MEMBERS ONLY

The Halftime Show: 100th and LAST Show!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete presents the 100th and final edition ofStockCharts TV'sHalftime! This week, Pete shares some parting tips on what to look for when the trends change from defense, (risk off) to offense (risk on). He explains how he saw them coming and how the Chaikin Power Gauge did as...

READ MORE

MEMBERS ONLY

Find Stocks That Are BEATING The S&P 500 - In Just One Click!

by Grayson Roze,

Chief Strategist, StockCharts.com

Feel like you never find those high-flying stocks before they make their big moves? This week's edition of StockCharts TV'sStockCharts in Focus is for you! Grayson walks you through the 3 simple steps he uses to find, track and trade the market's strongest stocks...

READ MORE

MEMBERS ONLY

Top 10 Actionable Charts to Watch 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Grayson and Dave run through the 10 charts they feel present actionable opportunities based on their technical analysis setups. They'll cover breakout strategies, moving average techniques, relative strength, and much more. And you'll have ten new...

READ MORE

MEMBERS ONLY

Ozempic Set the Stage, But Could Novo's Newest Drug Be the Real Moneymaker?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Novo Nordisk A/S (NVO) has been riding a strong uptrend since 2017, fueled by its Ozempic drug.

* This last week, positive results for its new drug, amycretin, transformed the Ozempic fever into a Wall Street frenzy.

* Technical and fundamental buy points seem to be at odds if...

READ MORE

MEMBERS ONLY

Clear Split in NY FANG+ Universe Offers Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* NYFANG+ Index at elevated levels in strong uptrend.

* New long positions are exposed to high risk.

* I found a pair trading opportunity within the NYFANG universe to avoid directional market risk.

It is no secret that the NYFANG+ Index is still in in incredible up-run after bottoming out...

