MEMBERS ONLY

GNG TV: Growth & Energy LEAD as S&P Chops Around

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler present trend analysis across the asset classes, sectors, and individual securities. The continued strong "Go" conditions in the US Dollar index (UUP) and US Treasury rates ($TNX) on both the daily and weekly timeframes highlights some headwinds...

READ MORE

MEMBERS ONLY

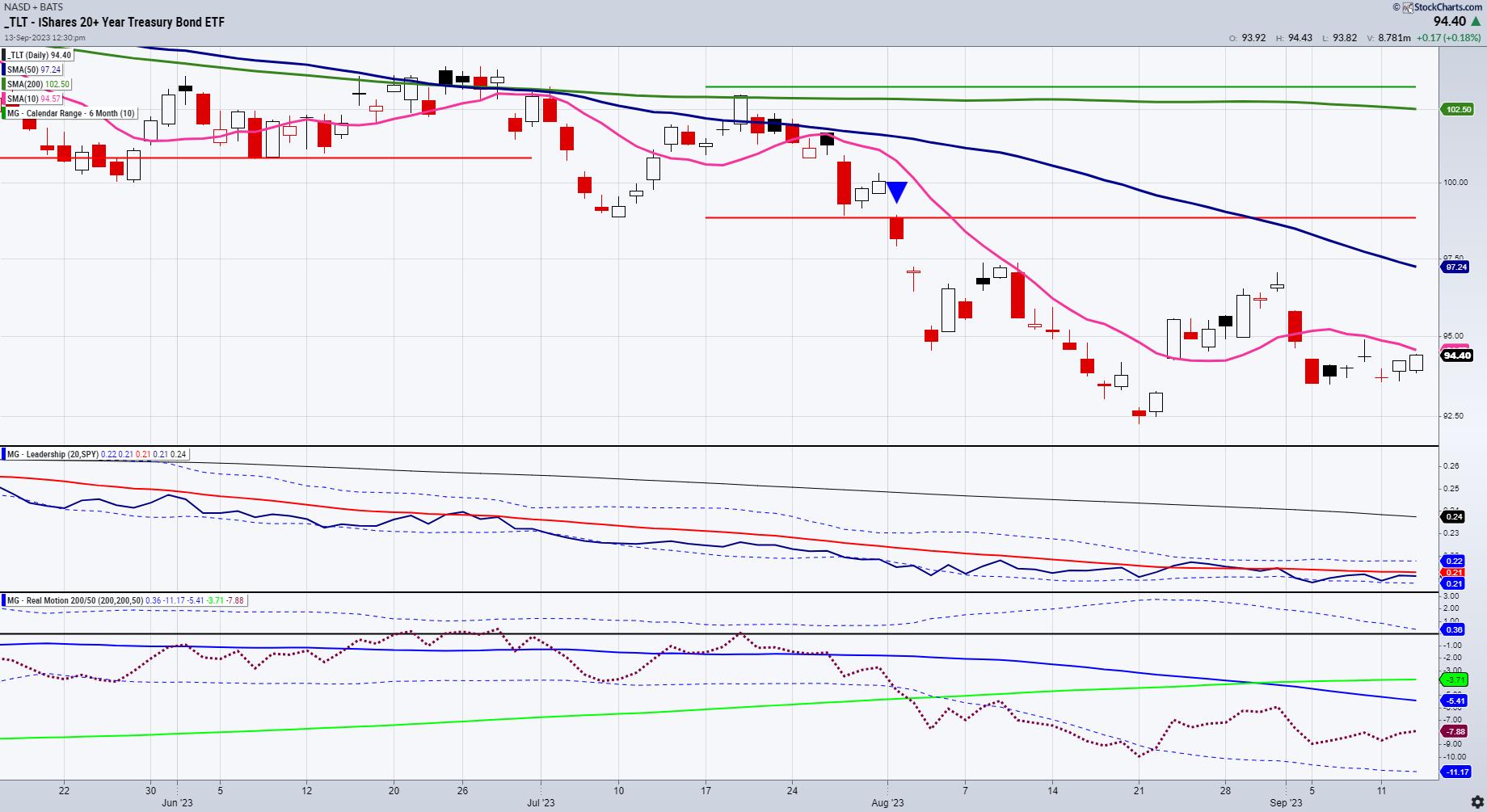

Bonds: Don't Forget the Long-Term Trend

by Carl Swenlin,

President and Founder, DecisionPoint.com

Many of the forecasts I hear regarding bonds seem to be based upon what bonds have done for most of the last 40 years, without acknowledging what has happened more recently. The chart below shows that 30-Year T-Bonds were in a rising trend from the 1982 low, but, in early...

