MEMBERS ONLY

The Best Five Sectors, #4

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

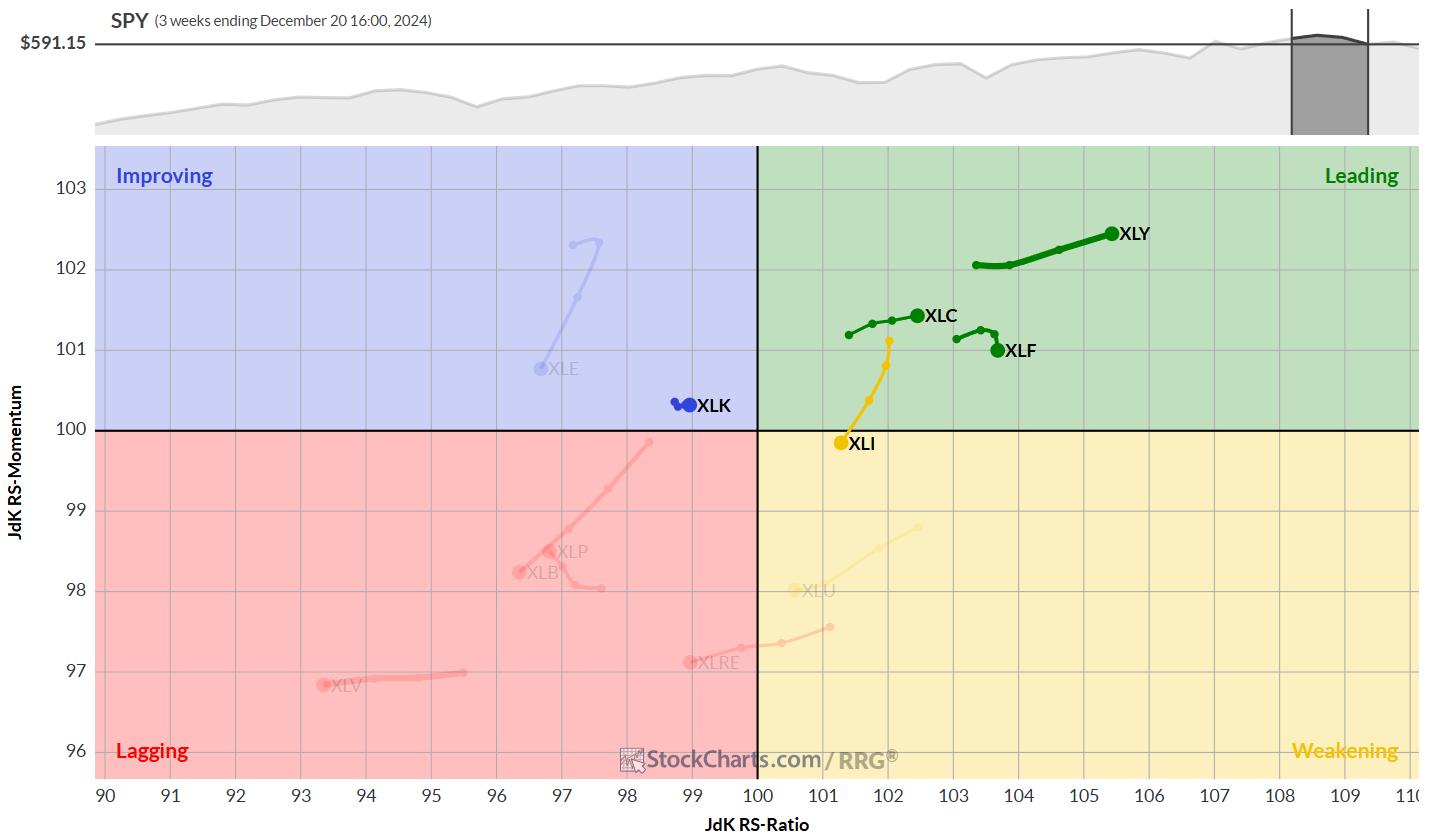

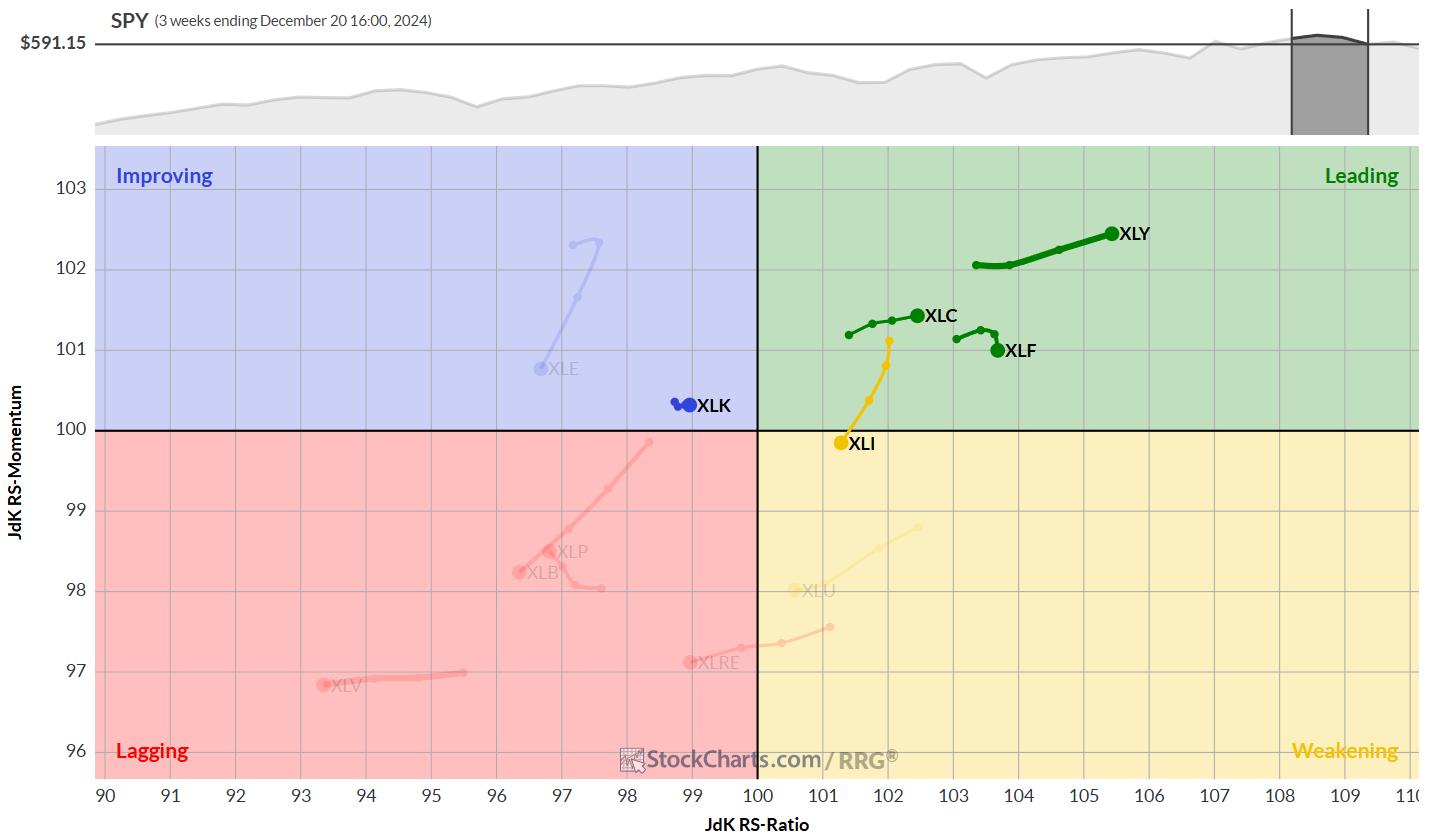

* No changes in top-5 sectors

* XLC showing strong break from consolidation flag

* XLE remains just barely above XLK as a result of strong daily RRG

No changes in the top-5

At the end of this week, there were no changes in the ranking of the top-5 sectors.

1....

READ MORE

MEMBERS ONLY

Semiconductors Have More to Prove Before Breakout is Believed

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The VanEck Vectors Semiconductor ETF (SMH) broke out of a six-month base this week, suggesting further upside potential.

* While the breakout in SMH appears bullish, the ETF still has yet to eclipse a key price gap from July 2025.

* A bearish engulfing pattern to end the week indicates...

READ MORE

MEMBERS ONLY

Mag7 ETF Leads as Bullish Pattern Forms - Charting the Trends and Trading Setups for the Mag7 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The Mag7 ETF (MAGS) is outperforming the market and in a strong uptrend.

* MAGS broke out of a short-term bullish continuation pattern this week.

* Nvidia, Tesla, Amazon and Meta are powering MAGS higher.

The Mag7 ETF (MAGS) formed another short-term bullish continuation pattern as it worked its way...

READ MORE

MEMBERS ONLY

Biotechs Looking Up - Two Stocks To Take Advantage

by Erin Swenlin,

Vice President, DecisionPoint.com

The Biotech industry group is making a comeback, with the 'under the hood' chart displaying new strength coming into the group. We have a constructive bottom that price is breaking from and, while it does need to overcome resistance at the 200-day EMA, it looks encouraging. What was...

READ MORE

MEMBERS ONLY

NVDA, TSMC, and Broadcom: Top Semiconductor Plays as SMH Hits New Highs

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMH has broken out of its three-month trading range.

* Trump's $500 billion Stargate AI initiative has injected optimism into the sector, accelerating gains in AI-related semiconductor stocks.

* Monitor the key levels for Nvidia, Broadcom, and TSMC for buying opportunities.

In the last quarter of 2024, semiconductors...

