MEMBERS ONLY

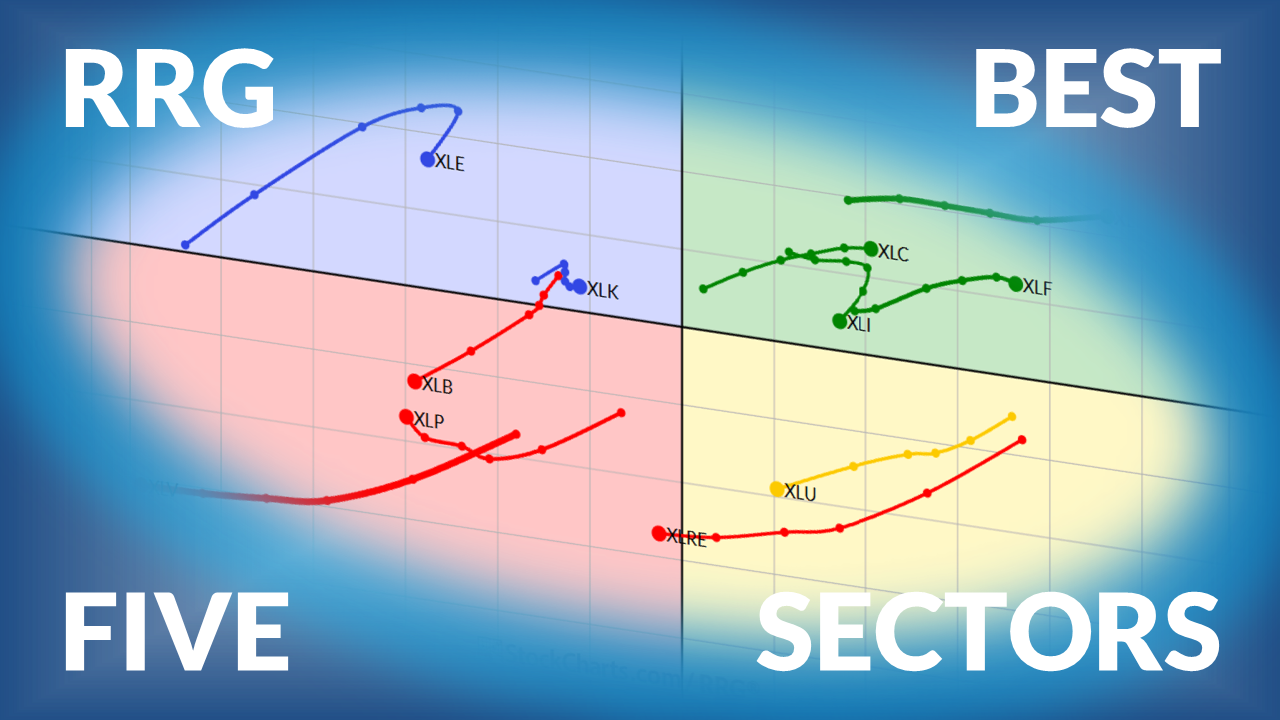

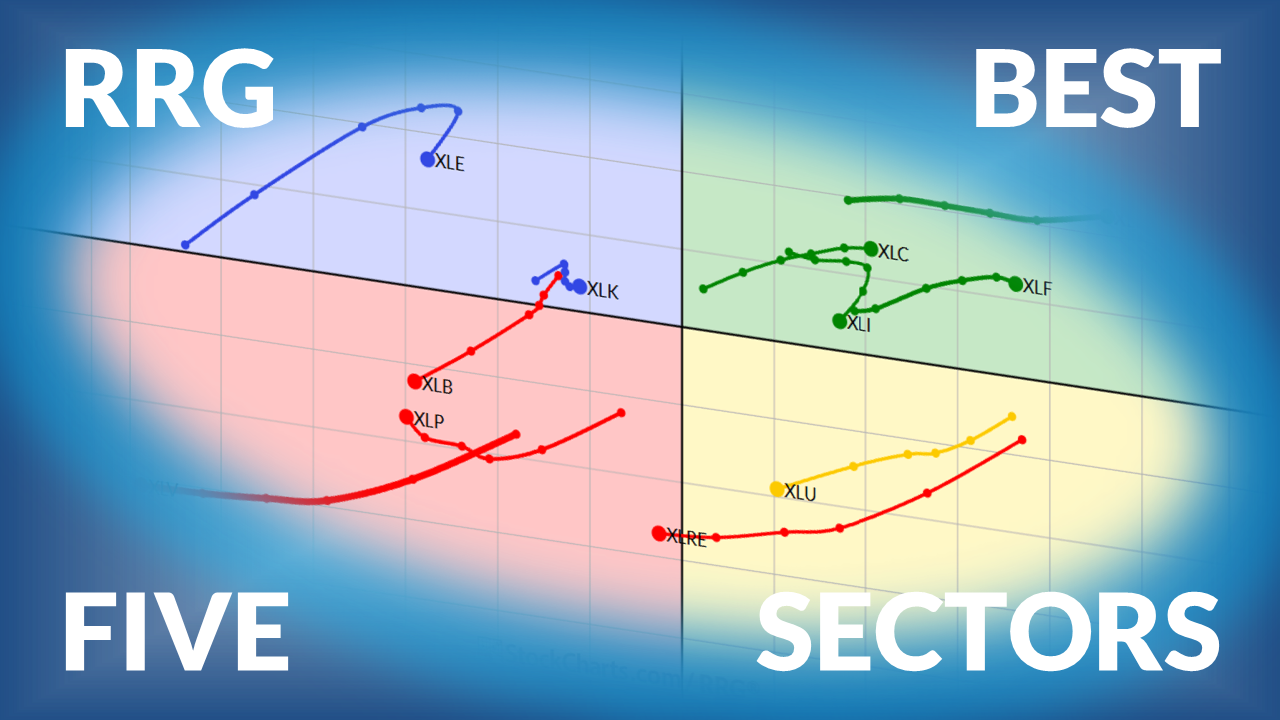

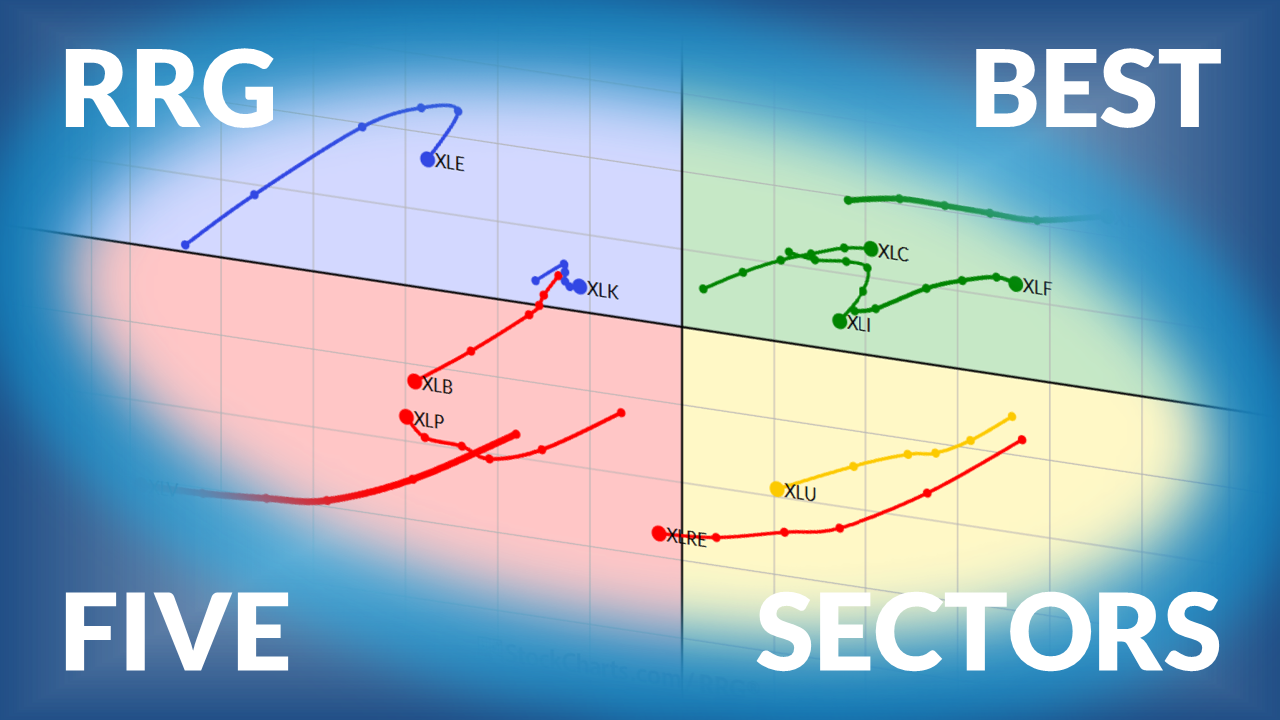

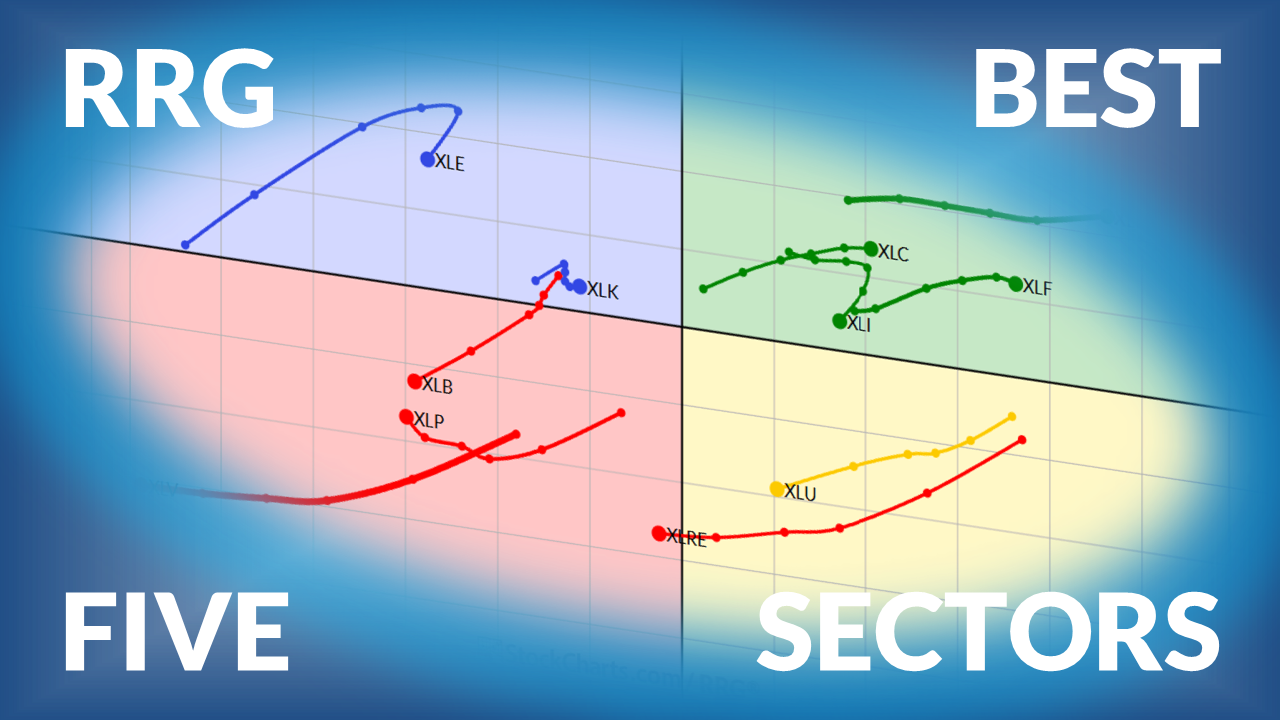

The Best Five Sectors This Week, #49

Weekly update on U.S. sector rotation using Relative Rotation Graphs.... READ MORE

Weekly update on U.S. sector rotation using Relative Rotation Graphs.... READ MORE

Value stocks are showing signs of strength, but it will take strength from sectors such as Energy and Financials to push this asset group higher. Learn about which charts could provide clues on the value vs. growth trade. ... READ MORE

The broader structure of the Nifty remains bullish, but the index is navigating a key inflection zone. Will the next week extend the trend?... READ MORE

Since the April low, the S&P 500 has shifted from a strong uptrend into a clear consolidation. Dave Keller, CMT, introduces a “traffic light” charting technique to define key support and resistance levels—and spot when sideways markets finally break into accumulation or distribution.... READ MORE