READ MORE

MEMBERS ONLY

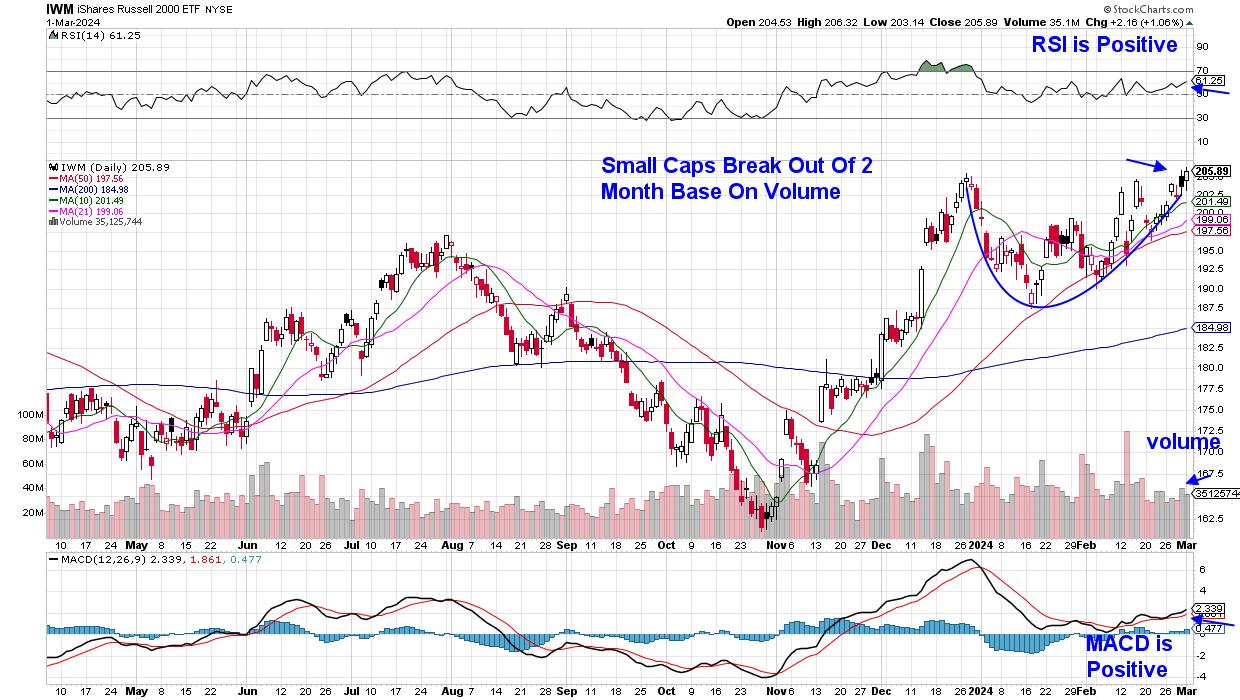

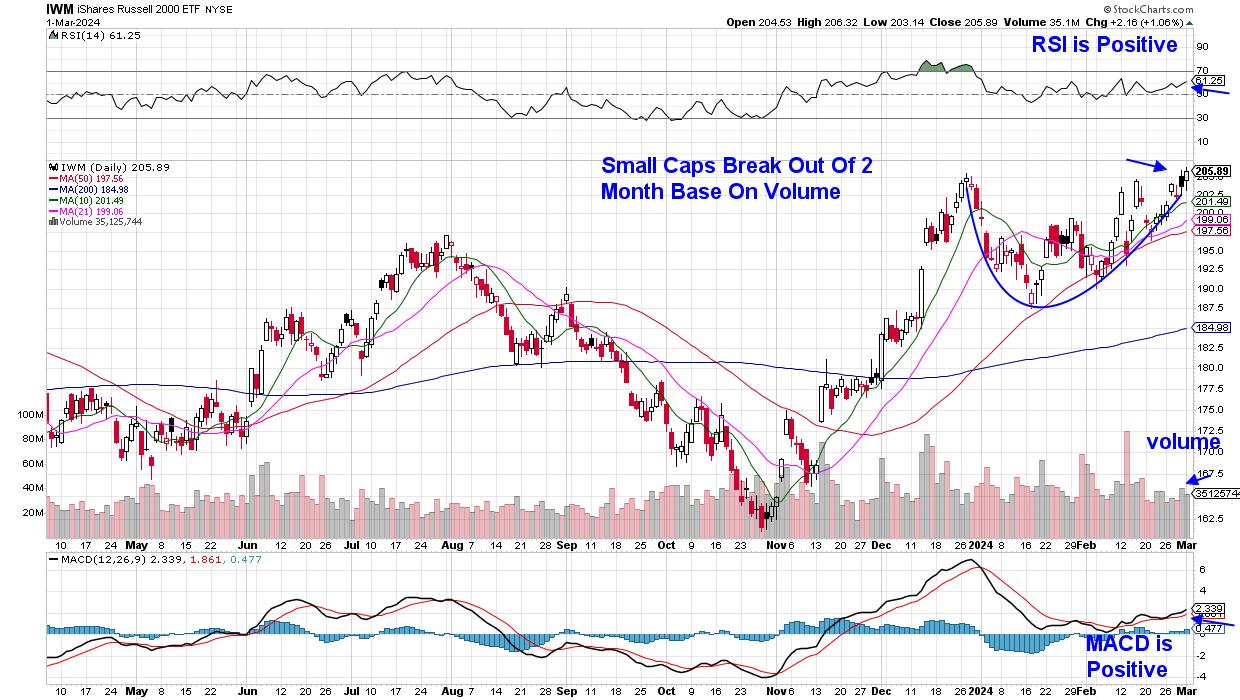

Small Caps Breaking Out BULLISH

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave interviews Ari Wald, CFA CMT of Oppenheimer. He also covers Kroger, the iShares S&P 500 Value ETF, and Costco.

This video originally premiered on March 7, 2024. Watch on our dedicated Final Bar pageon StockCharts TV!

New...

READ MORE

MEMBERS ONLY

How To Stop Missing Trades Using Price Alerts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use StockCharts price and advanced alerts to help you stop missing trades. He explains why he uses alerts of all kinds on stocks he is interested in buying, as well as current holdings. This...