READ MORE

MEMBERS ONLY

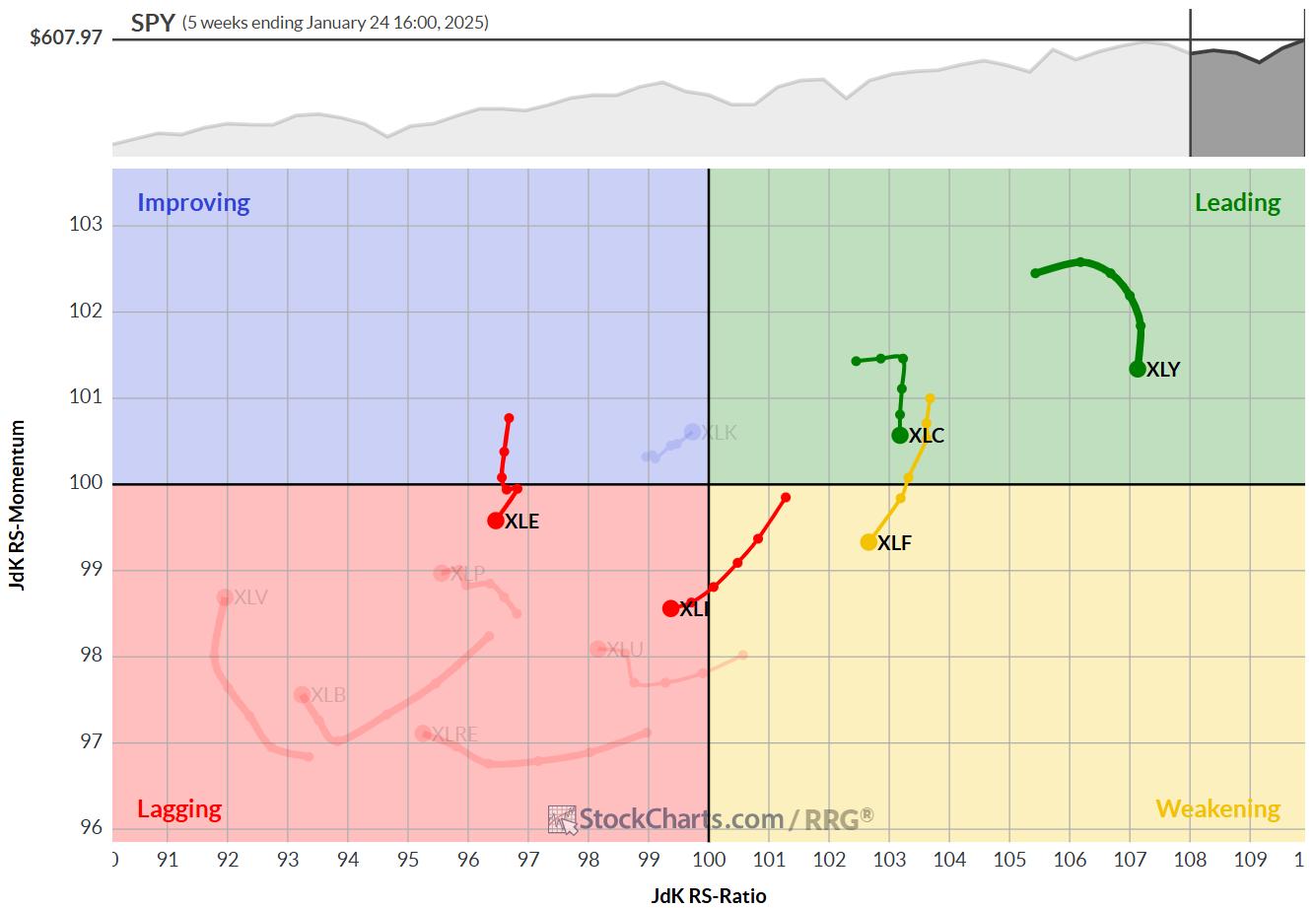

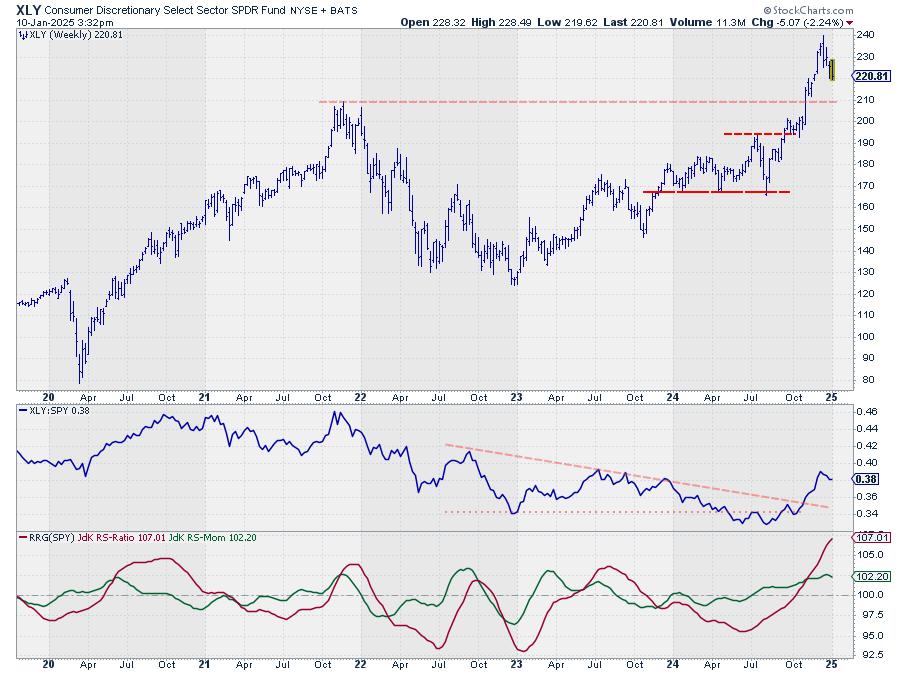

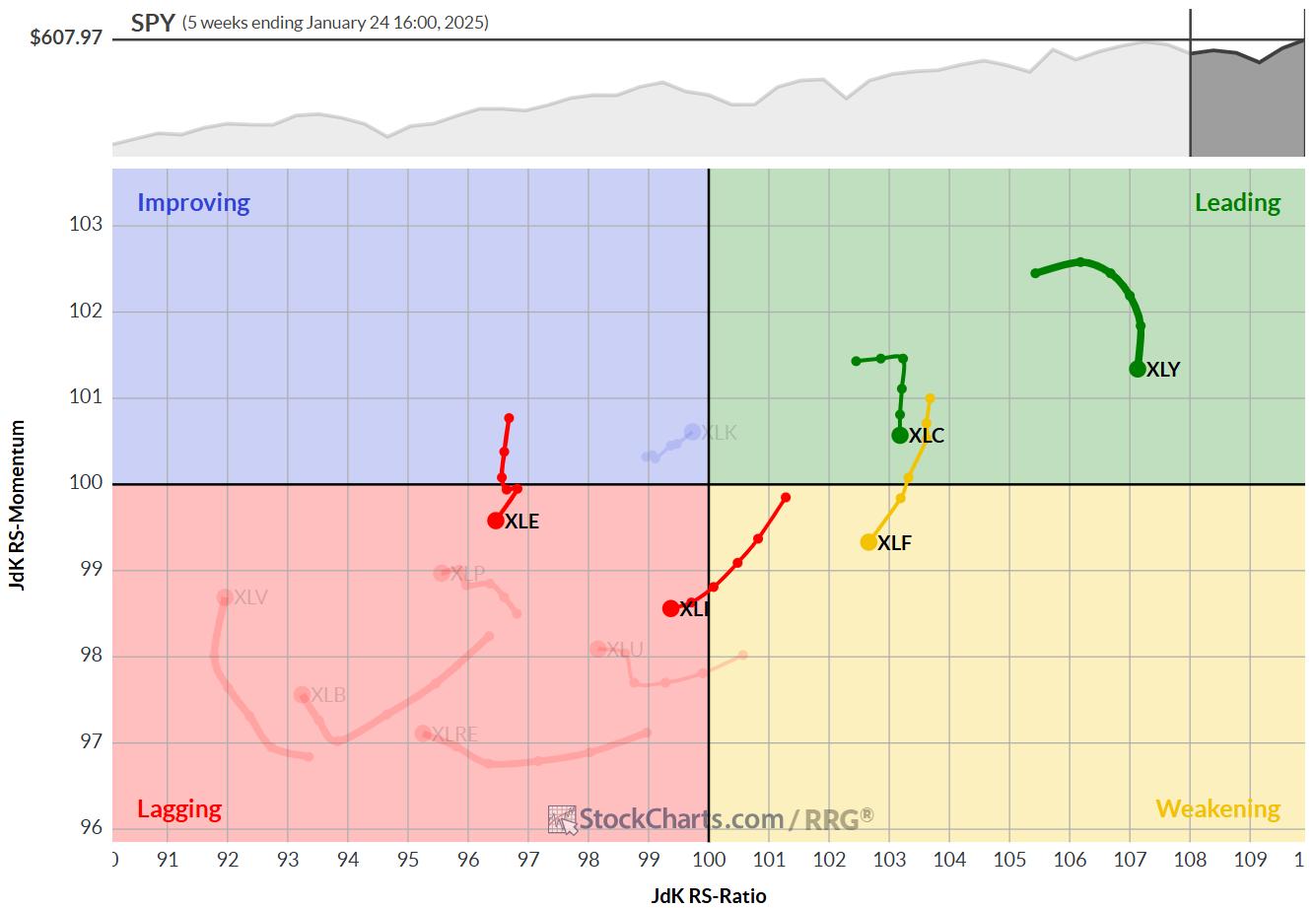

Energy Picks Up and Consumer Discretionary Continues to Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Short term strength drags enery sector up

* Long term strength keeps consumer discretionary on top

* Massive upside potential ready to get unlocked in EOG

I have been traveling in the US since 1/15 and attended the CMTA Mid-Winter retreat in Tampa, FL 1/16-1/17 and then...