READ MORE

MEMBERS ONLY

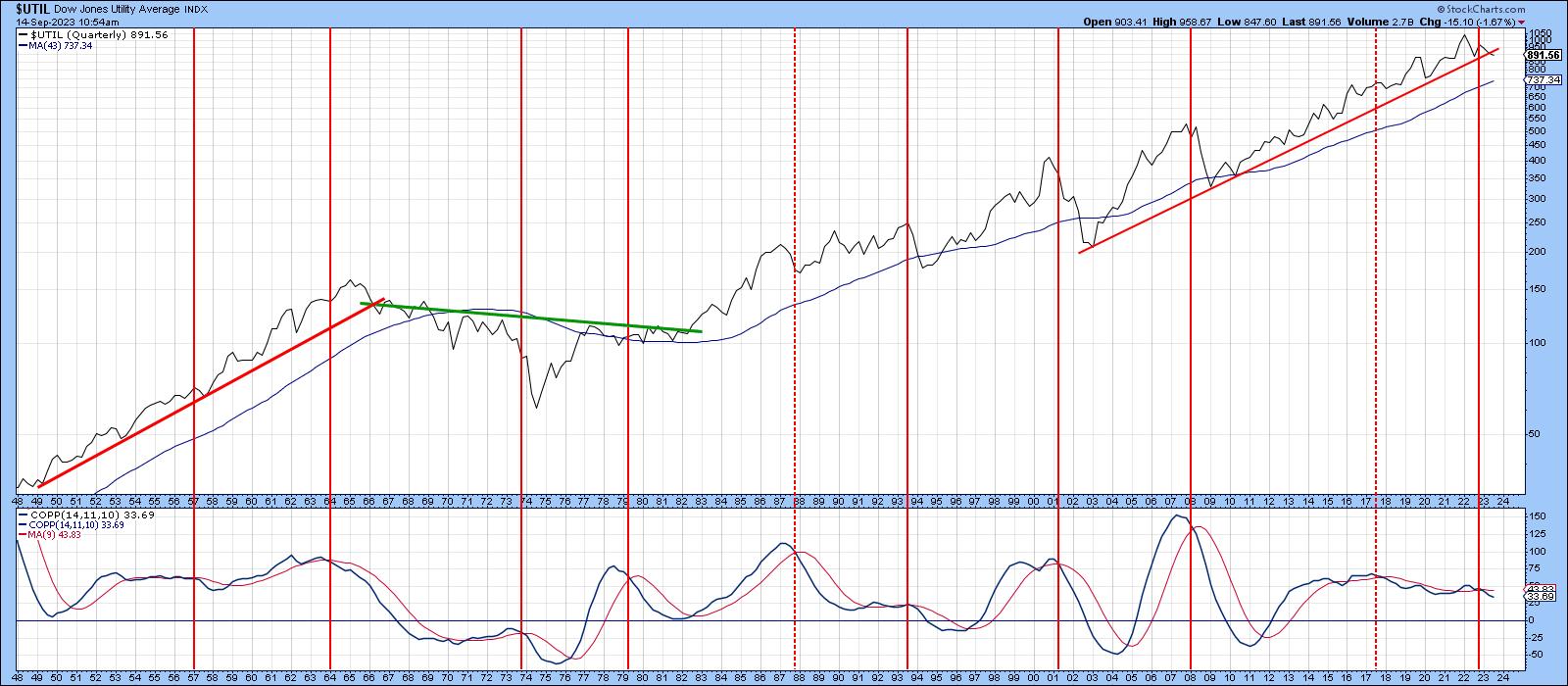

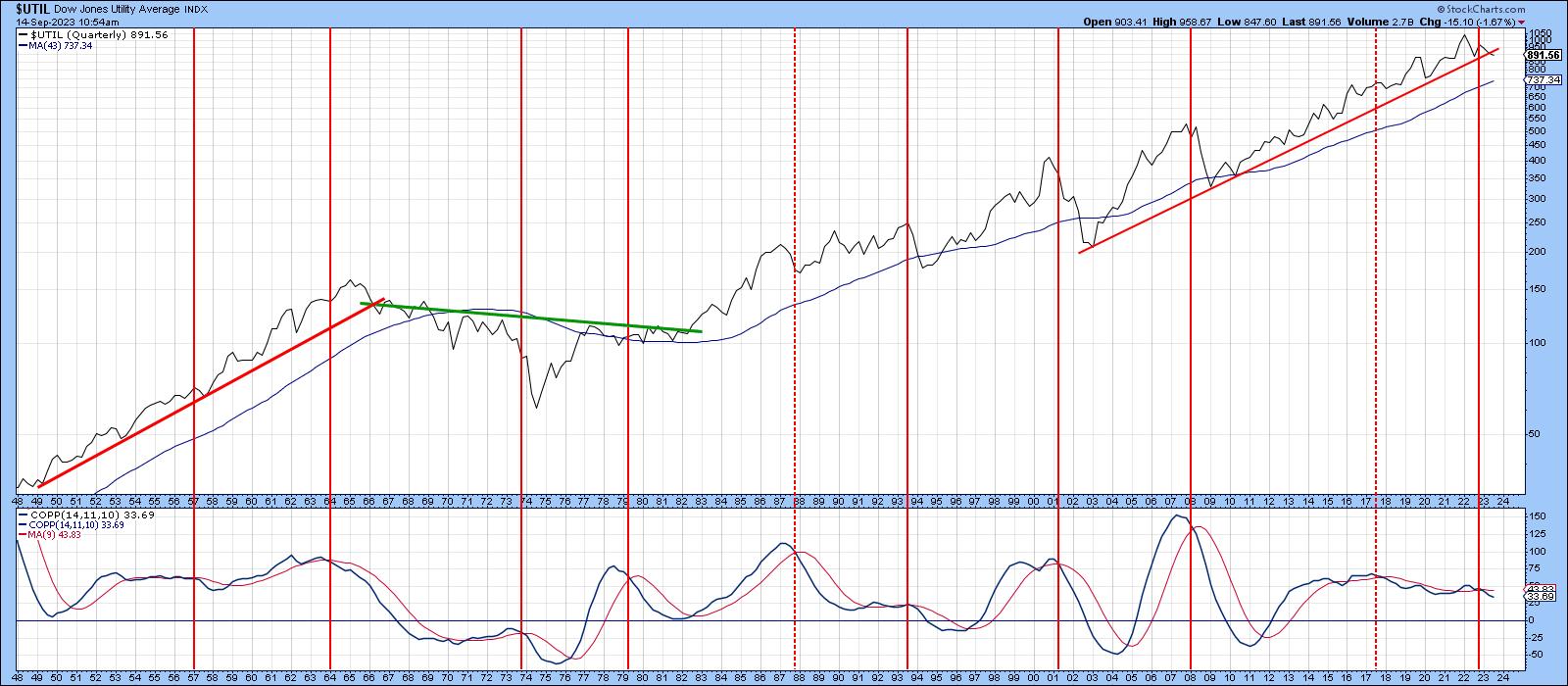

This Sector Looks Really Sick Long-Term

by Martin Pring,

President, Pring Research

The overall market has been rallying since registering its low last October. However, there is one sector which, in August, fell below its October low on a monthly closing basis. More serious is the fact that it recently violated a 23-year secular up trendline. Can you guess which sector I...

READ MORE

MEMBERS ONLY

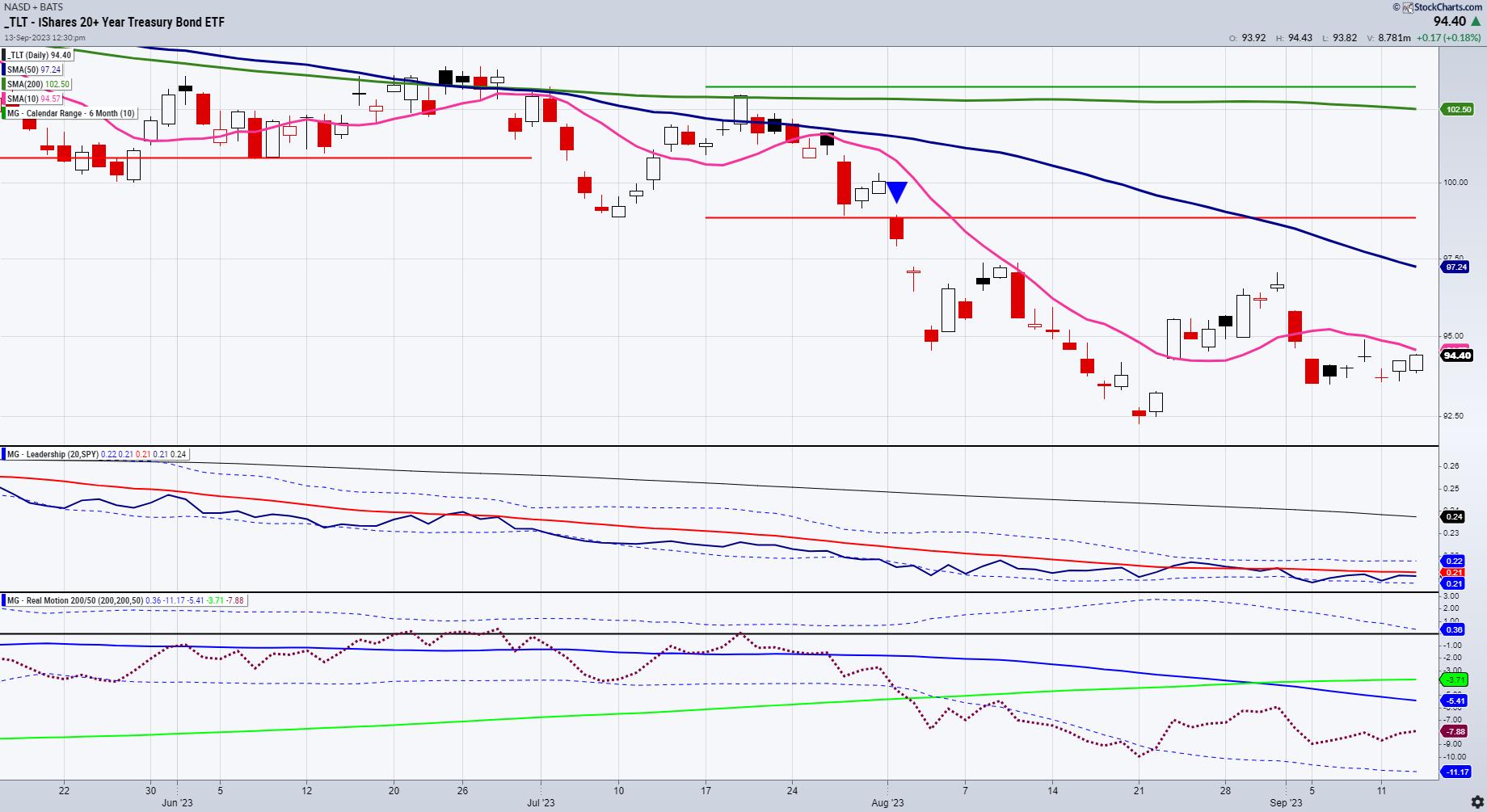

Fresh Look at Long Bonds

I doubt any of our readers are too surprised by the CPI reading coming in a bit hotter than expected.

The bulk of it was in energy costs. Food costs were, mixed with bread and meat, up, while eggs and milk were down. Services inflation was up slightly, while shelter...

READ MORE

MEMBERS ONLY

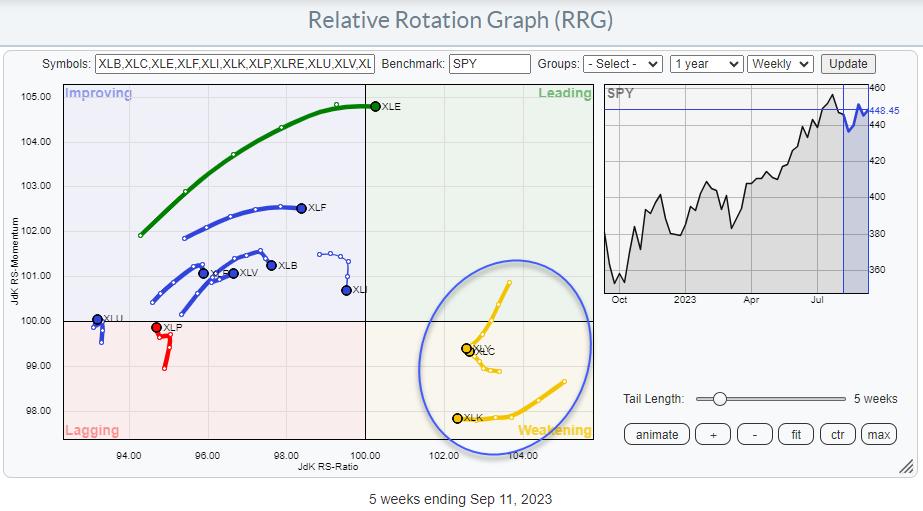

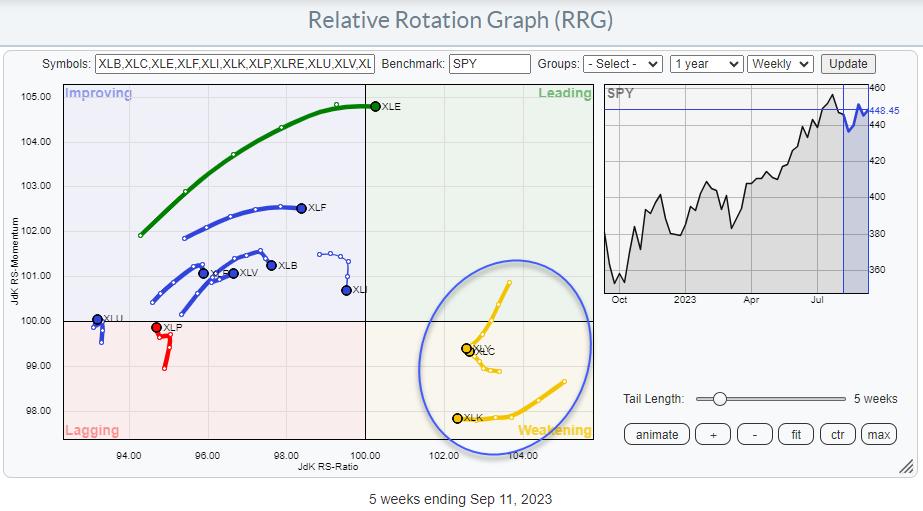

Sector Rotation Analysis Still Quite Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Julius de Kempenaer of RRG Research shows how his market visualizations still show stocks over bonds and offense over defense. Host David Keller, CMT highlights one industry sector breaking down due to higher crude oil prices.