READ MORE

MEMBERS ONLY

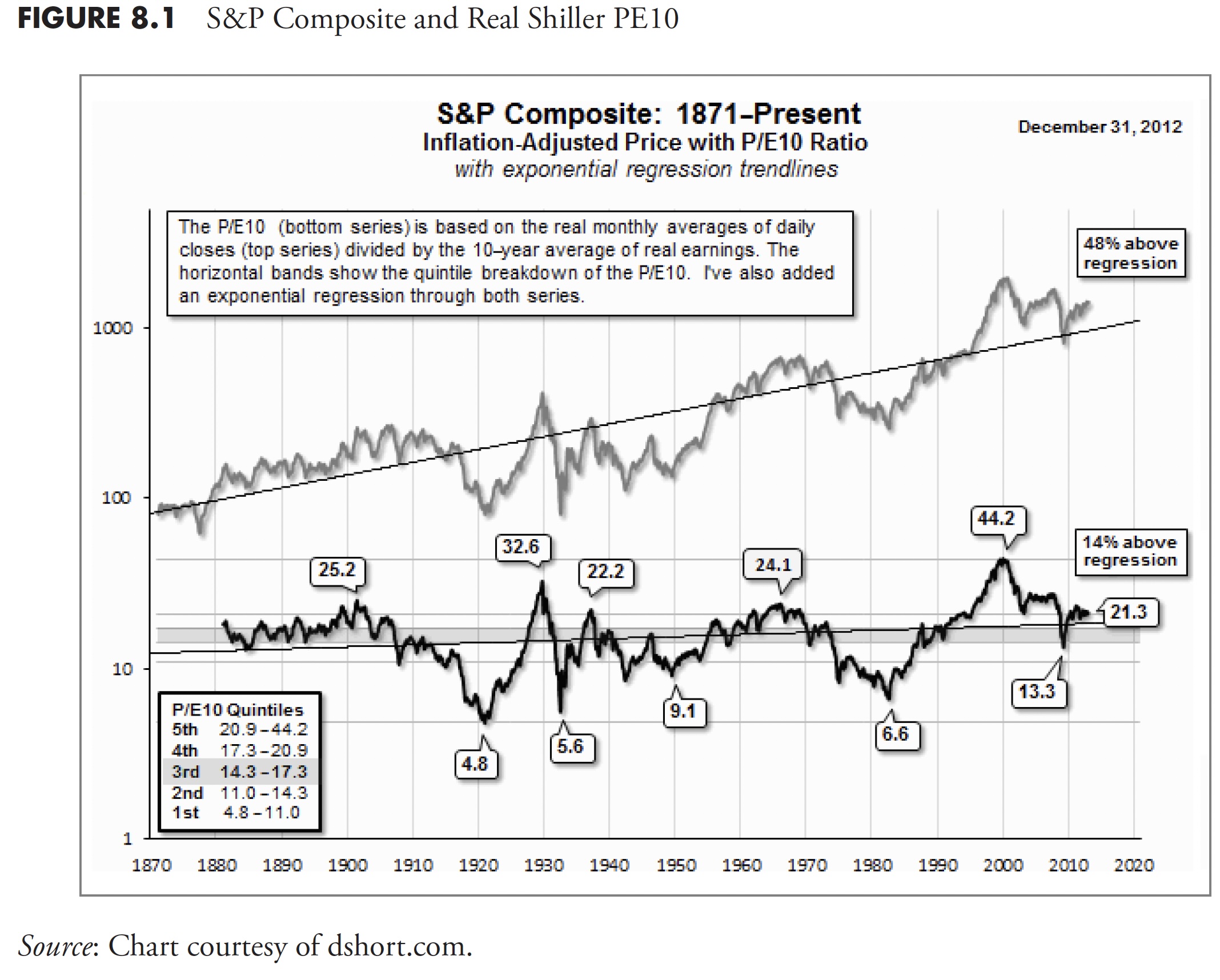

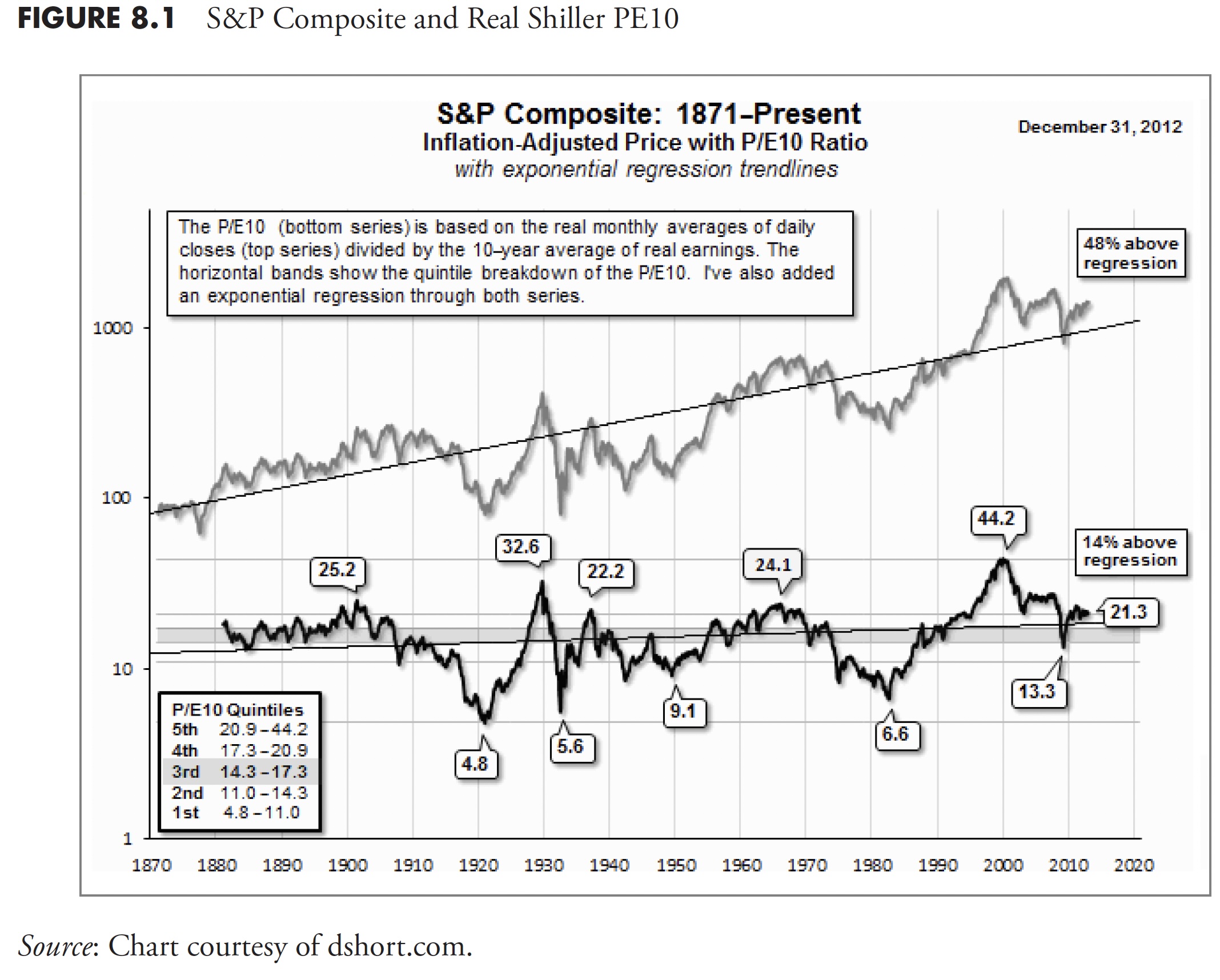

The Hoax of Modern Finance - Part 11: Valuations, Returns, and Distributions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eleventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

AAPL and TSLA Stocks Are COLLAPSING!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights mega-cap growth names that are in full breakdown mode, including TSLA, AAPL, and GOOGL. He also updates the latest market breadth indicators which suggest more of a leadership rotation into value-oriented sectors, and even Consumer Staples names including...

READ MORE

MEMBERS ONLY

Everyone Has a Plan Until They Get Punched in the Face. Did Jerome Powell Just Get Punched in the Face?

by Martin Pring,

President, Pring Research

The title of this article may be exaggerated, but, last Friday, the probabilities for an upward reversal in the rate of inflation later this year went substantially higher. That's because the gold price, an inflationary bellwether, broke out from a 4-year trading range to a new all-time high....

READ MORE

MEMBERS ONLY

Target's Stock Defied Gravity When the Market Tanked: Timely Buy or FOMO?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Target Corp (TGT) bucked the trend on Tuesday, popping 13% despite a broader market selloff.

* Investors jumped in despite the retailer's weak 2024 guidance.

* A potentially strong entry point for TGT rests on two factors, one technical and the other fundamental.

On Tuesday, Target Corp (TGT)...

READ MORE

MEMBERS ONLY

Bitcoin Tests All-Time Highs While Growth Stocks Sag

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the hourly chart of Bitcoin and highlights recent breakouts for regional banks. Guest Julius de Kempenaer of RRG Research focuses in on the Communication Services sector, including META, DIS, and GOOG, and shows how defensive sectors have...