READ MORE

MEMBERS ONLY

Market Internals Point to Large Growth Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the stronger US Dollar suggests caution for growth stocks, the ratios shows that growth continues to dominate value.

* While macro conditions appear beneficial for small cap stocks, large caps are back to a confirmed leadership role.

* Measures of offense vs. defensive suggest that investors are favoring offense...

READ MORE

MEMBERS ONLY

Stocks are Facing an Important Test

by Martin Pring,

President, Pring Research

I have been expecting a bull market correction for about a month, but it's not been as deep as I expected. Now, however, several indexes have completed small bullish two-bar reversal patterns on the weekly charts. If they work, that would be a characteristic of a bull market,...

READ MORE

MEMBERS ONLY

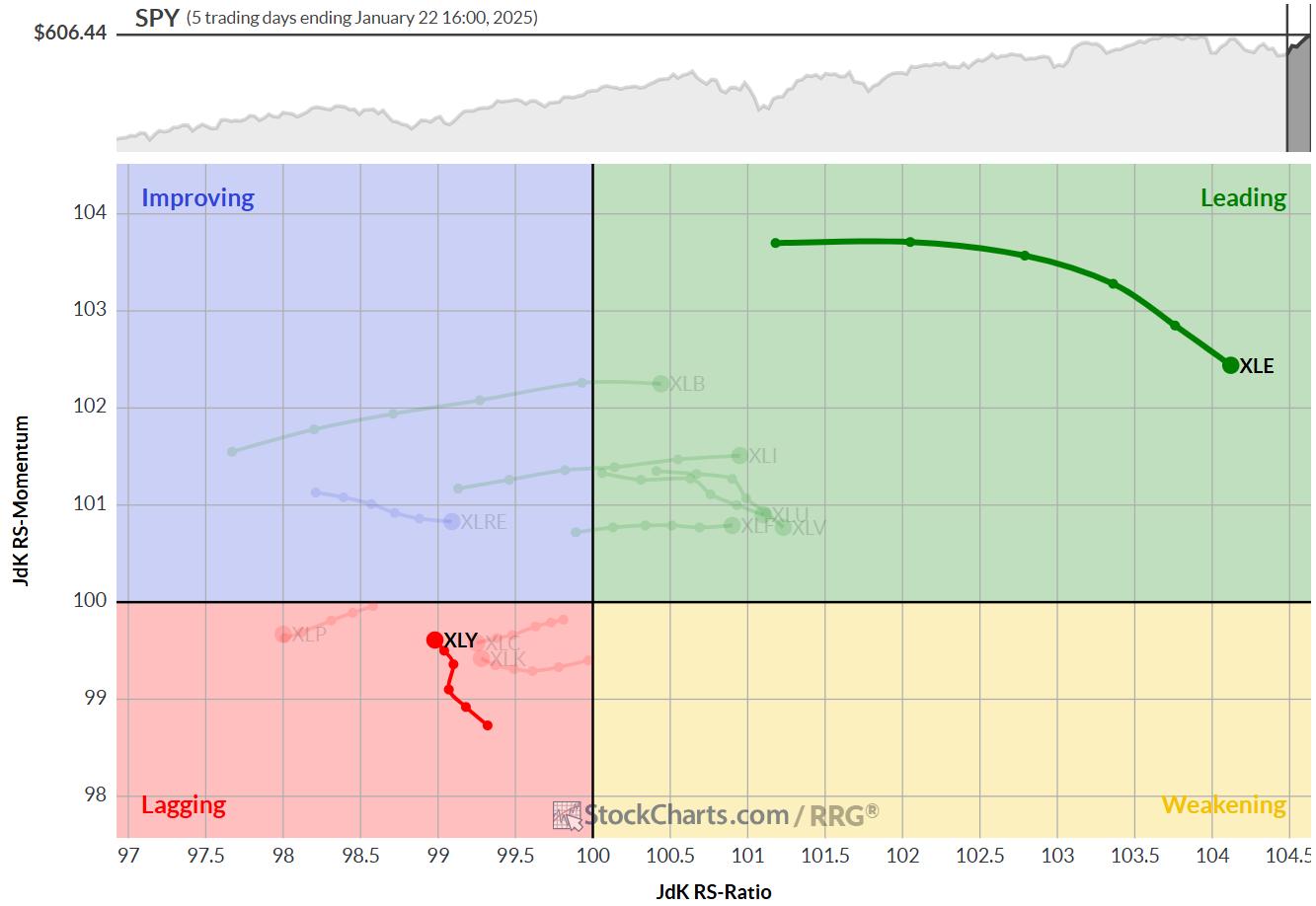

The Best Five Sectors, #3

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy replaces Technology in top-5

* Financials rise to #2 position pushing XLC down to #3

* Top-5 portfolio out-performs SPY 0.52%

* A closer look at the (equal) weighting scheme

Energy Replaces Technology

At the end of this week, 1/17/2024, the Technology sector dropped out of the...

READ MORE

MEMBERS ONLY

What Would It Take For Small Caps to Lead?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Financials represent one of the top sector weights in the IWM, and banks have kicked off earnings season with renewed strength.

* A resurgence in biotech stocks, one of the largest industries represented in the IWM, could provide an upside catalyst.

* US Dollar strength could adversely impact mega cap...

READ MORE

MEMBERS ONLY

The Financial Sector's Bullish Comeback: Is It Time to Start Looking at Bank Stocks?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Bullish Percentage Index for Financials made a dramatic jump on Wednesday.

* Positive bank earnings plus encouraging CPI and PPI data are driving market optimism.

* Citigroup stock notched a 52-week high, making the stock worth analyzing.

One effective way to spot potential market opportunities on a sector level...

READ MORE

MEMBERS ONLY

How to Find a BUY Signal Using The 1-2-3 Reversal Pattern

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe demonstrates how to use the 1-2-3 reversal pattern as a buy signal on the weekly chart. This approach can be used when the monthly chart is in a strong position. Joe shares how to use MACD and ADX to help when the trendline pattern...