This video originally...

READ MORE

MEMBERS ONLY

The Halftime Show: 6 ETFs That Are on My Radar

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete reviews 6 ETFs that are in different stages of trends. Two in the banking sector are in downtrends that are undeniable: KRE and KBE. This review ties in the recent commentary from Jamie Dimon, the CEO of JP...

READ MORE

MEMBERS ONLY

Finding and Trading Instrument Bottoms

In June, we wrote about the bottom in oil and cannabis through USO and MSOS (ETFs) respectively. In July, we wrote about the potential top in NASDAQ and SPY. In August, we wrote about the importance of the retail sector; XRT is below the July calendar range and a major...

READ MORE

MEMBERS ONLY

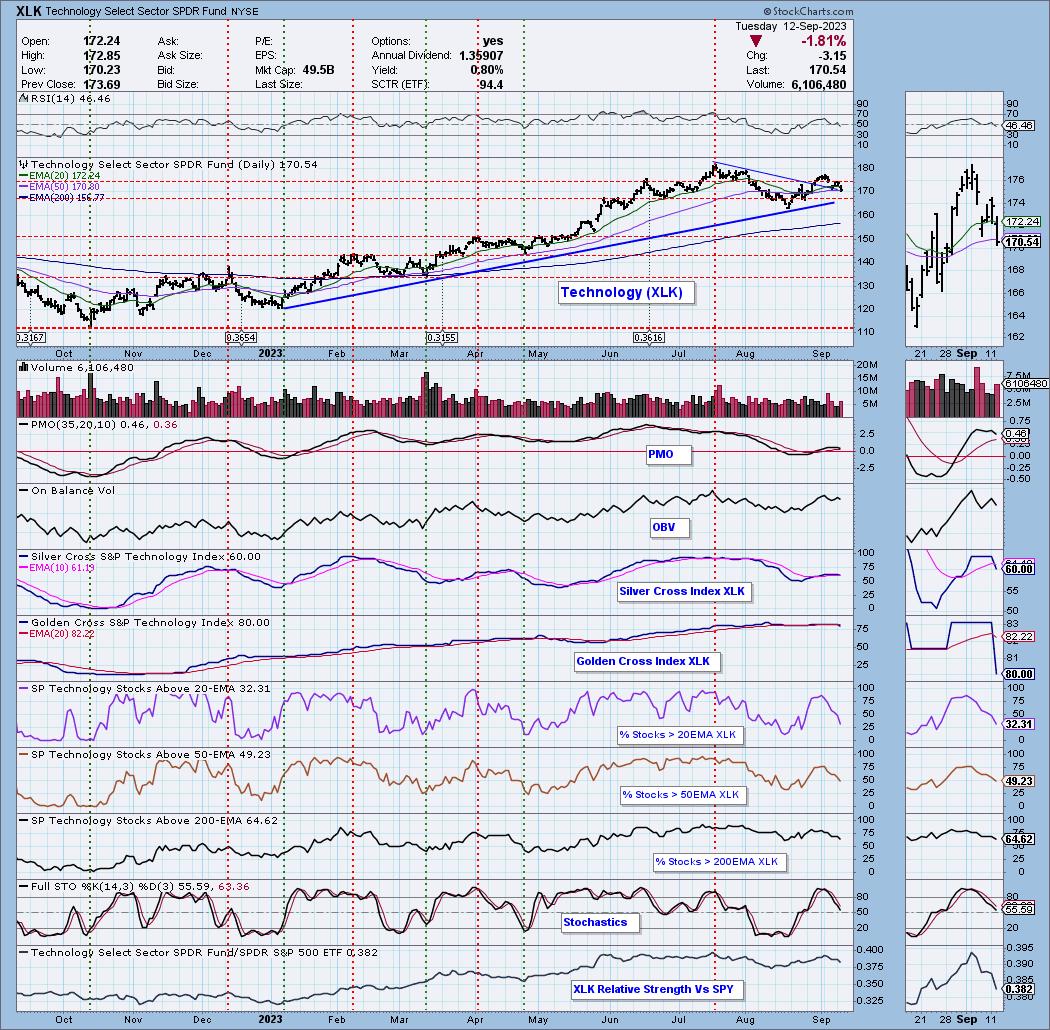

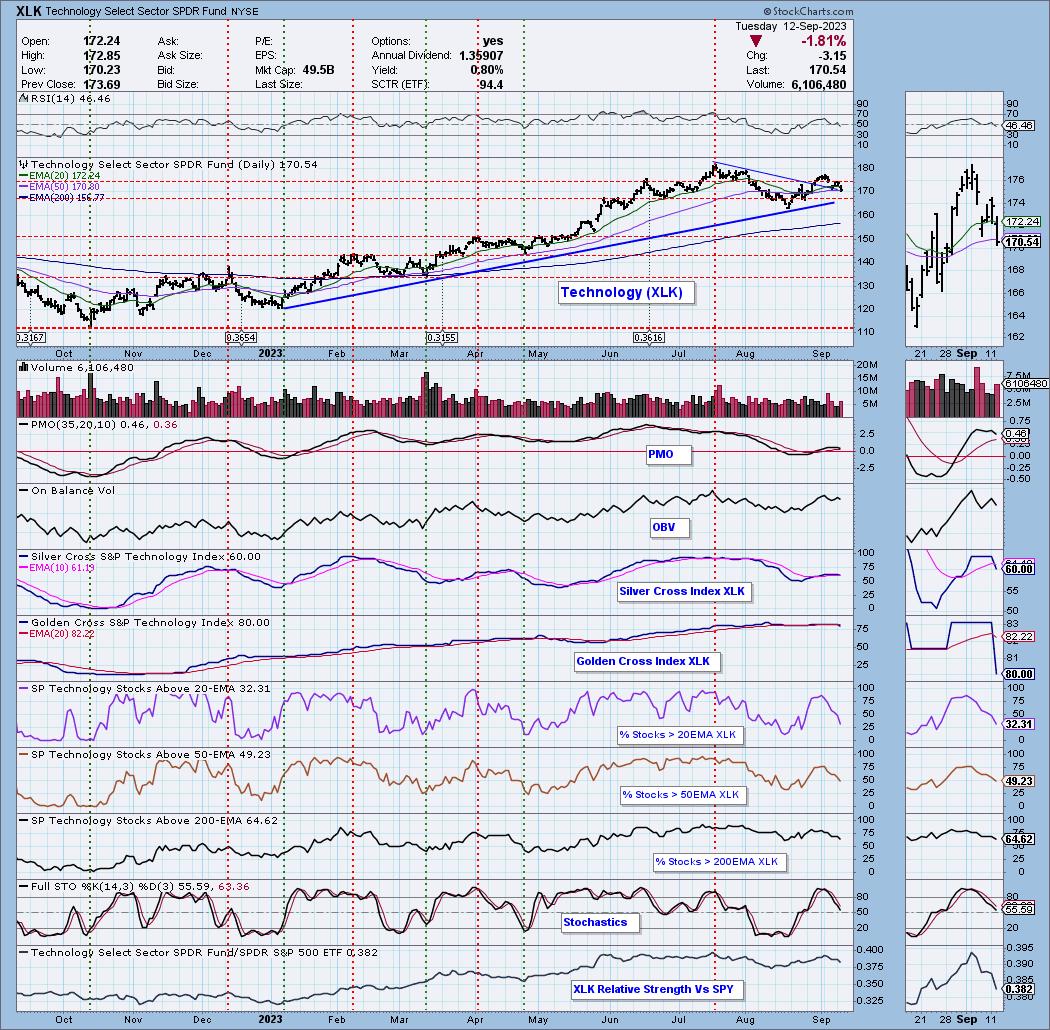

Technology, Last Man Standing... Falls

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* XLK "Bearish Shifts" Move IT and LT Bias to BEARISH

* XLK PMO Nearing Crossover SELL Signal

In Monday's DecisionPoint Trading Room we discussed that Technology (XLK) was the last one standing on our Bias Scoreboard with a Bullish Bias in both the intermediate term...

