MEMBERS ONLY

10-Year Yield at a Critical Juncture — What Happens Next?

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research breaks down why the 10-year yield is at a critical juncture after months of quiet trading, along with what that might signal. He also reviews SPY market conditions, gold, silver, and recent stock requests....

READ MORE

MEMBERS ONLY

Commodities Moving the Chains in Early 2026

Point & Figure charts are showing a breakout in broad commodities with a price target that suggests commodities have room to run. Here's a deep dive into the technical chart patterns that could support the run in commodities....

READ MORE

MEMBERS ONLY

StockCharts Insider: The Untapped Edge Hiding in Your Moving Averages

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Markets don’t always trend. They coil, surge, and then launch in one direction or another. The trick is being able to spot each phase and to use that information to act. A lone moving average can hint at direction, but it won’t tell you...

READ MORE

MEMBERS ONLY

Mixed Signals to Start the Year: Is Stock Market Leadership Changing?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Early price action shows mixed signals as Financials weaken, tech stalls, and oil, the dollar, and Bitcoin show signs of changing trends....

READ MORE

MEMBERS ONLY

Three Breadth Signals Confirming the Market’s Bullish Trend

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Market breadth has improved dramatically as the S&P 500 pushes to new highs. Dave Keller, CMT, reviews three key breadth indicators—including advance-decline lines, new highs vs. lows, and stocks above key moving averages—to assess whether this bullish trend remains intact....

READ MORE

MEMBERS ONLY

5 Breadth Signals Powering the 2026 Breakout and What Would Break It

by David Keller,

President and Chief Strategist, Sierra Alpha Research

David Keller breaks down five key breadth signals confirming the market’s 2026 breakout. At the same time, he also examines what each indicator could do that would signal weakening participation and a potential breakdown....

READ MORE

MEMBERS ONLY

Is the US Market Losing its Edge Relative to Global Equities?

by Martin Pring,

President, Pring Research

Are the U.S. markets showing signs of running out of steam? Martin Pring analyzes the relative strength of U.S. indexes with respect to non-U.S. indexes. Another group that could gain momentum is small-caps. Here's what you should be watching. ...

READ MORE

MEMBERS ONLY

Markets Look Past DC Drama as Bank Earnings and Charts Take Center Stage

Earnings season kicks off this week with big banks reporting. Follow the price action and market-based indicators in these charts to get clear clues rather than media headlines....

READ MORE

MEMBERS ONLY

Nifty at a Crossroads; Awaits Clarity from Global Triggers

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty was the only major global equity index to end the week in the red amid US tariff uncertainty. Is it vulnerable to further pressure?...

READ MORE

MEMBERS ONLY

The Market Is Shifting — What You Should Be Watching Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how market participation and sector movement are shifting early in the year, highlighting key signals investors should be watching as leadership rotates beneath the surface....

READ MORE

MEMBERS ONLY

The State of the Market: Trend, Breadth & Leadership, Plus a Trend-Momentum Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is in a clear uptrend with strong breadth, and three sectors leading the trend are Finance, Health Care, and Industrials. Arthur Hills shows you how to use a top-down approach to identify oversold stocks within uptrends....

READ MORE

MEMBERS ONLY

StockCharts Insider: How to Spot a Stock That’s Wound Tight and Ready to Break (Part 2 - TTM Squeeze)

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Every strong move begins with tension, a buildup of energy (sometimes hidden) before the next move. While most traders only notice the explosion, those who pay close attention to volatility are generally able to anticipate the big move before it happens. We covered this in part...

READ MORE

MEMBERS ONLY

The Market is Up, But the Warning Signs Are Adding Up!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Markets opened 2026 with solid gains, but Tom Bowley explains why several warning signs beneath the surface deserve attention. He breaks down leadership trends and intermarket relationships that are failing to confirm the rally, highlighting what traders should keep their eyes on....

READ MORE

MEMBERS ONLY

Momentum Is Building — These Stocks Stand Out!

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research breaks down a momentum shift, highlighting stocks beginning to stand out based on trend, momentum, and relative strength. He also reviews SPY market conditions, including volatility, sentiment, and multi-timeframe trend analysis....

