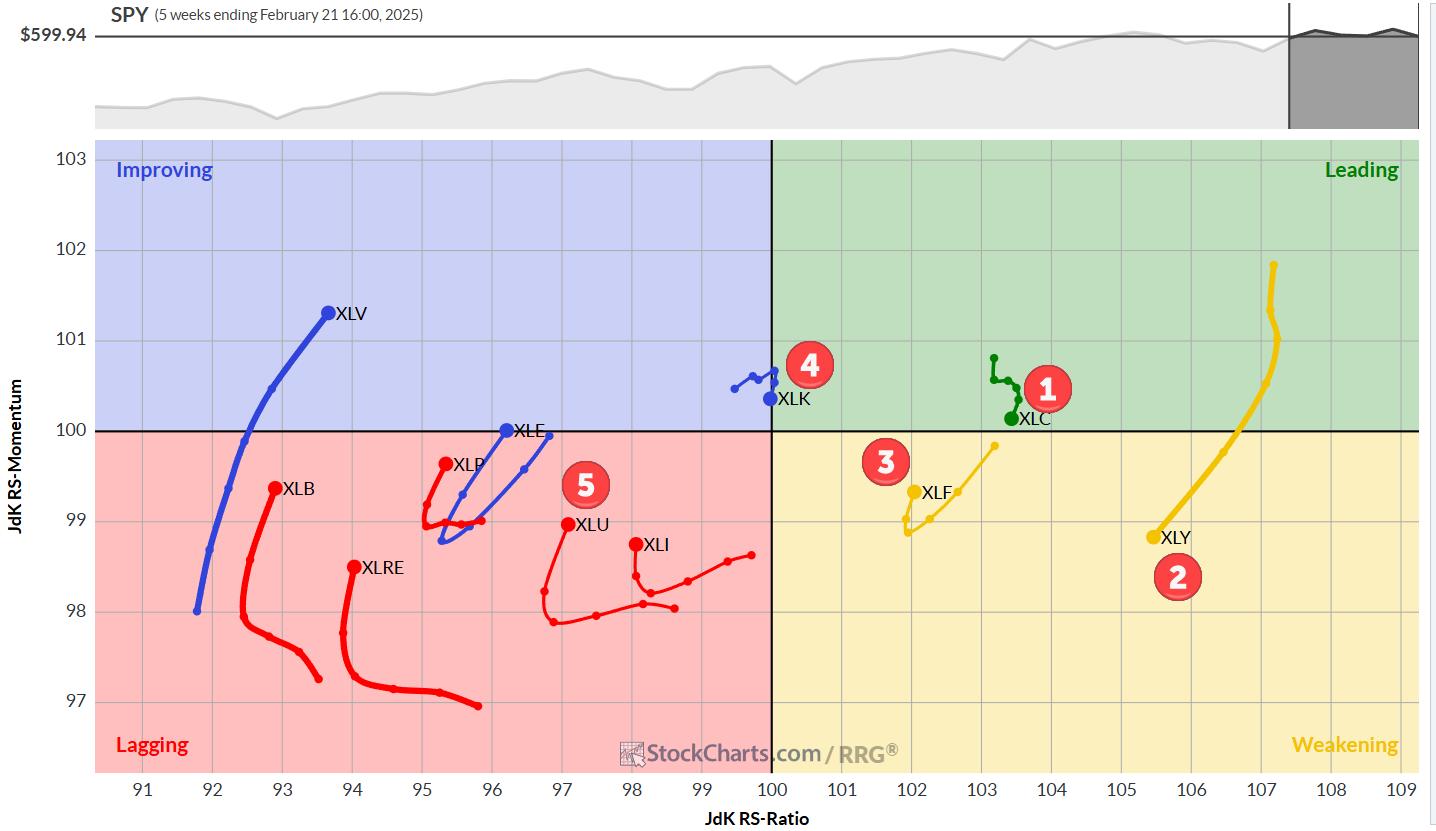

The Best Five Sectors, #7

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

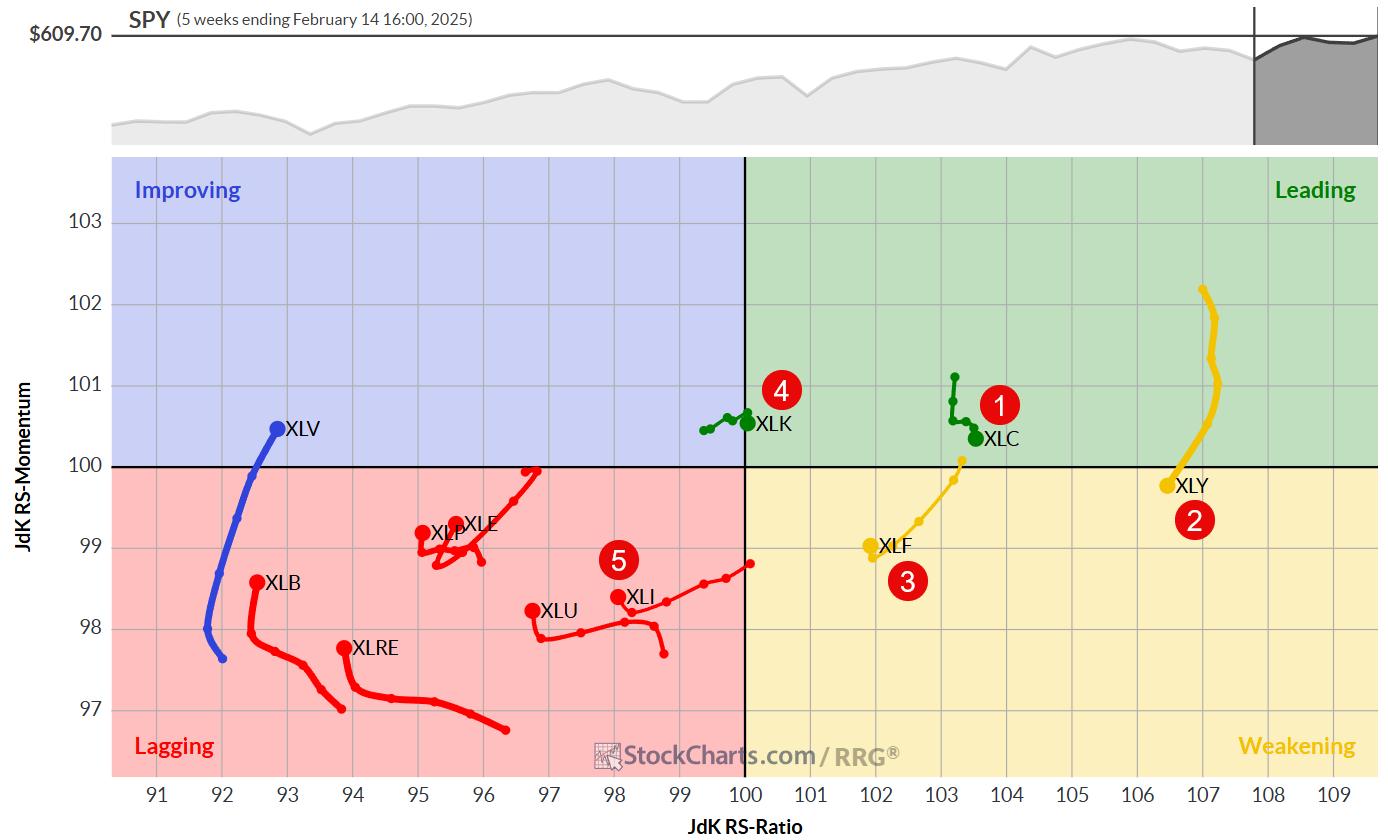

KEY TAKEAWAYS

* Communication services (XLC) claims the top spot, pushing consumer discretionary (XLY) to second place

* Technology (XLK) shows strength, moving up to fourth and displacing industrials (XLI)

* Industrials displaying weakness, at risk of dropping out of the top five

* RRG portfolio outperforming SPY benchmark by 69 basis points

Shifting...