READ MORE

MEMBERS ONLY

The Bull Case for Commodities

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, David Cox, CFA CMT of Raymond James reviews underperformance for defensive sectors like Utilities and describes why commodities should be an area of focus for investors. Host David Keller, CMT reviews today's drop in ORCL and AAPL as...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, September 14th at 3:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, September 14th at 3:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

Chesapeake Energy: A Stock That Could Pump Much More

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Chesapeake Energy stock has been trending higher since June 2023

* Chesapeake Energy stock has room for upside growth

* CHK could benefit from the rise in crude oil prices

In addition to analyzing the stock market's overall performance, running scans when the market opens and after it...

READ MORE

MEMBERS ONLY

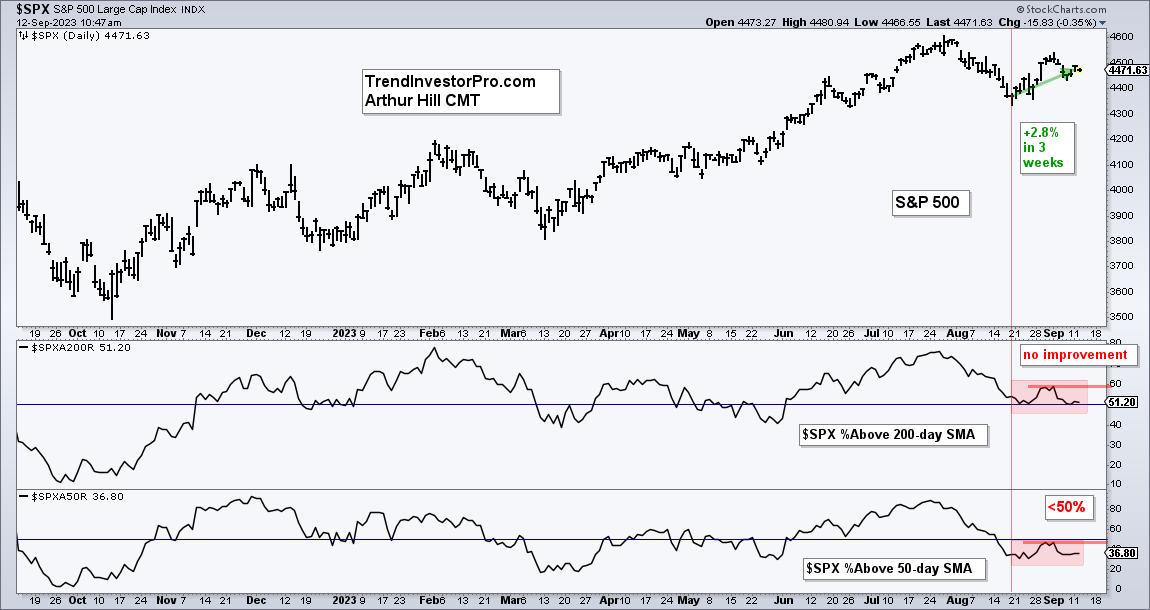

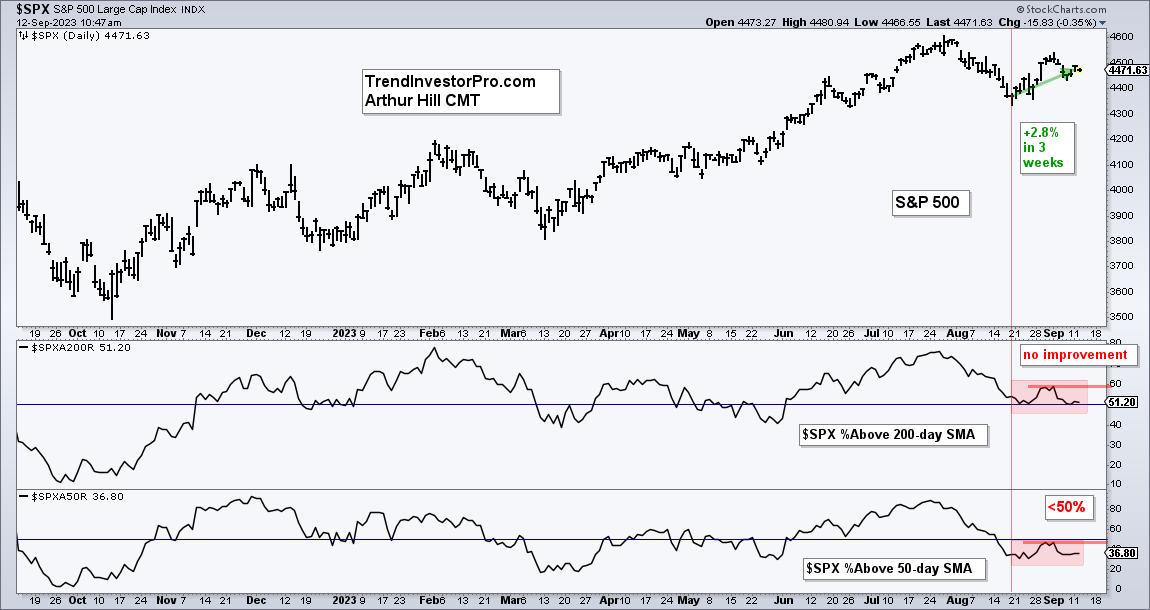

Breadth is Not Keeping Pace with the Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR bounced the last three weeks, but we did not see an improvement in breadth. Weak breadth is also reflected in performance for mid-caps and small-caps, which are lagging. Even so, SPY and QQQ are in short-term uptrends and I am watching the tech sector...

READ MORE

MEMBERS ONLY

DP Trading Room: Can Tech's Bullish Bias Hold?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl reviews the markets and shares the new DecisionPoint BIAS assessment list. Erin concentrates on Technology (XLK) and Utilities (XLU). Technology is only sector holding a bullish bias in the intermediate and long terms, will that hold up? Utilities...

READ MORE

MEMBERS ONLY

Looks Like a Strong Rotation to The Leading RRG Quadrant is Around the Corner for Three Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Three Sectors Are Ready to Rotate Back Towards the Leading Quadrant

* Technology, Discretionary, and Communication Services Together Are Almost Half Of Total Market Cap

* Daily Tails for these sectors are supporting the looming positive rotation for their weekly counterparts

First of all, for those who are awaiting a...

READ MORE

MEMBERS ONLY

When Facing a Market Pullback, RUN THESE SCANS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a big up day for TSLA and bearish engulfing pattern for energy stocks. He answers viewer questions on growth stocks during rising rate environment and shares two scans to identify potential opportunities during corrective periods.

This video originally...