READ MORE

MEMBERS ONLY

Would You Rather Own AMZN or AAPL Stock?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the Magnificent 7 has become much less of a comparable group of stocks, with TSLA, AAPL, and GOOGL all breaking down in recent weeks. He also tracks Bitcoin's retest of all-time highs and why high...

READ MORE

MEMBERS ONLY

DP Trading Room: Must See Gold Charts!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl begins today's show with a walk through General Electric (GE) which was in the news this week. See what Carl thinks of the charts!

Carl covers the market in general and pays particular attention to Gold as it launches skyward. Can this run continue? What does this...

READ MORE

MEMBERS ONLY

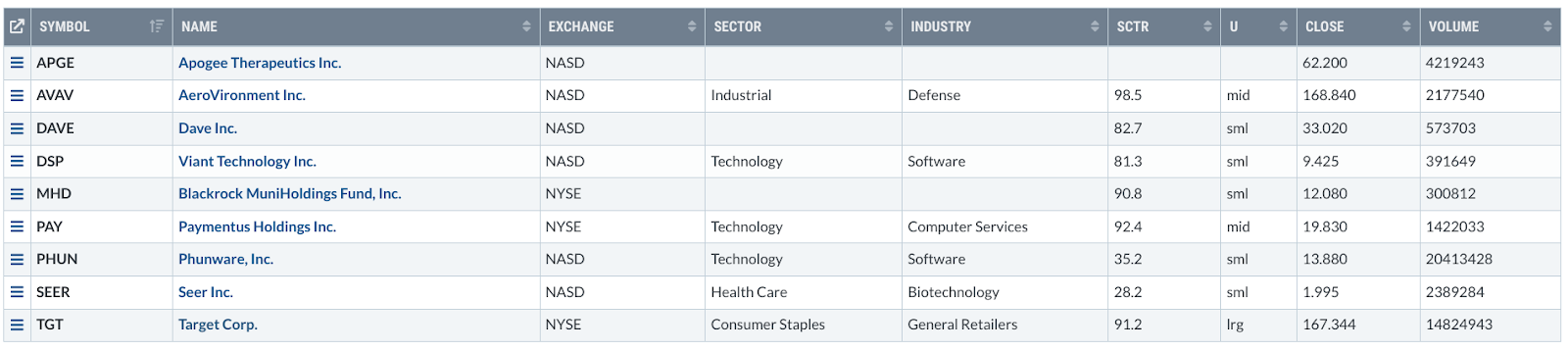

Small Caps Join The Party -- Here's a Top Stock to Consider

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 and the NASDAQ both reached an all-time high today boosted by a Tech-fueled rally amid AI-related names. Small-cap stocks also had a bullish day after posting a two-month base breakout to near-term highs. This index has had a tough period recently, as nearly 15% of...

READ MORE

MEMBERS ONLY

How I Found SMCI BEFORE the Stock Gained Over 205% (in 3 Simple Steps!)

by Grayson Roze,

Chief Strategist, StockCharts.com

Feel like you never find those high-flying stocks before they make their big moves? This week's edition of StockCharts TV'sStockCharts in Focus is for you! Grayson walks you through the 3 simple steps he uses to find, track and trade the market's strongest stocks...

READ MORE

MEMBERS ONLY

MEM TV: 3 Great WAYS to Play AMD Stock

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the move into Semiconductors and shares what that means for Technology. Diving in to volatility, she highlights 3 ways investors can take advantage of the moves in Advanced Micro Devices (AMD). She also highlights other bright spots...

READ MORE

MEMBERS ONLY

Could This Stock Be the NEXT NVDA?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps up his Dubai journey with a special Viewer's Questions Mailbag edition! Dave explores whether LABU is on the path to mimic NVIDIA and if it's still the right time to jump in. He also...

READ MORE

MEMBERS ONLY

Your Selling Methodology is Your Paramedic to Profits

by Gatis Roze,

Author, "Tensile Trading"

"When you feel like bragging, it's probably time to sell." — John Neff

Stock market investing is simple, really. You only need to make two choices: when to buy and when to sell. The unfortunate reality is that 75% of casual investors really only want to hear...