READ MORE

MEMBERS ONLY

Stay Ahead of Tariffs: Essential Chart Analysis for Investment Security

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has been trading sideways for an extended period.

* Tariffs, deregulation, inflation, and tax cuts are likely to occupy investors' minds for the next few years.

* Monitor the charts of the broader stock market, inflation expectations, and industries that are likely to benefit from the...

READ MORE

MEMBERS ONLY

Stash that Flash Right in the Trash

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Price represents a distillation of all news, events and rumors.

* Our job is to set biases aside and focus on price action.

* Chartists should focus on uptrends, relative strength and bullish setups.

The news cycle is in high gear lately, leading to some extra volatility. Traders reacting to...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #6

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

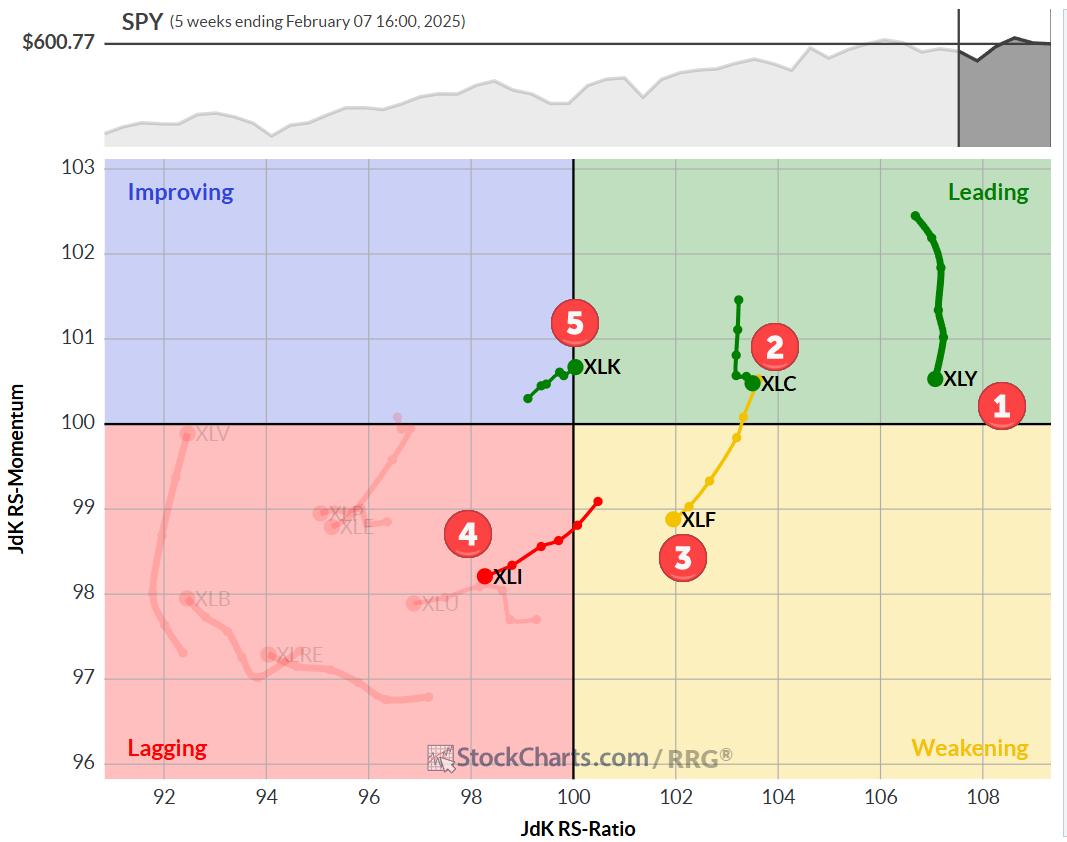

KEY TAKEAWAYS

* Top-5 remains unchanged

* Healthcare and Staples jump to higher positions

* Price and Relative trends remain strong for XLC and XLF

No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in...