READ MORE

MEMBERS ONLY

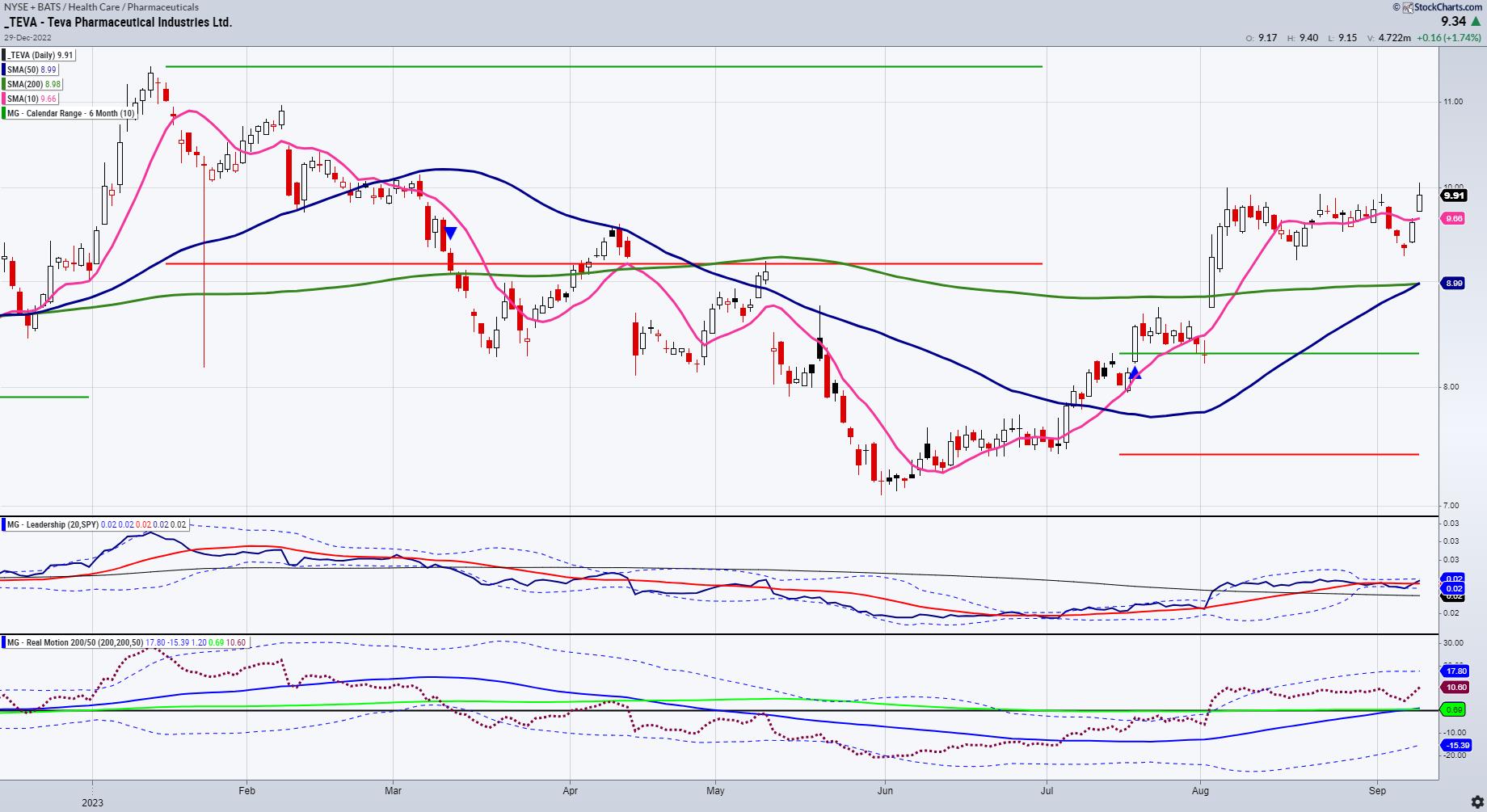

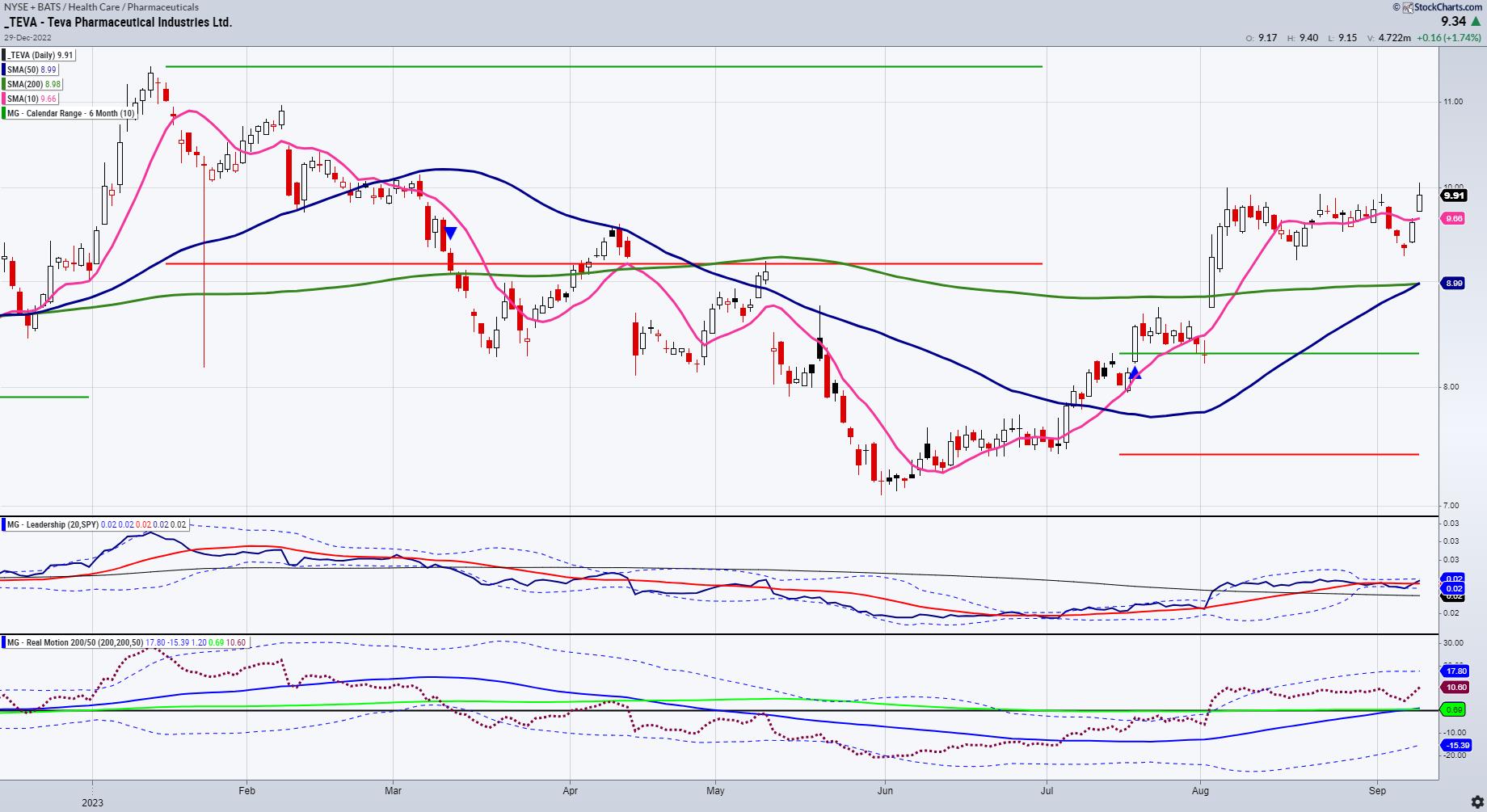

TEVA: A Pharma Stock to Watch

Every week, I am invited on Business First AM with Angela Miles to discuss the market and give a stock pick. This week, I covered TEVA, a stock I have talked about a few times and one, full disclosure, we are positioned in.

First, about the company:

Teva Pharmaceuticals is...

READ MORE

MEMBERS ONLY

Called It! The Drop in AAPL Before the Bell

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG presents a perfect example of what it is like being in the Moxie trading room, and the benefits the subscribers get from my trading methodology. TG was able to point out that AAPL was most likely going to pullback,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Forms a Key Support; These Sectors Set to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, the importance of the support level of 19250 was discussed; it was mentioned that, if this level stands protected for NIFTY, the Index can rebound and inch higher towards 19700+ levels. While trading along these lines, the markets enjoyed trending sessions throughout the week. It...

READ MORE

MEMBERS ONLY

StyleButtons: The Key to an Optimized Charting Process! Here's How I Use ‘Em

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares one of the simplest yet most effective ways to streamline and enhance your charting routines on the SharpCharts workbench: StyleButtons. By assigning your favorite "ChartStyles" (chart templates that include all of the indicators,...

READ MORE

MEMBERS ONLY

MEM TV: Major Tech Group Turns Negative

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen McGonagle reviews the weakness in the broader markets while highlighting bright spots amid base breakouts. She also shares best ways to prepare your watch list and why the Dow Industrial Index outperformed.

This video originally premiered September 8,...