READ MORE

MEMBERS ONLY

AMD Spikes Higher as AI Trade Still Kicking

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps today's market activity from the CMT 2024 Summit in Dubai, highlighting AMD's upside breakout, breadth improvement for US stocks, and why big round numbers matter for stocks like SMCI.

This video originally premiered on...

READ MORE

MEMBERS ONLY

Are "The Seven" Still Magnificent?

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have been hearing comments that some of the Magnificent Seven no longer qualify for membership, so I thought a quick look at them might be helpful. For this analysis, I'll be using weekly charts.

Apple (AAPL): AAPL is dealing with trying to move production out of China,...

READ MORE

MEMBERS ONLY

Apple (AAPL) and Google (GOOGL) Flashing "Pure Weakness"

by Erin Swenlin,

Vice President, DecisionPoint.com

We've begun talking more about the Price Momentum Oscillator (PMO) as it relates to finding "pure strength" and "pure weakness". What it all comes down to is the zero line and the PMO's behavior above or below.

We review the Magnificent 7...

READ MORE

MEMBERS ONLY

Swing Trading Strategies, Tips & Trends

by Joe Rabil,

President, Rabil Stock Research

by Bruce Fraser,

Industry-leading "Wyckoffian"

On this week's edition of Stock Talk with Joe Rabil, Joe features special guest, Bruce Fraser of Power Charting. Joe and Bruce discuss swing trading in detail, first by defining swing trading and how it is different from trend trading, and then spending time going through the SIG...