READ MORE

MEMBERS ONLY

Nasdaq DROPS on Weak AMZN, TSLA & GOOGL Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen reviews the market's flat momentum as uncertainty reemerges after weak AMZN, TSLA and GOOGL reports - PLUS more tariff talk from Trump. She also highlights the move into defensive sectors as growth stocks continue to struggle. Lastly, she shares the top stocks that...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch for in February 2025

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the major equity averages are certainly up year-to-date, we're detecting a growing number of signs of leadership rotation. As the Magnificent 7 stocks have begun to falter, with charts like Apple Inc. (AAPL) taking on a less-than-magnificent luster in February, we've identified ten key stocks...

READ MORE

MEMBERS ONLY

DeepSeek Rattles AI Stocks - Should You Buy The Dip?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen unpacks the week after the news drop roiled markets; coupled with major earnings reports, it's been a rough week. She highlights what drove the biggest winners last week as we head into one of the busiest time for earnings!

This video originally premiered...

READ MORE

MEMBERS ONLY

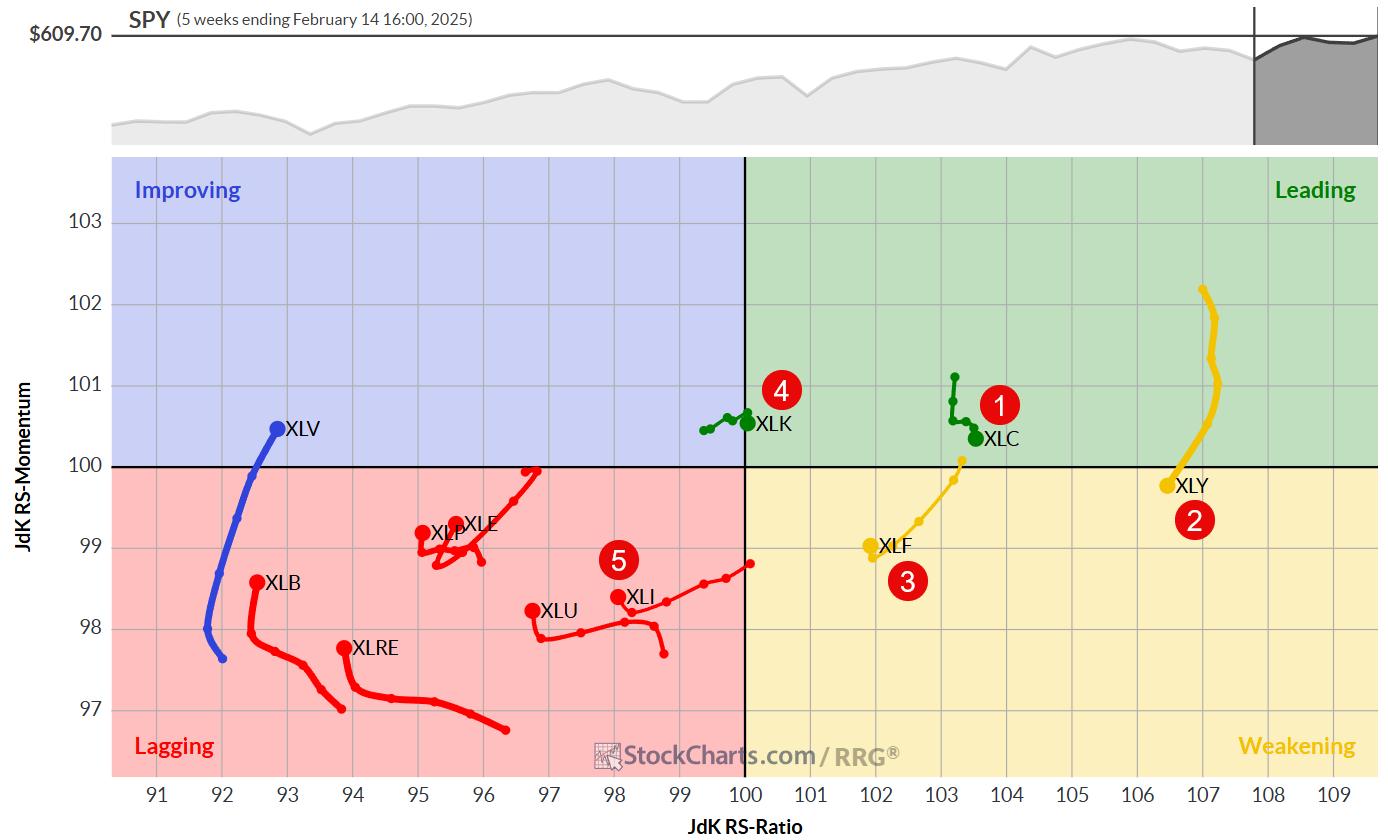

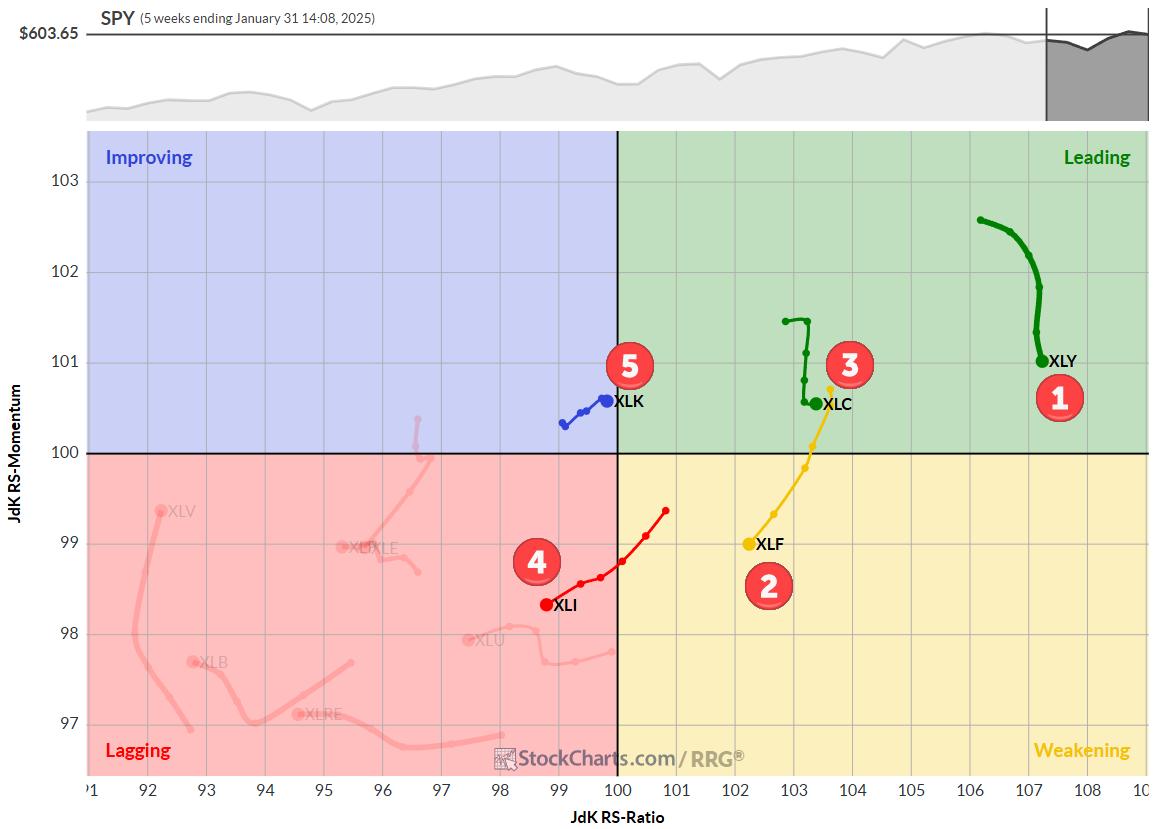

The Best Five Sectors, #5

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Technology (XLK) re-enters top 5 sectors, displacing Energy (XLE)

* Consumer Discretionary (XLY) maintains #1 position

* Weekly and daily RRGs show supportive trends for leading sectors XLY and XLC

* Top-5 portfolio outperforms S&P 500 by nearly 50 basis points

Technology Moves Back into Top-5

As we wrap...