READ MORE

MEMBERS ONLY

Financials, Semiconductors, and Bitcoin Are Moving: Here’s Why

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Frank Cappelleri breaks down why financials and semiconductors are showing strength and how Bitcoin is attempting to regain momentum early in 2026. Failed breakdowns, bullish patterns, and key levels are shaping what happens next in the market....

READ MORE

MEMBERS ONLY

Broadening, Broadening Everywhere in Early 2026: Record-High Mid-Caps

A shift is taking place in the stock market that investors shouldn't ignore. As leadership rotates beyond mega-cap stocks, mid-caps are breaking to record highs. What does this early-year price action indicate? Find out here....

READ MORE

MEMBERS ONLY

Unveiling the Factors Behind a Potential Energy Surge

by Martin Pring,

President, Pring Research

Although the Energy sector has been a laggard in the past 200 days, these charts suggest this sector may be about to reverse course. Here's a unique perspective....

READ MORE

MEMBERS ONLY

S&P 500 Earnings In for 2025 Q3; Overvaluation Persists

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 P/E in Q3 2025 is above normal and projected to rise in 2026. These charts will help you keep track of quarterly earnings....

READ MORE

MEMBERS ONLY

Maduro’s Fall, Energy’s Rise: Oil & XLE Are Back in Focus, Key Price Levels to Watch

Energy stocks are off to a good start, and after recent geopolitical headlines, you may want to consider this long-time underperforming sector. A break above key technical resistance levels will determine if energy stocks have staying power....

READ MORE

MEMBERS ONLY

Strong Start to 2026, But Will Nifty Hold the Momentum?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty's technical setup remains in a strong uptrend, trading above key moving averages. However, momentum seems to have moderated, suggesting possible fatigue. Here's a technical deep dive to prepare you for the coming week....

READ MORE

MEMBERS ONLY

What's Behind This Market Bounce? The Signals That Matter

by Mary Ellen McGonagle,

President, MEM Investment Research

The stock market kicked off the new year with a bounce, but is the strength as solid as it looks on the surface?

In this video, Mary Ellen McGonagle digs into the January rebound and takes a closer look at what's fueling the move. She breaks down recent...

READ MORE

MEMBERS ONLY

The Stock Market May Be Waking Up: It’s Not Just Tech Anymore

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Friday's market bounce brought a surprise: strength beyond Big Tech. See which sectors and ETFs are leading, and what it could mean for 2026....

READ MORE

MEMBERS ONLY

Capital Rotates Into Defense Stocks as the “Golden Dome” Theme Gains Traction

by Mary Ellen McGonagle,

President, MEM Investment Research

Defense stocks offer earnings visibility and act as a hedge against geopolitical risk. Here's a look at why defense-related stocks may be potential investment opportunities....

READ MORE

MEMBERS ONLY

Warning Signs Are Growing, Be Prepared!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

What should investors look forward to in 2026? Here's Tom Bowley's outlook. ...

READ MORE

MEMBERS ONLY

Bitcoin is at a 2026 Crossroad

by Martin Pring,

President, Pring Research

Bitcoin has recently sold off sharply. Was 2025 the top, or will prices continue to rise higher in 2026? Martin Pring analyzes Bitcoin from various angles and shares his perspective....

READ MORE

MEMBERS ONLY

5 Charts That Will Define Markets in 2026

What's on tap for 2026? Here's a deep dive into the five charts that matter most as this bull market matures....

READ MORE

MEMBERS ONLY

StockCharts Insider: The Hack to Hunting Early Leaders with New-Highs Scans

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

Ever watch a stock take off and think, “I wish I had gotten in earlier”? You probably could have. It’s just that early leaders rarely look like leaders at first. The good news is that there are ways to spot and measure emerging strength before...

READ MORE

MEMBERS ONLY

Volatility Hits Rock Bottom, What It Means for the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Though the NIFTY is trading just below lifetime highs, it appears to be in a zone of indecision. What's the best strategy in a setting where any adverse trigger could make the market vulnerable?...

READ MORE

MEMBERS ONLY

StockCharts Insider: The Five Questions That Bring the 10 Laws Together

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

After John Murphy’s 10 Laws, a nagging question remains: where do you actually begin once you’ve loaded your chart? Maybe you weren’t expecting it, but the answer isn’t an indicator or setup. Instead, it begins with a sequence of questions.