READ MORE

MEMBERS ONLY

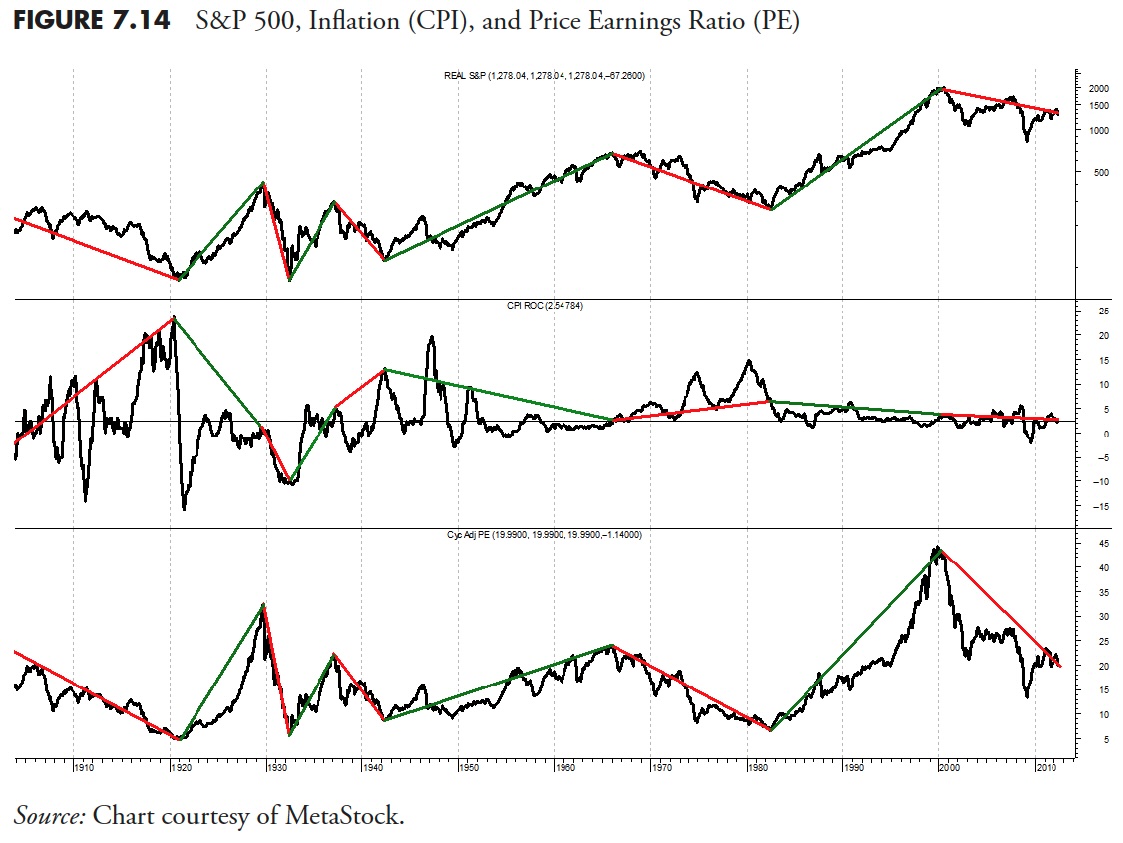

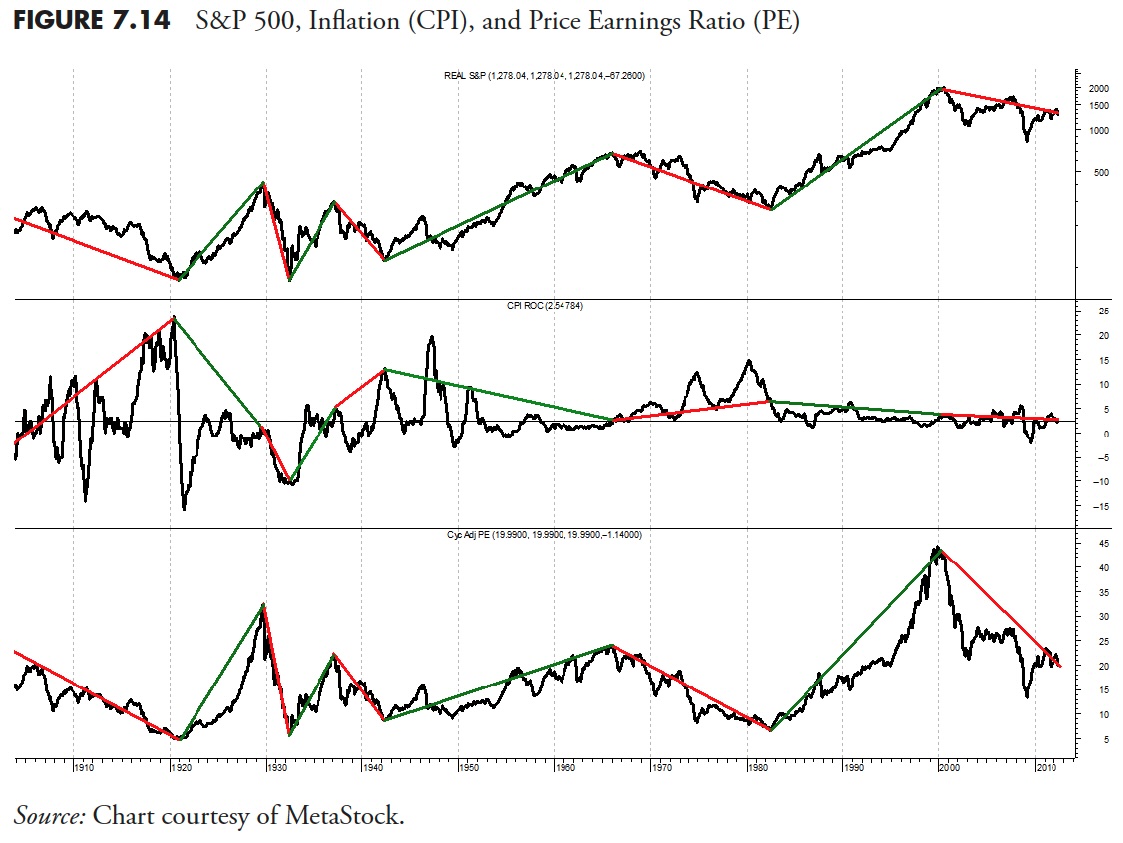

The Hoax of Modern Finance - Part 10: Market Facts — Secular Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the tenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Magnificent 7 Not All Magnificent!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to the diversifying patterns within the Magnificent 7, with GOOGL and AAPL showing clear signs of short-term distribution. He also tracks Bitcoin reaching the 64K level and shares some initial thoughts from the CMT Dubai Summit.

This video...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That Say This Bull Market is Going Higher

by Martin Pring,

President, Pring Research

Absorbing the information gleaned from monthly charts for various asset classes or sectors can help gain some perspective. However, I find that an examination of the relationships between them can be equally rewarding, if not moreso. That's because they point out the nature of the current investment environment,...