READ MORE

MEMBERS ONLY

XLF's Record Highs: Buy the Dip or Bail Out Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* XLF, heavily weighted in bank stocks, broke into all-time high territory, though conviction appears low.

* Breadth, momentum, and technical strength are leaning bullish.

* A likely pullback signals an opportunity for entry.

As the FOMC prepared to announce its rate decision on Wednesday, the Financial Select Sector SPDR Fund...

READ MORE

MEMBERS ONLY

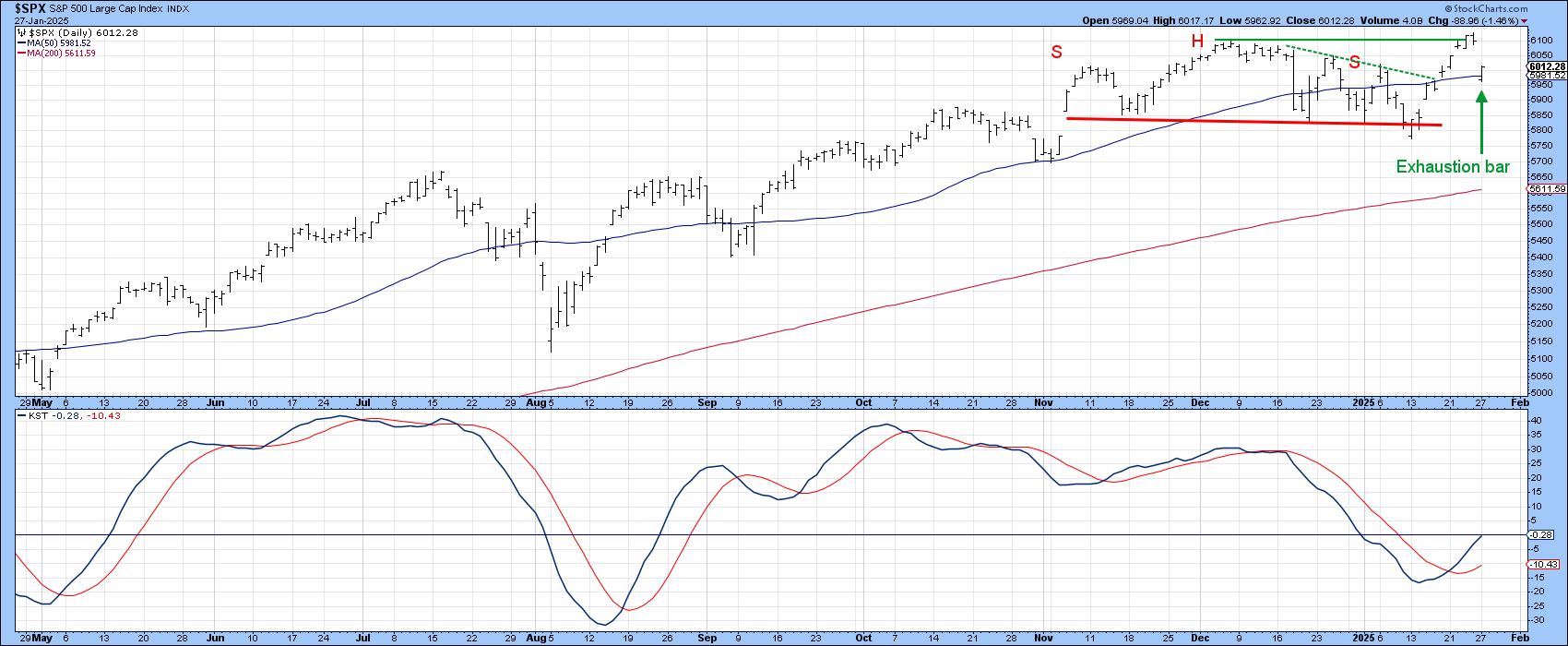

Some Silver Linings Following a Day of AI Panic

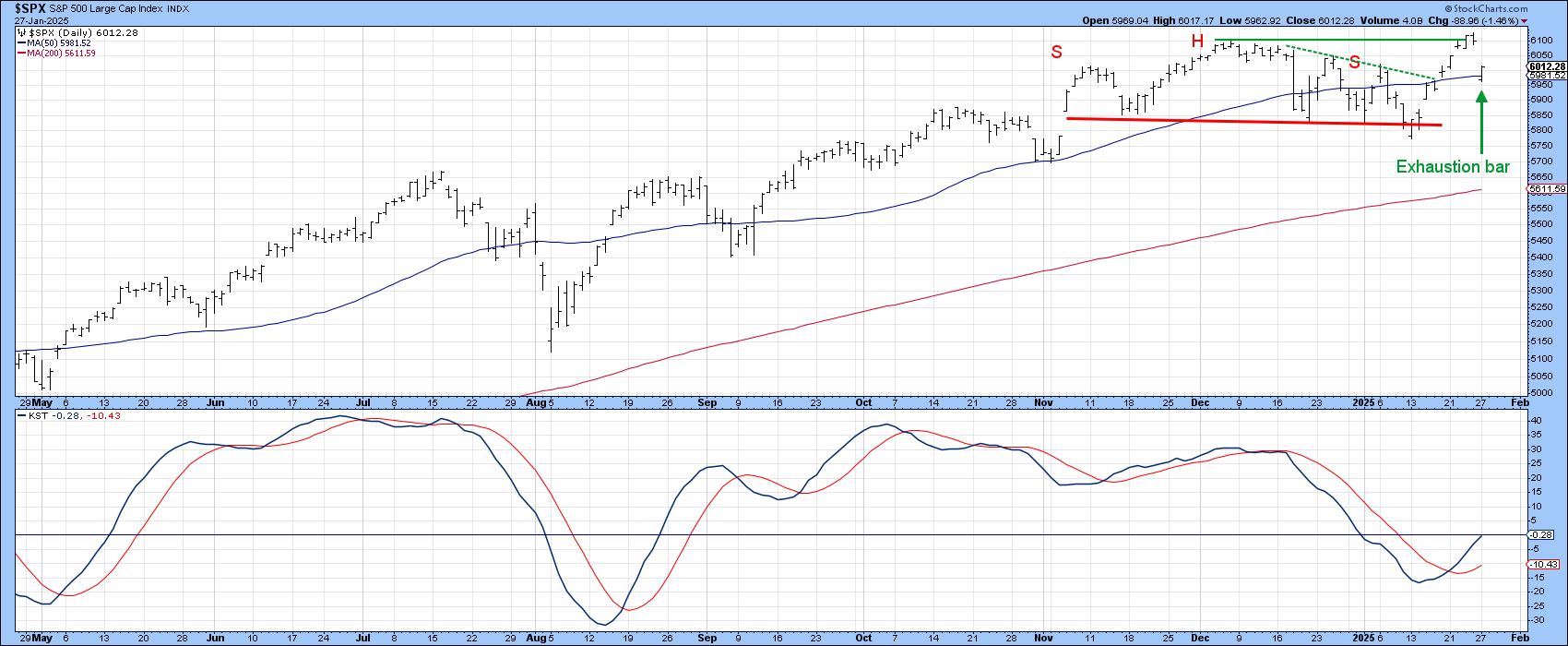

by Martin Pring,

President, Pring Research

I woke up this morning noting that NASDAQ futures had been down nearly 1,000 points at their overnight intraday low. Later, I tuned into a couple of general purpose, as opposed to financial, cable news channels. They, too, were talking about the sell-off and its rationale. I began to...

READ MORE

MEMBERS ONLY

What's NEXT for Semiconductors After Monday's SHOCKING Drop?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reviews the VanEck Semiconductor ETF (SMH) from a technical analysis perspective. He focuses on the recent failure at price gap resistance, the breakdown below price and moving average support, and the frequent appearance of bearish engulfing patterns which have often indicated major highs over the last...

READ MORE

MEMBERS ONLY

BEWARE! META, TSLA, AMZN, MSFT & AAPL Report Earnings Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen reviews the new uptrend in the S&P 500, and highlights what's driving it higher. She then shares new pockets of strength that are poised to take off, and what to be on the lookout for ahead of next week's...

READ MORE