READ MORE

MEMBERS ONLY

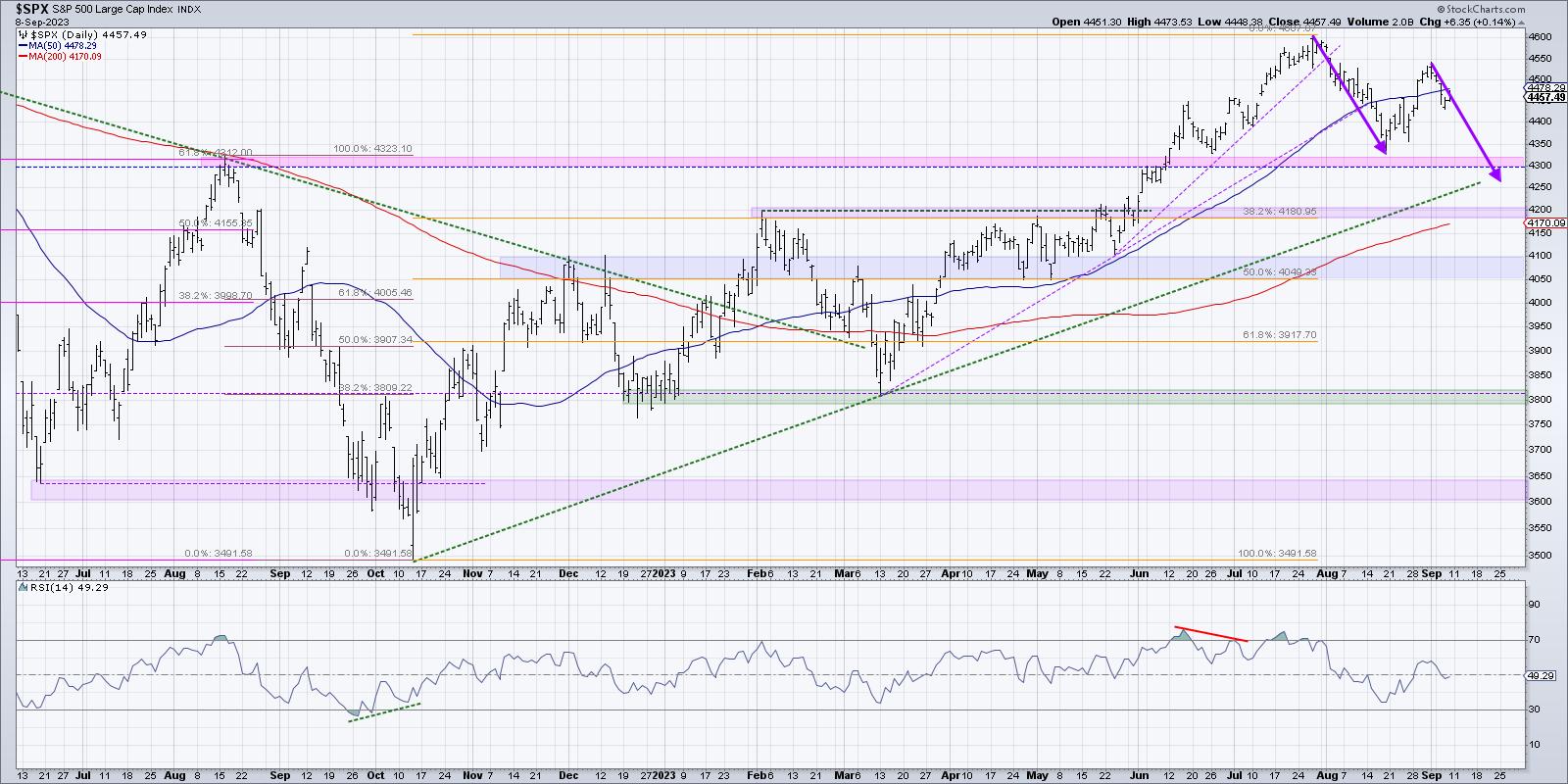

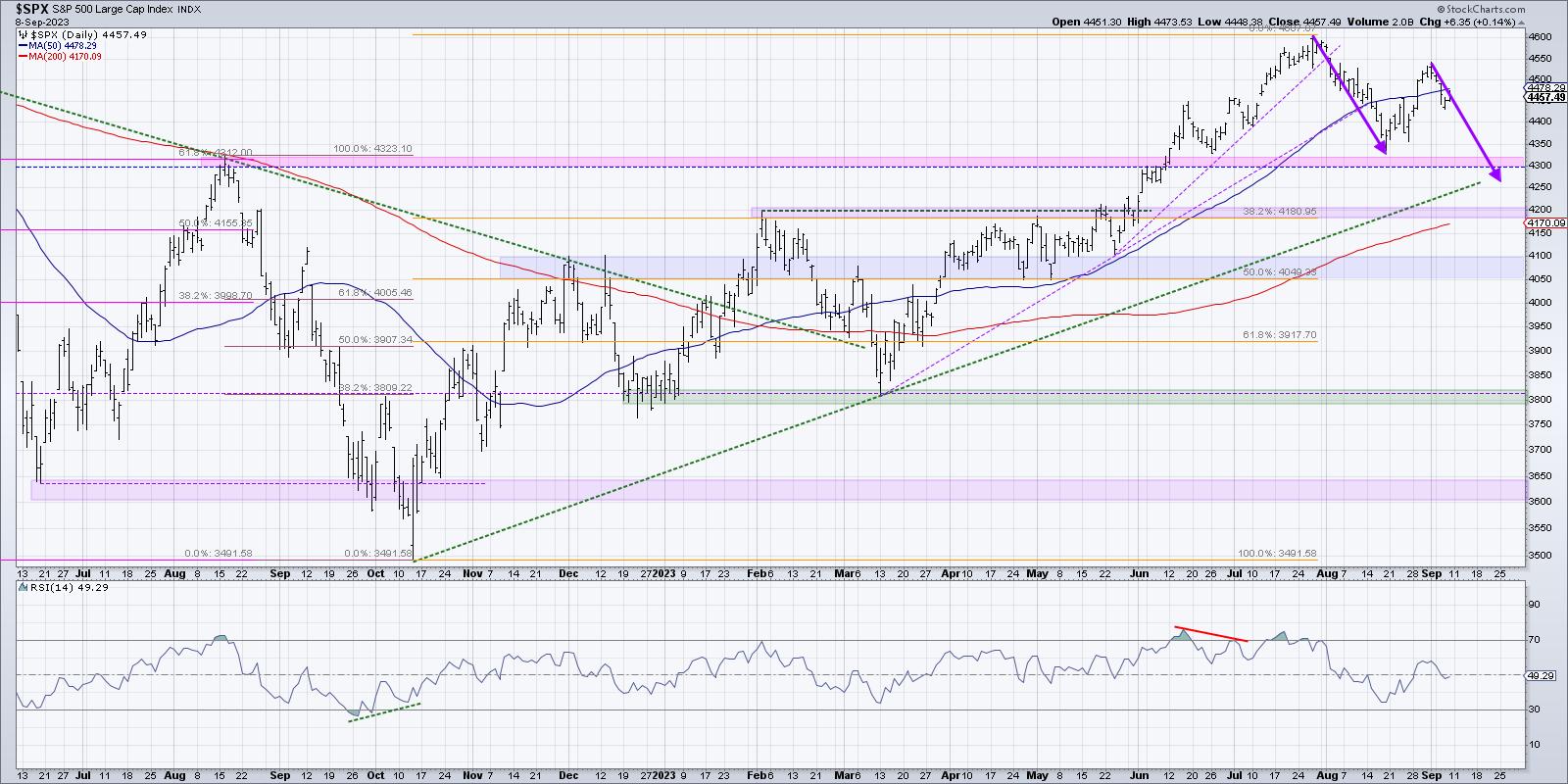

Which is More Likely -- SPX Over 4600 or Below 4200?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Top investors use probabilistic analysis to think through different scenarios to determine which appears the most likely.

* By thinking through each of four potential future paths for the S&P 500, we can be better prepared for whichever scenario actually plays out in the coming weeks.

We...

READ MORE

MEMBERS ONLY

BONDS & CASH - But Can We Find Better Income Alternatives?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

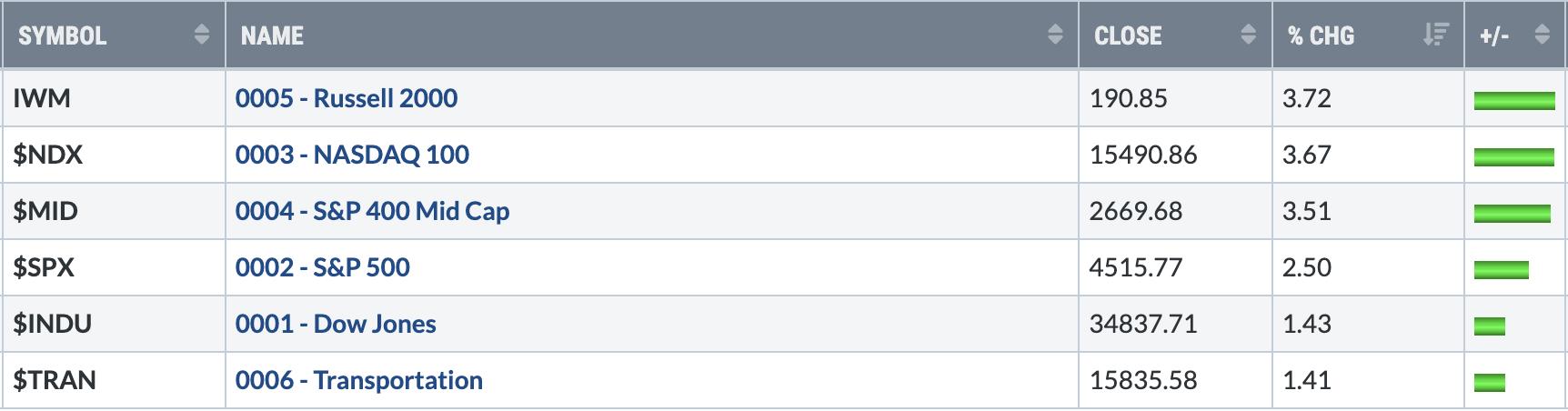

In this edition of StockCharts TV'sThe Final Bar, Dave wraps the week with a focus on weakening breadth conditions, the Russell 2000 and underperformance of small caps, and strong energy stocks driven by stronger crude oil prices. He answers viewer questions on using ETFs instead of bonds or...

READ MORE

MEMBERS ONLY

Stock Market Wrap-Up: Equities, Oil Close Higher While Treasury Yields Slightly Lower

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* September is usually a weak month in the stock market and this time it may be no different

* In spite of the selloff the broader equity indexes are still trending higher

* Rising oil prices and the US dollar may put some pressure on inflation

"September is when...

READ MORE

MEMBERS ONLY

Can the Windowmaker Natural Gas Resuscitate?

Probably the worst or at least one of the worst performers in the overall market and in the commodities market, natural gas is choppy and lifeless. So why write about it?

For starters, we love an underdog. Perhaps a bit too contrarian, as the reasons for the decline in natural...

READ MORE

MEMBERS ONLY

Optimizing Your Stock Selection With the Williams True Seasonal Indicator

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Williams True Seasonal is a unique tool that detects stocks via seasonality patterns

* The Williams True Seasonal indicator differs from other seasonality indicators in that it provides greater accuracy by tweaking the way it uses data

* The main benefit in using the Williams True Seasonal indicator is...