READ MORE

MEMBERS ONLY

Market In a "Wait and See" Mode: Awaiting Important Inflation Data

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors are anxiously awaiting the PCE data to get clues on when the Fed will start cutting interest rates

* Small cap stocks look like they want to break out of a range and join the bullish equity rally

* Bitcoin is having a strong week with three consecutive significant...

READ MORE

MEMBERS ONLY

New Dow Theory CONFIRMS BULL Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues his market recaps from Dubai, focusing on the impressive rally in small caps, continued strength in Bitcoin, and upside potential for crude oil and oil services stocks. He highlights one technology name in a persistent downtrend, but potentially...

READ MORE

MEMBERS ONLY

The False Flag of Fed Rate Cuts | Focus on Stocks: March 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at...

The False Flag of Fed Rate Cuts

Day after day, we hear how the Fed will embark on a series of rate cuts this year "because inflation has peaked" and is heading lower. The drop in inflation is...

READ MORE

MEMBERS ONLY

BITCOIN Rally Picks Up Steam, What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares his first market update from Dubai with a recap of Bitcoin's electrifying rally, Tesla's bounce higher, and Alphabet's pullback. The S&P 500 remains above 5K with plenty of new 52-week...

READ MORE

MEMBERS ONLY

DP Trading Room: The PMO Versus the MACD!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl explains the benefits of using the Price Momentum Oscillator versus the MACD. They are not the same!

Carl then gives us his insights on the market in general as well as Bitcoin news, Magnificent 7 overview, as well as Crude Oil and Interest Rates.

Erin gives us an...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Consolidating; Finding Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, while the overall trend may stay intact, the markets could continue to largely consolidate. In line with the analysis, the markets kept consolidating, staying in a broad but defined trading range. That range, over the past week, was 422 points;...

READ MORE

MEMBERS ONLY

How Overextended Are You, QQQ?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've highlighted all the warning signs as this bull market phase has seemed to near an exhaustion point. We shared bearish market tells, including the dreaded Hindenburg Omen,and how leading growth stocks have beendemonstrating questionable patterns. But despite all of those signs of market exhaustion, our growth-led...

READ MORE

MEMBERS ONLY

MEM TV: Simple Way to Identify a Buy Point in NVDA

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also shares how to identify a buy point in NVDA after its gap up following earnings, as well as how to determine when a...

READ MORE

MEMBERS ONLY

AMD's Sensational Halt — What You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Advanced Micro Devices (AMD) recovered quickly from a post-earnings slump

* Its longer term price action suggests indecision and the current pattern can also break either way

* This can either be a short-term trade or an investment; both scenarios will require different strategies

If you ran a StockCharts Gap...

READ MORE

MEMBERS ONLY

The Best Technical Indicator for Long-Term Investors

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops an all-mailbag episode featuring viewer questions on the Hindenburg Omen, ascending triangle patterns, Fibonacci Retracements, projecting upside targets for stocks like NVDA, and the best technical indicator long-term investors should use!

This video originally premiered on February 23,...

READ MORE

MEMBERS ONLY

Is Energy About to Undergo a Strong Seasonal Sector Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Combining fundamental forecasts with seasonality patterns offers a potent strategy for identifying tradable opportunities in specific sectors

* The Energy (XLE), Utilities (XLU), and Materials (XLB) sectors exhibit the strongest seasonal performance in the near-term

* Seasonality charts provide valuable insights, but checking overall stock market conditions and technical trading...

READ MORE

MEMBERS ONLY

NVDA SCREAMS BULL With Earnings Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies key resistance levels for QQQ and HYG, along with a technical analysis downtrend checklist for charts in confirmed bear phases. Guest Larry Tentarelli of Blue Chip Daily Trend Report shares two stocks he's tracking along with...

READ MORE

MEMBERS ONLY

S&P 500's Sensational Rally Keeps On Going Thanks to NVDA — What You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* S&P 500 hits a new all-time high and could keep on going

* NVIDIA's stellar earnings report was a catalyst to the rise in the S&P 500

* Volatility declined, indicating that investors are still relatively calm

Well, Nvidia did it! A stellar earnings...

READ MORE

MEMBERS ONLY

3 Unique RSI Techniques to Maximize Your Investments

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe dives into the world of technical analysis by sharing three unique ways to utilize the RSI indicator alongside MACD and ADX -- the Pullback Trade, Confirming a Breakout and 2nd Chance Entry. He then covers the symbol...

READ MORE