READ MORE

MEMBERS ONLY

Investors Await CPI and Bank Earnings: Will They Spark Investor Optimism?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes are seeing a lot of choppy activity.

* December CPI and bank earnings are on deck and could move the markets.

* The interest rate-sensitive banking sector will be impacted by CPI and bank earnings.

The December Producer Price Index (PPI) came in cooler than expected,...

READ MORE

MEMBERS ONLY

The Bullish Case for Small Caps vs. Large Caps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Will small cap stocks finally take on a leadership role in 2025? In this video, Dave provides a thorough technical analysis discussion of the Russell 2000 ETF (IWM) and how that compares to the current technical configuration of the S&P 500 index. He also shares three charts he&...

READ MORE

MEMBERS ONLY

Gold Prices: De-Dollarization, Inflation, and $3,000 Gold—What You Need to Know Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Central banks are accumulating gold at an increased pace which could increase the price of gold.

* While retail sentiment for gold may decline slightly, institutional accumulation remains steady.

* Compare gold futures with the ETF and look at the key levels, as a buying opportunity may be near.

Gold...

READ MORE

MEMBERS ONLY

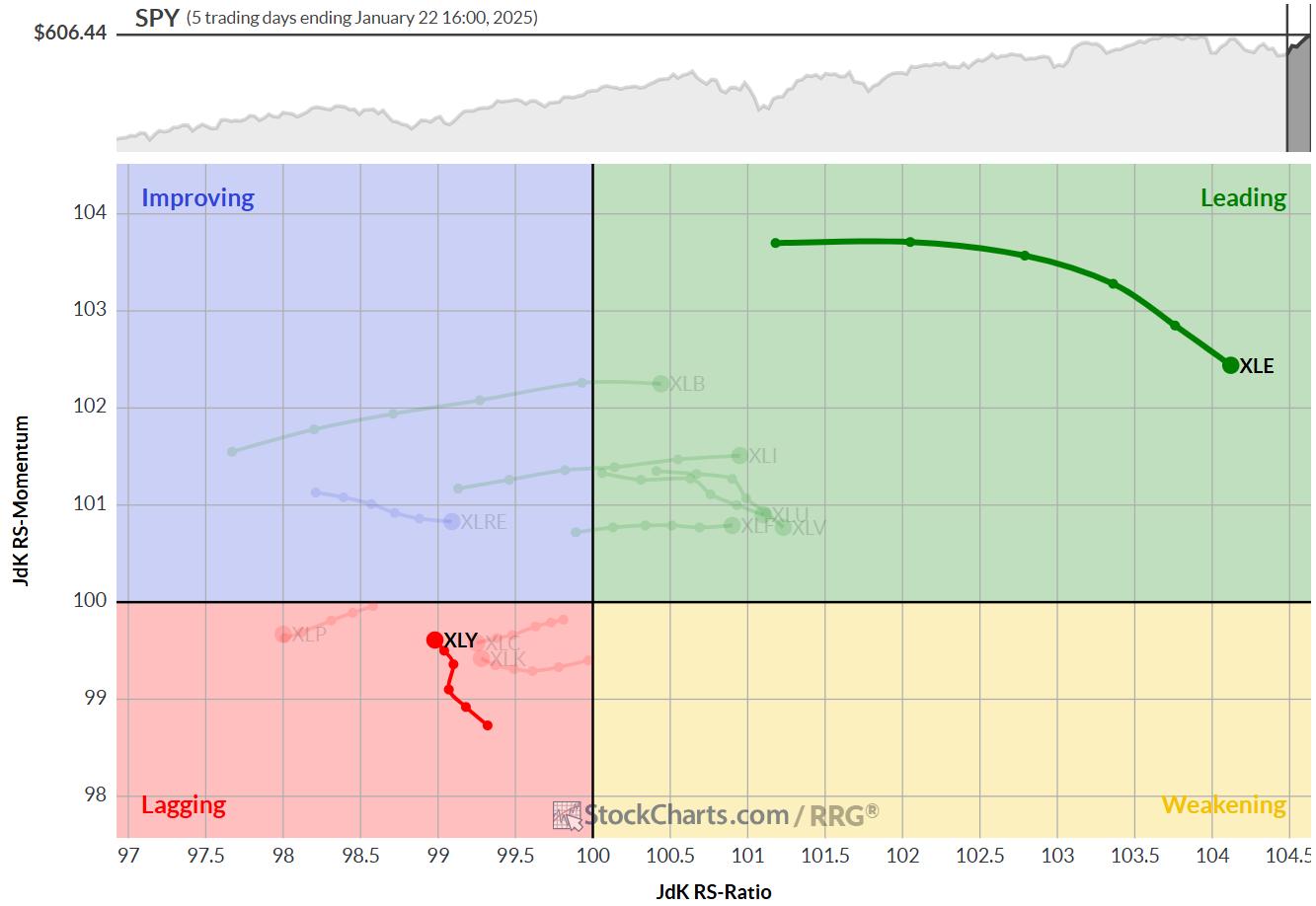

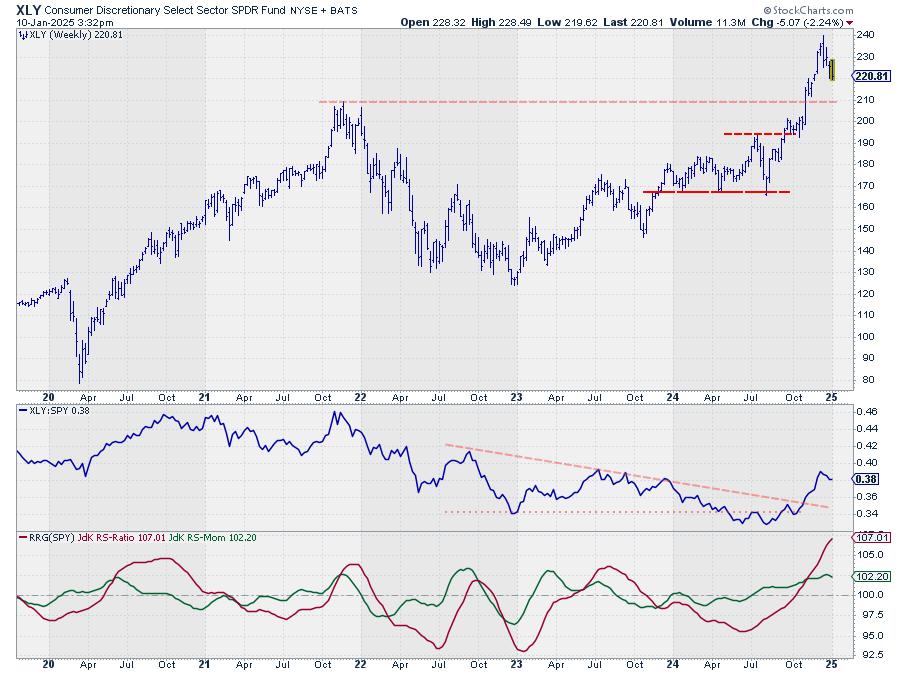

The Best Five Sectors, #2

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The best five sectors remain unchanged.