Mary Ellen McGonagle breaks down the current market rally and examines whether expanding participation and sector movement are confirming the move. Discover what market breadth, equal-weight indexes, and sector charts are revealing beneath the surface.... READ MORE

Are semiconductors due for a correction? Tom Bowley analyzes the longer-term chart of the Dow Jones US Semiconductors Index. Find out what his analysis reveals.... READ MORE

Money is rotating sharply out of large-cap growth and into areas like small caps, transports, and regional banks. Tom Bowley of EarningsBeats explains why that shift matters, breaking down the signals raising caution and the five stocks showing standout strength as the market resets.... READ MORE

The Fed cut sparked new life in the stock market. See which sectors broke out, where weakness remains, and what it means for investors.... READ MORE

Joe Rabil of Rabil Stock Research highlights a momentum shift taking shape across sectors, showing which ones are beginning to wake up as 2026 begins. He also reviews the S&P 500, market conditions, and individual stock setups showing improving structure and momentum.... READ MORE

With equities resilient and the 10-year yield holding below 4.5%, we could see stocks lift into year-end. What could change this? Find out here.... READ MORE

Small caps have made very little upside movement since 2021, but that could be changing. Martin Pring analyzes small-cap stocks and makes his case for a potential rally in this asset group.... READ MORE

Weekly update on sector rotation ranking based on Relative Rotation Graphs... READ MORE

The Nifty ended the week flat to mildly negative. The lack of participation from the broader market and weakening market breadth indicate that investors should be cautious. Here's a deep dive into the analytics.... READ MORE