You see,...

READ MORE

MEMBERS ONLY

Peace on Earth, Stability in Bonds? Watch These 3 Charts for Fixed Income in 2026

What does next year have in store for the bond market? Treasury yields, the yen, and credit spreads are expected to shape fixed-income returns in 2026. Which charts should you be watching? Find out here....

READ MORE

MEMBERS ONLY

Larry Williams’ 2026 Market Forecast: Cycles, Risks, and Opportunities

by Larry Williams,

Veteran Investor and Author

Larry Williams presents his full-year 2026 market outlook, explaining why many popular bearish forecasts don’t align with history or market data. With the help of cycles, valuations, and employment trends, Larry outlines what investors can realistically expect in the year ahead....

READ MORE

MEMBERS ONLY

Watch This Chart — “Affordability” May Be About to Get Less Affordable

by Martin Pring,

President, Pring Research

Gold's historic leadership may be shifting. A critical Gold/CRB signal suggests a potential commodity bull market and rising affordability risks ahead. ...

READ MORE

MEMBERS ONLY

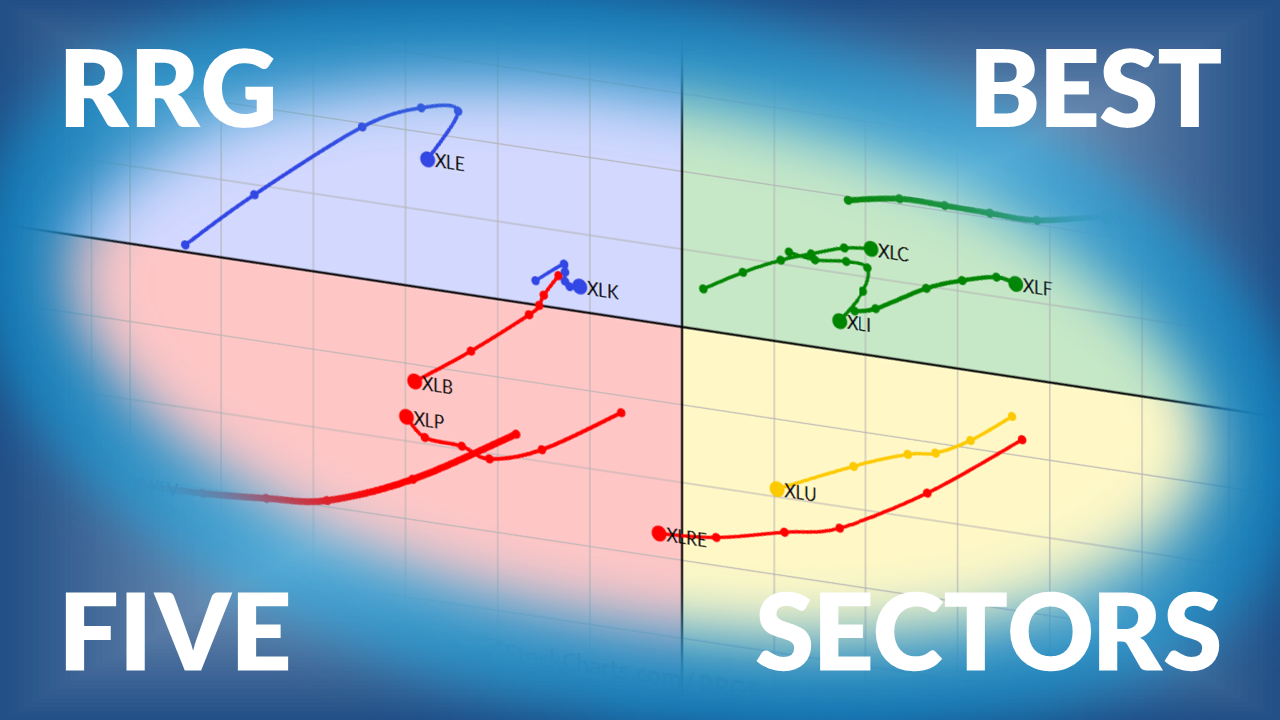

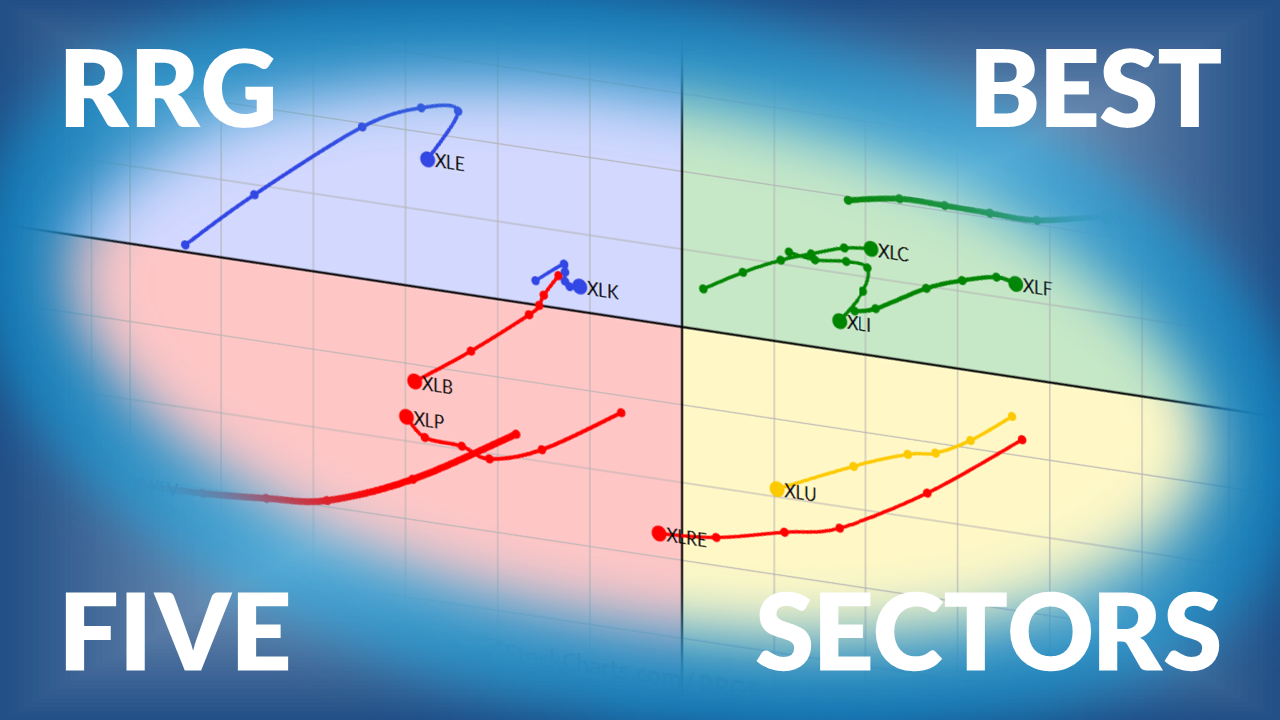

The Best Five Sectors This Week, #50

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly Sector Rotation Update for US Sectors based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Consolidation Continues: Nifty Awaits Trigger for Directional Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the Nifty now in a sideways consolidation, what will it take to reignite upward momentum? And what does the truncated week ahead look like for the Indian market?...

READ MORE

MEMBERS ONLY

J.P. Morgan's Top Picks for 2026: A Closer Look at the Charts

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle takes a close look at some seminconductor and networking names that J.P. Morgan has ranked as top picks for the new year. What are her thoughts?...

READ MORE

MEMBERS ONLY

Semiconductors Crumble; Big Warning Signs Flashing!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom looks at the last week's market action and what it means for bulls....

READ MORE

MEMBERS ONLY

What Is The Crypto Selloff Telling Us About Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bitcoin and the S&P 500 often move in tandem, but when they move in opposite directions, it's time to pay attention. Find out what Tom Bowley's analysis reveals about Bitcoin signaling an early warning....

READ MORE

MEMBERS ONLY

To Be Invested or Not to be Invested? That is the Question

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

These three indicators will filter out the noise and identify whether the stock market is bullish or bearish. This, in turn, will help you determine whether you should remain invested or not. Explore these indicators and find out which key levels to watch....

READ MORE