* XLC and XLF are both starting to show weakness.

* XLI is holding above support, while XLK remains within rising channel.

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop...

READ MORE

MEMBERS ONLY

These Riskier Areas Start the New Year RALLY!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen analyzes the divergence between the S&P 500 and the Nasdaq while highlighting some of the areas driving Growth stocks. She also talks about the continuation rally in Energy and Utility stocks and shares which stocks are driving these areas higher.

This video originally...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #1

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

HAPPY NEW YEAR!!!

Ever since the introduction of RRG back in 2011, many people have asked me questions like: "What is the track record for RRG" or "What are the trading rules for RRG"?

My answers have always been, and will continue to be, "There...

READ MORE

MEMBERS ONLY

These Bars and Candles May Hold the Key for 2025

by Martin Pring,

President, Pring Research

Most of the time, when we study bars or candlesticks, our attention is focused on daily and intraday charts, since they give early warnings of a possible change in the short-term trend. Nonetheless, it occasionally makes sense to step back and take a look at monthly bars and candlesticks. Not...

READ MORE

MEMBERS ONLY

Trump's Policy Shift Reveals Potential Big Winner!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights whether to buy last week's pullback. She discusses the rise in interest rates and why, as well as which areas are being most impacted. Last up, she reviews potential winners with new Trump policy, how to spot a downtrend reversal, and the...

READ MORE

MEMBERS ONLY

Quantum Computing Stocks: Why You Should Invest in Them Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Quantum computing stocks have been rising since November.

* Four quantum computing stocks were in the "Small-Cap, Top 10" category in the StockCharts Technical Rank (SCTR) report.

* You can also gain exposure to quantum computing stocks by investing in the Defiance Quantum ETF.

Qubits, quantum advantage, gate...

READ MORE

MEMBERS ONLY

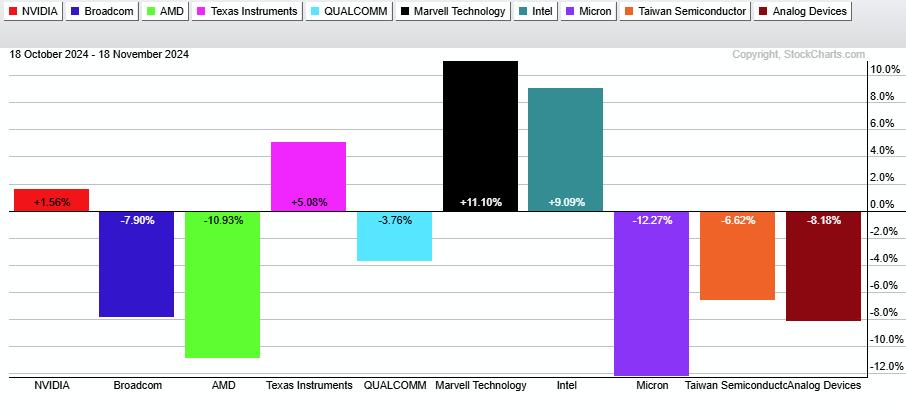

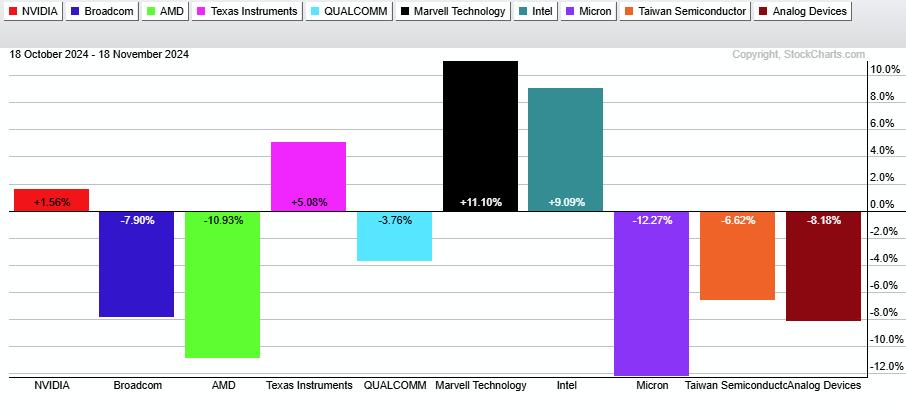

AI Boom Meets Tariff Doom: How to Time Semiconductor Stocks

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Semiconductors are caught in a tug-of-war with AI demand on one side and tariff fears on the other.

* The industry's technical performance shows a narrow standstill that can break either way.

* Watch SMH and its top three holdings—NVDA, TSM, and AVGO—for insights into timing...