READ MORE

MEMBERS ONLY

Crucial Insights: How Rising Rates IMPACT You!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Willie Delwiche, CMT, CFA of Hi Mount Research outlines the long-term uptrend in interest rates and shares two sectors to focus on given the rising rate environment. Host David Keller, CMT tracks the sharp pullback for semiconductors and breaks...

READ MORE

MEMBERS ONLY

GNG TV: XOP's Strength vs. the S&P's Weakness

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Tyler examines a return to strong "Go" conditions in the US Dollar index (UUP) and US Treasury rates ($TNX) on both the daily and weekly timeframes. The trend following model is clearly to the upside, but momentum has not shown...

READ MORE

MEMBERS ONLY

How to Identify Great Trade Opportunities Using the MACD Zero Line

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the importance of the MACD Zero line. First, he discusses what the zero line is and why it is significant. Then, Joe shows how it can identify great trade opportunities when used in multiple timeframes. Joe...

READ MORE

MEMBERS ONLY

The Halftime Show: Energy Sector Continues Uptrend

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete goes over the usual suspects in the markets. He presents a review of both the SPX and the NDX indexes, followed by a review of the US Dollar and a quick look at bonds using the TLT ETF....

READ MORE

MEMBERS ONLY

Energy Stocks in the Spotlight: A Look at Diamondback Energy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Energy stocks are in focus as US crude oil prices continue rising higher

* Oil prices have more room to rise but if prices go too high there may be demand pressures

* Diamondback Energy is getting close to its 52-week high

With Labor Day weekend behind us, it'...

READ MORE

MEMBERS ONLY

FORGET Valuations, REMEMBER the Charts!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Ari Wald, CFA, CMT of Oppenheimer & Co. shows how energy stocks are taking a leadership role, with high beta sectors still outperforming low volatility defensive stocks. Host David Keller, CMT tracks the latest downswing and describes a potential...

READ MORE

MEMBERS ONLY

Technical Correction? Or Return of the Bear Market?

On July 5th, Mish wrote an article called "Sell in July and Go Away? Calendar Range Reset".

In that article, she noted, "should IWM fail to clear the calendar range high and worse, break down under a new 6-month calendar range low[...] it would be hard to...

READ MORE

MEMBERS ONLY

Small-Caps Take BIG Plunge in Risk-Off Move

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave notes severe weakness in the small-cap space as the Russell 2000 forms a potential head-and-shoulders topping pattern. He answers viewer questions on index volume, Coppock curves and running oscillators on breadth indicators.

This video originally premiered on September 5,...

READ MORE

MEMBERS ONLY

It's Really All About the Retail Sector Now

This entire year, retail, as measured by the ETF XRT (a.k.a. the Granny of the Economic Modern Family), has underperformed the SPY and QQQs. Encumbered by higher interest rates, higher oil prices, higher inflation, higher insurance costs, and a burgeoning credit card debt, we have wondered many times...