The Nasdaq 100 sits near record highs, but where does it go from here? Dave Keller, CMT, lays out four scenarios—ranging from a Santa Claus rally to a deeper correction—and assigns probabilities to each to help investors prepare for early 2026’s next big move.... READ MORE

Learn how to quantify signals using new highs, new lows, and the percentage of stocks with golden crosses. Another area that could hold the key to broadening leadership in 2026 is homebuilder stocks. ... READ MORE

Market breadth is strengthening as small caps, transports, and banks show leadership. See what these trends mean for the next potential breakout. ... READ MORE

The StockCharts Sample Gallery contains charts of economic data, such as unemployment rate, inflation, and mortgage rates. Calm bond and mortgage markets could offer a potential tailwind as we head into 2026.... READ MORE

In this video, Frank Cappelleri takes us on a tour of the market, discussing the Nasdaq 100's huge run since April and the healthy pullback that followed. He points out a possible inverse head-and-shoulders pattern forming under the surface and why it could matter as we head toward... READ MORE

If you're looking for a quick pulse of the stock market heading into the last month of the year, David Keller, CMT, just dropped a video breaking down the 10 charts he's watching, and there's a lot to unpack. Some stocks are powering higher... READ MORE

Historical stock market patterns point to strength heading into Christmas. Keep an eye on the US dollar, Treasury yields, retail stocks, and volatility as we close out the year.... READ MORE

The S&P and NYSE Composites have reached resistance. Can the push through, or will they back off?... READ MORE

Nifty is in an uptrend and continues to scale new heights, but the market remains somewhat narrow. Are we approaching a zone of resistance?... READ MORE

The US Dollar Index has reached a key resistance level. Will it break through it and rally higher? Martin Pring provides his expert insight into the dollar's potential to rally.... READ MORE

Market breadth is turning bullish while sentiment lags. Get a clear breakdown of what's driving this week's market action.... READ MORE

The mega-cap growth stocks are no longer moving in sync, and that's creating big opportunities. In this video, David Keller, CMT, breaks down the "Magnificent 7 and Friends" into four clear technical categories to reveal where leadership is emerging and where weakness is starting to bite.... READ MORE

Weekly Update on Sector Ranking for US stocks based on Relative Rotation Graphs... READ MORE

The Dow Transports has been a laggard, moving sideways since May 2021. However, lately, there have been some signs that this industry group may be perking up. Watch these technical setups as we head into 2026.... READ MORE

The Nifty is at a crucial inflection zone, trading just below its all-time high; could it see a breakout?... READ MORE

A “change of character” is emerging as major indexes weaken in November. Equal-weight indexes confirm a bearish turn, Bitcoin’s collapse highlights fading speculation, and the S&P 500’s key support near 6550 may be the final line before a deeper market correction.... READ MORE

Are we seeing a repeat of the late 2023 stock market pullback? Compare today's price action to that of 2023 and identify the similarities.... READ MORE

There's a lot of noise in the market right now, but the longer-term perspective shows the major indexes testing key support levels. Investor sentiment may also be shifting. What could lie ahead? Take a look at these charts.... READ MORE

With a massive shift in market leadership underway, Julius de Kempenaer looks at sector rotation to see where leadership is moving now—and what that could mean for portfolio positioning ahead.... READ MORE

It was a tough week for equities as major indices broke below key levels and money rotated away from growth. Tom Bowley highlights where strength is emerging — especially in healthcare and energy — and highlights stocks showing strong accumulation and breakout potential.... READ MORE

Stocks have pulled back quickly. Explore what NVDA's earnings, breadth indicators, and sentiment data suggest for the market's next move.... READ MORE

David Keller, CMT uses the modern Dow Theory, sector rotation, and Bitcoin’s decline to illustrate what might be a developing market top. With StockCharts’ tools, Dave tracks weakening momentum, defensive shifts, and the S&P 500’s crucial 6550 support level.... READ MORE

Joe Rabil breaks down the MACD warning and weakening momentum in the S&P 500 as the index tests support near its 18-week moving average. Additionally, he reviews Bitcoin’s reversal setup and highlights stocks with improving relative strength and trend structure.... READ MORE

Frank Cappelleri breaks down a major market inflection point as the S&P 500 tests a topping pattern and several key levels. He also reviews financials and semiconductors where structure shifts and breakdown risks may determine the next move.... READ MORE

Nifty's current technical setup reflects a strong market, steadily grinding higher. What does the coming week have in store?... READ MORE

The stock market churned but went nowhere this week as breadth held steady and rate-cut odds shifted. Here's what investors should watch next week.... READ MORE

Mary Ellen McGonagle breaks down how hawkish Fed comments and rising yields rattled the markets this week. See where investors are finding opportunity — and which sectors are offering shelter as volatility returns.... READ MORE