READ MORE

MEMBERS ONLY

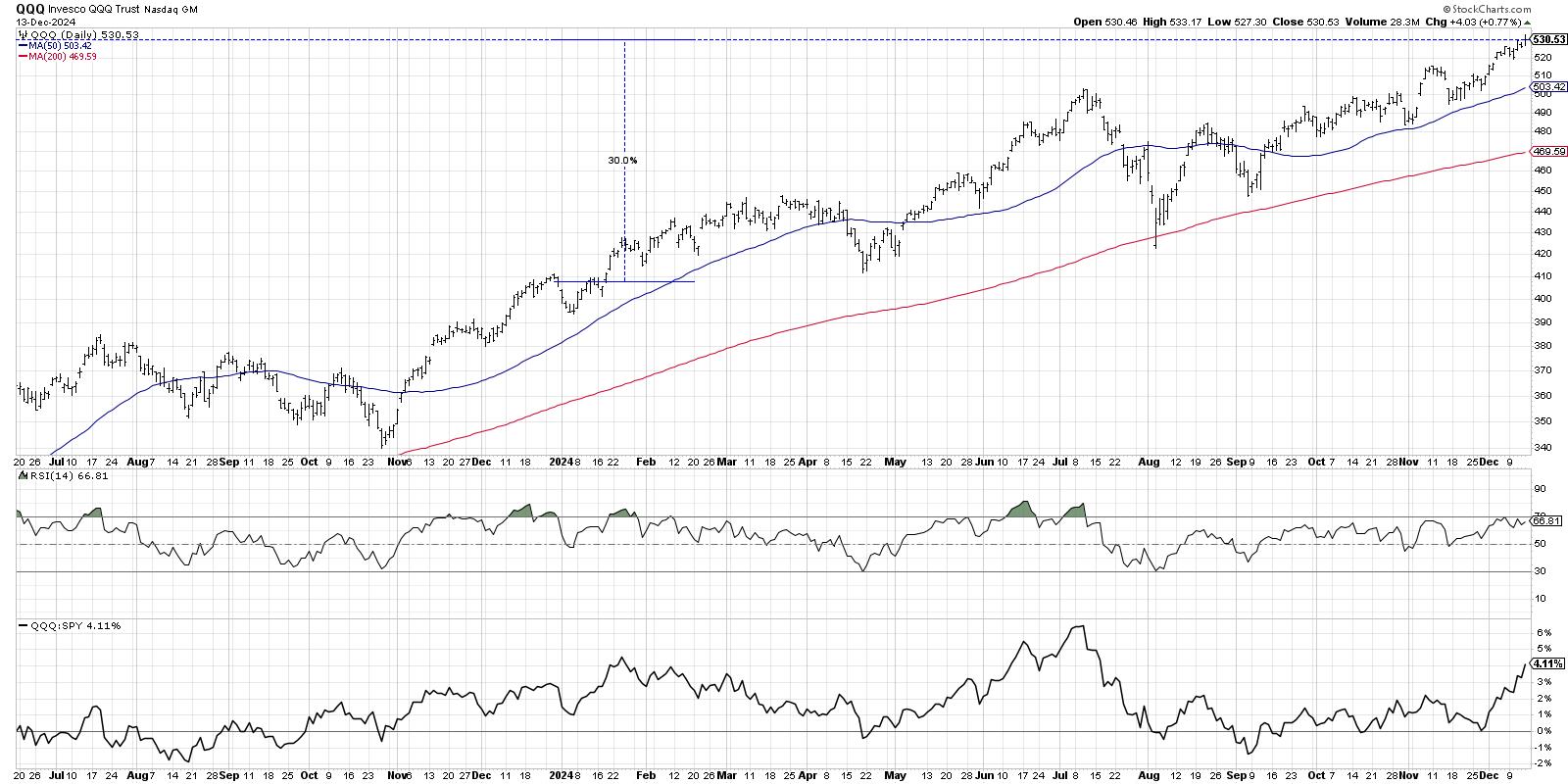

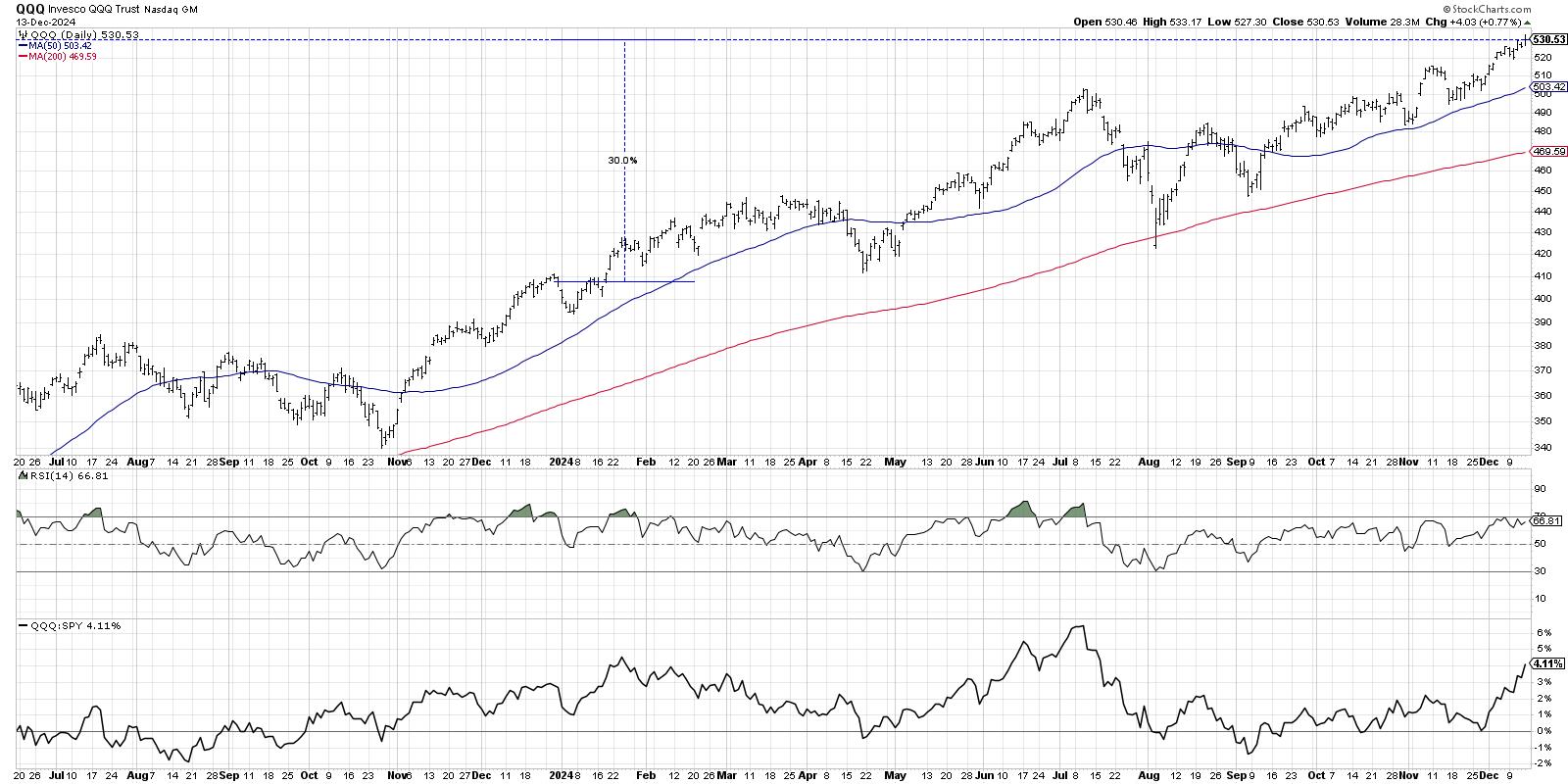

Three Big Negatives Overshadow the Uptrends in SPY and QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY and QQQ are still in long-term uptrends, but the red flags are rising.