READ MORE

MEMBERS ONLY

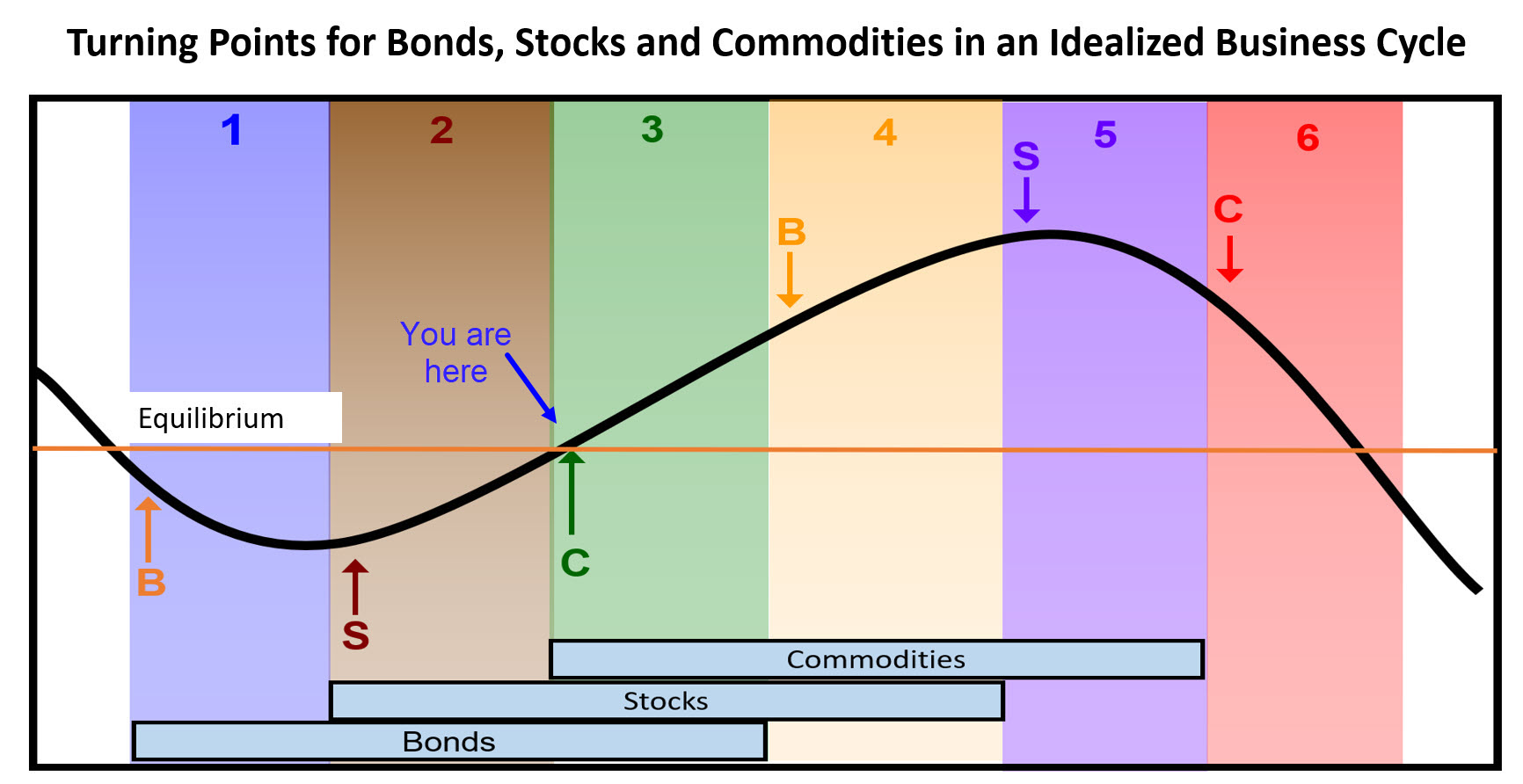

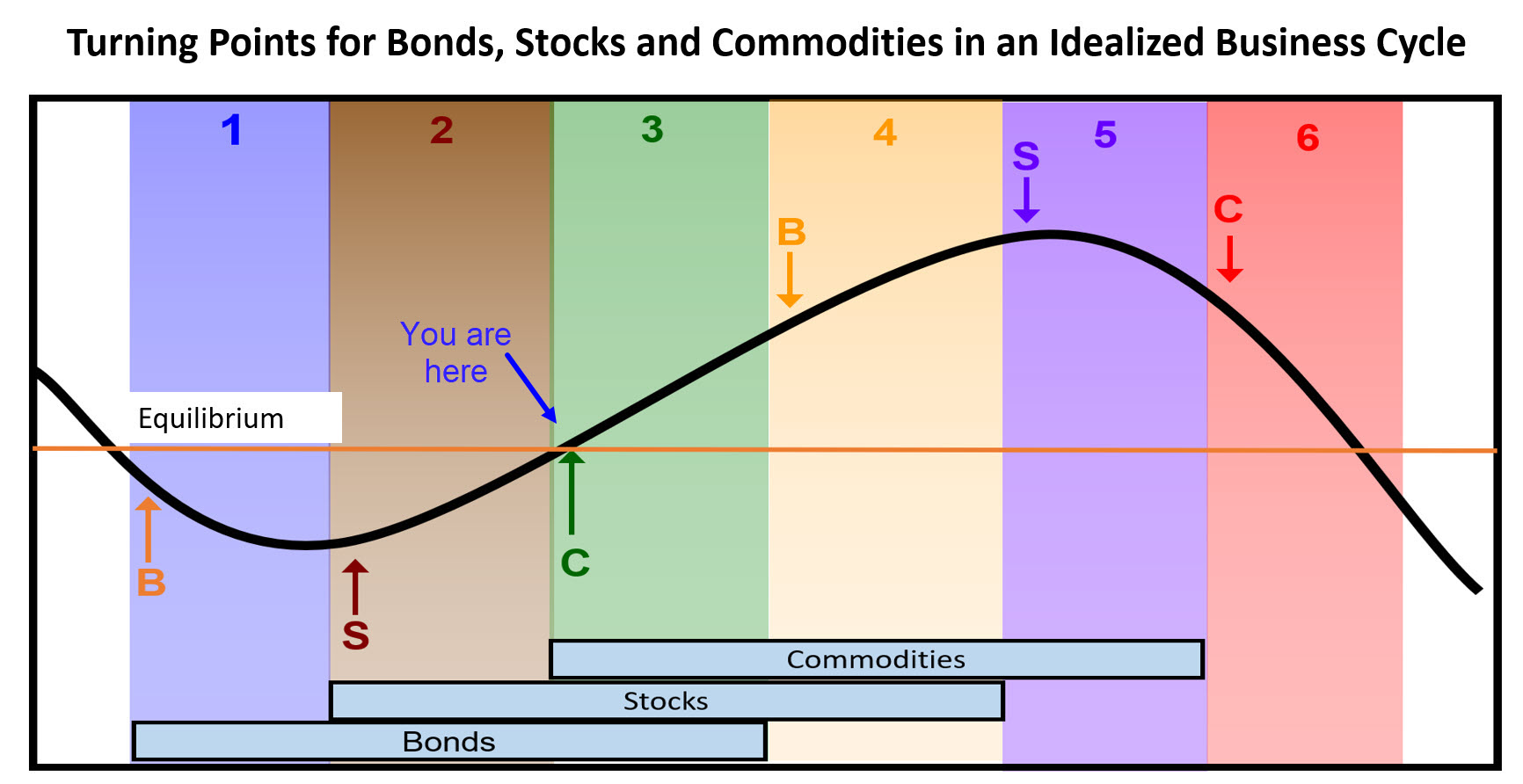

Some Investment Implications for Stage 3 of the Business Cycle

by Martin Pring,

President, Pring Research

The business cycle has been with us for as long as reliable financial records have been available, and that's at least 200 years. It may seem to be a mysterious force, but it is nothing more than a set sequence of chronological events that just keeps repeating. The...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch, September 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson co-host a special presentation, wherein they unveil the top 10 charts that are poised to shape the landscape of September 2023.

This video originally premiered on September 4, 2023. Watch on our dedicated Final Bar pageon StockCharts...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly RRG Shows Preference for Stocks Over Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The month of August has come to an end, and that means a focus on long-term trends, using monthly Relative Rotation Graphs in combination with the finalized price (bar-)charts for August, on this episode of StockCharts TV's Sector Spotlight. Julius de Kempenaer assesses the rotations of asset...

READ MORE

MEMBERS ONLY

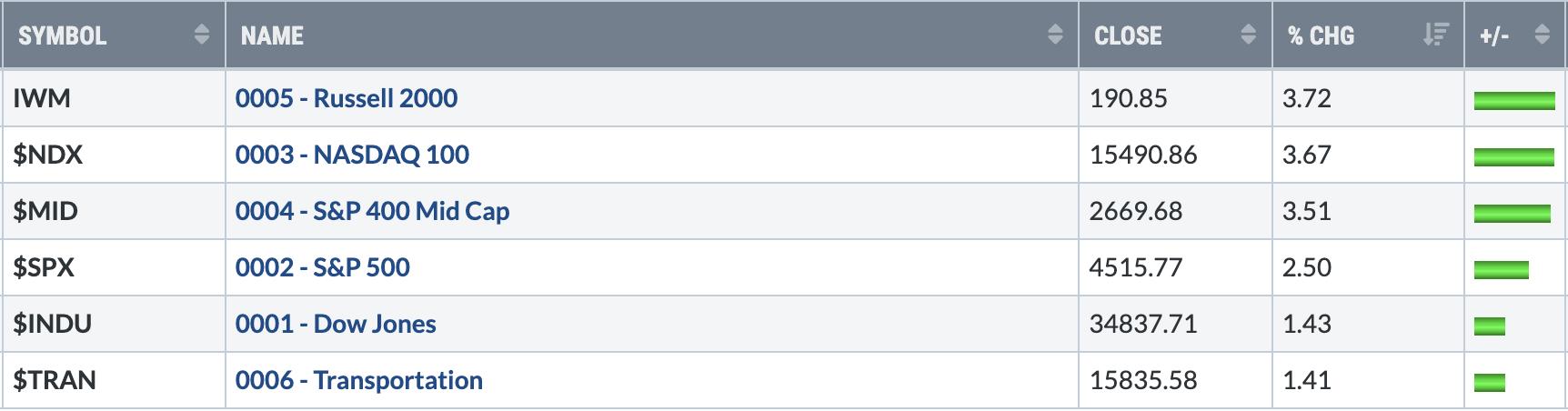

Here's My Latest View of Current Market Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hello to all my StockCharts supporters! First of all, thank you for your readership of my Trading Places blog, which is now in its 8th year. Also, thanks to all of you that watch my Trading Places LIVE shows that air on Tuesdays, Wednesdays, and Thursdays at 9:00am ET....

READ MORE

MEMBERS ONLY

Week Ahead: Important for NIFTY To Stay Above This Level; Expect Outperformance in These Pockets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past five sessions of the week saw the Indian equities trading in a defined and narrower range. The first four sessions were seen leading the markets to a weekly loss, but the strong trading session on Friday saw NIFTY recouping its losses. The index oscillated in 234.90-point range,...

READ MORE

MEMBERS ONLY

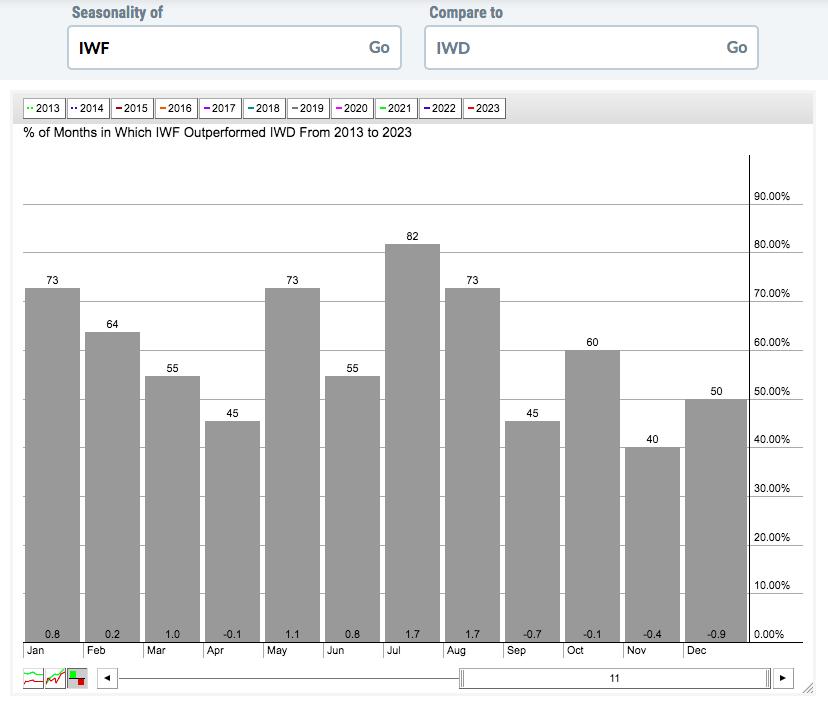

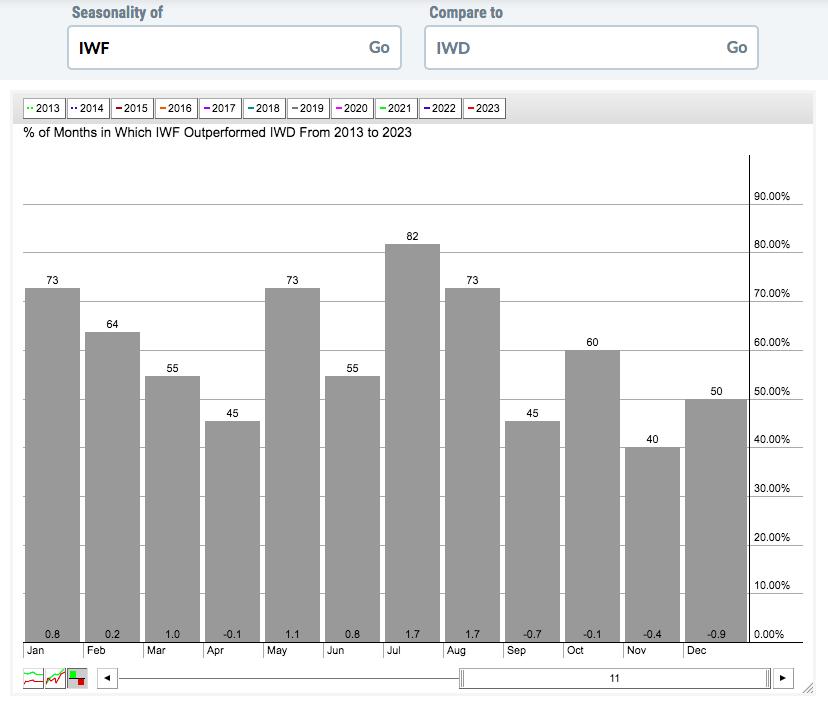

You MUST Be Aware of This Seasonality Change

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love the seasonality information that StockCharts.com provides. It's important to keep in mind that seasonal tendencies are secondary indicators. I don't buy and sell based on them, because the price/volume combination will always be my primary indicator. But if technical indications point to...

READ MORE