* Housing and semis, two key cyclical groups, are in downtrends.

* Interest rates are rising as the 10-yr Yield reversed a 13 month downtrend.

SPY and QQQ remain in long-term uptrends, but three big negatives...

READ MORE

MEMBERS ONLY

Navigating the Indecisive SPY: What Investors Should Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) was flagged as a technically strong chart.

* An analysis of the SPY chart shows the ETF is being indecisive.

* Monitor the chart of SPY for indications of a decisive move in either direction.

When running my StockCharts Technical Rank (SCTR)...

READ MORE

MEMBERS ONLY

Will the QQQ Sell Off in January? Here's How It Could Happen

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In recent interviews for my Market Misbehavior podcast, I've asked technical analysts including Frank Cappelleri, TG Watkins, and Tom Bowley what they see happening as we wrap a very successful 2024. With the Nasdaq 100 logging about a 30% gain for 2024, it's hard to imagine...

READ MORE

MEMBERS ONLY

Small Caps are Set to Skyrocket in 2025—Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Small caps tend to outperform following an election year.

* In most annual cycles, small caps also have their seasonal tendencies.

* The chart of the iShares Russell 2000 ETF (IWM) is worth monitoring, especially as it approaches a buy point.

With an new administration inbound in Washington, D.C....

READ MORE

MEMBERS ONLY

Master the MACD Zero Line for a Trading Edge!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows how to use the MACD zero line as a bias for a stock. As opposed to offering a buy signal, this Zero line level can provide insight into a market or stock's underlying condition; Joe shows how to refine that information...

READ MORE

MEMBERS ONLY

Are ARK's Innovation ETFs on to Something BIG?

by Mary Ellen McGonagle,

President, MEM Investment Research

After a broad market review, Mary Ellen shares strategies for trading pull backs and breakouts in stocks. Highlights include a deep dive into ARK's Innovation ETFs and their holdings, locating market strength in the process. Tune in for valuable insights and tips to help you make informed investment...

READ MORE

MEMBERS ONLY

Two ETFs That Could Thrive Based on a Normal Yield Curve

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My recent discussions on the Market Misbehavior podcasthave often included some comments on the interest rate environment, particularly the shape of the yield curve. We've had an inverted yield curve since late 2022, and so the yield curve taking on a more normal shape could mean a huge...

READ MORE

MEMBERS ONLY

Get Ahead of 2025 Stock Trends!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe uses long-term views of the S&P 500 to explain how the market is positioned as we move into 2025. He uses Yearly and Quarterly Candles and describes why there is a risk of a pullback next year, and he also covers the...

READ MORE

MEMBERS ONLY

Can You Really Predict Stock Market Success Using the Yield Curve?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reflects on the shape of the yield curve during previous bull and bear cycles with the help of StockCharts' Dynamic Yield Curve tool. He shares insights on interest rates as investors prepare for the final Fed meeting of 2024, and shares two additional charts he&...

READ MORE

MEMBERS ONLY

Five Ways You Should Use ChartLists Starting Today!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Having used many technical analysis platforms over my career as a technical analyst, I can tell you with a clear conscience that the ChartList feature on StockCharts provides exceptional capabilities to help you identify investment opportunities and manage risk in your portfolio. Once you get your portfolio or watch list...

READ MORE

MEMBERS ONLY

Can the S&P 500 Rally Without Tech?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a deep dive into US sector rotation, breaking it down into offensive, defensive and cyclical sectors. He first looks at the relative rotations that are shaping up inside the group, assessing each sector's price chart in combination with the rotation...

READ MORE

MEMBERS ONLY

Plunge in Treasury Yields Triggers Gap-Surge in Home Builders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The 10-yr Treasury Yield reversed its upswing with a sharp decline.

* The 7-10 Yr Treasury Bond ETF surged and reversed its downswing.

* Lower yields provided a big boost to the Home Construction ETF.

The 10-yr Treasury Yield reversed its upswing with a sharp decline and the Home Construction...

READ MORE

MEMBERS ONLY

These Old-School Stocks Have Joined The AI Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broad-based rally that pushed the Equal-Weighted SPX to new highs. She also shared base breakouts and downtrend reversal candidates in the now hot Retail space, and takes a close look at 3 old school stocks that are seeing AI-related growth.

This...

READ MORE

MEMBERS ONLY

Financial Upswing: Understanding the Stock Market Rally and Yield Rise

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market indexes resumed their bullish trend.

* Small- and mid-cap stocks rose the most showing strong upside movement.

* Treasury yields rose higher on concerns of reinflation.

The afternoon turnaround seems to be more the norm than the exception. Thursday's stock market action followed the trend. What...

READ MORE

MEMBERS ONLY

These Country ETFs are Looking Particularly Vulnerable

by Martin Pring,

President, Pring Research

Chart 1, below, compares the S&P Composite to the Europe Australia Far East ETF (EFA), which is effectively the rest of the world. It shows that US equities have been on a tear against its rivals since the financial crisis. More to the point, there are very few...

READ MORE

MEMBERS ONLY

Be ALERT for Warning Signs - S&P 500 Downturn

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe goes into detail on the S&P 500 ETF (SPY), sharing why using MACD and ADX together can be beneficial -- especially in the current environment. He touches on Sentiment, Volatility and Momentum, pointing to reasons why we need to be on alert...

READ MORE

MEMBERS ONLY

A Tale of Two Semiconductor ETFs - Why is SMH holding up better than SOXX?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SOXX is lagging SMH as it broke the 200-day SMA and confirmed a bearish pattern.

* SMH is holding up because its top component remains strong.

* Nevertheless SMH is at a moment of truth ahead of a big earnings report from Nvidia.

Even though the iShares Semiconductor ETF (SMH)...

READ MORE

MEMBERS ONLY

MarketCarpets Secrets: How to Spot Winning Stocks in Minutes!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* StockCharts' MarketCarpets can be customized to find stocks to invest in using specific criteria.

* The MarketCarpets tool helps users drill down from a big-picture view to individual stocks.

* Getting an at-a-glance view of strong stocks poised to bounce can be done immediately and efficiently with MarketCarpets.

When...

READ MORE